One challenge senior accountants often face when crafting their resumes is effectively conveying the breadth and depth of their experience in financial analysis, budgeting, and forecasting. Our guide can assist by providing precise language and action-driven bullet points that highlight these complex skills and accomplishments in an easily understandable format.

Our senior accountant guide will help you perfect your resume by explaining you how to:

- Alight your senior accountant resume with the role you're applying for ensuring it will be read by the applicant tracking system.

- Tailor your specific senior accountant experience to get the attention of recruiters.

- List your relevant education to impress hiring managers.

- Discover job-winning senior accountant professional resume examples to inspire writing yours.

Recommended reads:

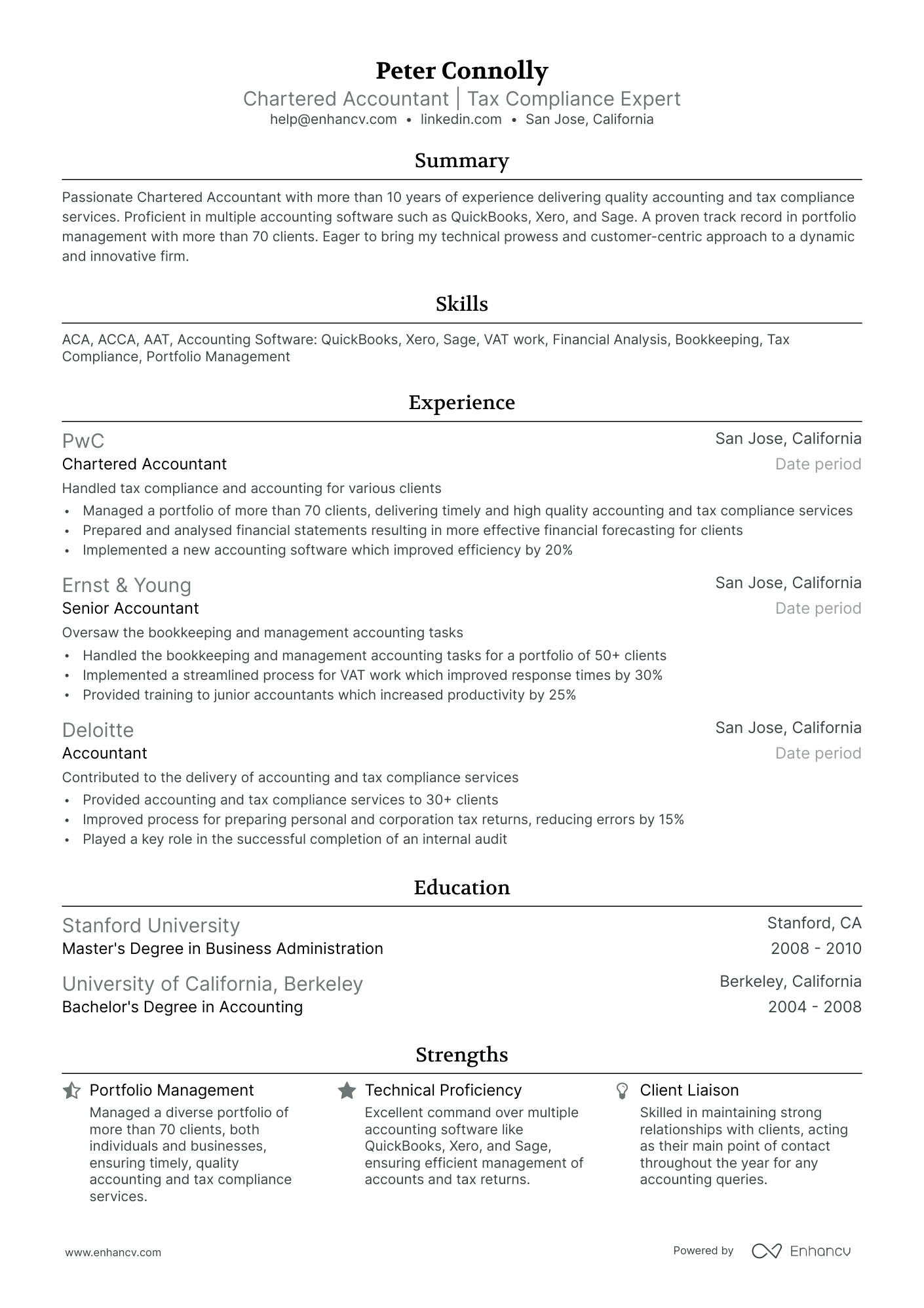

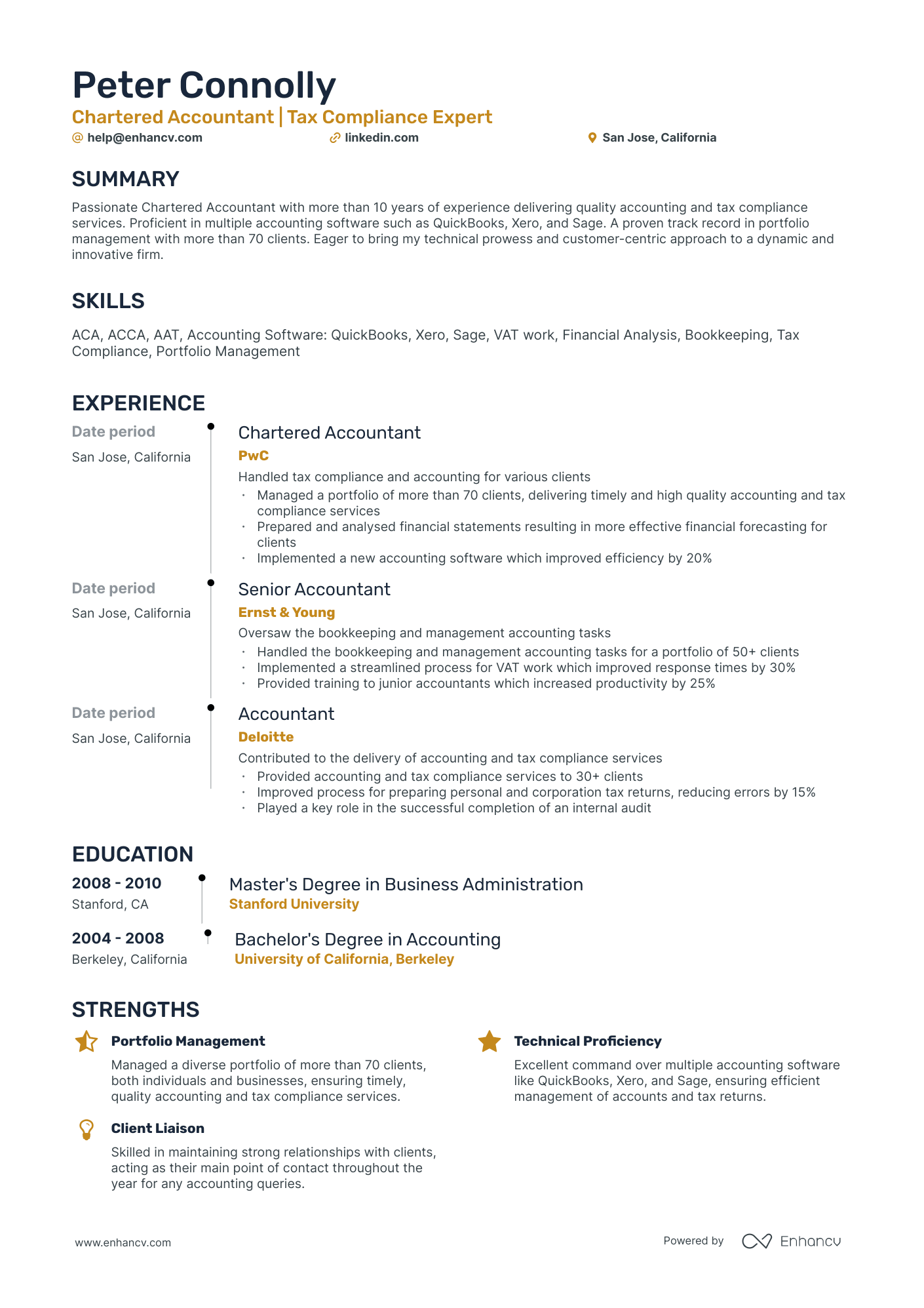

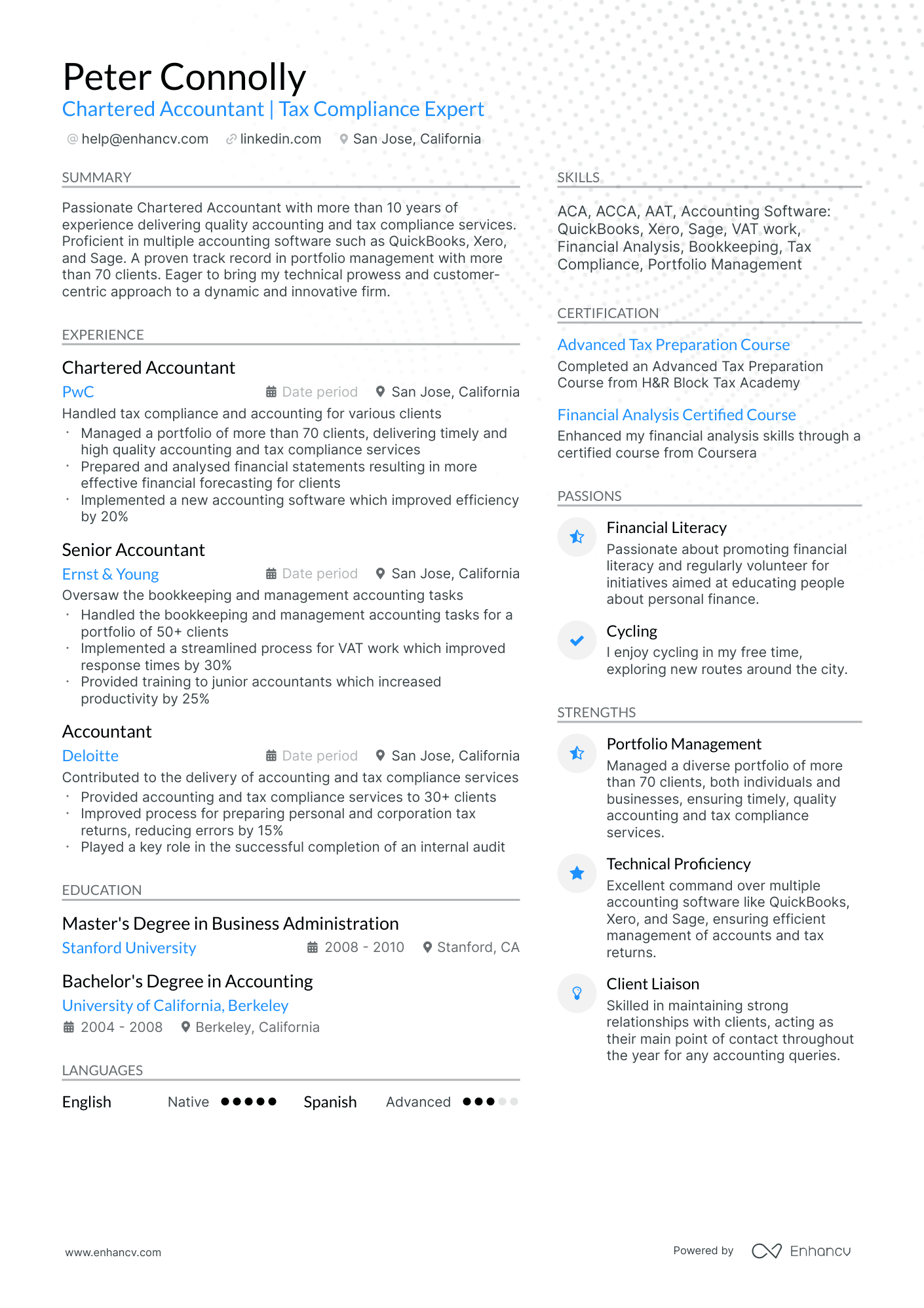

Tips for refining your senior accountant resume format

The resume format sets the stage for your professional narrative. Ensure it:

- Adopts the reverse-chronological format, placing your most recent experiences at the forefront. This format is ideal for those with relevant and up-to-date experience.

- Features a clear headline, making it straightforward for recruiters to access your contact details, portfolio, or current role.

- Stays concise, ideally spanning no more than two pages, focusing on relevant experiences and skills.

- Maintains its layout by being saved as a PDF, ensuring compatibility with Applicant Tracking Systems (ATS).

Remember, resume layouts can vary by country – for example, a Canadian resume format could look different.

Upload your resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Pro tip

While color can enhance your senior accountant resume by emphasizing key details like headlines, job titles, and degrees, moderation is key. Stick to a primary and a secondary color to maintain professionalism and avoid a cluttered appearance.

To craft a compelling senior accountant resume, focus on these sections:

- A scannable header

- A snapshot of your professional persona, showcasing soft skills, achievements, and a summary or objective

- Skills that align with the job advert

- Quantifiable achievements in your experience section

- An education and technical skills section that underscores your proficiency with specific tools or software

What recruiters want to see on your resume:

- Certifications: Relevant qualifications, such as Certified Public Accountant (CPA) or Chartered Accountant (CA), are highly prioritized.

- Experience: Number of years in accounting and specific experience in a senior role or with leadership responsibilities.

- Technical Skills: Proficiency in accounting software and systems like QuickBooks, SAP, Oracle, etc., as well as advanced Excel skills.

- Industry Knowledge: Familiarity with the industry-specific accounting practices, regulations, and standards.

- Communication Skills: Ability to effectively communicate financial information to non-financial stakeholders.

Recommended reads:

Optimizing your senior accountant resume experience section

Your resume's experience section should resonate with your accomplishments while aligning with the job's demands. Here's how:

- Highlight significant career moments, and back them up with relevant skills.

- Analyze the job description to address both basic and advanced requirements.

- If you have unrelated roles, consider a separate section, but emphasize transferable skills.

- Avoid listing roles from over a decade ago unless they showcase your trajectory, especially for senior roles.

- Illustrate how your contributions enhanced the team or company, linking challenges to solutions.

Review how seasoned senior accountant professionals have crafted their experience sections, emphasizing their contributions.

- Led financial analysis and reporting for ABC Corporation, resulting in a 15% reduction in operating costs.

- Developed and implemented streamlined accounting processes, reducing monthly closing time by 30%.

- Managed a team of junior accountants, providing training and guidance to improve accuracy and efficiency.

- Collaborated with cross-functional teams to implement ERP system, enhancing data integrity and streamlining financial operations.

- Prepared annual budgets and forecasts, analyzing variances and recommending cost-saving measures.

- Performed month-end close activities, ensuring accurate and timely financial reporting.

- Implemented automated expense tracking system, resulting in a 20% reduction in processing time.

- Managed accounts receivable and payable processes, optimizing cash flow and minimizing delinquent payments.

- Conducted variance analysis and provided recommendations to senior management for cost control.

- Assisted in the preparation of annual audit schedules and supported auditors during the review process.

- Led financial statement preparation and analysis, ensuring compliance with GAAP standards.

- Managed fixed asset register, resulting in improved accuracy and timely recording of assets.

- Developed and implemented internal controls, reducing financial risks and improving process efficiency.

- Collaborated with tax advisors to optimize tax planning strategies, resulting in a 10% reduction in tax liabilities.

- Supported the CFO in financial planning and analysis, providing insights for strategic decision-making.

- Managed the preparation of quarterly and annual financial statements, ensuring accuracy and compliance.

- Implemented cost accounting system, resulting in improved tracking and allocation of expenses.

- Led cross-functional teams in system integration projects, enhancing data flow and process efficiency.

- Coordinated with external auditors to facilitate annual audits and address audit findings.

- Developed and implemented inventory management processes, reducing stockouts by 25%.

- Prepared complex financial analyses for mergers and acquisitions, supporting executive decision-making.

- Developed and maintained financial models to evaluate investment opportunities and potential risks.

- Managed the implementation of financial software systems, improving data accuracy and reporting capabilities.

- Collaborated with legal team on contract negotiations, ensuring favorable financial terms for the company.

- Conducted due diligence reviews of target companies, identifying financial risks and opportunities.

- Oversaw the consolidation of financial statements for multiple international subsidiaries.

- Developed and executed internal audit plans, identifying control weaknesses and recommending improvements.

- Collaborated with external auditors to ensure compliance with regulatory requirements.

- Implemented financial policies and procedures to strengthen internal controls and mitigate risks.

- Led cross-functional teams in ERP system implementation, improving data accuracy and streamlining processes.

- Managed accounts payable function, optimizing vendor relationships and negotiating favorable terms.

- Developed and implemented cash flow forecasting models, resulting in improved working capital management.

- Analyzed pricing strategies and profitability, recommending adjustments to maximize revenue.

- Coordinated with external tax advisors to ensure compliance with tax regulations and minimize liabilities.

- Assisted in the preparation of financial reports for board meetings and investor presentations.

- Managed the preparation of monthly management reports and financial statements.

- Implemented automated reconciliation processes, reducing errors by 40% and saving 15 hours per month.

- Provided financial analysis and insights to support business decision-making and cost control initiatives.

- Collaborated with external auditors during annual audits and addressed audit findings.

- Led process improvement projects, resulting in increased efficiency and reduced processing time.

- Performed general ledger reconciliations and journal entries, ensuring accuracy and compliance.

- Assisted in the preparation of financial statements and regulatory reporting requirements.

- Managed fixed asset accounting, tracking additions, disposals, and depreciation.

- Collaborated with cross-functional teams to implement accounting software upgrades.

- Supported annual budgeting process and provided variance analysis for management review.

- Led corporate tax planning initiatives, resulting in a 15% reduction in tax liabilities.

- Conducted financial due diligence for potential acquisitions, assessing financial risks and opportunities.

- Developed and implemented transfer pricing strategies to optimize intercompany transactions.

- Collaborated with external auditors on quarterly and annual audits, addressing audit findings.

- Supervised the preparation of monthly management reports and supported financial planning processes.

Quantifying impact on your resume

<ul>

Addressing a lack of relevant senior accountant experience

Even if you lack direct senior accountant experience, you can still craft a compelling resume. Here's how:

- Highlight projects or publications that demonstrate your relevant skills or knowledge.

- Emphasize transferable skills, showcasing your adaptability and eagerness to learn.

- In your objective, outline your career aspirations and how they align with the company's goals.

- Consider a functional or hybrid resume format, focusing on skills over chronological experience.

Recommended reads:

Pro tip

The experience section is all about relevancy to the senior accountant role. Decide on items that will show your expertise and skills in the best possible light.

Spotlighting your senior accountant hard and soft skills

Hard skills denote your technological proficiency and expertise in specific tools or software. These skills are often validated through certifications and hands-on experience.

Soft skills, on the other hand, reflect your interpersonal abilities and how you navigate workplace dynamics. These skills are cultivated over a lifetime and can be more nuanced.

Why the emphasis on both? Hard skills demonstrate your technical competence and reduce training needs. Soft skills suggest adaptability and cultural fit.

To optimize your skills section:

- Forego basic skills like "Excel" in favor of more specific proficiencies like "Excel Macros".

- Highlight core values and work ethics as soft skills, indicating what you prioritize in a professional setting.

- If relevant, create a distinct section for language proficiencies.

- Balance hard and soft skills by crafting a strengths or achievements section, illustrating outcomes achieved through both skill sets.

To assist you, we've curated a list of skills highly sought after by recruiters. Ensure you integrate those that resonate with your expertise and the prospective employer's needs:

Top skills for your senior accountant resume:

Advanced Excel

SAP ERP

QuickBooks

Oracle Financial Services

Microsoft Dynamics GP

Financial Reporting Software

Tax Preparation Software

Data Analysis Tools

Accounting Software Integration

Budgeting and Forecasting Tools

Attention to Detail

Analytical Thinking

Problem-Solving

Communication Skills

Time Management

Leadership

Team Collaboration

Adaptability

Critical Thinking

Interpersonal Skills

Pro tip

Double-check the spelling of all skills and tools on your resume. Remember, software like the Applicant Tracker System (ATS) scans for these details.

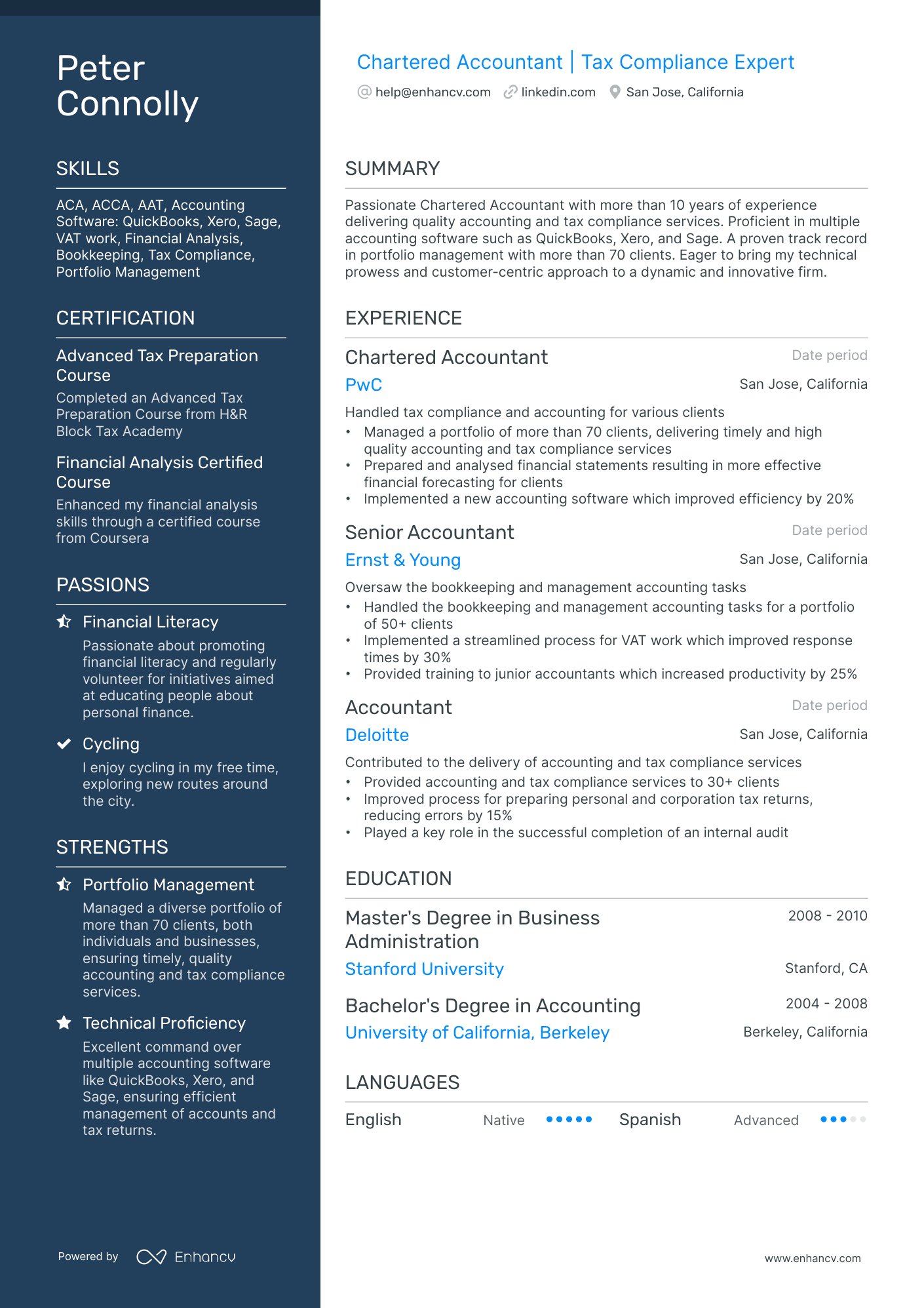

Detailing your education and top senior accountant certifications on your resume

Your education section can reflect a variety of skills and experiences relevant to the position.

- List post-secondary qualifications, noting the institution and duration.

- If you're currently studying, mention your expected graduation date.

- Exclude qualifications unrelated to the role or industry.

- If relevant, delve into your educational background, especially if it was research-intensive.

Including both relevant education and certifications on your senior accountant resume can set you apart. It not only showcases your qualifications but also your commitment to the profession.

When listing these on your senior accountant resume, make sure to:

- Highlight degrees and certificates relevant to the role.

- Mention the awarding institution for credibility.

- Include the start and end dates, or if the education/certification is ongoing.

- If relevant, incorporate a few keywords from the job advert within the description of the certification or degree.

If you have additional certifications not directly related to the role, consider placing them towards the end of your resume. This way, they can be viewed as personal interests rather than core qualifications.

For a quick update, check out our list of popular senior accountant certifications curated by the Enhancv team.

Best certifications to list on your resume

- Certified Information Systems Auditor (CISA) - ISACA

- Energy Risk Professional (ERP) - Global Association of Risk Professionals (GARP)

Pro tip

If a particular certification is highly valued in the industry or by the company, consider highlighting it in your resume's headline.

Recommended reads:

Summary or objective: making your senior accountant resume shine

Start your resume with a strong summary or objective to grab the recruiter's attention.

- Use a resume objective if you're newer to the field. Share your career dreams and strengths.

- Opt for a resume summary if you have more experience. Highlight up to five of your top achievements.

Tailor your summary or objective for each job. Think about what the recruiter wants to see.

Resume summary and objective examples for a senior accountant resume

A seasoned senior accountant with over a decade of experience, specializing in comprehensive financial reporting and analysis. Expertise includes advanced knowledge of Excel, QuickBooks, and Oracle Financial Software. Recognized for successfully leading a financial audit that resulted in an annual saving of $2M for ABC Corp.

With 15 years in the banking sector, now seeking to leverage analytical skills in the senior accounting field. Proven ability in managing large-scale financial data, proficient in SAP and QuickBooks. Directed a project at XYZ Bank which improved financial efficiency by 30%.

Dynamic individual with 8+ years in sales management, eager to transition into the field of senior accounting. Exceptional proficiency in financial analysis software like Sage and Excel. Noteworthy accomplishment includes increasing revenue by 40% within two years at DEF Organization.

As a former finance manager with 7 years of experience, I am drawn to the precision and consistency of accounting. Proficient in Sage 50 and MS Excel, and adept at streamlining complex financial data. At my previous role at GHI Inc., implemented a new budgeting process, reducing costs by 20%.

An enthusiastic graduate with a major in Finance, looking to apply academic knowledge and analytical skills in a real-world setting as a senior accountant. Strongly proficient in MS Excel, QuickBooks, and financial data interpretation. Goal-oriented and keen to contribute positively to the financial stability of any organization.

As a recent MBA graduate with a concentration in finance, my objective is to utilize my strong analytical skills and commitment to accuracy as a senior accountant. Proven expertise in financial software such as Oracle and SAP. Determined to help maximize profitability and improve financial controls.

Extra sections to boost your senior accountant resume

Add more sections to show off your unique skills and personality.

- Projects - Include any impressive ones you've done outside of work.

- Awards - Show off any industry recognition.

- Volunteering - Share causes you care about and skills you've gained.

- Personality - Hobbies or favorite books can give a glimpse into who you are.

Key takeaways

- Craft a senior accountant resume that's easy to read and aligns with the role's requirements.

- The top third of your resume should clearly convey your unique value proposition for the senior accountant role.

- Tailor your resume to the job, highlighting skills, achievements, and the tangible results of your efforts.

- Detail your certifications and technical skills to demonstrate proficiency with specific tools and technologies.

- The sections you choose should collectively present a comprehensive view of your professional expertise and personality.