As a bank branch manager, articulating your extensive experience in financial management and customer service on a single-page resume can be a daunting task. Our guide offers structured tips and tailored examples to help you condense your expertise into a compelling resume, ensuring your skills shine through effectively.

- Incorporate bank branch manager job advert keywords into key sections of your resume, such as the summary, header, and experience sections;

- Quantify your experience using achievements, certificates, and more in various bank branch manager resume sections;

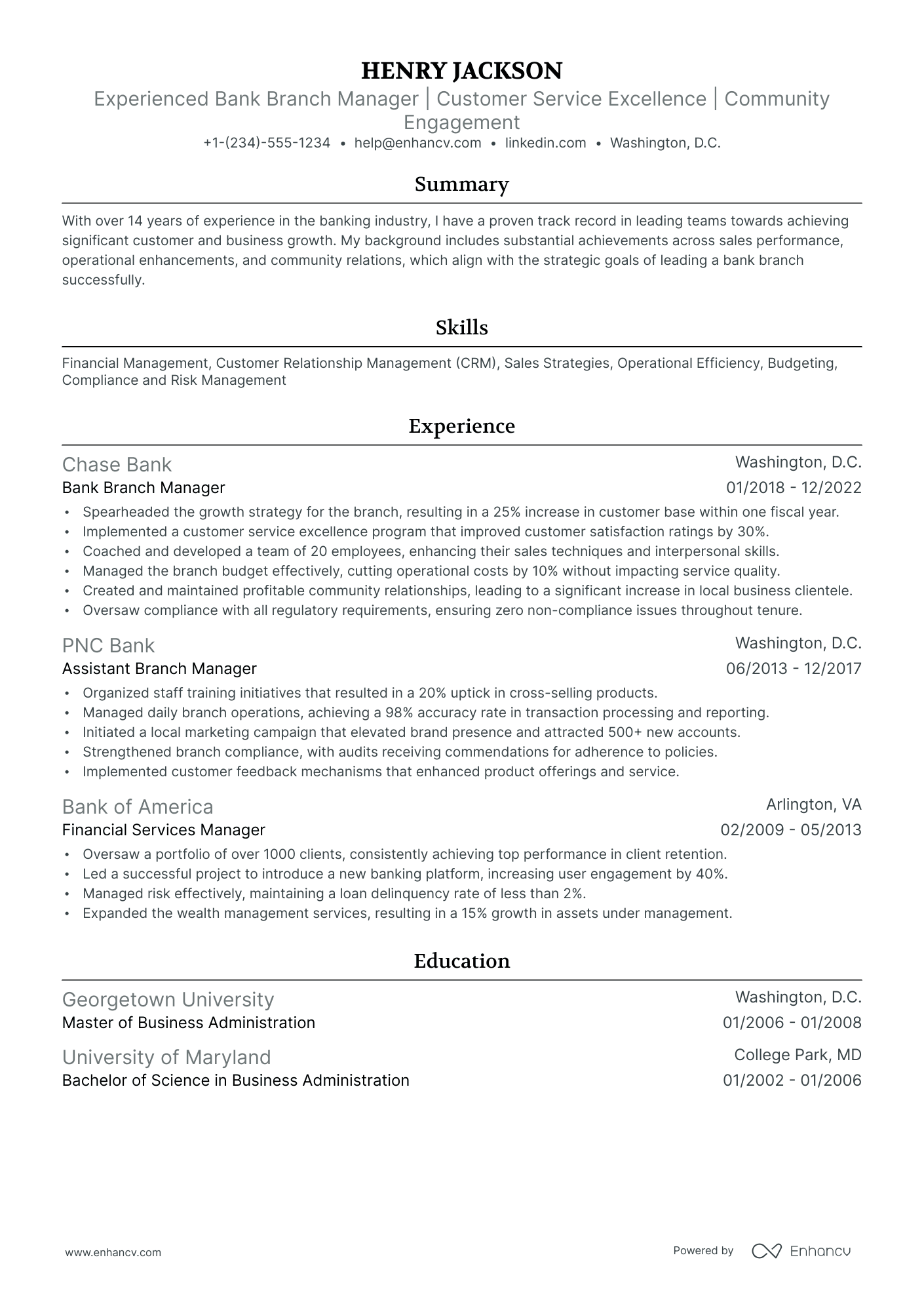

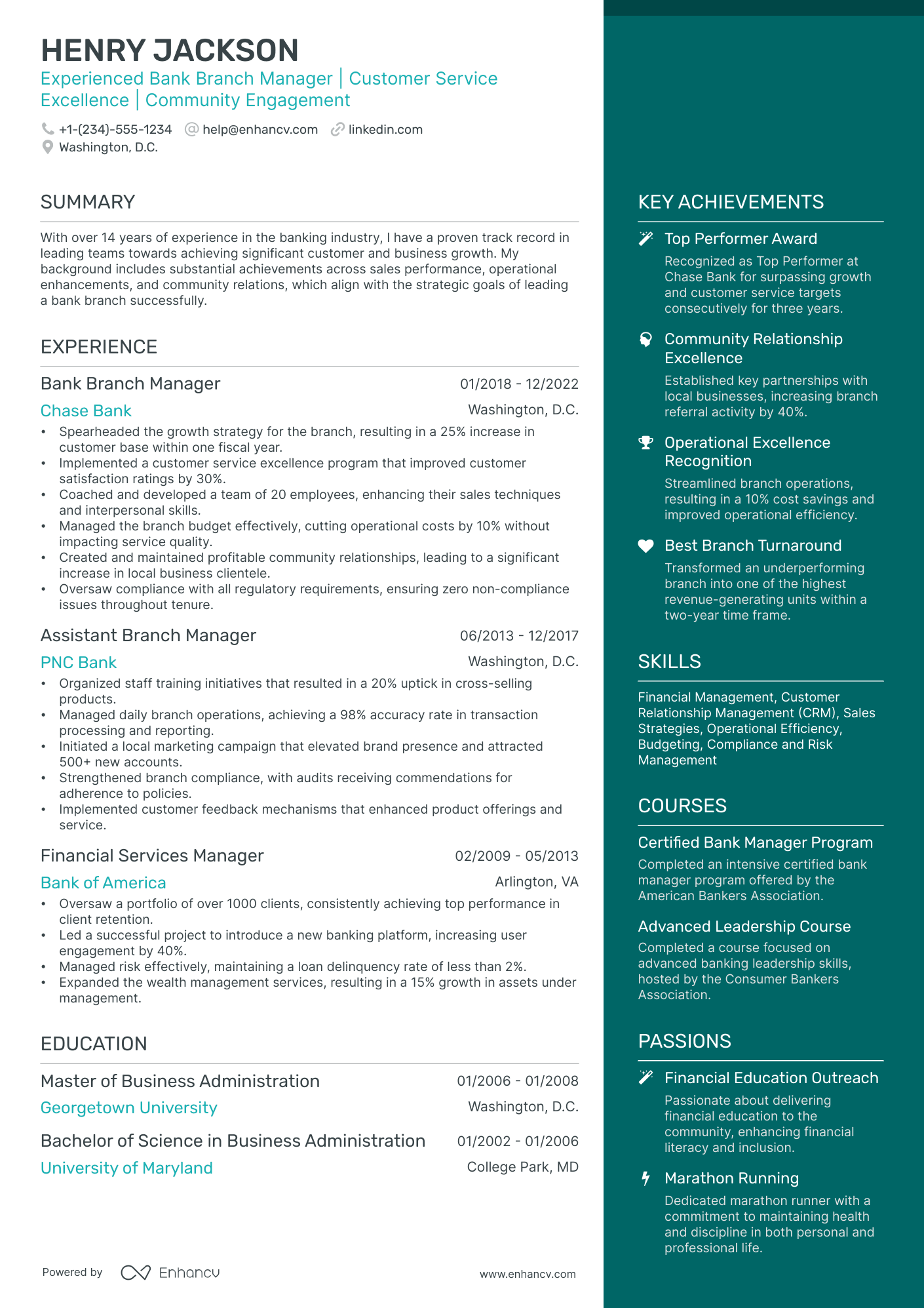

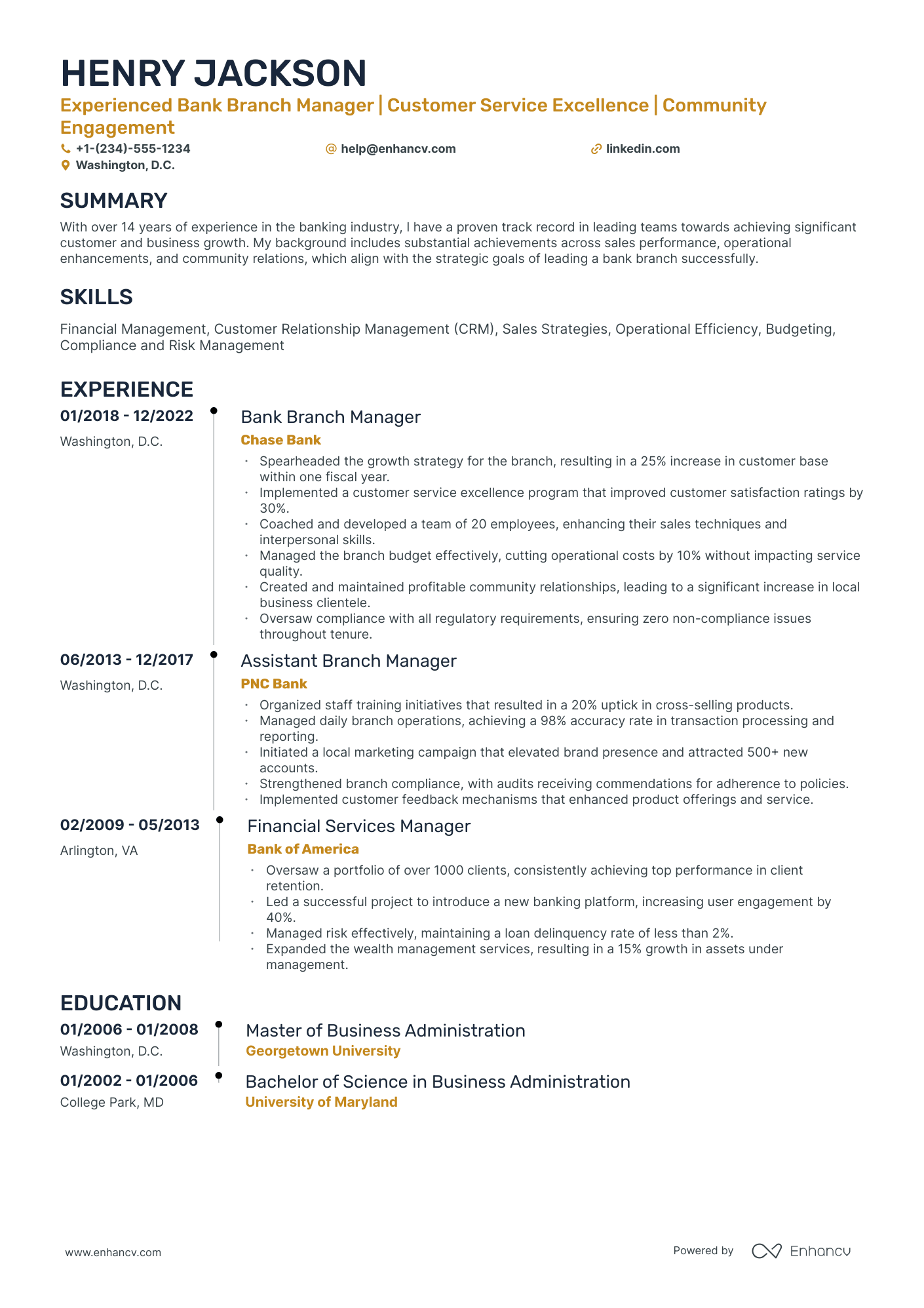

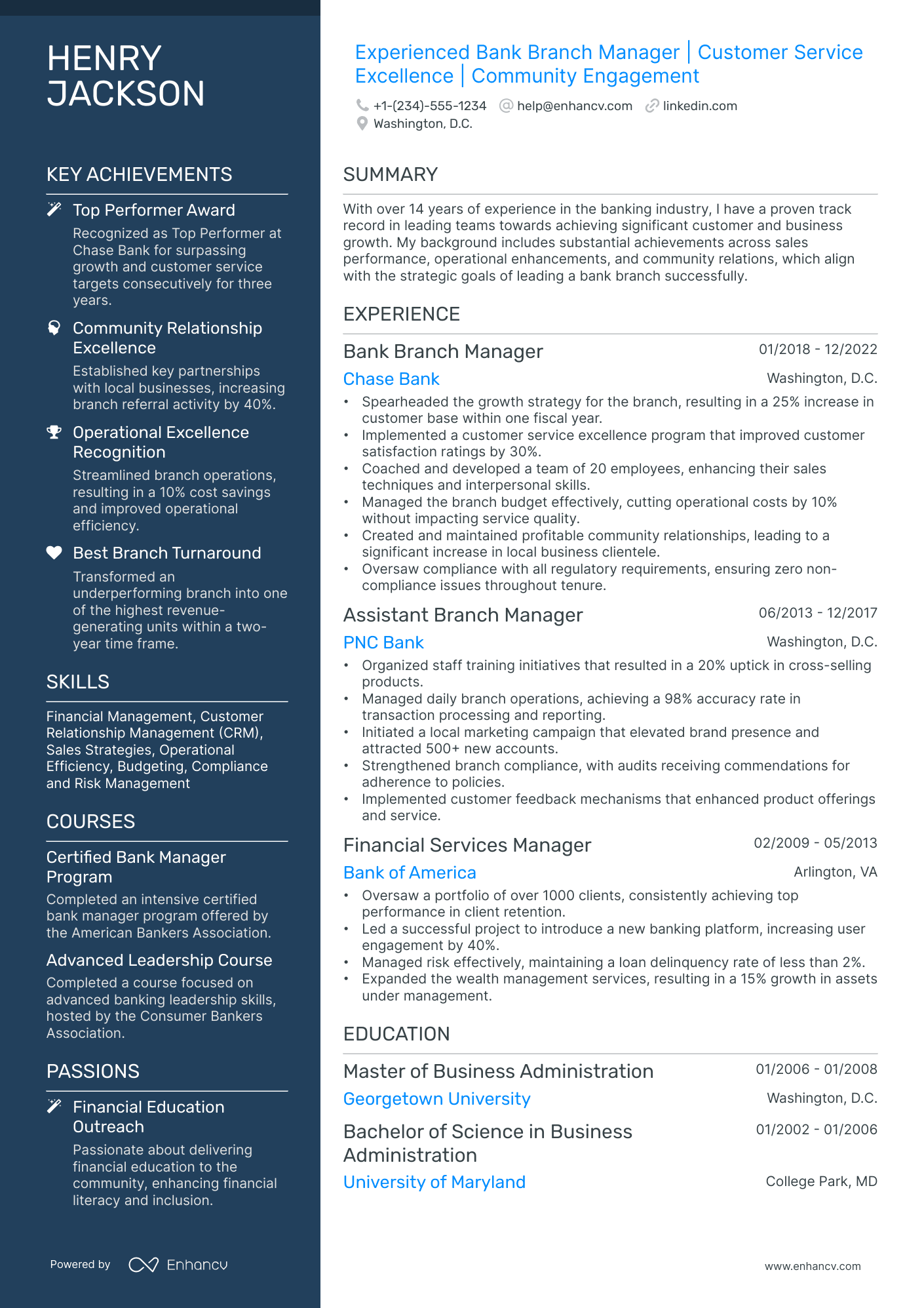

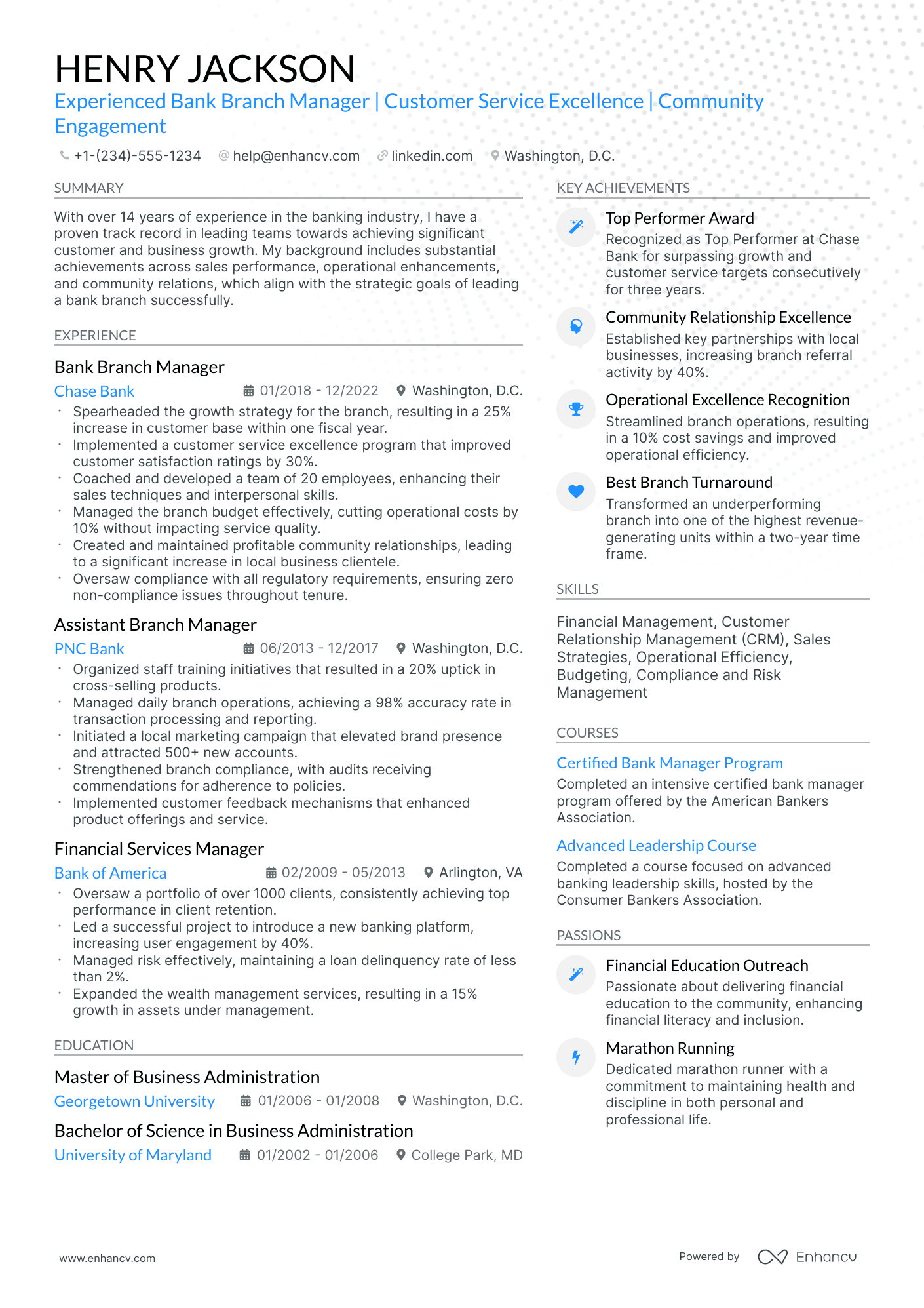

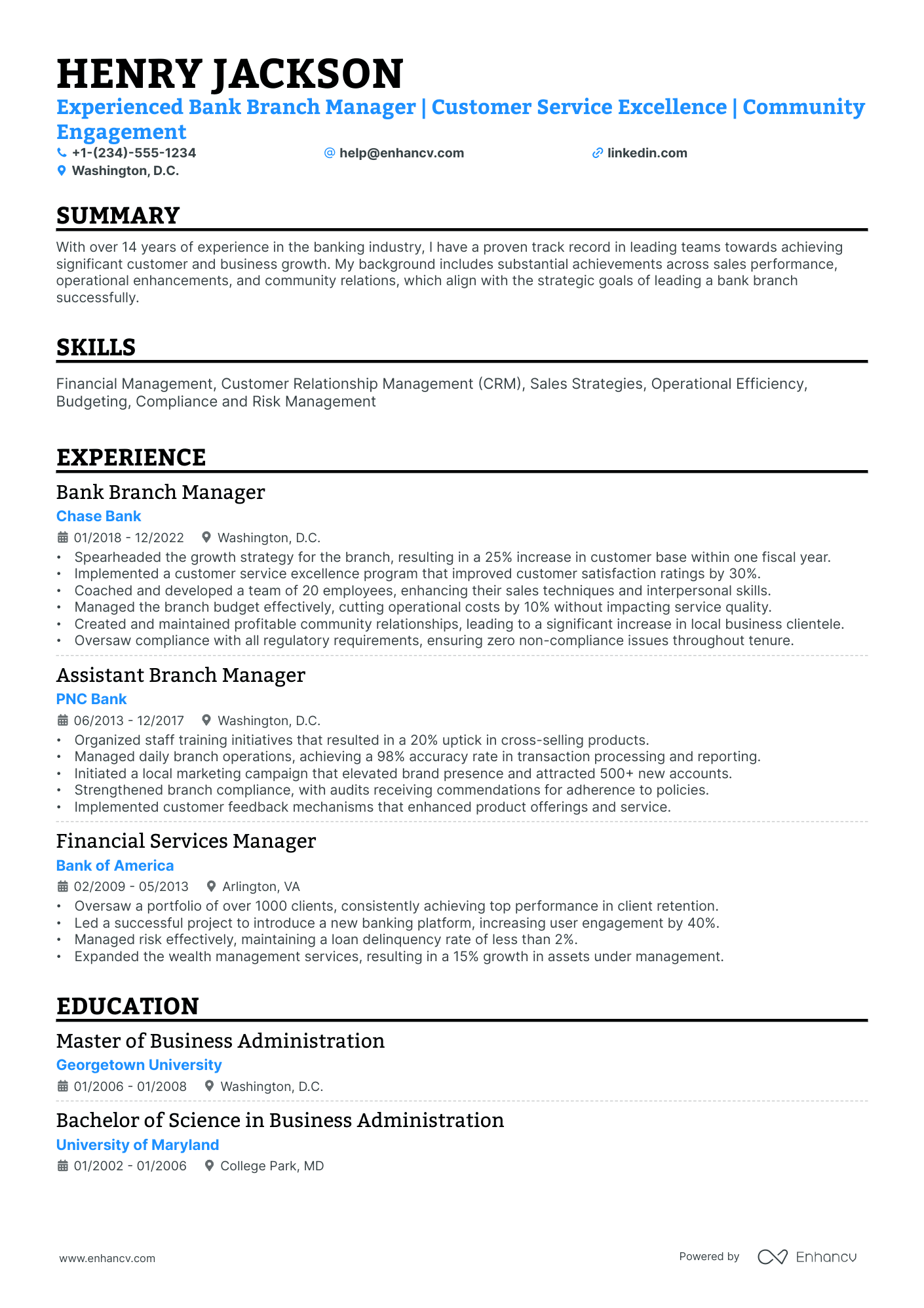

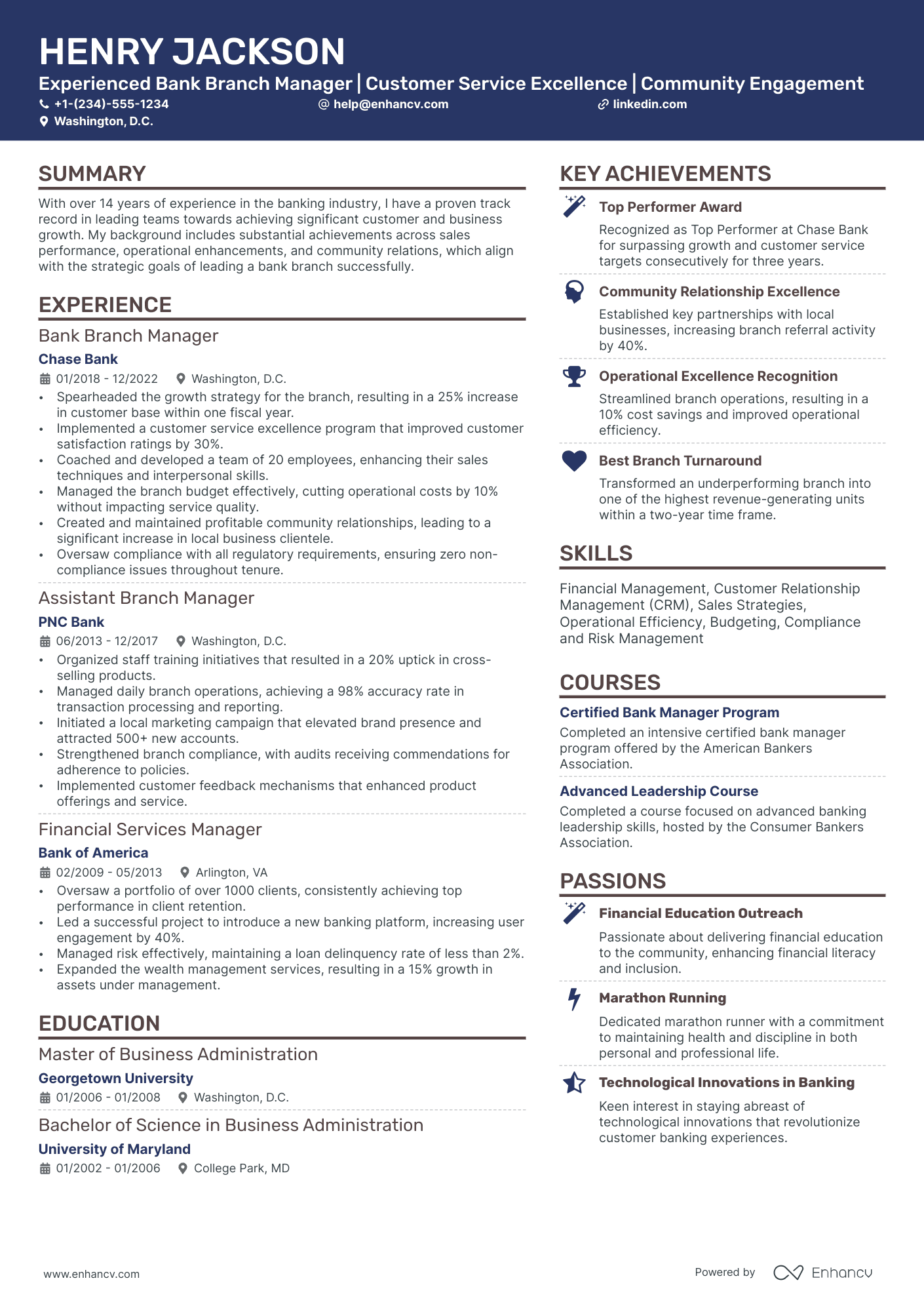

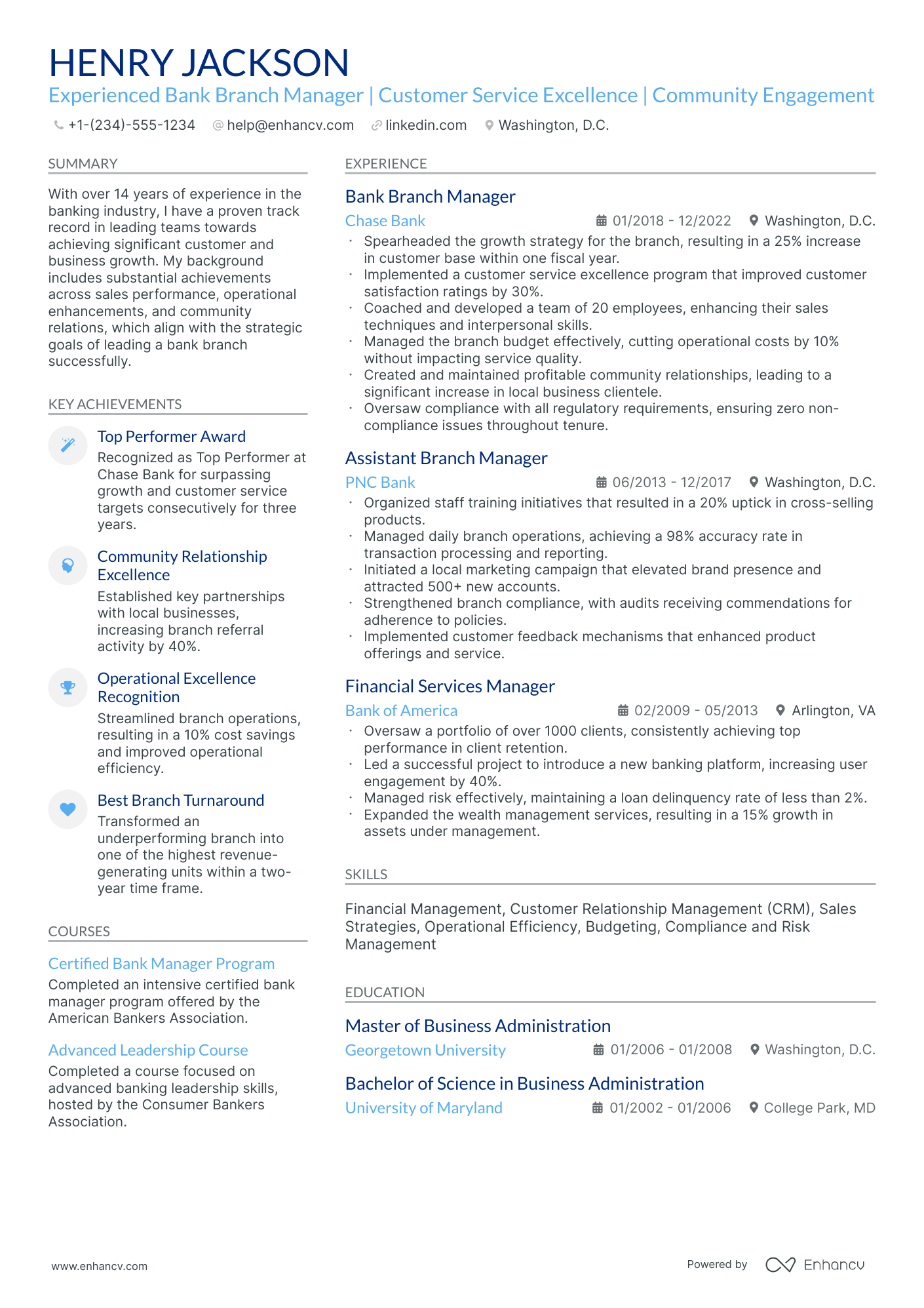

- Apply practical insights from real-life bank branch manager resume examples to enhance your own profile;

- Choose the most effective bank branch manager resume format to succeed in any evaluation process.

- Financial Reporting Manager Resume Example

- Night Auditor Resume Example

- Portfolio Manager Resume Example

- Functional Accounting Resume Example

- Loan Officer Resume Example

- Financial Assistant Resume Example

- Finance Specialist Resume Example

- Corporate Accounting Resume Example

- Bank Manager Resume Example

- Director of Accounting Resume Example

Tips and tricks for your bank branch manager resume format

Before you start writing your resume, you must first consider its look-and-feel - or resume format . Your professional presentation hence should:

- Follow the reverse-chronological resume format , which incroporates the simple logic of listing your latest experience items first. The reverse-chronological format is the perfect choice for candidates who have plenty of relevant (and recent) experience.

- State your intention from the get-go with a clear and concise headline - making it easy for recruiters to allocate your contact details, check out your portfolio, or discover your latest job title.

- Be precise and simple - your resume should be no more than two pages long, representing your experience and skills that are applicable to the bank branch manager job.

- Ensure your layout is intact by submitting it as a PDF. Thus, your resume sections would stay in place, even when assessed by the Applicant Tracker System (ATS).

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

Traditional sections, appreciated by recruiters, for your bank branch manager resume:

- Clear and concise header with relevant links and contact details

- Summary or objective with precise snapshot of our career highlights and why you're a suitable candidate for the bank branch manager role

- Experience that goes into the nuts and bolts of your professional qualifications and success

- Skills section(-s) for more in-depth talent-alignment between job keywords and your own profile

- Education and certifications sections to further show your commitment for growth in the specific niche

What recruiters want to see on your resume:

- Proven experience in financial management and developing strategies for revenue growth within the banking sector.

- Demonstrated leadership abilities to manage, coach, and motivate branch staff to meet high customer service and sales targets.

- Solid understanding and compliance with banking laws, regulations, and the ability to implement risk management practices effectively.

- Strong interpersonal skills to foster relationships with clients, manage customer satisfaction, and address complex customer service issues.

- A track record of successful branch management, including operational efficiency, cost control, and implementing improvements to banking processes.

The experience section or the essence of your professional bank branch manager resume

Recruiters always have and always will appreciate well-written bank branch manager resume experience sections.

The experience section is perhaps the most crucial element of your professional presentation, as it needs to answer job requirements while showcasing your technical expertise and personality.

Create your best resume experience section yet by:

- Selecting only relevant experience items to the role you're applying for;

- Always ensure you've listed a metric to quantify your success alongside each experience item;

- Create a narrative that showcases your bank branch manager career succession: this goes to show the time and effort you've invested in the field to build your experience from the ground up;

- Within each experience bullet, consider a problem you've solved, the skills you've used, and the bigger impact this has made in the organization.

Take a look at how other real-life professionals have curated their experience with the bank branch manager samples below:

- Led a team of 25 bank professionals overseeing daily operations, compliance, and business development, resulting in a 20% growth in customer base.

- Designed and implemented a local market penetration strategy that increased mortgage loan volume by 30% within the first year of execution.

- Collaborated with the regional manager to reallocate branch resources, optimizing staff performance and reducing operational costs by 15%.

- Spearheaded the digital transformation initiative by integrating mobile banking solutions, enhancing customer experience and operational efficiency.

- Achieved top 5% in national customer satisfaction ratings through the implementation of tailored financial advising processes.

- Managed risk and compliance adherence, significantly reducing audit discrepancies and maintaining a superior audit rating for four consecutive years.

- Directed branch sales strategies increasing cross-selling rates by 25%, thereby boosting the profitability of savings and investment products.

- Mentored a team of junior managers across five bank branches, cultivating a culture of high performance and excellent customer service.

- Pioneered a community outreach program that established key relationships with local businesses, expanding the branch’s commercial loan portfolio by $50 million.

- Enhanced client retention by 22% through a bespoke client relationship program that emphasizes personalized financial planning.

- Orchestrated branch's response to COVID-19 pandemic, maintaining full service operations while ensuring employee safety and customer convenience.

- Leveraged data analytics to refine lending practices, which improved loan approval rates by 18% without compromising risk management standards.

- Drove branch to outperform regional sales goals by 35% through strategic leadership and the implementation of an incentive-based rewards system.

- Navigated branch through a significant IT systems upgrade, ensuring a seamless transition for both staff and customers with zero downtime.

- Hosted quarterly financial literacy workshops for the community, which enhanced the branch's public image and led to a 15% increase in new personal account openings.

- Executed a streamlined loan underwriting process, cutting down approval times by 40% and simultaneously improving portfolio quality.

- Implemented a conflict resolution protocol for customer disputes, enhancing client satisfaction and reducing formal complaints by 20%.

- Cultivated an employee development program that reduced staff turnover by 10% and improved employee engagement scores.

- Revitalized a struggling branch, transforming it into a regional top performer with a 40% increase in profitability over a four-year period.

- Developed and led a successful campaign to promote digital banking tools, leading to a 50% adoption rate among the branch's clients.

- Implemented a risk management framework that reduced loan delinquencies by 25%, bolstering the financial health of the branch.

- Reinvigorated the commercial lending division, resulting in a 75% uplift in B2B loan products due to robust market analysis and strategic business partnerships.

- Overhauled customer service protocols contributing to a client recommendation score increase from 70% to 90% within two years.

- Launched a successful employee talent retention plan that decreased turnover by 18% and increased branch productivity by 12%.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for bank branch manager professionals.

Top Responsibilities for Bank Branch Manager:

- Establish and maintain relationships with individual or business customers or provide assistance with problems these customers may encounter.

- Oversee the flow of cash or financial instruments.

- Plan, direct, or coordinate the activities of workers in branches, offices, or departments of establishments, such as branch banks, brokerage firms, risk and insurance departments, or credit departments.

- Recruit staff members.

- Evaluate data pertaining to costs to plan budgets.

- Oversee training programs.

- Establish procedures for custody or control of assets, records, loan collateral, or securities to ensure safekeeping.

- Communicate with stockholders or other investors to provide information or to raise capital.

- Develop or analyze information to assess the current or future financial status of firms.

- Approve, reject, or coordinate the approval or rejection of lines of credit or commercial, real estate, or personal loans.

Quantifying impact on your resume

- Include the percentage growth of customer deposits to demonstrate success in client asset acquisition.

- Specify the number of branch personnel managed to showcase leadership and team management skills.

- Mention the dollar amount of loans generated to highlight proficiency in credit administration and sales.

- Detail the year-over-year growth rate of the branch to display business development capabilities.

- Outline the cost-saving measures implemented and the resulting percentage reduction in operating expenses.

- List the number of successful regulatory audits to prove adherence to compliance standards.

- Provide the Net Promoter Score or customer satisfaction ratings to illustrate a focus on customer service.

- State the number of new business accounts opened to show effectiveness in expanding the customer base.

Action verbs for your bank branch manager resume

Remember these four tips when writing your bank branch manager resume with no experience

You've done the work - auditing the job requirements for keywords and have a pretty good idea of the skill set the ideal candidate must possess.

Yet, your professional experience amounts to a summer internship .

Even if you have limited or no professional expertise that matches the role you're applying for, you can use the resume experience section to:

- List extracurricular activities that are relevant to the job requirements. Let's say you were editor-in-chief of your college newspaper or part of the engineering society. Both activities have taught you invaluable, transferrable skills (e.g. communication or leadership) that can be crucial for the job;

- Substitute jobs with volunteer experience. Participating in charity projects has probably helped you develop an array of soft skills (e.g. meeting deadlines and interpersonal communications). On the other hand, volunteering shows potential employers more about you: who you are and what are the causes you care about;

- Align job applications with your projects. Even your final-year thesis work could be seen as relevant experience, if it's in the same industry as the job you're applying for. Ensure you've listed the key skills your project has taught you, alongside tangible outcomes or your project success;

- Shift the focus to your transferrable skills. We've said it before, but recruiters will assess your profile upon both job requirements and the skills you possess. Consider what your current experience - both academic and life - has taught you and how you've been able to develop your talents.

Recommended reads:

PRO TIP

If you happen to have some basic certificates, don't invest too much of your bank branch manager resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

Key hard skills and soft skills for your bank branch manager resume

At the top of any recruiter bank branch manager checklist, you'd discover a list of technical competencies, balanced with personal skills.

Hard or technical skills are your opportunity to show how you meet the essential responsibilities of the role. The ability to use a particular job-crucial technology or software would also hint to recruiters whether you'd need a prolonged period of on-the-job training - or you'd fit right in the job.

But to land your dream role, you'd also need to demonstrate a variety of soft or people resume skills . Employers care about soft skills as they show how each candidate would fit into the team and company culture.

Both types of skills are specific and to best curate them on your resume, you'd need to:

- Create a skill section within which you showcase your hard and soft skills and present how they help you succeed.

- List specific examples of projects, tasks, or competitions, within which your skill set has assisted your results.

- Soft skills are harder to measure, so think about situations in which they've helped you thrive. Describe those situations concisely, focusing on how the outcome has helped you grow as a professional.

- Metrics of success - like positive ROI or optimized workplace processes - are the best way to prove your technical and people skills.

Take a look at some of bank branch manager industry leaders' favorite hard skills and soft skills, as listed on their resumes.

Top skills for your bank branch manager resume:

Financial Analysis Software

Customer Relationship Management (CRM) Systems

Point of Sale (POS) Systems

Loan Processing Software

Accounting Software

Risk Management Tools

Data Analysis Tools

Microsoft Excel

Regulatory Compliance Software

Budgeting and Forecasting Tools

Leadership

Communication

Problem Solving

Team Management

Customer Service

Decision Making

Conflict Resolution

Time Management

Adaptability

Interpersonal Skills

Next, you will find information on the top technologies for bank branch manager professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Bank Branch Manager’s resume:

- Oracle PeopleSoft

- Workday software

- Microsoft PowerPoint

- Microsoft SQL Server

- Yardi software

PRO TIP

Always remember that your bank branch manager certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

Showcase academic background with education and certifications' sections

Listing your education and certifications should be a rudimentary part of your resume writing.

Including your relevant academic background - in the form of your higher education degree and niche-specific certificates - will prove knowledge of the industry.

For your education section:

- Start by including your degree, followed by start and graduation dates, as well as the institution;

- You could include relevant coursework, major/minor , or GPA, only if your've just graduated from college or if this information would further support your application;

- If you have an "ongoing" degree, you can still list it in case you think your diploma can impress recruiters or it's required;

Follow a similar logic for your certifications section by listing the institution, alongside dates you've obtained the certificate. For some of the most recent and relevant industry certificates , check out the next part of our guide:

The top 5 certifications for your bank branch manager resume:

- Certified Bank Manager (CBM) - Institute of Bank Management and Research

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Financial Planner (CFP) - Certified Financial Planner Board of Standards

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants

- General Banking Officer (GBO) - American Bankers Association

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for bank branch manager professionals.

Top US associations for a Bank Branch Manager professional

- AICPA and CIMA

- American Bankers Association

- Association for Financial Professionals

- Association of Government Accountants

- CFA Institute

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

Recommended reads:

Professional summary or objective for your bank branch manager resume

bank branch manager candidates sometimes get confused between the difference of a resume summary and a resume objective.

Which one should you be using?

Remember that the:

- Resume objective has more to do with your dreams and goals for your career. Within it, you have the opportunity to showcase to recruiters why your application is an important one and, at the same time, help them imagine what your impact on the role, team, and company would be.

- Resume summary should recount key achievements, tailored for the role, through your career. Allowing recruiters to quickly scan and understand the breadth of your bank branch manager expertise.

The resume objectives are always an excellent choice for candidates starting off their career, while the resume summary is more fitting for experienced candidates.

No matter if you chose a summary or objective, get some extra inspiration from real-world professional bank branch manager resumes:

Resume summaries for a bank branch manager job

- Veteran financial strategist boasting a stellar 15-year record spearheading the commercial prowess of mid-sized community banks in the Northeast. Expertise in driving operational efficiency, implementing robust risk management practices, and augmenting customer retention rates. Lauded for orchestrating a 40% increase in loan portfolio growth at previous institution.

- Dynamic leader with over a decade’s experience transforming regional bank branches into high-performing powerhouses, adept in advanced financial analysis and strategic business development. Excelled in achieving top-tier satisfaction ratings and leading a branch to win the National Excellence Award in 2021.

- Former retail management professional eager to channel extensive people-management and sales expertise into banking. With a keen acumen for driving operational success and enhancing customer experiences, aspiring to leverage 8 years of retail leadership to pivot into branch banking management and contribute to sustainable growth.

- Accomplished educator with over 20 years fostering academic excellence, now aspiring to apply transferable leadership skills to the banking sector. Exceptional ability to cultivate collaborative work environments and adept at driving initiatives that align with organizational objectives, determined to bring educational innovation to client financial services.

- Eager to embark on a career in banking management, bringing forth a fresh perspective, strong analytical aptitude, and a vibrant enthusiasm for developing financial solutions that resonate with community needs. Keen to absorb industry knowledge and contribute to the growth of a leading financial institution.

- Highly motivated professional with extensive customer service experience and a passion for finance, seeking to leverage interpersonal skills and a relentless work ethic in the pursuit of excellence in banking branch management. Dedicated to mastering regulatory compliance and client relations to foster an environment of trust and prosperity.

Average salary info by state in the US for Bank Branch Manager professionals

Local salary info for Bank Branch Manager.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $156,100 |

| California (CA) | $169,780 |

| Texas (TX) | $155,380 |

| Florida (FL) | $135,780 |

| New York (NY) | $215,430 |

| Pennsylvania (PA) | $137,770 |

| Illinois (IL) | $149,900 |

| Ohio (OH) | $131,610 |

| Georgia (GA) | $159,620 |

| North Carolina (NC) | $146,860 |

| Michigan (MI) | $131,770 |

Showcasing your personality with these four bank branch manager resume sections

Enhance your bank branch manager expertise with additional resume sections that spotlight both your professional skills and personal traits. Choose options that not only present you in a professional light but also reveal why colleagues enjoy working with you:

- My time - a pie chart infographic detailing your daily personal and professional priorities, showcasing a blend of hard and soft skills;

- Hobbies and interests - share your engagement in sports, fandoms, or other interests, whether in your local community or during personal time;

- Quotes - what motivates and inspires you as a professional;

- Books - indicating your reading and comprehension skills, a definite plus for employers, particularly when your reading interests align with your professional field.

Key takeaways

- Your bank branch manager resume is formatted professionally and creates an easy-to-read (and -understand) experience for recruiters;

- You have included all pertinent sections (header, summary/objective, experience, skills, certifications) within your bank branch manager resume;

- Instead of just listing your responsibilities, you've qualified them with skills and the results of your actions;

- Within your bank branch manager resume, you've taken the time to align specific job requirements with your unique expertise, showcasing the value you can provide as a professional;

- Technologies and personal skills are featured across different sections of your bank branch manager resume to achieve the perfect balance.