As a financial operations manager, articulating your complex financial management and strategic planning experience in a concise and compelling manner poses a significant resume challenge. Our guide provides expert tips and actionable examples to help you distill your expertise into a powerful resume, ensuring your unique skills shine through to potential employers.

- The most effective financial operations manager resume samples, reflecting on experience and skills.

- +10 simple, yet impactful methods to tailor your financial operations manager resume to the job advert.

- Using your professional achievements as the North Star to your unique value as a financial operations manager candidate.

- 'No one cares about your education nowadays …' Let's prove this statement wrong with the best-kept industry secrets to your education and certifications.

If the financial operations manager resume isn't the right one for you, take a look at other related guides we have:

- Financial Consultant Resume Example

- Bank Manager Resume Example

- Tax Director Resume Example

- Hotel Accounting Resume Example

- Public Accounting Resume Example

- Phone Banking Resume Example

- Finance Clerk Resume Example

- General Ledger Accounting Resume Example

- Account Executive Resume Example

- Government Accounting Resume Example

The ultimate formula for your financial operations manager resume format

Our best advice on how to style your financial operations manager resume is this - first, take the time to study the job advert requirements.

The resume format you select should ultimately help you better align how your experience matches the specific role.

There are four crucial elements you need to thus take into consideration:

- How you present your experience. If you happen to have plenty of relevant expertise, select the reverse-chronological resume format to organize your experience by dates, starting with the latest.

- Don't go over the top with writing your resume. Instead, stick with a maximum of two-page format to feature what matters most about your profile.

- Headers aren't just for "decoration". The header of your resume helps recruiters allocate your contact details, portfolio, and so much more.

- The PDF format rules. It's the most common practice to submit your financial operations manager resume as a PDF so that your resume doesn't lose its layout. However, make sure the read the job well - in some instances, they might require a doc file.

Customize your resume for the market – a Canadian format, for example, might vary in structure.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Always remember that your financial operations manager certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

Don't forget to include these six sections on your financial operations manager resume:

- Header and summary for your contact details and to highlight your alignment with the financial operations manager job you're applying for

- Experience section to get into specific technologies you're apt at using and personal skills to deliver successful results

- Skills section to further highlight how your profile matches the job requirements

- Education section to provide your academic background

- Achievements to mention any career highlights that may be impressive, or that you might have missed so far in other resume sections

What recruiters want to see on your resume:

- Proven experience in financial planning and strategy, including budgeting, forecasting, and investment analysis.

- Strong knowledge of financial regulations and accounting principles specific to the company's industry.

- Demonstrated ability to implement and optimize financial processes and systems for efficiency and compliance.

- Experience with financial risk management, including currency and interest rate fluctuation strategies.

- Leadership skills with a track record of managing financial teams and cross-departmental collaboration.

Writing your financial operations manager resume experience

Within the body of your financial operations manager resume is perhaps one of the most important sections - the resume experience one. Here are five quick tips on how to curate your financial operations manager professional experience:

- Include your expertise that aligns to the job requirements;

- Always ensure that you qualify your achievements by including a skill, what you did, and the results your responsibility led to;

- When writing each experience bullet, ensure you're using active language;

- If you can include a personal skill you've grown, thanks to your experience, this would help you stand out;

- Be specific about your professional experience - it's not enough that you can "communicate", but rather what's your communication track record?

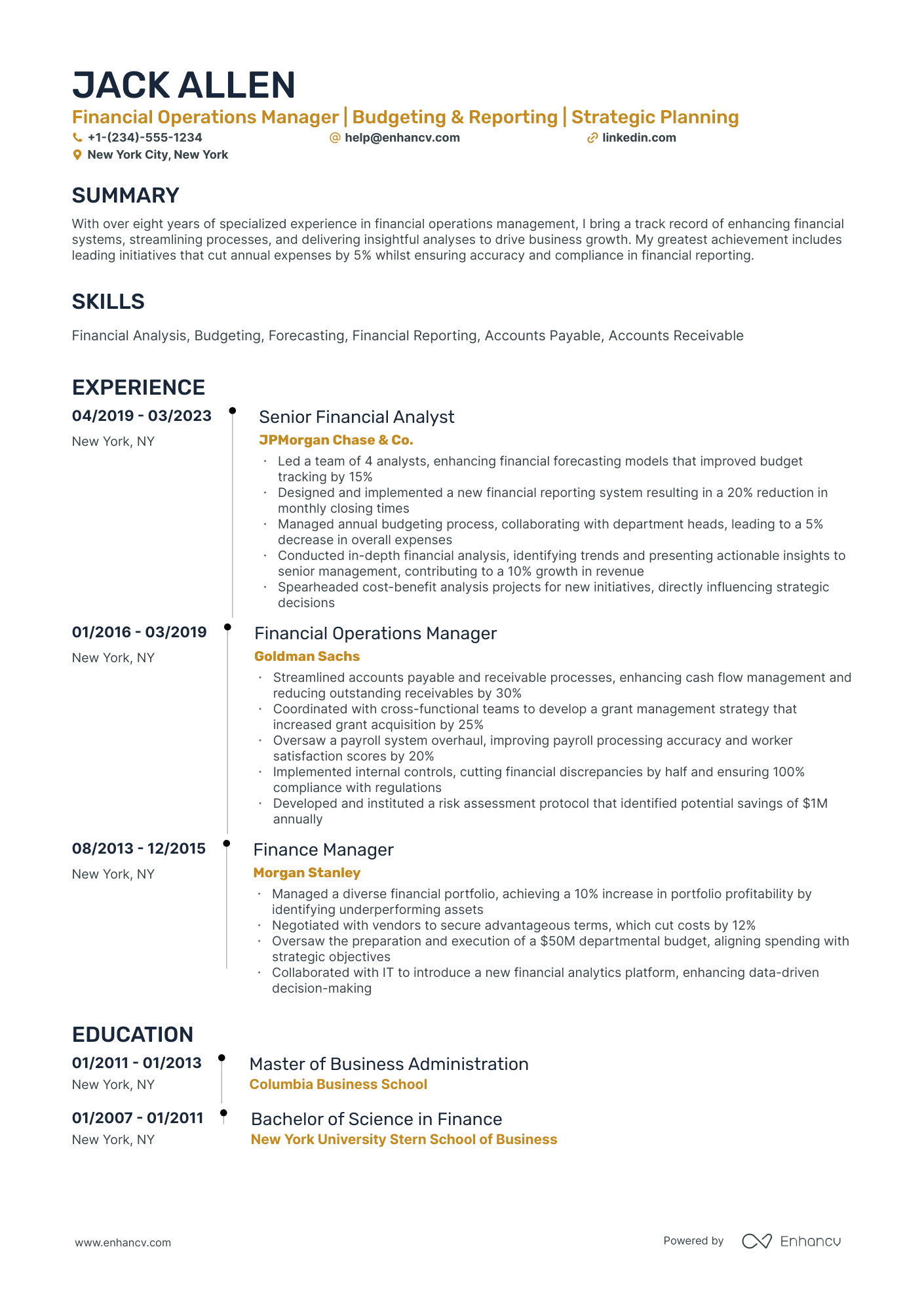

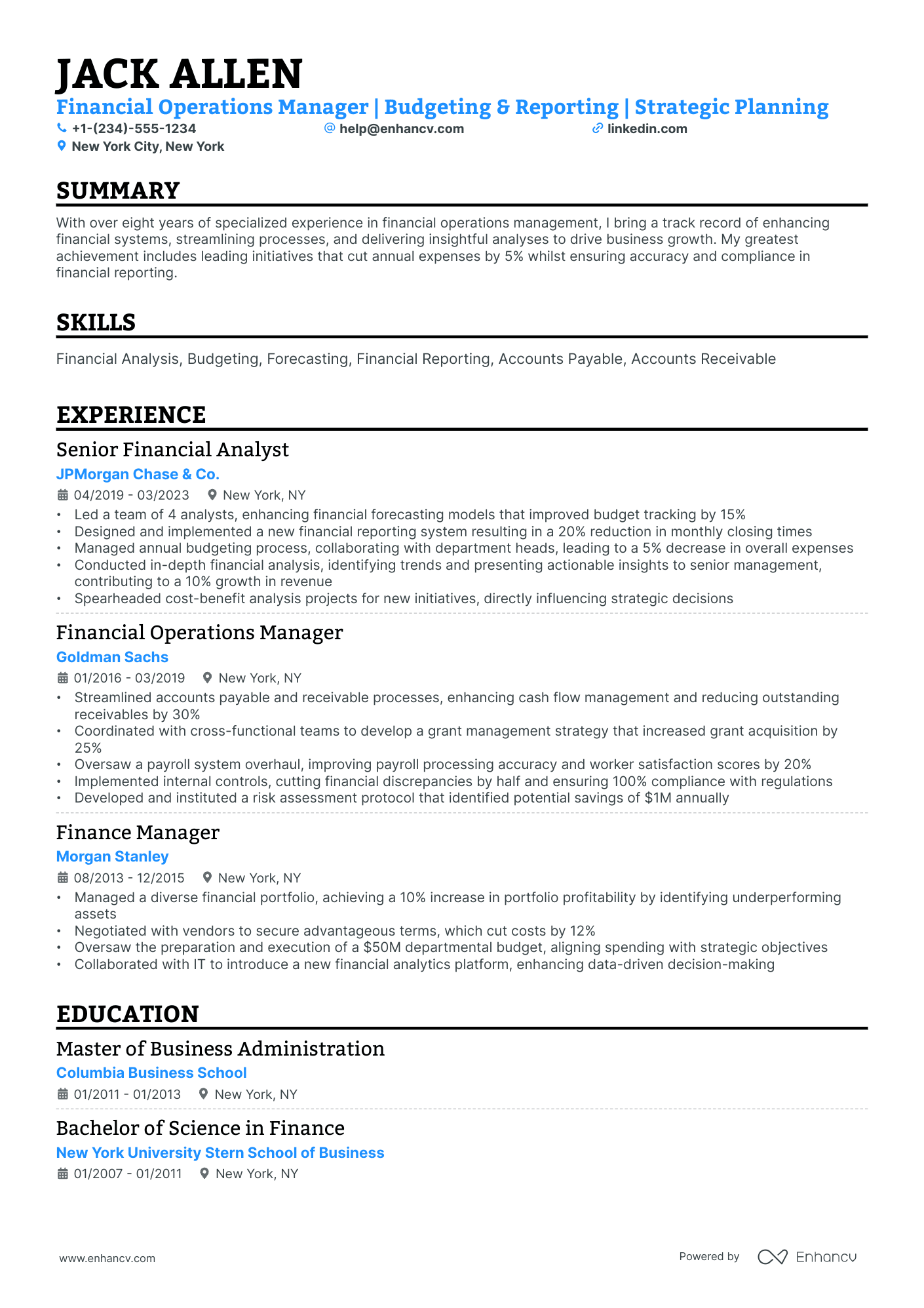

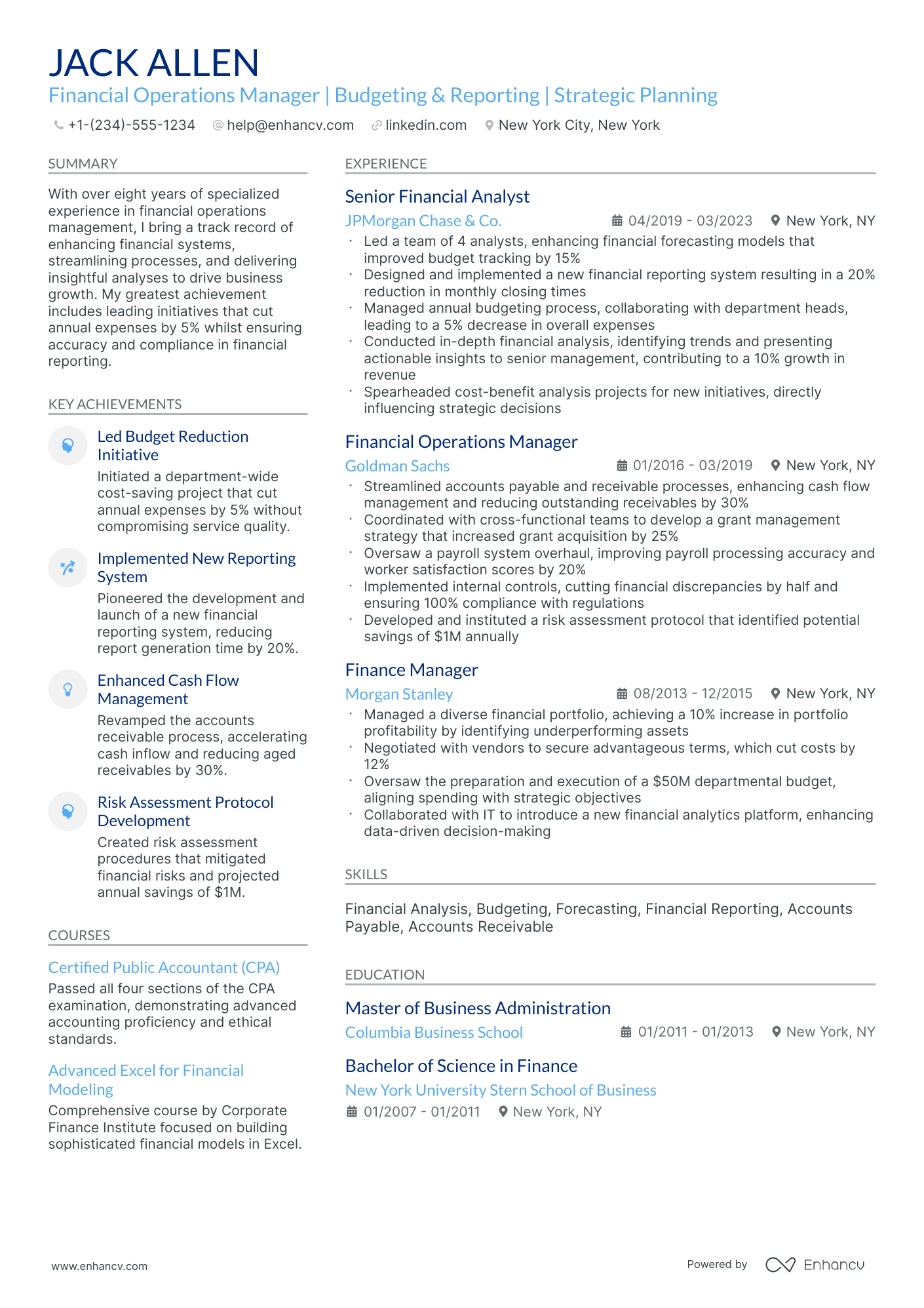

Wondering how other professionals in the industry are presenting their job-winning financial operations manager resumes? Check out how these financial operations manager professionals put some of our best practices into action:

- Spearheaded the integration of a new financial system which streamlined transaction processing, reducing errors by 25% and increasing efficiency.

- Directed a team of 15 in managing financial operations for a multi-million dollar project, ensuring budget adherence and optimizing resource allocation.

- Analysed and reported on financial performance to senior stakeholders, providing strategic recommendations that contributed to a 10% increase in profitability.

- Developed and implemented new cash management strategies, resulting in a 20% improvement in liquidity across all company accounts.

- Negotiated with banking institutions to secure reduced fee structures for transaction services, saving the company over $400,000 annually.

- Conducted comprehensive risk assessments for financial operations, mitigating potential financial losses and safeguarding company assets.

- Managed the successful audit of the company’s financial operations, ensuring compliance with GAAP and regulatory requirements.

- Led cross-functional initiatives to automate financial reporting, shortening the monthly close cycle by 5 days.

- Facilitated training programs for finance staff on updated operational procedures, increasing department productivity by 15%.

- Oversaw daily financial operations for a global portfolio, monitoring transactions in excess of $500 million.

- Coordinated with international teams to ensure smooth financial workflows and adherence to country-specific fiscal policies.

- Implemented a new expense tracking system that reduced discrepancies in financial reporting by 30%.

- Led a project team in the transition to a new enterprise resource planning system, improving financial data accuracy and reporting capabilities.

- Reviewed and improved financial control systems, increasing the organization's financial integrity and stakeholder confidence.

- Collaborated with department heads to trim budgets by 10% without compromising key financial operations or growth objectives.

- Developed a financial analysis framework that improved forecasting accuracy by 18%, enabling more informed strategic planning.

- Managed vendor contracts and relationships, ensuring service delivery met stringent financial operation standards.

- Worked closely with the M&A team, conducting due diligence and financial integration for five successful acquisitions.

- Conducted in-depth profitability analysis for new product launches which influenced the go/no-go decision-making process.

- Played a pivotal role in revamping the company's financial reporting system which increased report generation speed by 40%.

- Led a productivity improvement initiative in the finance department that elevated transaction processing volume by 20% without additional headcount.

- Oversaw financial operations during a period of aggressive growth, scaling the team from 10 to 30 while managing a 300% increase in transaction volume.

- Established robust financial controls that significantly minimized risks associated with international currency transactions.

- Collaborated with IT to develop a custom financial data analysis platform, enhancing decision-making and supporting a 15% year-over-year revenue growth.

- Pioneered the adoption of AI in financial forecasting, providing more accurate predictions that led to a 12% reduction in excess inventory costs.

- Managed and optimized a $50 million operational budget, delivering all financial objectives while enhancing key performance metrics.

- Drove a company-wide initiative to improve the financial literacy of non-finance managers, fostering a culture of fiscal responsibility.

- Initiated a cost-reduction strategy that slashed operational expenses by 22% without impacting critical financial processes or services.

- Enhanced financial operations transparency which facilitated better investor relations and a 10% increase in invested capital.

- Supervised and mentored a team of financial analysts, raising the department's performance standards and improving report accuracy.

Quantifying impact on your resume

- Highlight the successful management of financial portfolios by quantifying assets under management to demonstrate capacity and proficiency.

- Include specific figures on cost reduction achievements to showcase efficiency and cost-saving capabilities.

- Detail the size of teams managed and budgetary responsibility to underscore leadership and financial stewardship.

- Mention the precise percentage improvement of financial reporting accuracy to illustrate attention to detail and impact on decision-making.

- Quantify any increases in revenue streams attributed to strategic decisions to display a track record of growth and business development.

- Detail the exact number of financial models developed to exhibit analytical skills and contribution to strategic planning.

- Specify monetary value of investments sourced or deals closed to highlight the ability to generate significant income for the business.

- Include the scale or percentage of regulatory compliance improvements to show commitment to corporate governance and risk management.

Action verbs for your financial operations manager resume

Four quick steps for candidates with no resume experience

Those with less or no relevant experience could also make a good impression on recruiters by:

- Taking the time to actually understand what matters most to the role and featuring this within key sections of their resume

- Investing resume space into defining what makes them a valuable candidate with transferrable skills and personality

- Using the resume objective to showcase their personal vision for growth within the company

- Heavily featuring their technical alignment with relevant certifications, education, and skills.

Remember that your resume is about aligning your profile to that of the ideal candidate.

The more prominently you can demonstrate how you answer job requirements, the more likely you'd be called in for an interview.

Recommended reads:

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

Financial operations manager skills and achievements section: must-have hard and soft skills

A key principle for your financial operations manager resume is to prominently feature your hard skills, or the technologies you excel in, within the skills section. Aim to list several hard skills that are in line with the job's requirements.

When it comes to soft skills, like interpersonal communication abilities and talents, they're trickier to quantify.

Claiming to be a good communicator is one thing, but how can you substantiate this claim?

Consider creating a dedicated "Strengths" or "Achievements" section. Here, you can describe how specific soft skills (such as leadership, negotiation, problem-solving) have led to concrete achievements.

Your financial operations manager resume should reflect a balanced combination of both hard and soft skills, just as job requirements often do.

Top skills for your financial operations manager resume:

Financial Analysis

Budgeting Software (e.g., Adaptive Insights, Hyperion)

Microsoft Excel

ERP Systems (e.g., SAP, Oracle)

Financial Reporting Tools

Data Visualization Tools (e.g., Tableau, Power BI)

Accounting Software (e.g., QuickBooks, Xero)

Risk Management Tools

SQL

Financial Modeling

Leadership

Analytical Thinking

Communication

Problem-Solving

Attention to Detail

Time Management

Team Collaboration

Adaptability

Strategic Planning

Conflict Resolution

PRO TIP

Mention specific courses or projects that are pertinent to the job you're applying for.

Qualifying your relevant certifications and education on your financial operations manager resume

In recent times, employers have started to favor more and more candidates who have the "right" skill alignment, instead of the "right" education.

But this doesn't mean that recruiters don't care about your certifications .

Dedicate some space on your resume to list degrees and certificates by:

- Including start and end dates to show your time dedication to the industry

- Adding credibility with the institutions' names

- Prioritizing your latest certificates towards the top, hinting at the fact that you're always staying on top of innovations

- If you decide on providing further information, focus on the actual outcomes of your education: the skills you've obtained

If you happen to have a degree or certificate that is irrelevant to the job, you may leave it out.

Some of the most popular certificates for your resume include:

The top 5 certifications for your financial operations manager resume:

- Certified Treasury Professional (CTP) - Association for Financial Professionals (AFP)

- Certified Public Accountant (CPA) - American Institute of CPAs (AICPA)

- Chartered Financial Analyst (CFA) - CFA Institute

- Financial Risk Manager (FRM) - Global Association of Risk Professionals (GARP)

- Chartered Global Management Accountant (CGMA) - American Institute of CPAs (AICPA) & Chartered Institute of Management Accountants (CIMA)

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

Recommended reads:

Professional summary or objective for your financial operations manager resume

financial operations manager candidates sometimes get confused between the difference of a resume summary and a resume objective.

Which one should you be using?

Remember that the:

- Resume objective has more to do with your dreams and goals for your career. Within it, you have the opportunity to showcase to recruiters why your application is an important one and, at the same time, help them imagine what your impact on the role, team, and company would be.

- Resume summary should recount key achievements, tailored for the role, through your career. Allowing recruiters to quickly scan and understand the breadth of your financial operations manager expertise.

The resume objectives are always an excellent choice for candidates starting off their career, while the resume summary is more fitting for experienced candidates.

No matter if you chose a summary or objective, get some extra inspiration from real-world professional financial operations manager resumes:

Resume summaries for a financial operations manager job

- With 10+ years of dedicated experience in financial planning and operations management within multinational corporations, this seasoned professional has streamlined processes, secured cost savings exceeding $1 million, and effectively managed budgets over $30 million.

- Accomplished CPA transitioning from audit to financial operations, leveraging 8 years of experience in financial analysis and risk management at top accounting firms to enhance organizational efficiency and profitability through data-driven decision making.

- Esteemed financial operations strategist coming from a robust 12-year tenure in banking, where innovative cost-reduction strategies and astute operational oversight resulted in a 20% increase in fiscal efficiency for a Fortune 500 institution.

- A dynamic professional shifting from a successful 15-year career in technology project management to financial operations, bringing a strong aptitude for data analytics, budgetary control, and cross-departmental collaboration to drive financial performance.

- Eager to apply a fresh perspective to financial operations management, my goal is to leverage my Master's degree in Finance and immersive internship experience to implement cutting-edge financial strategies and foster continuous organizational growth.

- Determined to build a career in financial operations, I am committed to utilizing my recent degree in Business Administration and proficiency in financial software to contribute to efficient fiscal management and support informed decision-making processes.

Extra sections to include in your financial operations manager resume

What should you do if you happen to have some space left on your resume, and want to highlight other aspects of your profile that you deem are relevant to the role? Add to your financial operations manager resume some of these personal and professional sections:

- Passions/Interests - to detail how you spend both your personal and professional time, invested in various hobbies;

- Awards - to present those niche accolades that make your experience unique;

- Publications - an excellent choice for professionals, who have just graduated from university or are used to a more academic setting;

- Volunteering - your footprint within your local (or national/international) community.

Key takeaways

- Invest in a concise financial operations manager professional presentation with key resume sections (e.g. header, experience, summary) and a simple layout;

- Ensure that the details you decide to include in your resume are always relevant to the job, as you have limited space;

- Back up your achievements with the hard and soft skills they've helped you build;

- Your experience could help you either pinpoint your professional growth or focus on your niche expertise in the industry;

- Curate the most sought-after certifications across the industry for credibility and to prove your involvement in the field.