Crafting a CV that effectively showcases your strategic financial management and leadership skills can be a challenge for any financial controller. Our guide provides you with tailored tips and templates to help you highlight your proficiency in fiscal oversight and financial reporting, ensuring you distinguish yourself in the competitive finance industry.

- Applying best practices from real-world examples to ensure your profile always meets recruiters' expectations;

- What to include in your work experience section, apart from your past roles and responsibilities?

- Why are both hard and soft skills important for your application?

- How do you need to format your CV to pass the Applicant Tracker Software (ATS) assessment?

If you're writing your CV for a niche financial controller role, make sure to get some inspiration from professionals:

Resume examples for financial controller

By Experience

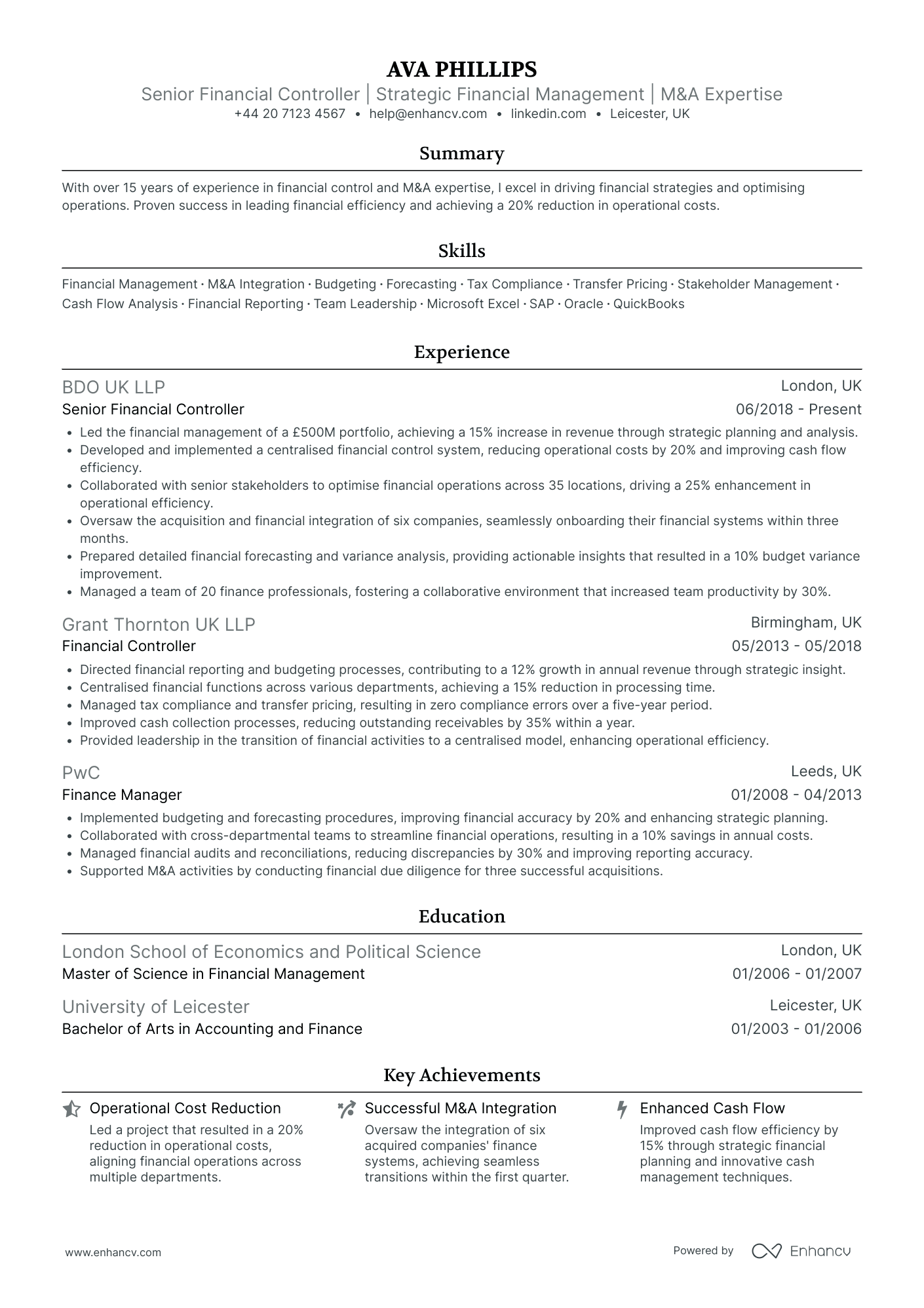

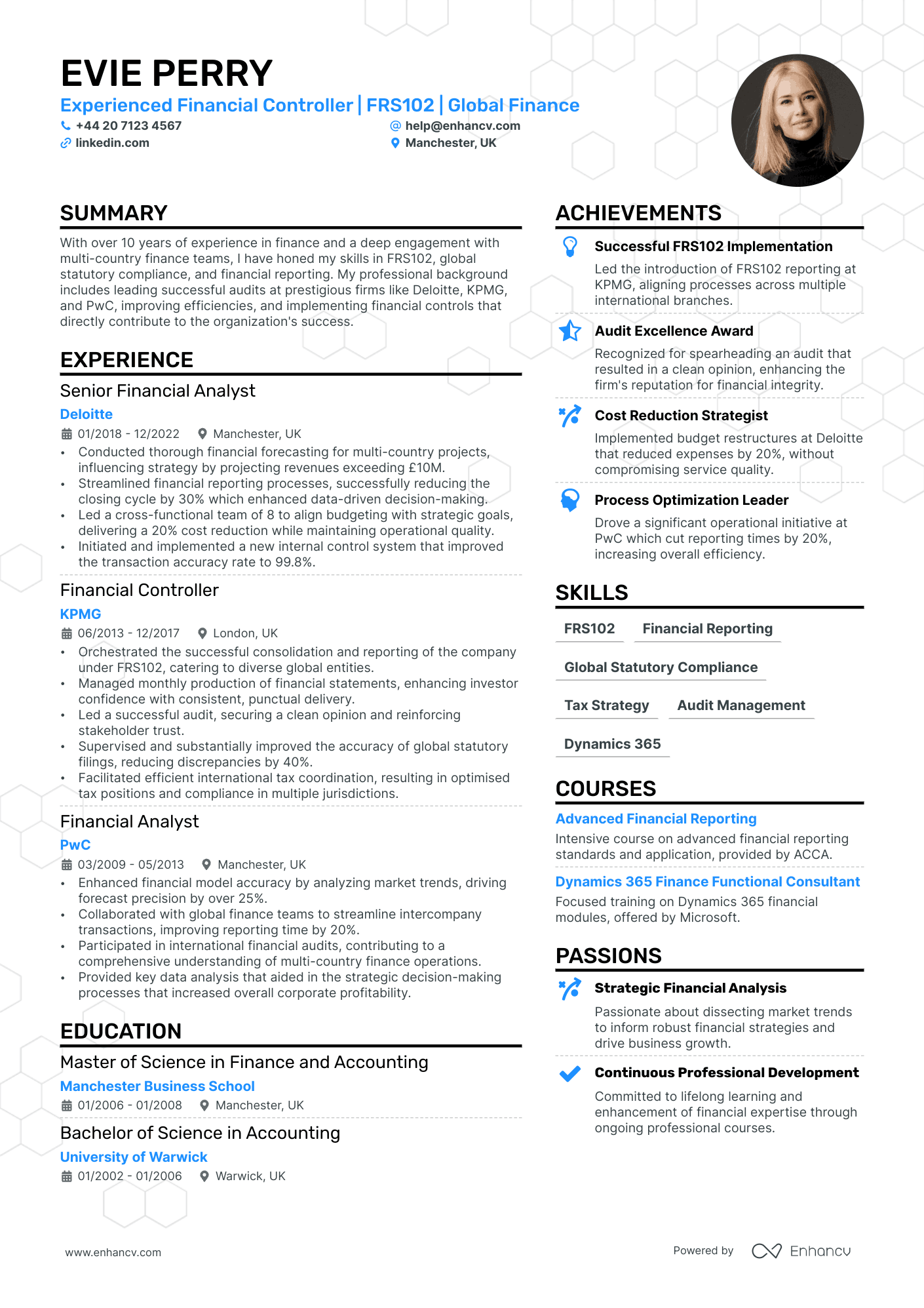

Senior Financial Controller

- Structured and Comprehensive Presentation - The CV is meticulously organized with clear sections that cover all essential areas such as experience, education, skills, courses, achievements, languages, and passions. Each segment is well-structured, allowing recruiters to quickly identify key qualifications and insights without any ambiguity.

- Demonstrates a Consistent Trajectory of Advancement - Ava Phillips displays a logical and impressive career progression from Finance Manager to Senior Financial Controller, underlining her professional growth while maintaining focus within the financial sector. Her movement between roles reveals strategic gains in responsibility and expertise, particularly in financial management and M&A operations, signaling her readiness for more senior positions.

- Effectiveness Through Quantifiable Achievements - The CV stands out by providing specific, quantifiable achievements, such as increasing revenue by 15% and decreasing operational costs by 20%. These accomplishments are not just numbers; they indicate her ability to implement impactful financial strategies that drive significant organizational improvements and efficiencies. Such tangible results strengthen the business relevance of her work history.

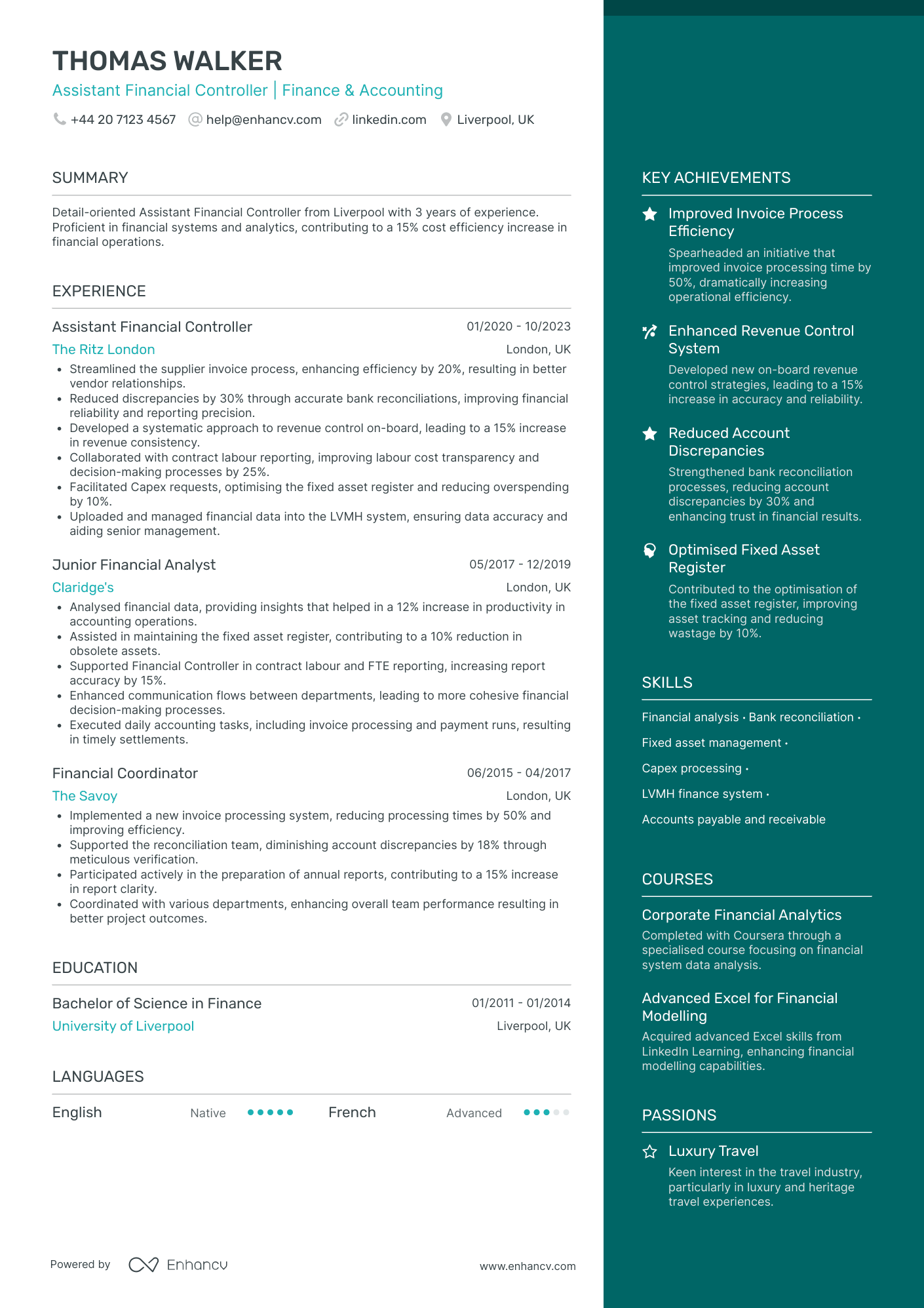

Assistant Financial Controller

- Concise and Structured Content - The CV presents information in a well-organized manner, making it easy for readers to quickly grasp key qualifications and experiences. Sections are clearly delineated, ensuring that each part of the CV, from experience to skills, contributes effectively to the overall narrative without overwhelming details.

- Career Progression and Growth - Thomas Walker’s career trajectory showcases a steady progression from Financial Coordinator to Assistant Financial Controller in notable establishments. This demonstrates his ability to advance within the field of finance and accounting, continuously building on his expertise and taking on more complex responsibilities over time.

- Achievements with Tangible Business Impact - The CV highlights numerous accomplishments with concrete metrics, such as increasing cost efficiency by 15% and reducing discrepancies by 30%. These achievements not only underscore Thomas's financial acumen but also emphasize the direct impact he has had on improving business operations and financial health at his workplaces.

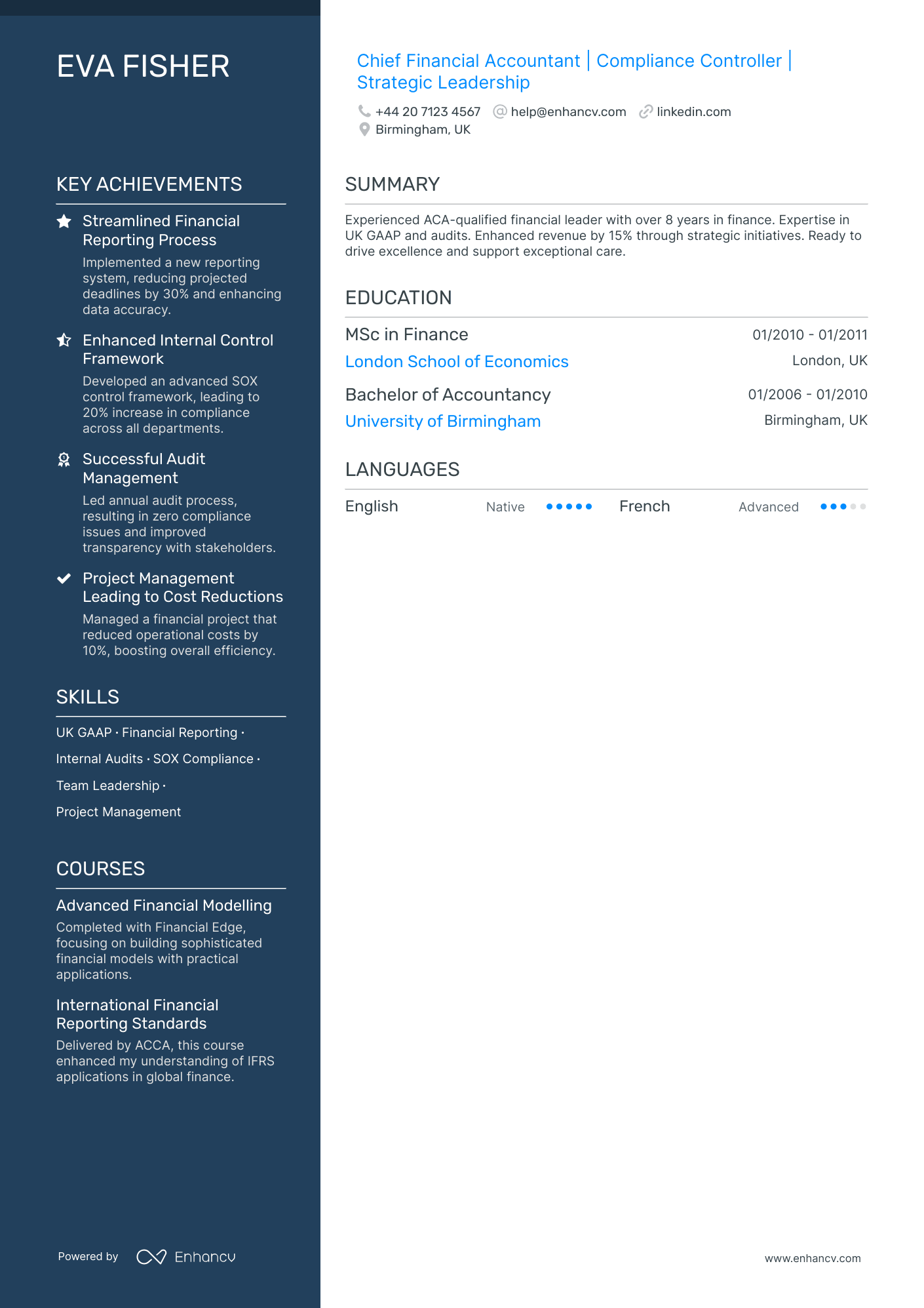

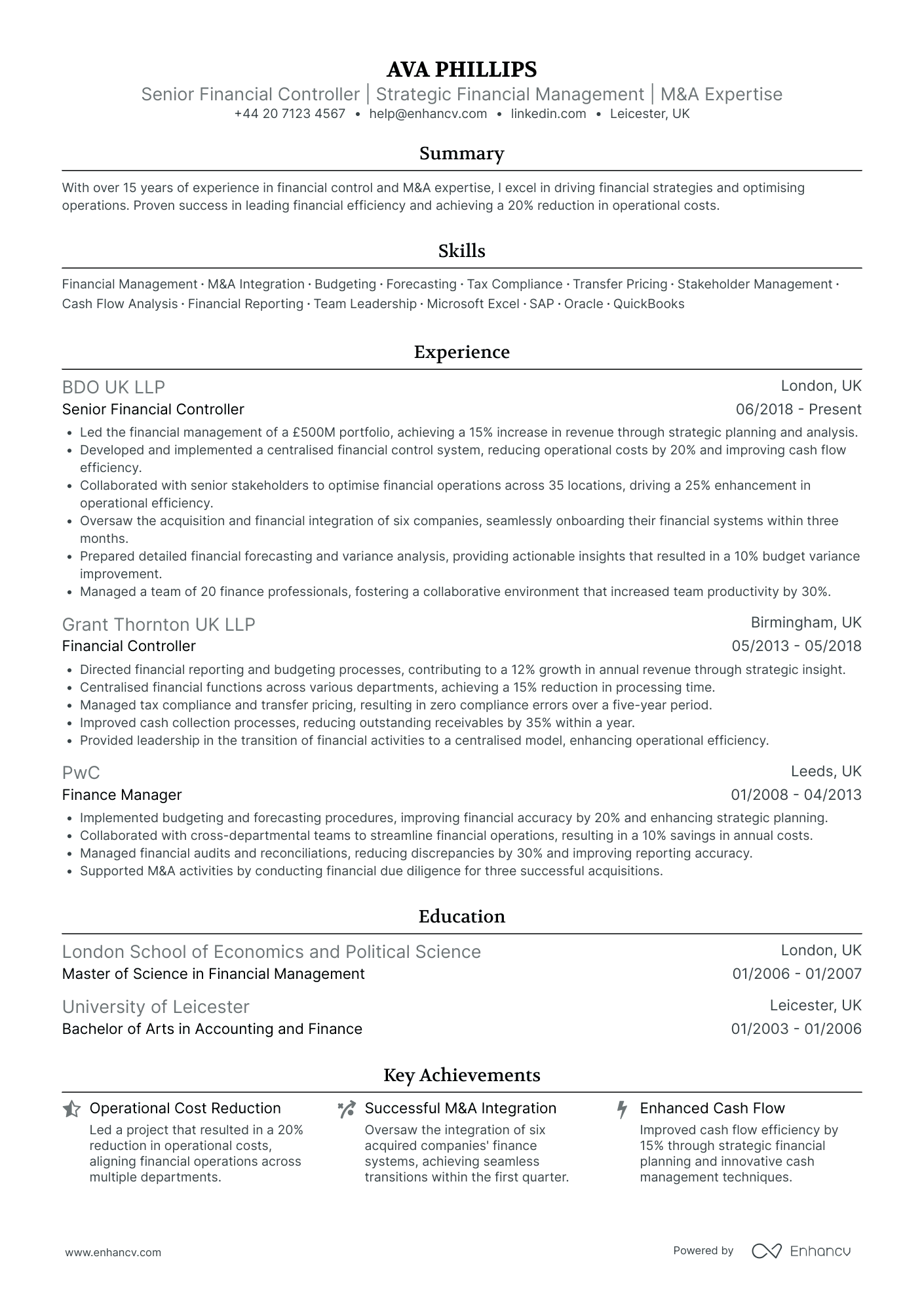

Chief Financial Controller

- Effective Content Presentation - The CV is organized with clarity and structure, allowing the reader to quickly absorb key information. Each section is concise, presenting only the most relevant details, which enhances readability and ensures that Eva Fisher's accomplishments and skills are easily recognizable.

- Impressive Career Trajectory - Eva Fisher's career path demonstrates significant growth, with an evident progression from an Audit Senior at PwC to her current role as a Senior Financial Accountant at Bupa. This trajectory underscores her ability to adapt and excel within her industry, showcasing her readiness for leadership and strategic roles in finance.

- Noteworthy Achievements and Impact - The CV highlights achievements that translate directly into business relevance, such as increasing revenue by 15% through strategic initiatives. This not only demonstrates Eva's ability to contribute to organizational growth but also her capability to implement changes that result in improved efficiency and compliance.

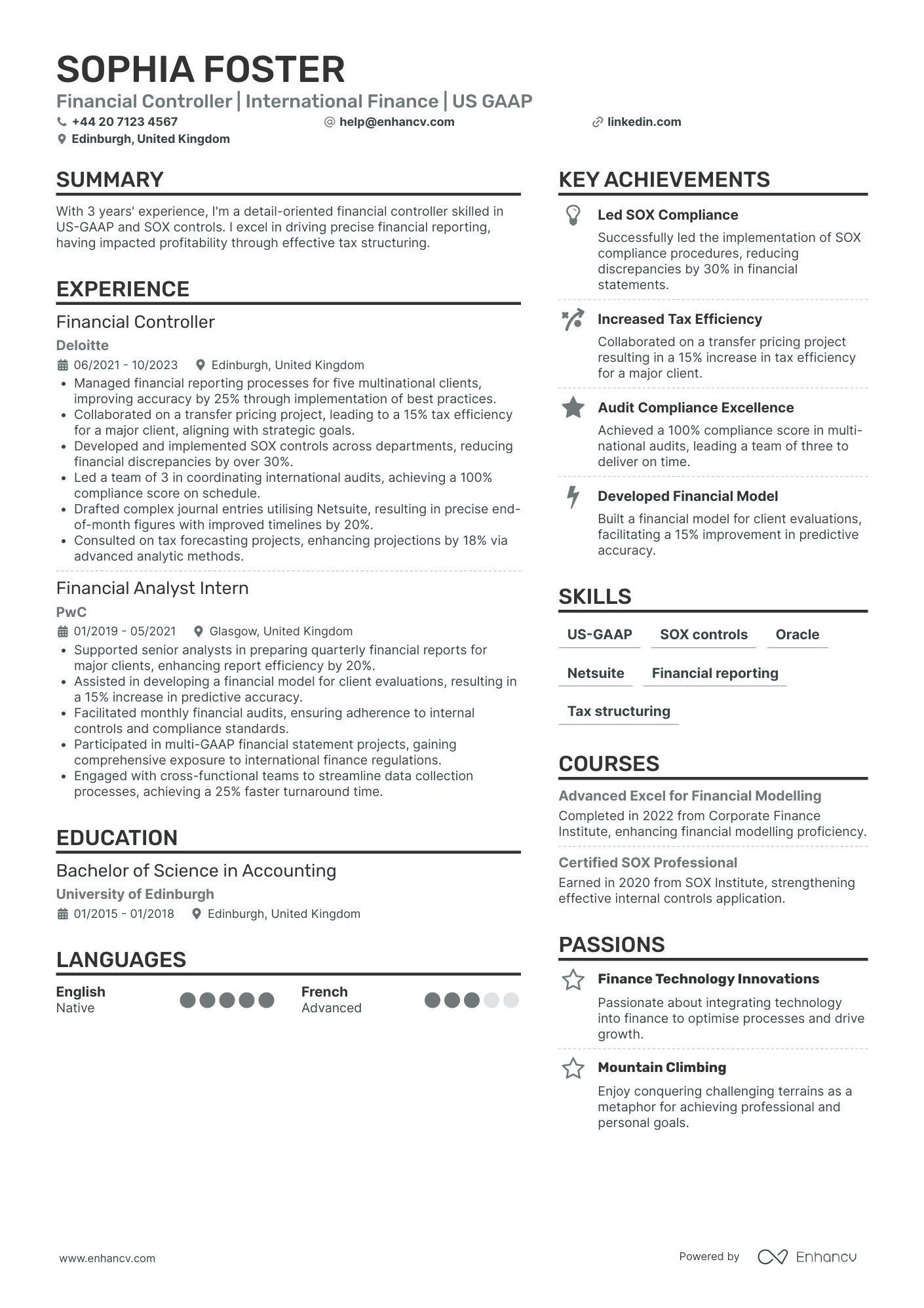

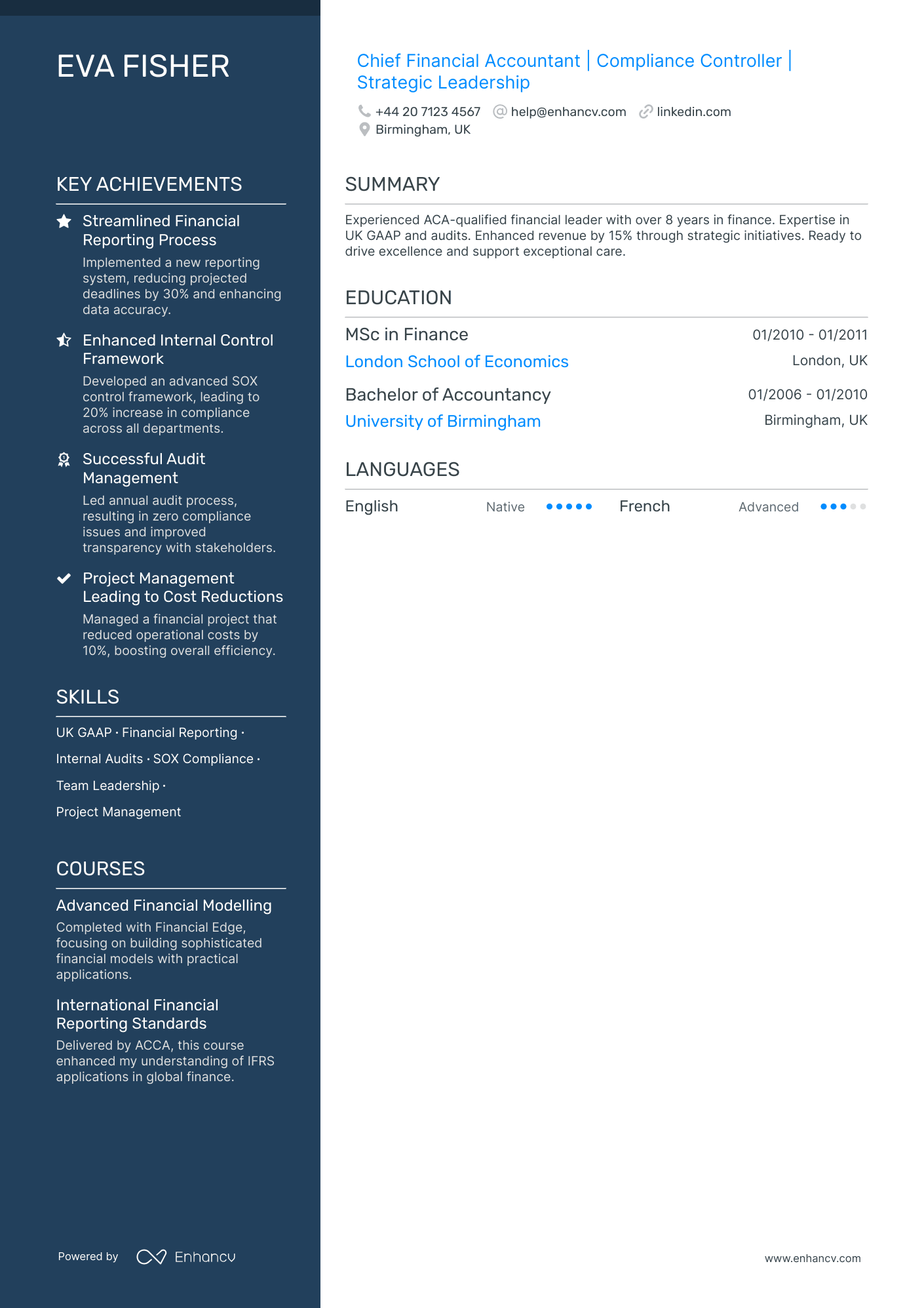

Junior Financial Controller

- Strong Career Progression and Diverse Experience - Throughout her career, Sophia Foster demonstrates significant growth and versatility, moving from a Financial Analyst Intern at PwC to a Financial Controller role at Deloitte. This trajectory indicates a solid ability to advance in the financial sector while gaining exposure to both domestic and international finance environments.

- Effective Implementation of Industry-Specific Practices - The CV showcases Sophia's proficiency in utilizing industry-standard methodologies and tools such as US-GAAP, SOX controls, Oracle, and Netsuite. Her role in developing SOX controls to reduce discrepancies by 30% underscores her technical depth and ability to apply specific frameworks to enhance financial accuracy and compliance.

- Demonstrates Strategic Leadership and Achievements - The CV highlights impactful achievements, like leading a team to achieve 100% compliance in international audits and a successful tax efficiency project. These accomplishments reflect not only her technical abilities but also her potential to influence organizational success through strategic leadership and effective teamwork.

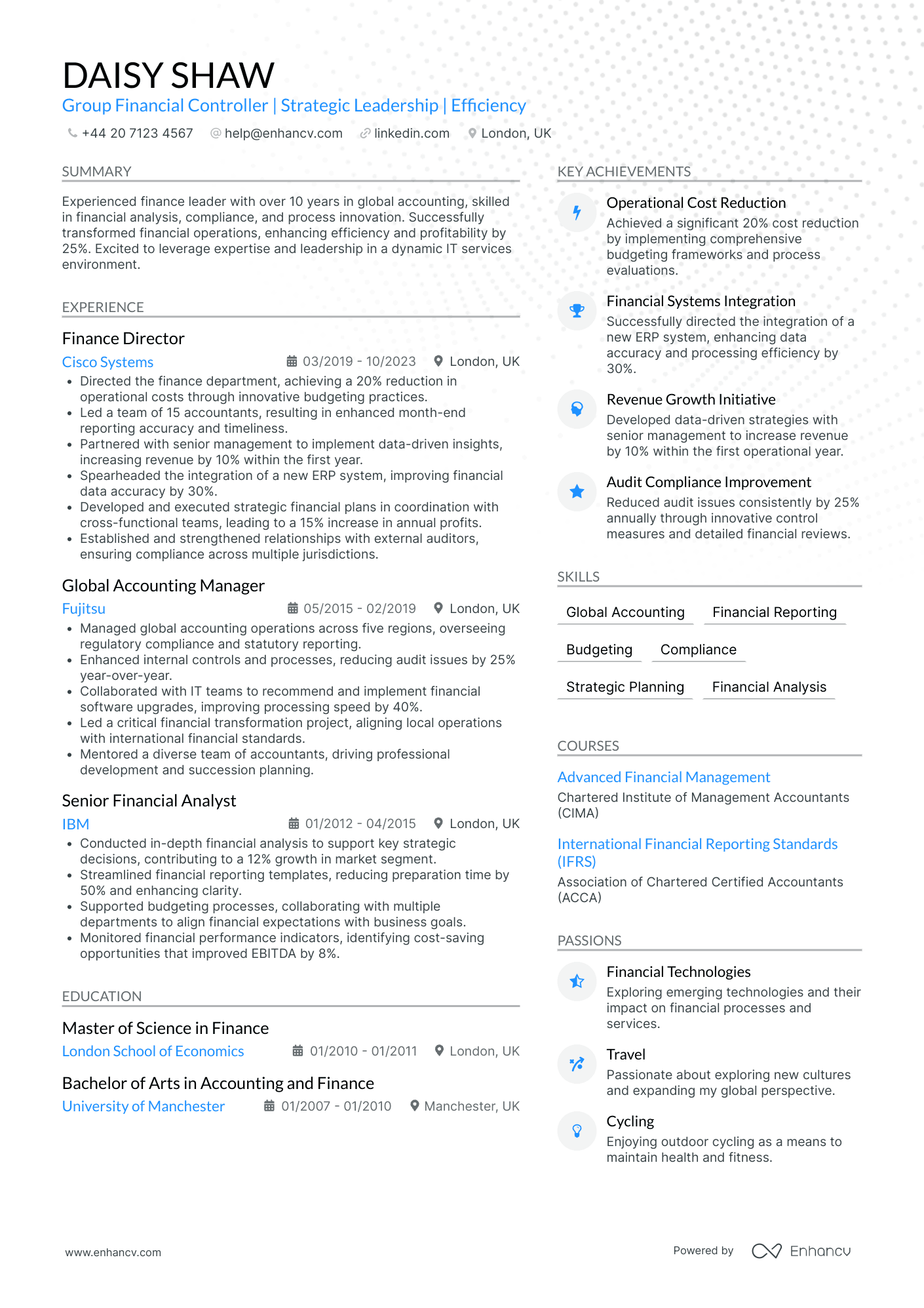

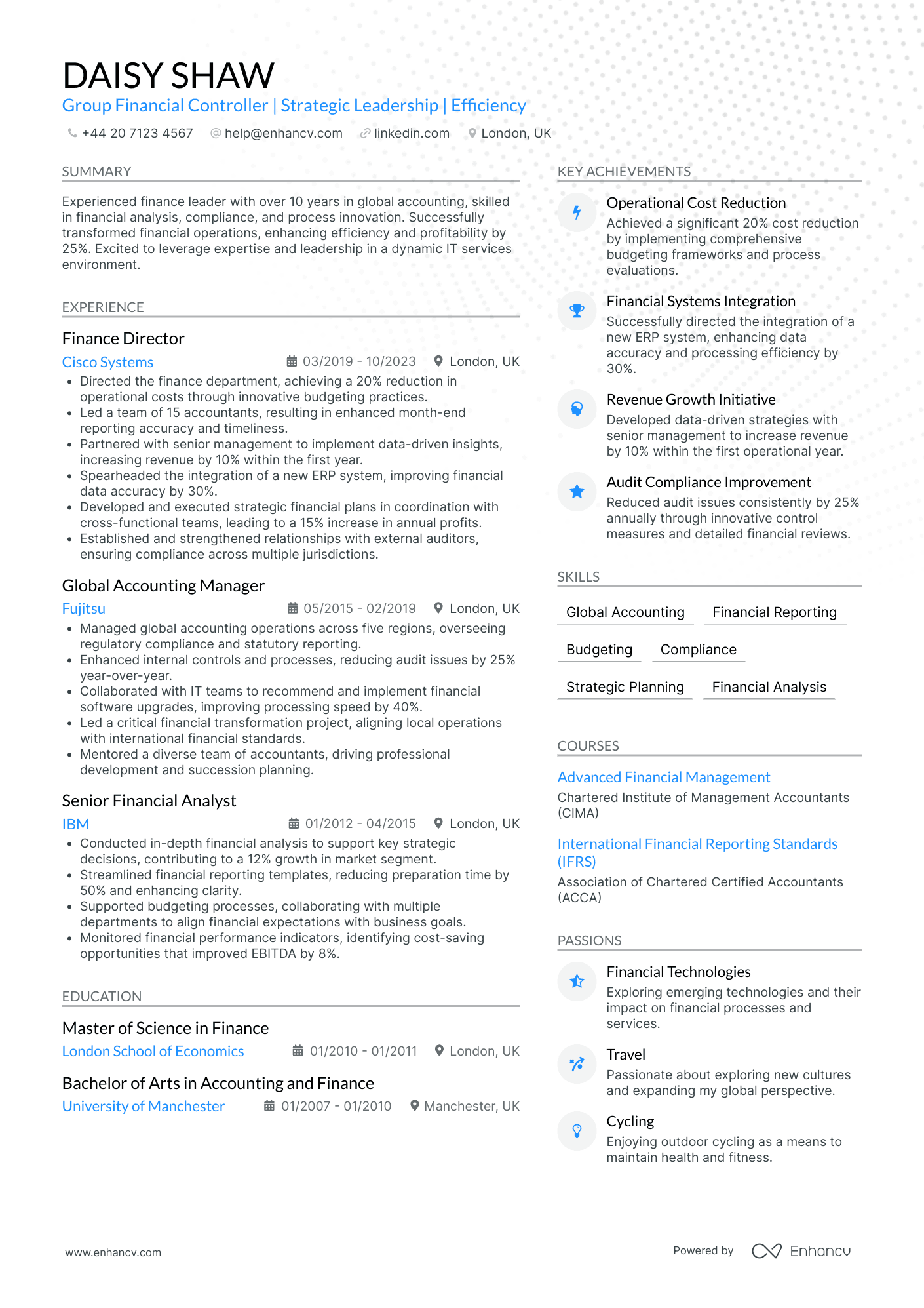

Group Financial Controller

- Clarity and Strategic Structure - The CV is well-organized and concise, presenting each section with clear headers and bullet points that enhance readability. Daisy Shaw effectively introduces her qualifications, skills, and achievements, allowing her expertise in financial analysis and innovative leadership to stand out without overwhelming the reader.

- Progressive Career Trajectory - Daisy's career path shows a strategic rise through prominent roles, from a Senior Financial Analyst at IBM to a Finance Director at Cisco Systems. This progression demonstrates her ability to adapt and thrive in complex environments, underscoring her growth in managing larger teams and responsibilities in global finance.

- Integration of Innovative Financial Technology - A unique aspect of Daisy's experience is her emphasis on technological integration, notably spearheading the implementation of an ERP system to enhance financial accuracy. Her commitment to leveraging technology to drive efficiency and data accuracy speaks volumes about her forward-thinking approach in the finance domain.

Regional Financial Controller

- Structured Presentation of Content - The CV is well-organized and clear, allowing the reader to easily navigate through the candidate's professional journey. The use of concise bullet points in the experience section aids in highlighting key responsibilities and achievements, ensuring that essential information is easily accessible and digestible.

- Demonstrates Career Progression and Specialization - The candidate's career trajectory showcases significant growth, transitioning from a Senior Financial Analyst to a Regional Financial Controller within a decade. Each role reflects a deeper engagement with financial management responsibilities, emphasizing expertise developed in both finance and regional management.

- Achievements Emphasize Operational Impact - Notable achievements like reducing report preparation time by 30% and increasing project margins by 10% underline the candidate’s effectiveness in enhancing operational efficiencies. These accomplishments not only present numerical improvements but also highlight business relevance and impactful strategic contributions.

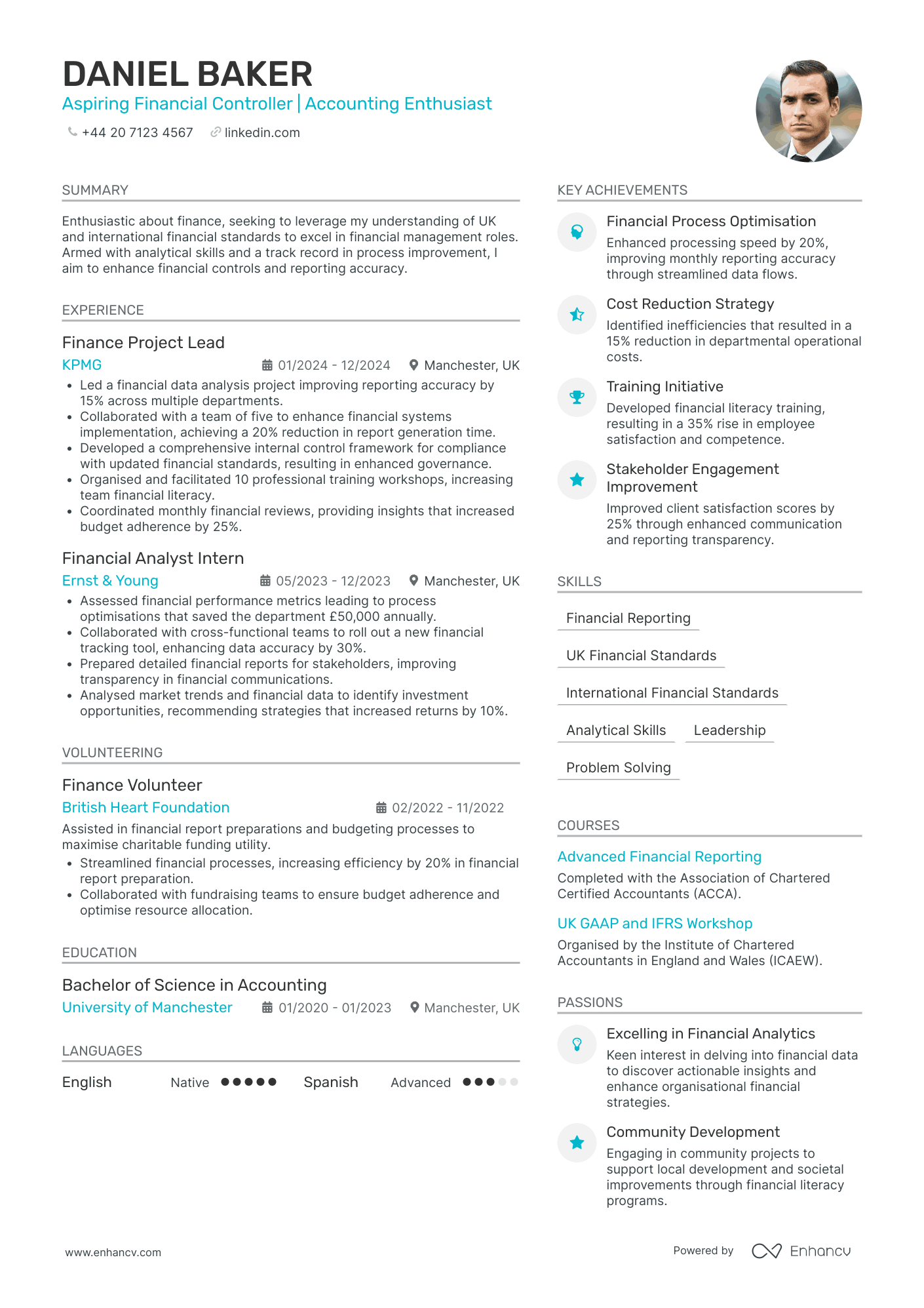

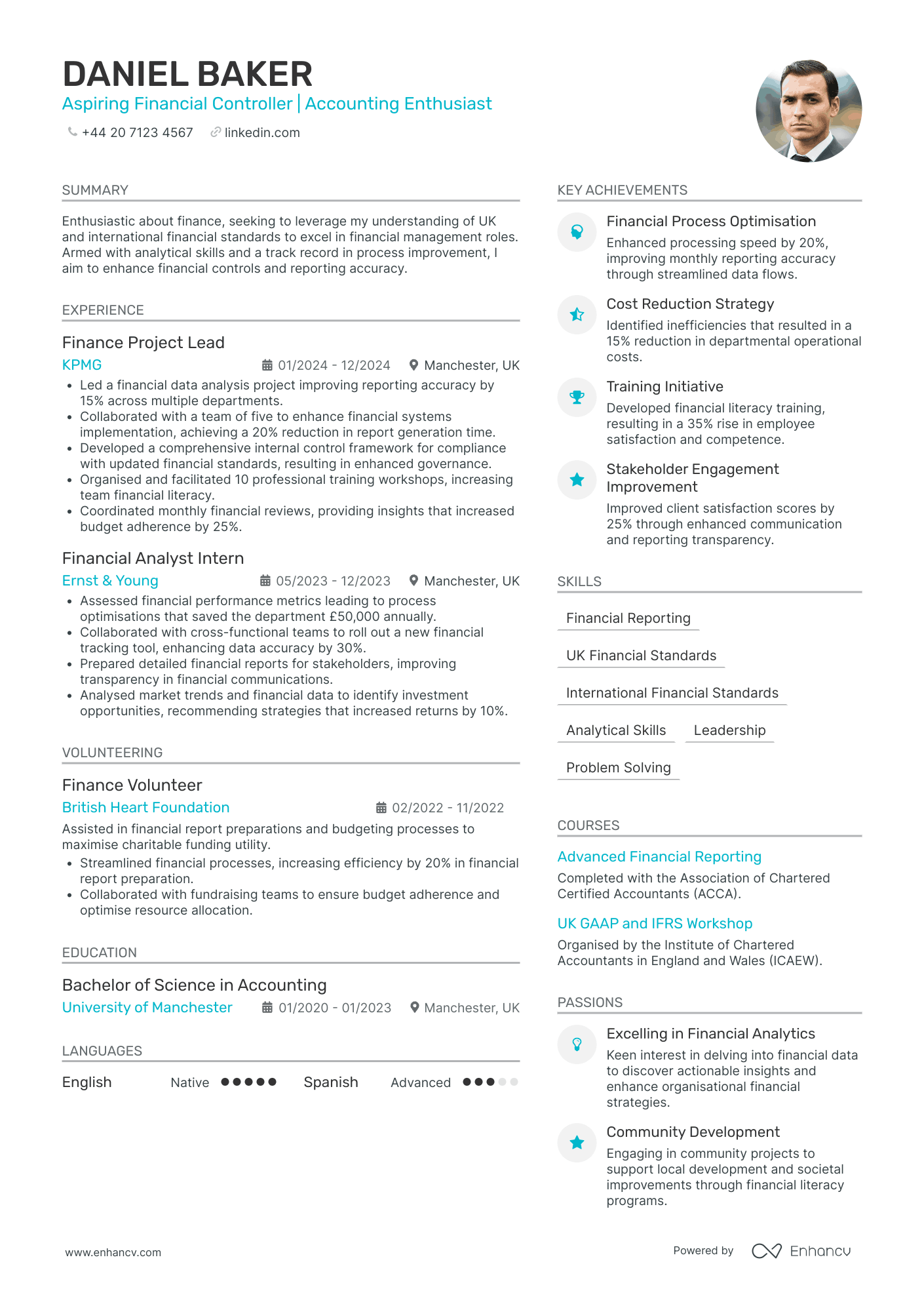

International Financial Controller

- Strong progression in financial roles - Daniel Baker's career trajectory demonstrates a clear progression in financial roles, starting from a Financial Analyst Intern at Ernst & Young to taking on a Finance Project Lead position at KPMG. This trajectory indicates strategic career planning and the ability to take on increasing responsibilities, reflecting a deepening expertise in financial management.

- Emphasis on process improvement and efficiency - The CV highlights Daniel's contributions to enhancing financial systems and streamlining processes, evident in achievements like improving reporting accuracy by 15% and achieving a 20% reduction in report generation time. These accomplishments denote a focus on optimizing operations to benefit the overall financial health of the organization.

- Comprehensive section on skills and certifications - The inclusion of detailed skills such as Financial Reporting, UK and International Financial Standards, along with advanced courses like ACCA's Advanced Financial Reporting and a GAAP and IFRS workshop, showcases Daniel's dedication to continual learning and technical proficiency. This combination supports his aspirations to excel as a Financial Controller.

Divisional Financial Controller

- Structured Presentation and Clear Clarity - Ava Phillips' CV is meticulously organized, with each section clearly defined and well-structured, which enhances readability and allows the reader to quickly identify key elements such as experience, skills, and achievements. This clarity ensures that the CV communicates the candidate's career highlights concisely and effectively.

- Impressive Career Growth and Progressive Roles - Ava's career trajectory demonstrates significant growth, showcasing a progression from a Financial Analyst at CMA CGM Group to a Divisional Financial Controller at Maersk Line. This upward career movement reflects her ability to take on increasing responsibilities and leadership roles within the finance sector.

- Demonstrated Business Impact through Achievements - The CV emphasizes meaningful achievements that have had tangible business impacts, such as driving a 20% efficiency increase and achieving a 30% reduction in audit discrepancies. These achievements not only illustrate Ava's strategic financial leadership but also her ability to deliver substantial value to organizations.

By Role

Financial Controller in Manufacturing

- Solid Career Progression - Chloe Bell's CV demonstrates clear career advancement within the management accounting sector, transitioning from an Assistant Management Accountant to her current role as a Senior Management Accountant at GKN Aerospace. This progression within the manufacturing industry shows commitment and consistency in developing expertise, which is crucial for higher-level finance roles.

- Industry-Specific Expertise and Tools Mastery - The CV is rich with technical depth, particularly in specialized tools and methodologies pertinent to the manufacturing industry. Chloe’s proficiency in SAP, Lean methodologies, and Six Sigma, along with implementation of variance analysis, highlights her industry-specific knowledge that enhances operational efficiency and cost reduction.

- Demonstrated Leadership and Soft Skills - Chloe's leadership qualities shine through her experience in managing teams and projects, such as directing a financial tool upgrade project. Her ability to lead a team to deliver on-time financial statements and her strong communication skills underscore her capacity to inspire and guide others in complex financial environments.

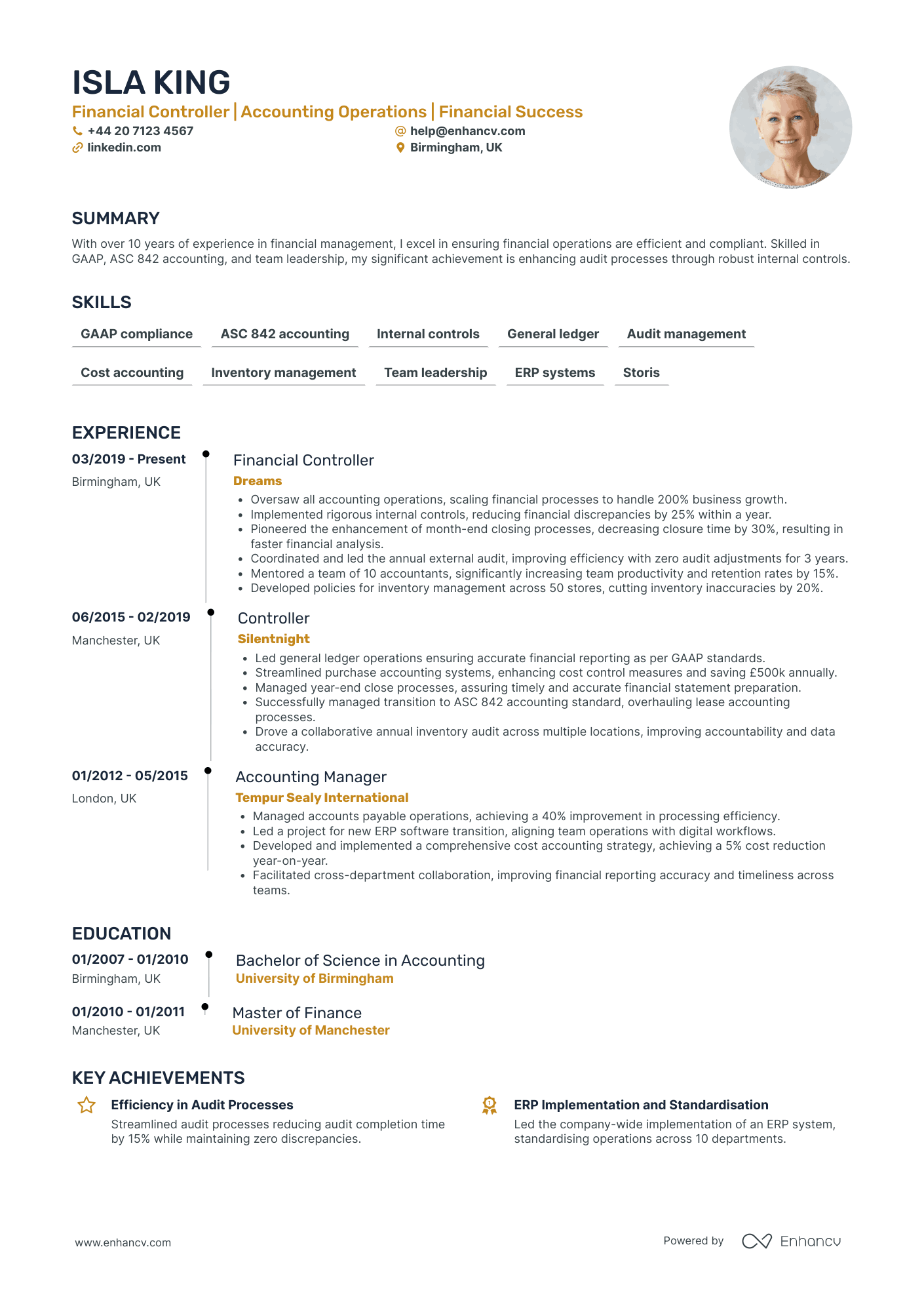

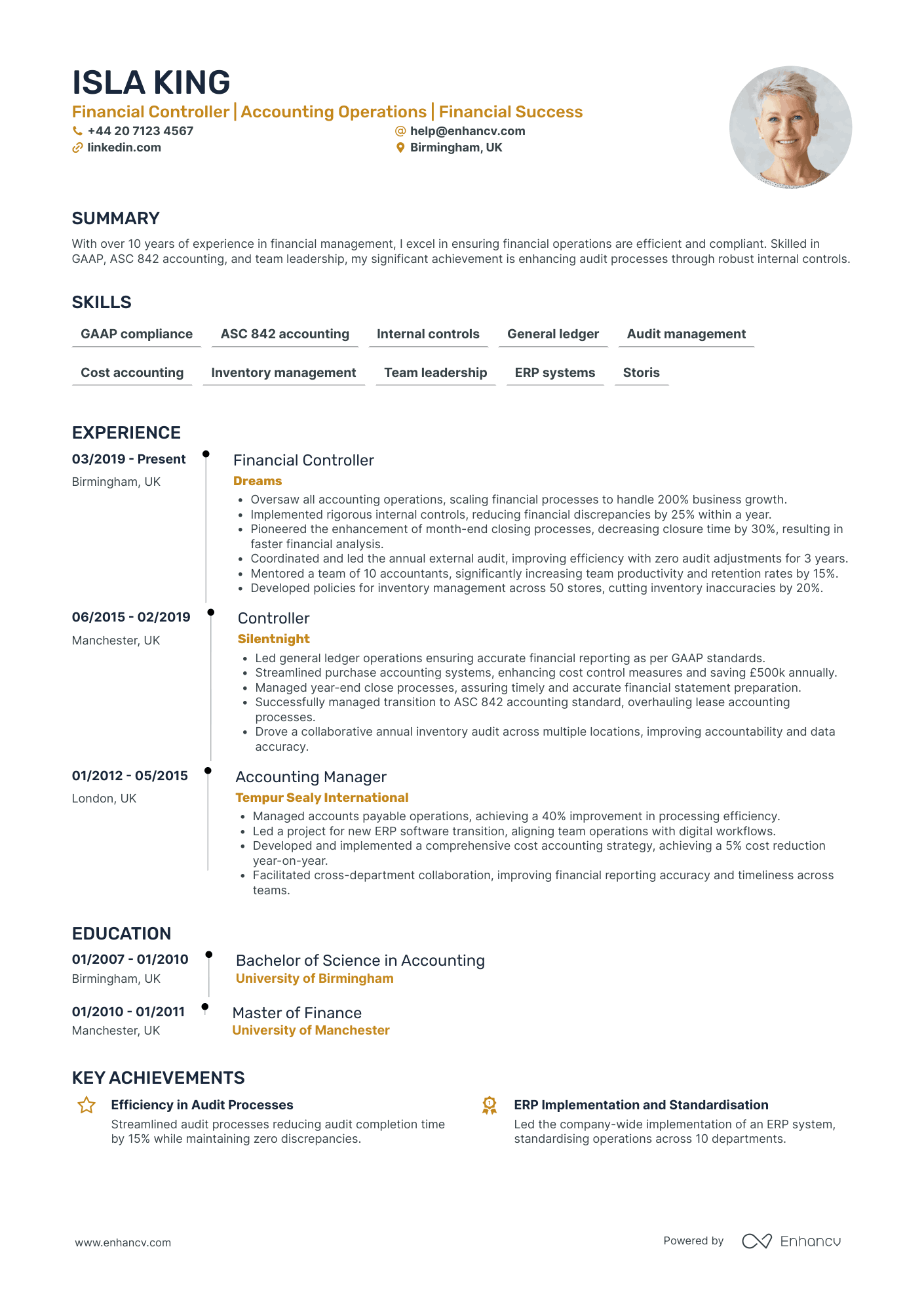

Financial Controller in Retail

- Structured and Efficient Presentation - The CV is meticulously structured, providing a clear overview of the candidate's career. Each section is concise yet comprehensive, ensuring that key information such as skills, experience, and education are immediately accessible. This clarity in presentation allows for quick comprehension of the candidate’s qualifications and expertise in financial management.

- Progressive Career in Finance - Isla King's career trajectory demonstrates significant growth and depth within the finance industry. Starting as an Accounting Manager and advancing to roles such as Controller and Financial Controller, she has developed her abilities by handling increasingly complex financial operations. Her career showcases an impressive progression marked by strategic roles and responsibilities.

- Impactful Financial Management and Operations - Her achievements, such as reducing financial discrepancies by 25% and saving £800k annually through a cost reduction strategy, highlight her direct impact on business efficiency and profitability. These accomplishments not only underline her expertise in implementing sound financial practices but also showcase her ability to drive substantial business improvements through her work.

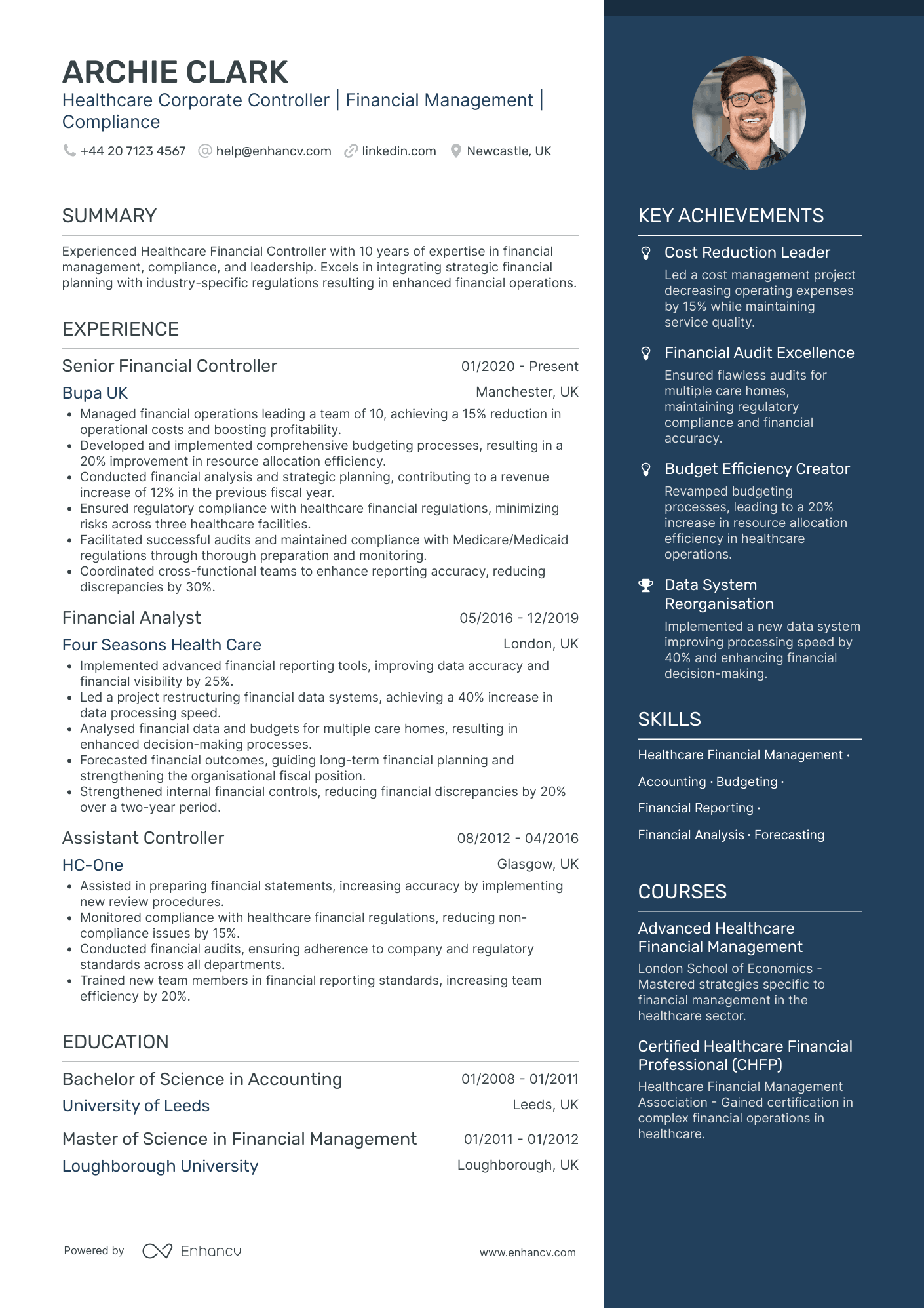

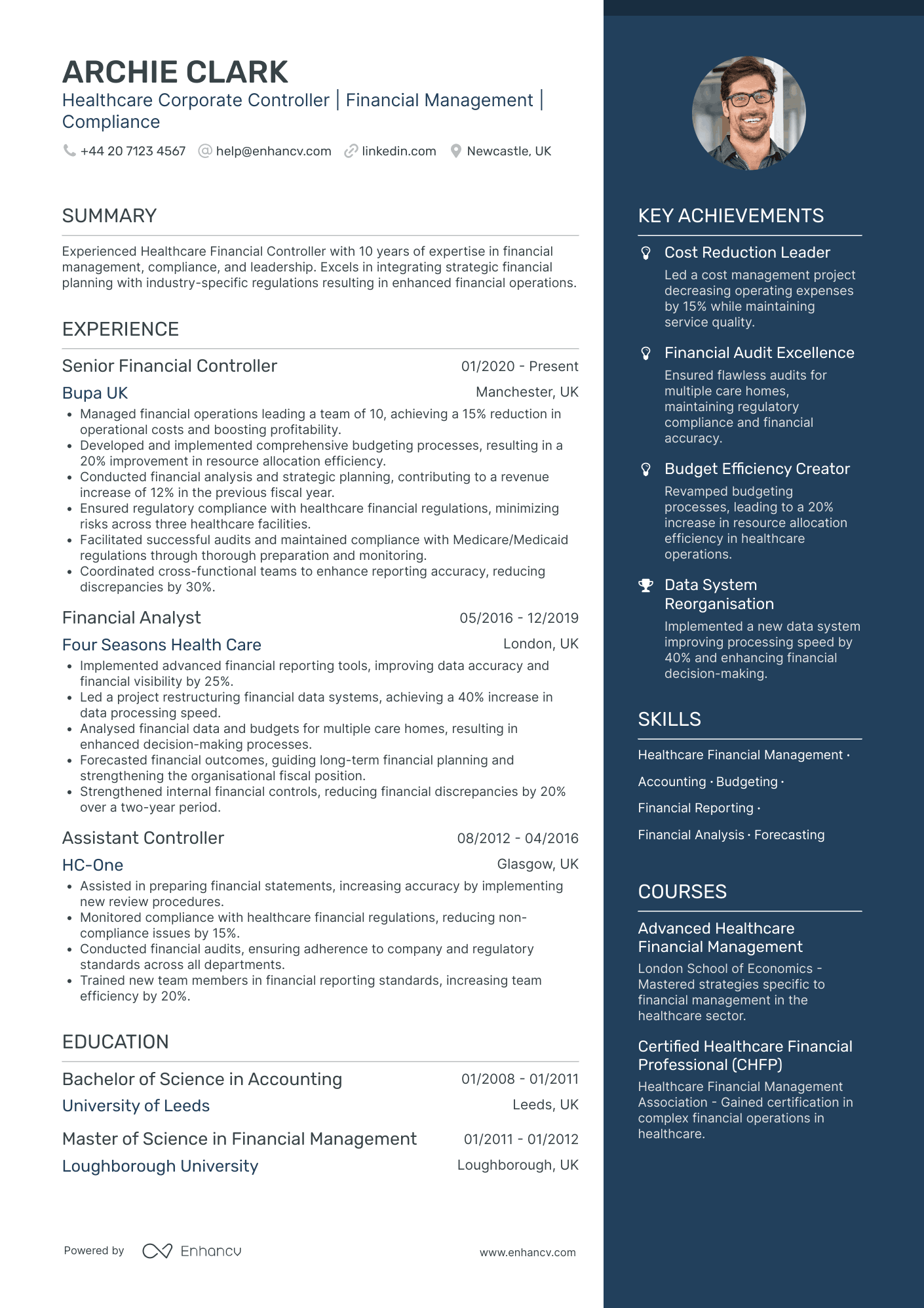

Financial Controller in Healthcare

- Clear and Structured Presentation - The CV is well-organized, beginning with a succinct summary of qualifications that allows easy navigation by recruiters. Each section is clearly delineated, and bullet points effectively convey key responsibilities and achievements, emphasizing conciseness and clarity for better readability.

- Career Growth in Healthcare Sector - Archie Clark's career trajectory showcases a consistent rise through the ranks in financial management roles within the healthcare industry, from an Assistant Controller to a Senior Financial Controller. This progression highlights his capability to handle increasingly complex financial responsibilities and lead larger teams over time.

- Industry-Specific Expertise and Tools - The CV emphasizes Archie’s proficiency in healthcare financial management, evidencing the use of industry-specific methodologies and tools such as Medicare/Medicaid regulations, Advanced Excel, and specialized ERP systems. This highlights his ability to navigate the complex regulatory landscape of healthcare finance.

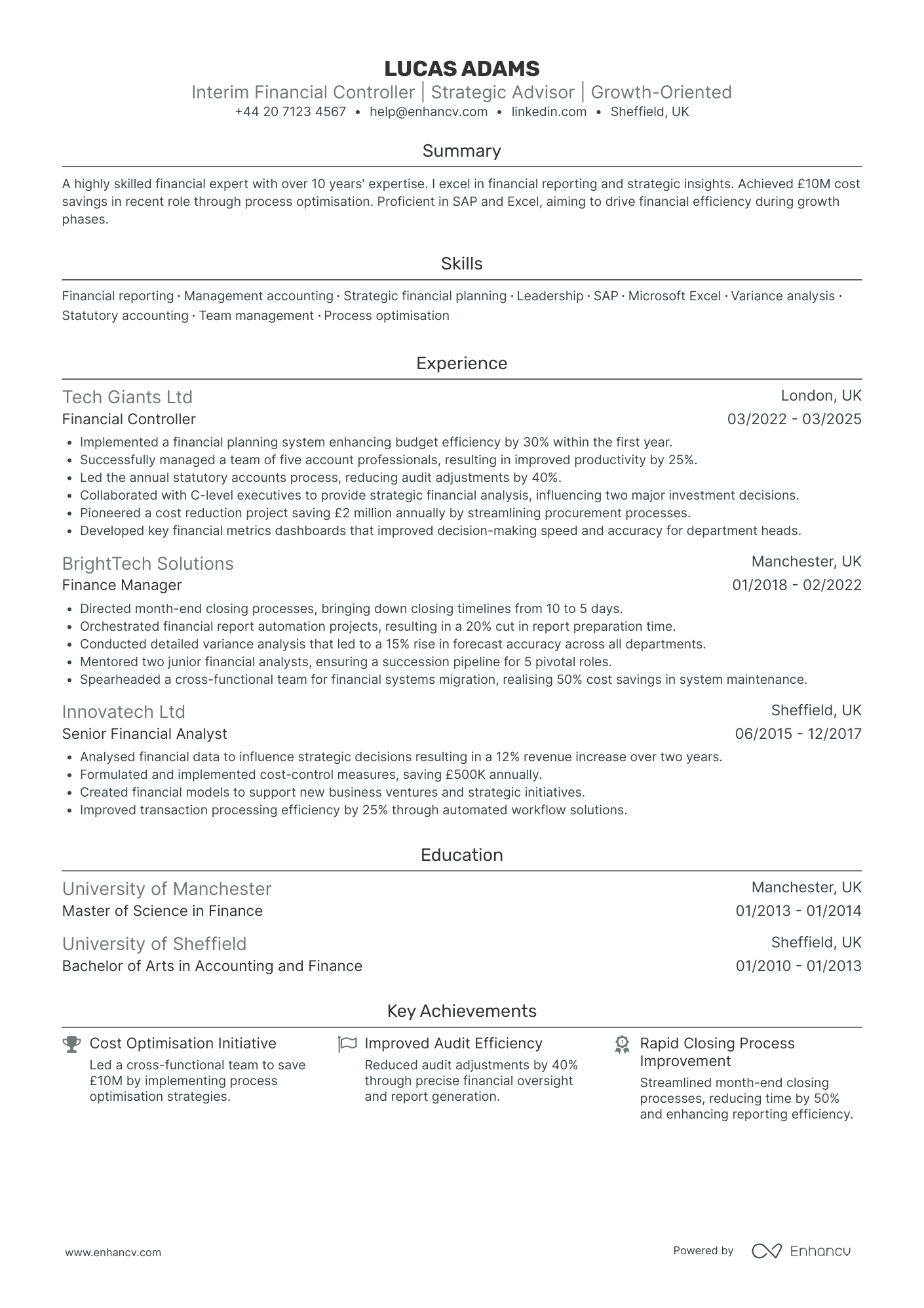

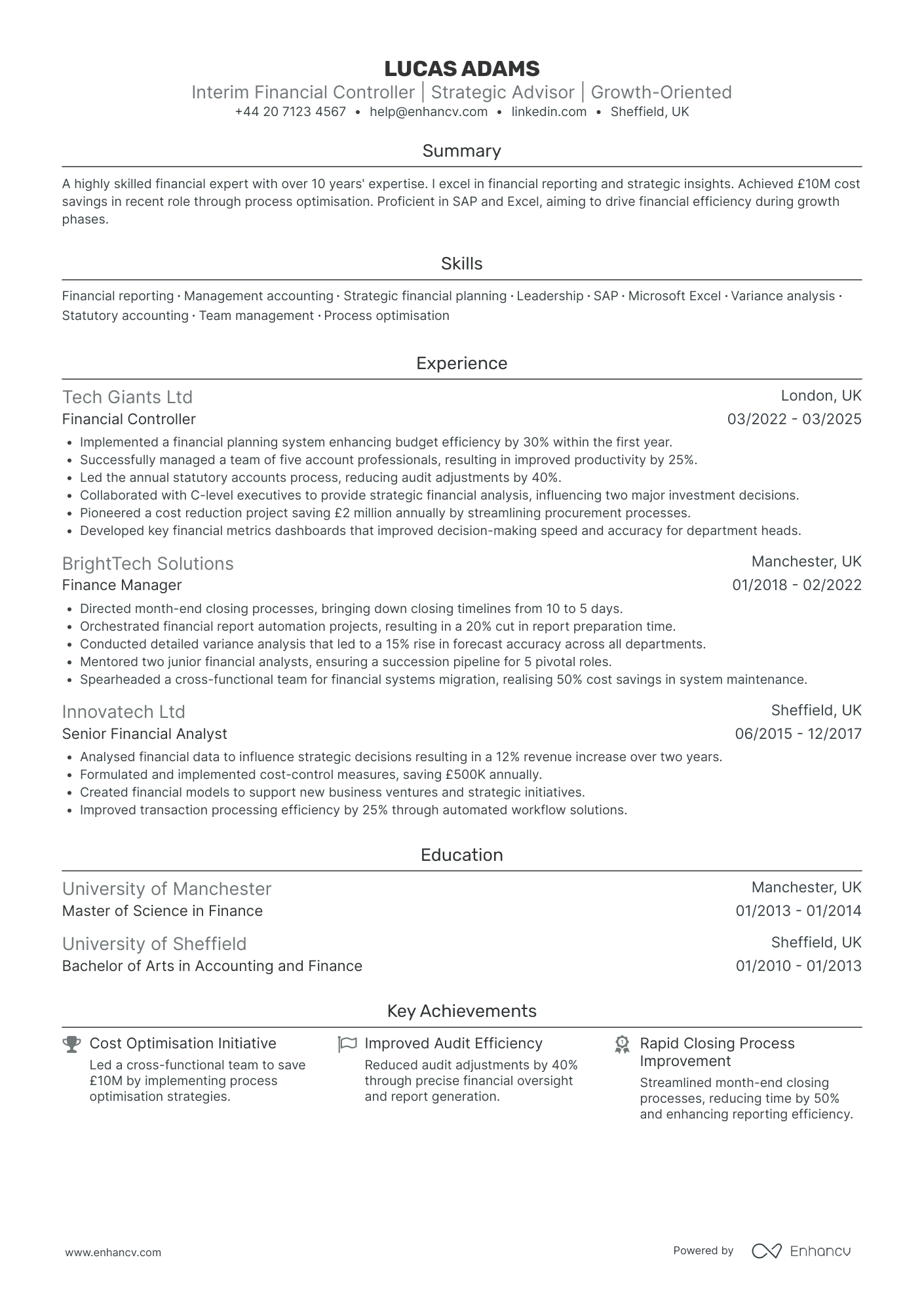

Strategic Financial Controller

- Emphasis on Strategic and Analytical Leadership - Lucas Adams' CV highlights significant leadership qualities and a strategic mindset, illustrated by his role in providing financial analysis that influenced major investment decisions. This demonstrates his ability to align financial goals with organizational strategy, positioning him as a strategic partner in business growth.

- Demonstrated Cost-Effectiveness and Process Efficiency - The CV showcases several instances where Lucas has led projects that resulted in substantial cost savings and operational efficiencies, including a £10M cost-saving initiative. These achievements underline his ability to not just cut costs but enhance business sustainability and agility through improved processes.

- Adaptability Across Diverse Financial Roles - Lucas' career trajectory reflects a diverse experience set spanning from Senior Financial Analyst to Financial Controller, each role building on his experience with financial data analysis, team leadership, and systems optimization. This adaptability signals a professional well-prepared to tackle complex financial challenges in various contexts.

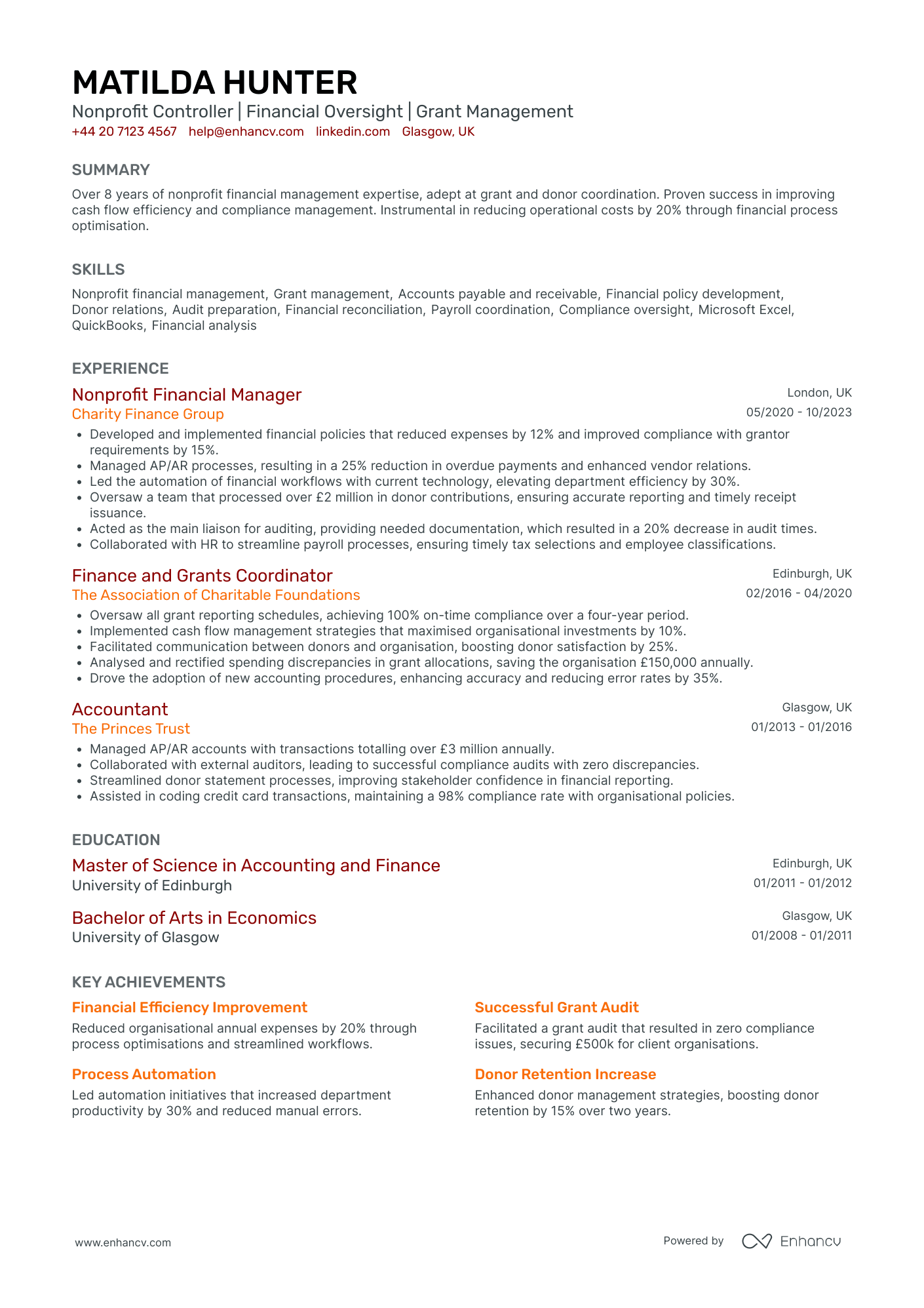

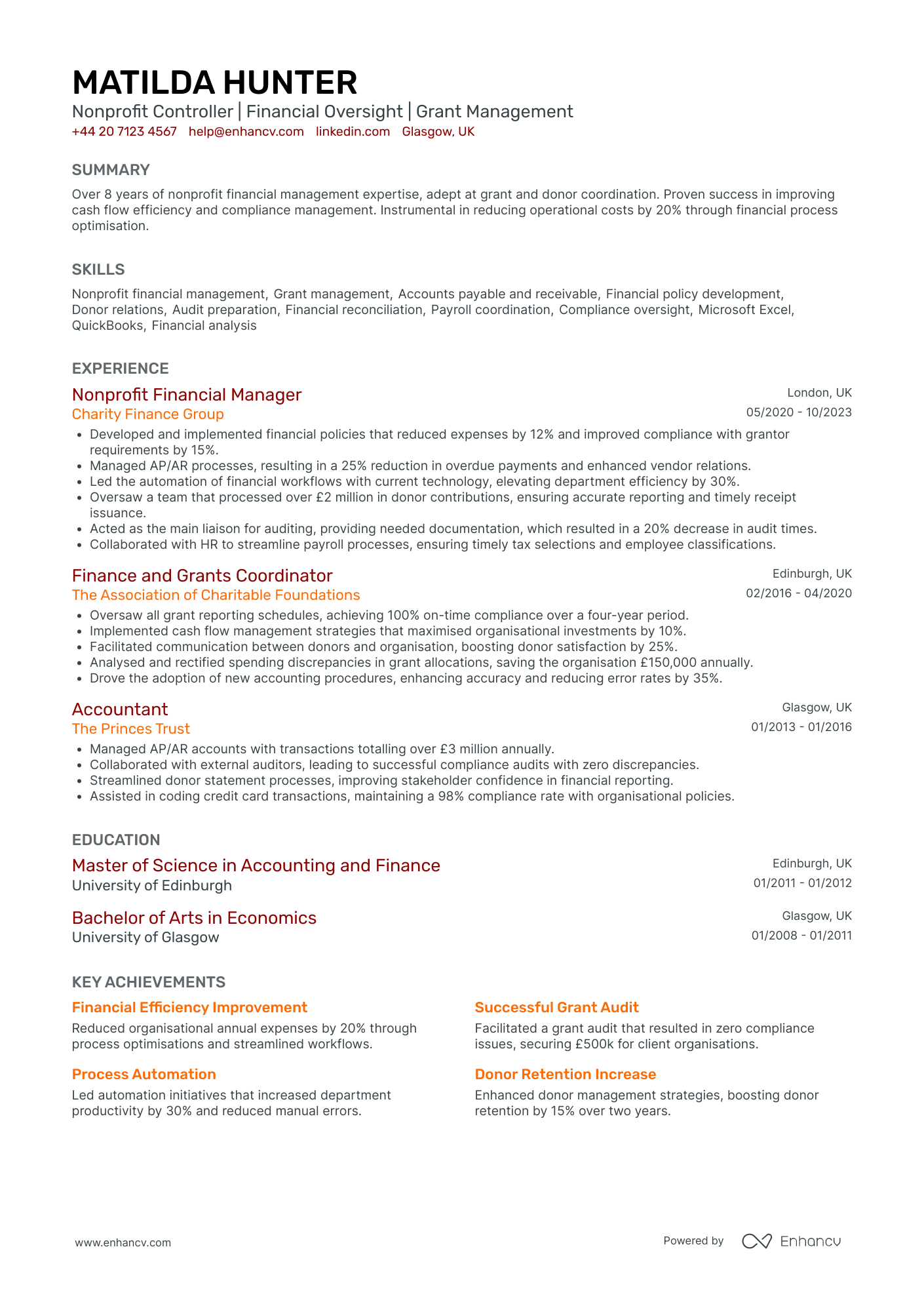

Financial Controller in Non-Profit

- Comprehensive Career Progression - Matilda Hunter's CV clearly demonstrates a robust career trajectory, with consistent growth in the nonprofit finance sector. Progressing from an Accountant at The Princes Trust to a Nonprofit Financial Manager at Charity Finance Group, it reflects her ability to take on increasing responsibilities and leadership roles over time, showcasing her dedication and performance within this specialized field.

- Strategic Financial Acumen - The CV highlights Matilda's impressive ability to implement effective financial strategies, particularly her success in cost reduction and compliance improvement. Achievements such as a 20% expense reduction and a 35% error rate decrease underscore her capacity to significantly enhance organizational efficiency and operational integrity, making her a valuable asset to any nonprofit organization.

- Cross-Functional and Technological Proficiency - Matilda's experience in leading process automation initiatives and streamlining workflows shows her adaptability and expertise in modern financial tools and digital transformation within the nonprofit sector. Her skills in Microsoft Excel and QuickBooks, combined with her role in enhancing department productivity by 30%, demonstrate her proficiency in leveraging technology for financial management.

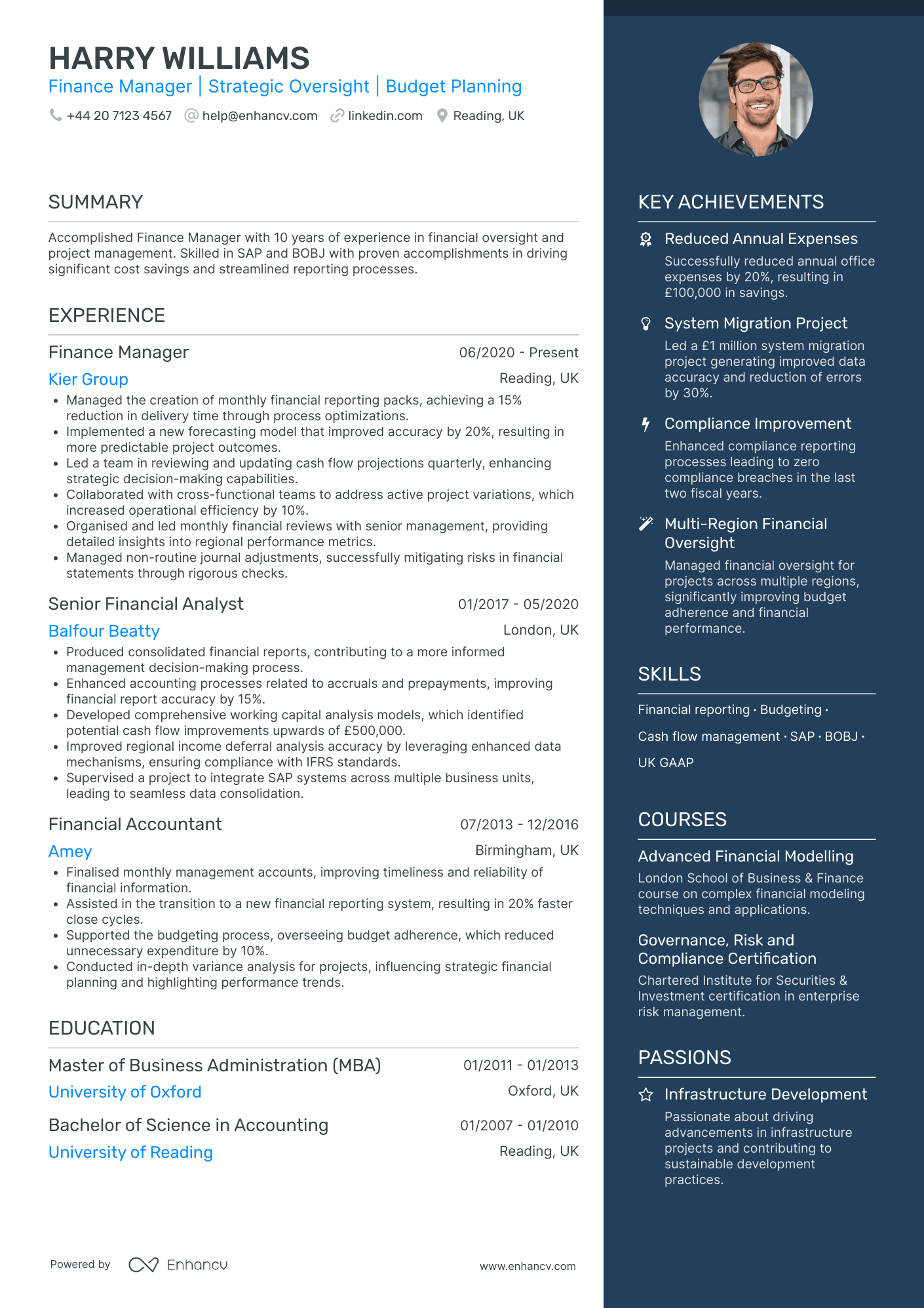

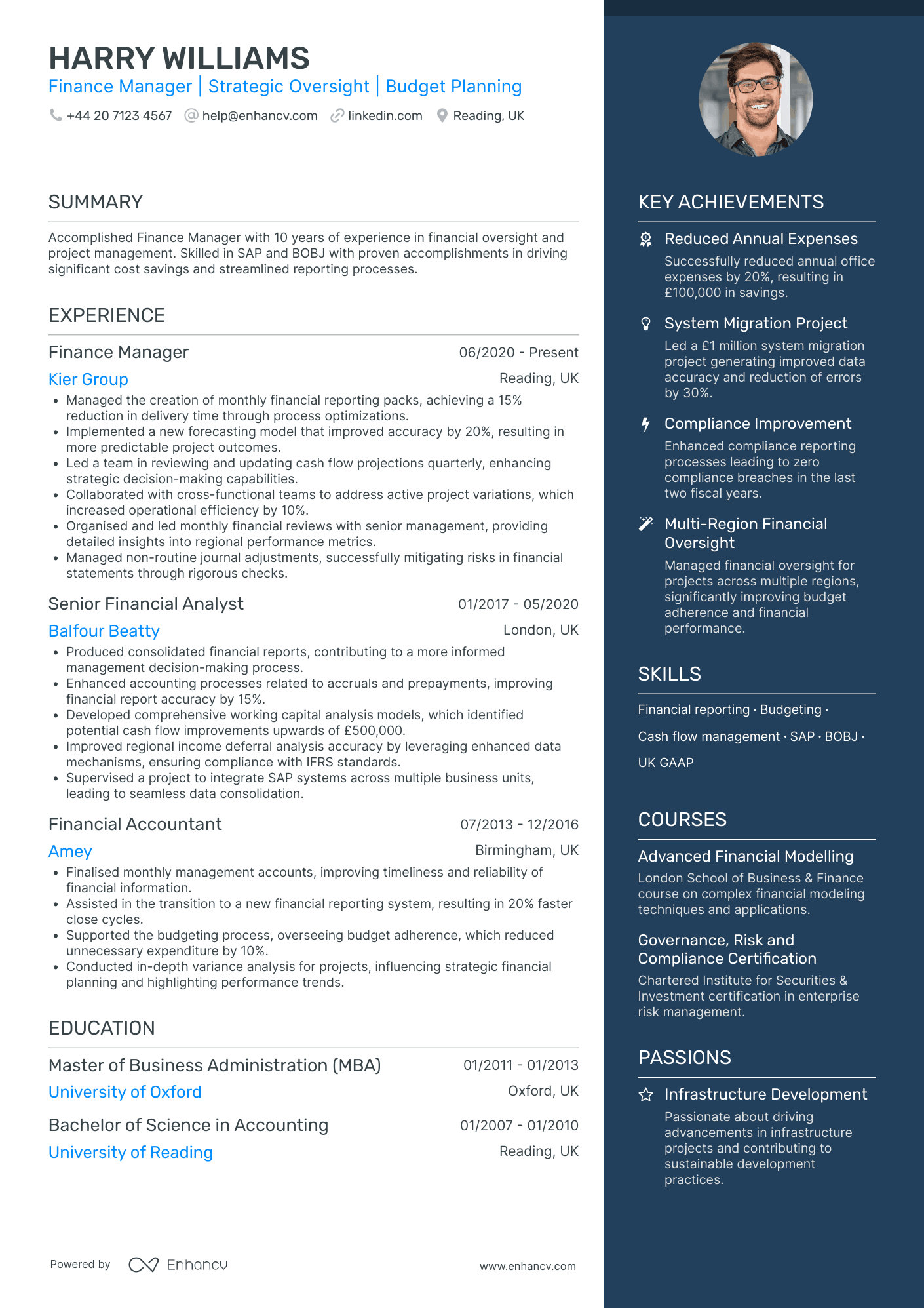

Financial Controller in Education

- Structured Content Presentation - The CV is well-organized, with clearly defined sections for experience, education, skills, and achievements. This structure facilitates easy navigation and comprehension, allowing the reader to quickly identify key qualifications and career milestones.

- Progressive Career Trajectory - Harry Williams' career reflects a steady climb up the professional ladder, showcasing roles with increasing responsibility and complexity, from Financial Accountant to Finance Manager. This trajectory underscores his capacity for growth and his ability to adapt to diverse financial challenges within the industry.

- Demonstrated Strategic Impact - The achievements listed in the CV not only quantify outcomes but also highlight their strategic significance, such as the introduction of a forecasting model that improved project predictability. These articulate Harry's capacity to drive substantial business value and foster an environment of effective financial management.

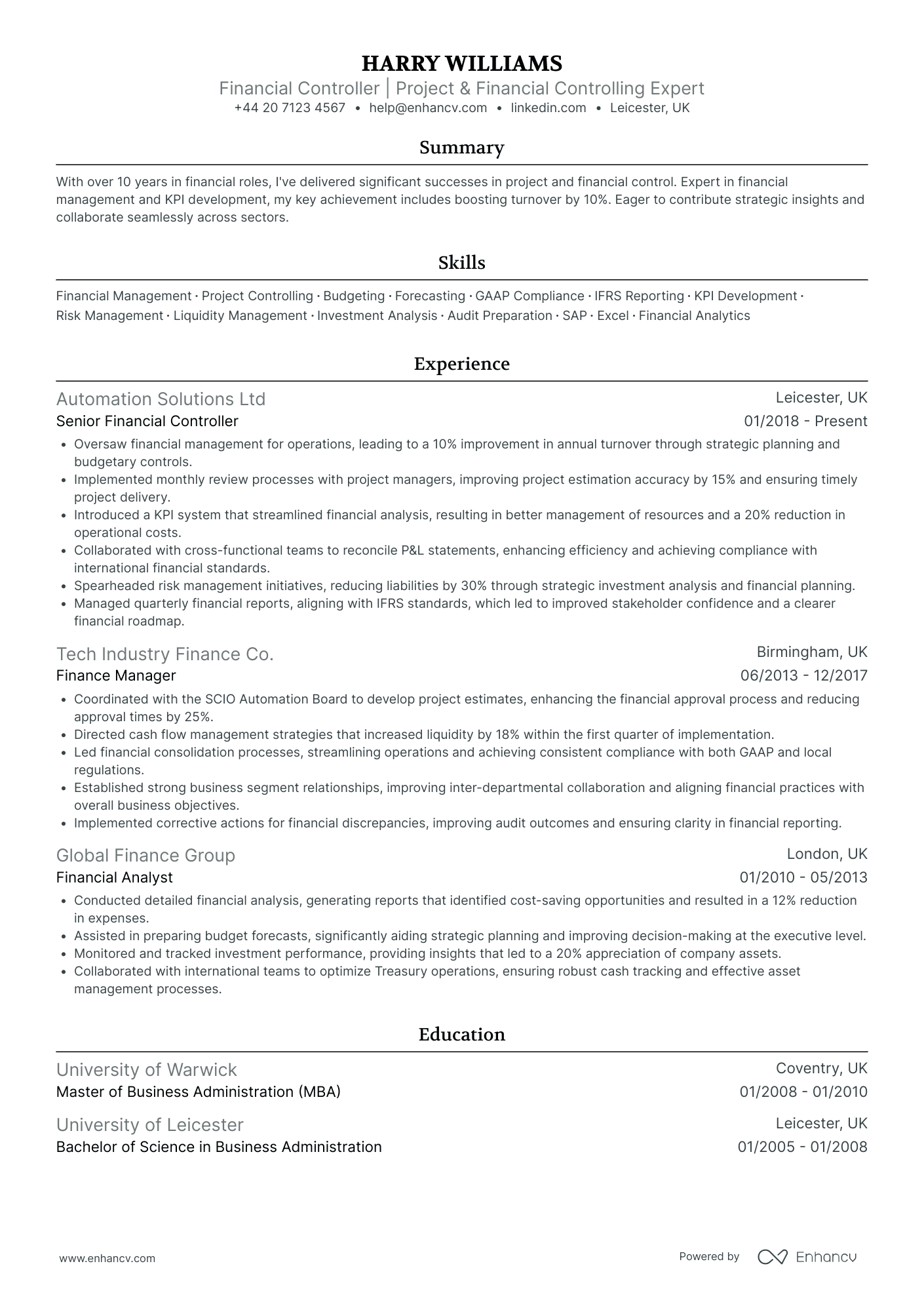

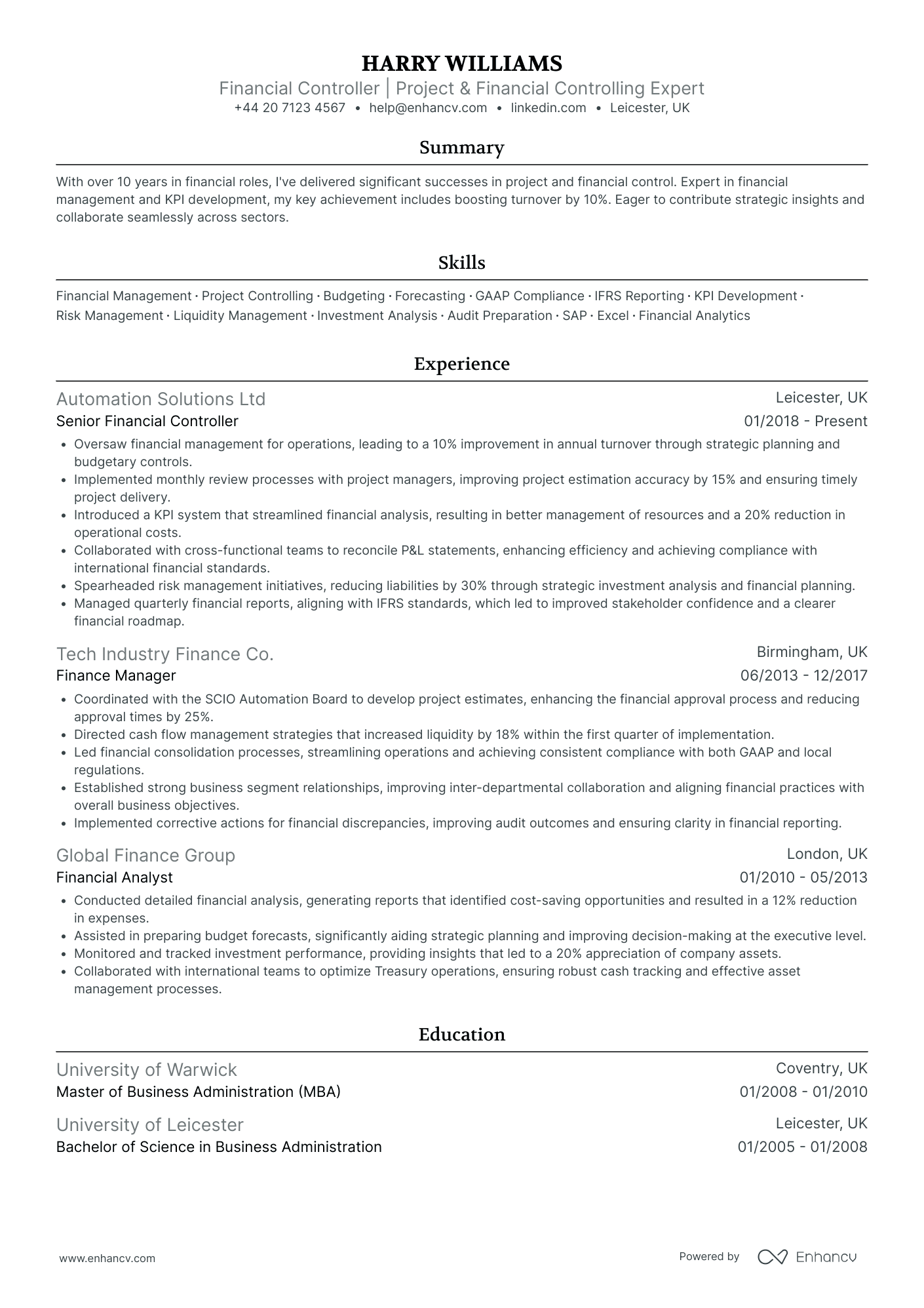

Operational Financial Controller

- Strategically Structured Work Experience - The CV effectively organizes work history chronologically, emphasizing growth in complexity and responsibility. Each role details clear achievements, demonstrating a strategic management of financial operations and project oversight, illustrating a natural progression and increased impact over time.

- Depth in Financial Methodologies - The inclusion of advanced financial techniques such as IFRS standards, GAAP compliance, and KPI development exhibits a deep technical competency. This showcases the candidate's ability to implement refined financial controls and align them with global standards, offering a technical depth crucial for a financial controller.

- Cross-Functional and Industry Relevance - The CV underscores adaptability and collaboration with diverse teams, indicating experience across different industry sectors such as automation and technology finance. This experience is pertinent for a financial controller, as it suggests a broad understanding of varied financial landscapes and the soft skills necessary for cross-functional teamwork.

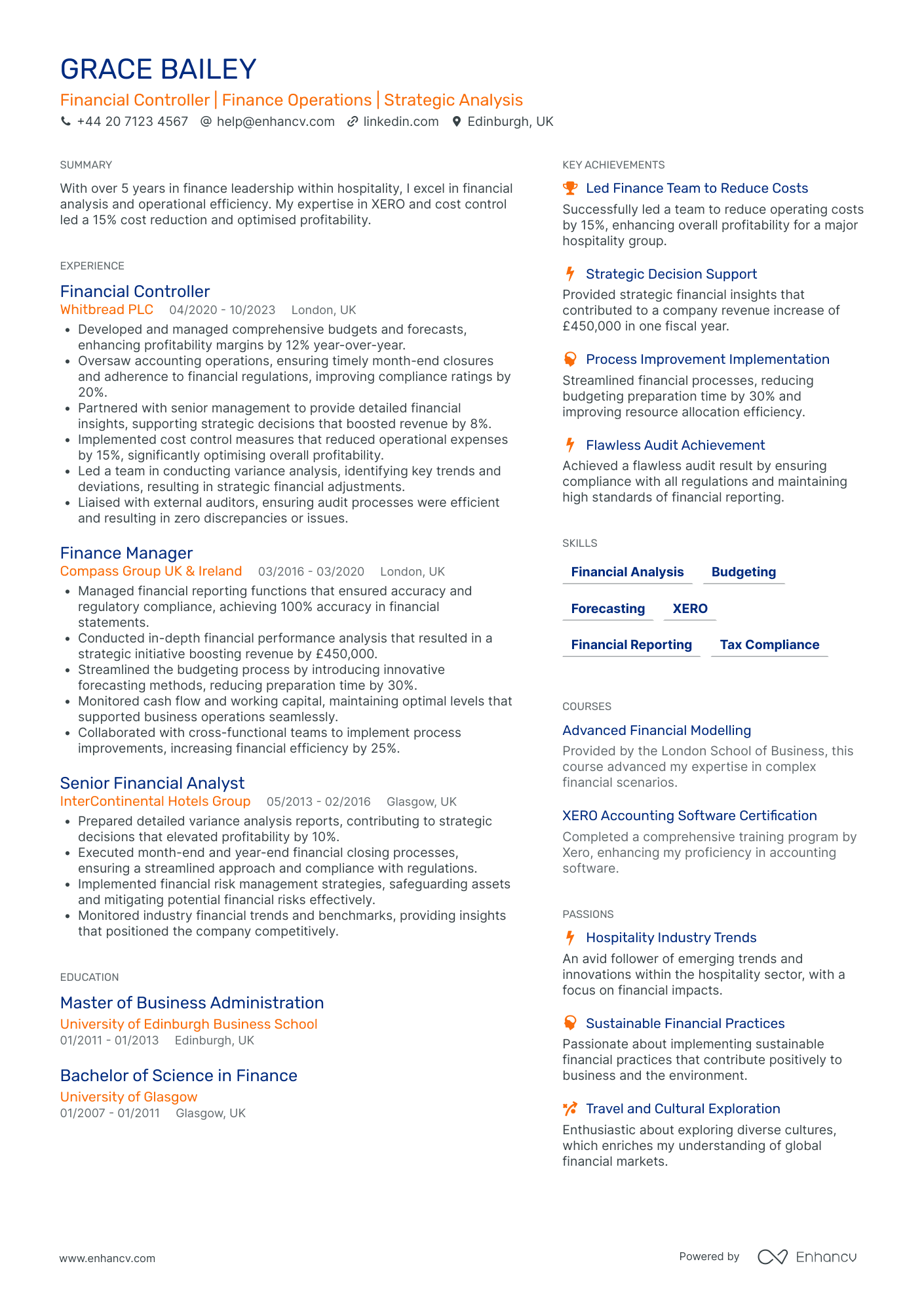

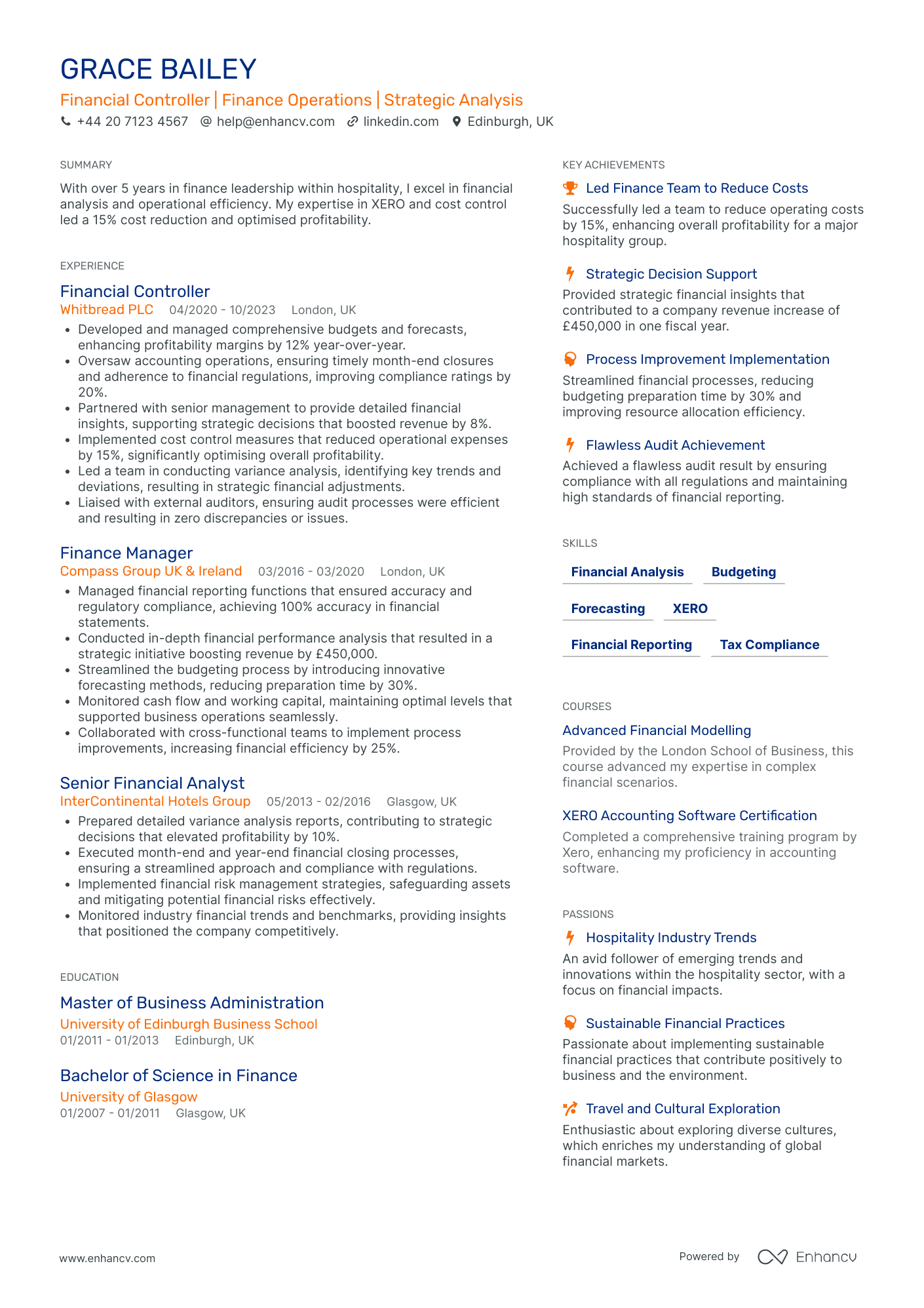

Financial Controller in Hospitality

- Effective Use of Metrics - Grace Bailey's CV distinctly emphasizes measurable achievements, such as the notable 15% cost reduction and an 8% revenue boost she enabled at Whitbread PLC. These metrics provide concrete evidence of her impact on the financial health of the organizations she worked with, underscoring her strategic contributions and effectiveness.

- Comprehensive Career Trajectory - The CV outlines a clear upward trajectory in Grace's finance career, from a Senior Financial Analyst to a Financial Controller, demonstrating her capability for growth and leadership in the financial management sector. Her consistent career development within renowned companies in the hospitality industry highlights her dedication and expertise refinement over time.

- Cross-functional Engagement and Leadership - Grace's CV outlines significant cross-functional collaboration, as seen in her initiative to work closely with senior management and cross-functional teams to enhance strategic decisions, improve processes, and drive revenue. Her leadership in coordinating with diverse teams showcases her adaptability and ability to lead effectively in complex organizational settings.

Financial Controller in Technology

- Structured Career Progression - Charlie Thomas's CV illustrates a clear and strategic career progression from a Senior Financial Analyst to a Financial Manager within the finance sector. Each role builds upon the last, demonstrating an increase in responsibility and an expansion of his skill set, particularly his move from financial analysis to managing entire teams and complex financial operations.

- Diverse Financial Expertise - The CV highlights Charlie's proficiency in various financial domains such as budgeting, financial management, risk management, and digital transformation. His ability to lead financial efficiencies, implement strategic cost reductions, and manage stakeholder relationships reflects a comprehensive understanding of the financial industry and modern practices.

- Tangible Achievements with Business Impact - Charlie’s contributions are measured by specific achievements such as a 25% reduction in processing time, cost savings of £800,000, and enhancement of financial reporting accuracy. These accomplishments not only demonstrate his effectiveness but also underline his capacity to deliver significant business value, aligning financial operations with broader strategic goals.

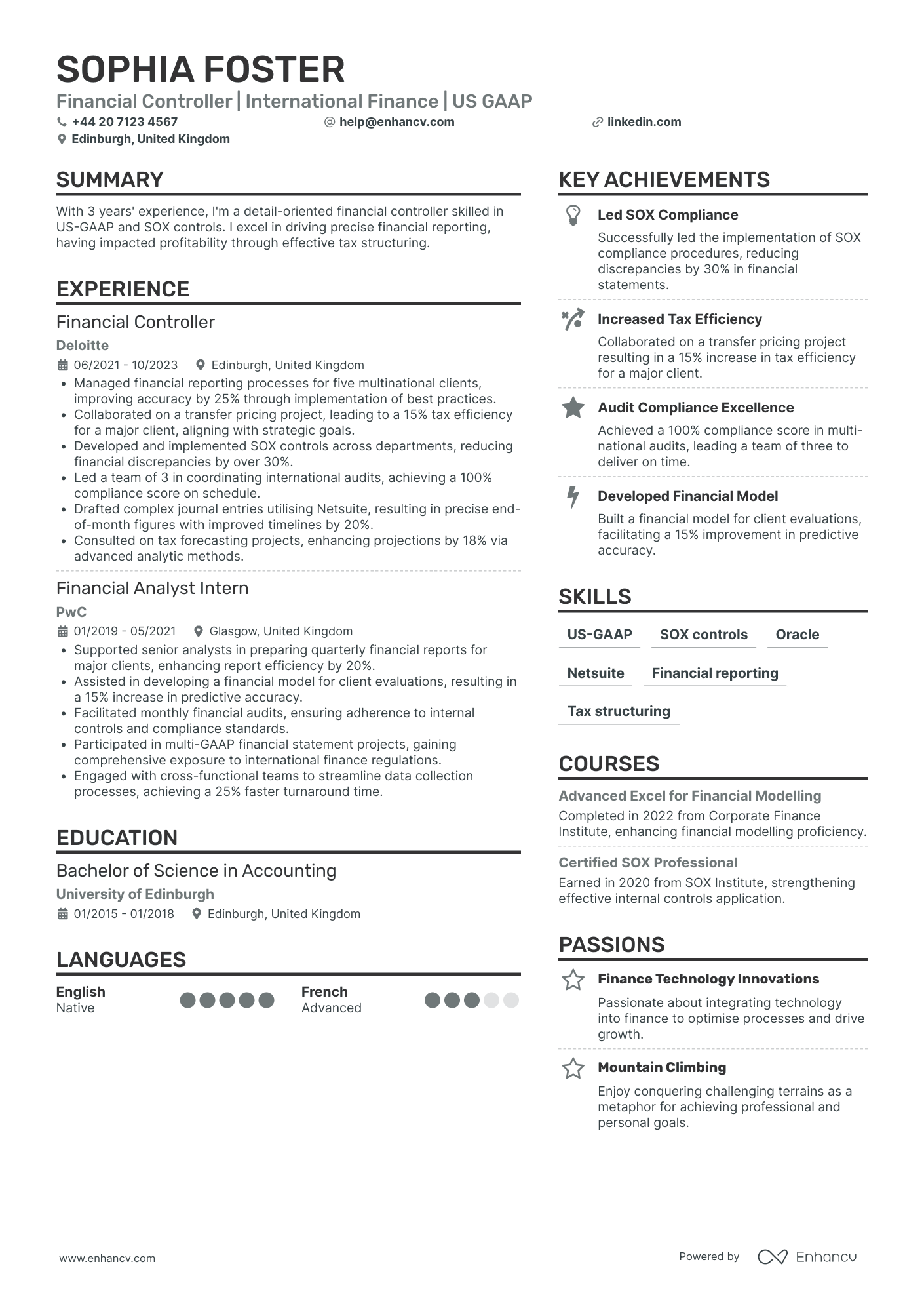

Project Financial Controller

- Effective Structure and Clarity - The CV is well-organized with clear sections for professional experience, education, skills, and achievements, making it easy to navigate. Each section is concise yet detailed, using bullet points for readability and ensuring that key information is accessible at a glance.

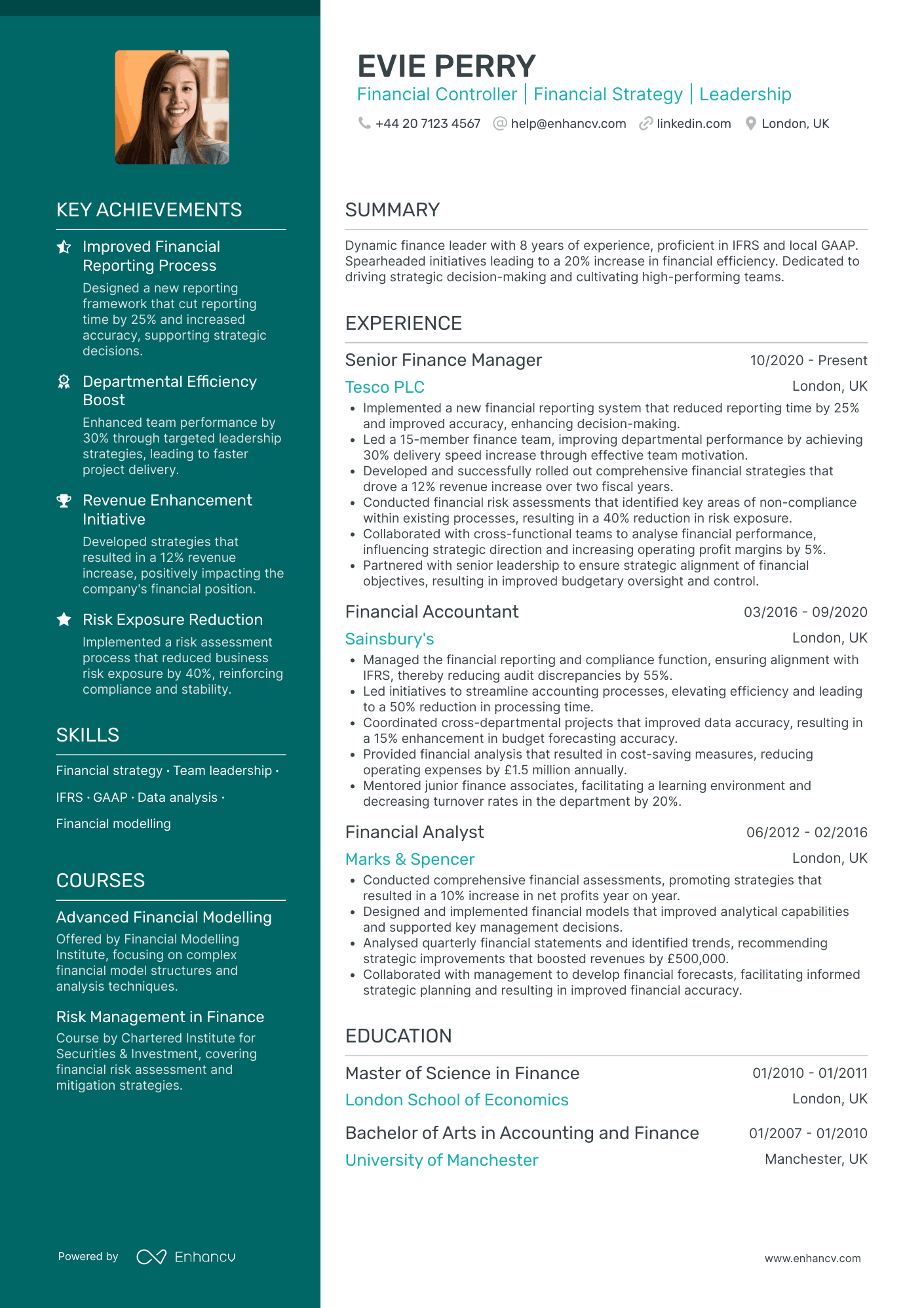

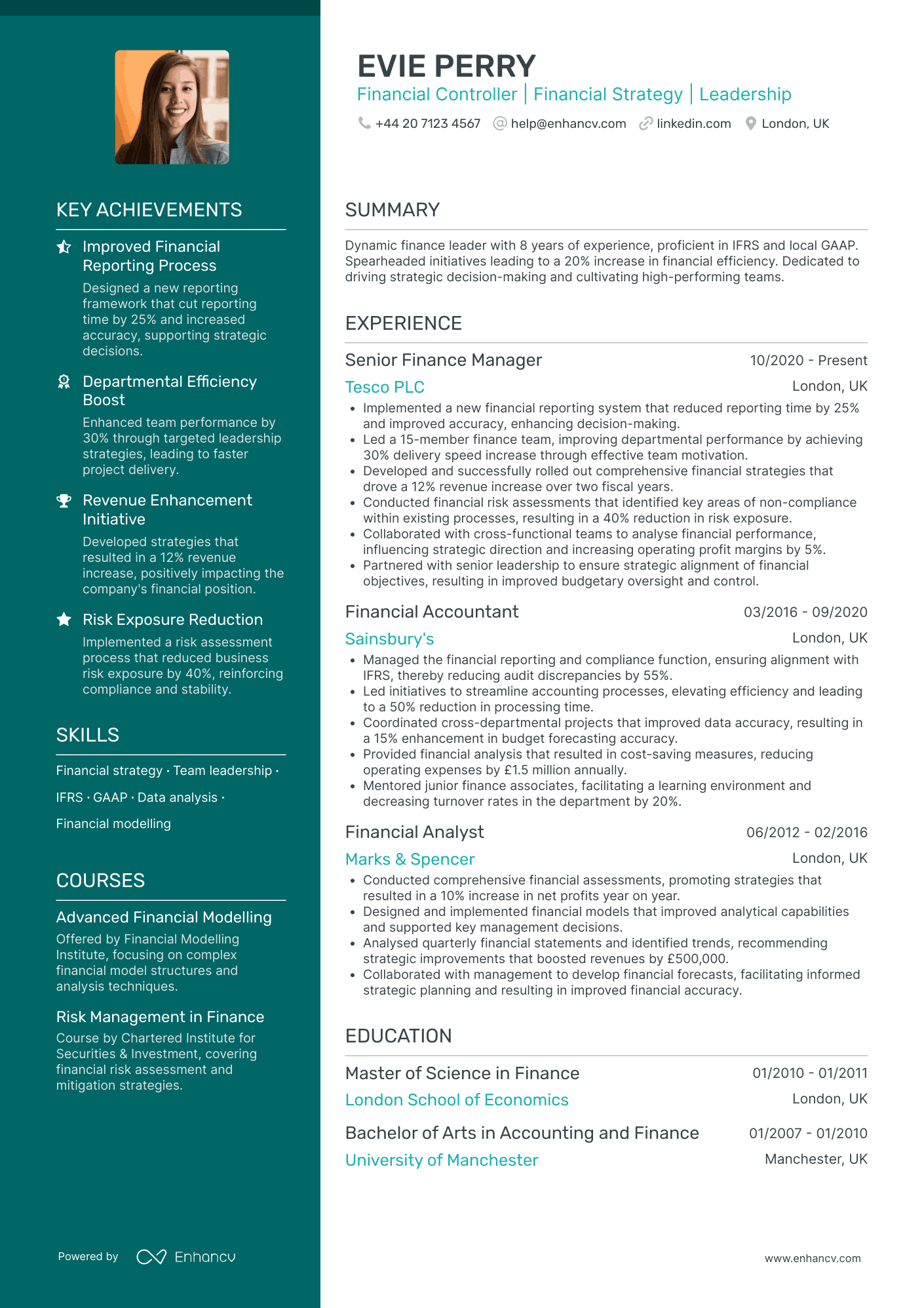

- Demonstrates Career Progression and Growth - Evie Perry's career trajectory shows a natural progression from a Financial Analyst to a Senior Finance Manager, illustrating growth in responsibilities and expertise. Transitioning between major UK retailers like Marks & Spencer, Sainsbury's, and Tesco demonstrates her ability to adapt and excel in different organizational cultures.

- Significance of Achievements and Impact on Business - The achievements detailed in the CV not only highlight impressive numerical outcomes but also underline their strategic importance. For instance, enhancing financial reporting efficiency and improving team performance are not just metrics; they speak to Evie's ability to drive substantial business improvements and influence strategic decision-making within large corporations.

Financial Controller in Construction

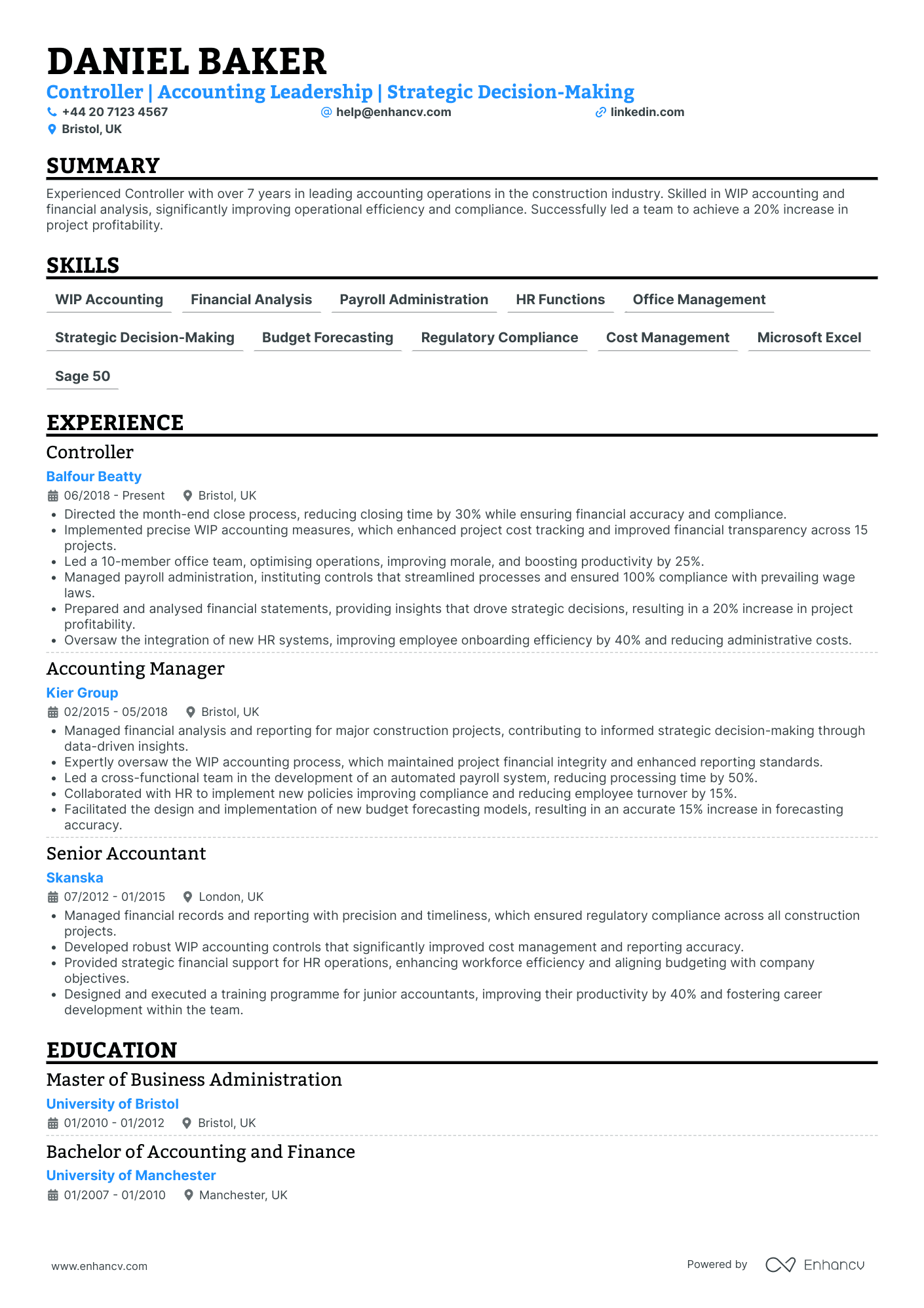

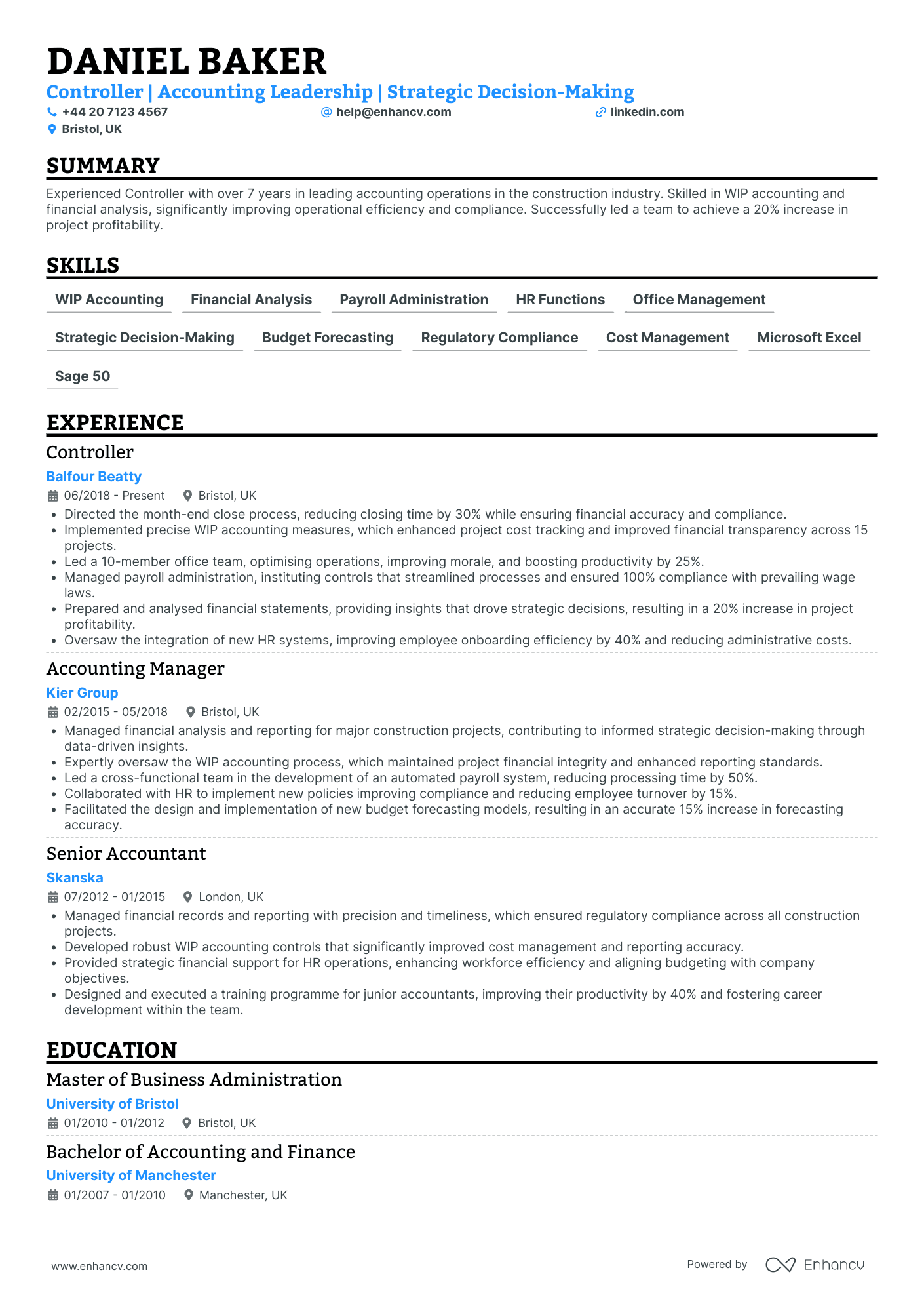

- Clear and Concise Content Presentation - The CV is structured in a way that clearly outlines the candidate's experience, skills, and achievements, making it easy for the reader to quickly understand Daniel's qualifications and career progression. The use of bullet points helps in highlighting key accomplishments and responsibilities succinctly.

- Demonstrates Career Growth and Industry Expertise - Daniel's career trajectory is clearly illustrated through his positions at Balfour Beatty, Kier Group, and Skanska. His progression from a Senior Accountant to a Controller shows a steady advancement in responsibilities and leadership roles within the construction industry, underlining his growing expertise in accounting leadership and strategic decision-making.

- Impacts Business Outcomes Through Achievements - The CV goes beyond listing responsibilities by showcasing the concrete impact of Daniel’s work. His achievements, such as reducing the month-end close time by 30% and enhancing project profitability by 20%, are not just numbers but reflect significant contributions to business efficiency and profitability, demonstrating his ability to drive meaningful change and value.

Financial Controller in Logistics

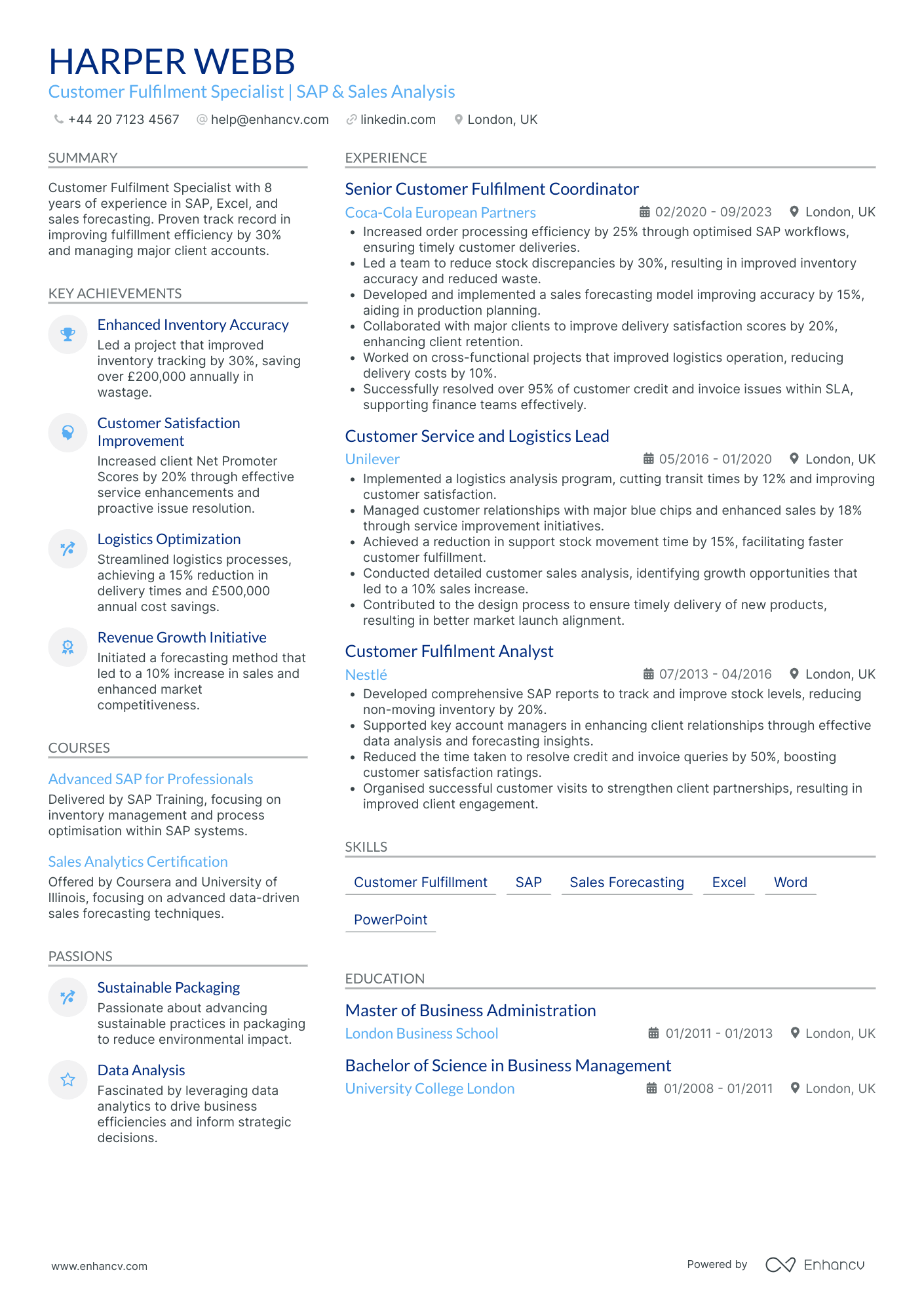

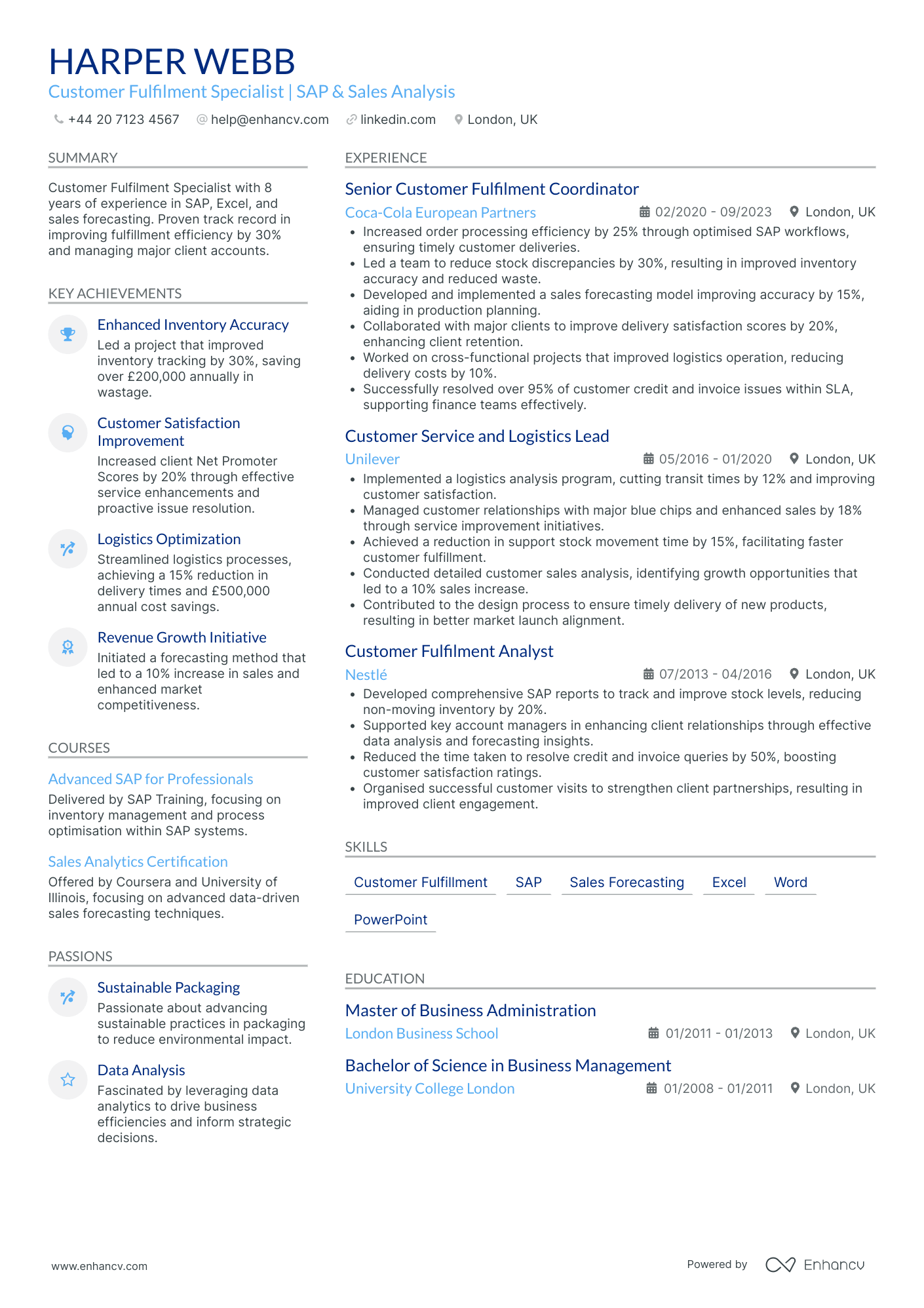

- Clarity and Structured Presentation - The CV is meticulously organized, beginning with a succinct summary that encapsulates the candidate’s expertise and notable achievements. Each section follows a logical order, ensuring recruiters can easily navigate through career milestones, education, and skills. Bullet points are used effectively to present information concisely without overwhelming the reader, providing a clear understanding of the candidate's capabilities.

- Impressive Career Trajectory - Harper Webb's career progression demonstrates significant growth, transitioning from a Customer Fulfilment Analyst to a Senior Customer Fulfilment Coordinator at a prestigious company like Coca-Cola European Partners. This upward movement not only highlights increased responsibilities and leadership potential but also underscores a deepening expertise in customer fulfillment and sales analysis within a highly competitive industry.

- Technical Proficiency and Industry-Specific Tools - The CV emphasizes Harper’s adeptness with vital industry tools and methodologies, such as SAP and advanced Excel functions, critical for inventory management and sales forecasting. Courses and certifications in advanced SAP and sales analytics further reinforce the candidate’s commitment to mastering technical skills that drive process optimization and enhance business operations, making Harper a valuable asset in fulfillment roles.

How complex should the format of your financial controller CV be?

Perhaps, you decided to use a fancy font and plenty of colours to ensure your financial controller CV stands out amongst the pile of other candidate profiles. Alas - this may confuse recruiters. By keeping your format simple and organising your information coherently, you'll ultimately make a better impression. What matters most is your experience, while your CV format should act as complementary thing by:

- Presenting the information in a reverse chronological order with the most recent of your jobs first. This is done so that your career history stays organised and is aligned to the role;

- Making it easy for recruiters to get in touch with you by including your contact details in the CV header. Regarding the design of your CV header, include plenty of white space and icons to draw attention to your information. If you're applying for roles in the UK, don't include a photo, as this is considered a bad practice;

- Organising your most important CV sections with consistent colours, plenty of white space, and appropriate margins (2.54 cm). Remember that your CV design should always aim at legibility and to spotlight your key information;

- Writing no more than two pages of your relevant experience. For candidates who are just starting out in the field, we recommend to have an one-page CV.

One more thing about your CV format - you may be worried if your double column CV is Applicant Tracker System (ATS) complaint. In our recent study, we discovered that both single and double-column CVs are ATS-friendly . Most ATSes out there can also read all serif and sans serif fonts. We suggest you go with modern, yet simple, fonts (e.g. Rubik, Lato, Raleway) instead of the classic Times New Roman. You'll want your application to stand out, and many candidates still go for the classics. Finally, you'll have to export your CV. If you're wondering if you should select Doc or PDF, we always advise going with PDF. Your CV in PDF will stay intact and opens easily on every OS, including Mac OS.

PRO TIP

Incorporate a touch of colour in headers or section breaks, but keep it professional and ensure it doesn’t detract from readability, especially in more conservative industries.

The top sections on a financial controller CV

- Professional Summary showcases your finance expertise and leadership skills, summarising your qualifications for recruiters.

- Work Experience details your past roles, highlighting your accomplishments and financial management capabilities.

- Financial Skills section demonstrates your proficiency with accounting software, financial analysis, and compliance.

- Education and Certifications list your relevant degrees and finance-related qualifications, ensuring your technical knowledge.

- Achievements in Finance underlines noteworthy successes like cost reduction initiatives or systems improvements.

What recruiters value on your CV:

- Emphasise your proficiency in financial reporting and compliance by detailing your experience with financial statements, tax returns, and audit processes.

- Showcase your strategic financial management abilities, highlighting any experience with budgeting, forecasting, and implementing cost-reduction strategies.

- Demonstrate your leadership and team management skills by mentioning the size of teams you've supervised and the financial operations you've streamlined.

- Highlight your expertise in financial software and systems, specifying any industry-standard tools like SAP, Oracle, or advanced Excel you're proficient with.

- Illustrate your communication skills by detailing your experience in presenting financial information to stakeholders and how you've supported decision-making processes.

Recommended reads:

Tips and tricks on writing a job-winning financial controller CV header

The CV header is the space which most recruiters would be referring most often to, in the beginning and end of your application. That is as the CV header includes your contact details, but also a headline and a professional photo. When writing your CV header:

- Double-check your contact details for spelling errors or if you've missed any digits. Also, ensure you've provided your personal details, and not your current work email or telephone number;

- Include your location in the form of the city and country you live in. If you want to be more detailed, you can list your full address to show proximity to your potential work place;

- Don't include your CV photo, if you're applying for roles in the UK or US, as this may bias initial recruiters' assessments;

- Write a professional headline that either integrates the job title, some relevant industry keywords, or your most noteworthy achievement.

In the next part of our guide, we'll provide you with professional CVs that showcase some of the best practices when it comes to writing your headline.

Examples of good CV headlines for financial controller:

- Financial Controller | Chartered ACCA | Risk Management Expert | 8+ Years in Corporate Finance

- Senior Finance Controller | CIMA Certified | Strategic Planning & Analysis | International Experience | 12+ Years

- Associate Financial Controller | MBA Graduate | Budgeting & Forecasting Specialist | 5 Years in SME Finance

- Financial Controller | CPA Qualified | Compliance & Internal Controls | M&A Experience | 10 Years

- Principal Financial Controller | Expert in Taxation | Treasury Management | CA Credential | 15+ Years

- Lead Financial Controller | Financial Reporting & Auditing | IFRS Knowledgeable | 7+ Years Progressing Roles

Choosing your opening statement: a financial controller CV summary or objective

At the top one third of your CV, you have the chance to make a more personable impression on recruiters by selecting between:

- Summary - or those three to five sentences that you use to show your greatest achievements. Use the CV summary if you happen to have plenty of relevant experience and wish to highlight your greatest successes;

- Objective - provides you with up to five sentences to state your professional aims and mission in the company you're applying for

CV summaries for a financial controller job:

- Accomplished Chartered Accountant with 8 years of robust experience in financial management within the tech industry, specialising in budget forecasting, risk analysis, and streamlining financial operations. Notable achievement includes reducing operational costs by 15% through strategic process optimisation at Tech Innovate Ltd.

- Seasoned Financial Controller with over 10 years of dedicated work in the manufacturing sector, capable of managing large-scale budgets and leading cross-functional teams. Implemented a financial reporting system at ManuCraft Enterprises that improved reporting accuracy by 25%.

- Highly analytic former IT Project Manager eager to transfer 7 years of project budgeting and cost reduction expertise into the financial sector. Adept at complex data analysis and keen to apply these skills to drive financial efficiency and growth within a new industry.

- Resourceful Marketing Director looking to pivot to financial control after 6 years of overseeing multimillion-pound campaigns, with a talent for cost management and investment planning. Excited to bring a creative yet analytical approach to optimising financial performance and capital investment strategies.

- Aspiring Financial Controller, recently graduated with an MSc in Finance, eager to utilise exceptional academic knowledge and strong analytical skills to assist in effective financial analysis and reporting. Driven to gain hands-on experience and contribute to an organisation's financial integrity and success.

- Dynamic individual with a recent MBA in Finance seeking entry-level opportunities to apply strong foundation in investment strategy, financial modelling, and management accounting. Committed to learning and excelling in financial oversight and regulatory compliance while supporting overall business goals.

The best formula for your financial controller CV experience section

The CV experience section is the space where many candidates go wrong by merely listing their work history and duties. Don't do that. Instead, use the job description to better understand what matters most for the role and integrate these keywords across your CV. Thus, you should focus on:

- showcasing your accomplishments to hint that you're results-oriented;

- highlighting your skill set by integrating job keywords, technologies, and transferrable skills in your experience bullets;

- listing your roles in reverse chronological order, starting with the latest and most senior, to hint at how you have grown your career;

- featuring metrics, in the form of percentage, numbers, etc. to make your success more tangible.

When writing each experience bullet, start with a strong, actionable verb, then follow it up with a skill, accomplishment, or metric. Use these professional examples to perfect your CV experience section:

Best practices for your CV's work experience section

- Managed timely and accurate monthly, quarterly, and annual financial reporting, ensuring compliance with IFRS and other regulatory requirements to maintain the company’s financial integrity and transparency.

- Implemented and monitored internal controls and policies to mitigate financial risk, and regularly reviewed systems for efficiency and compliance, leading to an improved annual audit outcome and reduced risk exposure.

- Streamlined budgeting and forecasting processes, working closely with department heads to deliver a more effective financial planning mechanism that aligns with strategic business objectives.

- Played a pivotal role in financial decision-making, providing strategic recommendations to the CEO and Board of Directors that contributed to a 15% increase in profitability over two years.

- Supervised a team of accountants and finance professionals, fostering a culture of continuous improvement and professional development, which resulted in a 20% increase in team productivity.

- Led complex financial projects, including the successful integration of new accounting software that automated key financial processes and enhanced reporting capabilities.

- Conducted thorough financial analysis and prepared detailed reports, presenting critical financial data and narrative that supported strategic business initiatives and growth opportunities.

- Efficiently managed cash flow and working capital, negotiating with suppliers and financial institutions to optimise liquidity and maintain strong credit standing.

- Collaborated with external auditors during annual audits, ensuring all financial statements and disclosures were accurate and in accordance with applicable standards, leading to no significant audit findings.

- Directed the financial operations and strategised the cost-reduction plan, resulting in a 15% decrease in expenses after streamlining supplier contracts.

- Implemented an ERP system to overhaul the company's accounting framework, increasing reporting accuracy and reducing monthly closing time by 30%.

- Led a team of 12 in the finance department, fostering professional development and high standards of performance to achieve a 20% increase in department efficiency.

- Managed the preparation of statutory financial statements and coordinated the external audit process, ensuring full compliance with IFRS.

- Spearheaded a company-wide budget restructuring initiative, leading to improved financial forecasting accuracy by 25%.

- Negotiated and secured a £2 million revolving credit facility to enhance the company's cash flow and working capital management.

- Developed and implemented financial policies and procedures that enhanced internal controls and supported the company's international expansion efforts.

- Orchestrated a financial turnaround strategy, taking the company from a £300,000 annual loss to a £500,000 profit in under three years.

- Actively collaborated with the CFO to drive the business strategy, contributing to a 15% annual growth rate.

- Optimized cash flow management by implementing robust forecasting models that improved the cash conversion cycle by 20 days.

- Coordinated the due diligence and financial assessment for an acquisition worth £50 million, providing critical insights to the executive team.

- Developed a comprehensive corporate tax strategy that reduced the company's effective tax rate by 5% annually.

- Instrumental in developing a business continuity plan which safeguarded critical financial operations during a major system outage and prevented revenue loss.

- Managed the quarterly financial reporting process to stakeholders in a timely manner, promoting transparency and upholding the firm's reputation.

- Enhanced financial insight by implementing a new BI tool for data analysis and reporting, empowering management with real-time financial information.

- Analysed financial results and market trends to present quarterly reports to the board, influencing the strategic decision-making process.

- Revamped the financial risk management framework which reduced financial risks by 22% and safeguarded the company's assets.

- Played a key role in integrating the finance function of three newly acquired subsidiaries, ensuring cohesive and efficient financial operations.

- Implemented a cost-saving initiative that resulted in the successful renegotiation of supply chain contracts, saving the company £1.2 million annually.

- Led the adoption of new accounting software which enhanced the finance team's productivity by 35% and minimised human errors in financial documentation.

- Presented intricate financial data to non-financial stakeholders in a clear manner, aiding the board in understanding the financial implications of their strategic choices.

- Streamlined financial reporting processes, reducing the time taken to produce monthly reports from 10 to 6 business days.

- Led the strategic budget planning process, which aligned 10+ departments with the organisation's financial goals and priorities.

- Coordinated with IT to enhance cybersecurity measures for financial data, drastically reducing the risk of financial data breaches.

Writing your CV without professional experience for your first job or when switching industries

There comes a day, when applying for a job, you happen to have no relevant experience, whatsoever. Yet, you're keen on putting your name in the hat. What should you do? Candidates who part-time experience , internships, and volunteer work.

Recommended reads:

PRO TIP

Talk about any positive changes you helped bring about in your previous jobs, like improving a process or helping increase efficiency.

Key financial controller CV skills: what are hard skills and soft skills

Let's kick off with the basics. You know that you have to include key job requirements or skills across your CV. For starters, take individual skills from the job description and copy-paste them into your CV, when relevant. Doing so, you'll ensure you have the correct skill spelling and also pass the Applicant Tracker System (ATS) assessment. There are two types of skills you'll need to include on your CV:

- Hard skills - technical abilities that are best defined by your certificates, education, and experience. You could also use the dedicated skills section to list between ten and twelve technologies you're apt at using that match the job requirements.

- Soft skills - your personal traits and interpersonal communication skills that are a bit harder to quantify. Use various CV sections, e.g. summary, strengths, experience, to shine a spotlight on your workspace achievements, thanks to using particular soft skills.

Remember that your job-winning CV should balance both your hard and soft skills to prove your technical background, while spotlighting your personality.

Top skills for your financial controller CV:

Financial Reporting

Accounting

Auditing

Budgeting

Forecasting

Financial Analysis

Taxation

Risk Management

Regulatory Compliance

ERP Systems

Leadership

Communication

Problem-Solving

Attention to Detail

Strategic Thinking

Time Management

Negotiation

Adaptability

Teamwork

Decision-Making

PRO TIP

If there's a noticeable gap in your skillset for the role you're applying for, mention any steps you're taking to acquire these skills, such as online courses or self-study.

Further professional qualifications for your financial controller CV: education and certificates

As you're nearing the end of your financial controller CV, you may wonder what else will be relevant to the role. Recruiters are keen on understanding your academic background, as it teaches you an array of hard and soft skills. Create a dedicated education section that lists your:

- applicable higher education diplomas or ones that are at a postgraduate level;

- diploma, followed up with your higher education institution and start-graduation dates;

- extracurricular activities and honours, only if you deem that recruiters will find them impressive.

Follow a similar logic when presenting your certificates. Always select ones that will support your niche expertise and hint at what it's like to work with you. Balance both technical certification with soft skills courses to answer job requirements and company values. Wondering what the most sought out certificates are for the industry? Look no further:

PRO TIP

If there's a noticeable gap in your skillset for the role you're applying for, mention any steps you're taking to acquire these skills, such as online courses or self-study.

Recommended reads:

Key takeaways

What matters most in your financial controller CV-writing process is for you to create a personalised application. One that matches the role and also showcases your unique qualities and talents.

- Use the format to supplement the actual content, to stand out, and to ensure your CV experience is easy to comprehend and follows a logic;

- Invest time in building a succinct CV top one third. One that includes a header (with your contact details and headline), a summary or an objective statement (select the one that best fits your experience), and - potentially - a dedicated skills section or achievements (to fit both hard skills and soft skills requirements);

- Prioritise your most relevant (and senior) experience closer to the top of your CV. Always ensure you're following the "power verb, skill, and achievement" format for your bullets;

- Integrate both your technical and communication background across different sections of your CV to meet the job requirements;

- List your relevant education and certificates to fill in gaps in your CV history and prove to recrutiers you have relevant technical know-how.