Ensuring that your CV stands out in the competitive private equity sector can be a daunting task, given the high calibre of candidates vying for limited positions. By utilising our guide, you'll receive tailored advice on how to enhance your CV's appeal, ensuring your skills and experience are presented in the most compelling way to potential employers.

- Create an attention-grabbing header that integrates keywords and includes all vital information;

- Add strong action verbs and skills in your experience section, and get inspired by real-world professionals;

- List your education and relevant certification to fill in the gaps in your career history;

- Integrate both hard and soft skills all through your CV.

Discover more industry-specific guides to help you apply for any role in the links below:

Resume examples for private equity

By Experience

Junior Private Equity Analyst

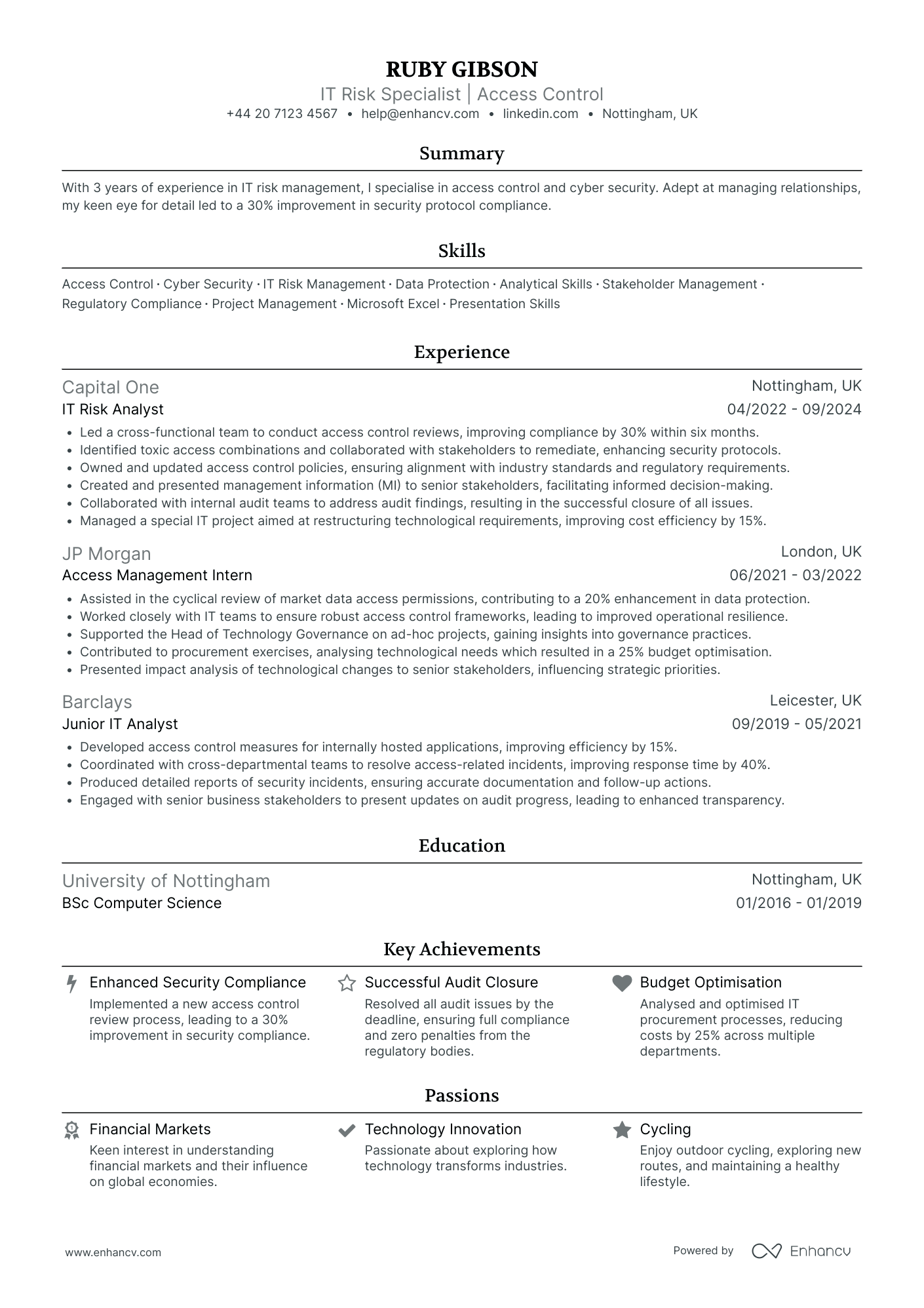

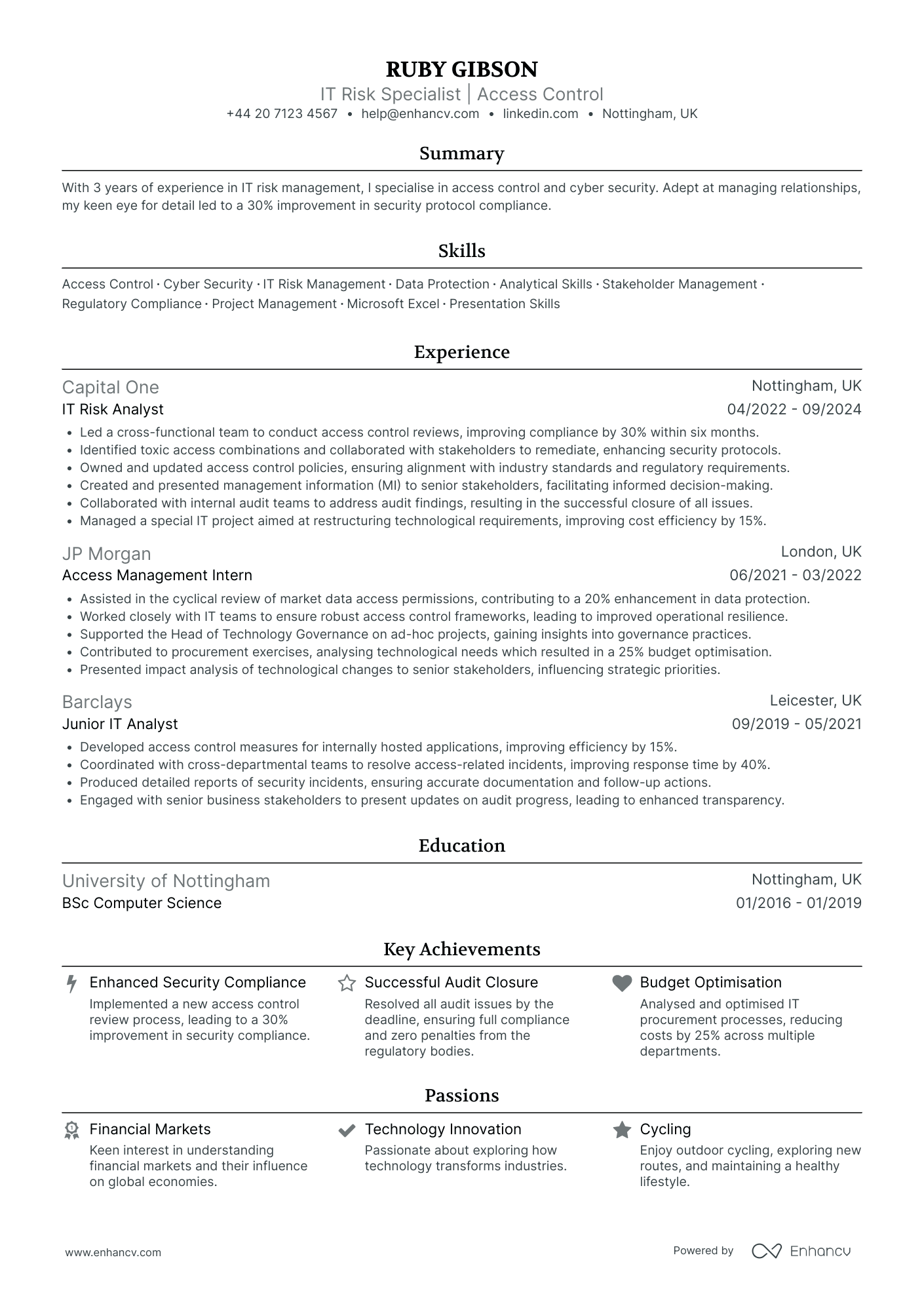

- Strong Emphasis on Security Accomplishments - Ruby's CV is distinct in its focus on quantifiable security improvements within her roles. With multiple references to percentage gains in compliance, cost efficiency, and data protection, it effectively communicates the tangible benefits she brought to her previous employers.

- Comprehensive Career Progression - The CV outlines a well-structured career trajectory in IT risk management and access control, demonstrating a steady rise from a Junior IT Analyst at Barclays to an IT Risk Analyst at Capital One. This progression reflects her growing expertise and leadership in the field, underscored by her promotions and expanded responsibilities.

- Adaptability and Cross-Functional Experience - The document highlights Ruby's adaptability by detailing her successful collaborations with various stakeholders, including internal audit, IT teams, and senior management. Her ability to manage cross-functional projects and contribute to strategic decision-making showcases her versatile and dynamic skill set.

Senior Private Equity Analyst

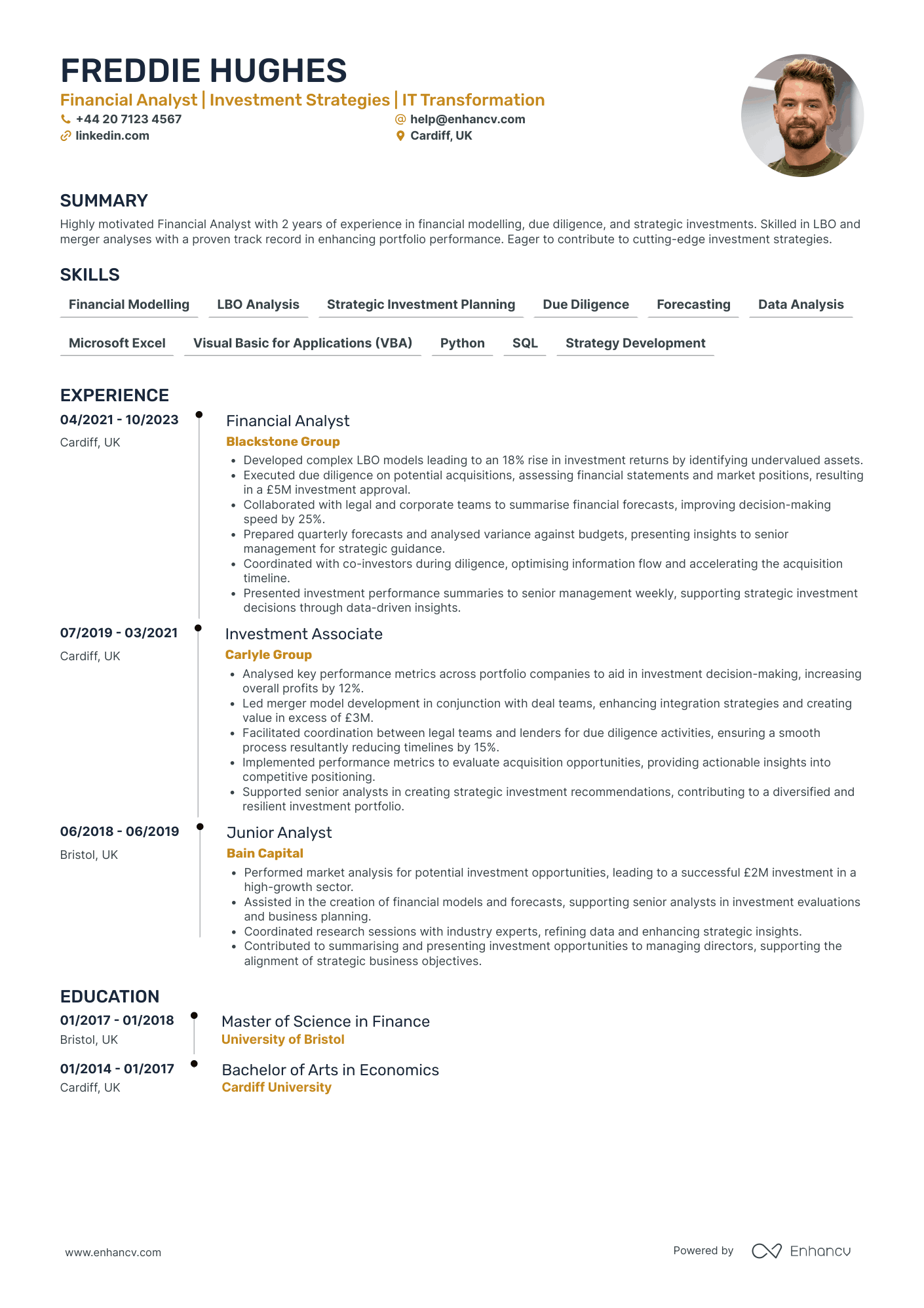

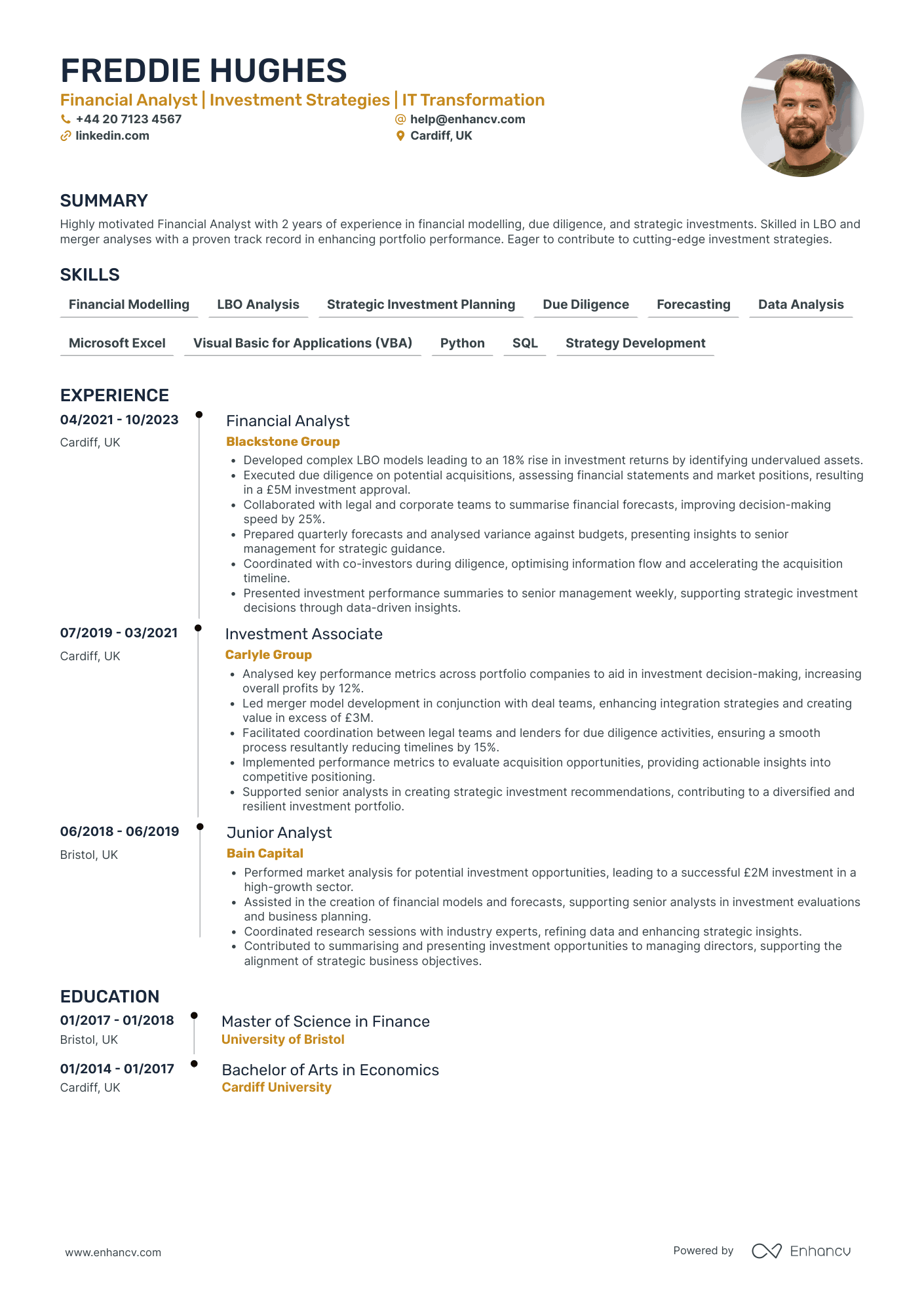

- Strategic Career Growth - Freddie Hughes' career trajectory showcases a steady ascension from a Junior Analyst to a Financial Analyst, indicating a strong capacity for professional development and increasing responsibility. This progression from Bain Capital to Blackstone Group through Carlyle Group demonstrates adaptability and enhances credibility in high-pressure financial environments.

- Technical Proficiency in Financial Analysis - The CV emphasizes an impressive arsenal of financial tools and methodologies, including LBO analyses and proficiency in Python and SQL, which are critical for developing complex financial models and executing precise market analyses. Hughes' technical depth in these areas adds significant value to his profile as a Financial Analyst.

- Impactful Achievements with Business Relevance - Freddie's accomplishments clearly show a pattern of delivering business-relevant impact, such as enhancing investment returns by 18% and facilitating value creation in mergers exceeding £3M. These quantifiable results underline his ability to leverage financial acumen to drive positive economic outcomes within organizations.

By Role

Private Equity Associate

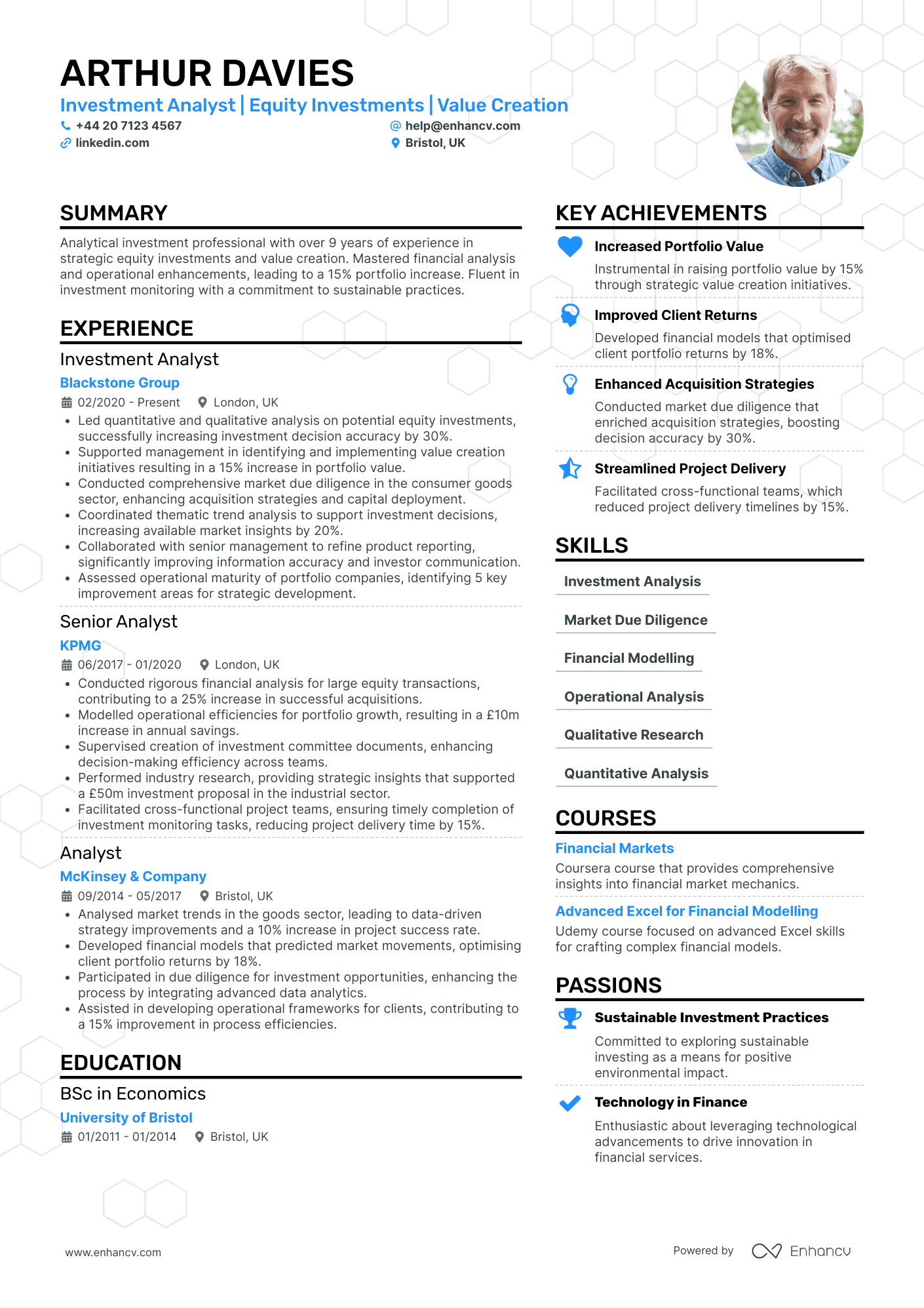

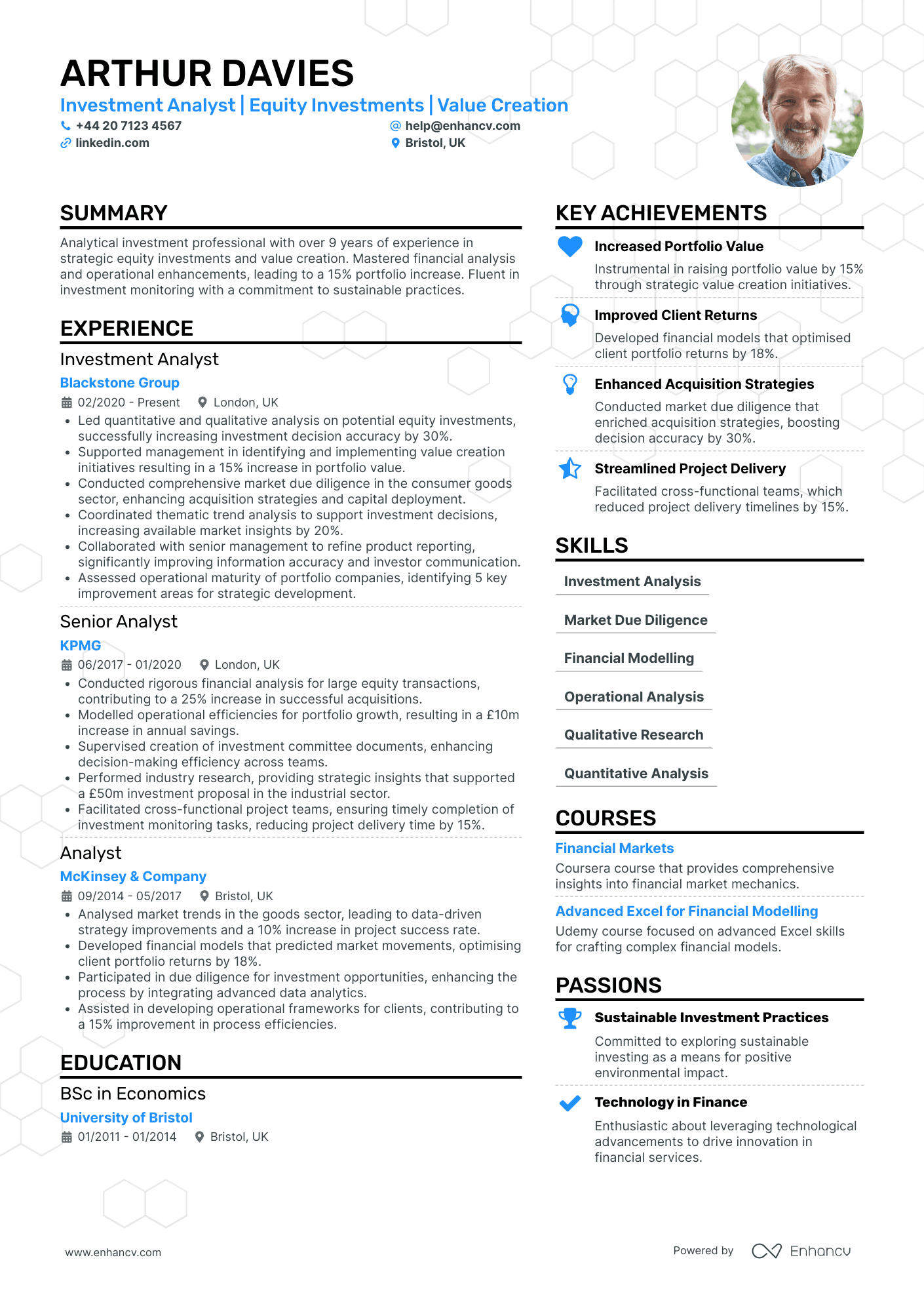

- Content presentation - The CV is presented with clarity and structured in a way that allows quick absorption of key data points. It concisely organizes information into sections, making it easy to navigate while providing a comprehensive view of skills, experience, and achievements relevant to the role of an Investment Analyst.

- Career trajectory - Arthur Davies' career exhibits a clear growth pattern, moving from an Analyst position at McKinsey & Company to a Senior Analyst at KPMG, and finally achieving the role of Investment Analyst at Blackstone Group. This trajectory showcases his ability to adapt and thrive within top-tier firms while advancing his expertise in equity investments and value creation.

- Achievements and their business relevance - The CV highlights significant achievements such as a 15% increase in portfolio value and an 18% improvement in client portfolio returns. These accomplishments go beyond mere numbers, illustrating the candidate's ability to implement strategic initiatives that yield substantial business impact in equity investments.

Private Equity Vice President

- Clear career progression with major financial institutions - Isla King's CV illustrates a solid career trajectory, moving from an Investment Analyst role at Carlyle Group to a Senior Product Specialist position at Blackstone Group. This progression highlights her growing responsibilities and increasing influence on capital formation strategies, signifying a deepening expertise in private markets fundraising.

- Emphasis on impact through quantifiable achievements - The CV effectively employs specific figures to demonstrate impact, such as leading campaigns that exceeded fundraising targets by 30% and securing over £1.3 billion in investments. Such metrics underscore Isla's ability to deliver substantial financial outcomes, reinforcing her proficiency and leadership in investor relations.

- Strong interdisciplinary collaboration skills - A key highlight is her capacity to work across different functional teams, such as legal, compliance, and analytics, to ensure seamless fund structuring and management. This adaptability and cross-functional experience are crucial in navigating the complexities of capital markets and enhancing client and investor relations.

Private Equity Investment Director

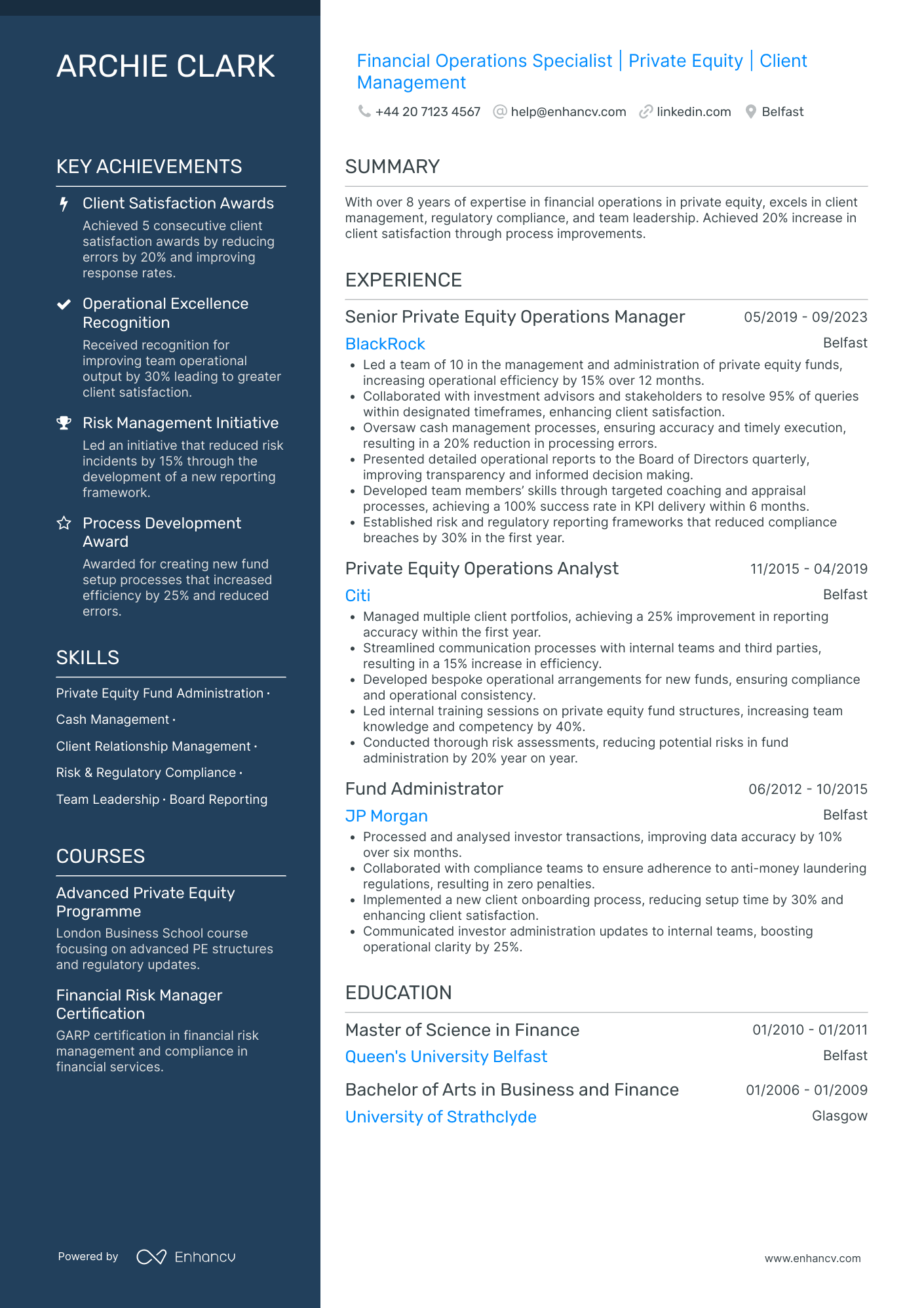

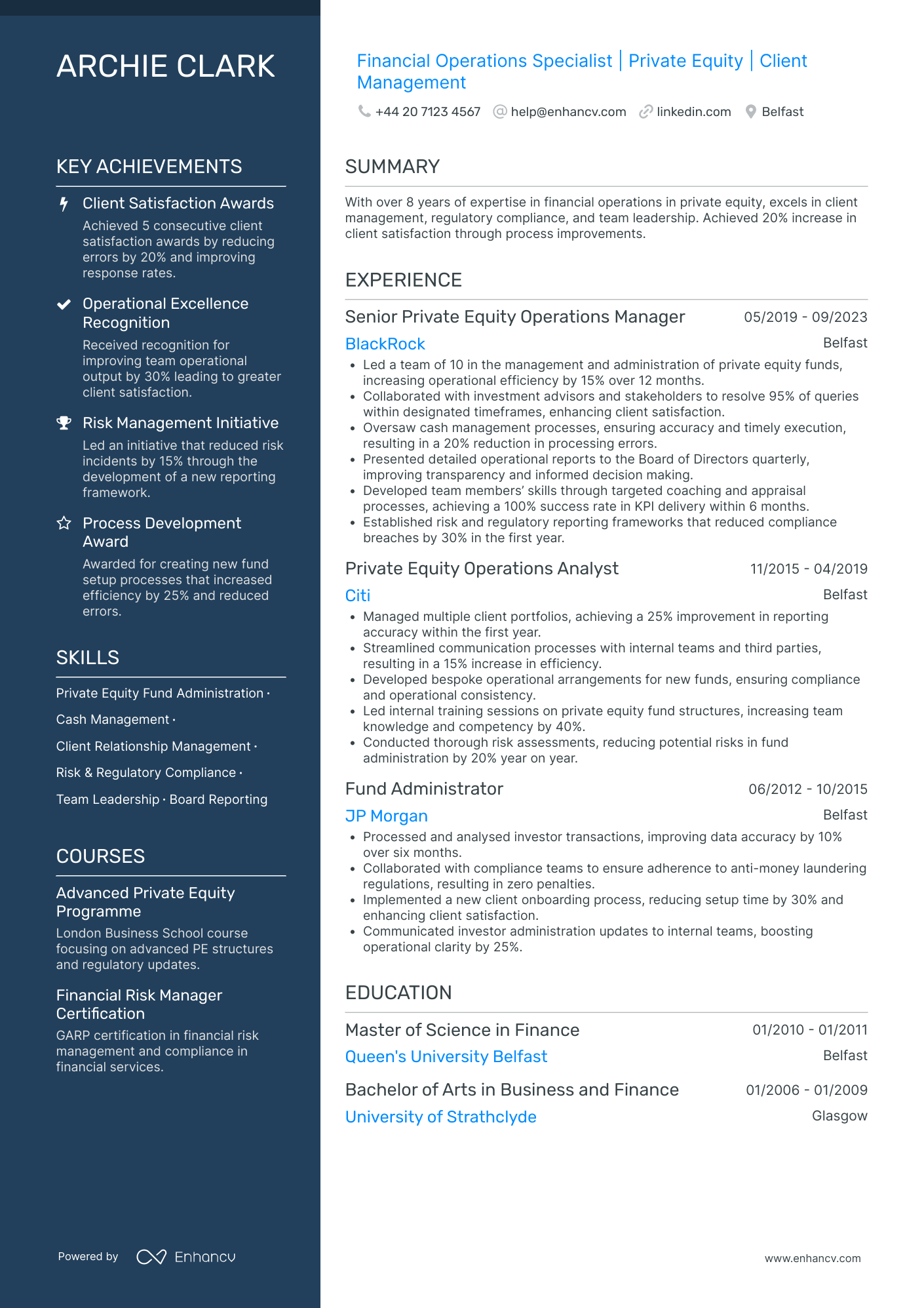

- Structured and Detailed Presentation - The CV is well-organized, with clearly defined sections and bullet points that concisely highlight key responsibilities and achievements. The use of metrics throughout provides clarity and quantifiable evidence of the candidate's capabilities in financial operations.

- Progressive Career Trajectory - Archie's career reflects significant growth and increasing responsibilities, transitioning from a Fund Administrator to a Senior Private Equity Operations Manager at reputable firms. This upward trajectory underscores their expanding expertise and leadership abilities in the financial sector.

- Emphasis on Regulatory Compliance and Risk Management - The CV distinctively showcases industry-specific strengths, including regulatory compliance and risk management initiatives. The candidate’s ability to establish frameworks that significantly reduce compliance breaches and risk incidents demonstrates a deep understanding of critical financial operation elements.

Private Equity Healthcare Specialist

- Comprehensive structure and clarity - This CV is notable for its well-organized layout that makes it easy to navigate. Each section is clearly delineated with headings, effectively guiding the reader through the candidate's education, experience, skills, and accomplishments, which aids in quick comprehension of their qualifications and career journey.

- Demonstrated career growth and industry relevance - Florence Knight's career trajectory showcases progressive responsibility, moving from a Clinical Research Assistant to a Clinical Laboratory Specialist. This progression highlights her growing expertise in laboratory management and procedural training, underscoring an upward career movement relevant to healthcare and clinical education industries.

- Emphasis on leadership and impact - The CV emphasizes Florence's leadership qualities and her ability to drive significant improvements, such as a 40% reduction in training time and a 30% increase in laboratory efficiency. Her proactive initiatives, like the waste reduction program, demonstrate an ability to lead sustainable practices and contribute positively to organizational goals.

Private Equity Real Estate Manager

- Clear and Structured Content Presentation - The CV stands out due to its clear structure and concise presentation. Each section is logically organized, beginning with a succinct summary and flowing through professional experiences, which are neatly divided by roles and companies for quick comprehension. The use of bullet points ensures that key achievements and responsibilities are easily identifiable, contributing to a smooth reading experience.

- Diverse and Progressive Career Trajectory - Oscar Evans has a consistent and upward career trajectory marked by increasing responsibilities and roles in renowned firms such as Deloitte, PwC, and KPMG. The progression from M&A Analyst to Corporate Finance Manager demonstrates professional growth and increased expertise in corporate finance and M&A, highlighting a clear path of career advancement and specialization in the industry.

- Emphasis on Measurable Achievements and Business Impact - The CV effectively communicates the candidate's impact through quantifiable achievements that detail both the financial magnitude and strategic importance to business outcomes. For instance, closed deals and executed strategies are not only reflected in figures but also in the strategic benefits they brought, such as improving market share by 15% and enhancing client portfolios, which underscores both financial acumen and strategic advisory skills.

Private Equity Operations Analyst

- Clarity and Organization - The CV is well-structured with distinct sections that clearly outline the candidate's qualifications, experience, and skills. This allows for easy navigation and ensures that the most critical details are readily accessible, reflecting the candidate’s methodical and organized approach to investments operations.

- Progressive Career Growth - Henry White's career trajectory showcases a steady progression through increasingly responsible roles. Starting from an Operations Analyst at Lloyds Banking Group and advancing to an Investments Operations Manager at HSBC Private Bank, this evolution demonstrates his ability to take on more complex and demanding responsibilities.

- Impactful Achievements - The CV emphasizes the candidate's ability to generate substantial business impact, such as a 30% increase in operational efficiency and a 25% rise in client satisfaction ratings. These achievements underscore the candidate’s effectiveness in translating strategic initiatives into tangible outcomes that benefit the organization.

Private Equity Research Associate

- Clear and Structured Presentation - The CV is laid out in a logical and concise manner, making it easy to navigate and digest. The use of bullet points for experience and achievements provides clarity and highlights key contributions without overwhelming the reader with excess information.

- Diverse Career Trajectory - Louis’s career path demonstrates significant growth and versatility. Transitioning from data analysis at Capgemini to a financial analyst role at Barclays, and eventually becoming a software sales specialist at Oracle, showcases a trajectory of increasing responsibility and industry shifts that broaden their expertise.

- Impactful Achievements - The CV emphasizes achievements with business relevance, such as a 30% increase in sales and a 40% improvement in analysis speed. These figures not only highlight Louis's ability to exceed targets but also underline the positive impact on organizational success and efficiency.

Private Equity Fund Accountant

- Strategically structured career progression - The CV outlines a clear trajectory of growth, showcasing Alice's advancement from an Assistant Fund Accountant to a Senior Fund Accountant at prestigious firms like Goldman Sachs. This upward movement indicates her ability to assume greater responsibilities and adapt to the complex demands of the financial sector.

- Integration of advanced financial tools - The CV highlights Alice's use of sophisticated Excel models and her effectiveness in NAV calculations, demonstrating her technical expertise essential for a fund accountant. Her proficiency in these tools not only showcases her ability to handle complex financial data but also her contribution to increasing efficiency and accuracy in financial reporting.

- Emphasis on collaborative leadership - Alice's role in leading a team to streamline hedge fund accounting processes, as well as her ability to partner with client relationship managers, underlines her leadership and collaborative skills. These descriptions emphasize her effectiveness in managing teams and her proactive approach in fostering productive partnerships to enhance client satisfaction and business outcomes.

Private Equity Compliance Officer

- Structured and Methodical Presentation - The CV is organized with precision, using headers and bullet points to present information clearly and concisely. This structured approach ensures that the reader can efficiently identify key aspects of the candidate’s career and competencies, demonstrating the candidate’s attention to detail and clarity in communication.

- Demonstrated Career Growth and Specialization - Elsie's career trajectory shows a clear advancement from a Compliance Analyst to a Compliance Specialist, reflecting her growth in expertise and responsibility within financial services. This upward movement is indicative of her evolving capabilities in an increasingly specialized domain, showing a strong commitment to her career advancement in regulatory compliance and risk management.

- Significant Industry-Specific Accomplishments - The CV highlights Elsie’s proficiency with regulatory compliance tools and frameworks such as SM&CR, MCOB, and CONC. These industry-specific elements underline her technical depth and demonstrate her familiarity with the regulatory landscape, critical for effectiveness in her role as a Compliance Specialist.

Private Equity Legal Counsel

- Strategic presentation of roles and responsibilities - The CV meticulously outlines each position held, providing clear and concise bullet points that emphasize key responsibilities and accomplishments. This structured format enhances readability and allows the reader to quickly grasp the candidate's expertise in legal counsel and private equity fund structuring.

- Career growth with a strong industry focus - Ethan Palmer's career trajectory showcases a clear progression from Associate to Senior Associate, and subsequently to Legal Counsel, reflecting notable advancement within prestigious firms. His dedication to the private equity sector is evidenced by his consistent career choices, demonstrating a deepening expertise and commitment to his field.

- Impactful achievements with quantifiable results - The CV highlights Ethan's ability to deliver substantial business impact, such as leading legal workstreams for private equity fund launches that collectively raised over £300M and improving investor returns by 15% through tax-efficient structures. These achievements underscore his capability to drive significant outcomes and enhance investor satisfaction and retention.

Private Equity Business Development Manager

- Comprehensive career trajectory and industry focus - Charlotte Powell's CV showcases a steady advancement through roles in prominent companies like BAE Systems and Rolls-Royce Marine. The progression from Account Manager to Business Development Manager highlights a strategic career path focused on maritime systems, underscoring her commitment to and expertise in the industry.

- Robust achievements emphasizing business impact - Beyond merely presenting numbers, the CV highlights impactful outcomes such as achieving a 35% increase in revenue and a 40% improvement in conversion rates. These accomplishments demonstrate Charlotte's ability to implement effective strategies that resonate with business goals, driving significant growth and client retention.

- Effective use of technical tools and methodologies - The CV uniquely emphasizes Charlotte's command of industry-specific tools like Microsoft Dynamics CRM and methodologies like strategic market analysis. Her ability to leverage these tools for enhancing forecasting accuracy and product positioning further distinguishes her as a technically adept leader in maritime business development.

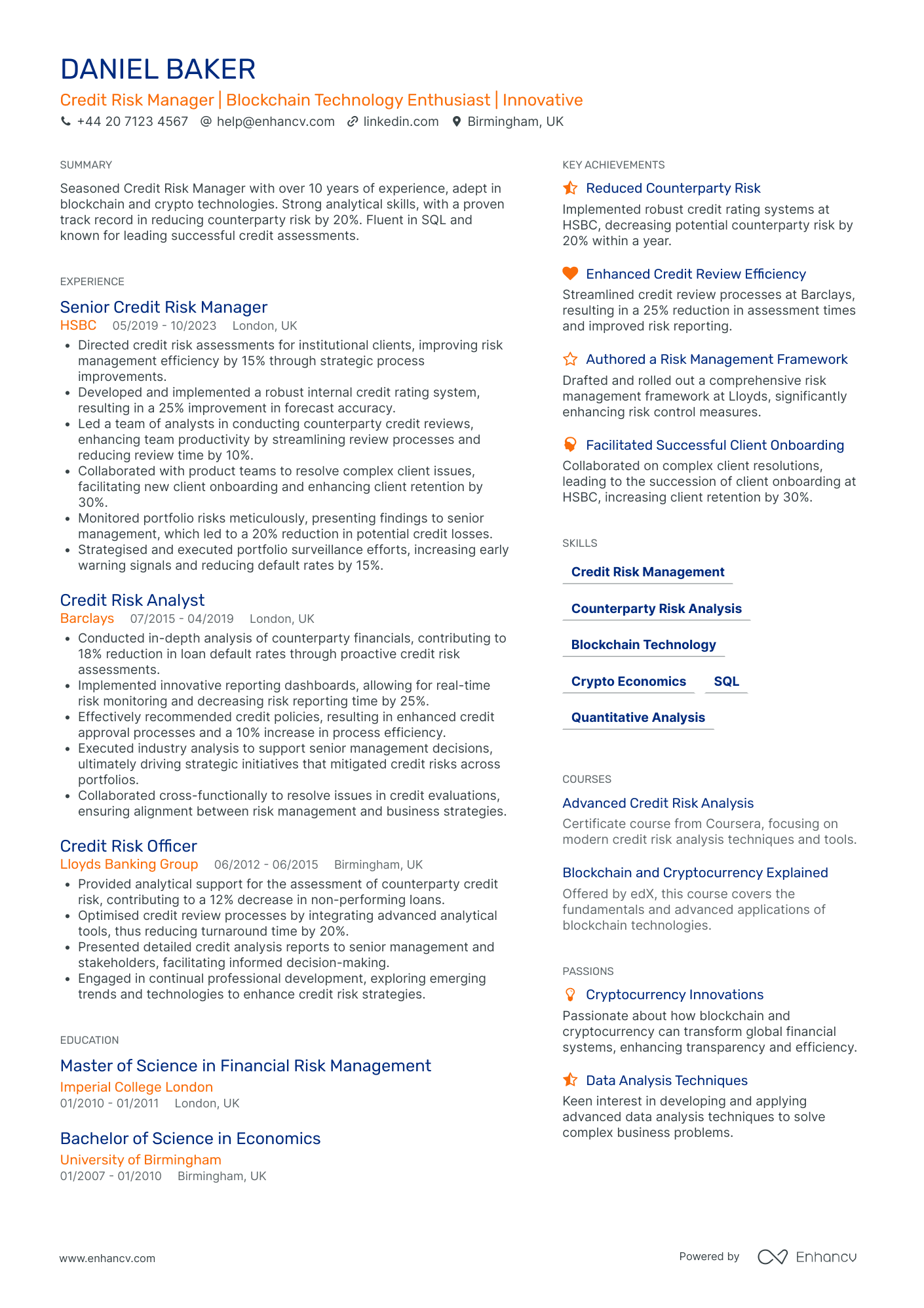

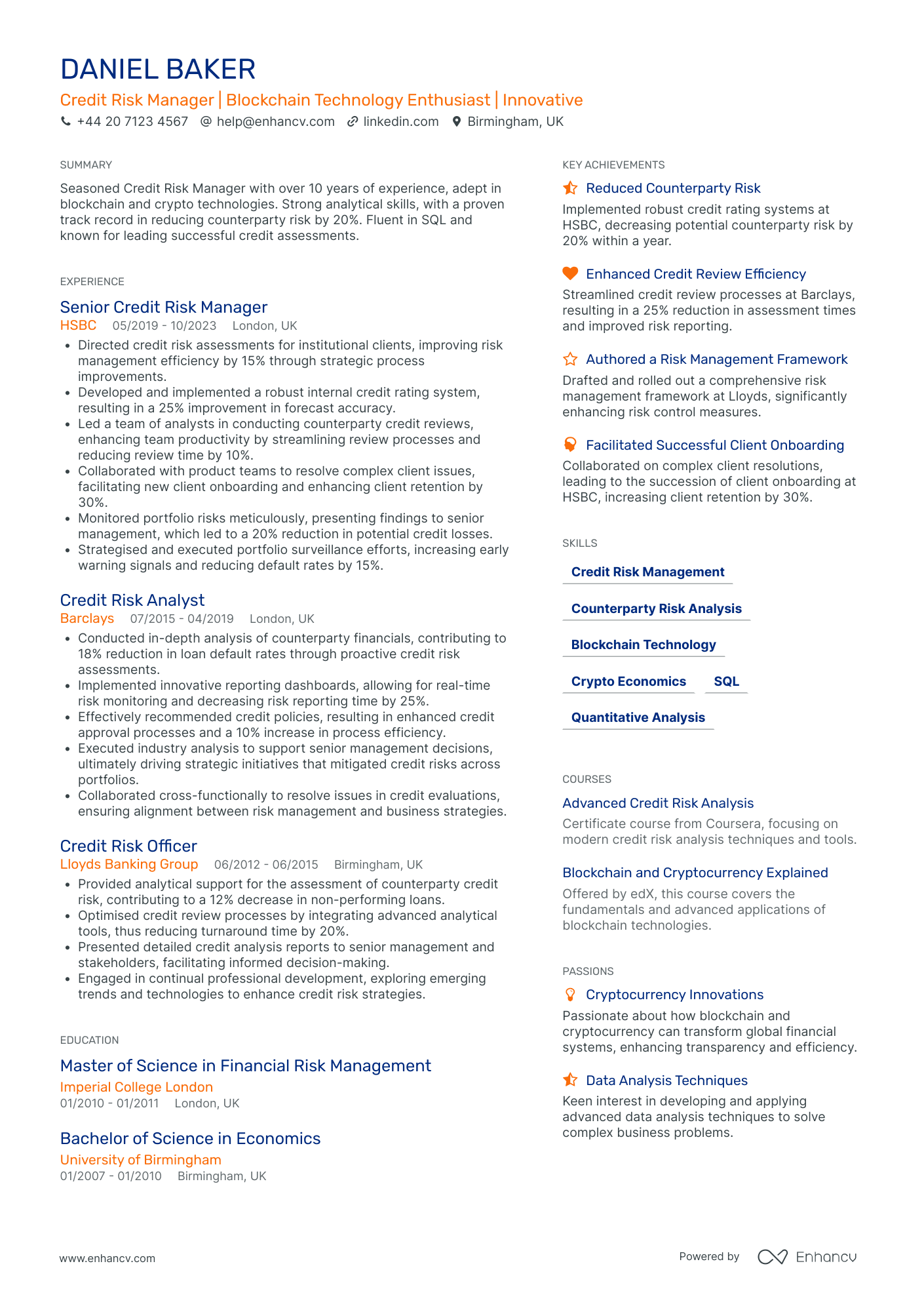

Private Equity Risk Manager

- Strategic Career Growth - Daniel's career trajectory exhibits a clear path of upward mobility, moving from a Credit Risk Officer to Senior Credit Risk Manager at top financial institutions. He has consistently earned promotions, demonstrating his ability to take on more complex responsibilities in credit risk management.

- Impressive Technical Proficiency - The CV highlights Daniel's expertise in utilizing advanced tools and methodologies such as SQL and financial modeling, crucial in the financial industry. His focus on blockchain technology and crypto economics adds a unique layer to his profile, reflecting his capacity to innovate and adapt to industry changes.

- Quantifiable Business Impact - Daniel's achievements are presented with specific, measurable results that emphasize his impact on business outcomes. Reduction in counterparty risk by 20% and enhancing client retention by 30% at HSBC are just a couple of examples that underline his strategic influence in risk management and client relations.

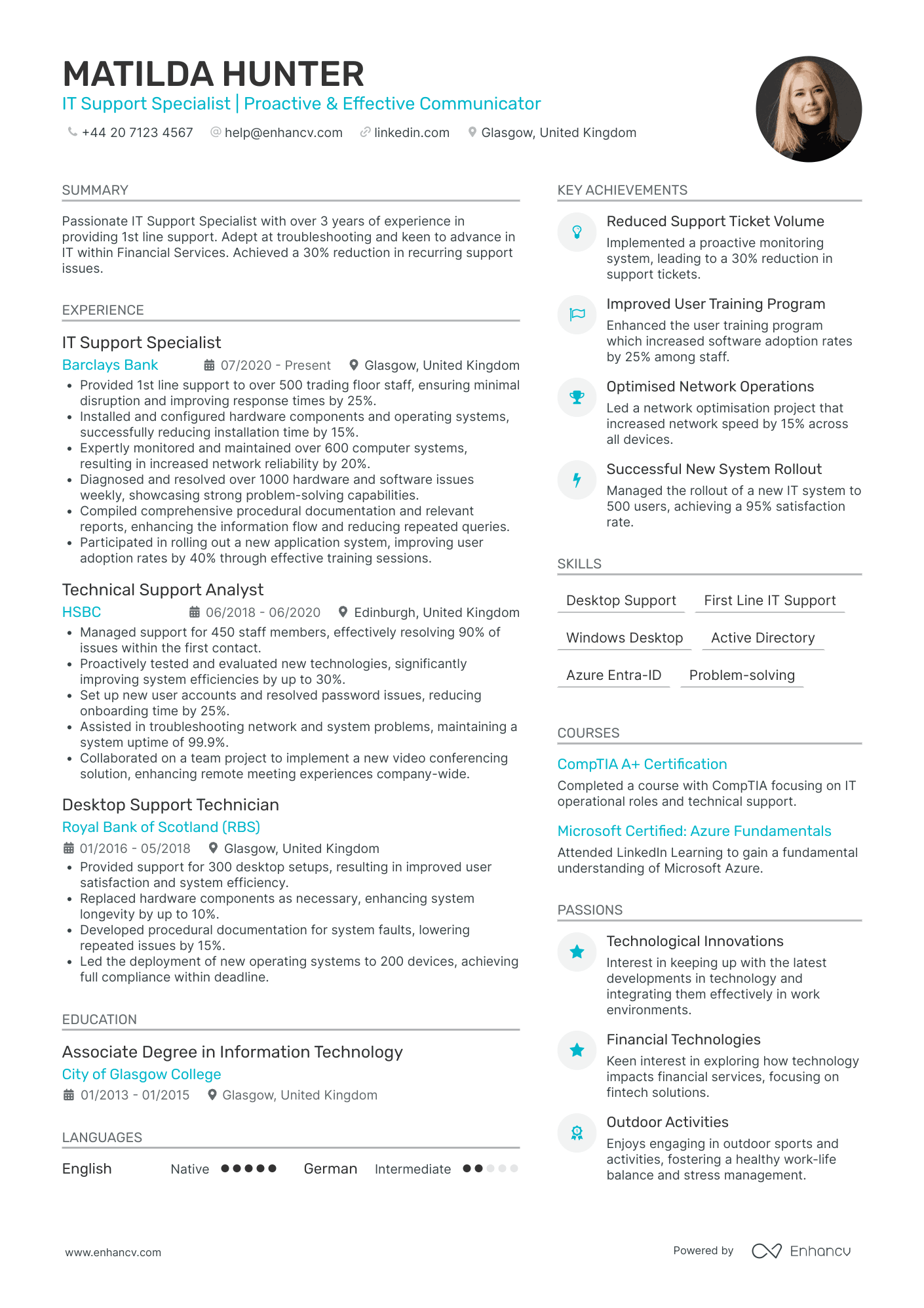

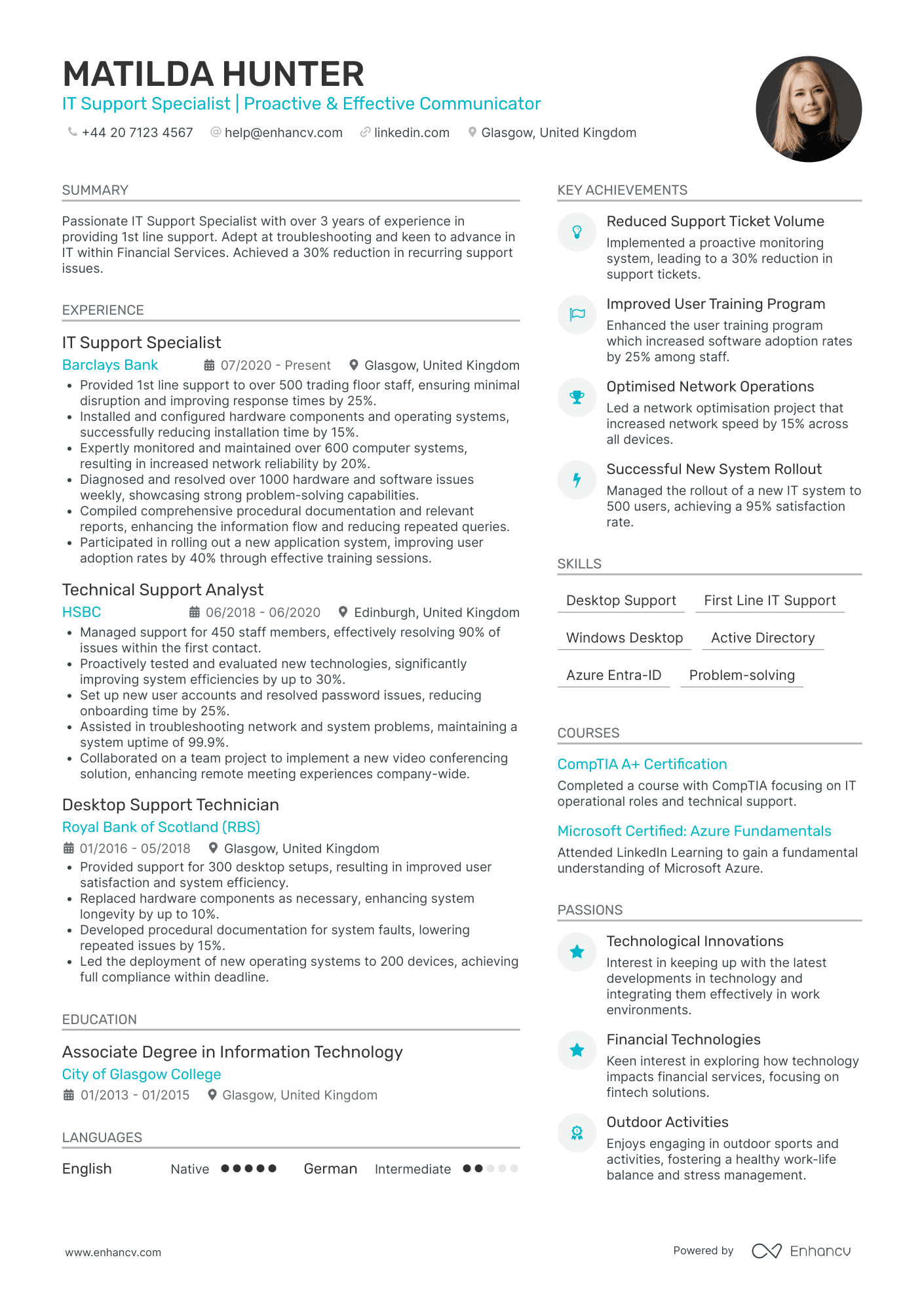

Private Equity IT Specialist

- Clarity and Structure in Presentation - Matilda Hunter's CV stands out due to its clear and structured presentation, making it easy for recruiters to follow her professional journey. Each section is clearly delineated, with well-organized bullet points that highlight key responsibilities and achievements concisely, allowing quick assessment of her qualifications and impact.

- Demonstrated Career Growth in IT Support - The career trajectory displayed in the CV effectively portrays Matilda's progression within the IT support realm, illustrating her rise from a Desktop Support Technician to an IT Support Specialist at prestigious financial institutions. This progression underscores her ability to adapt and excel in increasingly challenging roles, reinforcing her capability to handle elevated responsibilities.

- Technical Proficiency and Industry-Specific Tools - Matilda’s profound technical depth is highlighted by her proficiency in industry-specific tools and methodologies such as Active Directory, Azure, VMware, and Cisco Networking. Her diverse skill set, supported by certifications like CompTIA A+ and Microsoft Azure Fundamentals, underscores her thorough understanding of essential IT infrastructure in the financial services sector.

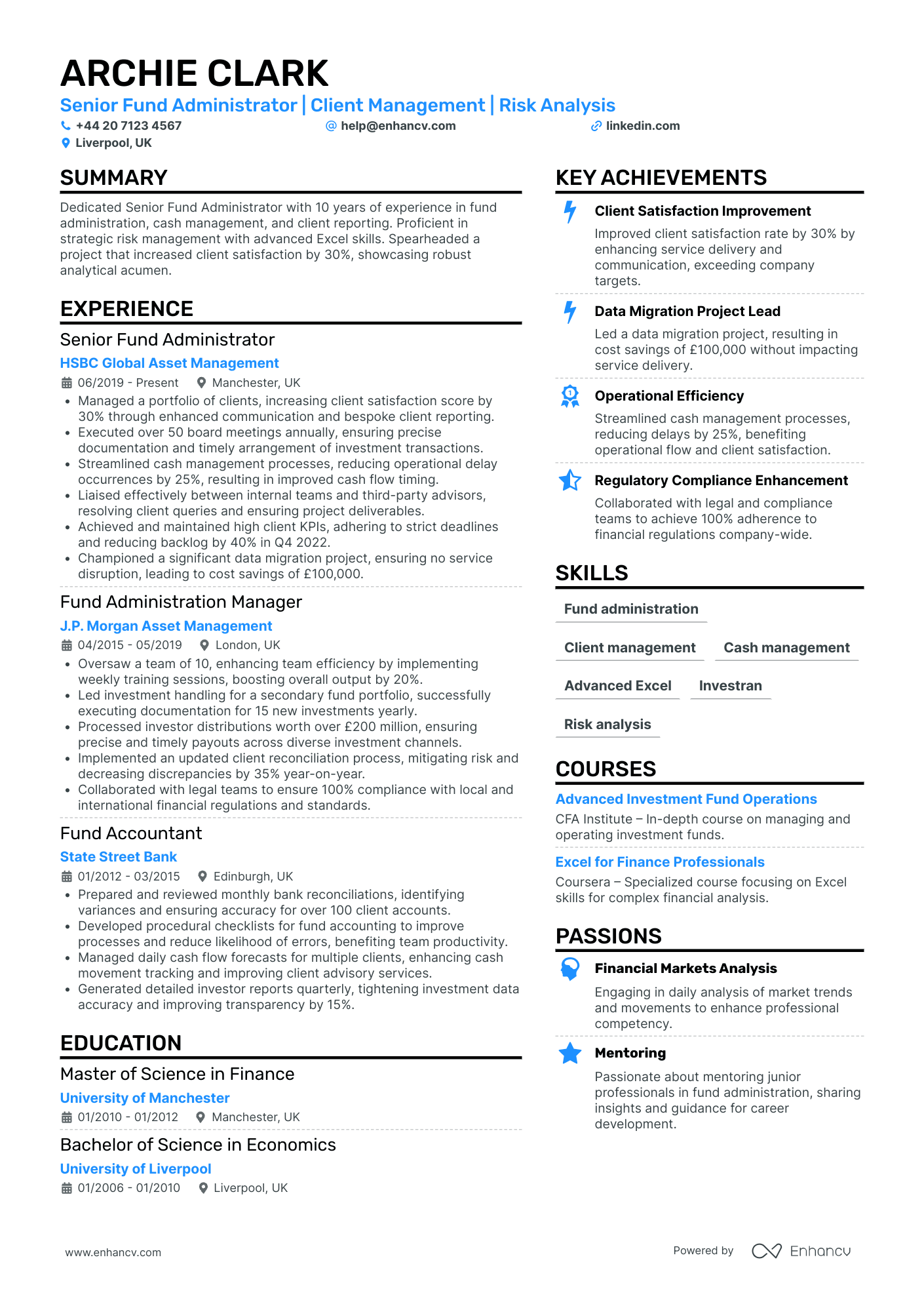

Private Equity HR Consultant

- Logical Structure and Cohesion - The CV is structured clearly, following a logical progression that allows for easy navigation. Each section is distinct and concise, providing a focused view into the candidate’s qualifications, experience, and achievements without overwhelming the reader with unnecessary details. This clarity enhances the overall presentation and readability of the document.

- Consistent Career Advancement - Archie Clark’s career trajectory showcases a steady and impressive rise through the ranks in the finance and fund administration industry. From starting as a Fund Accountant to becoming a Senior Fund Administrator at HSBC Global Asset Management, his career path reflects significant professional growth, increased responsibilities, and a deepening of expertise in client management and risk analysis.

- Adoption of Advanced Tools and Techniques - The CV demonstrates Clark's proficiency with industry-specific tools and methodologies such as Investran and advanced Excel skills, which are crucial for effective fund administration and risk analysis. His ability to lead a data migration project and execute precise client reporting further highlights his technical depth and adaptability to complex financial environments.

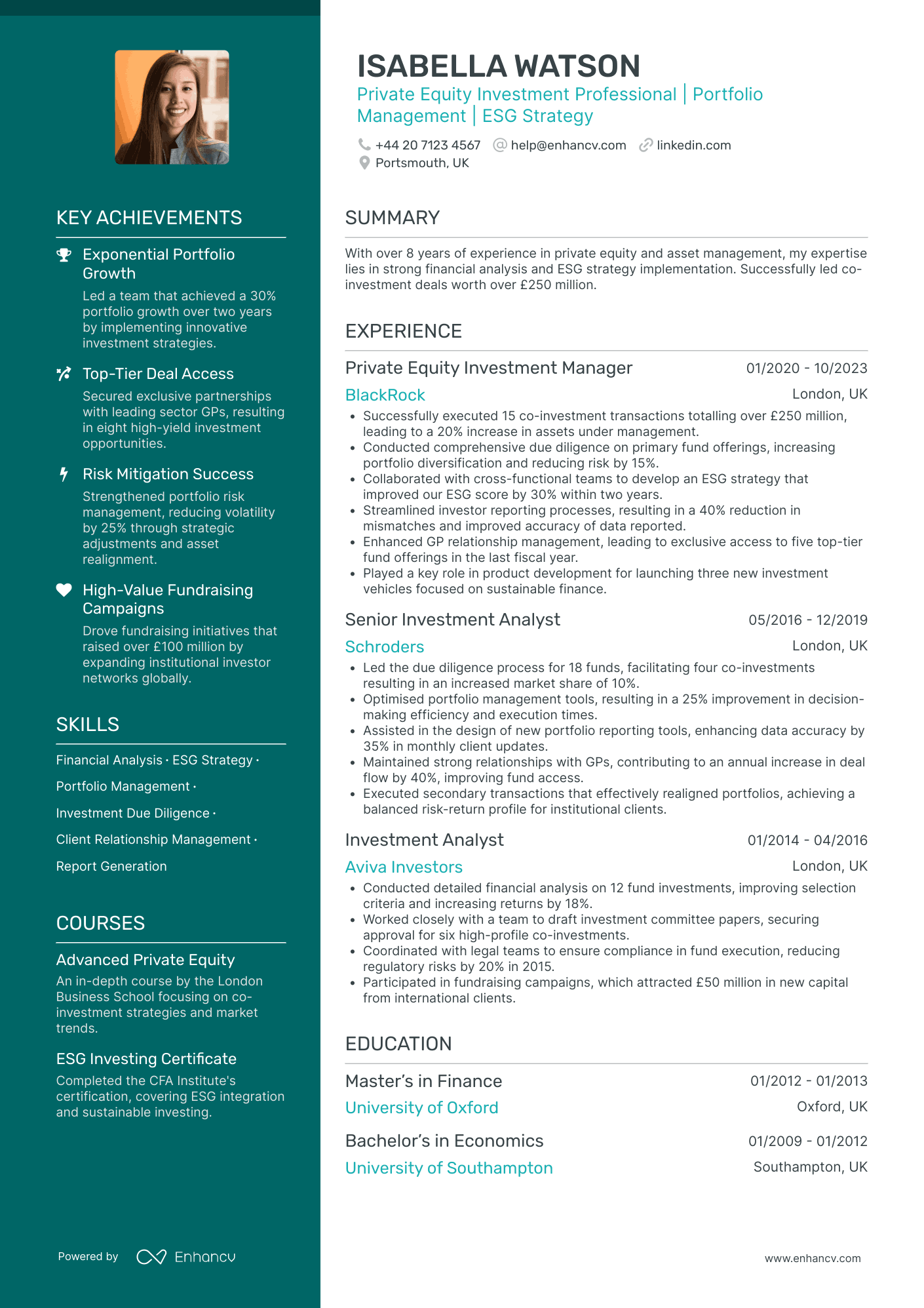

Private Equity Fundraising Manager

- Organized and Concise Structure - The CV exhibits a well-organized layout, where each section is clearly defined and easily navigable. The concise presentation of achievements, skills, and experience ensures that critical information is captured quickly and effectively, making it easy for recruiters to identify Isabella's core competencies and track record.

- Strong Career Progression in Finance - Isabella’s career trajectory reflects a strong and upward momentum within the private equity and investment management sectors. Transitioning from an Investment Analyst to a Private Equity Investment Manager, she demonstrates significant progression and increased responsibility, affirming her expertise and capability in leading large-scale investment initiatives.

- Emphasis on ESG Integration - The CV prominently highlights ESG strategy as a key area of expertise. Isabella's involvement in improving ESG scores and launching sustainable finance vehicles indicates her commitment to incorporating environmental, social, and governance factors into investment decisions, a crucial element in today's finance landscape.

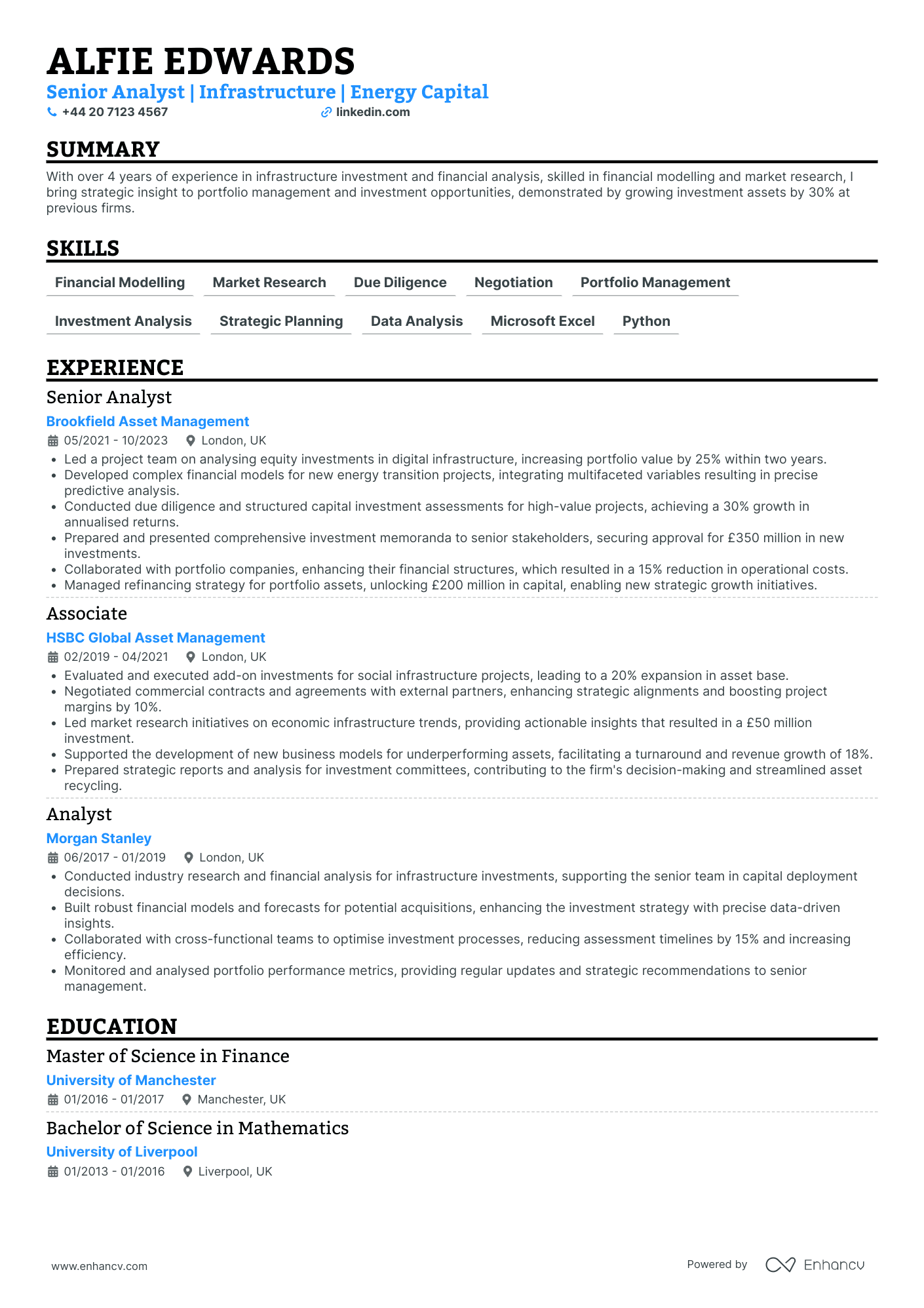

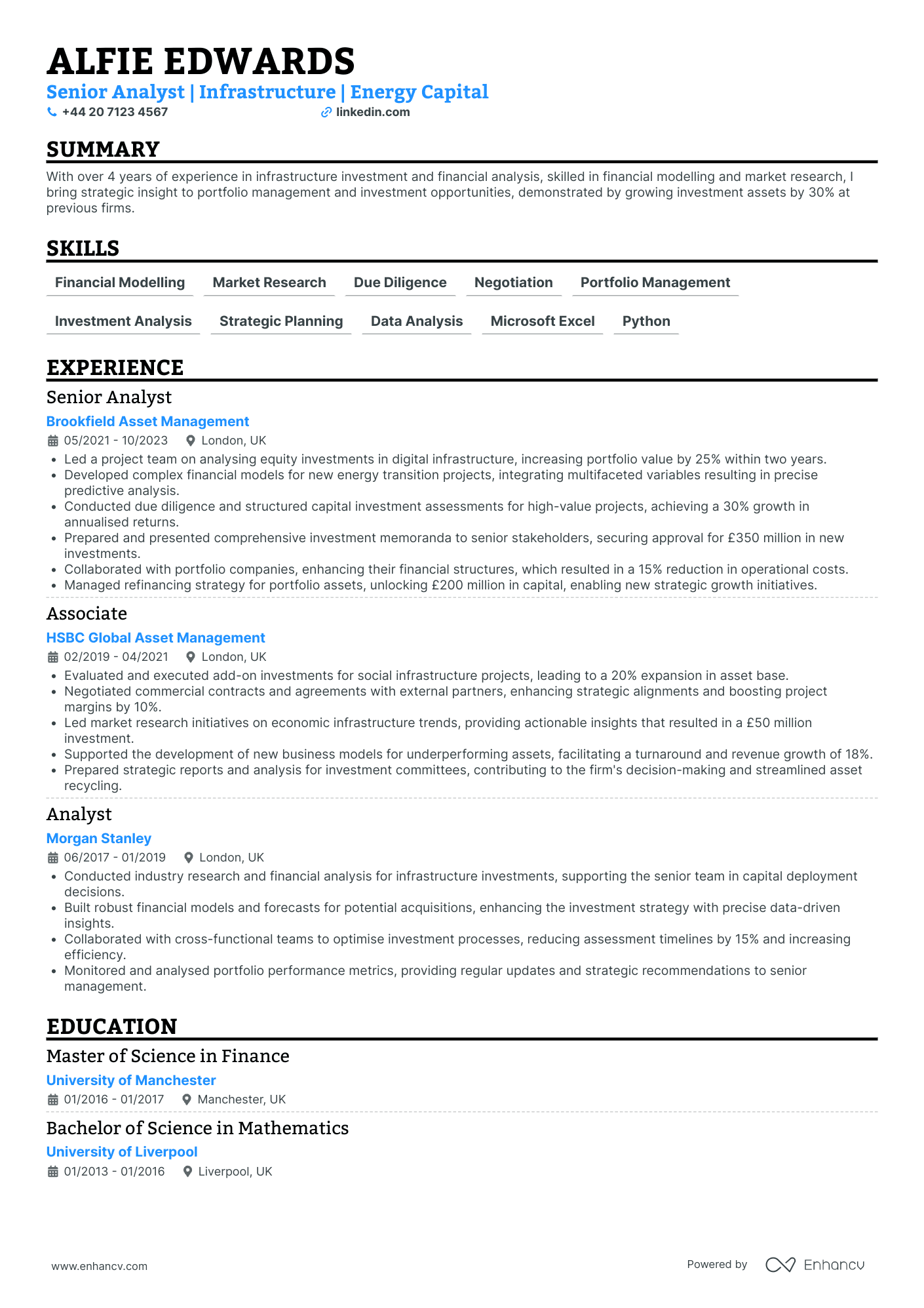

Private Equity Energy Sector Analyst

- Structured and Clear Presentation - The CV is expertly structured, providing a clear and concise presentation of Alfie's career. It is well-organized, making it easy for readers to quickly understand his professional journey. Each section is deliberately formatted to improve readability, delivering key information effectively without unnecessary complexity.

- Evidence of Progressive Career Growth in the Industry - Alfie's career trajectory is impressive, showing a clear progression from Analyst at Morgan Stanley to Senior Analyst at Brookfield Asset Management. The CV reflects his rising responsibilities and achievements, underlining his ability to navigate and excel in the competitive field of infrastructure and energy capital investment.

- Significant Industry-Specific Achievements and Tools - The CV highlights Alfie's technical depth in financial modeling, due diligence, and strategic planning. His achievements, such as leading major refinancing deals and expanding asset bases, underscore his capability to deliver substantial impact and innovation within the infrastructure investment sector, reflecting his deep industry insights and expertise.

Private Equity Infrastructure Investment Manager

- Clarity and Structure - The CV is presented with a cohesive structure that starts with an organized header, leading to a succinct summary of the candidate's professional profile. Each section flows logically, with clear demarcations between roles, responsibilities, and achievements, offering a streamlined reading experience.

- Steady Career Progression - Oliver’s career trajectory denotes a clear path of growth in the infrastructure investment sector, progressing from an Analyst to a Senior Infrastructure Investment Analyst. Each position reflects an increasing level of responsibility, further showcasing his ability to adapt and excel in the competitive investment industry.

- Industry-Specific Expertise and Tools - The CV highlights profound competencies in industry-specific practices such as financial modeling and quantitative due diligence. As a vital aspect of infrastructure investment, these skills are underscored by advanced certifications and significant project contributions, illustrating Oliver’s deep technical acumen and specialized knowledge.

How to ensure your profile stands out with your private equity CV format

It's sort of a Catch 22. You want your private equity CV to stand out amongst a pile of candidate profiles, yet you don't want it to be too over the top that it's unreadable. Where is the perfect balance between your CV format simple, while using it to shift the focus to what matters most. That is - your expertise. When creating your private equity CV:

- list your experience in the reverse chronological order - starting with your latest roles;

- include a header with your professional contact information and - optionally - your photograph;

- organise vital and relevant CV sections - e.g. your experience, skills, summary/ objective, education - closer to the top;

- use no more than two pages to illustrate your professional expertise;

- format your information using plenty of white space and standard (2.54 cm) margins, with colours to accent key information.

Once you've completed your information, export your private equity CV in PDF, as this format is more likely to stay intact when read by the Applicant Tracker System or the ATS. A few words of advice about the ATS - or the software used to assess your profile:

- Generic fonts, e.g. Arial and Times New Roman, are ATS-compliant, yet many candidates stick with these safe choices. Ensure your CV stands out by using a more modern, and simple, fonts like Lato, Exo 2, Volkhov;

- All serif and sans-serif fonts are ATS-friendly. Avoid the likes of fancy decorative or script typography, as this may render your information to be illegible;

- Both single- and double-column formatted CVs could be assessed by the ATS;

- Integrating simple infographics, icons, and charts across your CV won't hurt your chances during the ATS assessment.

PRO TIP

For certain fields, consider including infographics or visual elements to represent skills or achievements, but ensure they are simple, professional, and enhance rather than clutter the information.

The top sections on a private equity CV

- Investment track record showcases past success and relevant experience.

- Industry specialisation presents expertise in specific sectors.

- Deal origination and execution illustrate hands-on experience in sourcing and completing investments.

- Financial modelling and analysis skills reflect competence in evaluating investment opportunities.

- Educational background emphasises qualifications and relevant knowledge base.

What recruiters value on your CV:

- Highlight your transaction experience by detailing your involvement in deals, emphasising your role in sourcing, executing, and exiting investments, as well as the financial impact of your contributions.

- Quantify your achievements by exploring the results you brought to previous positions, such as improvements in portfolio company performance or successful fundraisings, to demonstrate your impact on the bottom line.

- Showcase your financial modelling and analytical skills, as these are crucial for private equity roles; include specific examples of complex models you've developed or analyses you've conducted.

- Emphasise your ability to work in high-pressure environments by providing examples of tight deadlines or challenging situations that you navigated successfully.

- Demonstrate your understanding of industry sectors relevant to private equity by including any sector-specific knowledge or experience you hold, illustrating your ability to identify and capitalise on market trends.

Recommended reads:

How to present your contact details and job keywords in your private equity CV header

Located at the top of your private equity CV, the header presents recruiters with your key personal information, headline, and professional photo. When creating your CV header, include your:

- Contact details - avoid listing your work email or telephone number and, also, email addresses that sound unprofessional (e.g. koolKittyCat$3@gmail.com is definitely a big no);

- Headline - it should be relevant, concise, and specific to the role you're applying for, integrating keywords and action verbs;

- Photo - instead of including a photograph from your family reunion, select one that shows you in a more professional light. It's also good to note that in some countries (e.g. the UK and US), it's best to avoid photos on your CV as they may serve as bias.

What do other industry professionals include in their CV header? Make sure to check out the next bit of your guide to see real-life examples:

Examples of good CV headlines for private equity:

- Associate Director, Private Equity | Growth Strategies | LBO Expertise | CFA Level II | 7 Years' Experience

- Private Equity Analyst | Due Diligence Specialist | Emerging Markets Focus | CIMA Qualified | 4 Years' Experience

- Senior Investment Manager | Portfolio Optimisation | M&A Integration | MBA | 12+ Years in Private Equity

- Junior Private Equity Associate | Market Analysis Enthusiast | Financial Modelling | 2 Years Professional Experience

- Principal, Private Equity | Value Creation | Operational Turnaround | ACCA | 15+ Years Industry Leadership

- Investment Executive | Private Equity | Sector Specialist: Healthcare | Risk Assessment | 9 Years' Track Record

Choosing your opening statement: a private equity CV summary or objective

At the top one third of your CV, you have the chance to make a more personable impression on recruiters by selecting between:

- Summary - or those three to five sentences that you use to show your greatest achievements. Use the CV summary if you happen to have plenty of relevant experience and wish to highlight your greatest successes;

- Objective - provides you with up to five sentences to state your professional aims and mission in the company you're applying for

CV summaries for a private equity job:

- Seasoned finance professional with over a decade of experience in managing multi-million-dollar investment portfolios, specialising in maximising return on investment and risk management strategies. Notable achievement includes leading a successful $200 million acquisition and integration process for a global investment firm.

- Adept financial analyst with 8 years of experience adept in quantitative analysis, financial modelling, and due diligence. Spearheaded the turnaround of a distressed asset portfolio, resulting in a 25% increase in profitability within two years.

- Highly motivated former management consultant seeking to transfer a robust analytical skill set and strategic prowess into the realm of private equity, after a prosperous 5-year tenure at a top-tier firm where I steered key business transformations for multinational corporations.

- Accomplished tech entrepreneur looking to pivot into private equity, bringing a unique perspective from founding and scaling a successful SaaS company to an $80 million exit. Expertise in market analysis, growth hacking methods, and technology sector trends will fuel data-driven investment decisions.

- Eager to initiate a career in private equity, leveraging a strong academic foundation with a Master's in Finance and internships at top-tier banks. Committed to contributing to deal scouting and analysis while acquiring hands-on experience in portfolio company management and value creation strategies.

- Recent economics graduate aiming to apply a comprehensive understanding of market dynamics and financial instruments within a private equity setting. Poised to utilise keen research and due diligence capabilities to support the identification and execution of lucrative investment opportunities.

More detailed look into your work history: best advice on writing your private equity CV experience section

The CV experience is a space not just to merely list your past roles and responsibilities. It is the CV real estate within which you could detail your greatest accomplishments and skills, while matching the job requirements. Here's what to have in your experience section:

- Prove you have what the job wants with your unique skill set and past successes;

- Start each bullet with a strong, action verb, and continue with the outcome of your responsibility;

- Use any awards, nominations, and recognitions you've received as solid proof of your skill set and expertise;

- align your experience with the role responsibilities and duties.

For more help on how to write your CV experience section, check out the next section of our guide:

Best practices for your CV's work experience section

- Demonstrate your analytical skills by highlighting your experience in financial modelling and valuation. Specify any advanced Excel techniques and software you are proficient in.

- Illustrate your investment track record by detailing successful deals you've closed. Include size, industry, and your direct role in the transaction.

- Showcase your ability to source and execute deals by discussing your networking strategies and relationships with deal referral sources.

- Exhibit your due diligence capabilities by outlining processes you have run or participated in. Mention specific sectors or types of transactions you have experience with.

- Mention any experience with portfolio management, including post-acquisition strategies and operational improvements you've successfully implemented.

- Underline your project management skills by referring to instances where you led cross-functional teams in a transaction or post-investment integration.

- Detail your experience in fundraising and investor relations. Include your role in preparing LP presentations and handling due diligence queries.

- Highlight any international experience if applicable, especially if it includes emerging markets, to demonstrate a broad investment perspective.

- Emphasise your communication abilities by including experiences where you've worked with senior stakeholders, boards, and investment committees.

- Led the due diligence process for a £250 million acquisition of a manufacturing firm, enhancing the company portfolio and synergies.

- Managed a small-cap investment portfolio generating a 20% IRR over four years, significantly above industry benchmarks.

- Negotiated with founders and leveraged in-depth industry analysis to secure a 30% stake in an emerging FinTech startup.

- Structured complex leveraged buyouts that increased assets under management by £600 million within a highly competitive mid-market space.

- Executed end-to-end cross-border M&A transactions, collaborating with international teams to integrate acquired entities smoothly.

- Implemented cost-saving measures for portfolio companies, averaging a reduction in operational expenses by 15% annually.

- Spearheaded a growth equity investment initiative resulting in a 2.5x return over a three-year period through strategic guidance and financial restructuring.

- Guided a portfolio company through a successful IPO, outlining the strategy and managing expectations of various stakeholders.

- Cultivated strong relationships with C-level executives, leading to exclusive investment opportunities and partnerships.

- Orchestrated turnaround strategies for underperforming portfolio entities, reversing losses and driving a 25% increase in profitability within two years.

- Developed sophisticated financial models to evaluate potential investment returns, influencing the decision-making process for assets totalling over £350 million.

- Fostered junior team members through mentorship, enhancing the overall analytical capabilities of the department.

- Championed the launch of a new sector-focused investment fund, raising £200 million in capital commitments from institutional investors.

- Conducted comprehensive market research and formulated investment theses that successfully guided the acquisition strategy in the healthcare sector.

- Pioneered the implementation of ESG criteria within the investment screening process, promoting sustainable and ethical investing practices.

- Oversaw a portfolio restructuring plan that resulted in divesting non-core assets, thereby increasing focus on high-growth sectors.

- Initiated and managed fruitful relationships with investment banking firms to ensure a steady flow of high-quality deal origination.

- Achieved successful exits through strategic sales and recapitalizations, providing substantial returns to limited partners.

- Instrumental in launching a technology-focused investment initiative that created a 40% YoY growth in the value of tech portfolio companies.

- Developed and executed a streamlined post-merger integration process for newly acquired companies, minimizing costs and maximizing operational efficiency.

- Led negotiations for a high-profile leveraged buyout that doubled the enterprise value of the portfolio company within five years.

- Identified and evaluated potential investment opportunities in emerging markets, resulting in a record 35% increase in regional investments.

- Facilitated the strategic planning and execution of value-enhancement initiatives for portfolio companies, culminating in a marked improvement in their market positioning.

- Directed the firm's participation in a landmark infrastructure fund, committing £100 million to projects that showed strong potential for economic impact.

Writing your CV without professional experience for your first job or when switching industries

There comes a day, when applying for a job, you happen to have no relevant experience, whatsoever. Yet, you're keen on putting your name in the hat. What should you do? Candidates who part-time experience , internships, and volunteer work.

Recommended reads:

PRO TIP

If applicable, briefly mention a situation where things didn’t go as planned and what you learned from it, demonstrating your ability to learn and adapt.

Key private equity CV skills: what are hard skills and soft skills

Let's kick off with the basics. You know that you have to include key job requirements or skills across your CV. For starters, take individual skills from the job description and copy-paste them into your CV, when relevant. Doing so, you'll ensure you have the correct skill spelling and also pass the Applicant Tracker System (ATS) assessment. There are two types of skills you'll need to include on your CV:

- Hard skills - technical abilities that are best defined by your certificates, education, and experience. You could also use the dedicated skills section to list between ten and twelve technologies you're apt at using that match the job requirements.

- Soft skills - your personal traits and interpersonal communication skills that are a bit harder to quantify. Use various CV sections, e.g. summary, strengths, experience, to shine a spotlight on your workspace achievements, thanks to using particular soft skills.

Remember that your job-winning CV should balance both your hard and soft skills to prove your technical background, while spotlighting your personality.

Top skills for your private equity CV:

Financial Modeling

Valuation Techniques

Due Diligence

Deal Structuring

Market Analysis

Portfolio Management

Financial Analysis

Leveraged Buyouts

Investment Strategies

Capital Raising

Negotiation

Leadership

Communication

Strategic Thinking

Problem Solving

Time Management

Teamwork

Adaptability

Attention to Detail

Interpersonal Skills

PRO TIP

If there's a noticeable gap in your skillset for the role you're applying for, mention any steps you're taking to acquire these skills, such as online courses or self-study.

Your university degree and certificates: an integral part of your private equity CV

Let's take you back to your uni days and decide what information will be relevant for your private equity CV. Once more, when discussing your higher education, select only information that is pertinent to the job (e.g. degrees and projects in the same industry, etc.). Ultimately, you should:

- List only your higher education degrees, alongside start and graduation dates, and the university name;

- Include that you obtained a first degree for diplomas that are relevant to the role, and you believe will impress recruiters;

- Showcase relevant coursework, projects, or publications, if you happen to have less experience or will need to fill in gaps in your professional history.

PRO TIP

Order your skills based on the relevance to the role you're applying for, ensuring the most pertinent skills catch the employer's attention first.

Recommended reads:

Key takeaways

Impressing recruiters with your experience, skill set, and values starts with your professional private equity CV. Write concisely and always aim to answer job requirements with what you've achieved; furthermore:

- Select a simple design that complements your experience and ensures your profile is presentable;

- Include an opening statement that either spotlights your key achievements (summary) or showcases your career ambitions (objective);

- Curate your experience bullets, so that each one commences with a strong, action verb and is followed up by your skill and accomplishment;

- List your hard and soft skills all across different sections of your CV to ensure your application meets the requirements;

- Dedicate space to your relevant higher education diplomas and your certificates to show recruiters you have the necessary industry background.