Quantitative researchers often struggle with adequately quantifying and articulating their complex data analysis projects on a resume in a concise yet impactful manner. Our guide can assist by providing specific strategies to effectively communicate research findings and technical skills, using industry-relevant keywords and examples of well-structured data analysis project descriptions.

Dive into our quantitative researcher resume guide to:

- Explore top-tier resume examples, offering insights into the industry's best practices.

- Enhance sections like experience, education, and achievements with expert advice.

- Articulate your technical prowess and personal attributes, setting you apart from other candidates.

- Sharpen your focus on the distinct skills that make your quantitative researcher resume resonate with recruiters.

Recommended reads:

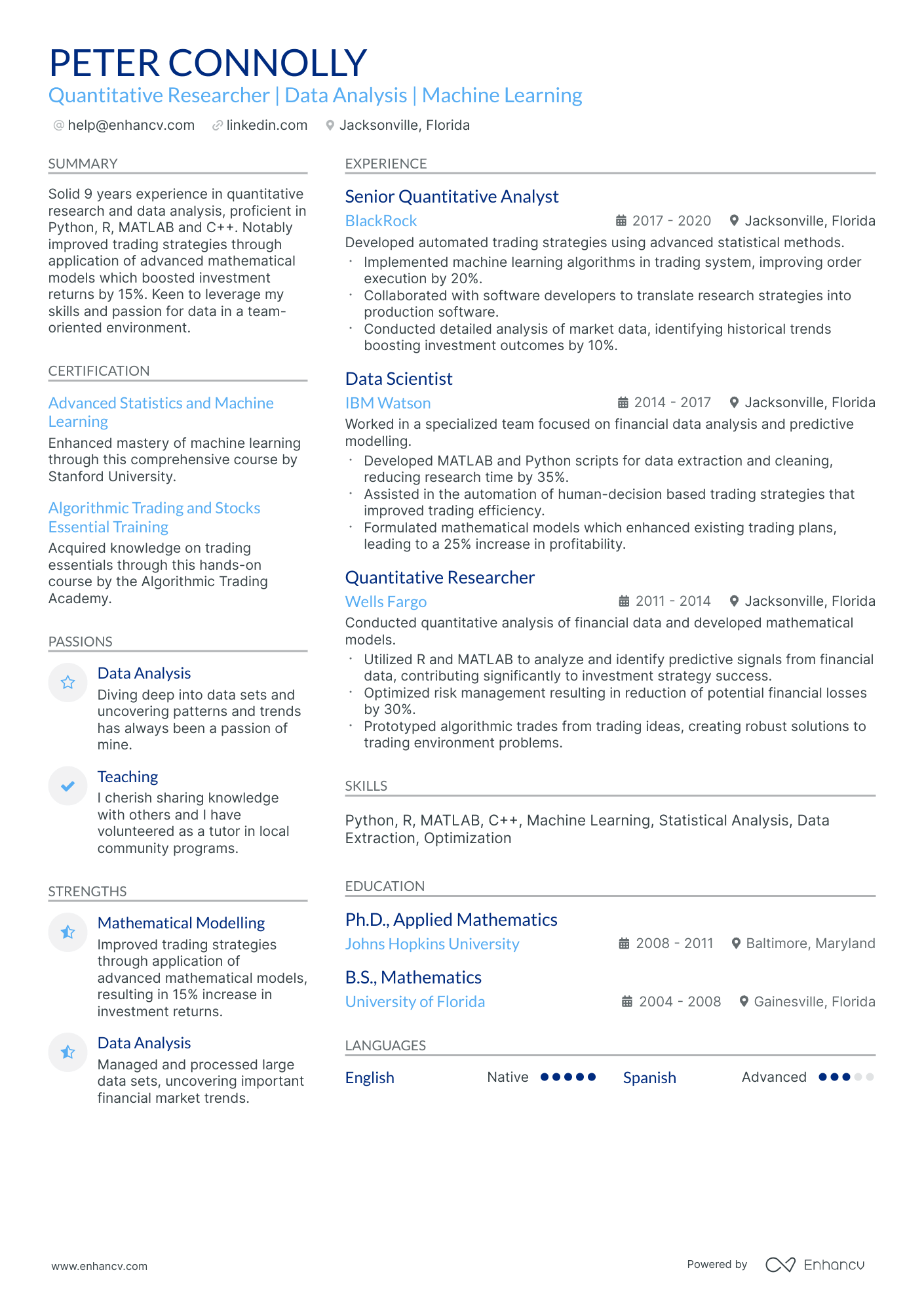

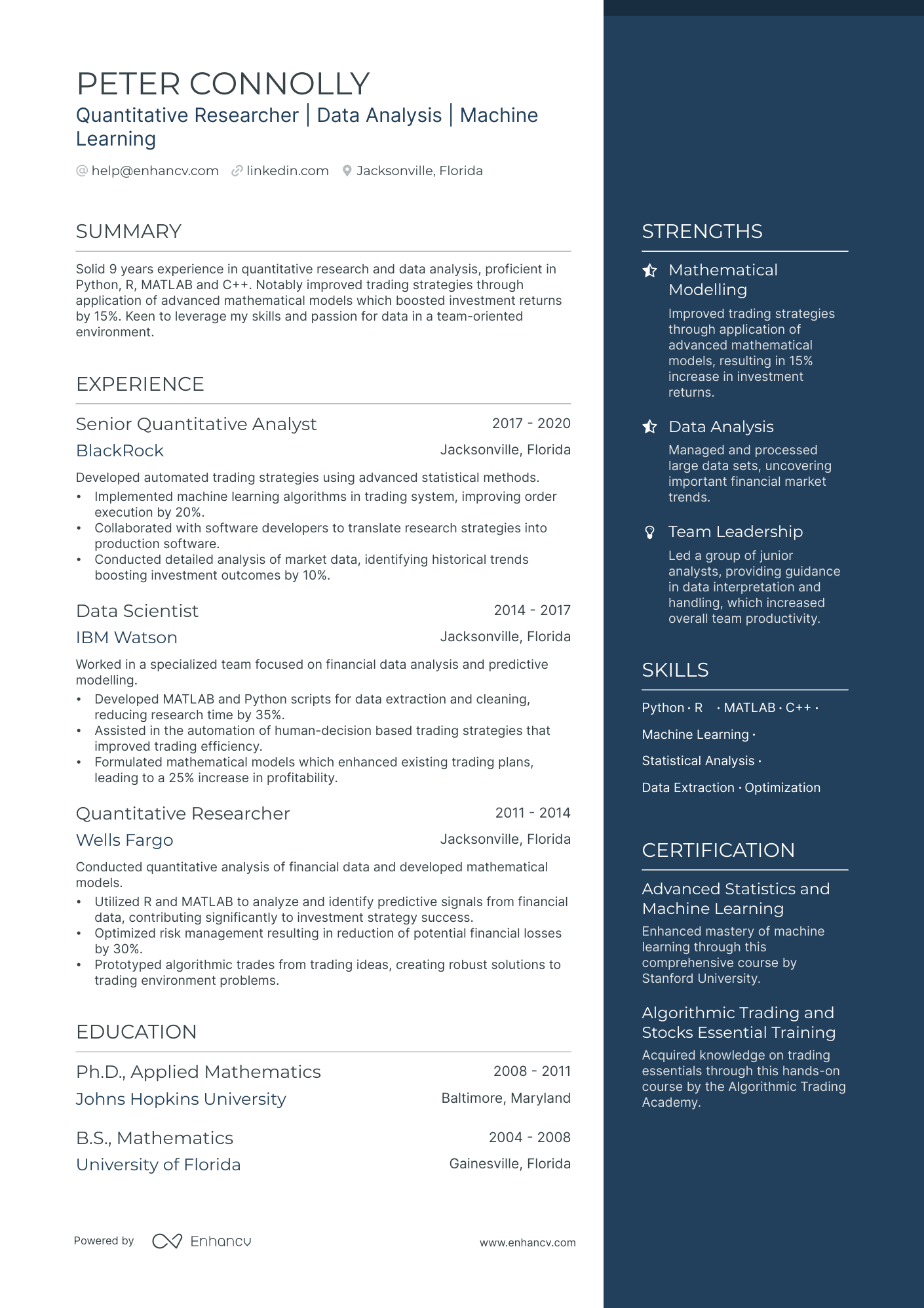

crafting a stellar quantitative researcher resume format

Navigating the maze of resume formatting can be challenging. But understanding what recruiters prioritize can make the process smoother.

Wondering about the optimal format, the importance of certain sections, or how to detail your experience? Here's a blueprint for a polished resume:

- Adopt the reverse-chronological resume format. By spotlighting your latest roles upfront, you offer recruiters a snapshot of your career trajectory and recent accomplishments.

- Your header isn't just a formality. Beyond basic contact information, consider adding a link to your portfolio and a headline that encapsulates a significant achievement or your current role.

- Distill your content to the most pertinent details, ideally fitting within a two-page limit. Every line should reinforce your candidacy for the quantitative researcher role.

- To preserve your resume's layout across different devices and platforms, save it as a PDF.

Each market has its own resume standards – a Canadian resume layout may differ, for example.

Upload your resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Pro tip

Make sure your resume is ATS compliant and catches the recruiters' attention by tailoring your experience to the specific job requirements. Quantify and highlight why you're the best candidate for the role on the first page of your resume.

Elevate your quantitative researcher resume with these essential sections:

- Header: The go-to section for recruiters seeking your contact details, portfolio, or current role.

- Summary or objective: A snapshot of your achievements and aspirations.

- Experience: A testament to your technical and interpersonal prowess.

- Skills: A showcase of your capabilities aligned with the job requirements.

- Certifications/Education: A reflection of your commitment to staying updated in the industry.

What recruiters want to see on your resume:

- Quantitative Skills: Demonstrated proficiency in quantitative methods such as statistics, machine learning, data analysis, etc., preferably with evidence like relevant projects or previous job experience.

- Programming Proficiency: Proficiency in programming languages commonly used in quantitative research, especially Python, R, SQL, or MATLAB. Knowledge of big data tools like Hadoop or Spark can also be advantageous.

- Advanced Degree: Possession of an advanced degree (master's, PhD) in a quantitative field like Mathematics, Statistics, Physics, Economics, Computer Science, or Engineering.

- Industry Knowledge: Understanding of the industry where the research will be applied, for example finance for a quantitative finance role, is often highly valued.

- Communication Skills: Ability to explain complex concepts and findings to non-technical stakeholders, demonstrated through presentations, reports, or other communication experiences.

Recommended reads:

Writing your quantitative researcher resume experience

Here are some quick tips on how to curate your quantitative researcher professional experience:

- Always ensure that you quantify your achievements by implementing the Situation-Task-Action-Result framework;

- When writing each experience bullet, make sure you're using active voice;

- Stand out by including personal skills you've grown while at the job;

- Be specific about your professional experience - it's not enough to say you have great communication skills, but rather explain what your communication track record led to?

Wondering how other professionals in the industry are presenting their job-winning experience? Check out how these quantitative researcher professionals put some of these best practices into action:

- Conducted quantitative analysis of financial data to develop trading strategies resulting in a 20% increase in portfolio returns.

- Implemented machine learning algorithms for market prediction, leading to improved trading accuracy by 15%.

- Collaborated with cross-functional teams to optimize risk management models and reduce portfolio volatility by 10%.

- Researched and implemented high-frequency trading algorithms, resulting in a 25% reduction in trade execution time.

- Developed statistical models to identify market inefficiencies, generating $1 million in annual revenue.

- Analyzed large datasets using Python and SQL, extracting key insights for investment decision-making.

- Performed extensive backtesting of trading strategies, resulting in the identification of profitable opportunities and an annual return rate of 18%.

- Collaborated with portfolio managers to develop systematic trading models, improving overall portfolio performance by 12%.

- Conducted research on alternative data sources and integrated them into existing models, enhancing predictive accuracy by 20%.

- Presented research findings to senior stakeholders, facilitating data-driven investment decisions.

- Built and maintained statistical models for analyzing market trends and forecasts, resulting in accurate predictions of asset price movements.

- Collaborated with traders to develop algorithmic trading strategies, leading to a 15% increase in trading profitability.

- Conducted research on market microstructure and liquidity risk, contributing to the development of robust trading execution algorithms.

- Developed risk management frameworks to mitigate market volatility, resulting in a 30% reduction in portfolio downside risk.

- Worked closely with software engineers to implement complex trading systems and optimize trade execution speed.

- Performed statistical analysis on historical financial data, identifying patterns and correlations for predictive modeling.

- Collaborated with portfolio managers to develop asset allocation strategies, resulting in a 10% increase in portfolio returns.

- Conducted research on market anomalies and developed trading signals to exploit inefficiencies, resulting in a 20% annualized return.

- Optimized existing trading models by incorporating machine learning techniques, improving accuracy by 12%.

- Assisted in the development of proprietary risk models and stress testing methodologies.

- Designed and implemented quantitative investment strategies using advanced mathematical models and statistical methods.

- Developed automated trading systems, resulting in a 25% increase in trade execution efficiency.

- Conducted research on market impact and transaction cost analysis, leading to improved trading performance and reduced slippage.

- Collaborated with data scientists to analyze alternative datasets and extract valuable insights for trading decisions.

- Implemented reinforcement learning algorithms for portfolio optimization, resulting in a 15% improvement in risk-adjusted returns.

- Developed statistical models for pricing and risk analysis of complex derivative products.

- Conducted quantitative research on multi-factor investment strategies, resulting in an annualized return of 12%.

- Collaborated with traders to design and implement algorithmic trading systems using C++ and MATLAB.

- Performed backtesting and performance attribution analysis to evaluate the effectiveness of trading strategies.

- Presented research findings to clients and provided recommendations based on data-driven insights.

- Conducted statistical analysis of market data to identify trends and patterns for systematic trading strategies.

- Built predictive models using machine learning algorithms, resulting in a 20% reduction in prediction error.

- Collaborated with portfolio managers to develop risk management frameworks and optimize portfolio allocation.

- Researched and implemented advanced statistical techniques for volatility modeling and option pricing.

- Contributed to the development of trading infrastructure and supported live trading operations.

- Assisted in the collection and cleaning of financial market data for quantitative analysis and modeling purposes.

- Performed statistical analysis of historical price data to identify patterns and correlations for trading strategy development.

- Collaborated with senior researchers to evaluate the performance of existing trading models and propose improvements.

- Contributed to the development of risk management tools and systems for effective portfolio monitoring.

- Conducted ad-hoc research projects to investigate market anomalies and trading opportunities.

- Developed and implemented quantitative investment strategies using mathematical and statistical models.

- Performed extensive data analysis on large financial datasets, identifying profitable trading opportunities.

- Collaborated with traders to optimize trade execution algorithms and reduce market impact.

- Researched and implemented machine learning techniques for portfolio optimization, resulting in a 10% increase in risk-adjusted returns.

- Analyzed market microstructure data to gain insights into liquidity patterns and improve trading strategies.

- Conducted quantitative analysis of financial markets, focusing on equity pricing and risk modeling.

- Collaborated with portfolio managers to develop asset allocation strategies based on risk-return profiles.

- Performed historical backtesting of trading strategies and recommended adjustments for improved performance.

- Assisted in the development of valuation models for derivatives and structured products.

- Participated in research projects exploring emerging quantitative finance concepts and methodologies.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for quantitative researcher professionals.

Top Responsibilities for Quantitative Researcher:

- Apply mathematical or statistical techniques to address practical issues in finance, such as derivative valuation, securities trading, risk management, or financial market regulation.

- Research or develop analytical tools to address issues such as portfolio construction or optimization, performance measurement, attribution, profit and loss measurement, or pricing models.

- Interpret results of financial analysis procedures.

- Develop core analytical capabilities or model libraries, using advanced statistical, quantitative, or econometric techniques.

- Define or recommend model specifications or data collection methods.

- Produce written summary reports of financial research results.

- Maintain or modify all financial analytic models in use.

- Provide application or analytical support to researchers or traders on issues such as valuations or data.

- Devise or apply independent models or tools to help verify results of analytical systems.

- Collaborate in the development or testing of new analytical software to ensure compliance with user requirements, specifications, or scope.

Quantifying impact on your resume

<ul>

Lacking experience? Here's what to do.

Candidates with limited experience often fall into two categories:

- Recent graduates aiming for a quantitative researcher role

- Professionals transitioning from a different field

Both can still land a job in the industry. Here's how to optimize the experience section of your quantitative researcher resume:

- Highlight your strengths, especially if they align with the job requirements.

- Remove unrelated experiences. Your resume should tell a story that resonates with the quantitative researcher role.

- Showcase your personality. Traits like ambition and diligence can make you an attractive candidate.

- Align your experience with the job requirements, ensuring your resume speaks directly to the role.

Recommended reads:

Pro tip

If your experience section doesn't directly address the job's requirements, think laterally. Highlight industry-relevant awards or positive feedback to underscore your potential.

Highlighting your quantitative researcher skills

Recruiters look for a mix of technical and personal skills in your quantitative researcher resume.

Technical or hard skills are specific tools or software you use for the job. They're easy to spot through your education and work achievements.

On the other hand, soft skills like communication or adaptability show how you work with others. They come from both your personal and work life.

To showcase your skills:

- Have a skills section for technical abilities and another for personal strengths.

- Be clear about your skills. Name the exact tools you use and describe how you've used your soft skills.

- Avoid common terms like "Microsoft Office" unless the job specifically asks for them.

- Choose up to ten key skills and organize them in different sections of your resume.

Make your resume pop with top technical and personal skills that recruiters value.

Top skills for your quantitative researcher resume:

Statistical Analysis Software (e.g., R, Python, MATLAB)

Machine Learning Algorithms

Data Visualization Tools (e.g., Tableau, Matplotlib)

Quantitative Modeling Techniques

Database Management (e.g., SQL, NoSQL)

Time Series Analysis

Financial Modeling

Risk Management Frameworks

Programming Languages (e.g., C++, Java)

Optimization Techniques

Analytical Thinking

Problem-Solving

Attention to Detail

Communication Skills

Collaboration

Critical Thinking

Adaptability

Time Management

Creativity

Decision Making

Next, you will find information on the top technologies for quantitative researcher professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Quantitative Researcher’s resume:

- C#

- Perl

- Microsoft PowerPoint

- IBM SPSS Statistics

- The MathWorks MATLAB

Pro tip

Consider dedicating a separate skills section on your quantitative researcher resume to showcase your technical proficiencies, especially if you want to highlight specific software expertise.

Highlighting education and certification on your quantitative researcher resume

Your education section is a testament to your foundational knowledge and expertise.

Consider:

- Detailing your academic qualifications, including the institution and duration.

- If you're still studying, mention your anticipated graduation date.

- Omit degrees that aren't pertinent to the job.

- Highlight academic experiences that underscore significant milestones.

For quantitative researcher roles, relevant education and certifications can set you apart.

To effectively showcase your qualifications:

- List all pertinent degrees and certifications in line with the job requirements.

- Include additional certifications if they bolster your application.

- Provide concise details: certification name, institution, and dates.

- If you're pursuing a relevant certification, indicate your expected completion date.

Your education and certification sections validate both your foundational and advanced knowledge in the industry.

Best certifications to list on your resume

- Certified Financial Analyst (CFA) - CFA Institute

- Financial Risk Manager (FRM) - Global Association of Risk Professionals (GARP)

- Data Science Certification - Harvard University

- Certificate in Quantitative Finance (CQF) - Fitch Learning

- Certified Analytics Professional (CAP) - INFORMS

- Advanced Data Analysis Certificate - Cornell University

- Postgraduate Certificate in Quantitative Finance - Imperial College London

Pro tip

List your degrees in reverse order, starting with the newest. A recent PhD or unique field could set you apart.

Recommended reads:

Deciding between a quantitative researcher resume summary or objective

While some argue the resume summary or objective is outdated, these sections can effectively:

- Integrate pivotal quantitative researcher keywords.

- Showcase your achievements.

- Clarify your motivation for applying.

The distinction lies in their focus:

- A resume objective emphasizes your career aspirations.

- A resume summary spotlights your career milestones.

Opt for a summary if you have a rich experience you wish to highlight immediately. Conversely, an objective can be ideal for those wanting to underscore their aspirations and soft skills.

For inspiration, we've curated samples from industry professionals to guide your resume summary or objective crafting:

Resume summary and objective examples for a quantitative researcher resume

Extra sections to boost your quantitative researcher resume

Recruiters love candidates who offer more. Share your personality or extra industry credentials. Consider adding:

- Projects showcasing standout work.

- Top awards or recognitions.

- Relevant publications.

- Hobbies and interests that reveal more about you.

Key takeaways

- Format your quantitative researcher resume for clarity and coherence, ensuring it aligns with the role.

- Highlight key sections (header, summary/objective, experience, skills, certifications) within your quantitative researcher resume.

- Quantify achievements and align them with skills and job requirements.

- Feature both technical and personal skills across your resume for a balanced portrayal.