Crafting a standout CV as an investment banking analyst can often be challenging due to the highly competitive nature of the industry and the need to demonstrate complex financial skills concisely. By following our guide, you'll learn how to showcase your achievements and tailor your experience effectively, ensuring your CV rises to the top of the pile.

- Applying best practices from real-world examples to ensure your profile always meets recruiters' expectations;

- What to include in your work experience section, apart from your past roles and responsibilities?

- Why are both hard and soft skills important for your application?

- How do you need to format your CV to pass the Applicant Tracker Software (ATS) assessment?

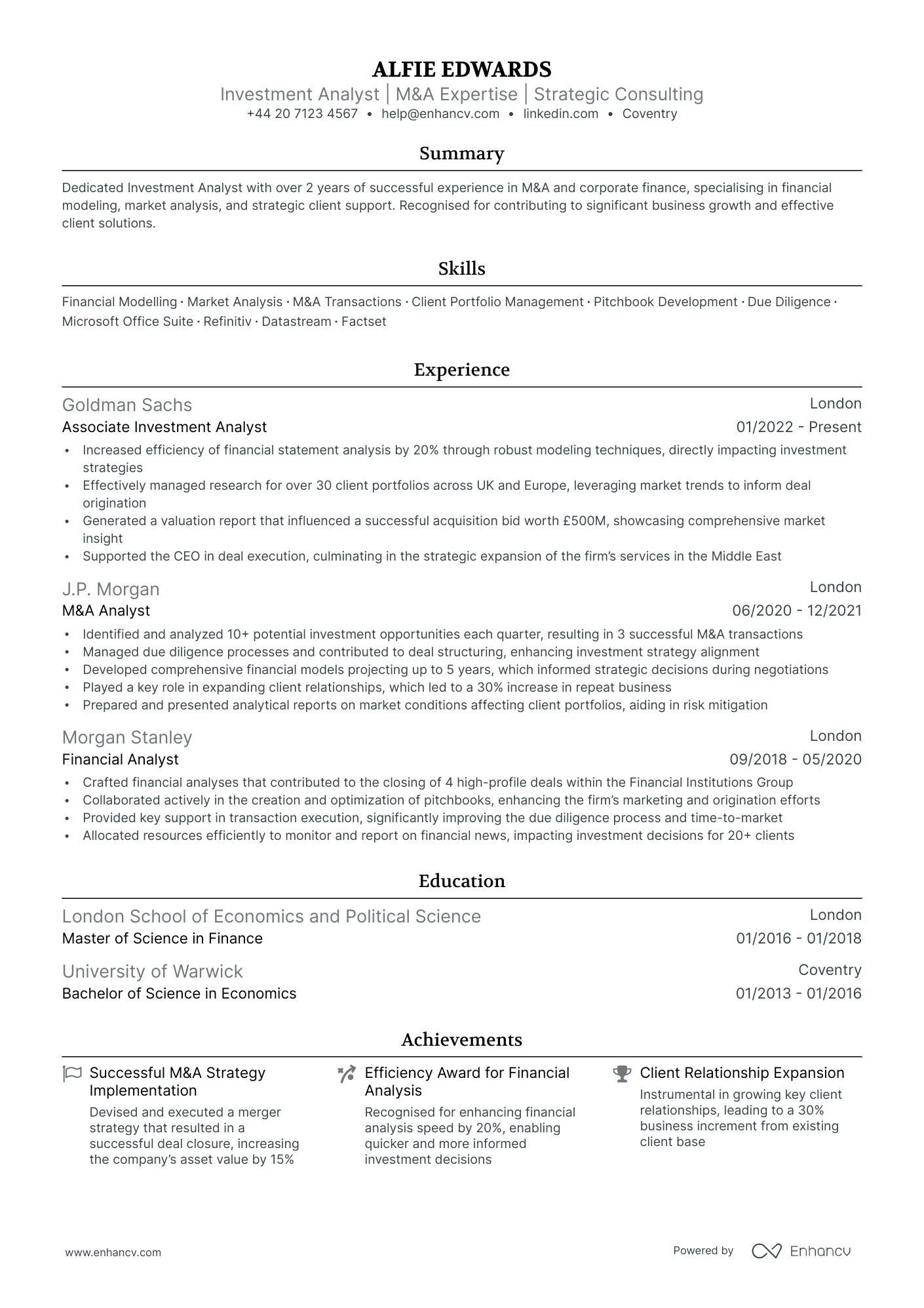

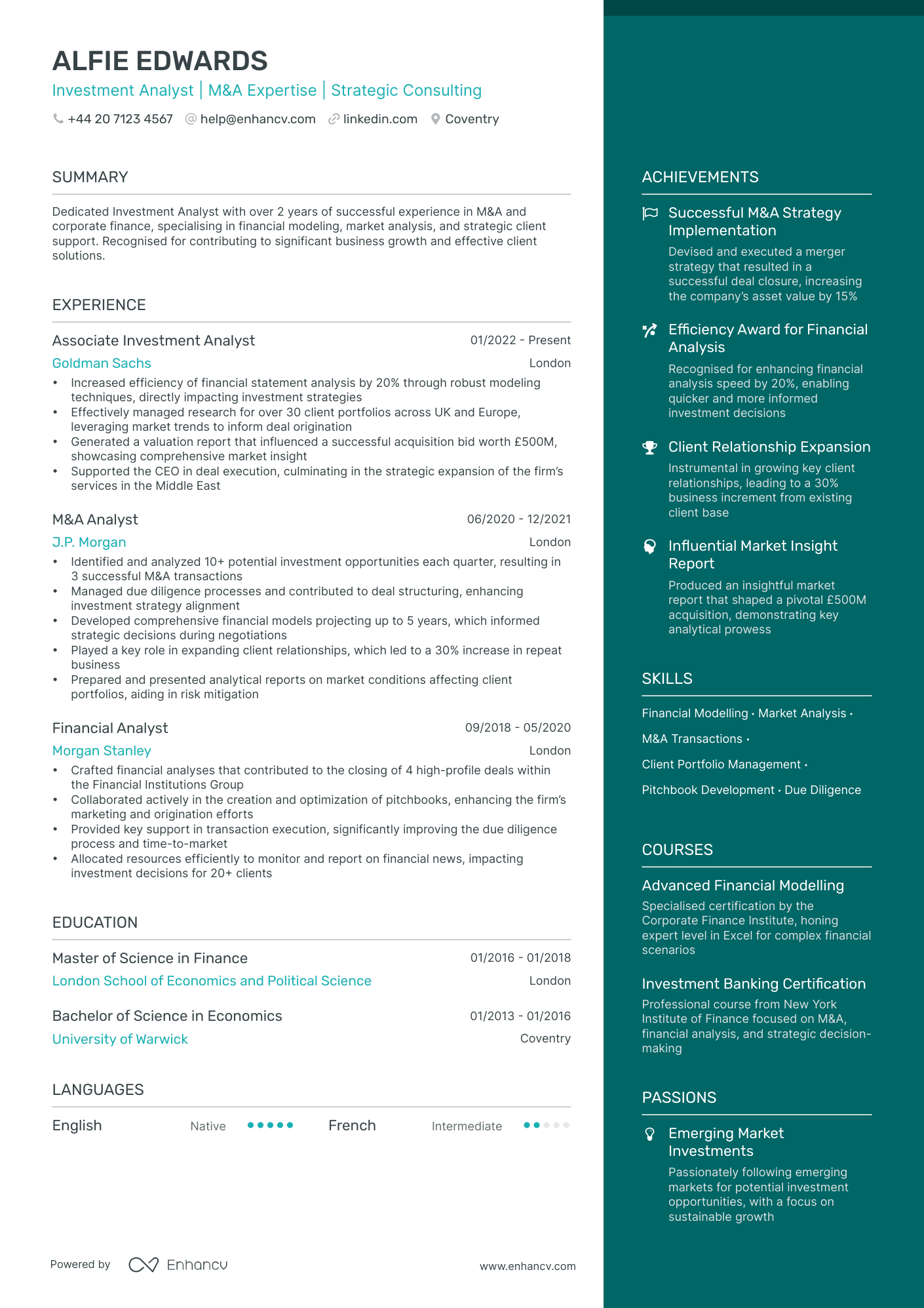

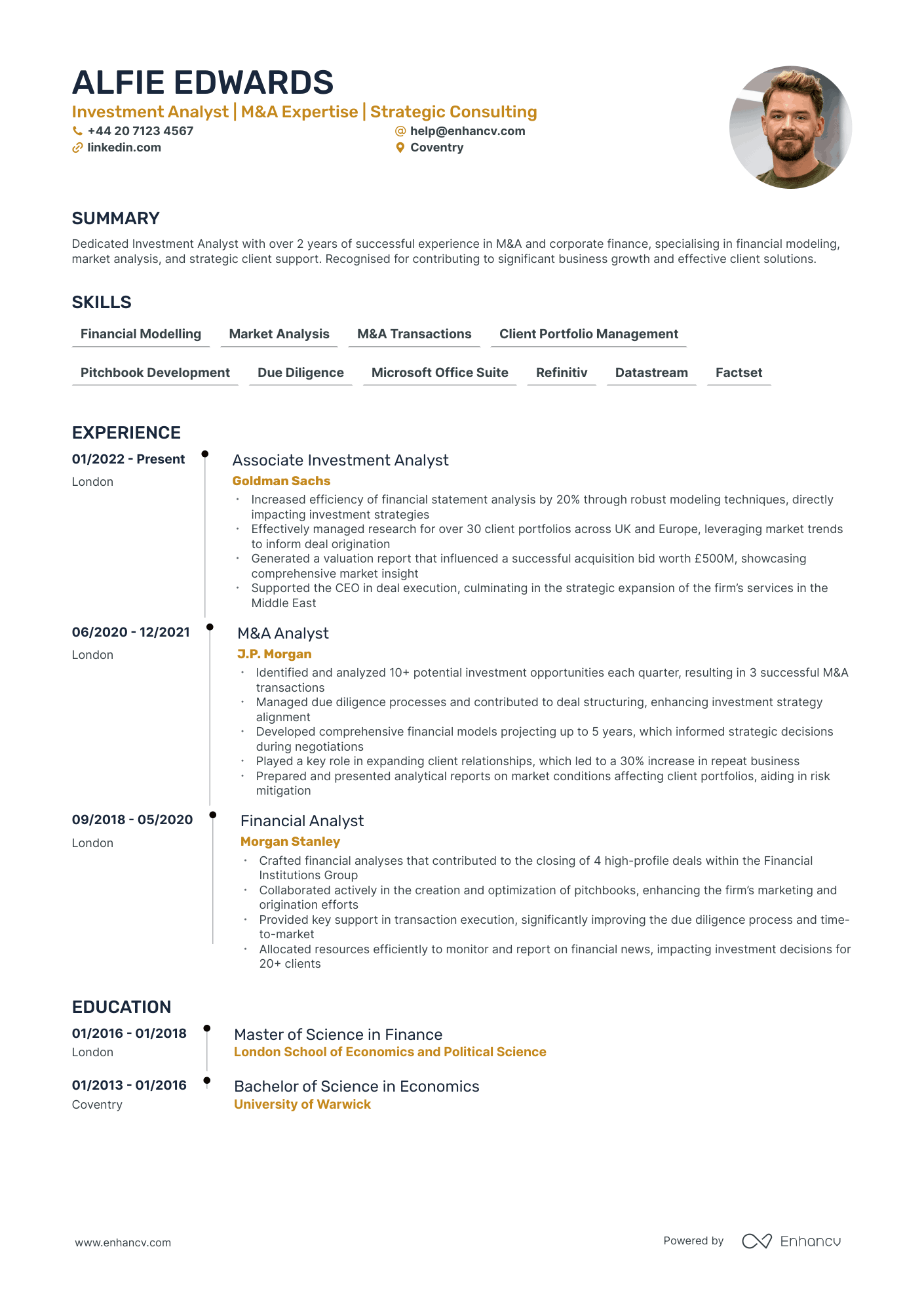

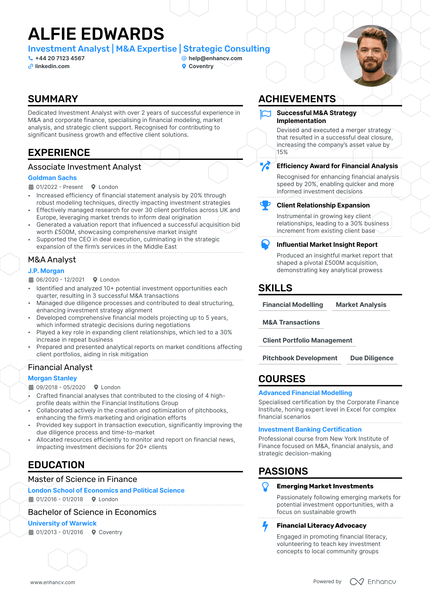

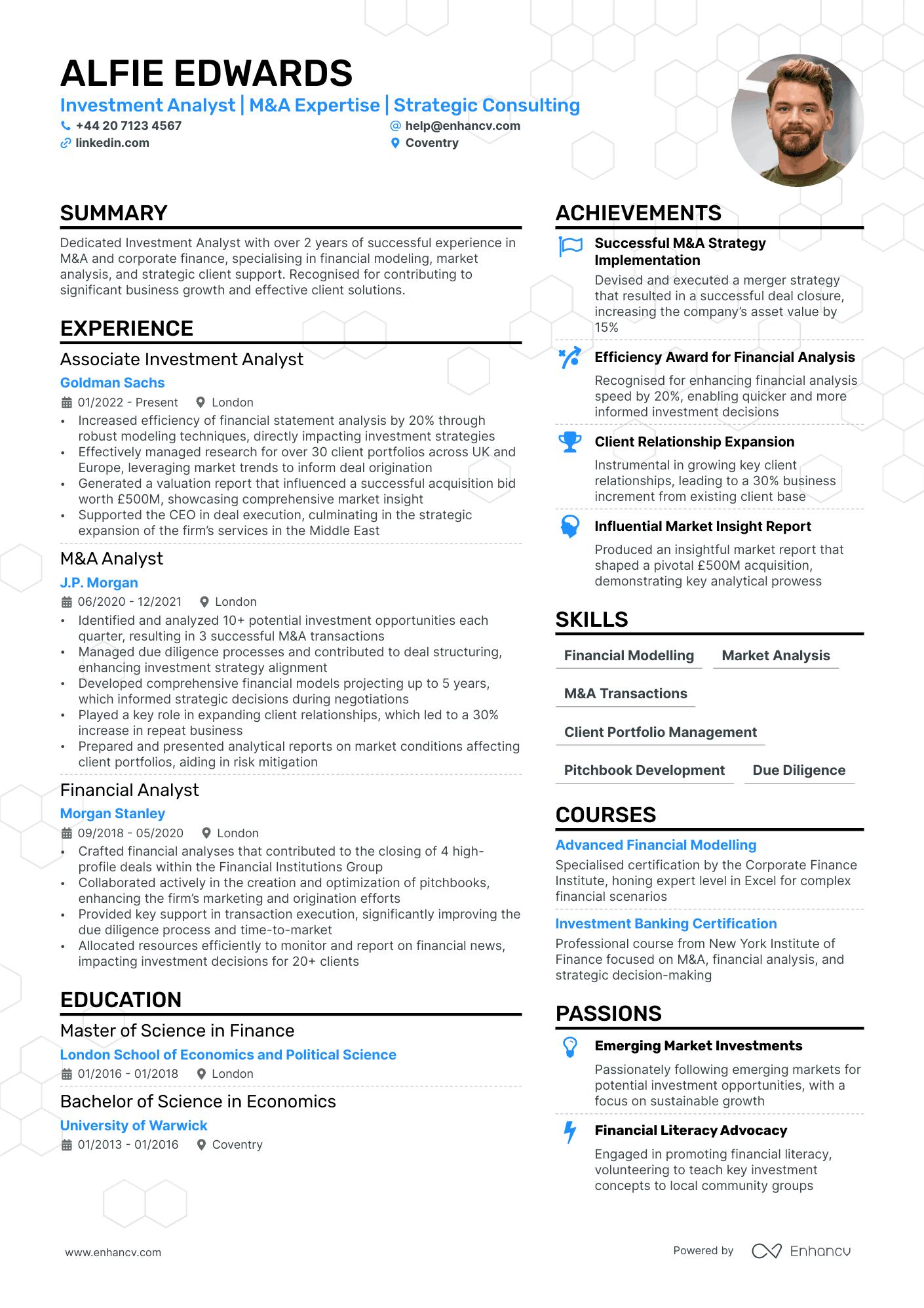

If you're writing your CV for a niche investment banking analyst role, make sure to get some inspiration from professionals:

Structuring and formatting your investment banking analyst CV for an excellent first impression

The experts' best advice regarding your CV format is to keep it simple and concise. Recruiters assessing your CV are foremost looking out for candidates who match their ideal job profile. Your white space, borders, and margins. You may still be wondering which format you need to export your CV in. We recommend using the PDF one, as, upon being uploaded, it never alters your information or CV design. Before we move on to the actual content of your investment banking analyst CV, we'd like to remind you about the Applicant Tracker System (or the ATS). The ATS is a software that is sometimes used to initially assess your profile. Here's what you need to keep in mind about the ATS:- All serif and sans-serif fonts (e.g. Rubik, Volkhov, Exo 2 etc.) are ATS-friendly;

- Many candidates invest in Arial and Times New Roman, so avoid these fonts if you want your application to stand out;

- Both single and double column CVs can be read by the ATS, so it's entirely up to you to select your CV design.

PRO TIP

Be mindful of white space; too much can make the CV look sparse, too little can make it look cluttered. Strive for a balance that makes the document easy on the eyes.

The top sections on a investment banking analyst CV

- Education details showing relevant degrees outlines the academic foundation necessary for the analyst role.

- Work experience in finance highlights direct industry exposure and relevant professional accomplishments.

- Technical skills with financial software demonstrate proficiency with tools essential in investment banking.

- Key transactions or deals worked on showcases practical experience and contribution to significant projects.

- Awards and honours specific to finance or banking underline recognised excellence and competitive distinction.

What recruiters value on your CV:

- Emphasise quantitative skills by showcasing your experience with financial modelling, valuation techniques, and proficiency in Excel and other financial software, as these skills are crucial for an investment banking analyst.

- Detail any previous internships or work experiences in finance, particularly in M&A, IPOs, or corporate finance, to demonstrate relevance and familiarity with investment banking operations.

- Highlight any deal or transaction experience, including the sizes and types of deals involved, since specifics can help illustrate your direct exposure to investment banking activities.

- Include educational background, such as a degree in finance, economics, or business, and mention any relevant courses taken, like corporate finance or investment analysis, to underscore your foundational knowledge.

- Point out soft skills like attention to detail, the ability to work under pressure, excellent communication and teamwork capabilities, as these are essential for an analyst to collaborate effectively with investment banking teams.

Recommended reads:

Tips and tricks on writing a job-winning investment banking analyst CV header

The CV header is the space which most recruiters would be referring most often to, in the beginning and end of your application. That is as the CV header includes your contact details, but also a headline and a professional photo. When writing your CV header:

- Double-check your contact details for spelling errors or if you've missed any digits. Also, ensure you've provided your personal details, and not your current work email or telephone number;

- Include your location in the form of the city and country you live in. If you want to be more detailed, you can list your full address to show proximity to your potential work place;

- Don't include your CV photo, if you're applying for roles in the UK or US, as this may bias initial recruiters' assessments;

- Write a professional headline that either integrates the job title, some relevant industry keywords, or your most noteworthy achievement.

In the next part of our guide, we'll provide you with professional CVs that showcase some of the best practices when it comes to writing your headline.

Examples of good CV headlines for investment banking analyst:

- Associate Investment Analyst | Mergers & Acquisitions | CFA Level II Candidate | 3+ Years Experience

- Senior Financial Analyst | Capital Markets & Advisory | Chartered Accountant | Strategic Planning | 7 Years Expertise

- Investment Banking Analyst | Equity Research & Valuation | Bloomberg Proficiency | 5 Years in Banking

- Junior Investment Analyst | Financial Modelling & Risk Assessment | BSc Economics | Entry-Level Professional

- Investment Strategist | Portfolio Management | CFA Charterholder | International Markets Expertise | 10 Years Experience

- Lead Analyst | Debt Capital Markets | Financial Restructuring | MBA Finance | 8+ Years Industry Leadership

Your investment banking analyst CV introduction: selecting between a summary and an objective

investment banking analyst candidates often wonder how to start writing their resumes. More specifically, how exactly can they use their opening statements to build a connection with recruiters, showcase their relevant skills, and spotlight job alignment. A tricky situation, we know. When crafting you investment banking analyst CV select between:

- A summary - to show an overview of your career so far, including your most significant achievements.

- An objective - to show a conscise overview of your career dreams and aspirations.

Find out more examples and ultimately, decide which type of opening statement will fit your profile in the next section of our guide:

CV summaries for a investment banking analyst job:

- Seasoned Investment Banking Analyst with over 5 years of experience, specializing in M&A transactions and equity research. Instrumental in closing deals worth over $1 billion, adept in financial modelling, and committed to delivering detailed analytical insights to drive strategic investments and maximize client portfolio growth.

- Dynamic financial professional transitioning from a successful 7-year tenure in corporate finance management into investment banking. Holds a solid foundation in risk assessment, budget forecasting, and market trend analysis. Eager to apply a track record of reducing overhead costs by 20% and managing multimillion-dollar budgets to impactful investment strategies.

- Acclaimed financial auditor aiming to leverage an 8-year career at Big Four firms to pivot into investment banking. Proven expertise in rigorous financial analysis, compliance, and reporting standards, coupled with a strong desire to utilise analytical skills to influence high-stakes investment decisions and capital raising initiatives.

- Motivated graduate with a Master’s in Finance, seeking to employ a profound understanding of financial markets, valuation techniques, and econometric tools garnered through rigorous academic training. Driven by a passion for the complex mechanisms of capital markets and a commitment to dive headfirst into dynamic and challenging deals.

- Exceptional analytical thinker possessing a double major in Mathematics and Economics aiming to embark on a career in investment banking. Keen to apply quantitative skills, a deep enthusiasm for market analysis, and fresh knowledge from a top-tier university to contribute to strategic investment insights and decision-making processes.

The best formula for your investment banking analyst CV experience section

The CV experience section is the space where many candidates go wrong by merely listing their work history and duties. Don't do that. Instead, use the job description to better understand what matters most for the role and integrate these keywords across your CV. Thus, you should focus on:

- showcasing your accomplishments to hint that you're results-oriented;

- highlighting your skill set by integrating job keywords, technologies, and transferrable skills in your experience bullets;

- listing your roles in reverse chronological order, starting with the latest and most senior, to hint at how you have grown your career;

- featuring metrics, in the form of percentage, numbers, etc. to make your success more tangible.

When writing each experience bullet, start with a strong, actionable verb, then follow it up with a skill, accomplishment, or metric. Use these professional examples to perfect your CV experience section:

Best practices for your CV's work experience section

- Conducted complex financial modelling and analysis for various transaction types, including M&A, LBOs, and IPOs, accurately forecasting performance under different scenarios.

- Participated in all stages of transaction executions, from the pitch phase through to closing, ensuring all client deliverables were met on time and adhered to the highest standards of quality.

- Analysed companies' financial statements and business strategies, identifying key trends and investment risks to present insightful recommendations to clients and senior bankers.

- Prepared comprehensive pitch books and marketing materials, utilising advanced Excel, PowerPoint, and data visualisation tools to convey strategic advice and transaction rationales.

- Supported deal origination by compiling industry research, participating in due diligence processes, and synthesising financial information into actionable investment theses.

- Facilitated seamless communication between all parties involved in transactions, including legal advisors, accountants, and other consultants, by acting as a key point of contact.

- Managed the development and maintenance of complex financial databases and models, ensuring data integrity and accuracy for use in high-stakes decision-making.

- Liaised with clients to gather necessary financial and operational data, maintaining a professional demeanour and exceptional attention to detail throughout intensive information-gathering processes.

- Contributed to team success by working effectively under pressure during long hours, consistently meeting tight deadlines for deliverables throughout multiple back-to-back transactions.

- Analysed complex financial data to model M&A transactions for major telecom firms, leading to actionable investment strategies that increased client portfolios by 25%.

- Managed the due diligence process for a $10B cross-border merger, highlighting key financial risks and opportunities, which informed the negotiation strategies.

- Coordinated with a team of associates to develop comprehensive pitch books that resulted in the acquisition of three high-profile client accounts.

- Structured and executed numerous capital raising deals, including a $500M IPO and a $350M bond issuance, contributing to the expansion of our client's operations internationally.

- Created and maintained complex financial models to analyse various investment scenarios, facilitating a 15% year-on-year growth in client investments.

- Led the preparation of quarterly market performance reports, delivering insights that shaped the investment strategy for a portfolio valued at over $8B.

- Instrumental in crafting bespoke financial solutions for private equity clients, enabling successful acquisitions and divestitures within the healthcare sector.

- Conducted exhaustive industry research to support the firm's investment thesis, contributing to the accurate valuation of assets worth over $2B.

- Facilitated client meetings and presentations which enhanced relationships and led to a 20% increase in business from repeat clients.

- Orchestrated the leverage buyout model for a tech startup, securing funding of $100M that facilitated innovative product development and market entry.

- Provided transaction support for M&A activities, including developing investment memorandums and liaising with legal parties, to ensure seamless deal execution.

- Performed quantitative analysis that contributed to a 30% return on investments for a portfolio concentrating on renewable energy projects.

- Spearheaded the financial analysis and modeling for a landmark $200M infrastructure project, which significantly enhanced the firm's market presence in emerging economies.

- Executed sector-specific valuation analyses, particularly in the consumer goods space, allowing clients to make informed decisions on potential $1B+ investments.

- Participated in the strategic planning process for the investment banking division, directly contributing to a 10% increase in the annual revenue.

- Engaged closely with senior bankers to streamline the underwriting process for a series of successful debt offerings, aggregating over $750M.

- Pioneered the integration of new financial modelling software which improved forecasting accuracy by 40% and significantly reduced the time to deliver client reports.

- Authored in-depth industry analysis reports that guided the investment strategy for the Asian markets within the technology and electronics sectors.

- Liaised with venture capital firms and facilitated seed funding rounds for fintech startups, averaging deals worth $50M and driving forward economic growth in the sector.

- Monitored and reported on post-investment performance, ensuring compliance with financial covenants and providing strategic recommendations to maximize returns.

- Crafted bespoke valuation models tailored to new-market ventures, supporting a diverse range of clientèle in making data-driven, strategic investment decisions.

- Developed a proprietary risk assessment model that improved the risk evaluation process for investment portfolios, resulting in a more robust risk management framework.

- Headed a comprehensive comparative analysis of European markets post-Brexit, allowing the firm to realign its investment strategies and mitigate potential losses.

- Cultivated key partnerships with industry leaders, expanding the firm's influence and ensuring a stream of lucrative opportunities for top-tier clients.

Writing your CV without professional experience for your first job or when switching industries

There comes a day, when applying for a job, you happen to have no relevant experience, whatsoever. Yet, you're keen on putting your name in the hat. What should you do? Candidates who part-time experience , internships, and volunteer work.

Recommended reads:

PRO TIP

Include examples of how you adapted to new tools, environments, or work cultures, showing your flexibility.

The CV skills' divide: between hard and soft skills

Of course, you may have read the job requirements plenty of times now, but it's key to note that there is a difference between technical and personal skills. Both are equally relevant to your job application. When writing about your skill set, ensure you've copy-pasted the precise skill from the job requirement. This would not only help you ensure you have the correct spelling, but also pass any Applicant Tracker System (ATS) assessments.

- Hard skills show your technological capabilities. Or whether you'll be a good technical fit to the organisation. Ensure you've spotlighted your hard skills in various sections of your CV (e.g. skills section, projects, experience) by including the technology and what you've attained;

- Soft skills pinpoint your personality and people or communication skills, hinting at if you'll easily accomodate into the team or organisation. Quantify your soft skills in your CV achievements, strengths, summary/objective, and experience sections. Always support your soft skills with how they've helped you grow as a professional.

Top skills for your investment banking analyst CV:

Financial Modelling

Corporate Finance

Valuation Techniques

Mergers & Acquisitions

Financial Analysis

Capital Markets Knowledge

Due Diligence

Accounting Principles

Microsoft Excel Expertise

Bloomberg Terminal Proficiency

Analytical Thinking

Attention to Detail

Teamwork

Communication Skills

Problem-Solving Abilities

Time Management

Adaptability

Proactivity

Stress Management

Client Relationship Management

PRO TIP

Use mini case studies or success stories in your CV to demonstrate how your skills have positively impacted previous roles or projects.

Your university degree and certificates: an integral part of your investment banking analyst CV

Let's take you back to your uni days and decide what information will be relevant for your investment banking analyst CV. Once more, when discussing your higher education, select only information that is pertinent to the job (e.g. degrees and projects in the same industry, etc.). Ultimately, you should:

- List only your higher education degrees, alongside start and graduation dates, and the university name;

- Include that you obtained a first degree for diplomas that are relevant to the role, and you believe will impress recruiters;

- Showcase relevant coursework, projects, or publications, if you happen to have less experience or will need to fill in gaps in your professional history.

PRO TIP

Focus on describing skills in the context of the outcomes they’ve helped you achieve, linking them directly to tangible results or successes in your career.

Recommended reads:

Key takeaways

Write your professional investment banking analyst CV by studying and understanding what the role expectations are. You should next:

- Focus on tailoring your content to answer specific requirements by integrating advert keywords through various CV sections;

- Balance your technical know-how with your personal skills to showcase what the unique value would be of working with you;

- Ensure your CV grammar and spelling (especially of your key information and contact details) is correct;

- Write a CV summary, if your experience is relevant, and an objective, if your career ambitions are more impressive;

- Use active language by including strong, action verbs across your experience, summary/objective, achievements sections.