If you’re enthusiastic about helping people make smart financial choices by protecting their assets, then working as an insurance salesperson is a good career choice.

To do this, you must display your strong risk assessment skills, proficiency in state and federal insurance regulations, and ability to address your clients’ needs. These are the essential building blocks that make up an effective insurance sales resume as they will let agencies know you have the experience and expertise to bring in new business.

In this guide, we’ll cover:

- How to choose a suitable resume format to showcase your relevant skills and training.

- What type of experience hiring managers are searching for and how to frame it.

- How to craft an insurance sales resume with no prior industry experience.

- How to curate your certificates, so that they align with the offered position.

- How to choose between a resume objective or a summary as your professional profile.

- How to use the real insurance sales resume examples in the article to build an impressive job application.

Check out other guides we have on related roles:

- Account Manager Resume

- Sales Manager Resume

- Entry Level Sales Resume

- Sales Associate Resume

- Sales Director Resume

- Insurance sales Cover Letter

How to format your insurance sales resume

Having a background in insurance and risk management means there’s lots of opportunities along your career path. That’s why it’s important you clearly state how your career has progressed so far and how you plan to continue growing professionally in the future.

To do this, you must pick an appropriate resume format to display your current insurance expertise properly. So, let’s look at the three most suitable formats for the job.

Reverse-chronological resume format

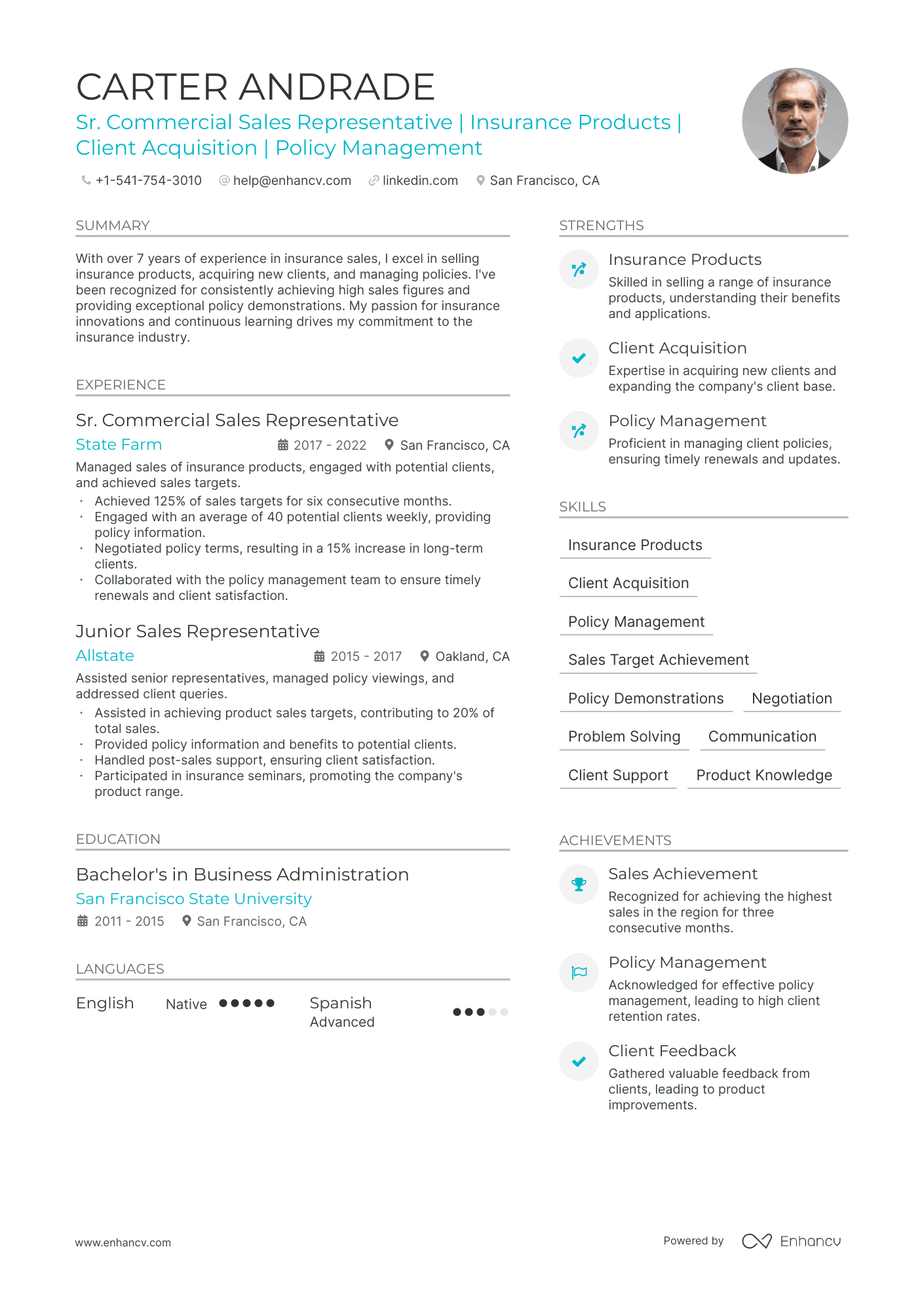

Opt for the reverse-chronological resume format, if you have at least 5 years of industry experience. It’s considered hiring managers’ favorite as this layout is the most common and most easy-to-read one. For this reason, it’s also known as the traditional resume format.

Make sure to showcase how each of your past roles has helped you gain the necessary experience and knowledge to climb the professional ladder. Note that this layout makes career gaps more visible. So, if you have any, add details on your resume that will explain the gaps, such as undergoing professional training or other commitments you may have had.

Being an insurance sales specialist means you’re dealing with sensitive private information and large budgets. Hence, recruiters want to ensure you’re trustworthy and that the gaps on your resume aren’t red flags they have to worry about.

In addition, be selective about the roles you include on your resume, and don’t go back further than 10 years. Insurance regulations and standards keep changing over time. So, while some agencies will appreciate your deep industry knowledge, they also prefer candidates who are aware of the latest changes in the insurance landscape.

Hybrid (combination) resume format

If you’re switching careers from an adjacent field or have less than 5 years of practical experience, pick the hybrid resume format. This one will allow you to emphasize your understanding of the industry alongside any job-related and other transferable skills you have to offer.

Keep in mind that because the format is not as popular with recruiters as the traditional one, it may disrupt the usual reading flow. Pay attention to which roles, qualifications, and skills you highlight. Place the most relevant near the top of your resume to increase your chances of getting noticed.

Generally, recruiters spend only 6 seconds reviewing a resume before they decide whether it’s worth it to continue reading.

Functional resume format

Finally, if you have little to no industry experience, select the functional resume format. The template is best suited for recent college grads because it’s designed to emphasize your educational background and training — especially if you’re adept at a particular range of products, such as health or property insurance.

However, don’t forget to list any internships you’ve completed. Although this isn’t the main focus of this layout, employers favor applicants who have some practical experience, even if it’s just shadowing other professionals.

Resume design tips

After you select a resume format, consider the additional writing tips below. These will help you further customize the design of your insurance sales resume and tailor it to your desired role:

- Arrange your experience entries in reverse chronological order: Regardless of the layout you’ve chosen, remember to start your experience section with your most recent position. Hiring managers prefer it when candidates begin their application by introducing the current scope of their skills.

- Include your credentials in the resume header: Many job seekers overlook this section as merely a place to list your name, occupation, and contact information. But there are other details you can add to let recruiters get to know you faster. Since most insurance sales roles demand a specific combination of qualifications, list your credentials next to your name.

- Keep your resume under two pages: The key to writing an impactful insurance sales resume lies in relevance and brevity. Stick to a one-page resume and only go for two pages, if you have more than 10 years of experience.

- Apply the agency’s brand colors to your resume: Presentation matters — particularly, if you have to establish your financial and regulatory expertise and build trust with clients. You can apply the same tactics when customizing the design of your insurance sales resume. Demonstrate your ability to observe, adapt, and present.

- Pick a readable serif or sans-serif resume font: You don’t have to stick to the overused Arial or Times New Roman. All Google fonts, such as Rubik or Lato, are compatible with Applicant Tracking System (ATS). Just make sure the font complements the overall design of your resume.

- Preserve the design of your resume by saving it as a PDF file: Employers are on the lookout for candidates who are meticulous and professional, especially when it comes to representing their company. So, make sure your information isn’t getting all messed up after you hit submit.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Next, take into account the space you have to work with and the sections you want to include. Begin with the most essential resume sections first:

The top sections on an insurance sales resume:

- Contact information: Provide necessary details for the recruiter to be able to reach out to you.

- Career objective/summary: Showcase specific sales goals and understanding of the insurance industry.

- Work experience: Demonstrate previous roles, accomplishments, and skills relevant to insurance sales.

- Certifications and licenses: Verify your professional capabilities, especially important in the insurance field.

- Skills: Highlight proficiencies relevant to insurance sales such as product knowledge, customer service, and negotiation skills.

Finally, think about how you can align your experience and expertise with the following key factors:

What recruiters want to see on your resume:

- Experience in insurance sales: Recruiters prioritize this as it shows the candidate knows the industry landscape and possesses techniques for successful selling.

- Licensing: Being licensed in insurance selling demonstrates that the candidate meets state regulations and standards, which is crucial for the role.

- Knowledge of insurance products: Understanding the intricacies of different insurance products is essential for effective selling and providing excellent customer service.

- Communication skills: These are vital as insurance sales personnel constantly interact with potential and existing clients, explaining complex insurance policies in clear terms.

- Sales target achievement: Achieving or exceeding sales targets in previous jobs indicates a proven seller, which is an asset in insurance sales.

Now, let’s explore how to take advantage of the above tips when building individual sections.

How to write your insurance sales resume experience section

The main purpose of the experience section is to outline the scope of your insurance knowledge, regulatory expertise, and skills.

This sounds quite straightforward, but many candidates make the mistake of listing all the tasks they were responsible for during their tenure. Of course, this can give employers an idea about your range of capabilities, but the most effective way to do it is through achievements.

Instead of recounting job duties, focus on the impact of your work. Leverage your career accomplishments to showcase your skills without explicitly naming them.

Remember, each agency has specific processes set to acquire new clients or renegotiate existing policies. So, read the job description carefully and take note of the specific experience and talents recruiters are searching for. Then, ensure your work history and skill section reflect them.

For instance, describe the size of the portfolio you manage and how you stay on top of addressing your clients’ needs. Or highlight your ability to employ specific customer retention tactics by citing the retention rate you’ve maintained over the years.

If you don’t have much experience, mention additional training you’ve undergone or sales campaigns you’ve worked on.

To do this, create a separate entry for each of the positions you want to list on your insurance resume. Afterwards:

- Cite the full legal name of your past employer: Insurance and brokerage agencies often operate alongside their sister companies and it’s easy to get them mixed up. To guarantee hiring managers see the right company, don’t forget to check for any typos before you submit your application.

- List your full job title: Odds are, you’re responsible for handling a particular type of clients or products. Don’t make recruiters guess where your strengths lie. Recount specific policies you’ve sold or regulations you’re proficient in.

- Provide a brief company description: Even if the agency you’ve worked for is famous, do include a short overview of its business operations. This will show hiring managers you’re mindful of their time and attention by not making them research the agencies on their own.

- Reference the dates of your employment: Listing the month and the year is enough. If you’re currently still in employment, write “Present” as the end date.

- Include the names of software, techniques, or skills you’ve used: Wherever possible, recount the name of insurance sales techniques or tools you’ve employed to achieve your accomplishments.

- Name certificates you’ve managed to obtain: Irrespective of your expertise level, insurance sales agents are required to keep up with industry trends and regulatory developments. Hence, it’s recommended you mention any qualifications you’ve obtained while on the job.

- Emphasize your career growth: Beside acquiring further competencies, hiring managers favor candidates who can outline their professional development, as well as showcase how they plan to grow further.

- Tailor your experience towards: Don’t forget to align your achievements with the job ad demands. Employers want to ensure that applicants have taken the time to research the agency’s portfolio and explain how their skills can benefit the employer in the long run.

Pay special attention to how you frame the accomplishments part of your experience entries:

- Don’t include more than 5 bullet points under each experience entry.

- Begin each bullet point with an action verb to highlight your achievements.

- Make use of the resume keywords from the job ad by referencing them in your entries.

- Avoid using resume buzzwords and adjectives to embellish your accomplishments.

- Cite concrete numbers to describe the scale of your successes.

Let’s look at a bad example first:

- •Renegotiated existing life insurance policies.

- •Onboarded 8+ new transport and logistics clients.

- •Mentored 5 Insurance Sales Interns.

Here is why this sample experience section doesn’t work:

- The company name is wrong: Insurance and risk management recruiters are familiar with the main market players in the industry. As such, they would notice misspelled names and typos. By not writing out the proper legal name, the applicant demonstrates their lack of attention to detail.

- The company description is not informative: Despite its nationwide fame, companies continuously develop and add new services and products to their portfolio. That’s why it’s best to offer a short overview of the agency’s current business focus.

- Much of the context in the bullet points is missing: The first bullet point lists a single job responsibility, but no actual work results have been cited. In addition, the second bullet point features a specific accomplishment, yet, there’s no further information on how it was achieved.

Taking these notes into account, an enhanced version of the example would be:

- •Increased 2023 YoY revenue by $2.8 million through renegotiating existing life insurance policies and cross-selling critical illness and long-term care insurance policies.

- •Onboarded 8+ new transport and logistics clients, each with more than 5,000 employees, by offering a portfolio of policies and consulting executives.

- •Mentored 5 Insurance Sales Interns on the use of forecasting tools, analyzing risk, and client relationship management.

This one is much better because the applicant has:

- Made comparative analysis of their work: Employers are concerned with the bottom line. This means they prefer candidates with a results-oriented approach towards their work.

- Elaborated on the size of their portfolio: A great way to showcase the scope of their responsibilities and the type of clients they usually cater to.

- Displayed initiative to guide other insurance sales specialists: Being in a position to mentor interns means that the employer has a deep trust in the candidate’s sales capabilities and industry knowledge.

How to quantify impact on your resume

insurance sales is almost always a numbers game. Employers often work with projections as their work directly reflects on earnings and investor relations.

As a result, hiring managers notice applicants who share specific data to quantify their achievements. This emphasizes the candidate’s ability for strategizing, budget planning, and forecasting. A skilled insurance sales agent is constantly aware of how their agency is performing and which processes can be improved.

So, when referencing achievements on your resume, remember to:

- Show you have the ability to manage multiple relationships simultaneously — a key aspect in insurance sales — by including the number of the clients you’ve handled.

- Provide concrete proof of your sales proficiency by specifying sales targets you’ve achieved.

- Demonstrate your financial acumen and trustworthiness by mentioning the size of the portfolio you’ve managed.

- Highlight your efficiency in selling by reporting the number of insurance policies you’ve sold.

- Illustrate the quality of your services by indicating customer retention and satisfaction rates.

- Display your skills in strategically increasing revenue by detailing the percentage of upselling or cross-selling you’ve made.

- Emphasize your ability to grow the business by quantifying the number of new clients you’ve brought in.

- Stress your commitment to continuous skills development by stating the number of industry-specific training courses you’ve attended.

Whatever statistics you decide to include on your resume, always bear in mind to adhere to any non-disclosure agreements (NDAs) you’ve signed. After all, you’re dealing with sensitive information and employers want to maintain the data privacy of their clients.

How do I write an insurance sales resume with no experience

If you’re a recent college graduate who’s trying to create an insurance sales resume with no experience, you must place an emphasis on your professional training, participation in workshops, and other sales positions you’ve held.

Some of the ways you can make a lasting impression include:

- Highlight your academic background and your qualifications: Shine a spotlight on your training to show recruiters that you’ve met regulatory standards to practice as an insurance sales agent and can perform well.

- Expand on workshops you’ve participated in: Hiring managers favor candidates who show initiative to immerse themselves in the industry and grow their skill set.

- Showcase your transferable skills: If your work history includes any kind of customer-facing position, include it. Recruiters know that certain sales skills, such as problem-solving, decision-making, and effective communication are best developed through practice.

Speaking of sales skills, let’s explore how to demonstrate your skill set on your resume.

How to list your hard and soft skills on your resume

One of the main goals you want to achieve when writing your insurance sales resume is to provide a well-balanced representation of your abilities. As mentioned, your experience entries will reflect some of your talents.

The rest will be covered in the skills section, which references additional competencies you haven’t yet had the chance to address in other parts of your resume.

Something to keep in mind is tailoring your skills section to the job description. While there’s many talents associated with being an insurance sales agent, different roles call for a varied combination of skills and know-how. So, you’re not obliged to list every single ability in your skill section; it helps to know how to select which ones to include.

Hard vs soft skills

Skills are usually categorized into two groups:

- Insurance sales hard skills: This category includes your financial, regulatory, and sales knowledge, as well as your ability to evaluate, analyze, and operate forecasting tools.

- Insurance sales soft skill: By contrast, this category is about your ability to foster relationships with clients, present insurance products, and provide informed, ethical financial advice to your clients.

Before you start building your skills section:

- Review your work history and education section once again.

- Take note of the skills you’ve already mentioned.

- Go over the job description for skills you may have missed to reference in other sections of your resume.

- Add your talents to the skills section. Don’t overcrowd this segment with too many skills of the same category. Hiring managers prefer applicants with a well-rounded profile.

Also, avoid filling the section with more than 10 skills at a time. Ultimately, your goal is to align your strengths and expertise with the demands of the offered position. But if by chance you still have extra space left and you’re not sure what else to add, here are some suggestions:

Best hard skills for your insurance sales resume

- Negotiation

- Lead generation

- Knowledge of insurance policies

- Client relationship management

- Risk assessment

- Financial reporting

- Data analysis

- Microsoft Office suite proficiency

- CRM software proficiency

- Use of sales forecasting tools

- Understanding of underwriting principles

- Knowledge of different insurance products (Life, Auto, Health, Property, etc.)

- Sales presentation techniques

- Product development

- Familiarity with insurance software

- Compliance with insurance laws and regulations

- Budget planning

- Proficiency in advanced Excel

- Experience with data visualization tools

- Use of digital marketing tools for sales promotion

Best soft skills for your insurance sales resume

How to list your certifications and education on your resume

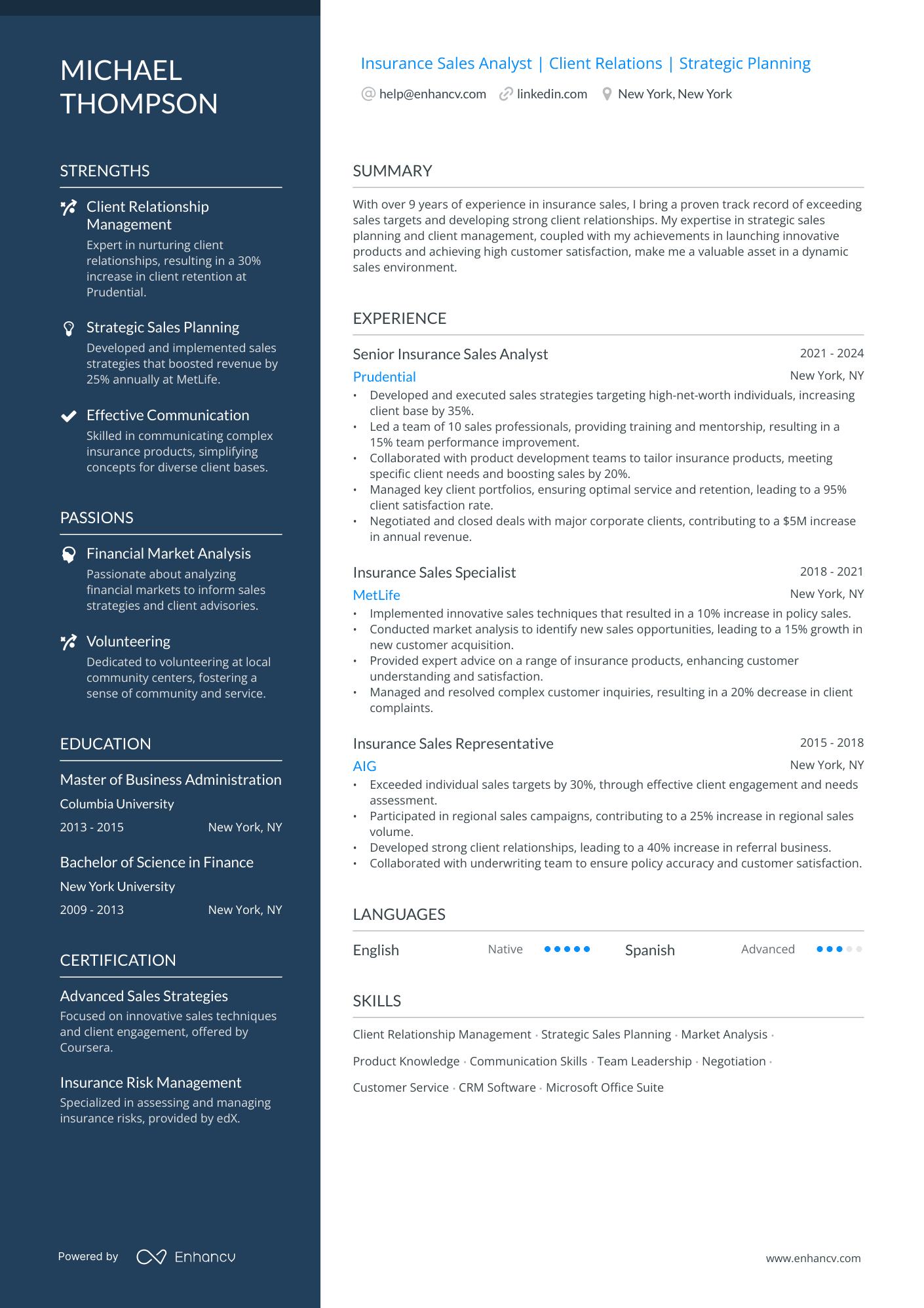

Given the variety of sales insurance positions available, it’s not unusual for recruiters to be very particular about a candidate’s academic background. There are two reasons for this— the type of products being offered and the customer base the agency targets.

As a result, hiring managers want to confirm that the perfect candidate is well-versed in the foundational knowledge required for the job.

That’s why the next section we’ll focus on is the education section. Ideally, this segment should display a mix of your qualifications — a degree in a relevant field and certifications.

Let’s review them one by one.

Formal education

If you have a degree in an insurance-related field, refrain from listing your high school diploma. Lead directly with your degrees, then move on to an overview of any extra qualifications you have — more on these in a bit.

To detail a single degree, follow the simple structure below:

- State the name of your degree and relevant majors you’ve studied.

- List the name and location of the academic institution.

- Cite the date you completed your course. If you’re still studying, provide the date you expect to graduate.

If you’re a recent graduate, you can also include:

- Your GPA, if it’s above 3.5

- Relevant research and coursework you’ve conducted

- MBA courses you’ve completed

This may seem like a lot of information to share. However, the following framework will help you organize all the details into a compact and informative education section entry:

- •Published a paper on The Importance and Effects of Relationship Building in Client Acquisition and Retention in the International Journal of Commerce and Management.

- •Majored in Principles of Risk Management & Insurance, Risk Assessment Methods, and Theory of Risk.

Note that some recruiters aren’t as fixed on applicants having a Bachelor’s or a Master’s degree — especially for an entry-level position. In this case, the emphasis would fall on your additional professional training.

Certifications

By listing certifications on your resume, you demonstrate your specific professional specialization, as well as strive to continue developing your insurance sales skills. These will help recruiters determine whether your career profile fits the candidate they’re searching for.

To include a certificate on your resume just:

- Cite the qualifications you were awarded.

- Name the accrediting institution.

- Provide the date you obtained the certificate.

- Offer a one-sentence explanation of how the listed credentials are relevant to the position. This step is optional, but it’s worth the effort because sometimes certificate names aren’t as descriptive.

You can use the following example certificate section for reference:

Below, you’ll find some of the most popular insurance sales certificates:

Best certifications for your insurance sales resume

How to write your insurance sales resume summary or objective

Last on the list of essential sections for your resume is the resume profile. It serves to showcase your key sales achievements, specific career goals, and understanding of the insurance industry in a concise paragraph of no more than 100 words.

Based on the amount of experience you have, there are two types of resume profiles you can choose from — the objective and the summary.

The resume objective is best used by entry-level insurance sales agents with less than 3 years of experience. It lists the following:

- Career goals and aspirations: Given your limited experience, instead of detailing your accomplishments, emphasize your professional goals. Remember to align them with the agency’s current business plans and mission.

- Core insurance sales skills: Provide an overview of your main sales skills and explain how they align with the agency’s business focus and operations.

- Value as an insurance sales professional: When recounting your technical and sales abilities, tailor them to the job description. Don’t forget to use the exact phrasing recruiters have employed in the ad.

In contrast, the resume summary is better suited for seasoned professionals because this resume profile aims to underscore your sales track record. It includes your:

- Current professional accomplishments: Highlight your top 1-2 achievements, making sure you outline the results of your work. Include the names of notable past employers.

- Additional qualifications and specializations: If you’re aiming for a senior position, you must demonstrate an in-depth understanding of the regulatory insurance landscape. The best way to do this is by referencing extra certifications and memberships in relevant associations.

- Insurance sales focus: Describe your particular professional specialization, such as in-depth knowledge of the healthcare industry and health insurance products.

To get a better idea of what makes the two types of resume profiles different, let’s have a look at a few examples.

Check out the insurance sales resume objective example below:

While the paragraph is succinct, it relies too much on skills to impress recruiters, instead of citing any pertinent achievements. It also abbreviates the candidate’s credentials.

Avoid abbreviations in your resume objective as they make your experience appear even more limited. It's best to have the full name of their course written out to avoid any ambiguity.

Considering these errors, here is how the resume objective could be improved:

Now hiring managers have a better understanding of the applicant’s profile as the resume objective outlines their academic background, practical insurance sales expertise, and relevant additional qualifications.

Next, take a look at the following insurance sales resume summary example:

Here, this applicant has missed the opportunity to reference more job-relevant hard and soft skills. Plus, the resume summary doesn’t list the candidate’s full credentials or provide the right data to support their claims and impress recruiters.

An upgraded version of the resume summary would be:

By amending the mistakes in the previous sample, hiring managers now know that the applicant is well-versed in a variety of skills and is able to leverage existing business relationships. This also means that the candidate is experienced in navigating complex financial and insurance projects.

Additional sections for an insurance sales resume

Finally, along with the essential sections on your insurance sales resume, there are other ways to boost your application. These represent other aspects of your professional profile that may not exactly fit into any of the key resume sections.

Some of the additional information you can include are:

- Relevant association memberships: Being part of an industry-related organization proves you have a good network of other insurance sales specialists you can rely on and consult with.

- Awards and prizes you’ve received: Professional recognition will always make you stand out. Even if the award is in your former team’s name, list it because it emphasizes your ability to collaborate and work well with other sales specialists towards a common goal.

- Publications you’ve authored: For senior positions, employers prefer to understand your personal views on the insurance industry and your ability to forecast sales trends — especially if you’re to publicly represent the agency.

- Foreign languages: Depending on the customer base of your employer, foreign languages can play an important part in bringing in new business and fostering existing client relationships.

Key takeaways

In essence, to build an impressive insurance sales resume, you must:

- Select a resume format according to the level of your expertise and years of experience.

- Organize your work history in reverse chronological order, regardless of the layout you choose.

- Include your professional credentials next to your name in the resume header.

- Pick a resume design and colors that invoke trustworthiness in your abilities and demonstrate your confidence as an insurance sales specialist.

- Use the resume objective or summary as an opportunity to appeal to hiring managers with your achievements and core insurance sales skills.

- Tailor your experience entries to the job ad demands and the agency’s business goals.

- Quantify your achievements, but don’t forget to adhere to any NDAs you’ve signed.

- Provide a well-rounded combination of hard and soft insurance sales skills.

- Favor your professional training and qualifications to your high school diploma, if you don’t have a Bachelor’s or a Master’s degree in an insurance-related field.