As a finance officer, articulating the complex nature of your financial management and analytical skills on your resume can be a significant challenge. Our guide offers targeted advice on how to succinctly translate your intricate financial expertise into compelling, job-winning resume content.

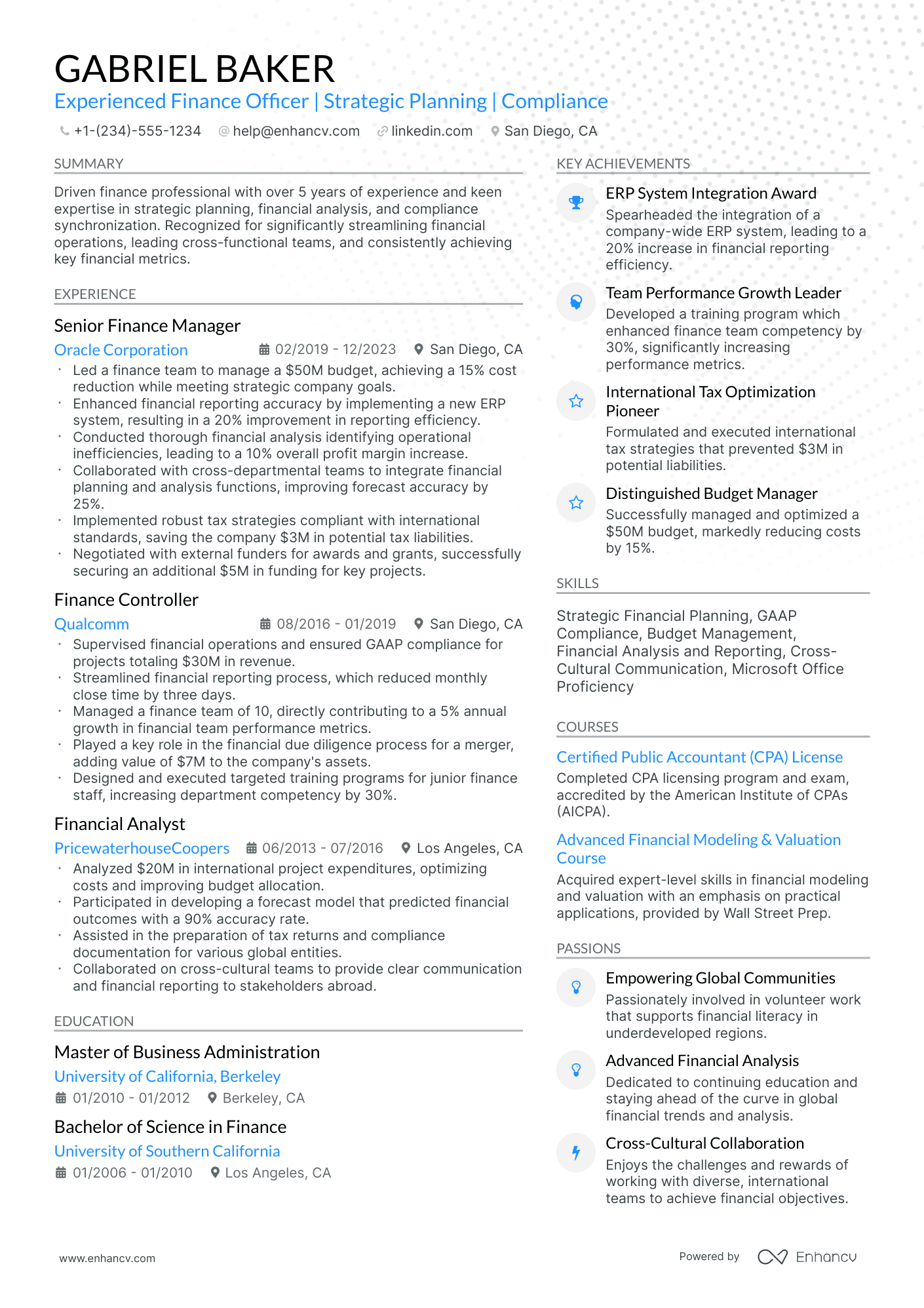

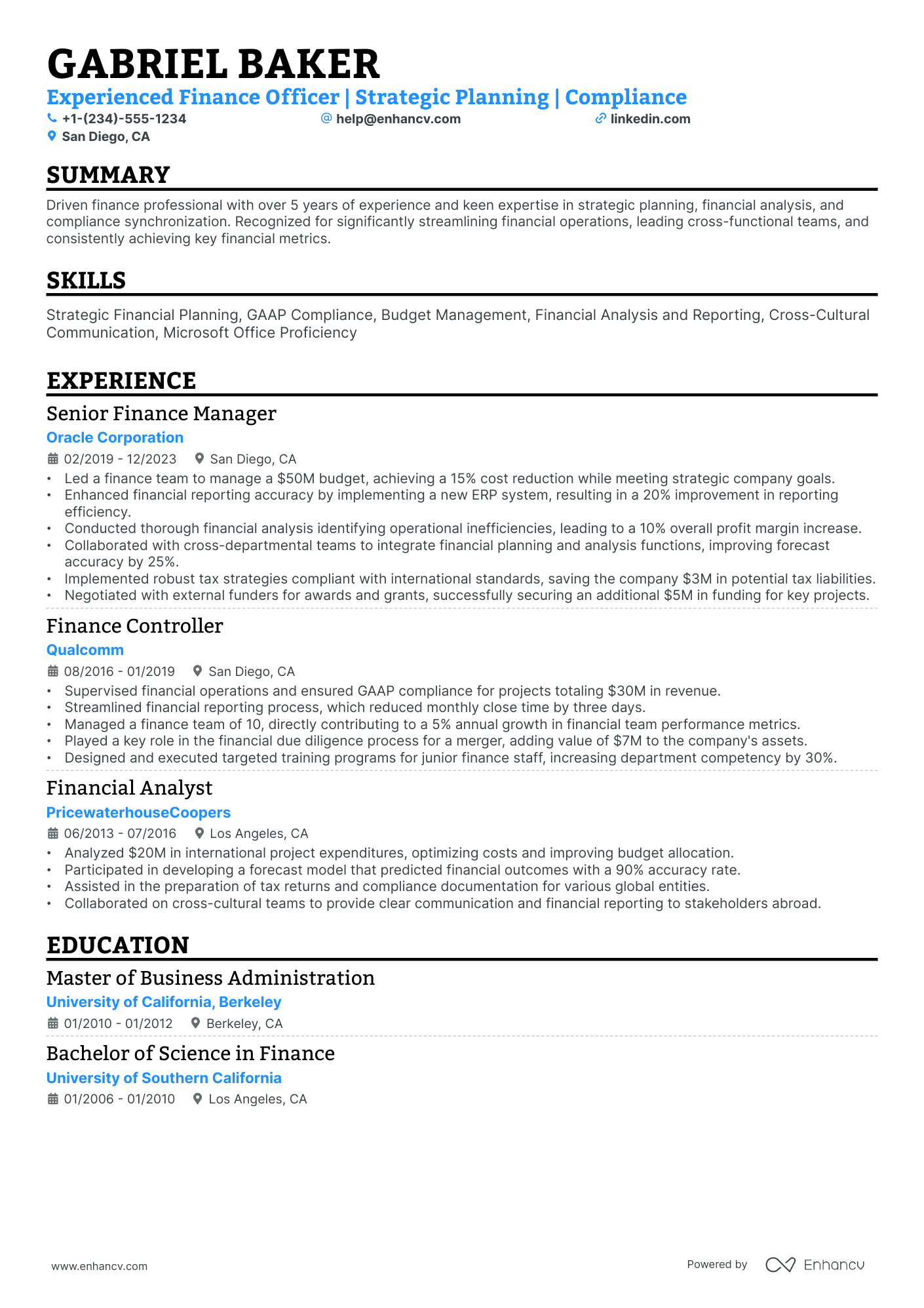

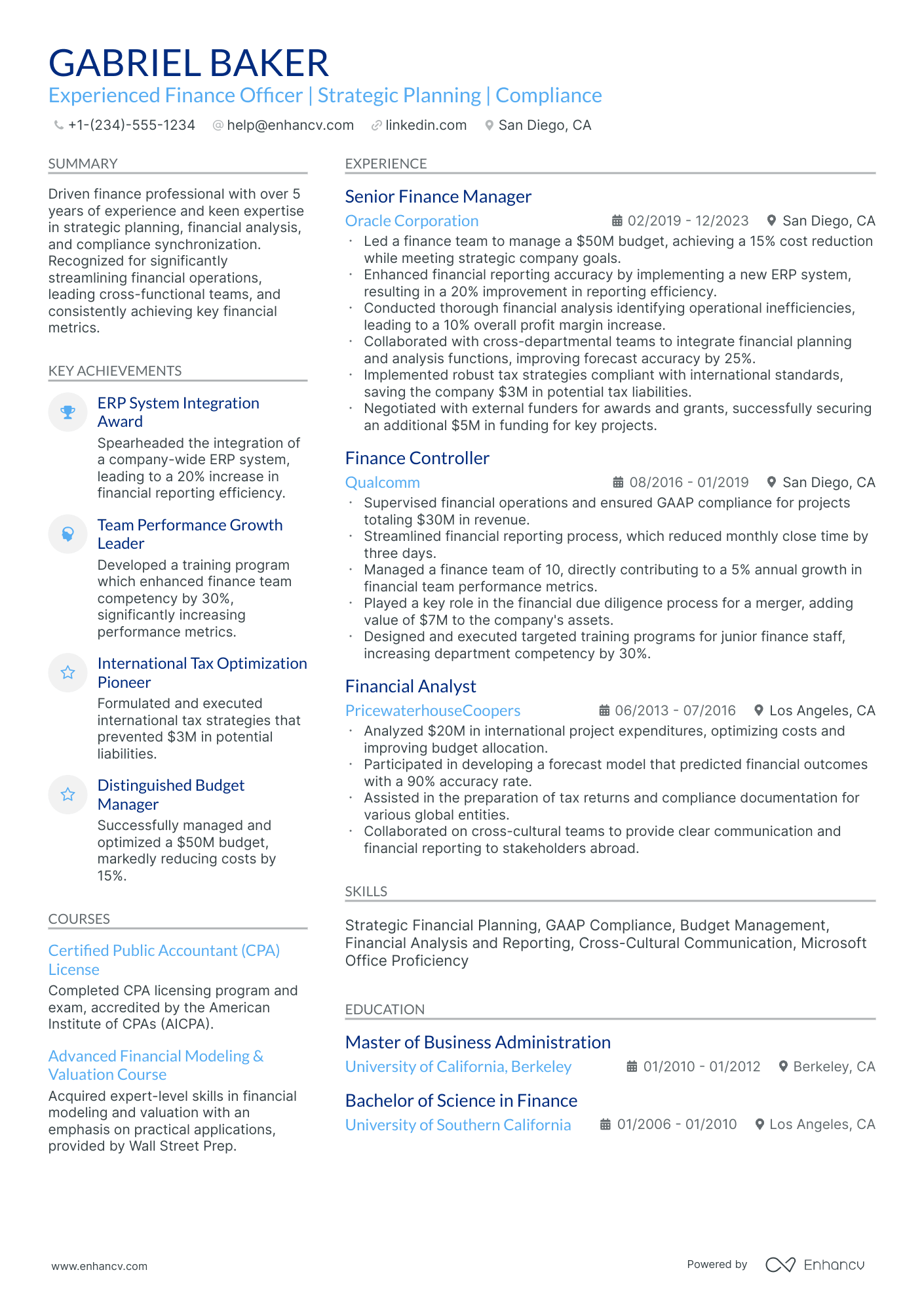

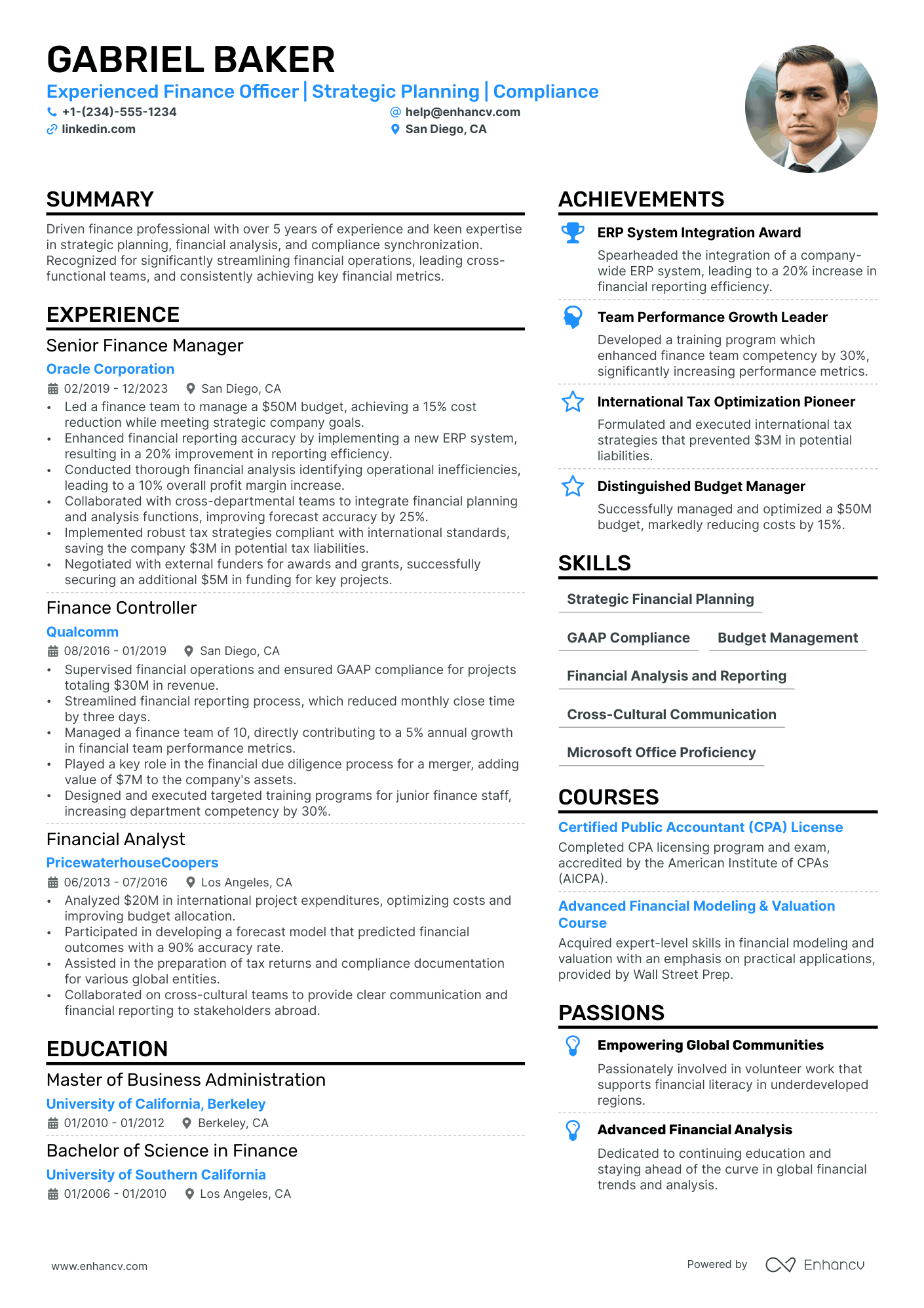

- Finance officer resume samples that got people hired at top companies.

- How to perfect the look-and-feel of your resume layout.

- How to showcase your achievements and skills through various resume sections.

- How you could hint to recruiters why your resume is the ideal profile for the job.

If the finance officer resume isn't the right one for you, take a look at other related guides we have:

- Bank Branch Manager Resume Example

- Project Accounting Resume Example

- Billing Manager Resume Example

- Big 4 Auditor Resume Example

- Tax Manager Resume Example

- Accounting Assistant Resume Example

- External Auditor Resume Example

- Financial Project Manager Resume Example

- Director of Accounting Resume Example

- Commercial Banking Resume Example

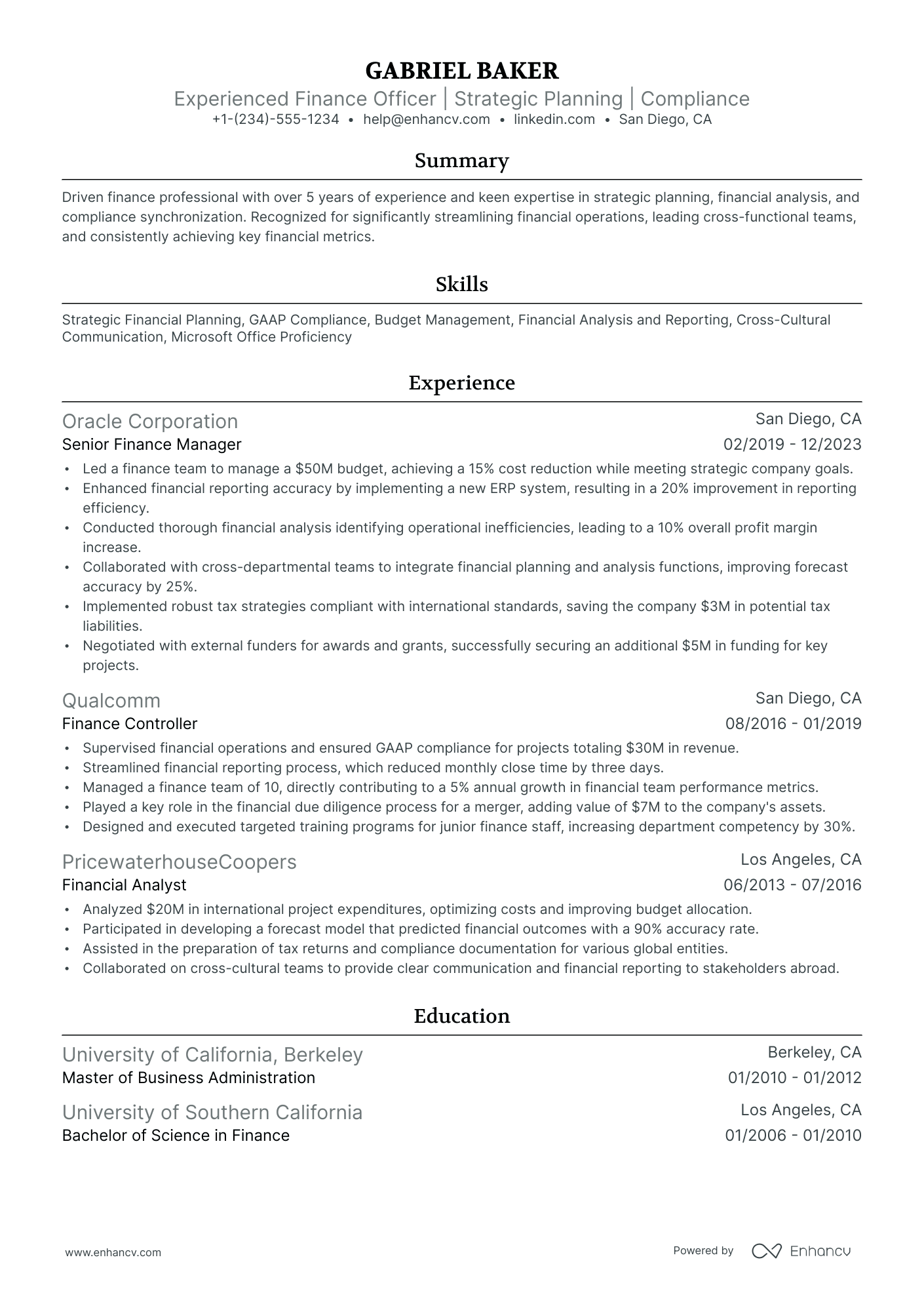

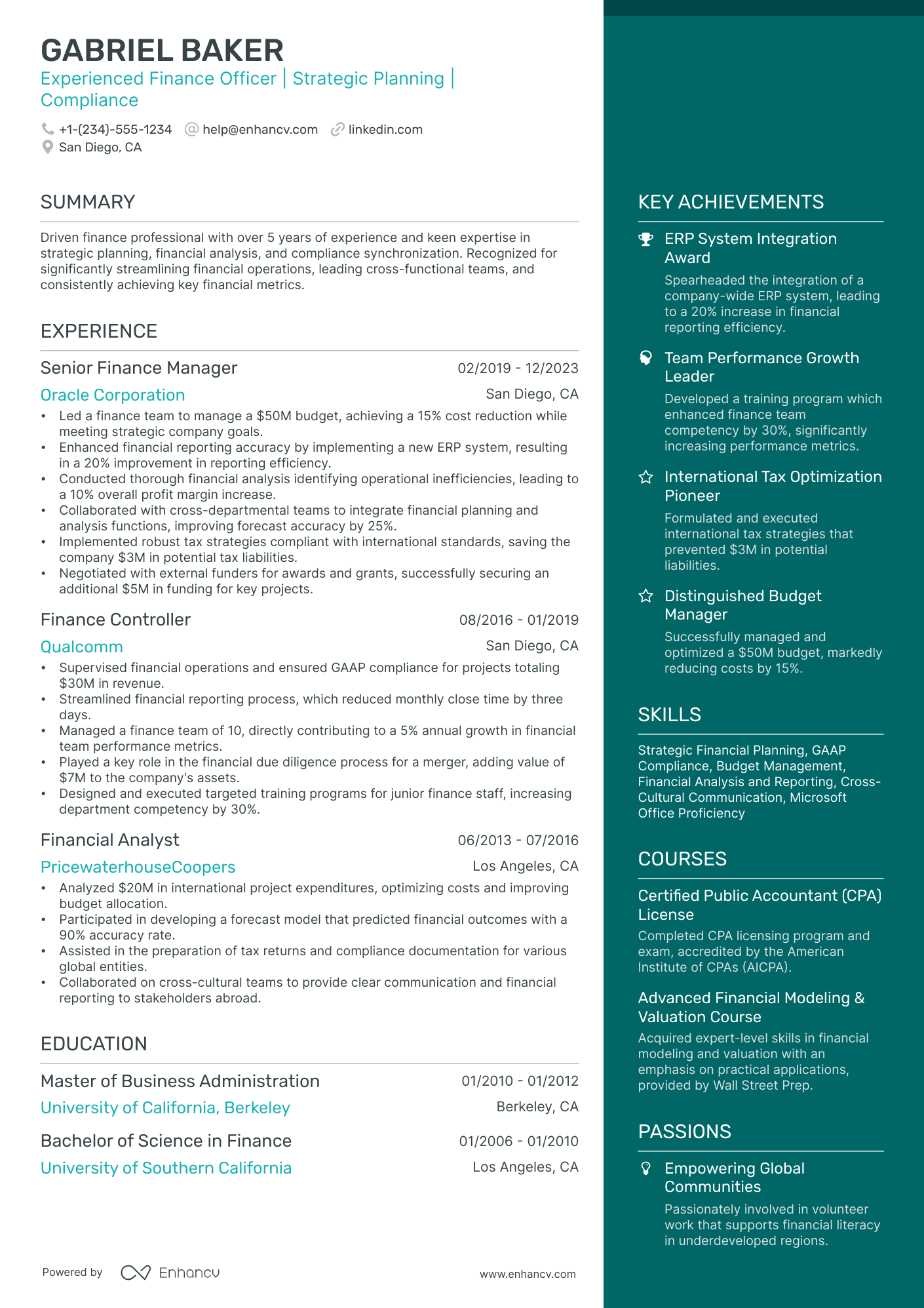

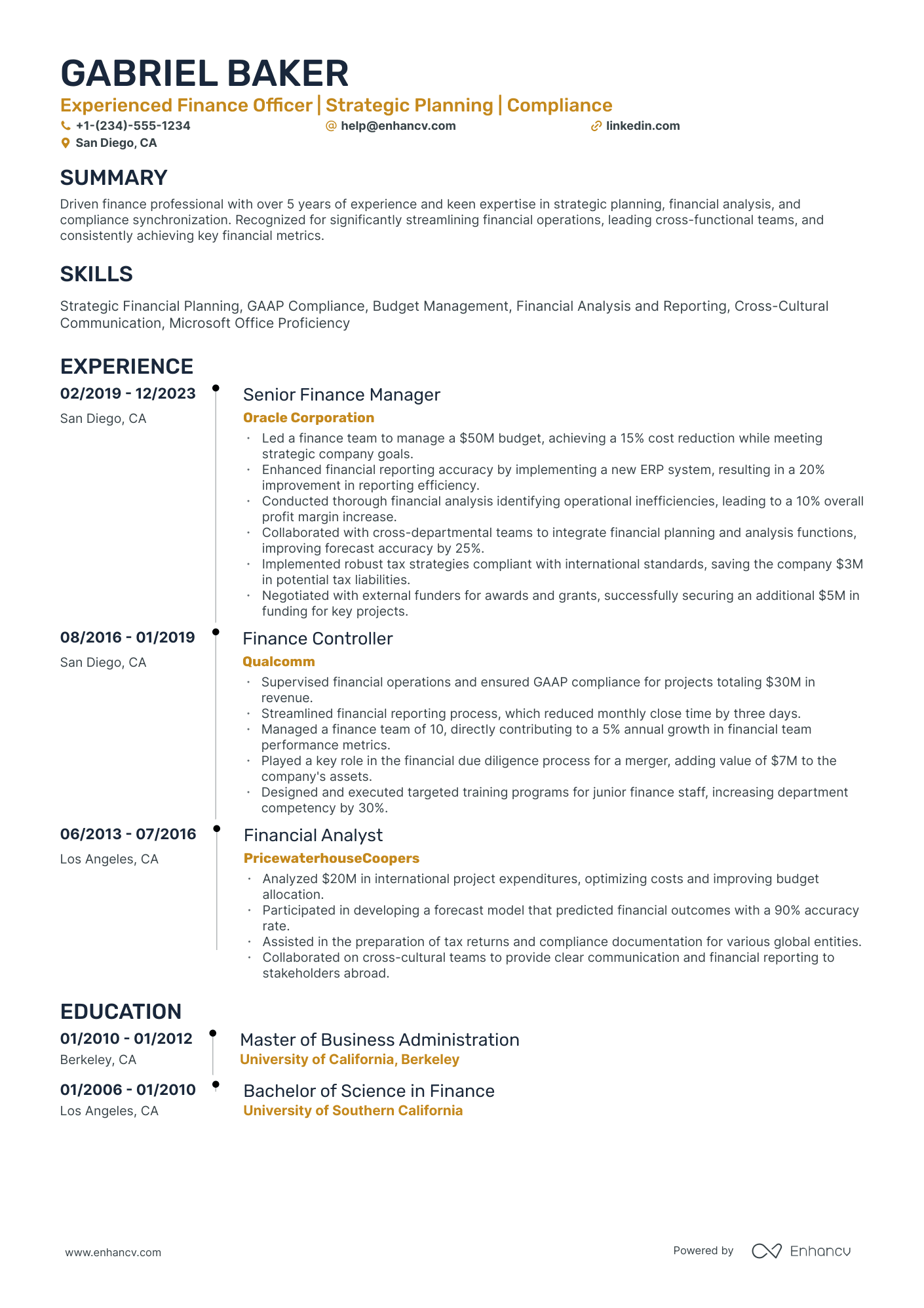

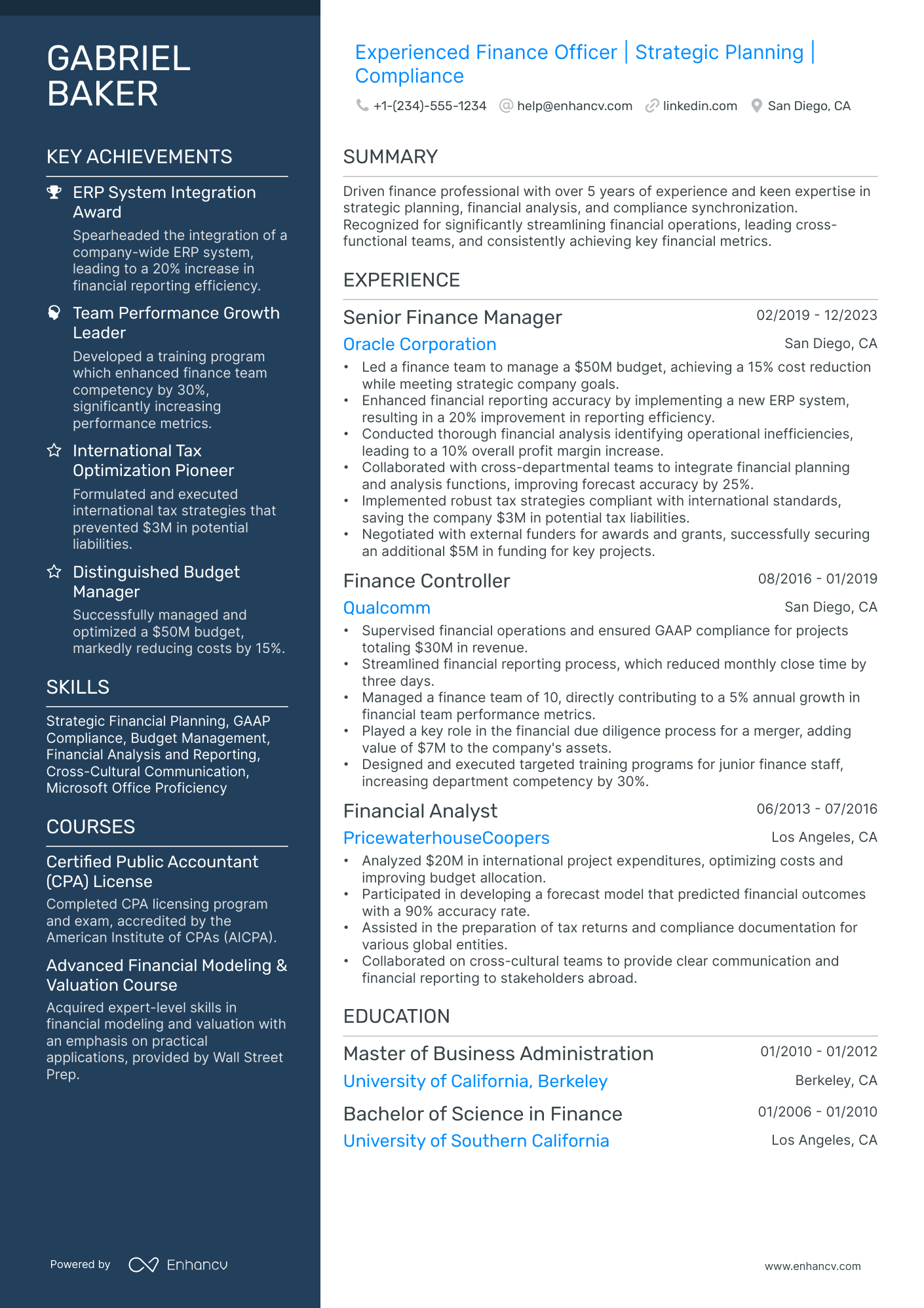

Professional finance officer resume format advice

Achieving the most suitable resume format can at times seem like a daunting task at hand.

Which elements are most important to recruiters?

In which format should you submit your resume?

How should you list your experience?

Unless specified otherwise, here's how to achieve a professional look and feel for your resume.

- Present your experience following the reverse-chronological resume format . It showcases your most recent jobs first and can help recruiters attain a quick glance at how your career has progressed.

- The header is the must-have element for your resume. Apart from your contact details, you could also include your portfolio and a headline, that reflects on your current role or a distinguishable achievement.

- Select relevant information to the role, that should encompass no more than two pages of your resume.

- Download your resume in PDF to ensure that its formatting stays intact.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If the certificate you've obtained is especially vital for the industry or company, include it as part of your name within the resume headline.

The six in-demand sections for your finance officer resume:

- Top one-third should be filled with a header, listing your contact details, and with a summary or objective, briefly highlighting your professional accolades

- Experience section, detailing how particular jobs have helped your professional growth

- Notable achievements that tie in your hard or soft skills with tangible outcomes

- Popular industry certificates to further highlight your technical knowledge or people capabilities

- Education to showcase your academic background in the field

What recruiters want to see on your resume:

- Proven experience with financial analysis, forecasting, and budgeting

- Strong knowledge of accounting principles, laws, and regulations

- Expertise in financial software applications (e.g., SAP, Oracle, Quickbooks)

- Excellent mathematical skills and attention to detail

- Demonstrated leadership abilities and experience in managing financial teams

Quick guide to your finance officer resume experience section

After deciding on the format of your resume, it's time to organize your experience within the dedicated section.

It's common for finance officer professionals to be confused in this part of the process, as they may have too much or little expertise.

Follow the general rules of thumb to be successful when writing this part of your resume:

- The perfect number of bullets you should have under each experience item is no more than six;

- Select not merely your responsibilities, but the most noteworthy achievements for each role that match the job requirements;

- List any certificates or technical expertise you've gained on the job and how they've helped you progress as a professional;

- Carefully select the power verbs to go along with each bullet to avoid generic ones like "managed" and instead substitute those with the actuality of your particular responsibility;

- Integrate valuable keywords from the job advert in the form of achievements under each role you list.

If you're on the search for further advice on how to write your finance officer experience section, get some ideas from real-world professional resumes:

- Oversaw the financial strategy, including forecasting, budgeting and allocating $10M+ in departmental funds, leading to a 15% reduction in overhead costs over three years.

- Implemented a new financial reporting system using SAP, which improved monthly reporting times by 30% and enhanced data accuracy.

- Directed the capital investment planning for a major equipment upgrade that has increased production capacity by 20%, aligning with long-term business growth objectives.

- Managed a team of 5 financial analysts, developing a comprehensive training program that increased team productivity by 25%.

- Played a key role in securing a $50M line of credit by presenting compelling financial forecasts and strategies to the bank.

- Conducted thorough risk management assessments for new business initiatives, which prevented potential losses estimated at $3M.

- Designed and executed an operational cost reduction plan, which saved the company $5M annually without compromising service quality.

- Coordinated with cross-functional teams to introduce a new financial compliance framework that decreased regulatory fines by 40% over two years.

- Managed the due diligence process for a $25M acquisition, identifying key financial risks and opportunities that informed the negotiation strategy.

- Developed and implemented a strategic investment plan that yielded a 15% return on investment for high-risk portfolios, surpassing industry benchmarks.

- Spearheaded the restructuring of the company’s debt, resulting in a 10% interest cost savings annually.

- Collaborated with the executive team to create a financial turnaround plan that returned the company to profitability within 18 months.

- Directed a comprehensive review and optimization of the company's international tax structure, reducing effective tax rate by 8% within two years.

- Developed performance metrics that directly tied to strategic business goals, enhancing the financial decision-making process company-wide.

- Led the finance department in supporting a merger valued at $30M, integrating financial systems and teams smoothly within the projected 9-month timeframe.

- Instituted a financial control system across multinational branches, ensuring a consistent and compliant fiscal operation, cutting compliance costs by 20%.

- Orchestrated a successful negotiation of a major corporate insurance contract, achieving a premium reduction of 15%, which significantly reduced operational risk.

- Facilitated a partnership with IT department to deploy a cutting-edge financial analysis software, enhancing forecasting precision by 35%.

- Pioneered the development of a proprietary risk modeling tool that decreased financial exposure by 25% on new ventures.

- Leveraged data analytics to provide insights that drove a 10% year-over-year increase in revenue through optimized pricing strategies.

- Guided a cross-department expense optimization task force that successfully identified and implemented cost-saving measures amounting to $2M in annual savings.

- Established a robust internal audit process that identified inefficiencies in transaction processing, resulting in a 50% reduction in error rate.

- Managed international financial operations, ensuring adherence to both U.S. GAAP and IFRS standards across 8 global subsidiaries.

- Designed a sustainability-focused investment strategy that funneled $100M into environmentally responsible funds, achieving a 12% investment return in the first year.

Quantifying impact on your resume

- Quantify the value of financial portfolios managed and how they have grown over time under your stewardship.

- Highlight the percentage of cost savings achieved through strategic budgeting or cost reduction initiatives.

- Illustrate your experience with financial forecasting by detailing how accurate your predictions were over a given period.

- Specify the amount of funds you have successfully raised or managed through loans, investments, or grants.

- Showcase the efficiency improvements you introduced, quantifying the reduction in time or increase in processing capacity.

- Include figures on compliance or audit issues resolved, emphasizing the scale and importance of these resolutions.

- Detail the number of financial reports generated, emphasizing the complexity and frequency to demonstrate consistency and reliability.

- Mention any financial risk management successes with metrics on the reduction of risk exposure or financial losses averted.

Action verbs for your finance officer resume

What to do if you don't have any experience

It's quite often that candidates without relevant work experience apply for a more entry-level role - and they end up getting hired.

Candidate resumes without experience have these four elements in common:

- Instead of listing their experience in reverse-chronological format (starting with the latest), they've selected a functional-skill-based format. In that way, finance officer resumes become more focused on strengths and skills

- Transferrable skills - or ones obtained thanks to work and life experience - have become the core of the resume

- Within the objective, you'd find career achievements, the reason behind the application, and the unique value the candidate brings about to the specific role

- Candidate skills are selected to cover basic requirements, but also show any niche expertise.

Recommended reads:

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

Bringing your finance officer hard skills and soft skills to the forefront of recruiters' attention

Hard skills are used to define the technological (and software) capacities you have in the industry. Technical skills are easily defined via your certification and expertise.

Soft skills have more to do with your at-work personality and how you prosper within new environments. People skills can be obtained thanks to your whole life experience and are thus a bit more difficult to define.

Why do recruiters care about both types of skills?

Hard skills have more to do with job alignment and the time your new potential employers would have to invest in training you.

Soft skills hint at how well you'd adapt to your new environment, company culture, and task organization.

Fine-tune your resume to reflect on your skills capacities and talents:

- Avoid listing basic requirements (e.g. "Excel"), instead substitute with the specifics of the technology (e.g. "Excel Macros").

- Feature your workplace values and ethics as soft skills to hint at what matters most to you in a new environment.

- Build a separate skills section for your language capabilities, only if it makes sense to the role you're applying for.

- The best way to balance finance officer hard and soft skills is by building a strengths or achievements section, where you define your outcomes via both types of skills.

There are plenty of skills that could make the cut on your resume.

That's why we've compiled for you some of the most wanted skills by recruiters, so make sure to include the technologies and soft skills that make the most sense to you (and the company you're applying for):

Top skills for your finance officer resume:

Financial Analysis

Budgeting Software (e.g., QuickBooks, SAP)

Excel (Advanced Functions and Macros)

Financial Reporting Tools

Accounting Software (e.g., Oracle, FreshBooks)

Data Analysis Tools (e.g., Tableau, Power BI)

Tax Preparation Software

Risk Management Software

ERP Systems

Compliance Management Tools

Attention to Detail

Analytical Thinking

Communication Skills

Problem-Solving

Time Management

Team Collaboration

Adaptability

Organizational Skills

Critical Thinking

Interpersonal Skills

PRO TIP

List all your relevant higher education degrees within your resume in reverse chronological order (starting with the latest). There are cases when your PhD in a particular field could help you stand apart from other candidates.

The importance of your certifications and education on your finance officer resume

Pay attention to the resume education section . It can offer clues about your skills and experiences that align with the job.

- List only tertiary education details, including the institution and dates.

- Mention your expected graduation date if you're currently studying.

- Exclude degrees unrelated to the job or field.

- Describe your education if it allows you to highlight your achievements further.

Your professional qualifications: certificates and education play a crucial role in your finance officer application. They showcase your dedication to gaining the best expertise and know-how in the field. Include any diplomas and certificates that are:

- Listed within the job requirements or could make your application stand out

- Niche to your industry and require plenty of effort to obtain

- Helping you prepare for professional growth with forward-facing know-how

- Relevant to the finance officer job - make sure to include the name of the certificate, institution you've obtained it at, and dates

Both your certificates and education section need to add further value to your application. That's why we've dedicated this next list just for you - check out some of the most popular finance officer certificates to include on your resume:

The top 5 certifications for your finance officer resume:

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Management Accountant (CMA) - Institute of Management Accountants

- Chartered Global Management Accountant (CGMA) - American Institute of CPAs & Chartered Institute of Management Accountants

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Recommended reads:

Finance officer resume summary or objective? The best choice is based on your experience

If you're wondering about the relevancy of the resume summary or the resume objective to your finance officer application - here's the truth.

The summary and objective provide recruiters with your expertise and accomplishments at a glance, within an up-to-five-sentence structure.

The difference is that the:

- Resume objective is also more focused on emphasizing your career goals. The objective is the perfect fit for (potentially more junior) candidates who'd like to balance their relevant experience with their career goals.

- Resume summary can provide you with space to also detail the unique value of what it's like to work with you. Finance officer candidates who have many noteworthy accomplishments start from the get-go with their summary.

Ensure that either type of resume introduction presents your finance officer expertise in the best light and aligns it with the job advert.

The more details you can provide with numbers, the more compelling your resume summary or objective will be.

Real-world finance officer candidates follow these frameworks in writing their resume summaries and objectives.

The end results are usually as such:

Resume summaries for a finance officer job

- Highly skilled finance officer with over 12 years of experience in corporate financial management and strategic planning. Adept at budgeting, forecasting, and analysis within high-growth tech firms, boasting a track record of reducing costs by 25% year-on-year. Excelled in implementing robust financial control systems at a leading software company.

- Accomplished financial analyst eager to transition to a finance officer role after 7 years of experience. Excel at identifying inefficiencies and cost-saving opportunities, having successfully advised on a $10 million cost reduction strategy. Holds an MBA with a focus on finance and is a certified CFA, ready to leverage strong analytical skills for strategic financial planning.

- Seasoned marketing manager transitioning to a finance career brings 10+ years of expertise in managing budgets and driving revenue growth. Spearheaded a go-to-market strategy that resulted in a 40% increase in annual revenue. Pursuing a Master’s in Finance to complement practical experience with formal financial training.

- Dynamic professional with an honors degree in Economics, poised to bring a fresh perspective to the finance sector. With a passion for financial markets and a dedicated focus on continuous learning, ready to commit to rigorous analysis and effective financial stewardship. Excel in fast-paced environments and eager to contribute to high-stakes financial projects.

- Ambitious recent graduate with a Bachelor's degree in Finance, aiming to apply my theoretical knowledge and enthusiastic work ethic to a practical finance setting. Aspires to develop expert-level skills in financial analysis and reporting, and to contribute to the fiscal success of a cutting-edge financial institution.

- Driven individual with a strong aptitude for numbers and a Master's in Accountancy, seeking to delve into the finance sector. Eager to offer keen attention to detail, a robust understanding of financial principles, and a commitment to achieving accuracy in financial reporting and budget management for sustainable business growth.

More relevant sections for your finance officer resume

Perhaps you feel that your current resume could make use of a few more details that could put your expertise and personality in the spotlight.

We recommend you add some of these sections for a memorable first impression on recruiters:

- Projects - you could also feature noteworthy ones you've done in your free time;

- Awards - showcasing the impact and recognition your work has across the industry;

- Volunteering - the social causes you care the most about and the soft skills they've helped you sustain and grow;

- Personality resume section - hobbies, interests, favorite quote/books, etc. could help recruiters gain an even better understanding of who you are.

Key takeaways

- Your resume layout plays an important role in presenting your key information in a systematic, strategic manner;

- Use all key resume sections (summary or objective; experience; skills; education and certification) to ensure you’ve shown to recruiters just how your expertise aligns with the role and why you're the best candidate;

- Be specific about listing a particular skill or responsibility you've had by detailing how this has helped the role or organization grow;

- Your personality should shine through your resume via the interests or hobbies, and strengths or accomplishments skills sections;

- Certifications go to provide further accreditation to your technical capabilities, so make sure you've included them within your resume.