Crafting a CV that effectively showcases your analytical prowess and attention to detail can be a daunting task for any financial analyst. By delving into our comprehensive guide, you'll discover tailored strategies to enhance your CV, ensuring your skills and experiences resonate with prospective employers.

- Design and format your professional financial analyst CV;

- Curate your key contact information, skills, and achievements throughout your CV sections;

- Ensure your profile stays competitive by studying other industry-leading financial analyst CVs;

- Create a great CV even if you happen to have less professional experience, or switching fields.

When writing your financial analyst CV, you may need plenty of insights from hiring managers. We have prepared industry-leading advice in the form of our relevant CV guides.

Resume examples for financial analyst

By Experience

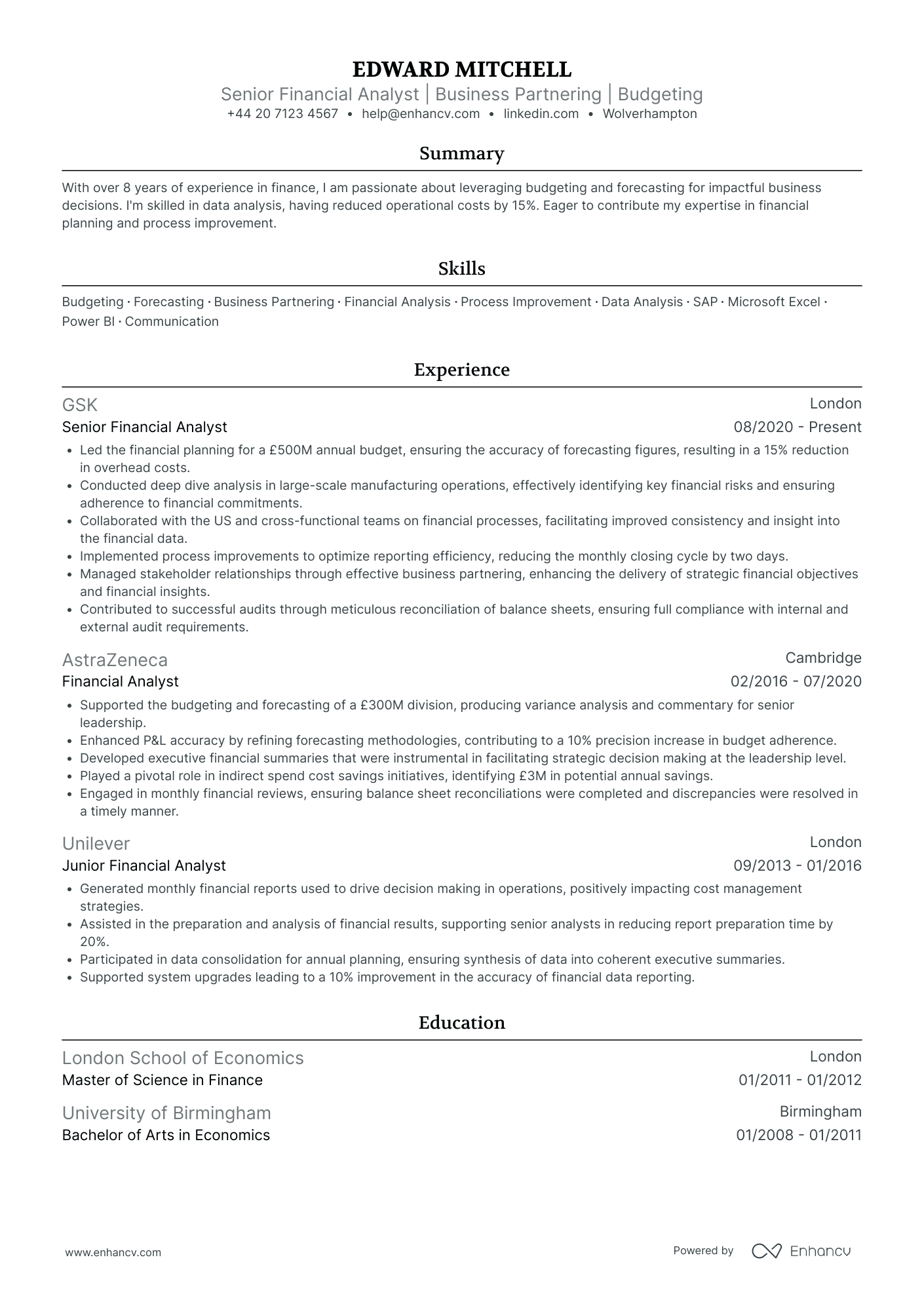

Senior Financial Analyst

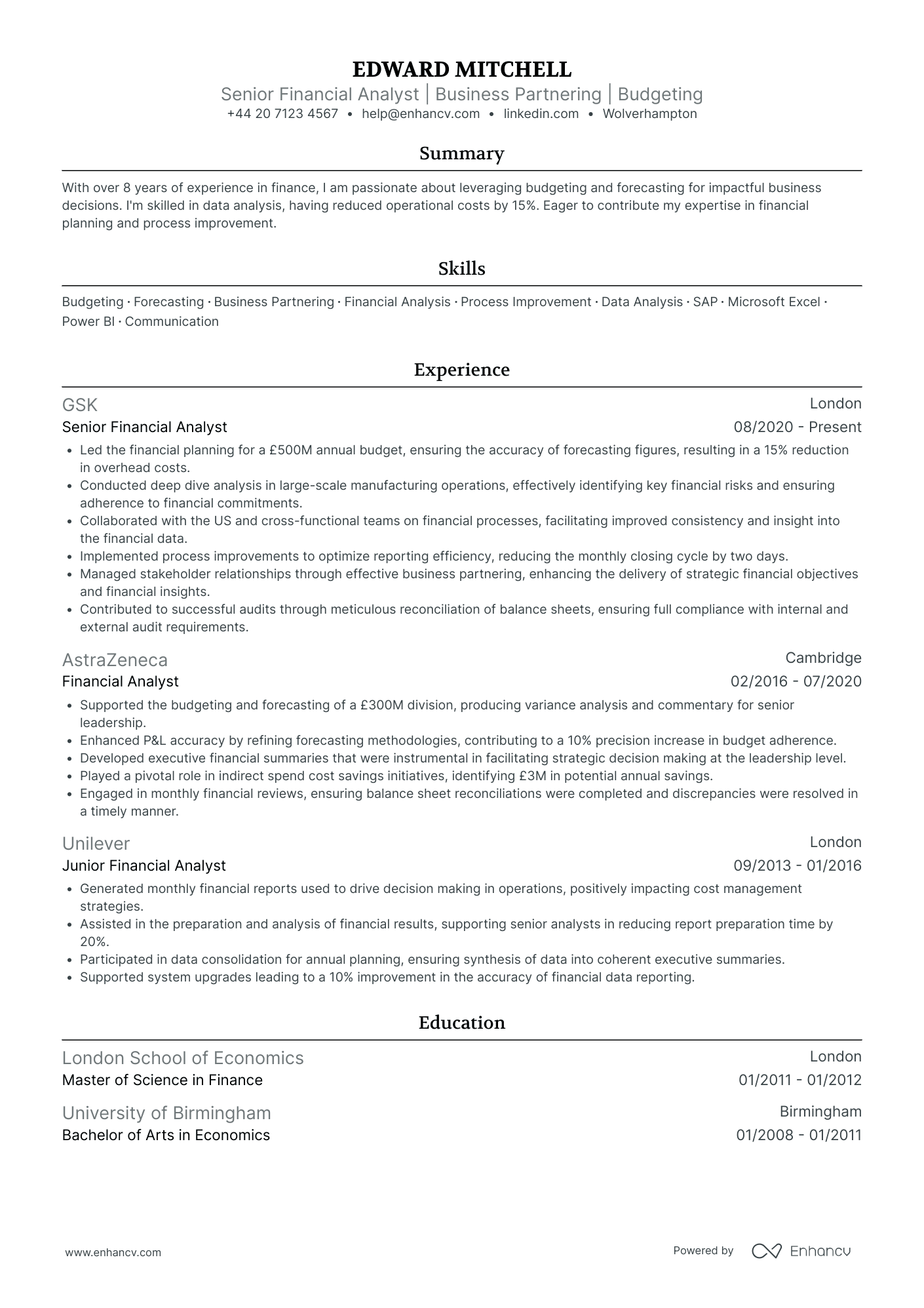

- Strategic Use of Financial Tools and Techniques - Edward Mitchell's CV highlights his adeptness with industry-specific tools like SAP and Power BI, showcasing his capability to manage data and make informed financial decisions. The inclusion of courses like "Advanced Financial Modelling and Valuation" indicates his commitment to employing advanced spreadsheet techniques to refine financial analysis processes.

- Dynamic Career Progression in Financial Leadership - Mitchell's career trajectory is marked by a steady progression from a Junior Financial Analyst at Unilever to a Senior Financial Analyst at GSK. This advancement illustrates not only his growing expertise but also his ability to adapt to larger responsibilities, reflected in his work managing multi-million pound budgets and leading teams in strategic business partnering.

- Significant Achievements with Measurable Outcomes - The CV effectively underscores Edward's impactful contributions with quantifiable achievements, such as leading a process improvement project that reduced operational overheads by 15%. These metrics demonstrate his ability to drive cost reductions and improve organizational efficiencies, adding tangible value to his roles in every company he has been with.

Junior Financial Analyst

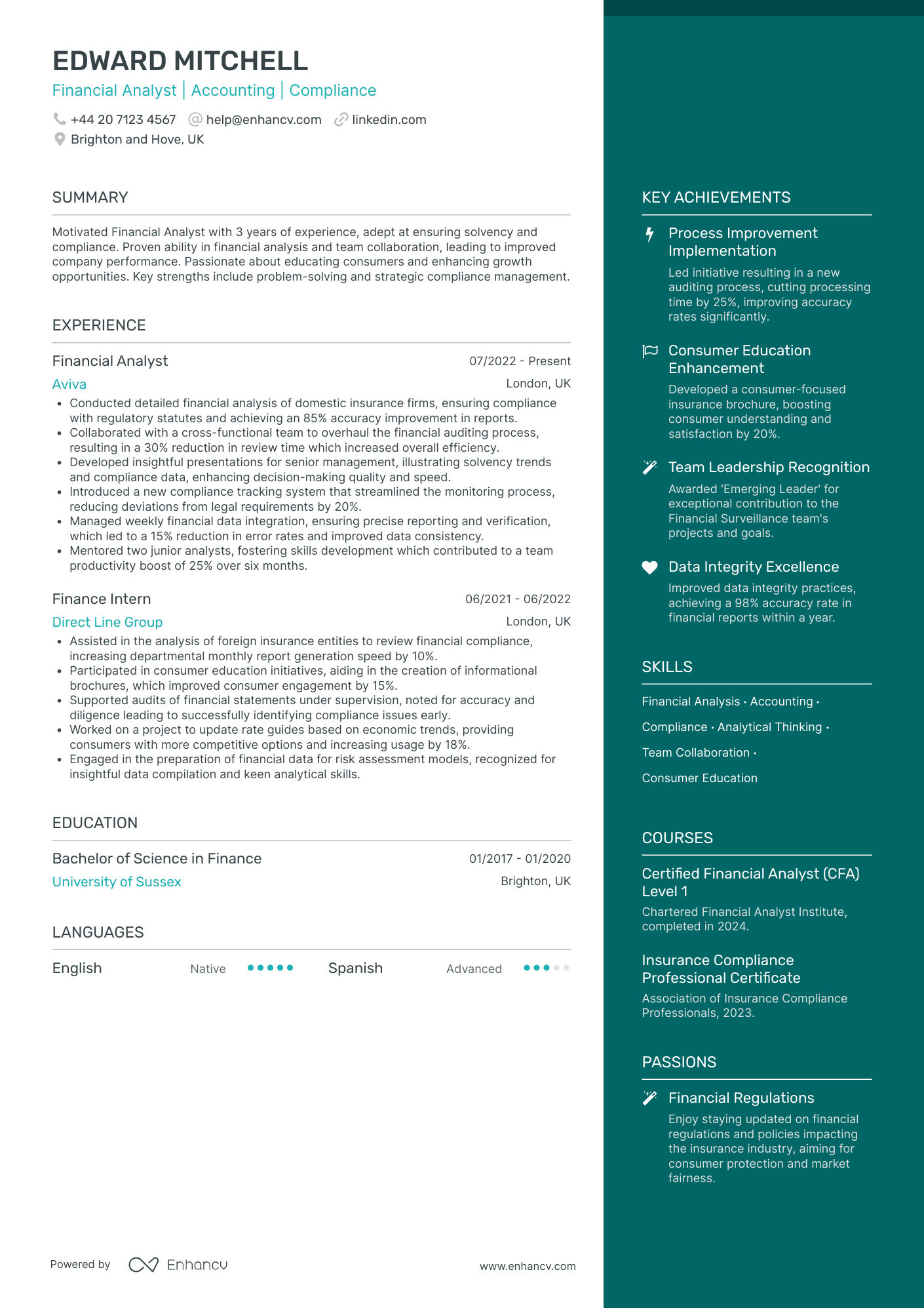

- Clear and Comprehensive Structure - The CV is well-organized, providing a clear structure that leads the reader through each section logically. It begins with a succinct header, followed by a detailed professional experience section where each role includes specific achievements, enhancing the overall readability and impact of the document.

- Diverse and Rapid Career Growth - Edward Mitchell’s career trajectory is impressive, showing a swift progression from a Finance Intern to a Financial Analyst within just a few years. This advancement underscores a strong capacity for growth and a quick adaptability to the evolving demands of the finance industry.

- Demonstrated Leadership and Mentorship - The CV highlights Edward’s soft skills in leadership by mentioning his role in mentoring junior analysts. This experience aligns closely with his achievements in team productivity, reflecting his ability to lead and enhance team performance, furthering his capacity for future leadership roles.

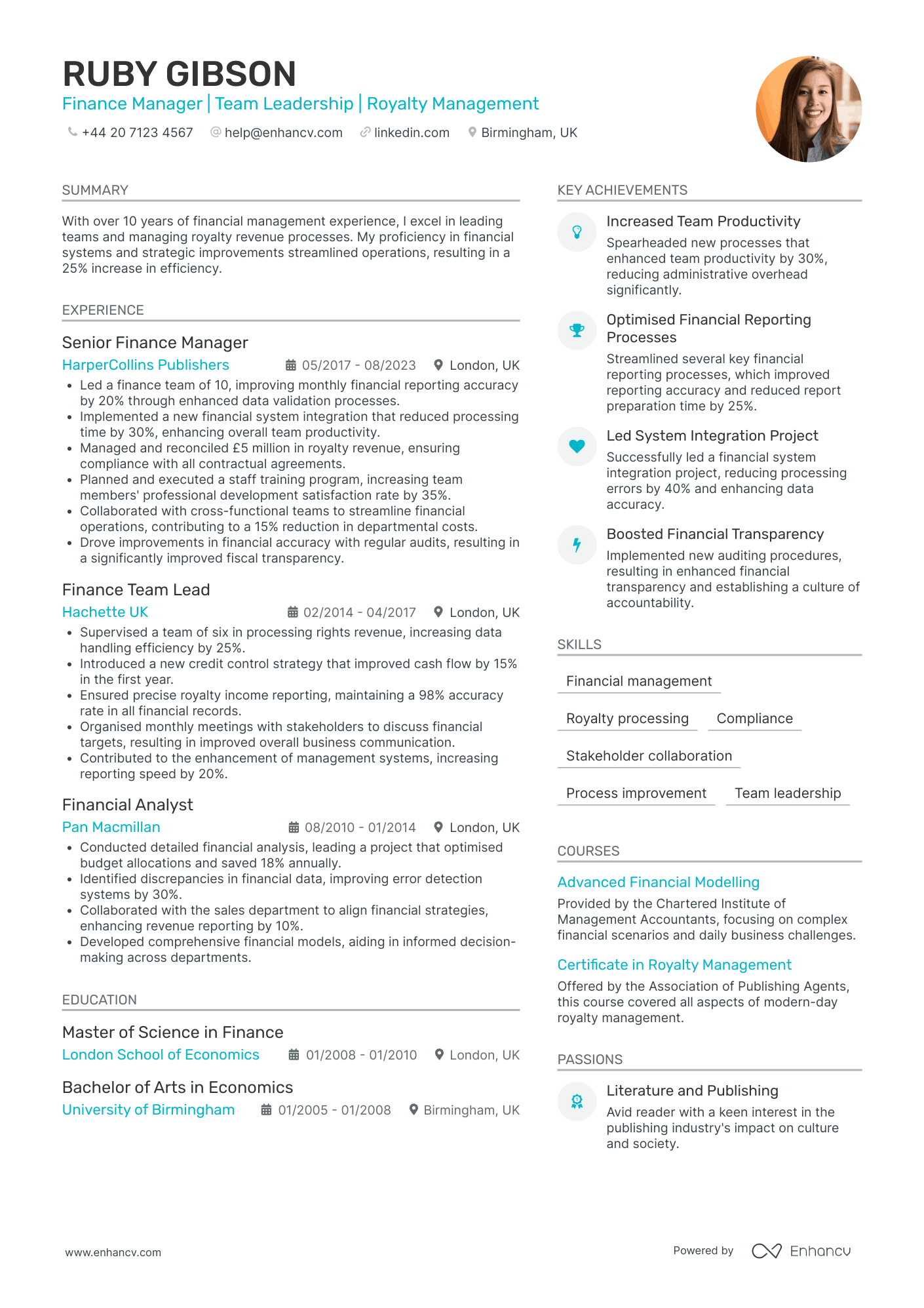

Financial Analyst Manager

- Clear and structured presentation - The CV is well-organized with a clear separation of sections, making it easy to navigate. Each section is concise and presents information in a structured manner, allowing the reader to quickly grasp key aspects of Ruby Gibson's qualifications and achievements.

- Consistent career growth and industry expertise - Ruby Gibson's career trajectory reflects consistent growth from a Financial Analyst to a Senior Finance Manager. This progression highlights not just promotions but an increasing level of responsibility and expertise in the finance and publishing industries, with a clear focus on royalty management and financial systems integration over the years.

- Strong emphasis on measurable achievements - The CV includes detailed accomplishments with specific metrics, such as improving team productivity by 30% and increasing financial reporting accuracy by 20%. These achievements underscore the business impact of Ruby's contributions, showcasing an ability to drive operational efficiency and strategic improvements within financial management.

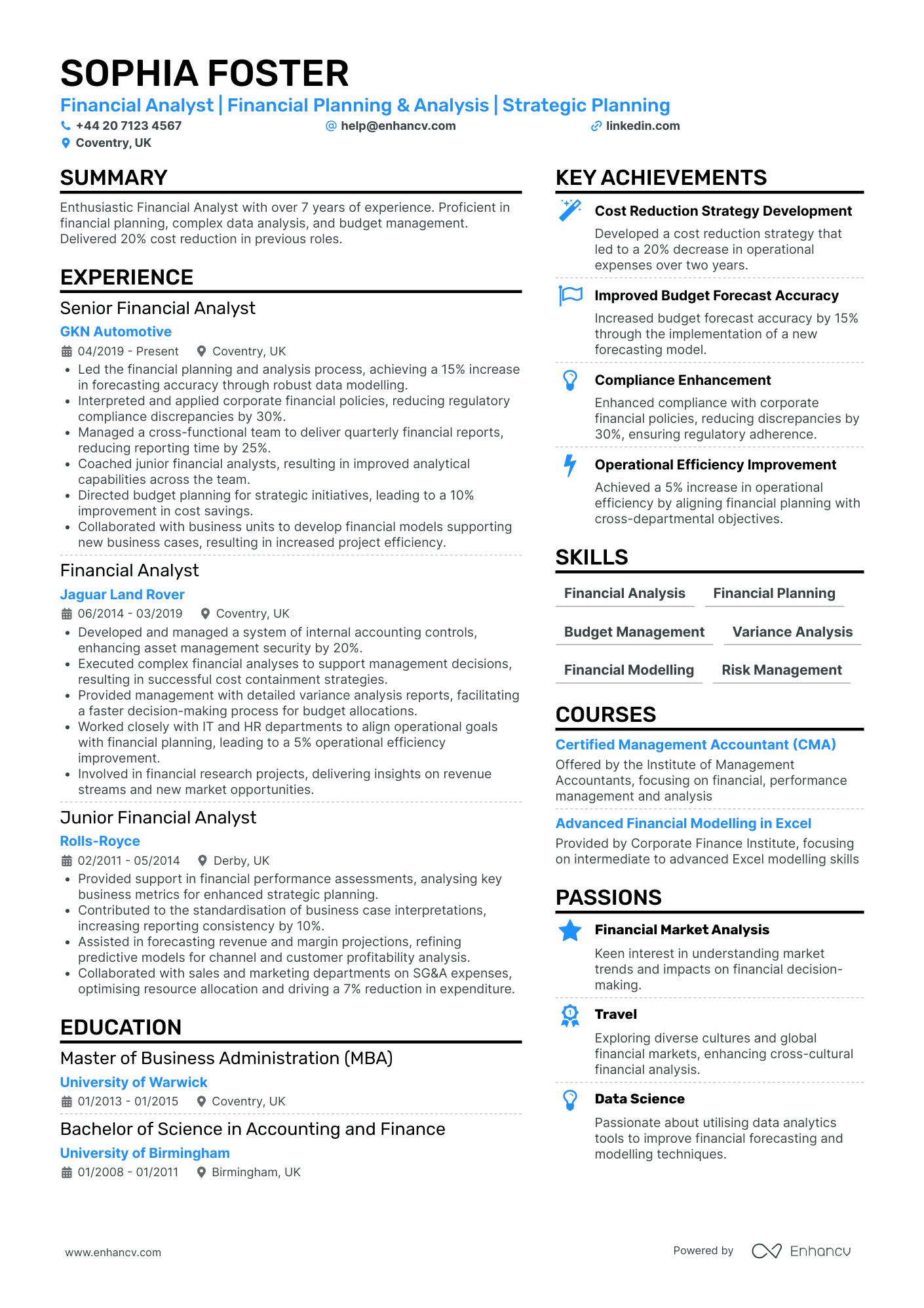

Lead Financial Analyst

- Clear and Structured Presentation - The CV's content is well-organized, ensuring clarity in presenting Sophia's professional history and achievements. Each section is distinctly labeled, with concise bullet points that effectively communicate her roles, responsibilities, and accomplishments. This structure makes it easy for readers to grasp her career highlights quickly.

- Proven Growth and Promotion Trajectory - Sophia's career progression is evident, moving from a Junior Financial Analyst at Rolls-Royce to a Senior Financial Analyst at GKN Automotive. This advancement reflects her capability and adaptability in the financial analysis domain, showcasing her growth within the industry and her increasing responsibilities over time.

- Robust Skill Set with Industry-Relevant Tools - The CV highlights an impressive array of industry-specific skills, such as financial analysis, budgeting, and regulatory compliance. Sophia is proficient in Microsoft Excel and has completed advanced financial modeling courses, underscoring her technical depth and readiness to handle complex financial data.

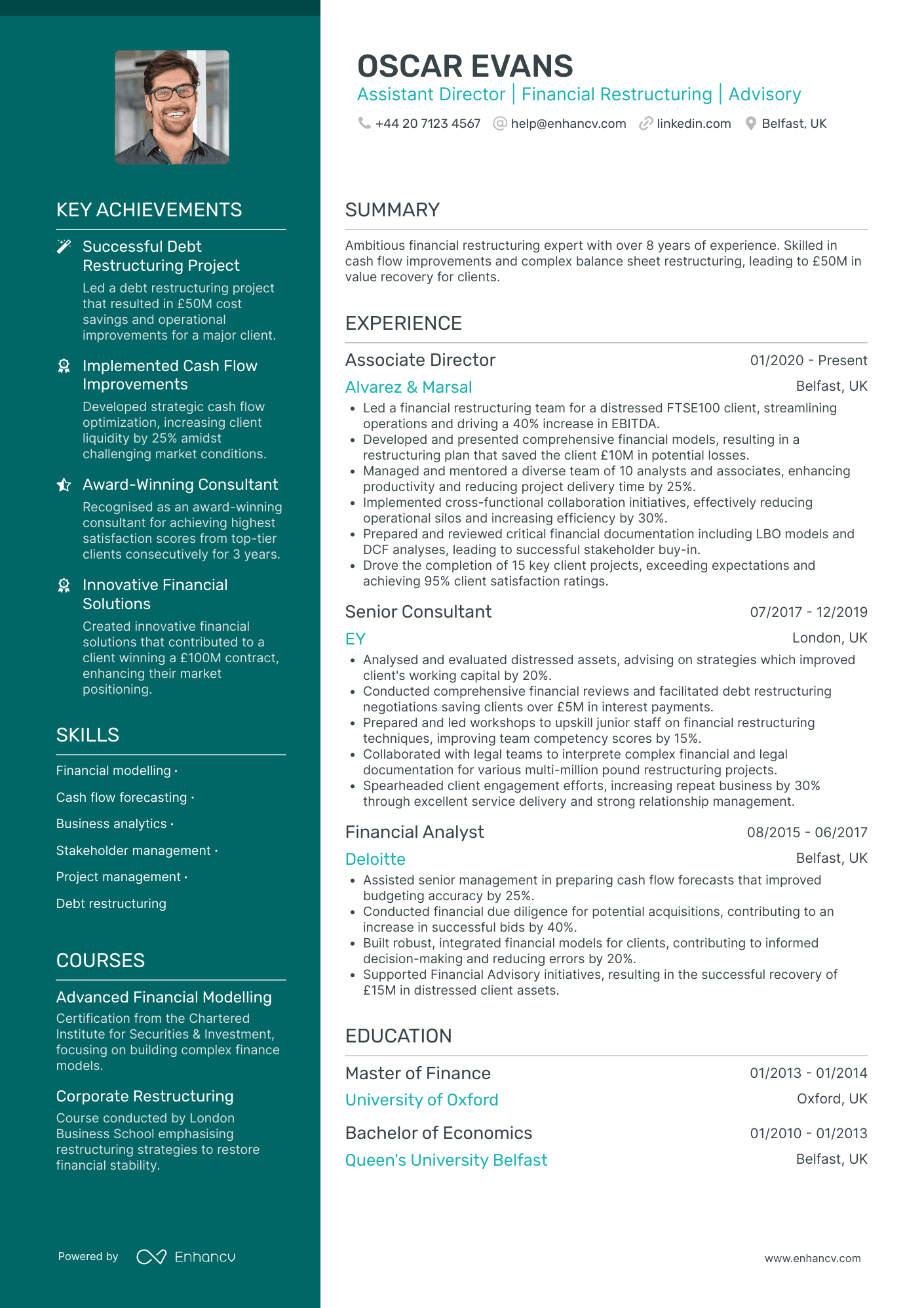

Financial Analyst Director

- Structured and Comprehensive Layout - Oscar's CV is meticulously structured, presenting each section distinctly with a concise and clear narrative. This enables potential employers to quickly identify key aspects of his career, including his expertise in financial restructuring and advisory.

- Progressive Career Advancement - The career trajectory details a steady progression through increasingly responsible roles within the financial restructuring sector, moving from a Financial Analyst at Deloitte to an Associate Director at Alvarez & Marsal. This demonstrates his career growth and ability to adapt to complex, high-stakes environments.

- Quantifiable Impact and Results - The CV highlights significant achievements with measurable impact, such as leading a team that increased a client's EBITDA by 40% and successfully saving over £50M through restructuring projects. These accomplishments underline the strategic value Oscar brings to any advisory or financial restructuring role.

Chief Financial Analyst

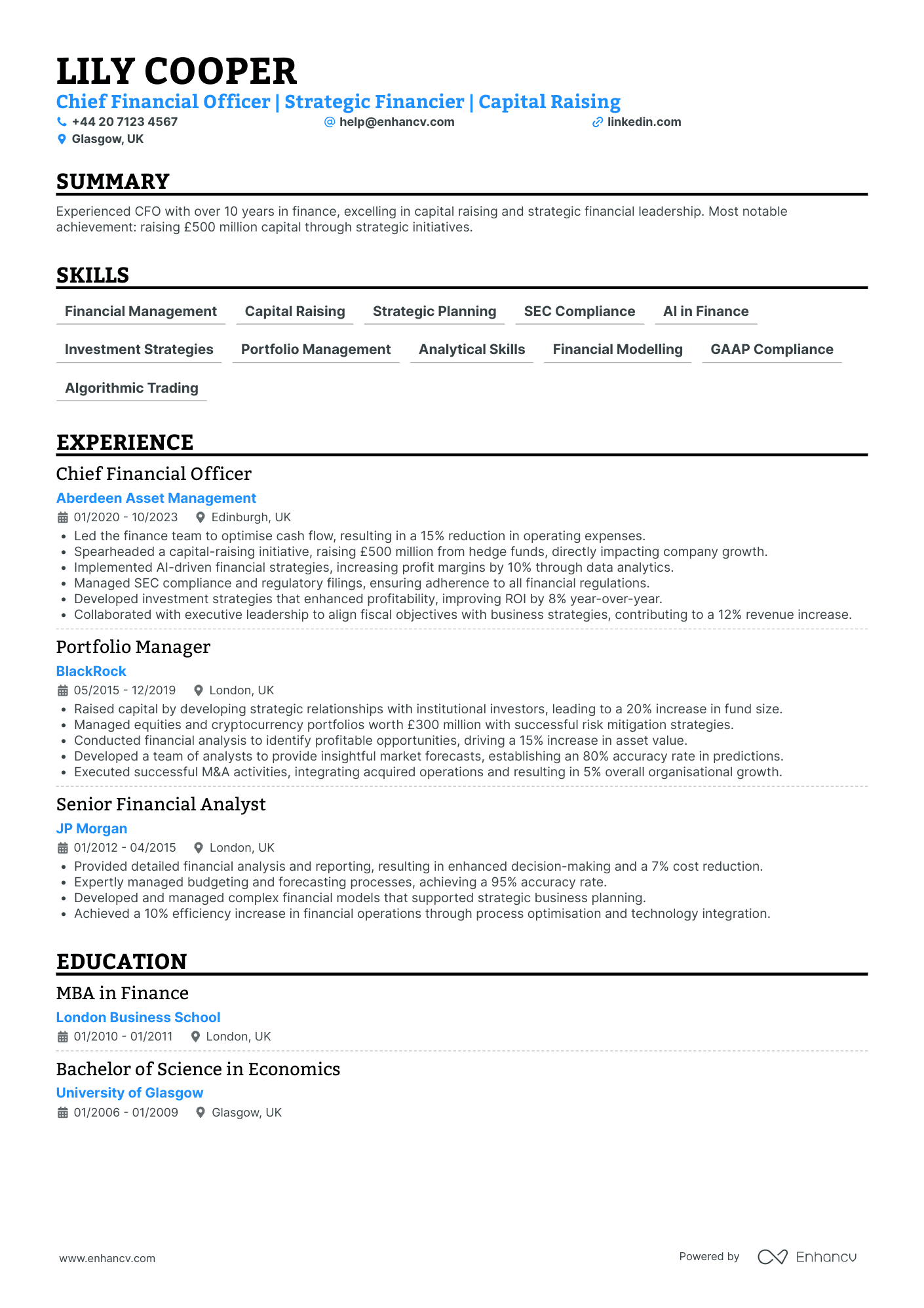

- Clear Career Progression - Lily Cooper's career trajectory is clearly defined, showcasing her growth from a Senior Financial Analyst to a Chief Financial Officer. This progression illustrates her ability to take on increased responsibilities and highlights her commitment to professional growth within the finance industry.

- Strategic Financial Leadership - The CV emphasizes Lily's strategic financial leadership through her achievements in capital raising and implementation of AI-driven strategies. Her ability to lead initiatives that directly impact profitability and company growth is a testament to her strategic mindset and decision-making prowess.

- Industry-Specific Methodologies - Lily showcases her technical depth by highlighting her use of AI in financial forecasting and algorithmic trading. These elements demonstrate her ability to leverage cutting-edge technologies to optimize financial processes and enhance decision-making, setting her apart in the finance sector.

By Role

Financial Risk Analyst

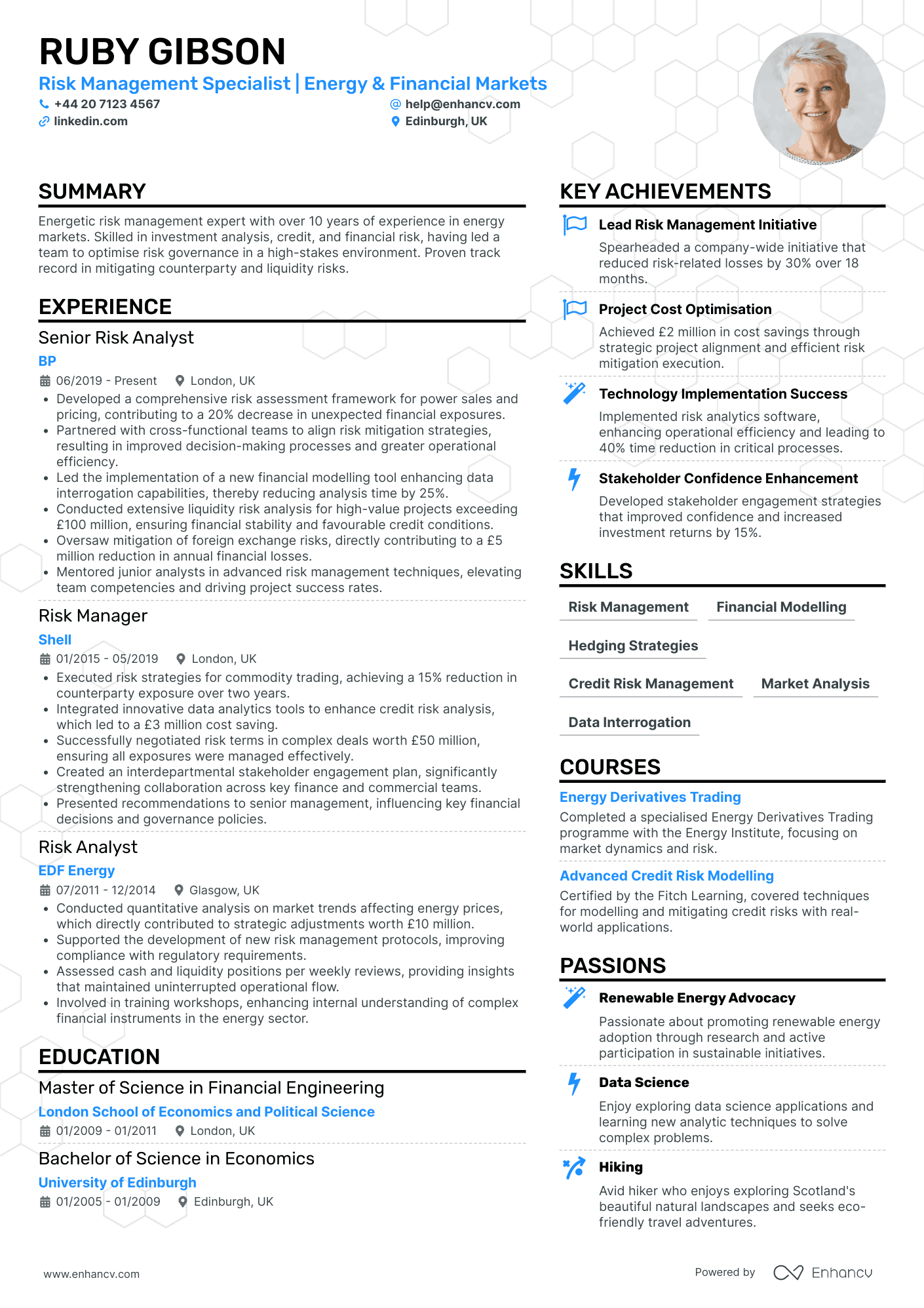

- Strong Professional Growth and Consistency - Ruby Gibson's career trajectory demonstrates a clear and consistent upward movement within the risk management field. Starting as a Risk Analyst at EDF Energy and advancing to a Senior Risk Analyst at BP, her progression reflects considerable professional growth and specialization in energy and financial markets. Each role highlights increased responsibility and technical depth, resonating with her expertise as a Risk Management Specialist.

- Technical Acumen and Innovative Tools Utilization - The CV underscores Ruby's proficiency in leveraging industry-specific tools and methodologies. Her experience at BP involves implementing a financial modelling tool that improved data interrogation capabilities, showcasing her ability to integrate technology for enhanced operational efficiency. Furthermore, her knowledge of Python and SQL illustrates a solid technical foundation in data analysis, which is crucial for risk management roles in energy and financial markets.

- Achievement-Driven with Notable Business Impact - Ruby’s accomplishments are not just presented through numbers but emphasize the significant business impact. She spearheaded an initiative that reduced risk-related losses by 30% and achieved substantial cost savings of £2 million, reflecting her strategic and results-driven approach. These achievements underline her capacity to drive valuable business outcomes through effective risk strategies and stakeholder engagement.

Financial Systems Analyst

- Clear and Structured Presentation - The CV presents information in a clear and well-organized manner, making it easy for recruiters to quickly understand the candidate's qualifications and track record. The use of bullet points under each experience enhances readability and conciseness, highlighting key achievements and responsibilities efficiently.

- Steady Career Growth and Industry Expertise - Poppy Griffiths demonstrates a consistent progression in her finance career, moving from a Financial Analyst role to more advanced positions like Commercial Finance Partner and Finance Analyst at prominent companies. This trajectory highlights her increasing responsibilities and expertise in the finance industry, particularly in areas involving SAP and UK GAAP.

- Significant Soft Skills and Leadership - Beyond technical expertise, the CV emphasizes soft skills such as communication, problem-solving, and collaboration. These skills are pivotal for Poppy's roles, where she successfully led projects, facilitated workshops, and collaborated with cross-functional teams, indicating strong leadership and interpersonal capabilities critical for a Finance Analyst.

Financial Reporting Analyst

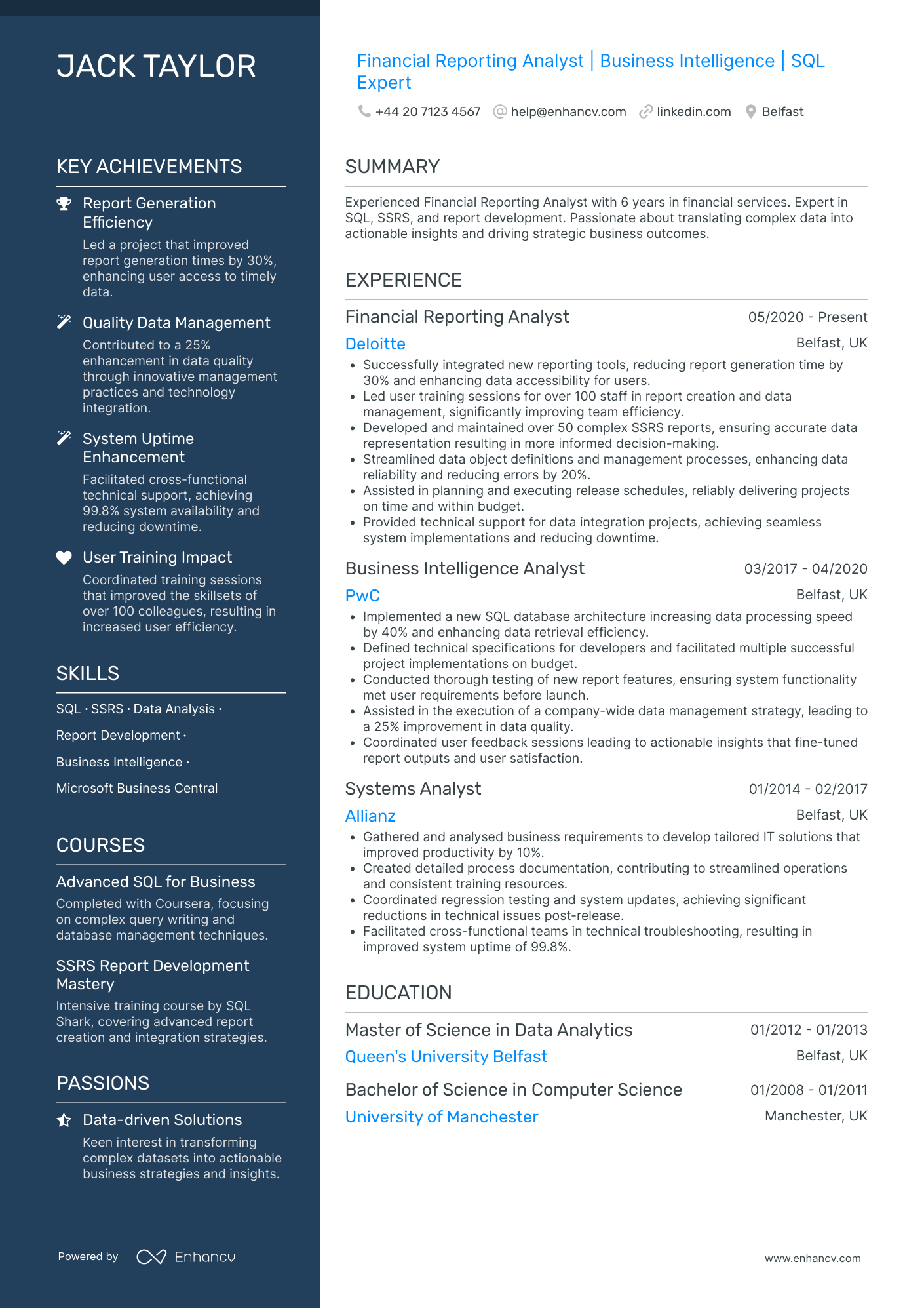

- Clear and Structured Presentation - The CV excels in presenting content clearly and concisely. Each section is well-organized with headings and bullet points, making it easy to skim for relevant details. The structured approach ensures that key information, such as experience, education, and skills, is readily accessible and logically arranged.

- Progressive Career Trajectory - Jack’s career shows a progression through reputable companies like Deloitte and PwC, illustrating a steady growth in responsibility. His transition from Systems Analyst to Financial Reporting Analyst highlights a clear path of career advancement within the financial services sector, reflecting both commitment and the accumulation of expertise.

- Deep Technical Proficiency with Industry Tools - The CV underscores Jack’s proficiency with industry-specific tools such as SQL and SSRS, showcasing technical depth that is crucial for a Financial Reporting Analyst. His experience in integrating new reporting tools and optimizing database architectures adds substantial value and highlights his technical capability within business intelligence and financial reporting.

Financial Crime Analyst

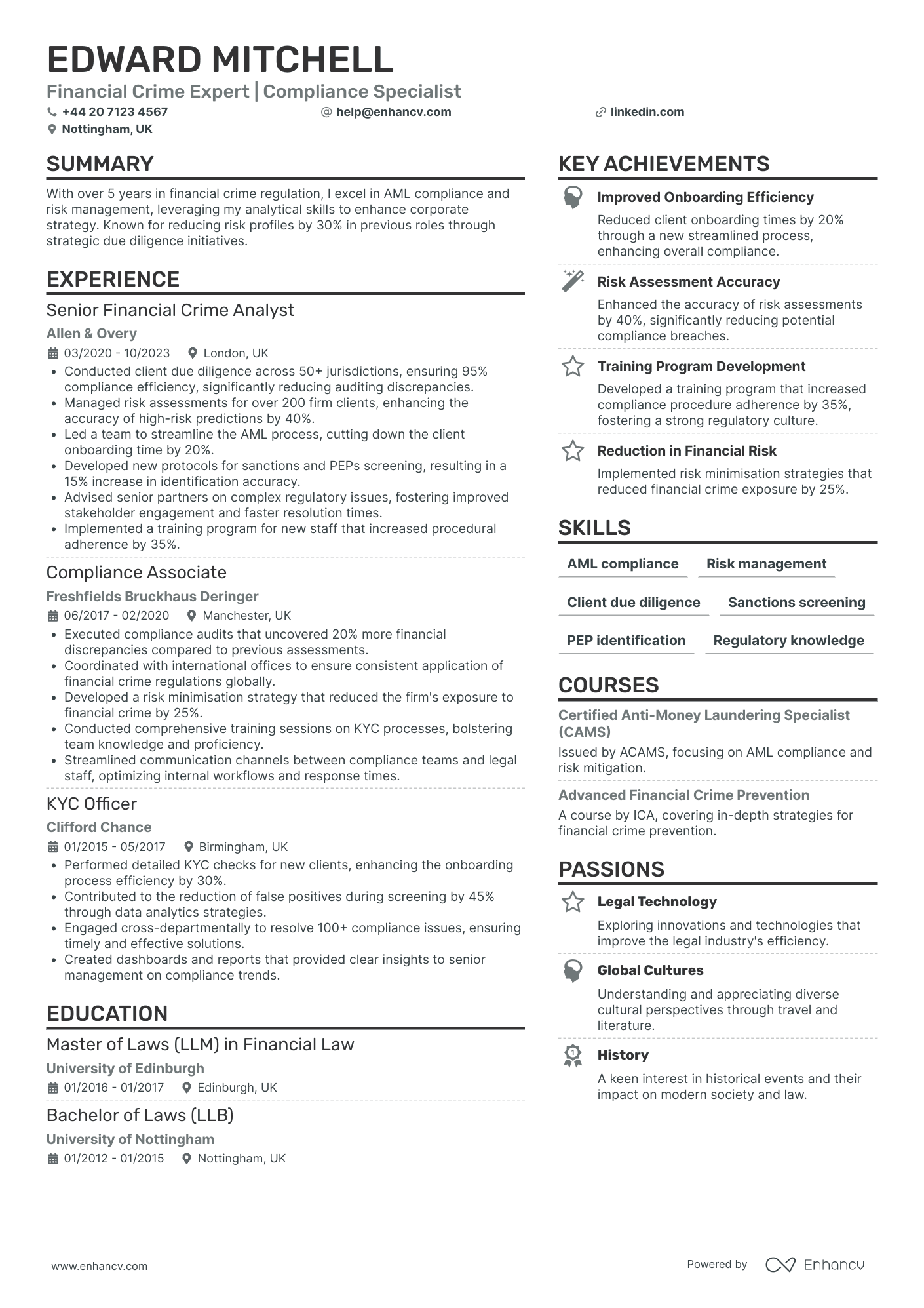

- Structured with a clear professional narrative - The CV is meticulously arranged, beginning with personal details and a concise summary, setting the stage for the detailed experiences and educational background that follow. This organization respects the reader's time and highlights key information succinctly.

- Steady career progression in financial compliance - Edward Mitchell's career trajectory demonstrates significant growth from a KYC Officer to a Senior Financial Crime Analyst, highlighting a natural progression within the financial compliance industry. This advancement reflects his growing expertise and increasing responsibility in financial crime regulation and AML compliance.

- Strategic skills and tangible impact - The CV effectively communicates not just numerical accomplishments but the strategic impact of Edward's contributions, such as reducing firm risk profiles and improving compliance efficiency. These achievements indicate his ability to influence business strategy and foster a robust compliance culture.

Healthcare Financial Analyst

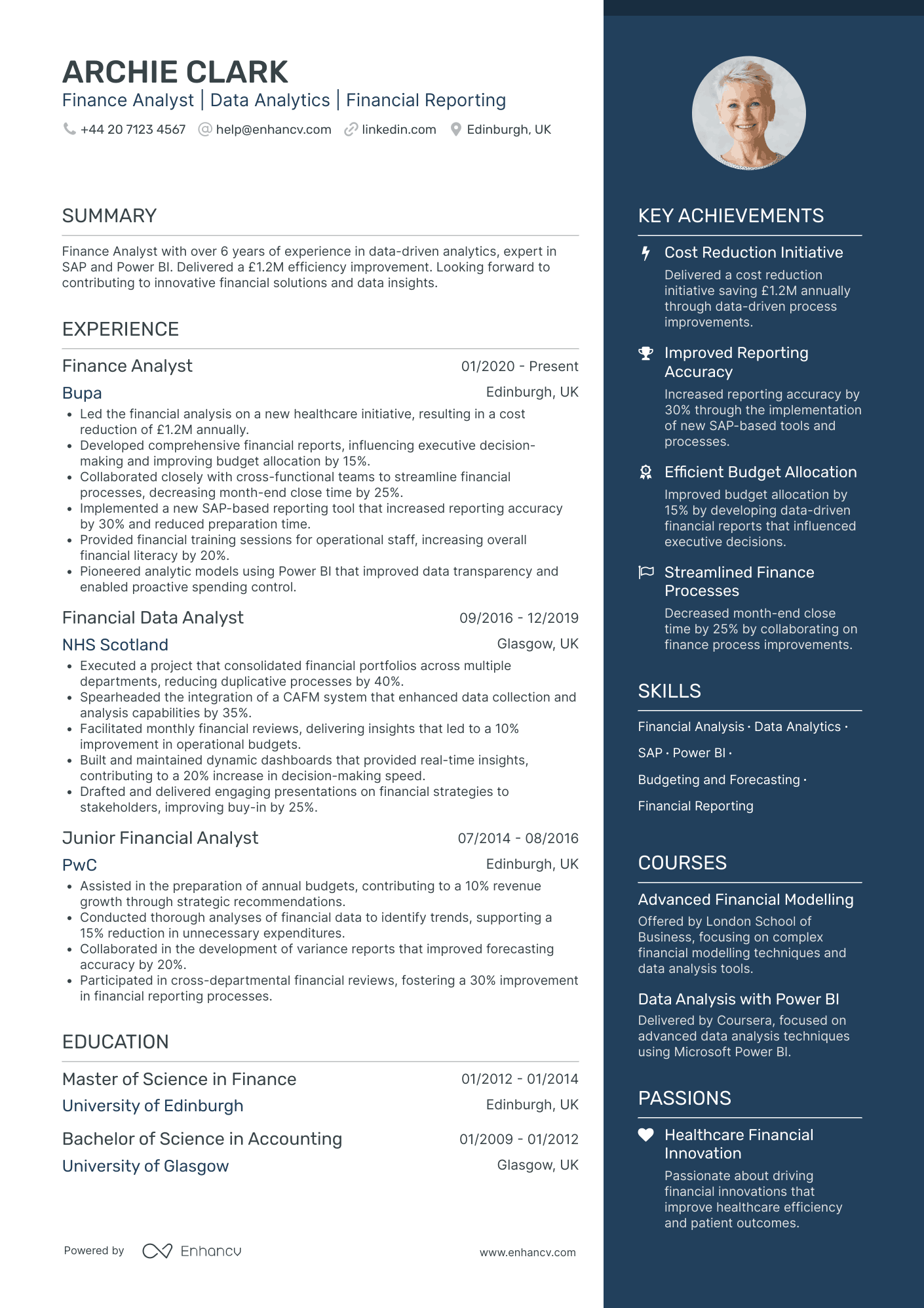

- Exemplary Content Presentation - The CV is structured in a clear and concise manner, utilizing bullet points and headers to effectively guide the reader through the candidate's professional journey. This format ensures key achievements and skills are easy to find and absorb, enhancing overall readability and impact.

- Impressive Career Trajectory - The candidate showcases a consistent upward trajectory in their career, with several promotions that reflect their growth and increasing responsibilities. Notably, transitions from junior to senior roles within the same company indicate depth of experience and trust built with employers.

- Industry-Specific Methodologies - Unique to this CV is the inclusion of specialized industry tools and methodologies. The candidate demonstrates technical depth by listing proficiency with current industry software and innovative practices, particularly in data analysis and content optimization.

Investment Financial Analyst

- Structured and Concise Presentation - The CV is meticulously organized, facilitating easy navigation through sections like experience, skills, and achievements. Each section offers concise bullet points that highlight essential information without overwhelming the reader, ensuring clarity and quick comprehension of Grace's capabilities.

- Dynamic Career Progression - Grace's career trajectory illustrates a clear path of upward mobility, progressing from a Junior Financial Analyst to a Senior Financial Analyst. This advancement reflects not only her growing expertise and contribution within the financial sector but also her successful transitions across notable companies like Whitbread and Mitchells & Butlers.

- Effective Use of Industry-Specific Tools - The CV showcases Grace's proficiency in specialized financial tools such as Oracle, MicroStrategy BI, and OneStream. Her expertise in these technical platforms enhances her ability to deliver nuanced financial insights, demonstrating technical depth necessary for sophisticated financial analysis roles.

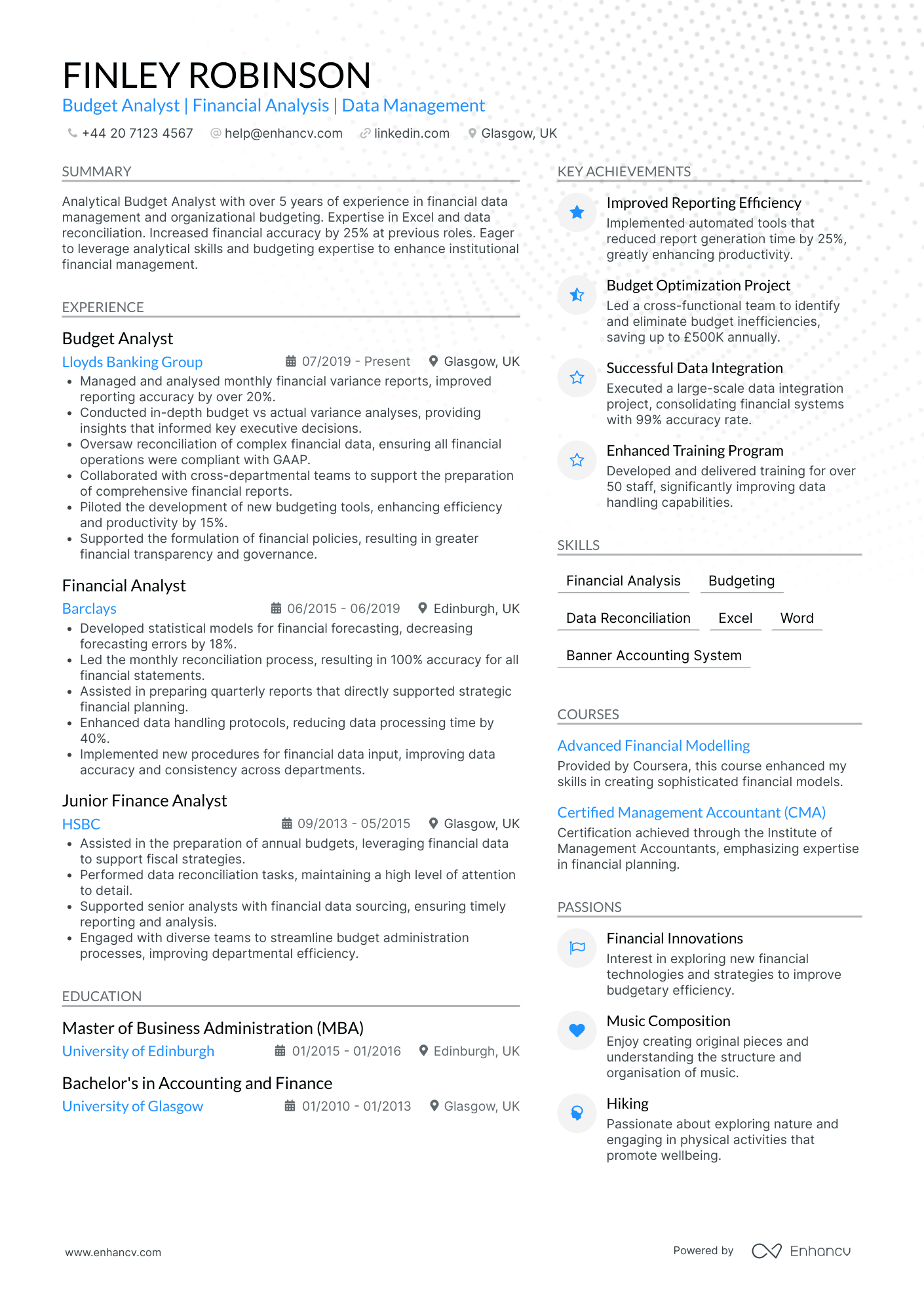

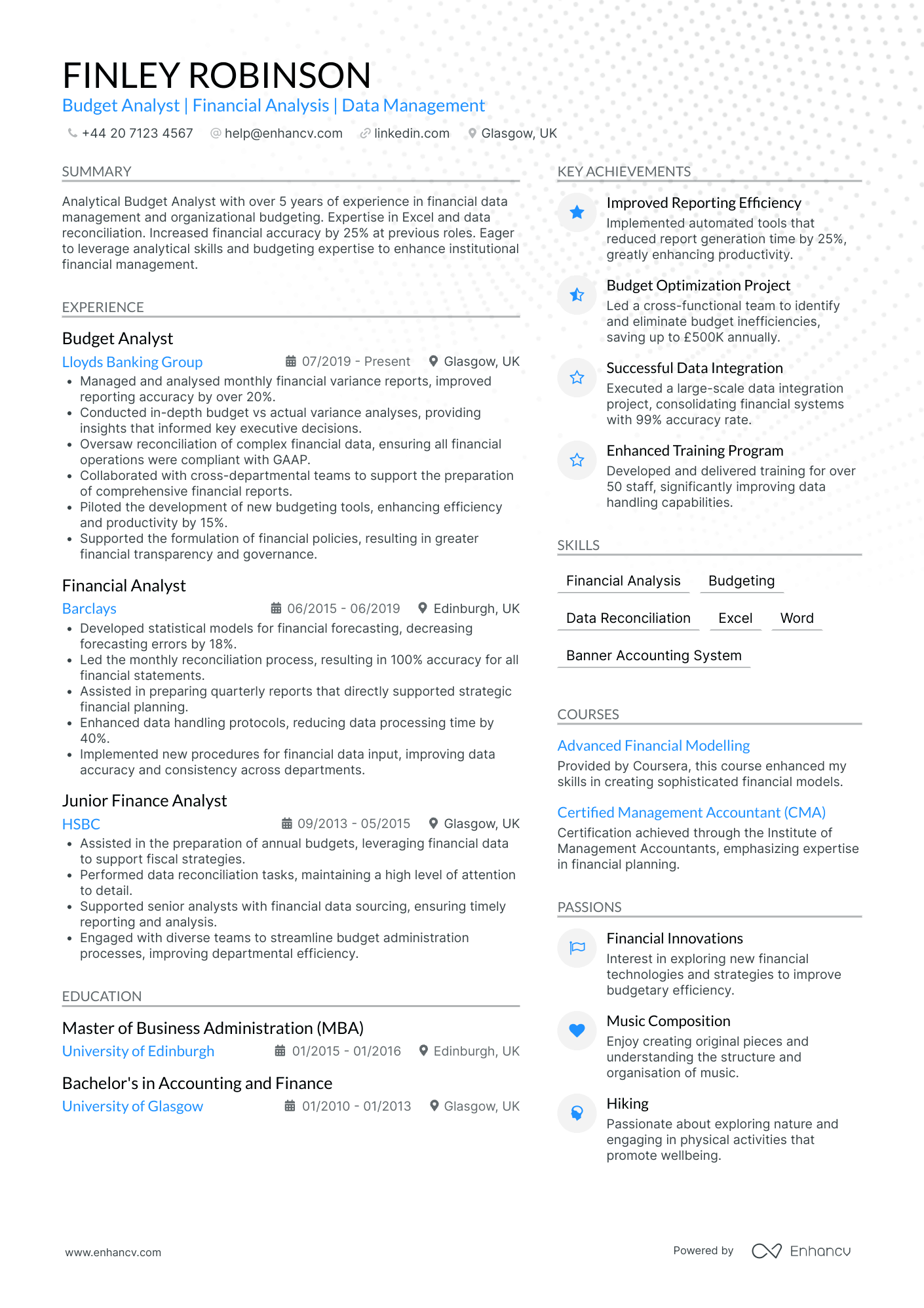

Financial Budget Analyst

- Structured Presentation of Skills and Experience - The CV is well-organized with each section clearly defined, ensuring that information is easily accessible. The use of bullet points in the experience section highlights key achievements concisely, making it easy for potential employers to quickly assess Finley's contributions and competencies.

- Consistent Career Growth in Finance - Finley’s career trajectory shows consistent growth within the financial analysis and budgeting space. From a Junior Finance Analyst position at HSBC to a Budget Analyst at Lloyds Banking Group, there's a clear progression in the level of responsibility and complexity of tasks managed, indicating a deepening of expertise and trust garnered over the years.

- Proven Impact through Achievements - Each achievement listed not only quantifies success, such as reducing report generation time by 25%, but also contextualizes the business relevance like saving £500K annually. This not only highlights Finley's competence but also their ability to drive substantial business improvements that affect a company’s bottom line positively.

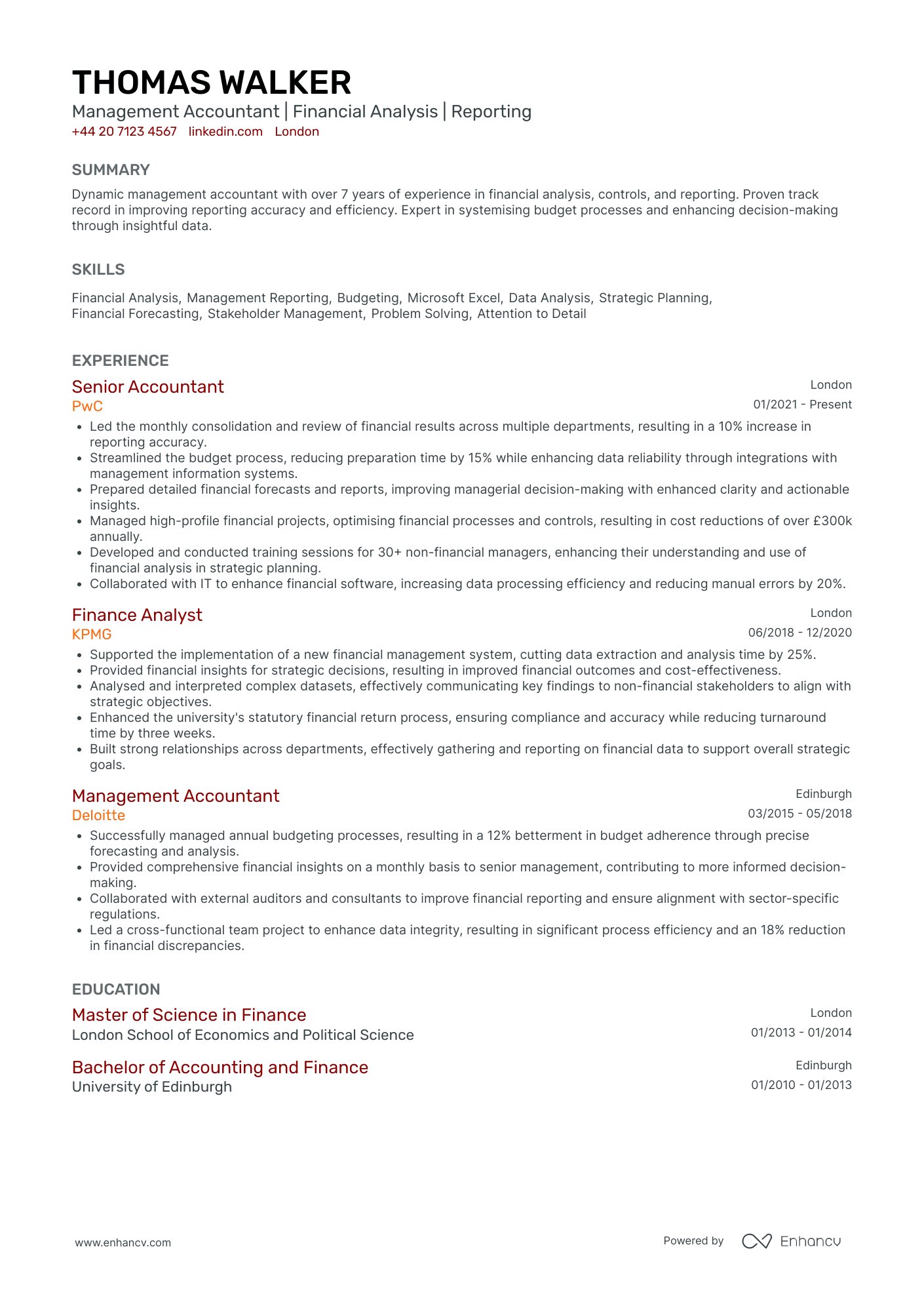

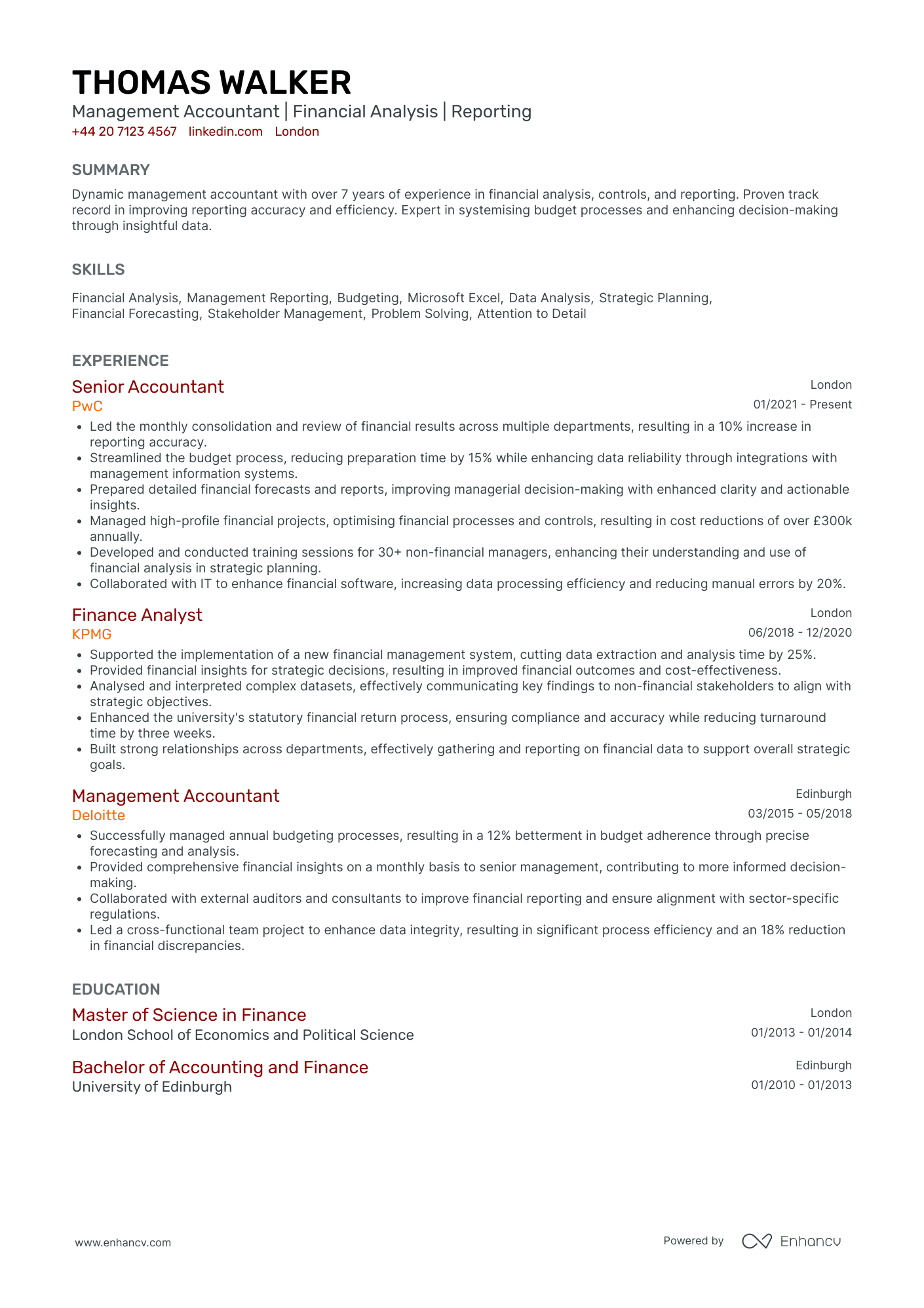

Operational Financial Analyst

- Strong Career Progression and Industry Experience - Thomas Walker's CV reflects a clear advancement in his career from a Management Accountant at Deloitte to a Senior Accountant at PwC. His roles in prestigious firms like PwC, KPMG, and Deloitte highlight his broad experience in the financial sector, emphasizing his ability to navigate and excel within top-tier professional environments.

- Effective Communication of Impactful Achievements - The CV showcases significant achievements that underline Walker’s impact on business performance. For instance, he successfully implemented cost reduction strategies leading to savings of over £300k annually and streamlined budget processes at PwC, which demonstrate his capability to drive financial efficiency and value.

- Comprehensive Skill Set and Educational Background - Walker's CV includes a robust set of financial skills such as Financial Analysis, Management Reporting, and Budgeting, complemented by proficiency in tools like Microsoft Excel. His academic credentials, a Master of Science in Finance from the London School of Economics and a Bachelor in Accounting and Finance from the University of Edinburgh, further bolster his profile, making him a strong candidate for roles requiring advanced financial insight and analytical skills.

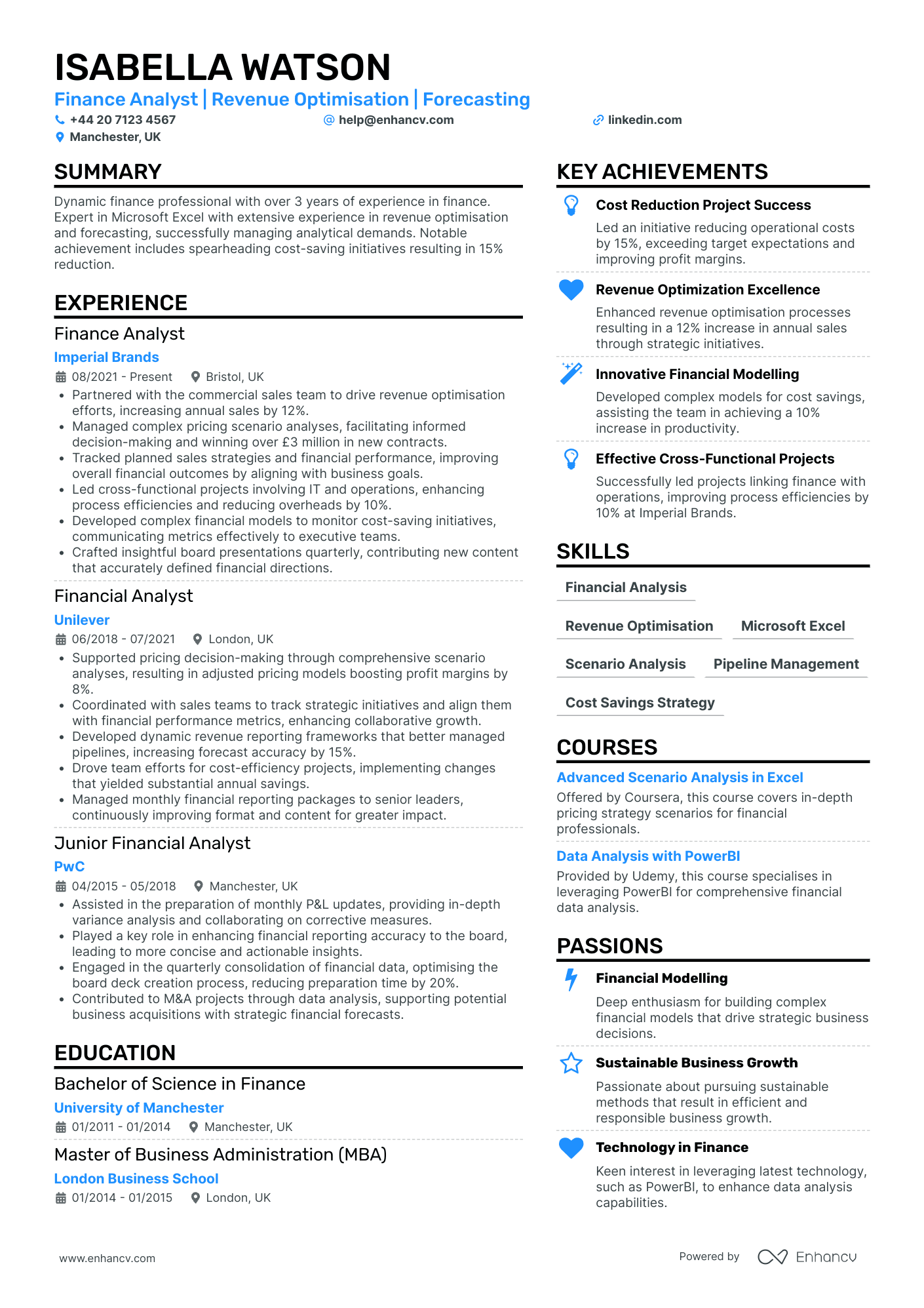

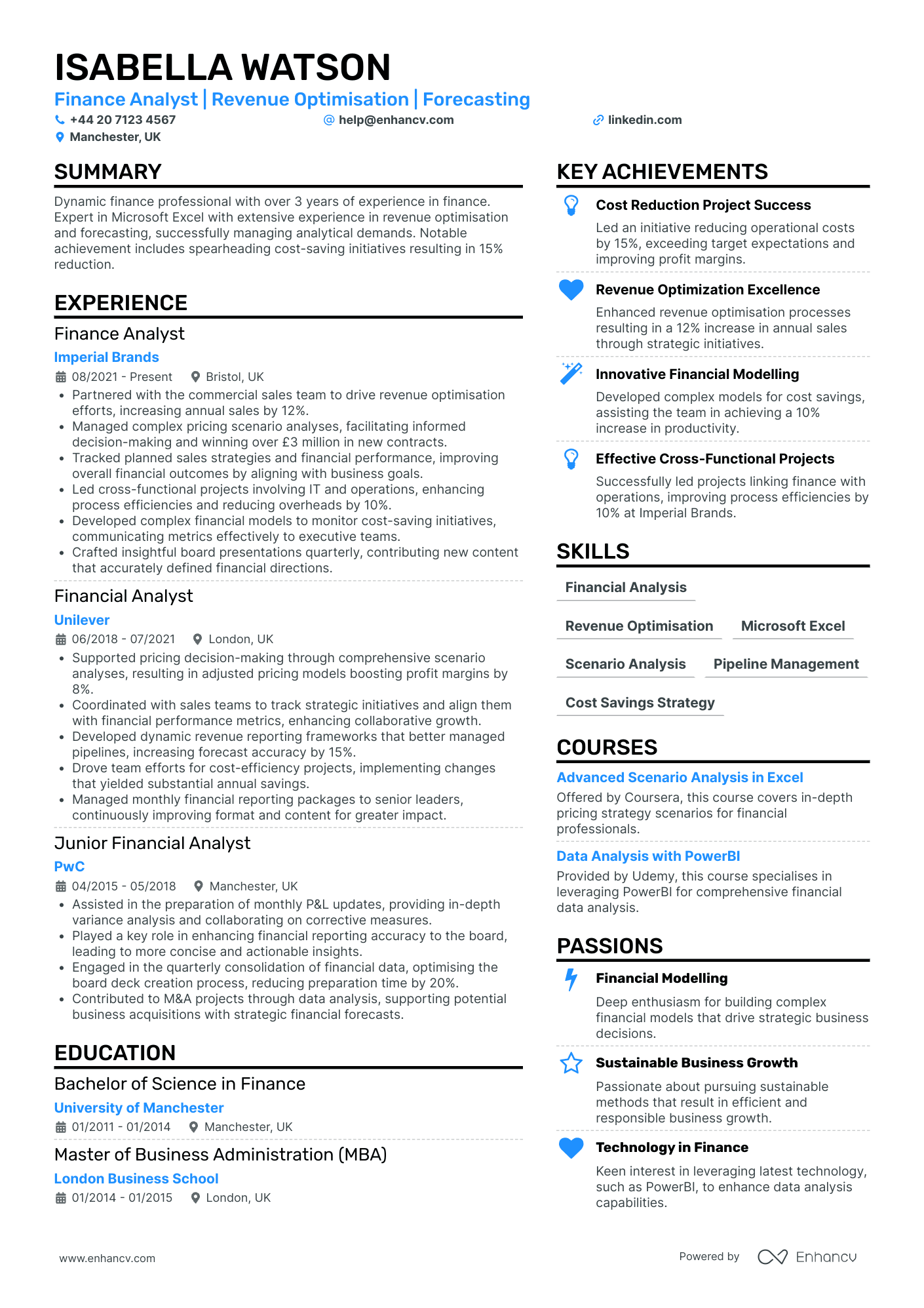

Strategic Financial Analyst

- Well-structured presentation of content - The CV is organized in a manner that enhances readability and quick understanding. Each section flows logically, with concise bullet points that effectively communicate the candidate's accomplishments and responsibilities without overwhelming the reader with too much detail.

- Demonstrable career growth and trajectory - Isabella’s career path shows a clear progression from a Junior Financial Analyst to a Finance Analyst, with increasing responsibilities and leadership roles in esteemed firms like PwC, Unilever, and Imperial Brands. This trajectory illustrates her ability to adapt, learn, and excel in the finance industry over time.

- Proven impact through significant achievements - The CV highlights Isabella's quantifiable achievements such as spearheading projects that led to a 15% cost reduction at Imperial Brands and a 12% increase in sales. Beyond numbers, these illustrate her capability to drive efficiency, increase profitability, and influence strategic business outcomes.

Financial Research Analyst

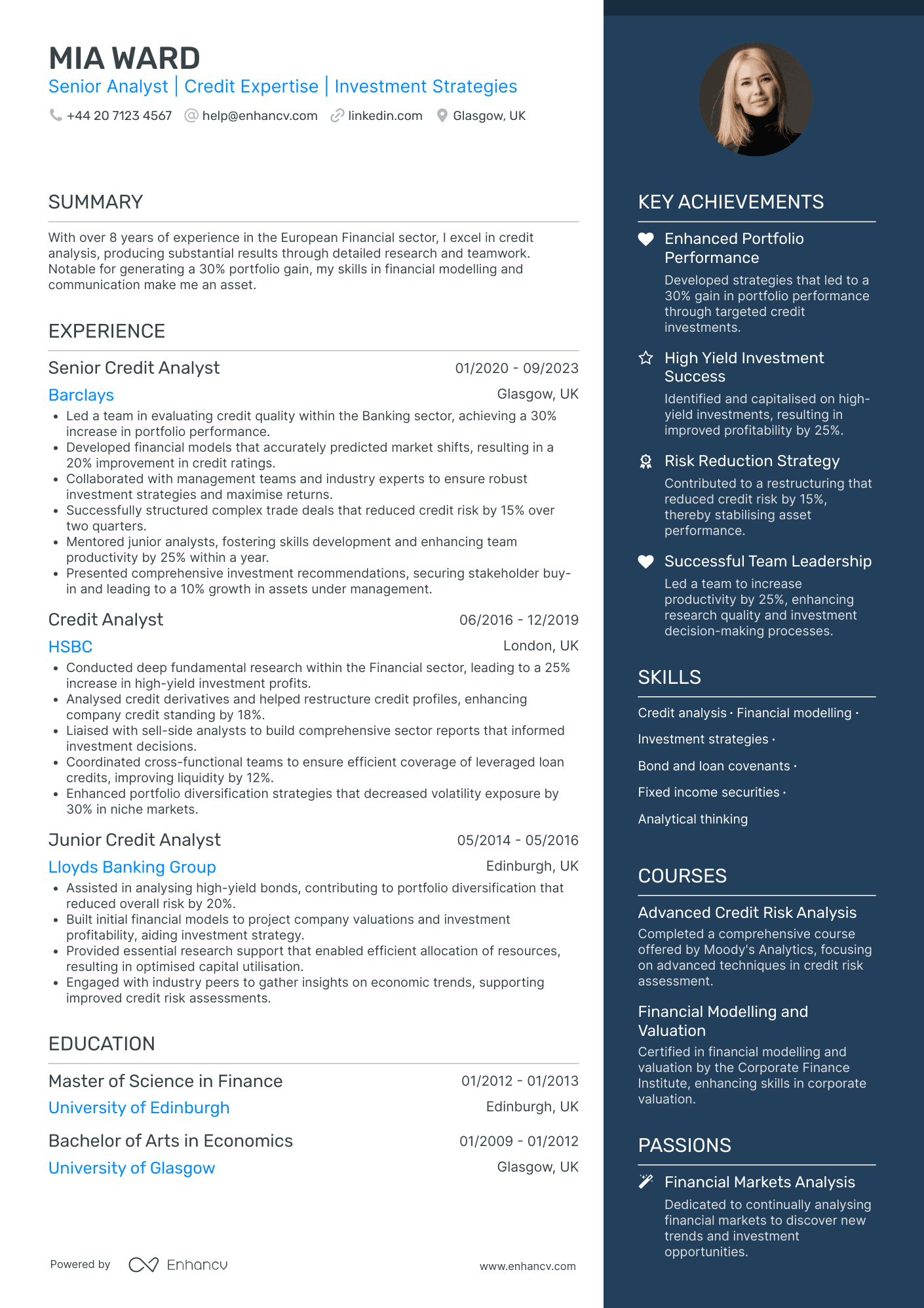

- Comprehensive Career Progression - Mia Ward’s CV distinctly highlights her career growth from a Junior Credit Analyst to a Senior Analyst position. Her promotions within reputable financial institutions like Barclays and HSBC demonstrate her capabilities, increasing responsibilities, and industry acumen, underscoring a successful career trajectory in finance.

- Industry-Specific Tools and Academic Credentials - The CV emphasizes Mia's proficiency in essential financial tools such as the Bloomberg Terminal and Advanced Excel, coupled with advanced degrees in Finance and Economics from prestigious UK universities. This combination showcases technical prowess and a strong academic foundation, setting her apart in credit analysis and investment strategy domains.

- Leadership and Collaborative Skills - Mia's experience section reveals strong leadership abilities, including mentoring junior analysts and leading teams to increase productivity by 25%. Her ability to collaborate effectively with management teams and industry experts underscores her strong interpersonal skills, crucial for fostering teamwork and driving organizational growth.

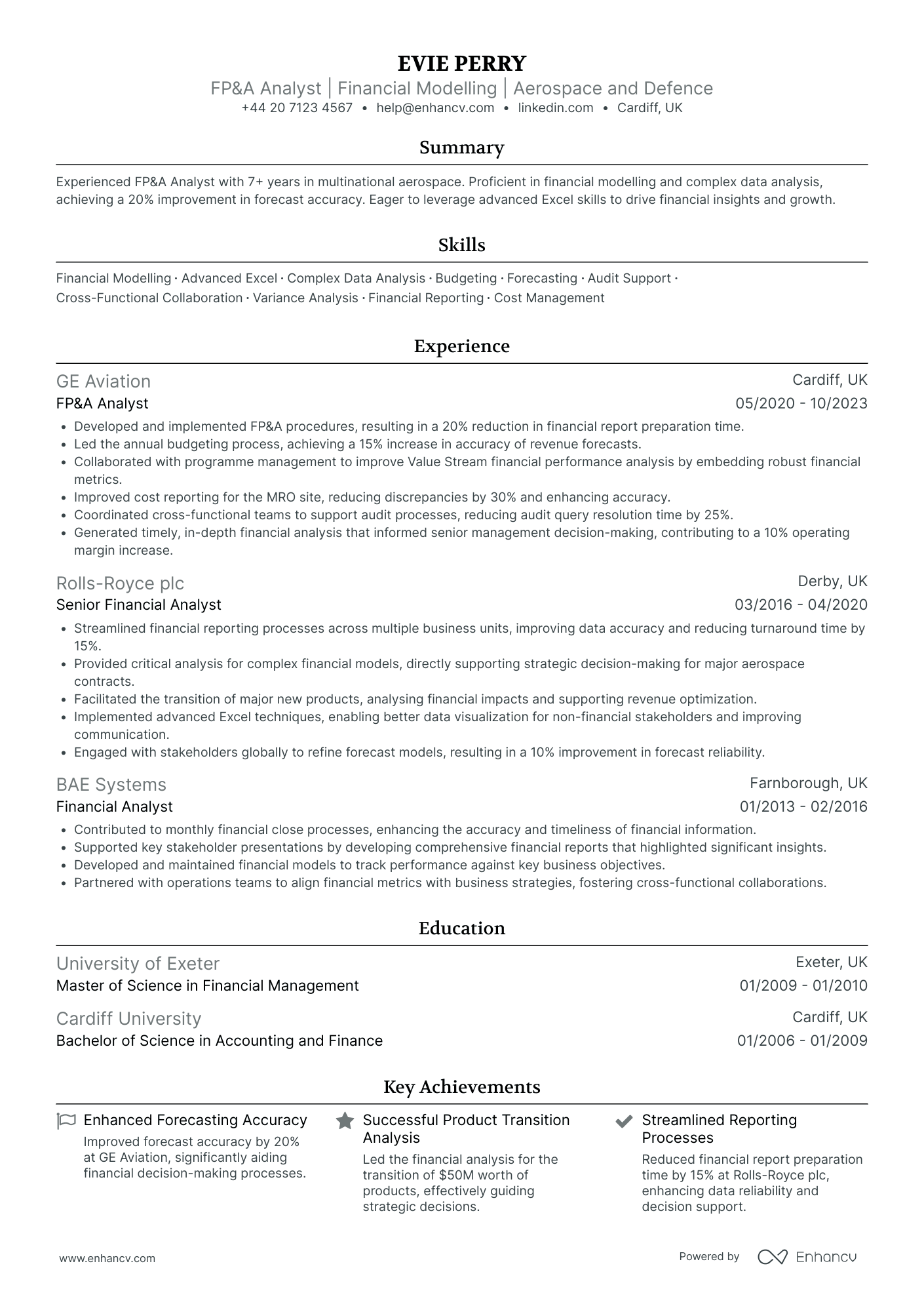

Financial Planning Analyst

- Structured and Clear Presentation - The CV is well-organized into distinct sections, which makes it user-friendly and easy to navigate. Each section is succinctly labeled, ensuring that key information such as experience, education, and skills are highlighted effectively. This clarity and structural conciseness facilitate a seamless reading experience for potential employers.

- Impressive Career Growth in Aerospace - Evie Perry's career trajectory demonstrates progressive advancement from a Financial Analyst role at BAE Systems to a Senior Financial Analyst at Rolls-Royce and ultimately to an FP&A Analyst at GE Aviation. This progression reflects significant career growth and industry expertise within the aerospace and defense sectors, emphasizing her commitment and proficiency.

- Quantifiable Achievements and Impact - The CV effectively emphasizes Evie's accomplishments, not merely by listing responsibilities but by showcasing their business relevance. For instance, achieving a 20% improvement in forecast accuracy and contributing to significant operational margin increases translates her contributions into measurable impacts on overall business performance, making her an attractive candidate to potential employers.

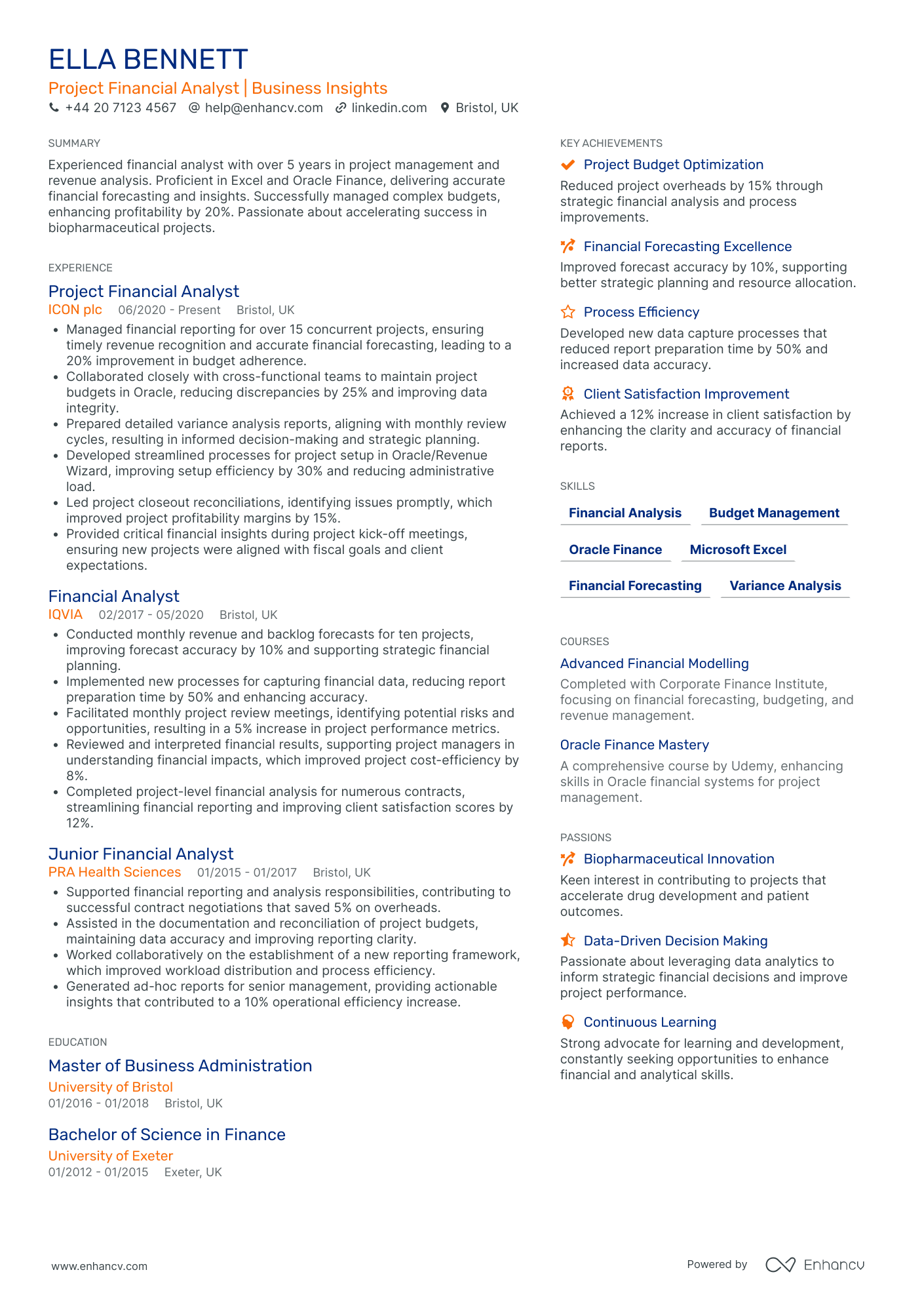

Corporate Financial Analyst

- Logical Content Flow - The CV is systematically structured, beginning with a concise summary that effectively encapsulates the candidate's relevant experience and skills. The sections are logically ordered, with clear headings that allow for effortless navigation through the candidate's career history, education, and other essential qualifications. This clarity ensures that the information is easily digestible for employers.

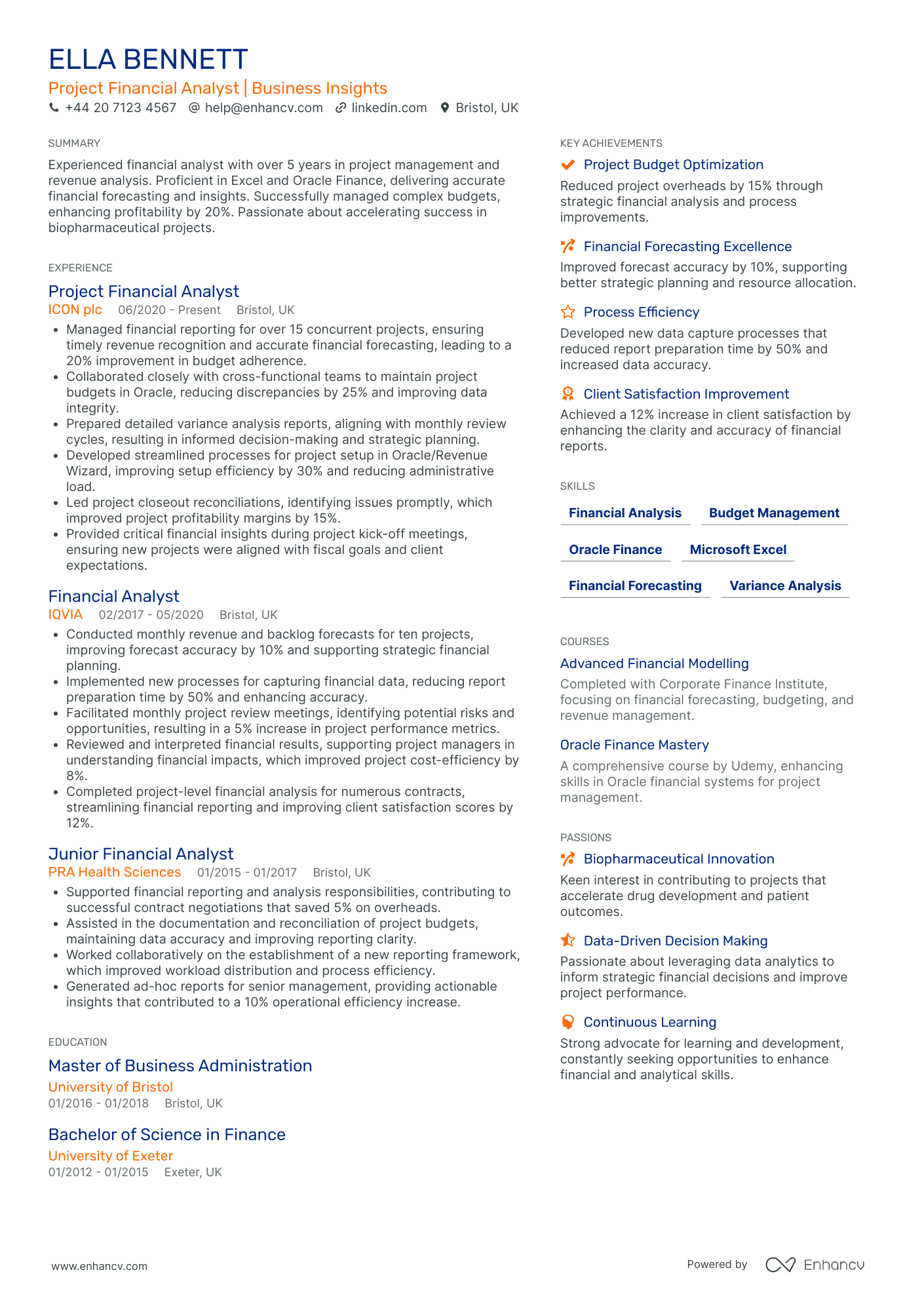

- Progressive Career Development - Ella Bennett's career trajectory showcases significant growth and learning, transitioning smoothly from a Junior Financial Analyst to a Project Financial Analyst. This progression reflects not only a deepening expertise in financial analysis and project management but also highlights her adaptability and constant pursuit of professional development within the biopharmaceutical sector.

- Specialized Tool Proficiency - The CV highlights proficiency in industry-specific tools such as Oracle Finance and Excel, demonstrating technical depth that is crucial for project financial analysis. Such expertise ensures precise financial forecasting and management, indicating that the candidate possesses the necessary technical skills to enhance operational effectiveness within the financial divisions of her projects.

How complex should the format of your financial analyst CV be?

Perhaps, you decided to use a fancy font and plenty of colours to ensure your financial analyst CV stands out amongst the pile of other candidate profiles. Alas - this may confuse recruiters. By keeping your format simple and organising your information coherently, you'll ultimately make a better impression. What matters most is your experience, while your CV format should act as complementary thing by:

- Presenting the information in a reverse chronological order with the most recent of your jobs first. This is done so that your career history stays organised and is aligned to the role;

- Making it easy for recruiters to get in touch with you by including your contact details in the CV header. Regarding the design of your CV header, include plenty of white space and icons to draw attention to your information. If you're applying for roles in the UK, don't include a photo, as this is considered a bad practice;

- Organising your most important CV sections with consistent colours, plenty of white space, and appropriate margins (2.54 cm). Remember that your CV design should always aim at legibility and to spotlight your key information;

- Writing no more than two pages of your relevant experience. For candidates who are just starting out in the field, we recommend to have an one-page CV.

One more thing about your CV format - you may be worried if your double column CV is Applicant Tracker System (ATS) complaint. In our recent study, we discovered that both single and double-column CVs are ATS-friendly . Most ATSes out there can also read all serif and sans serif fonts. We suggest you go with modern, yet simple, fonts (e.g. Rubik, Lato, Raleway) instead of the classic Times New Roman. You'll want your application to stand out, and many candidates still go for the classics. Finally, you'll have to export your CV. If you're wondering if you should select Doc or PDF, we always advise going with PDF. Your CV in PDF will stay intact and opens easily on every OS, including Mac OS.

PRO TIP

Use bold or italics sparingly to draw attention to key points, such as job titles, company names, or significant achievements. Overusing these formatting options can dilute their impact.

The top sections on a financial analyst CV

- Professional Summary illustrates candidate's financial expertise.

- Key Skills section highlights relevant financial analysis abilities.

- Work Experience showcases past roles and finance-related achievements.

- Educational Background outlines degrees and certifications in finance.

- Technical Proficiencies detail software and tools expertise for analysis.

What recruiters value on your CV:

- Highlight quantitative skills by mentioning your experience with statistical analysis, financial modelling, and use of tools like Excel, SQL, or financial software pertinent to a financial analyst role.

- Detail your understanding of financial statements, including the balance sheet, income statement, and cash flow statement, to showcase your competence in financial reporting and analysis.

- Emphasise any experience with budgeting, forecasting, variance analysis, and financial planning, as these are key responsibilities in financial analyst positions.

- Showcase your knowledge of regulatory environments and compliance standards relevant to the financial industry, such as IFRS or GAAP, if applicable to the role you're applying for.

- Demonstrate your ability to communicate complex financial information by highlighting experiences where you've presented analysis to management or written detailed reports, underlining your written and verbal communication skills.

Recommended reads:

How to present your contact details and job keywords in your financial analyst CV header

Located at the top of your financial analyst CV, the header presents recruiters with your key personal information, headline, and professional photo. When creating your CV header, include your:

- Contact details - avoid listing your work email or telephone number and, also, email addresses that sound unprofessional (e.g. koolKittyCat$3@gmail.com is definitely a big no);

- Headline - it should be relevant, concise, and specific to the role you're applying for, integrating keywords and action verbs;

- Photo - instead of including a photograph from your family reunion, select one that shows you in a more professional light. It's also good to note that in some countries (e.g. the UK and US), it's best to avoid photos on your CV as they may serve as bias.

What do other industry professionals include in their CV header? Make sure to check out the next bit of your guide to see real-life examples:

Examples of good CV headlines for financial analyst:

- Financial Analyst | CFA Level II Candidate | Data Analysis | Financial Modelling | 3+ Years Experience

- Senior Investment Analyst | Equity Research | Portfolio Management | ACCA Qualified | 8 Years in Finance

- Junior Finance Analyst | Budgeting Expertise | SAP Proficient | BSc Economics | 2 Years Hands-On Experience

- Lead Risk Analyst | Quantitative Analytics | Regulatory Compliance | FRM Certified | Over 10 Years Industry Insight

- Financial Planning Specialist | Cash Flow Forecasting | Strategic Insight | CPA | 5+ Years Professional Tenure

- Commercial Finance Analyst | M&A Due Diligence | Excel & VBA Savvy | 4 Years Sector Experience

What's the difference between a financial analyst CV summary and objective

Why should it matter to you?

- Your financial analyst CV summary is a showcasing your career ambitions and your unique value. Use the objective to answer why your potential employers should hire you based on goals and ambitions. The objective is the ideal choice for candidates who happen to have less professional experience, but still meet some of the job requirements.

Before you select which one will be more relevant to your experience, have a look at some industry-leading CV summaries and objectives.

CV summaries for a financial analyst job:

- Seasoned Financial Analyst with over 9 years of experience in multinational investment banking, skilled in creating detailed financial models and forecasting revenue streams. Successfully identified and mitigated risk in volatile markets, leading to a 15% portfolio growth for key clients in the past three years.

- Meticulous Senior Financial Analyst with a decade-long track record at a Fortune 500 company. Expert in quantitative analysis, budgeting, and strategic planning. Spearheaded a cost-saving initiative that cut operational expenses by 20%, showcasing strong analytical and problem-solving abilities.

- Dedicated former Sales Manager with 7 years of consistent success in the retail industry, aiming to leverage substantial skills in market trend analysis and sales forecasting. Proficient in Excel and devoted to learning financial modelling to drive profitability in a new financial analyst capacity.

- Ambitious Chemical Engineer ready to transition into financial analysis, bringing 5 years of expertise in data-driven process optimisation. Keen to apply advanced analytical skills and a methodical approach to financial data interpretation, contributing to informed decision-making for portfolio management.

- Eager to embark on a career as a Financial Analyst with a focus on deploying strong statistical analysis skills honed through a rigorous mathematics degree. Committed to developing a mastery of financial modelling tools and keen to contribute to strategic planning initiatives through in-depth market research.

- Highly motivated graduate with a degree in Business Administration, specialising in Finance. Aspiring to utilise strong theoretical knowledge in real-world financial analysis scenarios. Enthusiastic about acquiring practical experience in management accounting and investment strategy to make a tangible impact on financial decision-making processes.

More detailed look into your work history: best advice on writing your financial analyst CV experience section

The CV experience is a space not just to merely list your past roles and responsibilities. It is the CV real estate within which you could detail your greatest accomplishments and skills, while matching the job requirements. Here's what to have in your experience section:

- Prove you have what the job wants with your unique skill set and past successes;

- Start each bullet with a strong, action verb, and continue with the outcome of your responsibility;

- Use any awards, nominations, and recognitions you've received as solid proof of your skill set and expertise;

- align your experience with the role responsibilities and duties.

For more help on how to write your CV experience section, check out the next section of our guide:

Best practices for your CV's work experience section

- Analysed historical financial data to forecast company revenue growth, achieving a 95% accuracy rate over a 12-month period, leading to more informed decision-making.

- Utilised advanced Excel functions to develop and maintain complex financial models, significantly increasing efficiency in budget analysis and monthly reporting activities.

- Collaborated with cross-functional teams to provide monthly expense forecasts, helping to reduce overall department spending by 10% through precise budgetary control.

- Conducted variance analysis to identify discrepancies between actual and projected financial performance, enabling management to address issues proactively and improve fiscal health.

- Presented financial reports to senior management on a quarterly basis with clear graphical representations, ensuring a thorough understanding of the company's financial status.

- Led a project to implement a new financial analysis software, which resulted in a 20% reduction in time spent on data processing and increased data accuracy.

- Developed and delivered comprehensive training to new analysts on financial reporting standards and internal procedures, improving team productivity by 15%.

- Performed due diligence on potential investment opportunities, incorporating risk analysis and return projections, assisting the company in expanding its portfolio effectively.

- Engaged in continuous learning about current market trends and financial regulations, applying this knowledge to enhance the strategic planning process and risk management.

- Performed complex financial modeling & valuation on potential acquisition targets, contributing to a 20% increase in the company's market share within the enterprise software sector.

- Collaborated with interdepartmental teams to optimize budgeting processes, leading to a 15% reduction in unnecessary expenditure in the fiscal year 2020.

- Developed comprehensive quarterly forecasting reports that enabled the executive team to make informed decisions, reducing financial risk by 30%.

- Conducted thorough industry analysis and presented findings to management which influenced the realignment of the investment portfolio, realizing a profit growth of 10%.

- Led a successful project to automate the financial reporting process using advanced analytics tools which saved the company over 200 hours of manual work annually.

- Provided detailed revenue and expense tracking, enhancing forecasting accuracy by 25% and enabling more strategic budget allocations.

- Revamped the existing cost analysis system with a focus on scalability and accuracy, achieving a 5% year-over-year cost-saving for the company.

- Played a pivotal role in the quarterly earnings reporting process, ensuring 100% compliance with SEC regulations and zero discrepancies.

- Participated actively in the due diligence process for M&A activities, directly influencing over $500 million in deals.

- Prepared detailed investment memoranda, creating financial forecasts that were integral in raising $250 million in capital for new ventures.

- Led a team of junior analysts in the creation of a risk assessment framework that decreased financial misstatements by 15%.

- Spearheaded the implementation of a new ERP system which resulted in a 20% improvement in financial reporting efficiency.

- Designed and monitored financial KPI dashboards which supported the executive team in strategic planning and resulted in a sustained 5% increase in ROI over 3 years.

- Analyzed competitors' financial health and market positioning, delivering insights that guided the launch of a new product line contributing to a 12% revenue increase.

- Crafted and executed training programs for new hires in financial analysis, improving overall department productivity by 18%.

- Managing the fiscal analysis for a portfolio of international projects valued at over $400 million, identifying trends and potential cost-saving measures.

- Enhancing financial models and simulations to drive a 35% improvement in investment decision-making accuracy for the company's venture capital arm.

- Directing quarterly competitive analysis reports that inform C-suite on industry shifts, influencing the company's strategic pivot towards emergent market opportunities.

- Optimized cash flow management techniques for the organization, ensuring liquidity and operational efficiency that supported a period of rapid 25% year-over-year revenue growth.

- Piloted a benchmarking initiative against top competitors, providing actionable insights that elevated our market position from fourth to second.

- Drove the annual budgeting process, aligning departmental spend with company objectives and aiding in a 10% overall cost reduction.

- Analyzed product line profitability, leading to the restructuring of pricing strategies and an enhancement in gross margin by 8% within one financial year.

- Headed monthly financial reviews with project managers that helped identify variances exceeding 10% early and implement corrective actions swiftly.

- Automated financial processes using Business Intelligence tools which reduced reporting errors by 20% and increased team productivity.

- Conducted in-depth cost-benefit analyses for key infrastructure projects, leading to a more strategic allocation of the $300 million annual budget.

- Facilitated cross-functional workshops focused on financial best practices, which led to the identification of $50 million in operational cost savings.

- Implemented a dynamic forecasting model that reduced the time to generate financial outlooks by 60%, enhancing the agility of business response to market changes.

- Created a proprietary quantitative model for predicting stock performance, which outperformed the S&P 500 index by 7% annually.

- Guided the treasury function in foreign exchange hedging strategies, minimizing currency exposure and saving the company upwards of $1 million in potential forex losses.

- Established a robust financial control framework that was critical during an external audit, resulting in a clean opinion with no material findings.

Lacking professional expertise: how to write your CV to highlight your best talents

Don't count on your lucky stars when you're applying for a role, where you happen to have less (or almost none) professional experience. Recruiters sometimes do hire inexperienced candidates if they're able to present their unique value from the get-go. So, instead of opting for the traditional, CV experience section:

- List any applicable expertise you happen to have - no matter if it's a part-time job, internship, or volunteer work. This would hint to recruiters that your profile is relevant;

- Focus your CV on your transferrable skills or talents you've obtained thanks to your whole life and work experience. In effect, you'll be spotlighting your value as a candidate;

- Separate more space for your applicable academic background and certificates to show you have the technical know-how;

- Ensure that within your objective, you've defined why you'll like the job and how you'll be the perfect match for it. Always ensure you've tailored your CV to individual applications.

Looking for more good examples for your first job? We'll show you how other candidates, with less professional experience, have created their job-winning CVs.

Recommended reads:

PRO TIP

If applicable, briefly mention a situation where things didn’t go as planned and what you learned from it, demonstrating your ability to learn and adapt.

Hard skills and soft skills to showcase your unique skill set on your financial analyst CV

Did you know that your CV will mostly likely be assessed by recruiters based on skill alignment? And that means that the way you feature your key skills across different CV sections will play a crucial role in landing you that first interview. We recommend you add your:

- technical capabilities or hard skills in your CV experience, certificates, projects, etc. Use your past accomplishments to prove your technical capabilities. List up to a dozen different software or hardware in your dedicated skills section to match the job keywords;

- personal and communication skills or soft skills in your CV strengths, achievements, summary/ objective, etc. Soft skills are a bit more difficult to prove. How do you define your aptitude in active listening? So, instead of just listing the skill name, include a tangible metric to show your success.

On a final note, when you're in a hurry to create your profile, you may misspell a particular technology or soft skill. That's why we suggest you copy and paste the particular skill name (or keyword), directly from the job advert. This would also help you to pass any initial Applicant Tracker System (ATS) tests.

Top skills for your financial analyst CV:

Financial Modelling

Data Analysis

Financial Forecasting

Variance Analysis

Accounting Principles

Risk Management

Knowledge of Financial Reporting Standards

Budgeting

Proficiency in Financial Software

Spreadsheet Skills

Analytical Thinking

Problem-Solving

Attention to Detail

Communication

Time Management

Business Acumen

Adaptability

Teamwork

Leadership

Decision-Making

PRO TIP

Order your skills based on the relevance to the role you're applying for, ensuring the most pertinent skills catch the employer's attention first.

CV education and certificates: your academic background as proof of your skill set

A common misconception about your financial analyst CV education is that you only need it, if you have less professional experience. That is completely false. The CV education section serves to back up your technical (and sometimes personal) capabilities, fill in gaps in your work history, and show you have the initial industry background and know-how. When creating your education section:

- List your degrees in the reverse chronological order, starting with the most recent (and relevant) ones first;

- Include your degree and university names, start and graduation dates. It's optional to also denote you received a "First-Class Honours" for diplomas that are more relevant to the role;

- Curate your relevant university coursework, projects, or thesis work if you happen to have less professional expertise and need to integrate more job keywords and skills.

Your professional qualifications don't need to stop at your academic background. It's advisable to also select up to three of your most noteworthy (and relevant) industry certificates and feature them in a dedicated section. Once more, include the certificate name, the institution that issued it out, and the date you obtained it on. You could feature both hard skills and soft skills certificates, as in the examples below:

PRO TIP

If there's a noticeable gap in your skillset for the role you're applying for, mention any steps you're taking to acquire these skills, such as online courses or self-study.

Recommended reads:

Key takeaways

What matters most in your financial analyst CV-writing process is for you to create a personalised application. One that matches the role and also showcases your unique qualities and talents.

- Use the format to supplement the actual content, to stand out, and to ensure your CV experience is easy to comprehend and follows a logic;

- Invest time in building a succinct CV top one third. One that includes a header (with your contact details and headline), a summary or an objective statement (select the one that best fits your experience), and - potentially - a dedicated skills section or achievements (to fit both hard skills and soft skills requirements);

- Prioritise your most relevant (and senior) experience closer to the top of your CV. Always ensure you're following the "power verb, skill, and achievement" format for your bullets;

- Integrate both your technical and communication background across different sections of your CV to meet the job requirements;

- List your relevant education and certificates to fill in gaps in your CV history and prove to recrutiers you have relevant technical know-how.