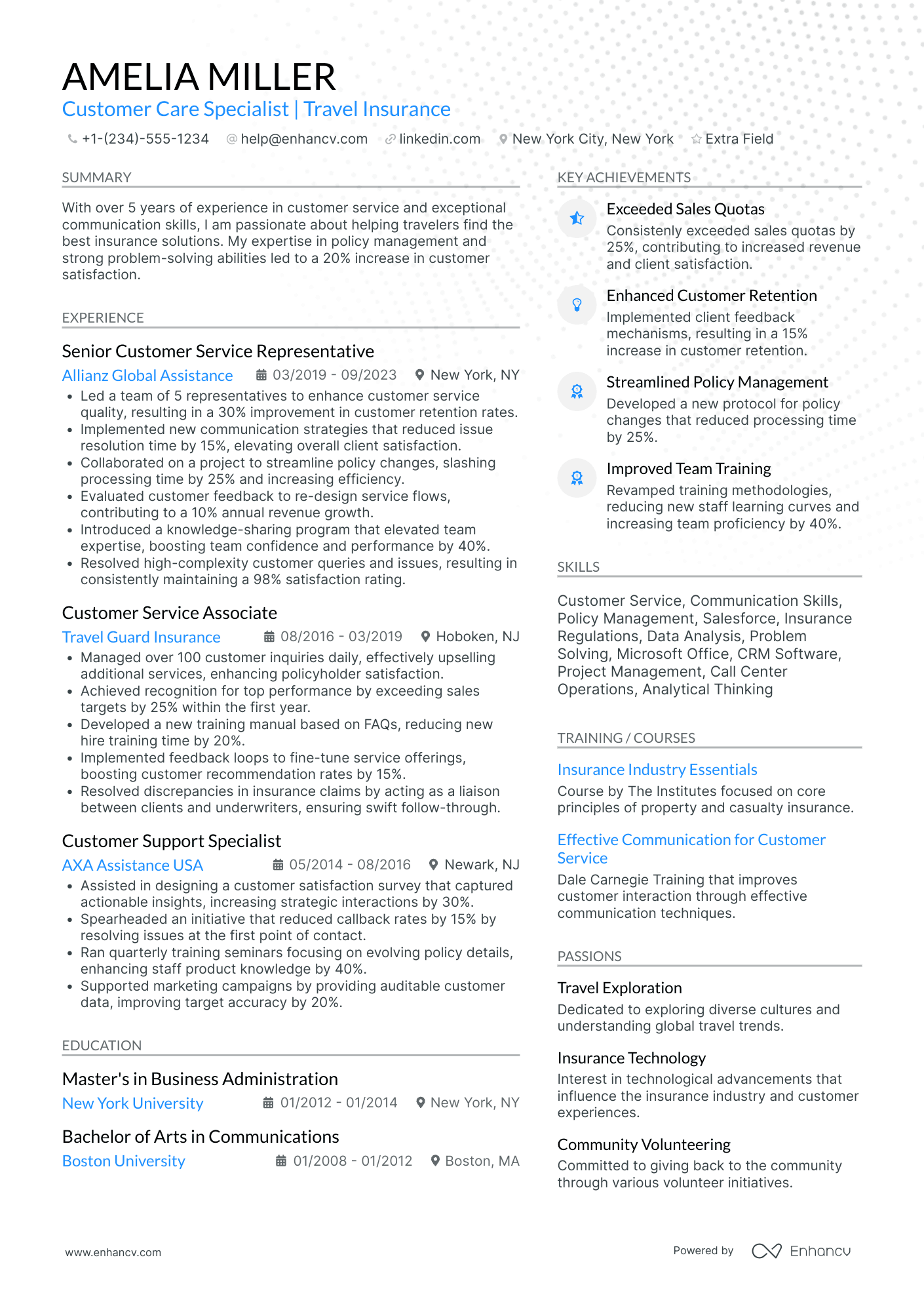

As an insurance agent, your resume challenge may involve finding the right balance between showcasing your sales proficiency and demonstrating your expertise in complex insurance products. Our guide provides targeted advice to help you effectively communicate both your sales achievements and your industry knowledge, ensuring your resume stands out to potential employers.

- Sample industry-leading professional resumes for inspiration and insurance agent resume-writing know-how.

- Focus recruiters' attention on what matters most - your unique experience, achievements, and skills.

- Write various resume sections to ensure you meet at least 95% of all job requirements.

- Balance your insurance agent technical expertise with personality to stand out amongst candidates.

If the insurance agent resume isn't the right one for you, take a look at other related guides we have:

- Lead Generation Resume Example

- National Sales Manager Resume Example

- Sales Officer Resume Example

- Wine Sales Representative Resume Example

- Sales Executive Resume Example

- Customer Relations Manager Resume Example

- Sales Support Specialist Resume Example

- Leasing Manager Resume Example

- Fashion Retail Resume Example

- Beauty Consultant Resume Example

Don't stress out over your insurance agent resume format

Remember, the elaborate design of your insurance agent resume isn't what impresses recruiters most. They are primarily searching for candidates who meet the job requirements. The main aim of your resume should be to clearly and concisely explain why employers should hire you.

Here are four straightforward steps to consider in your insurance agent resume design:

- Organize your resume based on experience: Start with your most recent roles. Besides using reverse chronological order, choose jobs relevant to the position you're applying for.

- Include your contact details (and portfolio or LinkedIn link) in your resume's header to ensure recruiters can easily reach you. If considering adding a professional photo, check acceptable practices in different countries first.

- Don't omit essential insurance agent resume sections such as the summary or objective, experience, and education. These sections should reflect your career progression and align with job requirements.

- Maintain conciseness in your resume. For those with less than ten years of experience, a one-page format is advisable.

Regarding the format to submit your insurance agent resume, PDF is preferable. PDFs are more likely to maintain their formatting when processed through recruitment software or ATS, saving you time in the application process.

When selecting a font for your insurance agent resume, consider the following:

- Choose ATS-friendly fonts such as Exo 2, Volkhov, Lato, etc., to keep your resume's content legible;

- All serif and sans-serif fonts are easily readable by ATS;

- While Arial and Times New Roman are common choices, opting for unique typography can help your resume stand out.

Concerned about ATS compatibility with charts and infographics? Our recent study has debunked this and other myths.

Consider your target market – resumes in Canada, for example, follow different layout conventions.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you happen to have some basic certificates, don't invest too much of your insurance agent resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

Insurance agent resume sections to answer recruiters' checklists:

- Header to help recruiters quickly allocate your contact details and have a glimpse over your most recent portfolio of work

- Summary or objective to provide an overview of your career highlights, dreams, and goals

- Experience to align with job requirements and showcase your measurable impact and accomplishments

- Skills section/-s to pinpoint your full breadth of expertise and talents as a candidate for the insurance agent role

- Education and certifications sections to potentially fill in any gaps in your experience and show your commitment to the industry

What recruiters want to see on your resume:

- Proven sales record of insurance policies to demonstrate successful customer acquisition and revenue generation.

- Knowledge of various types of insurance products (life, health, property, auto, etc.) and the ability to tailor policies to individual client needs.

- Strong communication and interpersonal skills, showcasing the ability to explain complex insurance concepts clearly to clients.

- Licenses and certifications relevant to the insurance industry (e.g., state insurance licenses, Certified Insurance Service Representative (CISR), Certified Insurance Counselor (CIC), etc.).

- Experience with customer relationship management (CRM) tools and insurance quoting software to illustrate technical proficiency in managing client data and preparing quotes.

Creating your insurance agent resume experience to catch recruiters' attention

Remember that for the insurance agent role, hiring managers are looking to see how your expertise aligns with their requirements. Here's where your resume experience section can help out. Make sure you:

- Include mainly roles that are relevant to the insurance agent job you're applying for;

- Don't go too far back in your experience - recruiters will only care what you did a decade ago if it's really important for the insurance agent role;

- Each bullet you include should say what you did, followed by the skills you used and the actual end result of your efforts;

- Quantify each of your achievements with numbers and possibly the overall effect it had on the organization;

- Highlight transferrable skills - or personal skills you've attained thanks to past jobs - that could be applicable within your potential workplace. This would showcase your unique value as a professional.

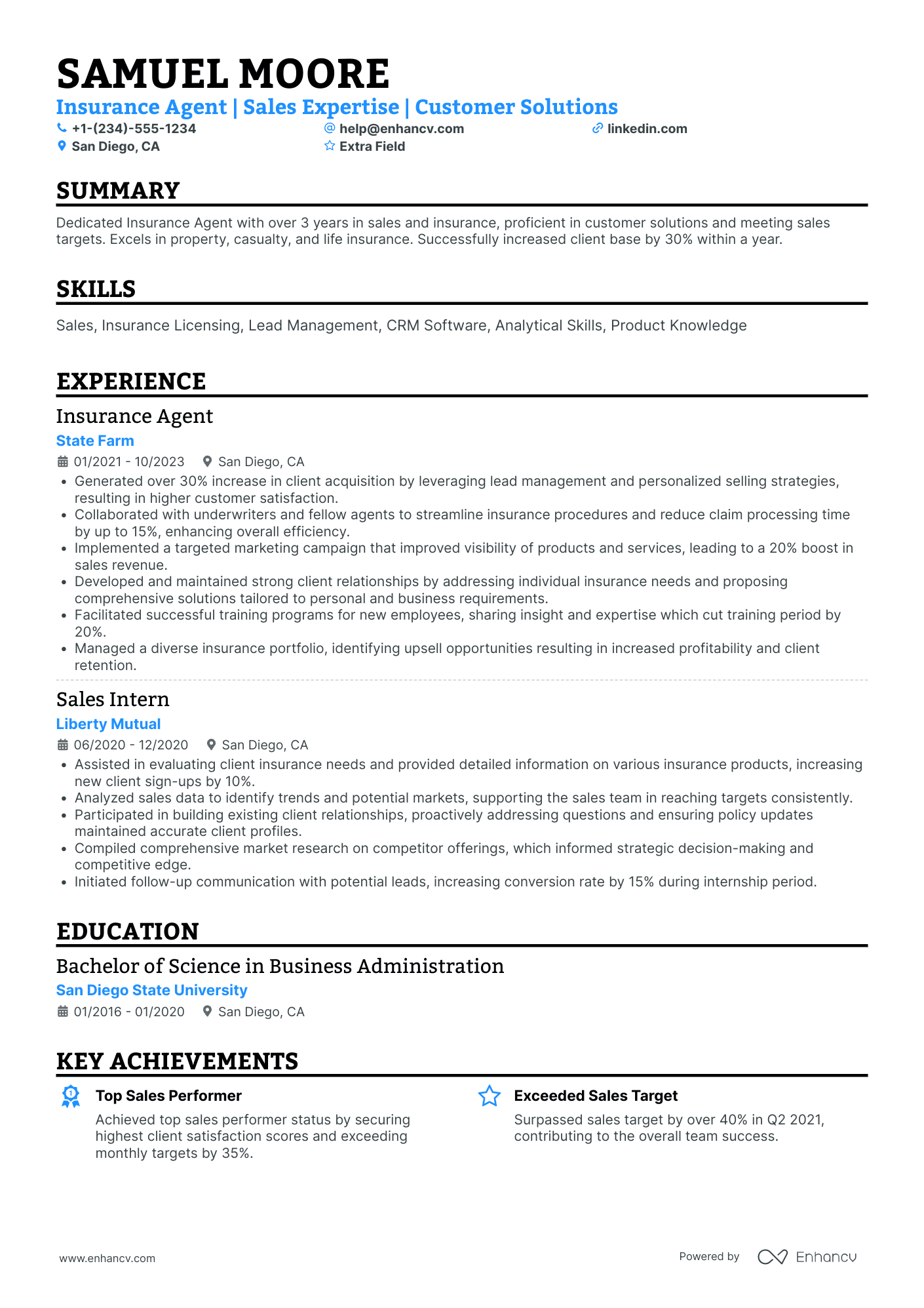

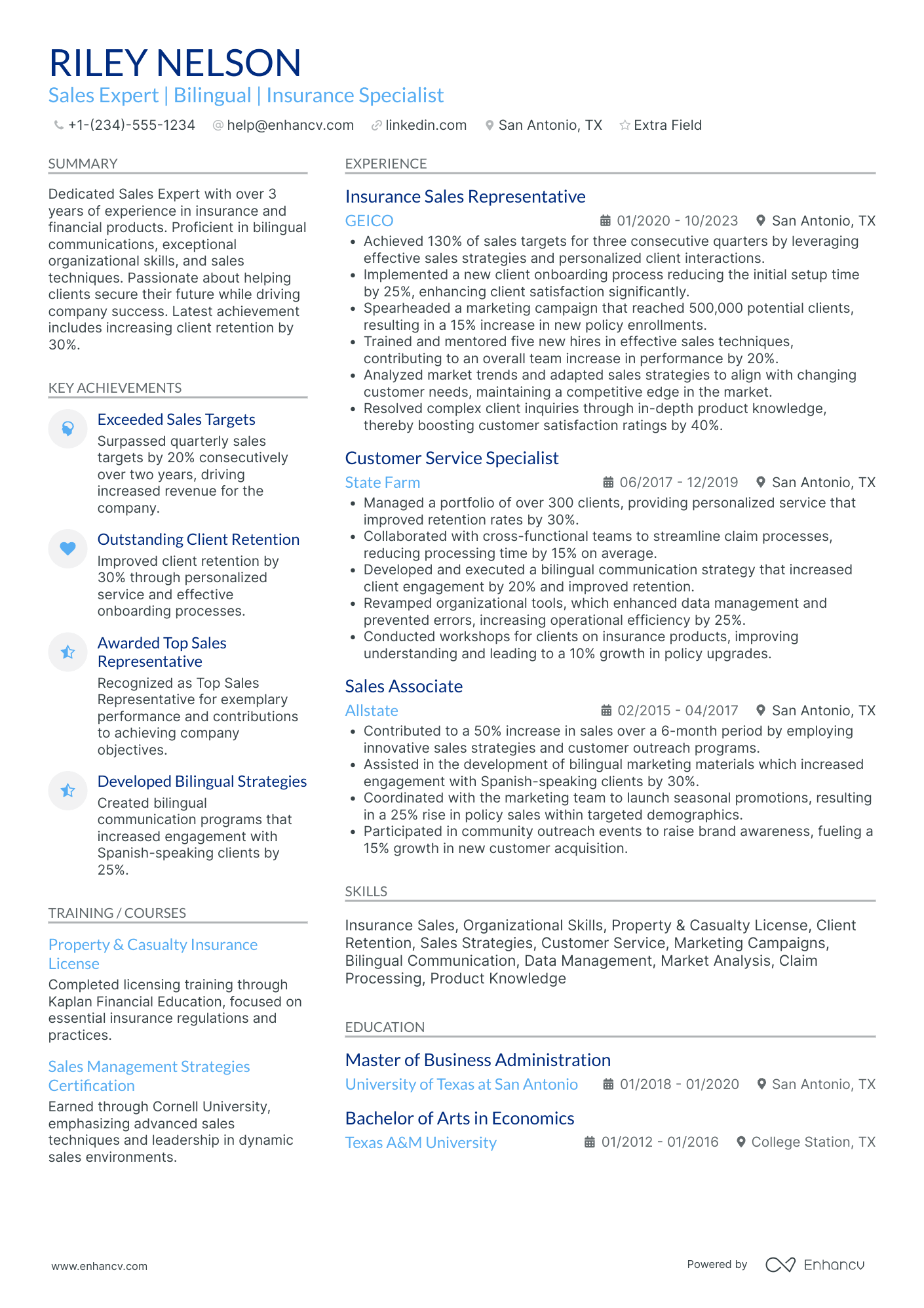

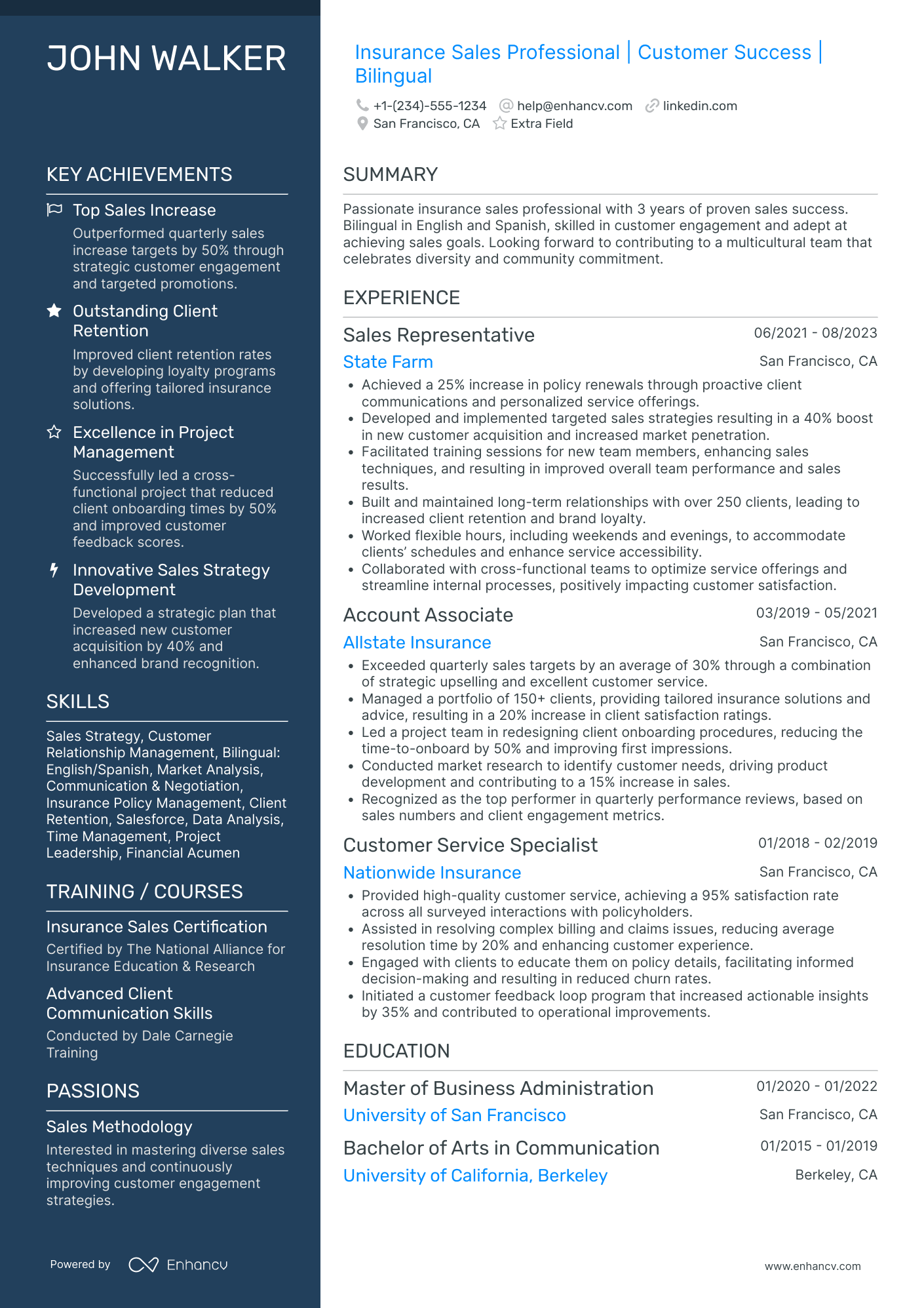

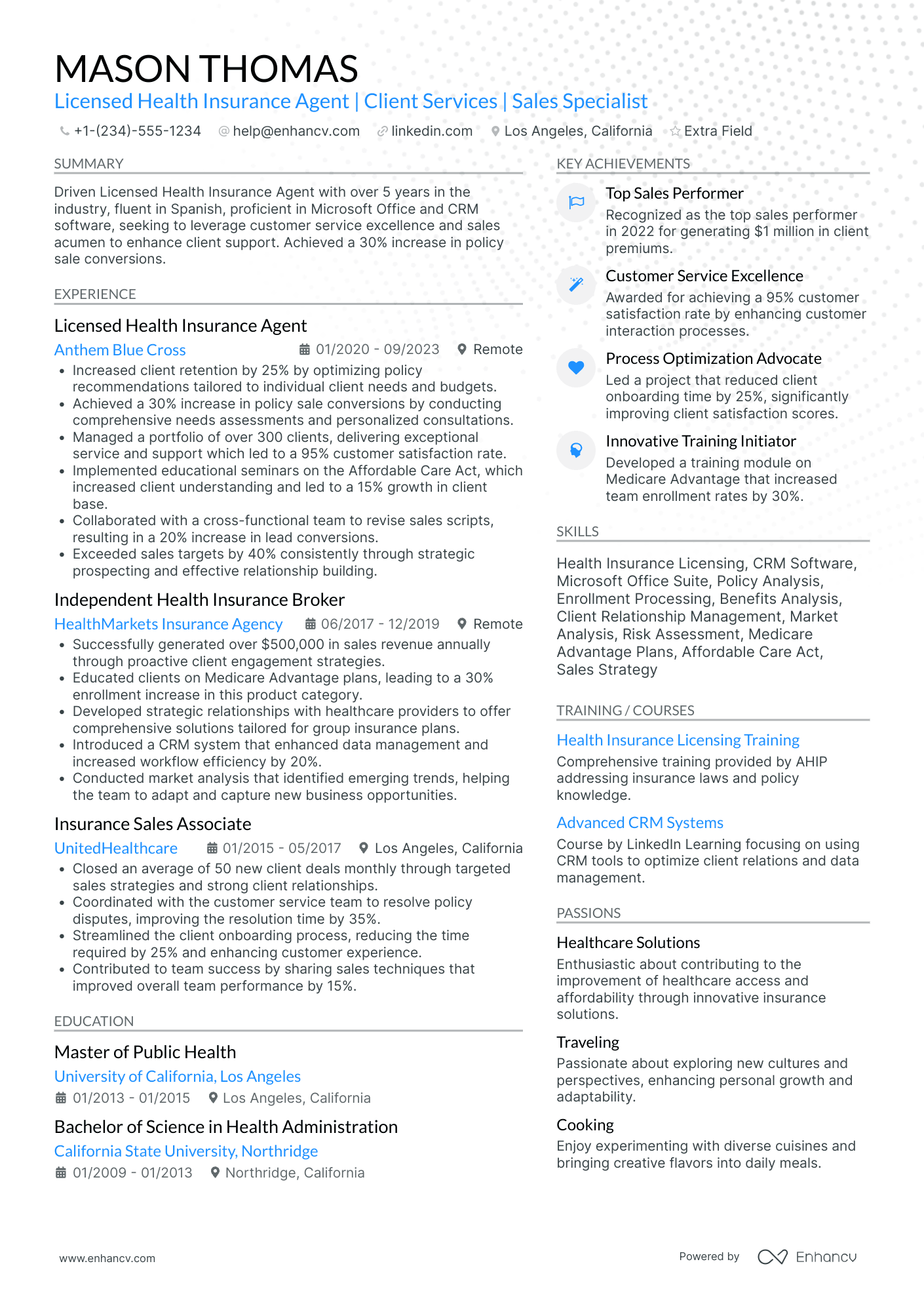

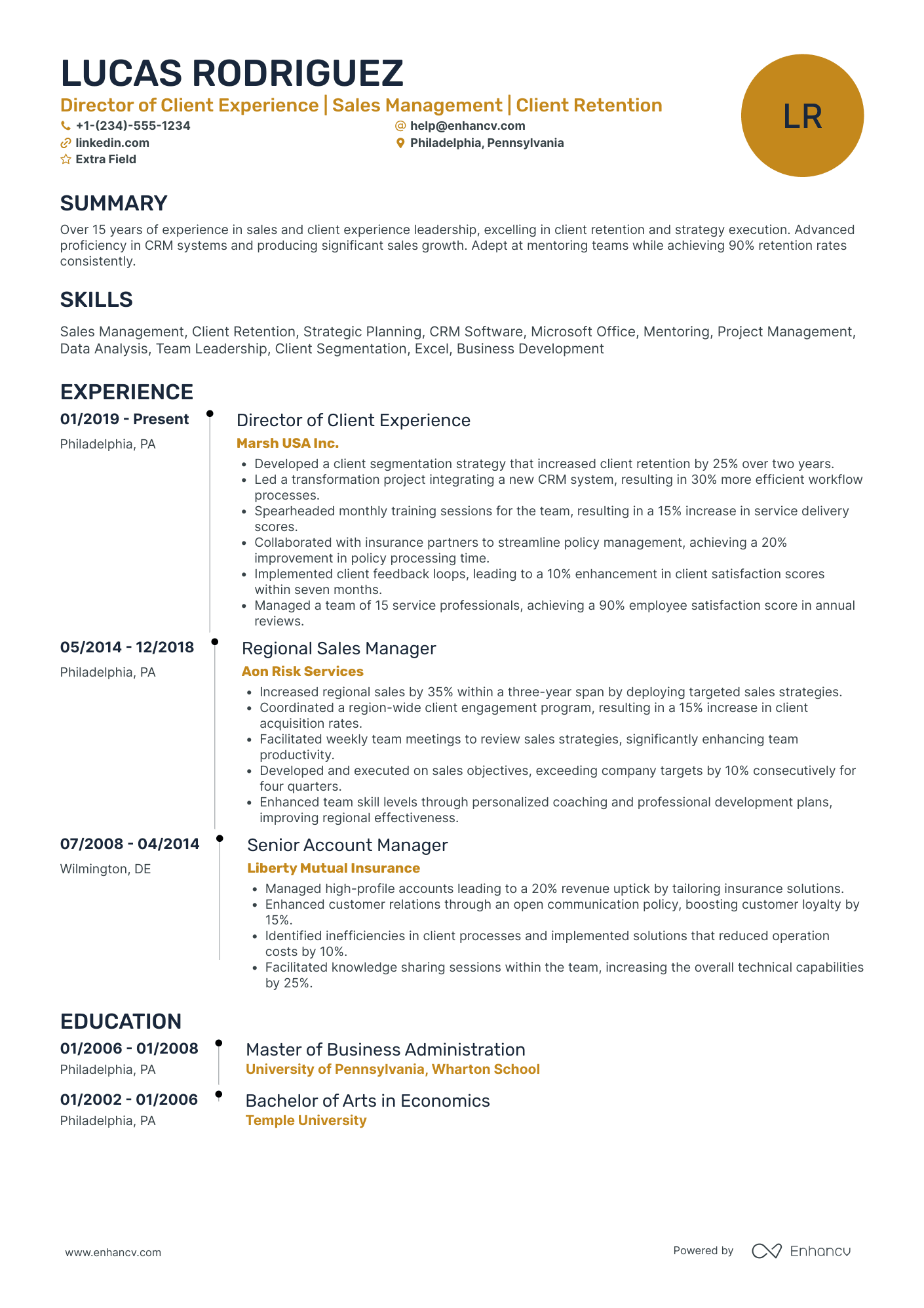

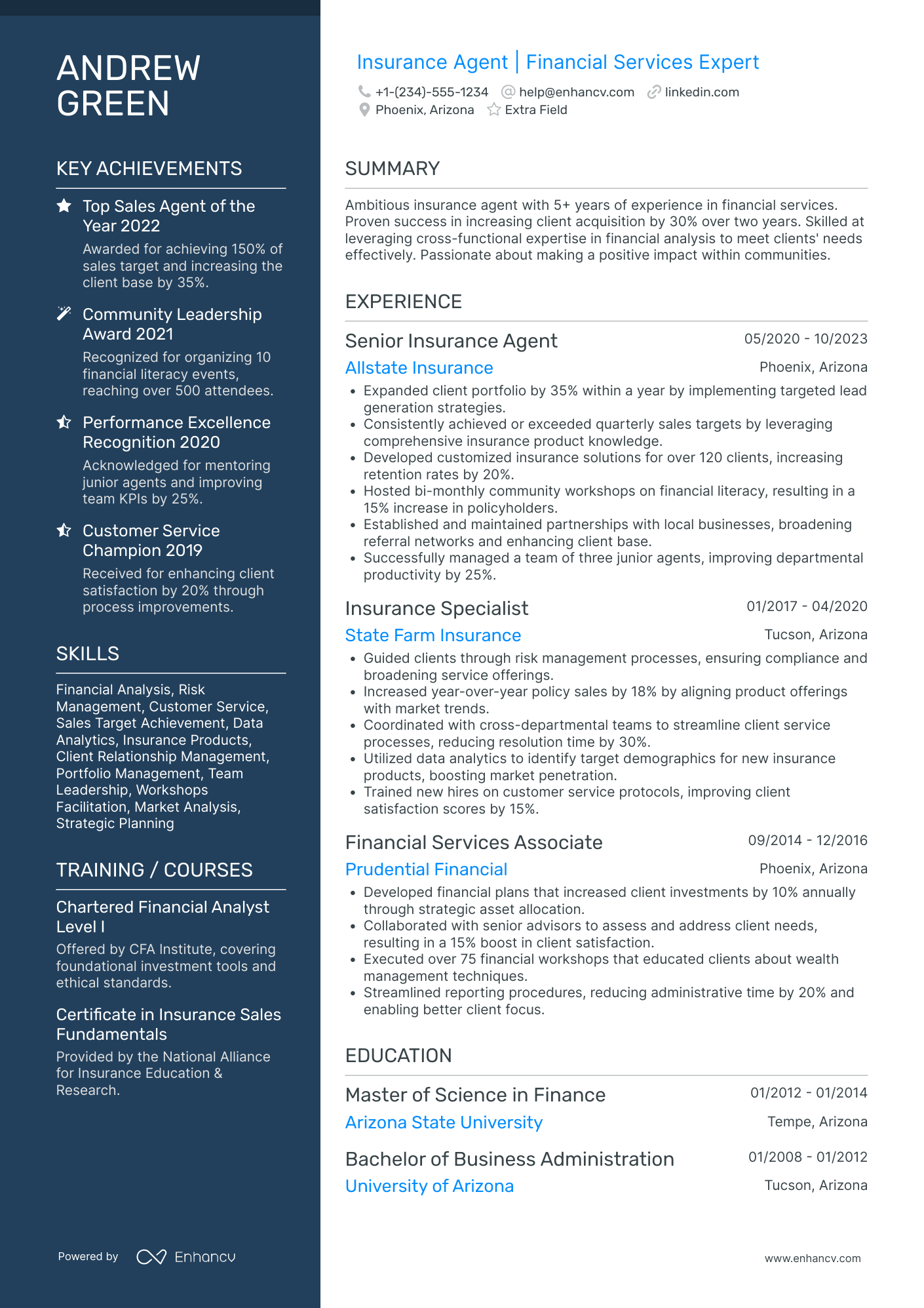

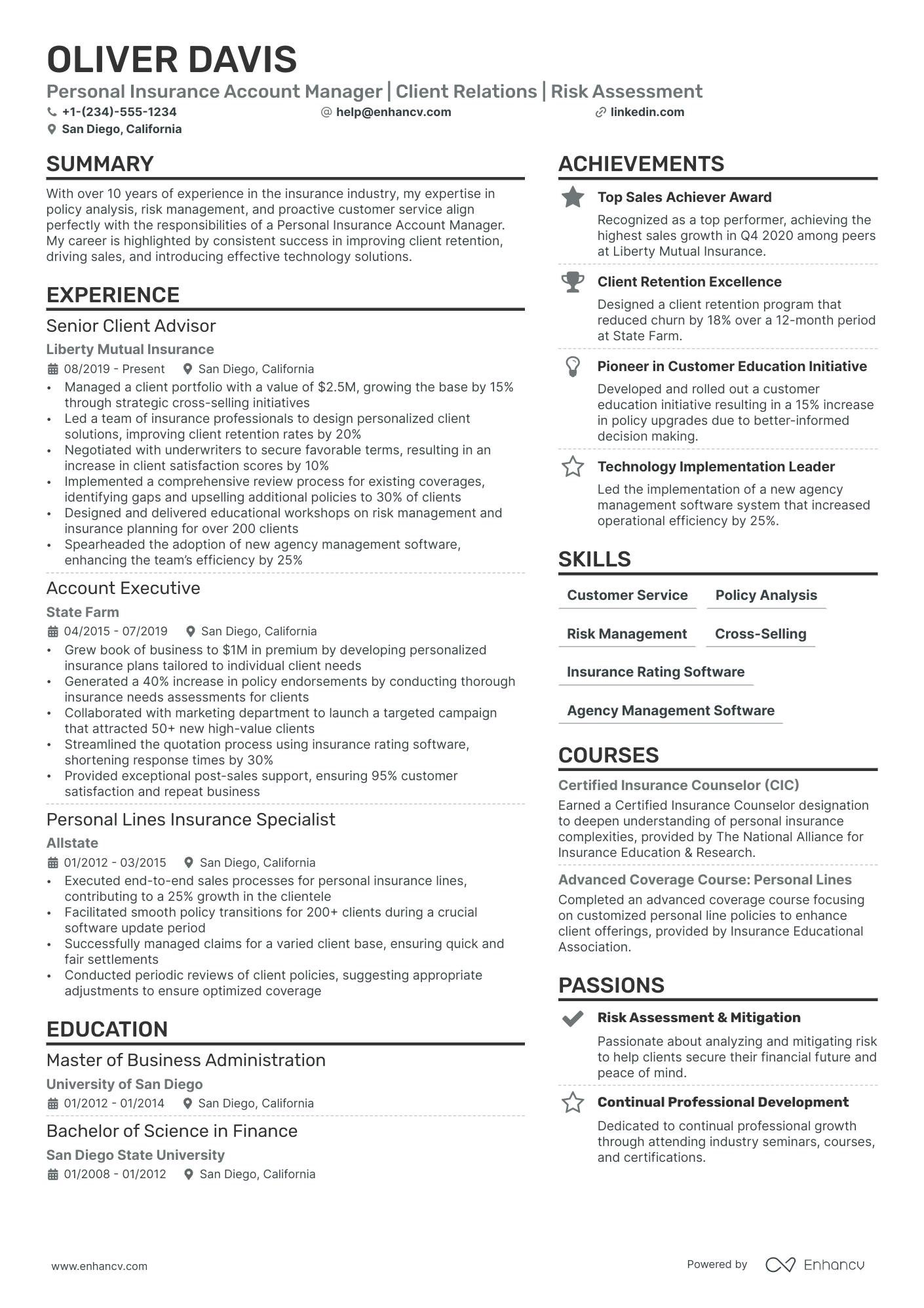

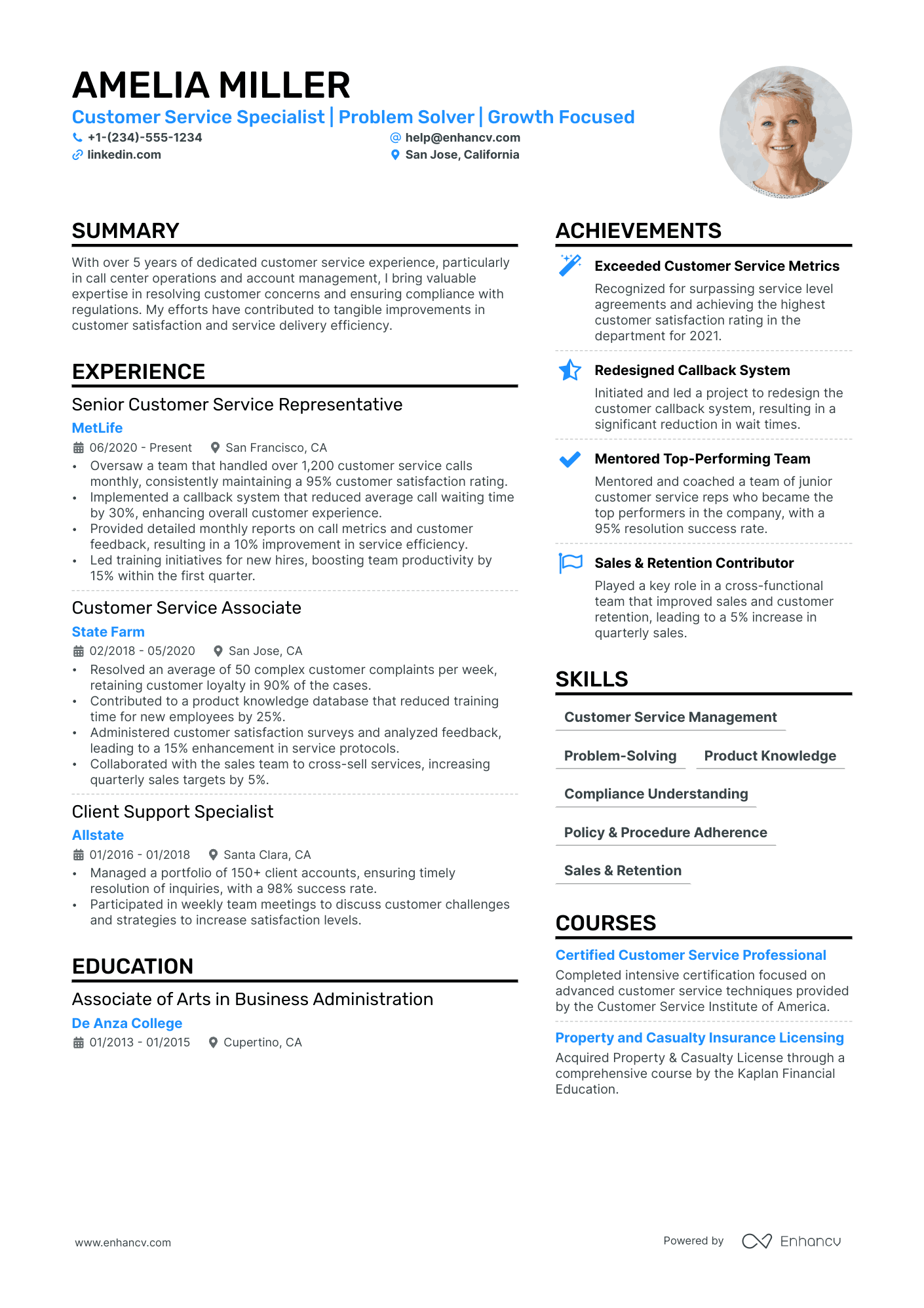

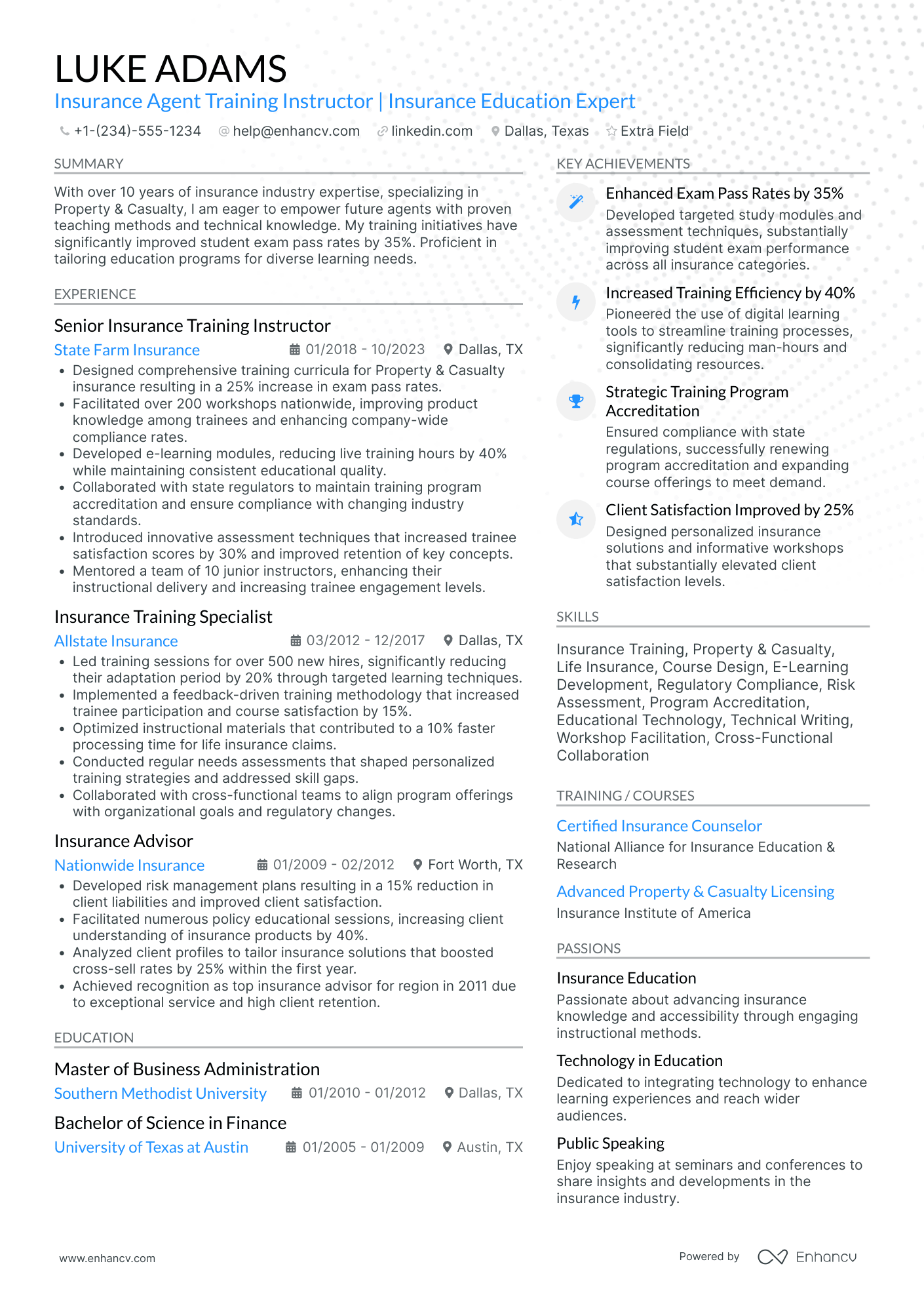

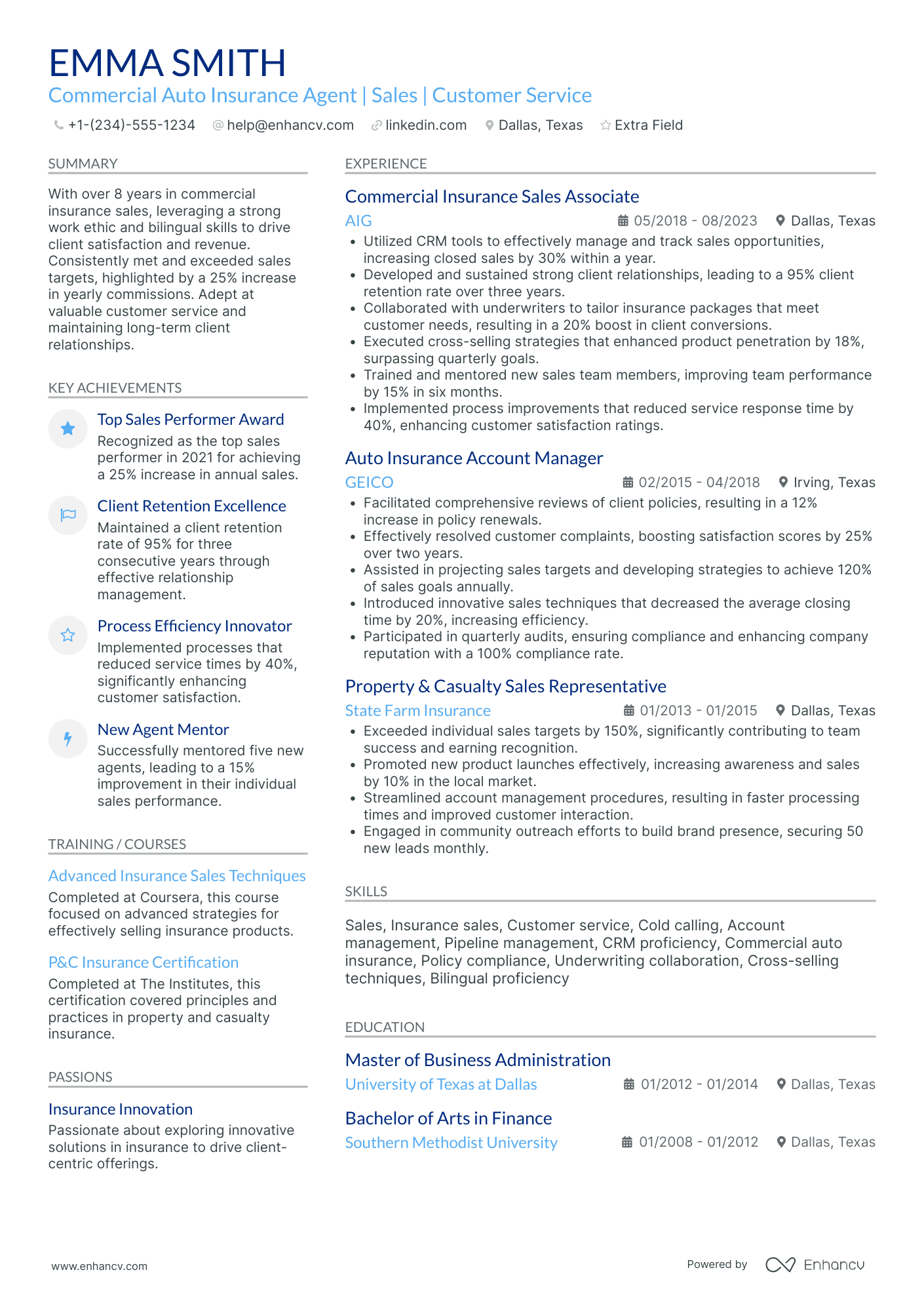

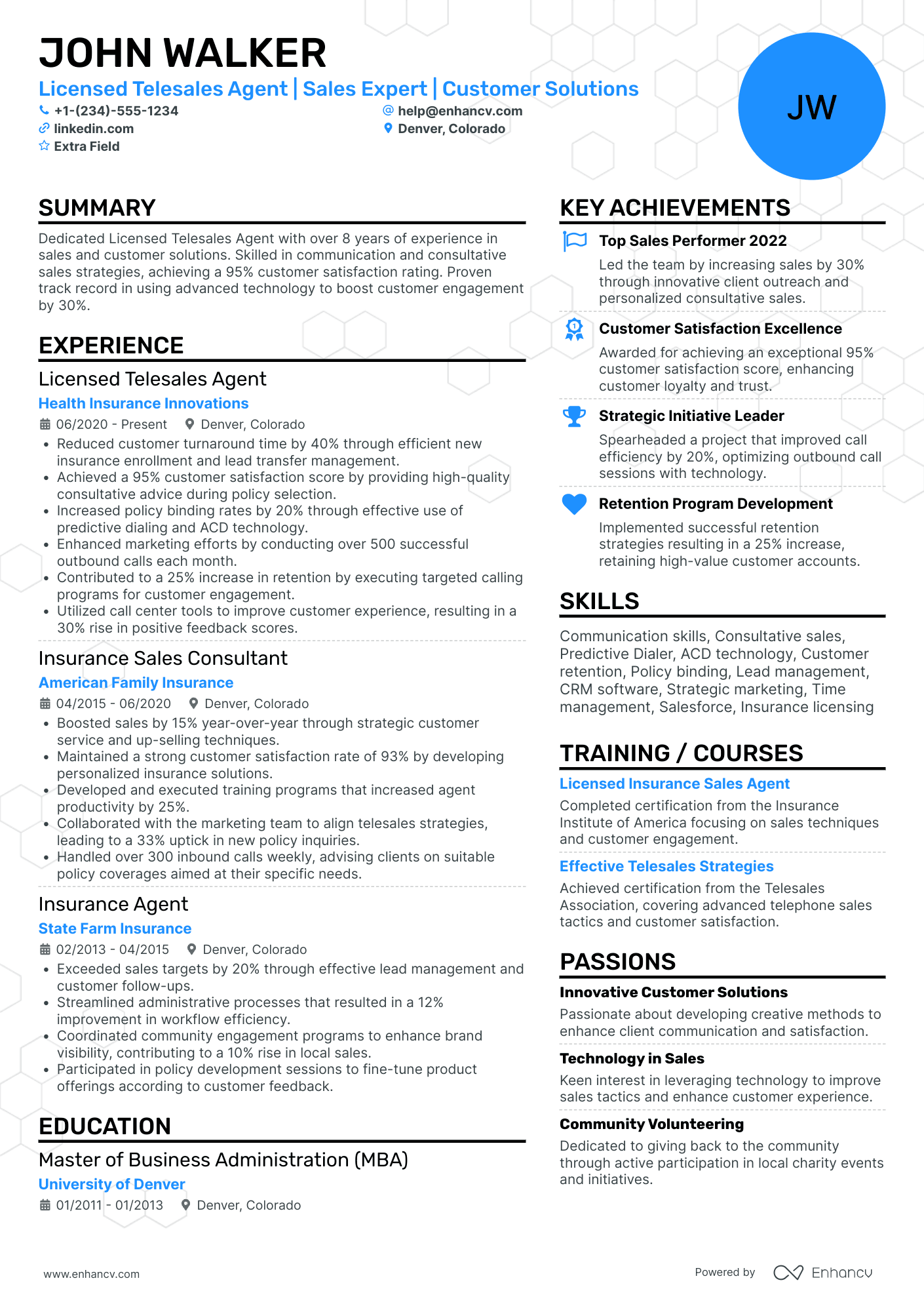

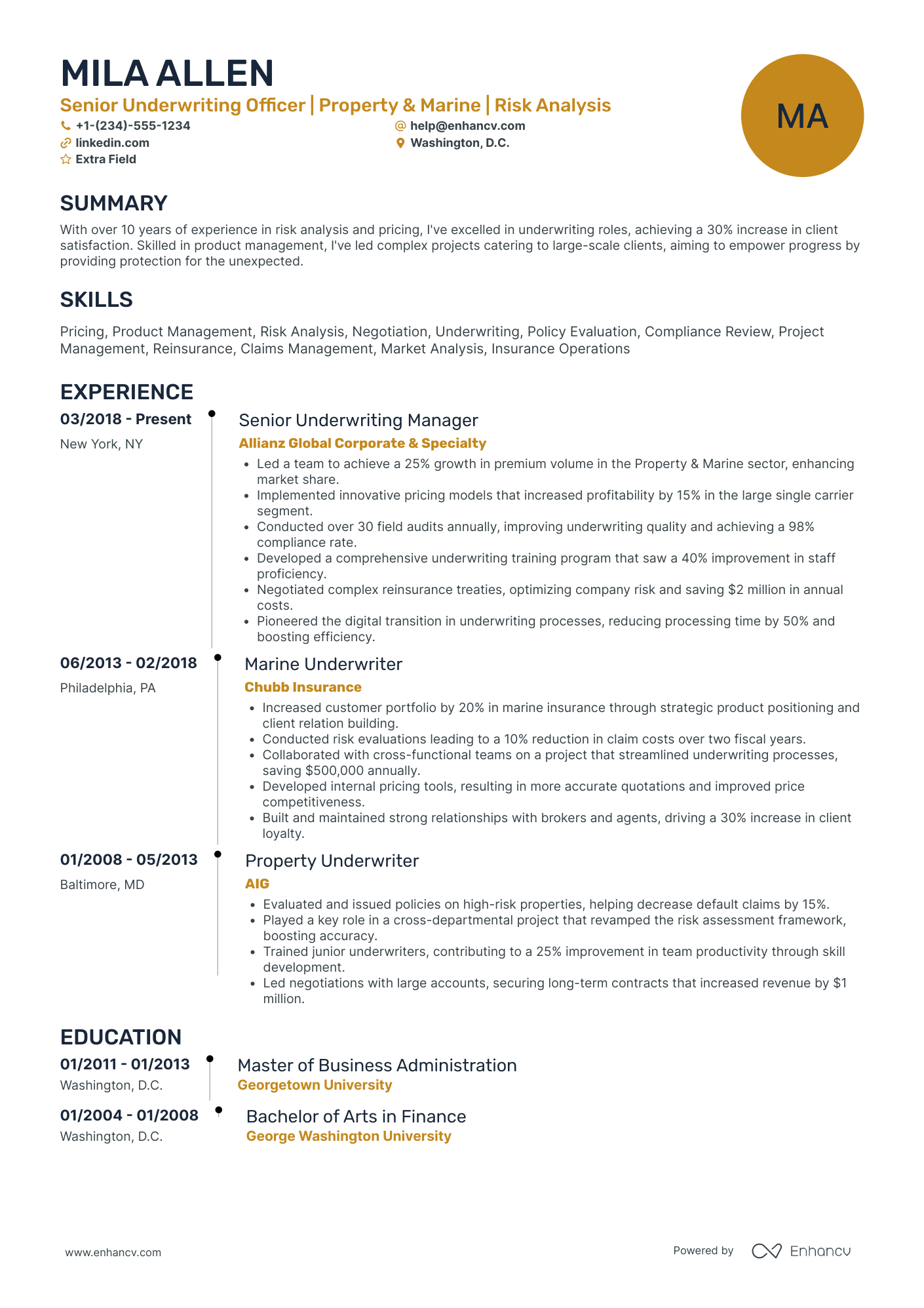

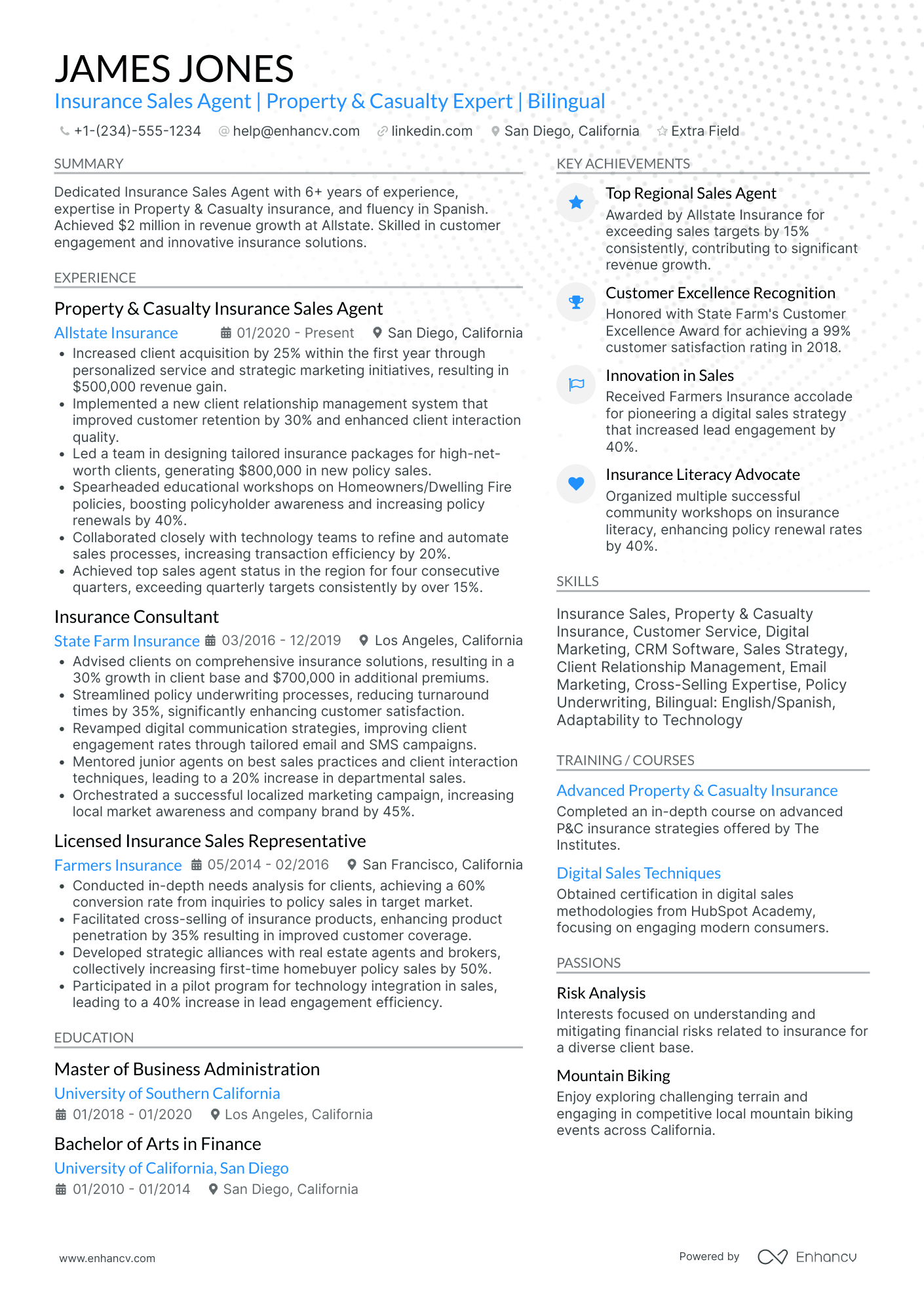

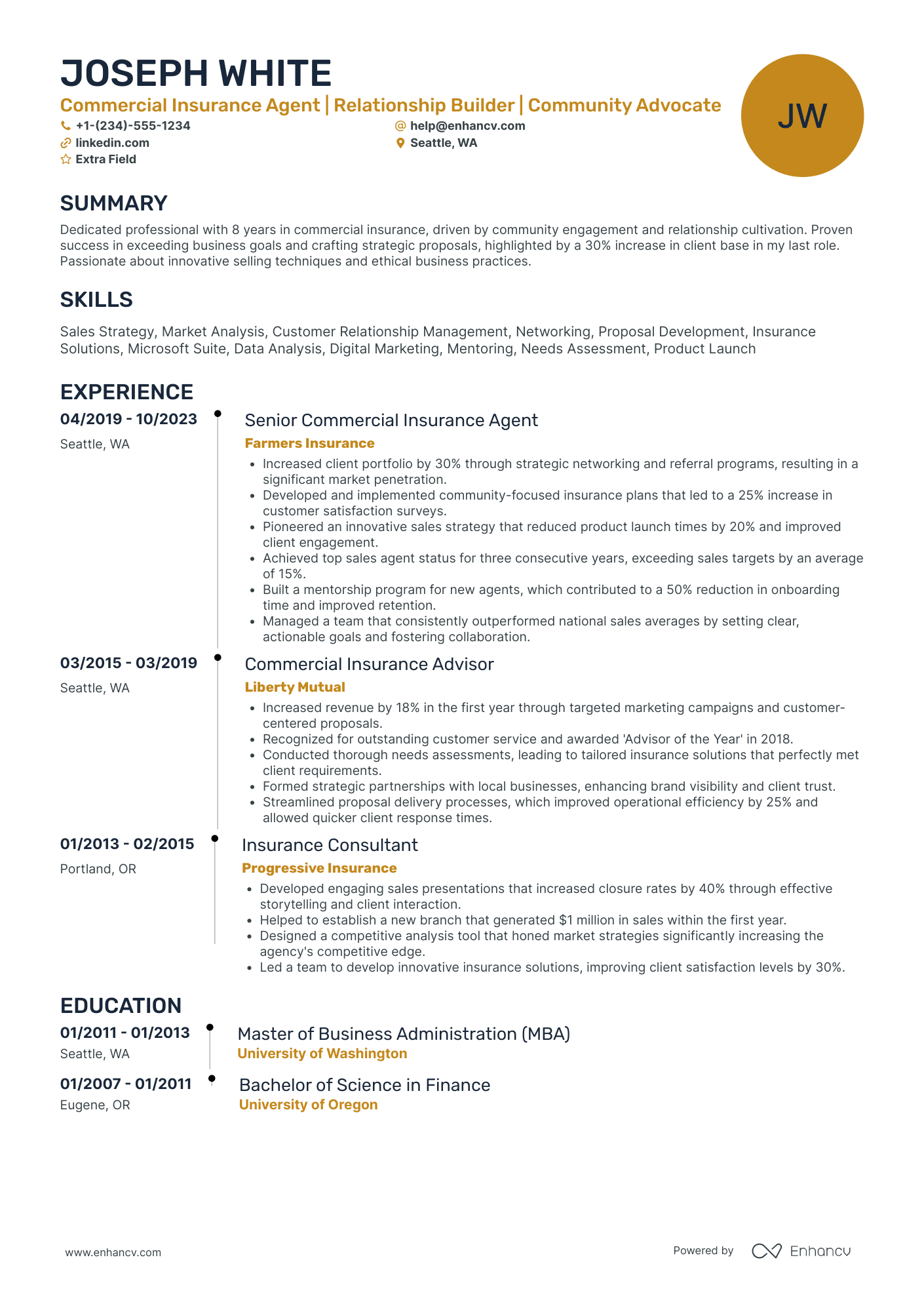

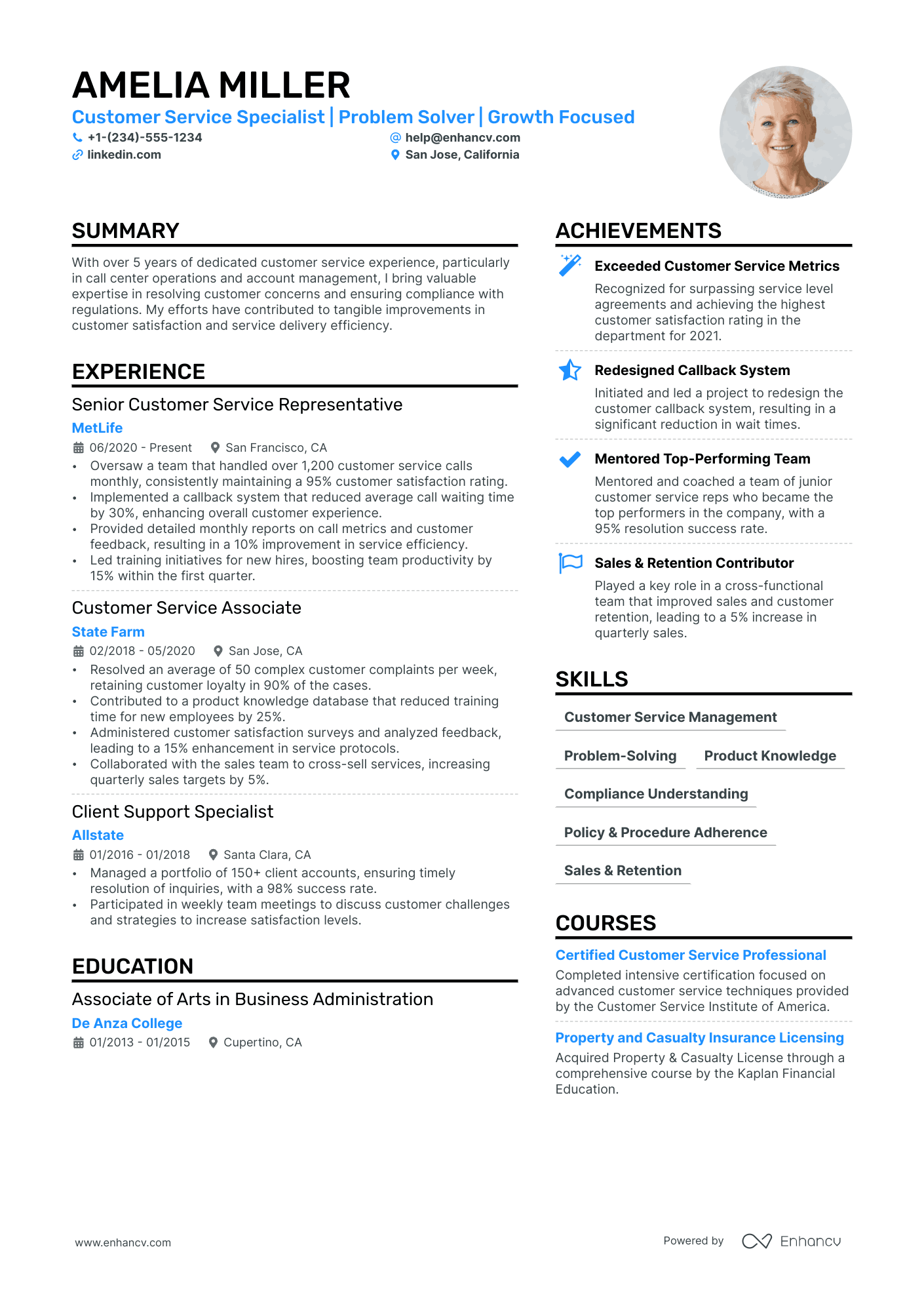

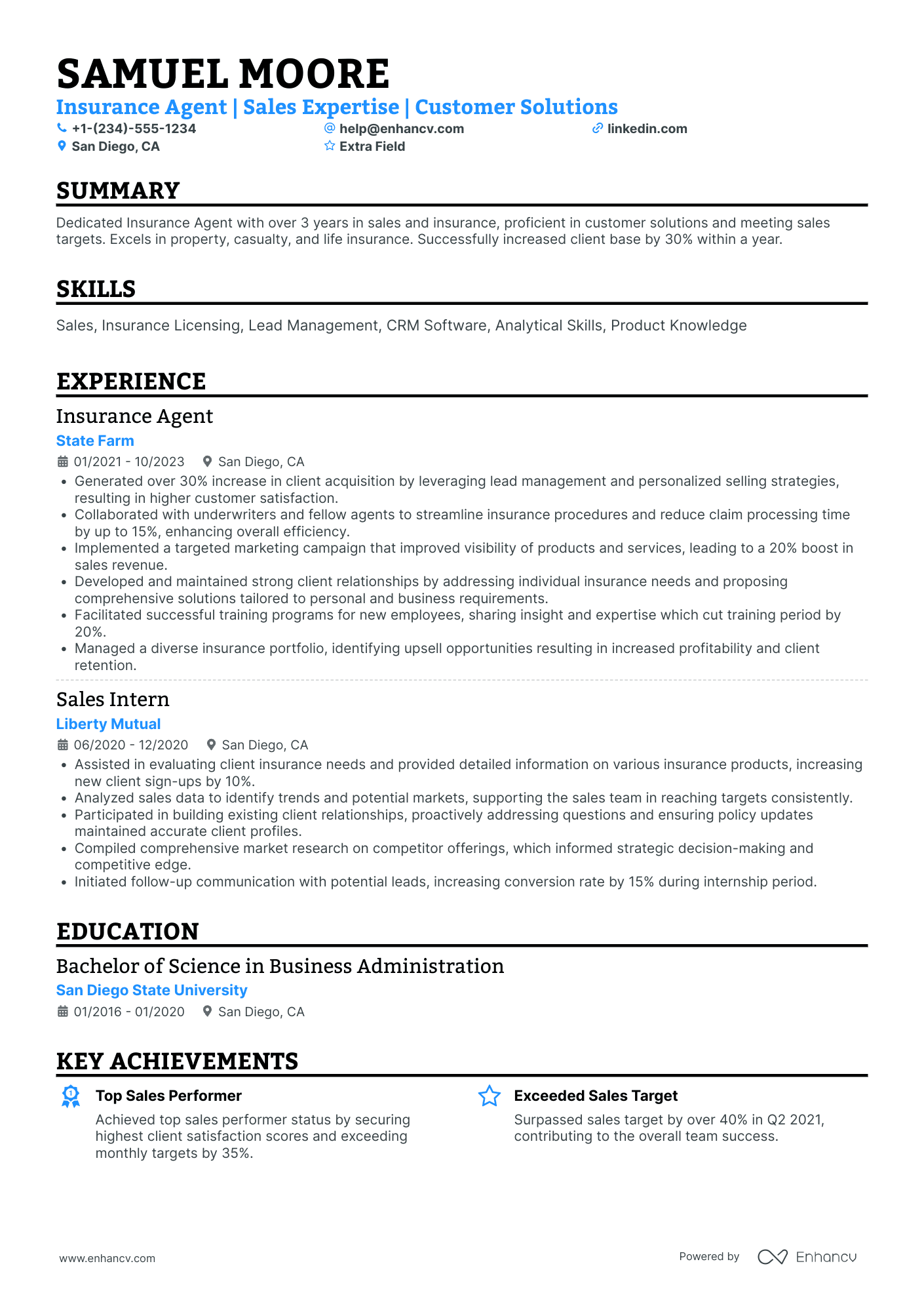

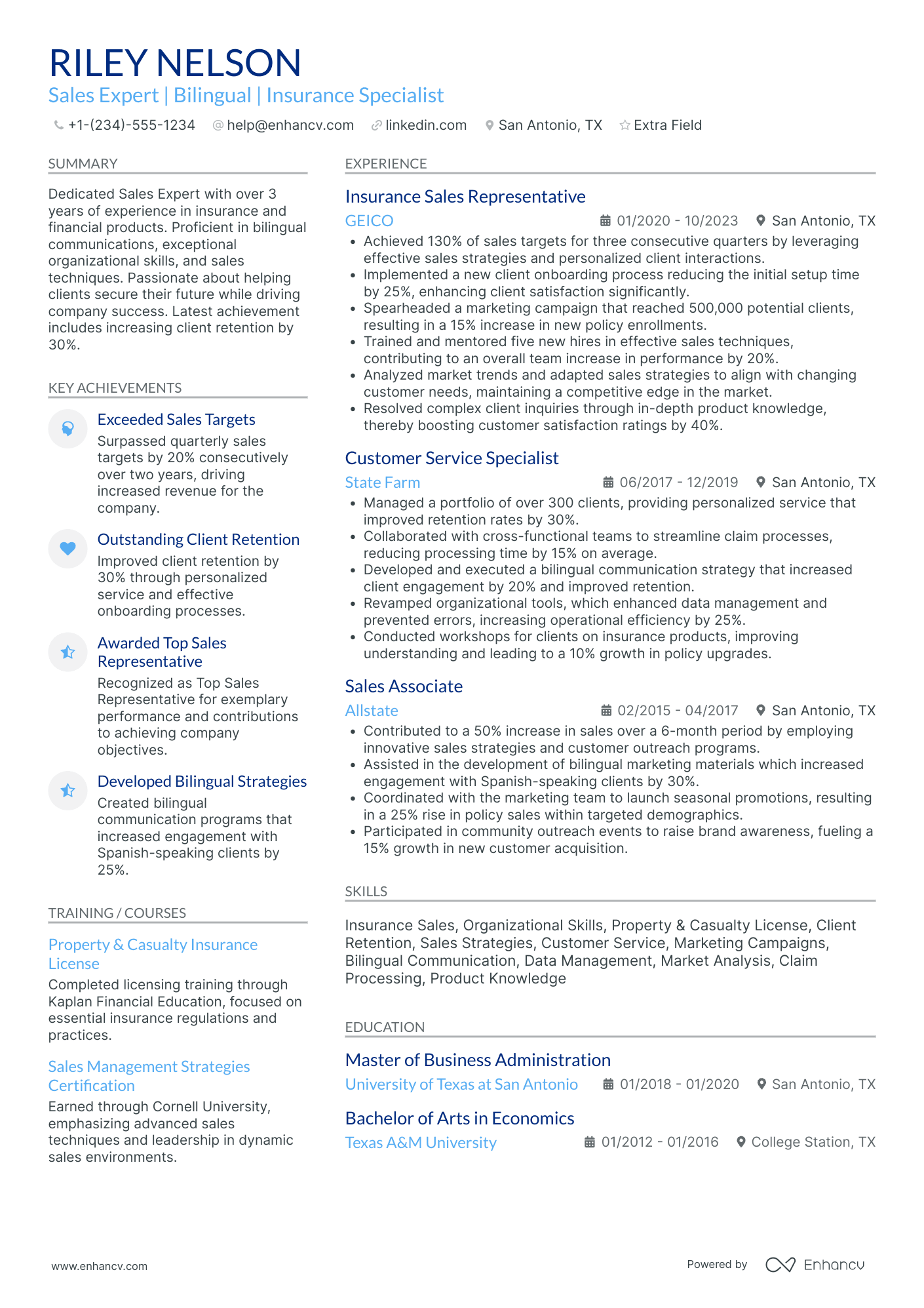

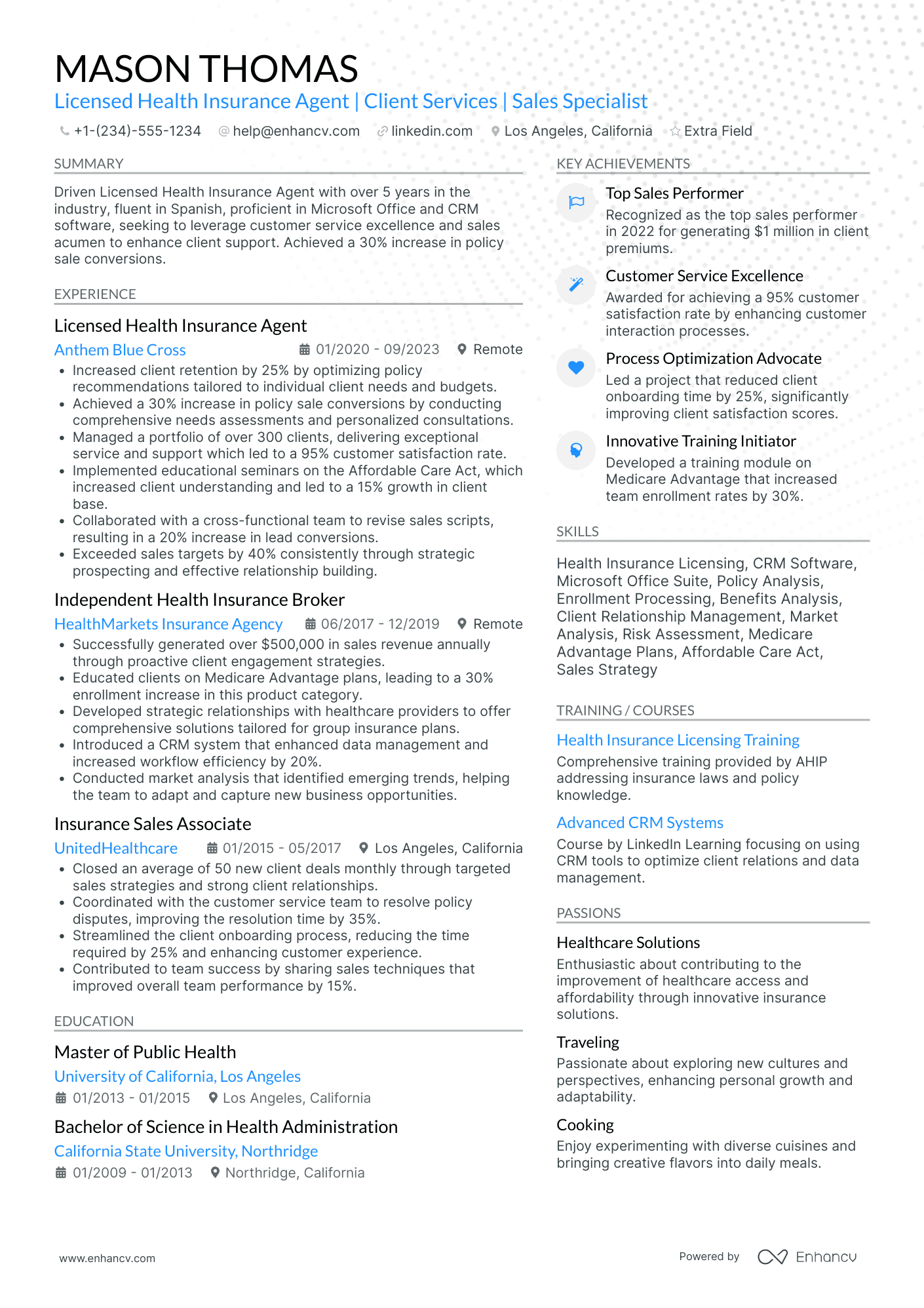

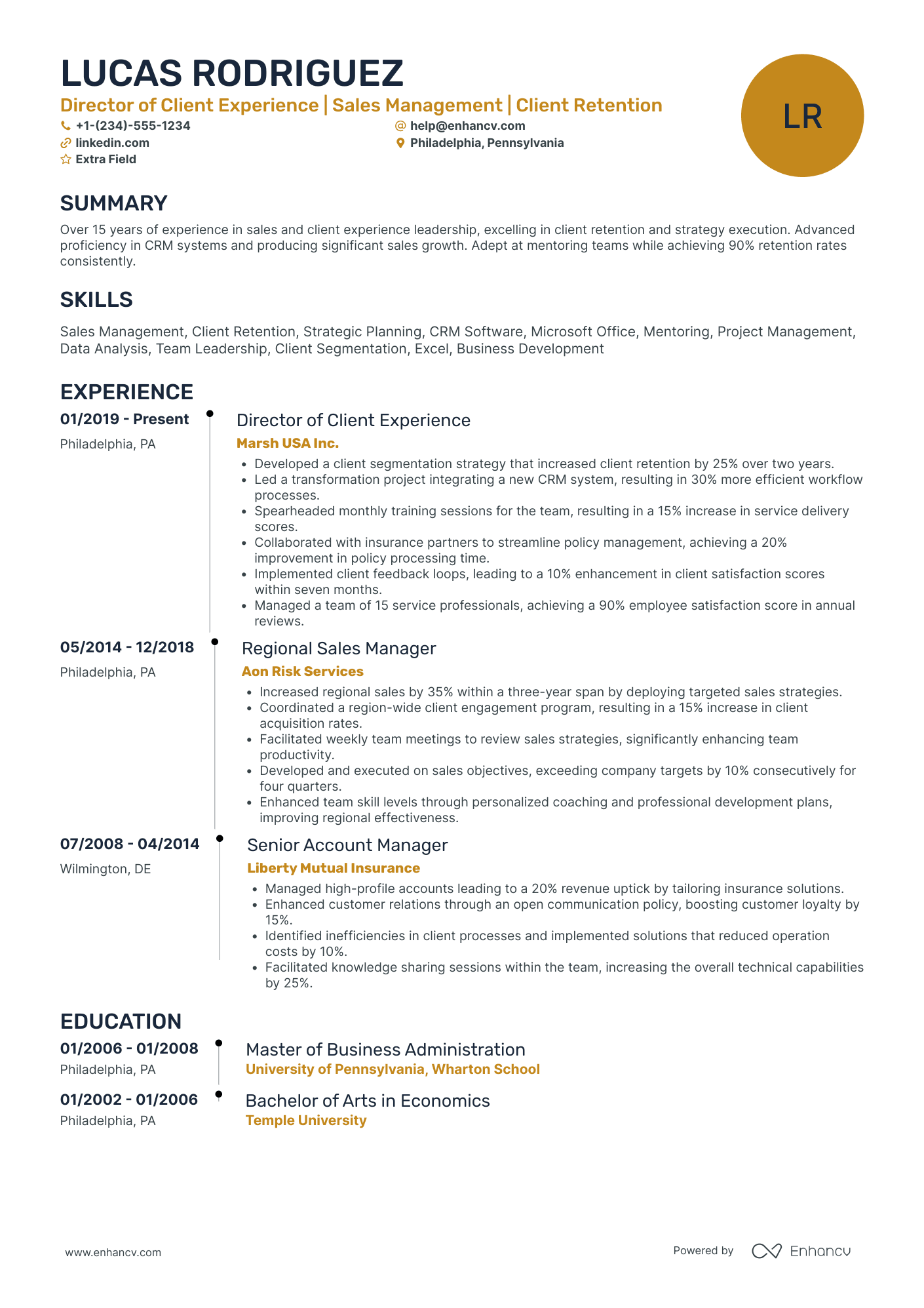

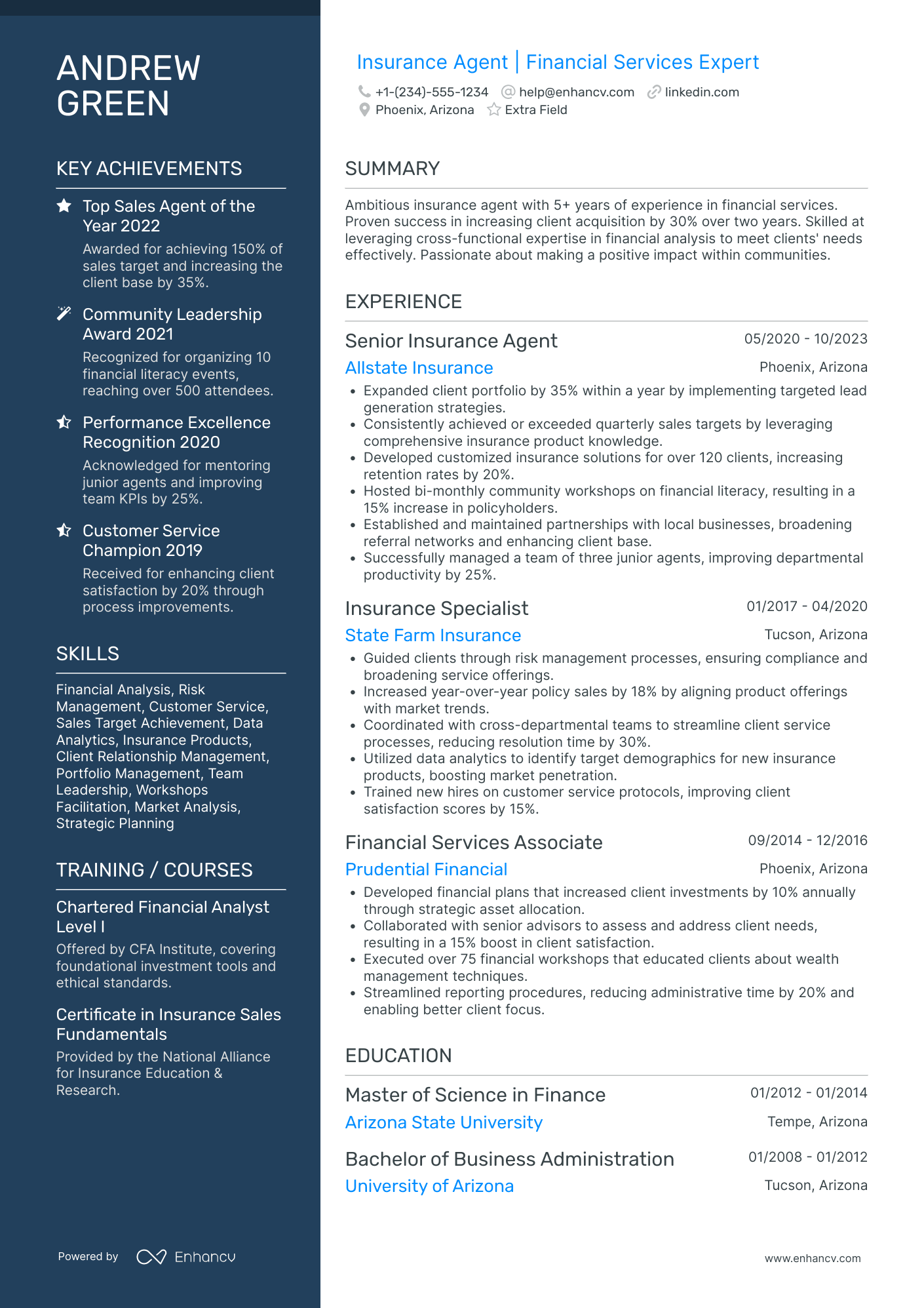

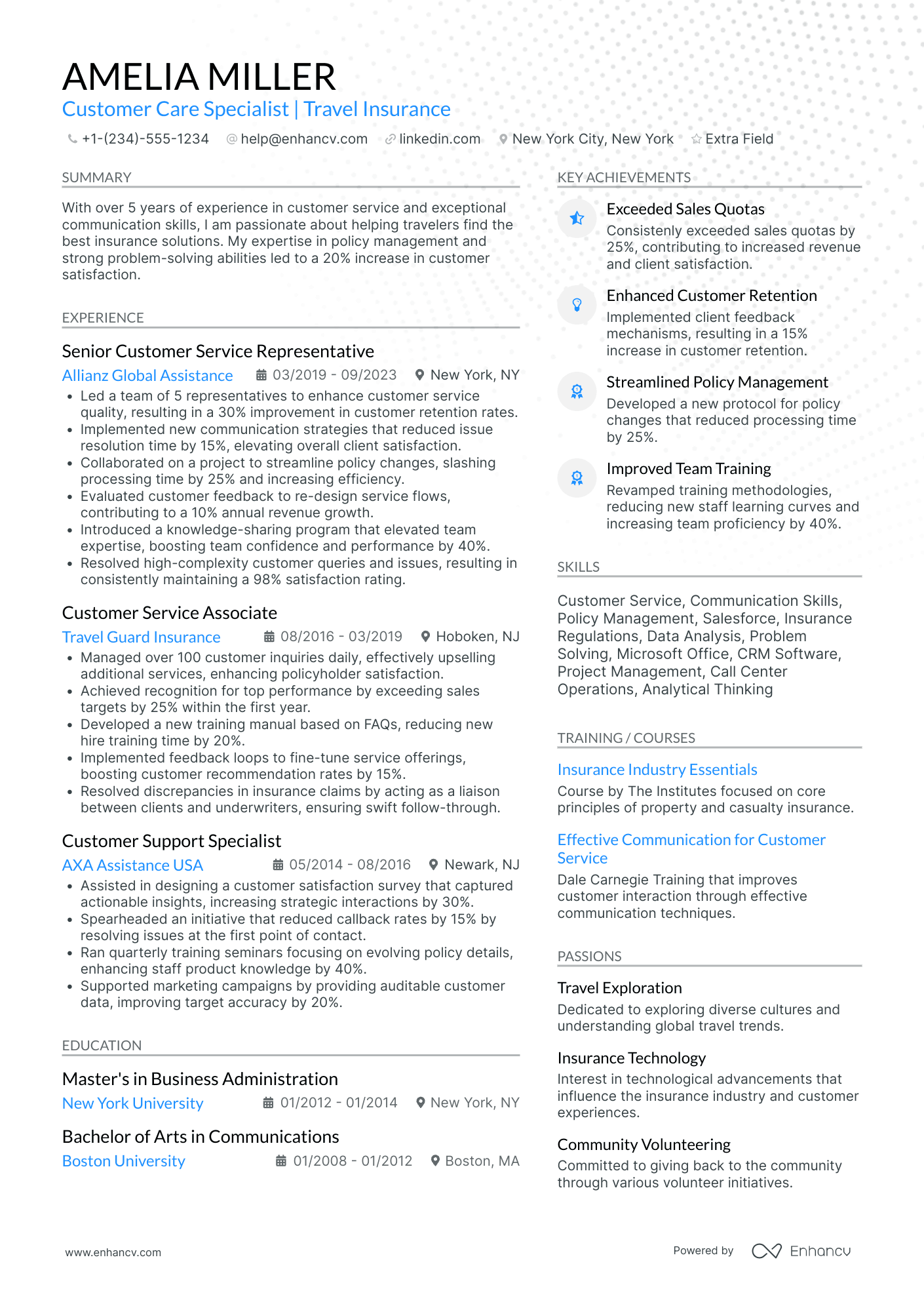

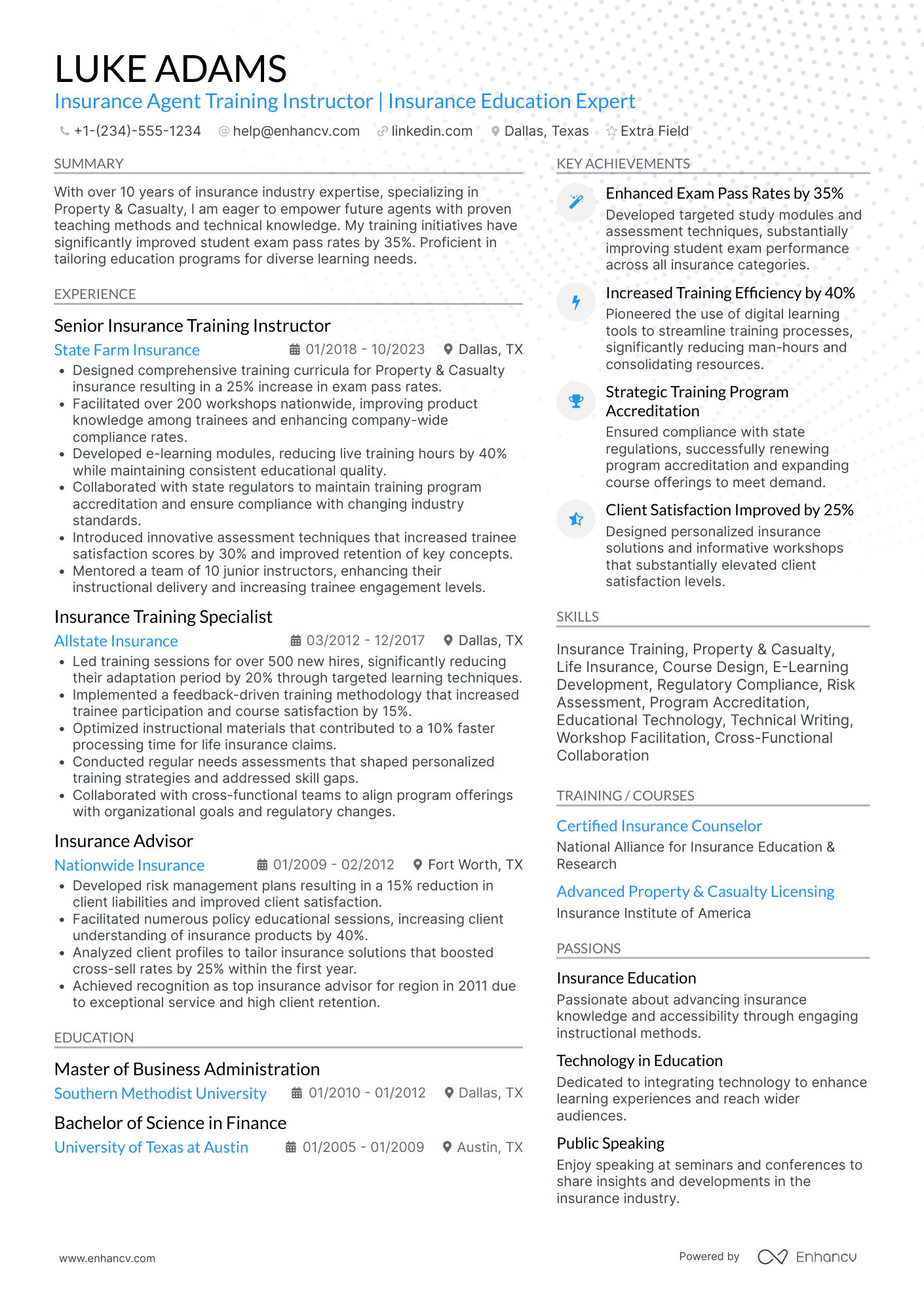

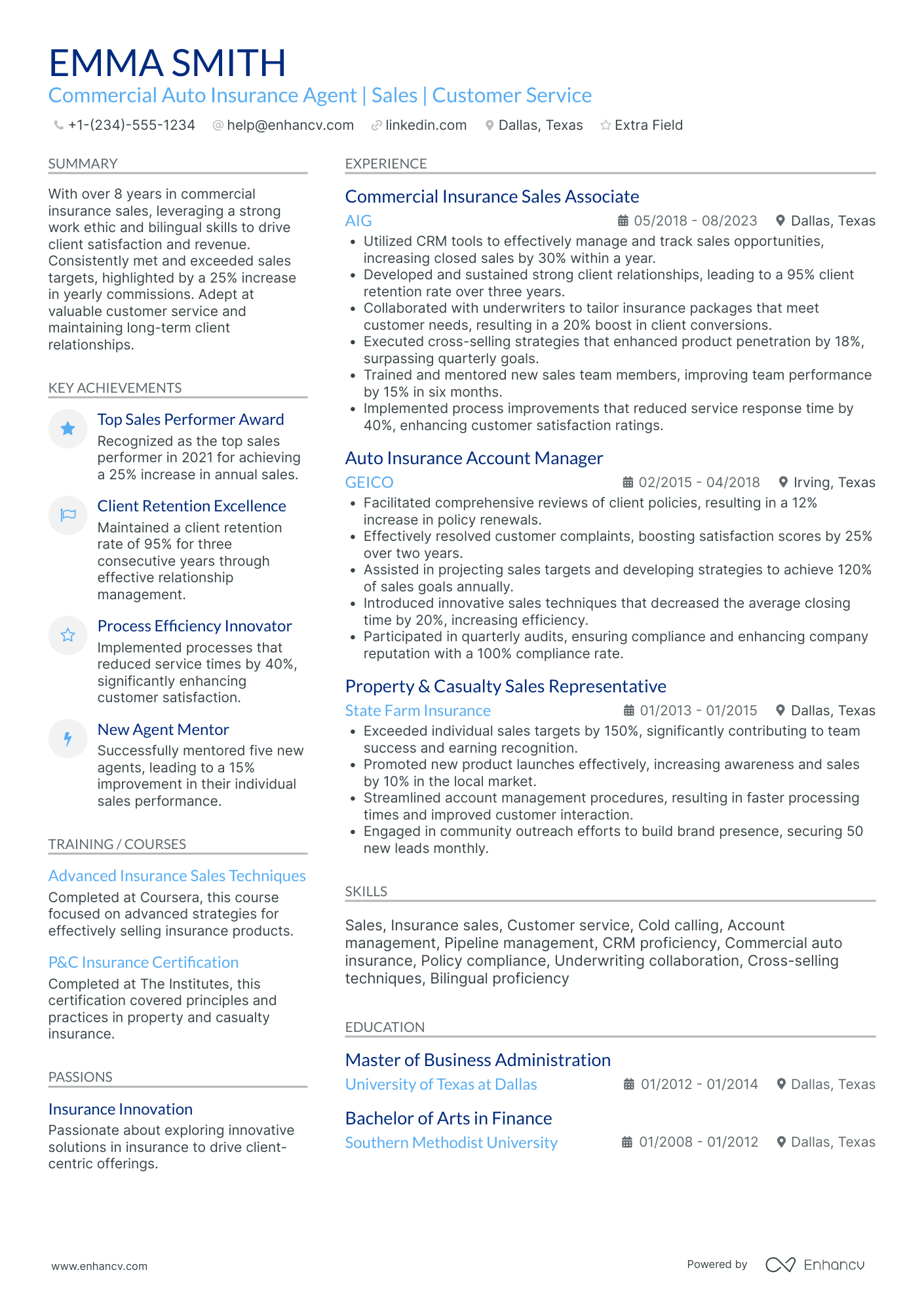

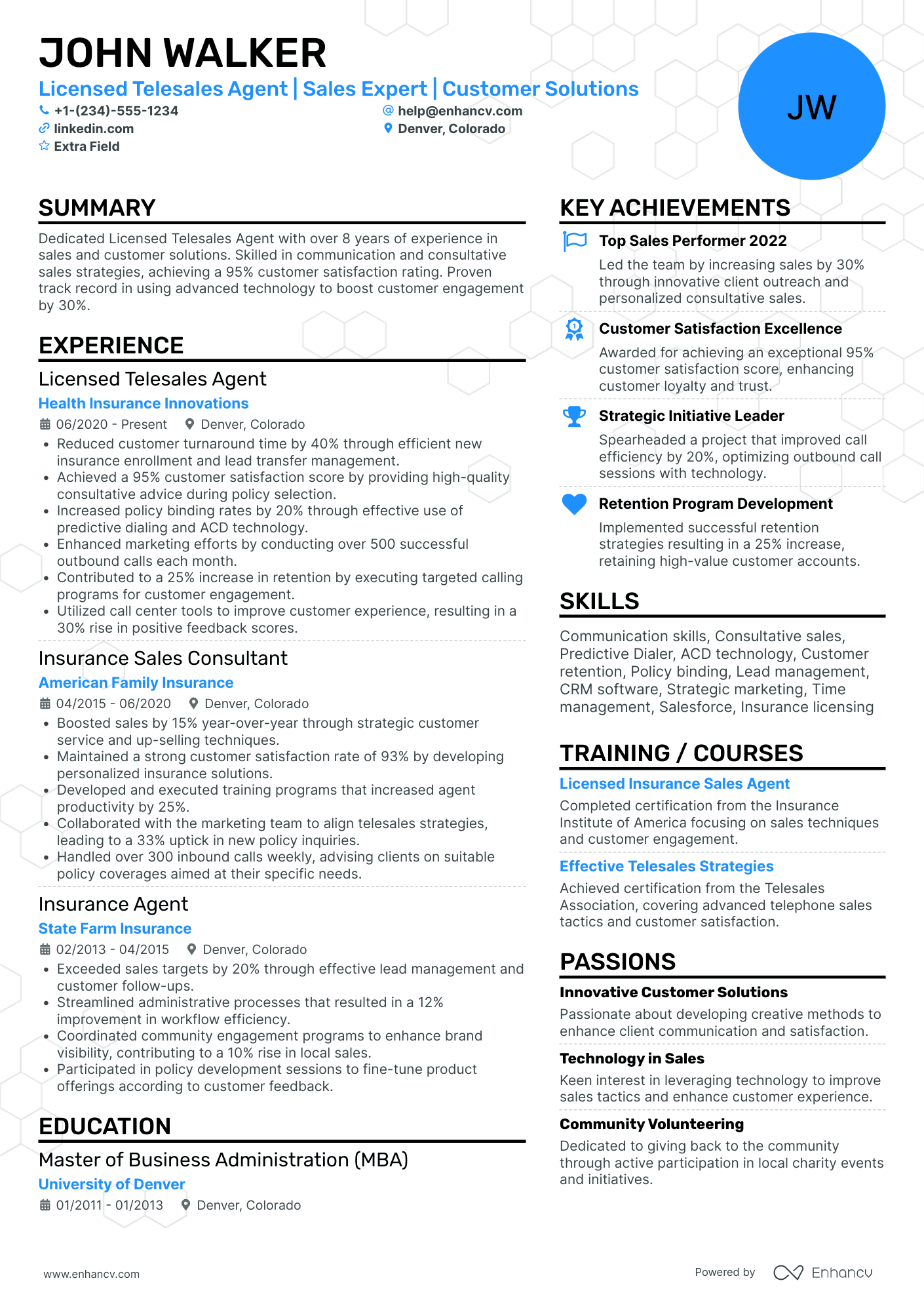

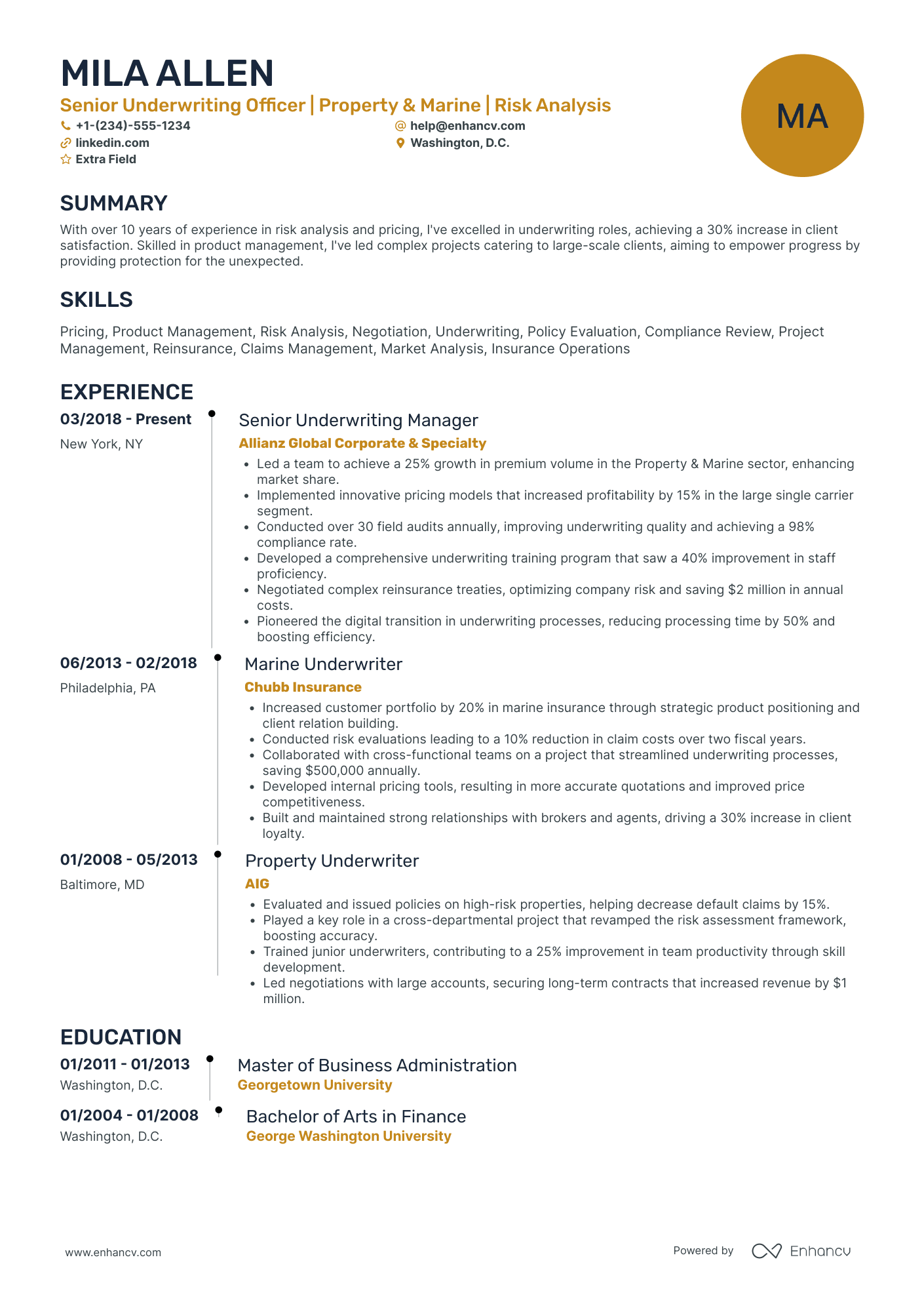

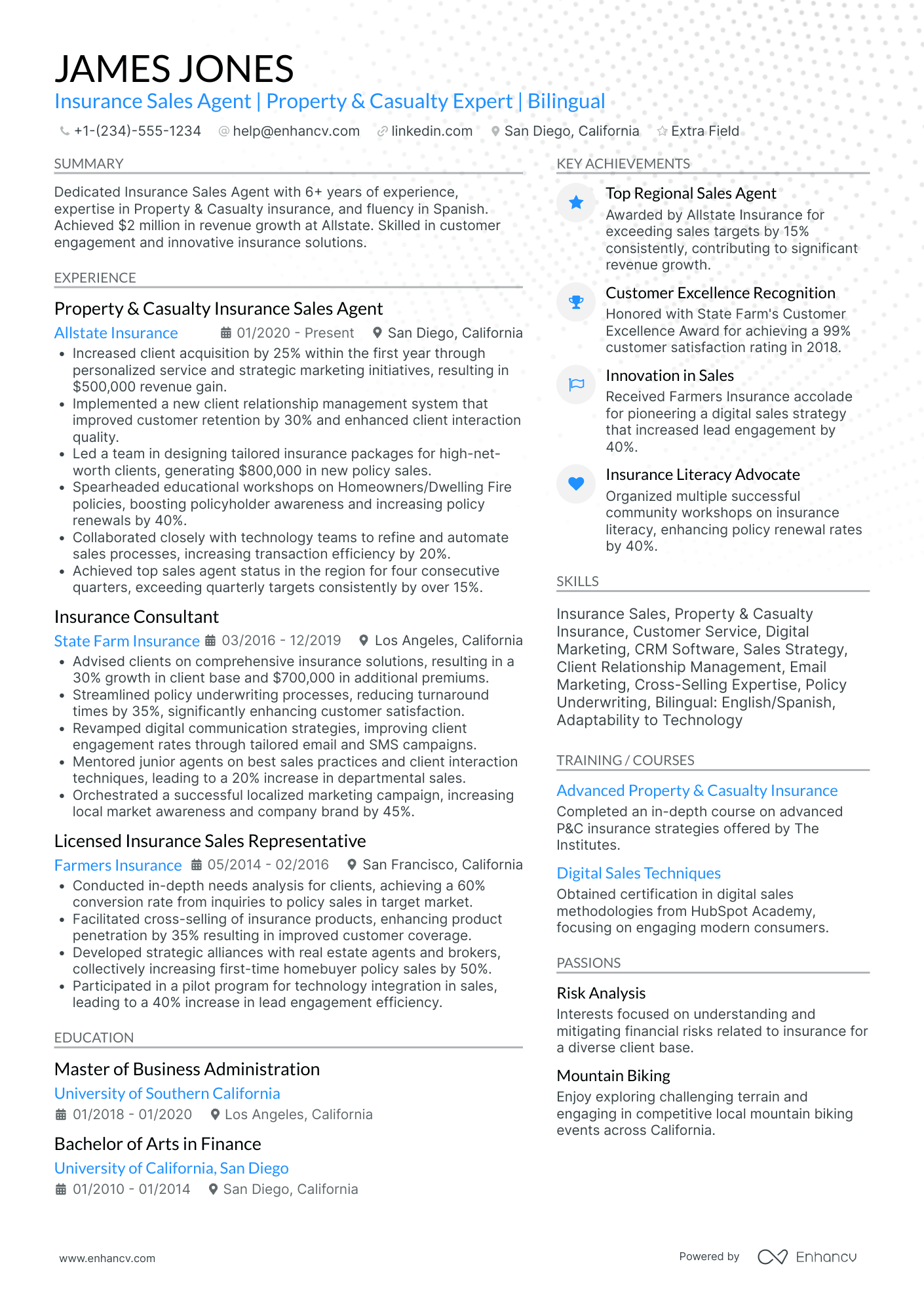

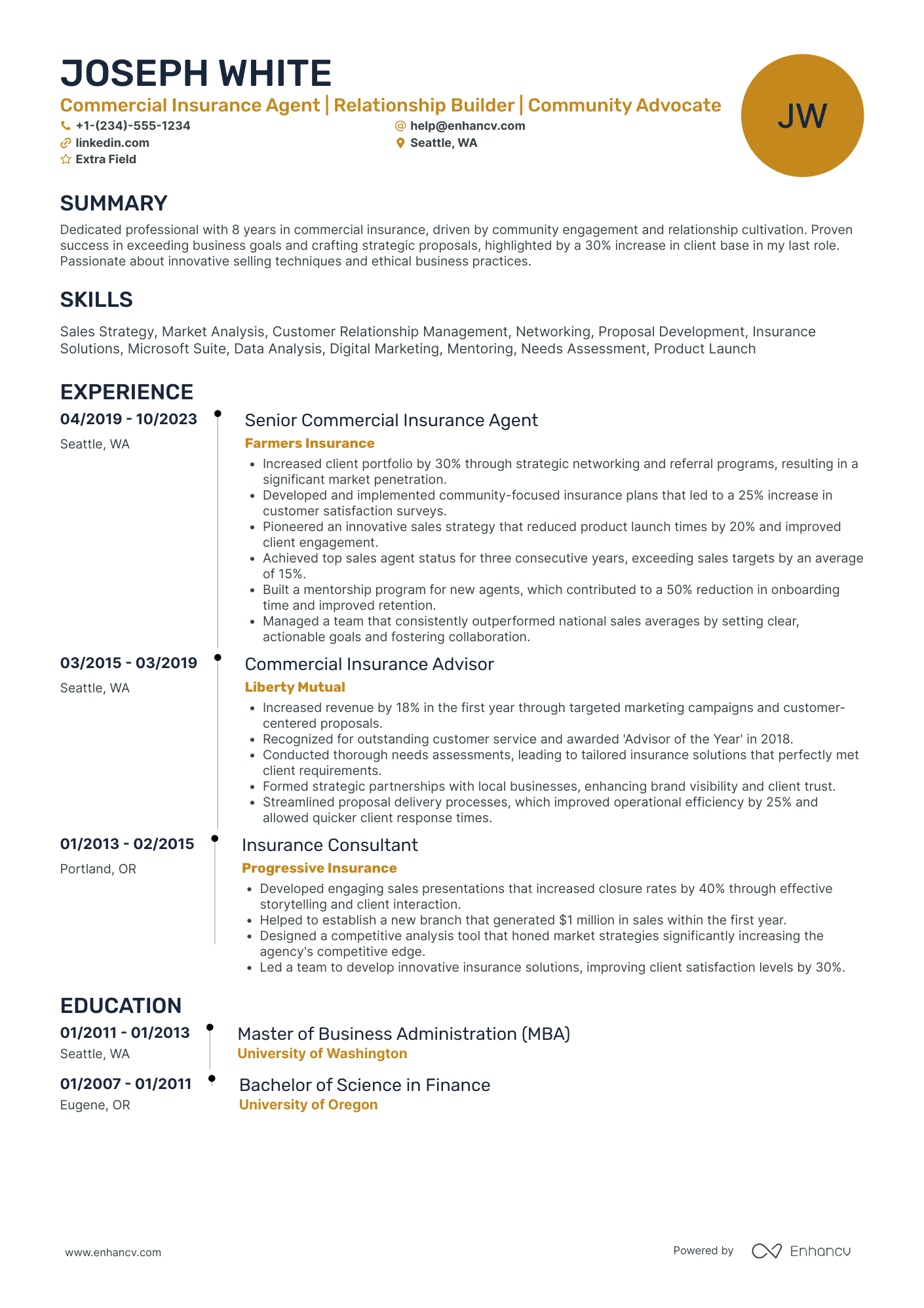

Formatting the experience section of your resume doesn't have to be an over-the-top deep dive into your whole career. Follow the insurance agent resume examples below to see how industry-leading professionals are presenting their experience:

- Spearheaded the development of a comprehensive life insurance program tailored to high-net-worth individuals, resulting in a 25% increase in policy sales within the first year of implementation.

- Established and nurtured relationships with over 100 clients, consistently maintaining a 90% customer satisfaction rate through personalized service and meticulous follow-up.

- Collaborated with cross-functional teams to integrate advanced CRM software, which enhanced client data organization and improved lead response time by 30%.

- Redesigned insurance portfolio strategies for more than 200 clients facilitating a diversified protection plan that catered to their unique risk profiles.

- Effectively managed continuous policy renewals with a retention rate exceeding 95%, by implementing targeted client education and service initiatives.

- Led a successful campaign focused on comprehensive insurance education for young adults, which expanded our market reach by 40% in the 20-30 year-old demographic.

- Orchestrated a strategic alliance with local businesses, expanding commercial insurance sales by 150% within a two-year time frame.

- Conducted thorough risk assessments and policy reviews for over 80 businesses, contributing to a revenue increase of $1.2 million.

- Implemented a comprehensive training program for new agents, which reduced average onboarding time by 25% and increased salesforce productivity.

- Developed and led a workshop series on the Affordable Care Act that educated over 500 individuals on health insurance options, which directly led to a 35% uptick in policy enrollments.

- Designed a bespoke health insurance package for small businesses that saw a 45% adoption by the target market in its first year.

- Streamlined the claim processing system, cutting processing times by 50% and significantly improving customer experience.

- Brokered complex insurance deals tailored to high-value properties, which resulted in growing the luxury estate insurance portfolio by $800,000.

- Optimized lead generation techniques via digital marketing efforts, which saw a quarterly increase in leads by 20% every year.

- Partnered with mortgage lenders to provide packaged financial solutions, enhancing customer value and boosting referral business by 50%.

- Analyzed and underwrote insurance policies for over 1,000 clients, maintaining a loss ratio 15% better than the company average.

- Contributed to developing an underwriting automation tool, reducing manual review times by 40% and improving overall team efficiency.

- Led quarterly underwriting training sessions for new hires, resulting in a quicker ramp-up period and more consistent adherence to underwriting guidelines.

- Drove a 200% increase in auto insurance policy sales through targeted marketing strategies and diligent follow-up with leads.

- Negotiated and closed policy contracts with clients, emphasizing the benefits of comprehensive coverage and securing an average deal size increase of 15%.

- Collaborated with the claims department to understand frequent issues, using the insights to refine our offerings and improve customer satisfaction scores.

- Designed tailor-made financial plans that incorporated insurance products, resulting in a year-over-year client financial portfolio growth of 20%.

- Innovated a client review process which enhanced service delivery and led to a client retention improvement of 95%.

- Executed an inter-agency workshop to boost knowledge sharing on the latest financial products, which resulted in our team achieving the top sales regionally for two consecutive years.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for insurance agent professionals.

Top Responsibilities for Insurance Agent:

- Customize insurance programs to suit individual customers, often covering a variety of risks.

- Sell various types of insurance policies to businesses and individuals on behalf of insurance companies, including automobile, fire, life, property, medical and dental insurance, or specialized policies, such as marine, farm/crop, and medical malpractice.

- Explain features, advantages, and disadvantages of various policies to promote sale of insurance plans.

- Perform administrative tasks, such as maintaining records and handling policy renewals.

- Seek out new clients and develop clientele by networking to find new customers and generate lists of prospective clients.

- Call on policyholders to deliver and explain policy, to analyze insurance program and suggest additions or changes, or to change beneficiaries.

- Confer with clients to obtain and provide information when claims are made on a policy.

- Interview prospective clients to obtain data about their financial resources and needs, the physical condition of the person or property to be insured, and to discuss any existing coverage.

- Contact underwriter and submit forms to obtain binder coverage.

- Select company that offers type of coverage requested by client to underwrite policy.

Quantifying impact on your resume

- List the total number of policies you have sold to showcase your sales achievements and ability to generate revenue for the company.

- Include the percentage growth in your client base to demonstrate your skills in expanding the company's market share.

- Mention the total value of claims you have handled to highlight your experience with managing significant financial transactions.

- Specify the reduction in processing time for claims or customer applications to show your efficiency in handling tasks and improving operational processes.

- Quantify the increase in customer satisfaction ratings you contributed to, proving your commitment to excellent client service.

- Detail the amount of cross-selling or upselling of insurance products to illustrate your ability to recognize and capitalize on sales opportunities.

- State the number of training sessions or workshops you have conducted or attended to emphasize your dedication to professional development.

- Include the size of the team you've managed or collaborated with, if applicable, to highlight your teamwork and leadership skills.

Action verbs for your insurance agent resume

Guide for insurance agent professionals kicking off their career

Who says you can't get that insurance agent job, even though you may not have that much or any experience? Hiring managers have a tendency to hire the out-of-the-blue candidate if they see role alignment. You can show them why you're the best candidate out there by:

- Selecting the functional skill-based or hybrid formats to spotlight your unique value as a professional

- Tailoring your insurance agent resume to always include the most important requirements, found towards the top of the job ad

- Substituting the lack of experience with other relevant sections like achievements, projects, and research

- Pinpoint both achievements and how you see yourself within this specific role in the insurance agent resume objective.

Recommended reads:

PRO TIP

Highlight any significant extracurricular activities that demonstrate valuable skills or leadership.

How to showcase hard skills and soft skills on your resume

Reading between the lines of your dream job, you find recruiters are looking for candidates who have specific software or hardware knowledge, and personal skills.

Any technology you're adept at shows your hard skills. This particular skill set answers initial job requirements, hinting at how much time your potential employers would have to invest in training you. Showcase you have the relevant technical background in your communicate, solve problems, and adapt to new environments. Basically, your interpersonal communication skills that show recruiters if you'd fit into the team and company culture. You could use the achievements section to tie in your greatest wins with relevant soft skills.

It's also a good idea to add some of your hard and soft skills across different resume sections (e.g. summary/objective, experience, etc.) to match the job requirements and pass the initial screening process. Remember to always check your skill spelling and ensure that you've copy-pasted the name of the desired skills from the job advert as is.

Top skills for your insurance agent resume:

Customer Relationship Management (CRM) Software

Insurance Policy Management Systems

Risk Assessment Tools

Underwriting Software

Claims Processing Systems

Sales Automation Tools

Data Analysis Software

Financial Modeling Tools

Market Research Tools

Regulatory Compliance Software

Communication Skills

Negotiation Skills

Problem-Solving Skills

Empathy

Time Management

Attention to Detail

Interpersonal Skills

Adaptability

Customer Service Orientation

Team Collaboration

Next, you will find information on the top technologies for insurance agent professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Insurance Agent’s resume:

- AMS Services AMS Sagitta

- Microsoft Dynamics

- Adobe After Effects

- YouTube

- Applied Systems Vision

- Tangle S Creations Your Insurance Office

PRO TIP

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

Certifications and education: in-demand sections for your insurance agent resume

Your academic background in the form of certifications on your resume and your higher degree education is important to your application.

The certifications and education sections pinpoint a variety of hard and soft skills you possess, as well as your dedication to the industry.

Add relevant certificates to your insurance agent resume by:

- Add special achievements or recognitions you've received during your education or certification, only if they're really noteworthy and/or applicable to the role

- Be concise - don't list every and any certificate you've obtained through your career, but instead, select the ones that would be most impressive to the role

- Include the name of the certificate or degree, institution, graduation dates, and certificate license numbers (if possible)

- Organize your education in reverse chronological format, starting with the latest degree you have that's most applicable for the role

Think of the education and certification sections as the further credibility your insurance agent resume needs to pinpoint your success.

Now, if you're stuck on these resume sections, we've curated a list of the most popular technical certificates across the industry.

Have a look, below:

The top 5 certifications for your insurance agent resume:

- Chartered Property Casualty Underwriter (CPCU) - The Institutes

- Certified Insurance Counselor (CIC) - The National Alliance for Insurance Education & Research

- Certified Risk Manager (CRM) - The National Alliance for Insurance Education & Research

- Life Underwriter Training Council Fellow (LUTCF) - The American College of Financial Services

- Accredited Advisor in Insurance (AAI) - The Institutes

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for insurance agent professionals.

Top US associations for a Insurance Agent professional

- America's Health Insurance Plans

- American Council of Life Insurers

- American Property Casualty Insurance Association

- Financial Industry Regulatory Authority

- Group Underwriters Association of America

PRO TIP

Mention specific courses or projects that are pertinent to the job you're applying for.

Recommended reads:

Writing the insurance agent resume summary or objective: achievements, keywords, dreams, and more

Deciding on whether to include a resume summary or resume objective should entirely depend on your career situation.

If you have:

- Plenty of relevant achievements you'd like to bring recruiters' focus to, make use of the resume summary. Ensure each of your achievements is quantified with concrete proof (e.g. % of cases solved).

- Less applicable experience, utilize the resume objective. Within the objective include a few noteworthy, past successes, followed up by your professional dreams.

As a bonus, you could define in either your insurance agent resume summary or objective what makes you the perfect candidate for the role.

Think about your unique hard and soft skills that would make your expertise even more important to the job.

These insurance agent professionals have completely covered the formula for the ideal resume introduction:

Resume summaries for a insurance agent job

- With over a decade of experience in the insurance industry, this seasoned professional has consistently exceeded sales targets by mastering policy customization and client relationship management. Adept at leveraging data-driven analysis to optimize coverage options, their leadership led to a 30% increase in policy renewals for a top-tier insurance firm in New York.

- An accomplished financial consultant with 7 years of experience, now seeking to apply analytical skills and a customer-centric approach to the insurance domain. Having excelled at comprehensive financial planning, the candidate offers a wealth of expertise in risk assessment and a track record of boosting client investment portfolio performance.

- Former healthcare administrator with strong interpersonal skills and extensive experience in managing patient care operations, now aspiring to pivot to the insurance industry. Brings an in-depth understanding of healthcare policies, regulatory compliance, and exceptional organizational abilities to navigate complex insurance landscapes efficiently.

- This impassioned recent graduate aspires to launch a career in insurance, bringing forth strong analytical abilities, a detail-oriented mindset, and a fervent commitment to learning industry regulations and market trends. Keen to apply academic achievements from a Bachelor’s in Business Administration to deliver value through meticulous policy analysis and client service excellence.

- As an innovative educator transitioning into the insurance sector, this candidate is eager to harness their strong communication skills and a proven track record in curriculum development to simplify and explain complex insurance products. Their value lies in the ability to engage and educate a diverse client base, just as effectively as they have in the classroom.

- Seeking to jumpstart an insurance career, this motivated individual offers a blend of fresh enthusiasm and a Bachelor’s in Finance. They are dedicated to applying their quantitative aptitude and eagerness to absorb new information to aid clients in making informed insurance decisions while contributing to sustained business growth.

Average salary info by state in the US for insurance agent professionals

Local salary info for Insurance Agent.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $59,080 |

| California (CA) | $63,400 |

| Texas (TX) | $44,700 |

| Florida (FL) | $56,360 |

| New York (NY) | $79,240 |

| Pennsylvania (PA) | $59,450 |

| Illinois (IL) | $50,790 |

| Ohio (OH) | $59,990 |

| Georgia (GA) | $51,540 |

| North Carolina (NC) | $57,160 |

| Michigan (MI) | $58,880 |

Extra insurance agent resume sections and elements

Creating a winning insurance agent resume isn't about following a rigid formula. The key is to tailor it to the job requirements while maintaining your unique personality.

Consider including these additional resume sections to enhance your profile:

- Awards - Highlight industry-specific awards as well as any personal accolades to demonstrate recognition of your expertise and achievements;

- Hobbies and interests - Share your interests outside of work. This can provide insights into your personality and indicate whether you'd be a good cultural fit for the organization;

- Projects - Detail significant projects you've been involved in, focusing on your contributions and the outcomes;

- Publications - If you've authored or co-authored academic papers or other publications, include them to establish your credibility and in-depth knowledge of the field.

These sections can give a more comprehensive view of your capabilities and character, complementing the standard resume content.

Key takeaways

- Ensure your insurance agent resume uses a simple, easy-to-read format that reflects upon your experience and aligns with the role;

- Be specific within the top one-third of your resume (header and summary or objective) to pinpoint what makes you the ideal candidate for the insurance agent role;

- Curate information that is tailored to the job by detailing skills, achievements, and actual outcomes of your efforts;

- List your certifications and technical capabilities to demonstrate your aptitude with specific software and technologies;

- The sections you decide on including on your insurance agent should pinpoint your professional expertise and personality.

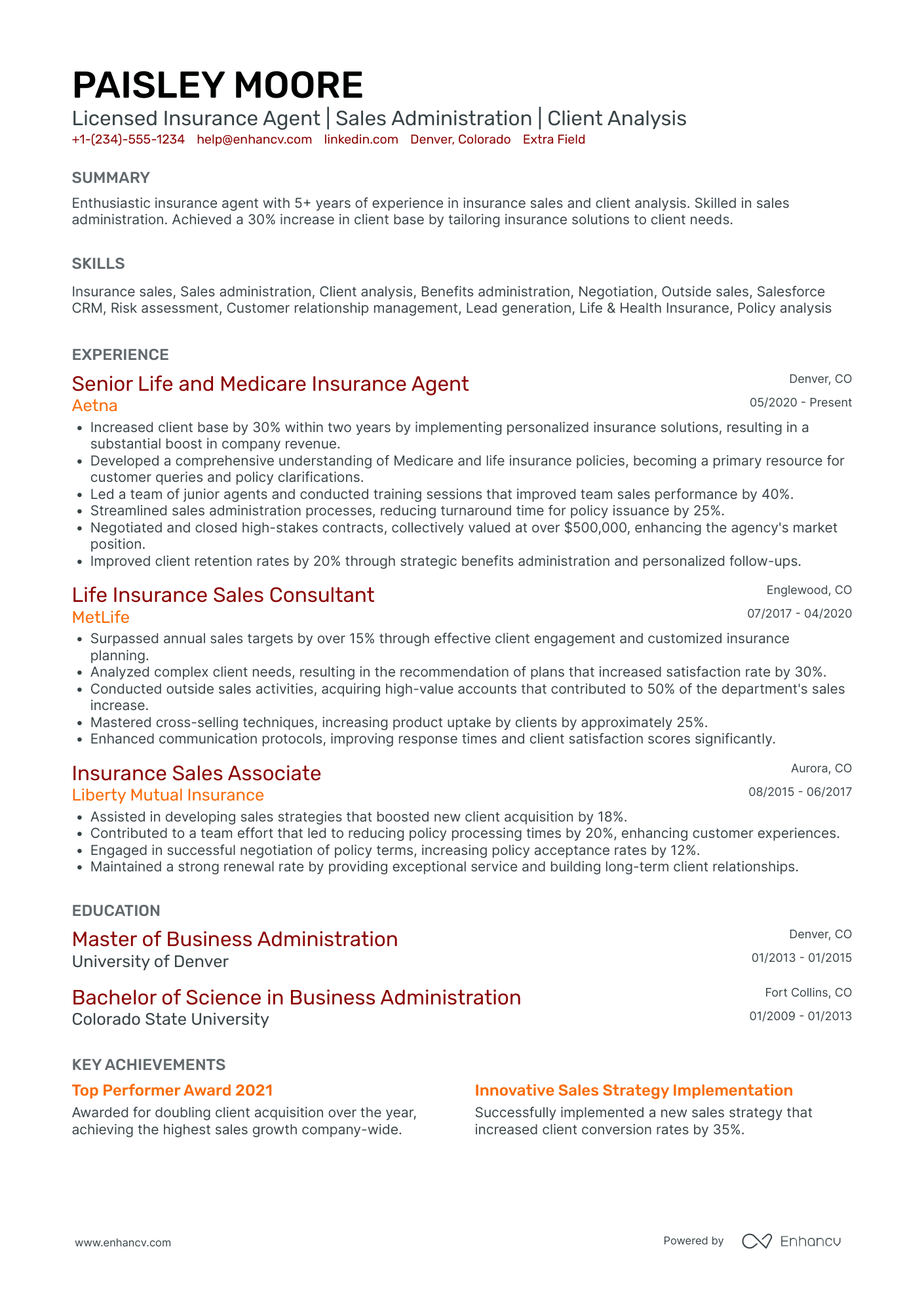

Insurance Agent resume examples

By Experience

Junior Insurance Agent

Senior Insurance Agent

Insurance Agent Trainee

Entry Level Insurance Agent

Experienced Insurance Agent

Insurance Agent Manager

Director of Insurance Agents

Principal Insurance Agent

Associate Insurance Agent

Lead Insurance Agent

By Role

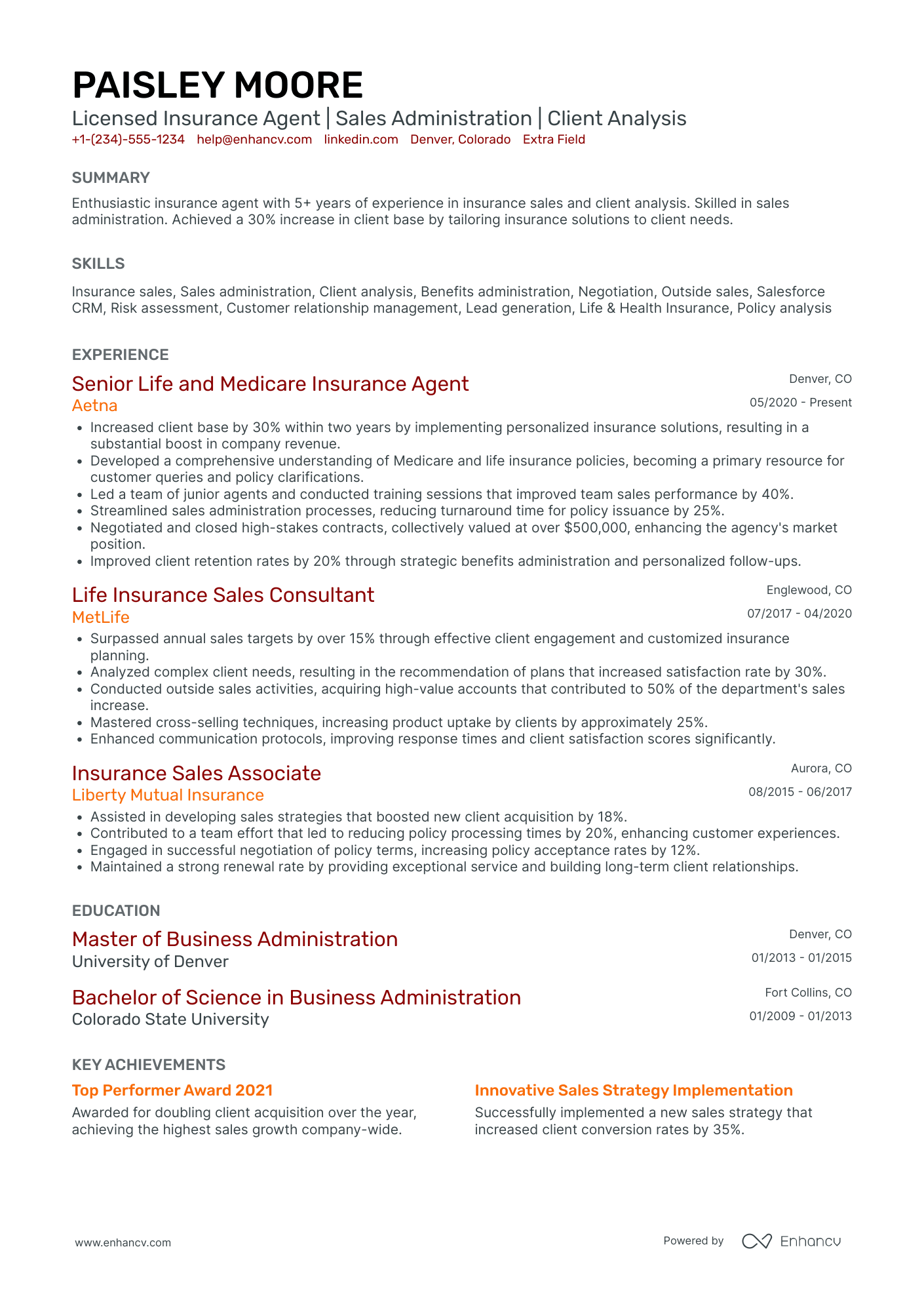

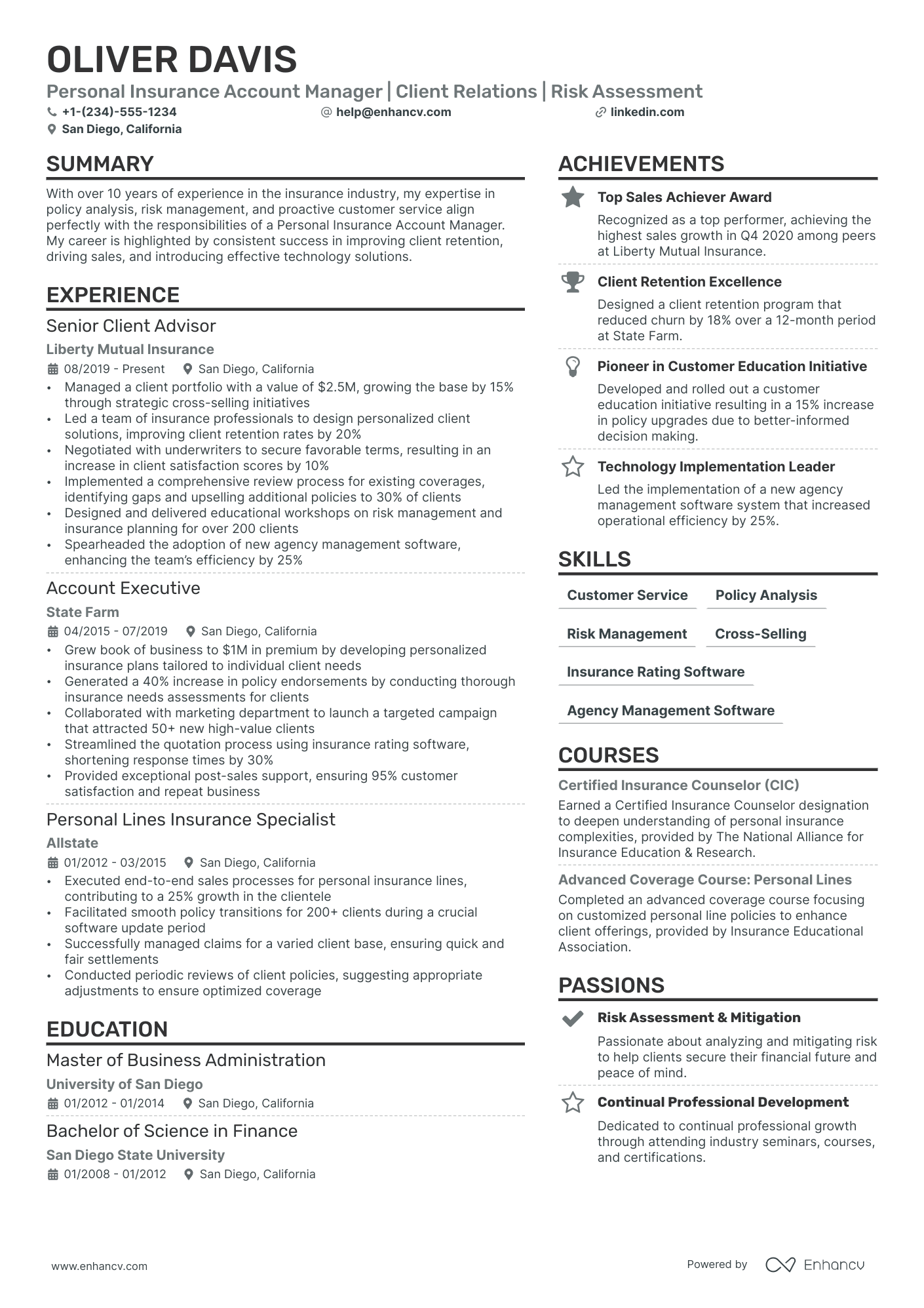

Insurance Account Manager

Insurance Agent

Insurance Agent positions stem from direct client communication roles within the insurance industry.

Tips to increase your probability of success when applying for Insurance Agent roles include:

- Experience with insurance underwriting and strong product knowledge is paramount. Highlight your familiarity with various insurance policies and their underwriting processes.

- Mention your abilities in client sourcing and relationship building. This should form a substantial part of your resume as tapping new clients and nurturing existing relationships are key to this role.

- Showcase strong negotiation and sales skills. Success as an insurance agent involves excellent negotiation tactics.

- Instead of merely listing skills, show how those skills have generated measured results. For instance, 'increased policy sales by...' or 'boosted client base by...'. Stick to the 'skill-action-results' paradigm in your resume.

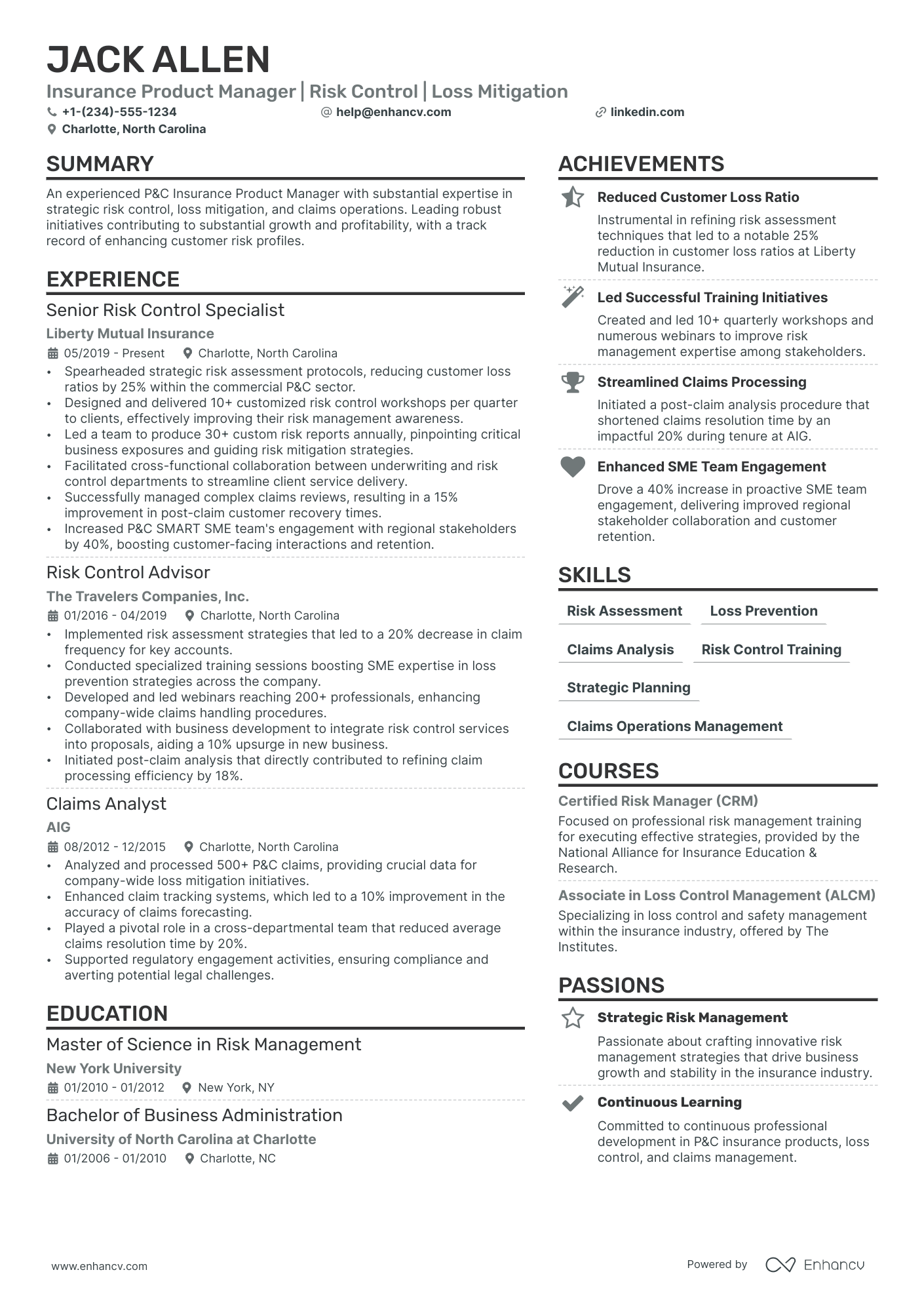

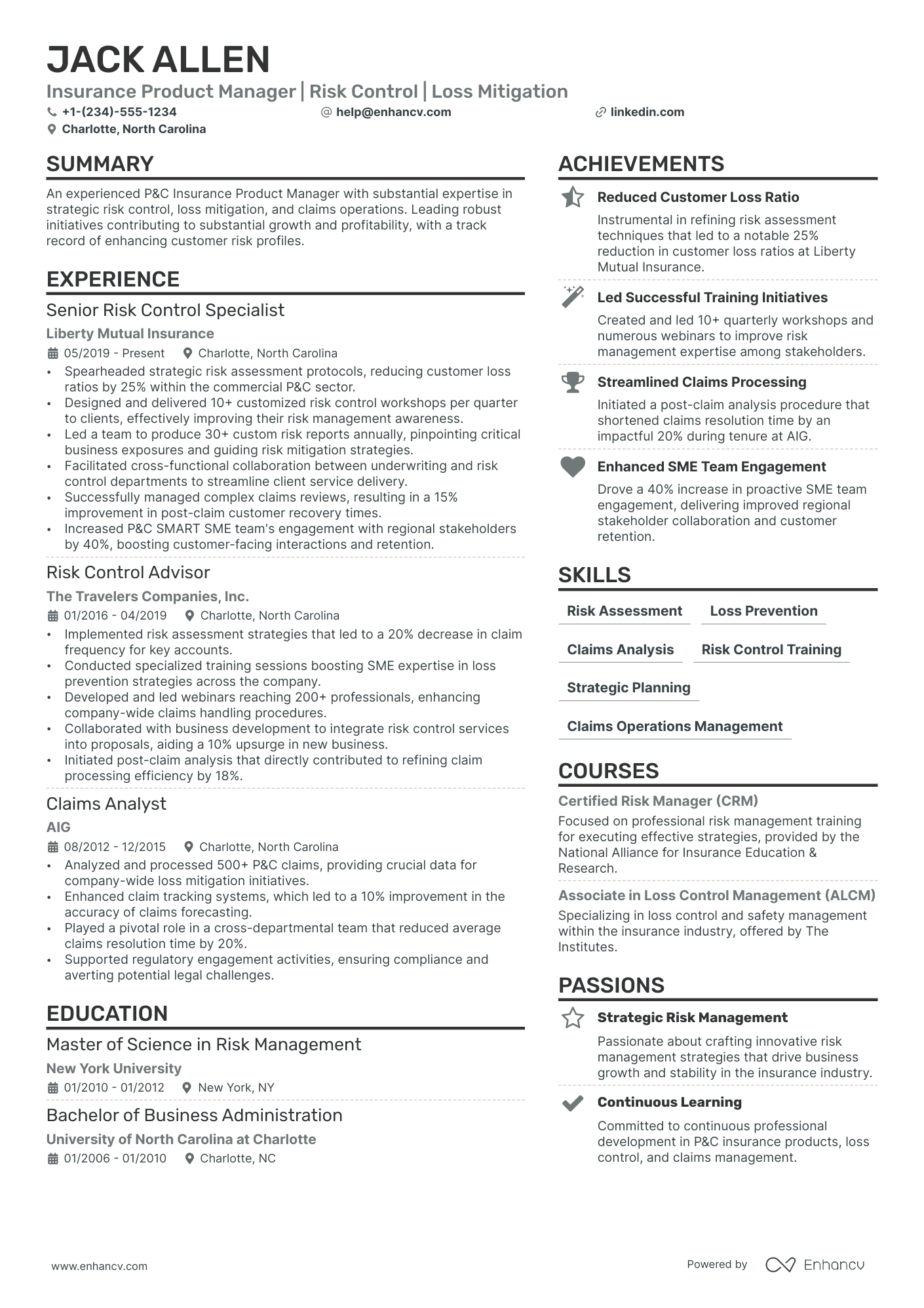

Insurance Product Manager

Insurance Product Manager roles have emerged from a blend of insurance industry knowledge and product management principals.

To make your application for Insurance Product Manager roles successful:

- Experience in insurance product development and management is important. Highlight your exposure to various stages of product development and lifecycle in the insurance sector.

- Emphasize your integration of market research into product creation. Demonstrating your ability to shape products based on customer needs and market trends is vital.

- Showcase your strategic planning and forecasting skills.

- Instead of listing skills, demonstrate how they translated to meaningful outcomes, for example 'launched a product that captured...%' of the market, or 'improvement of product features led to...%'. Attach numbers to your achievements and stick to the 'skill-action-results' rule.

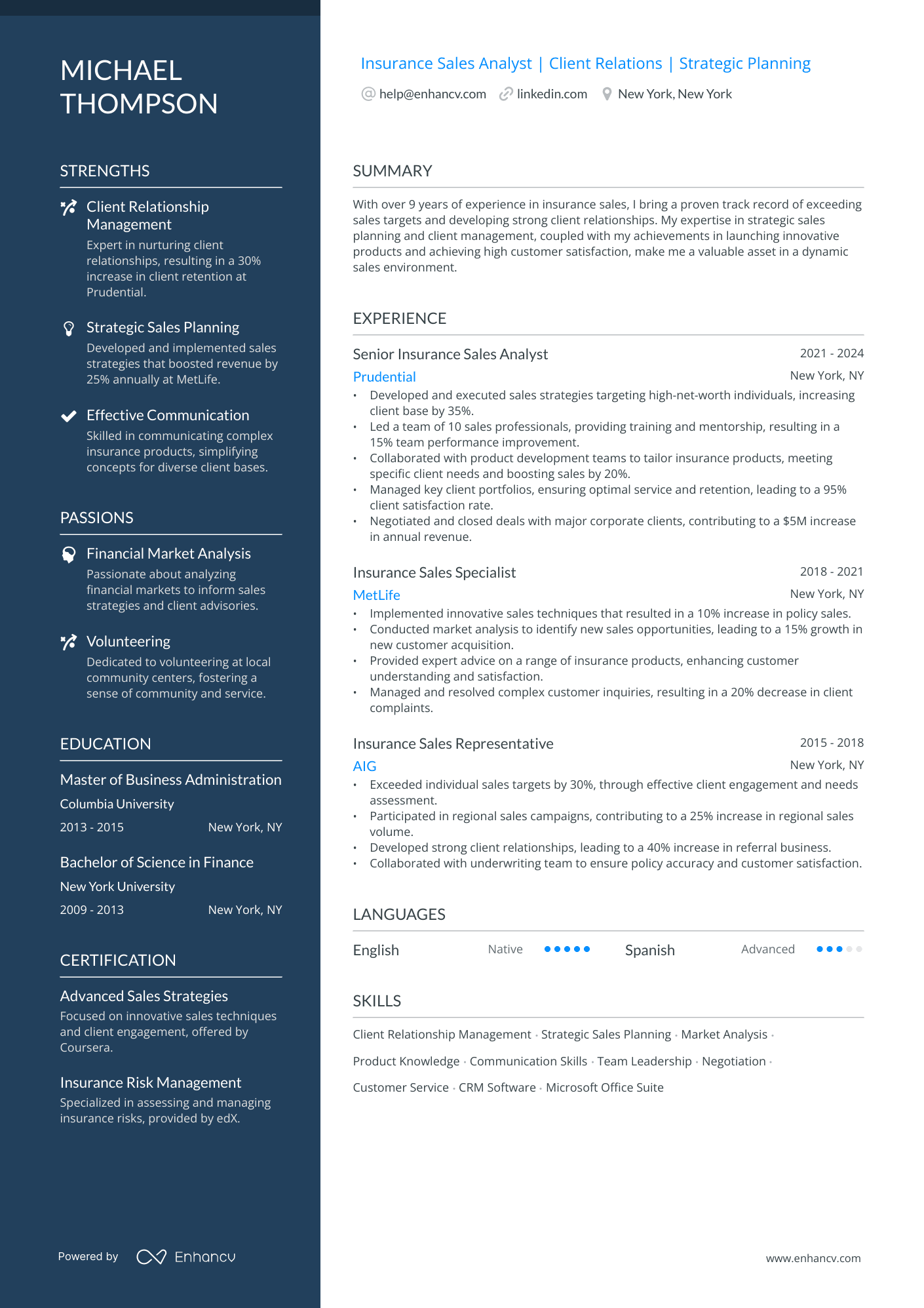

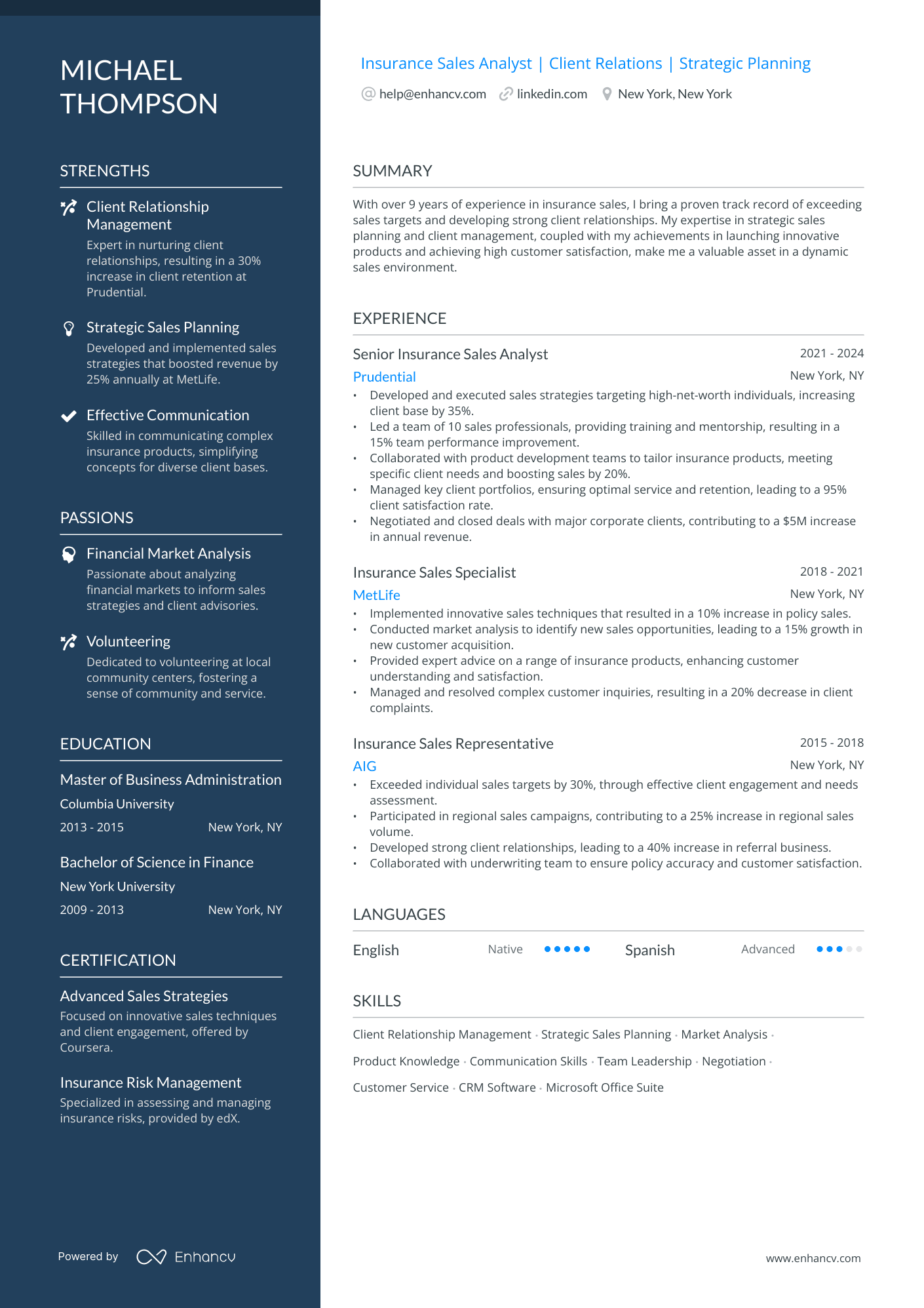

Insurance Sales

Insurance Sales roles are a derivative of sales roles within the broader insurance sector.

In order to increase your chances when applying for Insurance Sales roles, consider these tips:

- Having a robust understanding of different types of insurance products is vital. Ensure to include your knowledge and experiences dealing with various insurance products.

- Highlight your competencies in lead generation and client onboarding. These are essential sales tasks in the insurance field.

- Demonstrate your expertise in sales presentations and negotiations. Your ability to secure sales deals is fundamental to this role.

- Don’t just list skills, demonstrate how they led to positive results, for instance 'increased sales by...', 'achieved higher customer acquisition by...'. Present your achievements in a 'skill-action-results' method in your resume.