Crafting a CV that effectively showcases your extensive knowledge in wealth management and client advising can be a daunting task. Our guide offers tailored strategies to help you highlight your financial expertise and successes, ensuring your application stands out to potential employers.

- Applying best practices from real-world examples to ensure your profile always meets recruiters' expectations;

- What to include in your work experience section, apart from your past roles and responsibilities?

- Why are both hard and soft skills important for your application?

- How do you need to format your CV to pass the Applicant Tracker Software (ATS) assessment?

If you're writing your CV for a niche financial advisor role, make sure to get some inspiration from professionals:

Resume examples for financial advisor

By Experience

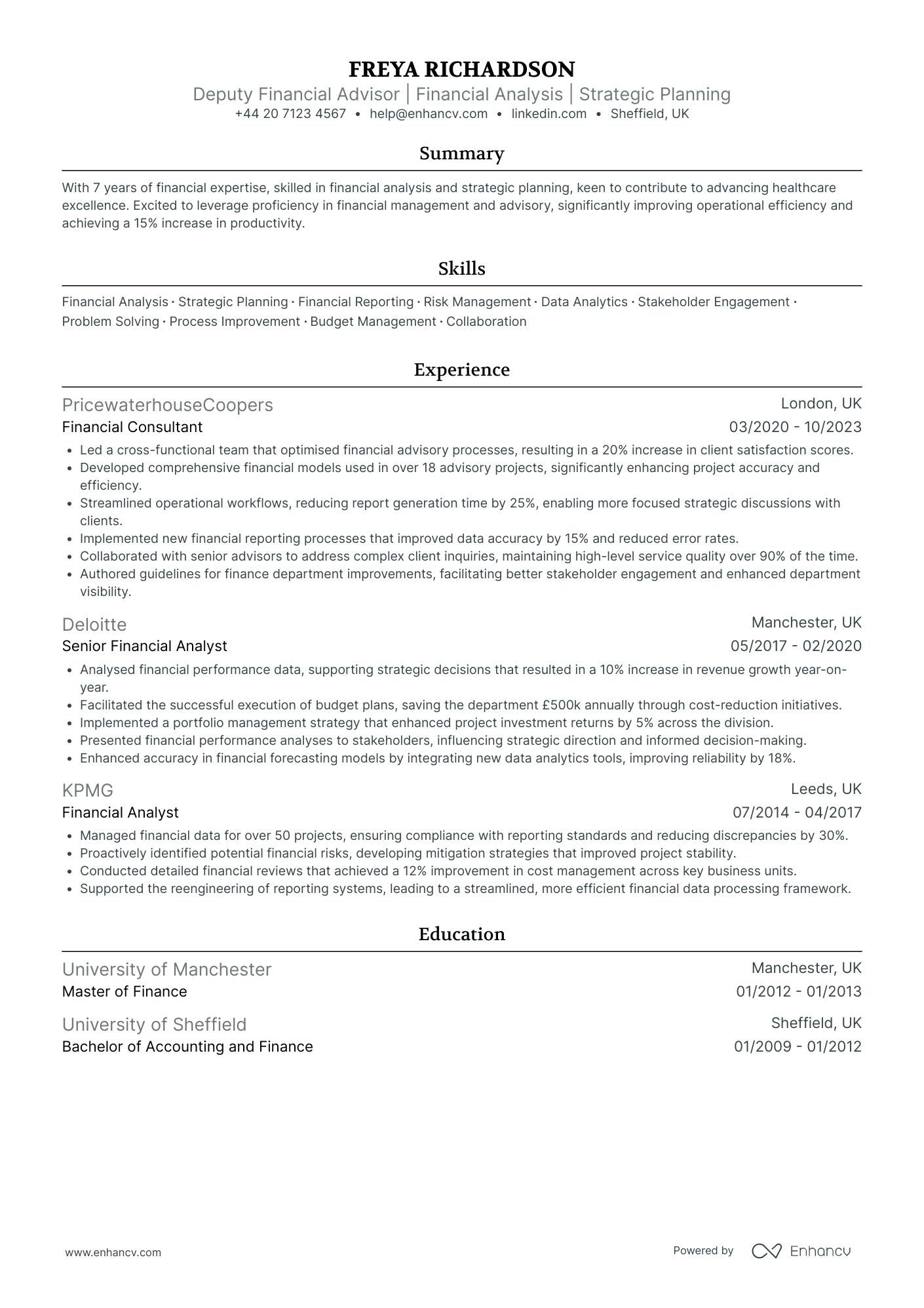

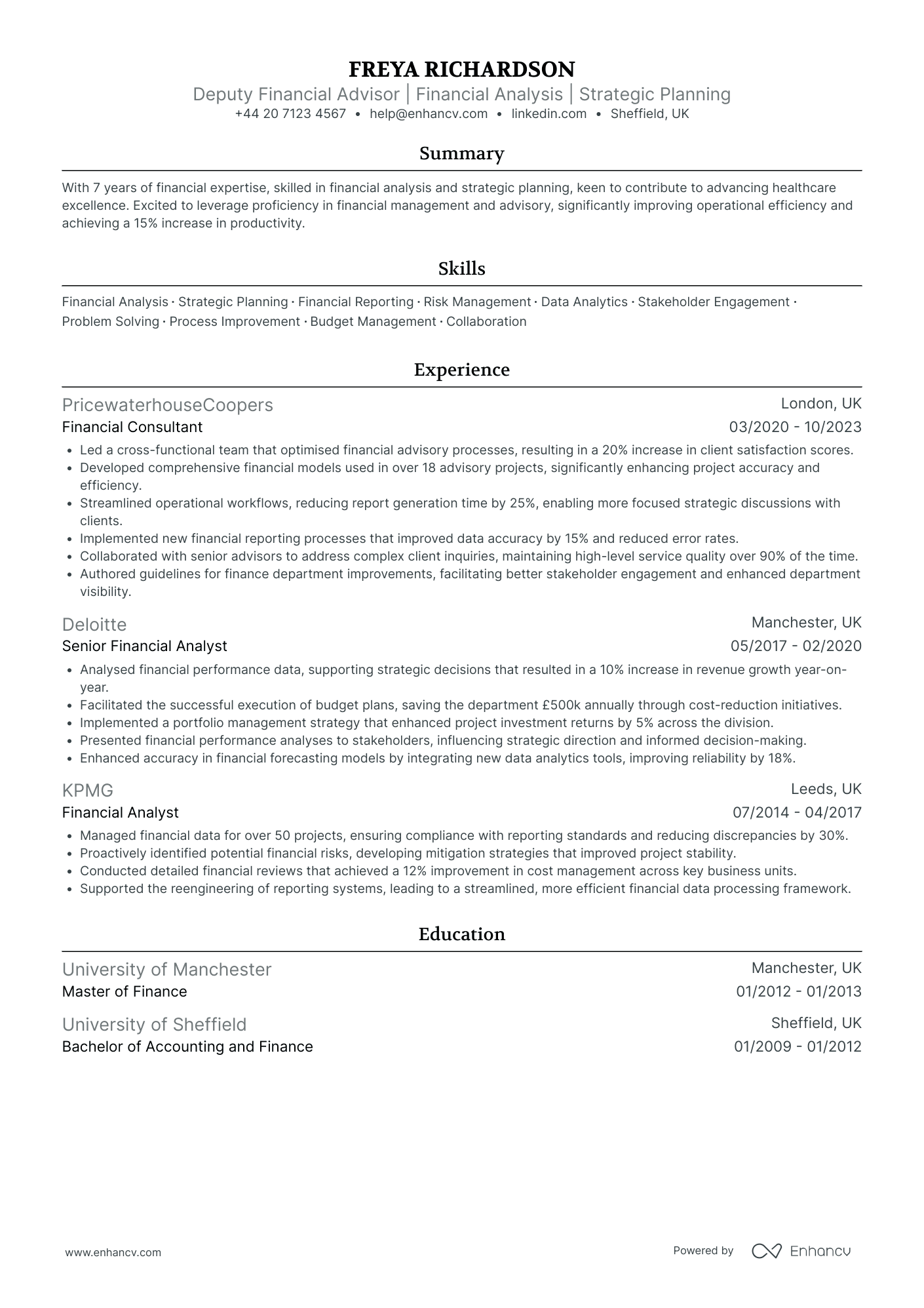

Senior Financial Advisor

- Clear and Structured Content Presentation - The CV excels in content presentation by providing a well-organized and concise overview of Freya Richardson’s professional experiences. Each section is clearly labeled and strategically ordered, starting with a compelling summary followed by detailed experience and education. Bulleted lists break down complex tasks and achievements, ensuring readability and quick comprehension of key qualifications and contributions.

- Consistent Career Growth in Financial Sector - Richardson’s career trajectory demonstrates a consistent upward progression within the financial industry, spanning roles from Financial Analyst to Senior Financial Analyst, and then to Financial Consultant. Each position showcases increased responsibilities and skill development, indicating a strong foundation in financial advisory and strategic planning. Her career path reflects dedication to developing expertise and advancing within her domain.

- Strong Impact through Achievements - The CV’s achievements section underlines the significant impact of Richardson’s work, connecting specific actions to measurable business outcomes. Metrics such as a 20% increase in client satisfaction, a 10% revenue growth, and a 25% reduction in report generation time exemplify her ability to drive substantial improvements in process efficiency and customer experience. This not only highlights her competence but also her capacity to contribute meaningfully to organizational success.

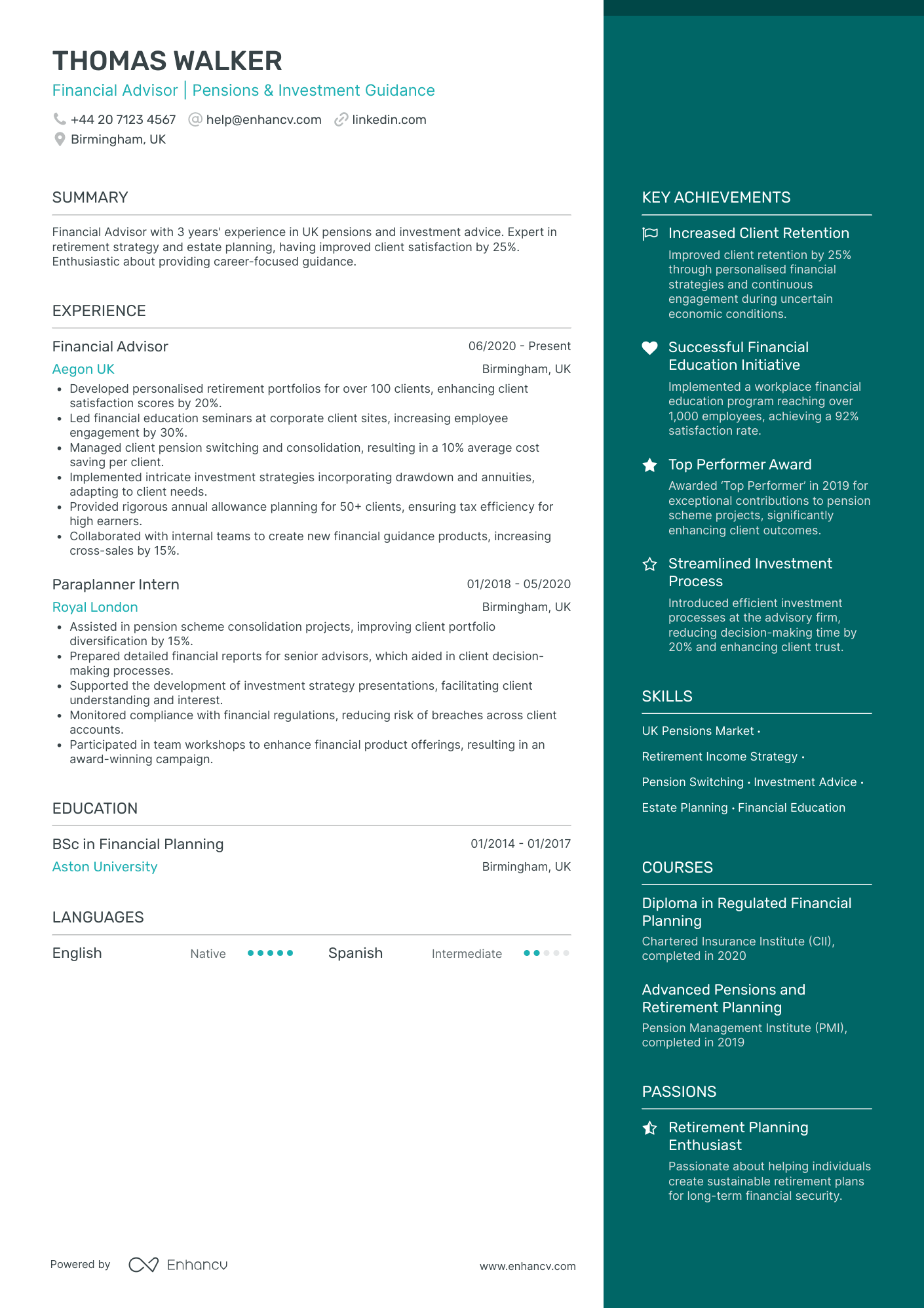

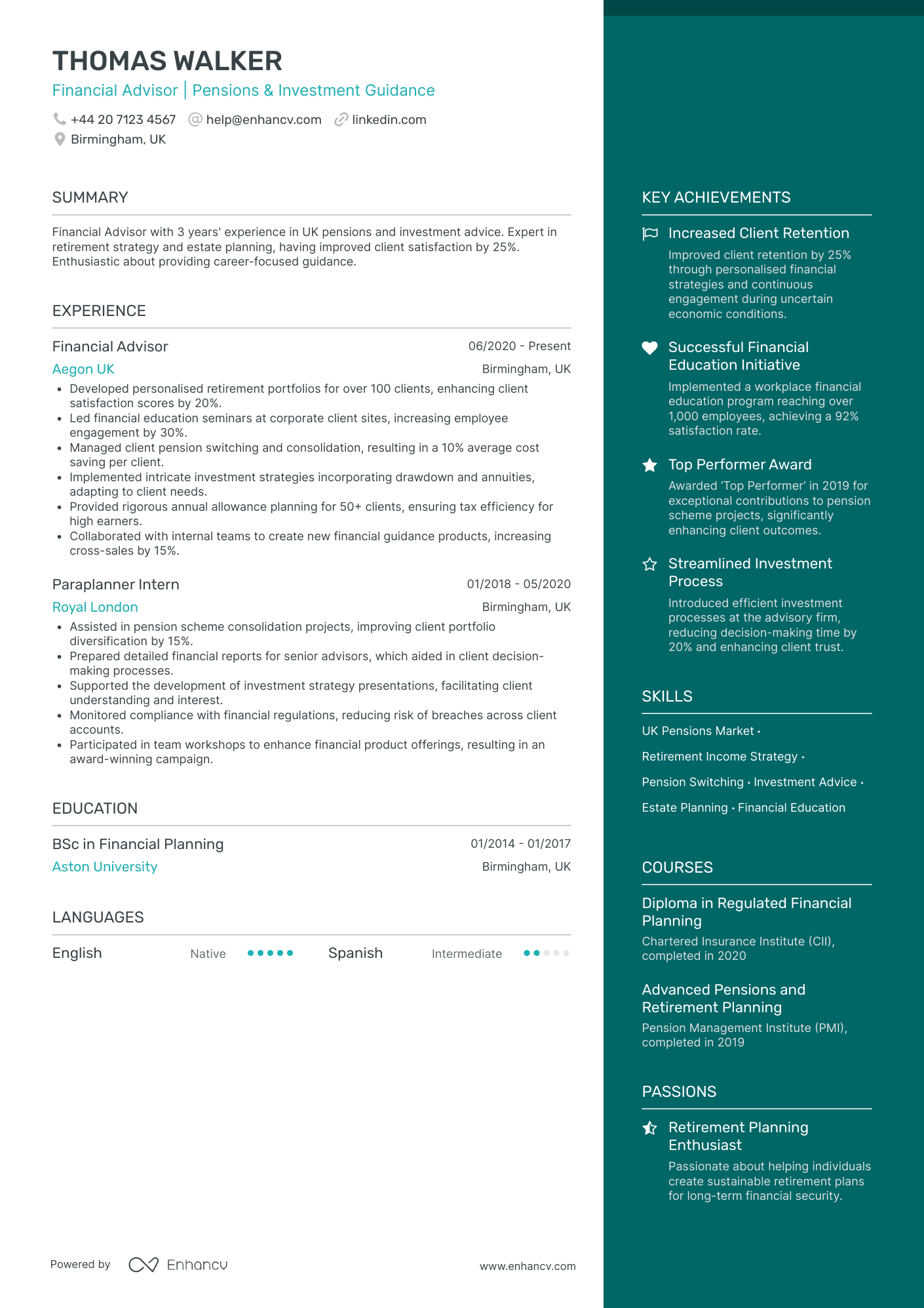

Junior Financial Advisor

- Structured Professional Growth - Thomas Walker's CV effectively outlines a clear career progression from a Paraplanner Intern at Royal London to a Financial Advisor role at Aegon UK. This growth narrative underscores his increasing responsibilities and expertise within the financial advisory field, highlighting significant achievements and increased impact over time.

- Distinctive Use of Industry Tools - The CV showcases industry-specific tools such as Intelliflo, Morningstar Advisor Workstation, and FE Analytics. Mentioning these platforms not only demonstrates Walker's technical proficiency but also signals his ability to leverage sophisticated technologies to optimize financial advisory processes and enhance client service quality.

- Impact-Driven Achievements - Achievements are framed in a way that illustrates not just quantitative improvements but genuine business impact. For instance, the implementation of intricate investment strategies and enhancement of client satisfaction emphasize strategic thinking and customer-centric service, essential for a Financial Advisor role.

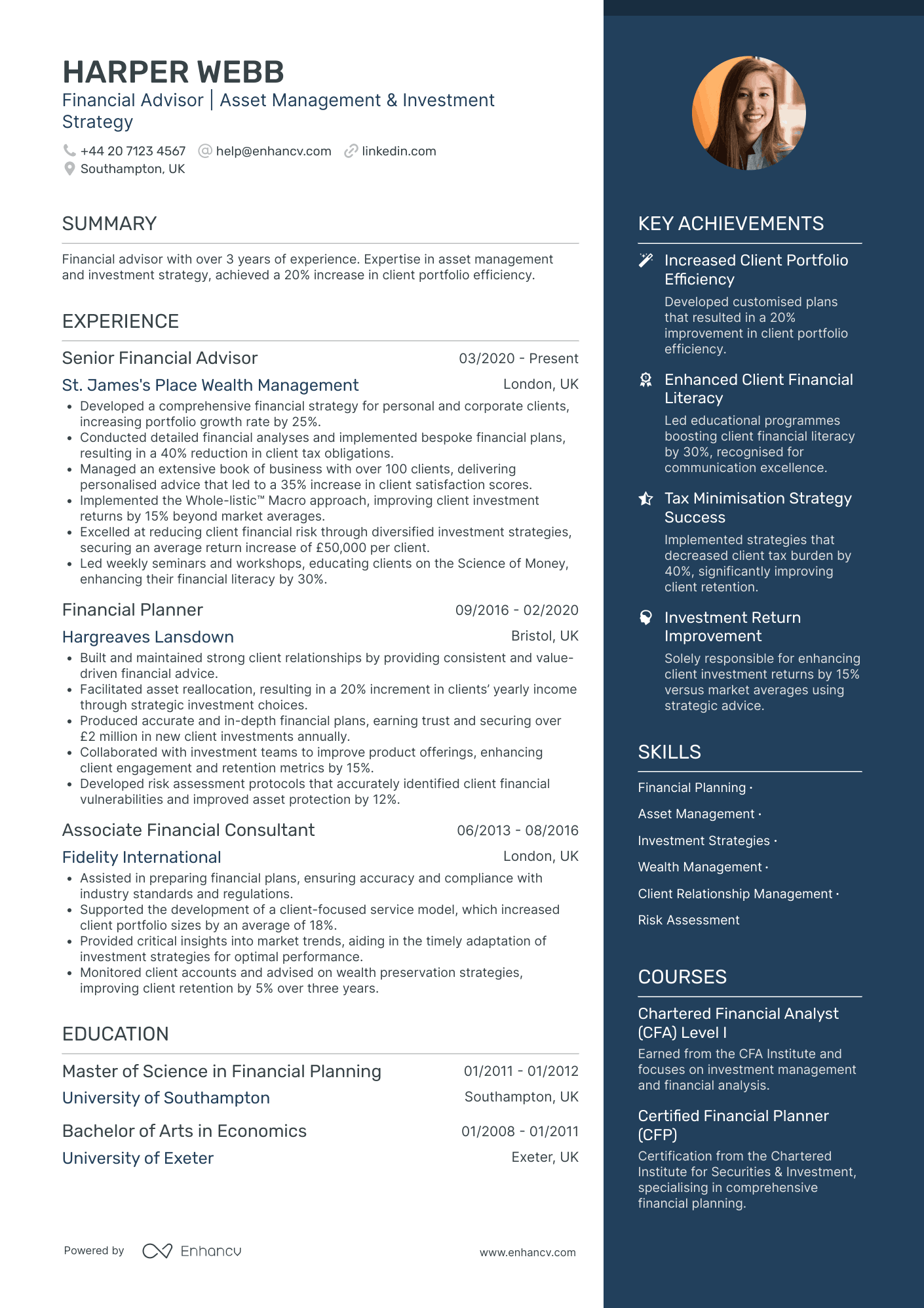

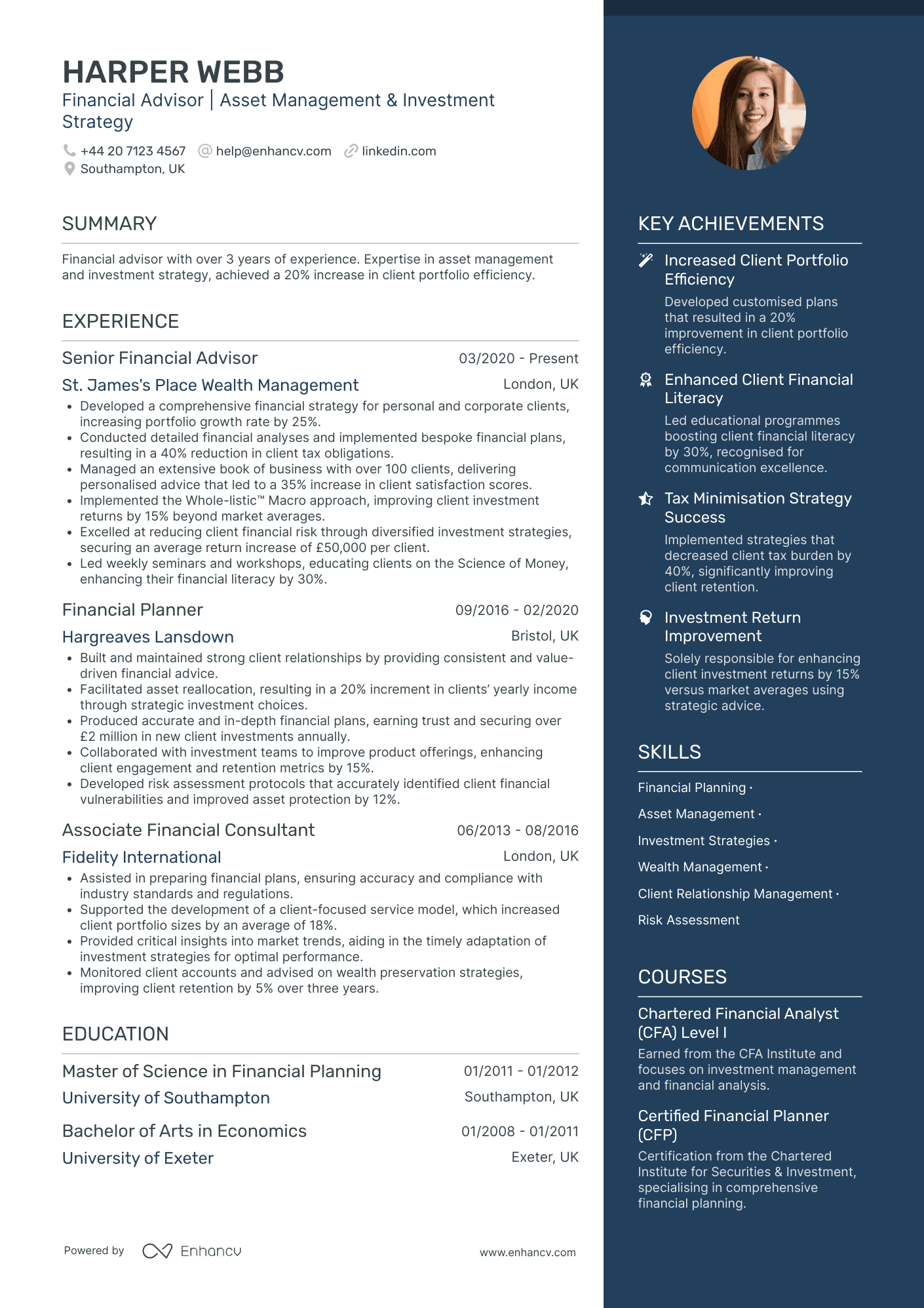

Lead Financial Advisor

- Comprehensive Experience Across Financial Institutions - The CV offers a clear trajectory of advancing responsibility and expertise within the financial sector. Harper Webb's roles at St. James's Place Wealth Management, Hargreaves Lansdown, and Fidelity International show a natural progression in his career, highlighting the accumulation of skills and experiences that are pertinent to financial advising and asset management.

- Emphasis on Client-Centric Achievements - The CV effectively underscores Harper's ability to deliver measurable improvements in client satisfaction and portfolio performance. The inclusion of specific metrics such as a 40% tax obligation reduction and a 35% increase in client satisfaction illustrates the tangible impact of his strategic financial advice and underscores his commitment to client outcomes.

- Diverse Skill Set and Continuous Professional Development - Harper's CV evidences a robust collection of skills and certifications that foster trust in his qualifications. By highlighting his Chartered Financial Analyst (CFA) Level I and Certified Financial Planner (CFP) credentials, coupled with an impressive array of financial and advisory skills, it showcases not only his technical prowess but also his dedication to professional growth and excellence.

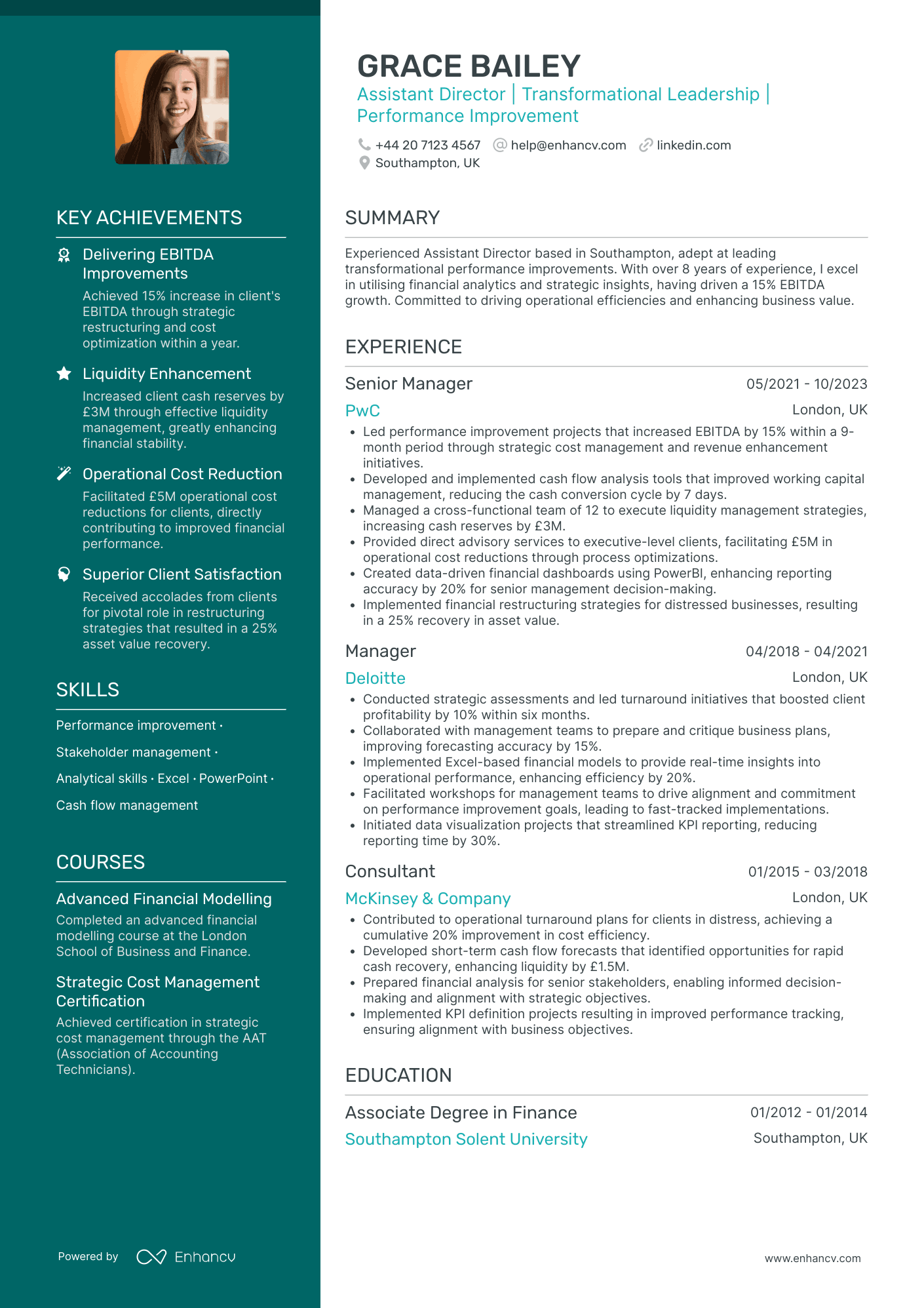

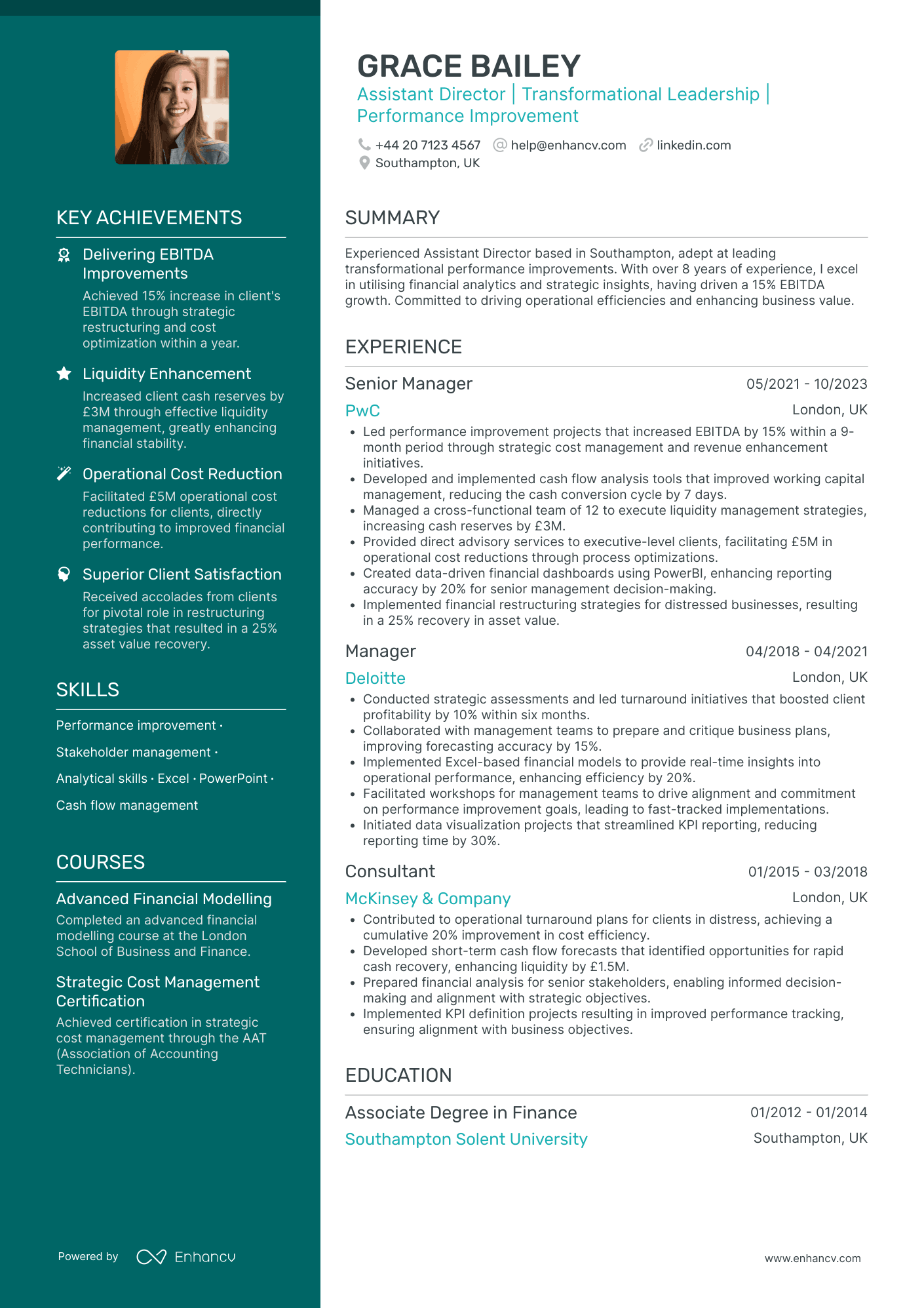

Associate Financial Advisor

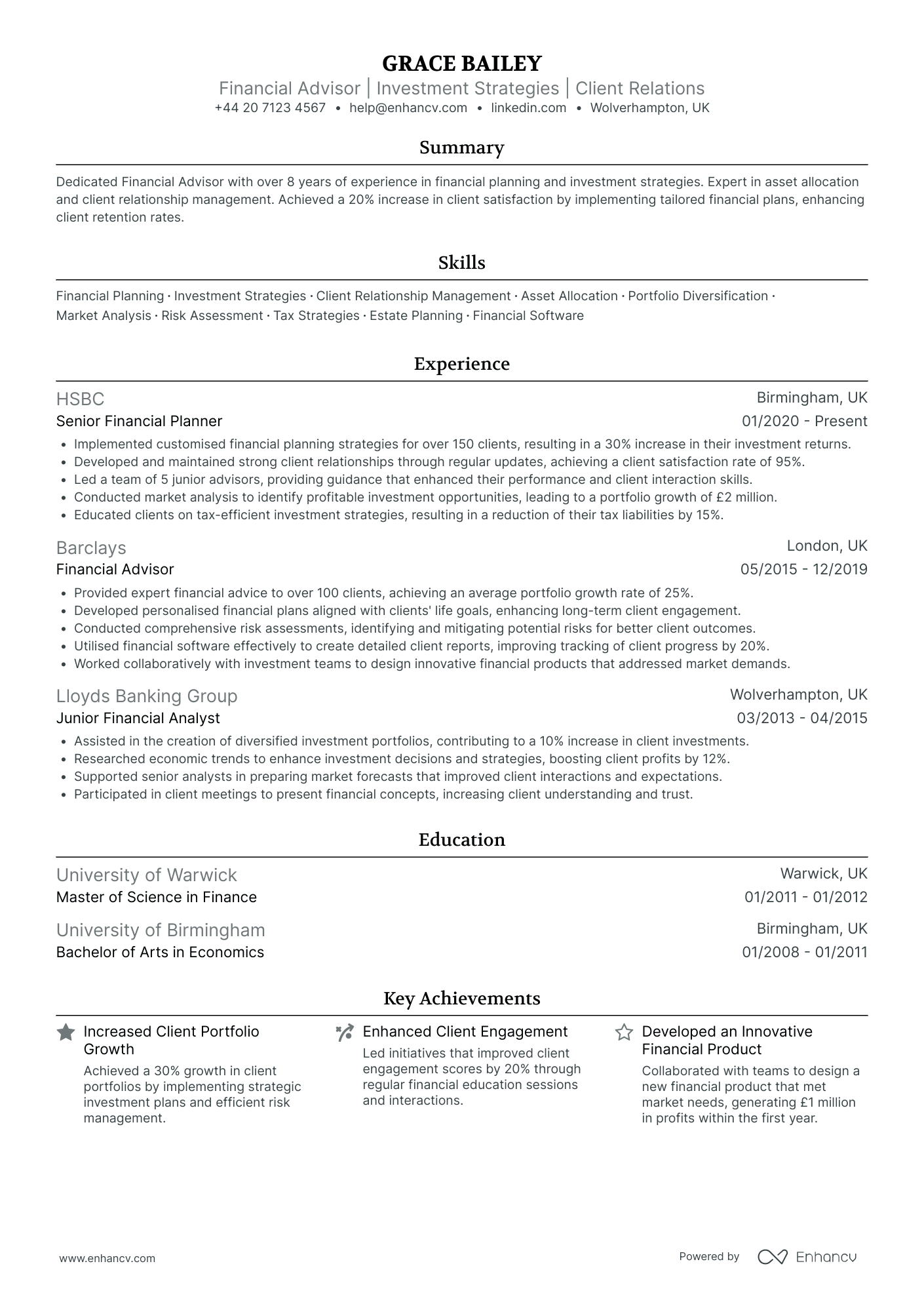

- Clarity and Structure in Content Presentation - Grace Bailey’s CV is meticulously organized, starting with a comprehensive header that succinctly presents essential contact information and a brief summary. The experience section is detailed yet concise, with each role broken down into easily digestible bullet points that clearly highlight key contributions and results, ensuring readability and impact at first glance.

- Dynamic Career Trajectory - The CV illustrates a compelling career progression from Consultant at McKinsey & Company to Senior Manager at PwC, showcasing consistent advancement in leadership roles. This trajectory not only highlights Bailey's ability to thrive in high-pressure environments but also her successful navigation through top-tier consulting firms, pointing to her rapidly growing expertise and value in transformational leadership and performance improvement.

- Substantial Achievements with Tangible Impact - The achievements listed in the CV go beyond mere numbers, detailing the significant business impact of strategic initiatives led by Bailey. For instance, a 15% growth in EBITDA and a £3M increase in cash reserves are positioned as outcomes of successful cost management and liquidity strategies, demonstrating a direct and substantial enhancement in business performance.

Executive Financial Advisor

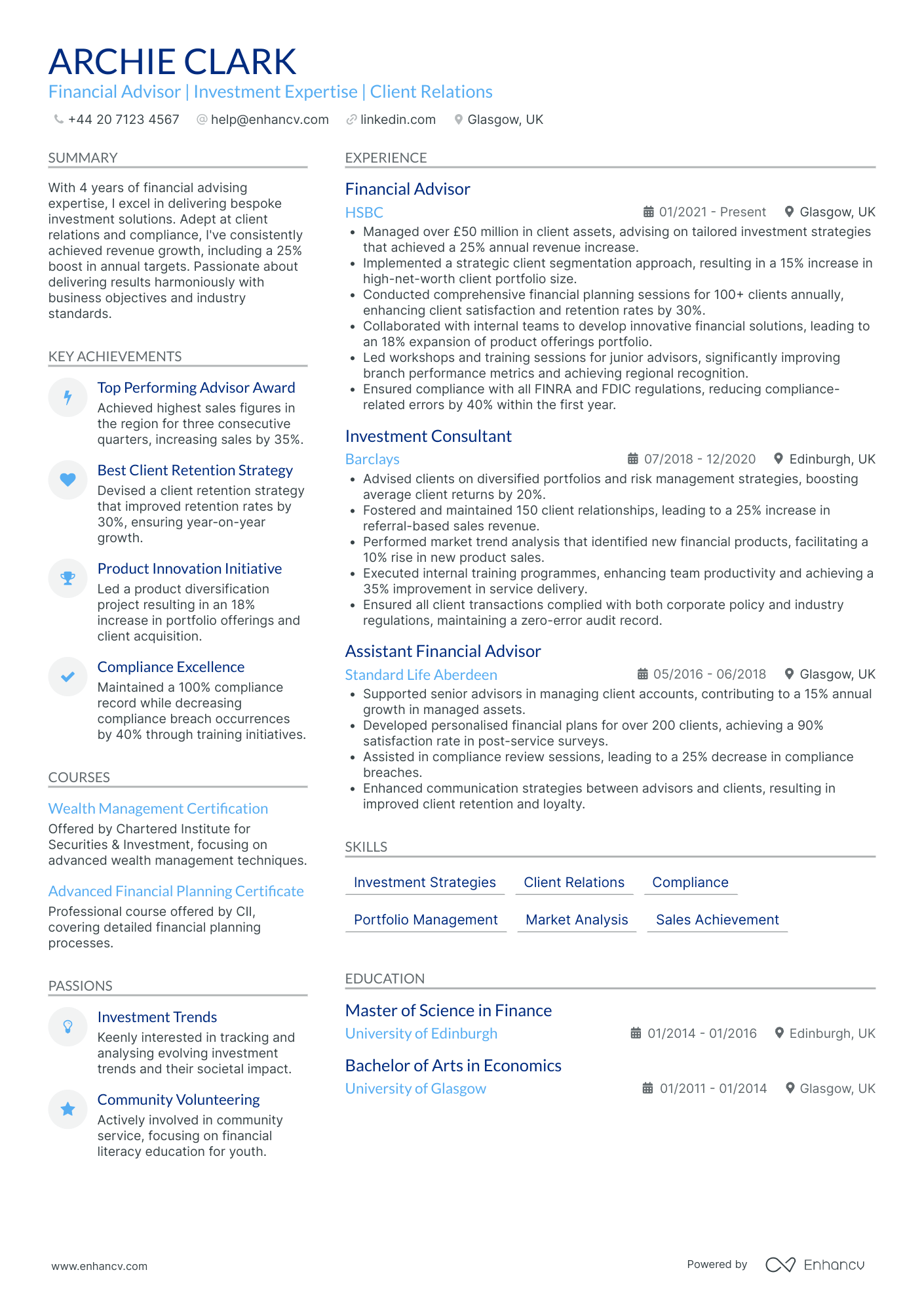

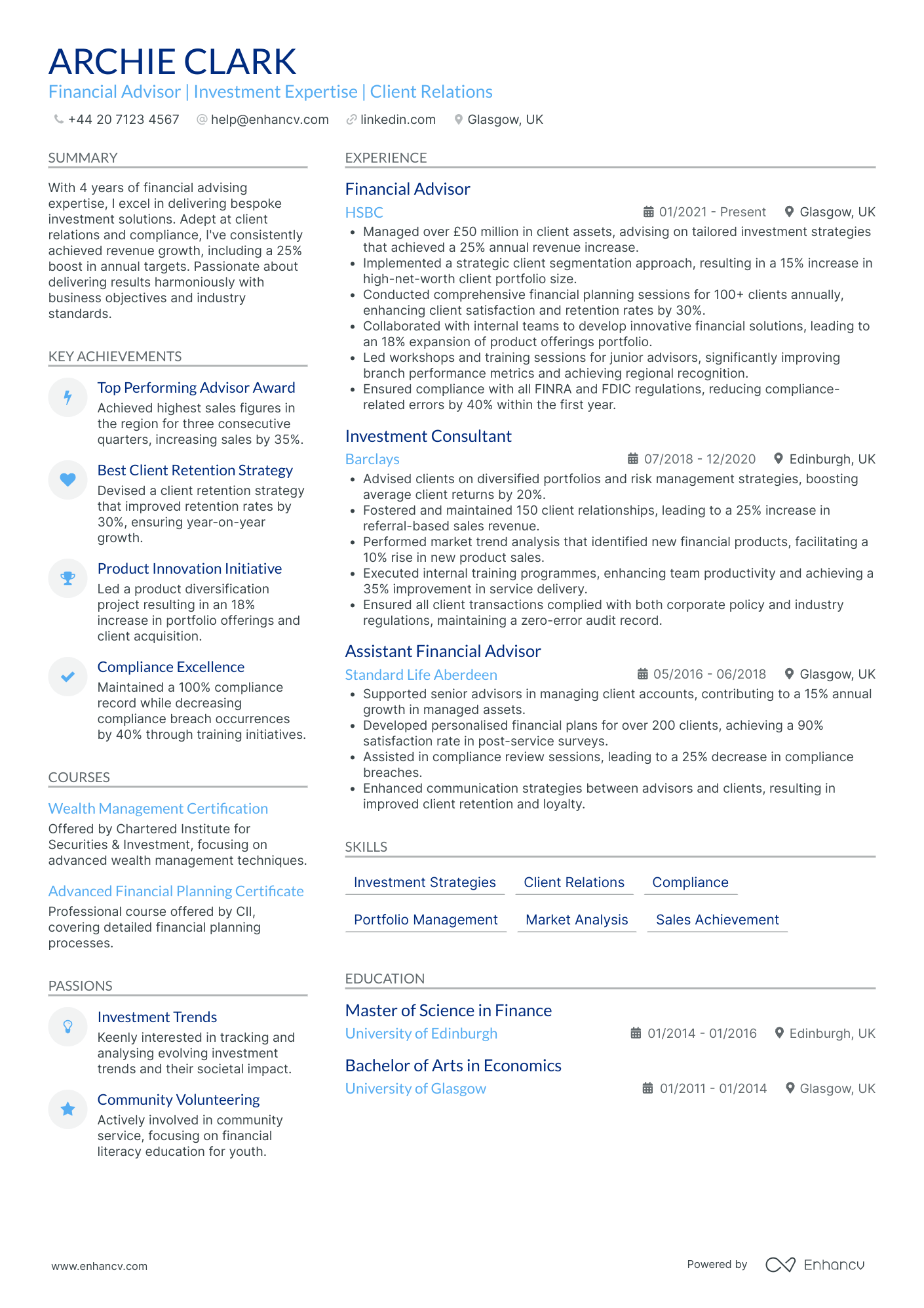

- Clear and Structured Presentation - The CV is well-organized, with a logical flow from personal details to summary, experience, education, and achievements. Each section is clearly defined, and the use of bullet points makes for easy readability, ensuring that key information is accessible at a glance.

- Solid Career Progression - Archie Clark's career trajectory shows a steady climb in the financial services industry. Starting as an Assistant Financial Advisor and advancing to a Financial Advisor role at a prestigious bank like HSBC, this growth reflects both proficiency and a successful track record in handling increasing levels of responsibility.

- Impactful Achievements with Relevance - The CV effectively emphasizes achievements that align with business objectives, such as a 25% increase in annual revenue and a 35% improvement in service delivery. These accomplishments not only highlight the candidate's ability to contribute to revenue growth but also underscore their impact on client satisfaction and overall business success.

By Role

Financial Advisor for Wealth Management

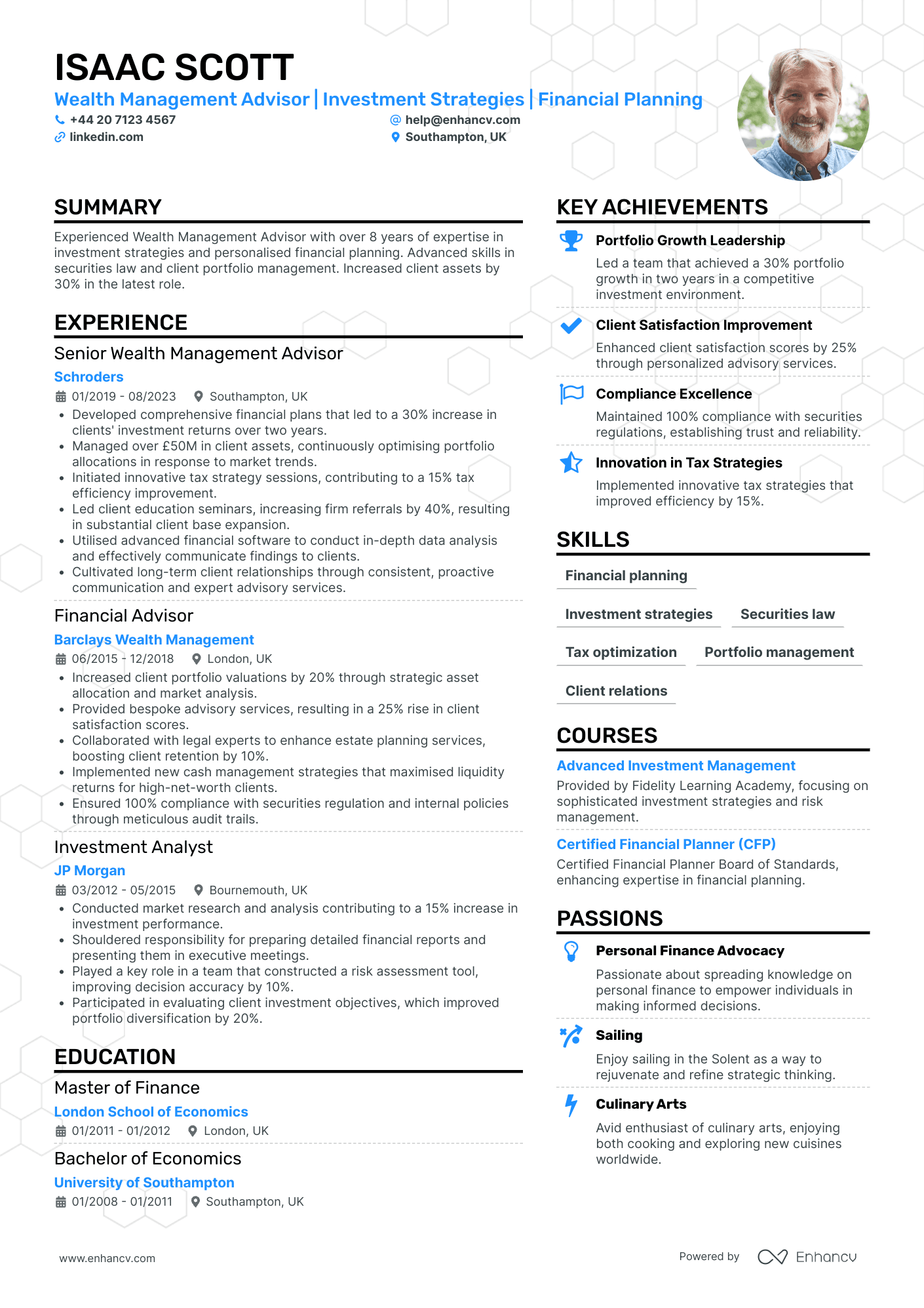

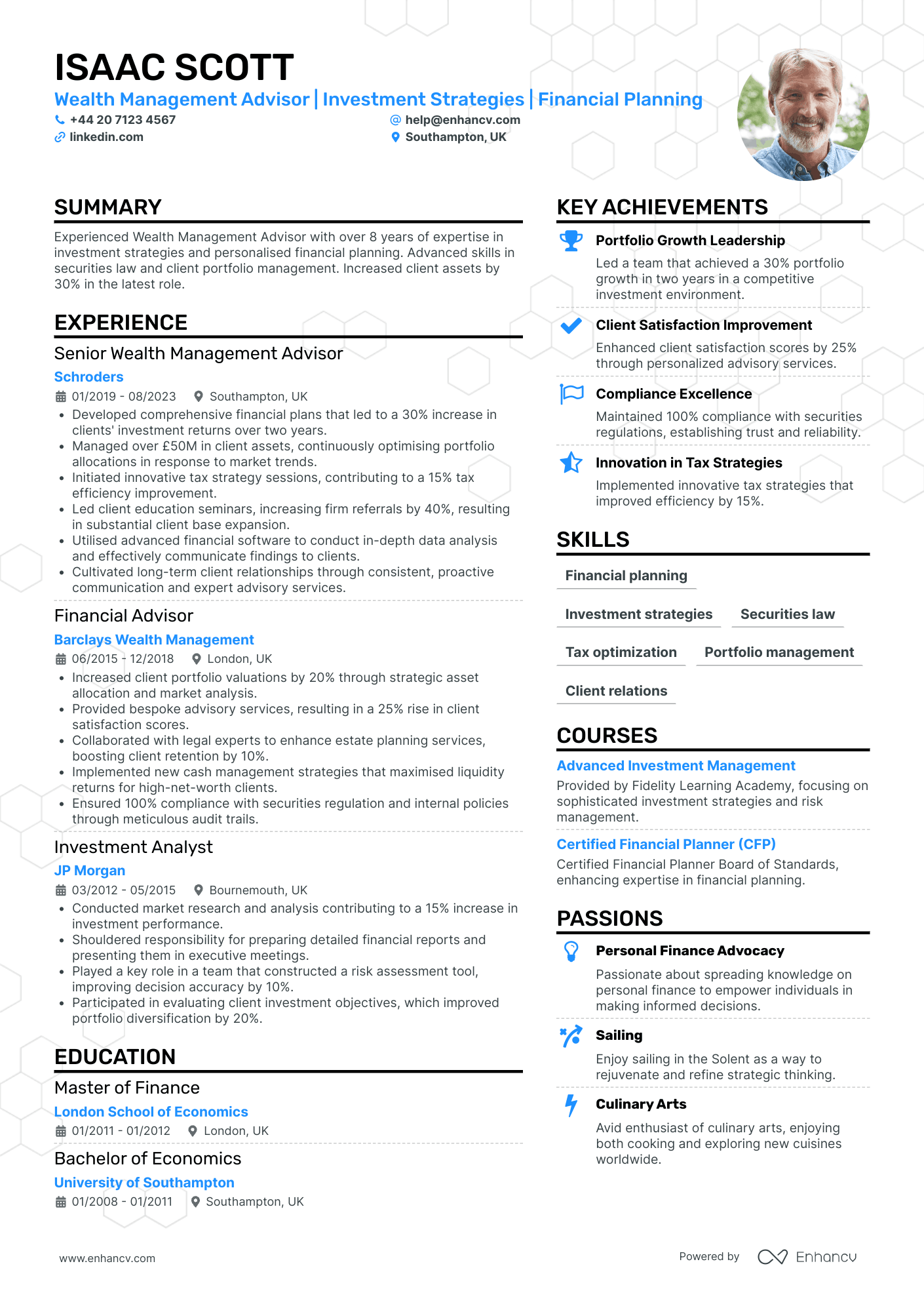

- Clarity and structure in presentation - The CV is well-organized, presenting information in a clear and concise manner that allows for easy navigation through various sections. It uses well-defined headings and bullet points, making it effortless for the reader to comprehend the candidate's experience, skills, and achievements.

- Strong career trajectory in wealth management - Isaac Scott’s journey from an Investment Analyst to a Senior Wealth Management Advisor demonstrates a significant upward career trajectory. This progression showcases not only his dedication but also his capability to assume greater responsibilities over time, positioning him as a seasoned professional in wealth management.

- Impactful achievements with clear business relevance - The CV highlights achievements with direct business impacts, such as a 30% increase in client assets and substantial improvements in tax efficiency and client satisfaction. These accomplishments underscore the candidate's ability to contribute valuable insights and strategies that lead to measurable results.

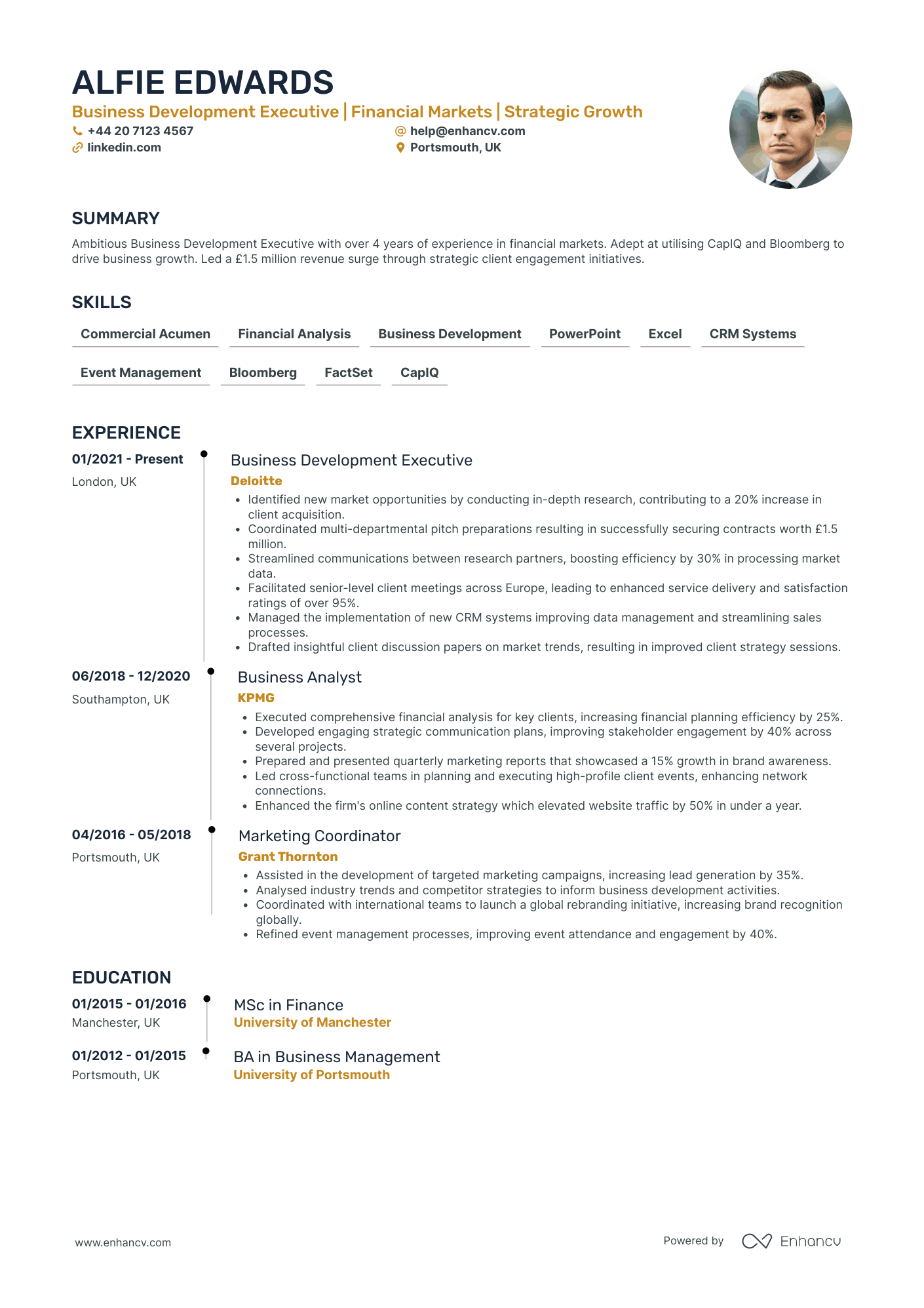

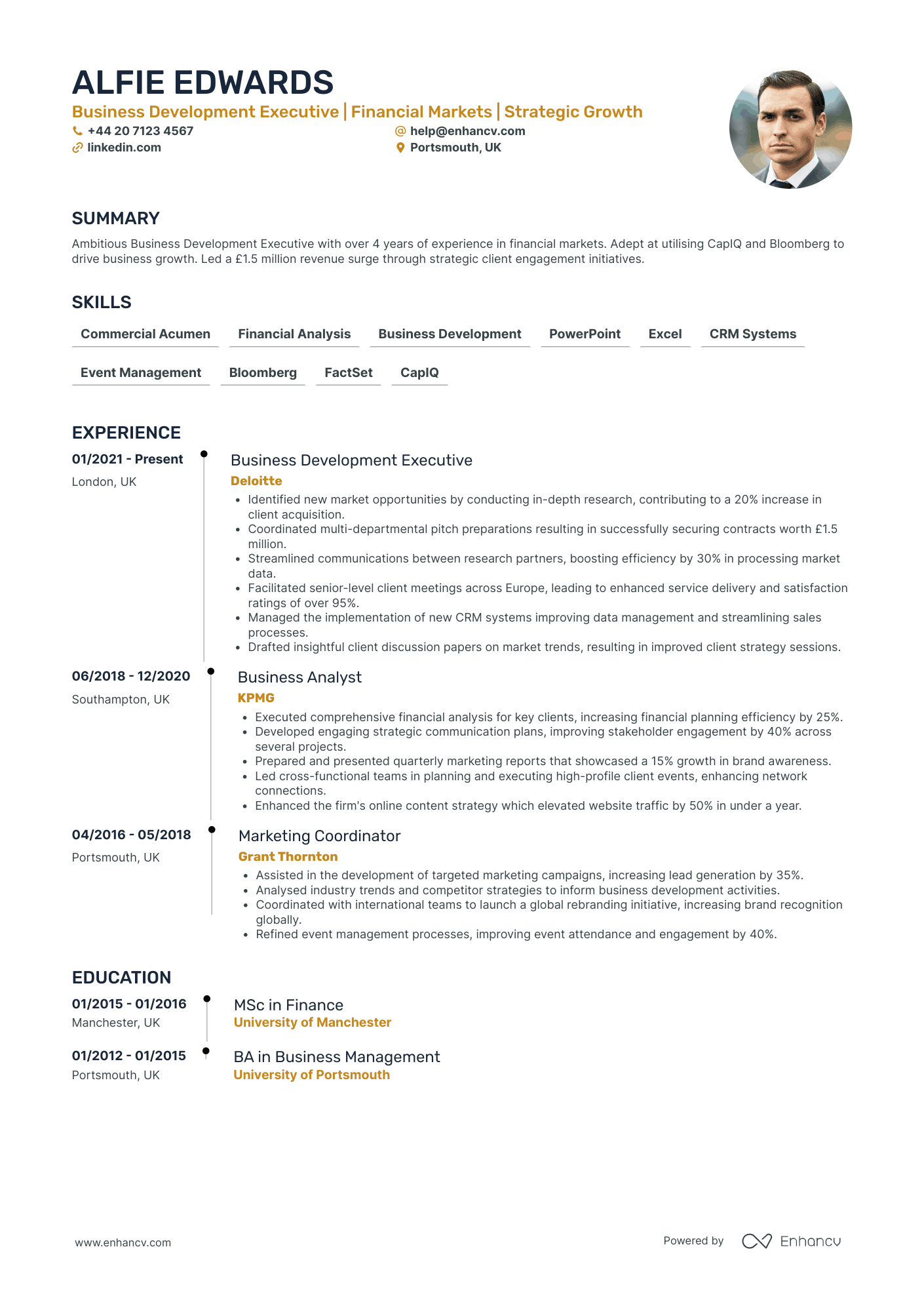

Financial Advisor for Corporate Finance

- Structured and Concise Presentation - The CV is well-organized with clearly delineated sections such as experience, education, skills, and achievements. It uses concise bullet points that allow readers to quickly grasp key aspects of Alfie's qualifications and contributions, ensuring clarity and ease of reading.

- Progressive Career Trajectory - Alfie's career showcases a clear growth pattern, starting from a Marketing Coordinator to a Business Development Executive. Each position reflects a step up in responsibility and expertise, indicating Alfie's ongoing commitment to personal development and professional advancement.

- Emphasis on Strategic Impact - The CV highlights achievements such as the implementation of a successful client acquisition strategy and initiatives leading to a revenue surge. These accomplishments underscore Alfie's ability to not only meet targets but also generate significant business value through strategic planning and execution.

Financial Advisor for Personal Finance

- Concise yet comprehensive content presentation - The CV is well-structured with clear headings and bullet points, facilitating easy navigation through different sections. It succinctly captures key expertise and achievements without overwhelming the reader, ensuring every point serves a purpose and contributes to an overarching narrative of financial proficiency.

- Demonstrated growth and industry shift adaptation - Grace Bailey's career progression from a Finance Officer to a Senior Assistant Financial Advisor with an evident focus on healthcare finance showcases a trajectory of growth and adaptability. The shift from Virgin Money to a healthcare organization like NHS Greater Glasgow and Clyde indicates a strategic move to integrate finance skills within a crucial service industry, highlighting versatility and a targeted career path.

- Depth of financial technical skills and leadership capabilities - The CV showcases proficiency in industry-standard tools and methodologies like Excel macro development and SAP, emphasizing technical depth in financial management. The leadership qualities are highlighted through her role in implementing a financial management system and initiating mentorship programs, showing her ability to influence and lead teams effectively.

Financial Advisor for Investment Management

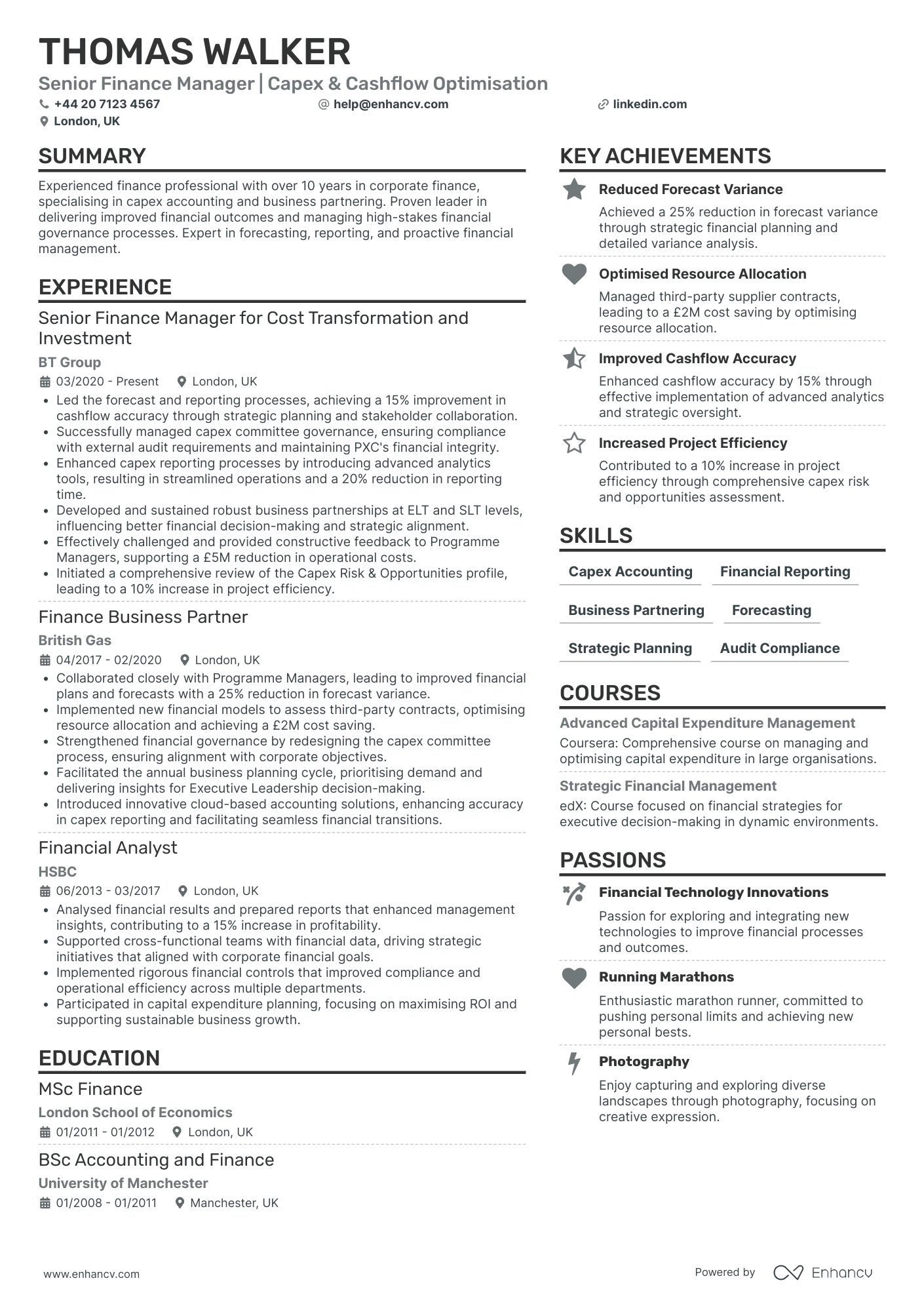

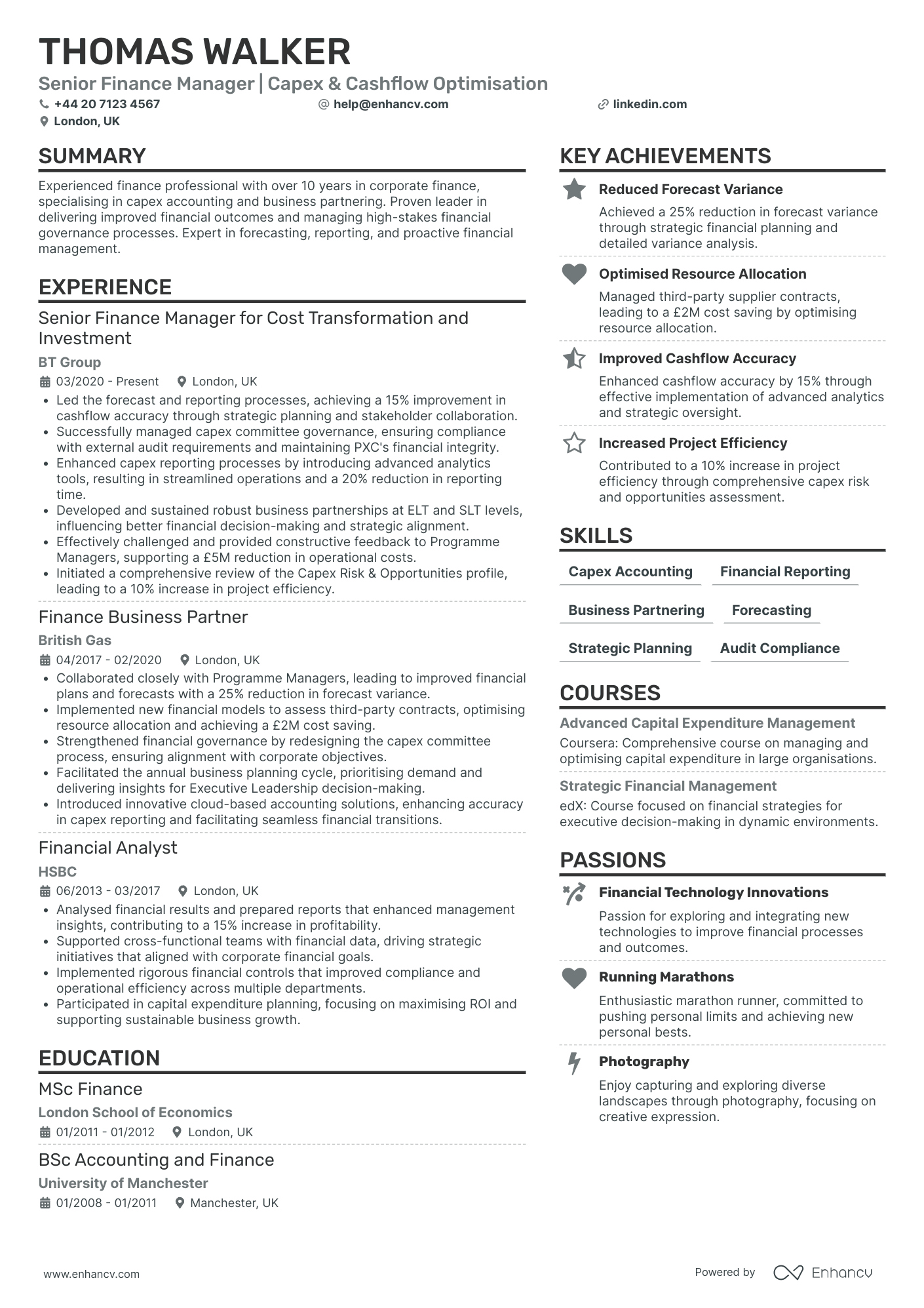

- Structured and Coherent Presentation - The CV maintains a clear structure with well-delineated sections. Each section is concise and logically ordered, making it easy for recruiters to follow the candidate's professional journey. The use of bullet points helps in highlighting key responsibilities and achievements, enhancing readability and clarity.

- Progressive Career Advancement - The candidate has demonstrated significant career progression, moving from a Financial Analyst to a Senior Finance Manager. This trajectory reflects a deepening specialization in finance management, alongside increased leadership responsibilities, particularly within key organizations like BT Group and British Gas.

- Evidence of High-impact Achievements - The CV provides concrete examples of achievements, such as a 15% improvement in cashflow accuracy and a £5M reduction in operational costs. These accomplishments do not only show numerical success but underline the candidate’s ability to effect meaningful financial improvements and strategic outcomes.

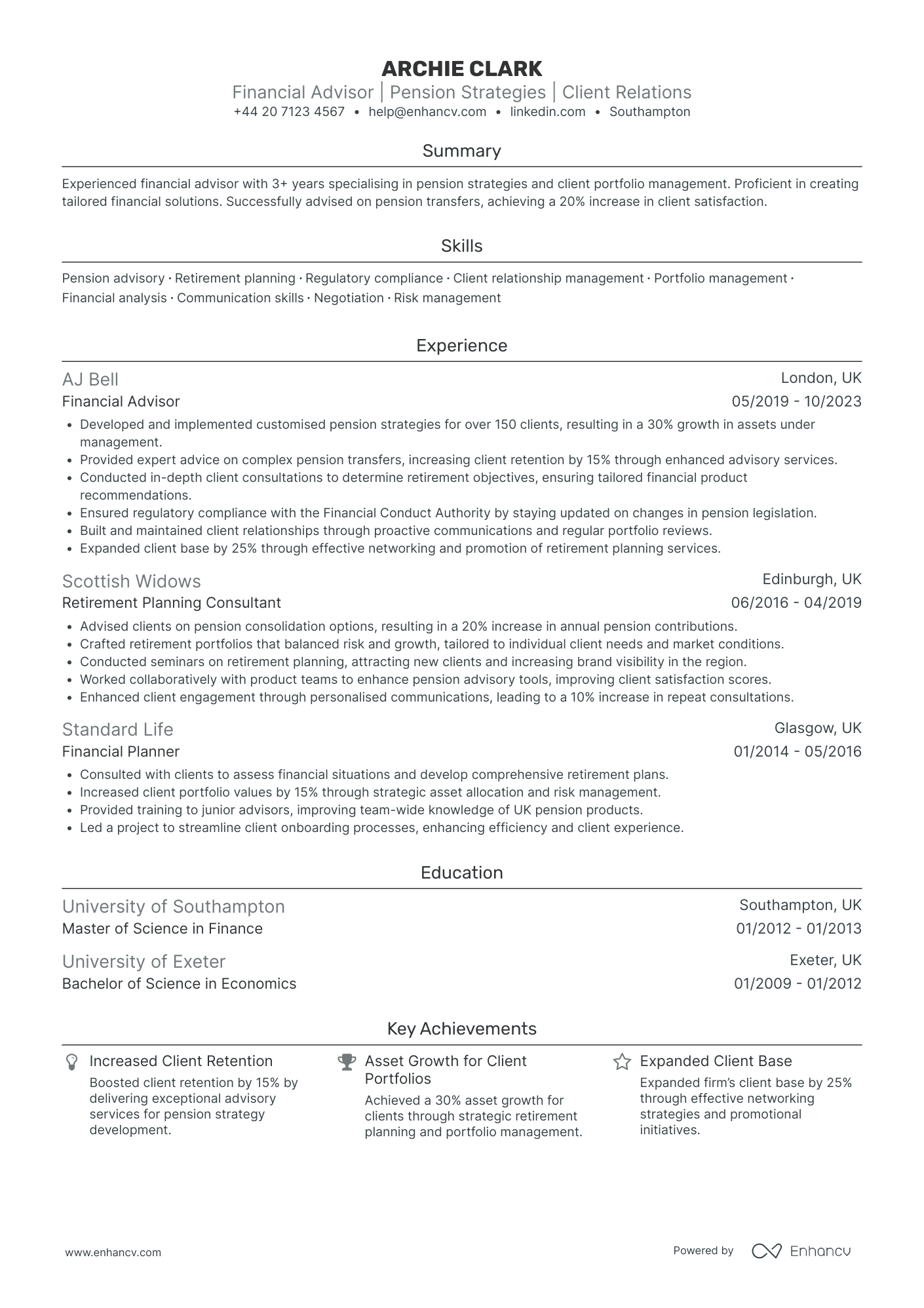

Financial Advisor for Retirement Planning

- Impressive Career Progression and Growth - Archie Clark's career trajectory illustrates consistent advancement in the financial industry. Starting as a Financial Planner and moving up to a Financial Advisor role, his growth reflects a deepening expertise in pension strategies and client relationships, highlighted by a successful tenure at AJ Bell where he managed assets and expanded the client base significantly.

- Impact-Oriented Achievements - The CV is rich with achievements that underscore Archie's impact. Increasing client assets by 30% and boosting client retention by 15% are not just numbers; they illustrate his ability to deliver substantial business growth and foster lasting client relationships. These accomplishments align perfectly with the expectations for a financial advisor role.

- Strong Emphasis on Client Relationship and Regulatory Compliance - A unique feature of this CV is its focus on maintaining regulatory compliance and nurturing client relations. Archie Clark stays updated with the Financial Conduct Authority regulations and builds sustained engagements with clients, which are critical skills for thriving in the financial advisory sector and ensuring client trust and satisfaction.

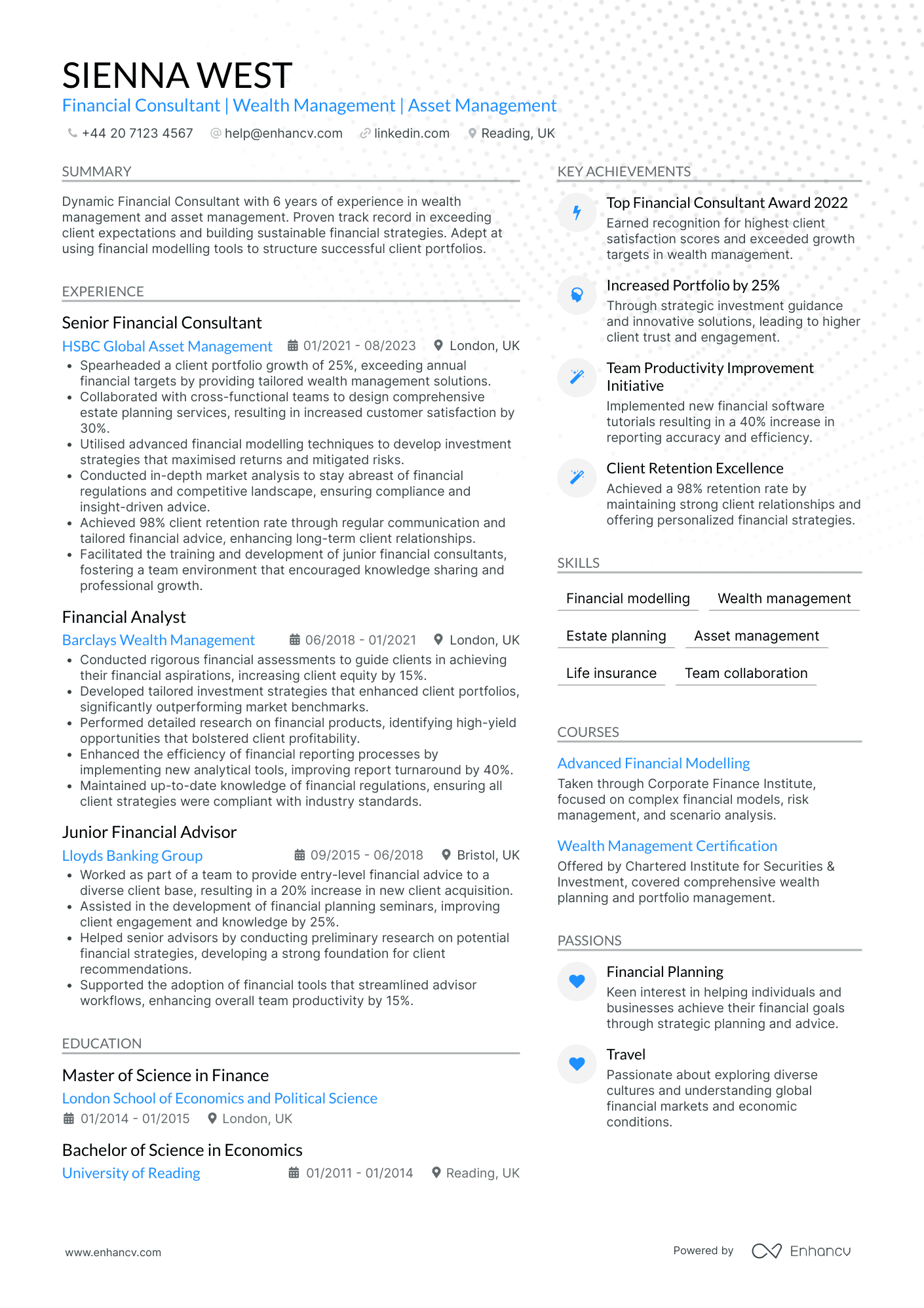

Financial Advisor for Estate Planning

- Structured and Concise Presentation - The CV is meticulously structured with clear sections for each aspect of the candidate's professional profile. The use of bullet points under each role ensures that key accomplishments and responsibilities are presented concisely, enabling easy reading and quick comprehension of information.

- Significant Career Progression - The trajectory from Junior Financial Advisor at Lloyds Banking Group to Senior Financial Consultant at HSBC Global Asset Management highlights a steady career advancement. The candidate demonstrates growth through increasingly responsible roles, reflecting enhanced expertise and leadership capabilities within the financial sector.

- Emphasis on Cross-Functional Competence - The CV illustrates the candidate’s cross-functional experience, notably through collaboration with diverse teams for estate planning at HSBC. This showcases adaptability and the ability to integrate seamlessly into various team environments, an essential trait for driving complex financial projects forward.

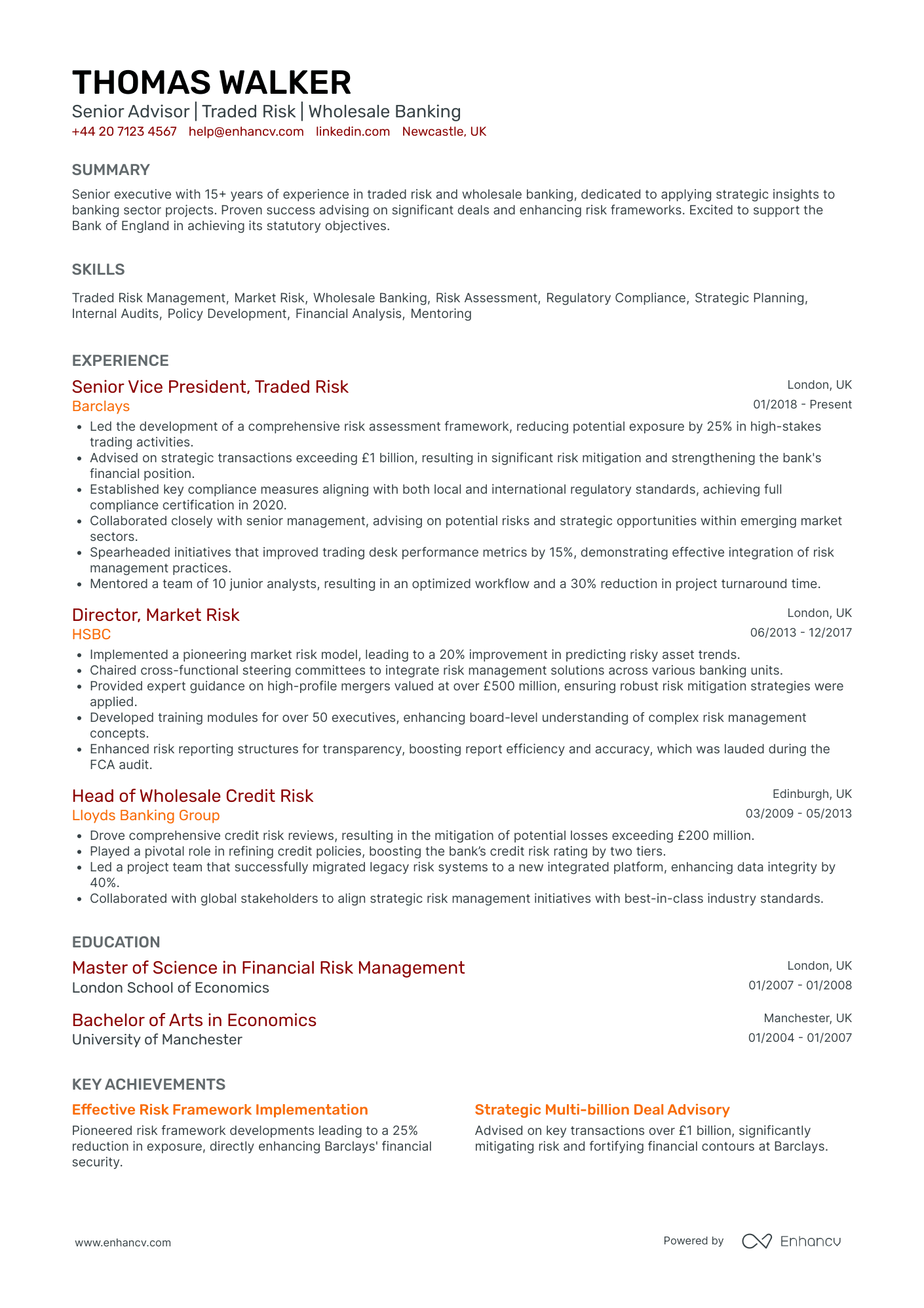

Independent Financial Advisor

- Structured for Clarity and Impact - The presentation of this CV is highly organized, with sections clearly demarcated for easy navigation. Each role is described in concise bullet points, making it simple to understand the candidate's responsibilities and achievements. This structured approach ensures that the information is both accessible and persuasive.

- Demonstrates Continuous Professional Growth - The career path outlined in the CV illustrates a clear trajectory of growth and advancement within the banking industry. The candidate has progressed from a Head of Wholesale Credit Risk to a Senior Vice President at Barclays, showing a steady climb up the corporate ladder while gaining expertise in traded risk and wholesale banking.

- Highlights Tangible Achievements and Their Impact - The CV effectively illustrates how the candidate's initiatives have had substantial business impacts, such as reducing potential exposure by 25% and increasing trading desk performance metrics by 15%. These achievements are not just about numbers but reflect strategic initiatives that significantly enhanced financial security and operational efficiency.

Certified Financial Planner Advisor

- Clear and Structured Content Presentation - The CV is meticulously organized, featuring sections that are clearly delineated to enhance readability and understanding. Each section, such as experience, education, and skills, is concisely presented, allowing for a quick yet comprehensive review of the candidate's qualifications and expertise. The strategic use of bullets facilitates easy exploration of key responsibilities and achievements.

- Distinct Career Trajectory with Gradual Promotions - The career history presents a clear trajectory of growth, evidencing a progression from an Asset Management Associate to a Senior Financial Advisor. This progression not only illustrates increased responsibilities and expertise but also highlights the candidate’s established credibility within the financial sector, demonstrating their capacity for development and leadership over the years.

- Industry-Specific Analytical and Client-Centered Skills - The CV showcases a profound depth of knowledge in investment and financial advising specific to the financial industry. It highlights the candidate's proficiency in developing sophisticated analytical models, implementing investment strategies, and maintaining robust client relationships, underpinning their capability to optimize fund performance and enhance client satisfaction effectively.

Financial Advisor for Non-Profit Organisations

- Clear and Concise Presentation - The CV is structured with clarity, effectively separating sections for readability. Information is concise and focused, utilizing bullet points for ease of understanding, especially in detailing experiences and achievements.

- Progressive Career Trajectory - William Hall showcases a steady career advancement, transitioning from a Senior Financial Analyst to a Fractional CFO. This progress reflects growth in responsibility and influence, as well as breadth in roles within diverse companies from startups to global firms.

- Impressive Strategic Achievements - Achievements communicate significant business impacts, such as a 20% increase in efficiencies and securing substantial funding in competitive situations. These entries emphasize not just numerical success but the strategic foresight and implementation skills William possesses.

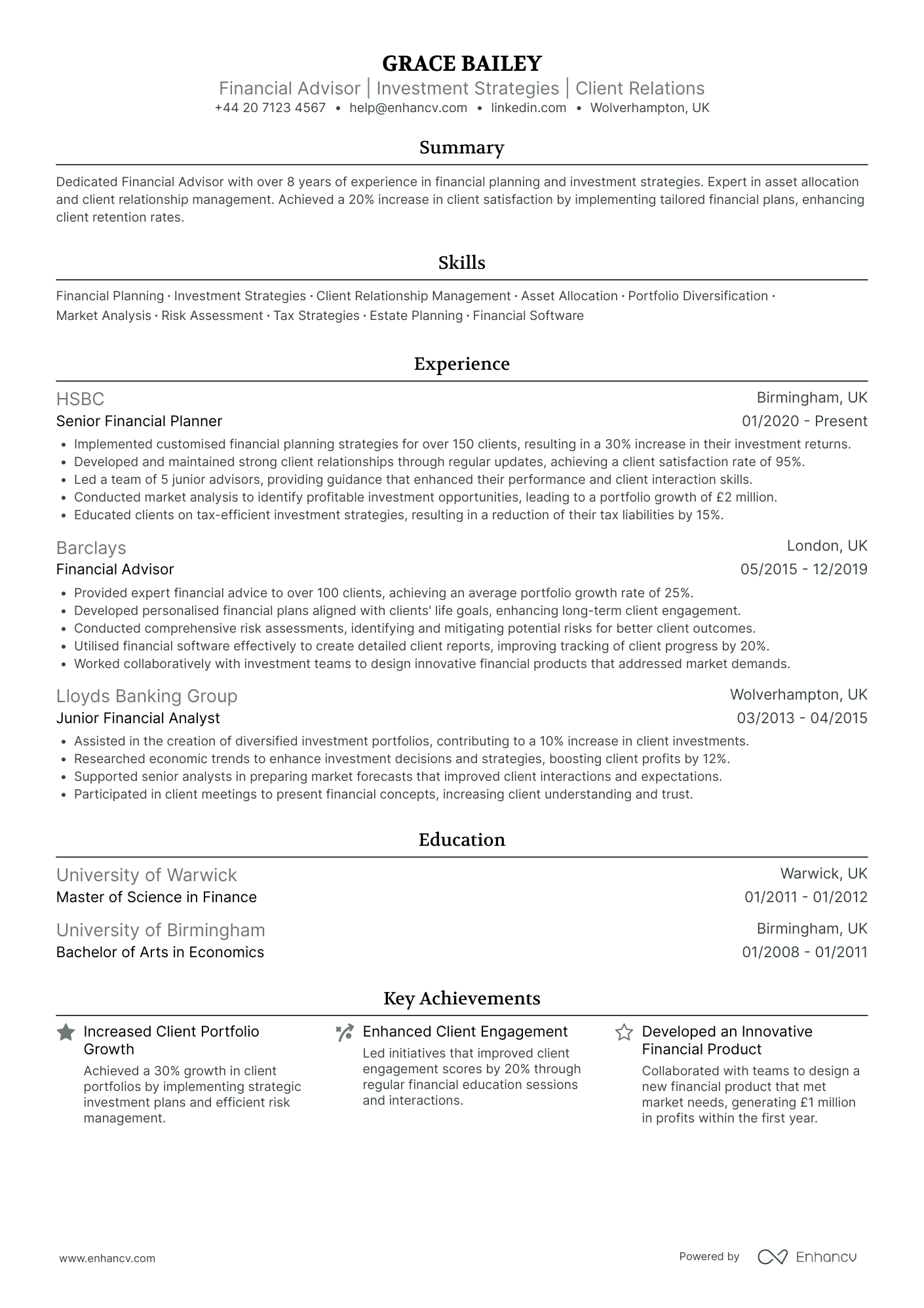

Financial Advisor for Small Businesses

- Clear and Structured Content Presentation - The CV is well-structured, with distinct sections for summary, experience, education, skills, and achievements. The information is concise and easy to follow, making it quick to identify key details like expertise in asset allocation and client relationship management.

- Progressive Career Trajectory - Grace Bailey's career showcases significant growth, from a Junior Financial Analyst to a Senior Financial Planner at HSBC. Each role indicates a step up in responsibility and expertise, reflecting a steady advancement within the financial sector.

- Industry-Specific Achievements with Impact - The CV highlights achievements that are not just about numbers but demonstrate real business impact. For example, the development of a financial product that generated £1 million in profits underscores an ability to innovate and meet market demands effectively.

Chartered Financial Advisor

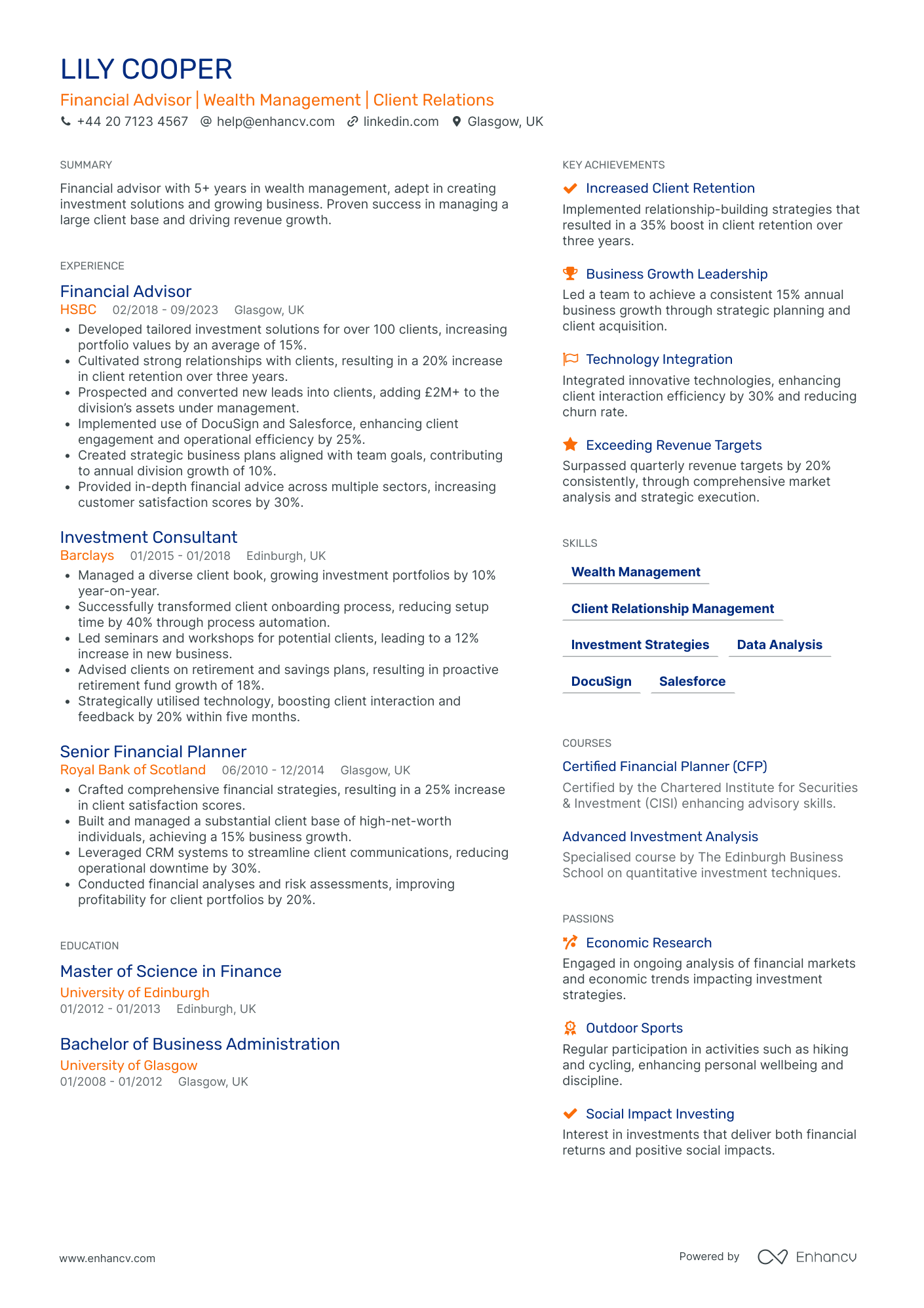

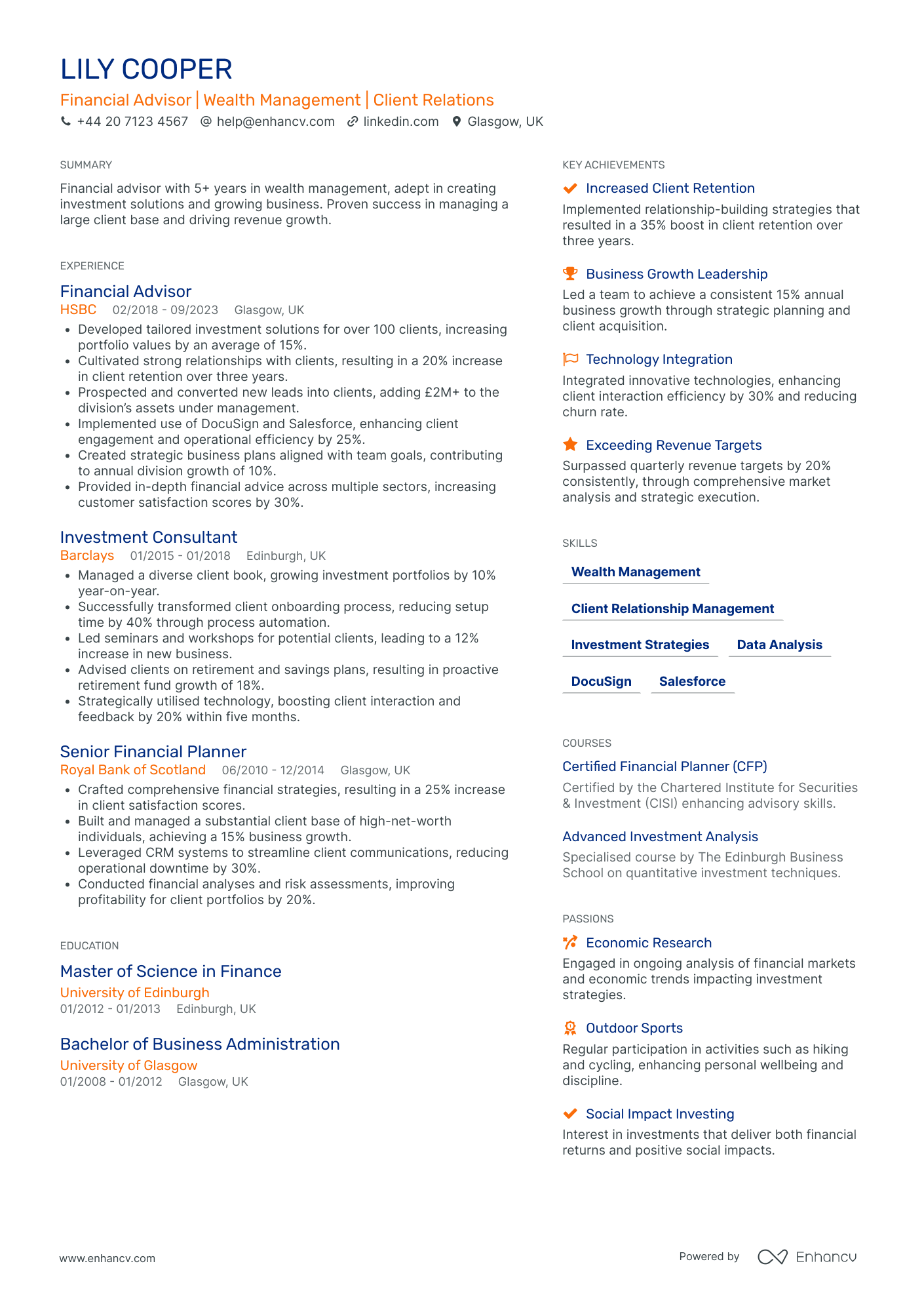

- Structured Career Progression - Lily Cooper's career trajectory demonstrates a clear growth path in the financial sector, moving from a Senior Financial Planner to a role as a Financial Advisor at HSBC. Her progression highlights consistent promotions, indicating her strong performance and industry recognition.

- Integration of Cutting-Edge Tools - The CV highlights Lily's proficiency in using industry-specific tools like DocuSign and Salesforce, which not only bolster her operational efficiency but also enhance client-facing interactions. This technical adeptness sets her apart as a forward-thinking professional who embraces technology in wealth management.

- Strategic Client Engagement and Retention - Her achievements section underscores her ability to cultivate and maintain robust client relationships, marked by a 35% increase in client retention. This capability is crucial for growing wealth management portfolios and ensuring long-term client loyalty.

Financial Advisor for Tax Planning

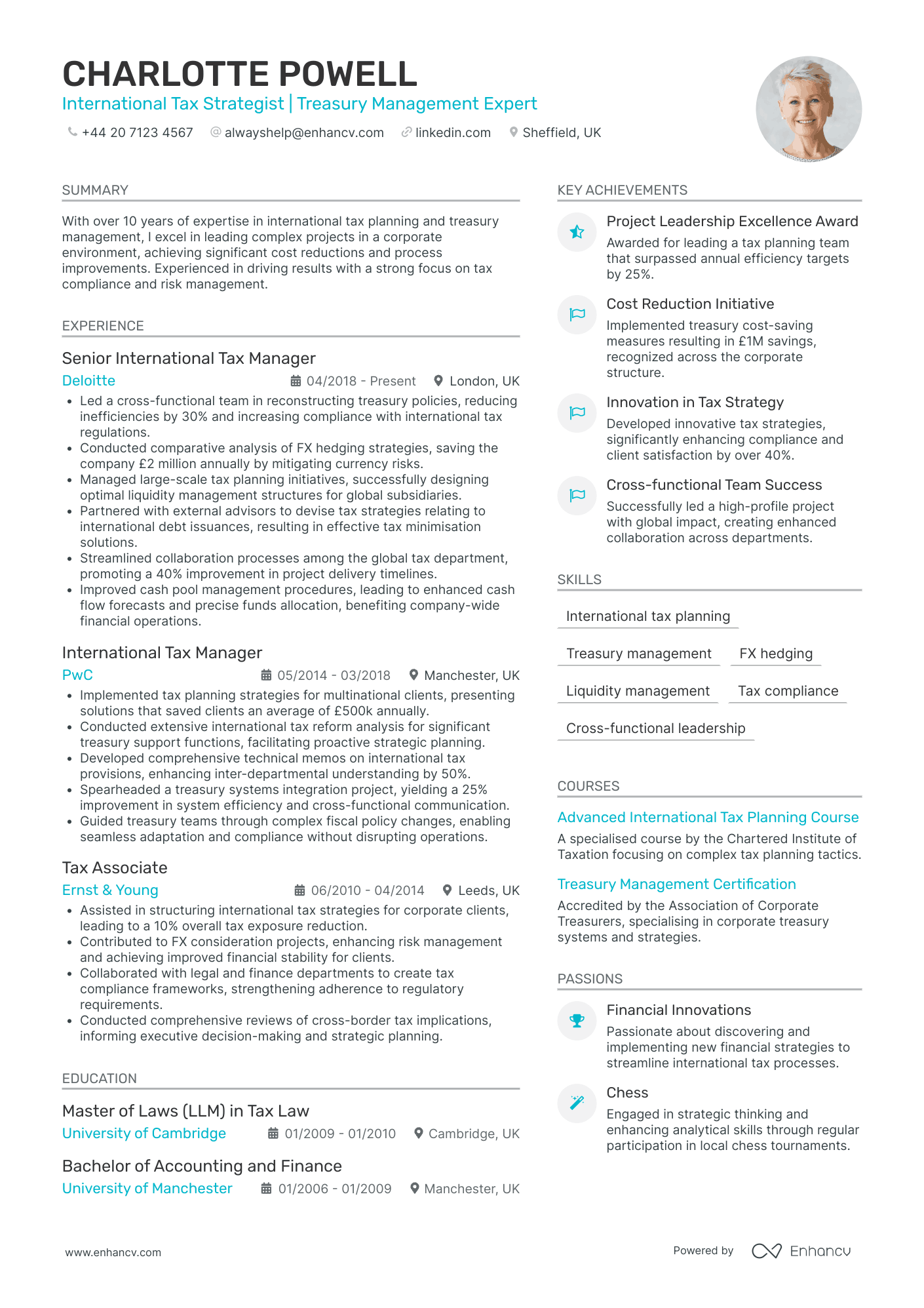

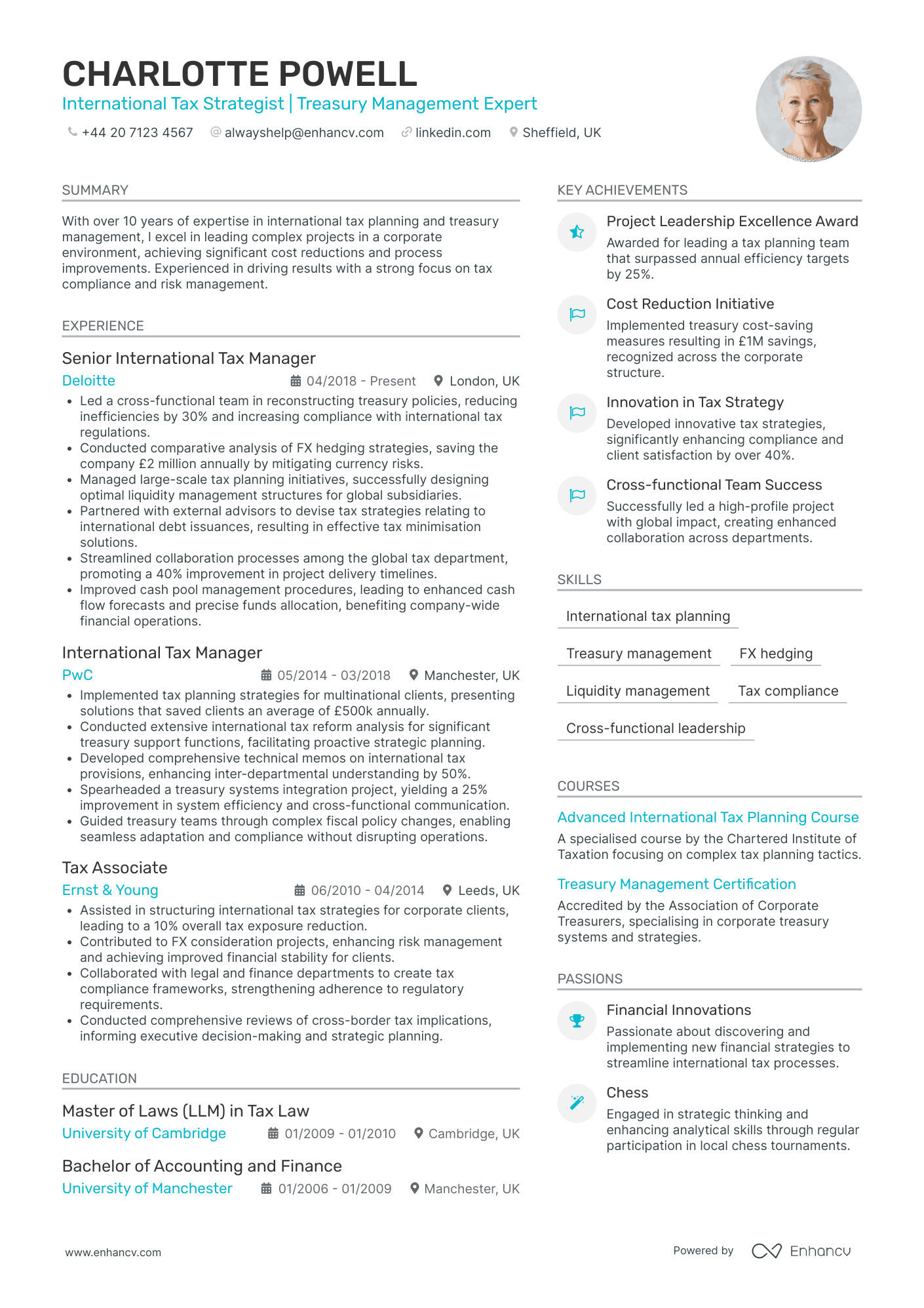

- Comprehensive Career Progression - The CV meticulously documents Charlotte Powell's advancement through reputable firms such as Ernst & Young, PwC, and Deloitte, highlighting a clear trajectory of increasing responsibility and expertise in international tax strategy and treasury management.

- Impactful Leadership and Achievements - The document effectively emphasizes high-impact accomplishments, such as leading projects that systematically enhanced project delivery timelines by 40% and secured £2 million in annual savings through strategic FX hedging, underscoring her effectiveness and strategic foresight.

- Focus on Cross-functional Collaboration - By detailing efforts to streamline collaboration processes and improve cross-functional communication through treasury systems integration, the CV underscores Powell's ability to foster teamwork and drive collective success across diverse corporate environments.

Financial Advisor for Education Planning

- Content presentation and clarity - The CV is structured with clearly defined sections that offer a concise overview of Sophia's professional journey. Each section is thoughtfully crafted, with bullet points that succinctly showcase her achievements and responsibilities, making it easy for potential employers to quickly understand her qualifications and the value she brings.

- Career trajectory and growth - Sophia's career progression from Financial Analyst to Senior Manager demonstrates a clear upward trajectory, highlighting her ability to take on increased responsibilities and leadership roles over time. Her transitions within leading fintech companies reflect adaptability and a commitment to excellence in the finance industry.

- Achievements and impact - The CV emphasizes Sophia's tangible contributions to business growth, such as a 20% revenue increase and a significant improvement in unit economics. These achievements not only highlight her strategic financial acumen but also underscore her capacity to drive meaningful business outcomes and support corporate objectives through data-driven decision-making.

Financial Advisor for Risk Management

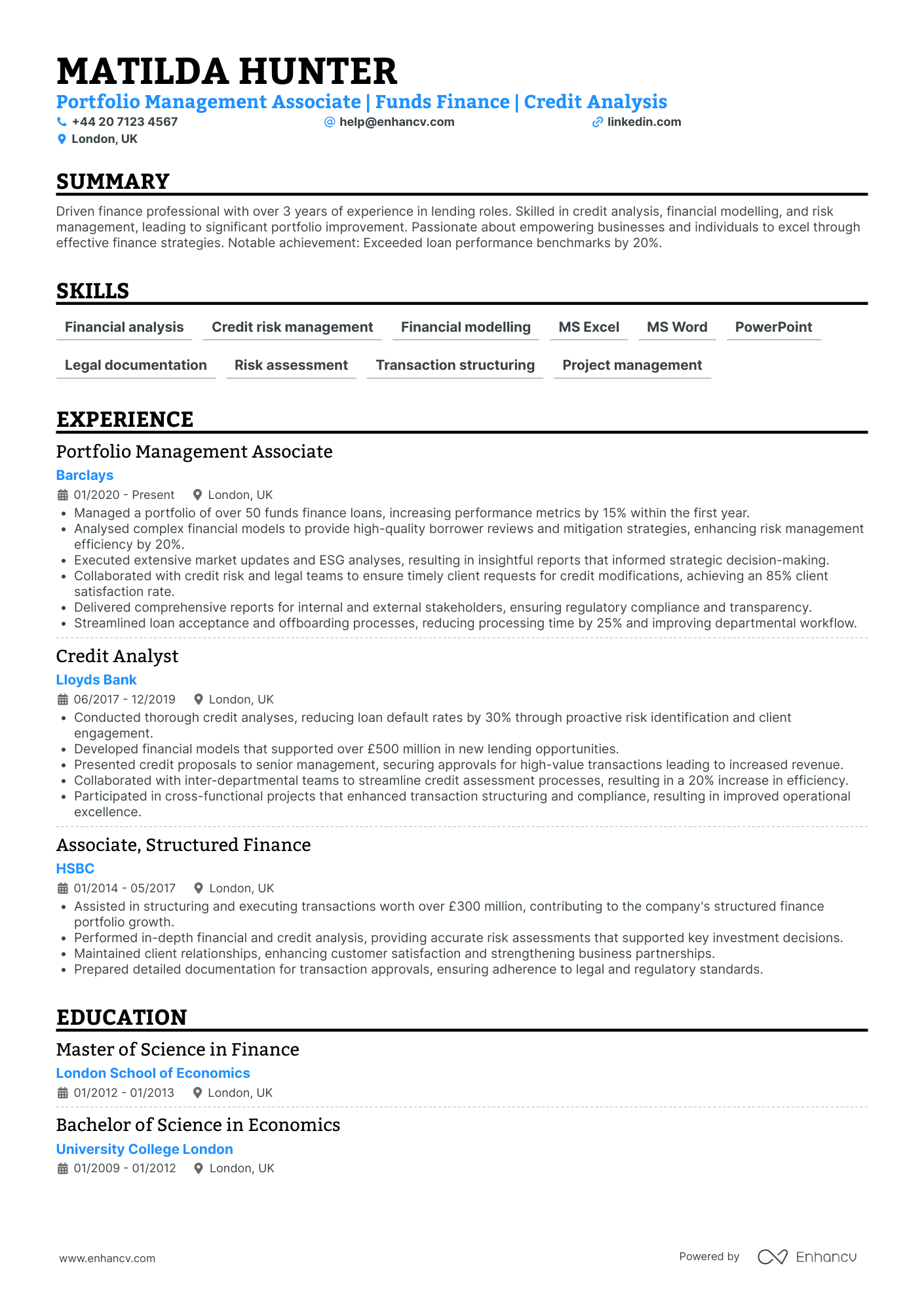

- Effective Content Presentation - The CV is structured in a clear and concise manner, showcasing the candidate’s relevant skills and experience without overwhelming the reader. It uses bullet points to highlight accomplishments and key responsibilities, making it easy to digest and focused on results.

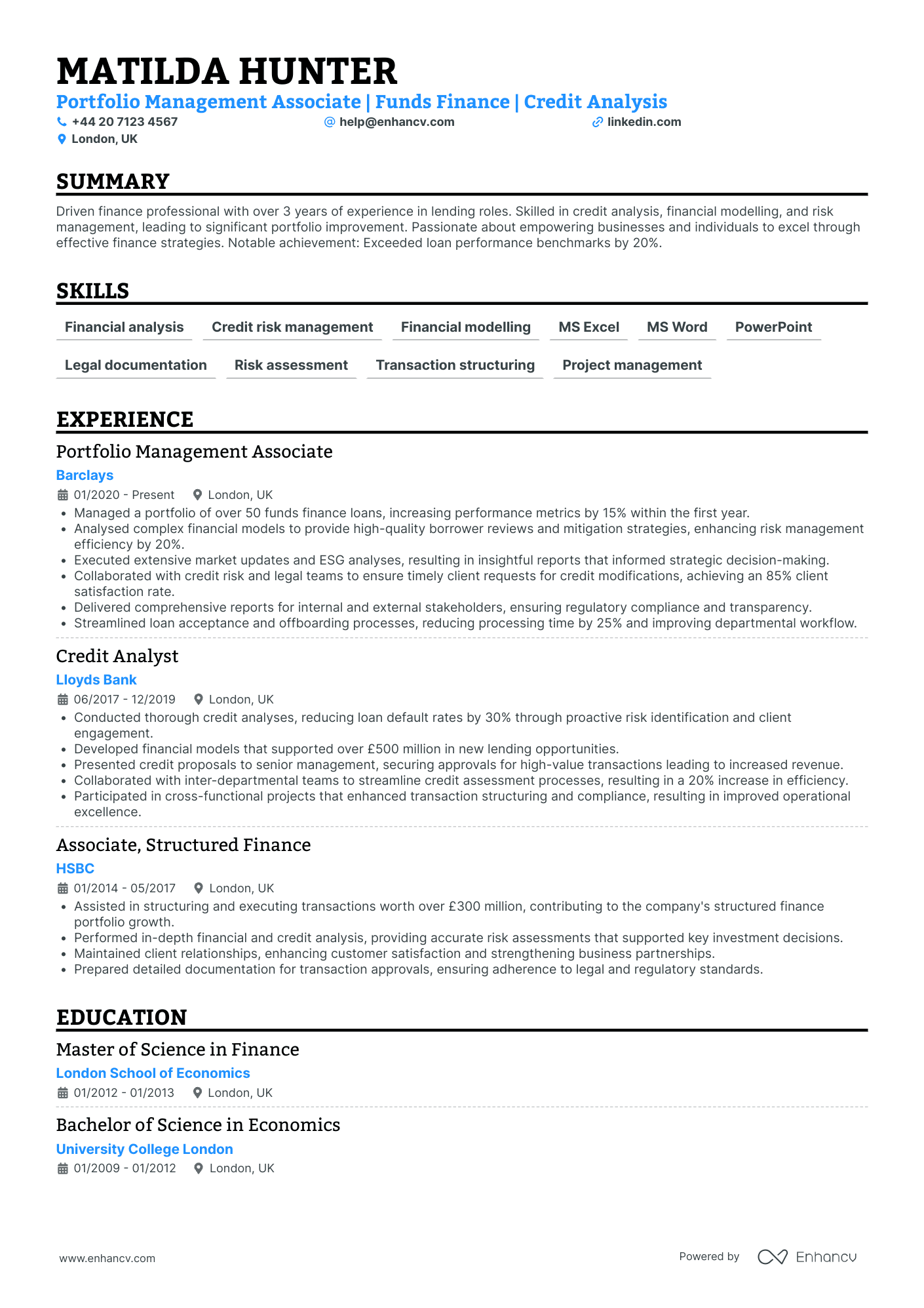

- Growth-Oriented Career Trajectory - Matilda Hunter’s career exhibits significant growth, with a progression from Associate roles at HSBC and Lloyds Bank to a Portfolio Management Associate position at Barclays. This upward trajectory highlights her expanding expertise and the increasing complexity of the responsibilities she manages.

- Emphasis on Achievements and Impact - The CV goes beyond listing duties by emphasizing achievements that had a tangible business impact. For example, reducing loan default rates by 30% and increasing loan performance metrics by 20% were key contributions that benefitted the organizations she worked with.

Financial Advisor for Insurance Planning

- Structured and concise presentation - Olivia Turner's CV is well-organized, presenting information clearly and succinctly. Each section is logically structured, allowing easy navigation through her career achievements, skills, and educational background. The use of bullet points under experience ensures that key details and accomplishments are highlighted for quick comprehension.

- Progressive career trajectory in healthcare finance - The CV reflects a clear career progression from a Financial Analyst at Spire Healthcare to a Senior Finance Business Partner at BMI Healthcare. This career advancement within the healthcare industry showcases her growing responsibilities, culminating in a role that integrates strategic financial planning with leadership, enhancing departmental efficiency and profitability.

- Impactful achievements with strategic focus - Olivia’s CV highlights substantial accomplishments that align financial insights with business goals. Her achievements include a notable 25% increase in profitability and securing £1.2 million in capital funds. These results underscore her ability to leverage financial analysis to drive strategic initiatives and operational improvements within the healthcare sector.

Structuring your financial advisor CV layout: four factors to keep in mind

There are plenty of best practices out there for your CV layout and design. At the end of the day, a clear format and concise CV message should be your top priority. Use your CV design to enhance separate sections, bringing them to the forefront of recruiters' attention. At the same time, you can write content that:

- Follows the reverse chronological order in the experience section by first listing your most recent jobs;

- Incorporates your contact information in the header, but do skip out on the CV photo for roles in the UK;

- Is spotlighted in the most important sections of your CV, e.g. the summary or objective, experience, education, etc. to show just how you meet the job requirements;

- Is no longer than two-pages. Often, the one-page format can be optimal for your financial advisor CV.

Before submitting your CV, you may wonder whether to export it in Doc or PDF. With the PDF format, your information and layout stay intact. This is quite useful when your CV is assessed by the Applicant Tracker System (or the ATS) . The ATS is a software that scans your profile for all relevant information and can easily understand latest study on the ATS , which looks at your CV columns, design, and so much more.

PRO TIP

For certain fields, consider including infographics or visual elements to represent skills or achievements, but ensure they are simple, professional, and enhance rather than clutter the information.

The top sections on a financial advisor CV

- Objective statement showcasing the candidate’s career goal, it engages the recruiter.

- Relevant financial certifications, essential for establishing credibility in the field.

- Professional experience with detailed achievements, demonstrating skills and successes.

- Education background with relevant finance degrees, proving theoretical knowledge.

- Key skills section featuring financial analysis and client management, tailored to the role.

What recruiters value on your CV:

- Highlight your certifications such as CFA, CFP, or other relevant financial planning qualifications to immediately establish credibility and professional expertise.

- Emphasise your client management skills, showcasing your ability to build and maintain relationships, as well as tailor financial advice to diverse client needs.

- Detail your proficiency with financial planning software and tools, including any experience with CRM systems, investment analysis, and portfolio management platforms specific to a financial advisor’s role.

- Quantify your achievements, such as assets under management or growth percentages, to provide concrete evidence of your financial acumen and success in advising clients.

- Include any specialised knowledge or expertise in areas such as retirement planning, estate planning, tax strategies or specific market segments, to stand out and demonstrate depth in financial advisory services.

Recommended reads:

How to present your contact details and job keywords in your financial advisor CV header

Located at the top of your financial advisor CV, the header presents recruiters with your key personal information, headline, and professional photo. When creating your CV header, include your:

- Contact details - avoid listing your work email or telephone number and, also, email addresses that sound unprofessional (e.g. koolKittyCat$3@gmail.com is definitely a big no);

- Headline - it should be relevant, concise, and specific to the role you're applying for, integrating keywords and action verbs;

- Photo - instead of including a photograph from your family reunion, select one that shows you in a more professional light. It's also good to note that in some countries (e.g. the UK and US), it's best to avoid photos on your CV as they may serve as bias.

What do other industry professionals include in their CV header? Make sure to check out the next bit of your guide to see real-life examples:

Examples of good CV headlines for financial advisor:

- Chartered Financial Planner | Wealth Management Specialist | CFPCM with 10+ Years' Experience

- Senior Investment Advisor | Portfolio Strategy Expert | CFA Level III Candidate | 15 Years' Experience

- Financial Consultant | Pensions & Retirement Planning | FCA Compliant | 8 Years in Finance

- Junior Financial Analyst | Data-Driven Investment Insights | MSc Finance | Recently Qualified

- Wealth Management Associate | High-Net-Worth Client Focus | CertPFS | 5 Years' Experience

- Lead Financial Strategist | Global Markets & Asset Allocation | MBA | 20+ Years' Industry Expertise

Your financial advisor CV introduction: selecting between a summary and an objective

financial advisor candidates often wonder how to start writing their resumes. More specifically, how exactly can they use their opening statements to build a connection with recruiters, showcase their relevant skills, and spotlight job alignment. A tricky situation, we know. When crafting you financial advisor CV select between:

- A summary - to show an overview of your career so far, including your most significant achievements.

- An objective - to show a conscise overview of your career dreams and aspirations.

Find out more examples and ultimately, decide which type of opening statement will fit your profile in the next section of our guide:

CV summaries for a financial advisor job:

- With over a decade of experience in the financial sector, I have honed my expertise in portfolio management, achieving a 20% average client ROI. My specialisation in behavioural finance has allowed me to tailor strategies to individual client needs, resulting in a proven track record of client retention and satisfaction.

- Certified Financial Planner with 15 years of experience in wealth management and estate planning for high-net-worth individuals. Possessing advanced knowledge in tax strategies and investments, I successfully grew a client base by 150% through diligent financial advisory and personalised service offerings.

- Former senior accountant with 8 years of comprehensive experience in corporate finance, transitioning into financial advising. My strong analytical skills and meticulous attention to detail have driven successful budget overhauls saving firms upwards of £1M annually, showcasing my capability to provide valuable financial insights and advice.

- As a seasoned real estate agent with a 7-year record of exceeding sales quotas by up to 30%, I aim to leverage my extensive client-facing experience and sales acumen to transition into the financial advising sector. My adeptness at building relationships and nuanced understanding of market dynamics inform my client-centric advisory approach.

- Eager to embark upon a new professional journey in financial advisement, I bring a fresh perspective complemented by a Bachelor’s degree in Finance and an unwavering commitment to continuous learning. I bring passion for helping individuals achieve their financial goals through evidence-based advice and strategic planning.

- A recent finance graduate with honours, I am enthusiastic about starting my career in financial advising. With internship experience at a leading investment firm, I gained practical knowledge of market trends and portfolio management, and I am eager to apply my strong analytical and communication skills to help clients navigate their financial futures.

The best formula for your financial advisor CV experience section

The CV experience section is the space where many candidates go wrong by merely listing their work history and duties. Don't do that. Instead, use the job description to better understand what matters most for the role and integrate these keywords across your CV. Thus, you should focus on:

- showcasing your accomplishments to hint that you're results-oriented;

- highlighting your skill set by integrating job keywords, technologies, and transferrable skills in your experience bullets;

- listing your roles in reverse chronological order, starting with the latest and most senior, to hint at how you have grown your career;

- featuring metrics, in the form of percentage, numbers, etc. to make your success more tangible.

When writing each experience bullet, start with a strong, actionable verb, then follow it up with a skill, accomplishment, or metric. Use these professional examples to perfect your CV experience section:

Best practices for your CV's work experience section

- Developed personalised investment strategies for over 100 clients, considering their financial goals and risk tolerance, leading to a 25% average client portfolio growth over 3 years.

- Conducted comprehensive market analysis to inform asset allocation for client portfolios, resulting in outperformance of benchmark indices by an average of 8% annually.

- Successfully grew the client base by 40% through networking and referral incentives, demonstrating strong client relationship management and sales skills.

- Provided regular, detailed financial planning reports and investment performance updates to clients, ensuring high satisfaction levels and retention rates.

- Implemented tax-efficient investment solutions, saving clients an average of 15% in tax liabilities and boosting their net investment returns.

- Regularly attended professional development seminars and completed a certified course on ethical investing, staying ahead in industry trends and regulatory compliance.

- Utilised advanced financial planning software to create simulations and forecasts, helping clients visualise potential outcomes and make informed decisions.

- Maintained a deep understanding of securities regulation and compliance, successfully navigating audits with zero compliance breaches over a 5-year period.

- Collaborated with estate lawyers and tax professionals to offer integrated wealth management services, which increased client assets under management by 30% due to enhanced service offerings.

- Developed tailored financial strategies for over 100 high-net-worth individuals, leading to a 20% increase in client investment performance.

- Initiated a risk assessment protocol that reduced client portfolio risks by 25% while optimizing for tax efficiency and compliance standards.

- Managed and grew a £50 million investment portfolio that consistently outperformed market benchmarks through strategic asset allocation.

- Spearheaded the integration of financial planning software, leading to a 30% reduction in process turnaround time for client financial plans.

- Conducted comprehensive market research to identify emerging investment opportunities, securing on average a 15% year-on-year return for client portfolios.

- Facilitated educational workshops on investment strategies for over 200 clients, greatly enhancing customer satisfaction and retention.

- Provided in-depth financial analysis and projections for startup enterprises, directly contributing to securing an average of £2 million in seed funding.

- Customized retirement planning services for a diverse range of clients, increasing their average expected retirement income by 15%.

- Actively managed asset allocations to respond to Brexit market volatility, which preserved client capital and offered growth opportunities amidst economic uncertainty.

- Pioneered a sustainable investing initiative, attracting and managing socially responsible portfolios, with £30 million in assets under management within the first year.

- Generated and implemented cost-saving tax strategies for clients leading to an average of £10,000 annual tax savings per client.

- Enhanced digital customer engagement by embracing technology platforms, which led to a 40% increase in digital interactions and client satisfaction.

- Orchestrated a client retention strategy that successfully retained 95% of the client base during the global financial crisis by re-evaluating risk profiles and adjusting investment plans.

- Developed and launched a comprehensive estate planning service, increasing the firm's revenue streams by 10%.

- Leveraged quantitative analysis to inform client portfolios, which consistently yielded above-industry-average returns.

- Managed a portfolio of technology start-ups, providing financial guidance that led to an average of 30% annual growth for client companies.

- Collaborated with the legal team to develop tax mitigation strategies for international investors, which improved their investment returns by reducing tax liabilities by up to 20%.

- Initiated and led a digital transformation project that modernized client reporting systems, enhancing transparency and trust.

- Collaborated intensively with high-tech firms to structure employee stock option plans, resulting in enhanced talent attraction and retention for client companies.

- Designed a series of fixed-income products tailored to the needs of conservative investors, which gathered £25 million in investments in the first six months.

- Implemented a mentorship programme that improved the efficiency and competencies of junior financial advisors, increasing departmental productivity by 20%.

- Executed over £200 million in trades annually, consistently achieving top quartile performance amongst peers in the wealth management division.

- Facilitated a cross-departmental collaboration to streamline the client onboarding process, significantly reducing onboarding time by 35%.

- Conducted market analyses to shape the investment strategies for the firm's flagship international equity fund, which grew 20% in value under my management.

Swapping your professional experience (when you have none) with skills and more

Never underestimate the importance of relevancе when it comes to your financial advisor CV. Even if you don't happen to have much or any standard (full-time contract) professional experience, this doesn't mean you shouldn't apply for the role. Instead of a bespoke CV experience section:

- Showcase more prominently any internships, part-time roles, and volunteer experience that are applicable to the role and have taught you job-crucial skills;

- Feature a strengths or achievements section with your transferrable skills or talents you've obtained thanks to your work or life experience;

- Write an objective statement that clearly outlines your values as a candidate and defines your career ambitions;

- List your education or certificates that match the job profile closer to the top of your CV.

Recommended reads:

PRO TIP

Include examples of how you adapted to new tools, environments, or work cultures, showing your flexibility.

The CV skills' divide: between hard and soft skills

Of course, you may have read the job requirements plenty of times now, but it's key to note that there is a difference between technical and personal skills. Both are equally relevant to your job application. When writing about your skill set, ensure you've copy-pasted the precise skill from the job requirement. This would not only help you ensure you have the correct spelling, but also pass any Applicant Tracker System (ATS) assessments.

- Hard skills show your technological capabilities. Or whether you'll be a good technical fit to the organisation. Ensure you've spotlighted your hard skills in various sections of your CV (e.g. skills section, projects, experience) by including the technology and what you've attained;

- Soft skills pinpoint your personality and people or communication skills, hinting at if you'll easily accomodate into the team or organisation. Quantify your soft skills in your CV achievements, strengths, summary/objective, and experience sections. Always support your soft skills with how they've helped you grow as a professional.

Top skills for your financial advisor CV:

Financial Planning

Investment Strategies

Risk Management

Tax Planning

Portfolio Management

Wealth Management

Retirement Planning

Insurance Knowledge

Estate Planning

Regulatory Compliance

Analytical Thinking

Communication

Problem-Solving

Client Relationship Management

Attention to Detail

Negotiation

Time Management

Leadership

Adaptability

Integrity

PRO TIP

If you have received professional endorsements or recommendations for certain skills, especially on platforms like LinkedIn, mention these to add credibility.

Listing your university education and certificates on your financial advisor CV

The best proof of your technical capabilities would be your education and certifications sections. Your education should list all of your relevant university degrees, followed up by their start and completion dates. Make sure to also include the name of the university/-ies you graduated from. If you happen to have less professional experience (or you deem it would be impressive and relevant to your application), spotlight in the education section:

- that you were awarded a "First" degree;

- industry-specific coursework and projects;

- extracurricular clubs, societies, and activities.

When selecting your certificates, first ask yourself how applicable they'd be to the role. Ater your initial assessment, write the certificate and institution name. Don't miss out on including the completion date. In the below panel, we've curated relevant examples of industry-leading certificates.

PRO TIP

If you have received professional endorsements or recommendations for certain skills, especially on platforms like LinkedIn, mention these to add credibility.

Recommended reads:

Key takeaways

Your successful job application depends on how you well you have aligned your financial advisor CV to the job description and portrayed your best skills and traits. Make sure to:

- Select your CV format, so that it ensures your experience is easy to read and understand;

- Include your professional contact details and a link to your portfolio, so that recruiters can easily get in touch with you and preview your work;

- Write a CV summary if you happen to have more relevant professional experience. Meanwhile, use the objective to showcase your career dreams and ambitions;

- In your CV experience section bullets, back up your individual skills and responsibilities with tangible achievements;

- Have a healthy balance between hard and soft skills to answer the job requirements and hint at your unique professional value.