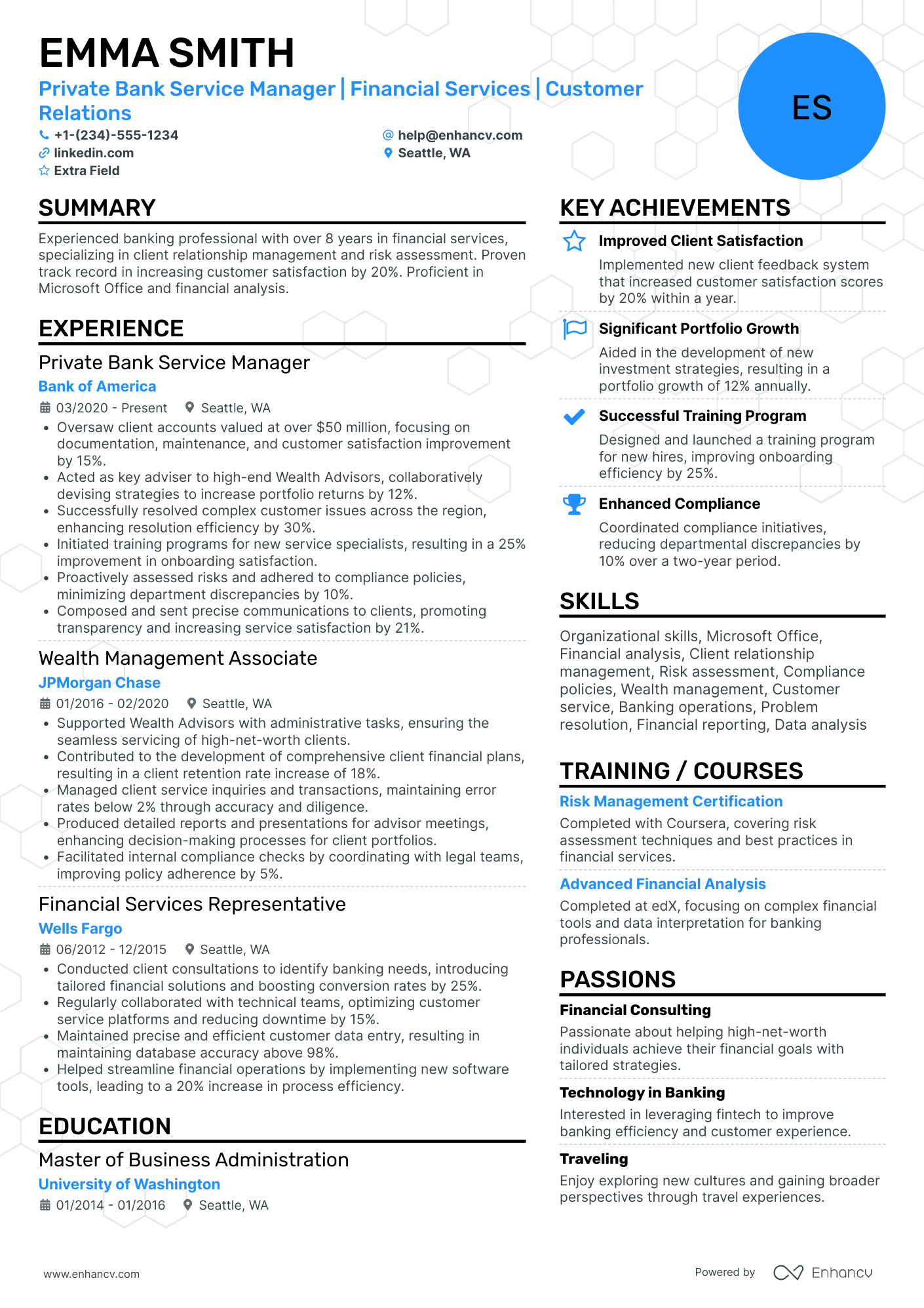

Crafting a resume that succinctly encapsulates your multifaceted experience as a bank manager can be daunting, as you need to balance technical skills with leadership prowess. Our guide provides tailored tips and examples to help you highlight your strategic planning and team management accomplishments, ensuring you present a compelling narrative to potential employers.

- Get inspired from our bank manager resume samples with industry-leading skills, certifications, and more.

- Show how you can impact the organization with your resume summary and experience.

- Introducing your unique bank manager expertise with a focus on tangible results and achievements.

If the bank manager resume isn't the right one for you, take a look at other related guides we have:

- Financial Management Analyst Resume Example

- Hotel Night Auditor Resume Example

- Loan Processor Resume Example

- Accounts Payable Resume Example

- Business Analyst Accounting Resume Example

- Tax Accountant Resume Example

- Forensic Accounting Resume Example

- Financial Controller Resume Example

- Finance Associate Resume Example

- Credit Manager Resume Example

Professional bank manager resume format advice

Achieving the most suitable resume format can at times seem like a daunting task at hand.

Which elements are most important to recruiters?

In which format should you submit your resume?

How should you list your experience?

Unless specified otherwise, here's how to achieve a professional look and feel for your resume.

- Present your experience following the reverse-chronological resume format . It showcases your most recent jobs first and can help recruiters attain a quick glance at how your career has progressed.

- The header is the must-have element for your resume. Apart from your contact details, you could also include your portfolio and a headline, that reflects on your current role or a distinguishable achievement.

- Select relevant information to the role, that should encompass no more than two pages of your resume.

- Download your resume in PDF to ensure that its formatting stays intact.

Remember, resume layouts can vary by country – for example, a Canadian resume format could look different.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

The six in-demand sections for your bank manager resume:

- Top one-third should be filled with a header, listing your contact details, and with a summary or objective, briefly highlighting your professional accolades

- Experience section, detailing how particular jobs have helped your professional growth

- Notable achievements that tie in your hard or soft skills with tangible outcomes

- Popular industry certificates to further highlight your technical knowledge or people capabilities

- Education to showcase your academic background in the field

What recruiters want to see on your resume:

- Proven experience in managing branch operations, including financial analysis, loan and deposit growth strategies, and risk management.

- Demonstrated ability to lead, develop, and motivate a team, showing a track record of high employee engagement and performance coaching.

- Expertise in regulatory compliance, with a strong understanding of banking laws and regulations, including anti-money laundering (AML) and Know Your Customer (KYC) procedures.

- Strong financial acumen with a history of successfully implementing business plans to achieve sales targets and profitability.

- Exceptional customer service skills and experience with relationship building, maintaining a high customer retention rate, and managing a diverse client portfolio.

Adding your relevant experience to your bank manager resume

If you're looking for a way to show recruiters that your expertise is credible, look no further than the resume experience section.

Your bank manager resume experience can be best curated in a structured, bulleted list detailing the particulars of your career:

- Always integrate metrics of success - what did you actually achieve in the role?

- Scan the bank manager advert for your dream role in search of keywords in the job requirements - feature those all through your past/current experience;

- Dedicate a bullet (or two) to spotlight your technical capabilities and how you're able to use the particular software/technology in your day-to-day roles;

- Write simple by including your responsibility, a job advert keyword or skill, and a tangible outcome of your success;

- Use the experience section to also define the unique value of working with you in the form of soft skills, relevant feedback, and the company culture you best thrive in.

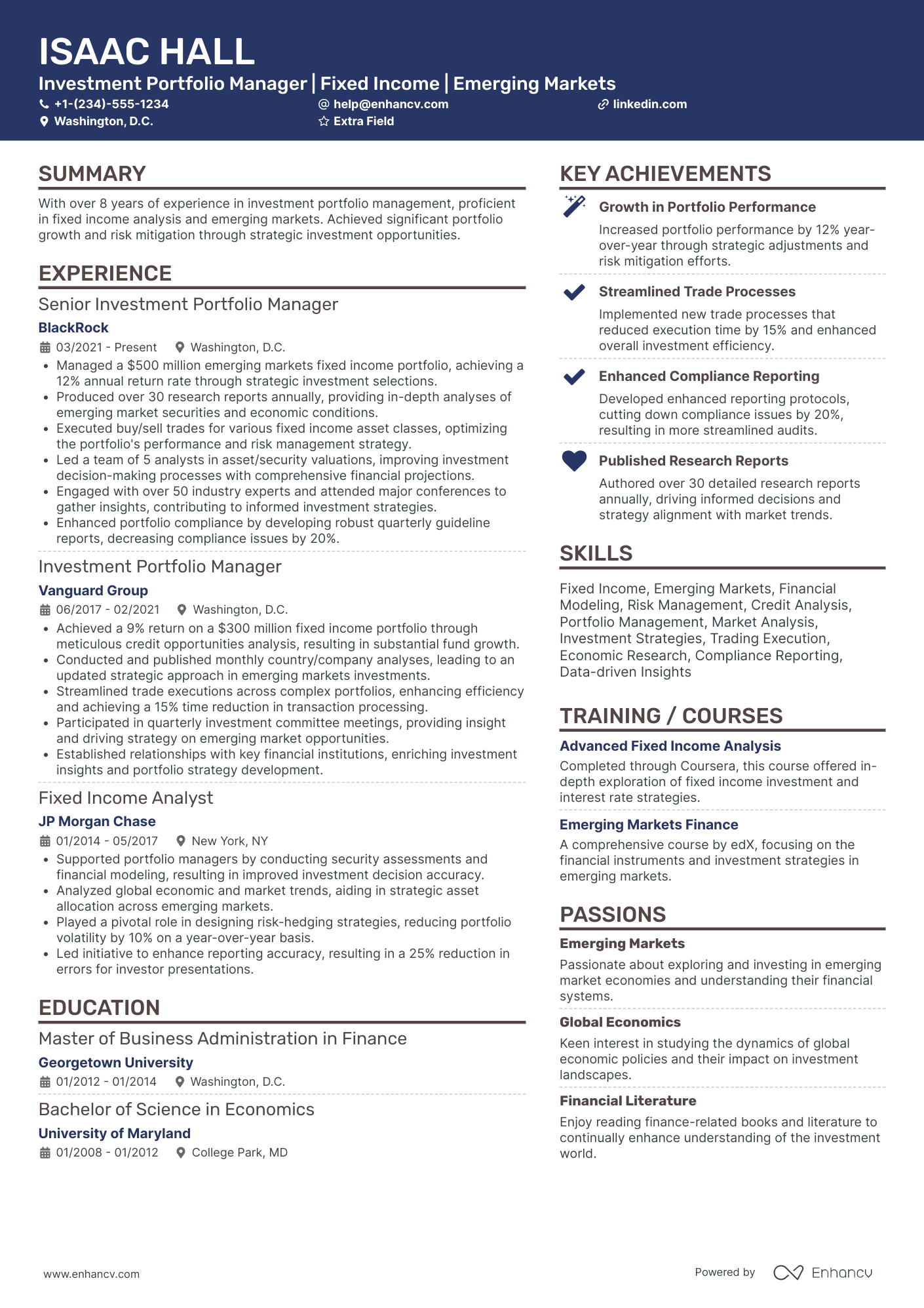

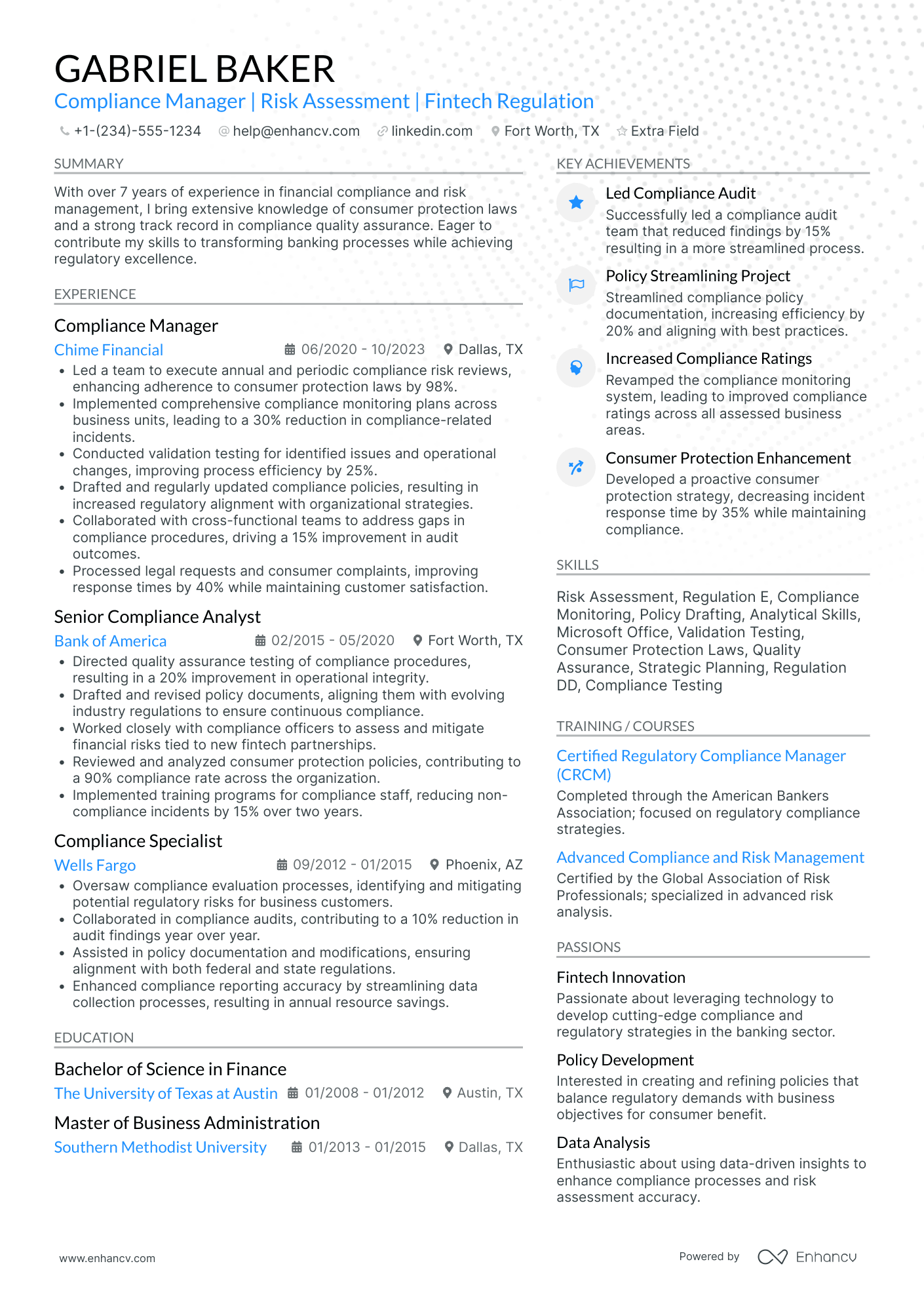

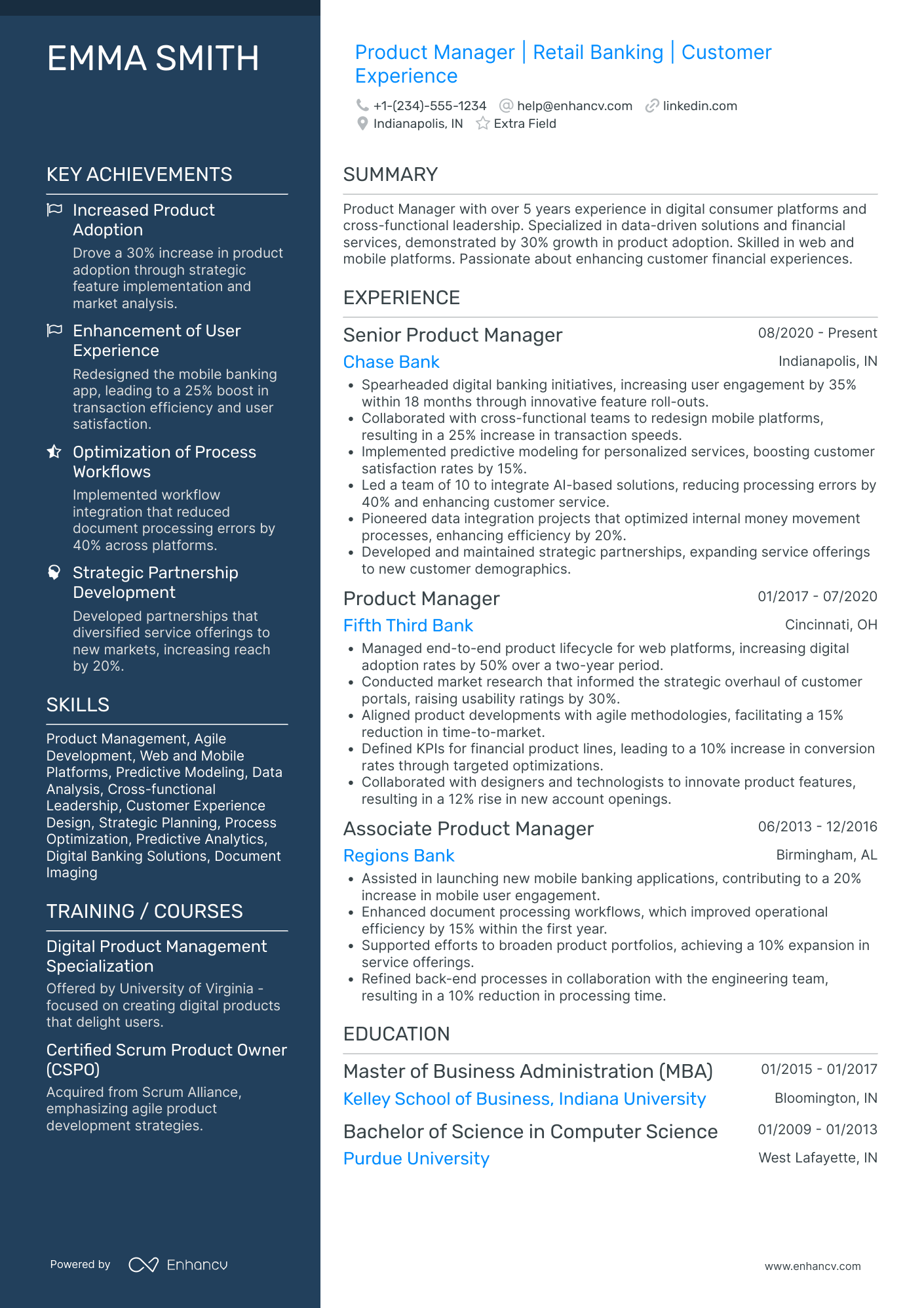

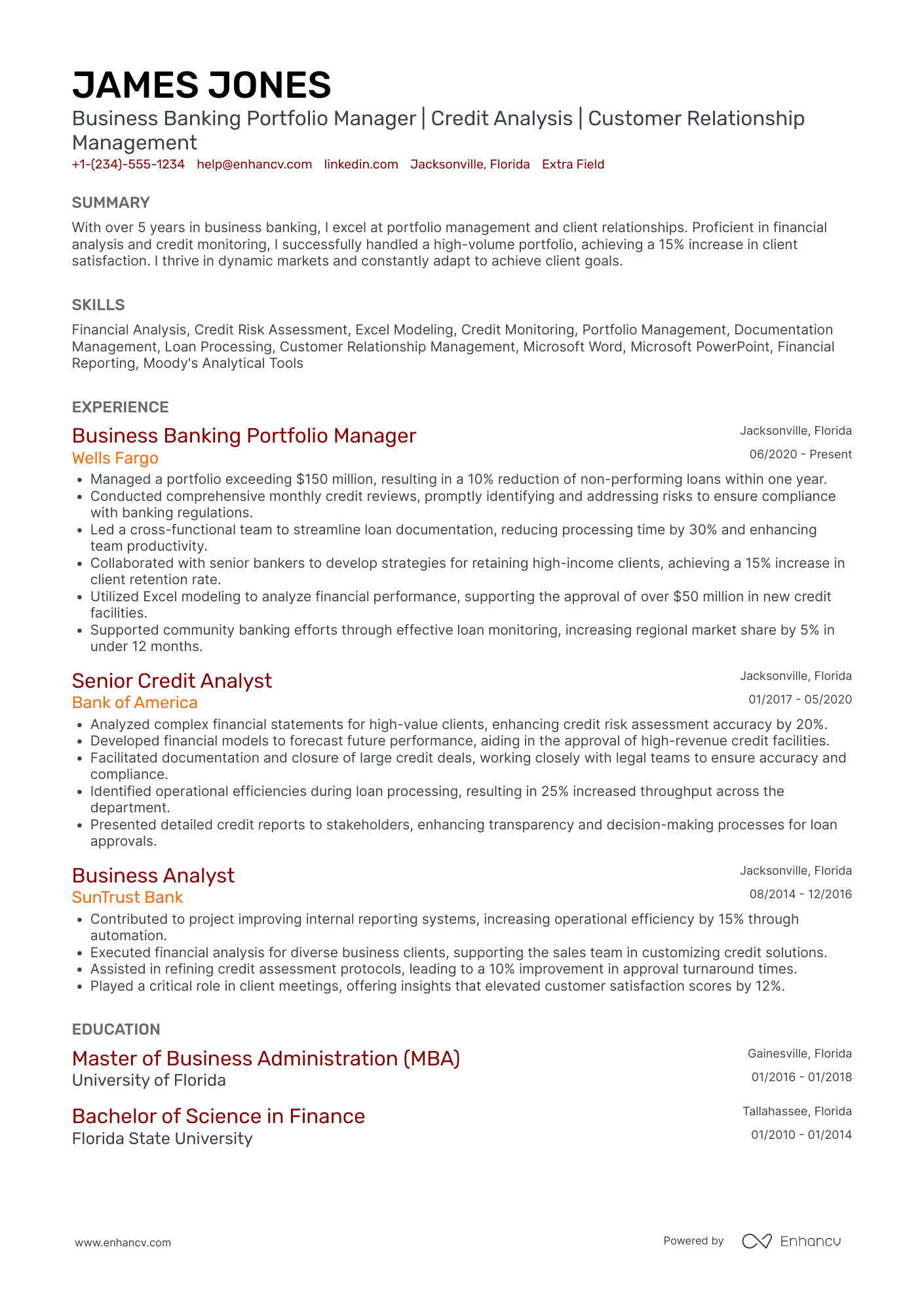

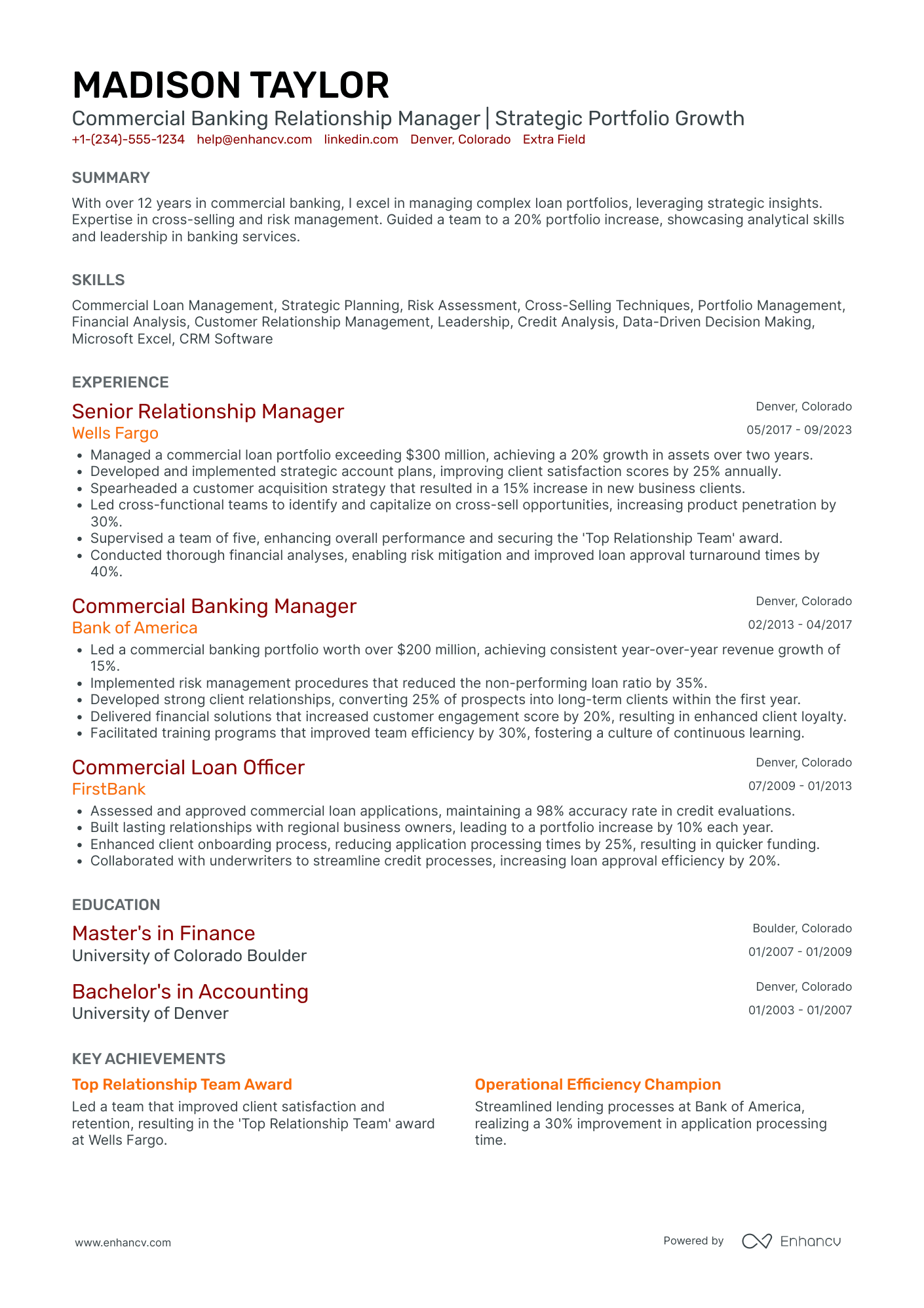

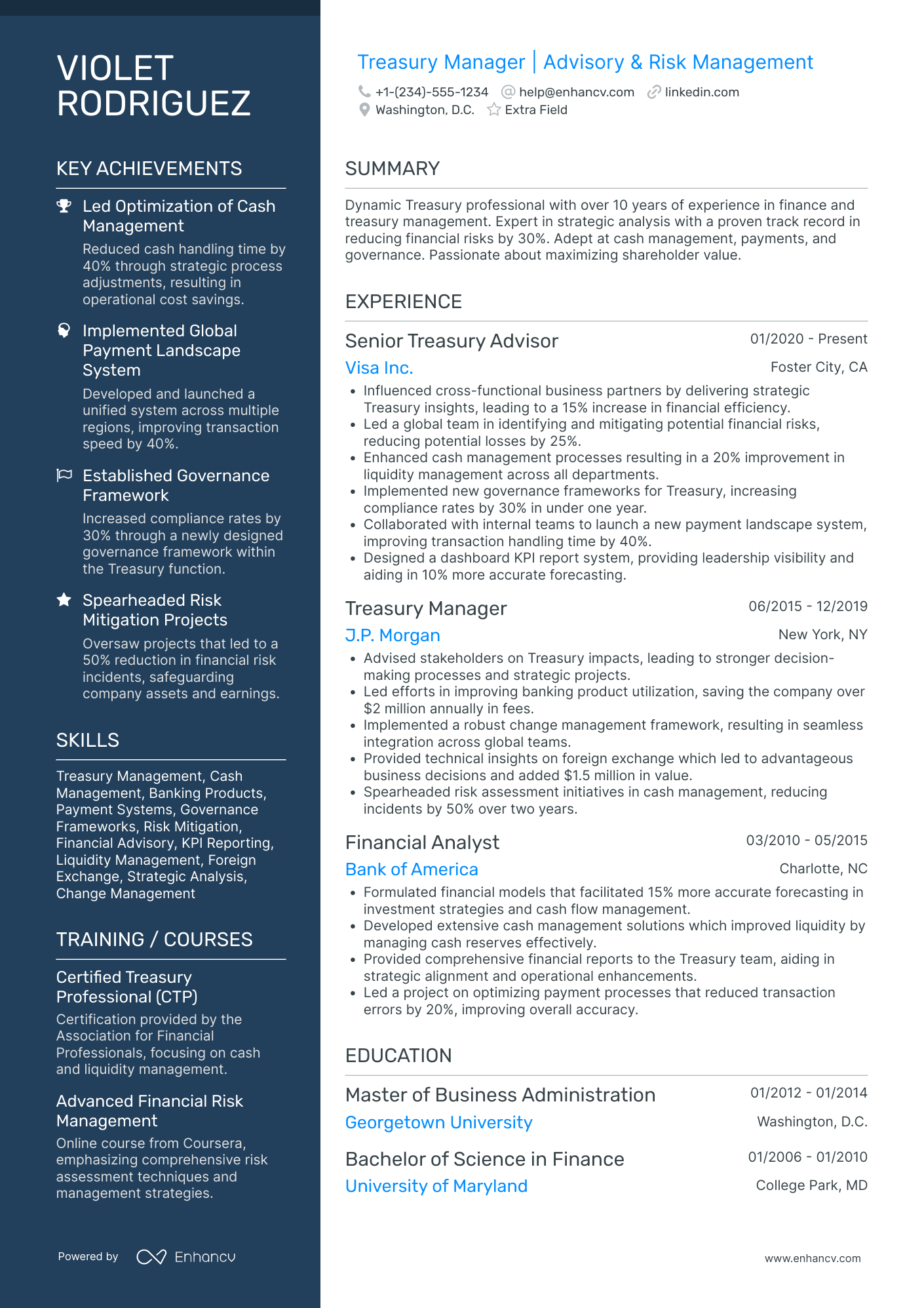

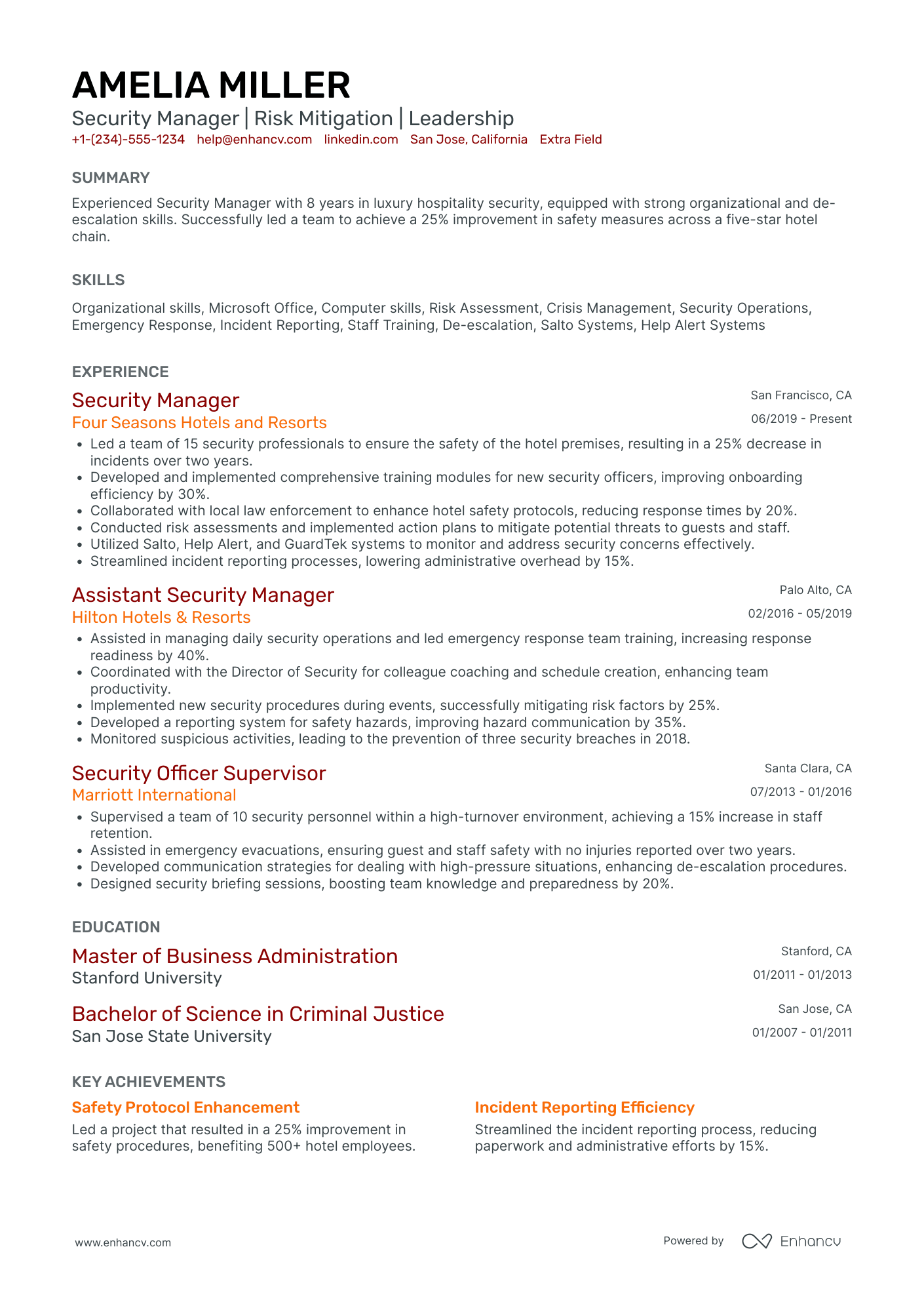

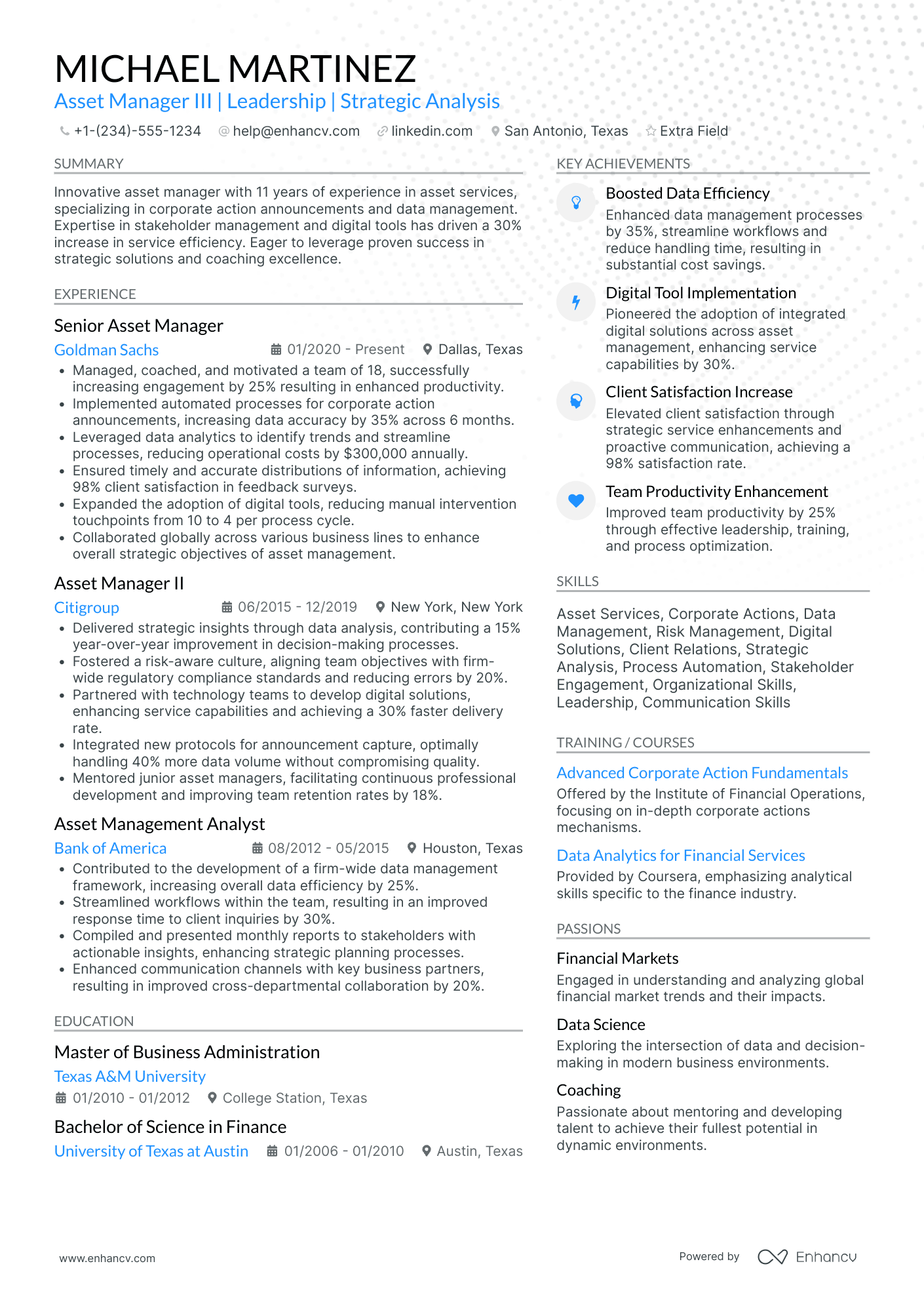

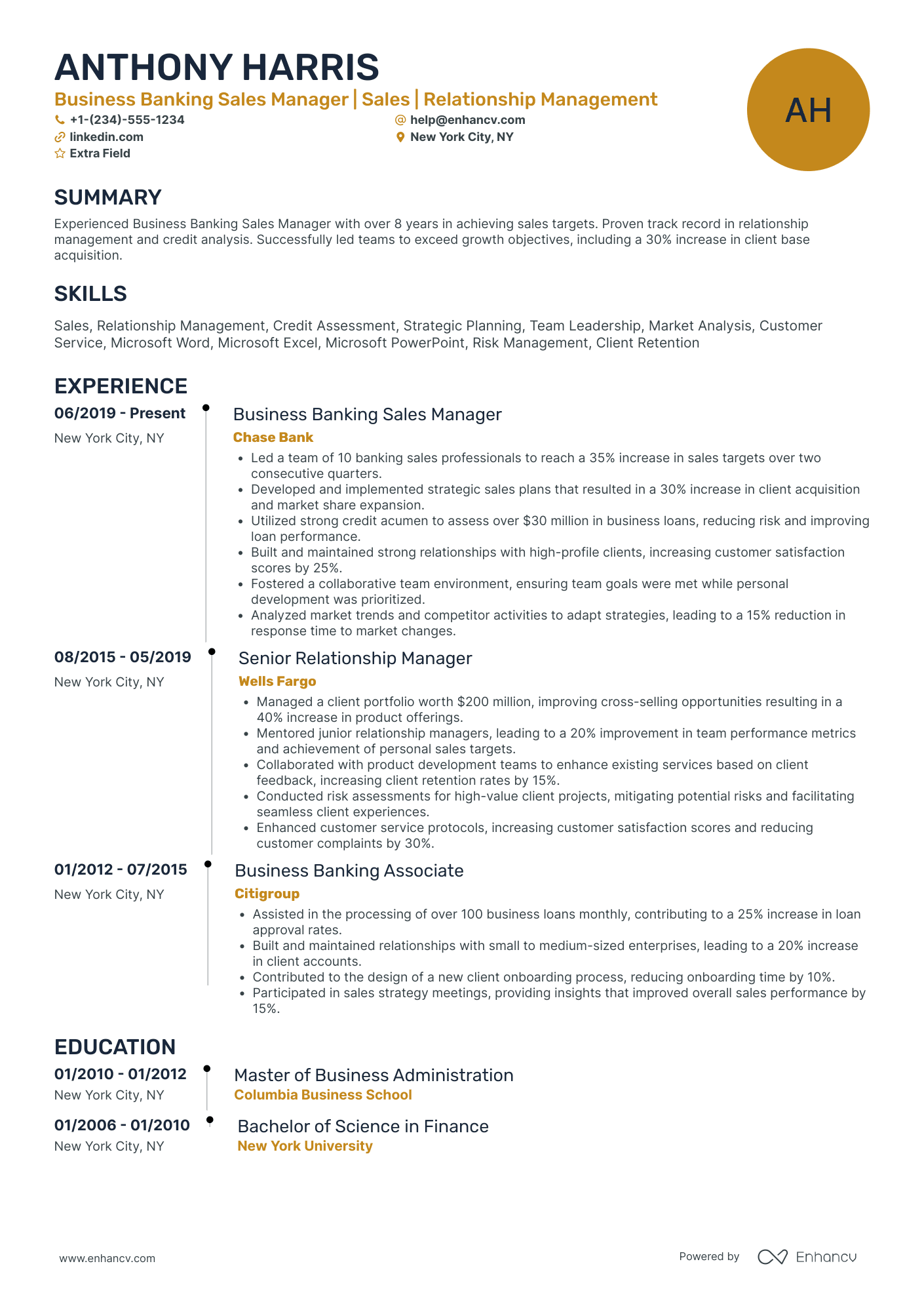

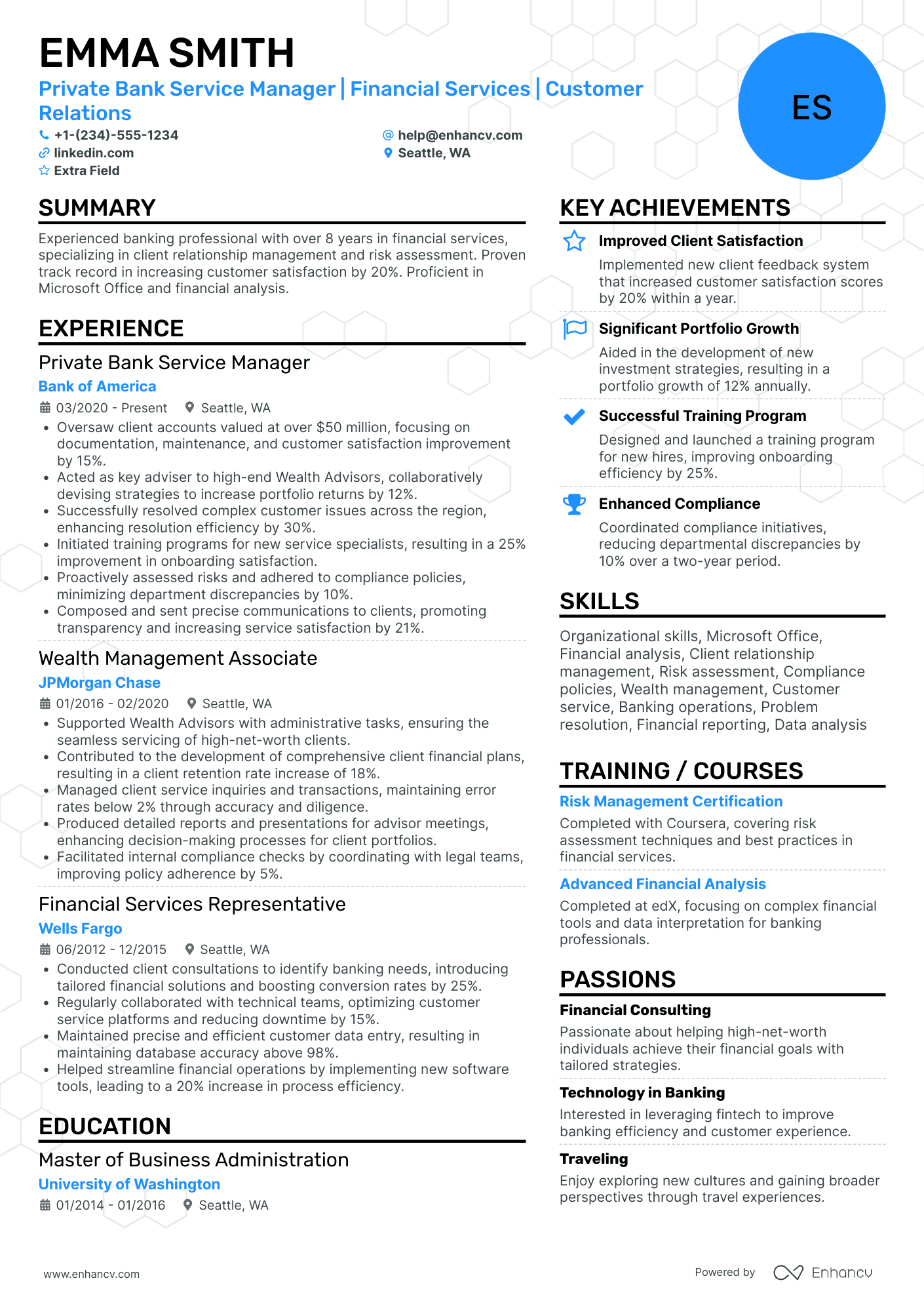

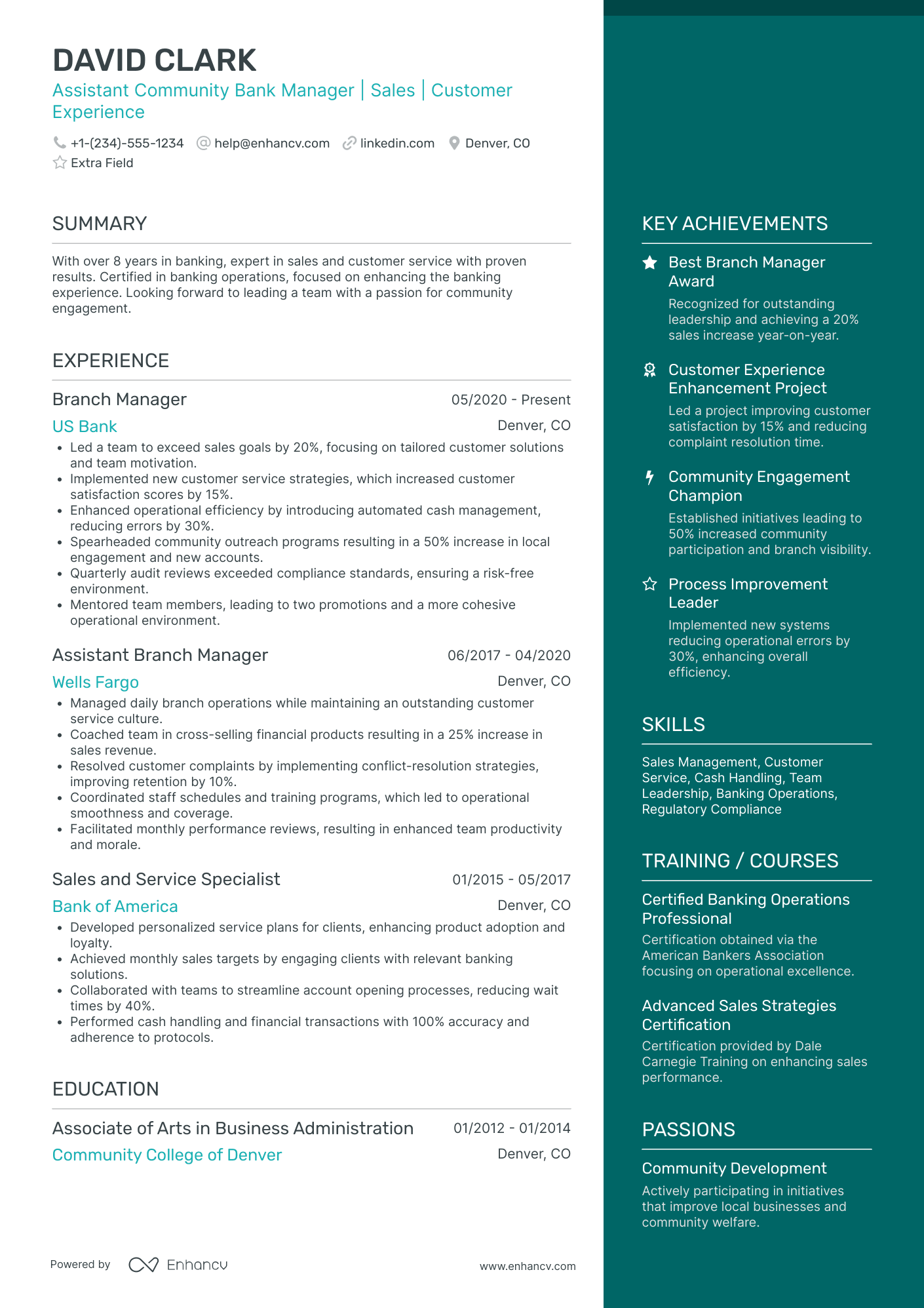

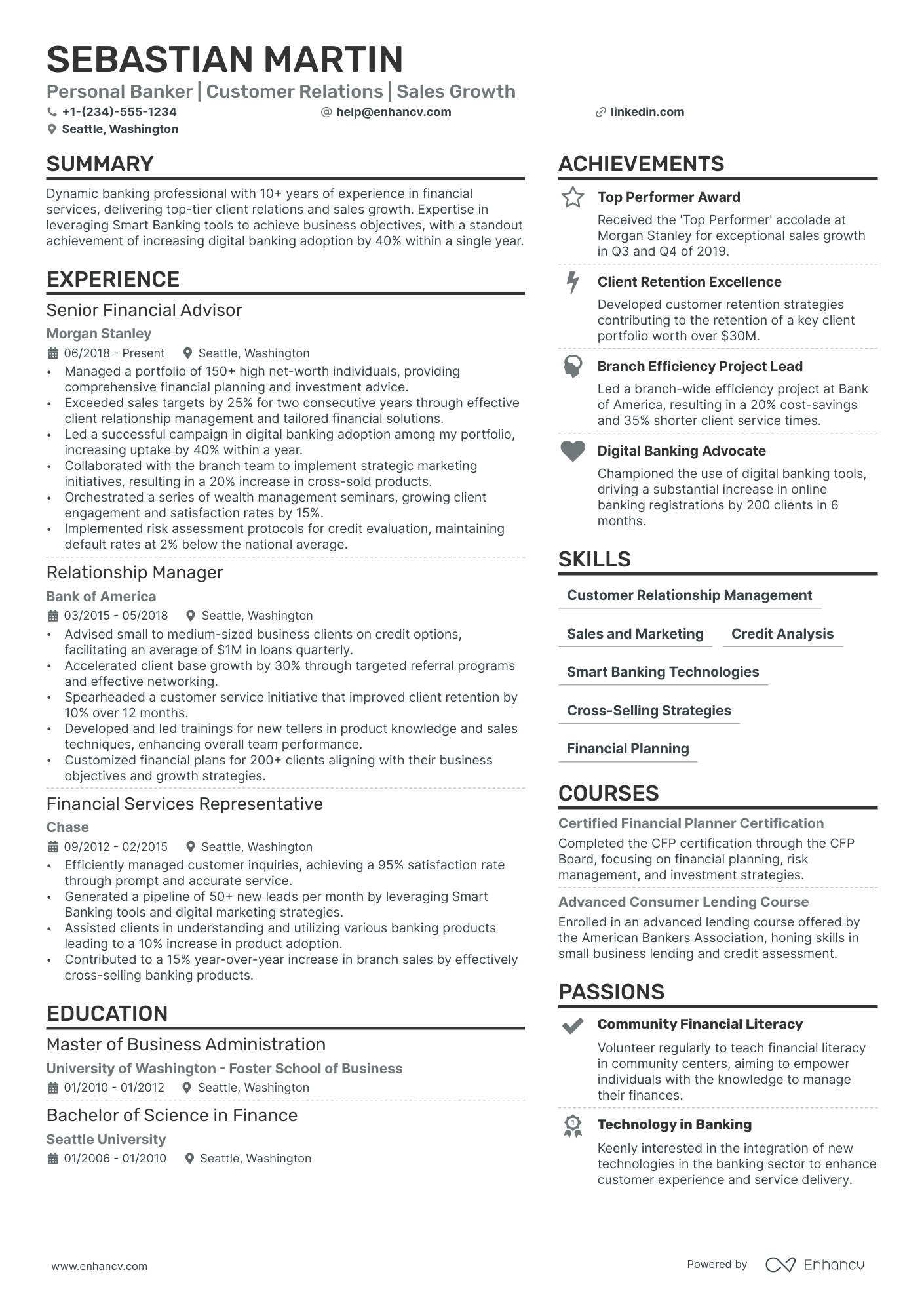

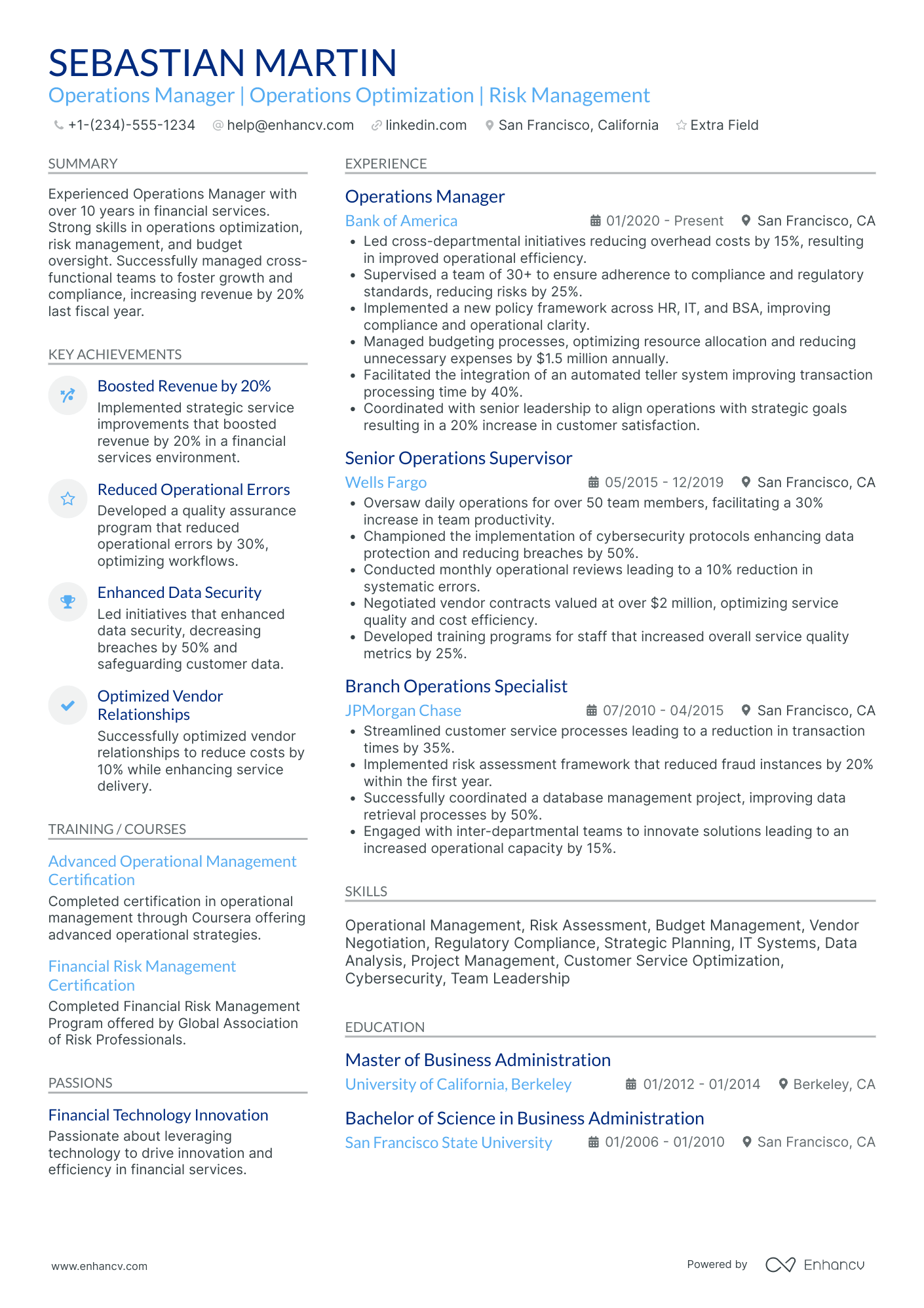

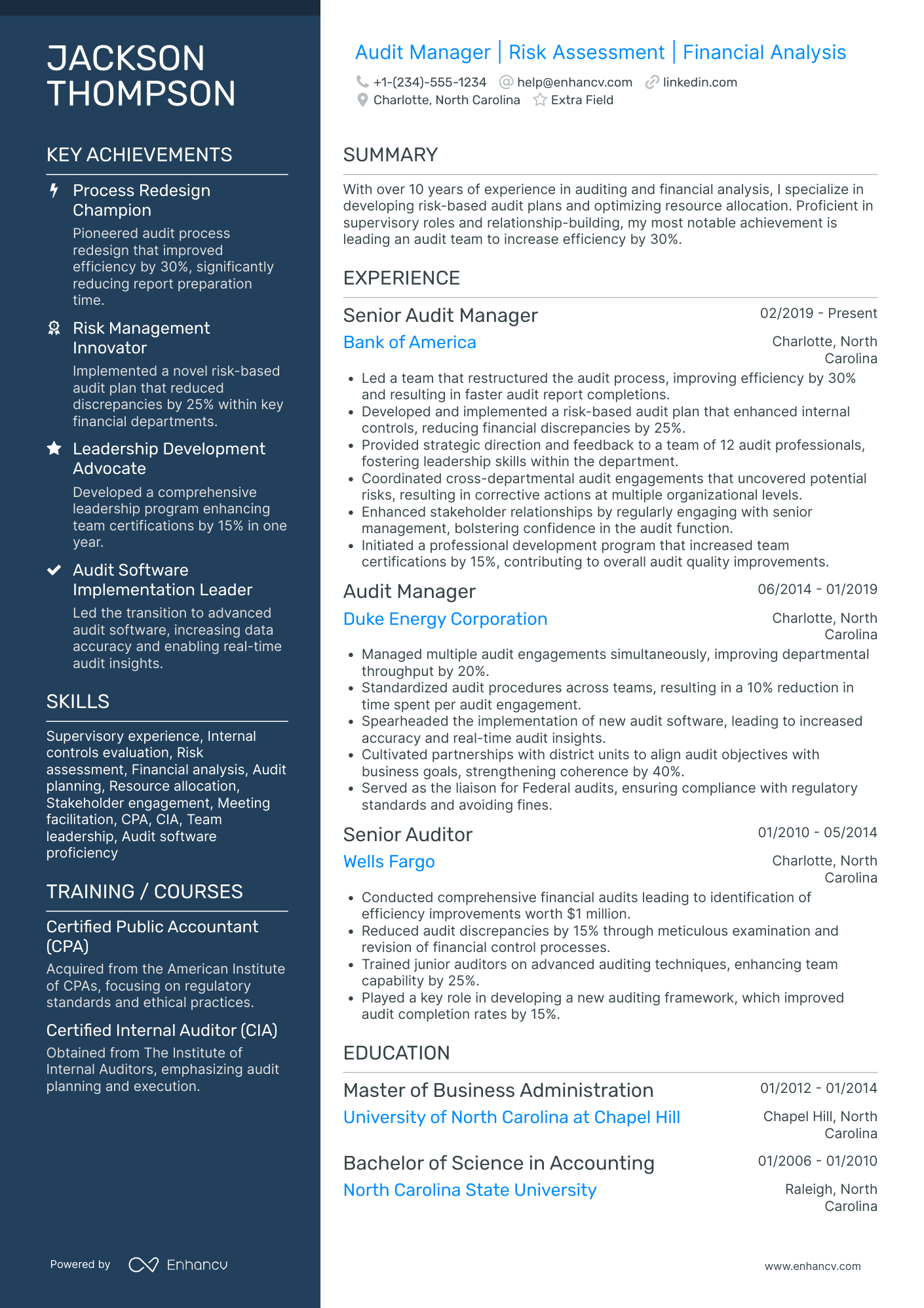

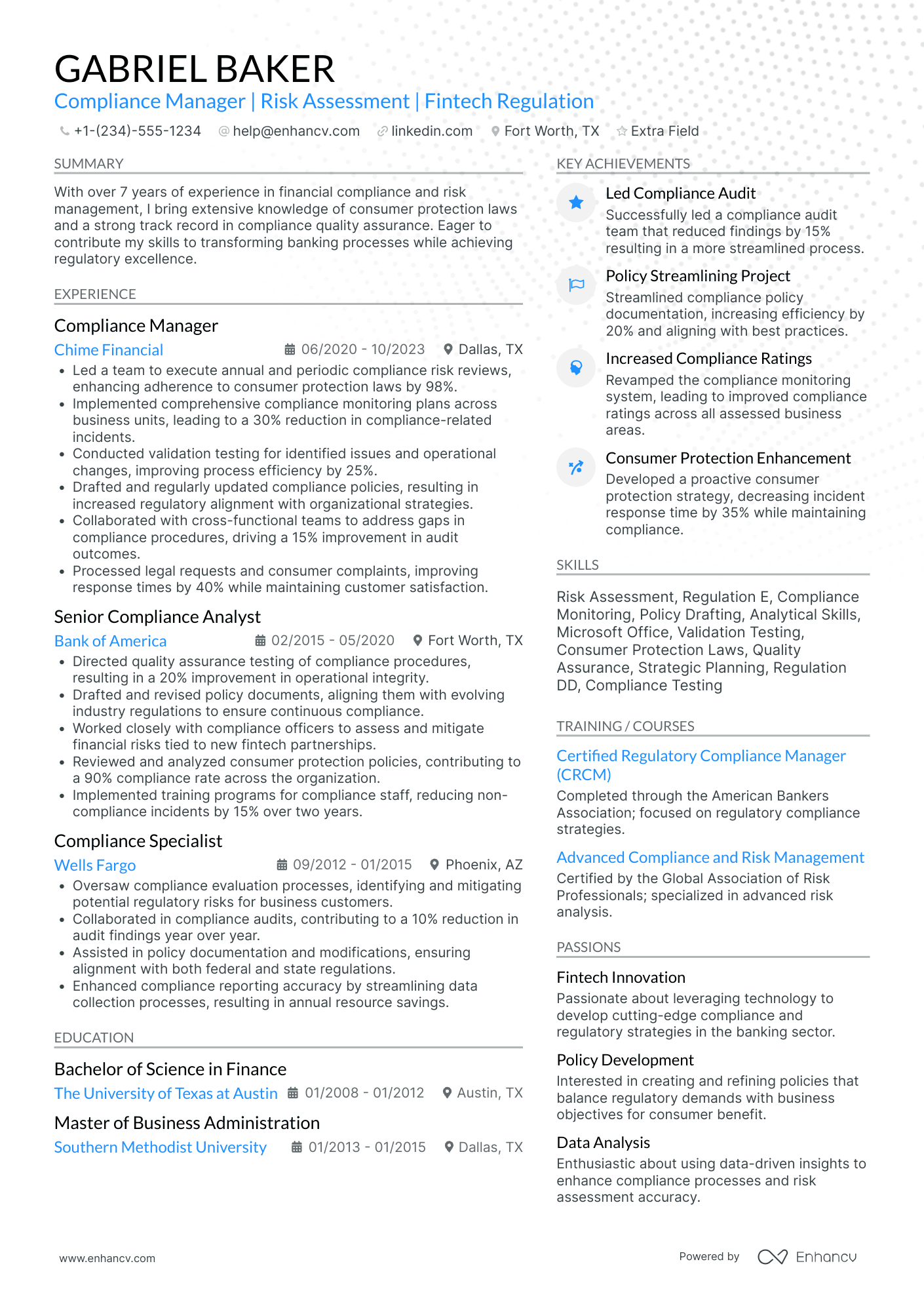

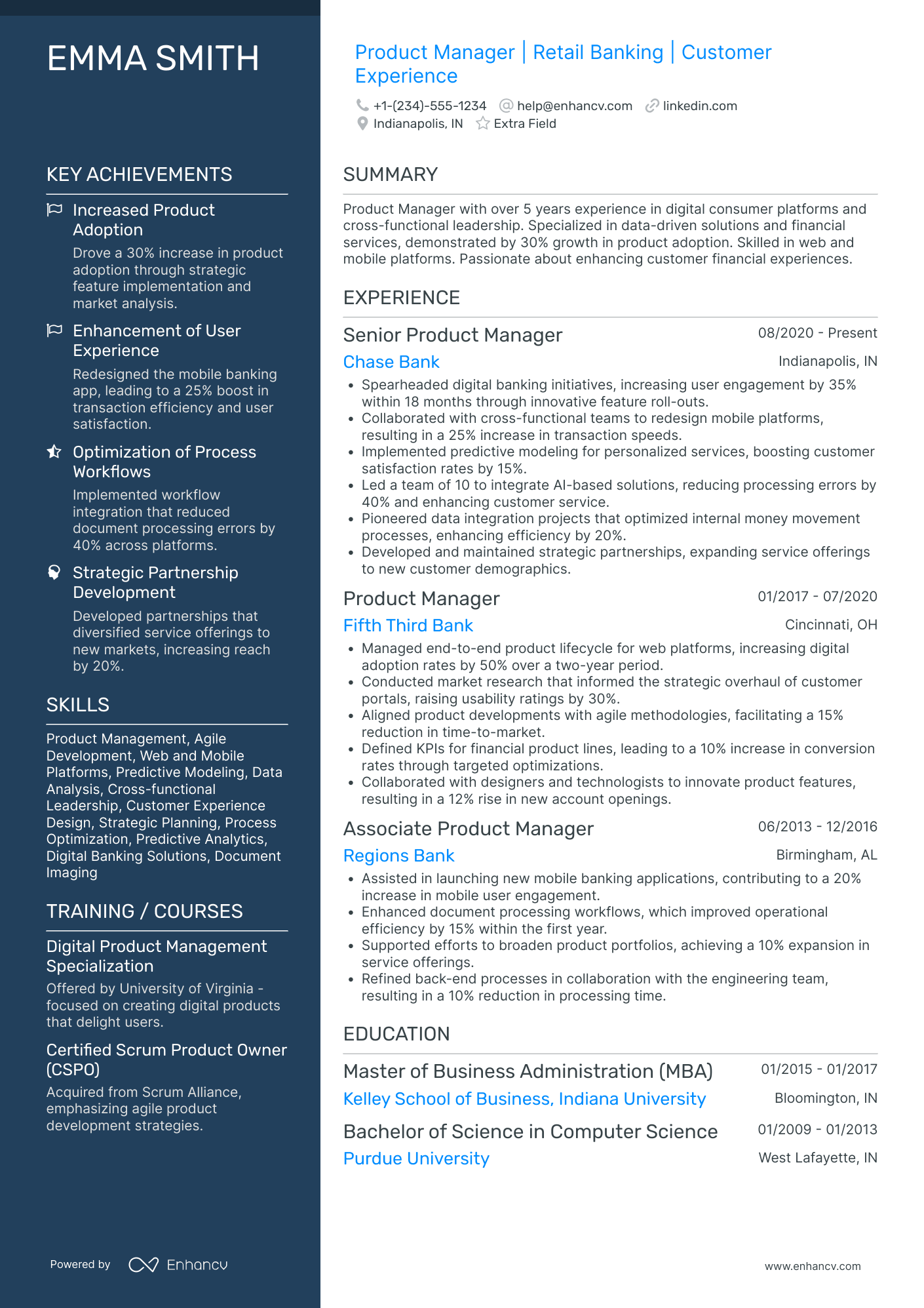

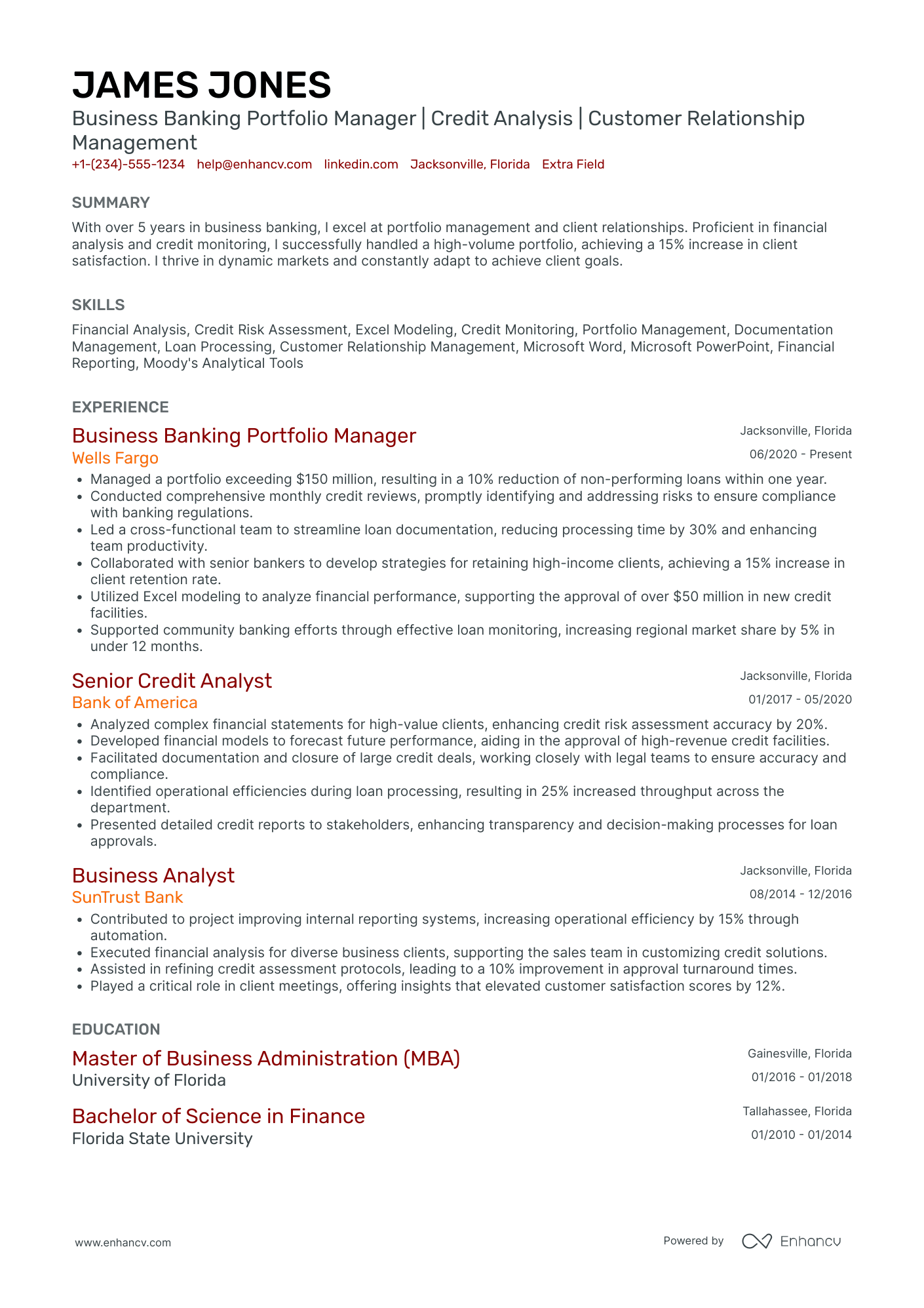

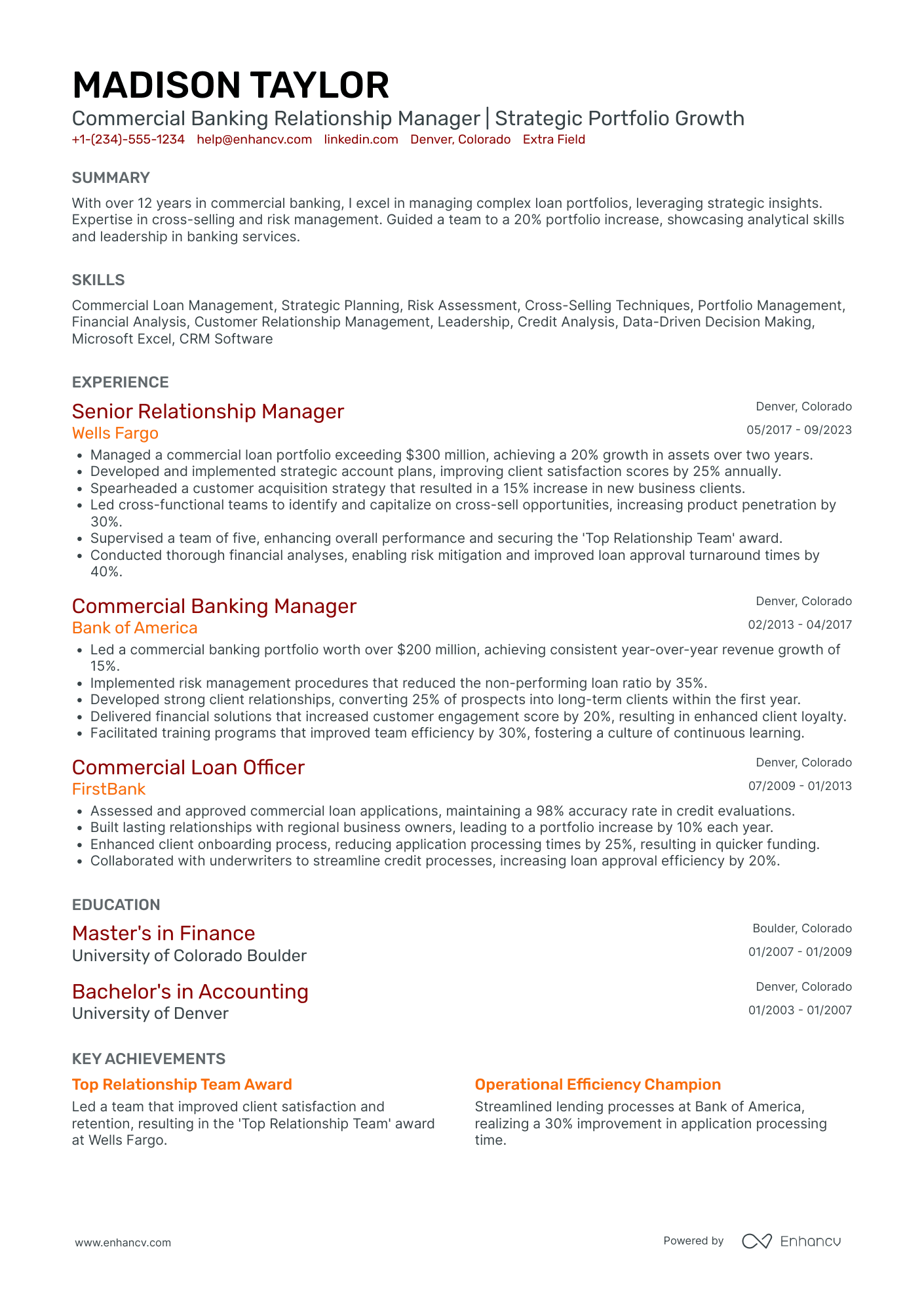

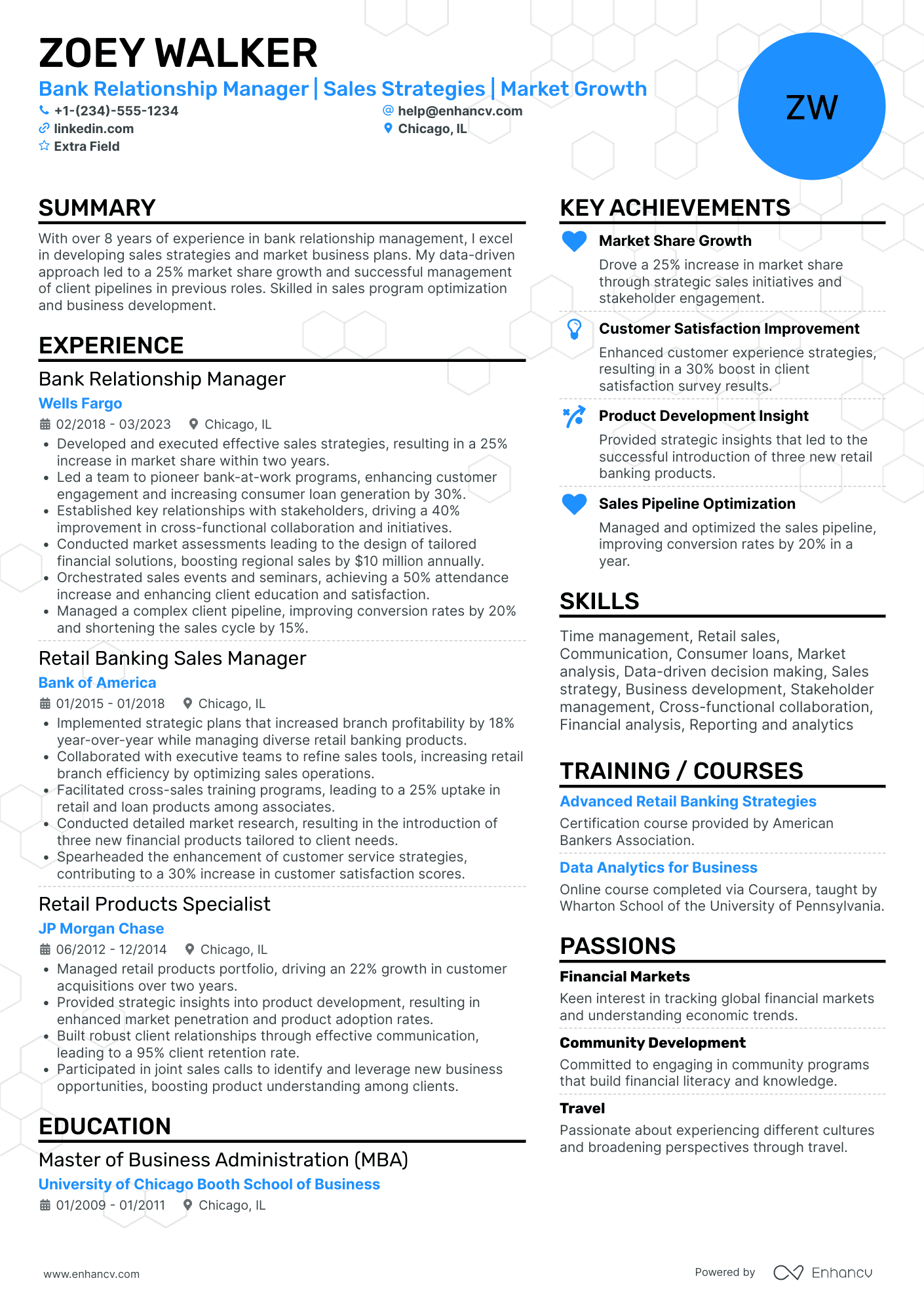

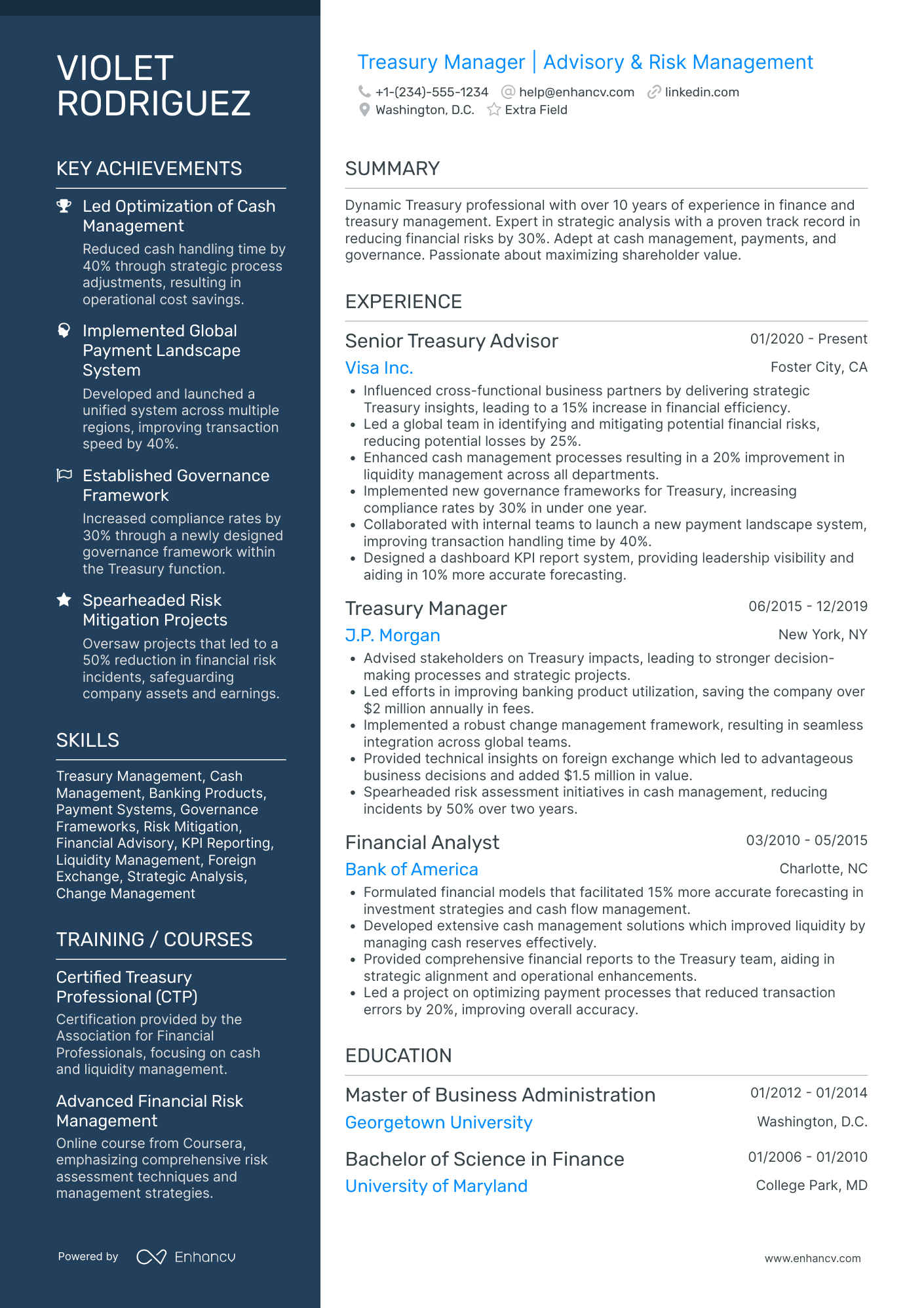

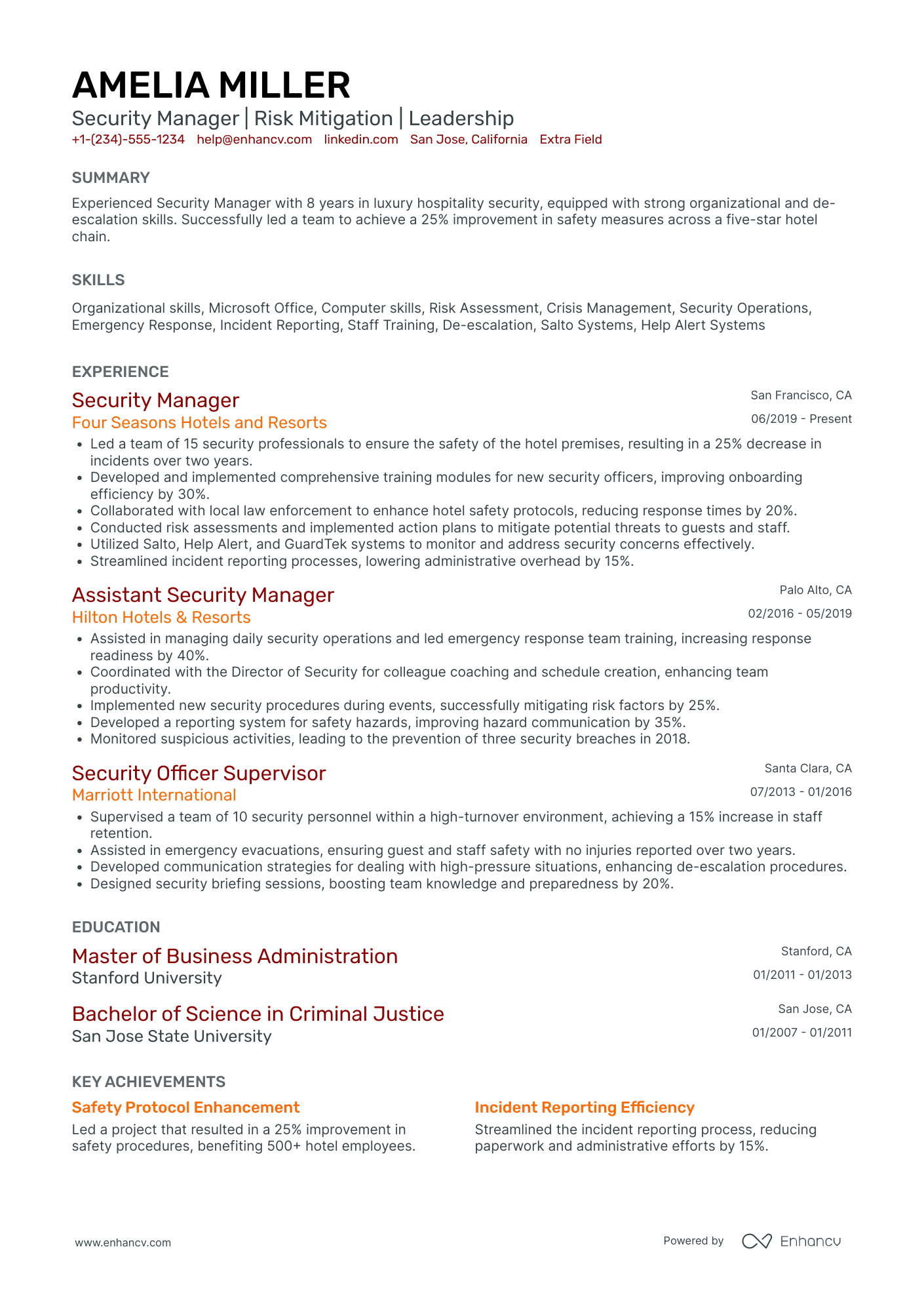

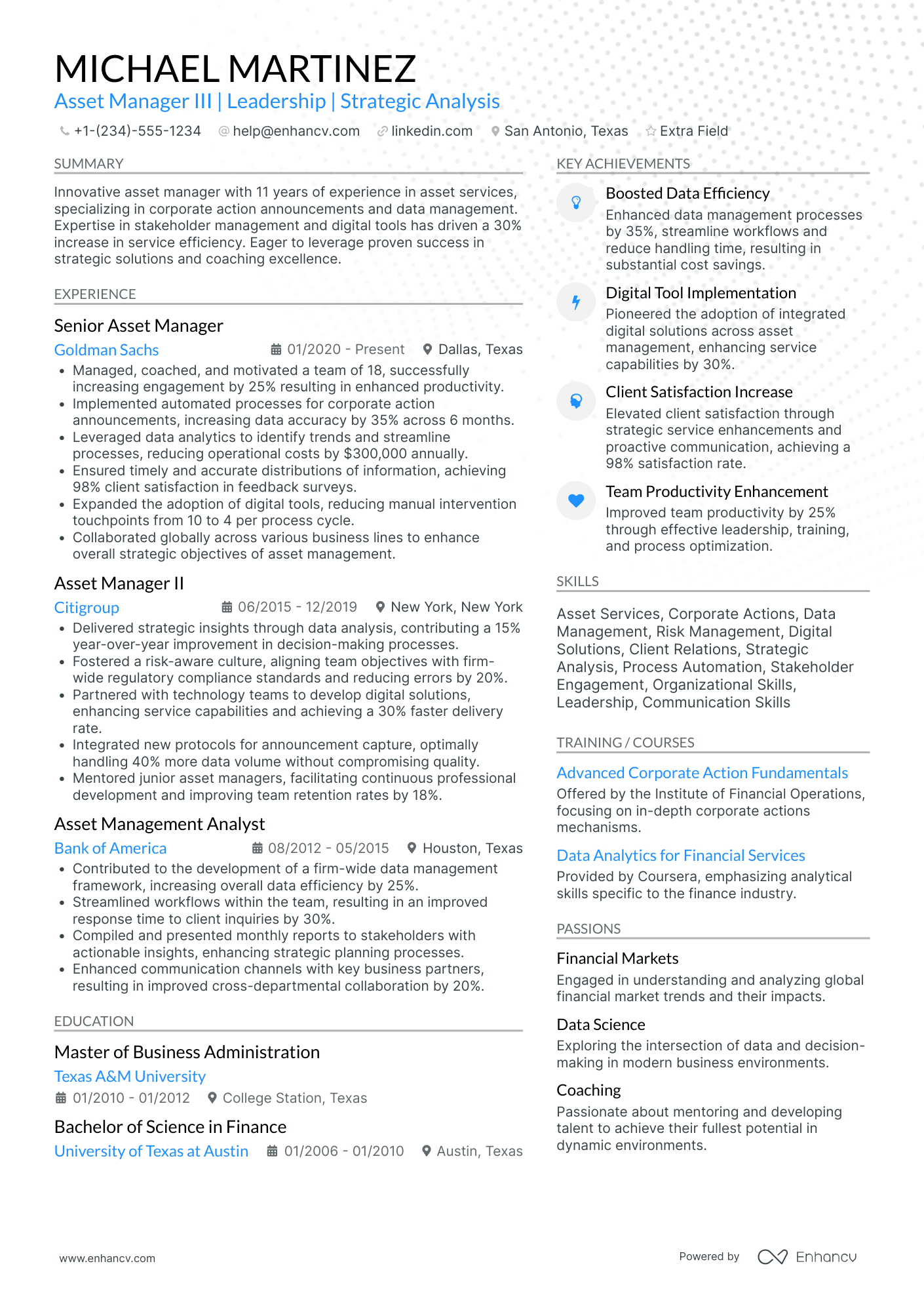

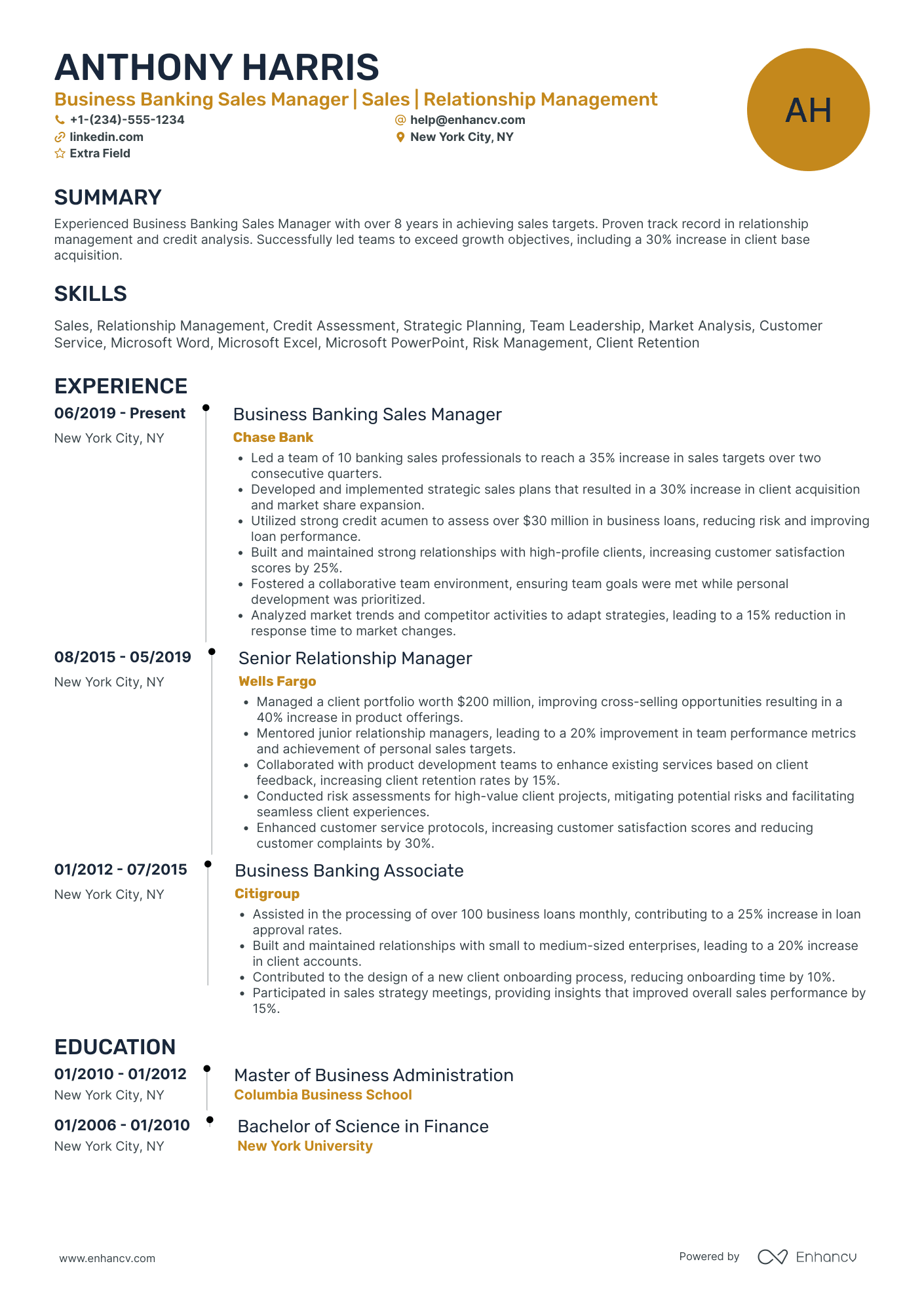

Industry leaders always ensure that their resume experience section offers an enticing glimpse at their expertise, while telling a career narrative. Explore these sample bank manager resumes on how to best create your resume experience section.

- Spearheaded branch-wide digital transformation by implementing new online banking platforms, enhancing customer experience and increasing digital transactions by 30%.

- Developed and executed innovative marketing strategies that targeted local businesses, growing the commercial loan portfolio by 25% within two years.

- Streamlined branch operations by introducing new risk assessment tools, reducing non-performing assets by 15% and bolstering overall financial stability.

- Successfully led a team of 20+ employees, fostering a collaborative environment that improved customer satisfaction scores by over 20%.

- Oversaw an increase in small business lending by 40%, by personally conducting community outreach and financial literacy workshops.

- Negotiated with third-party vendors to reduce operational costs by 10%, reallocating savings to customer retention programs.

- Masterminded the launch of a pilot financial advisory service within the branch, boosting cross-selling of investment products by 35%.

- Championed a high-performing sales culture that surpassed the region's sales goals by 50% for two consecutive years.

- Mentored and developed four assistant managers who went on to become successful branch managers at other locations.

- Directed branch operations, achieving top-tier performance in loan origination, with over $50 million in loans originated during my tenure.

- Implemented comprehensive compliance training, resulting in zero compliance violations during annual audits.

- Increased branch profitability by 18% through strategic cost reduction while maintaining high levels of customer service.

- Pioneered a customer relationship management program aimed at high-net-worth individuals, growing the number of premium accounts by 200.

- Leveraged advanced data analytics to redefine sales strategies, leading to an unprecedented 22% growth in deposit volume.

- Cultivated a culture of compliance and ethical behavior, reducing the risk of financial fraud and increasing customer trust.

- Orchestrated a branch turnaround strategy that enhanced overall performance, moving from the lowest to the highest quartile in the regional ranking within 18 months.

- Launched a successful customer retention initiative that reduced churn rate by 12% and improved overall customer satisfaction.

- Managed critical banking relationships that led to securing over 15 corporate accounts with deposits totaling over $30 million.

- Drove a culture change initiative, emphasizing ethical banking practices, which augmented the branch's reputation in the community.

- Expanded the branch's mortgage lending services, resulting in a 50% increase in home loan approvals and significantly contributing to revenue growth.

- Collaborated with the IT department to enhance the bank's cybersecurity measures, thus ensuring the safety of customer data and reducing potential financial liabilities.

- Led the development and implementation of a fintech partnership program, which attracted innovative startups and expanded the bank's technology offering.

- Managed the restructuring of the retail banking division, increasing operational efficiency by 15% without compromising service quality.

- Directed the investment and savings department achieving an increase in investment portfolio size by 30% through personalized investment planning services.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for bank manager professionals.

Top Responsibilities for Bank Manager:

- Establish and maintain relationships with individual or business customers or provide assistance with problems these customers may encounter.

- Oversee the flow of cash or financial instruments.

- Plan, direct, or coordinate the activities of workers in branches, offices, or departments of establishments, such as branch banks, brokerage firms, risk and insurance departments, or credit departments.

- Recruit staff members.

- Evaluate data pertaining to costs to plan budgets.

- Oversee training programs.

- Establish procedures for custody or control of assets, records, loan collateral, or securities to ensure safekeeping.

- Communicate with stockholders or other investors to provide information or to raise capital.

- Develop or analyze information to assess the current or future financial status of firms.

- Approve, reject, or coordinate the approval or rejection of lines of credit or commercial, real estate, or personal loans.

Quantifying impact on your resume

- List the dollar amount of deposits and loans managed to highlight your capability to handle significant financial assets.

- Indicate the percentage growth in customer accounts to showcase your success in business development.

- Specify the number of branch locations supervised to demonstrate managerial reach and scalability.

- Mention the exact number of employees you've led, emphasizing your leadership and team management skills.

- Quantify cost reductions achieved through operational improvements to show fiscal responsibility.

- Present the annual budget you have managed, underlining your financial oversight capabilities.

- Discuss the number of regulatory audits passed to reflect compliance and attention to detail.

- Detail the percentage increase in cross-sell and up-sell of financial products to exhibit sales and marketing acumen.

Action verbs for your bank manager resume

No experience, no problem: writing your bank manager resume

You're quite set on the bank manager role of your dreams and think your application may add further value to your potential employers. Yet, you have no work experience . Here's how you can curate your resume to substitute your lack of experience:

- Don't list every single role you've had so far, but focus on ones that would align with the job you're applying for

- Include any valid experience in the field - whether it's at research or intern level

- Highlight the soft skills you'd bring about - those personality traits that have an added value to your application

- Focus on your education and certifications, if they make sense for the role.

Recommended reads:

PRO TIP

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

Featuring your hard skills and soft skills on your bank manager resume

The skills section of your bank manager resume needs to your various capabilities that align with the job requirements. List hard skills (or technical skills) to showcase to potential employers that you're perfectly apt at dealing with technological innovations and niche software. Meanwhile, your soft skills need to detail how you'd thrive within your new, potential environment with personal skills (e.g. resilience, negotiation, organization, etc.) Your bank manager resume skills section needs to include both types of skills to promote how you're both technical and cultural fit. Here's how to create your bespoke bank manager skills section to help you stand out:

- Focus on skill requirements that are listed toward the top of the job advert.

- Include niche skills that you've worked hard to obtain.

- Select specific soft skills that match the company (or the department) culture.

- Cover some of the basic job requirements by including important skills for the bank manager role - ones you haven't been able to list through the rest of your resume.

Get inspired with our bank manager sample skill list to list some of the most prominent hard and soft skills across the field.

Top skills for your bank manager resume:

Financial Analysis Software

Customer Relationship Management (CRM) Systems

Banking Regulations and Compliance Tools

Loan Management Systems

Accounting Software

Data Analysis Tools

Risk Management Software

Microsoft Excel

Point of Sale (POS) Systems

Core Banking Systems

Leadership

Communication

Problem-Solving

Team Management

Customer Service

Analytical Thinking

Time Management

Decision-Making

Negotiation

Conflict Resolution

Next, you will find information on the top technologies for bank manager professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Bank Manager’s resume:

- Oracle PeopleSoft

- Workday software

- Microsoft PowerPoint

- Microsoft SQL Server

- Yardi software

PRO TIP

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

Education section and most popular bank manager certifications for your resume

Your resume education section is crucial. It can indicate a range of skills and experiences pertinent to the position.

- Mention only post-secondary qualifications, noting the institution and duration.

- If you're still studying, highlight your anticipated graduation date.

- Omit qualifications not pertinent to the role or sector.

- If it provides a chance to emphasize your accomplishments, describe your educational background, especially in a research-intensive setting.

Recruiters value bank manager candidates who have invested their personal time into their professional growth. That's why you should include both your relevant education and certification . Not only will this help you stand out amongst candidates, but showcase your dedication to the field. On your bank manager resume, ensure you've:

- Curated degrees and certificates that are relevant to the role

- Shown the institution you've obtained them from - for credibility

- Include the start and end dates (or if your education/certification is pending) to potentially fill in your experience gaps

- If applicable, include a couple of job advert keywords (skills or technologies) as part of the certification or degree description

If you decide to list miscellaneous certificates (that are irrelevant to the role), do so closer to the bottom of your resume. In that way, they'd come across as part of your personal interests, instead of experience. The team at Enhancv has created for you a list of the most popular bank manager certificates - to help you update your resume quicker:

The top 5 certifications for your bank manager resume:

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Bank Auditor (CBA) - Bank Administration Institute

- Certified Financial Services Auditor (CFSA) - The Institute of Internal Auditors

- Certified Banking & Credit Analyst (CBCA) - Corporate Finance Institute

- Professional Banker Certificate (PBC) - The American Bankers Association

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for bank manager professionals.

Top US associations for a Bank Manager professional

- AICPA and CIMA

- American Bankers Association

- Association for Financial Professionals

- Association of Government Accountants

- CFA Institute

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

Recommended reads:

Deciding between a resume summary or objective for your bank manager role

Understanding the distinction between a resume summary and an objective is crucial for your bank manager resume.

A resume summary, typically three to five sentences long, offers a concise overview of your career. This is the place to showcase your most pertinent experience, key accomplishments, and skills. It's particularly well-suited for those with professional experience relevant to the job requirements.

In contrast, a resume objective focuses on how you can add value to potential employers. It addresses why they should hire you and outlines your career expectations and learning goals. Therefore, it's ideal for candidates with less experience.

In the following section of our guide, explore how resume summaries and objectives differ through some exemplary industry-specific examples.

Resume summaries for a bank manager job

- With a robust 12-year tenure at a leading financial institution, I have directed operations with an emphasis on risk management, strategic planning, and optimizing client satisfaction. My track record features a 150% growth in loan portfolio and a 20% increase in overall customer retention through tailored financial solutions.

- Senior financial analyst for 10 years, transitioning into the banking sector, leveraging profound expertise in financial modeling, regulatory compliance, and market analysis. Recognized for spearheading a $50M company-wide cost-saving initiative leading to a 30% increase in EBITDA.

- Eager to apply 15 years of experience managing high-performance teams in the retail industry to a dynamic banking environment. Highly skilled in CRM systems, sales strategy, and fostering client loyalty, instrumental in achieving a 40% market share increase within a saturated market.

- Bilingual corporate lawyer with a decade-long track record in multinational contract negotiation, intellectual property rights, and corporate governance, seeking to leverage legal expertise and meticulous attention to detail to ensure stringent compliance and robust client relations in the banking industry.

- Seeking to bring fresh perspectives and an energetic drive to a career in banking. My passion for finance, coupled with a strong foundation in mathematics and a recent Bachelor’s degree in Business Administration, have equipped me with the analytical tools necessary to excel in fostering client financial success.

- Determined to embark on a banking career path where my adaptability and quick learning abilities will be assets. With a comprehensive understanding of economics and international finance from my academic pursuits, I am prepared to contribute positively to client service and financial management tasks.

Average salary info by state in the US for bank manager professionals

Local salary info for Bank Manager.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $156,100 |

| California (CA) | $169,780 |

| Texas (TX) | $155,380 |

| Florida (FL) | $135,780 |

| New York (NY) | $215,430 |

| Pennsylvania (PA) | $137,770 |

| Illinois (IL) | $149,900 |

| Ohio (OH) | $131,610 |

| Georgia (GA) | $159,620 |

| North Carolina (NC) | $146,860 |

| Michigan (MI) | $131,770 |

Recruiters' favorite additional bank manager resume sections

When writing your bank manager resume, you may be thinking to yourself, " Is there anything more I can add on to stand out? ".

Include any of the below four sections you deem relevant, to ensure your bank manager resume further builds up your professional and personal profile:

Key takeaways

We've reached the end of our bank manager resume guide and hope this information has been useful. As a summary of our key points:

- Always assess the job advert for relevant requirements and integrate those buzzwords across various sections of your bank manager resume by presenting tangible metrics of success;

- Quantify your hard skills in your certificates and skills section, while your soft skills in your resume achievements section;

- Ensure you've added additional relevant experience items, such as extracurricular activities and projects you've participated in or led;

- Use both your resume experience and summary to focus on what matters the most to the role: including your technical, character, and cultural fit for the company.

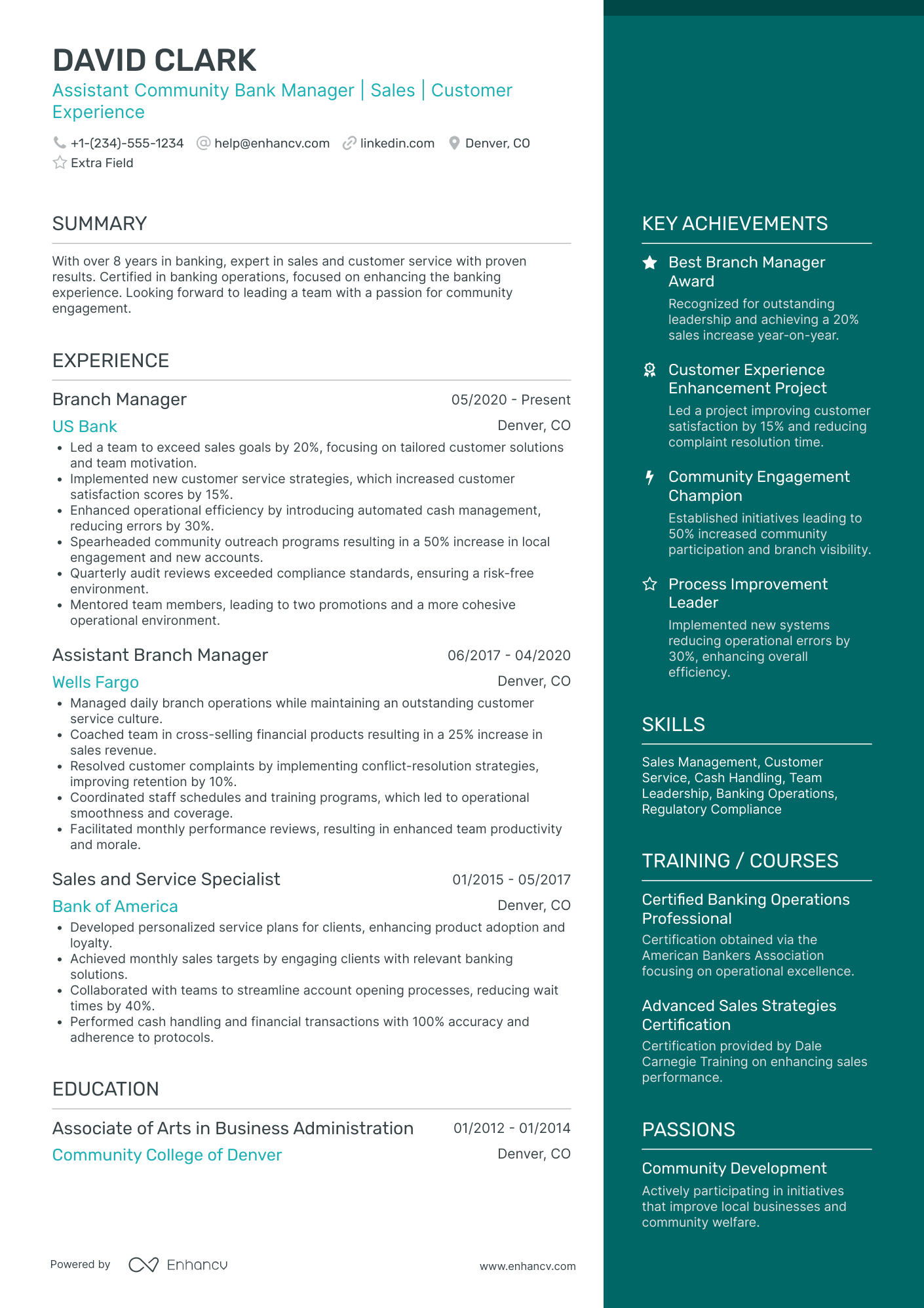

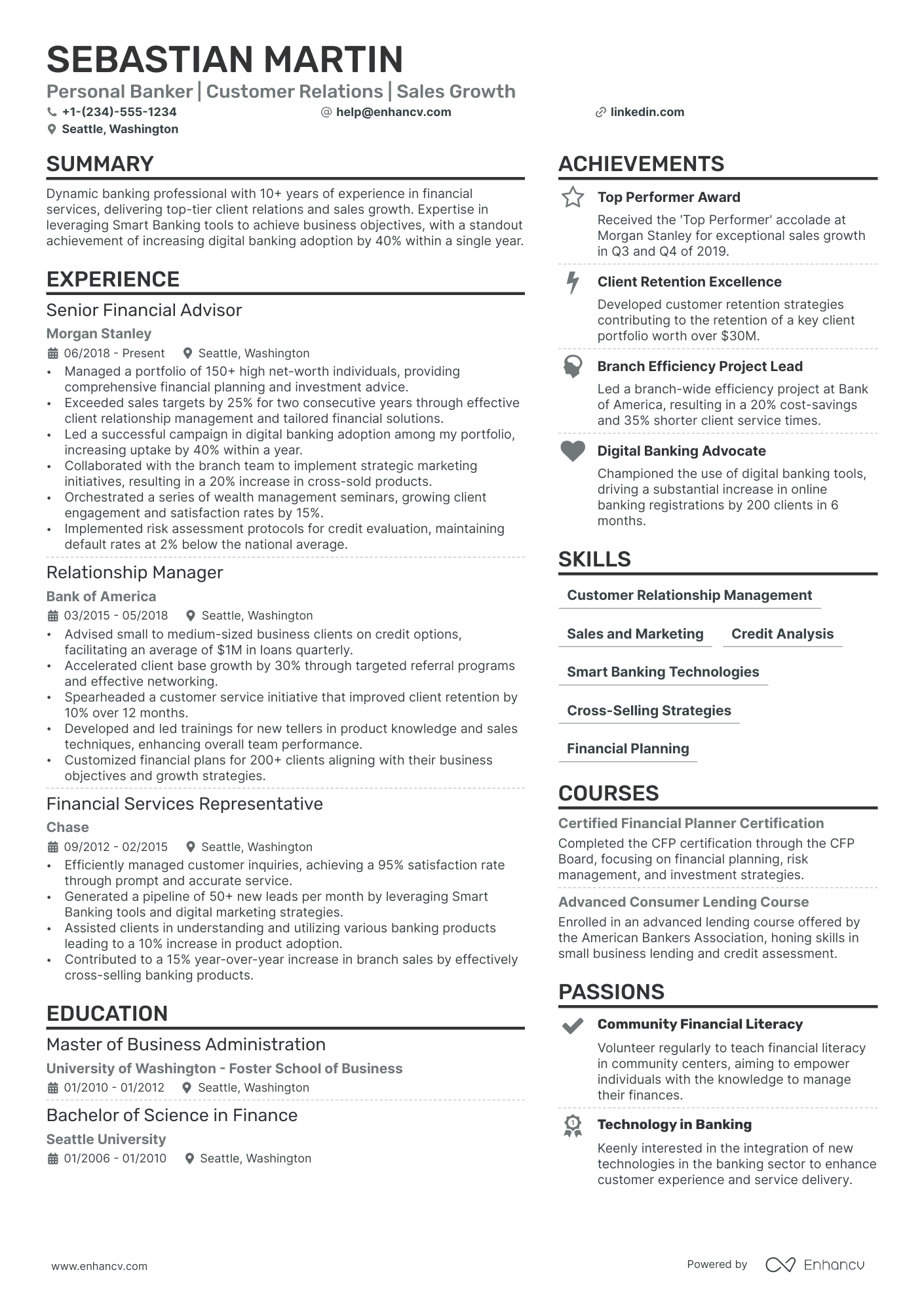

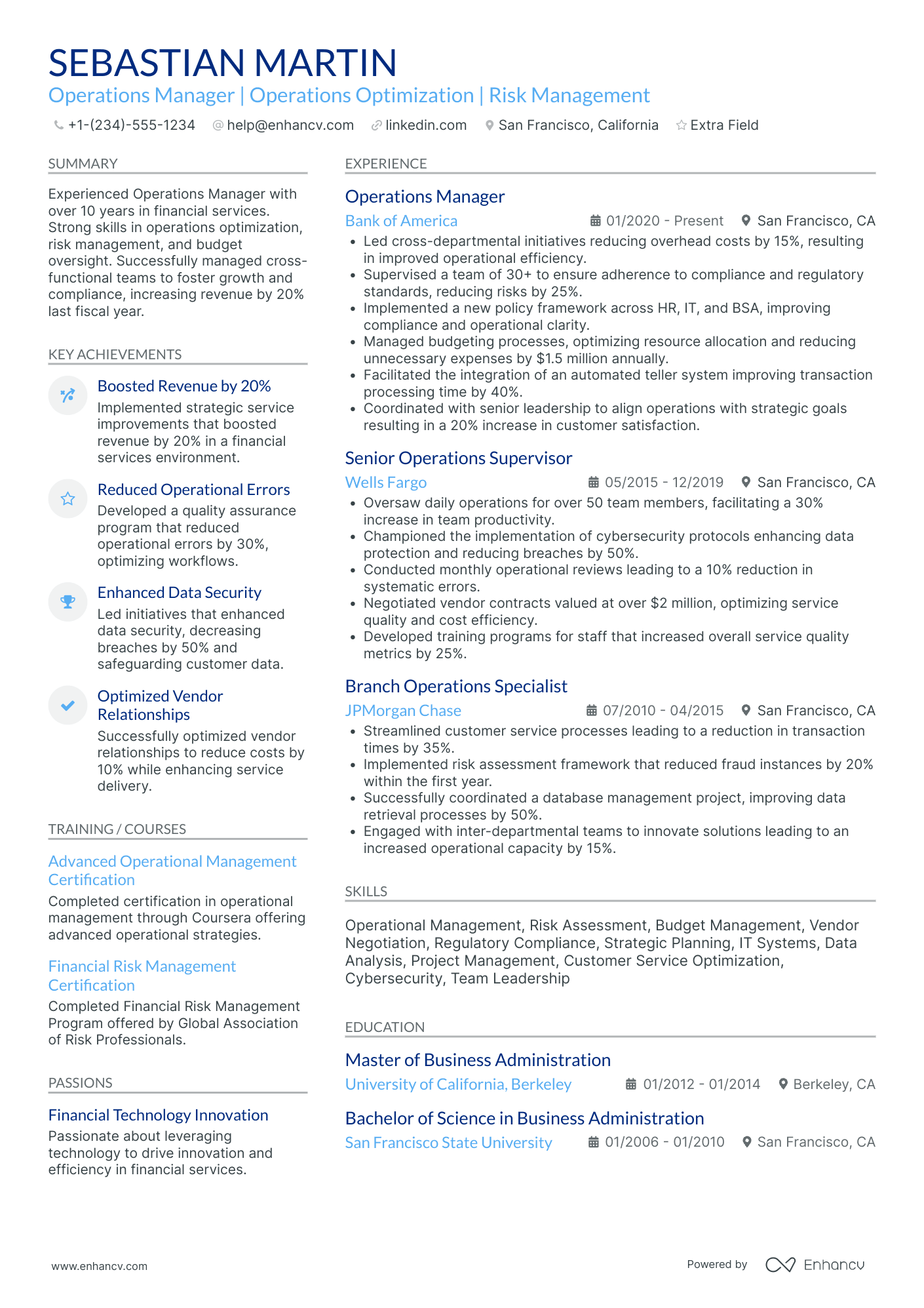

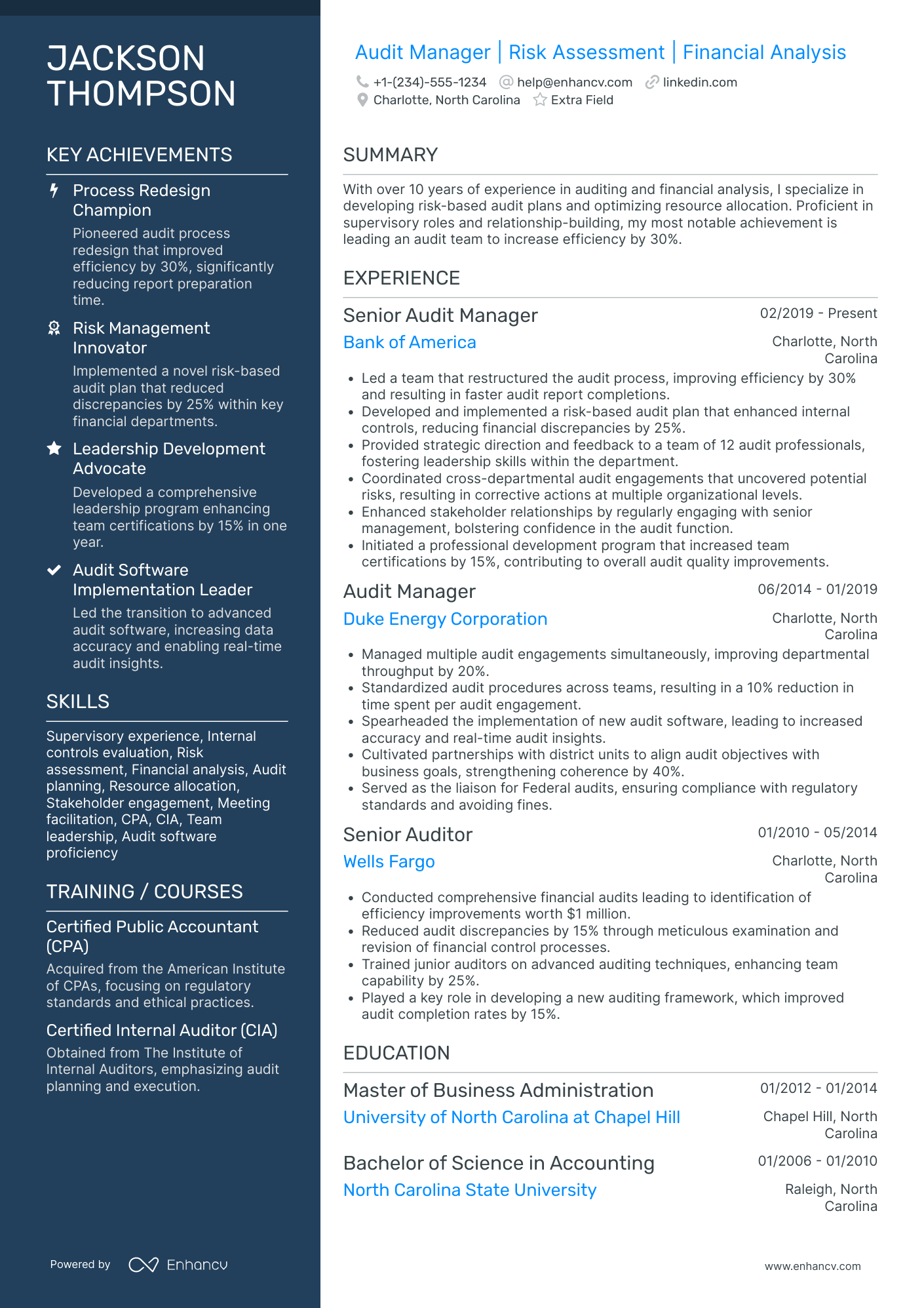

Bank Manager resume examples

By Experience

Assistant Bank Manager

Senior Bank Manager

Associate Bank Manager

By Role

Bank Branch Manager

Bank Branch Manager positions have strong roots in financial planning and customer service, which is why trends in these domains influence bank management trends globally.

When applying for Bank Branch Manager jobs in the banking industry, keep these points at the forefront:

- Competency in branch operations management is crucial. Delivery channel management, security & compliance, audit & budgeting are some practices you could have dealt with.

- Ensure to include relevant experience in these operations and your skills in the management area, or your application might get overlooked.

- Highlight financial planning expertise affecting the branch's success. Many successful Bank Branch Managers have well-rounded financial backgrounds. Feature your economic skills and how they have impacted the branch's financial health on your resume.

- Don’t simply list your finance skills. Illustrate how they contributed to the growth of the branch and its operations, e.g., 'improved bank's profitability by....', 'increased customer deposits after....' and so on. Stick to the 'skill-action-results' formula.