Understanding and communicating the complex risk landscape associated with cyber vulnerabilities is an increasingly daunting challenge for risk managers. Our guide offers you clear strategies and actionable insights to effectively evaluate and mitigate these cyber risks, ensuring your organisation remains resilient against digital threats.

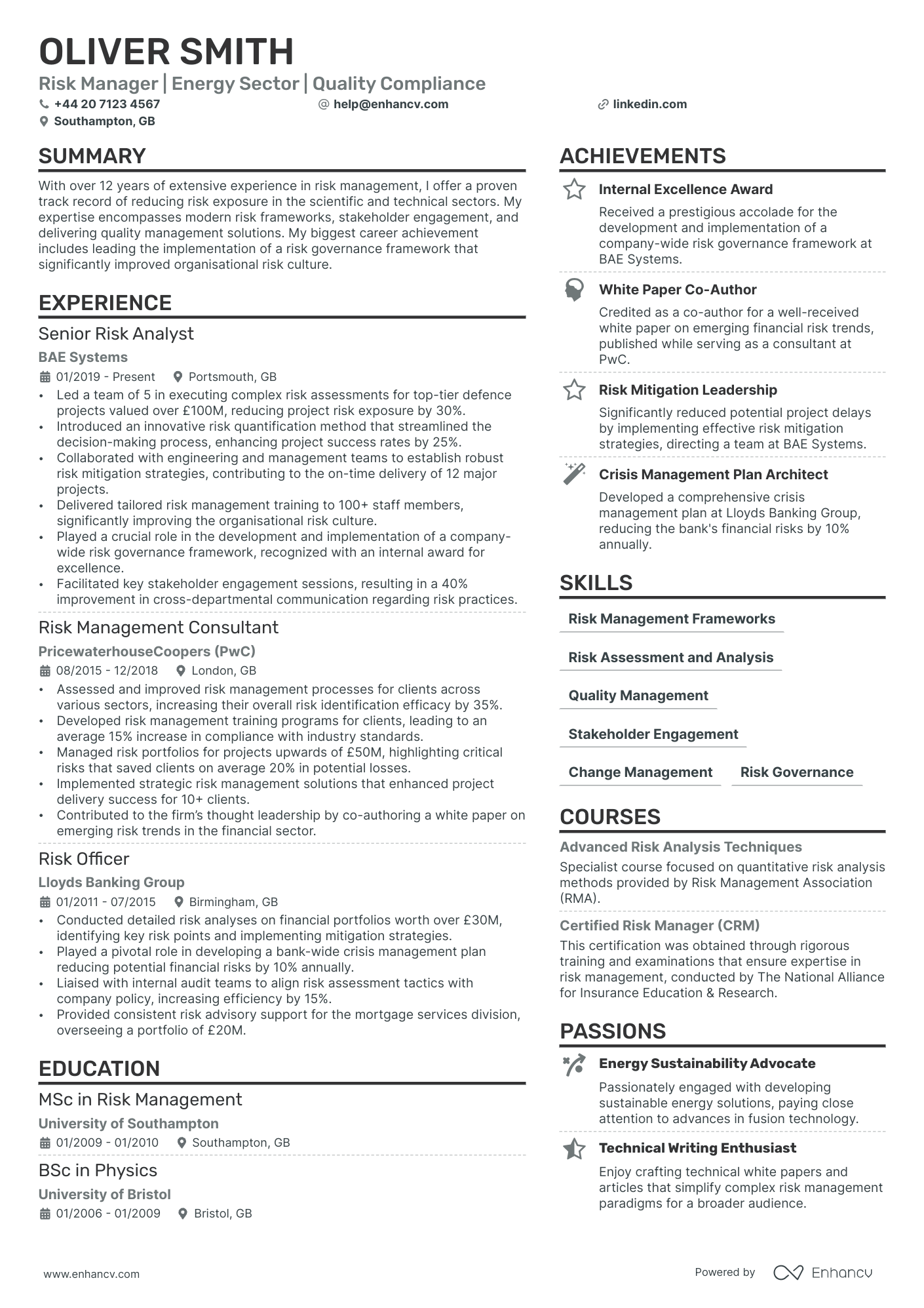

- Create an attention-grabbing header that integrates keywords and includes all vital information;

- Add strong action verbs and skills in your experience section, and get inspired by real-world professionals;

- List your education and relevant certification to fill in the gaps in your career history;

- Integrate both hard and soft skills all through your CV.

Discover more industry-specific guides to help you apply for any role in the links below:

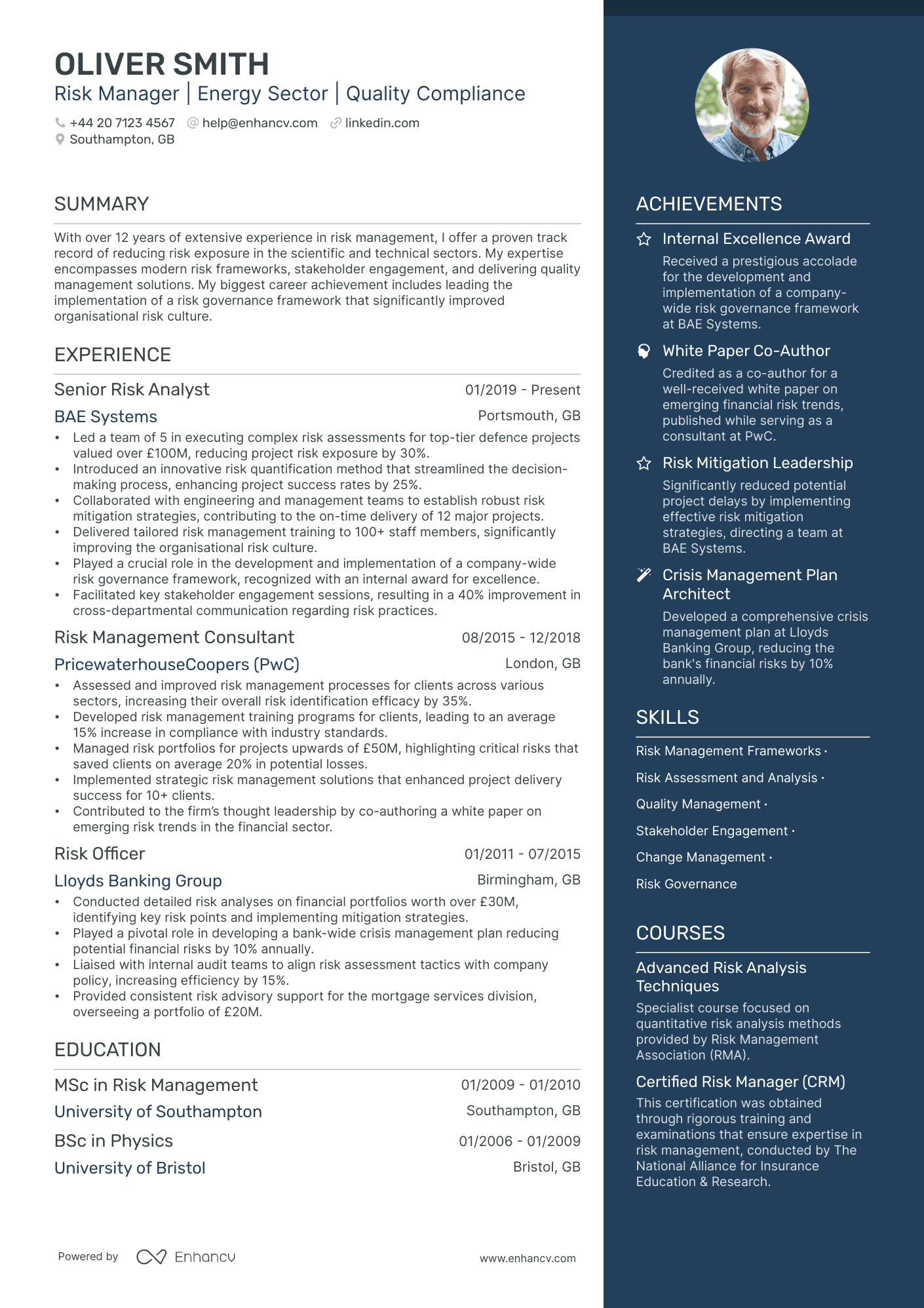

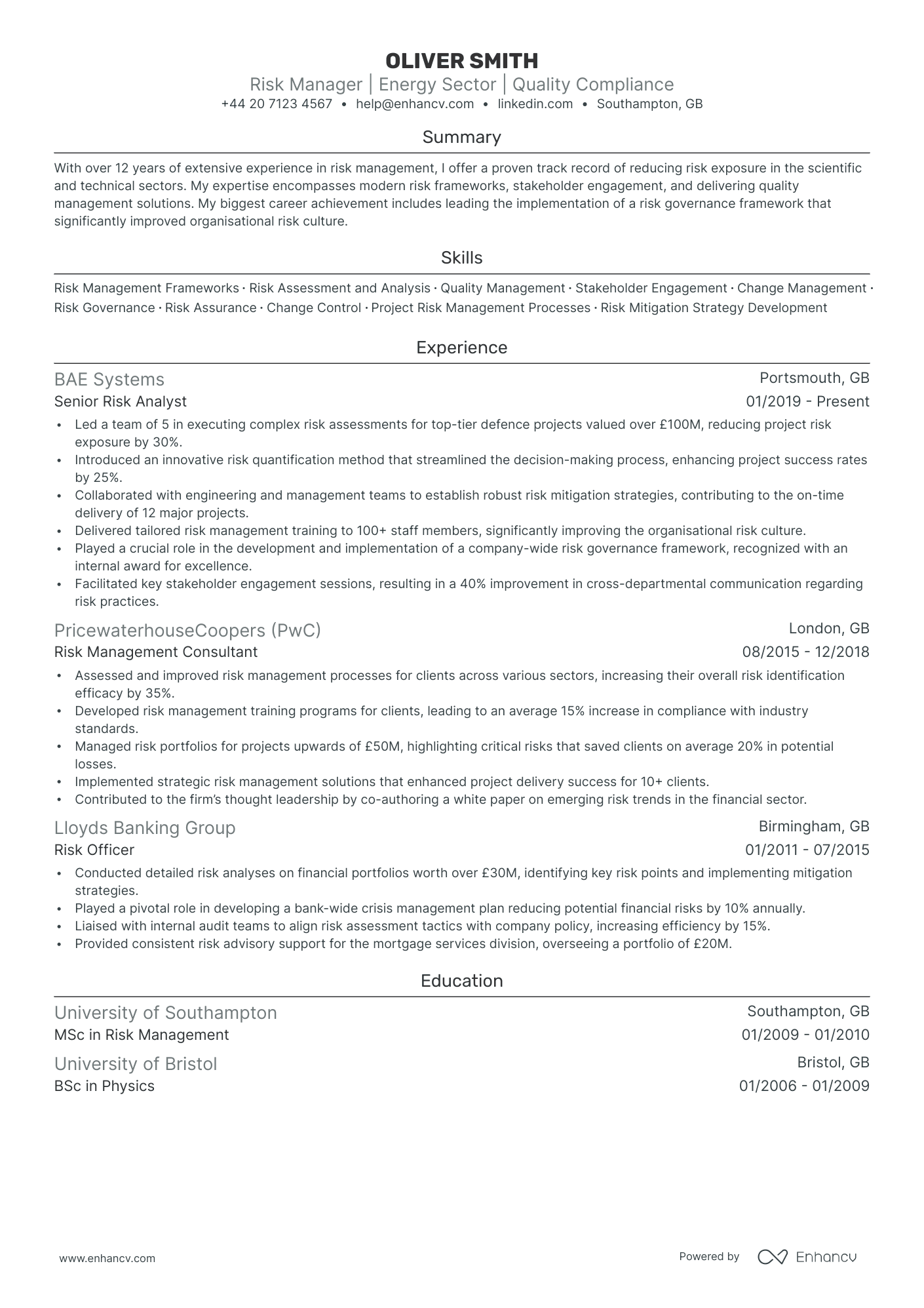

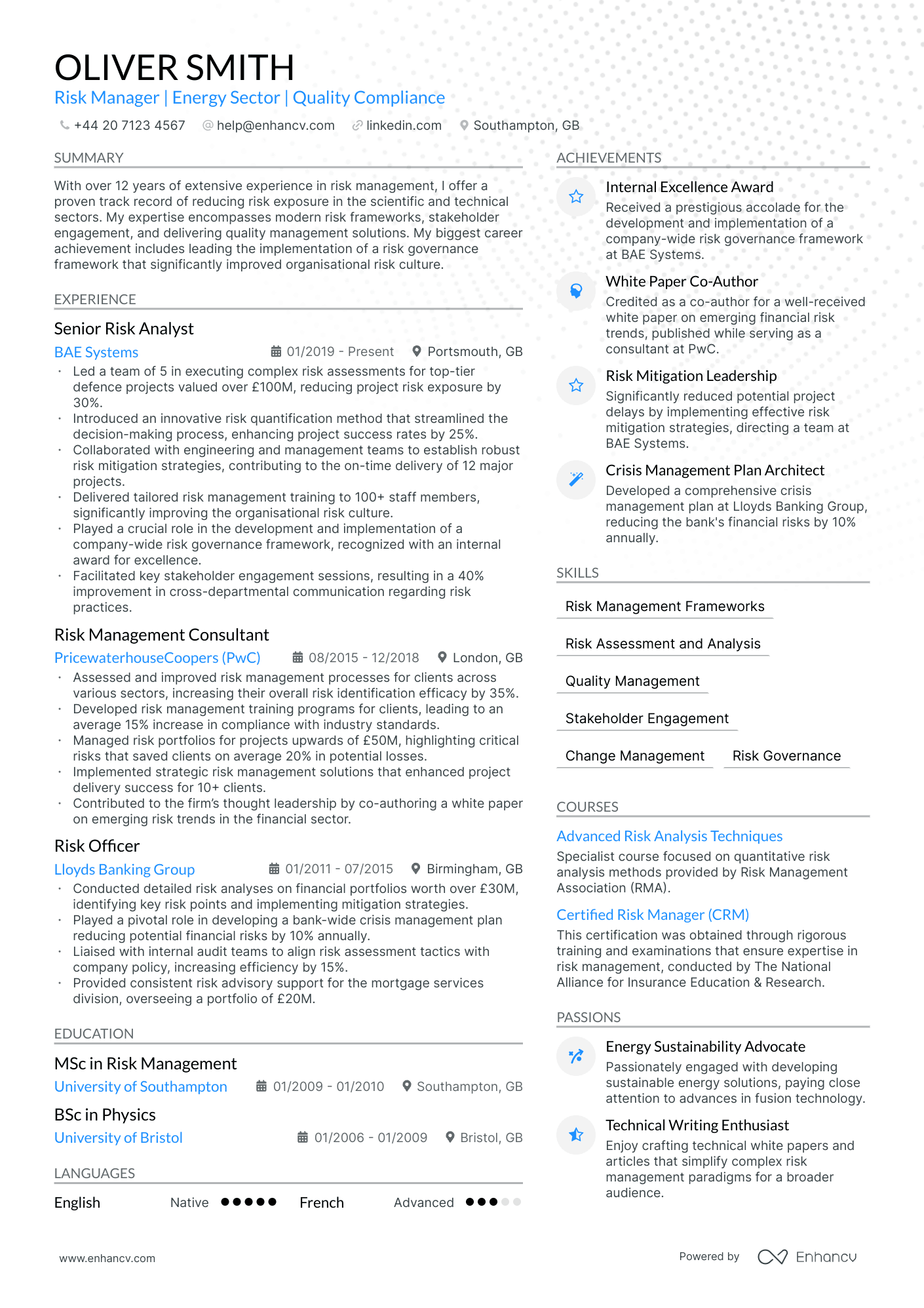

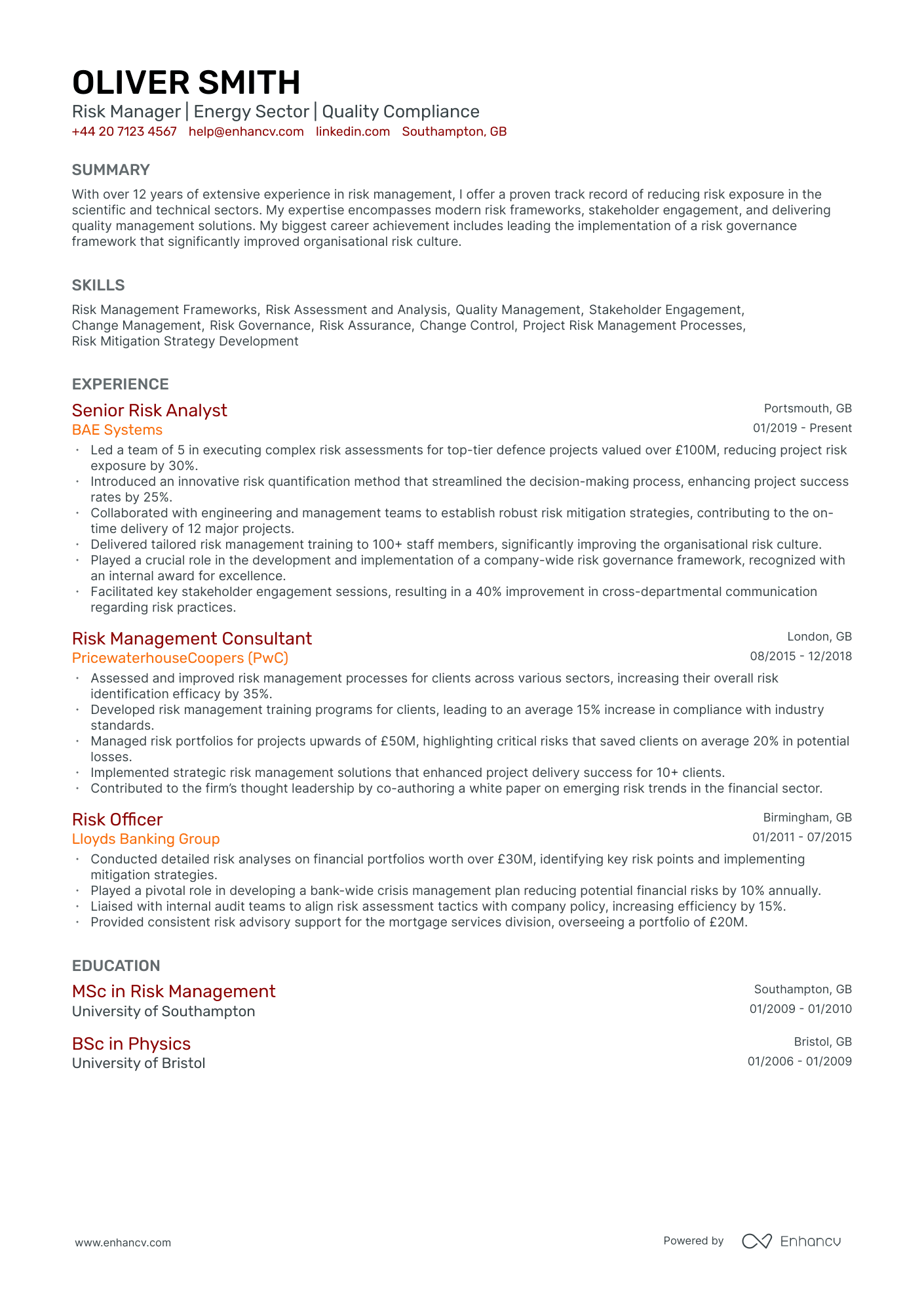

Structuring and formatting your risk manager CV for an excellent first impression

The experts' best advice regarding your CV format is to keep it simple and concise. Recruiters assessing your CV are foremost looking out for candidates who match their ideal job profile. Your white space, borders, and margins. You may still be wondering which format you need to export your CV in. We recommend using the PDF one, as, upon being uploaded, it never alters your information or CV design. Before we move on to the actual content of your risk manager CV, we'd like to remind you about the Applicant Tracker System (or the ATS). The ATS is a software that is sometimes used to initially assess your profile. Here's what you need to keep in mind about the ATS:- All serif and sans-serif fonts (e.g. Rubik, Volkhov, Exo 2 etc.) are ATS-friendly;

- Many candidates invest in Arial and Times New Roman, so avoid these fonts if you want your application to stand out;

- Both single and double column CVs can be read by the ATS, so it's entirely up to you to select your CV design.

PRO TIP

Be mindful of white space; too much can make the CV look sparse, too little can make it look cluttered. Strive for a balance that makes the document easy on the eyes.

The top sections on a risk manager CV

- Risk Management Experience to demonstrate hands-on skills and accomplishments in risk assessment and mitigation.

- Professional Qualifications showing relevant certifications like CRISC, FRM or IRM that establish industry competence.

- Key Risk Management Skills to highlight specific abilities such as quantitative analysis or regulatory compliance expertise.

- Education and Training section to establish foundational knowledge and ongoing learning in finance or risk-related fields.

- Relevant Achievements to showcase concrete results and recognitions received for effective risk management.

What recruiters value on your CV:

- Highlight your expertise in statistical analysis and risk assessment methodologies, illustrating your proficiency in predictive modelling and risk quantification that are essential for a Risk Manager.

- Emphasise your experience with regulatory frameworks and compliance requirements, as Risk Managers need to ensure that the company adheres to legal and industry-specific standards.

- Detail your past success in developing and implementing risk management policies and procedures, as this shows your ability to proactively manage risks and protect organisational interests.

- Include any relevant certifications such as Certified Risk Manager (CRM) or Financial Risk Manager (FRM), which demonstrate your dedication to the field and your specialised knowledge in risk management.

- Showcase your leadership and communication skills by mentioning projects where you led teams and worked across departments to address risk-related issues, indicating your capacity to influence and guide others.

Recommended reads:

Making a good first impression with your risk manager CV header

Your typical CV header consists of Your typical CV header consists of contact details and a headline. Make sure to list your professional phone number, email address, and a link to your professional portfolio (or, alternatively, your LinkedIn profile). When writing your CV headline , ensure it's:

- tailored to the job you're applying for;

- highlights your unique value as a professional;

- concise, yet matches relevant job ad keywords.

You can, for examples, list your current job title or a particular skill as part of your headline. Now, if you decide on including your photo in your CV header, ensure it's a professional one, rather than one from your graduation or night out. You may happen to have plenty more questions on how to make best the use of your CV headline. We'll help you with some real-world examples, below.

Examples of good CV headlines for risk manager:

- Risk Manager | Financial Risk Assessment Expert | FRM Certified | 10+ Years of Strategic Management

- Senior Risk Analyst | Cybersecurity Focus | CRISC Credential | Industry Regulations Specialist | 15 Years' Experience

- Enterprise Risk Consultant | Project Risk Management | MBA | 8 Years in Strategic Risk Planning

- Operational Risk Officer | Internal Control Systems | CERA Holder | Compliance Expertise | 12-Year Track Record

- Credit Risk Supervisor | Quantitative Analysis Pro | Chartered Financial Analyst | 6+ Years in Banking Sector

- Chief Risk Strategist | Market Risk Insight | FSA Accredited | Corporate Governance | 20 Years of Leadership

Opting between a risk manager CV summary or objective

Within the top one third of your risk manager CV, you have the opportunity to briefly summarise your best achievements or present your professional goals and dreams. Those two functions are met by either the CV summary or the objective.

- The summary is three-to-five sentences long and should narrate your best successes, while answering key requirements for the role. Select up to three skills which you can feature in your summary. Always aim to present what the actual outcomes were of using your particular skill set. The summary is an excellent choice for more experienced professionals.

- The objective is more focused on showcasing your unique value as a candidate and defining your dreams and ambitions. Think about highlighting how this current opportunity would answer your career vision. Also, about how you could help your potential employers grow. The objective matches the needs of less experienced candidates, who need to prove their skill set and, in particular, their soft skills.

Still not sure about how to write your CV opening statement? Use some best industry examples as inspiration:

CV summaries for a risk manager job:

- With over a decade of robust experience in financial risk management for top-tier banks in London, renowned for deploying predictive analytics to mitigate threats, I've delivered a 20% reduction in risk-related losses annually through strategic policy enhancements and team leadership.

- Accomplished IT security expert transitioning to financial risk management, bringing a 15-year portfolio of implementing resilient cyber-security frameworks and leveraging deep analytical expertise to fortify financial infrastructures against emergent digital risks.

- As a seasoned environmental consultant pivoting to risk management, I leverage my 8-year track record of designing and executing comprehensive risk assessments for multinational corporations to ensure sustainable, compliant operational strategies in the financial sector.

- Embarking on a risk management career with a strong foundation in statistical analysis and a Master's degree in Financial Engineering, I am eager to apply quantitative skills to model and predict risk scenarios, aiming to safeguard corporate assets and enhance decision-making processes.

- Keen to develop into an astute risk manager by capitalizing on my analytic acumen and extensive background in economics, my objective is to devise and implement cutting-edge risk assessment methodologies that bolster financial stability and influence critical business decisions.

How to meet job requirements with your risk manager CV experience

We've now reached the essence of your actual CV - your experience section. This is the space where you can list your career roles and on-the-job successes. Many candidates tend to underestimate just how much time and effort they should put into writing this CV section. Your experience shouldn't be a random list of your responsibilities, but instead:

- Match the job description with your skills, values, and accomplishments;

- Start each bullet with a strong action verb, followed up with one key skill and your outcome of applying this skill;

- Spotlight parts of your career history that are relevant to the job you're applying for.

Before we move on, make sure to check out some professional CV experience sections.

Best practices for your CV's work experience section

- Designed and implemented comprehensive risk management policies, procedures, and risk assessment programs, ensuring alignment with the company’s strategic objectives and regulatory requirements.

- Managed the identification, analysis, and evaluation of risks across all business areas, resulting in a 30% reduction in unforeseen financial losses over two years.

- Led cross-functional teams to conduct thorough risk assessments for new products and services, enhancing the company’s risk profile and competitive position in the market.

- Developed and executed risk mitigation strategies and contingency plans, effectively minimising the impact of potential threats on business continuity and reputation.

- Presented clear and concise risk reports to senior management and the board, providing actionable insights that informed critical decision-making processes.

- Played a pivotal role in crisis management by responding rapidly to emerging risks and leading recovery efforts after adverse events, mitigating both operational and reputational damage.

- Liaised with insurance companies to negotiate optimal coverage for various organisational risks, achieving a 20% cost-saving while improving the scope of protection.

- Trained and mentored junior risk analysts and team members, fostering a culture of risk awareness and promoting best practices throughout the organisation.

- Stayed abreast of industry trends and regulatory changes, ensuring the company’s risk management strategies remain proactive and compliant with evolving standards.

- Spearheaded the development of a comprehensive risk management strategy, which reduced operational risk by 30% through enhanced analytical models and risk assessment procedures.

- Coordinated with cross-functional teams to integrate risk management practices into the broader organisational framework and ensured compliance with regulatory standards, notably FCA requirements.

- Piloted a risk management training program that increased risk awareness among staff by 45% and significantly improved the company’s overall risk culture.

- Developed and oversaw the implementation of enterprise-wide risk analysis tools, achieving a 20% improvement in risk detection and mitigation effectiveness.

- Negotiated with third-party insurance providers to obtain better coverage terms, resulting in cost savings of £200,000 per year.

- Directed the company's response to internal risk events, significantly limiting both financial impact and reputational damage.

- Revamped the company’s risk assessment program, leading to a 25% improvement in the identification of industry-specific risks.

- Designed and implemented a sophisticated risk reporting system that was pivotal in strategic decision-making and protected against market volatility.

- Played a key role in establishing a risk committee, creating a structured approach to monitoring financial, strategic, and operational risks.

- Implemented a new risk matrix model, enhancing the accuracy of credit risk forecasting by 40%.

- Orchestrated a technology upgrade for risk analytics platforms, streamlining risk data processing and improving report generation time by 30%.

- Conceived and launched a dynamic risk monitoring program that delivered real-time risk insights, enabling proactive management of emerging risks.

- Directed the integration of a cybersecurity risk management framework that reduced the incidence of security breaches by 50%.

- Collaborated with international subsidiaries to create a unified risk assessment methodology, boosting the global consistency of risk management practices.

- Led a task force to mitigate risks associated with regulatory changes post-Brexit, safeguarding the company from potential non-compliance fines.

- Established a quantitative risk analysis department, enabling the incorporation of advanced statistical models in risk evaluation processes.

- Cultivated a risk management partnership program with key vendors, reducing supply chain risks by 35% and fostering stronger business continuity planning.

- Supervised regulatory compliance initiatives that maintained adherence to new EU data protection laws, significantly averting the potential for costly non-compliance issues.

- Initiated the transition towards an integrated risk framework, which combined credit, market, and operational risk monitoring, leading to enhanced risk visibility across the firm.

- Facilitated the adoption of risk-based pricing models, contributing to a 15% increase in profit margins by aligning pricing strategies with risk assessments.

- Collaborated with IT departments to incorporate artificial intelligence in risk detection systems, cutting down on false positives by 60%.

- Developed a corporate governance risk compliance framework which reduced legal infractions by 20% within the first year of implementation.

- Authored a risk reporting methodology that became adopted company-wide, enhancing the transparency of risk information communicated to stakeholders.

- Led the initiative for stress testing financial models in the wake of economic uncertainty, which bolstered the firm's resilience to market shocks.

What to add in your risk manager CV experience section with no professional experience

If you don't have the standard nine-to-five professional experience, yet are still keen on applying for the job, here's what you can do:

- List any internships, part-time roles, volunteer experience, or basically any work you've done that meets the job requirements and is in the same industry;

- Showcase any project you've done in your free time (even if you completed them with family and friends) that will hint at your experience and skill set;

- Replace the standard, CV experience section with a strengths or achievements one. This will help you spotlight your transferrable skills that apply to the role.

Recommended reads:

PRO TIP

Describe how each job helped you grow or learn something new, showing a continuous development path in your career.

The CV skills' divide: between hard and soft skills

Of course, you may have read the job requirements plenty of times now, but it's key to note that there is a difference between technical and personal skills. Both are equally relevant to your job application. When writing about your skill set, ensure you've copy-pasted the precise skill from the job requirement. This would not only help you ensure you have the correct spelling, but also pass any Applicant Tracker System (ATS) assessments.

- Hard skills show your technological capabilities. Or whether you'll be a good technical fit to the organisation. Ensure you've spotlighted your hard skills in various sections of your CV (e.g. skills section, projects, experience) by including the technology and what you've attained;

- Soft skills pinpoint your personality and people or communication skills, hinting at if you'll easily accomodate into the team or organisation. Quantify your soft skills in your CV achievements, strengths, summary/objective, and experience sections. Always support your soft skills with how they've helped you grow as a professional.

Top skills for your risk manager CV:

Risk Assessment

Financial Analysis

Regulatory Compliance

Quantitative Analysis

Data Analysis

Risk Modelling

Project Management

Auditing

Business Continuity Planning

Enterprise Risk Management

Problem Solving

Communication

Leadership

Strategic Thinking

Attention to Detail

Decision Making

Adaptability

Negotiation

Teamwork

Crisis Management

PRO TIP

If there's a noticeable gap in your skillset for the role you're applying for, mention any steps you're taking to acquire these skills, such as online courses or self-study.

Listing your university education and certificates on your risk manager CV

The best proof of your technical capabilities would be your education and certifications sections. Your education should list all of your relevant university degrees, followed up by their start and completion dates. Make sure to also include the name of the university/-ies you graduated from. If you happen to have less professional experience (or you deem it would be impressive and relevant to your application), spotlight in the education section:

- that you were awarded a "First" degree;

- industry-specific coursework and projects;

- extracurricular clubs, societies, and activities.

When selecting your certificates, first ask yourself how applicable they'd be to the role. Ater your initial assessment, write the certificate and institution name. Don't miss out on including the completion date. In the below panel, we've curated relevant examples of industry-leading certificates.

PRO TIP

If you have received professional endorsements or recommendations for certain skills, especially on platforms like LinkedIn, mention these to add credibility.

Recommended reads:

Key takeaways

Write your professional risk manager CV by studying and understanding what the role expectations are. You should next:

- Focus on tailoring your content to answer specific requirements by integrating advert keywords through various CV sections;

- Balance your technical know-how with your personal skills to showcase what the unique value would be of working with you;

- Ensure your CV grammar and spelling (especially of your key information and contact details) is correct;

- Write a CV summary, if your experience is relevant, and an objective, if your career ambitions are more impressive;

- Use active language by including strong, action verbs across your experience, summary/objective, achievements sections.