Crafting a standout CV as an investment banking analyst can often be challenging due to the highly competitive nature of the industry and the need to demonstrate complex financial skills concisely. By following our guide, you'll learn how to showcase your achievements and tailor your experience effectively, ensuring your CV rises to the top of the pile.

- Applying best practices from real-world examples to ensure your profile always meets recruiters' expectations;

- What to include in your work experience section, apart from your past roles and responsibilities?

- Why are both hard and soft skills important for your application?

- How do you need to format your CV to pass the Applicant Tracker Software (ATS) assessment?

If you're writing your CV for a niche investment banking analyst role, make sure to get some inspiration from professionals:

Resume examples for investment banking analyst

By Experience

Senior Investment Banking Analyst

- Strategically Structured Content - The CV is well-organized, with clear and concise sections that allow for easy navigation. Each section flows logically, presenting Chloe's career progression, skills, achievements, and education in a manner that's straightforward and comprehensive. This clarity ensures that potential employers can quickly identify her qualifications and expertise.

- Progressive Career Trajectory - Chloe's career path demonstrates a clear progression from an Associate role at HSBC Investment Bank to her current position as a Senior Analyst at Goldman Sachs. The progression signifies her growth and adaptation within the investment banking industry, highlighting her capability to take on increased responsibility and leadership roles over time.

- Industry-Specific Achievements with Impact - The CV doesn't just list achievements in terms of completed projects; it highlights their substantial business relevance. For instance, leading financial modelling for M&A transactions exceeding £1 billion and driving capital raising projects showcase her ability to influence significant financial outcomes, proving her value in strategic financial analysis and advisory.

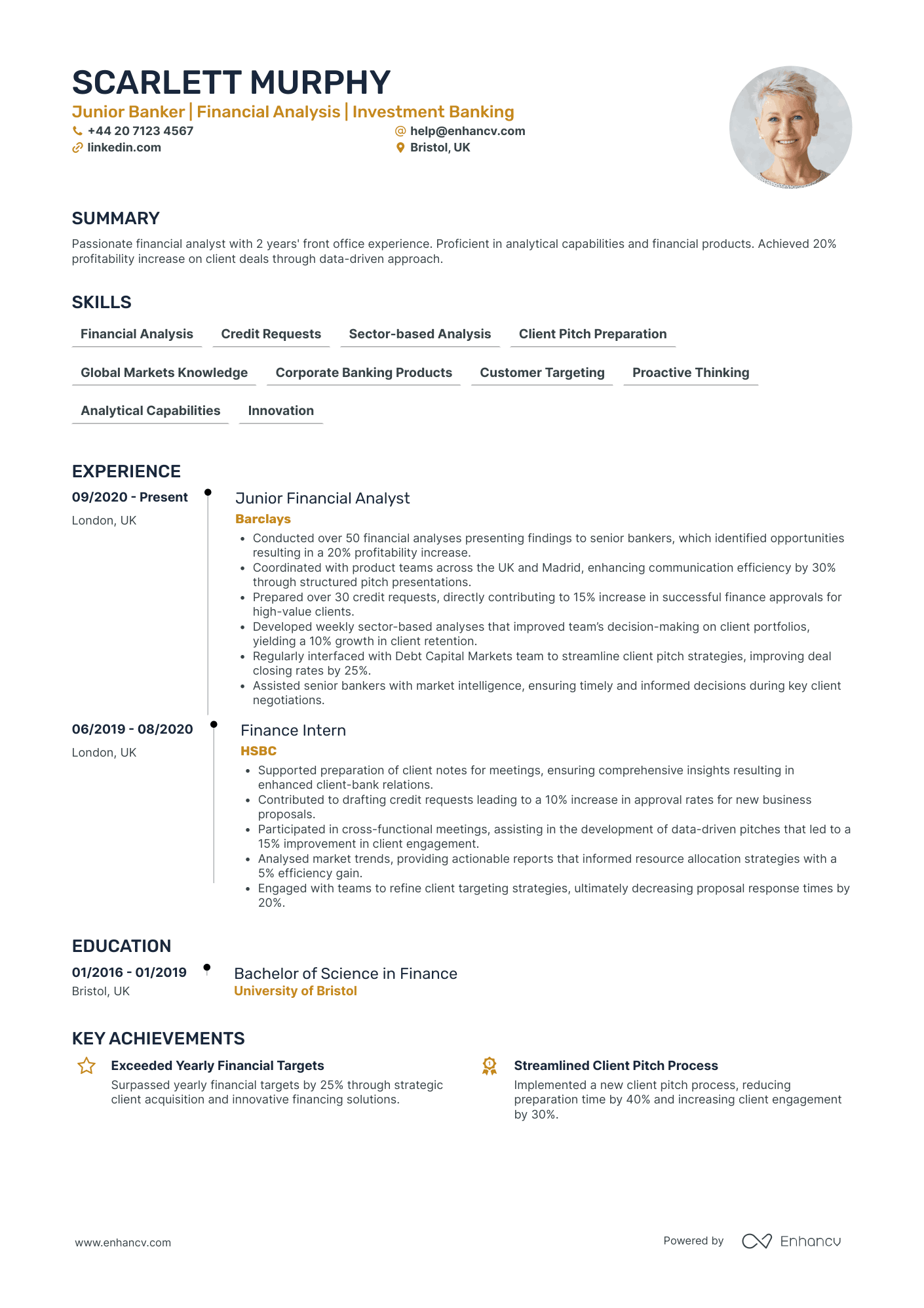

Junior Investment Banking Analyst

- Concise Presentation and Structured Layout - The CV is well-organized with clear sections that make it easy to scan through the candidate's qualifications and experiences. Each section is concise, providing just enough detail to highlight key achievements without overwhelming the reader, ensuring the main points are quickly grasped.

- Demonstrated Career Growth and Industry Focus - Scarlett Murphy's career trajectory is highlighted by a smooth progression from a finance intern at HSBC to a junior financial analyst at Barclays. This trajectory showcases her commitment to the financial industry and her ability to grow within a competitive sector, underpinned by her education in finance and further specialized courses.

- Highlighting the Impact of Achievements - The CV emphasizes not only numbers but the tangible impact of the candidate's contributions, such as increasing profitability and improving client retention. Achievements are articulated in a way that aligns with business objectives, demonstrating the candidate's ability to support and drive company success.

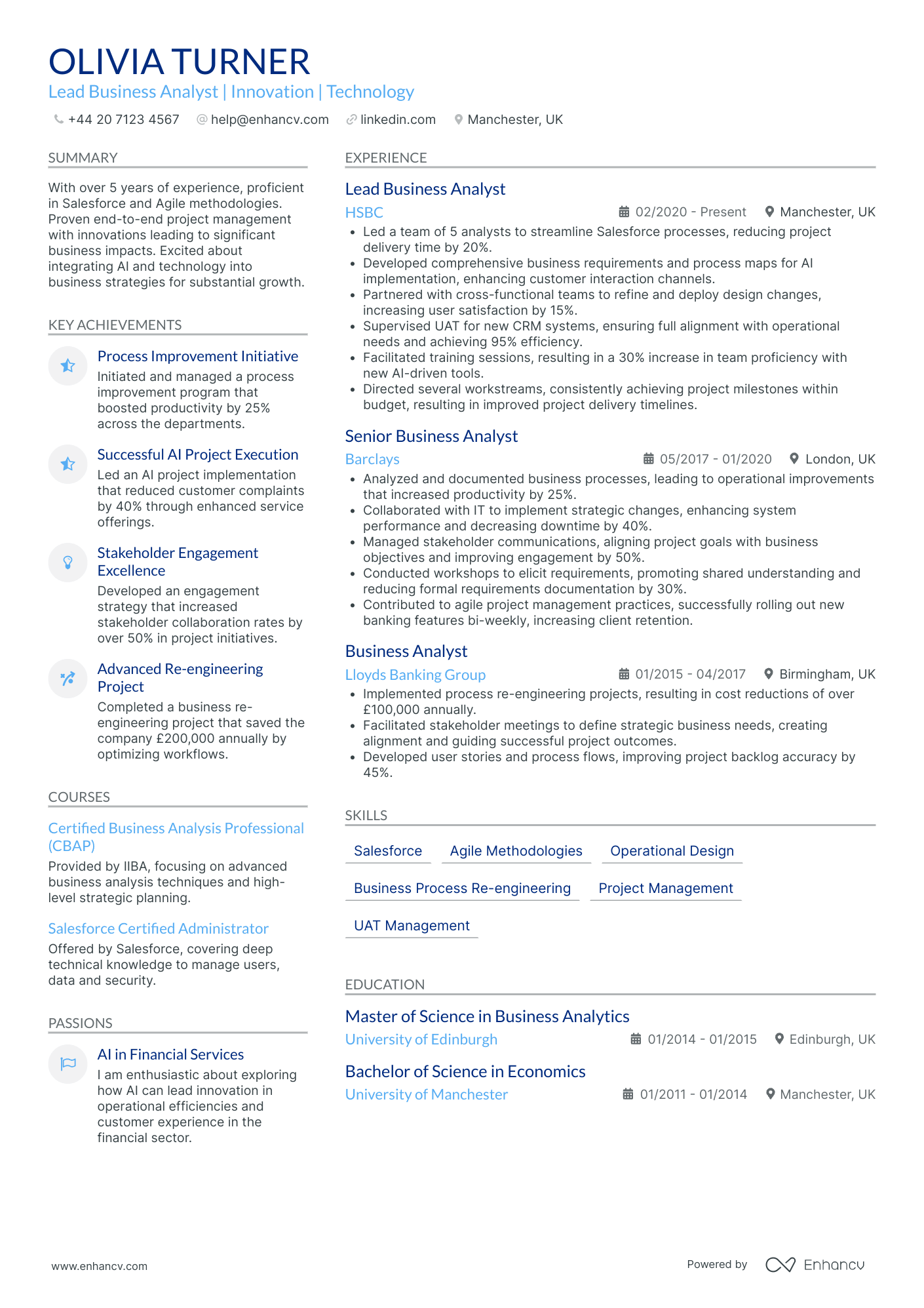

Lead Investment Banking Analyst

- Structured and Comprehensive Presentation - The CV is well-organized with clear sections that highlight Olivia Turner's strengths and achievements across her professional journey. It starts with a concise summary, followed by detailed experiences, education, skills, and additional information like courses and languages, all contributing to a comprehensive snapshot of her qualifications.

- Progressive Career Trajectory in Financial Services - Olivia Turner's career path demonstrates significant growth, starting as a Business Analyst and advancing to Lead Business Analyst. Her progression from roles at Lloyds Banking Group to Barclays, and currently at HSBC, shows a focused trajectory within the financial sector with increasing responsibilities and leadership roles over time.

- Impactful Achievements with Business Relevance - The CV highlights achievements that are not only quantified but also emphasize their business impact. For example, the process improvement initiative that boosted productivity by 25% and the AI project that reduced customer complaints by 40% showcase her ability to drive substantial organizational improvements that align with strategic business goals.

By Role

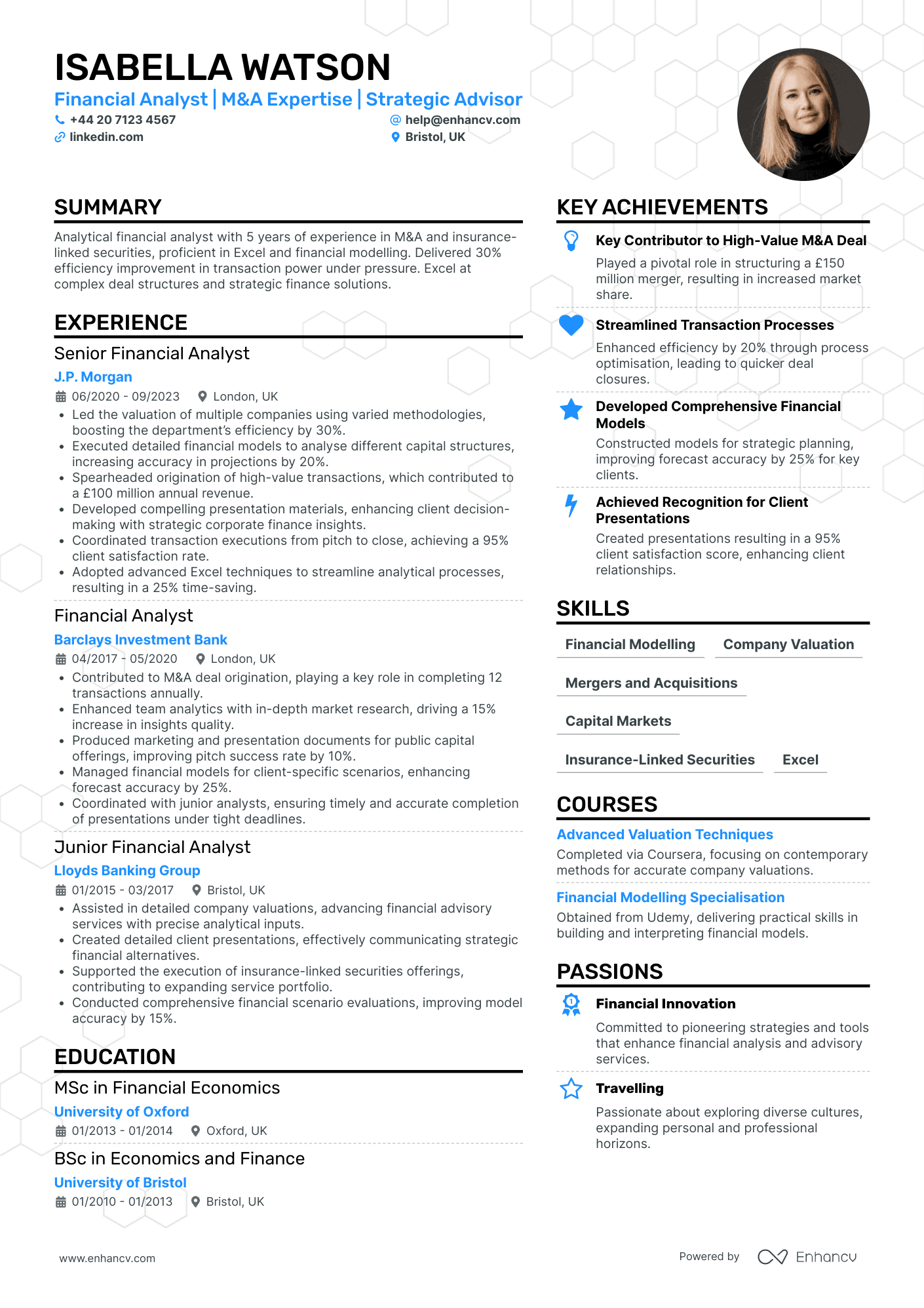

Investment Banking Analyst in Mergers and Acquisitions

- Structured Growth in Finance - The CV displays a clear career progression from a Junior Financial Analyst to a Senior role at top-tier investment firms, illustrating a steep learning curve and continued professional development. This trajectory highlights the candidate’s ability to acquire new skills and take on increasing responsibilities in financial analysis and M&A.

- Integration of Technical Skills in Real-World Applications - The candidate's proficiency in financial modelling and Excel, combined with experience in developing complex deal structures, is evident from their successful streamlining of processes and enhanced transaction efficiency. These skills have directly contributed to optimizing financial strategies and improving project outcomes.

- Achievements with Strategic Impact - Noteworthy achievements include contributing to a £150 million merger which increased market share, and enhancing transaction efficiency by 20%, resulting in expedited deal closures. These accomplishments are not just impressive in scale but also demonstrate a strategic influence on organizational growth and client relations.

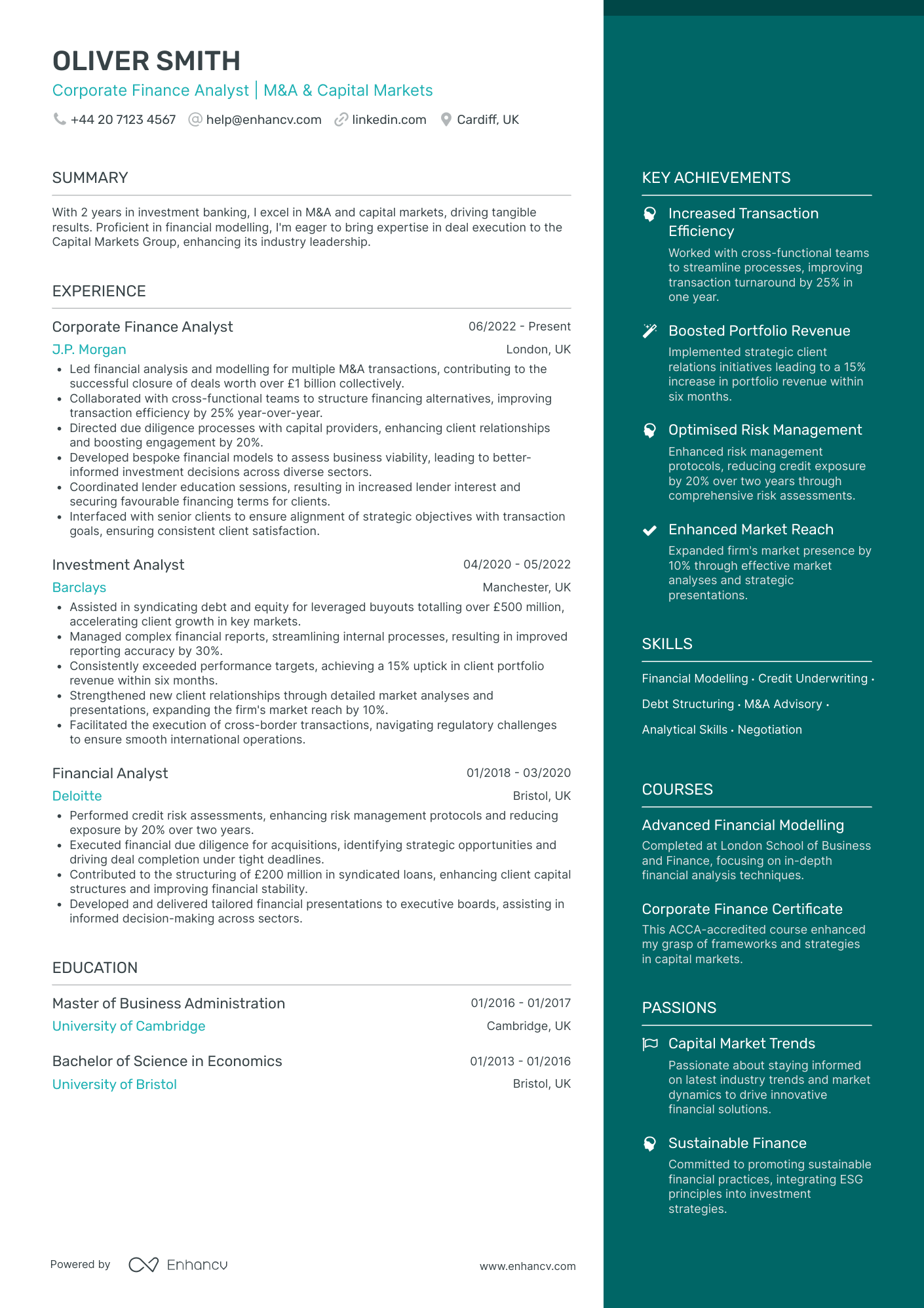

Investment Banking Analyst in Equity Capital Markets

- Concise yet comprehensive content presentation - The CV is exceptionally well-structured, providing a clear overview of Oliver Smith's professional journey. Each section is well-defined, from the snapshot summary to detailed career objectives, ensuring the reader can easily absorb key information while appreciating the breadth of experience presented.

- Progressive career trajectory in finance - Oliver's career journey demonstrates impressive growth and upward mobility within the corporate finance sector. Starting as a Financial Analyst and progressing to a Corporate Finance Analyst role at prestigious firms like J.P. Morgan, it emphasizes a clear and strategic career path focused on M&A and capital markets.

- Technical depth and industry-specific skills - The CV showcases Oliver's expertise in complex financial modeling and his adept use of industry-specific tools. The inclusion of advanced courses in financial modeling and certifications reinforces his technical proficiency and commitment to developing cutting-edge analytical skills critical in the finance industry.

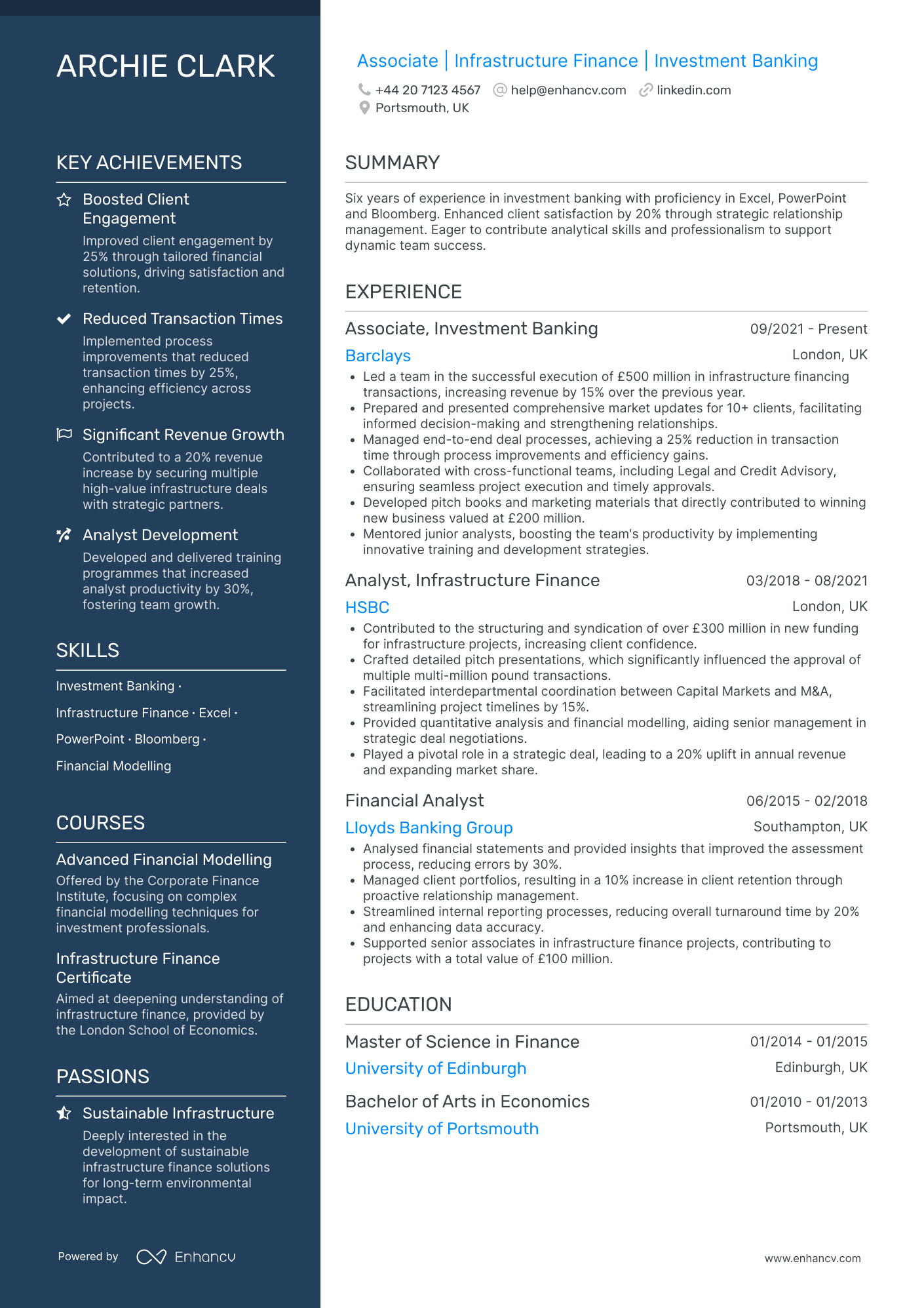

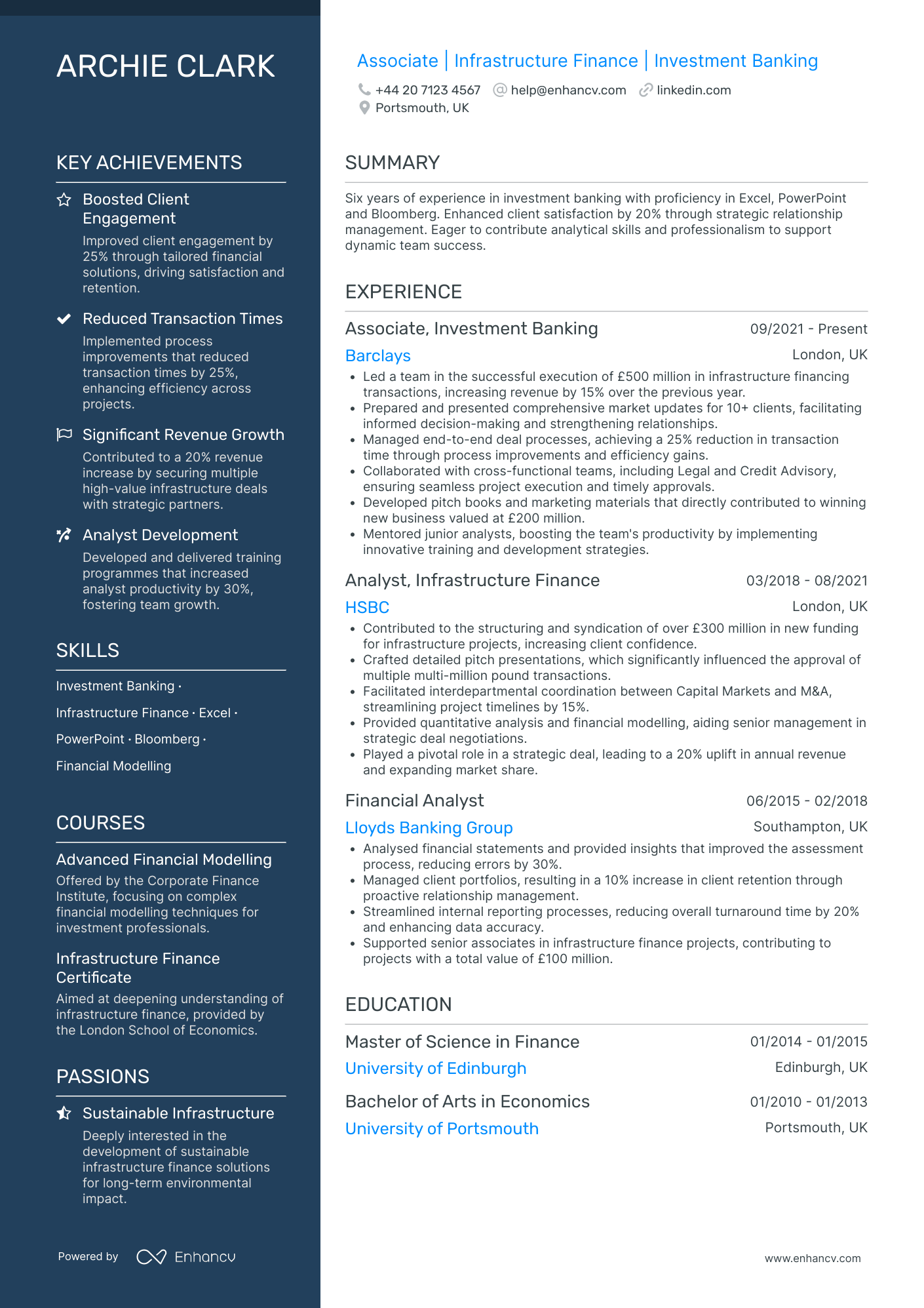

Investment Banking Analyst in Debt Capital Markets

- Clarity and Conciseness in Presentation - Archie's CV stands out for its well-structured format, where each section is clear and concise, making it easy for recruiters to follow his career progression and understand his qualifications. The bullet points succinctly convey achievements and responsibilities, ensuring the content is impactful without being overwhelming.

- Career Trajectory and Growth - The CV highlights a strong career trajectory from a Financial Analyst at Lloyds Banking Group to an Associate at Barclays, underscoring promotions and increased responsibilities. This advancement showcases Archie's growing expertise and leadership in infrastructure finance, reflecting a deliberate and successful career path in investment banking.

- Impactful Achievements - Archie’s achievements are not just numerical but convey significant business relevance, such as leading £500 million in infrastructure financing transactions and implementing process improvements that reduced transaction times by 25%. These points underscore the substantial impact he has had on organisational success, bolstering his credibility as a skilled finance professional.

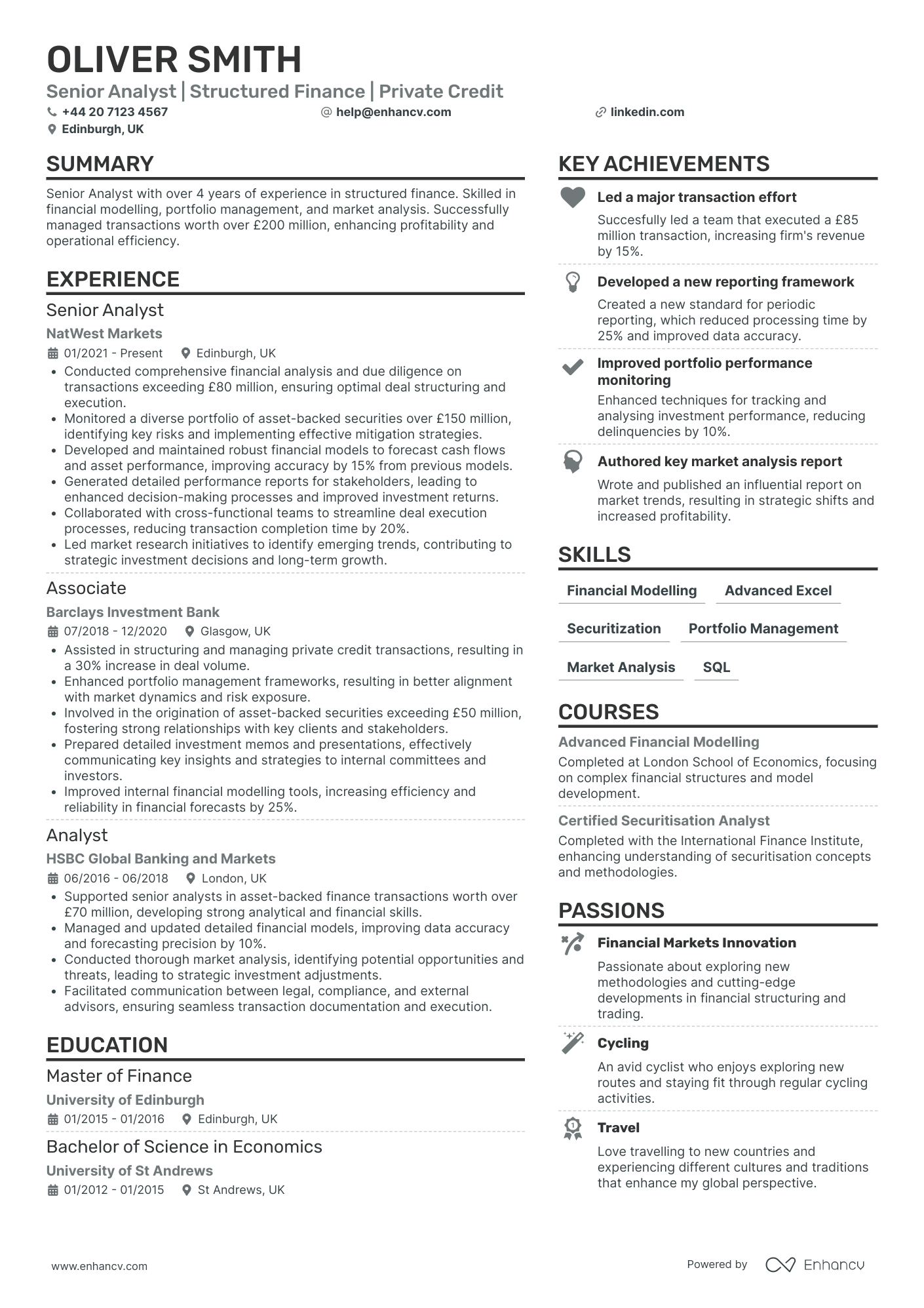

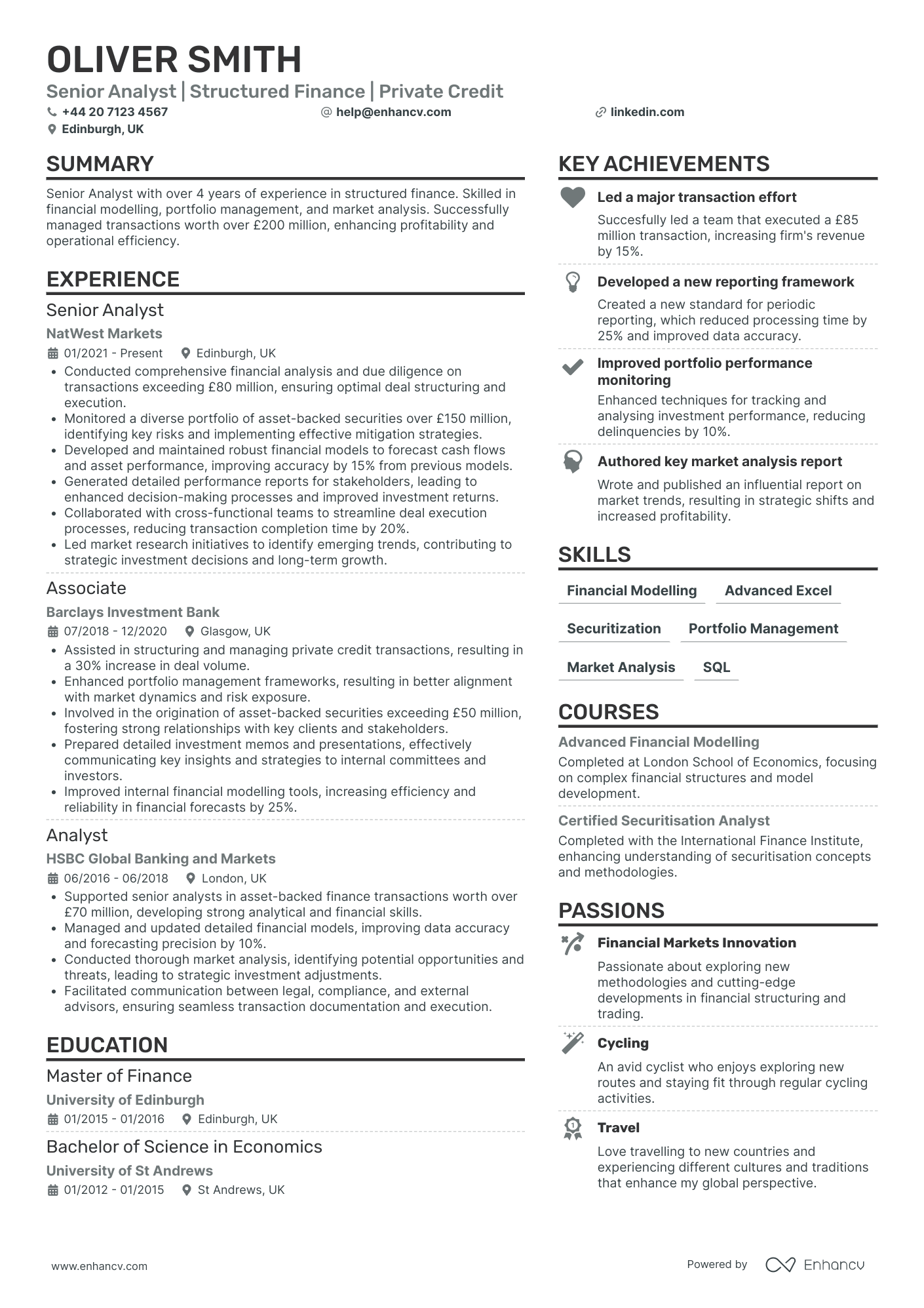

Investment Banking Analyst in Structured Finance

- Structured and concise content presentation - The CV is adeptly organized with clear sections for each aspect of the candidate's professional background, ensuring that information is easily digestible. Contributions and job responsibilities are succinctly bullet-pointed, allowing for quick and efficient navigation.

- Demonstrates a clear and progressive career trajectory - Oliver Smith’s career shows a steady progression through reputable companies in investment banking and structured finance. Each role displays an increase in responsibility and complexity, clearly indicating his growth and rising expertise in the field.

- Highlights specialized industry tools and methodologies - The CV stands out with its focus on technical skills and industry-specific capabilities. It lists advanced competencies in financial modelling, securitization, and cash flow analysis, while also demonstrating proficiency in SQL, Python, and VBA, which are critical for a data-driven financial role.

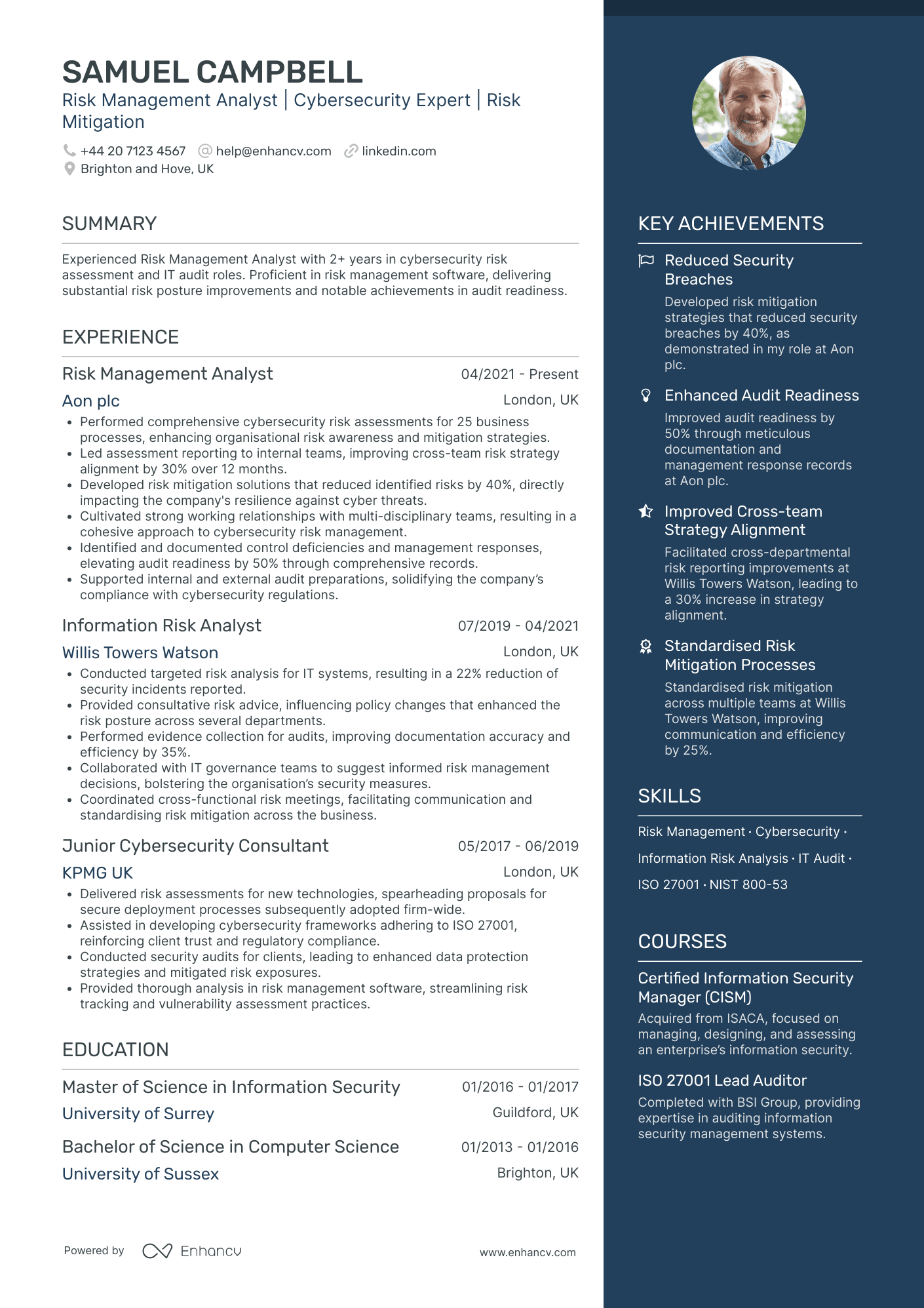

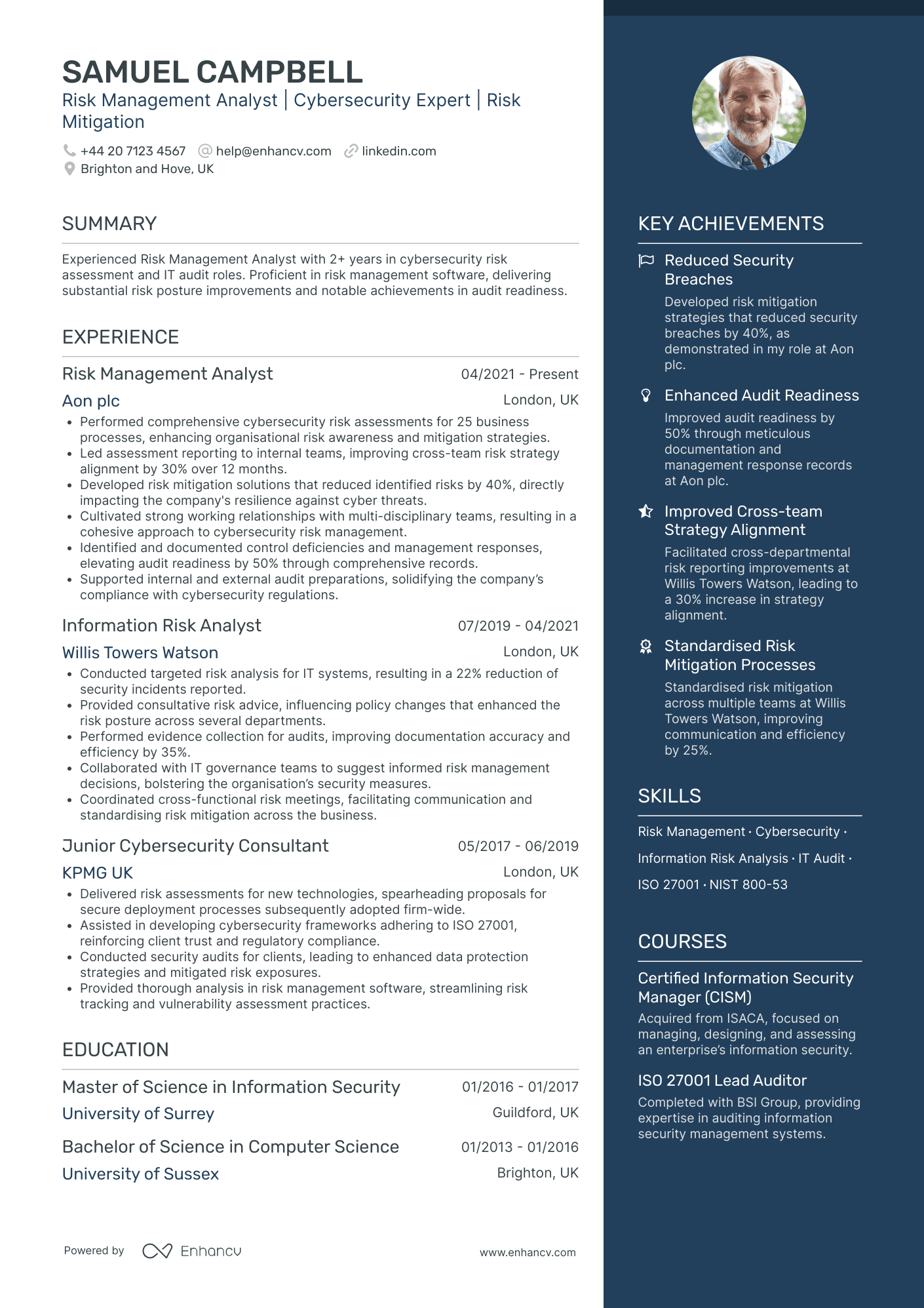

Investment Banking Analyst in Risk Management

- Efficient Content Presentation - The CV is structured with clear sections, ensuring that each aspect of Samuel Campbell's professional life is highlighted systematically. The concise bullet points within the experience section effectively convey key accomplishments and responsibilities, allowing for easy readability and quick comprehension, which is critical for hiring managers who receive numerous applications.

- Comprehensive Career Trajectory - Spanning several years and including roles at top-tier companies like Aon plc and KPMG UK, Samuel's career exhibits a clear growth pattern from a Junior Cybersecurity Consultant to a Risk Management Analyst. This progression highlights a strong capability to adapt and climb the career ladder within the cybersecurity and risk management domains, demonstrating a focus on specialization and expertise development.

- Impactful Achievements with Business Relevance - Samuel's CV effectively ties achievements to business outcomes, such as the 40% reduction in security breaches and a 50% increase in audit readiness. These metrics demonstrate not just technical prowess but also the ability to translate skills into tangible business enhancements, showcasing his strategic impact on organizational resilience and compliance.

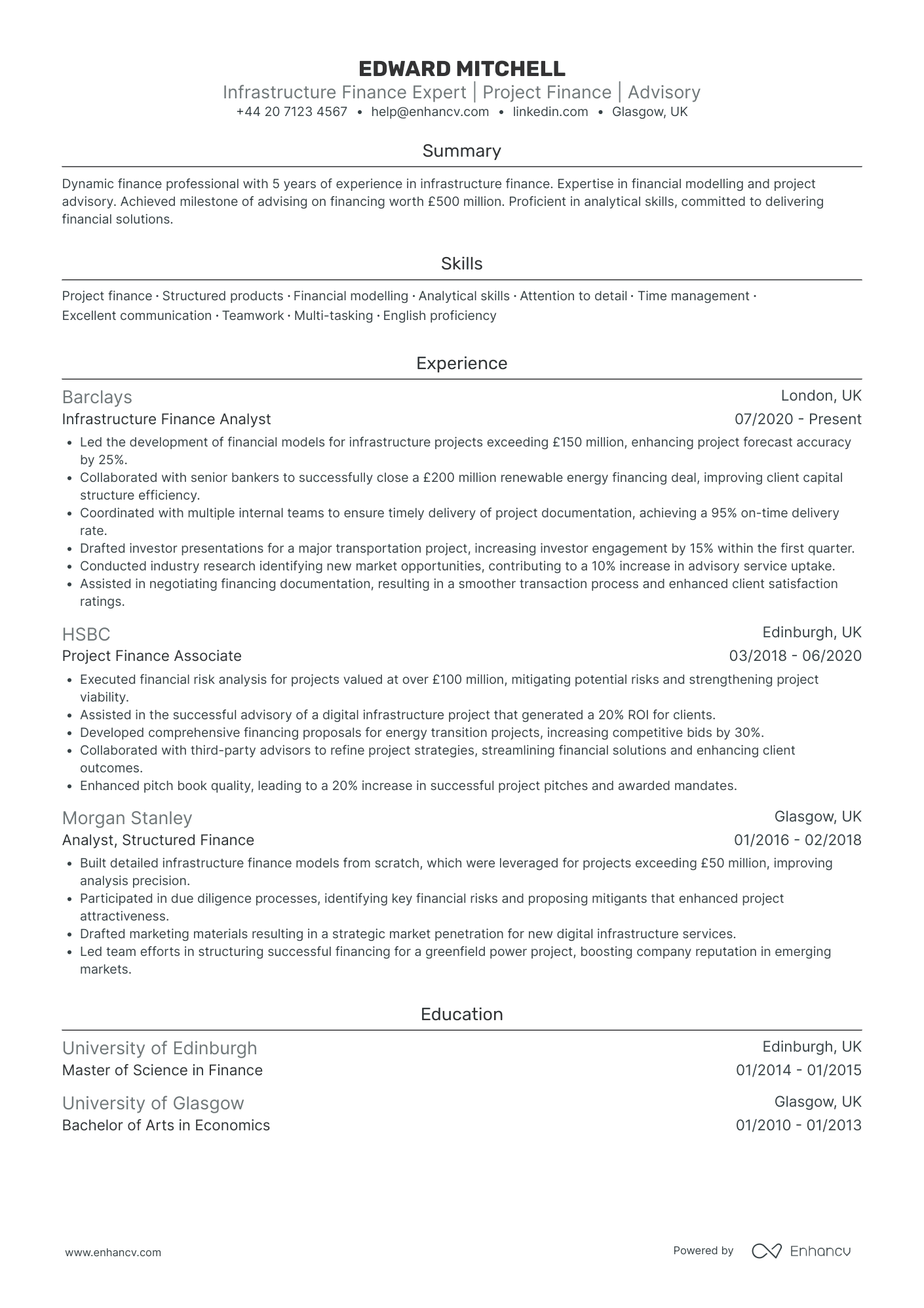

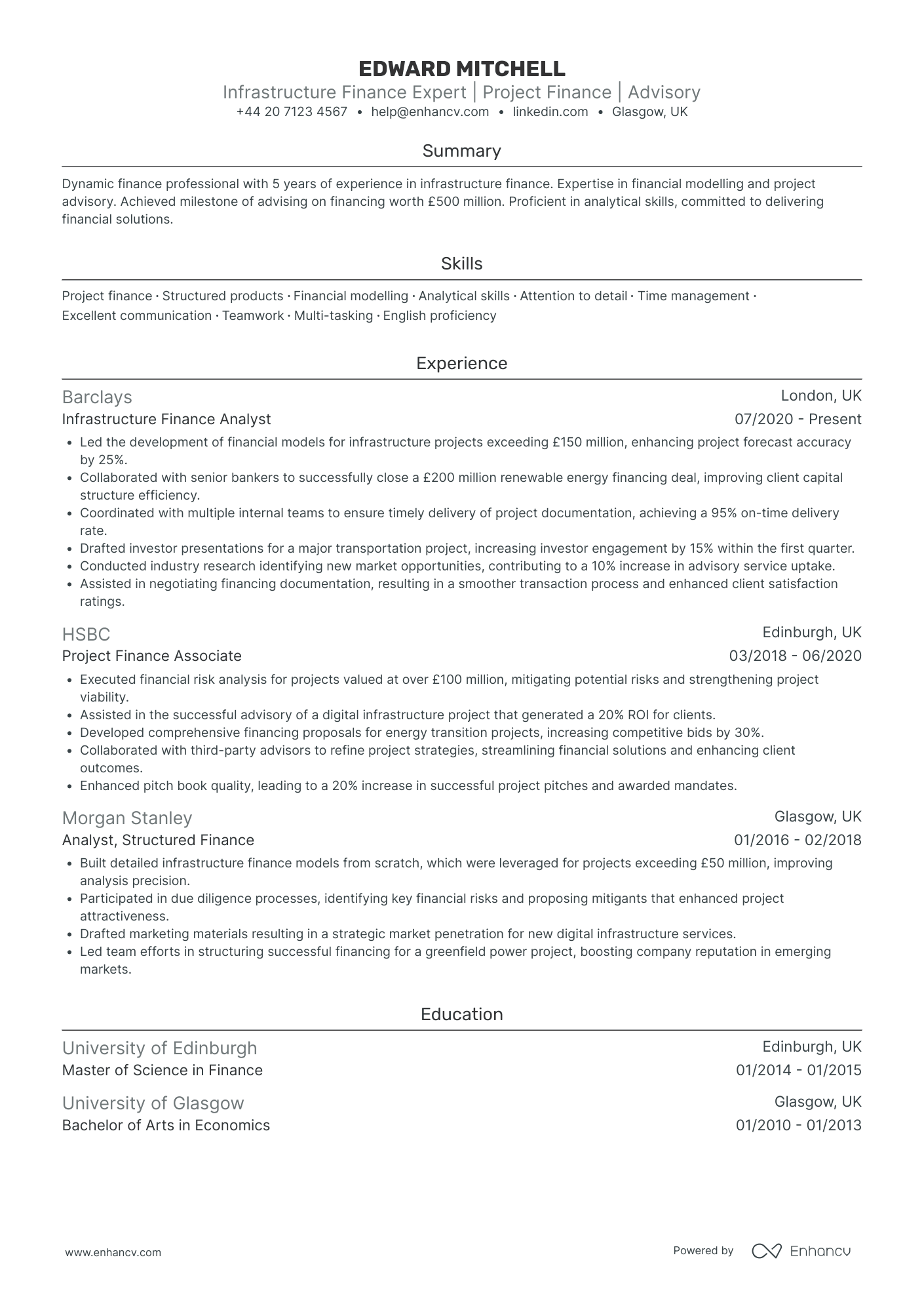

Investment Banking Analyst in Sales and Trading

- Clear and Structured Content Presentation - Edward Mitchell's CV presents information in a clear, concise manner, making it easy to follow his career journey. Each section flows logically, with well-organized bullet points that highlight key responsibilities and achievements. The use of quantifiable data in the experience section enhances understanding and impact.

- Impressive Career Trajectory in Finance - From starting as an Analyst in Structured Finance to becoming an Infrastructure Finance Analyst at Barclays, Edward's career progression showcases growth and adaptability within the finance industry. His shifts between prominent institutions like Morgan Stanley and HSBC demonstrate exposure to diverse financial environments and roles.

- Industry-Specific Technical Expertise - Edward's proficiency in financial modelling and structured finance reflects strong technical skills crucial for the infrastructure finance domain. His ability to lead complex financial model developments and coordinate large-scale financing deals underscores a depth of expertise valuable to project finance and advisory roles.

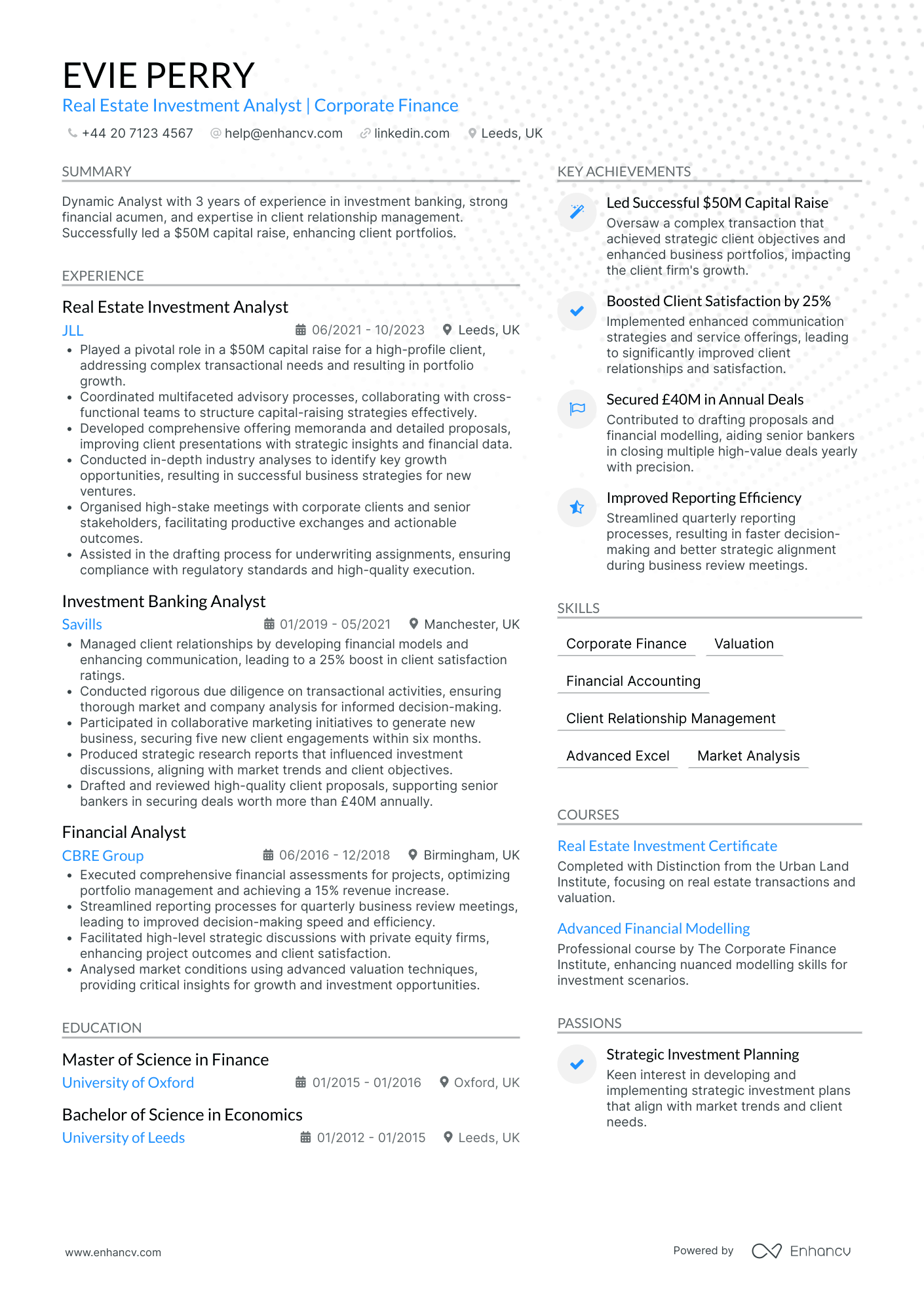

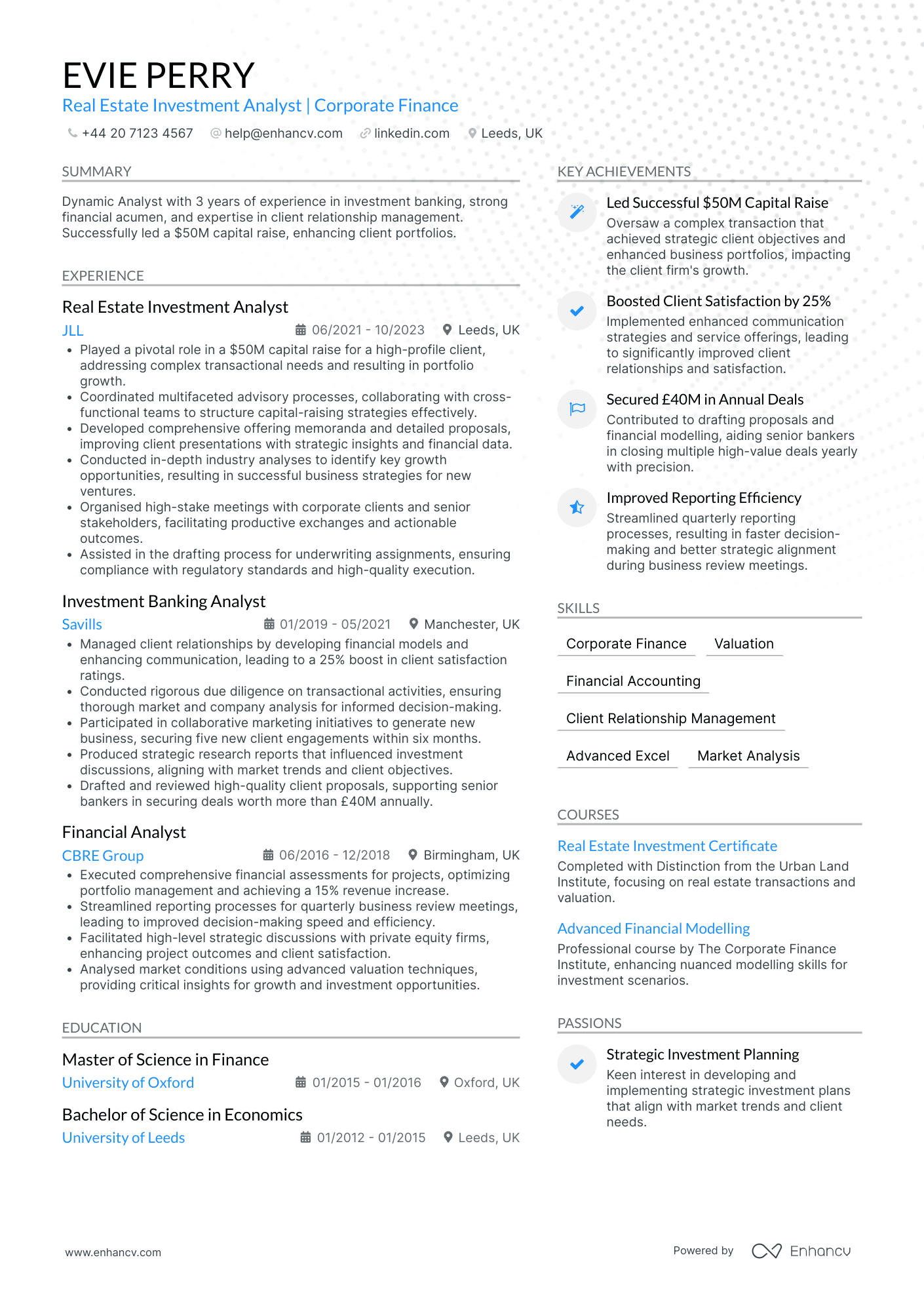

Investment Banking Analyst in Real Estate

- Structured progression in real estate and finance - The CV clearly illustrates a strategic career trajectory through progressive roles in the real estate investment and corporate finance sectors. It highlights Evie's advancements from Financial Analyst roles to high-impact positions as an Investment Banking Analyst and finally a Real Estate Investment Analyst, signaling growth in responsibility and expertise in increasingly complex financial environments.

- Interdisciplinary knowledge and adaptability - Evie demonstrates significant cross-functional experience by working across various teams and industries, effectively coordinating multifaceted capital-raising strategies and addressing complex transactional needs. This adaptability signals a strong capability to thrive in diverse settings, leveraging skills in both real estate and broader investment banking contexts.

- Impactful achievements with client-centric focus - Key achievements in the CV emphasize Evie's direct contributions to business growth, such as leading a $50M capital raise and boosting client satisfaction by 25%. These accomplishments not only reflect her analytical prowess but also her ability to enhance client relationships and deliver substantial business value.

Investment Banking Analyst in Financial Institutions Group

- Clarity and Structure in Content Presentation - The CV is meticulously organized, providing a clear and concise overview of the candidate's experience and skills. Sections are well-defined, making it easy to identify key elements such as work history, education, and achievements. Descriptions are succinct, highlighting only the most relevant details that synergize well with the role of an Investment Banking Analyst.

- Progressive Career Trajectory - Oscar Evans showcases a well-defined career progression, indicative of upward mobility within the investment banking sector. Starting as a Finance Associate and advancing to a position with Goldman Sachs demonstrates both growth in expertise and recognition within prestigious firms. This trajectory underlines a strong work ethic and commitment to the field.

- Achievements with Significant Business Impact - Each role includes quantifiable achievements that highlight tangible business outcomes, such as achieving a 30% improvement in client acquisition rates and increasing revenue by 15% through capital raising initiatives. These accomplishments reflect a strong capability to drive strategic results and add value to the organization.

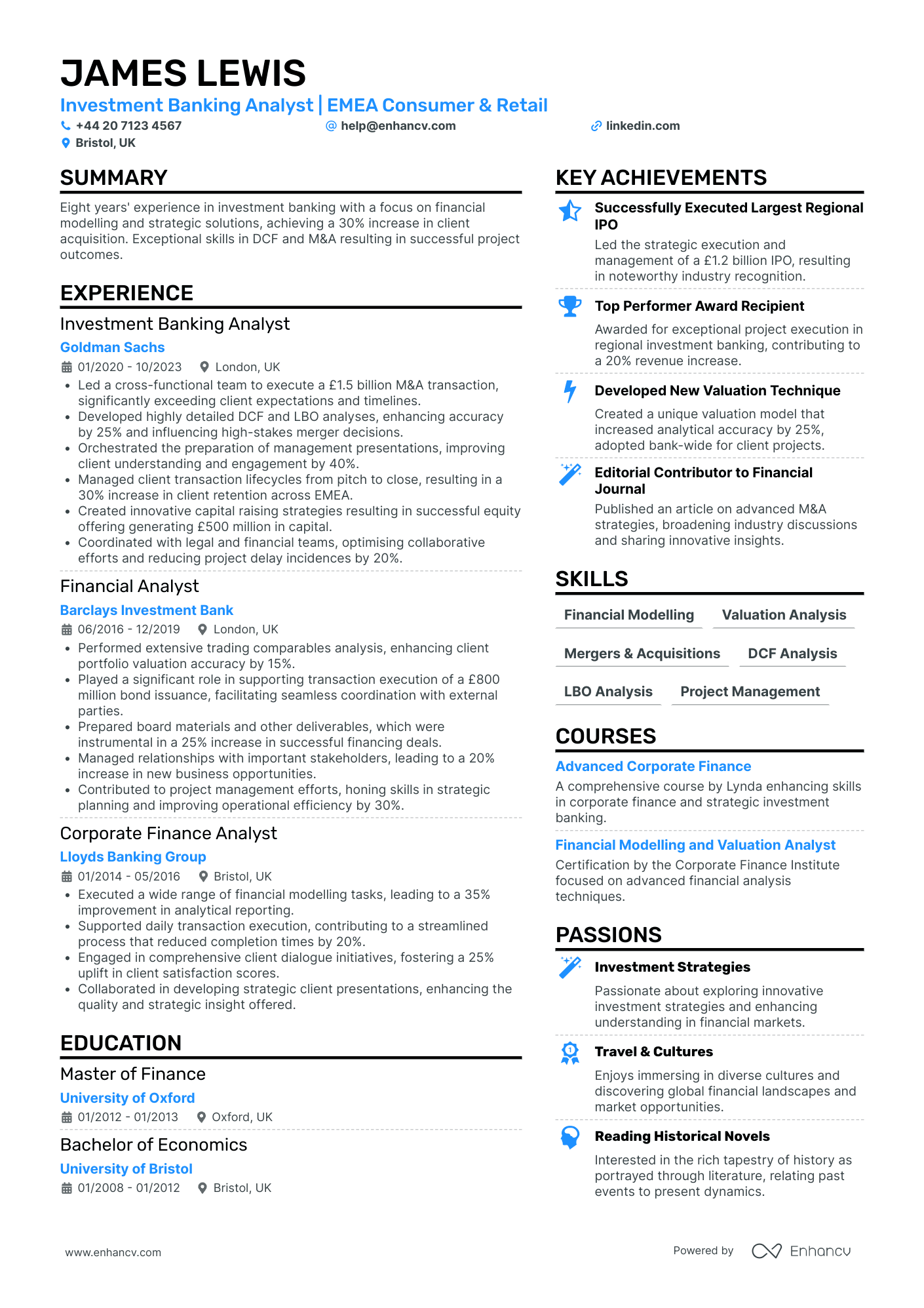

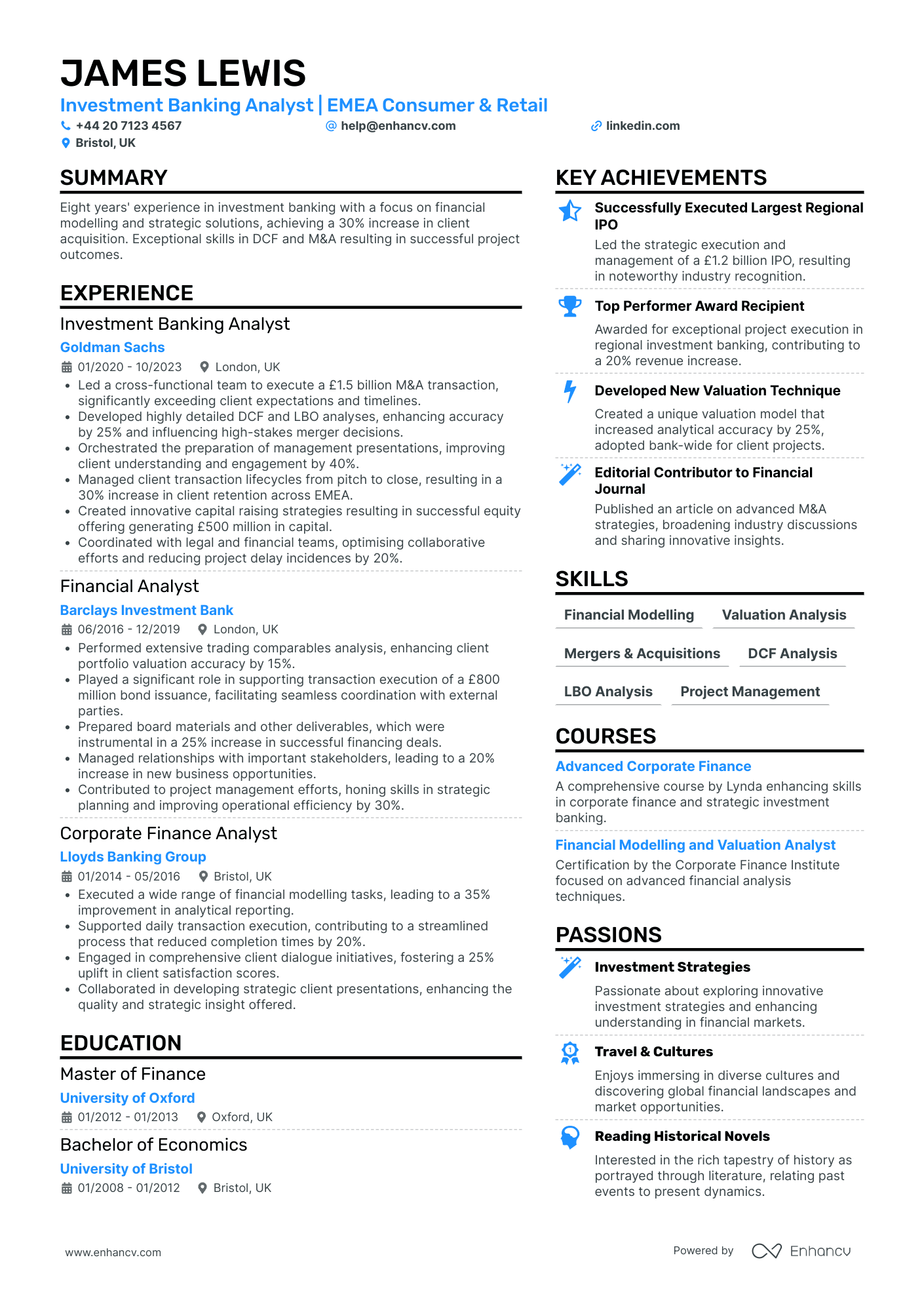

Investment Banking Analyst in Consumer Retail

- Strong Career Growth and Industry Focus - The CV showcases James Lewis's solid trajectory within investment banking, highlighting his rise from a Corporate Finance Analyst at Lloyds Banking Group to an Investment Banking Analyst at Goldman Sachs. Each role demonstrates progression in responsibilities and the significant projects he led, reflecting a deepening expertise in the consumer and retail sectors across EMEA.

- High-Impact Achievements with Quantified Business Results - Notable accomplishments are emphasized with precise figures, underscoring James's influence on organizational success. He not only led a £1.5 billion M&A transaction but also created a custom valuation model bank-wide. Such achievements reflect his capacity to pioneer impactful solutions, bolstering revenue and operational efficiencies and achieving prestigious accolades like the Top Performer Award.

- Adaptability and Cross-functional Expertise - James demonstrates versatility through his seamless transition to various roles that demand coordination with legal teams, strategic capital raising, and stakeholder management. Evidently thriving in cross-functional environments, he enhances collaboration while mitigating project delays, indicative of his adaptable nature and ability to thrive in dynamic settings.

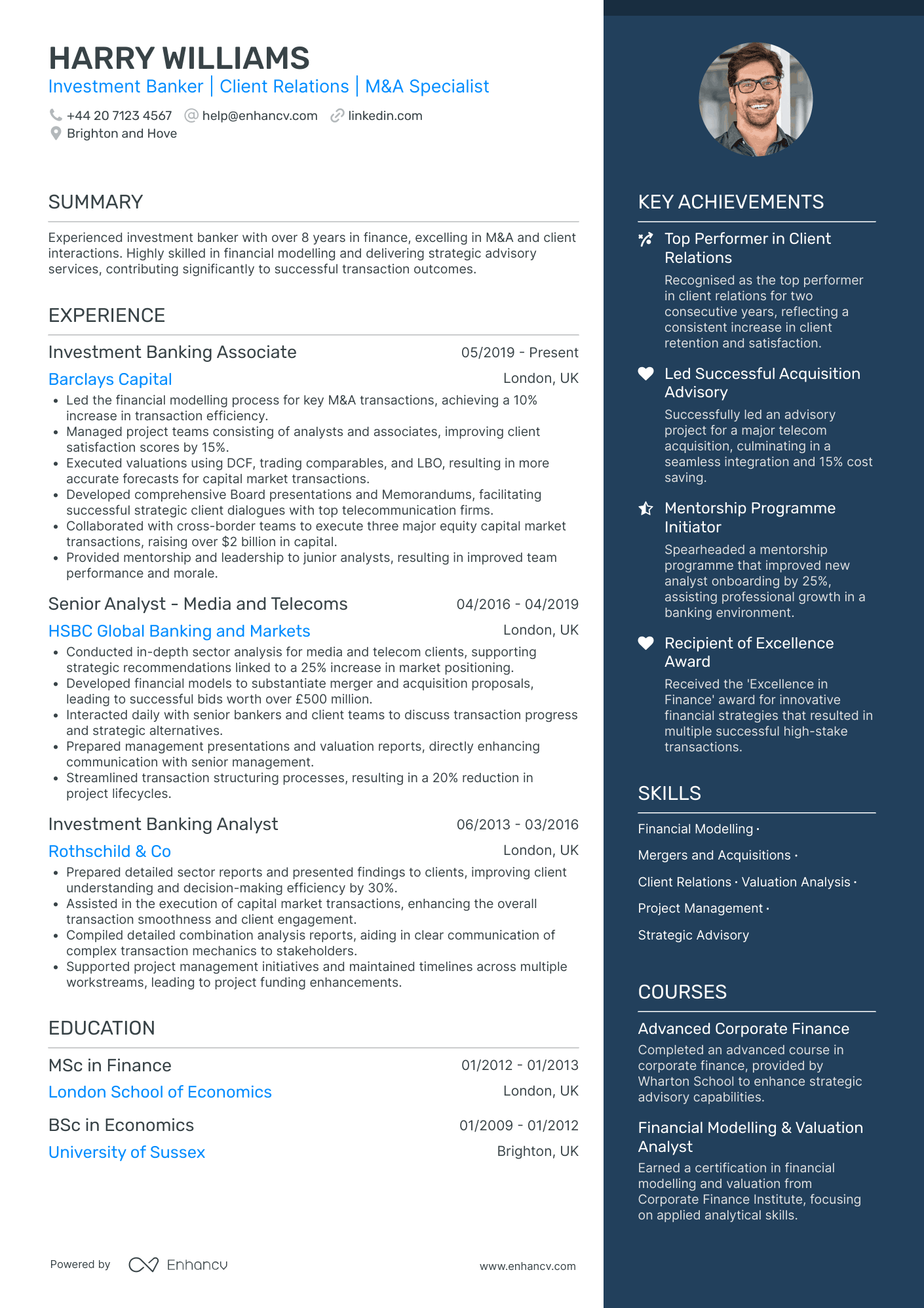

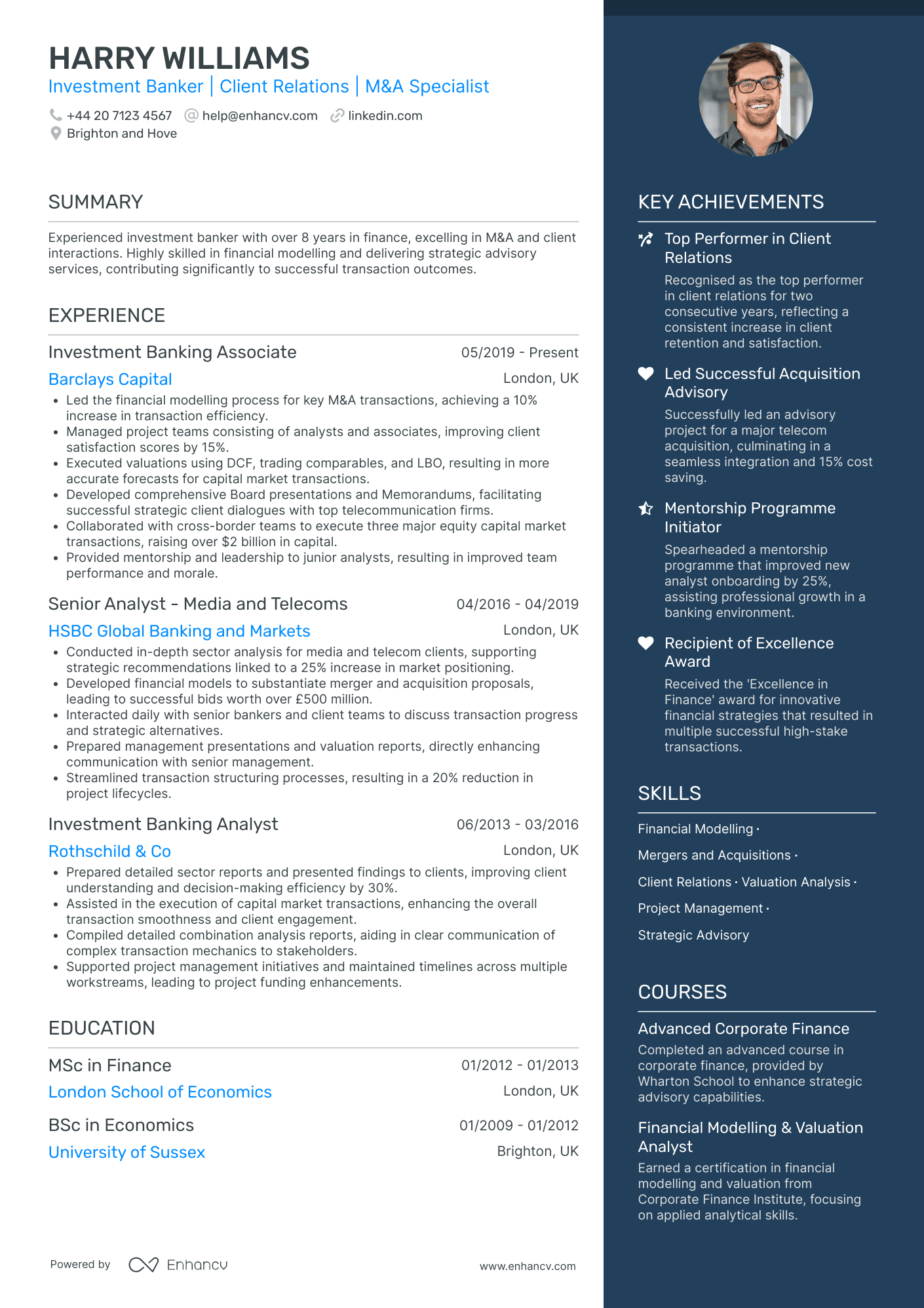

Investment Banking Analyst in Technology, Media, and Telecom

- Comprehensive Career Progression - The CV effectively narrates Harry Williams' career journey, showcasing a clear upward trajectory from an Investment Banking Analyst to an Associate at Barclays Capital. This progression highlights his ability to handle increasing responsibilities and evolve within the investment banking industry.

- Depth in M&A Expertise - Harry's background is particularly strong in mergers and acquisitions, reflected in the technical depth and industry-specific elements such as financial modeling, valuation techniques, and strategic advisory services. His contributions to successful transactions and capital market initiatives demonstrate a solid command of M&A strategies.

- Diverse Industry Engagement and Cross-Border Experience - With experience in media, telecom, and other sectors, Harry shows adaptability and cross-functional expertise. His collaborative projects with cross-border teams on significant equity capital market transactions underscore his ability to work effectively in global settings.

Investment Banking Analyst in Healthcare

- Comprehensive Structure and Clear Presentation - The CV is well-organized, with distinct sections for experience, education, skills, and achievements, allowing for easy navigation and understanding of the candidate's career path. Each section is concisely written, highlighting only the most critical points that are directly related to the financial analyst role in the healthcare sector.

- Solid Career Progression in Healthcare Finance - The CV reflects a clear trajectory of growth from a Junior Analyst at Pfizer to a Senior Financial Analyst at GlaxoSmithKline. This progression demonstrates the candidate's ability to adapt and excel in increasingly challenging roles, illustrating a deepening involvement in complex financial analyses and strategic advisories within the healthcare industry.

- Impactful Achievements with Business Relevance - The CV lists specific, quantifiable achievements that underscore the candidate's contributions to significant business decisions, such as leading the analysis for mergers worth over £200 million, improving compliance adherence by 25%, and boosting departmental efficiency by 30%. These accomplishments highlight their role in driving revenue growth and enhancing operational efficiency.

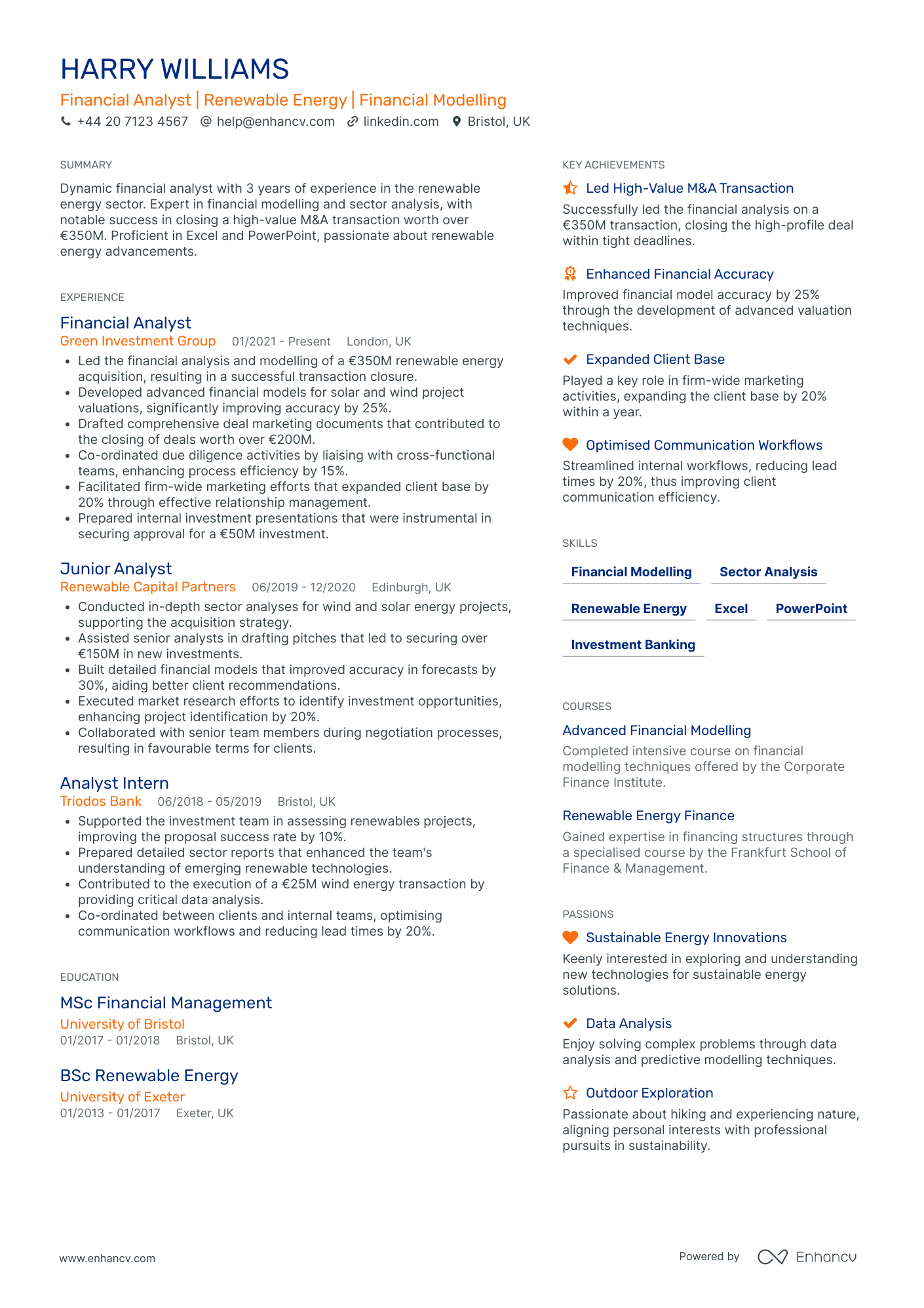

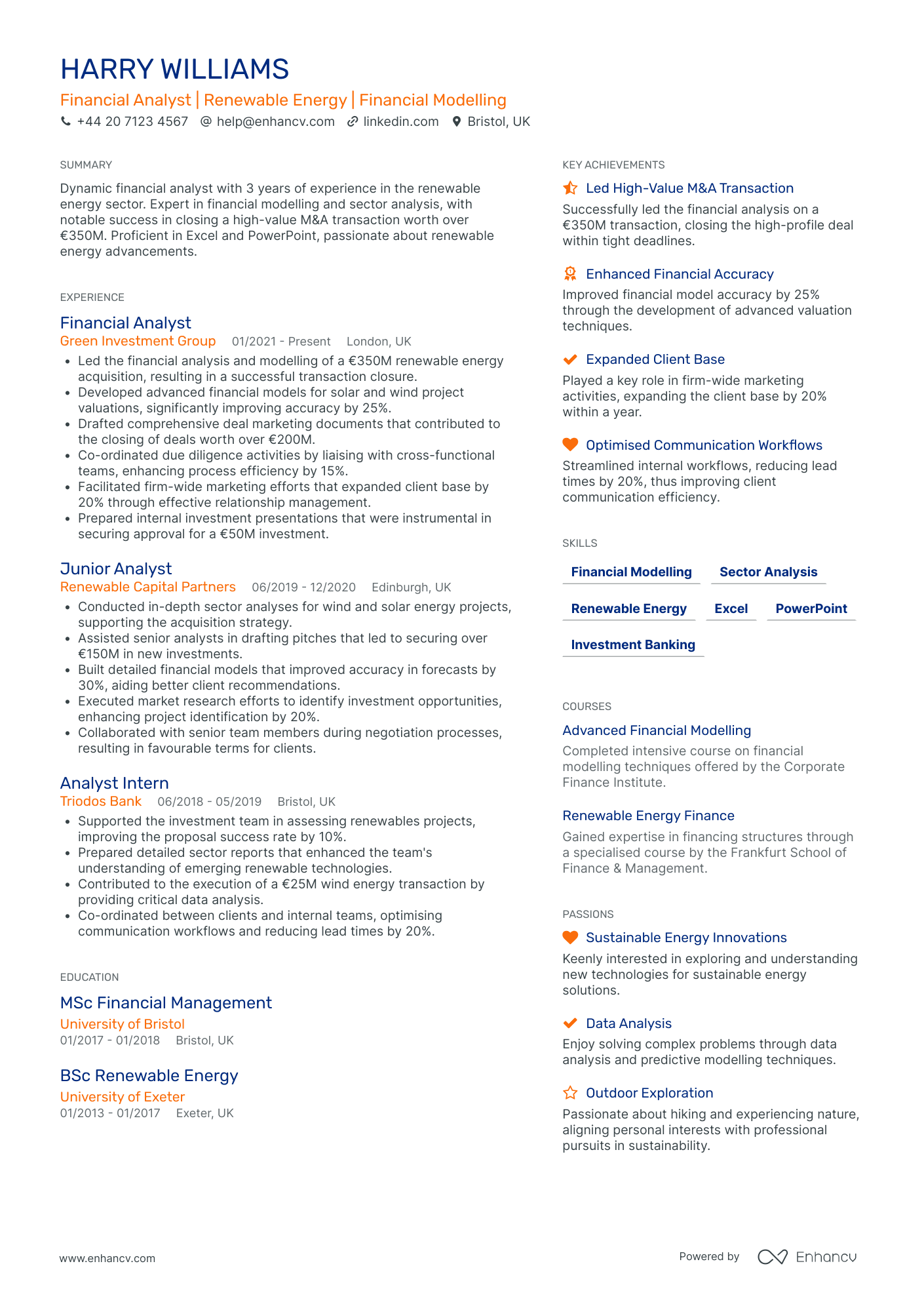

Investment Banking Analyst in Energy

- Clear and structured content presentation - The CV effectively uses clear and concise language to present Harry Williams' qualifications. Each section is well-organized, with lists that offer easy readability, ensuring key achievements and experiences stand out. The logical flow from experience to education to skills makes it easy for readers to quickly grasp the candidate's capabilities.

- Demonstrates a strong career trajectory in renewable energy finance - Harry's career progression from an Analyst Intern to a Financial Analyst shows significant growth, especially with an impressive role at Green Investment Group. His trajectory highlights increased responsibilities and impact, indicating readiness for more complex roles within the financial sector of the renewable energy industry.

- Showcases industry-specific methodologies and technical depth - The emphasis on financial modelling, sector analysis, and M&A strategy within the renewable energy sector highlights Harry's technical depth. His expertise in using tools like Excel and PowerPoint for financial presentations and model accuracy improvements demonstrates his capability in handling specialized financial roles in this niche industry.

Investment Banking Analyst in Infrastructure

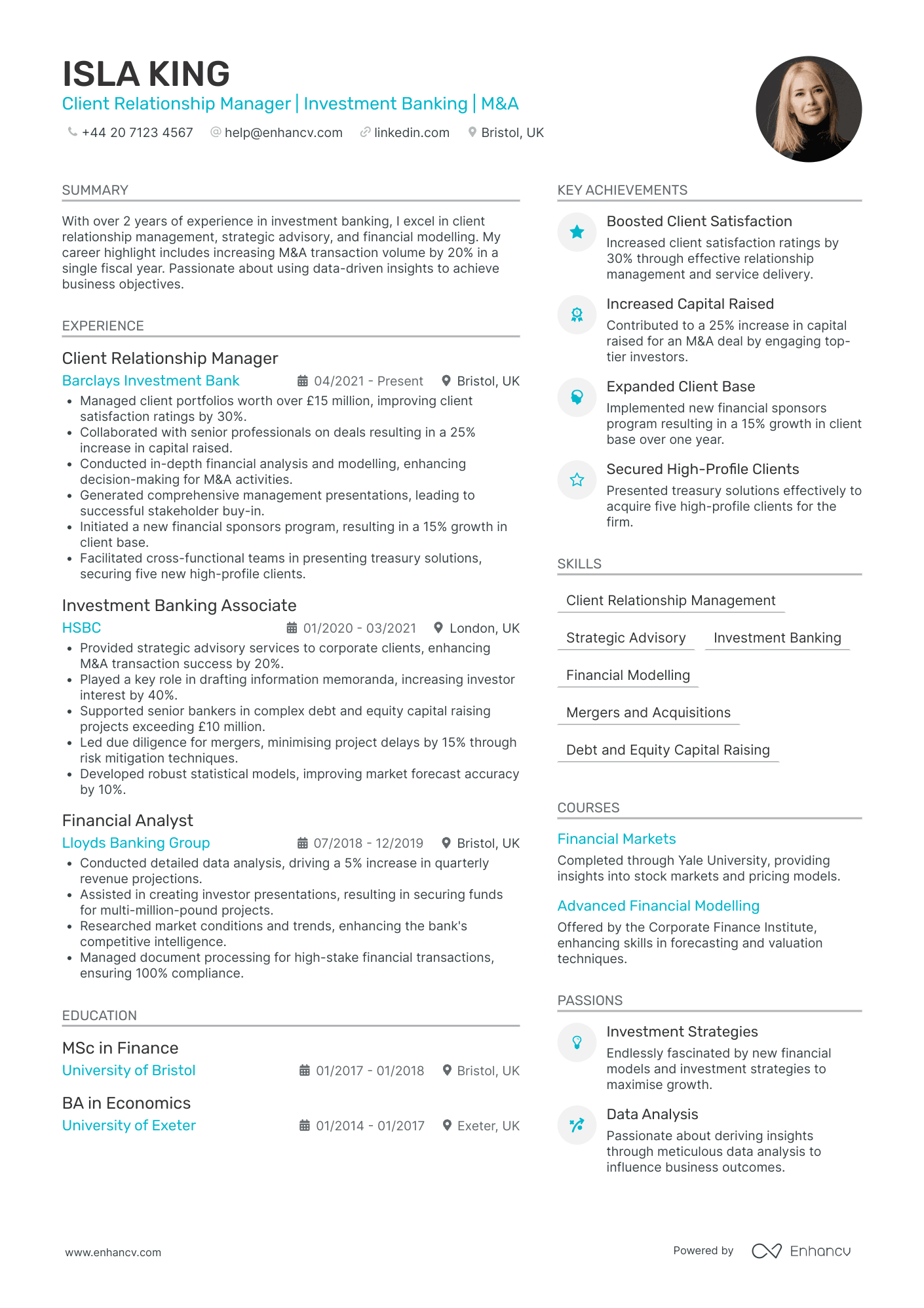

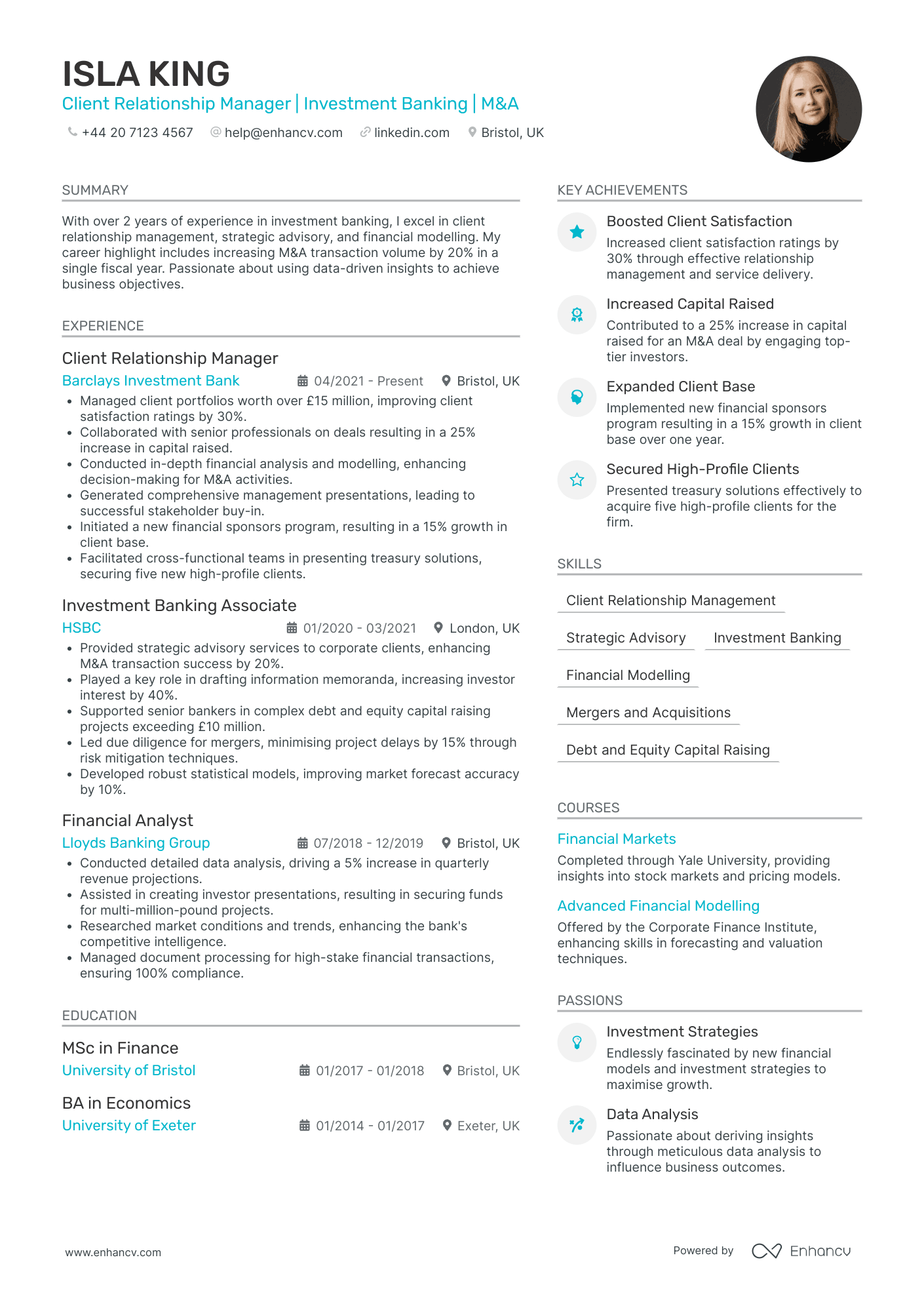

- Clarity and Structured Presentation - The CV is exceptionally well-organized, boasting clear sections that outline Isla King's qualifications, experience, education, and skills. Information flows logically, starting with a concise summary before delving into extensive professional achievements, ensuring a smooth reading experience for hiring managers focusing on investment banking and M&A roles.

- Diverse and Progressive Career Path - Isla King demonstrates significant growth within the financial industry, transitioning from a Financial Analyst to a Client Relationship Manager. Her career trajectory indicates a consistent upward progression, highlighting advanced expertise in managing high-value portfolios, exemplifying adaptability and a strong commitment to professional development in investment banking.

- Impact-Driven Achievements - The CV effectively emphasizes Isla's achievements, illustrating her ability to drive substantial business results. Notably, she has been instrumental in increasing M&A transaction volume by 20%, improving client satisfaction by 30%, and expanding the client base by 15%. These accomplishments underscore her capacity for generating positive impacts and delivering tangible benefits in her roles.

Investment Banking Analyst in Industrials

- Clearly Structured with Strong Sections - Edward Mitchell's CV is well-organized, featuring sections such as professional summary, experience, education, skills, and achievements, all laid out effectively. This structure makes it easy to navigate and highlights his core competencies immediately, particularly useful for roles within financial analysis and M&A advisory.

- Demonstrates Strategic Career Growth - The career trajectory presented in the CV showcases a clear path of growth from a Junior Analyst to a Senior Financial Analyst at prestigious institutions. Each role builds upon the previous one, highlighting promotions and increased responsibility that reflect his expertise and dedication within the investment banking sector.

- Exceptional Depth in Financial Tools and Methodologies - The CV highlights Edward's advanced skills in financial modeling, Excel, and PowerPoint. His hands-on experience with valuation strategies and real-time data analytics demonstrates his technical proficiency and ability to leverage industry-specific tools for impactful M&A strategy execution, relevant to the financial domain.

Investment Banking Analyst in Natural Resources

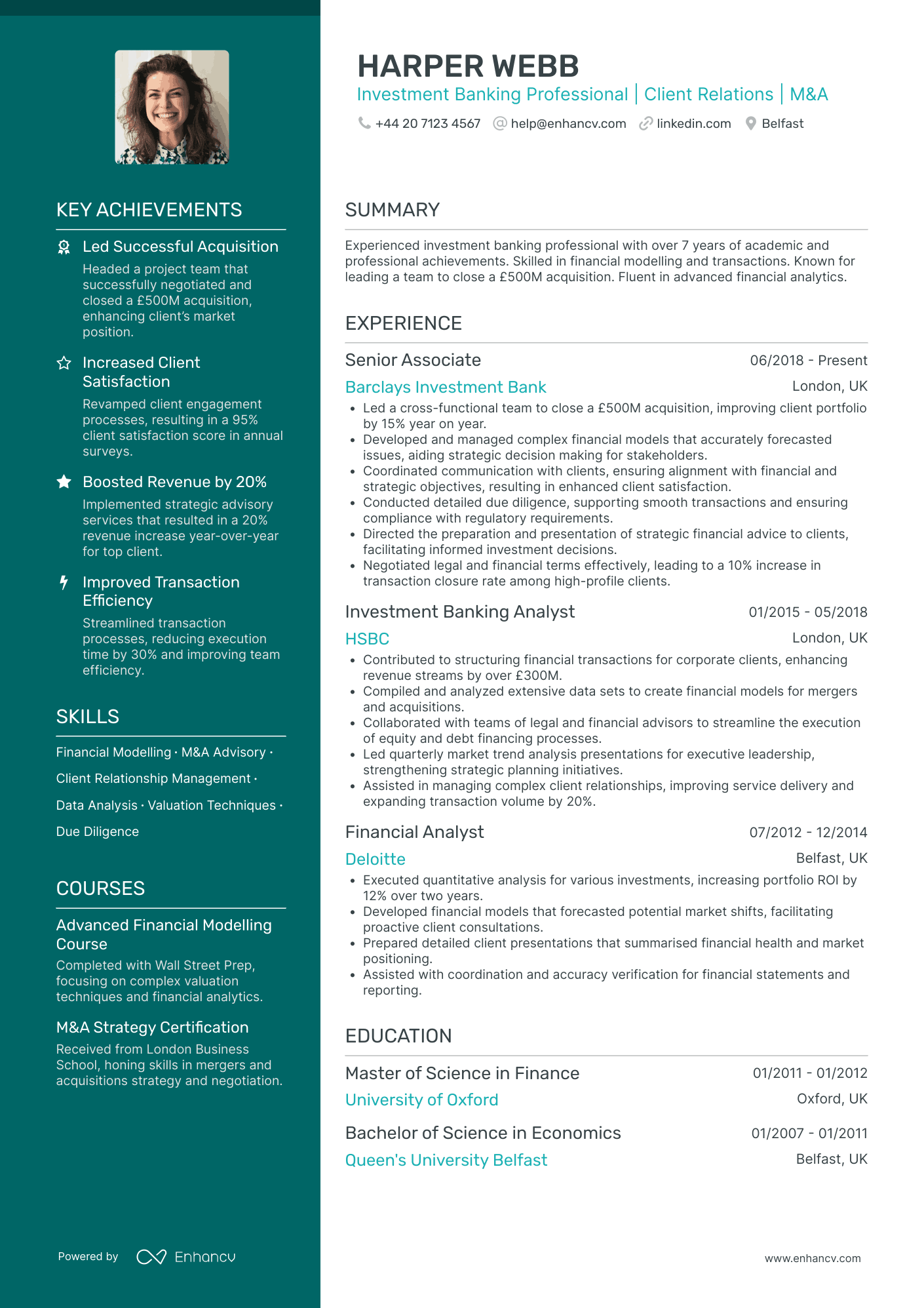

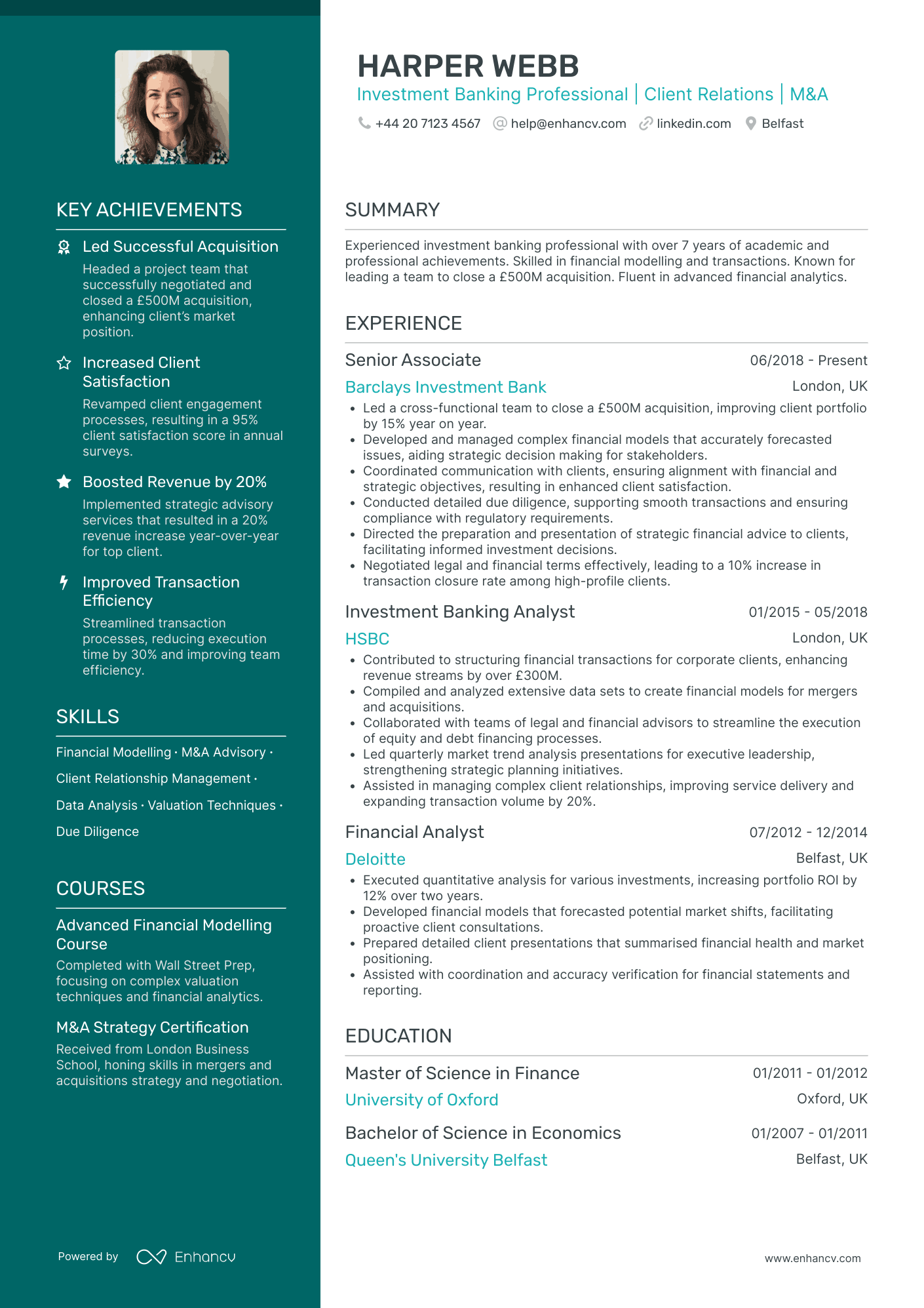

- Clear and Structured Presentation - The CV is organized logically with distinct sections that include professional experience, education, and achievements, allowing for an accessible and straightforward review. Each section is concise, listing only the most pertinent details which are clearly linked to the role in investment banking, ensuring a clutter-free presentation of Harper Webb's professional narrative.

- Impressive Career Growth and Trajectory - Harper Webb's career trajectory demonstrates a clear progression through increasingly responsible roles, from a Financial Analyst at Deloitte to a Senior Associate at Barclays Investment Bank. The timeline signifies consistent growth within the investment banking sector, highlighting his capability to ascend in highly competitive environments, where he has gained significant expertise in client relations and M&A.

- Strategic Achievements with Business Relevance - The CV places a strong emphasis on achievements that are not just numeric but underscore their impact on business outcomes. Notably, Harper's leadership in closing a £500M acquisition and improving transaction processes showcases his ability to deliver strategic value and enhanced client service, reinforcing his role as a key influencer in client relations and corporate restructuring.

Investment Banking Analyst in Private Equity

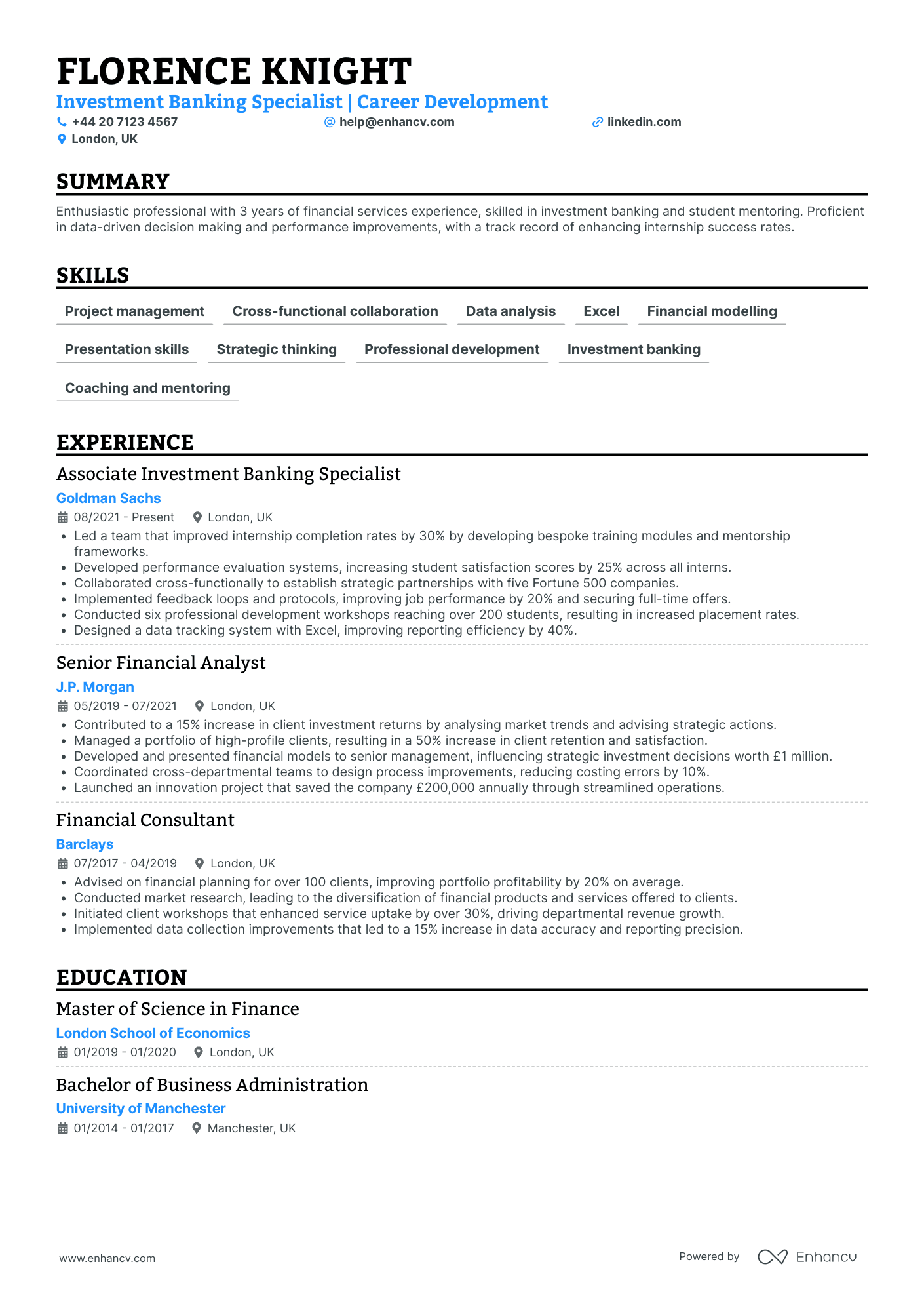

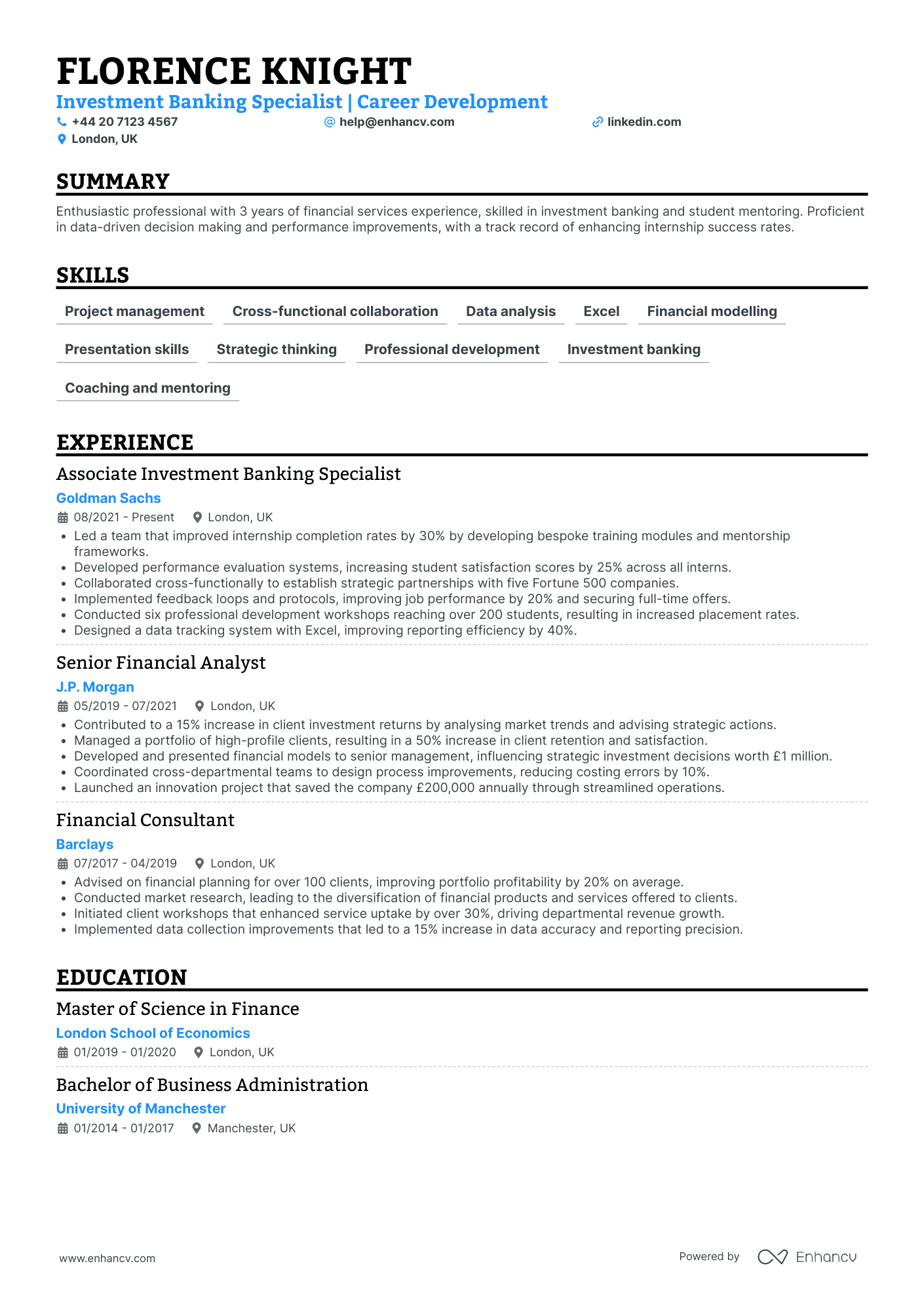

- Structured and Clear Presentation - The CV is well-organized, with clearly defined sections for experience, education, skills, and achievements. Each section is concise, allowing the reader to quickly gather key information about the candidate's background and accomplishments.

- Career Progression and Versatility - Florence's career trajectory shows significant growth and adaptability, starting as a Financial Consultant and advancing to an Associate Investment Banking Specialist. The roles cover varying domains within finance, demonstrating the ability to handle increased responsibilities and adapt to new challenges effectively.

- Strategic Impact and Business Relevance - Achievements highlight significant business impacts such as improving internship completion rates and saving the company substantial costs through innovation projects. These accomplishments not only reflect the candidate's competence but also their ability to drive strategic initiatives that contribute to the organization's success.

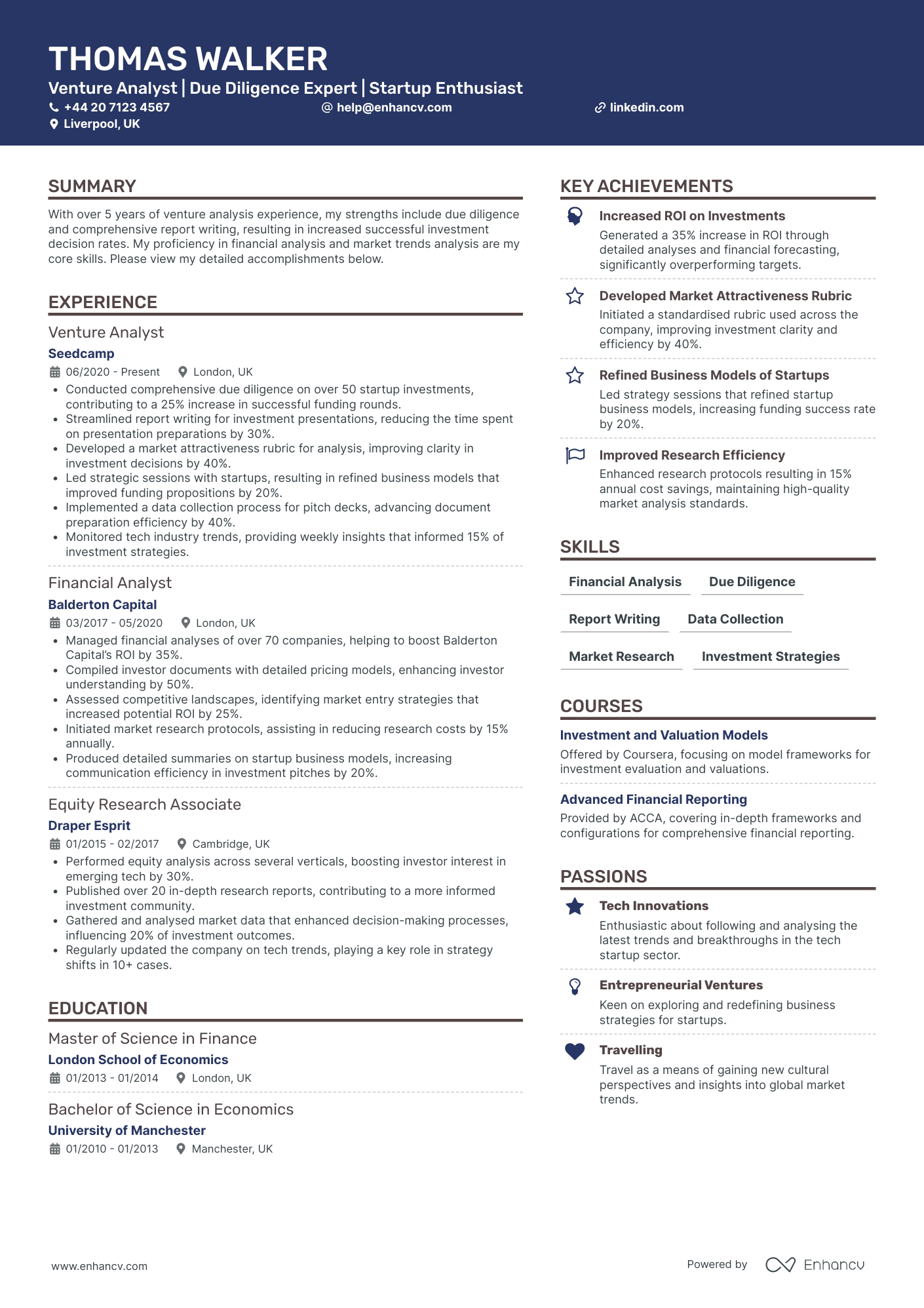

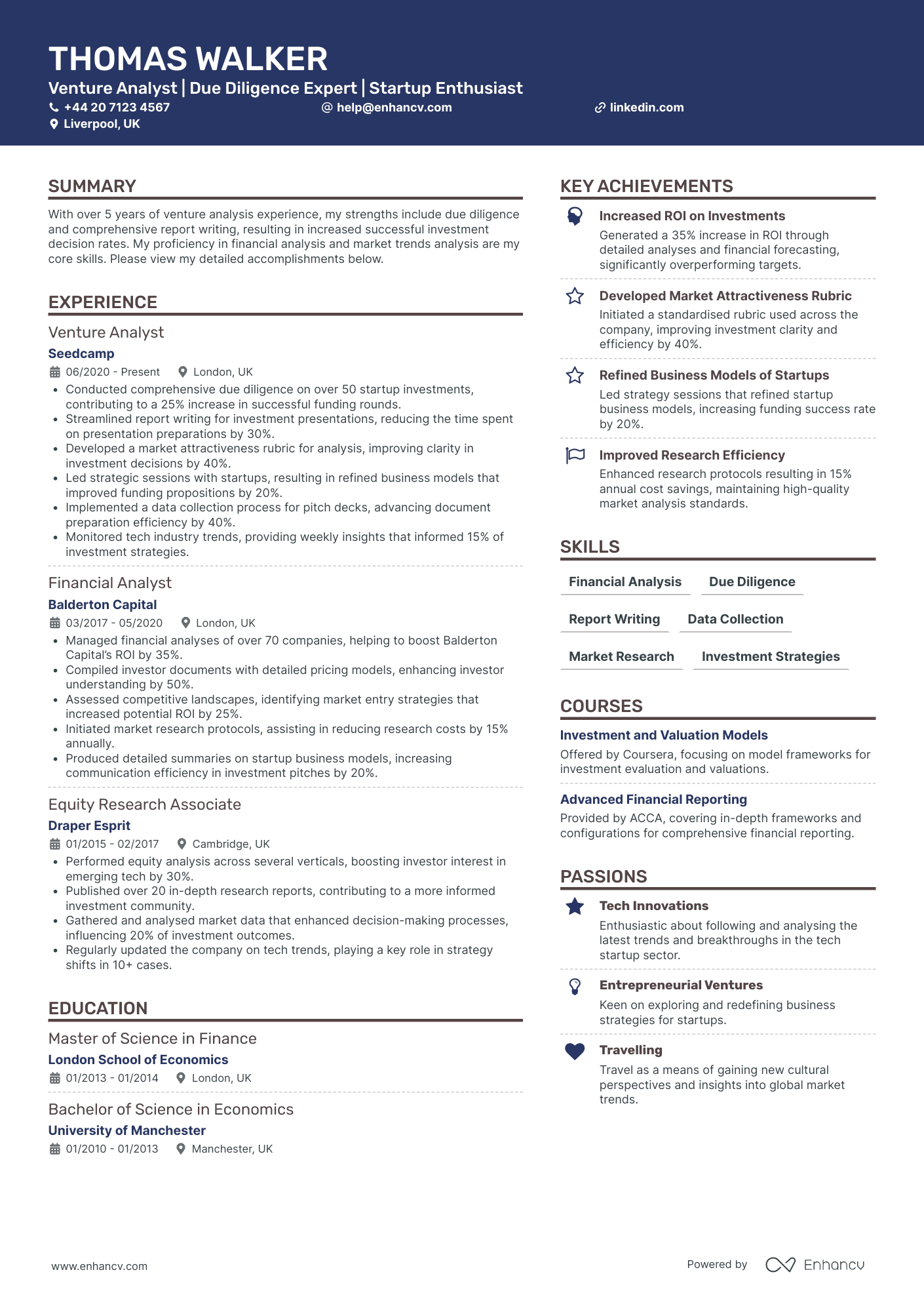

Investment Banking Analyst in Venture Capital

- Clear and Structured Content Presentation - The CV is meticulously organized, offering clarity and conciseness in its presentation. Each section is distinctly labeled, providing a comprehensive overview without overwhelming the reader. Important achievements and skills are highlighted with bullet points, making the information easy to digest and locate. The overall structure facilitates a seamless flow of information from personal details to professional experiences and education, aiding in quick understanding.

- Impressive Career Trajectory and Growth - Thomas Walker's career progression demonstrates a clear upward trajectory in the field of financial analysis and venture capital. Starting as an Equity Research Associate and advancing to a Venture Analyst role, his career path shows a solid foundation in financial skills and a subsequent focus on due diligence and investment analysis. The consistent growth in responsibilities and more complex tasks reflects his dedication and ability to excel in the venture capital industry.

- Industry-Specific Tools and Methodologies - The CV effectively highlights unique industry-specific elements that Thomas brings to the table, such as a market attractiveness rubric and innovative data collection processes for pitch decks. These tools and methodologies indicate a deep understanding of the venture analysis field and showcase his ability to enhance decision-making and document preparation. Additionally, his focus on tech industry trends further underscores his technical depth and ability to leverage market insights strategically.

Structuring and formatting your investment banking analyst CV for an excellent first impression

The experts' best advice regarding your CV format is to keep it simple and concise. Recruiters assessing your CV are foremost looking out for candidates who match their ideal job profile. Your white space, borders, and margins. You may still be wondering which format you need to export your CV in. We recommend using the PDF one, as, upon being uploaded, it never alters your information or CV design. Before we move on to the actual content of your investment banking analyst CV, we'd like to remind you about the Applicant Tracker System (or the ATS). The ATS is a software that is sometimes used to initially assess your profile. Here's what you need to keep in mind about the ATS:

- All serif and sans-serif fonts (e.g. Rubik, Volkhov, Exo 2 etc.) are ATS-friendly;

- Many candidates invest in Arial and Times New Roman, so avoid these fonts if you want your application to stand out;

- Both single and double column CVs can be read by the ATS, so it's entirely up to you to select your CV design.

PRO TIP

Be mindful of white space; too much can make the CV look sparse, too little can make it look cluttered. Strive for a balance that makes the document easy on the eyes.

The top sections on a investment banking analyst CV

- Education details showing relevant degrees outlines the academic foundation necessary for the analyst role.

- Work experience in finance highlights direct industry exposure and relevant professional accomplishments.

- Technical skills with financial software demonstrate proficiency with tools essential in investment banking.

- Key transactions or deals worked on showcases practical experience and contribution to significant projects.

- Awards and honours specific to finance or banking underline recognised excellence and competitive distinction.

What recruiters value on your CV:

- Emphasise quantitative skills by showcasing your experience with financial modelling, valuation techniques, and proficiency in Excel and other financial software, as these skills are crucial for an investment banking analyst.

- Detail any previous internships or work experiences in finance, particularly in M&A, IPOs, or corporate finance, to demonstrate relevance and familiarity with investment banking operations.

- Highlight any deal or transaction experience, including the sizes and types of deals involved, since specifics can help illustrate your direct exposure to investment banking activities.

- Include educational background, such as a degree in finance, economics, or business, and mention any relevant courses taken, like corporate finance or investment analysis, to underscore your foundational knowledge.

- Point out soft skills like attention to detail, the ability to work under pressure, excellent communication and teamwork capabilities, as these are essential for an analyst to collaborate effectively with investment banking teams.

Recommended reads:

Tips and tricks on writing a job-winning investment banking analyst CV header

The CV header is the space which most recruiters would be referring most often to, in the beginning and end of your application. That is as the CV header includes your contact details, but also a headline and a professional photo. When writing your CV header:

- Double-check your contact details for spelling errors or if you've missed any digits. Also, ensure you've provided your personal details, and not your current work email or telephone number;

- Include your location in the form of the city and country you live in. If you want to be more detailed, you can list your full address to show proximity to your potential work place;

- Don't include your CV photo, if you're applying for roles in the UK or US, as this may bias initial recruiters' assessments;

- Write a professional headline that either integrates the job title, some relevant industry keywords, or your most noteworthy achievement.

In the next part of our guide, we'll provide you with professional CVs that showcase some of the best practices when it comes to writing your headline.

Examples of good CV headlines for investment banking analyst:

- Associate Investment Analyst | Mergers & Acquisitions | CFA Level II Candidate | 3+ Years Experience

- Senior Financial Analyst | Capital Markets & Advisory | Chartered Accountant | Strategic Planning | 7 Years Expertise

- Investment Banking Analyst | Equity Research & Valuation | Bloomberg Proficiency | 5 Years in Banking

- Junior Investment Analyst | Financial Modelling & Risk Assessment | BSc Economics | Entry-Level Professional

- Investment Strategist | Portfolio Management | CFA Charterholder | International Markets Expertise | 10 Years Experience

- Lead Analyst | Debt Capital Markets | Financial Restructuring | MBA Finance | 8+ Years Industry Leadership

Your investment banking analyst CV introduction: selecting between a summary and an objective

investment banking analyst candidates often wonder how to start writing their resumes. More specifically, how exactly can they use their opening statements to build a connection with recruiters, showcase their relevant skills, and spotlight job alignment. A tricky situation, we know. When crafting you investment banking analyst CV select between:

- A summary - to show an overview of your career so far, including your most significant achievements.

- An objective - to show a conscise overview of your career dreams and aspirations.

Find out more examples and ultimately, decide which type of opening statement will fit your profile in the next section of our guide:

CV summaries for a investment banking analyst job:

- Seasoned Investment Banking Analyst with over 5 years of experience, specializing in M&A transactions and equity research. Instrumental in closing deals worth over $1 billion, adept in financial modelling, and committed to delivering detailed analytical insights to drive strategic investments and maximize client portfolio growth.

- Dynamic financial professional transitioning from a successful 7-year tenure in corporate finance management into investment banking. Holds a solid foundation in risk assessment, budget forecasting, and market trend analysis. Eager to apply a track record of reducing overhead costs by 20% and managing multimillion-dollar budgets to impactful investment strategies.

- Acclaimed financial auditor aiming to leverage an 8-year career at Big Four firms to pivot into investment banking. Proven expertise in rigorous financial analysis, compliance, and reporting standards, coupled with a strong desire to utilise analytical skills to influence high-stakes investment decisions and capital raising initiatives.

- Motivated graduate with a Master’s in Finance, seeking to employ a profound understanding of financial markets, valuation techniques, and econometric tools garnered through rigorous academic training. Driven by a passion for the complex mechanisms of capital markets and a commitment to dive headfirst into dynamic and challenging deals.

- Exceptional analytical thinker possessing a double major in Mathematics and Economics aiming to embark on a career in investment banking. Keen to apply quantitative skills, a deep enthusiasm for market analysis, and fresh knowledge from a top-tier university to contribute to strategic investment insights and decision-making processes.

The best formula for your investment banking analyst CV experience section

The CV experience section is the space where many candidates go wrong by merely listing their work history and duties. Don't do that. Instead, use the job description to better understand what matters most for the role and integrate these keywords across your CV. Thus, you should focus on:

- showcasing your accomplishments to hint that you're results-oriented;

- highlighting your skill set by integrating job keywords, technologies, and transferrable skills in your experience bullets;

- listing your roles in reverse chronological order, starting with the latest and most senior, to hint at how you have grown your career;

- featuring metrics, in the form of percentage, numbers, etc. to make your success more tangible.

When writing each experience bullet, start with a strong, actionable verb, then follow it up with a skill, accomplishment, or metric. Use these professional examples to perfect your CV experience section:

Best practices for your CV's work experience section

- Conducted complex financial modelling and analysis for various transaction types, including M&A, LBOs, and IPOs, accurately forecasting performance under different scenarios.

- Participated in all stages of transaction executions, from the pitch phase through to closing, ensuring all client deliverables were met on time and adhered to the highest standards of quality.

- Analysed companies' financial statements and business strategies, identifying key trends and investment risks to present insightful recommendations to clients and senior bankers.

- Prepared comprehensive pitch books and marketing materials, utilising advanced Excel, PowerPoint, and data visualisation tools to convey strategic advice and transaction rationales.

- Supported deal origination by compiling industry research, participating in due diligence processes, and synthesising financial information into actionable investment theses.

- Facilitated seamless communication between all parties involved in transactions, including legal advisors, accountants, and other consultants, by acting as a key point of contact.

- Managed the development and maintenance of complex financial databases and models, ensuring data integrity and accuracy for use in high-stakes decision-making.

- Liaised with clients to gather necessary financial and operational data, maintaining a professional demeanour and exceptional attention to detail throughout intensive information-gathering processes.

- Contributed to team success by working effectively under pressure during long hours, consistently meeting tight deadlines for deliverables throughout multiple back-to-back transactions.

- Analysed complex financial data to model M&A transactions for major telecom firms, leading to actionable investment strategies that increased client portfolios by 25%.

- Managed the due diligence process for a $10B cross-border merger, highlighting key financial risks and opportunities, which informed the negotiation strategies.

- Coordinated with a team of associates to develop comprehensive pitch books that resulted in the acquisition of three high-profile client accounts.

- Structured and executed numerous capital raising deals, including a $500M IPO and a $350M bond issuance, contributing to the expansion of our client's operations internationally.

- Created and maintained complex financial models to analyse various investment scenarios, facilitating a 15% year-on-year growth in client investments.

- Led the preparation of quarterly market performance reports, delivering insights that shaped the investment strategy for a portfolio valued at over $8B.

- Instrumental in crafting bespoke financial solutions for private equity clients, enabling successful acquisitions and divestitures within the healthcare sector.

- Conducted exhaustive industry research to support the firm's investment thesis, contributing to the accurate valuation of assets worth over $2B.

- Facilitated client meetings and presentations which enhanced relationships and led to a 20% increase in business from repeat clients.

- Orchestrated the leverage buyout model for a tech startup, securing funding of $100M that facilitated innovative product development and market entry.

- Provided transaction support for M&A activities, including developing investment memorandums and liaising with legal parties, to ensure seamless deal execution.

- Performed quantitative analysis that contributed to a 30% return on investments for a portfolio concentrating on renewable energy projects.

- Spearheaded the financial analysis and modeling for a landmark $200M infrastructure project, which significantly enhanced the firm's market presence in emerging economies.

- Executed sector-specific valuation analyses, particularly in the consumer goods space, allowing clients to make informed decisions on potential $1B+ investments.

- Participated in the strategic planning process for the investment banking division, directly contributing to a 10% increase in the annual revenue.

- Engaged closely with senior bankers to streamline the underwriting process for a series of successful debt offerings, aggregating over $750M.

- Pioneered the integration of new financial modelling software which improved forecasting accuracy by 40% and significantly reduced the time to deliver client reports.

- Authored in-depth industry analysis reports that guided the investment strategy for the Asian markets within the technology and electronics sectors.

- Liaised with venture capital firms and facilitated seed funding rounds for fintech startups, averaging deals worth $50M and driving forward economic growth in the sector.

- Monitored and reported on post-investment performance, ensuring compliance with financial covenants and providing strategic recommendations to maximize returns.

- Crafted bespoke valuation models tailored to new-market ventures, supporting a diverse range of clientèle in making data-driven, strategic investment decisions.

- Developed a proprietary risk assessment model that improved the risk evaluation process for investment portfolios, resulting in a more robust risk management framework.

- Headed a comprehensive comparative analysis of European markets post-Brexit, allowing the firm to realign its investment strategies and mitigate potential losses.

- Cultivated key partnerships with industry leaders, expanding the firm's influence and ensuring a stream of lucrative opportunities for top-tier clients.

Writing your CV without professional experience for your first job or when switching industries

There comes a day, when applying for a job, you happen to have no relevant experience, whatsoever. Yet, you're keen on putting your name in the hat. What should you do? Candidates who part-time experience , internships, and volunteer work.

Recommended reads:

PRO TIP

Include examples of how you adapted to new tools, environments, or work cultures, showing your flexibility.

The CV skills' divide: between hard and soft skills

Of course, you may have read the job requirements plenty of times now, but it's key to note that there is a difference between technical and personal skills. Both are equally relevant to your job application. When writing about your skill set, ensure you've copy-pasted the precise skill from the job requirement. This would not only help you ensure you have the correct spelling, but also pass any Applicant Tracker System (ATS) assessments.

- Hard skills show your technological capabilities. Or whether you'll be a good technical fit to the organisation. Ensure you've spotlighted your hard skills in various sections of your CV (e.g. skills section, projects, experience) by including the technology and what you've attained;

- Soft skills pinpoint your personality and people or communication skills, hinting at if you'll easily accomodate into the team or organisation. Quantify your soft skills in your CV achievements, strengths, summary/objective, and experience sections. Always support your soft skills with how they've helped you grow as a professional.

Top skills for your investment banking analyst CV:

Financial Modelling

Corporate Finance

Valuation Techniques

Mergers & Acquisitions

Financial Analysis

Capital Markets Knowledge

Due Diligence

Accounting Principles

Microsoft Excel Expertise

Bloomberg Terminal Proficiency

Analytical Thinking

Attention to Detail

Teamwork

Communication Skills

Problem-Solving Abilities

Time Management

Adaptability

Proactivity

Stress Management

Client Relationship Management

PRO TIP

Use mini case studies or success stories in your CV to demonstrate how your skills have positively impacted previous roles or projects.

Your university degree and certificates: an integral part of your investment banking analyst CV

Let's take you back to your uni days and decide what information will be relevant for your investment banking analyst CV. Once more, when discussing your higher education, select only information that is pertinent to the job (e.g. degrees and projects in the same industry, etc.). Ultimately, you should:

- List only your higher education degrees, alongside start and graduation dates, and the university name;

- Include that you obtained a first degree for diplomas that are relevant to the role, and you believe will impress recruiters;

- Showcase relevant coursework, projects, or publications, if you happen to have less experience or will need to fill in gaps in your professional history.

PRO TIP

Focus on describing skills in the context of the outcomes they’ve helped you achieve, linking them directly to tangible results or successes in your career.

Recommended reads:

Key takeaways

Write your professional investment banking analyst CV by studying and understanding what the role expectations are. You should next:

- Focus on tailoring your content to answer specific requirements by integrating advert keywords through various CV sections;

- Balance your technical know-how with your personal skills to showcase what the unique value would be of working with you;

- Ensure your CV grammar and spelling (especially of your key information and contact details) is correct;

- Write a CV summary, if your experience is relevant, and an objective, if your career ambitions are more impressive;

- Use active language by including strong, action verbs across your experience, summary/objective, achievements sections.