One CV challenge you may encounter as an insurance broker is differentiating yourself in a competitive job market. Our guide provides expert advice on tailoring your CV to showcase your unique skills and experiences, ensuring you stand out to potential employers.

- Applying best practices from real-world examples to ensure your profile always meets recruiters' expectations;

- What to include in your work experience section, apart from your past roles and responsibilities?

- Why are both hard and soft skills important for your application?

- How do you need to format your CV to pass the Applicant Tracker Software (ATS) assessment?

If you're writing your CV for a niche insurance broker role, make sure to get some inspiration from professionals:

Resume examples for insurance broker

By Experience

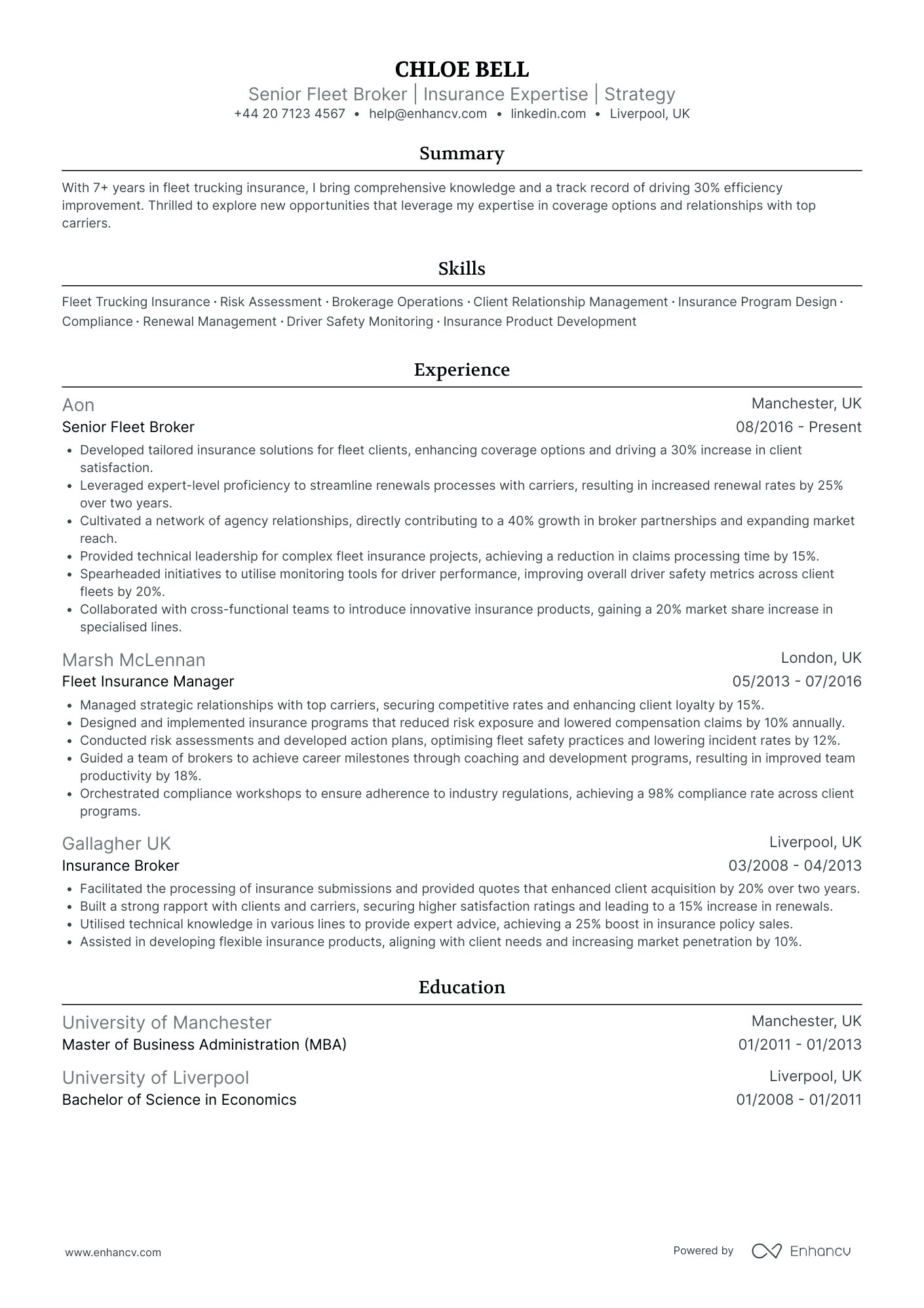

Senior Insurance Broker

- Content Presentation with Strategic Clarity - The CV employs an organized and concise structure that enhances readability. Each section is clearly delineated and provides targeted information relevant to Chloe's career as a Senior Fleet Broker. The bullet points are used effectively to convey key responsibilities and achievements, ensuring that the reader can quickly grasp the scope and impact of Chloe's work.

- Rich Career Trajectory Demonstrating Consistent Growth - Chloe's career path is marked by a smooth and consistent progression with increasing responsibilities. Transitioning from an Insurance Broker to a Fleet Insurance Manager, and ultimately to a Senior Fleet Broker at a leading firm like Aon, highlights her upward trajectory and deepening expertise in the insurance industry. This growth is indicative of her leadership capabilities and mastery of fleet insurance operations.

- Effective Use of Industry-Specific Tools and Innovations - The CV highlights Chloe's proficiency with industry-specific methodologies and tools such as driver performance monitoring, streamlined renewal processes, and innovative insurance product development. These elements demonstrate her technical depth and innovative approach, which are crucial for maintaining competitiveness and driving improvements in client satisfaction and safety metrics.

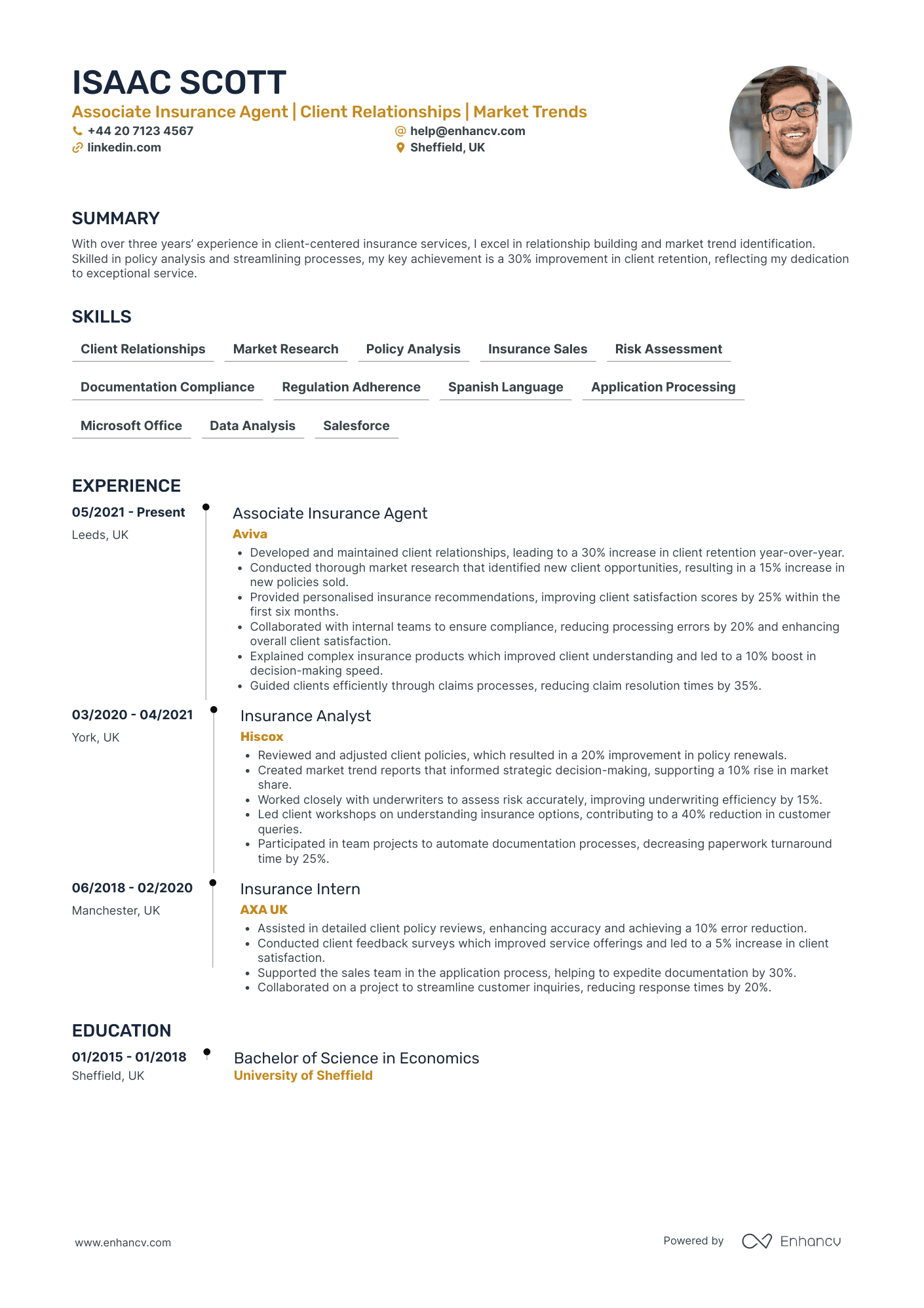

Junior Insurance Broker

- Structured Presentation of Content - The CV is structured in a clear and concise manner, which makes the content easily digestible. Sections are well defined and the use of bullet points under each experience entry allows for quick scanning of achievements and responsibilities. This focused presentation ensures that the key accomplishments and qualifications are immediately visible to recruiters.

- Progressive Career Trajectory - Isaac Scott's professional journey reflects consistent growth in responsibility, starting from an intern to an Associate Insurance Agent. This upward trajectory within the insurance industry indicates a commitment to the field and demonstrates increasing expertise, which is crucial for credibility in insurance services and consulting roles.

- Substantial Achievements Impacting Business Success - The CV details significant accomplishments, such as a 30% improvement in client retention and a 40% increase in quarterly sales. These metrics, coupled with the related business impacts, underscore Isaac's capacity to contribute meaningfully to organizational success, making him a valuable asset to prospective employers.

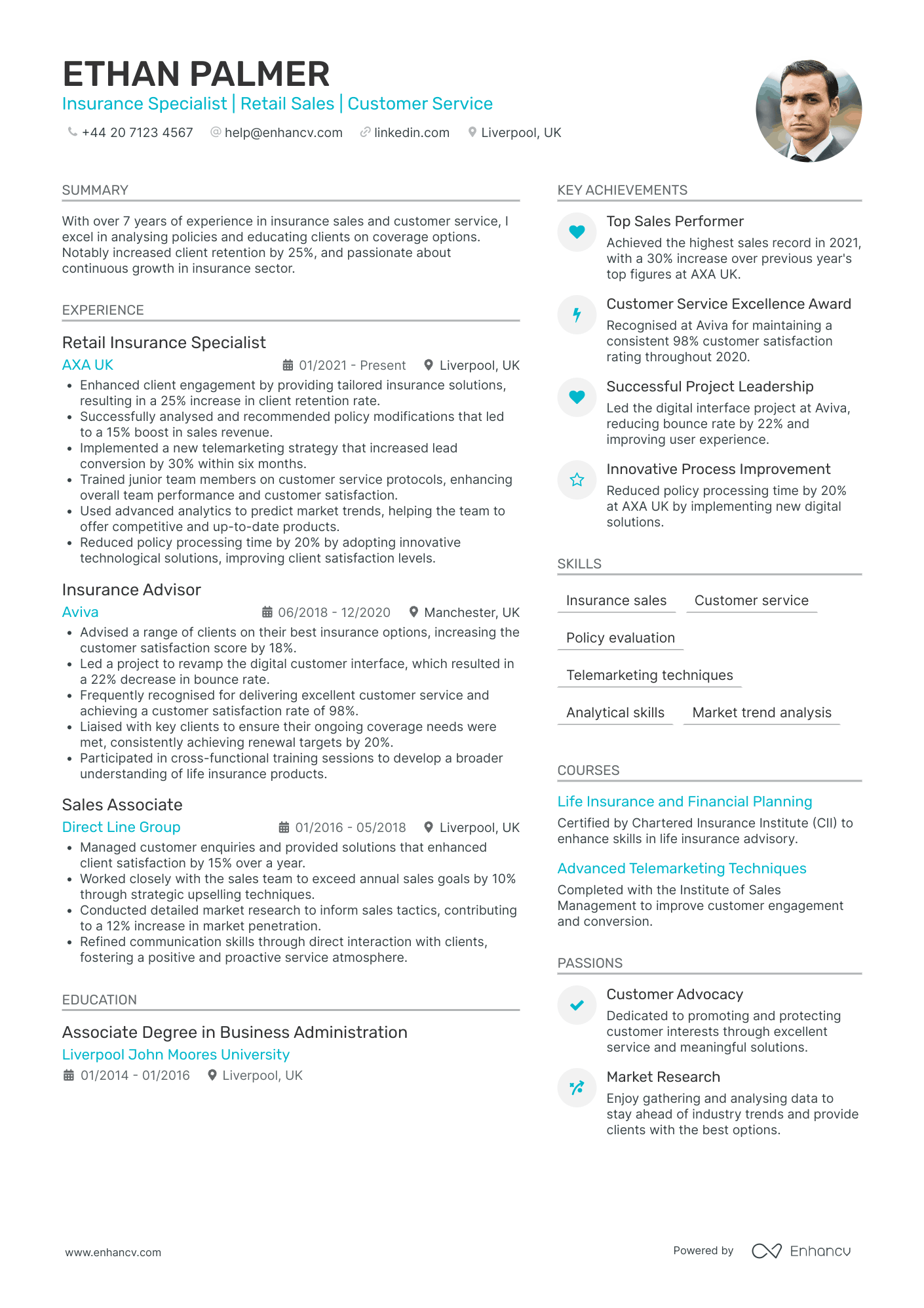

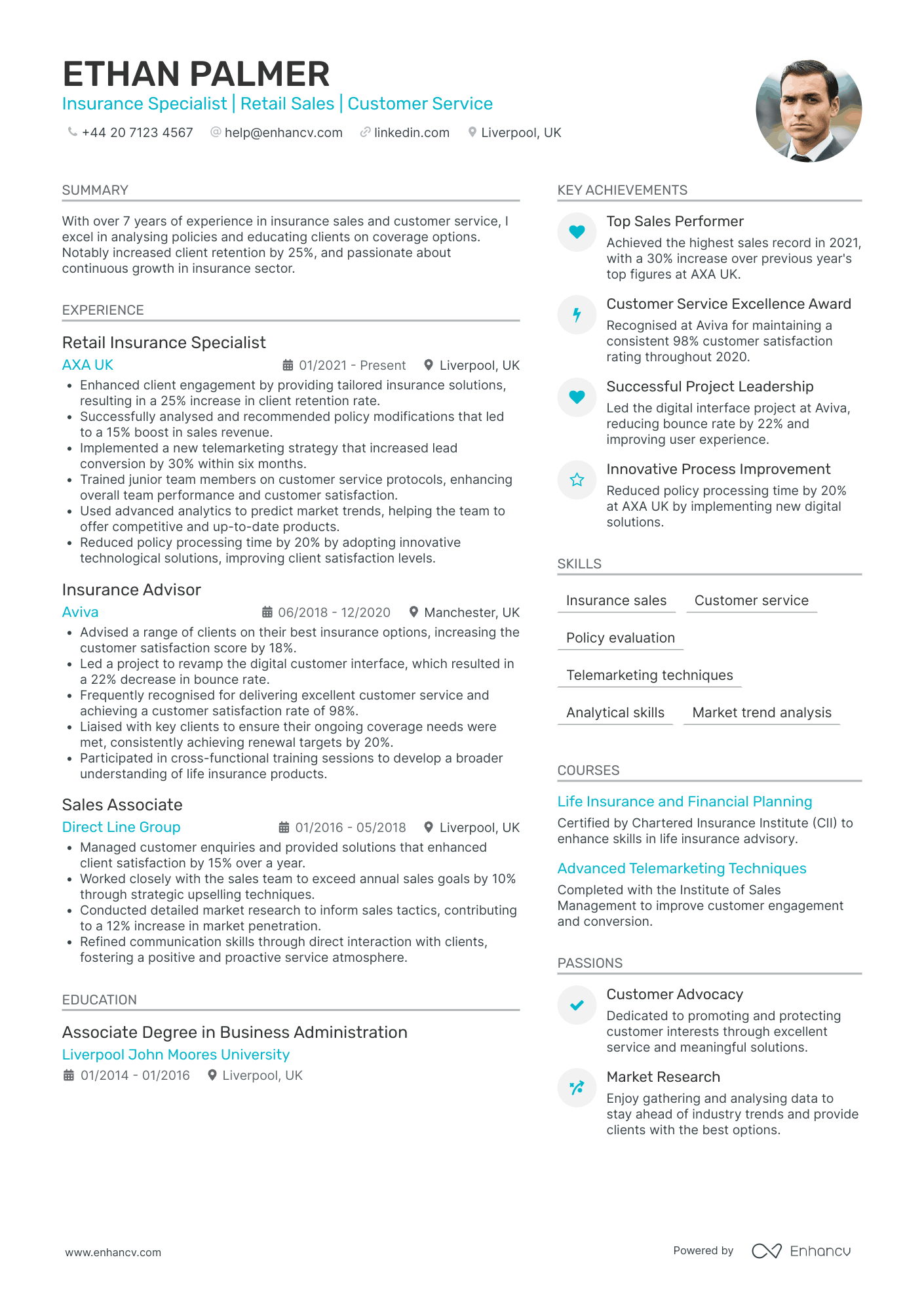

Specialist Insurance Broker

- Structured and Concise Presentation - The CV is well-organized with clear headings and bullet points that facilitate easy navigation and quick comprehension. It succinctly outlines Ethan Palmer's career achievements and qualifications, allowing the reader to quickly understand his professional background and expertise.

- Demonstrates Career Progression in the Insurance Industry - Ethan's career path shows a clear progression from a Sales Associate to a Retail Insurance Specialist. His promotions reflect an increasing level of responsibility and expertise, and his experience at major companies like AXA UK and Aviva confirms his dedication and growth in the insurance sector.

- Emphasis on Client-Centric Achievements - The CV highlights meaningful achievements such as increasing client retention by 25% and boosting sales revenue by 15%. These figures not only showcase Ethan's sales acumen but also emphasize his ability to positively impact client satisfaction and loyalty. Employing strategies that improve user experience and retention directly relate back to business success and relevance.

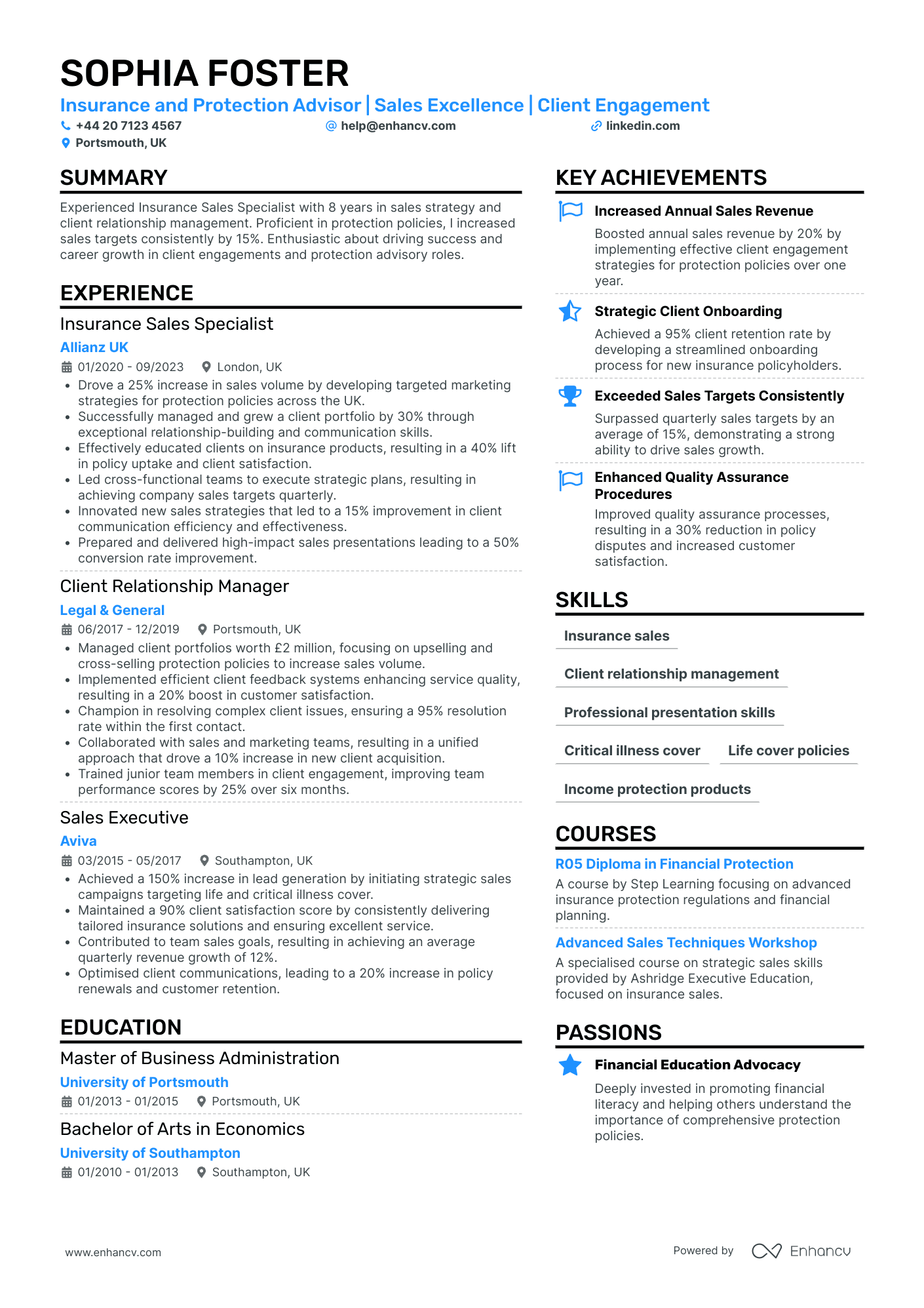

Trainee Insurance Broker

- Effective Presentation and Organization - The CV is clearly structured with distinct sections for experience, skills, education, and achievements, which makes it easy to navigate. Each section is concise yet comprehensive, ensuring all pertinent information is readily accessible, which is particularly effective for quickly conveying qualifications to potential employers.

- Consistent Career Growth - Sophia Foster's career trajectory demonstrates clear professional advancement, transitioning from a Sales Executive role to higher positions such as Client Relationship Manager and Insurance Sales Specialist. This upward movement highlights her ability to take on increased responsibilities and her consistent success in sales and client relationship management.

- Industry-Specific Expertise - The CV reflects deep expertise in the insurance industry with specific focus areas like protection policies, critical illness cover, and life cover policies. This technical depth, complemented by targeted courses like the R05 Diploma in Financial Protection, underscores her comprehensive knowledge and specialized skills in insurance sales and advisory roles.

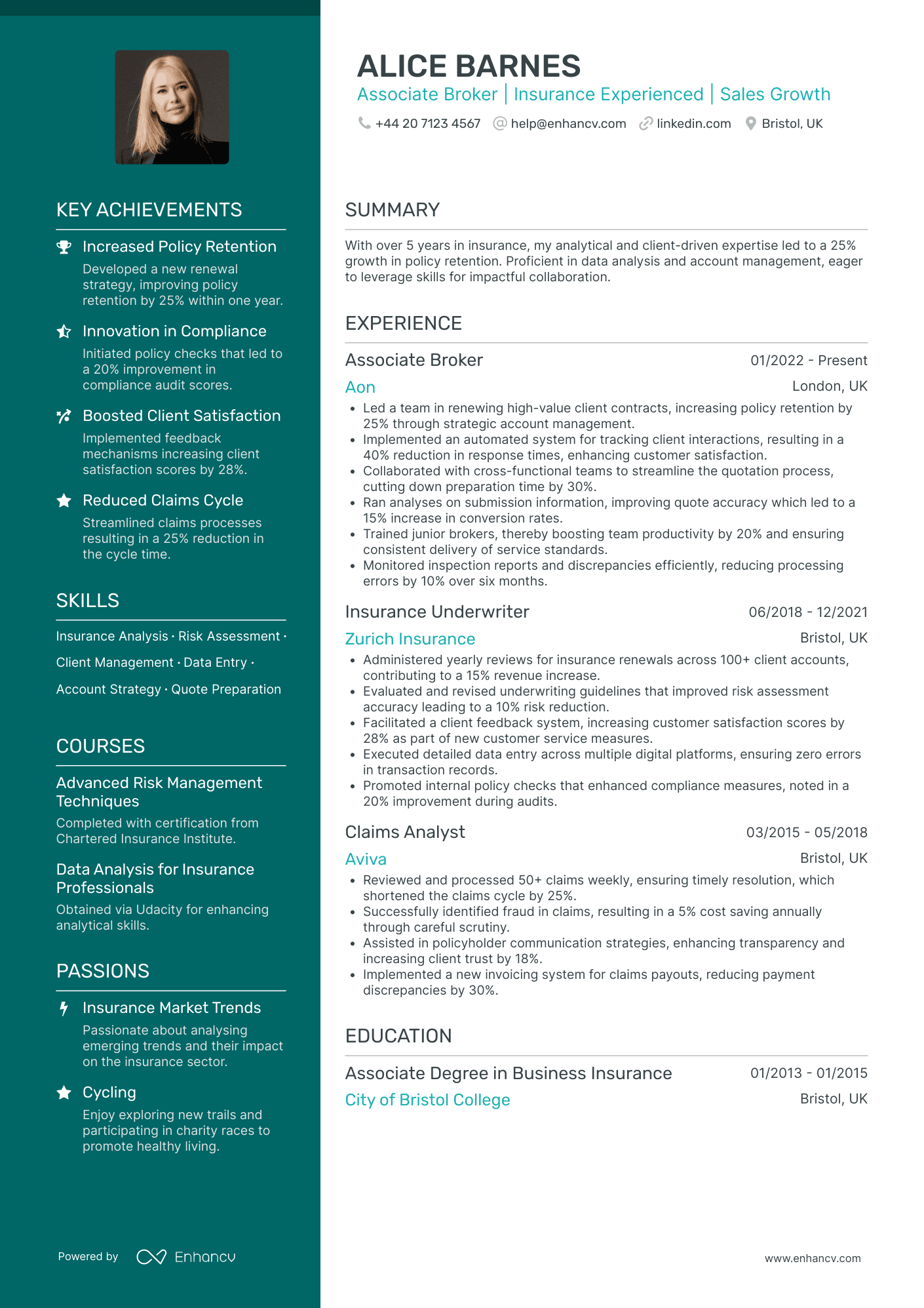

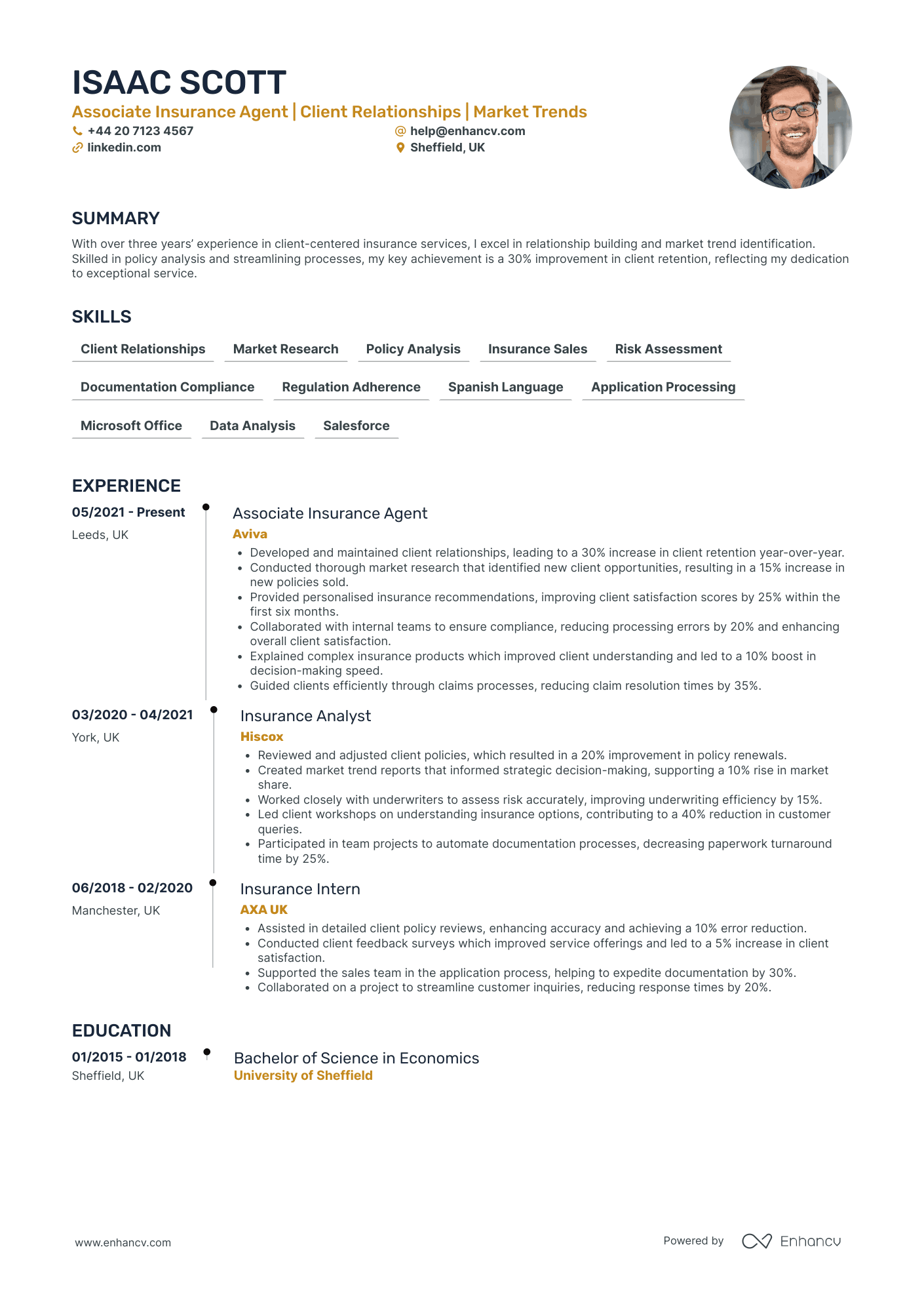

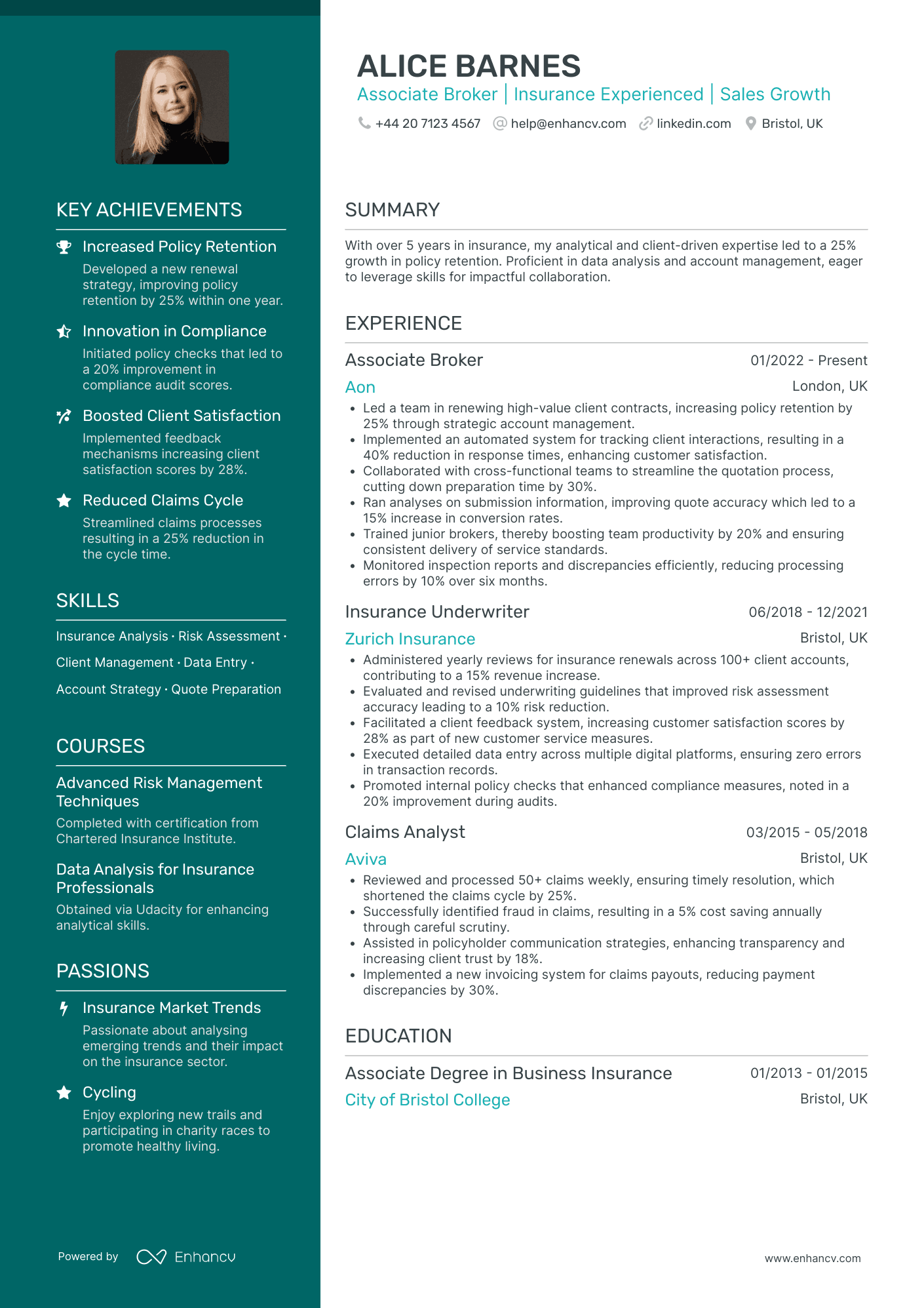

Associate Insurance Broker

- Clear structure and logical flow - The CV consistently maintains clarity and organization, presenting information in a structured manner. Each section is clearly delineated, allowing for easy navigation through various aspects of Alice Barnes' professional profile. Conciseness is achieved by summarizing complex responsibilities and achievements into precise bullet points that emphasize key contributions.

- Steady career progression and specialization - Alice has demonstrated notable career growth, progressing from a Claims Analyst to an Associate Broker. Her trajectory within the insurance industry is marked by increasingly responsible positions, reflecting her expertise and dedication to the field. She has successfully leveraged her skills in insurance analysis and account strategy to drive significant improvements in each role.

- Notable impact on business outcomes - The CV highlights Alice Barnes' ability to deliver substantial business impact through her accomplishments. One key achievement is the development of a renewal strategy that resulted in a 25% increase in policy retention within a year, showcasing her capacity for strategic planning and effective client management. These achievements underscore her ability to drive meaningful results that align with business objectives.

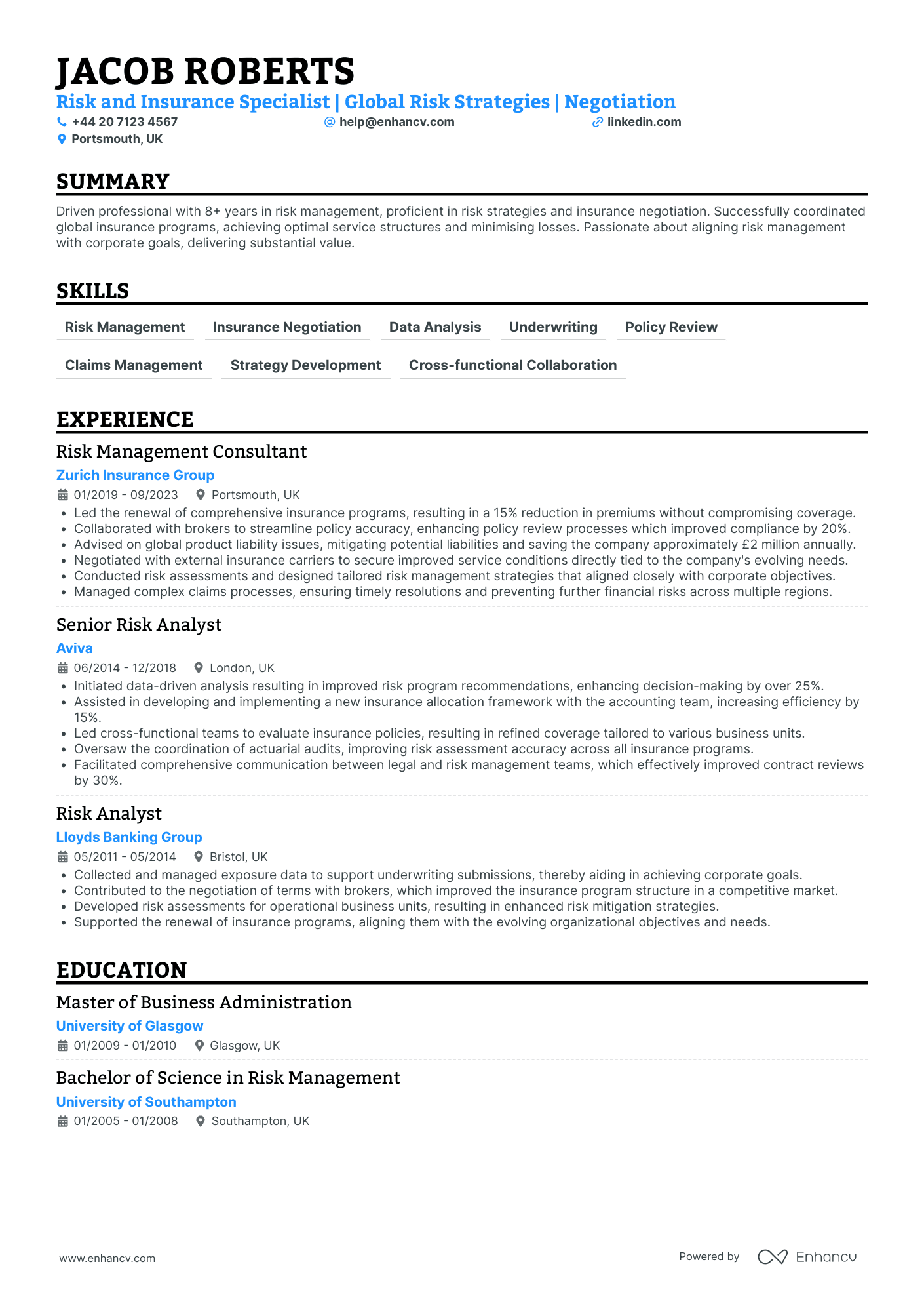

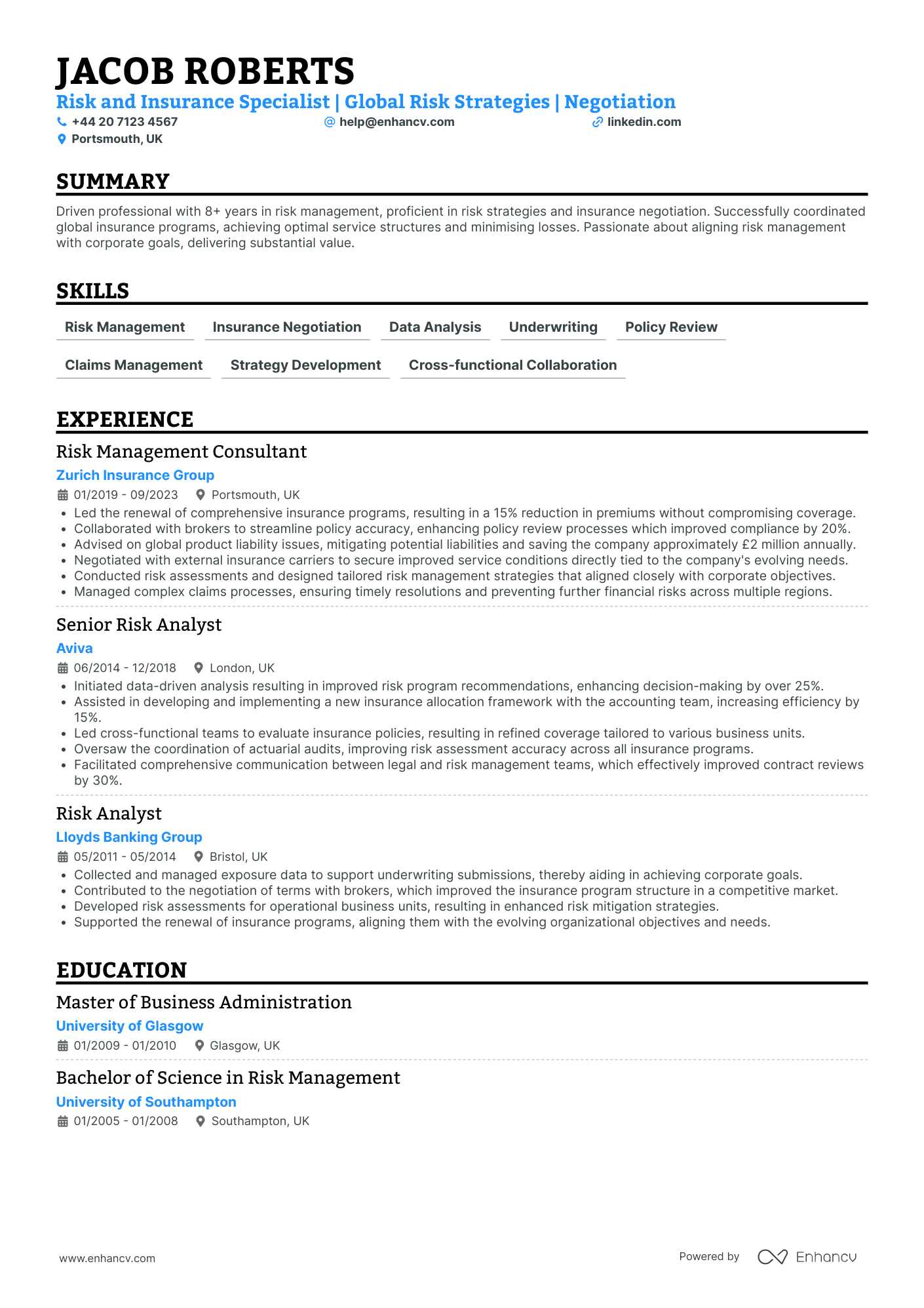

Lead Insurance Broker

- Excellent Content Structure and Presentation - The CV is structured meticulously, displaying clarity and conciseness across sections. The use of well-defined headings such as experience, education, skills, and achievements ensures ease of navigation, allowing readers to quickly locate relevant information without getting overwhelmed.

- Impressive Career Trajectory and Consistent Growth - Jacob's career progression from a Risk Analyst to a Risk Management Consultant exemplifies a clear growth trajectory, underscored by increasing responsibilities. His transition from Aviva to Zurich Insurance Group highlights a commitment to advancing within the insurance and risk management sectors, demonstrating both ambition and the ability to adapt to new environments.

- Significant Achievements with Business Impact - The CV details accomplishments that go beyond just numbers, showcasing how Jacob's actions directly translated into business benefits. For instance, a 15% premium reduction through insurance program renewals and a £2 million annual savings in liability mitigations speak to his strategic influence in optimizing financial performance and risk management.

Principal Insurance Broker

- Strategic Clarity in Presentation - The CV is structured to offer a clear and concise view of Oscar Evans' career progression. Key sections are well-organized, creating an easy flow for readers that highlights both educational achievements and detailed career milestones. This clarity ensures each professional step and accomplishment is readily recognizable amidst a compact format.

- Robust Career Advancement - Oscar demonstrates a clearly defined career trajectory within the insurance industry, moving from an Account Manager role to a Senior Corporate Insurance Broker. This upward movement reflects both solid industry comprehension and effectiveness within varied professional environments, showcasing a path of continuous growth and increased responsibility.

- Impressive Business Achievements - Achievements throughout Oscar's career are tied to tangible business metrics rather than mere numerical goals. Whether it's enhancing administrative efficiency by 40% or innovating new product offerings to increase market share by 20%, these accomplishments not only underpin personal success but also underline their direct impact on company performance and client satisfaction.

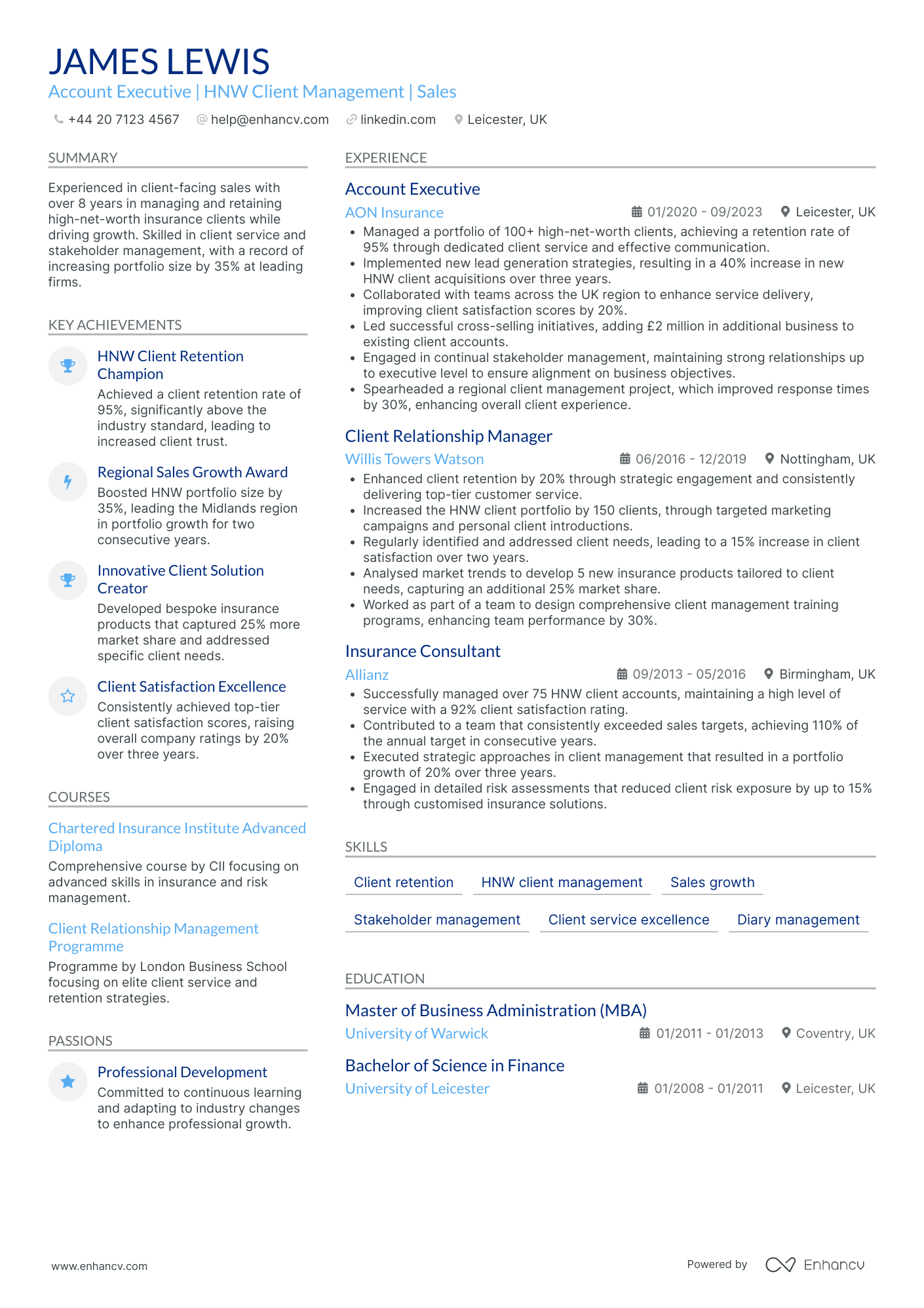

Executive Insurance Broker

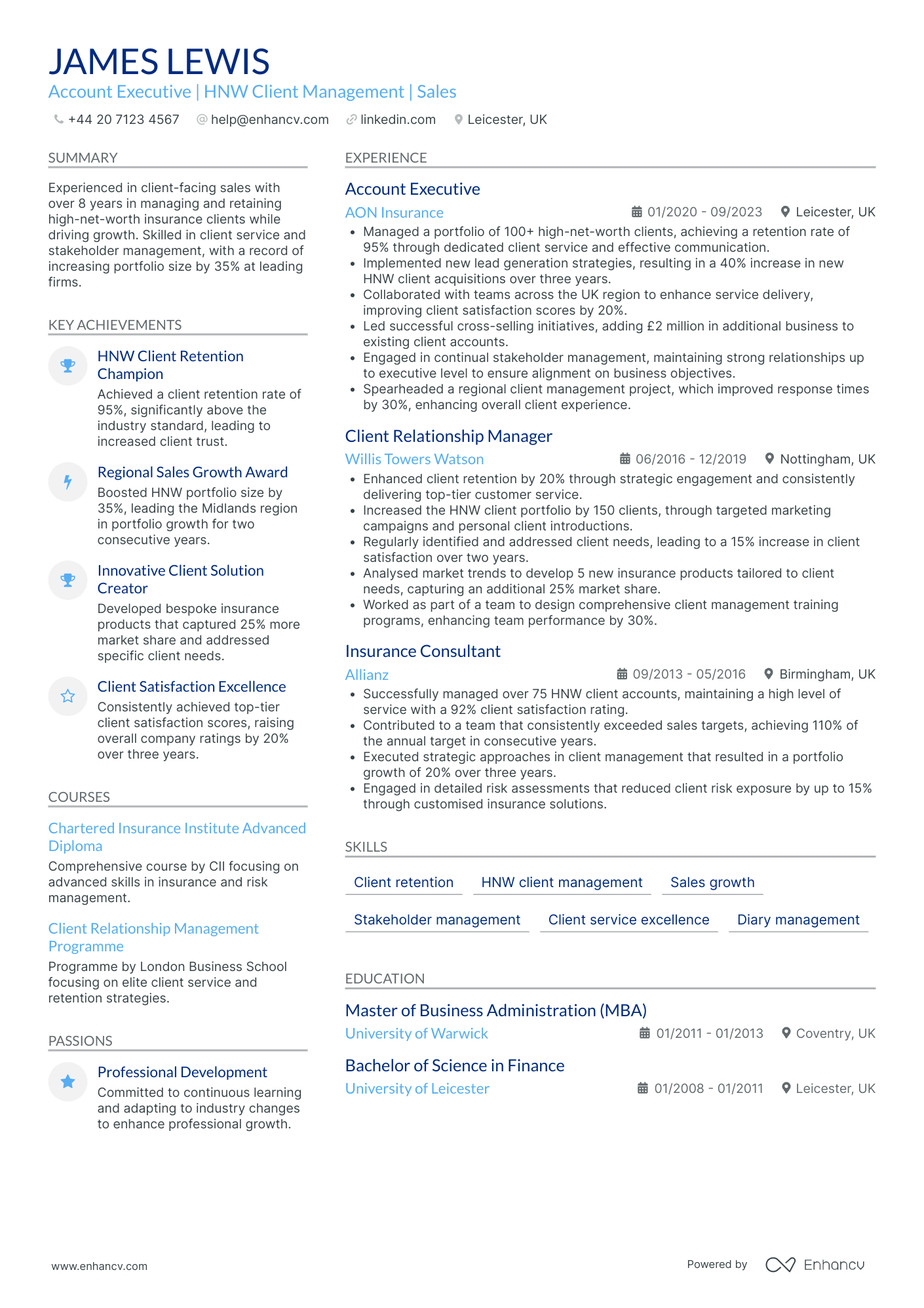

- Exceptional clarity and structure - The CV is meticulously organized, beginning with a concise summary that quickly establishes James’s expertise in client management and sales. Each section is clearly delineated, making it easy for the reader to navigate through his extensive experience and qualifications.

- Remarkable career progression - James's career trajectory demonstrates continuous growth and increasing responsibility, moving from an Insurance Consultant to a Client Relationship Manager, and ultimately to an Account Executive position at a renowned firm. This progression underscores his proficiency in handling high-net-worth clients and adapting to evolving industry demands.

- Innovative client management techniques - The CV highlights James's implementation of cutting-edge strategies, such as new lead generation methods that increased HNW client acquisitions by 40%. His ability to create tailored insurance products shows a deep understanding of market needs, setting him apart in the industry.

By Role

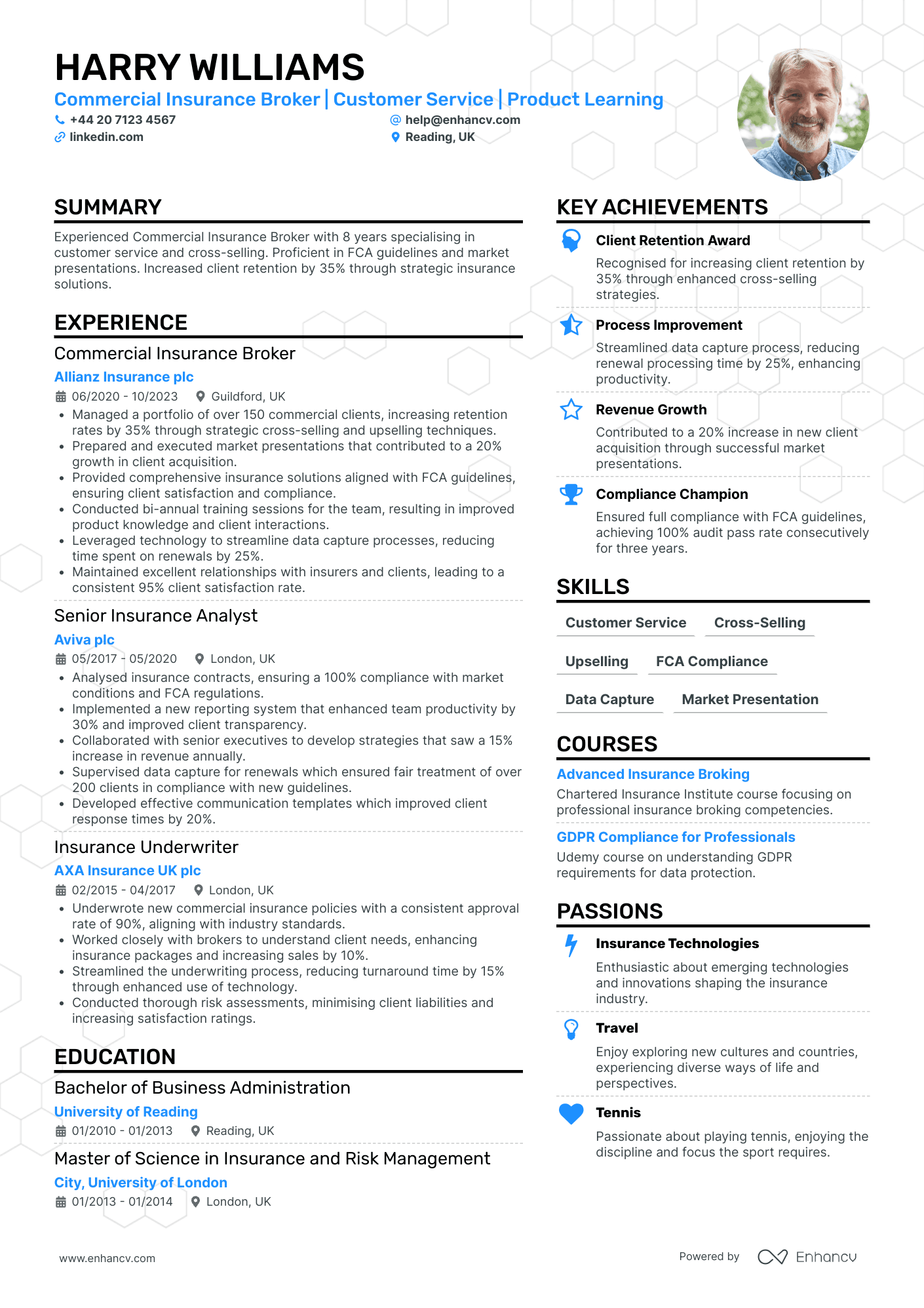

Commercial Insurance Broker

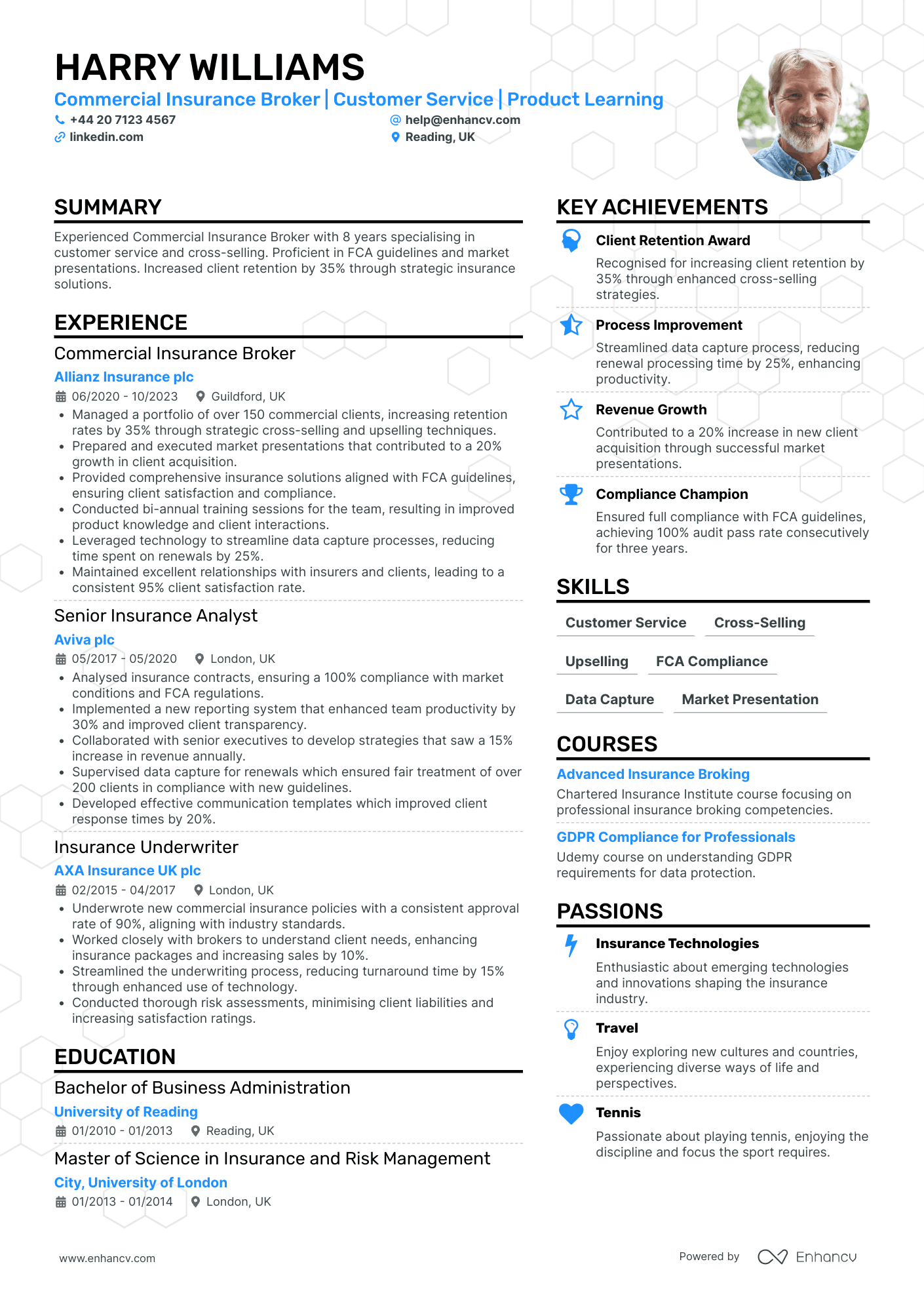

- Clear and Structured Presentation - The CV is laid out systematically, beginning with a well-defined summary and followed by detailed sections like experience, education, skills, and achievements. Each section is clearly labeled, making it easy for the reader to pinpoint specific information quickly, showcasing the candidate’s organizational abilities, which are crucial in the insurance sector.

- Diverse Career Growth - The career trajectory demonstrates a continuous path of growth and professional development, starting from an Insurance Underwriter to a Commercial Insurance Broker. Each role shows an increase in responsibility, indicating successful career advancement and a strong understanding of different facets of the insurance industry.

- Industry-Specific Expertise - The CV highlights unique elements specific to the insurance industry, such as proficiency in FCA guidelines, conducting risk assessments, and developing communication templates. This technical depth indicates the candidate's deep understanding of compliance and regulatory standards, critical for ensuring sector-specific operations run smoothly.

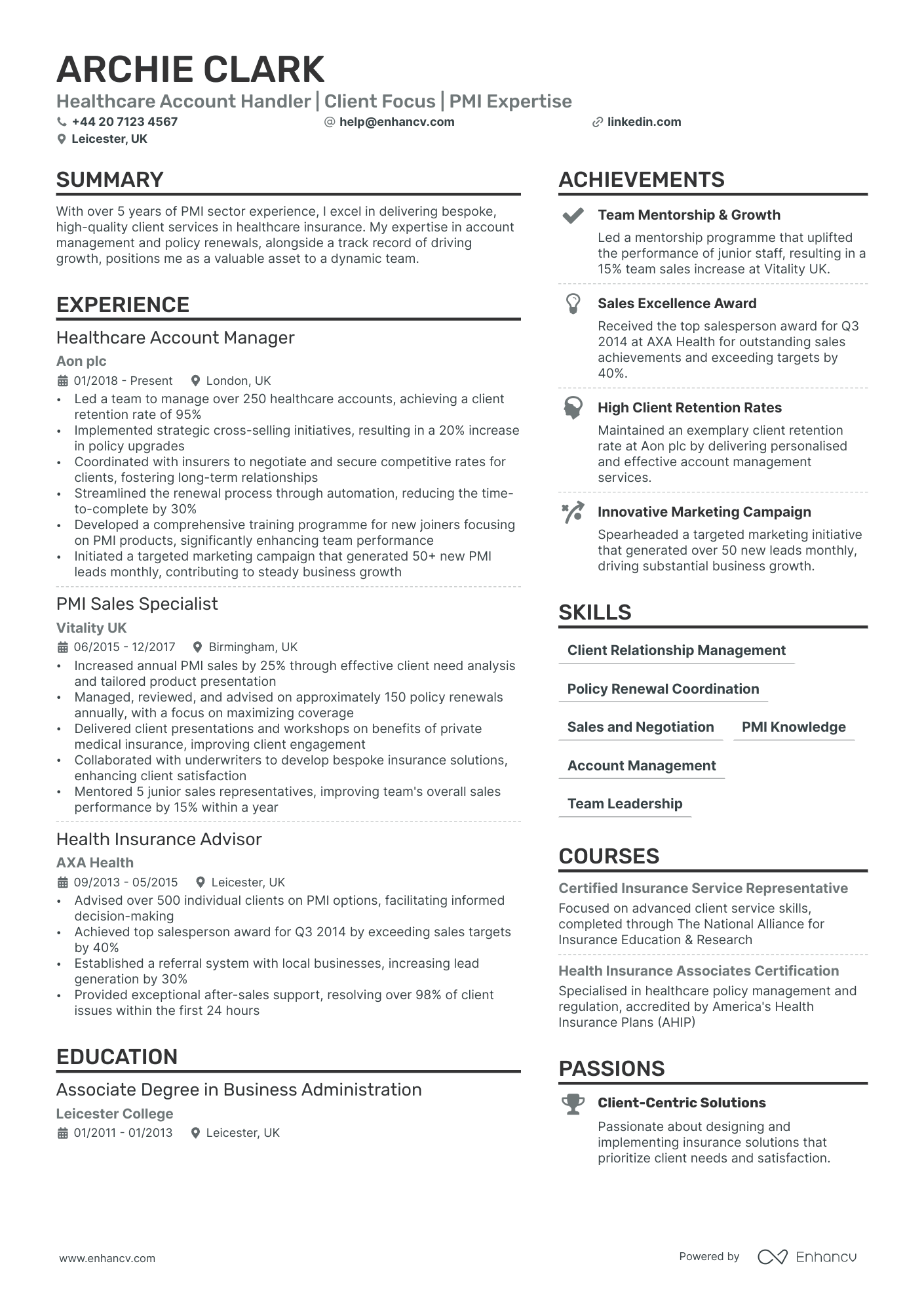

Life Insurance Broker

- Clarity and Structure in Presentation - The CV efficiently organizes content, making it easy to navigate through clearly defined sections like experience, education, and skills. Bulleted lists under each role highlight key responsibilities and achievements succinctly, allowing the reader to quickly grasp major contributions and skill sets.

- Career Progression and Specialization - Archie Clark’s career trajectory reflects a steady rise from Claims Manager to Senior Fleet Broker. This progression showcases not only industry experience but also an increasing level of responsibility and specialization in fleet trucking insurance, which is crucial for a Senior Broker role.

- Industry-Specific Expertise Leveraged - The CV emphasizes unique industry-specific tools and methodologies, such as developing driver safety programs and utilizing advanced monitoring tools. These elements underscore Archie Clark's technical depth and ability to implement innovative solutions for improving fleet safety and insurance efficiency.

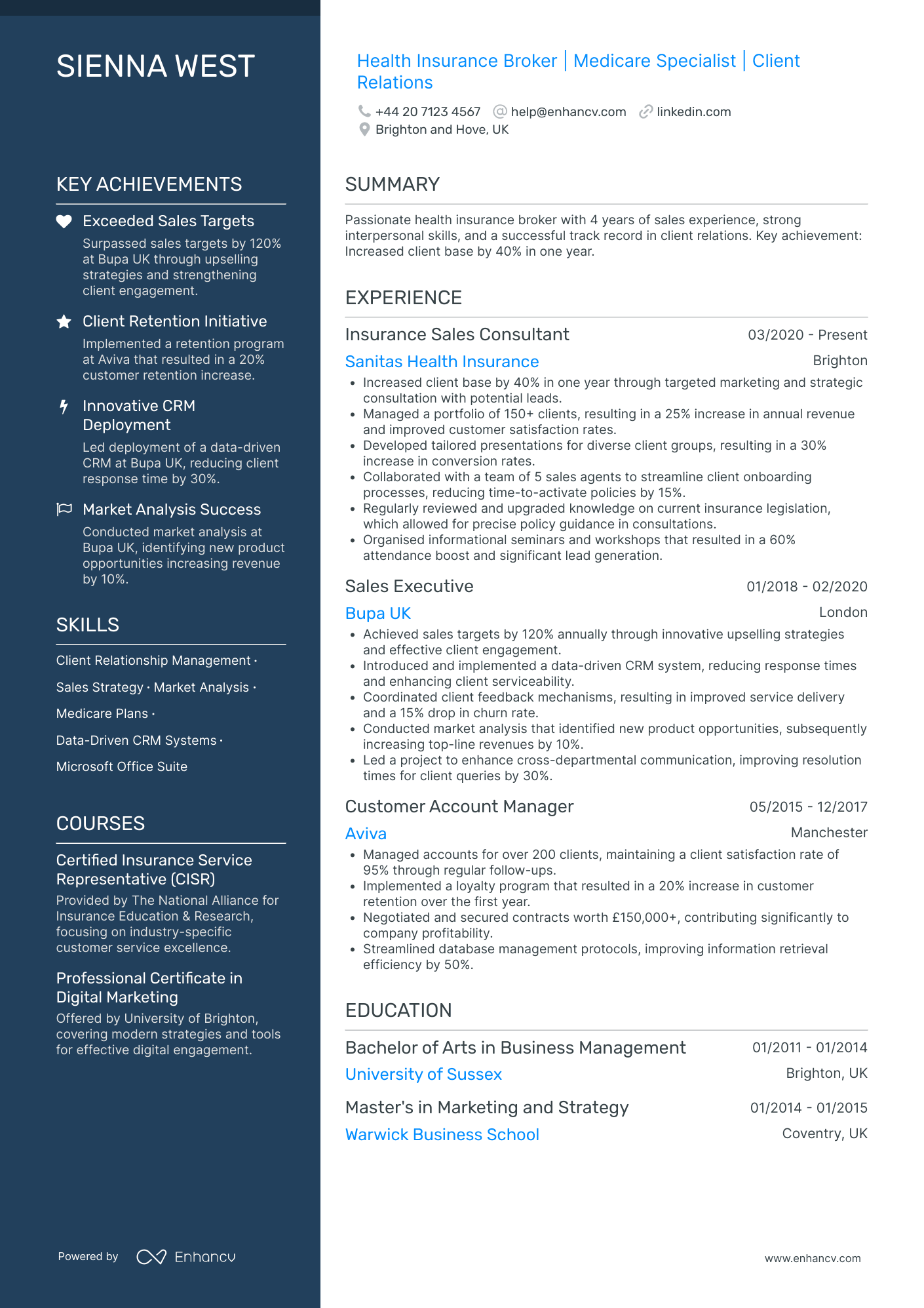

Health Insurance Broker

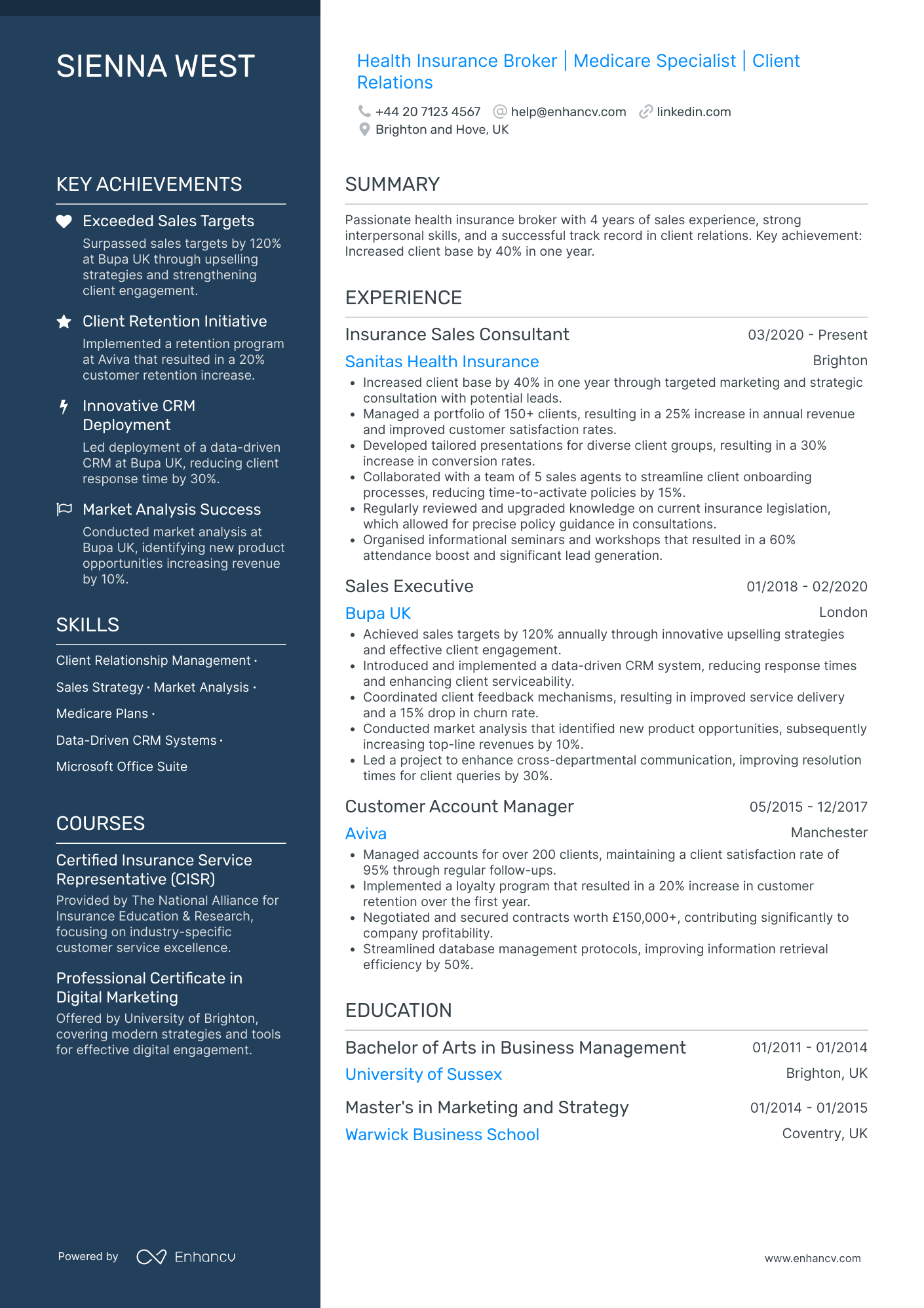

- Clear and Structured Presentation - Sienna West's CV is well-organized, providing a clear structure that guides the reader smoothly through different sections. Each part, from professional experience to education, is concise with bullet points that highlight key responsibilities and achievements, ensuring no detail is overlooked.

- Steady Career Growth in Health Insurance Industry - Sienna has consistently advanced her career in the health insurance domain, transitioning from a Customer Account Manager at Aviva to a Sales Executive at Bupa UK, and now serving as an Insurance Sales Consultant at Sanitas Health Insurance. This steady upward trajectory showcases her growing expertise and capacity for greater responsibilities in her field.

- Notable Achievements with Business Impact - The CV impressively captures Sienna's ability to drive significant business results, such as a 40% increase in client base at Sanitas and a 25% revenue boost. These accomplishments not only demonstrate her effectiveness in sales but also her strategic impact on business growth and client satisfaction.

Auto Insurance Broker

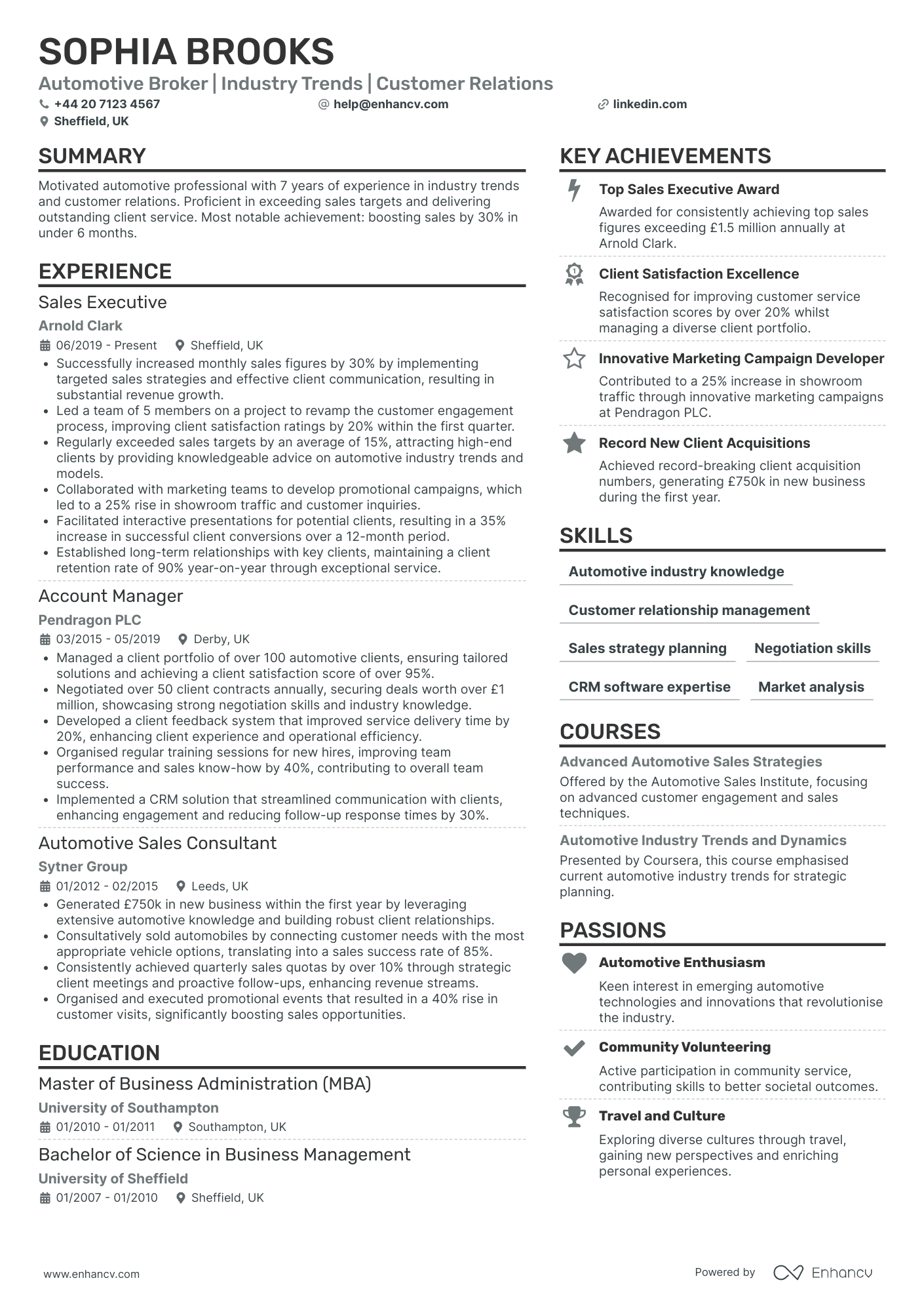

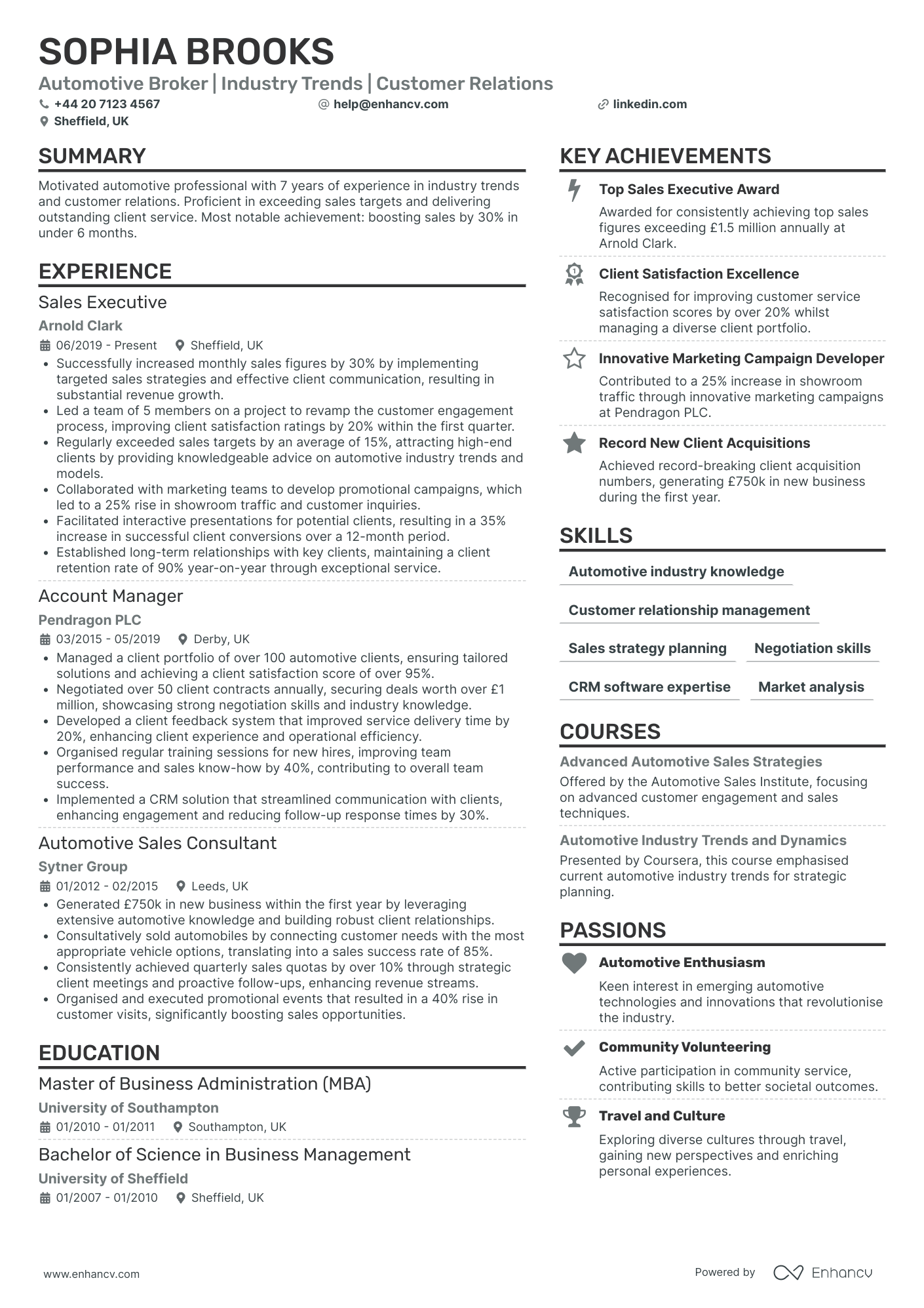

- Career Progression and Growth - Sophia Brooks clearly demonstrates a progressive career trajectory, advancing from an Automotive Sales Consultant to a Sales Executive, and eventually to an Account Manager. Each role highlights increased responsibilities, leadership opportunities, and a deeper involvement in strategic business decisions within the automotive sector.

- Industry-Specific Competencies and Tools - The CV showcases Sophia's proficiency in automotive industry trends, CRM software expertise, and market analysis. Her roles have involved using these skills strategically to enhance sales strategies and improve customer relationships, indicating a high level of technical depth specific to the automotive industry.

- Redeeming Business Achievements - The CV effectively details Sophia's impressive track record with achievements that have a tangible impact on business success. Specific accomplishments, like boosting sales by 30% in six months and securing deals worth over £1 million, demonstrate her capacity to drive significant revenue growth and contribute strategically to business objectives.

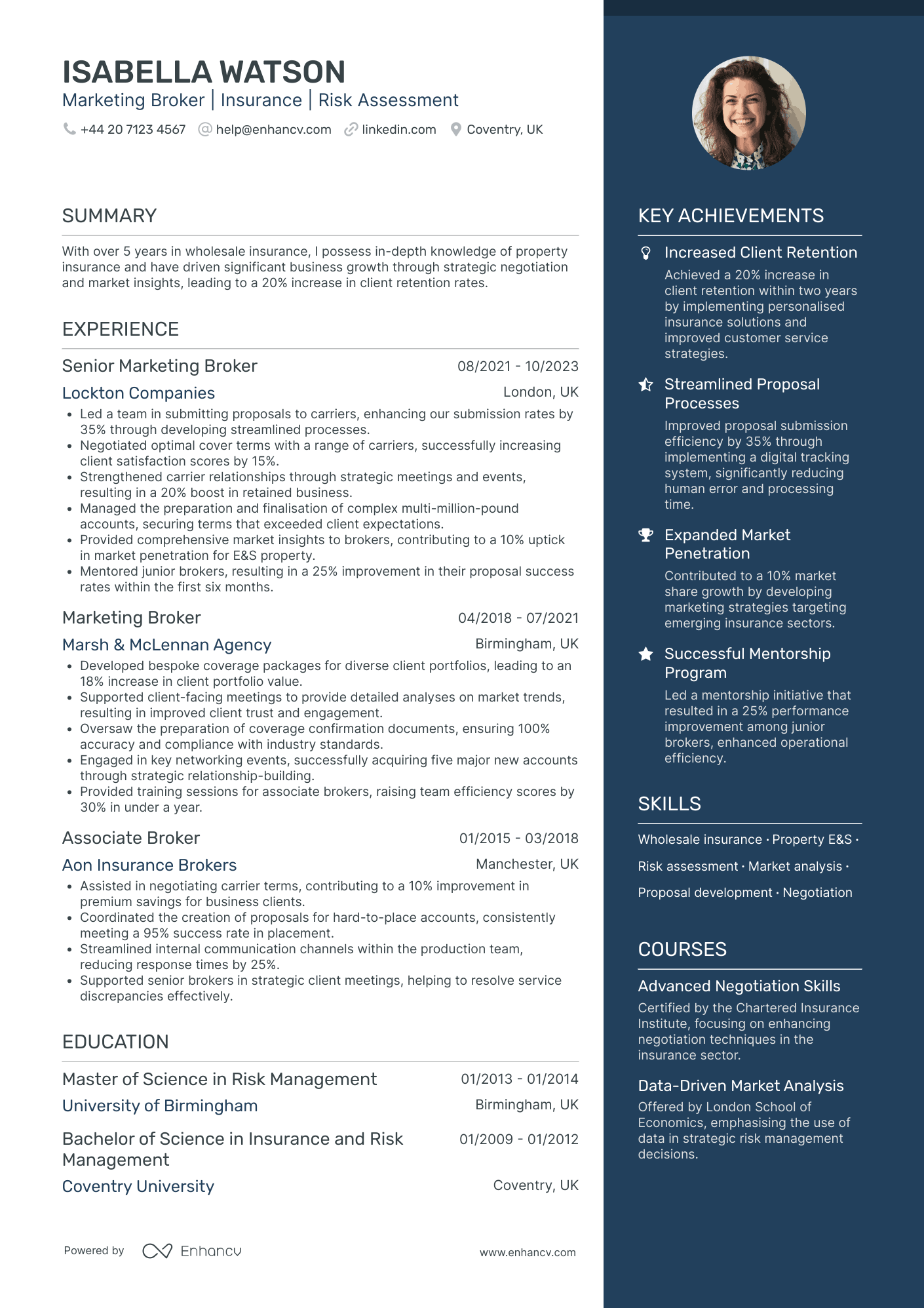

Property Insurance Broker

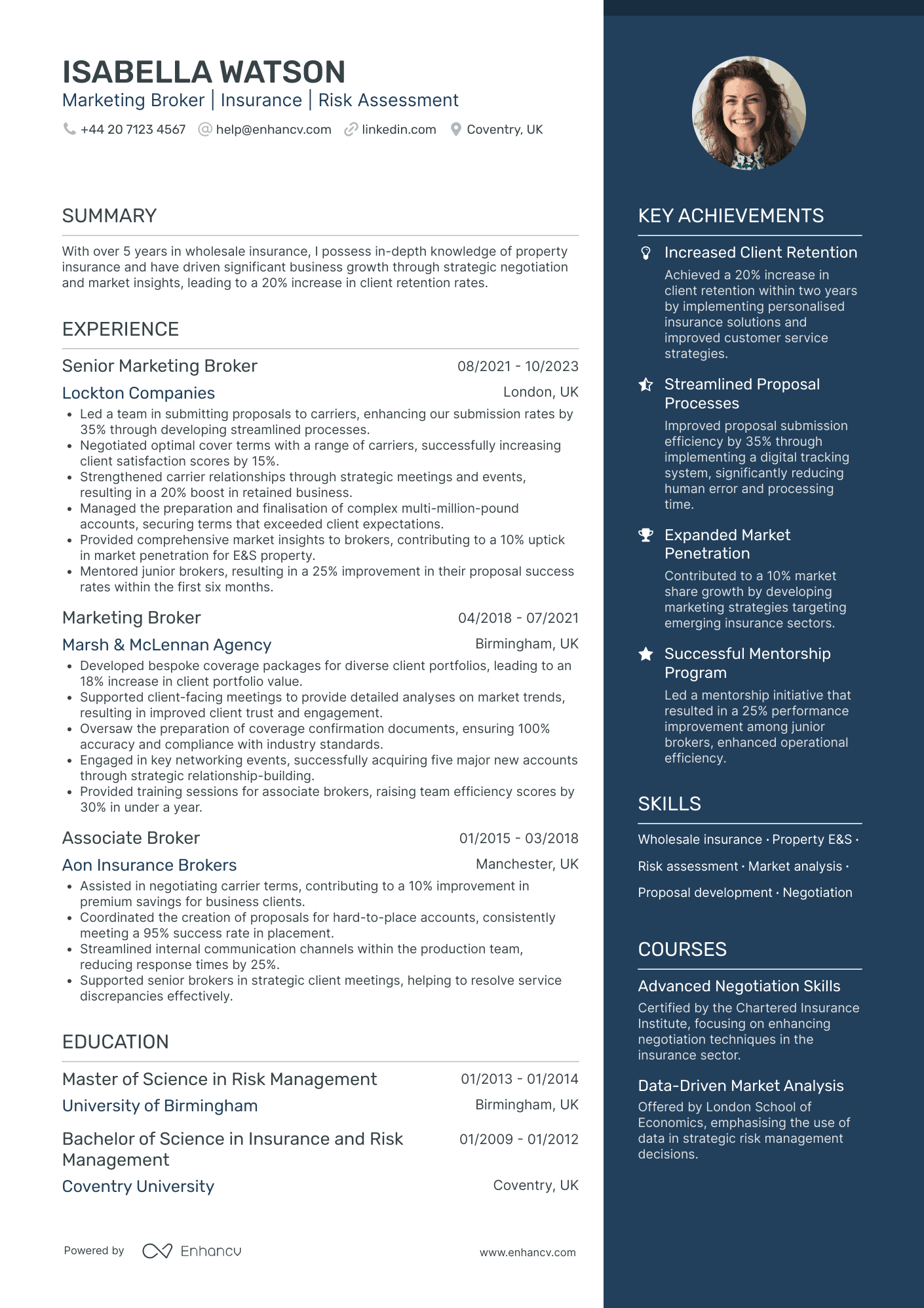

- Structured and Clear Content Presentation - The CV is efficiently structured, offering a clear and concise presentation of Isabella Watson's professional experience. Each section is well-organized with distinct headings and bullet points, allowing for easy navigation and comprehension. This clarity ensures that key achievements and responsibilities are highlighted effectively, making it easier for potential employers to assess her qualifications.

- Notable Career Trajectory - Isabella's career growth is evident as she progresses from an Associate Broker to a Senior Marketing Broker within renowned companies like Lockton and Marsh & McLennan. This upward trajectory underscores her ability to expand her expertise and take on increasing responsibilities, reflecting her ambition and capability to succeed in the insurance industry.

- Impactful Achievements with Industry Relevance - The CV emphasizes Isabella's significant achievements, such as increasing client retention by 20% and market penetration by 10%. These accomplishments demonstrate not only her commitment to driving business growth but also her strategic thinking in addressing client needs and enhancing market competitiveness.

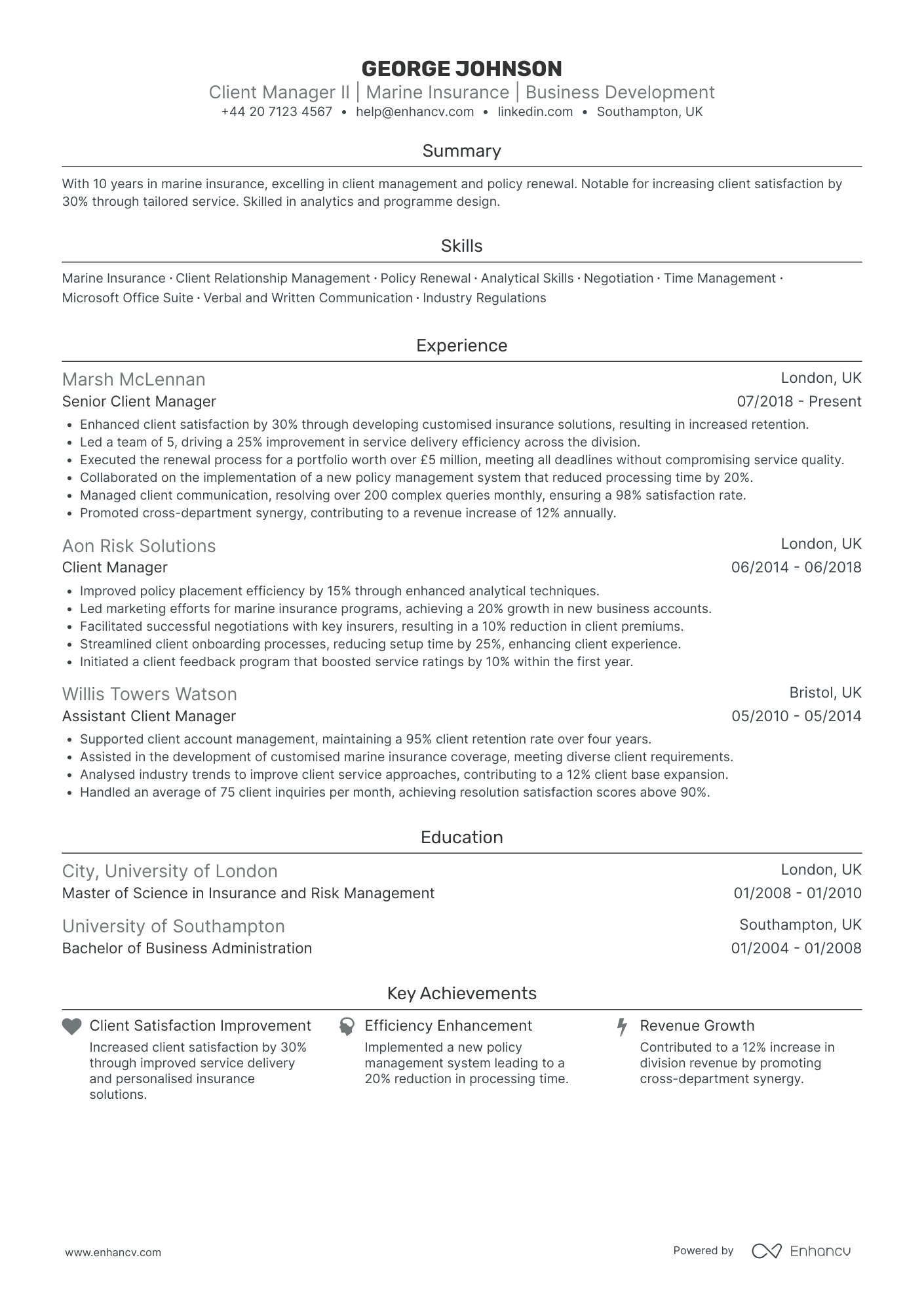

Marine Insurance Broker

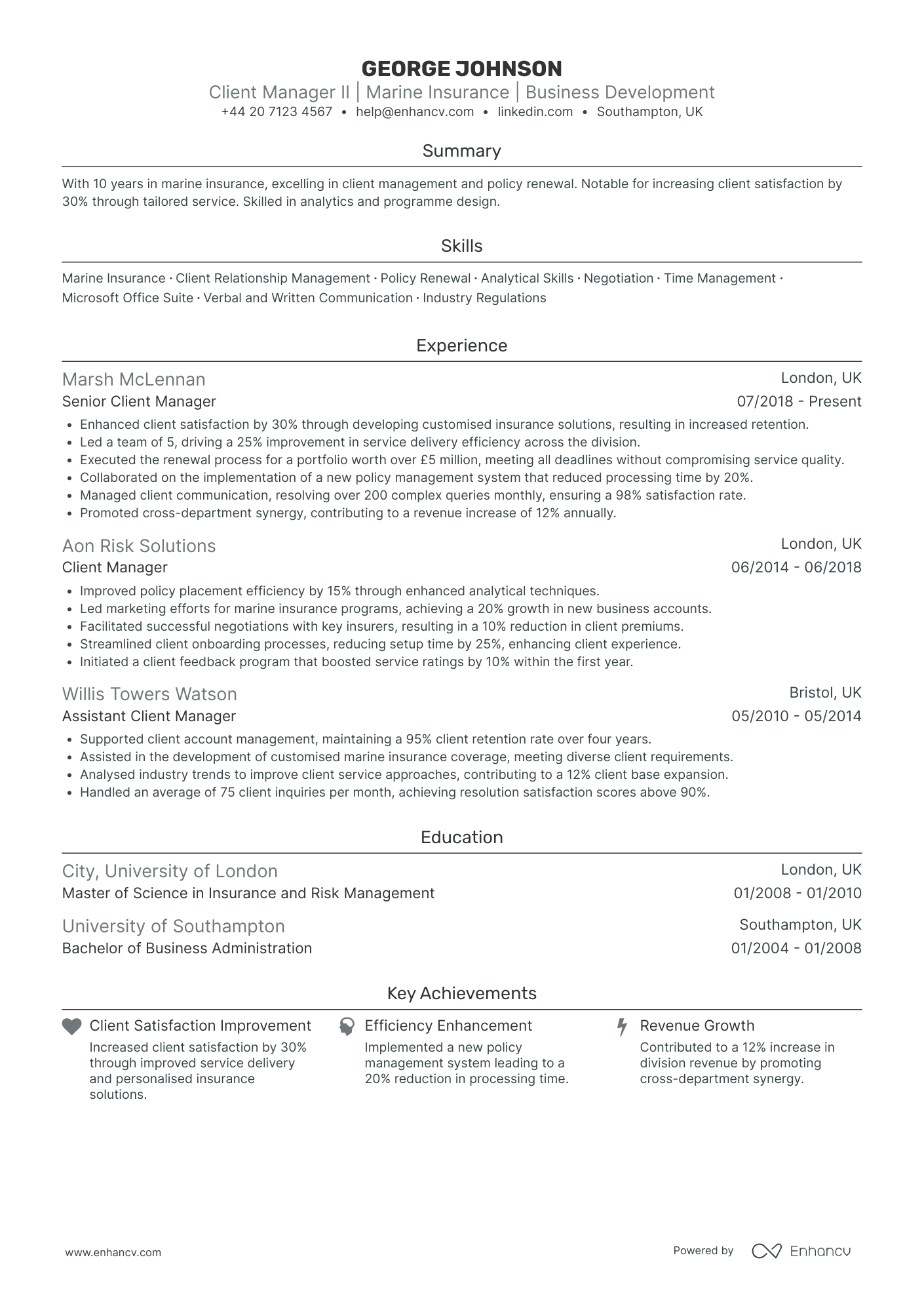

- Clear and Concise Content Presentation - The CV excels in its presentation with well-organized sections that provide a comprehensive overview of George Johnson's professional journey. The use of bullet points enhances readability and succinctly conveys key responsibilities and achievements in each role, ensuring that vital information is quickly accessible.

- Demonstrates Career Growth and Industry Expertise - George Johnson's career trajectory showcases a steady upward progression within the marine insurance sector. Starting as an Assistant Client Manager and advancing to Senior Client Manager at well-known firms highlights his growth and deepening expertise in client management and policy execution within the industry.

- Notable Achievements and Business Impact - The CV effectively highlights meaningful achievements, such as increasing client satisfaction by 30% and contributing to a 12% revenue growth. These metrics not only demonstrate George Johnson's capability to impact the business positively but also underline his strategic approach in enhancing client and company outcomes through innovation and efficiency.

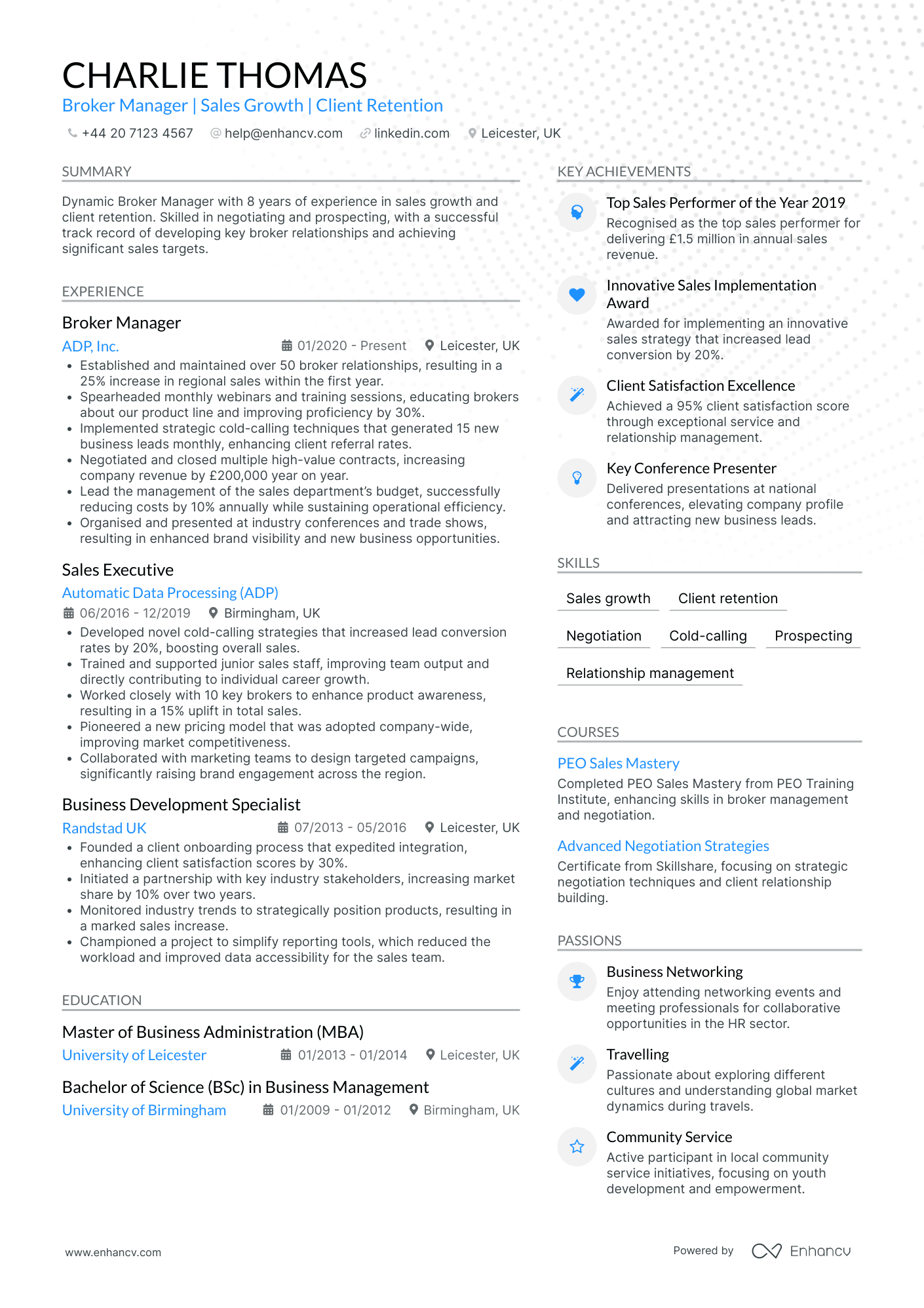

Travel Insurance Broker

- Clear Structure and Presentation - The CV is well-organized into distinct sections such as experience, education, skills, courses, achievements, and languages, making it easy for potential employers to find relevant information quickly. Each section is concise yet comprehensive, ensuring clarity without overwhelming the reader.

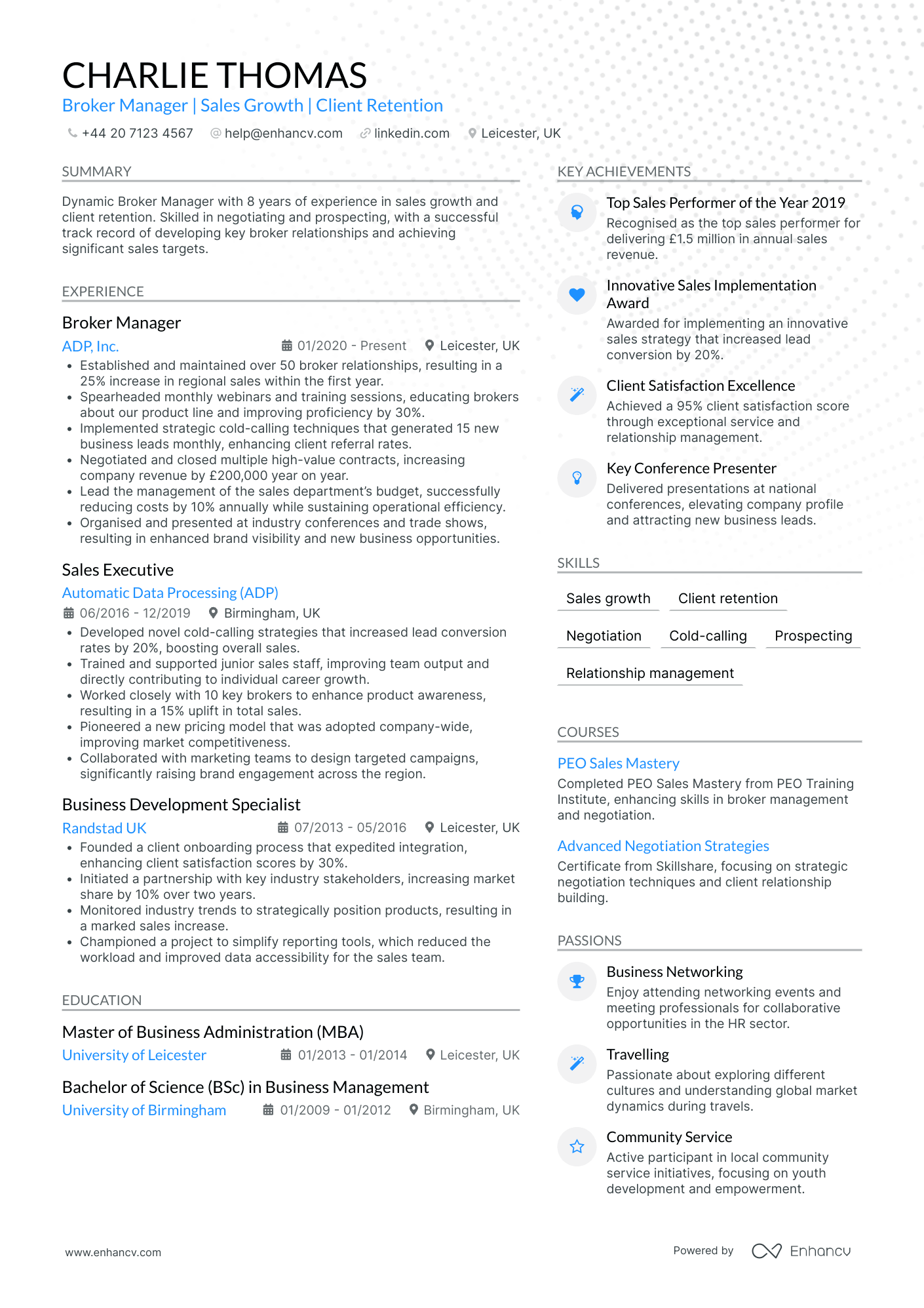

- Progressive Career Trajectory - Charlie Thomas has demonstrated significant career growth, moving from a Business Development Specialist to a Broker Manager. This progression is indicative of a professional who has consistently advanced through increased responsibilities and roles, showcasing dedication and competence in their field.

- Alignment of Achievements with Business Goals - The CV effectively ties individual accomplishments to broader business objectives. For example, increasing regional sales by 25% and augmenting company revenue by £200,000 annually are not just impressive figures, but they underscore Charlie's direct impact on business profitability and market expansion.

Farm Insurance Broker

- Clear Career Progression and Specialization - Charlie Thomas's CV demonstrates a clear and logical career trajectory, moving from an Associate Insurance Broker to becoming a Senior Life Insurance Advisor. This upward mobility highlights his dedication to the field and his ability to grow and take on more responsibility over time, showcasing his specialization in life insurance and sales.

- Effective Use of Quantifiable Achievements - The CV efficiently communicates Charlie's success by including specific percentages and figures that represent his impact. From increasing client retention by 20% to achieving a 95% customer satisfaction rate, these metrics illustrate his capability to drive significant business results and improvements in client relations.

- Strong Emphasis on Continuous Learning and Adaptability - Charlie's passion for continuous improvement is evident through his completion of industry-specific courses and achievements in adapting sales strategies to changing market dynamics. His commitment to lifelong learning and ability to upskill reflect his readiness to stay ahead in the competitive insurance landscape.

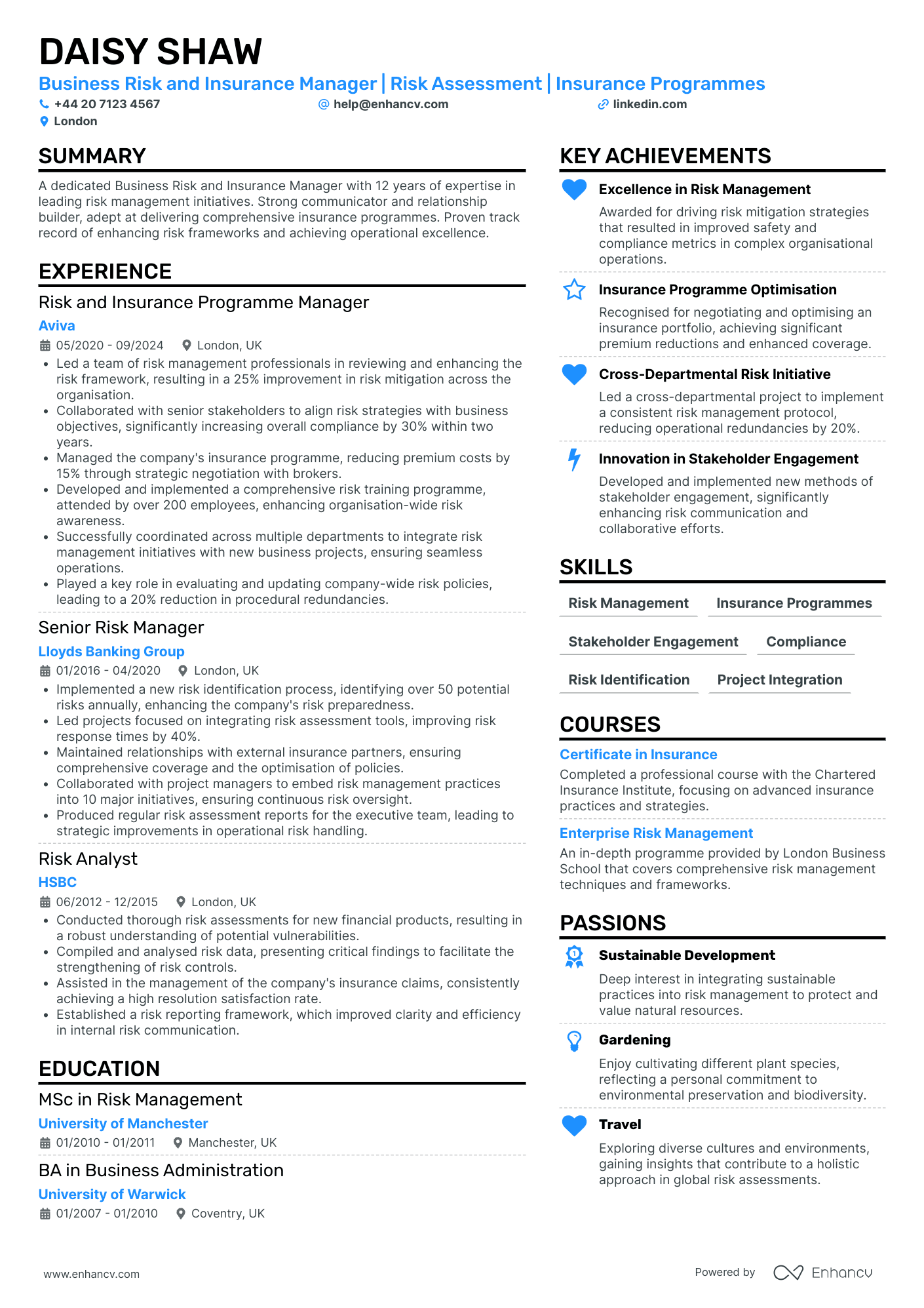

Business Insurance Broker

- Progressive Career Growth - The CV illustrates a well-defined career trajectory, showcasing Daisy Shaw's evolution from a Risk Analyst at HSBC to a Risk and Insurance Programme Manager at Aviva. This advancement highlights her capability to take on increasing responsibilities and leadership positions within the risk management and insurance sector.

- Cross-Functional Leadership - Daisy's experience in managing cross-departmental initiatives demonstrates her adaptability and capability to drive collaboration across different teams. Her ability to successfully integrate risk management into new business projects reflects her cross-functional expertise and leadership skills.

- Strategic Achievements with Business Impact - The documented achievements, such as a 25% improvement in risk mitigation and a 15% reduction in insurance premium costs, extend beyond metrics to reveal the significant business impact of her work. Her ability to deliver strategic risk management solutions that align with business objectives underscores her value addition to the organizations.

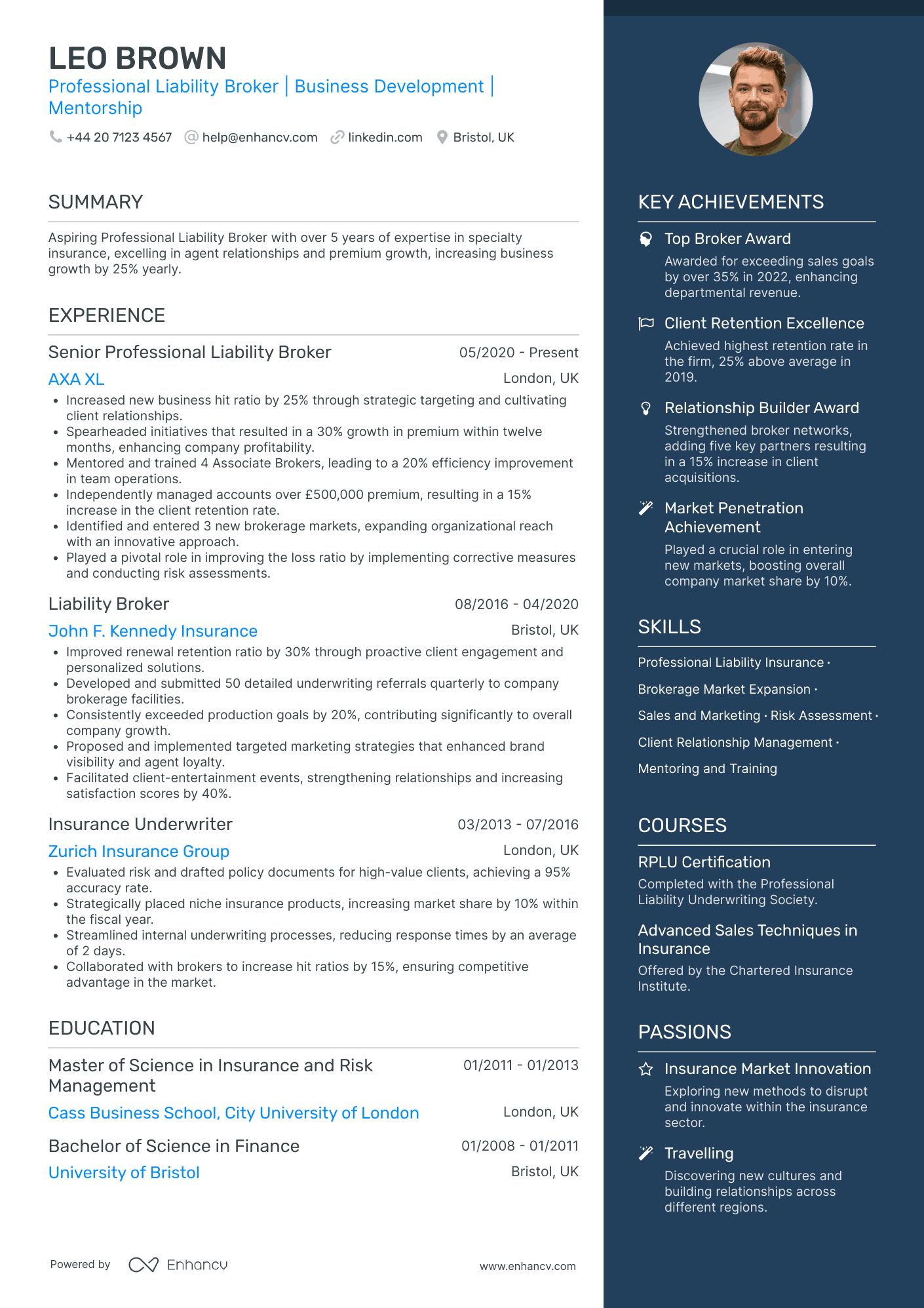

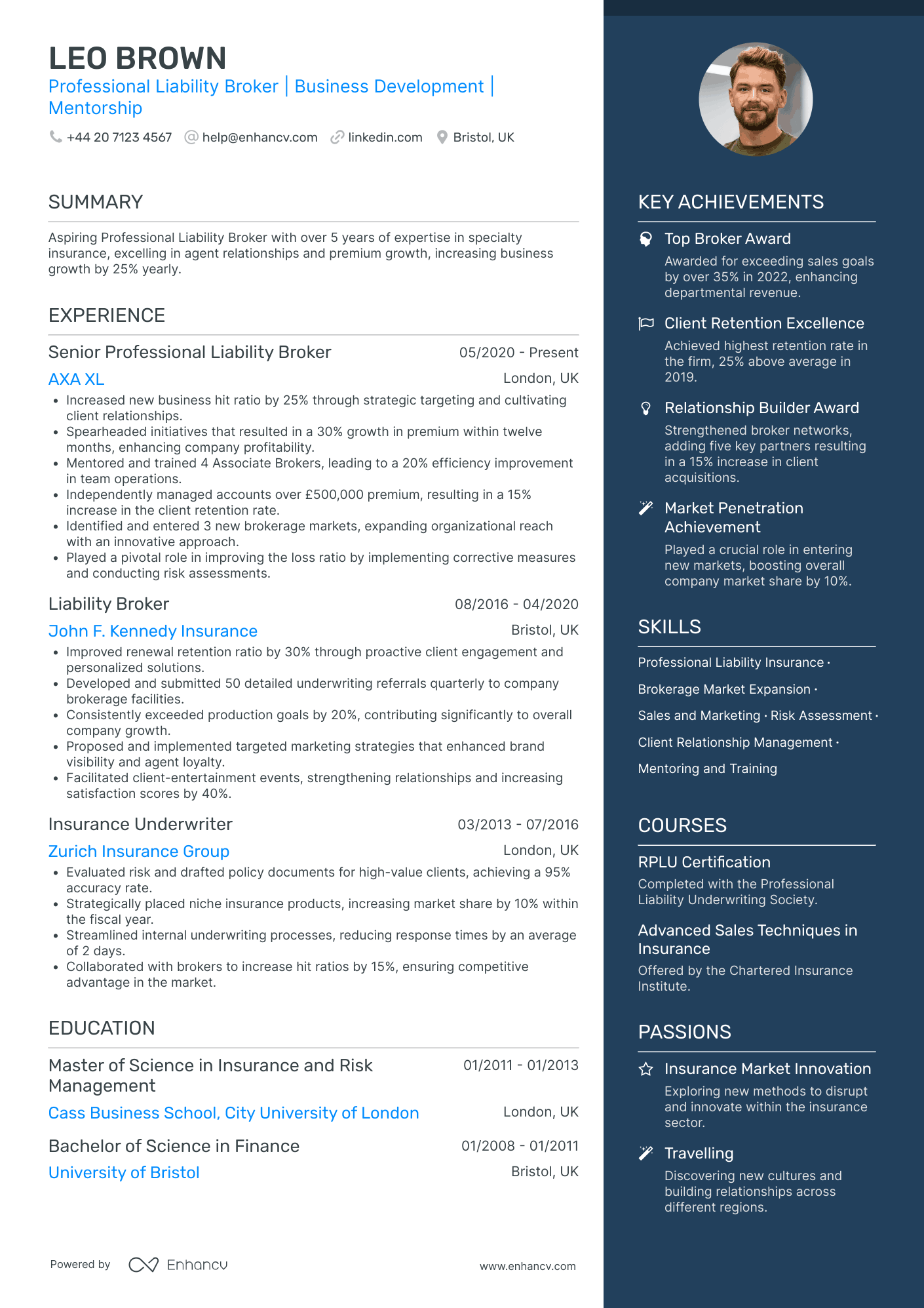

Professional Liability Insurance Broker

- Clear and structured content presentation - The CV is well-organized, presenting Leo Brown’s professional history in a coherent manner. It clearly delineates sections such as experience, education, skills, and achievements, making it easy for potential employers to get a comprehensive view of his qualifications at a glance. Each section is concise, yet detailed enough to convey key information effectively.

- Impressive career trajectory and growth - Throughout his career, Leo Brown has demonstrated significant upward mobility and industry contribution, transitioning from an Insurance Underwriter to a Senior Professional Liability Broker. This growth reflects his capability to embrace greater responsibilities, lead initiatives, and impact company profitability positively, showcasing a consistent pattern of professional development in the insurance domain.

- Distinctive achievements with real business impact - The CV highlights several notable achievements that illustrate Leo's ability to drive tangible outcomes. By spearheading strategies that led to premium growth and improving client retention rates, he has contributed materially to his employers’ successes. Awards such as the Top Broker Award further validate his excellence and leadership in the industry.

Workers Compensation Insurance Broker

- Strong Career Progression - The CV illustrates a clear career trajectory, starting from a Retail Sales Assistant and advancing to a Senior Insurance Consultant role. Moving through reputable companies like John Lewis & Partners and Aviva, it highlights the candidate's growth and willingness to take on increased responsibilities in the insurance industry.

- Industry-Specific Methodologies - The candidate employs effective strategies such as innovative customer feedback systems and specialised insurance packages. These methodologies not only led to a 25% improvement in customer satisfaction scores but also diversified the client portfolio by 20%, demonstrating a deep understanding of industry-specific needs.

- Emphasis on Soft Skills and Team Leadership - Soft skills such as client relations, negotiation, and communication are prominently showcased. Coaching and mentoring junior agents is emphasized as a crucial component of the candidate's leadership, indicating their capability to foster a collaborative environment and enhance team performance by 30% over two quarters.

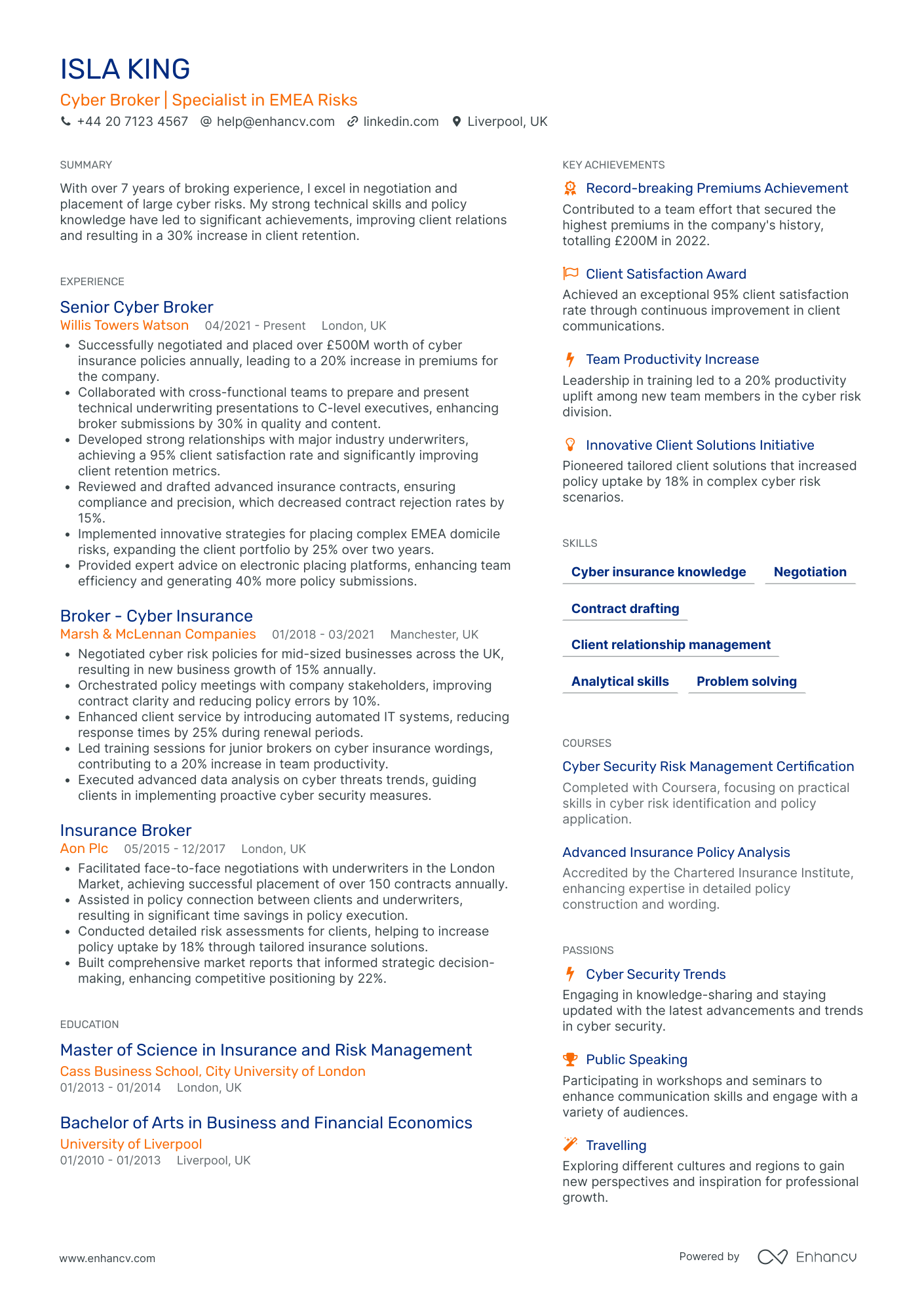

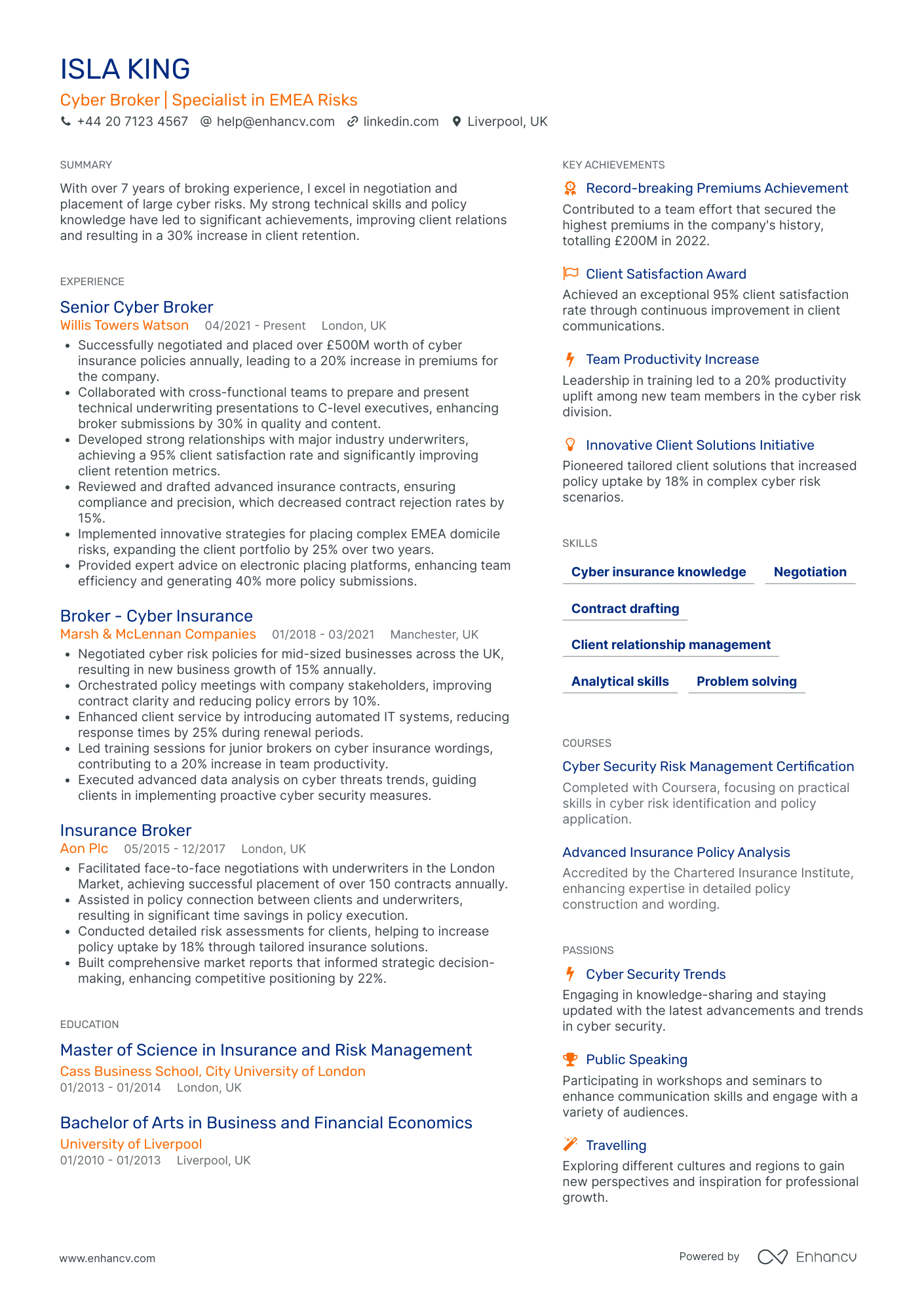

Cyber Risk Insurance Broker

- Structured progression in a specialized field - The CV effectively outlines the candidate’s career trajectory from an Insurance Broker to a Senior Cyber Broker, emphasizing steady growth in responsibilities and expertise in cyber risks within the EMEA region. This progression showcases a strategic focus and dedication to advancing within a highly specialized area of insurance.

- Emphasis on cross-functional collaboration and technical proficiency - The experience section highlights cross-functional collaboration, notably through working with diverse teams to enhance broker submissions and develop innovative risk strategies. The candidate’s proficiency in preparing technical underwriting presentations and enhancing team efficiency with electronic platforms accentuates their adeptness in both technical and interpersonal settings.

- Tangible achievements driving business impact - The inclusion of specific achievements emphasizes the candidate’s effectiveness in driving business outcomes, such as negotiating £500M in policies, improving client retention by 30%, and achieving high client satisfaction. These accomplishments are not merely numerical achievements but showcase a direct and positive impact on company performance and client relations.

Structuring and formatting your insurance broker CV for an excellent first impression

The experts' best advice regarding your CV format is to keep it simple and concise. Recruiters assessing your CV are foremost looking out for candidates who match their ideal job profile. Your white space, borders, and margins. You may still be wondering which format you need to export your CV in. We recommend using the PDF one, as, upon being uploaded, it never alters your information or CV design. Before we move on to the actual content of your insurance broker CV, we'd like to remind you about the Applicant Tracker System (or the ATS). The ATS is a software that is sometimes used to initially assess your profile. Here's what you need to keep in mind about the ATS:

- All serif and sans-serif fonts (e.g. Rubik, Volkhov, Exo 2 etc.) are ATS-friendly;

- Many candidates invest in Arial and Times New Roman, so avoid these fonts if you want your application to stand out;

- Both single and double column CVs can be read by the ATS, so it's entirely up to you to select your CV design.

PRO TIP

Be mindful of white space; too much can make the CV look sparse, too little can make it look cluttered. Strive for a balance that makes the document easy on the eyes.

The top sections on a insurance broker CV

- Professional Summary to provide a snapshot of key skills and experience.

- Insurance-Specific Skills detailing specific industry knowledge and proficiency.

- Relevant Work Experience to showcase direct experience and achievements.

- Education and Qualifications to show relevant academic and professional credentials.

- Industry Certifications to highlight specialised insurance brokerage training.

What recruiters value on your CV:

- Highlight your knowledge of different insurance products and markets; this showcases your ability to provide a range of options to clients.

- Emphasise your sales achievements and targets met or exceeded; firms are looking for brokers who can effectively close deals and grow their client base.

- Illustrate your strong communication and client relationship skills; as an insurance broker, the ability to establish trust and rapport with clients is crucial.

- Demonstrate your ability to accurately assess risk and your attention to detail; these are key in tailoring insurance policies to client needs.

- Showcase any relevant certifications or continuing education in the insurance sector, such as Chartered Insurance Institute qualifications; they affirm your commitment and expertise in the field.

Recommended reads:

Making a good first impression with your insurance broker CV header

Your typical CV header consists of Your typical CV header consists of contact details and a headline. Make sure to list your professional phone number, email address, and a link to your professional portfolio (or, alternatively, your LinkedIn profile). When writing your CV headline , ensure it's:

- tailored to the job you're applying for;

- highlights your unique value as a professional;

- concise, yet matches relevant job ad keywords.

You can, for examples, list your current job title or a particular skill as part of your headline. Now, if you decide on including your photo in your CV header, ensure it's a professional one, rather than one from your graduation or night out. You may happen to have plenty more questions on how to make best the use of your CV headline. We'll help you with some real-world examples, below.

Examples of good CV headlines for insurance broker:

- Chartered Insurance Broker | Risk Management Specialist | ACII Certified | 10+ Years’ Client Advisory Experience

- Expert in Commercial Insurance | BA in Business Administration | AIIN Holder | 5 Years at Industry Forefront

- Senior Insurance Advisor | Focus on SME Coverage | Claims Handling Expert | DipCII | 15 Years' Expertise

- Insurance Brokerage Leader | Specialised in Life & Pensions | Chartered Status | Innovation & Growth Driver | 20+ Years

- Associate Insurance Broker | Health & Benefits Strategist | Cert CII | Committed to Customer Excellence | 3 Years

- Insurance Broker Officer | Property & Casualty Focus | BSc in Finance | Market Analysis Enthusiast | 7 Years’ Experience

What's the difference between a insurance broker CV summary and objective

Why should it matter to you?

- Your insurance broker CV summary is a showcasing your career ambitions and your unique value. Use the objective to answer why your potential employers should hire you based on goals and ambitions. The objective is the ideal choice for candidates who happen to have less professional experience, but still meet some of the job requirements.

Before you select which one will be more relevant to your experience, have a look at some industry-leading CV summaries and objectives.

CV summaries for a insurance broker job:

- With over 10 years of dedicated experience in commercial insurance brokerage, a proven track record of exceeding sales targets by 30% consistently, and an expert level knowledge in risk management strategies, I am poised to deliver exceptional value to a forward-thinking insurance firm.

- Dynamic professional with 8 years' experience in the health insurance sector, boasting a Certified Insurance Broker credential and a history of developing tailored insurance solutions that resulted in a 25% client base expansion within just two years.

- Former financial analyst with 5 years' experience in the banking industry, now seeking to utilise an extensive background in data analysis, customer service excellence, and keen market insights to pivot seamlessly into a challenging new role within the insurance brokerage landscape.

- Accomplished retail manager recognised for team leadership and exceptional customer service, eager to transfer 7 years of client-focused experience to excel in fostering insurance client relationships and securing tailored coverage to meet diverse needs.

- As an aspiring insurance broker with a passion for helping others and a recent graduate in Business Administration, my objective is to leverage my academic understanding of finance and market trends to excel in providing comprehensive insurance advice and building strong client rapport.

- Goal-oriented individual with no prior insurance experience, but a strong desire to embrace a career where my analytical skills, quick learning ability, and commitment to client satisfaction can contribute to offering top-tier insurance solutions.

The best formula for your insurance broker CV experience section

The CV experience section is the space where many candidates go wrong by merely listing their work history and duties. Don't do that. Instead, use the job description to better understand what matters most for the role and integrate these keywords across your CV. Thus, you should focus on:

- showcasing your accomplishments to hint that you're results-oriented;

- highlighting your skill set by integrating job keywords, technologies, and transferrable skills in your experience bullets;

- listing your roles in reverse chronological order, starting with the latest and most senior, to hint at how you have grown your career;

- featuring metrics, in the form of percentage, numbers, etc. to make your success more tangible.

When writing each experience bullet, start with a strong, actionable verb, then follow it up with a skill, accomplishment, or metric. Use these professional examples to perfect your CV experience section:

Best practices for your CV's work experience section

- Developed a deep understanding of various insurance products, including life, health, and property insurance, to provide tailored advice to clients.

- Negotiated with insurance companies on behalf of clients to secure the most favourable terms and comprehensive coverage, demonstrating strong negotiation skills.

- Maintained a high level of accuracy in preparing and reviewing policy documents and endorsements, ensuring compliance with industry regulations and standards.

- Conducted thorough risk assessments for clients to identify insurance needs, resulting in a 20% increase in policy uptake amongst mid-sized businesses.

- Implemented a client retention strategy that reduced policy lapses by 15%, underlining commitment to long-term client relationships and satisfaction.

- Leveraged cutting-edge CRM tools to manage client portfolios effectively, ensuring prompt and personalised service for over 200 active clients.

- Shared market intelligence and insurance trends through regular newsletters, enhancing the firm's reputation as a thought leader in the insurance sector.

- Collaborated with underwriters to develop custom insurance solutions, resulting in a 25% increase in closed deals with niche industries.

- Regularly attended professional development workshops and insurance industry conferences to keep abreast of the latest products, regulations, and best practices.

- Spearheaded the design and implementation of a new client onboarding system that improved customer satisfaction by 20% due to enhanced personalisation.

- Negotiated with insurance providers to secure more competitive premium rates, resulting in an average cost savings of 15% for our clients.

- Led a team of junior brokers and trained them in risk assessment and client management, increasing team productivity by 30%.

- Managed a portfolio of over 300 high-net-worth individuals, achieving 95% client retention rate through customized insurance solutions.

- Facilitated risk management workshops to educate clients on potential vulnerabilities, enhancing their coverage understanding and preparedness.

- Collaborated on the development of an industry-first, AI-driven risk analysis tool that increased the accuracy of policy recommendations by 25%.

- Instituted a new CRM system that optimised client interactions and policy renewals, boosting sales conversions by 18%.

- Devised bespoke insurance packages for small and medium-sized enterprises which enhanced their coverage by an average of 20%.

- Cultivated long-term relationships with underwriters, improving the underwriting process and reducing claim processing time by an average of 4 days.

- Piloted a cross-selling strategy that expanded product offerings to existing clients and grew annual revenue by 12%.

- Optimized policy renewals by implementing automated reminders and follow-ups, achieving a renewal rate increase of 8%.

- Conducted in-depth market research to stay ahead of industry trends, ensuring our insurance proposals were 15% more competitive.

- Orchestrated the negotiation of complex claims with insurers, achieving a 95% success rate in claims settlements for clients.

- Implemented tailored risk management strategies for clients in the manufacturing sector that resulted in a 10% reduction in workplace incidents and related claims.

- Delivered comprehensive training programs to new brokers, enhancing the overall knowledge base of our brokerage team within the first year of mentoring.

- Binder 98% of client renewals through pro-active engagement and strategic policy adjustments tailored to changing client lifestyles and asset acquisitions.

- Successfully diversified the company's insurance offerings into life and health sectors, increasing cross-sell opportunities by 15%.

- Consistently achieved top sales performance, being awarded 'Broker of the Year' for three consecutive years due to outstanding client service and sales success.

- Pioneered the company's entry into cyber insurance market, exceeding sales targets by 22% in the first year through effective client education and needs analysis.

- Developed and maintained strong professional relationships that led to 25 new corporate accounts over the period, fostering business growth and brand reputation.

- Crafted customised insurance packages for tech startups, ensuring adequate protection for their unique risks, contributing to a sector portfolio growth of 18%.

- Instrumental in launching an environment-focused insurance product line, resulting in the acquisition of 50+ new eco-conscious business clients in the first year.

- Regularly re-evaluated and updated insurance policies due to regulatory changes, ensuring all our clients' policies were compliant and competitive.

- Masterminded the digital marketing campaign for new insurance products, which captured a 20% increase in online engagement and inquiries.

How to ensure your insurance broker CV stands out when you have no experience

This part of our step-by-step guide will help you substitute your experience section by helping you spotlight your skill set. First off, your ability to land your first job will depend on the time you take to assess precisely how you match the job requirements. Whether that's via your relevant education and courses, skill set, or any potential extracurricular activities. Next:

- Systematise your CV so that it spotlights your most relevant experience (whether that's your education or volunteer work) towards the top;

- Focus recruiters' attention to your transferrable skill set and in particular how your personality would be the perfect fit for the role;

- Consider how your current background has helped you build your technological understanding - whether you've created projects in your free time or as part of your uni degree;

- Ensure you've expanded on your teamwork capabilities with any relevant internships, part-time roles, or projects you've participated in the past.

Recommended reads:

PRO TIP

If you have experience in diverse fields, highlight how this has broadened your perspective and skill set, making you a more versatile candidate.

Describing your unique skill set using both hard skills and soft skills

Your insurance broker CV provides you with the perfect opportunity to spotlight your talents, and at the same time - to pass any form of assessment. Focusing on your skill set across different CV sections is the way to go, as this would provide you with an opportunity to quantify your achievements and successes. There's one common, very simple mistake, which candidates tend to make at this stage. Short on time, they tend to hurry and mess up the spelling of some of the key technologies, skills, and keywords. Copy and paste the particular skill directly from the job requirement to your CV to pass the Applicant Tracker System (ATS) assessment. Now, your CV skills are divided into:

- Technical or hard skills, describing your comfort level with technologies (software and hardware). List your aptitude by curating your certifications, on the work success in the experience section, and technical projects. Use the dedicated skills section to provide recruiters with up to twelve technologies, that match the job requirements, and you're capable of using.

- People or soft skills provide you with an excellent background to communicate, work within a team, solve problems. Don't just copy-paste that you're a "leader" or excel at "analysis". Instead, provide tangible metrics that define your success inusing the particular skill within the strengths, achievements, summary/ objective sections.

Top skills for your insurance broker CV:

Insurance Underwriting

Risk Management

Claims Handling

Product Knowledge

Regulatory Compliance

Customer Relationship Management (CRM)

Financial Analysis

Policy Structuring

Sales Techniques

Data Analysis

Communication

Negotiation

Problem-Solving

Customer Service

Networking

Attention to Detail

Time Management

Decision-Making

Adaptability

Teamwork

PRO TIP

Order your skills based on the relevance to the role you're applying for, ensuring the most pertinent skills catch the employer's attention first.

Your university degree and certificates: an integral part of your insurance broker CV

Let's take you back to your uni days and decide what information will be relevant for your insurance broker CV. Once more, when discussing your higher education, select only information that is pertinent to the job (e.g. degrees and projects in the same industry, etc.). Ultimately, you should:

- List only your higher education degrees, alongside start and graduation dates, and the university name;

- Include that you obtained a first degree for diplomas that are relevant to the role, and you believe will impress recruiters;

- Showcase relevant coursework, projects, or publications, if you happen to have less experience or will need to fill in gaps in your professional history.

PRO TIP

Use mini case studies or success stories in your CV to demonstrate how your skills have positively impacted previous roles or projects.

Recommended reads:

Key takeaways

Your successful job application depends on how you well you have aligned your insurance broker CV to the job description and portrayed your best skills and traits. Make sure to:

- Select your CV format, so that it ensures your experience is easy to read and understand;

- Include your professional contact details and a link to your portfolio, so that recruiters can easily get in touch with you and preview your work;

- Write a CV summary if you happen to have more relevant professional experience. Meanwhile, use the objective to showcase your career dreams and ambitions;

- In your CV experience section bullets, back up your individual skills and responsibilities with tangible achievements;

- Have a healthy balance between hard and soft skills to answer the job requirements and hint at your unique professional value.