Crafting a CV that effectively highlights your meticulous attention to detail and proficiency in various accounting software can be a formidable challenge for any bookkeeper. Our guide offers you expert tips and examples to showcase your skills and experience in a way that resonates with employers, ensuring your application stands out.

- Design and format your professional bookkeeper CV;

- Curate your key contact information, skills, and achievements throughout your CV sections;

- Ensure your profile stays competitive by studying other industry-leading bookkeeper CVs;

- Create a great CV even if you happen to have less professional experience, or switching fields.

When writing your bookkeeper CV, you may need plenty of insights from hiring managers. We have prepared industry-leading advice in the form of our relevant CV guides.

Resume examples for bookkeeper

By Experience

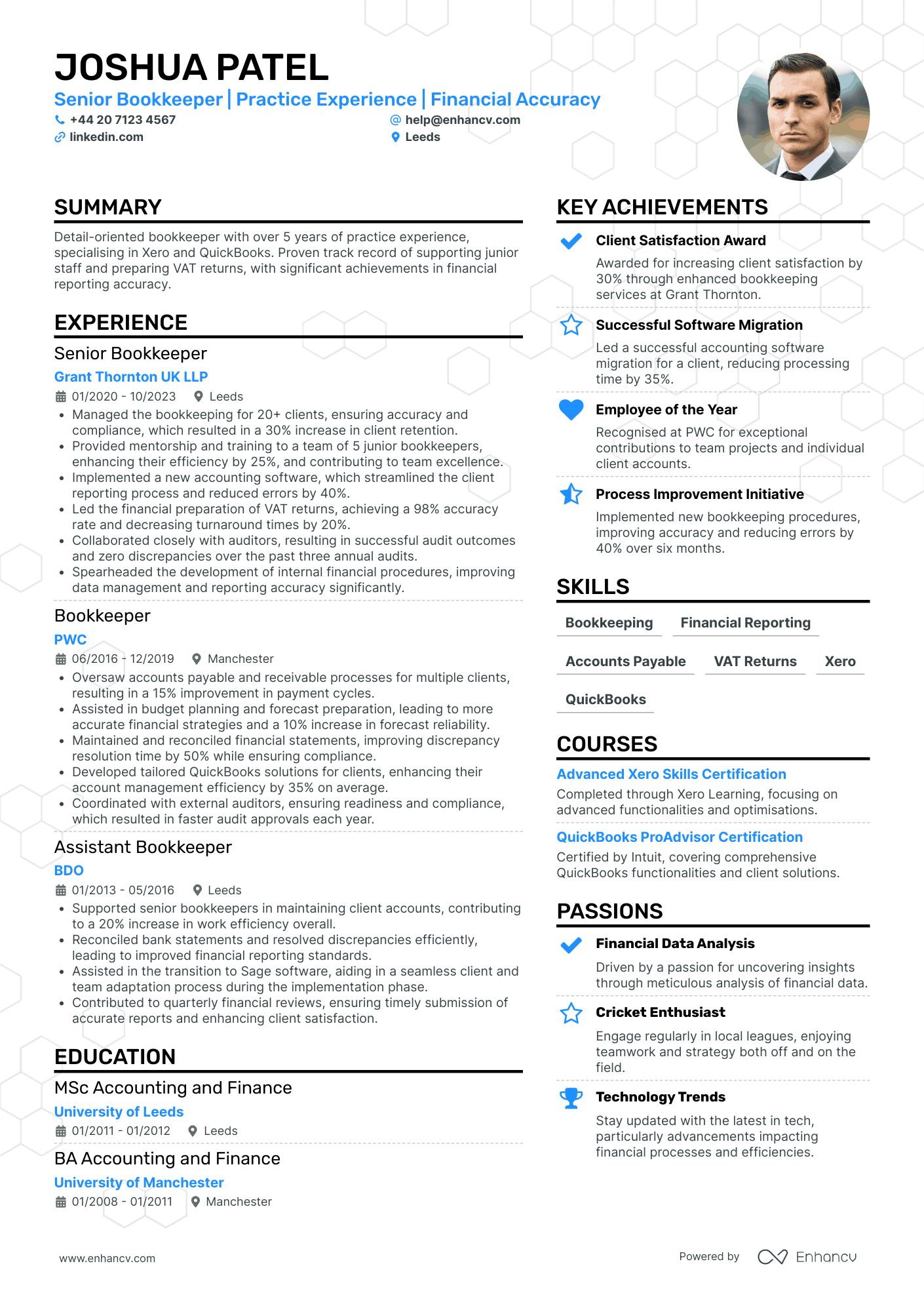

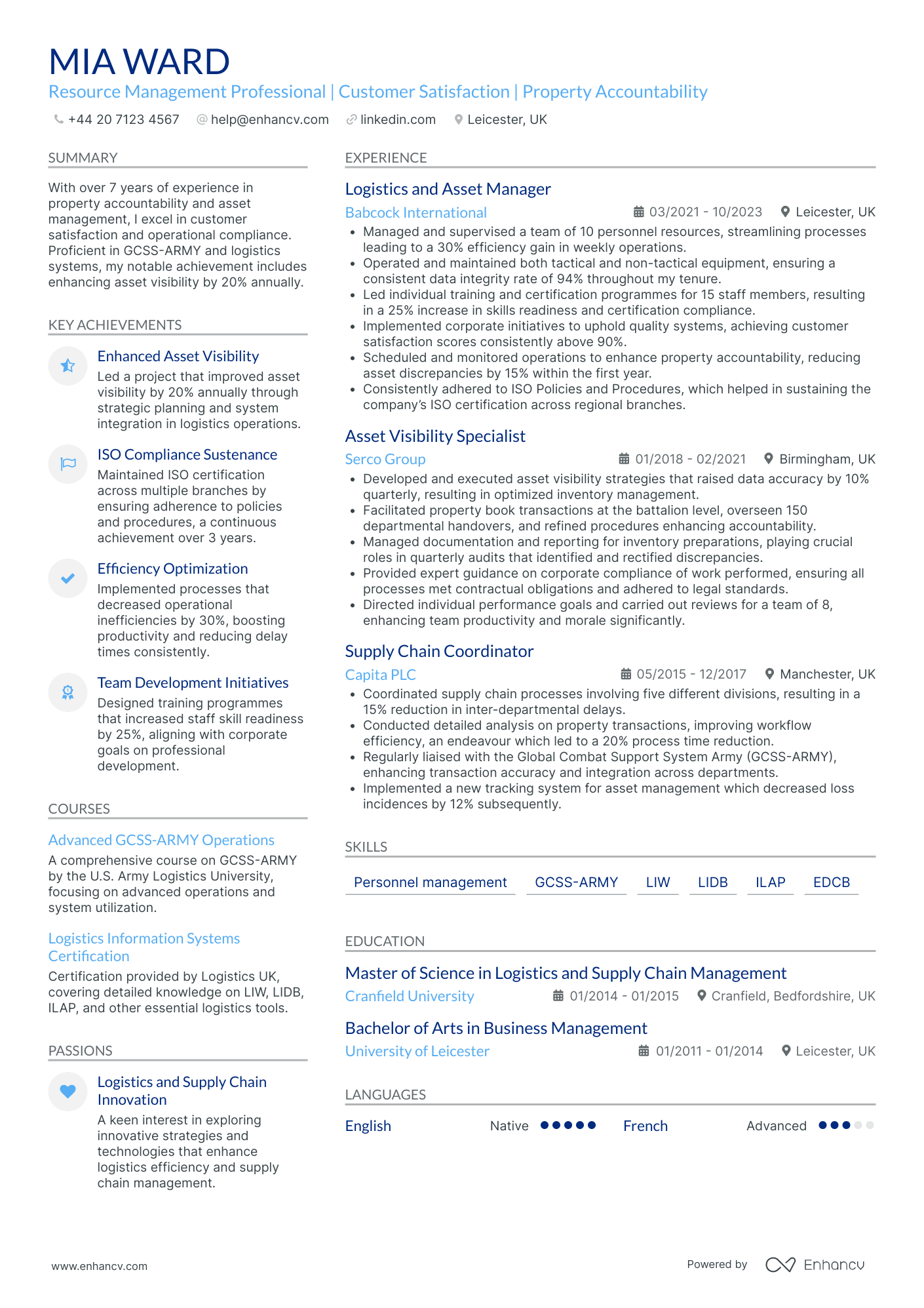

Senior Bookkeeper

- Clarity and Structured Content - The CV is well-organized with clearly marked sections, such as summary, experience, education, skills, and more, making it easy to navigate. Each section has concise bullet points that emphasize key responsibilities and achievements, providing a snapshot of the candidate's abilities and successes.

- Career Growth and Industry Experience - Joshua Patel's career trajectory shows a clear progression from Assistant Bookkeeper to Senior Bookkeeper, reflecting growth in responsibilities and expertise. His work spans well-known firms like Grant Thornton, PWC, and BDO, indicating exposure to diverse accounting environments and a strong professional background in the finance industry.

- Technical Proficiency and Software Expertise - The CV highlights specific industry tools such as Xero, QuickBooks, and Sage, demonstrating the candidate's technical depth and relevance in modern accounting practices. Certifications in advanced Xero skills and QuickBooks ProAdvisor further emphasize his expertise and commitment to staying updated with key technologies in bookkeeping.

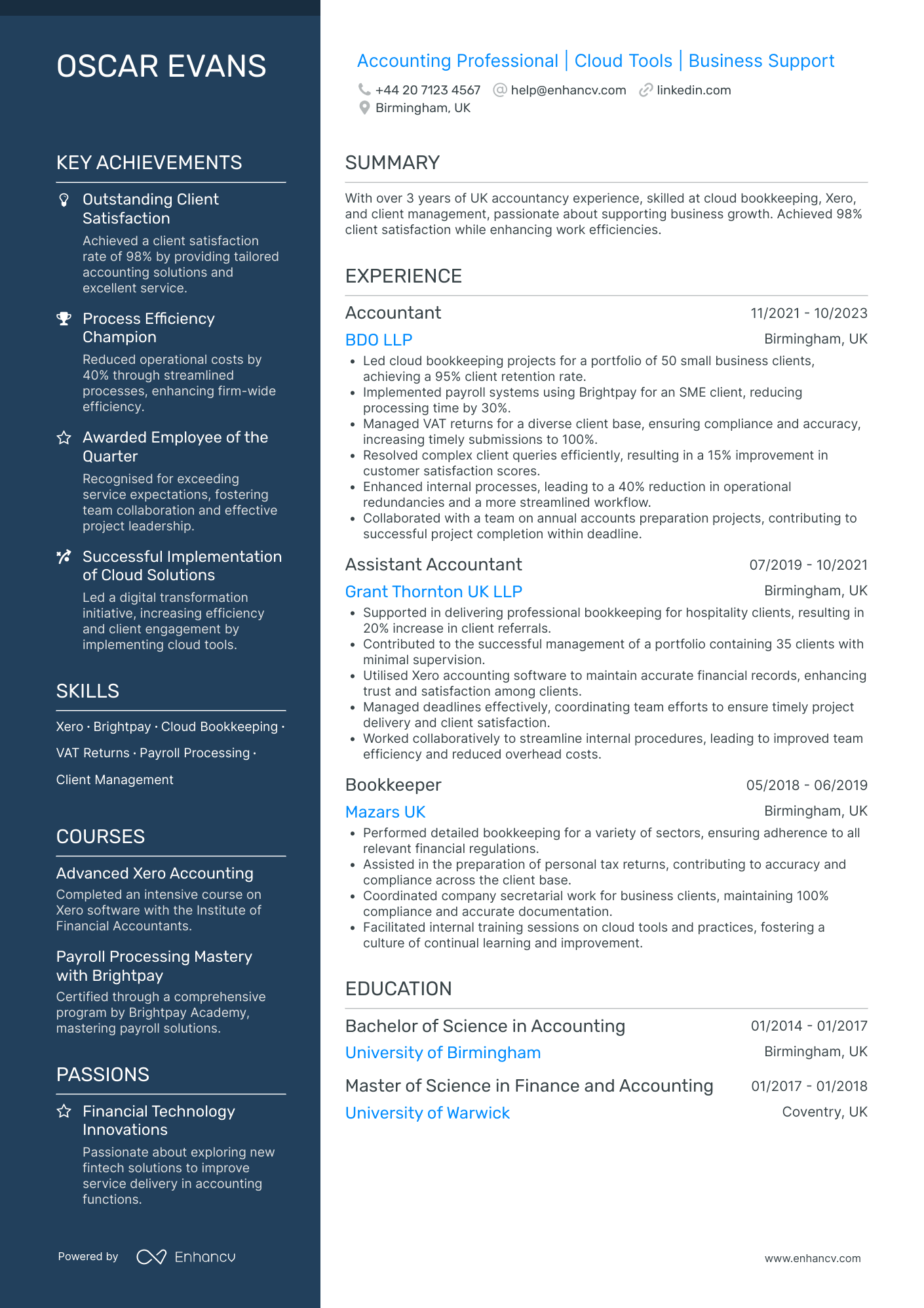

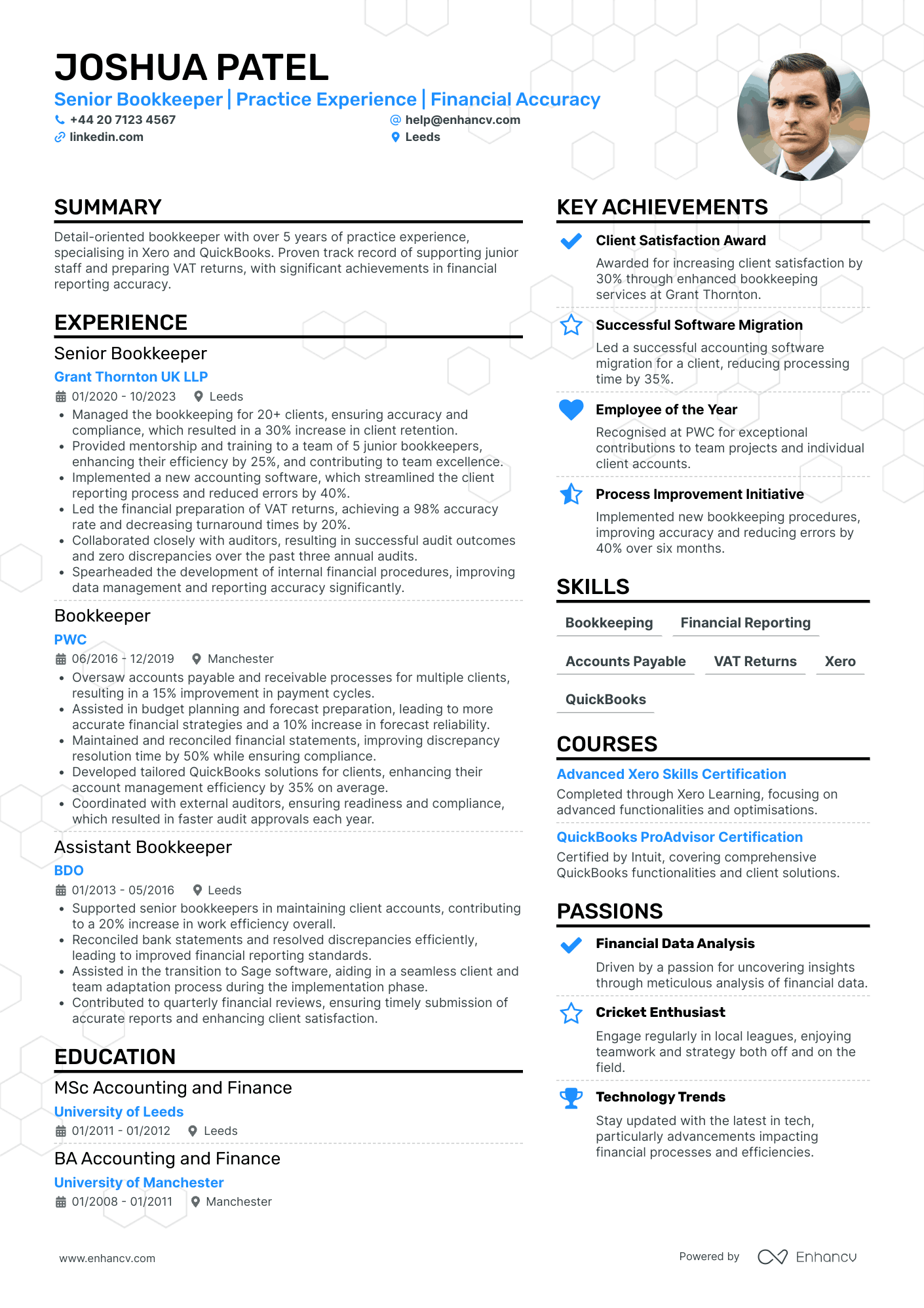

Certified Bookkeeper

- Concise and Structured Presentation - The CV exhibits clarity and brevity, structuring its content with a methodical approach. The header succinctly introduces Oscar Evans, establishing an immediate connection between his professional identity and expertise, which is further elaborated in a well-organized summary and detailed sections. Each role in the experience section follows a consistent format, making complex information easy to digest.

- Clear Career Progression - Oscar's career trajectory is marked by steady growth, showcasing a path from a Bookkeeper to an Accountant. The progression is logical, with each role building upon the previous one, highlighting increasing responsibility, from hands-on bookkeeping tasks at Mazars UK to leading projects and improving business processes at BDO LLP. His path evidences not only skill acquisition but also adaptability to meet client needs effectively.

- Impressive Use of Industry-Specific Tools - The CV prominently showcases Oscar's technical abilities with industry-standard tools such as Xero and Brightpay, demonstrating a high level of expertise in cloud bookkeeping, payroll processing, and VAT returns. His commitment to enhancing service delivery is underscored by the 'Successful Implementation of Cloud Solutions' achievement, emphasizing his role in leveraging technology to drive business growth and client engagement.

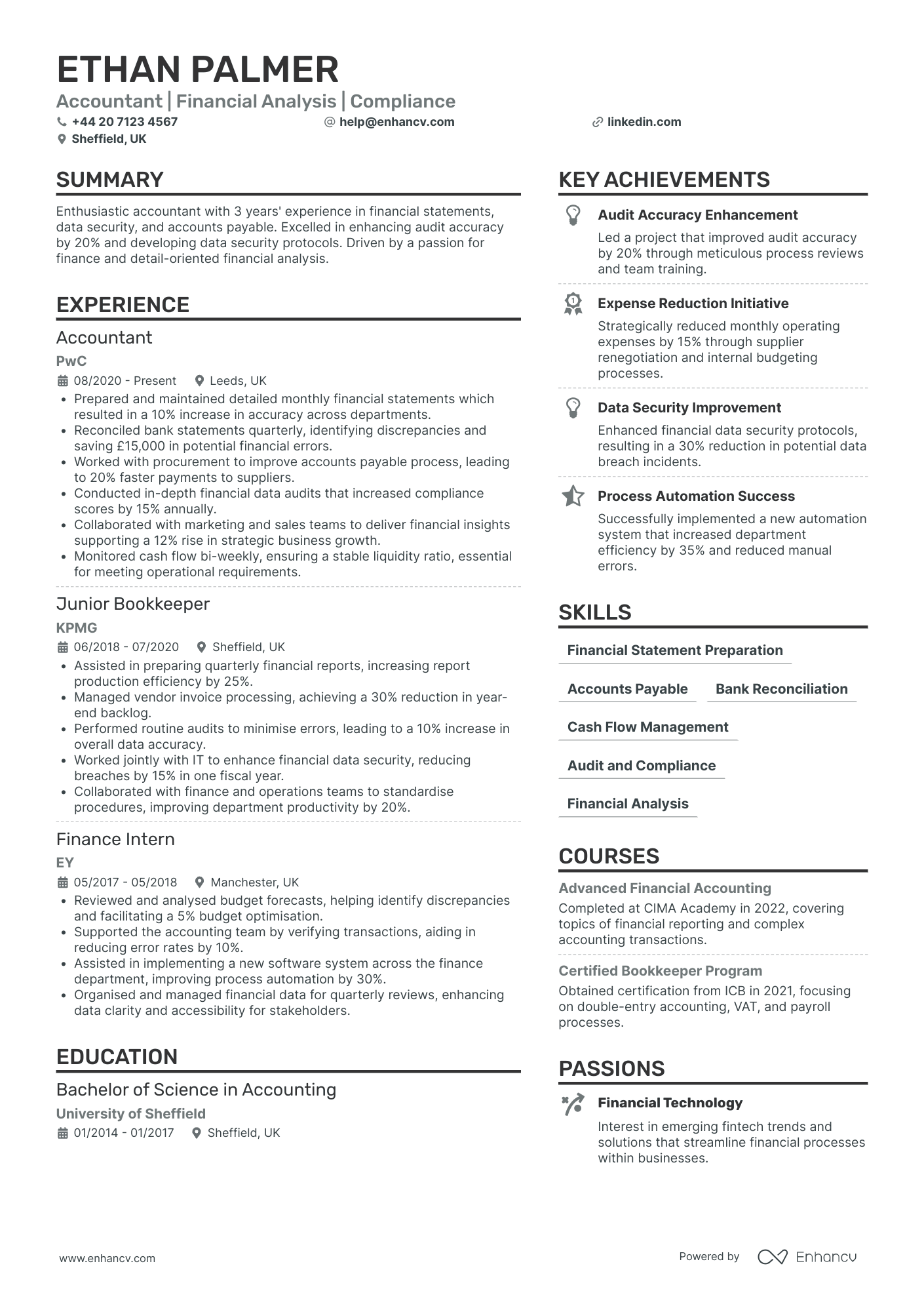

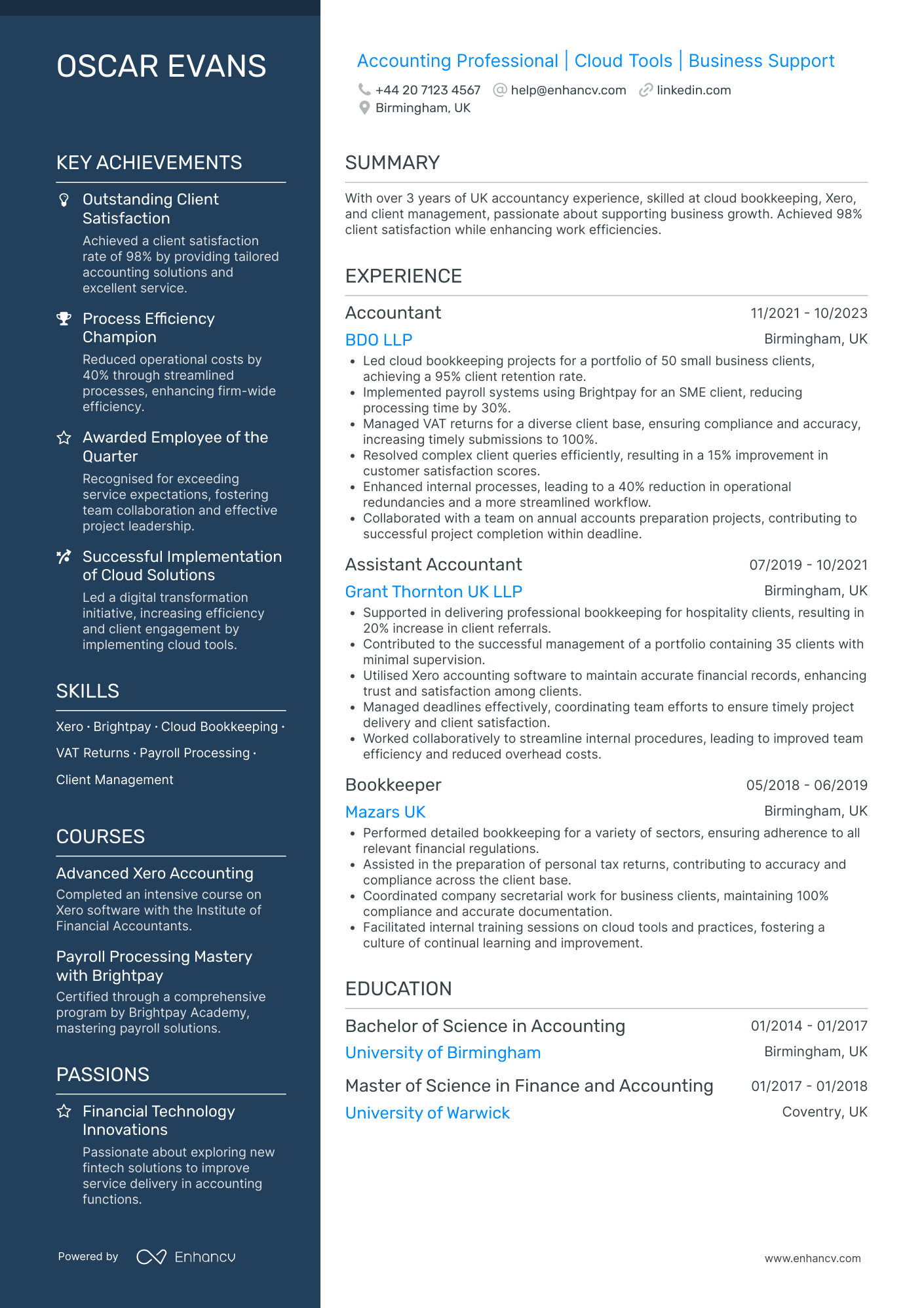

Junior Bookkeeper

- Clarity and Structure in Presentation - The CV is structured to present information logically and clearly, making it easy for recruiters to follow Ethan's career history and achievements. Key sections such as experience, education, and skills are distinctly outlined and help convey the candidate's qualifications effectively without overwhelming the reader with superfluous details.

- Career Trajectory and Growth - Ethan's career progression is noteworthy, moving from a Finance Intern to an Accountant at PwC. This trajectory demonstrates a consistent trend of growth and increasing responsibility, indicative of his capability and readiness for more senior financial roles. His time at reputable firms like EY, KPMG, and PwC showcases his solid grounding in the industry.

- Business-Relevant Achievements - The CV is compelling in its use of achievements that directly translate to business impacts. Ethan has contributed to process improvements, compliance enhancements, and cost reductions, such as saving £15,000 by identifying discrepancies and strategically reducing operating expenses by 15%. These accomplishments demonstrate his ability to deliver measurable value to an organization.

By Role

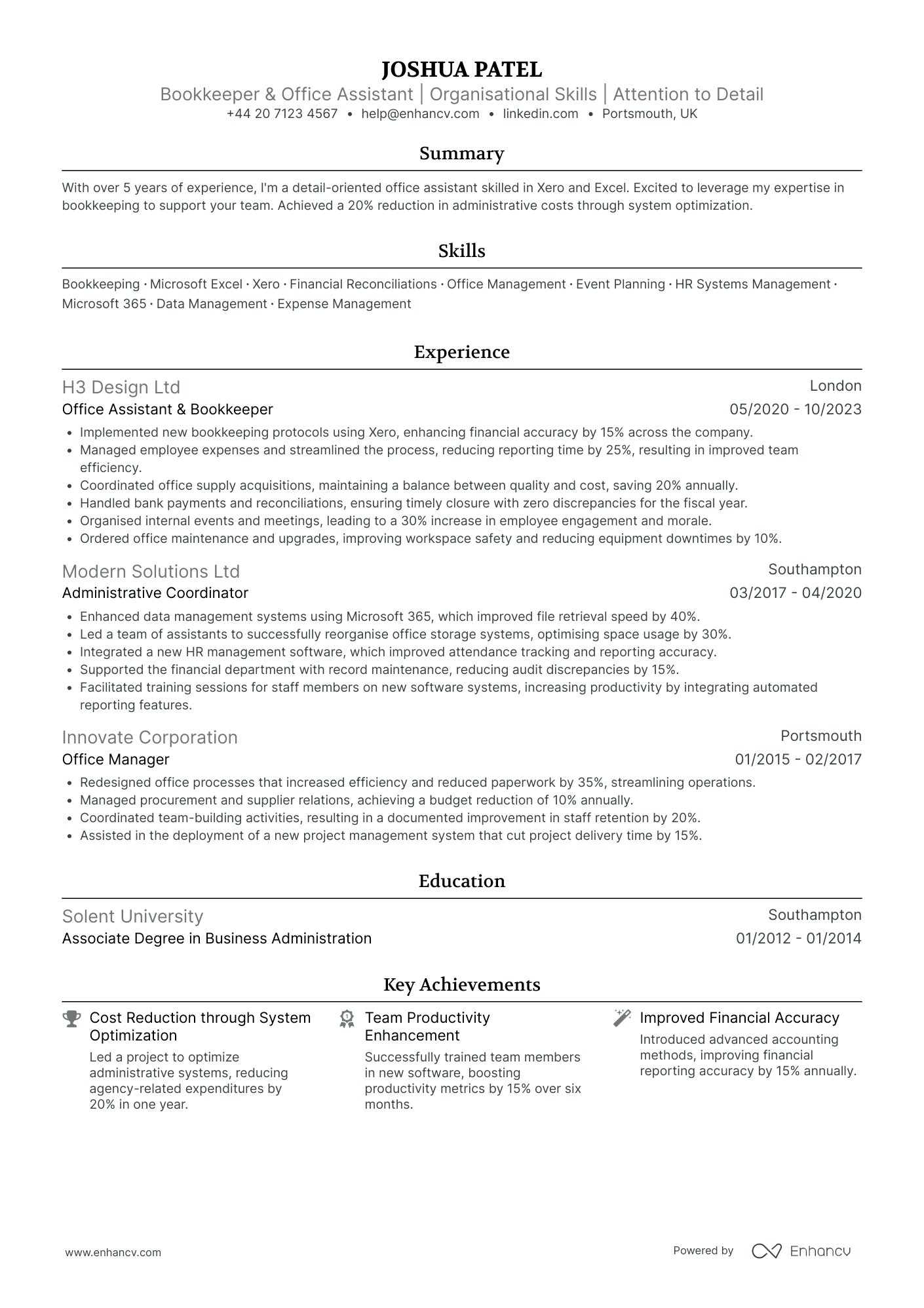

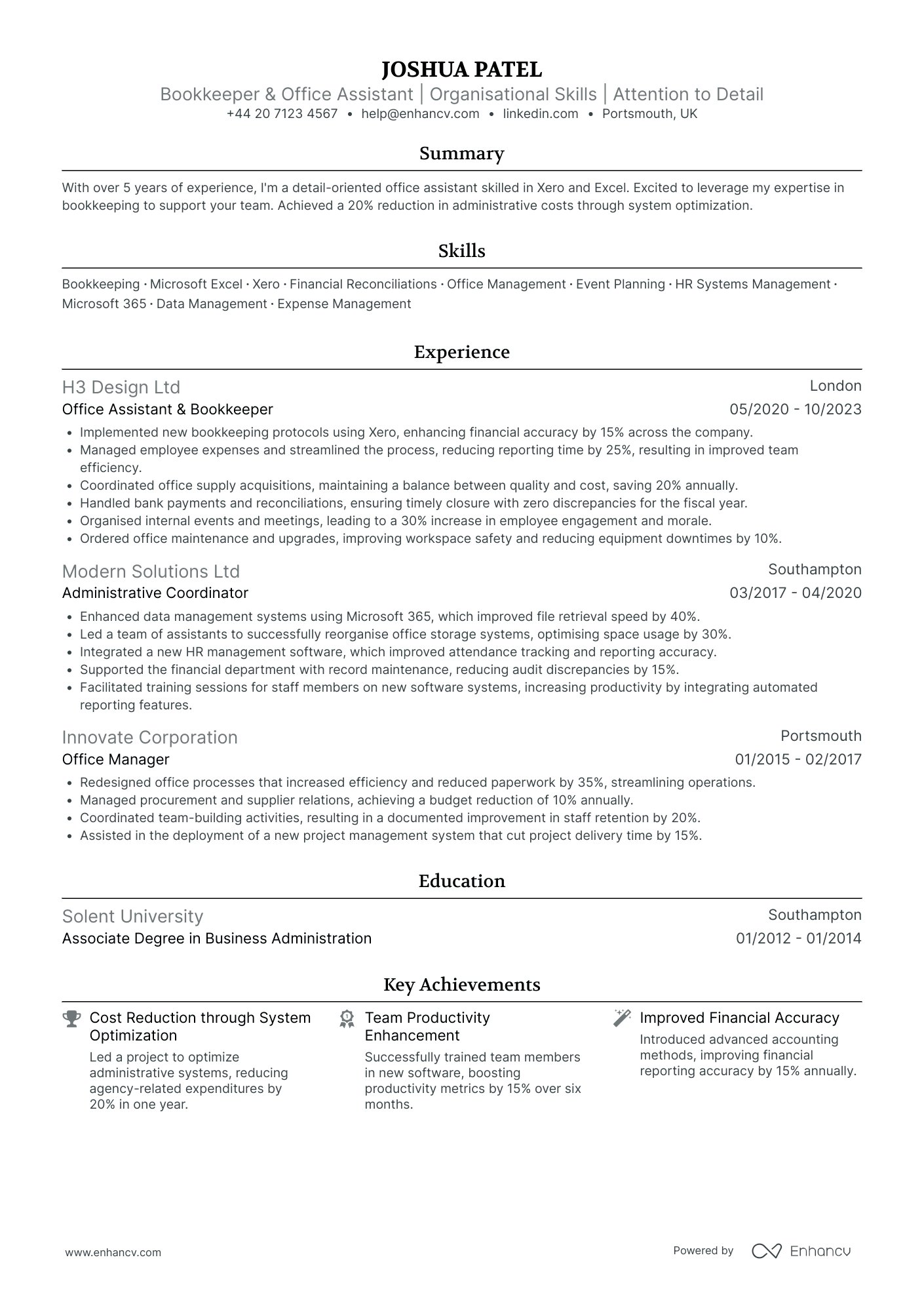

Bookkeeper Assistant

- Structured Career Progression - Joshua’s career trajectory is well-structured, demonstrating a steady rise in responsibility over time. Starting as an Office Manager and advancing to roles with more complex bookkeeping and administrative duties highlights his ability to grow and adapt in dynamic environments.

- Industry-Specific Proficiency - The CV showcases Joshua’s adeptness with industry-standard tools like Xero and Microsoft Excel, vital for bookkeeping tasks. His Xero Advisor Certification demonstrates an advanced understanding of accounting software, adding depth to his technical capabilities.

- Impactful Achievements - Joshua’s CV repeatedly highlights accomplishments with a direct impact on business success, such as cutting administrative costs by 20% through system optimization. The demonstrated improvements in financial accuracy and team productivity further underscore his ability to contribute effectively to organizational objectives.

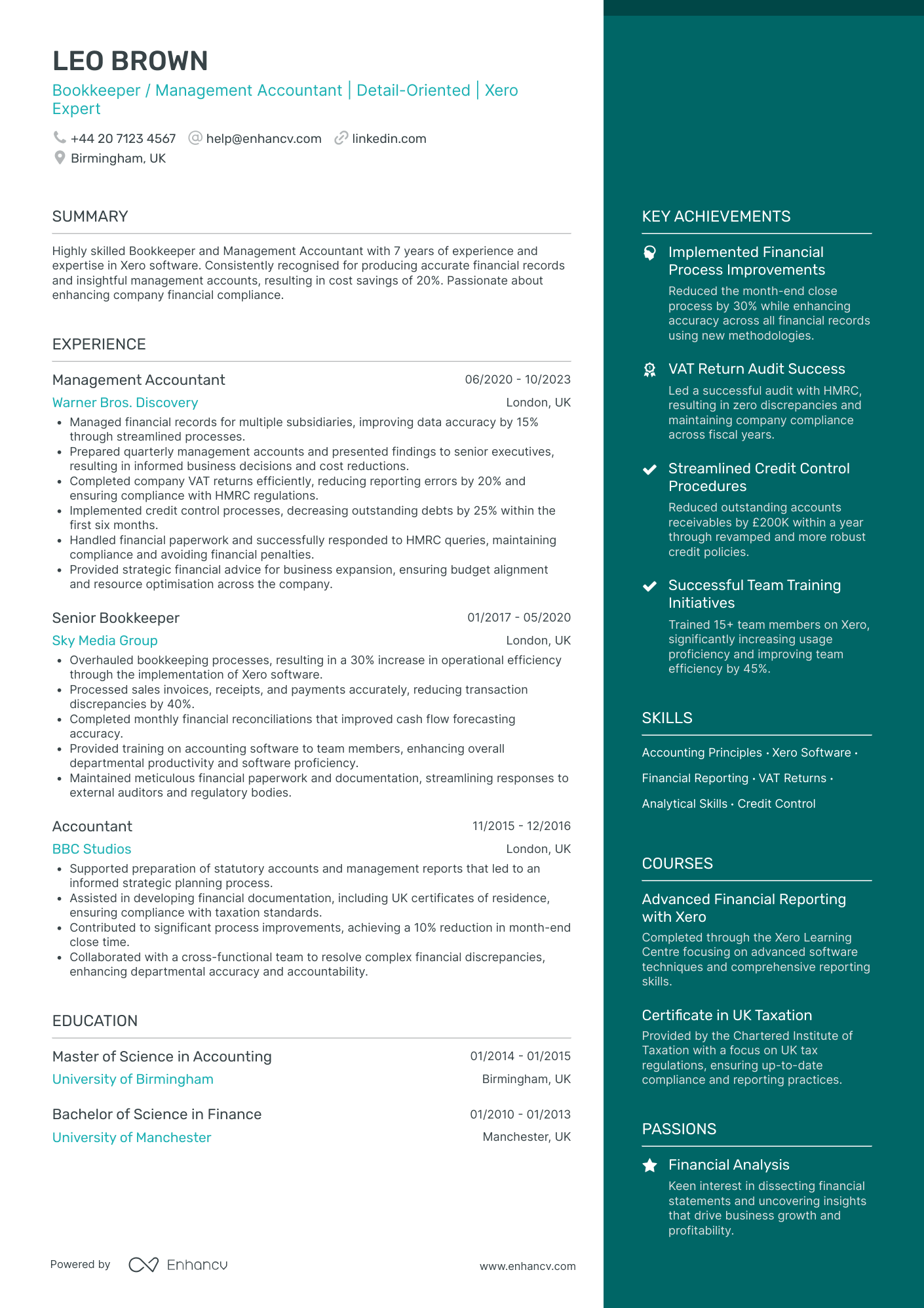

Financial Bookkeeper

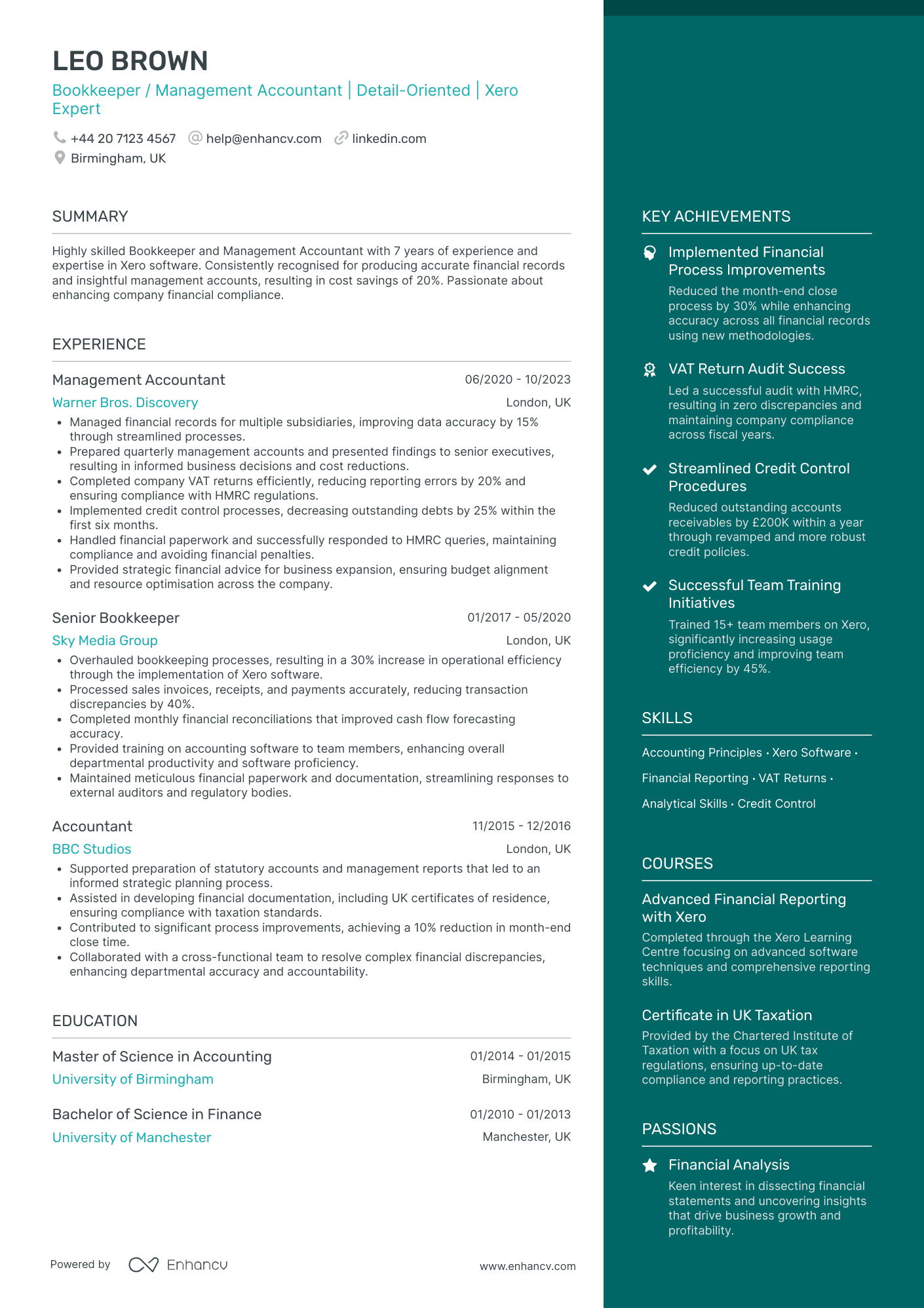

- Structured and Comprehensive Presentation - Leo Brown's CV is clearly structured with distinct sections for career experience, education, skills, courses, achievements, languages, and passions. This organization enhances readability, allowing easy navigation through key information such as professional achievements and skills, contributing to an immediate understanding of Leo's capabilities.

- Progressive Career Path in Accounting - Leo has charted a clear upward progression in his career, moving from roles in bookkeeping to more advanced positions as a Management Accountant. This trajectory showcases a steady growth in responsibility and expertise, including industry experience with prominent companies such as Warner Bros. Discovery and Sky Media Group.

- Robust Expertise in Xero Software - The CV highlights Leo's mastery of Xero software, underscored by specific achievements in implementing this tool to enhance financial processes significantly. This technical depth, augmented by advanced training, sets Leo apart as a specialist in accounting software, reflecting industry-specific proficiencies crucial for potential employers.

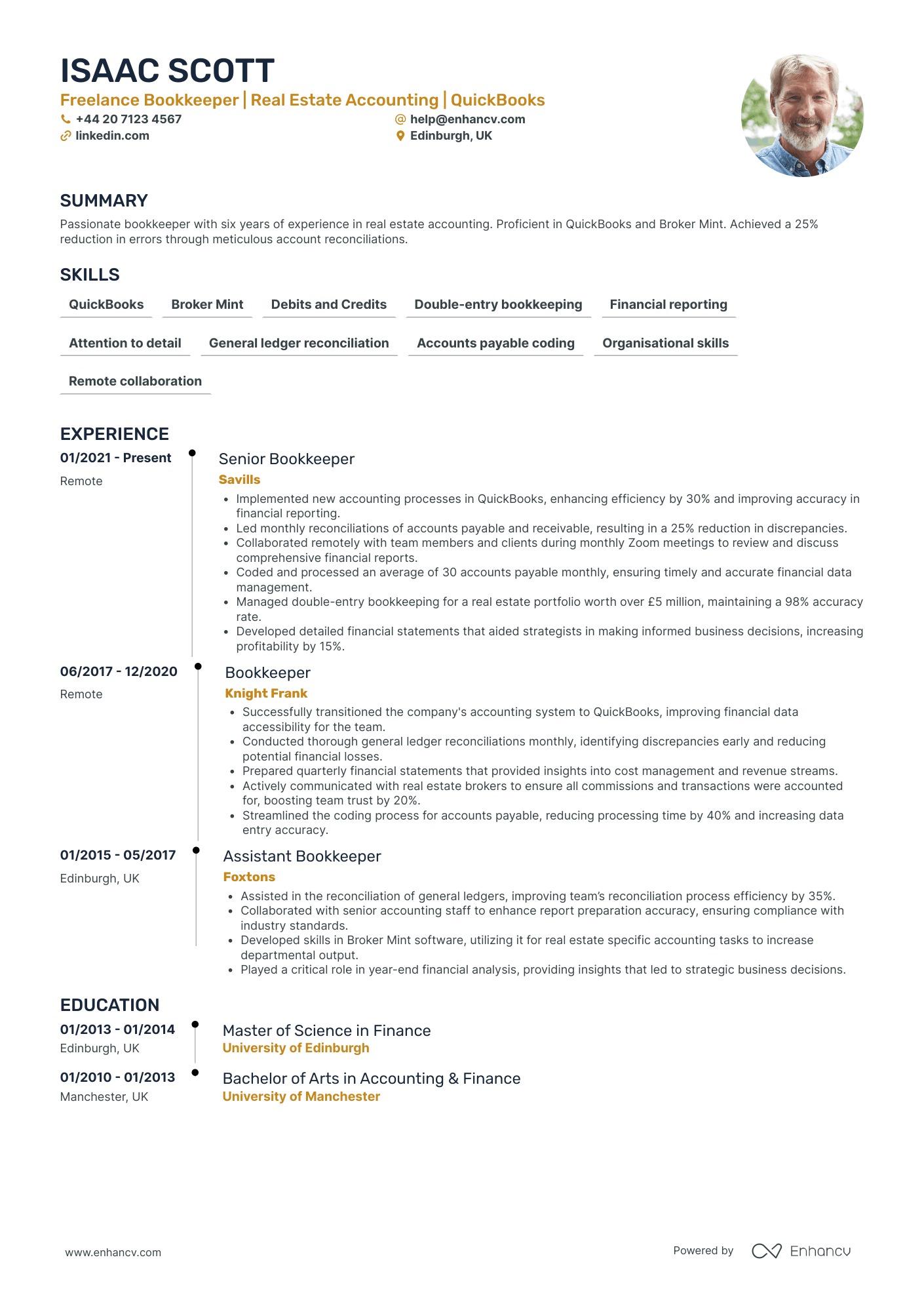

Freelance Bookkeeper

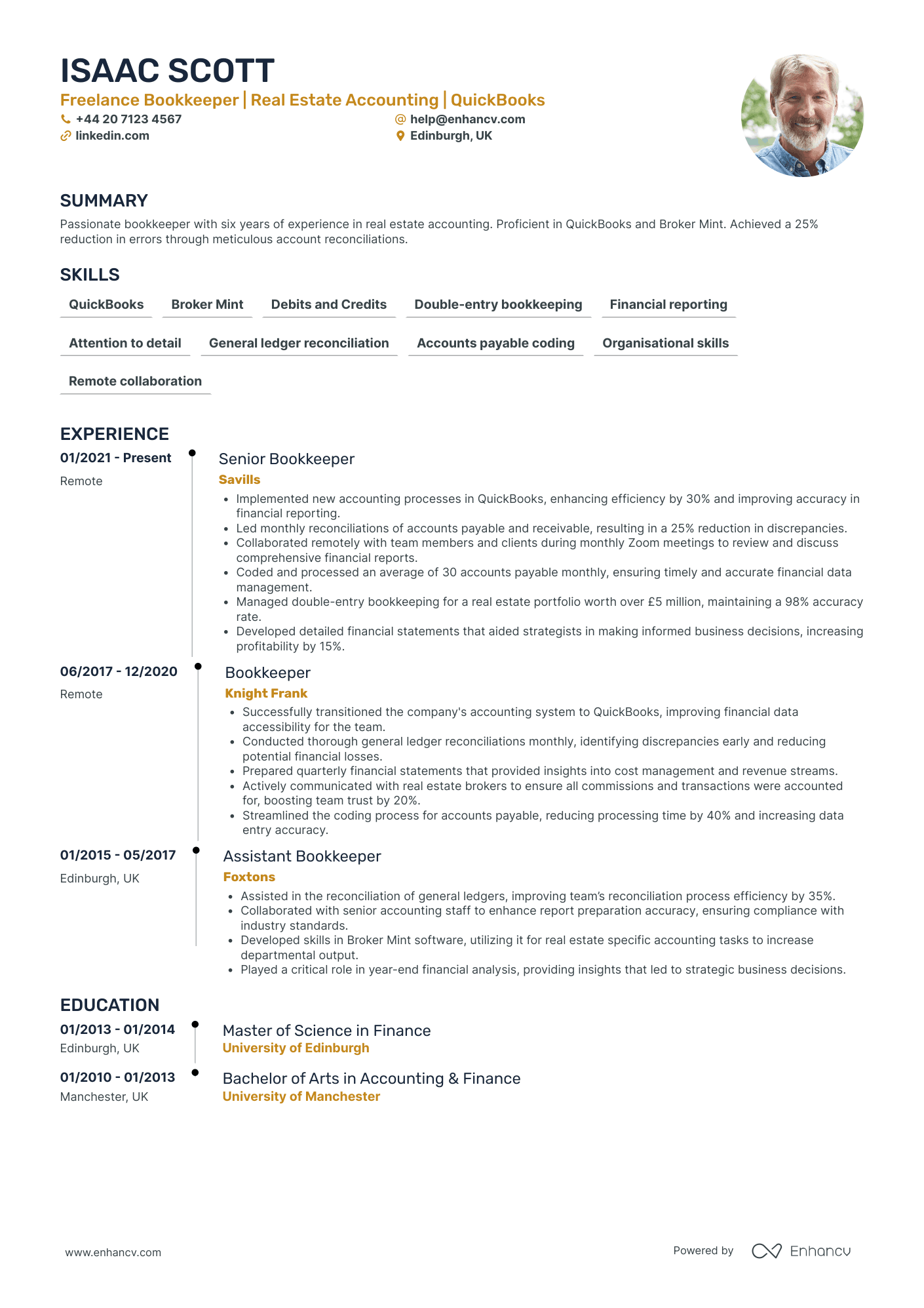

- Structured Presentation with Clear Role Segmentation - The CV is well-organized, with each section dedicated to specific aspects of the candidate's experience. This structured presentation allows for easy navigation and quick comprehension of Isaac Scott's career journey, showcasing his progression from an assistant bookkeeper to a senior role.

- Demonstrated Career Growth and Expertise in Real Estate Accounting - Isaac's career trajectory is marked by a clear progression in responsibility and depth of expertise, particularly in the real estate sector. His roles over time reflect upward mobility and specialization in real estate accounting, teaching him how to handle significant financial portfolios and complex reconciliations effectively.

- Proficiency in Specialized Accounting Tools and Processes - The CV highlights Isaac's adeptness with specific industry tools like QuickBooks and Broker Mint, proving his technical depth. These tools are crucial for his role, facilitating efficient financial data management and reporting capabilities that enhance data insight and strategic decision-making.

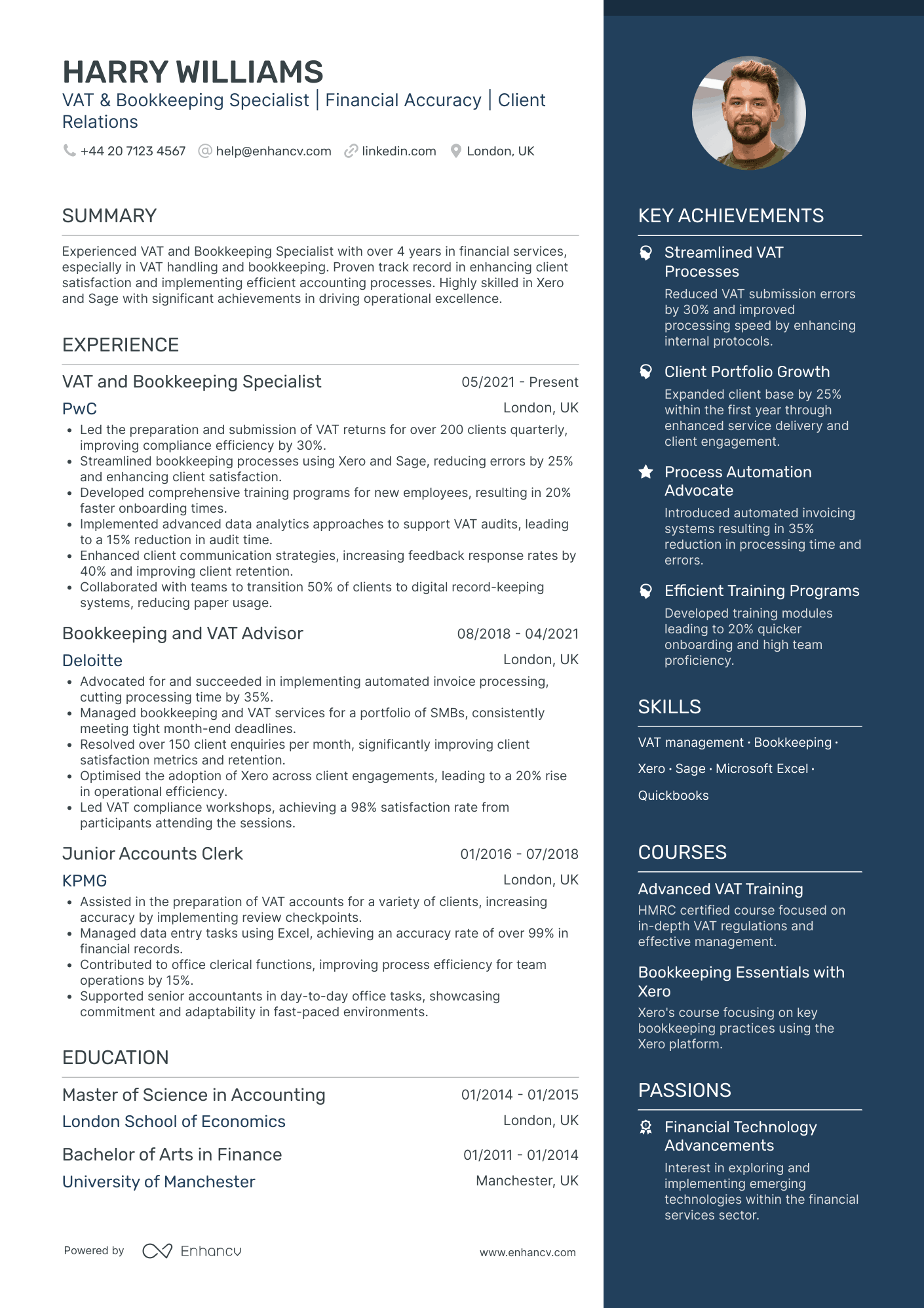

Bookkeeping Clerk

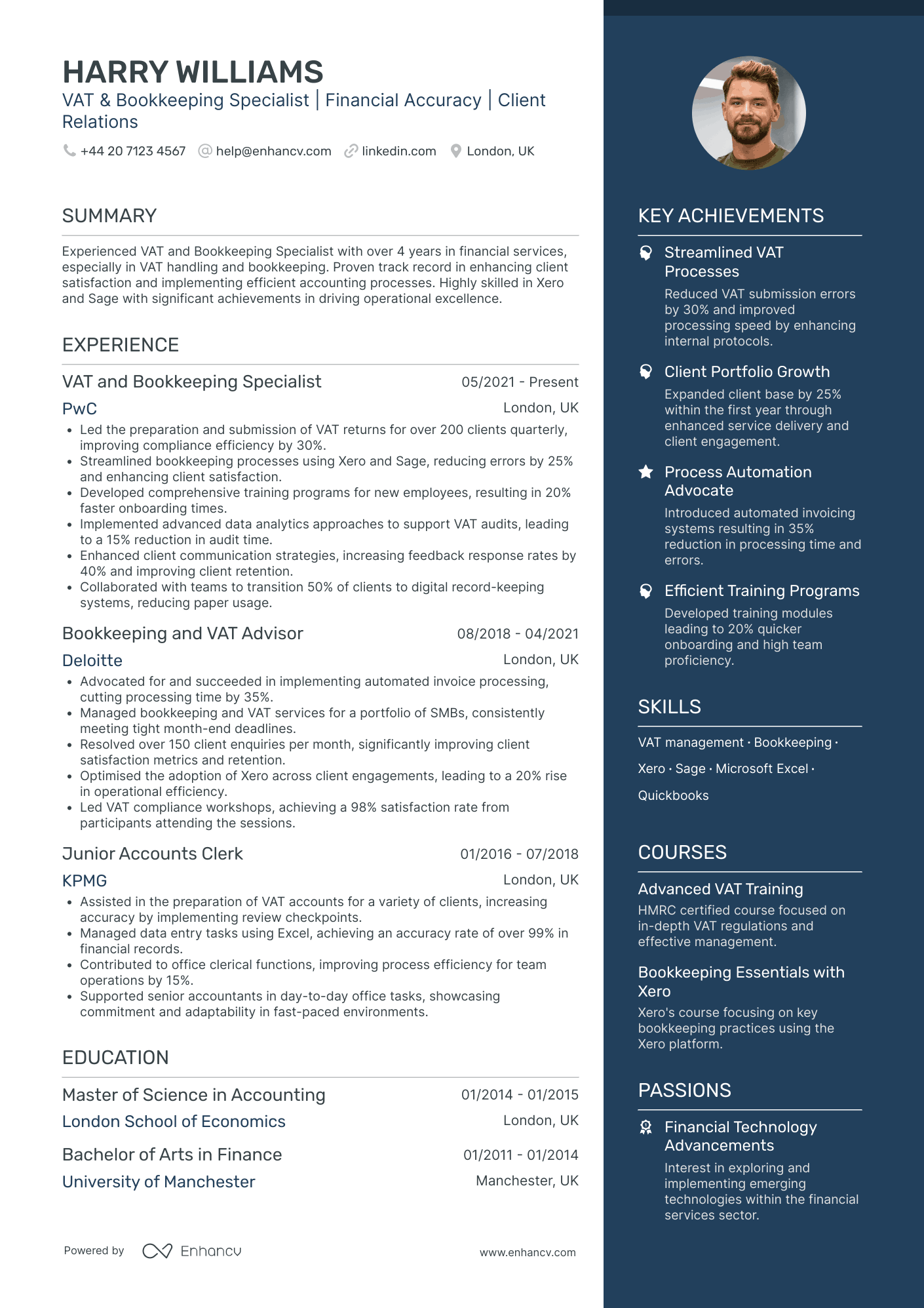

- Impressive Career Progression - Harry Williams' CV demonstrates a noteworthy career trajectory, advancing from a Junior Accounts Clerk at KPMG to a VAT and Bookkeeping Specialist at PwC. This steady upward movement indicates not just dedication and skillful performance but also recognition and leadership potential in the field.

- Emphasis on Adaptability and Innovation - The CV emphasizes adaptability, showcasing Harry's skill in transitioning from traditional bookkeeping to digital record-keeping systems. His ability to implement advanced data analytics and automated invoicing underlines his commitment to innovation and efficiency in financial processes.

- Key Achievements with Business Impact - Harry's achievements, such as improving compliance efficiency by 30% and expanding the client base by 25%, are presented with a focus on their business relevance, not just numerical value. This highlights a forward-thinking approach to achieving long-term growth and operational effectiveness for his employers.

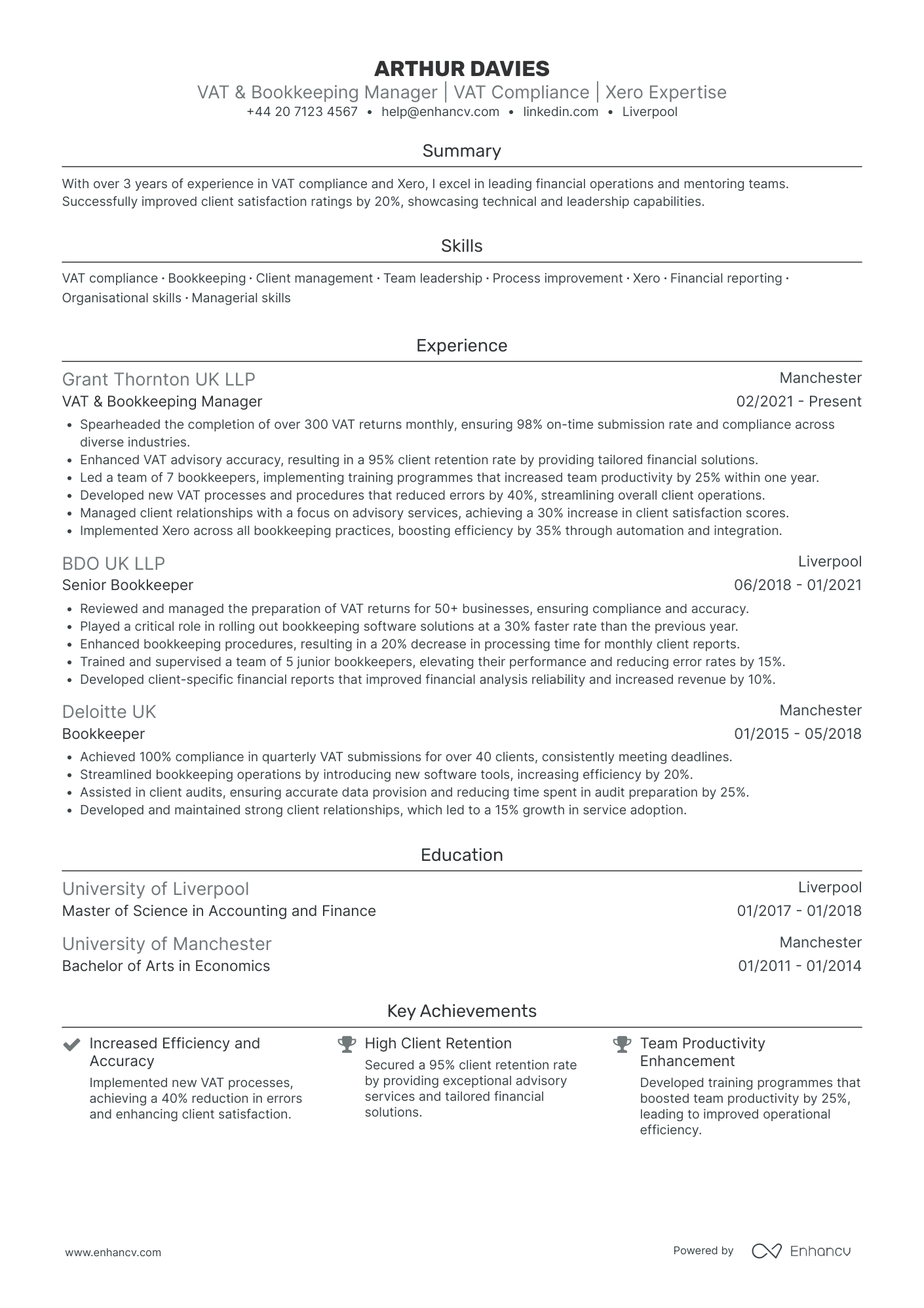

Bookkeeping Manager

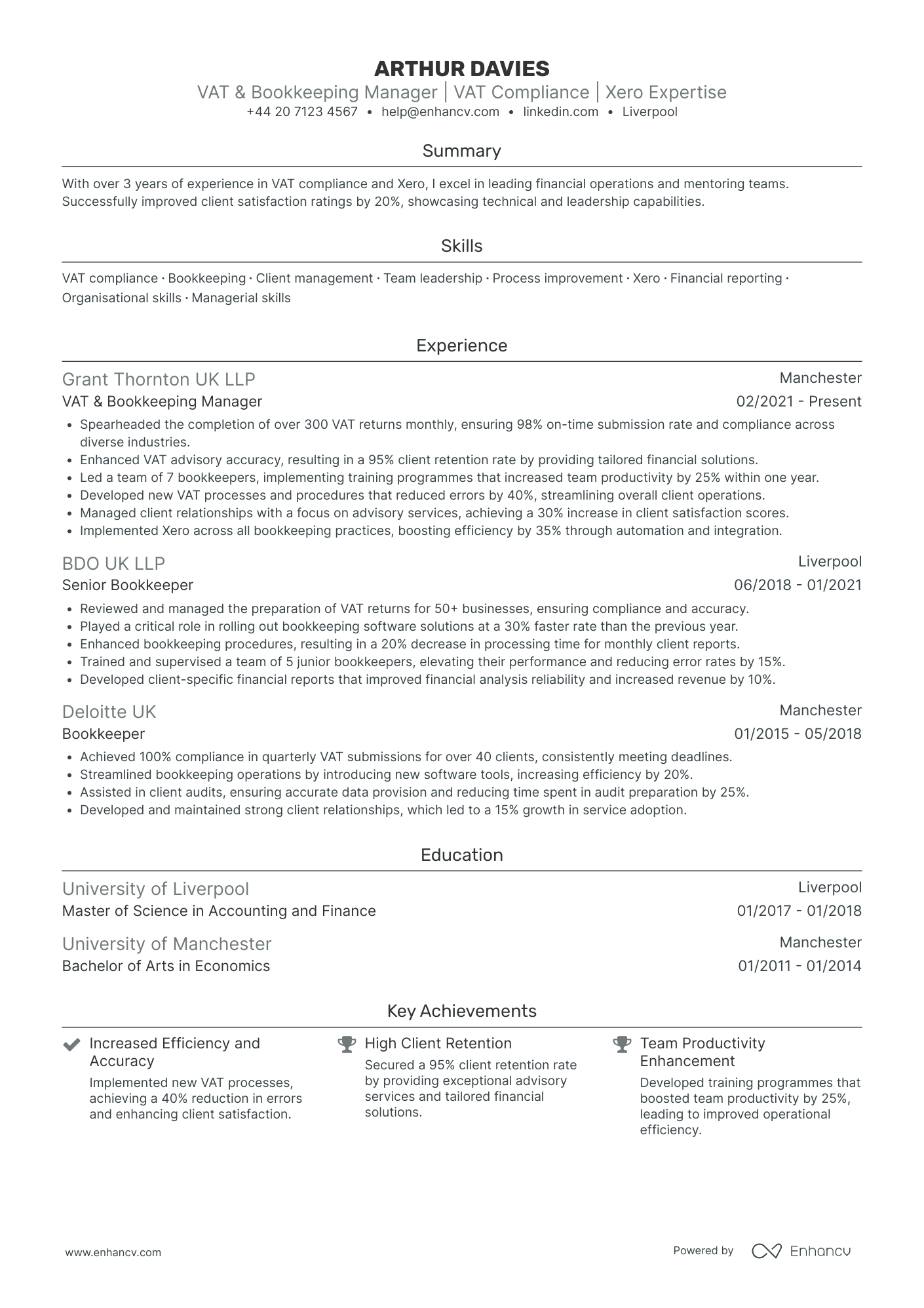

- Career Trajectory and Growth - Arthur's career journey showcases significant professional growth, moving from a Bookkeeper at Deloitte UK to a VAT & Bookkeeping Manager at Grant Thornton UK LLP. This progression highlights an increasing level of responsibility and expertise, indicative of strong performance and leadership potential in the field of accounting and finance.

- Utilization of Industry-Specific Tools - A standout aspect of Arthur's CV is his expertise in utilizing Xero, a critical tool in managing bookkeeping and financial tasks. His successful implementation of Xero across all bookkeeping practices at Grant Thornton, which increased efficiency by 35%, demonstrates not only technical proficiency but also a strong ability to integrate technology into processes for improved outcomes.

- Achievements with Tangible Impact - The CV emphasizes Arthur's substantial contributions to his teams and clients, with achievements such as enhancing VAT advisory accuracy to a 95% client retention rate and developing new processes that reduced errors by 40%. These accomplishments reflect Arthur's ability to deliver impactful results through strategic improvements, contributing directly to business success.

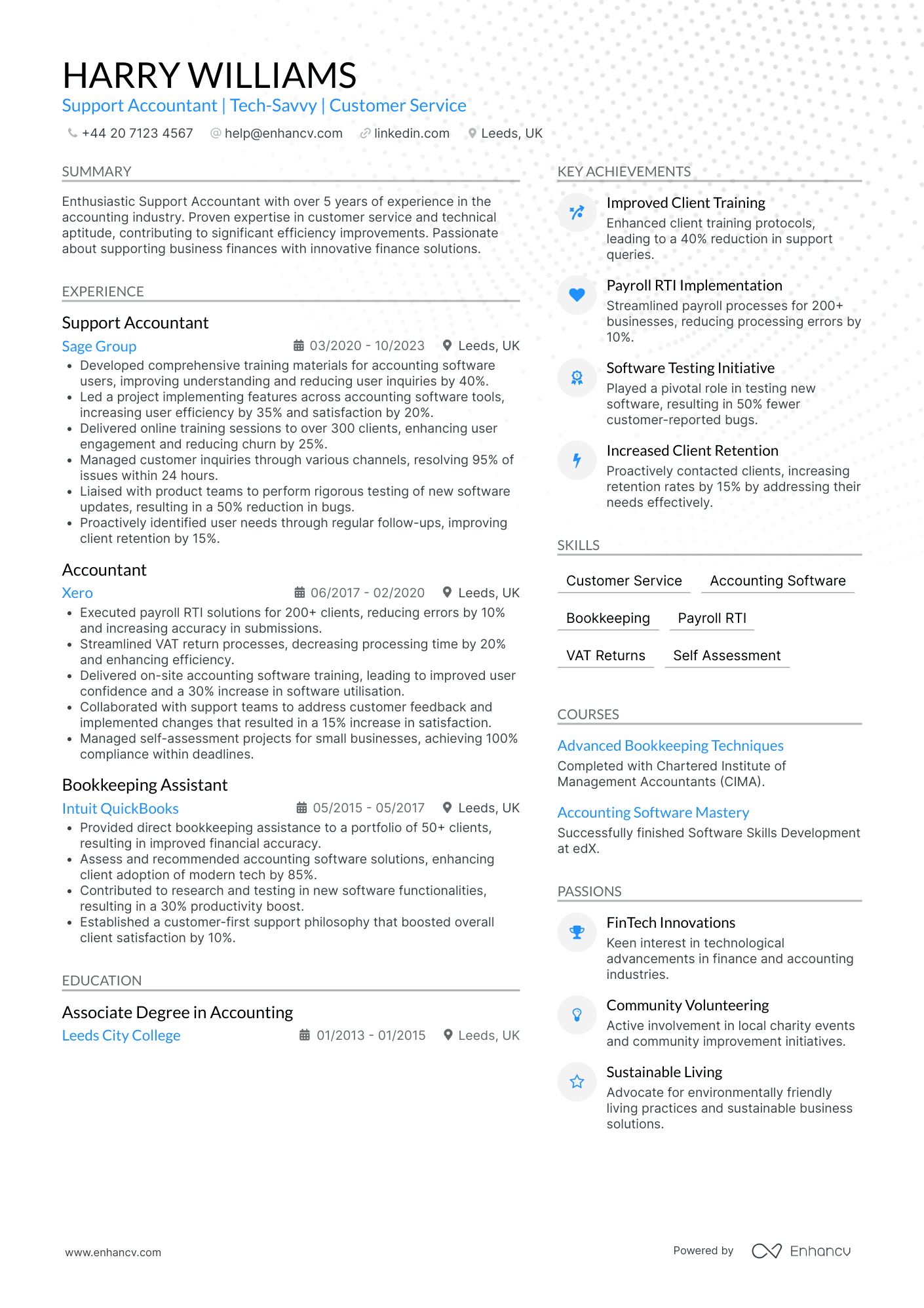

Bookkeeping Specialist

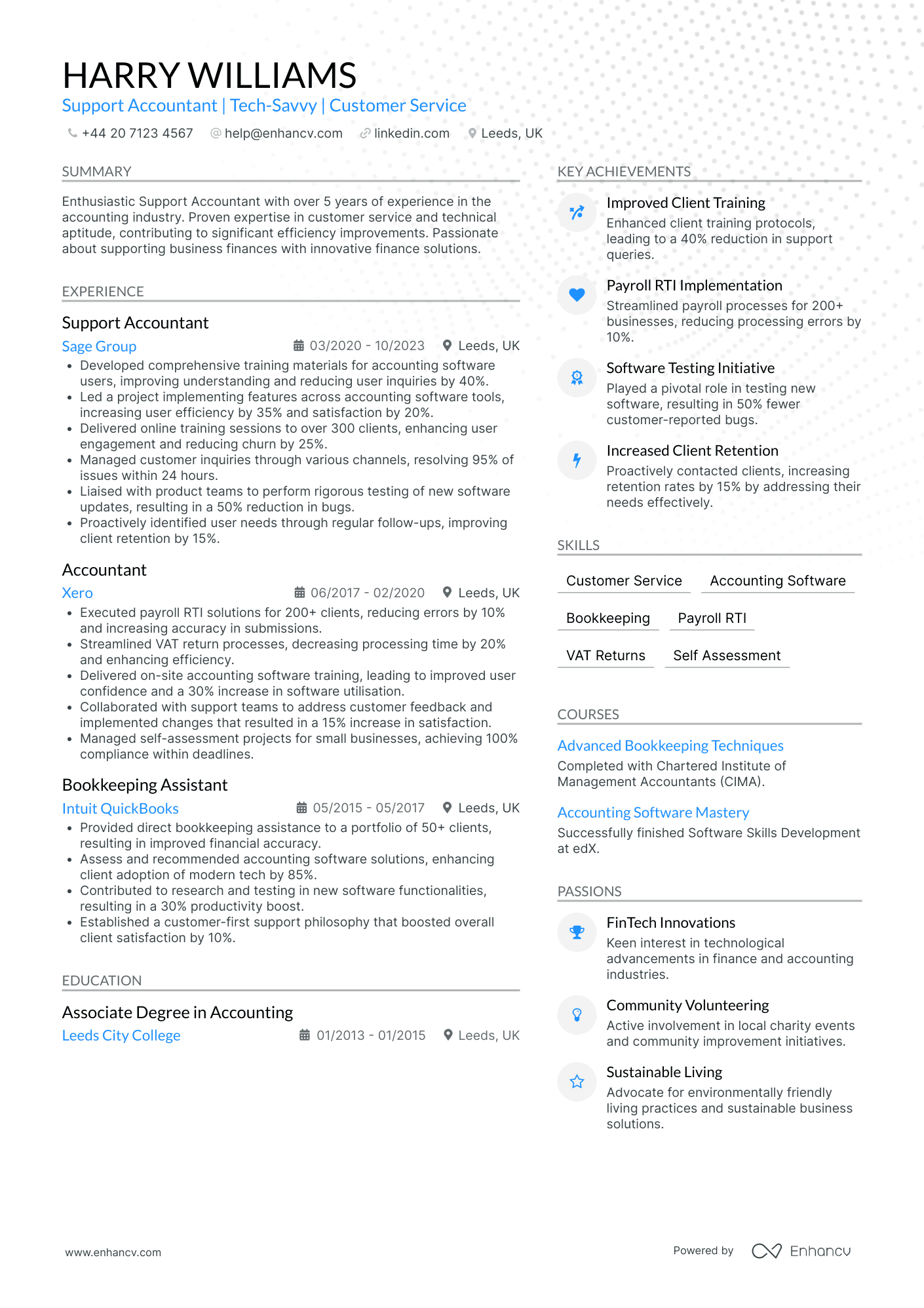

- Holistic Content Presentation - The CV is well-structured and concise, efficiently organizing the candidate's information. It opens with a strong header and personal summary, followed by clearly delineated sections for experience, education, skills, and achievements. Each section is directly relevant to the role of a Support Accountant, enhancing readability and focusing on essential information.

- Demonstrated Career Progression - Harry Williams showcases a notable career trajectory, moving from a Bookkeeping Assistant at Intuit QuickBooks to a Support Accountant at Sage Group. This progression highlights a consistent growth in responsibilities and expertise within the accounting industry, demonstrating commitment and advancement without any substantial industry shifts.

- Impactful Achievements - The CV places a strong emphasis on quantifiable achievements, such as reducing user inquiries by 40% and improving user efficiency by 35%. These not only provide concrete evidence of Williams' impact but also underline their ability to contribute meaningfully to business success, particularly in enhancing client satisfaction and retention.

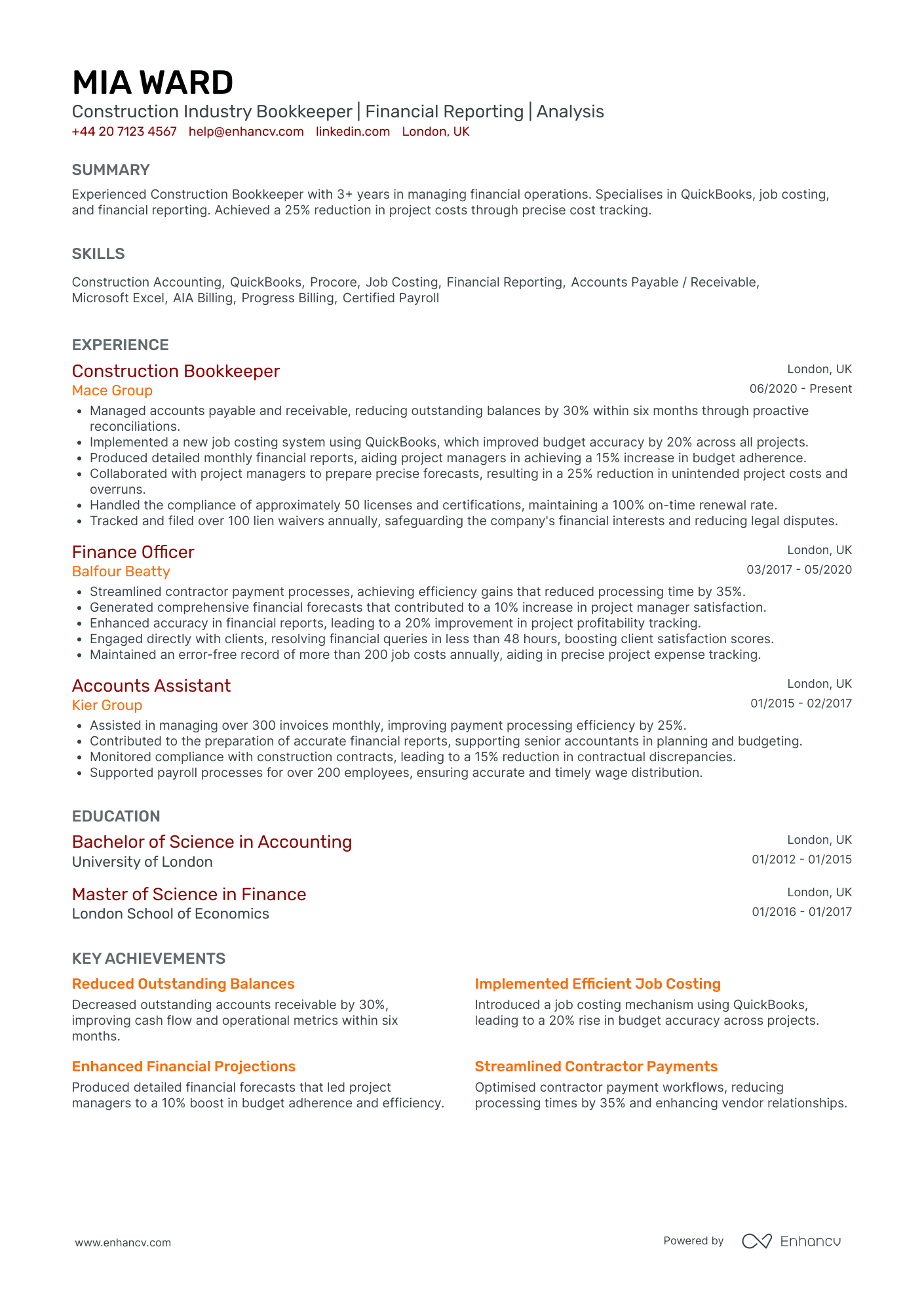

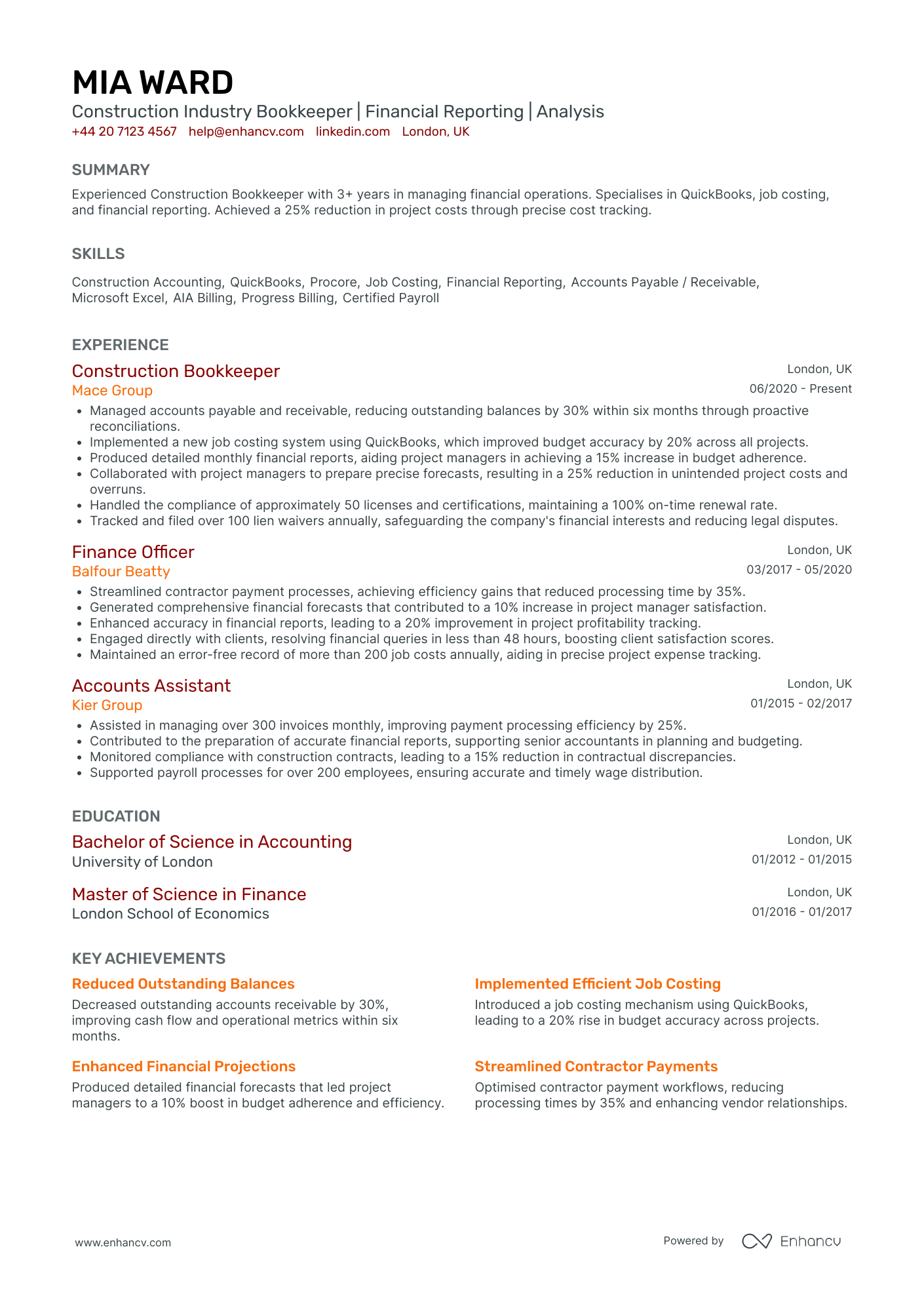

Construction Industry Bookkeeper

- Effective use of industry-specific tools and methodologies - Mia Ward's CV showcases a deep familiarity with crucial accounting tools like QuickBooks and Procore, demonstrating her ability to leverage these for enhanced job costing and financial reporting. This technical depth is fundamental in the construction industry, where precise cost tracking significantly improves project management efficiency.

- Strong career trajectory with a focus on growth and specialization - The progression from Accounts Assistant to Construction Bookkeeper highlights Mia's consistent career advancement, underscoring her accumulated expertise in financial management within the construction sector. Her commitment to refining her skills, evidenced by her transition from a Finance Officer at Balfour Beatty to her current role at Mace Group, reflects a deliberate focus on enhancing project cost management.

- Robust achievements with clear business impact - The CV eloquently communicates Mia's significant contributions, such as reducing outstanding balances by 30% and enhancing budget accuracy by 20%. These accomplishments not only highlight her financial acumen and project management capabilities but also underscore her role in driving cost efficiency and improving cash flow within her companies, thereby contributing directly to their financial health.

Bookkeeper for Non-Profit Organisation

- Content Presentation Excellence - Theodore Green’s CV is structured for clarity and conciseness, effectively navigating the reader through his career. Beginning with a succinct summary, it outlines his core competency in nonprofit bookkeeping and his passion for supporting literary initiatives. Each section is neatly compartmentalized, making it easy to differentiate between critical areas such as experience, education, skills, and achievements, thus ensuring no crucial detail is overlooked.

- Strategic Career Progression - The career trajectory demonstrates a clear growth path, moving from Bookkeeping Specialist to Financial Coordinator. Theodore’s experiences span tenures at renowned institutions, reflecting a consistent upward movement towards roles with increased responsibility and greater impact. The inclusion of duties and outcomes in each position highlights his ongoing commitment to developing his expertise in financial management within the nonprofit sector.

- Achievements with Significant Business Impact - The CV features notable achievements with tangible business relevance, such as improving financial accuracy and achieving a 100% audit success rate. These accomplishments detail not just the numerical results but their broader impact, like enhancing operational efficiency and strategic planning. The outcomes underline Theodore’s ability to make substantial contributions to organizational success, aligning with the goal of improving operational efficiency.

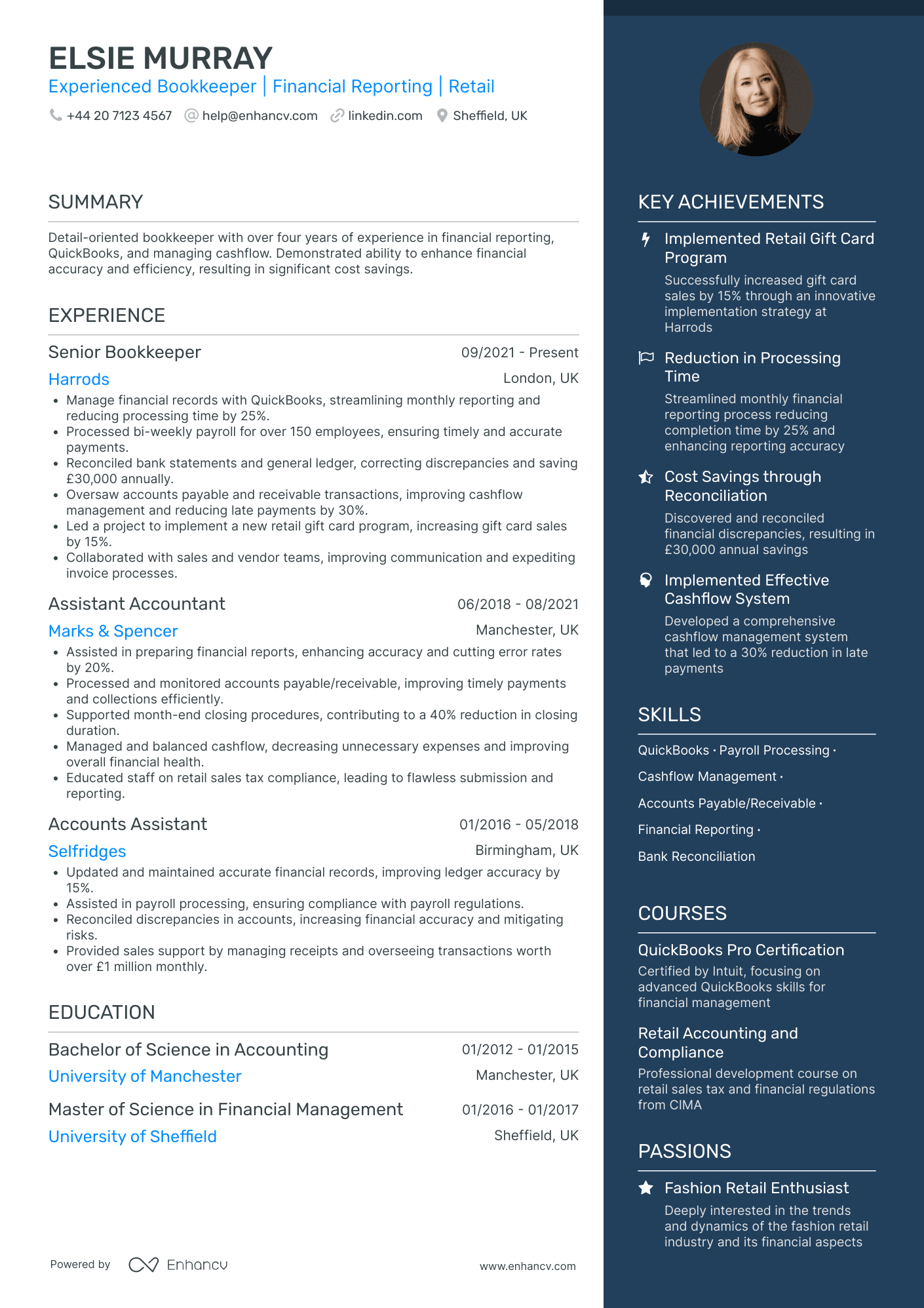

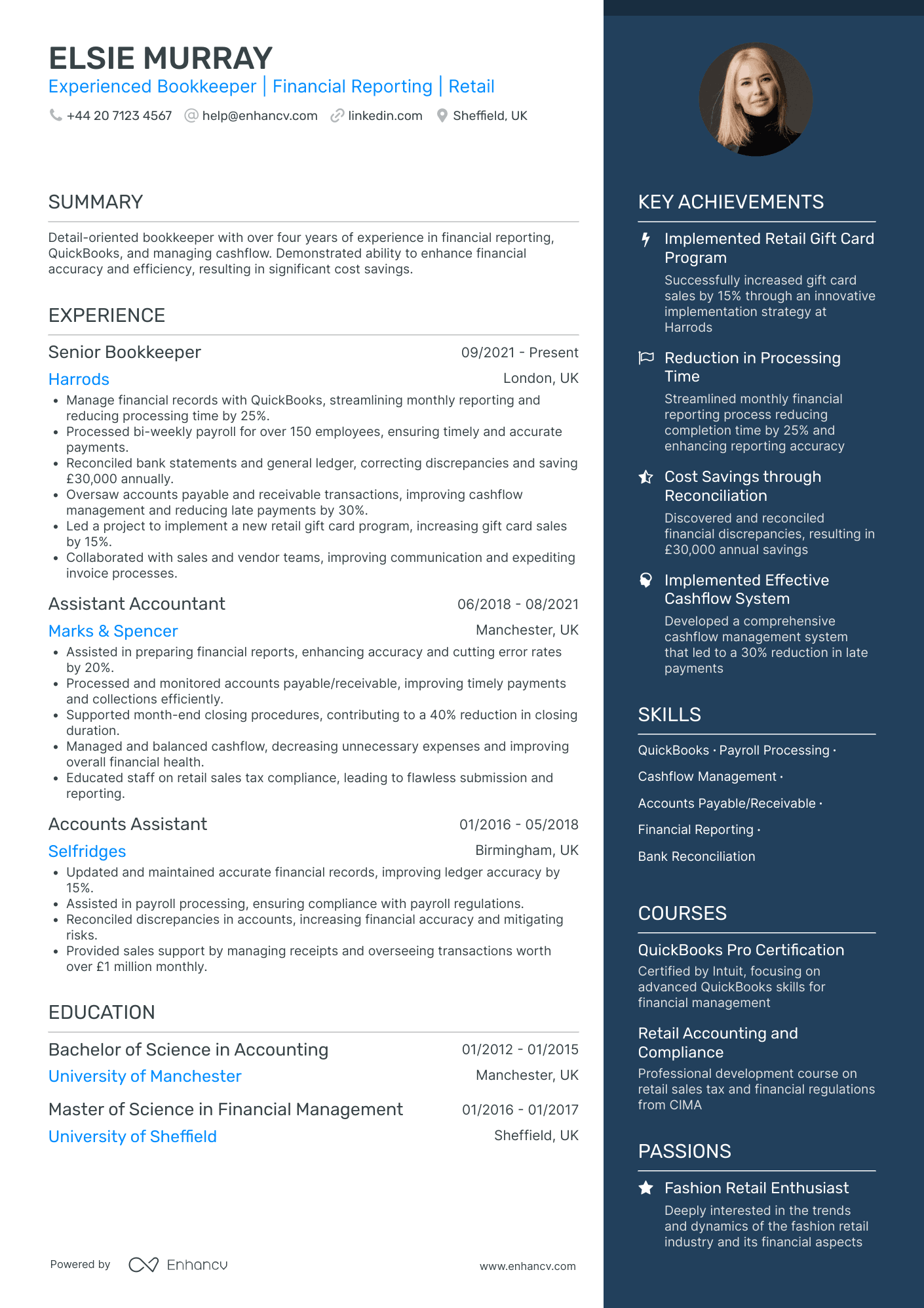

Bookkeeper for Retail Business

- Structured Educational Background Supporting Role - The CV includes a well-articulated education section featuring both a Bachelor's and a Master's degree in fields directly related to the candidate's profession. This provides a strong educational foundation for her expertise in financial reporting and management, reinforcing her credentials in accounting and financial disciplines relevant to her current and past roles.

- Showcases Cross-Functional Success with Measurable Business Impact - The achievements listed are particularly impactful, not only because they feature quantifiable outcomes such as cost savings of £30,000 but also because they highlight the candidate's ability to implement changes like a new retail gift card program at Harrods, leading to an increase of 15% in sales. These achievements demonstrate significant contributions to business success that go beyond routine bookkeeping responsibilities.

- Strong Focus on Adaptability and Industry-Specific Tools - Elsie Murray's CV emphasizes her proficiency with industry-specific tools such as QuickBooks and showcases her technical depth with certifications like the QuickBooks Pro Certification. This illustrates her adaptability and commitment to leveraging cutting-edge tools to enhance effectiveness and efficiency in her financial roles, which are crucial skills for a bookkeeper in the retail industry.

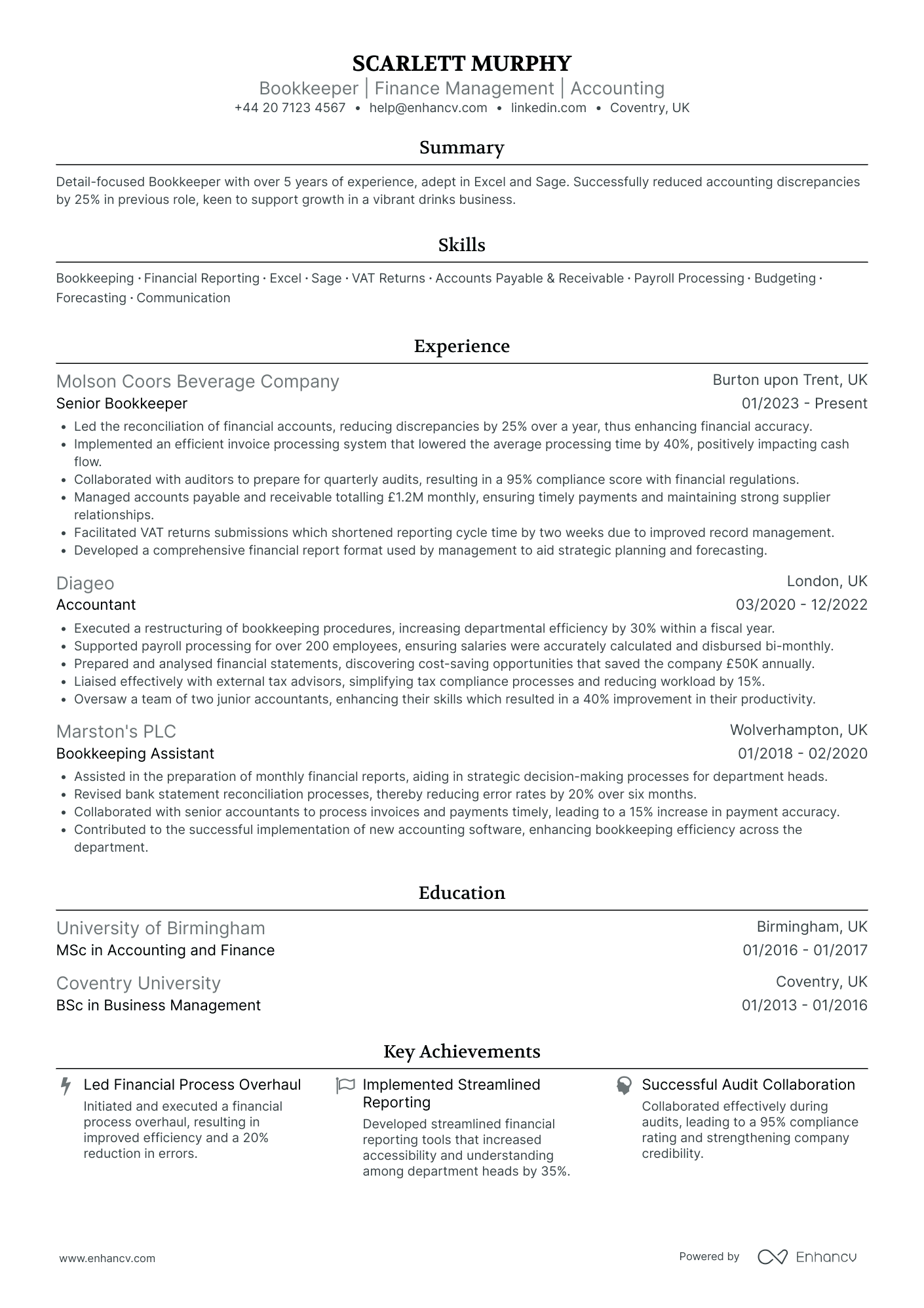

Bookkeeper for Hospitality Industry

- Content Presentation and Structured Clarity - Scarlett Murphy's CV is impressively structured, presenting key information with clarity and conciseness. Each section is well-defined, with concise bullet points under each role that effectively communicate responsibilities and successes. This organized approach ensures that the reader can quickly grasp the candidate's qualifications, making the CV both impactful and easy to navigate.

- Illustration of Career Growth and Industry Experience - The CV reflects a clear trajectory of growth and increased responsibility within the finance and accounting industry. Starting as a Bookkeeping Assistant and progressing to a Senior Bookkeeper, Scarlett has consistently taken on larger roles in reputable companies. This indicates not just a depth of experience but also a capacity for leadership and professional development within the financial sector.

- Technical Expertise and Industry-Specific Skills - Scarlett Murphy demonstrates strong technical skills relevant to her field, including proficiency in Excel and Sage, and experience with VAT returns, accounts payable, and receivables. Her skills section further bolsters this by listing courses like Advanced Excel for Financial Professionals, underscoring her commitment to maintaining up-to-date technical expertise, which is crucial for effective finance management.

Bookkeeping Consultant

- Clear and Concise Content Presentation - The CV stands out for its clarity and structured format, making it easy to navigate through the sections. Each experience bullet point is concise and focuses on the impact made, which enhances the overall readability and allows hiring managers to quickly grasp the candidate’s qualifications.

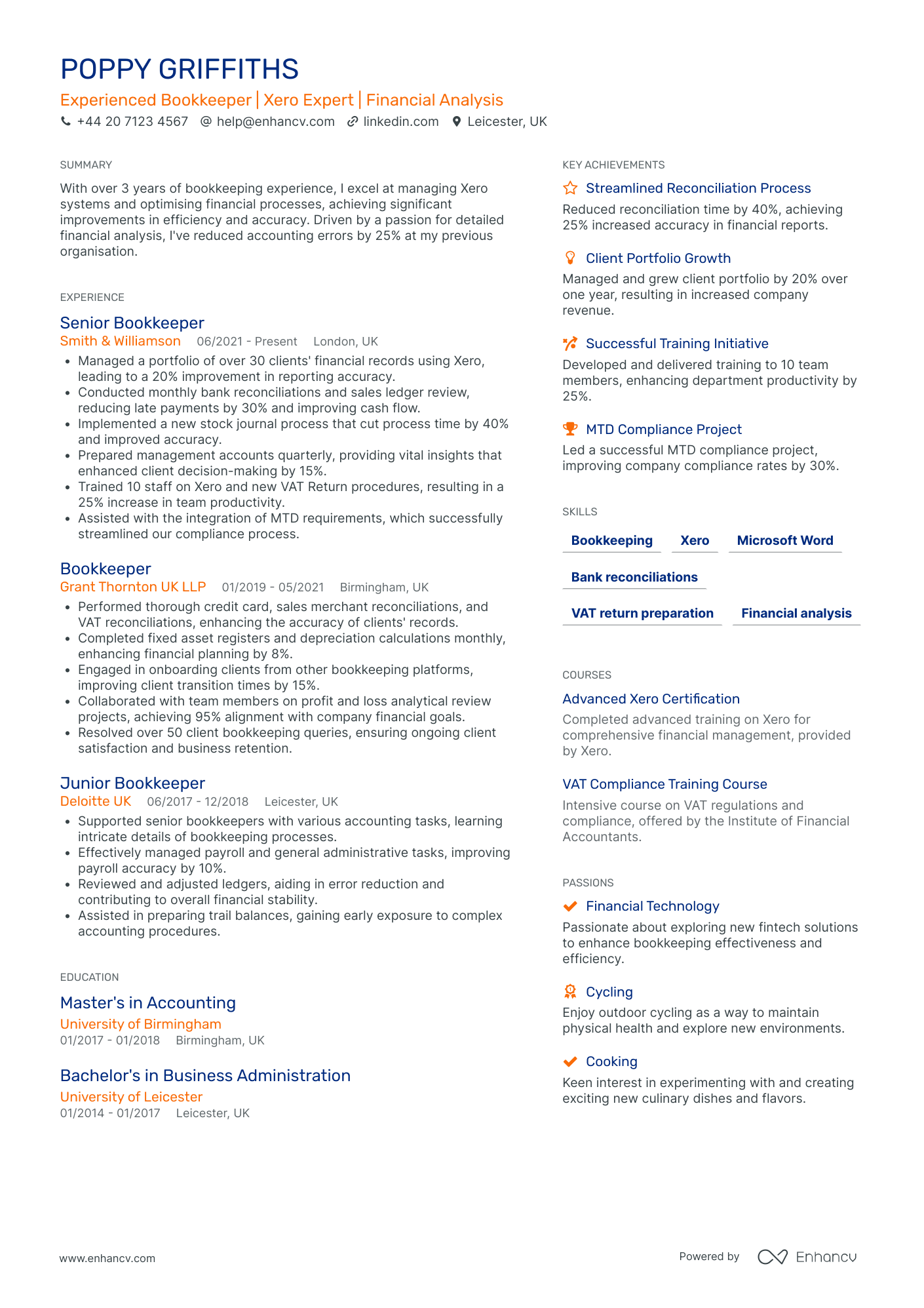

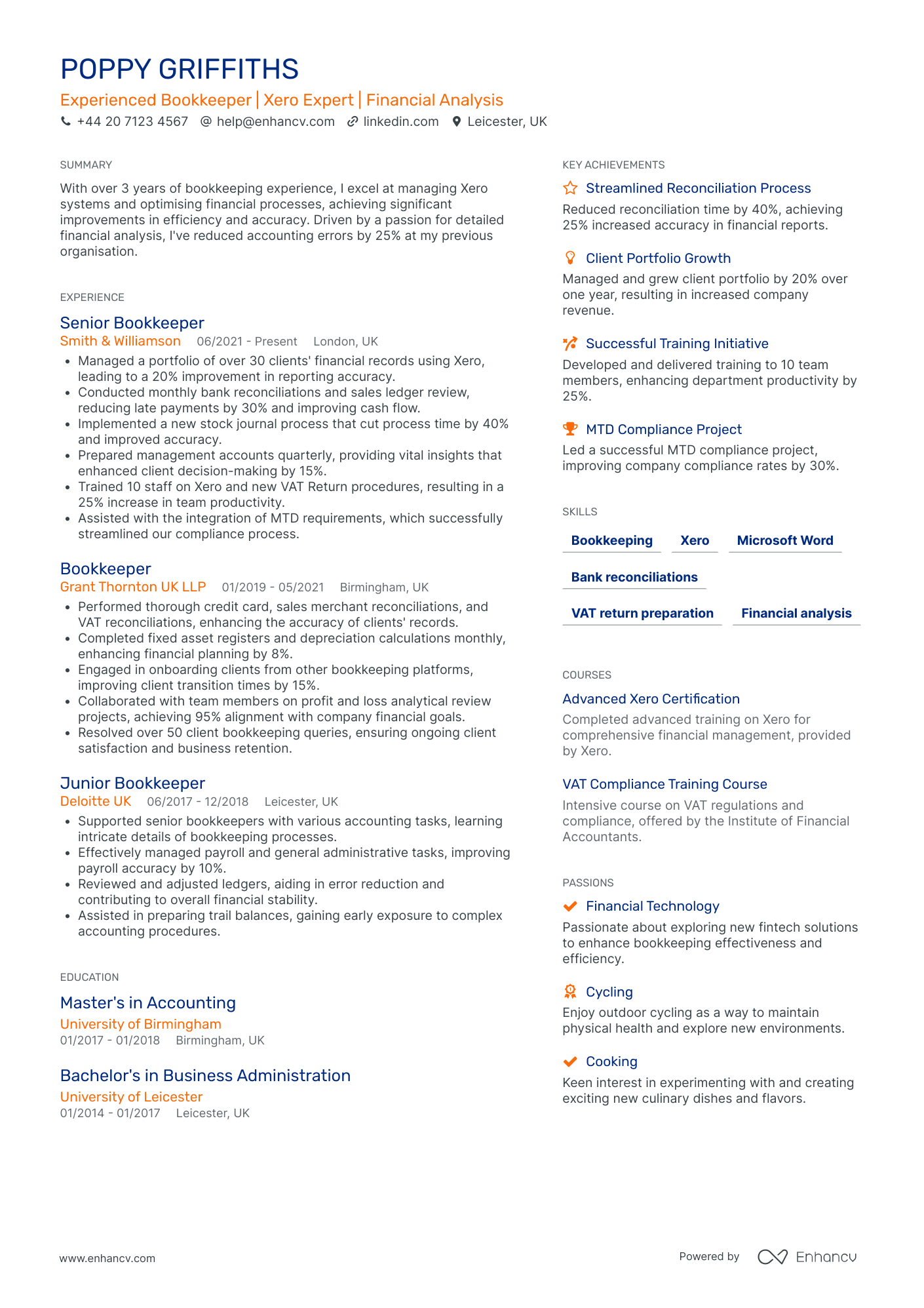

- Demonstrate Career Growth and Industry Expertise - Poppy Griffiths' progression from a Junior Bookkeeper at Deloitte to a Senior Bookkeeper at Smith & Williamson showcases a solid career trajectory. This progression underscores their growing responsibility and expertise within the industry, highlighting a commitment to advancing within financial roles.

- Utilization of Industry-Specific Tools and Methodologies - The CV effectively highlights the candidate's expertise with accounting software like Xero, a key tool in the bookkeeping industry. Their advanced certification in Xero and implementation of MTD compliance showcase a deep technical understanding crucial to modern bookkeeping roles.

Bookkeeping Coordinator

- Structured and Impactful Presentation - The CV is well-organized, with each section clearly delineated and easy to follow. The use of bullet points for achievements and responsibilities enhances readability and allows for a quick assessment of the candidate's qualifications and contributions.

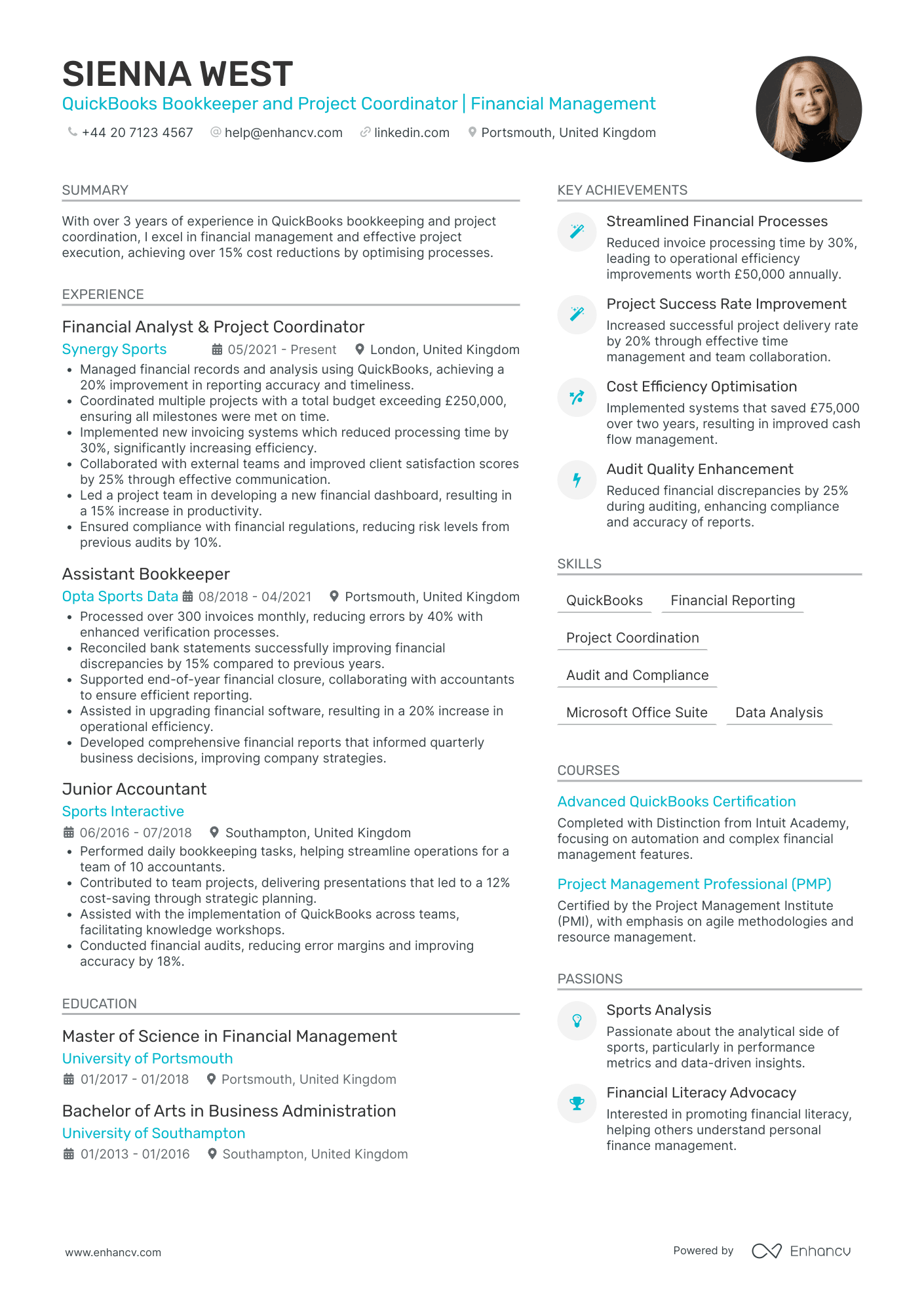

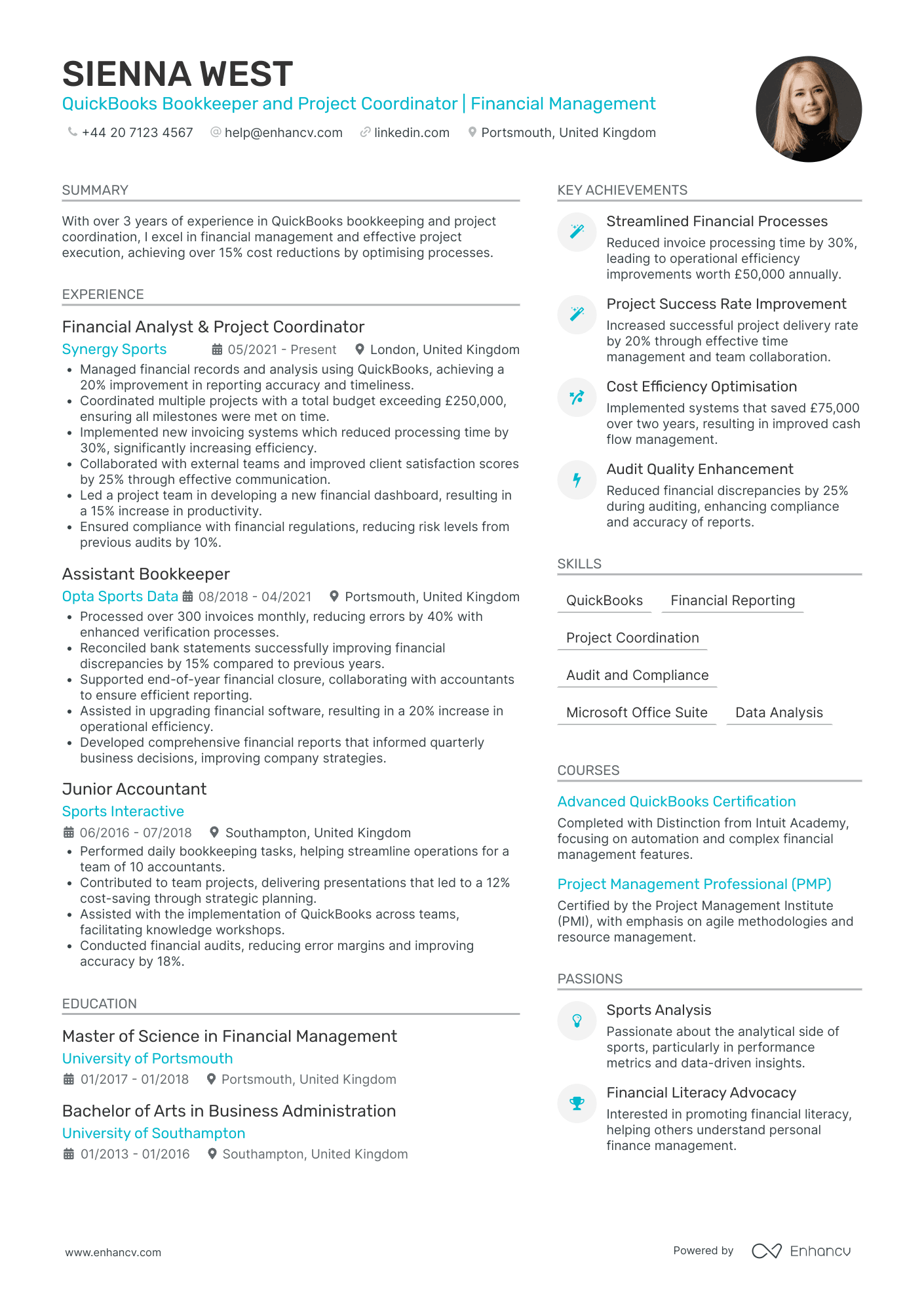

- Progression and Growth in Career - Sienna West’s career shows a clear trajectory of growth and progression, moving from a Junior Accountant to more senior roles such as Financial Analyst & Project Coordinator. This upward movement not only demonstrates her capability and ambition but also her ability to adapt and thrive in increasingly complex roles.

- Integration of Advanced Tools and Certifications - The CV prominently features industry-specific tools and methodologies such as QuickBooks and PMP, underscoring her technical prowess. Moreover, certifications in advanced QuickBooks and Project Management Professional indicate a commitment to continuous learning and expertise in her field.

Bookkeeper for Manufacturing Industry

- Clear and Structured Presentation - The CV is well-structured, with distinct sections for each key area, making it easy for potential employers to quickly identify qualifications and experiences pertinent to the role of a finance expert. Each section is concisely articulated, ensuring clarity and concentration on the most impactful career highlights.

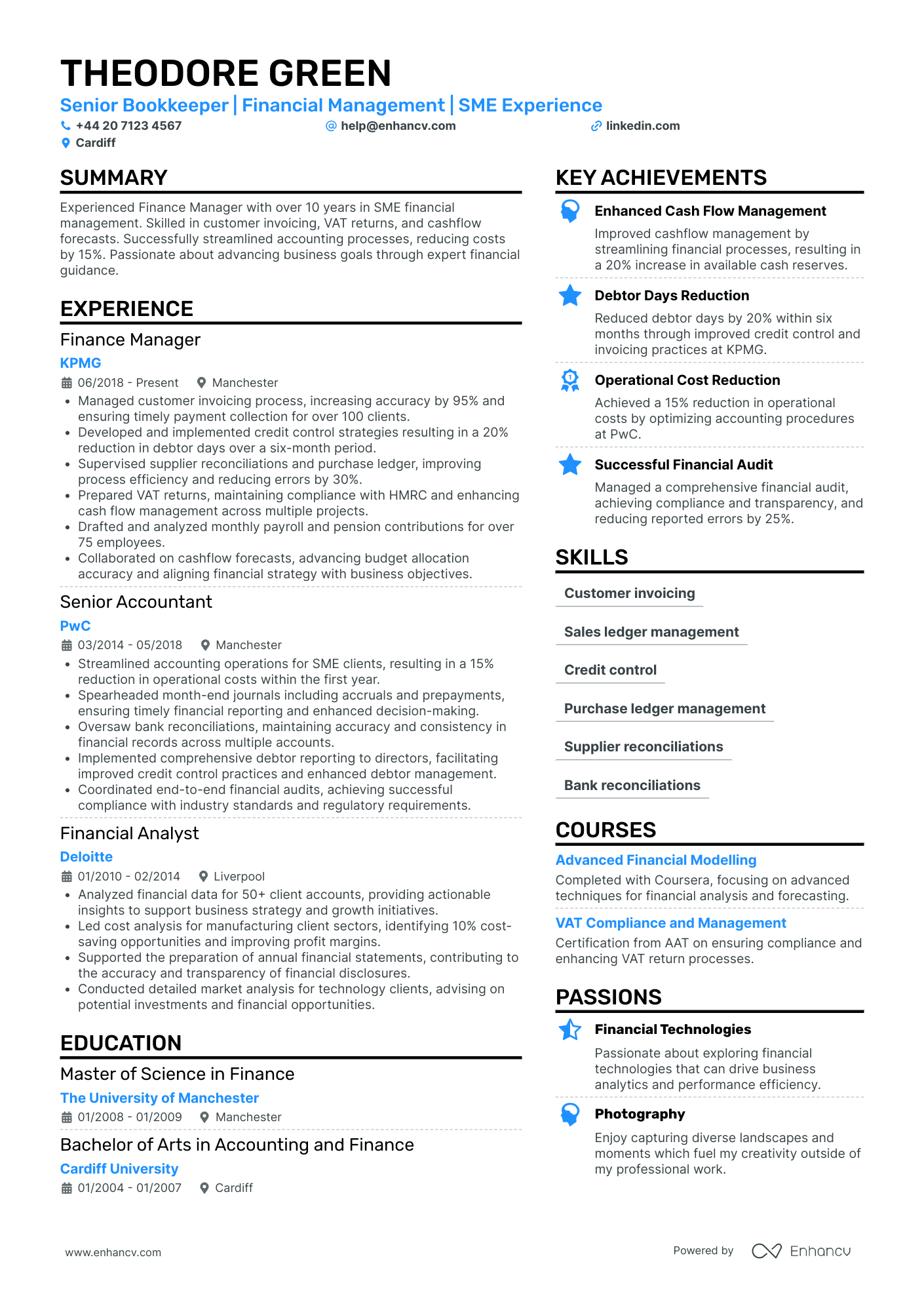

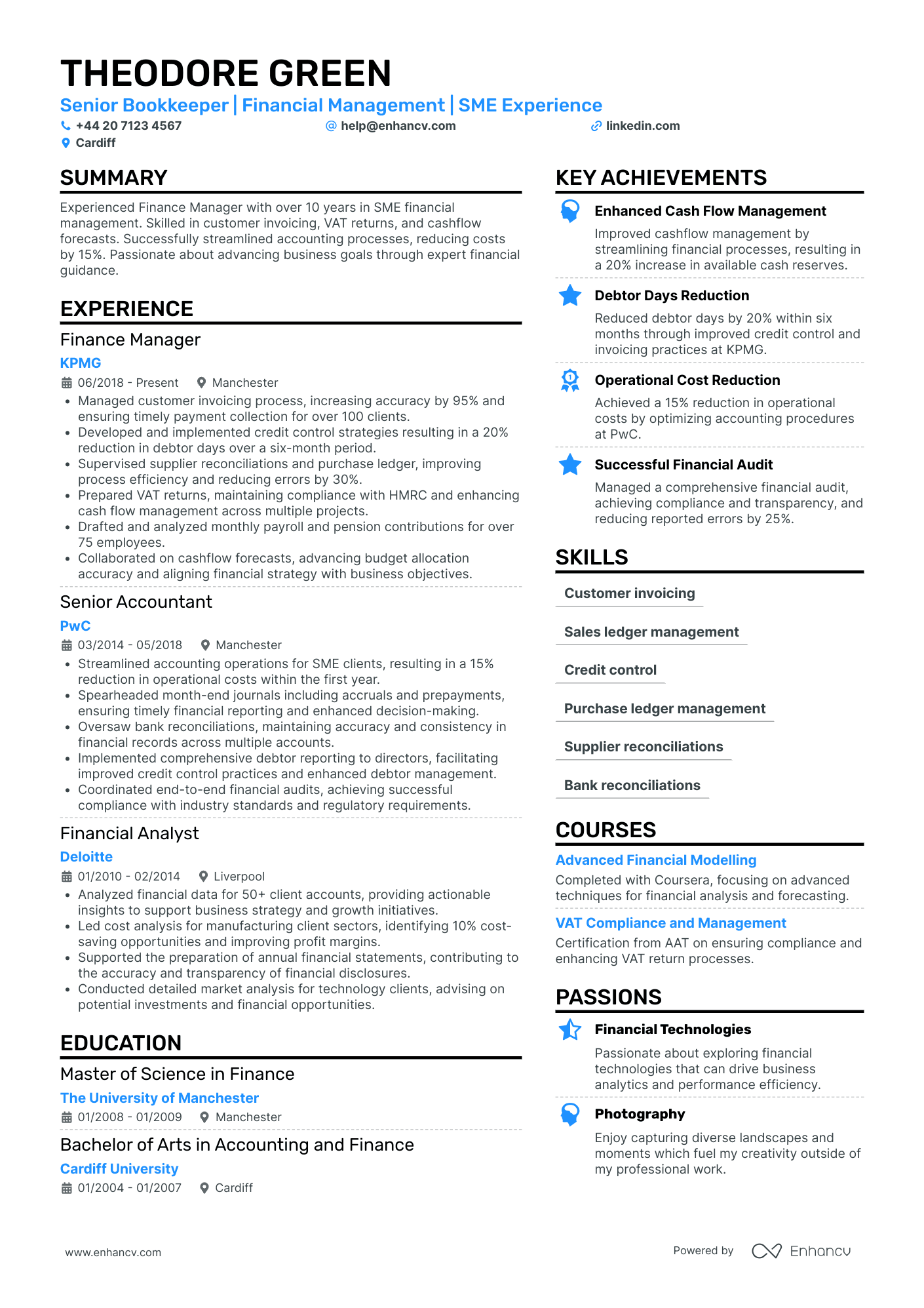

- Demonstrated Career Growth and Industry Shifts - The candidate's career trajectory illustrates significant growth from a Financial Analyst to a Senior Bookkeeper, with positions at prestigious firms such as Deloitte, PwC, and KPMG. This progression underscores the acquisition of advanced financial management skills and leadership capabilities, highlighting versatility within various business settings.

- Impressive Achievements with Business Impact - The CV highlights substantial achievements that are directly tied to business improvements, such as reducing operational costs, enhancing cash flow management, and achieving compliant financial audits. These accomplishments not only demonstrate the candidate's skill but also their ability to contribute to the financial well-being of their employers.

Bookkeeper for Healthcare Industry

- Clarity and Structure in CV Presentation - The CV is exceptionally well-organized, starting with a concise summary that succinctly captures Isla King's expertise and achievements. Each section is clearly defined, from professional experience to education and skills, facilitating easy navigation and quick understanding of the candidate's qualifications, particularly her impact on cost efficiency and patient care in the healthcare sector.

- Career Growth and Industry Specific Experience - Isla King's career shows a clear trajectory from an Accounts Assistant role to more advanced positions like Financial Analyst and Healthcare Bookkeeper, demonstrating her ability to grow professionally within the healthcare industry. Her transition from NHS Lothian to remote work with Bupa Healthcare highlights her expanding expertise in healthcare financial management and showcases her adaptability to different working environments.

- Impactful Achievements Beyond Numbers - While the CV provides quantitative success metrics, such as a 95% reduction in invoice errors and £50,000 annual savings, it goes further to detail the broader business impacts, such as improved operational efficiency and patient satisfaction. This approach shows Isla's deeper understanding of how financial management directly supports better healthcare outcomes, underlining her strategic mindset in aligning financial practices with patient care and organisational goals.

Bookkeeping Auditor

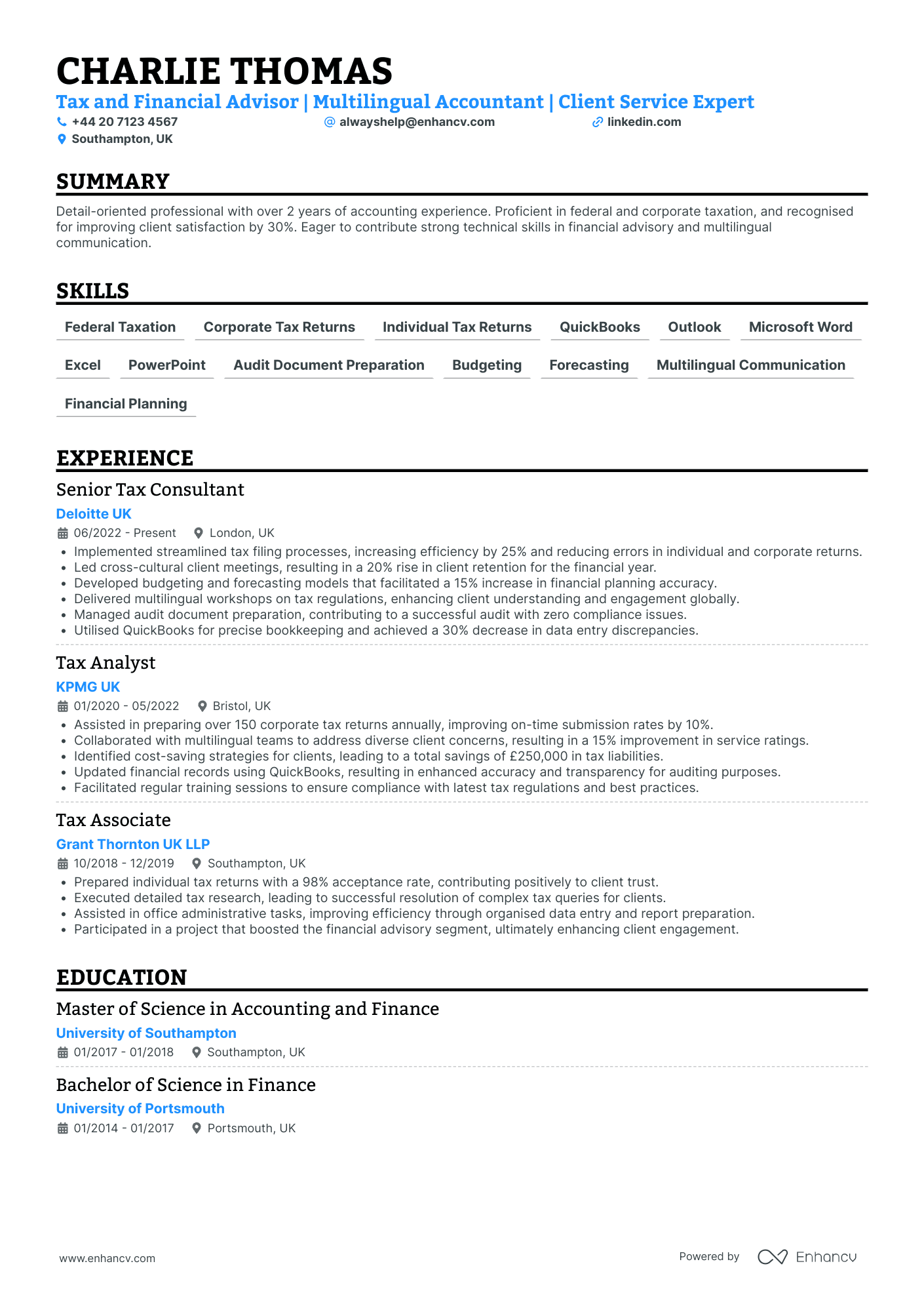

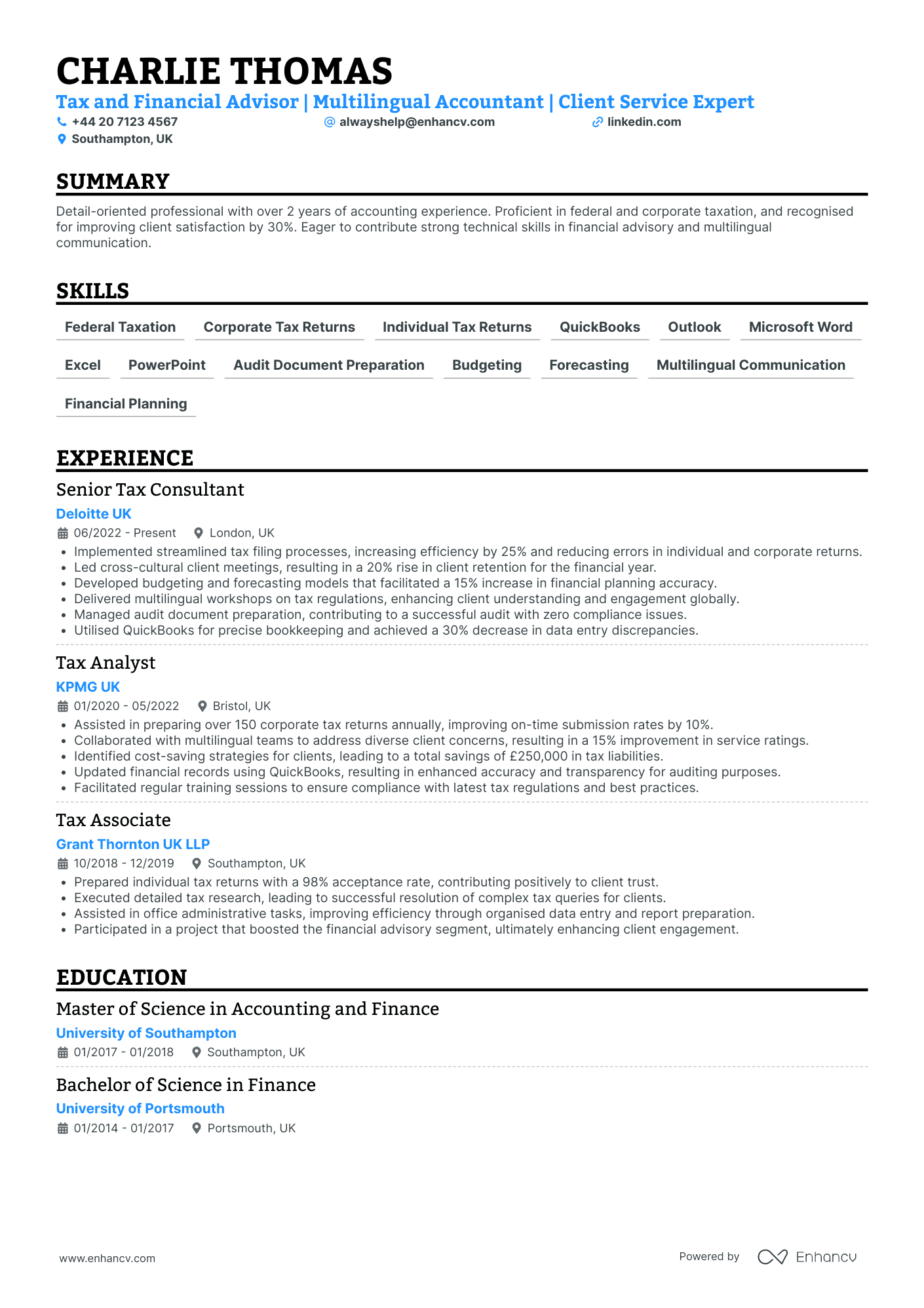

- Comprehensive Career Progression - The CV effectively demonstrates Charlie Thomas's growth within the field of tax and financial advisory, highlighting the progression from a Tax Associate to a Senior Tax Consultant in a short span of time. This advancement emphasizes both expertise and commitment to the field, as Charlie took on more complex roles and responsibilities at reputable firms like Deloitte and KPMG.

- Emphasis on Multilingual and Cross-Cultural Proficiency - A standout feature is the candidate's multilingual ability, particularly in English and Spanish, alongside the facilitation of multilingual workshops. This skill is underlined as essential to Charlie’s ability to lead cross-cultural client meetings, contributing significantly to improved client retention and satisfaction.

- Achievements Linked to Business Impact - The CV lists accomplishments, such as a 30% increase in client satisfaction and a 25% boost in operational efficiency, demonstrating the tangible effects of Charlie's strategies. These achievements are not only quantified but also tied to business outcomes that benefited the firms’ bottom lines, showcasing the candidate's ability to deliver impactful results.

Bookkeeping Analyst

- Structured and Clear Presentation - The CV is well-organized, enabling scannability and quick understanding of Joshua Patel's qualifications. Each section header is distinct, and bullet points effectively summarize key responsibilities and results, making it easy for hiring managers to pinpoint relevant information swiftly.

- Growth and Industry Focus - Joshua’s career trajectory shows a clear progression in responsibility and scope, moving from a Financial Assistant to a Finance Analyst. His targeted growth within non-profit organizations highlights his commitment to financial roles that support sustainability and social impact.

- Impactful Achievements in Finance - The CV details specific, significant accomplishments, like improving financial accuracy by 30% and securing funding for key initiatives. These achievements not only demonstrate competence but also illustrate how Joshua’s work directly contributes to operational enhancements and strategic objectives within the organizations he’s part of.

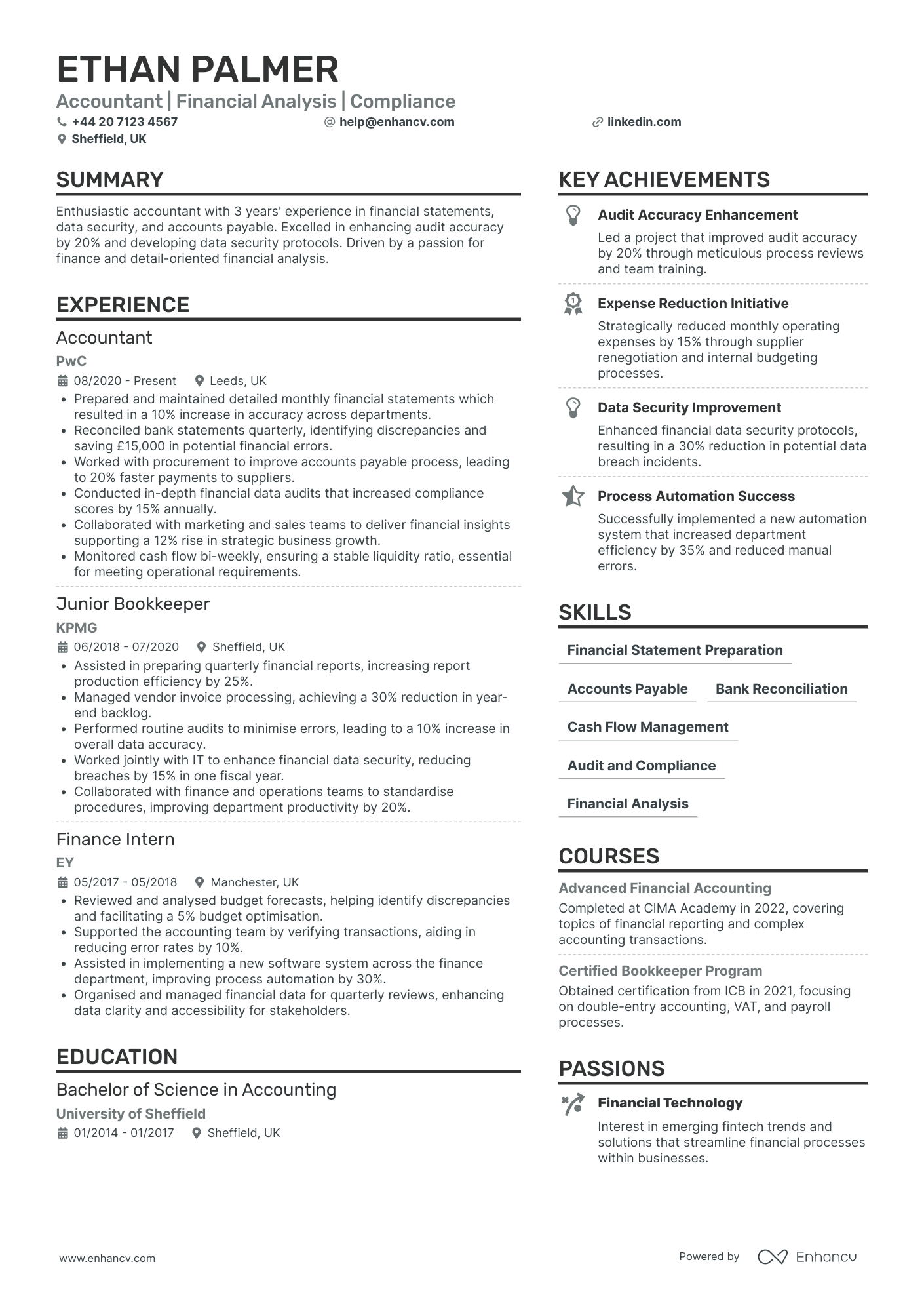

Bookkeeping Supervisor

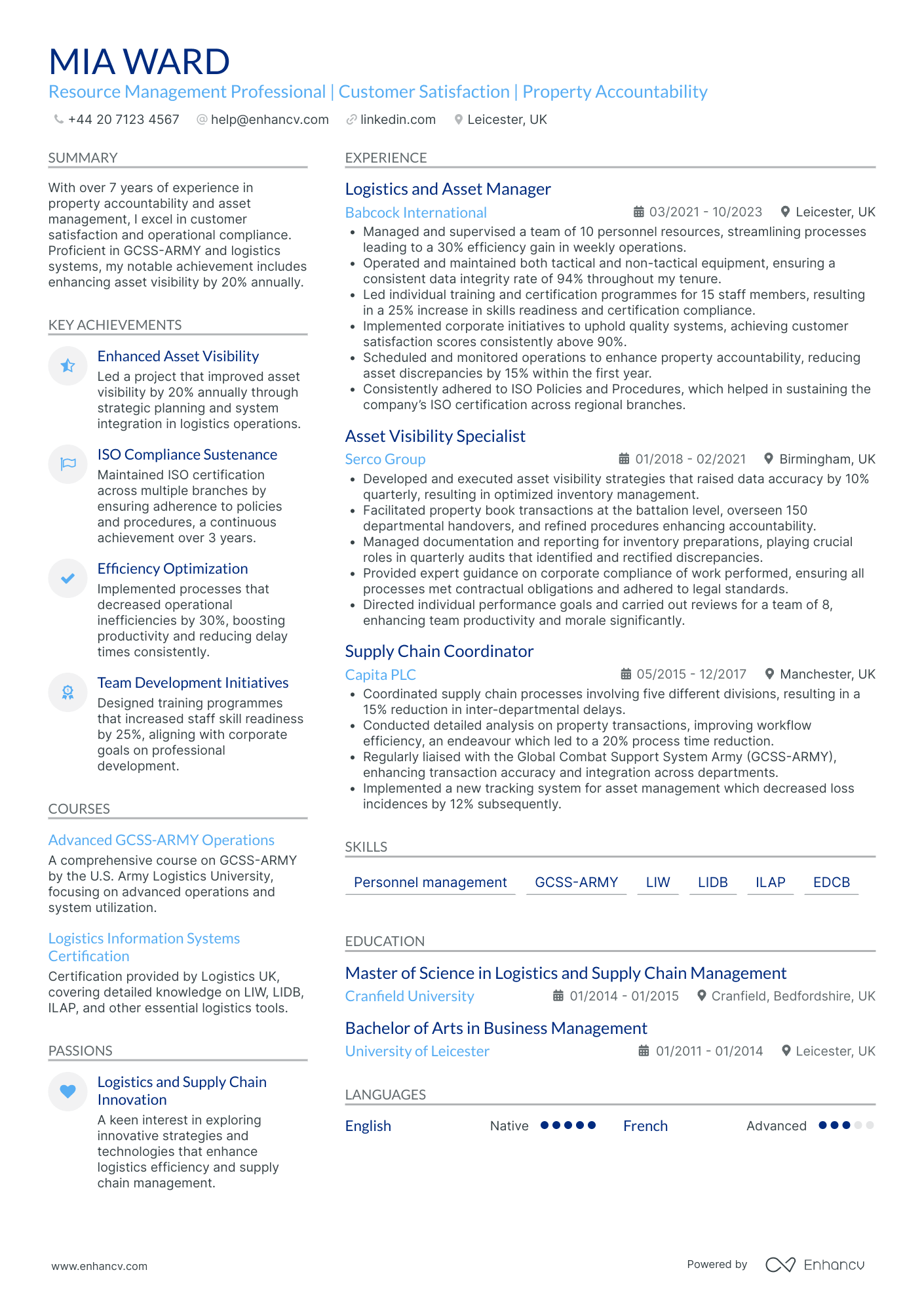

- Clear and Well-Organized Content Presentation - This CV is structured methodically, providing concise yet detailed summaries in each section that clearly convey the candidate’s vast expertise and achievements. The flow from personal information to education creates an easy-to-follow narrative, highlighting Mia Ward's career progression and skill set effectively.

- Strong Career Trajectory with Diverse Industry Experience - Mia has shown consistent growth, beginning as a Supply Chain Coordinator and advancing to positions like Asset Visibility Specialist and Logistics Manager. Her roles across different companies like Babcock International and Serco Group demonstrate versatility and continuous development within the logistics and asset management sector.

- Technical Proficiency and Industry-Specific Methodologies - The CV lists proficiency in specialized tools such as GCSS-ARMY, LIW, LIDB, and other logistics systems, showcasing Mia’s adeptness in managing complex asset and inventory operations. Her participation in relevant certification courses underscores her commitment to mastering essential industry techniques and technologies.

How to ensure your profile stands out with your bookkeeper CV format

It's sort of a Catch 22. You want your bookkeeper CV to stand out amongst a pile of candidate profiles, yet you don't want it to be too over the top that it's unreadable. Where is the perfect balance between your CV format simple, while using it to shift the focus to what matters most. That is - your expertise. When creating your bookkeeper CV:

- list your experience in the reverse chronological order - starting with your latest roles;

- include a header with your professional contact information and - optionally - your photograph;

- organise vital and relevant CV sections - e.g. your experience, skills, summary/ objective, education - closer to the top;

- use no more than two pages to illustrate your professional expertise;

- format your information using plenty of white space and standard (2.54 cm) margins, with colours to accent key information.

Once you've completed your information, export your bookkeeper CV in PDF, as this format is more likely to stay intact when read by the Applicant Tracker System or the ATS. A few words of advice about the ATS - or the software used to assess your profile:

- Generic fonts, e.g. Arial and Times New Roman, are ATS-compliant, yet many candidates stick with these safe choices. Ensure your CV stands out by using a more modern, and simple, fonts like Lato, Exo 2, Volkhov;

- All serif and sans-serif fonts are ATS-friendly. Avoid the likes of fancy decorative or script typography, as this may render your information to be illegible;

- Both single- and double-column formatted CVs could be assessed by the ATS;

- Integrating simple infographics, icons, and charts across your CV won't hurt your chances during the ATS assessment.

PRO TIP

Use font size and style strategically to create a visual hierarchy, drawing the reader's eye to the most important information first (like your name and most recent job title).

The top sections on a bookkeeper CV

- Professional Summary offers a snapshot of your skills and goals.

- Work Experience showcases your career progression and scope.

- Bookkeeping Certifications highlight industry-recognised qualifications.

- Key Accounting Skills provide an at-a-glance view of your abilities.

- Education History details your academic background in finance.

What recruiters value on your CV:

- Highlight your proficiency with accounting software and tools, as employers will look for bookkeepers who are comfortable with technology and can seamlessly integrate into their systems.

- Emphasise your attention to detail and accuracy in financial record-keeping, as these are the cornerstone skills of an efficient bookkeeper.

- Demonstrate your understanding of financial regulations and compliance, mentioning any experience you have with HM Revenue & Customs (HMRC) guidelines or other relevant legal standards.

- Showcase your ability to communicate financial information clearly by citing examples where you've prepared reports or presented financial data to management.

- Include any relevant certifications or continued education, such as AAT qualifications or similar credentials, to substantiate your expertise and commitment to the field.

Recommended reads:

Making a good first impression with your bookkeeper CV header

Your typical CV header consists of Your typical CV header consists of contact details and a headline. Make sure to list your professional phone number, email address, and a link to your professional portfolio (or, alternatively, your LinkedIn profile). When writing your CV headline , ensure it's:

- tailored to the job you're applying for;

- highlights your unique value as a professional;

- concise, yet matches relevant job ad keywords.

You can, for examples, list your current job title or a particular skill as part of your headline. Now, if you decide on including your photo in your CV header, ensure it's a professional one, rather than one from your graduation or night out. You may happen to have plenty more questions on how to make best the use of your CV headline. We'll help you with some real-world examples, below.

Examples of good CV headlines for bookkeeper:

- Senior Bookkeeper | AAT Qualified | Financial Reporting & Reconciliation | 10+ Years Experience

- Bookkeeping Specialist | Management Accounts | Budgeting Expertise | Certified Bookkeeper | 7 Years in Finance

- Junior Bookkeeper | Payroll Administration | VAT Returns | Pursuing ACCA | Eager to Learn and Grow

- Experienced Bookkeeper | Ledger Management | Tax Preparation | QuickBooks ProAdvisor | 15 Years in Practice

- Bookkeeping Coordinator | Credit Control | Cash Flow Management | CIMA Part-Qualified | 5 Years Experience

- Account Assistant | Invoice Processing Ace | Financial Analysis | Studying Towards CIPFA | 3 Years Hands-On Experience

Your bookkeeper CV introduction: selecting between a summary and an objective

bookkeeper candidates often wonder how to start writing their resumes. More specifically, how exactly can they use their opening statements to build a connection with recruiters, showcase their relevant skills, and spotlight job alignment. A tricky situation, we know. When crafting you bookkeeper CV select between:

- A summary - to show an overview of your career so far, including your most significant achievements.

- An objective - to show a conscise overview of your career dreams and aspirations.

Find out more examples and ultimately, decide which type of opening statement will fit your profile in the next section of our guide:

CV summaries for a bookkeeper job:

- With over 10 years of meticulous bookkeeping experience, proficient in QuickBooks and Excel, and a proven track record of managing financial records and processing payroll for SMEs, I have effectively streamlined accounts for a leading retail chain, achieving a 20% cost reduction in fiscal discrepancies.

- A seasoned financial assistant with 8 years in the hospitality sector, transitioning into bookkeeping, brings a robust understanding of cost control, budgeting, and financial reporting, eager to apply these skills to ensure precision in financial record-keeping and contribute to sustainable financial practices.

- As an accountant with a CPA qualification and 12 years' experience, I am now shifting my focus to bookkeeping, equipped with a strong foundation in financial analysis, tax preparation, and ledger management, aiming to deliver high-quality financial organisation and support strategic decision-making.

- An analytical thinker and recent graduate in Finance, I am looking to launch my career in bookkeeping, drawing upon my hands-on internship experience with a top accounting firm where I assisted with accounts payable and receivable, showcasing strong mathematical and organisational skills.

- Passionate about numbers and precision, I am an enthusiastic individual with a foundation in business administration seeking to secure a bookkeeper position. Equipped with strong theoretical knowledge of accounting principles and hands-on experience with spreadsheets, I am eager to contribute to meticulous financial record-keeping.

Best practices for writing your bookkeeper CV experience section

If your profile matches the job requirements, the CV experience is the section which recruiters will spend the most time studying. Within your experience bullets, include not merely your career history, but, rather, your skills and outcomes from each individual role. Your best experience section should promote your profile by:

- including specific details and hard numbers as proof of your past success;

- listing your experience in the functional-based or hybrid format (by focusing on the skills), if you happen to have less professional, relevant expertise;

- showcasing your growth by organising your roles, starting with the latest and (hopefully) most senior one;

- staring off each experience bullet with a verb, following up with skills that match the job description, and the outcomes of your responsibility.

Add keywords from the job advert in your experience section, like the professional CV examples:

Best practices for your CV's work experience section

- Managed daily financial transactions, ensuring accurate recording of incomes and expenditures across multiple accounts, enhancing company financial transparency.

- Performed reconciliation for bank and credit card statements monthly to ensure error-free records, preventing discrepancies and aiding in swift audit processes.

- Developed and maintained an organised filing system for all financial documents, facilitating easy access and compliance with statutory retention policies.

- Utilised accounting software (e.g., Xero, QuickBooks) to process and manage financial data, improving efficiency and reducing processing errors.

- Prepared and submitted VAT returns, maintaining up-to-date knowledge of HMRC regulations to ensure timely and accurate compliance.

- Assisted in budget preparation and expense management by providing detailed variance analysis reports, aiding in effective financial planning and control.

- Collaborated with external auditors during annual audits to provide necessary documentation and explanations, ensuring smooth and compliant audit processes.

- Processed payroll accurately and confidentially, ensuring all employees were paid on time and in accordance with employment regulations.

- Administered accounts payable and receivable tasks, including invoice generation and chasing outstanding payments, improving cash flow management.

- Oversaw the full spectrum of financial transactions, including accounts payable and receivable, for a mid-size manufacturing firm with £5M annual turnover.

- Implemented a new cloud-based accounting system that streamlined invoice processing by 25%, boosting efficiency and payment cycles.

- Prepared detailed quarterly financial reports that provided the management with insights, influencing the strategic planning process.

- Managed payroll for over 100 employees, ensuring accurate and timely processing, including deductions and tax implications.

- Liaised with external accountants for year-end financials, reducing reconciliation errors by 30% over previous years.

- Developed a system for monitoring daily cash flow which helped identify a pattern that averted potential shortfalls.

- Initiated a monthly budget review strategy that reduced extraneous expenditures by 10% within the first quarter of implementation.

- Managed accounts for key clients, maintaining an error rate of less than 1% for all financial postings and ledger entries.

- Collaborated with cross-functional teams to deploy financial best practices, significantly enhancing inter-departmental trust and collaboration.

- Conducted meticulous audits of company expenses against budget predictions, revealing opportunities for a 15% cost saving in non-essential spending areas.

- Spearheaded the transition to a paperless office, digitizing receipts and historical financial records, increasing document retrieval time by 40%.

- Played a pivotal role in a year-long project to streamline vendor payment methods, leading to a 20% reduction in administrative hours spent on payment processing.

- Undertook the reorganisation of the company’s stock inventory system which led to a 5% reduction in unaccounted stock losses.

- Routinely collaborated with external auditors, furnishing them with comprehensive reports that decreased audit time by 50%.

- Championed the adoption of electronic funds transfer for client invoicing, cutting down on average accounts receivable days from 45 to 30.

- Played a key role in negotiating payment terms with suppliers which improved cash flow by increasing average payment days from 30 to 45.

- Produced monthly reconciliation reports against bank statements, maintaining flawless records and contributing to an error-free annual audit.

- Formulated a budget forecasting model that predicted financial trends with a 90% accuracy rate, influencing cost-saving measures.

- Authored a comprehensive guide on financial best practices for small businesses for the company blog, enhancing our reputation as industry experts.

- Designed a customised financial dashboard for real-time tracking of key metrics, which became a central tool for strategic decision-making by the executive team.

- Initiated a monthly internal audit program that ensured continual adherence to financial regulations, reducing compliance risks.

- Collaboratively worked with the sales team to remodel the commission structure, aligning it more closely with company profitability targets.

- Established a more stringent debtor follow-up process that slashed bad debt write-offs by 50% within the first year of implementation.

- Contributed to the successful acquisition of a major competitor by performing due diligence and preparing financial outcome scenarios for the board.

Writing your CV without professional experience for your first job or when switching industries

There comes a day, when applying for a job, you happen to have no relevant experience, whatsoever. Yet, you're keen on putting your name in the hat. What should you do? Candidates who part-time experience , internships, and volunteer work.

Recommended reads:

PRO TIP

Describe how each job helped you grow or learn something new, showing a continuous development path in your career.

Mix and match hard and soft skills across your bookkeeper CV

Your skill set play an equally valid role as your experience to your application. That is because recruiters are looking for both:

- hard skills or your aptitude in applying particular technologies

- soft skills or your ability to work in a team using your personal skills, e.g. leadership, time management, etc.

Are you wondering how you should include both hard and soft skills across your bookkeeper CV? Use the:

- skills section to list between ten and twelve technologies that are part of the job requirement (and that you're capable to use);

- strengths and achievements section to detail how you've used particular hard and soft skills that led to great results for you at work;

- summary or objective to spotlight up to three skills that are crucial for the role and how they've helped you optimise your work processes.

One final note - when writing about the skills you have, make sure to match them exactly as they are written in the job ad. Take this precautionary measure to ensure your CV passes the Applicant Tracker System (ATS) assessment.

Top skills for your bookkeeper CV:

Double-entry bookkeeping

Financial reporting

Accounts payable/receivable

General ledger maintenance

Bank reconciliation

Tax preparation

Accounting software proficiency

Payroll processing

Cash flow management

Budgeting

Attention to detail

Analytical thinking

Time management

Problem-solving

Communication

Organisation

Confidentiality

Adaptability

Teamwork

Customer service orientation

PRO TIP

Use mini case studies or success stories in your CV to demonstrate how your skills have positively impacted previous roles or projects.

Education and more professional qualifications to include in your bookkeeper CV

If you want to showcase to recruiters that you're further qualified for the role, ensure you've included your relevant university diplomas. Within your education section:

- Describe your degree with your university name(-s) and start-graduation dates;

- List any awards you've received, if you deem they would be impressive or are relevant to the industry;

- Include your projects and publications, if you need to further showcase how you've used your technical know-how;

- Avoid listing your A-level marks, as your potential employers care to learn more about your university background.

Apart from your higher education, ensure that you've curated your relevant certificates or courses by listing the:

- name of the certificate or course;

- name of the institution within which you received your training;

- the date(-s) when you obtained your accreditation.

In the next section, discover some of the most relevant certificates for your bookkeeper CV:

PRO TIP

If there's a noticeable gap in your skillset for the role you're applying for, mention any steps you're taking to acquire these skills, such as online courses or self-study.

Recommended reads:

Key takeaways

Impressing recruiters with your experience, skill set, and values starts with your professional bookkeeper CV. Write concisely and always aim to answer job requirements with what you've achieved; furthermore:

- Select a simple design that complements your experience and ensures your profile is presentable;

- Include an opening statement that either spotlights your key achievements (summary) or showcases your career ambitions (objective);

- Curate your experience bullets, so that each one commences with a strong, action verb and is followed up by your skill and accomplishment;

- List your hard and soft skills all across different sections of your CV to ensure your application meets the requirements;

- Dedicate space to your relevant higher education diplomas and your certificates to show recruiters you have the necessary industry background.