One specific CV challenge faced by the banking sector is effectively sifting through high volumes of applications to find the most qualified candidates. By following our guide, you'll learn how to optimise your recruitment process using the latest screening technologies and best practices to quickly identify top talent.

- Create an attention-grabbing header that integrates keywords and includes all vital information;

- Add strong action verbs and skills in your experience section, and get inspired by real-world professionals;

- List your education and relevant certification to fill in the gaps in your career history;

- Integrate both hard and soft skills all through your CV.

Discover more industry-specific guides to help you apply for any role in the links below:

Resume examples for banking

By Experience

Investment Banking Analyst

- Showcases a Progressive Career Path - The CV illustrates a well-defined career trajectory, detailing significant promotions from entry-level roles to senior management positions. This progression highlights the candidate's ability to adapt and excel within their industry, suggesting a robust capacity for growth and leadership.

- Emphasizes Cross-Functional Collaboration - One of the CV's standout features is its clear narrative around cross-functional experience. The candidate effectively communicates their involvement in interdisciplinary projects, emphasizing their skills in working with diverse teams, managing cross-departmental projects, and aligning strategies across different business units.

- Utilizes Industry-Specific Tools and Methodologies - The document provides a deep dive into specialized industry tools and methodologies, demonstrating the candidate's technical prowess. Detailed mentions of software like Tableau, Six Sigma methodologies, and agile project management tools underscore their technical expertise and their value in industry-specific processes.

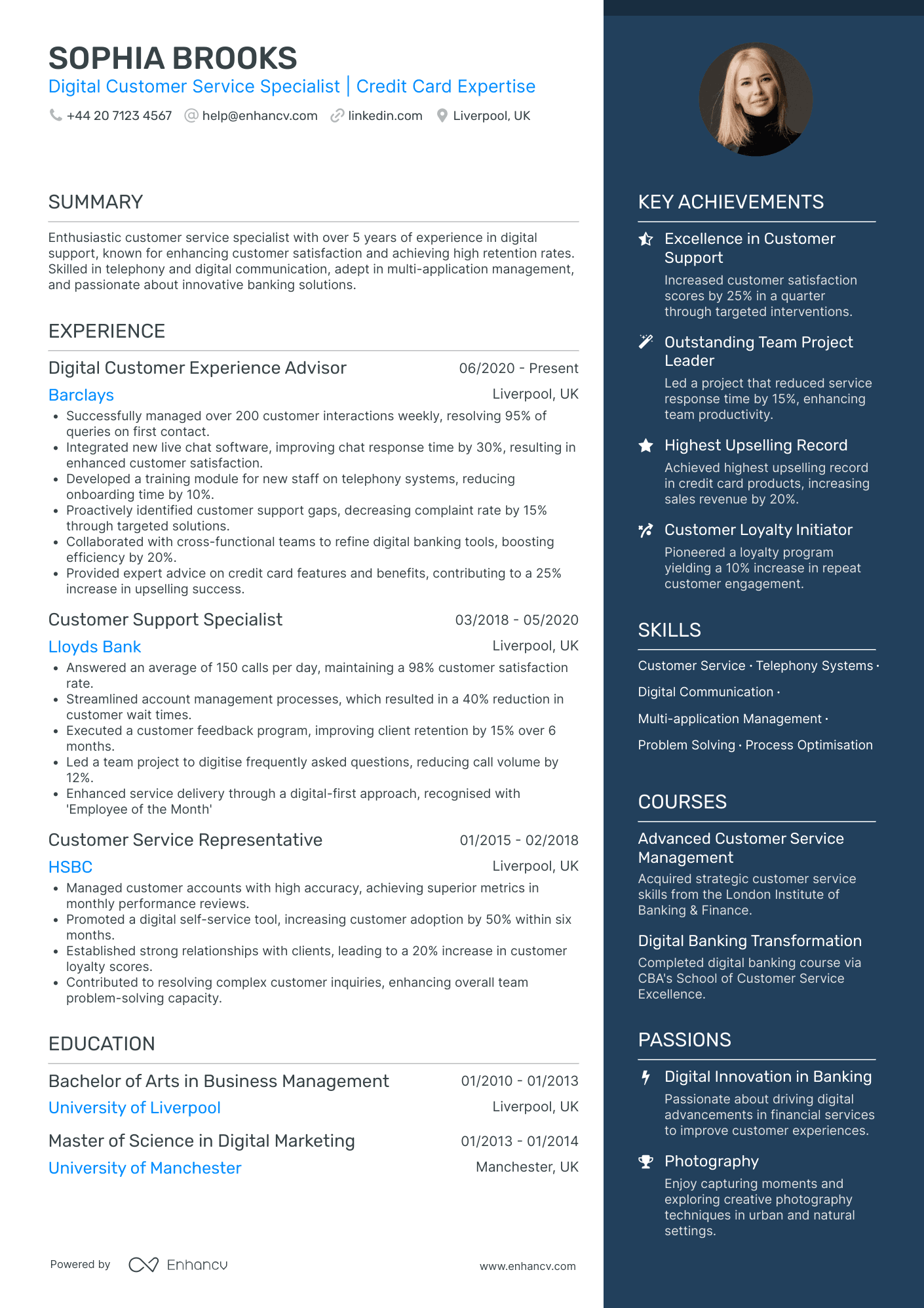

Entry Level Banking Associate

- Content presentation through structured sections - Sophia Brooks’ CV is well-organized, with clearly segmented sections that facilitate easy navigation and comprehension. Key parts like summary, experience, education, skills, and achievements are succinctly articulated, providing direct insights into her professional journey and qualifications.

- Career trajectory marked by progressively challenging roles - The chronological arrangement of her work experience, from a Customer Service Representative at HSBC to a Digital Customer Experience Advisor at Barclays, illustrates Sophia's increasing responsibilities and career growth. Her transition from general customer support roles to specialist positions highlights a focused development in digital customer service expertise.

- Tools and methodologies specific to the digital banking sector - Sophia's CV includes mention of integrating live chat software, telephony systems, and digital banking tools, indicating her practical knowledge of industry-specific technologies. This technical depth signifies her ability to leverage tools effectively in enhancing customer service operations.

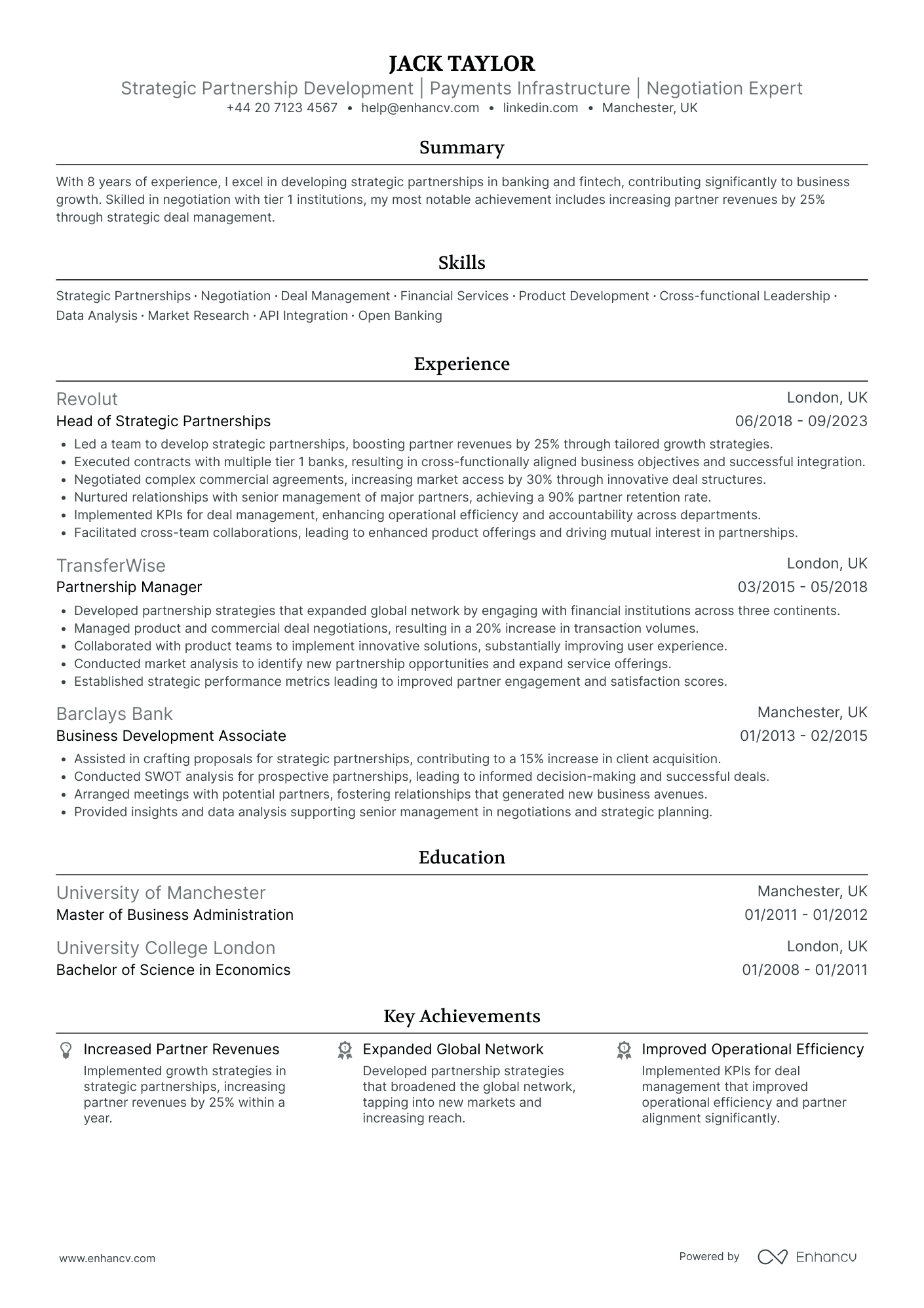

Senior Banking Consultant

- Comprehensive Career Growth - Jack Taylor's CV reflects a remarkable trajectory from a Business Development Associate at Barclays Bank to the Head of Strategic Partnerships at Revolut. Each role shows a clear step up in responsibilities and complexity, illustrating a consistent upward career path in the highly competitive fintech and banking industry.

- Effective Communication and Leadership - The CV highlights Jack's leadership skills through detailed examples, such as leading a team at Revolut to successfully negotiate strategic contracts, resulting in significant market access expansion. It demonstrates his capability in not only managing teams but also in developing strong partnerships with senior management of major partners.

- Strong Emphasis on Achievements - Rather than just listing roles and responsibilities, Jack's CV places significant emphasis on quantifiable achievements. It showcases how he increased partner revenues by 25% and expanded market access by 30%, emphasizing the impact of his strategic and negotiation skills on business outcomes.

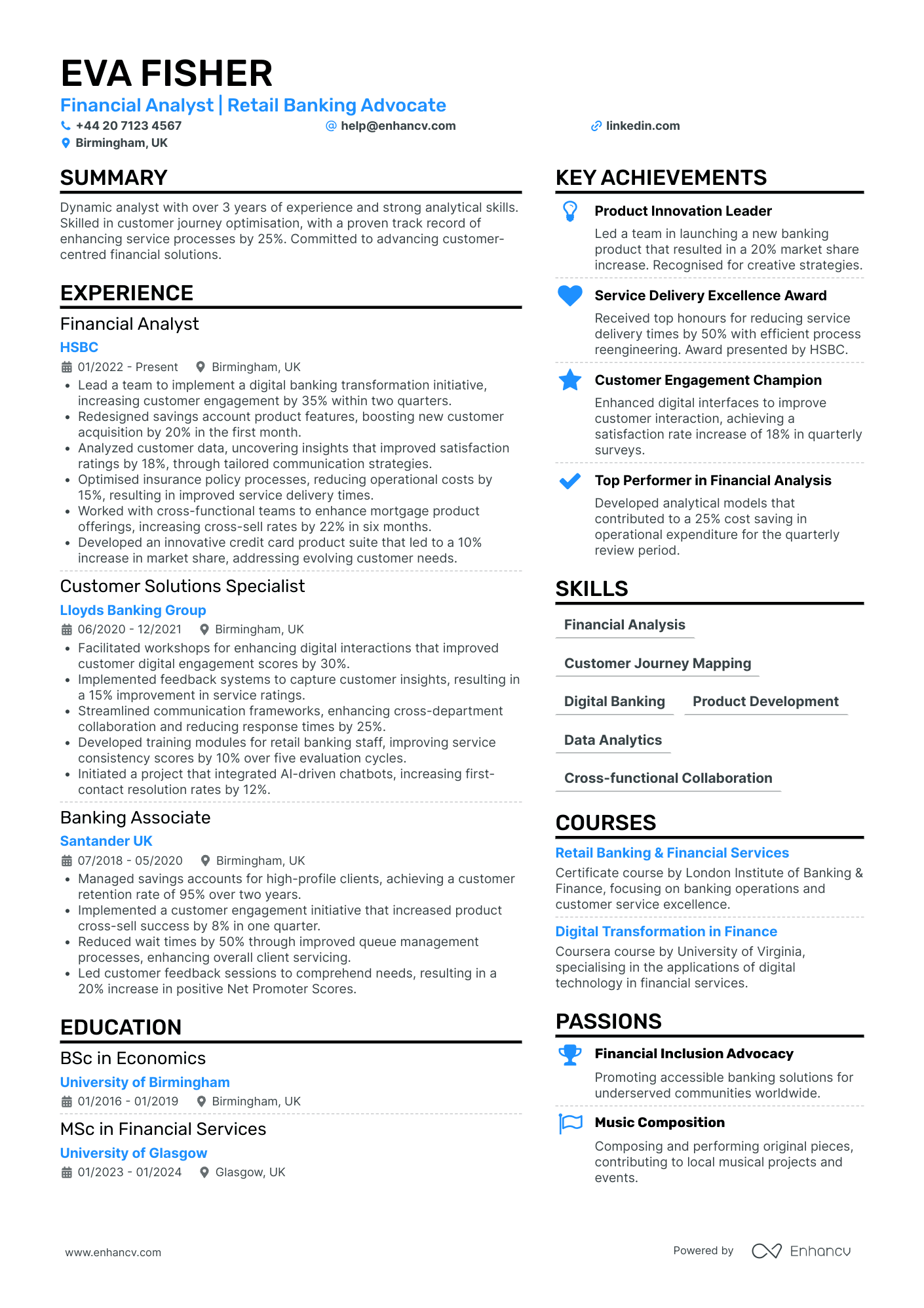

Mid-Level Banking Analyst

- Structured and Concise Presentation - Eva Fisher's CV is organized into clear sections, making it easy to parse important information swiftly. The use of bullet points in her experience section allows for quick identification of key achievements and contributions, maintaining conciseness while providing rich details.

- Comprehensive Career Growth - The CV showcases a logical career progression within the banking industry, moving from a Banking Associate to a Financial Analyst. Each role displays increased responsibilities and achievements, indicating strategic and thoughtful career growth, positioned within well-recognized financial institutions.

- Strong Emphasis on Achievements and Impact - Fisher's CV is laden with quantifiable achievements, such as a 35% increase in customer engagement following a digital transformation initiative, spotlighting her tangible impact on business outcomes. These metrics not only validate her contributions but also align them with business goals, making her a valuable candidate for roles focused on financial analysis and customer-centered initiatives.

Experienced Banking Auditor

- Clarity in Experience and Achievements - The CV is well-structured, ensuring clarity by organizing content into distinct sections like experience, education, skills, and achievements. Each position held by the candidate details specific contributions and results, making it easy to understand their direct impact on the organization's success.

- Progressive Career Trajectory in Financial Services - Charlotte's career shows a progressive trend from Audit Associate to Senior Auditor, indicating a clear path of growth and increased responsibility within top-tier financial institutions. Her advancement highlights her expertise in auditing and risk assessment, underscoring her capacity for leadership roles.

- Proficiency in Industry-Specific Tools and Techniques - The CV showcases Charlotte's technical proficiency, detailing her use of data analytics and advanced technologies to enhance audit frameworks and efficiency. This expertise is crucial in today's data-driven financial environments, adding a competitive edge to her profile.

By Role

Banking Operations Manager

- Structured Career Progression - Freya Richardson's career trajectory showcases a clear and structured progression within the financial services industry. Starting as a Financial Operations Associate at Barclays, she advanced to a Custody Services Specialist at J.P. Morgan, and currently holds a senior role at HSBC Securities Services. This progression highlights her ability to excel and take on increasing responsibilities within securities operations.

- Industry-Specific Expertise and Methods - The CV emphasizes Freya's proficiency in specialized areas of securities services, such as custody settlements and corporate actions processing. Additionally, she demonstrates knowledge of complex securities operations and best practices in custody and clearing, exhibited by her certifications and completed courses, which enhance her ability to contribute valuable industry insights.

- Significant Achievements with Quantifiable Impacts - Freya's achievements are clearly articulated with quantifiable metrics, reflecting her substantial impact on business operations. Examples include improving operational efficiency by 20% at HSBC through streamlined processes, enhancing client satisfaction by 40% at J.P. Morgan with a new management system, and increasing compliance efficiency at Barclays by 10% through better tax reporting.

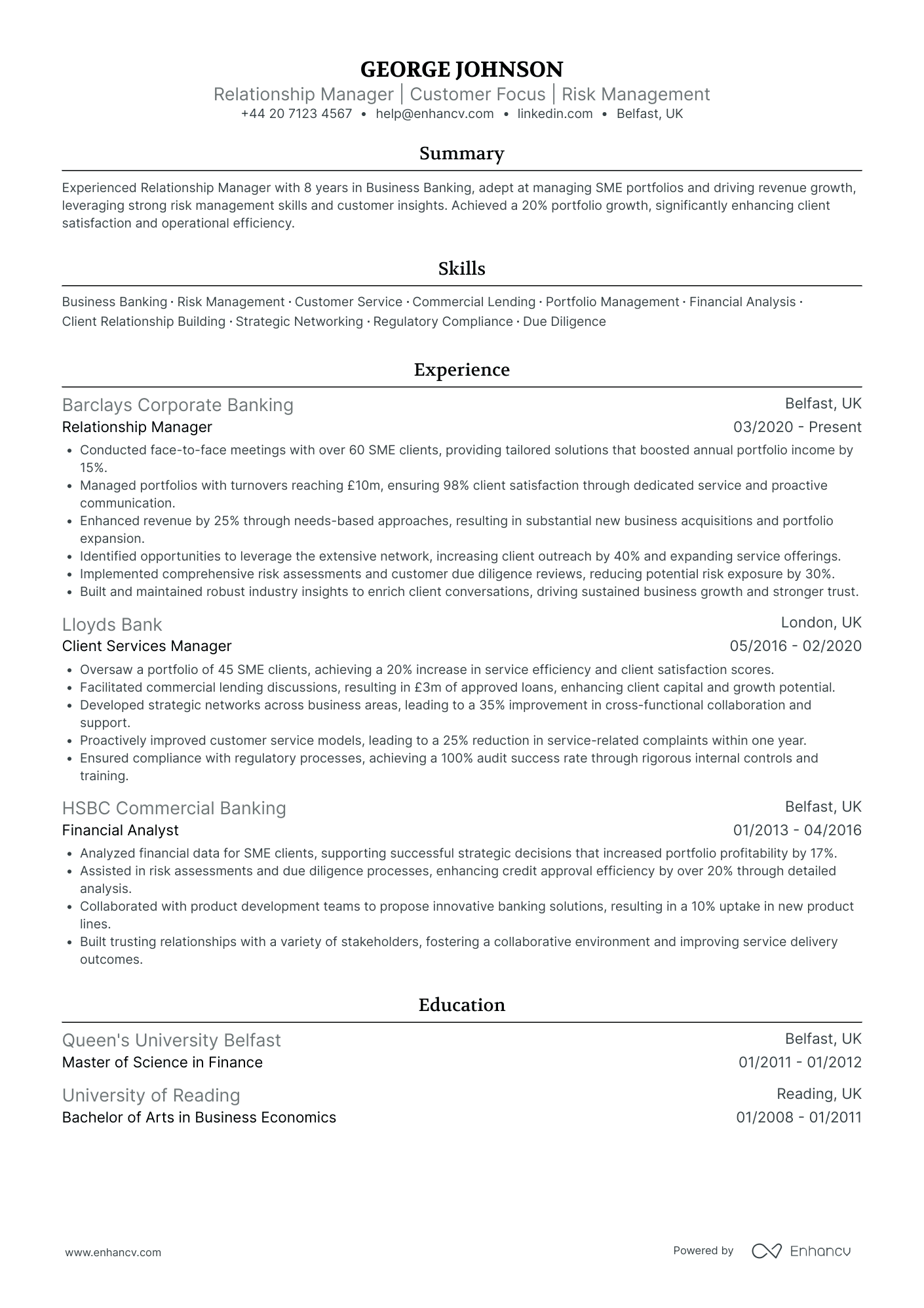

Banking Relationship Manager

- Strategic Career Progression - The CV illustrates a clear career trajectory within the banking sector, starting from a Financial Analyst role and advancing to Relationship Manager. This progression showcases the candidate’s ability to grow within the industry by consistently taking on roles that require increasing levels of responsibility and expertise.

- Robust Risk Management Utilization - Emphasizing unique industry elements, this CV stands out with its focus on risk management methodologies. The candidate’s experience in implementing comprehensive risk assessments and developing innovative models to reduce exposure underscores their technical depth and strategic thinking within business banking.

- Strong Leadership and Client Focus - Highlighting soft skills, the CV effectively details leadership capabilities and a commitment to client satisfaction. Through roles that required managing client portfolios and ensuring regulatory compliance, the candidate has demonstrated the capacity to lead teams, build strong client relationships, and improve service delivery outcomes.

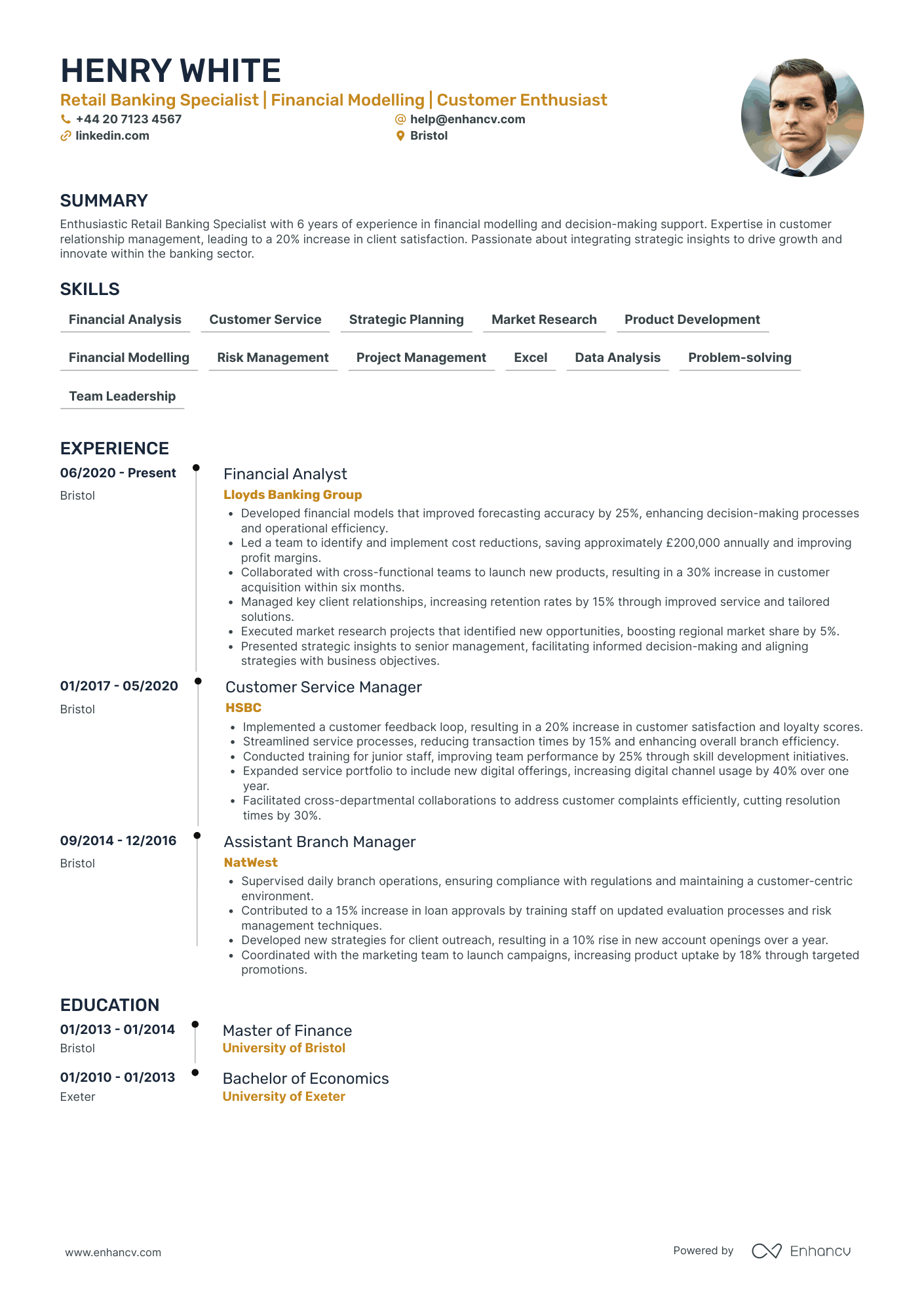

Retail Banking Manager

- Structured Career Advancement Path - The CV clearly outlines a progressive career trajectory, demonstrating a consistent rise through the ranks in the tech industry. Starting from entry-level roles in software development, the individual has methodically climbed up to managerial and leadership positions, evidencing their growth and ability to scale complexity and responsibilities.

- Integration of Industry-Specific Tools and Techniques - This CV excels in listing a comprehensive array of specialized tools and methodologies relevant to the financial services sector, such as Bloomberg Terminal and advanced quantitative modeling techniques. By doing so, it underscores the individual's technical depth and preparedness to tackle industry-specific challenges.

- Emphasis on Cross-Functional Collaboration - The individual's history includes significant cross-functional projects, highlighting their adaptability and ability to work collaboratively across various departments. This proficiency is particularly visible in roles where they have contributed to interdisciplinary teams, driving innovative solutions that integrate technological and strategic elements.

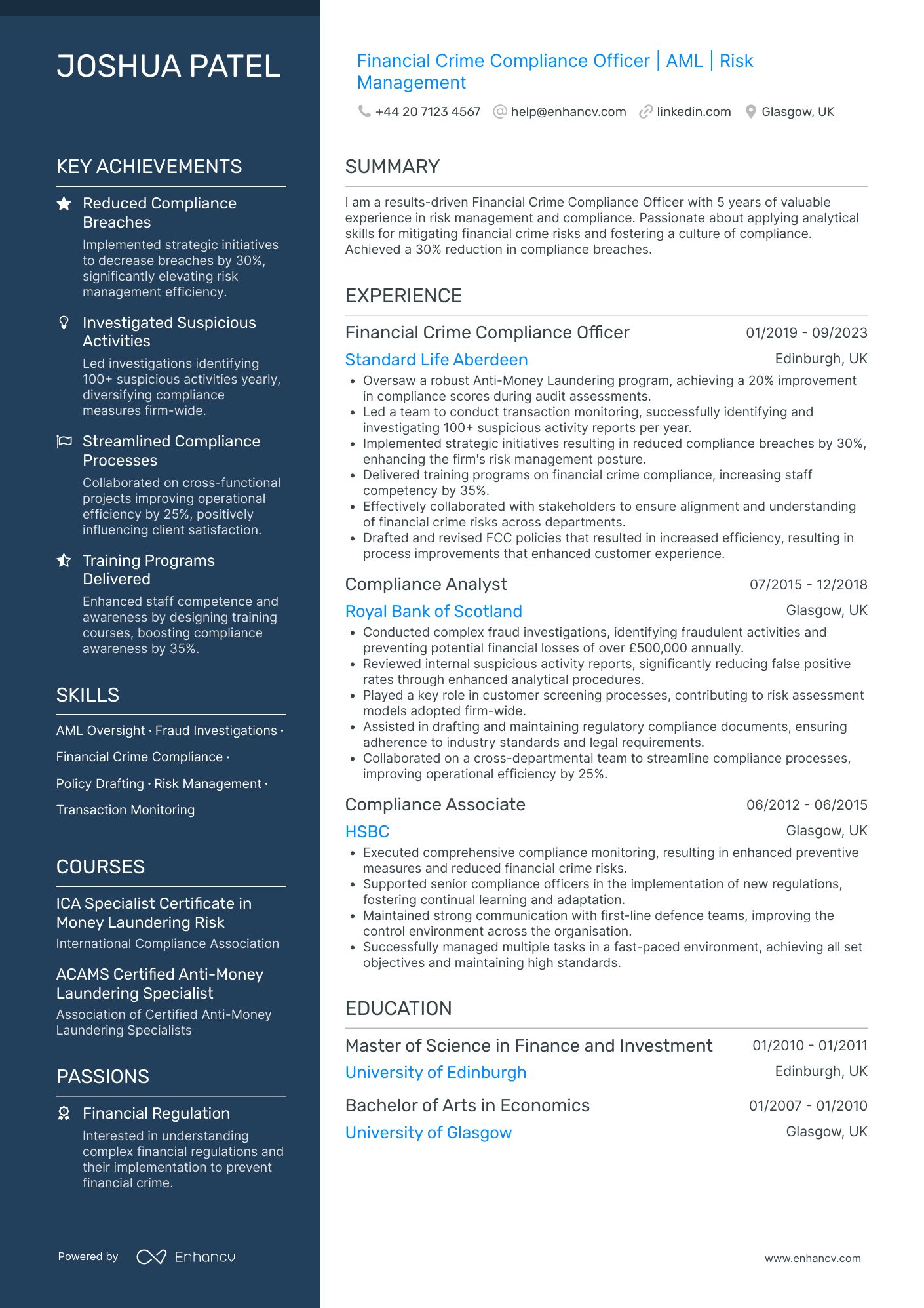

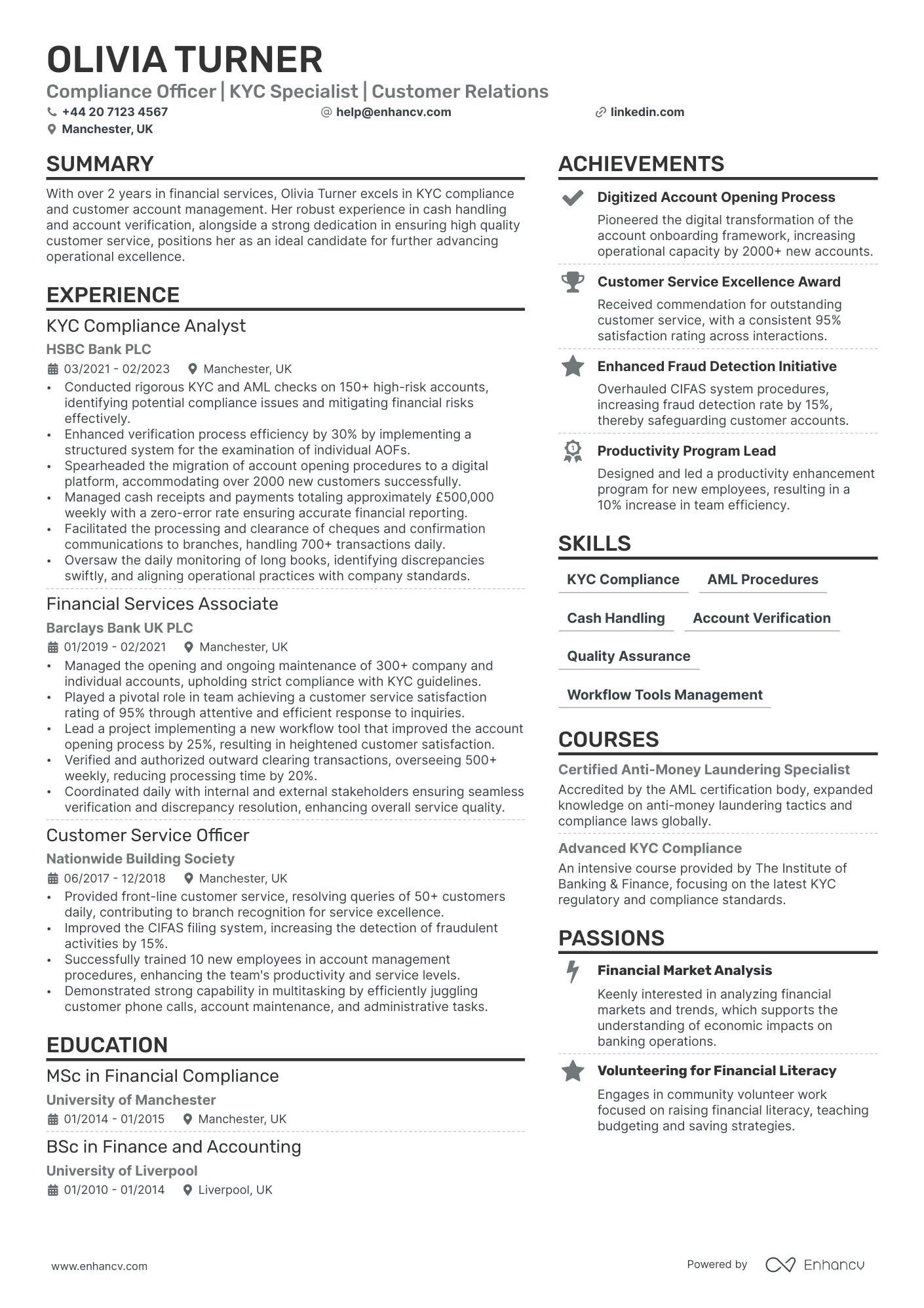

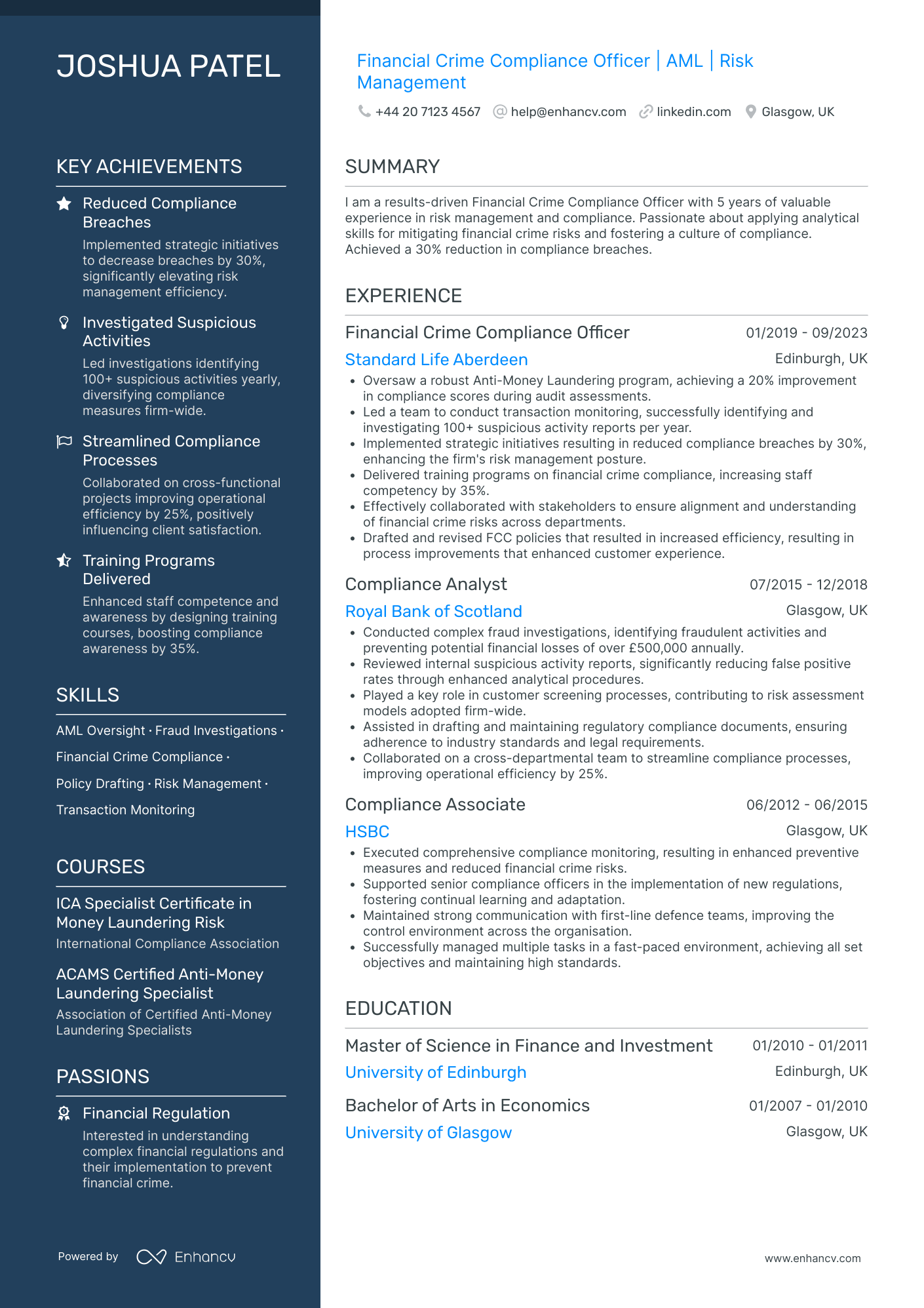

Banking Compliance Officer

- Structured Experience Section - The CV presents work experience in an orderly and concise manner, clearly outlining the previous roles, companies, and periods of employment, which helps in understanding the career trajectory at a glance. Each position is elaborated with bullet points focused on achievements rather than just responsibilities, showcasing the impact of the candidate's work.

- Career Growth in Compliance - Joshua Patel's career trajectory shows a consistent growth within the financial compliance sector. The progression from Compliance Associate to Compliance Analyst and subsequently to Financial Crime Compliance Officer reflects both industry-specific advancement and deepening expertise in the domain. This illustrates the candidate’s continuous development and dedication to the field.

- Focus on AML and Risk Management - The CV includes industry-specific skills and certifications in Anti-Money Laundering (AML) and risk management, highlighting a robust understanding of compliance tools such as transaction monitoring and policy drafting. Additionally, certifications like the ICA Diploma and ACAMS showcase both technical depth and a commitment to professional development in financial crime prevention.

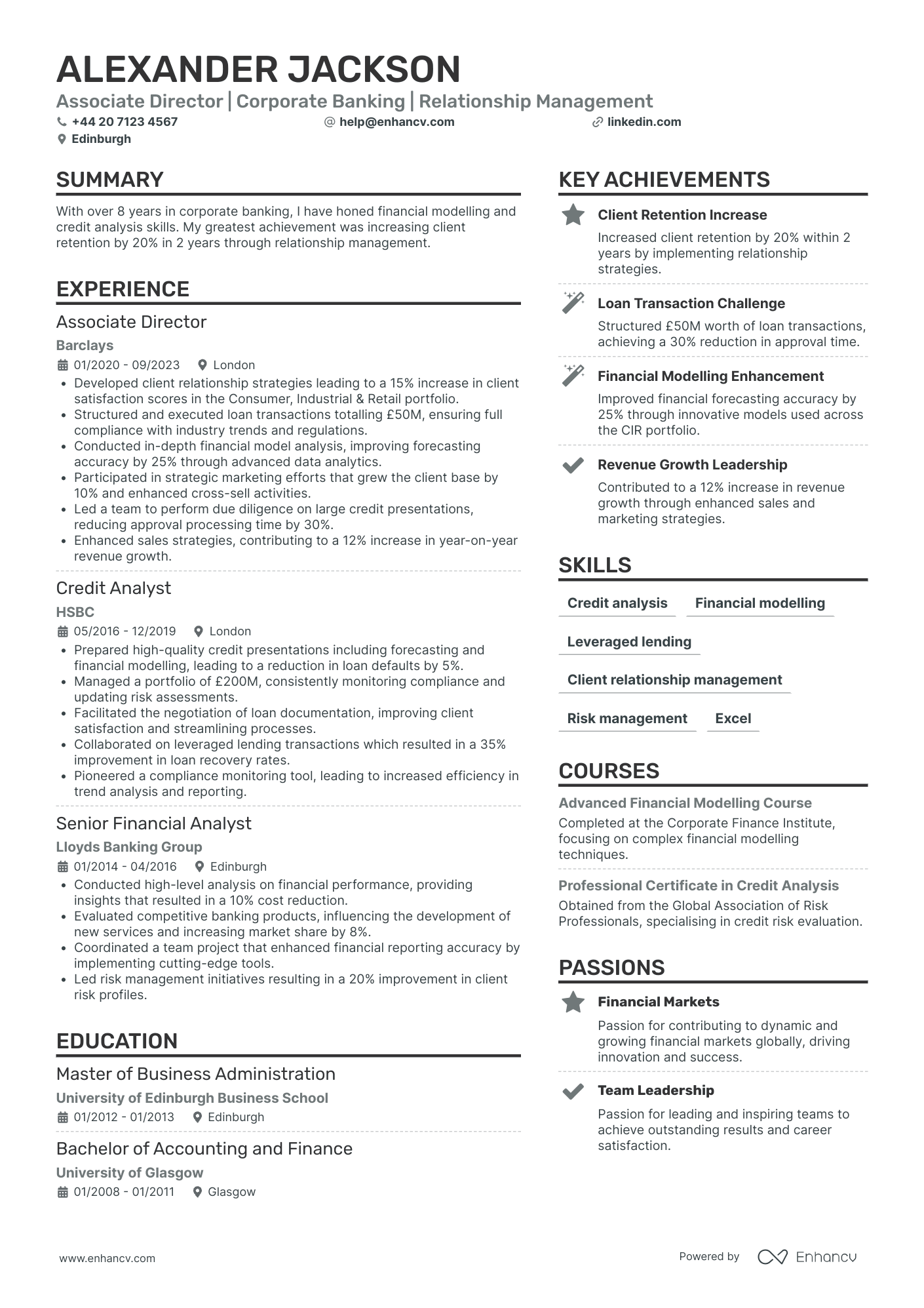

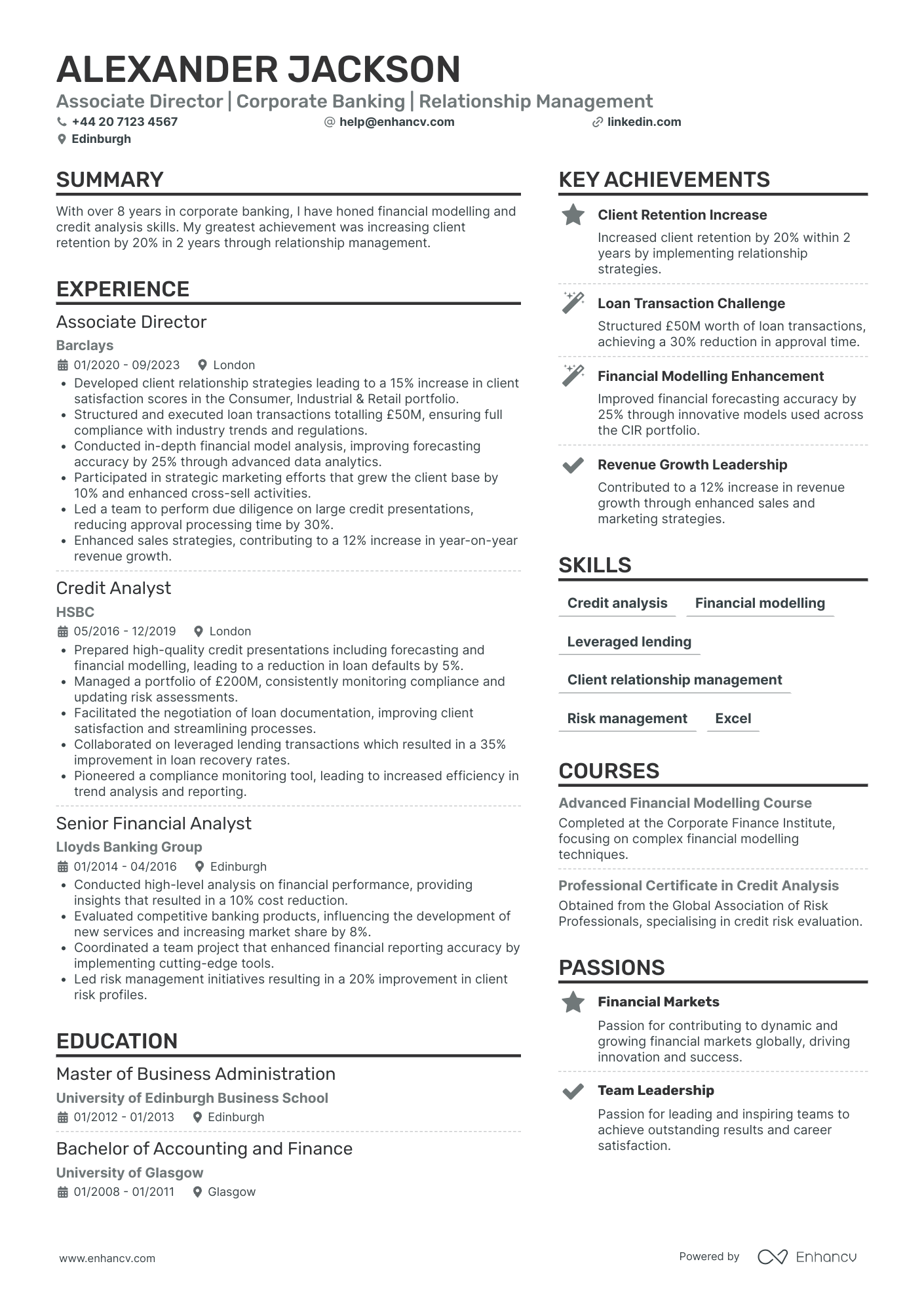

Corporate Banking Manager

- Well-Structured and Concise Presentation - The CV presents Alexander Jackson's experience in a clean and organized manner, listing roles in reverse chronological order with concise bullet points. Key accomplishments and responsibilities are clearly highlighted, making it easy for hiring managers to quickly grasp the candidate’s qualifications and track record.

- Strong Career Growth and Industry Focus - Demonstrating a clear upward career trajectory, Alexander Jackson has advanced from Senior Financial Analyst to Associate Director, showing consistent growth within the corporate banking and finance industry. This progression underscores his capacity for taking on increased responsibilities and leading complex financial projects.

- Emphasis on Measurable Achievements and Impact - Achievements are quantitatively detailed, such as a 20% increase in client retention and a 12% rise in revenue growth, illustrating the candidate’s ability to drive substantial business results. Each metric not only highlights success but also conveys the impact of these accomplishments on the company’s bottom line.

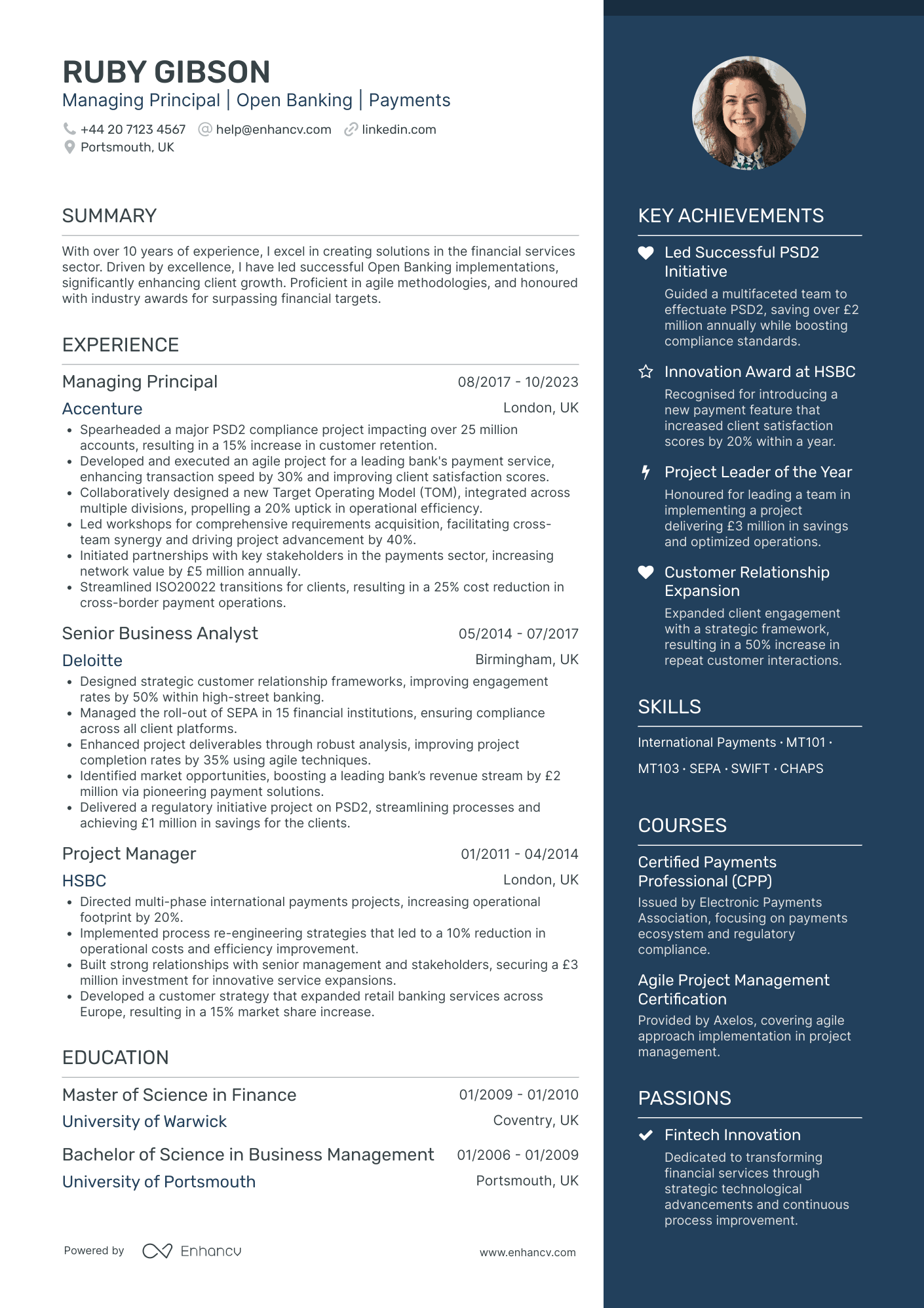

Private Banking Consultant

- Strategic Content Presentation - The structure of this CV adds clarity and precision, with clearly defined sections that efficiently communicate the candidate's career journey. The inclusion of concise bullet points in the experience section underscores significant achievements and responsibilities, making it easy for readers to quickly grasp the scope of the candidate's impact.

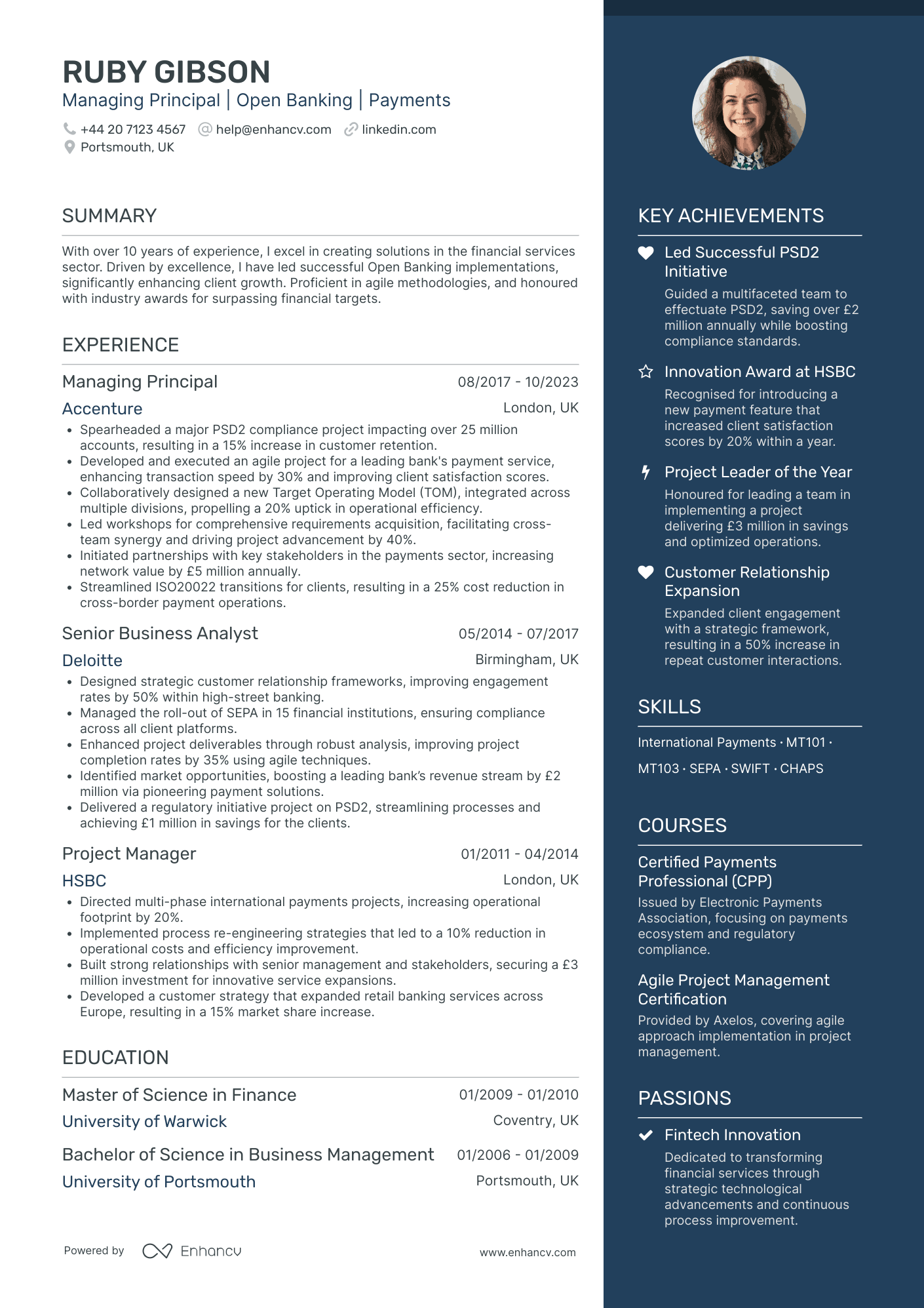

- Impressive Career Progression - This CV highlights a robust career trajectory, showcasing promotions from a Project Manager at HSBC to a Managing Principal at Accenture. Each role demonstrates progression in responsibilities and industry influence, especially within the payments and financial services sector, emphasizing the candidate's capability to grow and lead in dynamic environments.

- Specialized Industry Tools & Methodologies - The candidate's technical skills section reveals a deep understanding of specific industry tools such as SEPA, SWIFT, and ISO20022, along with experience in agile project management. This expertise, combined with the candidate's certifications, denotes a professional who is well-versed in payments systems and strategic implementation, setting them apart in the open banking arena.

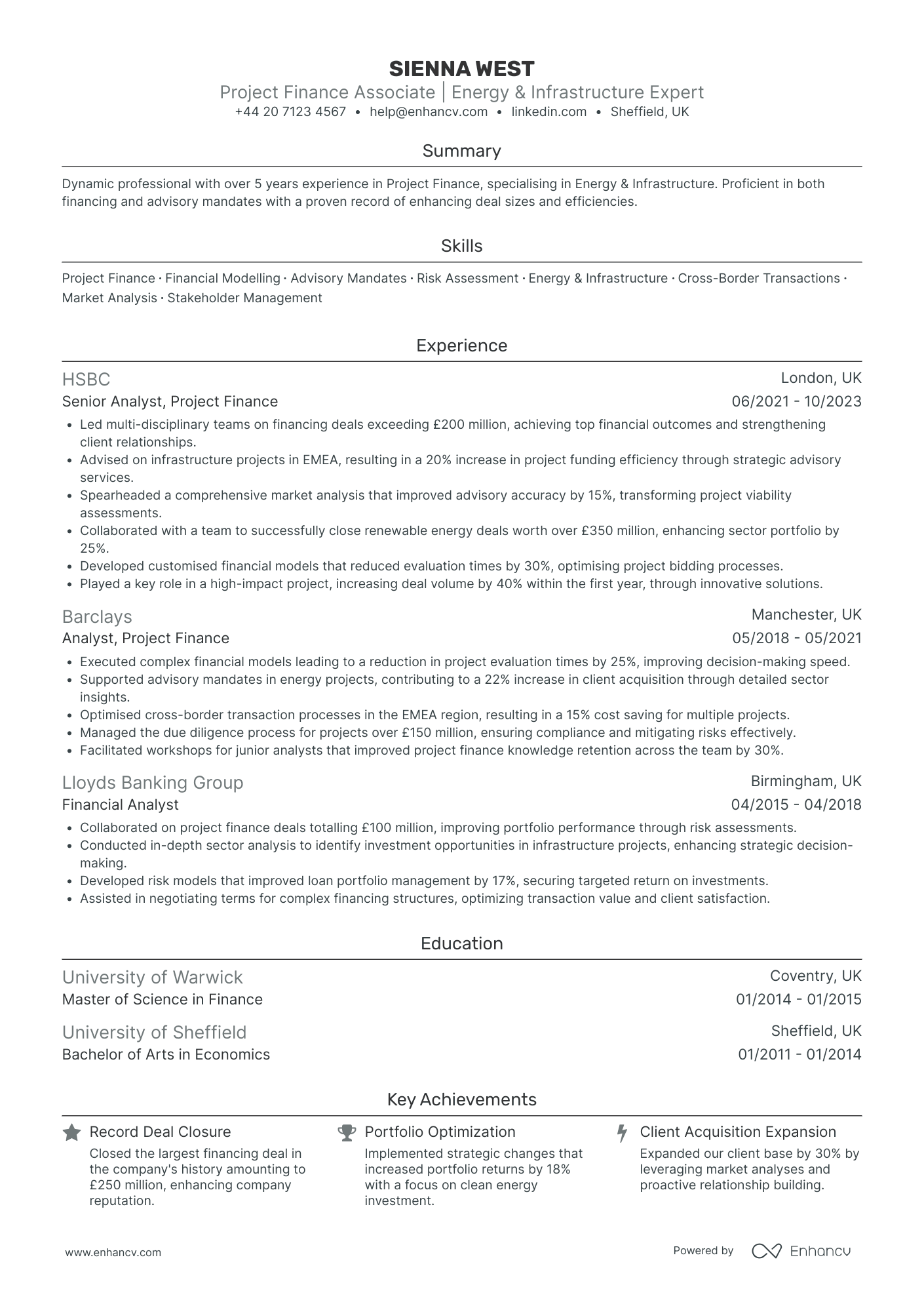

Banking Project Manager

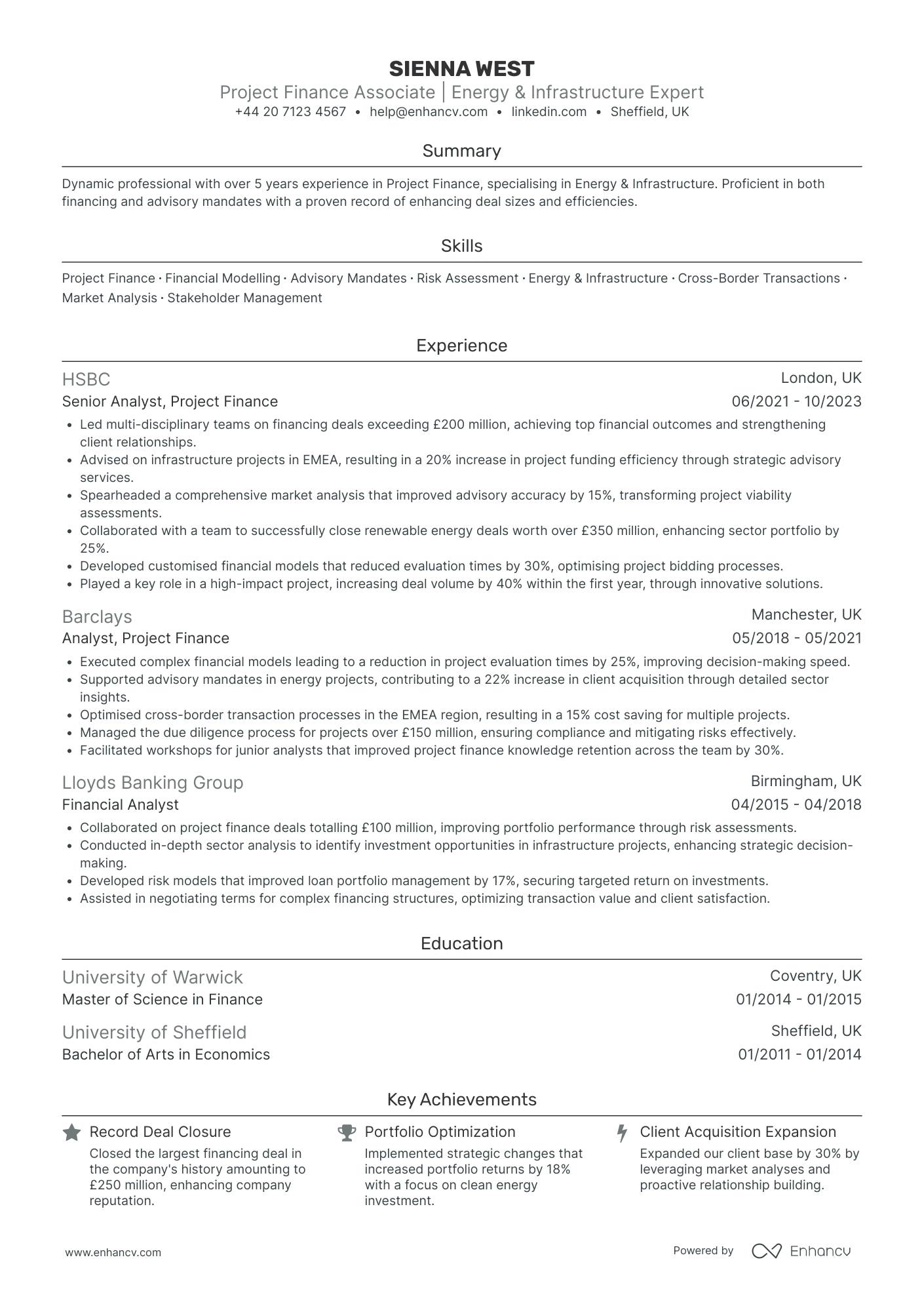

- Strong career progression and expertise development - Sienna West's career trajectory demonstrates significant growth and increasing responsibility, beginning as a Financial Analyst at Lloyds Banking Group, progressing to Analyst at Barclays, and culminating in a senior role at HSBC. This upward trajectory is indicative of her expanding expertise in project finance, particularly within the energy and infrastructure sectors.

- Emphasis on high-impact achievements - The CV effectively highlights notable achievements that are crucial to the business's success. Sienna has closed massive financing deals, significantly contributing to the company's financial health and reputation. Her efforts to enhance project funding efficiencies and improve portfolio returns emphasize her commercial impact and strategic focus.

- Comprehensive and relevant skill set - The skills section provides a clear overview of Sienna's capabilities pertinent to her field, such as project finance, financial modeling, and risk assessment. The inclusion of her specialized knowledge in cross-border transactions and market analysis reveals a well-rounded skill set essential for tackling complex financial projects and advising on strategic decisions.

Banking Risk Analyst

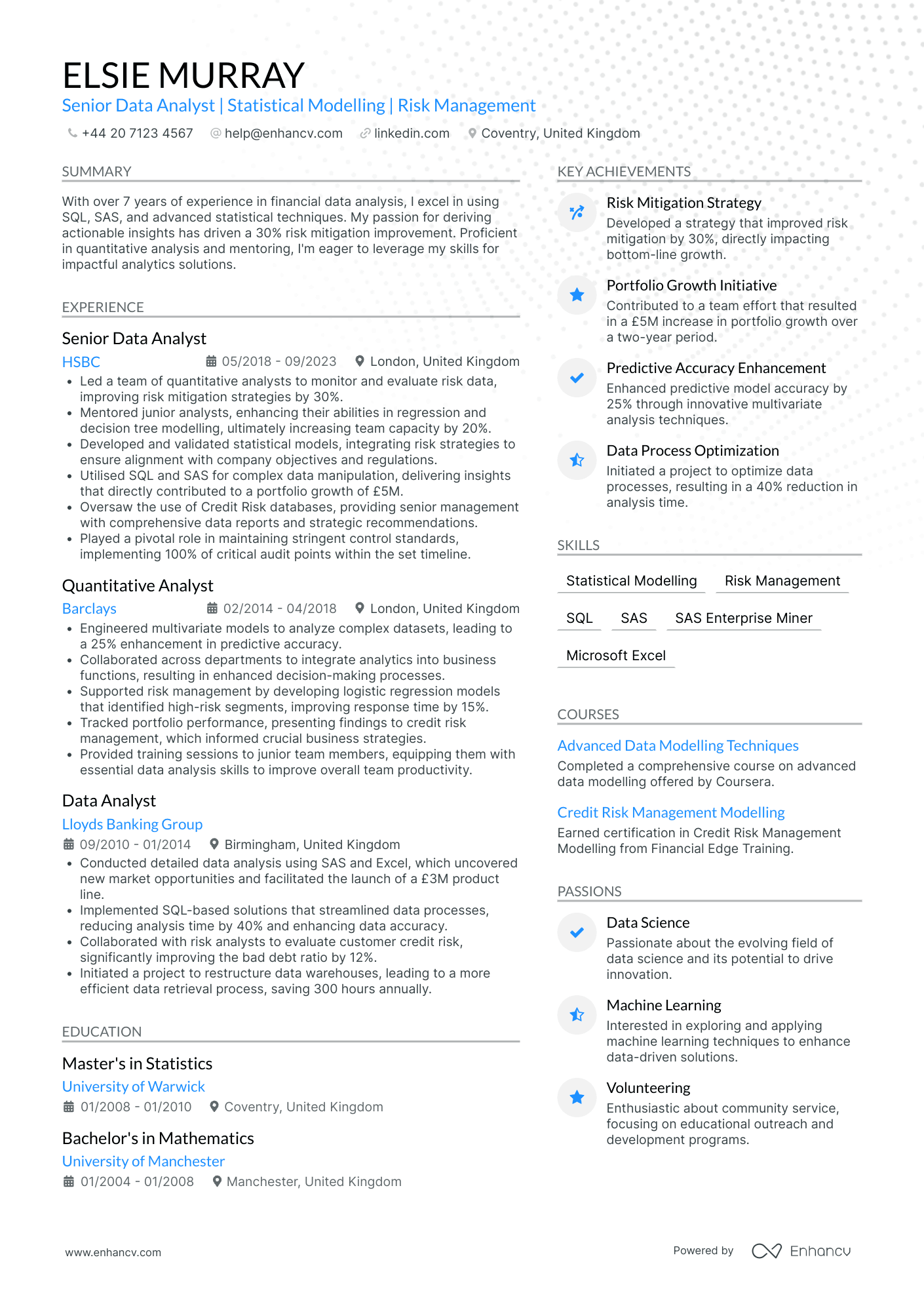

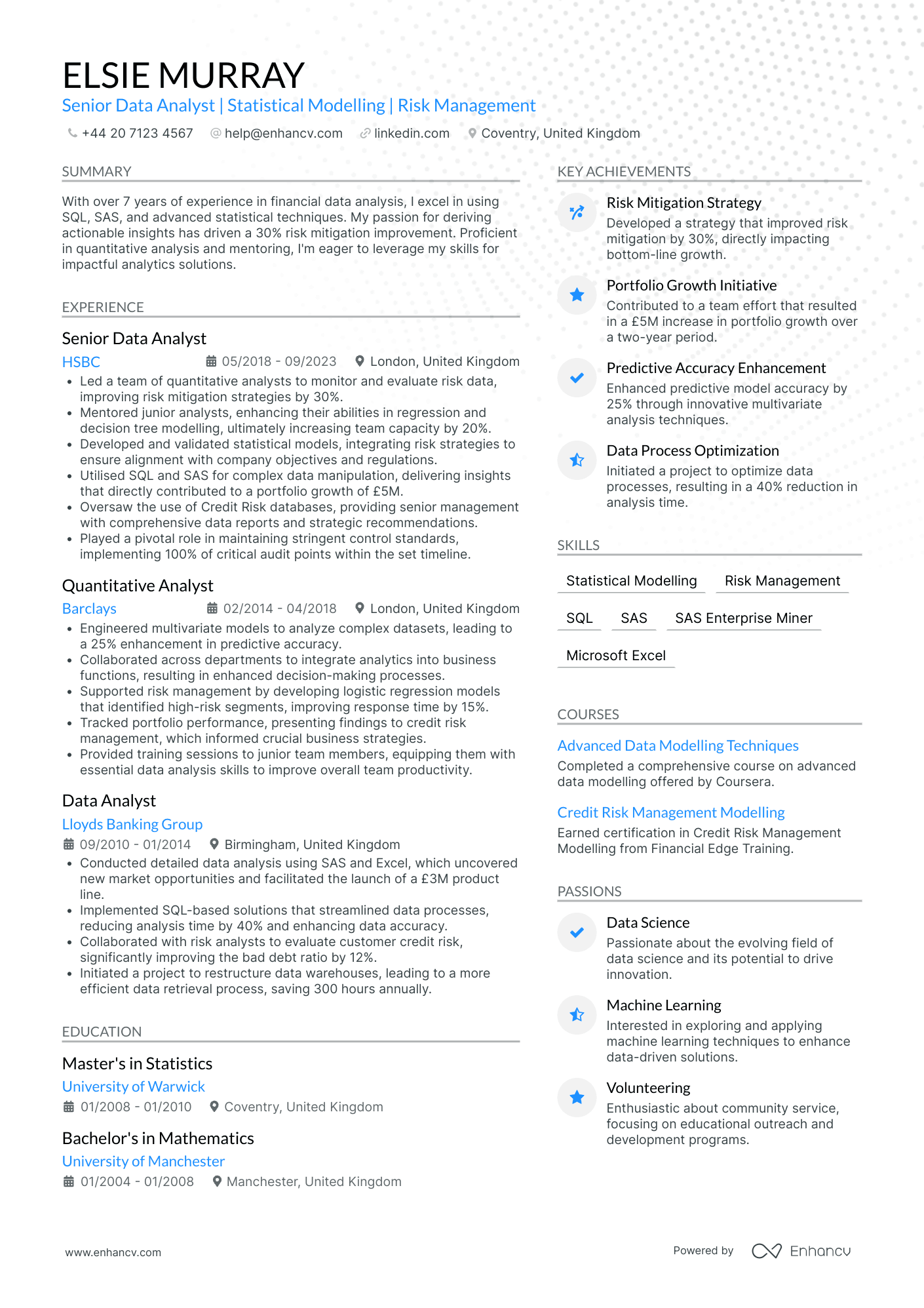

- Strategic Career Progression - Elsie Murray's career trajectory is impressive, displaying significant upward mobility across leading financial institutions like HSBC and Barclays. Her advancements from Data Analyst to Senior Data Analyst underscore her growing responsibility and expertise in data-driven risk management, highlighting her ability to adapt and lead within a competitive industry.

- Technical Acumen in Data Analysis - The CV showcases deep technical proficiency, particularly with statistical tools and software such as SQL, SAS, and SAS Enterprise Miner. Her role in developing and validating complex statistical models and integrating risk strategies demonstrates a robust understanding of predictive modeling, quantitative analysis, and credit risk analysis, all crucial for impactful financial analytics.

- Leadership and Mentoring Capabilities - Beyond technical expertise, Elsie has proven her leadership through mentoring junior analysts, leading teams to optimize risk mitigation strategies, and enhancing regression and decision tree modeling skills. This focus on nurturing talent and expanding team capacity emphasizes her role as a key leader who contributes to organizational growth and development.

Banking Services Manager

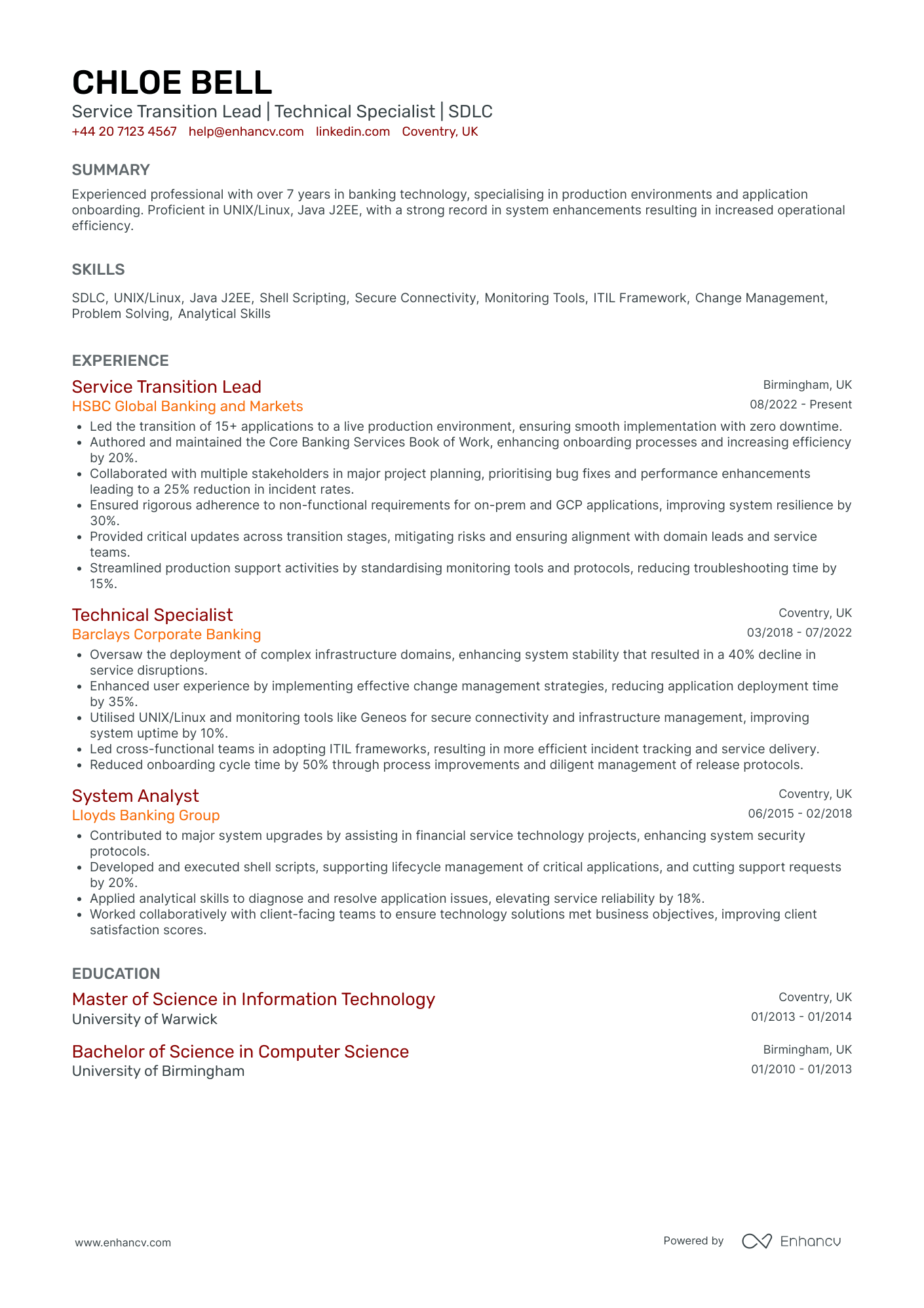

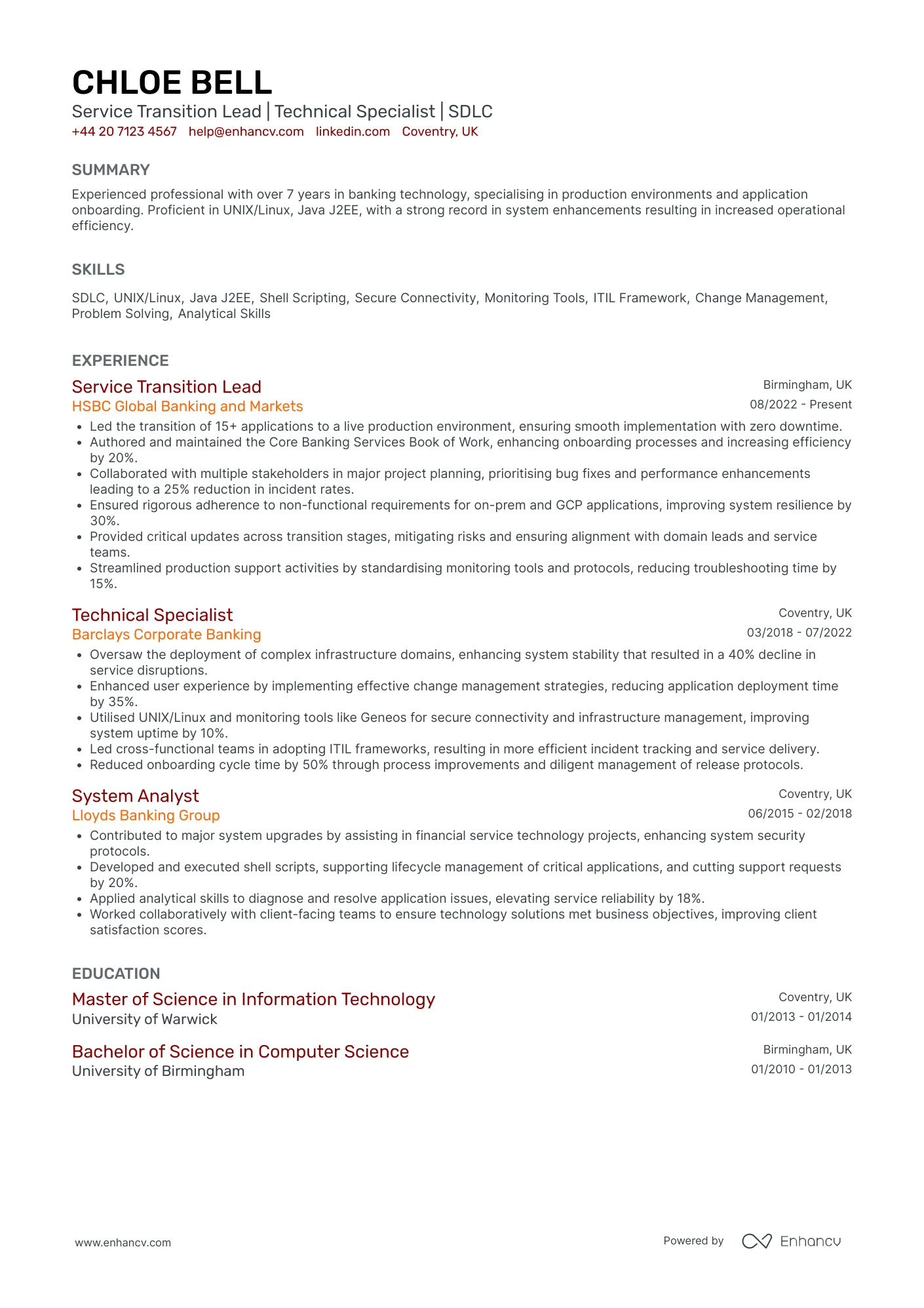

- Concise and structured content presentation - The CV is well-organized, with each section clearly outlined, allowing for easy navigation through Chloe Bell's extensive career history. Bullet points are utilized effectively to succinctly convey key responsibilities and achievements, ensuring clarity without overwhelming details.

- Impressive career trajectory - Chloe Bell demonstrates a clear progression in her career, moving from a System Analyst to a Service Transition Lead. This upward trajectory within high-profile organizations like HSBC and Barclays highlights her ability to take on increasing levels of responsibility and leadership, indicative of significant personal and professional growth.

- Specialized industry expertise - The CV showcases Chloe Bell's deep proficiency in banking technology, notably her expertise in UNIX/Linux, Java J2EE, and system enhancements. Her advanced understanding of production environments and application onboarding is underscored by specific methodologies like the ITIL framework and tools such as Geneos, which are crucial for effective service delivery in the banking sector.

Banking Technology Specialist

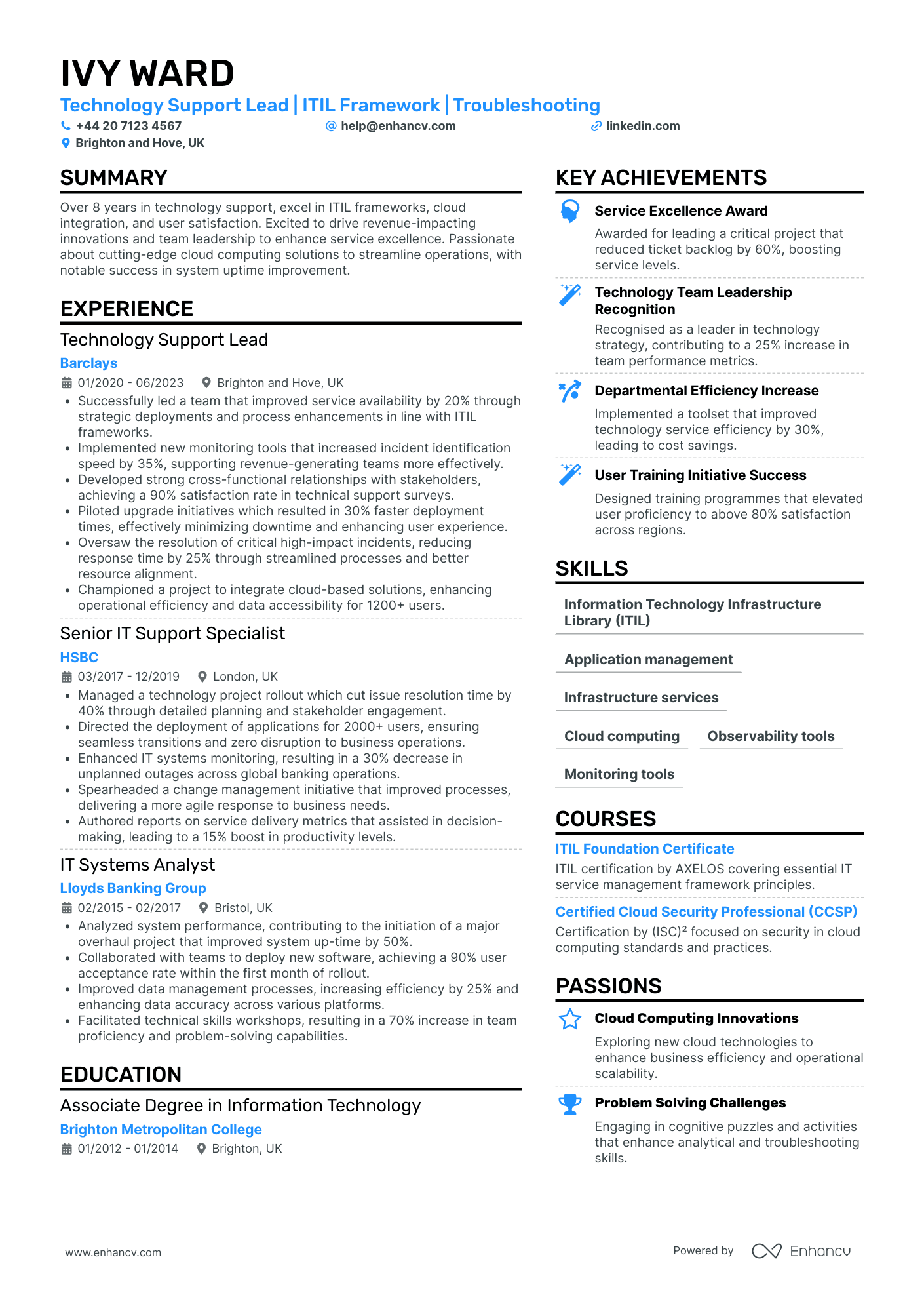

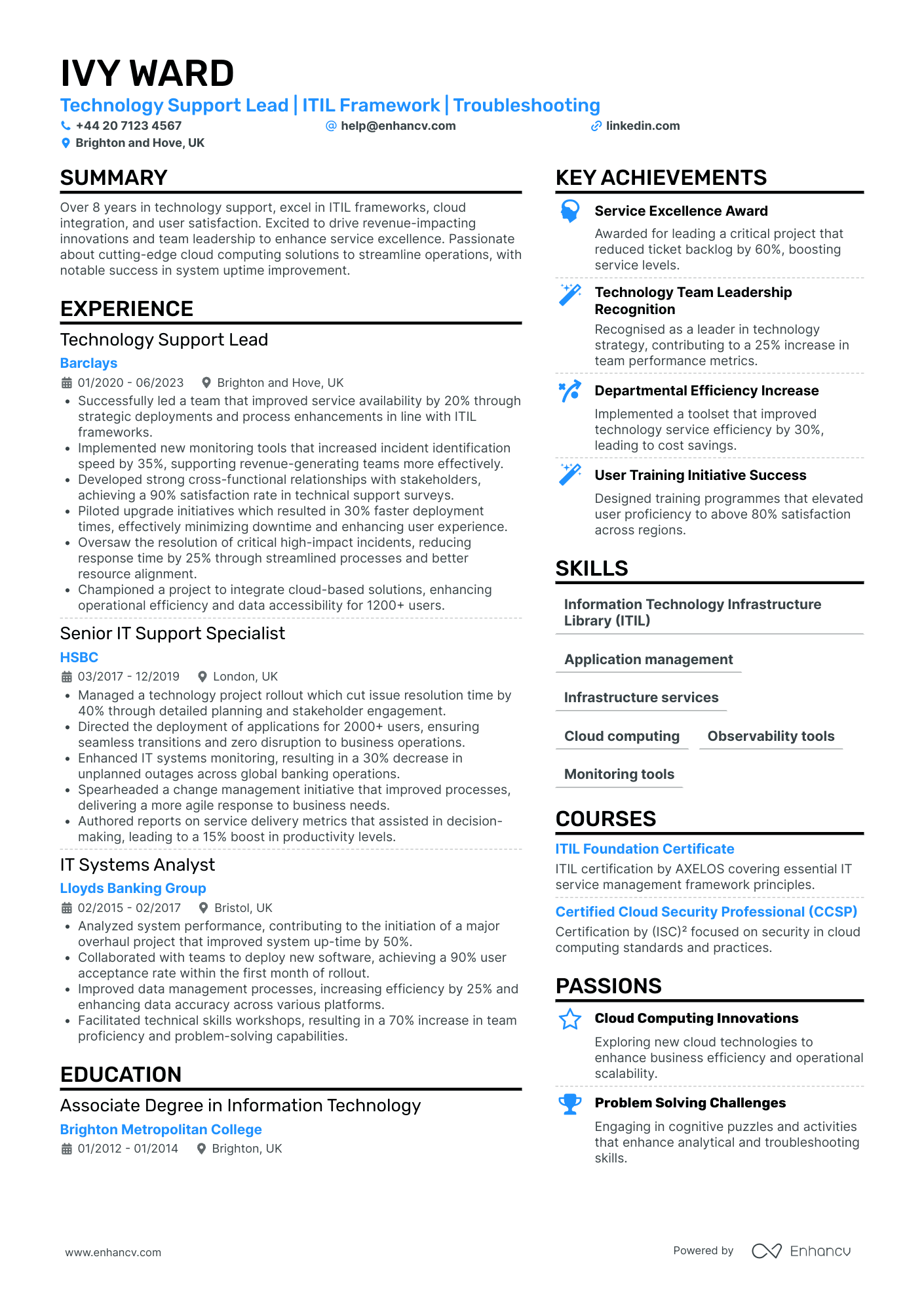

- Career Trajectory and Professional Growth - Ivy Ward’s career journey showcases a clear progression in roles and responsibilities, reflecting her growth from an IT Systems Analyst at Lloyds Banking Group to a Technology Support Lead at Barclays. This trajectory indicates a robust advancement in leadership and technical expertise, aligning with her roles' increasing complexity and a broader strategic impact.

- Technical Depth and Industry-Specific Expertise - The CV distinguishes Ivy through her in-depth knowledge of the ITIL framework and cloud-based solutions. Her experience with deploying monitoring tools and integrating cloud technologies indicates a strong proficiency in cutting-edge IT practices, which is crucial in staying ahead in the rapidly evolving tech support landscape.

- Impactful Achievements with Measurable Outcomes - Ivy’s accomplishments are underscored by quantifiable results, such as a 20% improvement in service availability at Barclays and a 40% reduction in issue resolution time at HSBC. These metrics not only demonstrate her effectiveness in driving operational improvements but also highlight her ability to deliver outcomes that have clear business implications, such as enhancing user satisfaction and minimizing downtime.

Banking Operations Director

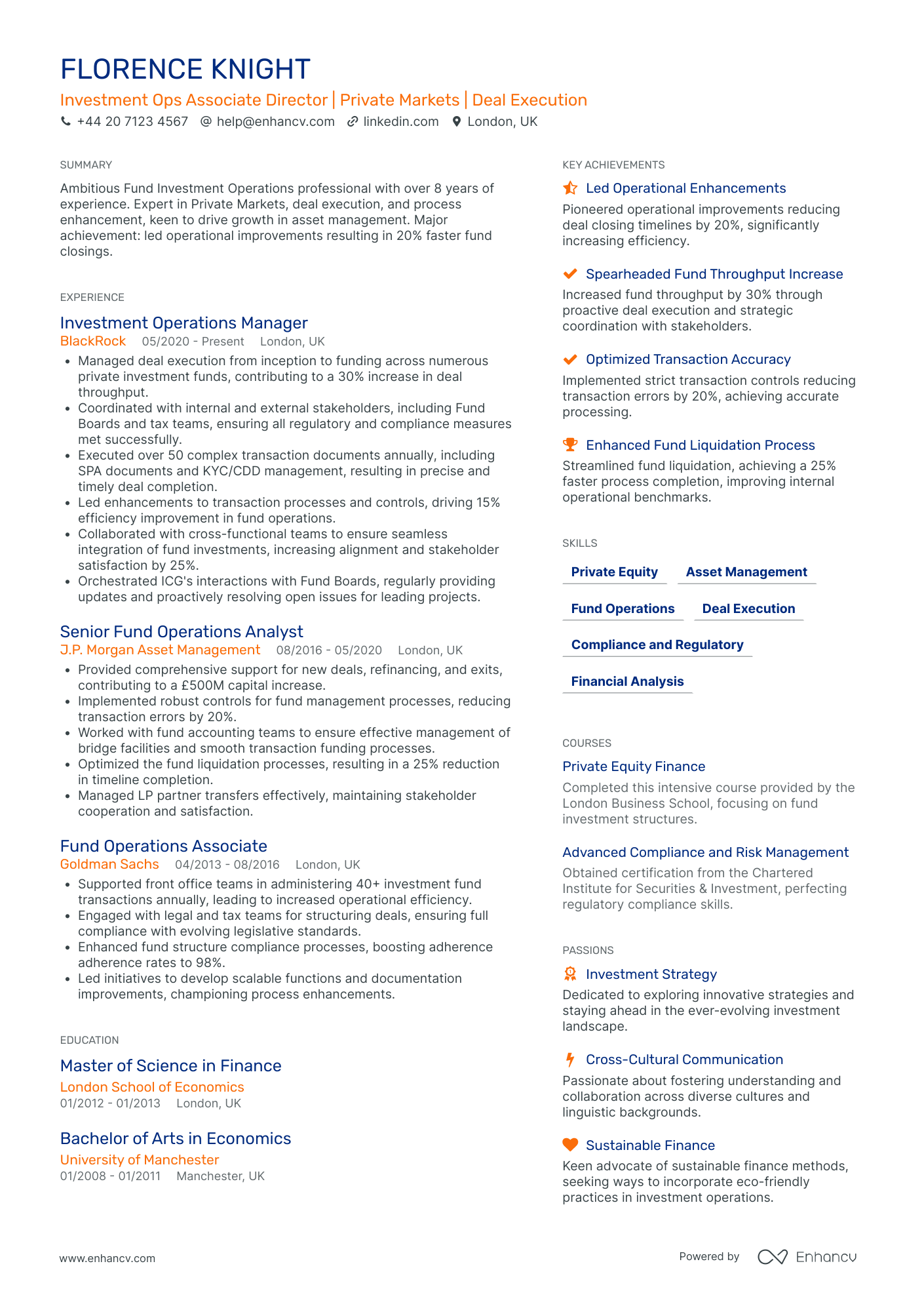

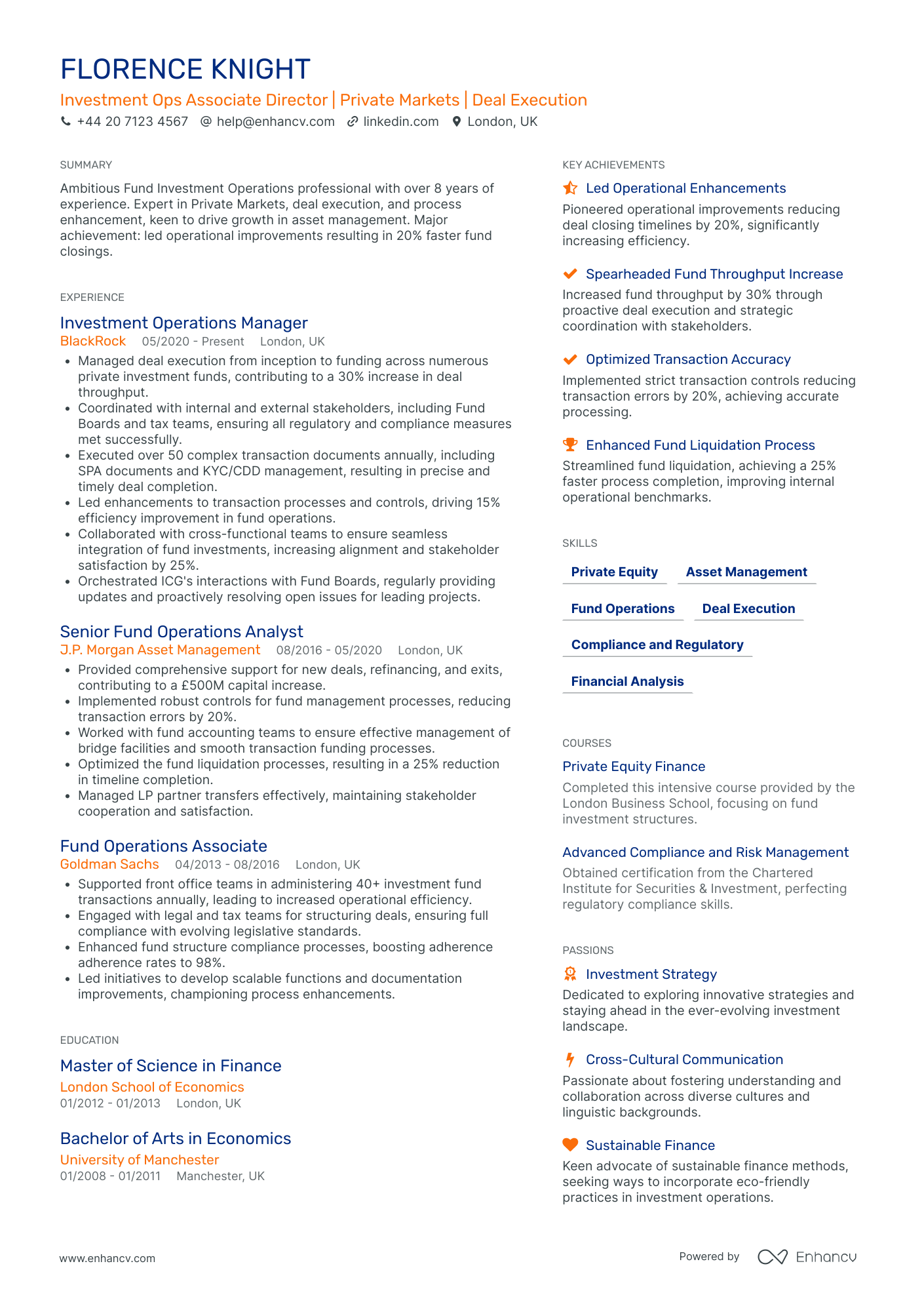

- Career Trajectory and Industry Shifts - Florence's career path is marked by steady progress through progressively senior roles, illustrating not just growth but a strategic deepening of expertise in private markets and deal execution. Her journey from a Fund Operations Associate at Goldman Sachs to an Associate Director role by way of J.P. Morgan and BlackRock underscores both her commitment to the field and her increasing responsibility over time.

- Diverse Skills and Cross-Functional Experience - Florence showcases a robust mix of technical, regulatory, and interpersonal skills that reflect her ability to navigate complex investment landscapes. Her proficiency in Private Equity and Asset Management is complemented by skills in financial analysis and compliance, demonstrating her adaptability and capability to work across diverse functions and teams.

- Achievements with Significant Business Relevance - The CV highlights achievements beyond mere numerical claims, focusing on the profound impact of Florence's contributions. By spearheading operational improvements, she achieved a 20% reduction in deal closing timelines, a feat that not only enhances efficiency but directly impacts the strategic and financial goals of her employers, distinguishing her as a key asset in any investment operation.

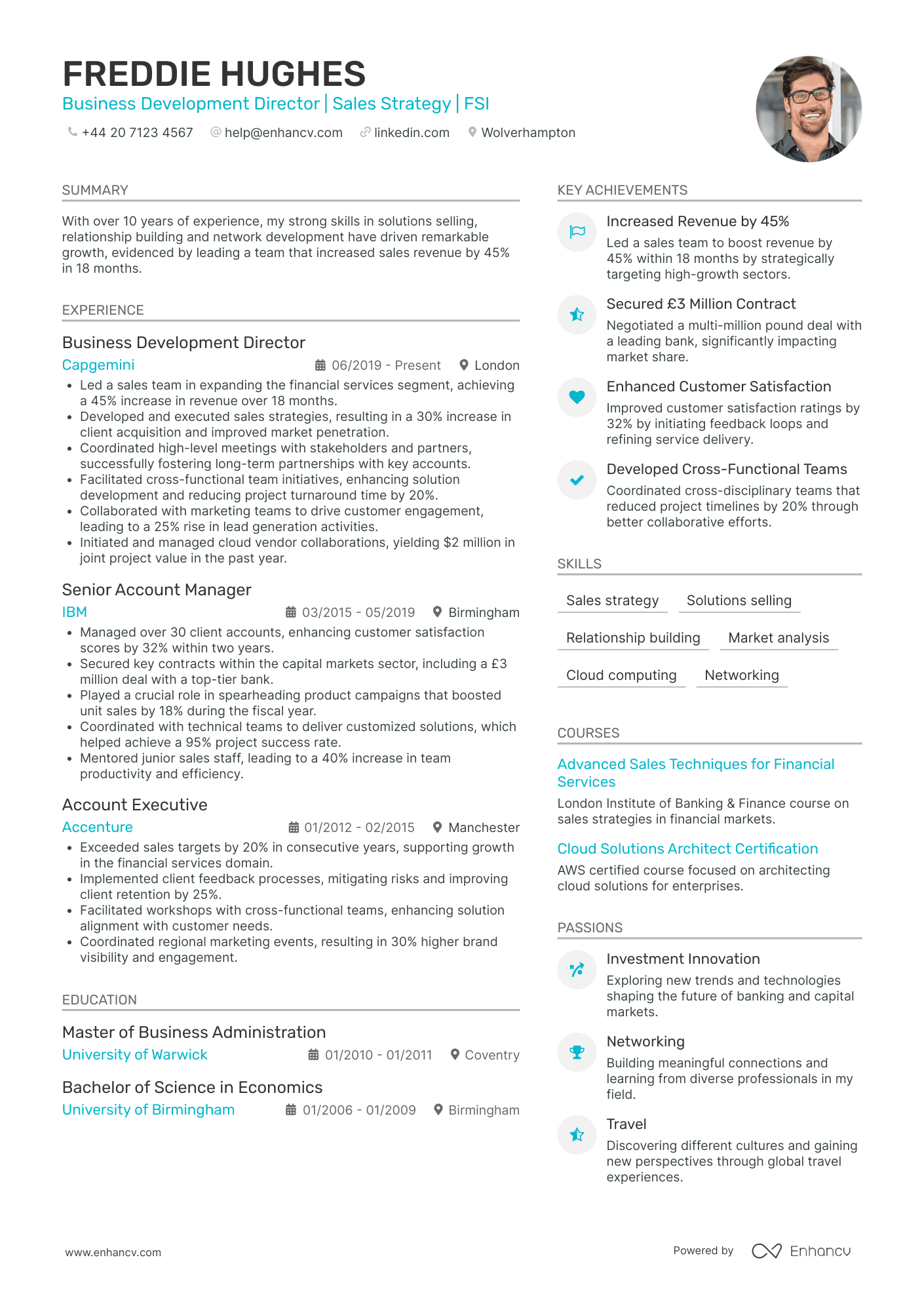

Banking Business Development Manager

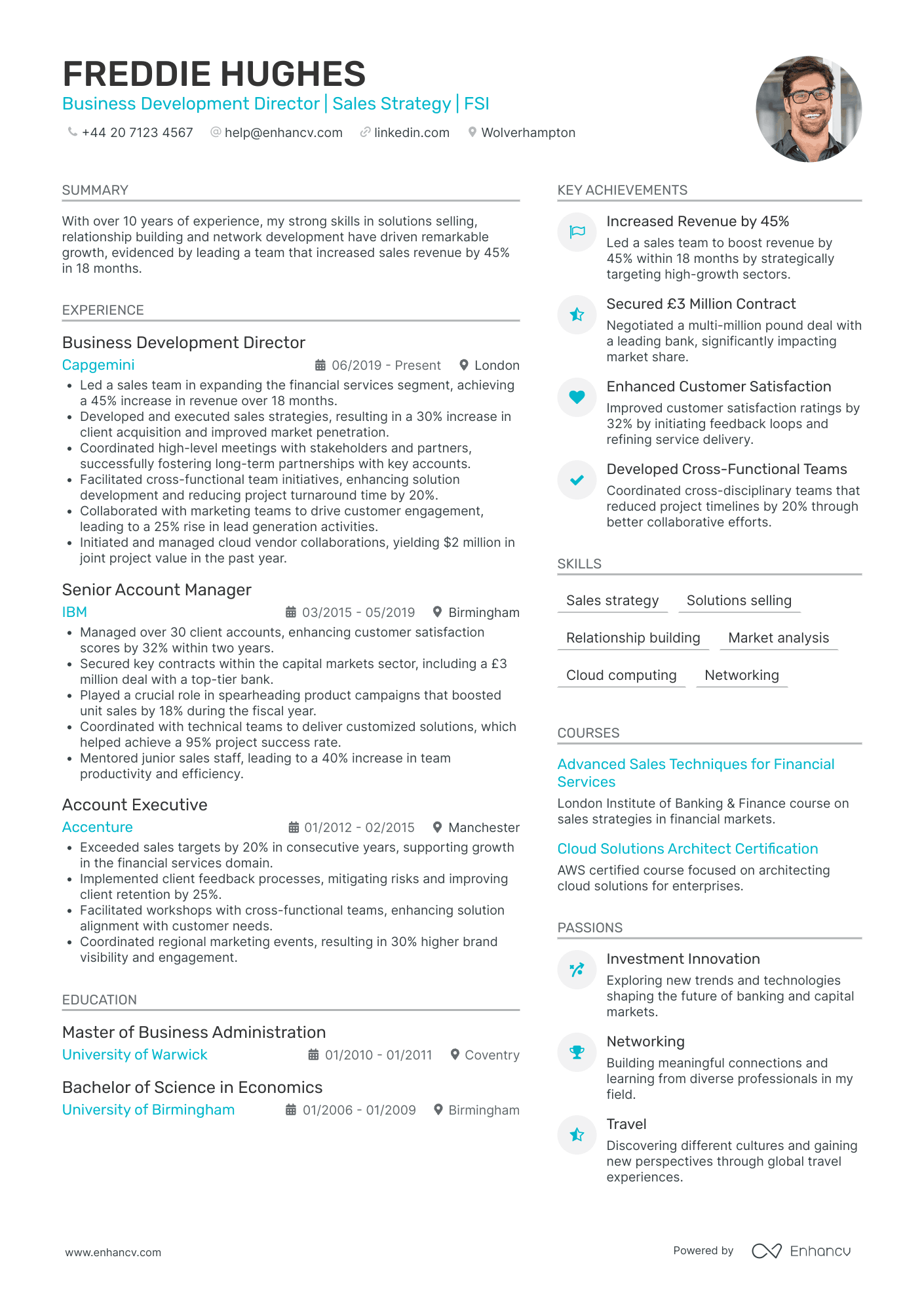

- Structured and Clear Content Presentation - The CV is well-organized, presenting information in a clear and concise manner. It effectively uses separate sections with bold headings for easy navigation, allowing readers to quickly grasp the candidate’s qualifications, experience, and achievements without being overwhelmed by irrelevant details.

- Impressive Career Trajectory - Freddie Hughes' career progression is notable, moving from an Account Executive to a Business Development Director within a decade. This trajectory shows career growth and the ability to adapt and excel in different roles across prestigious firms like Accenture, IBM, and Capgemini.

- Significant Achievements with Business Impact - The candidate’s CV highlights achievements that have directly impacted business growth, such as leading a team to a 45% revenue increase and negotiating multimillion-dollar deals. These accomplishments are not just about numbers; they demonstrate strategic foresight and substantial contributions to the companies' success.

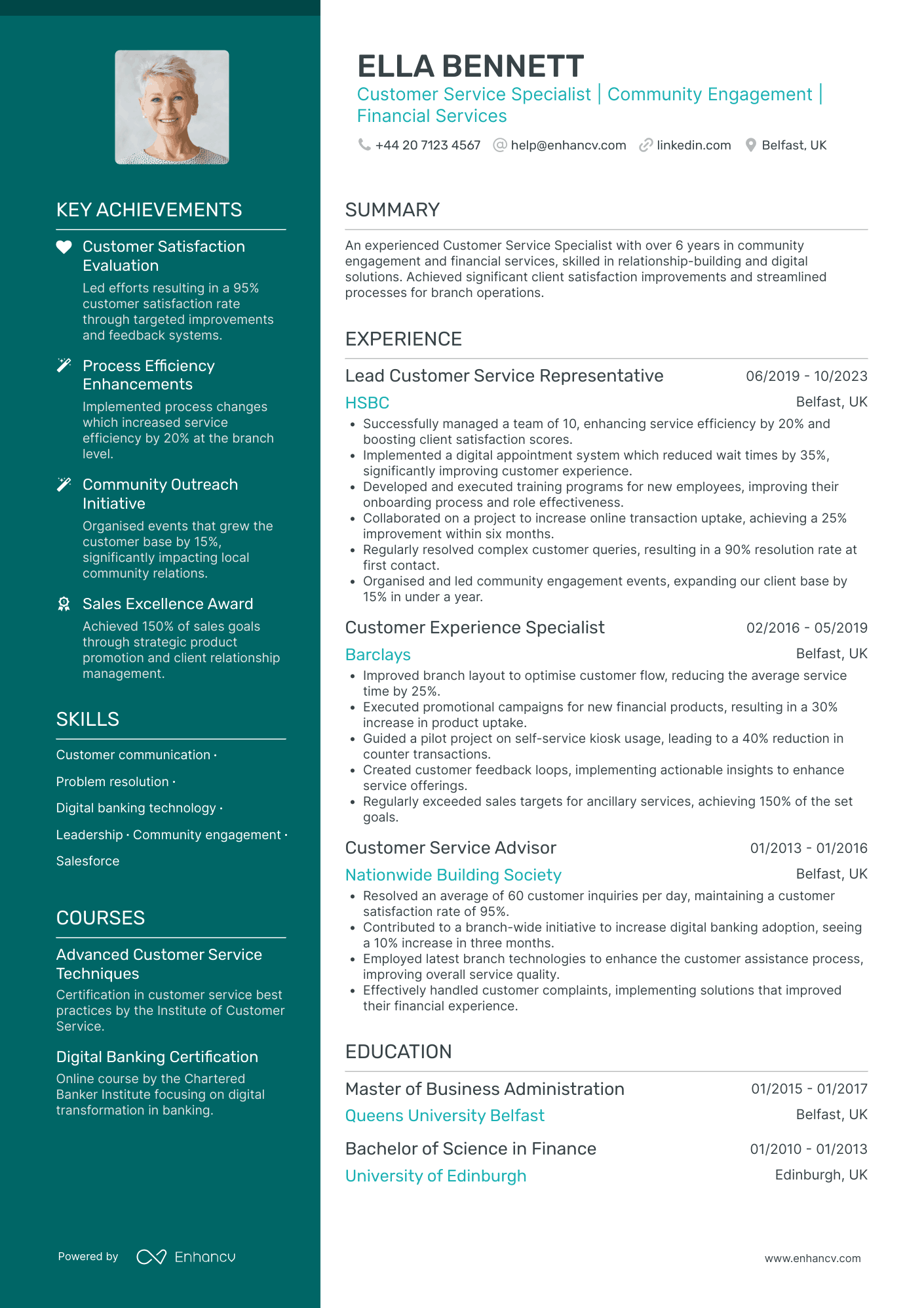

Banking Customer Service Representative

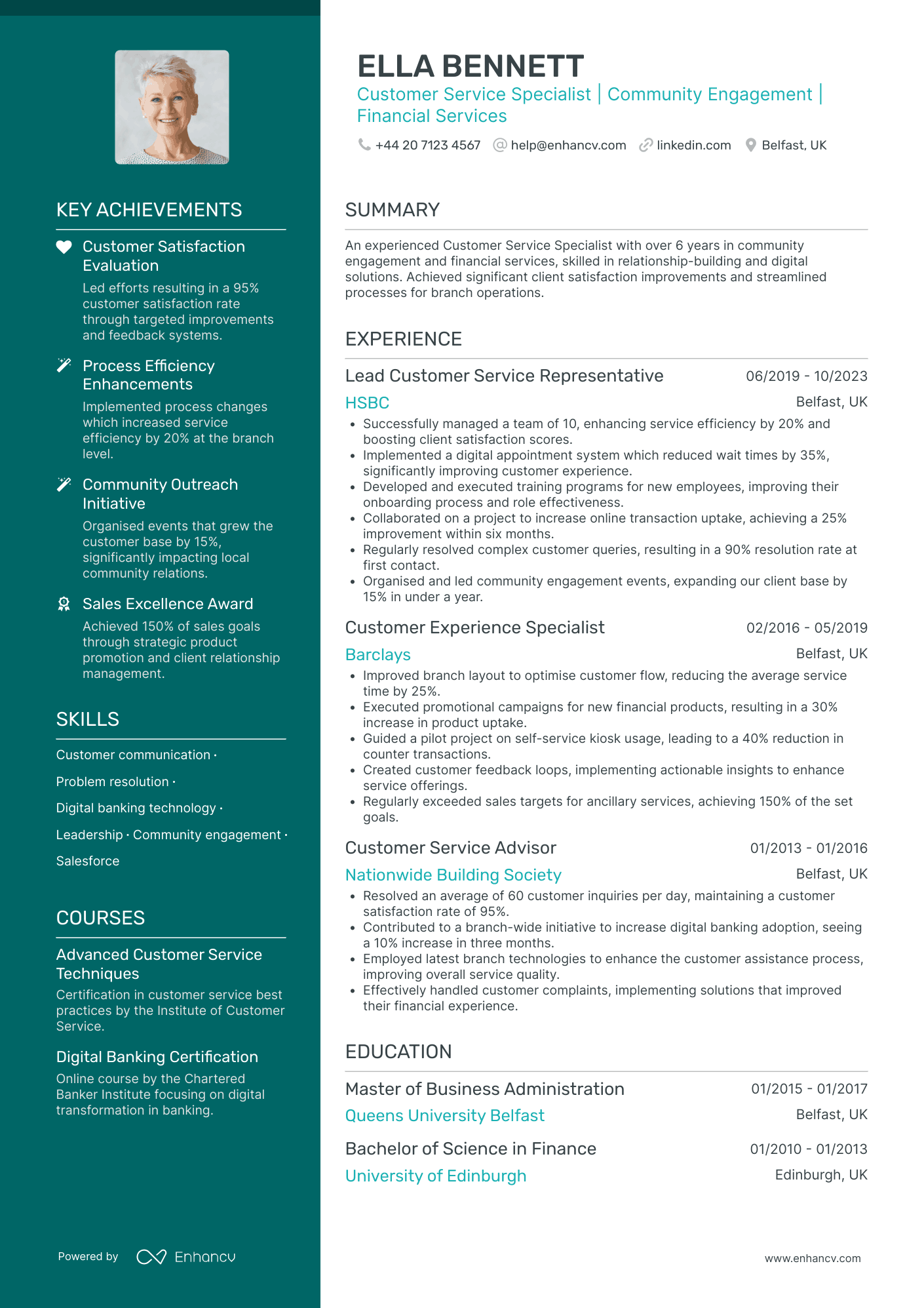

- Clear and Concise Presentation - The CV is well-structured, presenting information in a logical manner that enhances readability. Key sections such as experience, education, and skills are clearly delineated, making it easy for the reader to identify relevant information quickly. The use of bullet points in the experience section further aids in distillation of complex achievements into easily digestible insights.

- Progressive Career Growth - Ella Bennett demonstrates a clear upward trajectory in her career path, moving from a Customer Service Advisor position to a Lead Customer Service Representative. Each role builds upon the previous one, indicating an increase in responsibilities and leadership. This progression reflects her ability to leverage her skills in various capacities within the financial services industry, highlighting a strong foundation in customer engagement.

- Community Engagement Leadership - A unique aspect of Ella's CV is her emphasis on community engagement within the financial services sector. She has effectively merged customer service skills with community outreach, organizing events that expanded the client base by 15%. This not only showcases her ability to improve client relationships but also indicates her proficiency in augmenting business growth through innovative community-driven strategies.

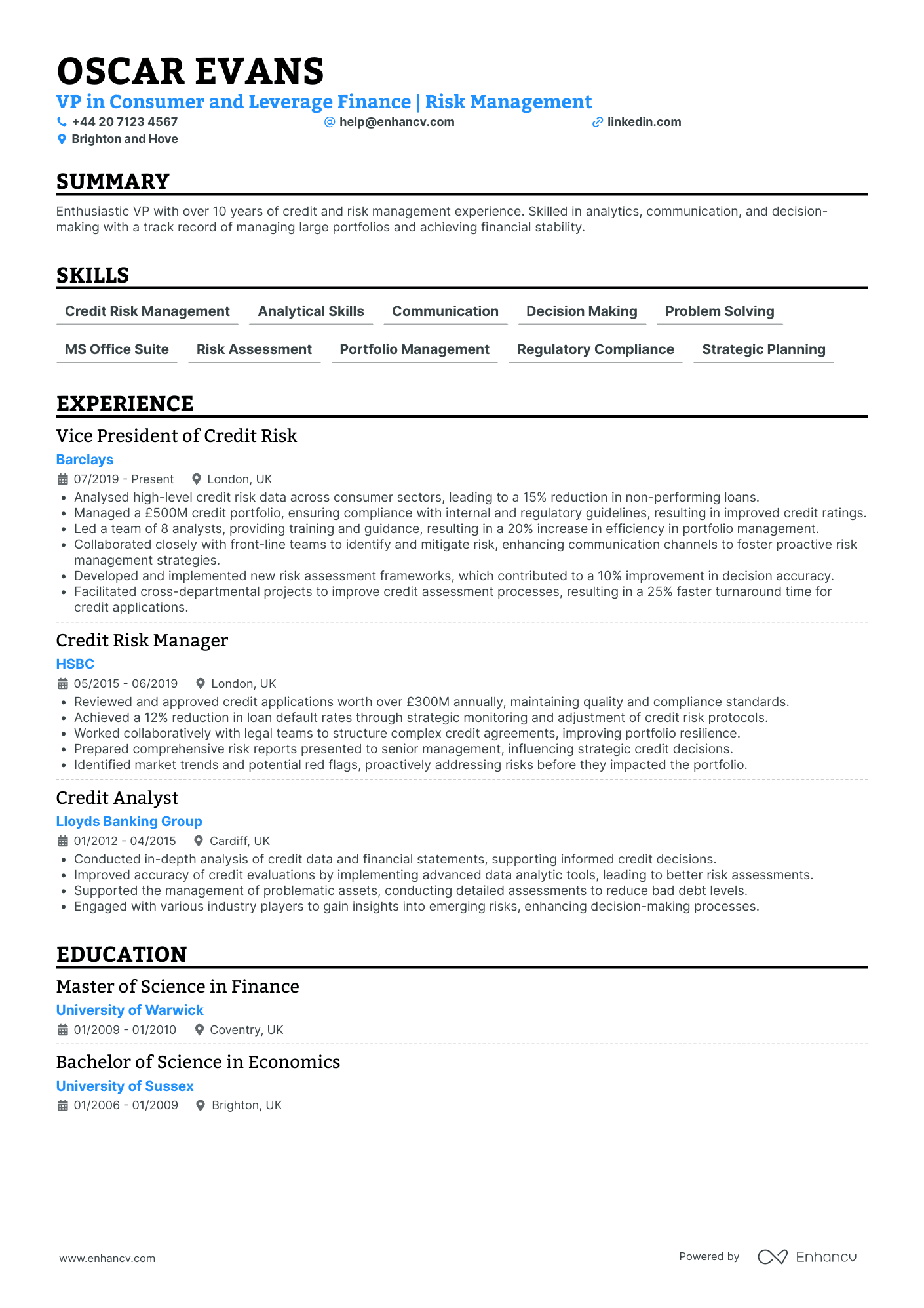

Senior Vice President, Corporate Banking

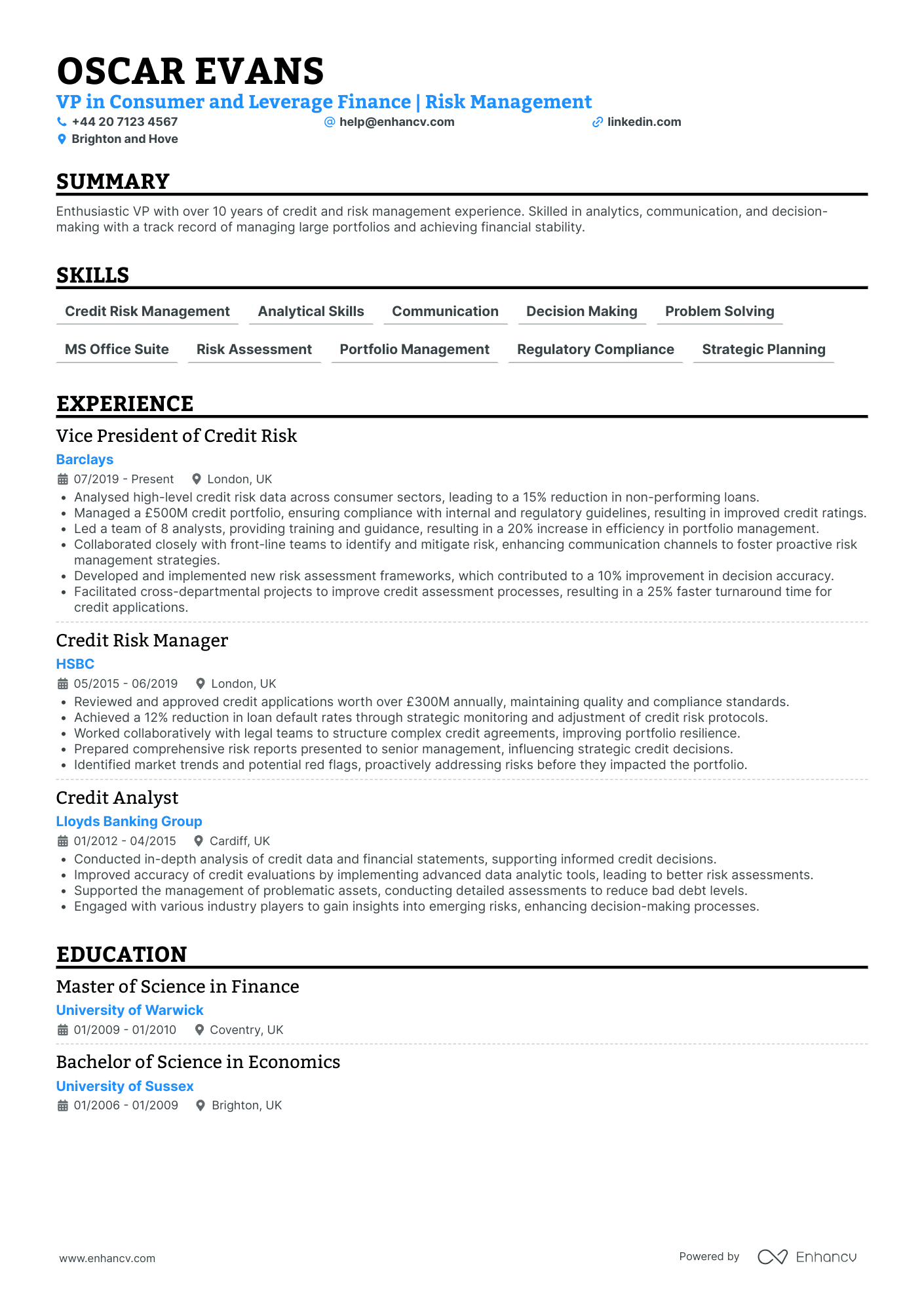

- Clear and Concise Content Presentation - The CV is structured in a straightforward manner, starting with a well-crafted summary that succinctly captures Oscar's extensive experience in risk management. Each section is clearly labeled, providing specific dates and responsibilities which ensures clarity and easy navigation. The use of bullet points in the experience section effectively communicates achievements without overwhelming the reader.

- Strong Career Trajectory in Risk Management - Oscar's career progression demonstrates a clear upward trajectory, starting from a Credit Analyst role to a Vice President position. This path highlights not only his growth and increased responsibilities but also his deepening expertise in credit risk management. His consistent rise in prominent companies within the banking industry, such as Barclays and HSBC, denotes a robust career development.

- Achievements with Tangible Business Impact - The CV emphasizes achievements that showcase significant impact on business outcomes. For example, Oscar's efforts in reducing non-performing loans by 15% and improving credit ratings at Barclays directly reflect his ability to enhance bottom-line financial performance. These accomplishments not only underline his proficiency but also signal his capacity to drive strategic improvements in complex financial environments.

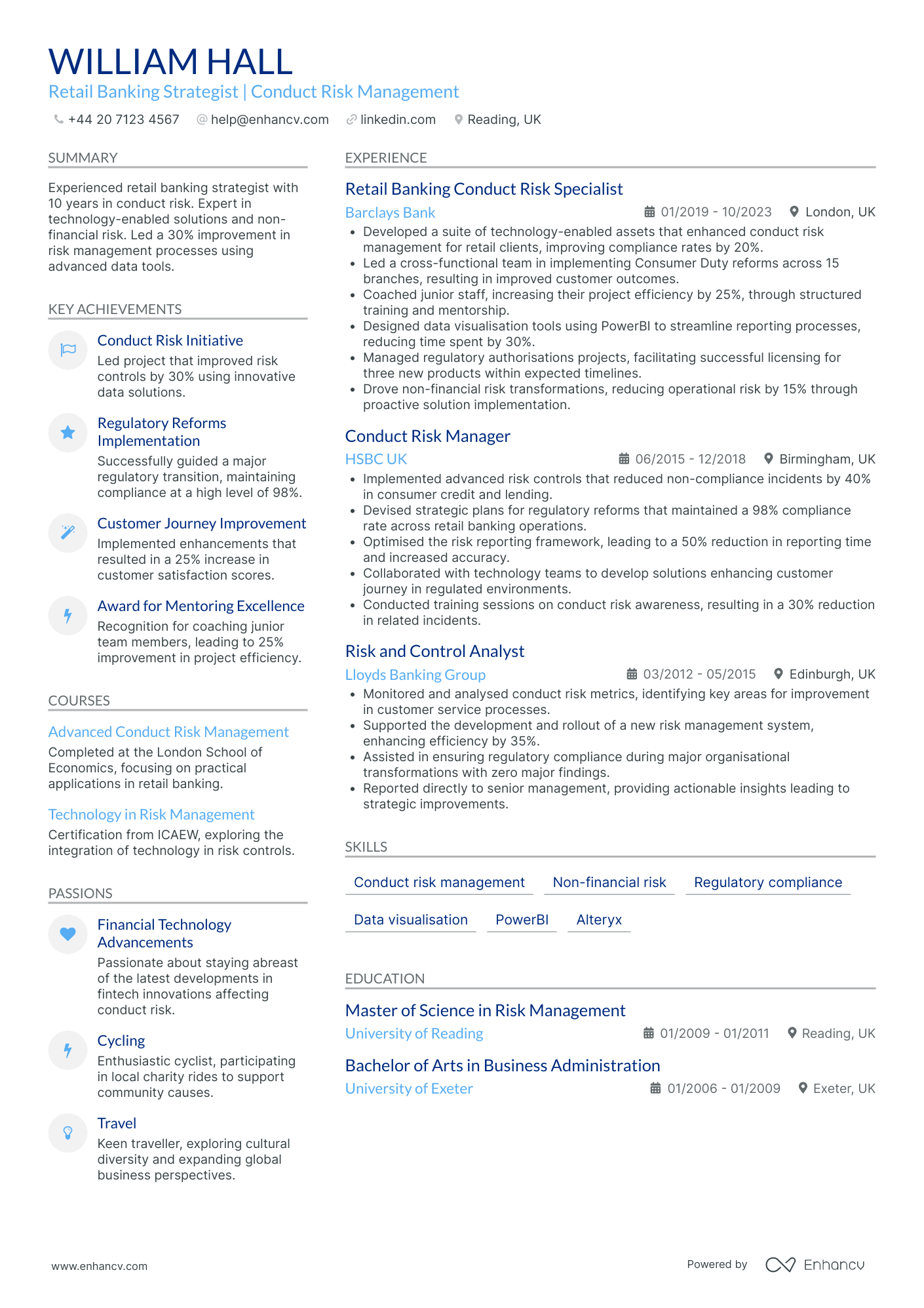

Head of Retail Banking

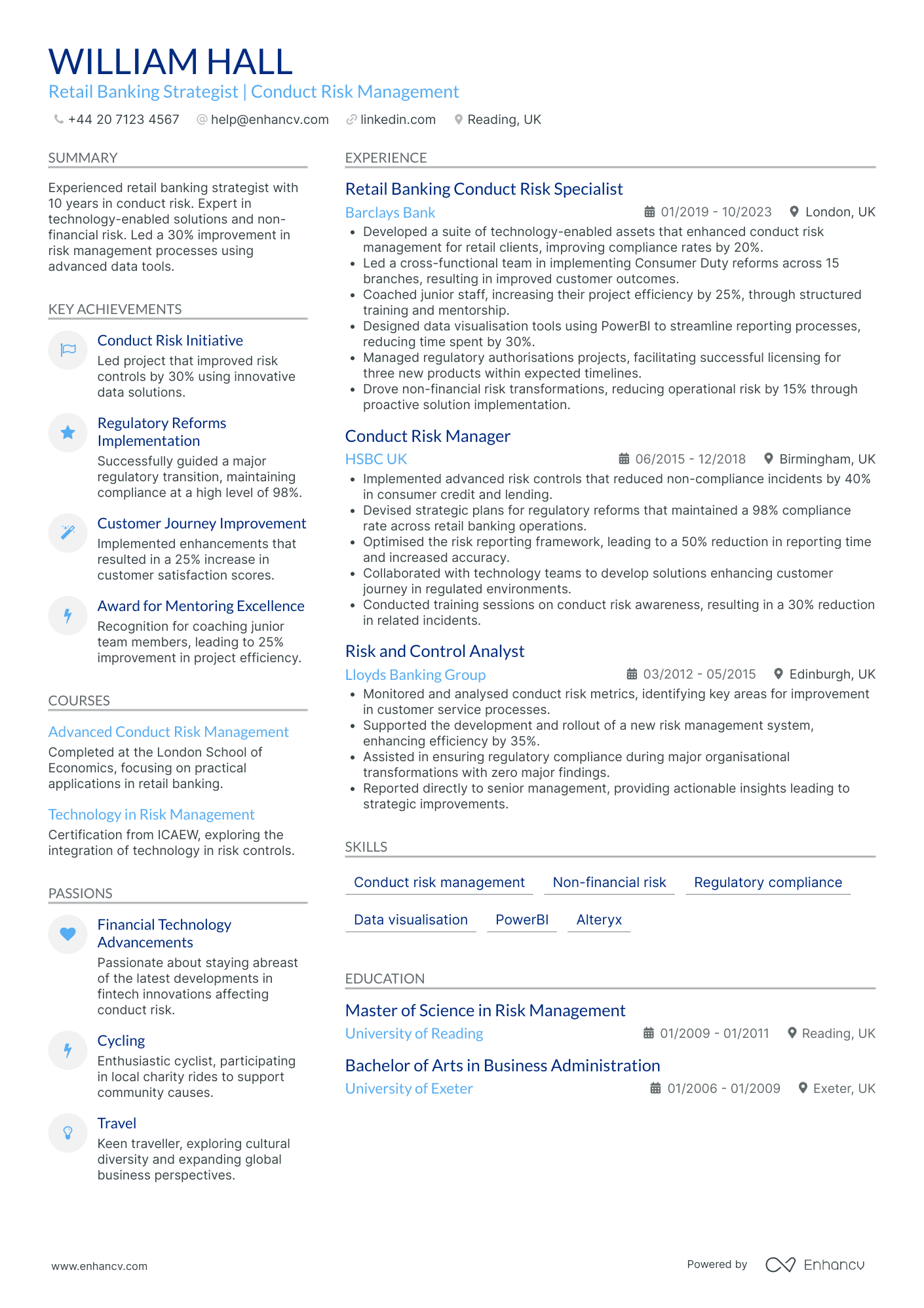

- Concise and Effective Content Presentation - The CV is well-structured with relevant sections such as summary, experience, education, and skills. Each section is clear and concise, making it easy for the reader to digest. Brief bullet points highlight the key achievements and skills, reflecting the candidate’s accomplishments without overwhelming detail.

- Impressive Career Trajectory and Growth - William Hall's career shows a clear progression within the banking industry, moving from a Risk and Control Analyst to a Conduct Risk Manager, and then into a specialist role at Barclays Bank. This trajectory indicates a strong growth curve, showcasing the candidate’s ability to scale responsibilities and handle complex regulatory environments.

- Strong Emphasis on Industry-Specific Tools and Techniques - The CV highlights William Hall’s expertise in utilizing advanced data visualization tools like PowerBI and Alteryx, which are critical for risk management and compliance in the banking sector. The use of technology-enabled solutions to enhance risk management processes is a standout element, demonstrating technical depth and innovation in his approach.

Formatting your banking CV to meet the role expectations

Staring at the blank page for hours on end, you still have no idea how you should start your professional banking CV. Should you include more colours, two columns, and which sections? What you should remember about your CV format is this - ensure it's minimalistic and doesn't go over the top with fancy fonts and many colours. Instead, focus on writing consistent content that actually answers the job requirements. But, how about the design itself :

- Use the reverse chronological order to showcase your experience, starting with your most recent role;

- Include your contact details (email address, phone number, and location) - and potentially your professional photo - in the header;

- Must-have CV sections include summary or objective, experience, education, and skills: curate the ones that fit your profile;

- Your professional banking CV should be between one-to-two pages long: select the longer format if you have more experience.

A little bit more about your actual CV design, ensure you're using:

- plenty of serif or sans serif font (e.g. Montserrat, Exo 2, Volkhov) as they are Applicant Tracker System (ATS) compliant. Avoid the likes of Arial and Times New Roman because most candidates' CVs are in this typography.

When submitting your CV, are you still not sure what format it should be? Despite the myth that has been circling around, most modern ATS systems are perfectly capable of reading PDFs. This format is an excellent choice as it keeps all of your information intact.

PRO TIP

For certain fields, consider including infographics or visual elements to represent skills or achievements, but ensure they are simple, professional, and enhance rather than clutter the information.

The top sections on a banking CV

- Personal Details include contact information for the recruiter's convenience.

- Professional Summary showcases banking expertise and career objectives.

- Banking Experience highlights specific financial roles and accomplishments.

- Education and Qualifications show relevant financial training and degrees.

- Relevant Skills demonstrate proficiency in banking technologies and practices.

What recruiters value on your CV:

- Quantify your achievements with numbers and percentages to demonstrate your impact on previous financial roles; banking employers value evidence of a candidate's ability to contribute to profitability.

- Highlight your proficiency in banking software and financial modelling techniques as bankers are expected to have strong technical skills and familiarity with industry-specific tools.

- Include any compliance and regulatory knowledge pertinent to banking; showcasing your awareness of the legal landscape can set you apart in this heavily regulated industry.

- Emphasise your experience with risk management, as the ability to assess and mitigate risks is crucial in banking and shows that you can protect the institution's interests.

- Describe your client relationship and portfolio management skills, ensuring to convey your ability to maintain and grow a customer base, as well as handle high-profile accounts responsibly.

Recommended reads:

How to present your contact details and job keywords in your banking CV header

Located at the top of your banking CV, the header presents recruiters with your key personal information, headline, and professional photo. When creating your CV header, include your:

- Contact details - avoid listing your work email or telephone number and, also, email addresses that sound unprofessional (e.g. koolKittyCat$3@gmail.com is definitely a big no);

- Headline - it should be relevant, concise, and specific to the role you're applying for, integrating keywords and action verbs;

- Photo - instead of including a photograph from your family reunion, select one that shows you in a more professional light. It's also good to note that in some countries (e.g. the UK and US), it's best to avoid photos on your CV as they may serve as bias.

What do other industry professionals include in their CV header? Make sure to check out the next bit of your guide to see real-life examples:

Examples of good CV headlines for banking:

- Assistant Branch Manager | Customer Relationship Management | Efficient Team Leadership | 5+ Years’ Banking Experience

- Senior Financial Analyst | Investment Strategy Specialist | CFA Charterholder | Data-Driven Decision Making | 10 Years' Insight

- Commercial Banking Executive | Portfolio Growth Expert | Credit Risk Evaluation | Strategic Business Development | 15+ Years

- Junior Credit Risk Analyst | Regulatory Compliance Understanding | Financial Modelling | Recent Finance Graduate | ACCA Part-Qualified

- Investment Banking Associate | M&A Execution | Capital Markets Knowledge | 3 Years' Progressive Experience | ACA Qualified

- Head of Retail Banking | Digital Transformation Leader | Customer Service Excellence | Wealth Management | 20+ Years' Tenure

Your banking CV introduction: selecting between a summary and an objective

banking candidates often wonder how to start writing their resumes. More specifically, how exactly can they use their opening statements to build a connection with recruiters, showcase their relevant skills, and spotlight job alignment. A tricky situation, we know. When crafting you banking CV select between:

- A summary - to show an overview of your career so far, including your most significant achievements.

- An objective - to show a conscise overview of your career dreams and aspirations.

Find out more examples and ultimately, decide which type of opening statement will fit your profile in the next section of our guide:

CV summaries for a banking job:

- Seasoned banking professional with over a decade of hands-on experience in retail and commercial banking at Citibank UK. Proven expertise in credit risk analysis, strategic financial planning, and leading high-achieving sales teams to exceed targets. Awarded ‘Banker of the Year’ three times for exceptional customer service and portfolio growth.

- Dynamic and results-driven Barclays manager with 7 years of progressive experience in wealth management and investment banking. Adept at financial modelling, client asset management, and regulatory compliance with a strong track record of cultivating long-term client relationships and securing lucrative bank contracts.

- Highly analytical former finance consultant eager to leverage 5 years of experience at Accenture into a challenging banking environment. With a sharp acumen for risk management strategies and efficiency improvements, I bring to the table a robust background in financial forecasting and strategic planning initiatives from a top-tier consultancy perspective.

- Dedicated software engineer transitioning to the banking sector after 4 years at Google, offering a unique blend of technology prowess, innovative problem-solving skills, and a keen interest in financial systems. Keen to apply software development expertise to drive forward technological advancements in banking operations and digital customer interfaces.

- Recently graduated from the University of Manchester with a first-class degree in Economics and eager to apply theoretical knowledge into practical banking applications. With a strong foundation in quantitative analysis, economic theory, and a passion for financial markets, I am committed to contributing to a dynamic banking environment with fresh insights and relentless enthusiasm.

- Ambitious individual with a recently completed finance internship and a bachelor's degree from the London School of Economics, aiming to build a career in banking. Eager to develop a deep understanding of financial products, client relationship management, and banking operations, and to make a meaningful impact on clients' financial standing through dedicated service.

The best formula for your banking CV experience section

The CV experience section is the space where many candidates go wrong by merely listing their work history and duties. Don't do that. Instead, use the job description to better understand what matters most for the role and integrate these keywords across your CV. Thus, you should focus on:

- showcasing your accomplishments to hint that you're results-oriented;

- highlighting your skill set by integrating job keywords, technologies, and transferrable skills in your experience bullets;

- listing your roles in reverse chronological order, starting with the latest and most senior, to hint at how you have grown your career;

- featuring metrics, in the form of percentage, numbers, etc. to make your success more tangible.

When writing each experience bullet, start with a strong, actionable verb, then follow it up with a skill, accomplishment, or metric. Use these professional examples to perfect your CV experience section:

Best practices for your CV's work experience section

- Detail your understanding of financial regulations and compliance, showcasing specific instances where you maintained or improved compliance measures.

- Highlight your experience with financial analysis and reporting, providing examples of insights delivered and their impact on decision-making.

- Demonstrate your expertise in risk management by describing scenarios where you identified and mitigated financial risks.

- Showcase your customer service skills by mentioning how you contributed to customer satisfaction and retention in a banking environment.

- Illustrate your proficiency with banking software and technology, including any specific platforms you have used and how they benefited operations.

- Emphasise your track record in sales or business development by quantifying your achievements in attracting new clients or upselling products.

- Discuss your role in team leadership or collaboration, detailing initiatives you led or contributions to team projects that improved bank performance.

- Mention any experience you have with training or mentoring colleagues, highlighting the outcomes and improvements observed.

- Include any specialised knowledge or certifications related to banking, such as investment strategies, loan origination, or financial planning.

- Successfully led a team in the adoption of a new risk assessment software, increasing efficiency by 25% within the first six months of implementation.

- Managed a portfolio of high-net-worth clients, growing the portfolio by £10 million in assets under management through strategic investment advice.

- Implemented a customer relationship management (CRM) system to improve client satisfaction scores by 15% year-over-year.

- Performed daily credit analysis on small to medium enterprises, contributing to a loan book growth of 20% for the fiscal year 2017.

- Streamlined loan processing times by initiating process improvements, reducing average application turnaround by 4 days.

- Collaborated on the development of a fintech app that saw a 30% uptake by our SME customer base within the first year of launch.

- Orchestrated the merger of two branch customer bases effectively, ensuring seamless service delivery and retention of 98% of clients.

- Spearheaded the introduction of an online banking platform, resulting in a 40% reduction in in-branch transactions and enhanced customer self-service.

- Conducted comprehensive market research that directed the marketing campaign for a new credit product, achieving 150% of the target sales in the first quarter.

- Managed and resolved over 200 complex customer inquiries per month, maintaining a resolution rate of 95%.

- Developed and delivered training to new hires on banking products which improved team productivity by 18%.

- Championed a cross-sell initiative that increased the uptake of personal loans among existing deposit customers by 22%.

- Negotiated and closed an average of £50 million in commercial real estate loans annually, contributing significantly to the department's revenue targets.

- Led a pilot project for the adoption of blockchain technology for secure transactions that improved transaction times by 30%.

- Crafted and maintained strategic partnerships with property developers, which led to a sustained 20% growth in loan origination.

- Analysed and reported on economic trends affecting mortgage rates, influencing the bank’s competitive positioning and contributing to a 5% market share increase.

- Pioneered a digital mortgage application process that improved the customer experience and reduced error rates by 15%.

- Cultivated a culture of risk awareness that decreased mortgage defaults by 10% through targeted educational initiatives for borrowers.

- Instrumental in launching a new savings product tailored for millennials, achieving an initial subscription rate that surpassed projections by 200%.

- Conducted due diligence on loan applications, ensuring a default rate of less than 2% on a £30 million loan book.

- Initiated and led community financial literacy workshops, increasing the bank’s brand presence and community engagement by 35%.

- Delivered top-tier private banking services, expanding client investment portfolios by average of 12% annually through customized wealth management strategies.

- Executed a digital transformation strategy that enabled clients to access wealth management services online, increasing user engagement by 50%.

- Designed and implemented compliance protocols that reduced regulatory breaches by 100%, ensuring a spotless audit record.

How to ensure your banking CV stands out when you have no experience

This part of our step-by-step guide will help you substitute your experience section by helping you spotlight your skill set. First off, your ability to land your first job will depend on the time you take to assess precisely how you match the job requirements. Whether that's via your relevant education and courses, skill set, or any potential extracurricular activities. Next:

- Systematise your CV so that it spotlights your most relevant experience (whether that's your education or volunteer work) towards the top;

- Focus recruiters' attention to your transferrable skill set and in particular how your personality would be the perfect fit for the role;

- Consider how your current background has helped you build your technological understanding - whether you've created projects in your free time or as part of your uni degree;

- Ensure you've expanded on your teamwork capabilities with any relevant internships, part-time roles, or projects you've participated in the past.

Recommended reads:

PRO TIP

Include examples of how you adapted to new tools, environments, or work cultures, showing your flexibility.

Describing your unique skill set using both hard skills and soft skills

Your banking CV provides you with the perfect opportunity to spotlight your talents, and at the same time - to pass any form of assessment. Focusing on your skill set across different CV sections is the way to go, as this would provide you with an opportunity to quantify your achievements and successes. There's one common, very simple mistake, which candidates tend to make at this stage. Short on time, they tend to hurry and mess up the spelling of some of the key technologies, skills, and keywords. Copy and paste the particular skill directly from the job requirement to your CV to pass the Applicant Tracker System (ATS) assessment. Now, your CV skills are divided into:

- Technical or hard skills, describing your comfort level with technologies (software and hardware). List your aptitude by curating your certifications, on the work success in the experience section, and technical projects. Use the dedicated skills section to provide recruiters with up to twelve technologies, that match the job requirements, and you're capable of using.

- People or soft skills provide you with an excellent background to communicate, work within a team, solve problems. Don't just copy-paste that you're a "leader" or excel at "analysis". Instead, provide tangible metrics that define your success inusing the particular skill within the strengths, achievements, summary/ objective sections.

Top skills for your banking CV:

Financial Analysis

Risk Management

Regulatory Compliance

Accounting

Financial Modeling

Credit Analysis

Banking Software Proficiency

Investment Management

Loan Processing

Data Analysis

Customer Service

Problem-Solving

Attention to Detail

Communication

Teamwork

Time Management

Adaptability

Negotiation

Leadership

Decision-Making

PRO TIP

Use mini case studies or success stories in your CV to demonstrate how your skills have positively impacted previous roles or projects.

Further professional qualifications for your banking CV: education and certificates

As you're nearing the end of your banking CV, you may wonder what else will be relevant to the role. Recruiters are keen on understanding your academic background, as it teaches you an array of hard and soft skills. Create a dedicated education section that lists your:

- applicable higher education diplomas or ones that are at a postgraduate level;

- diploma, followed up with your higher education institution and start-graduation dates;

- extracurricular activities and honours, only if you deem that recruiters will find them impressive.

Follow a similar logic when presenting your certificates. Always select ones that will support your niche expertise and hint at what it's like to work with you. Balance both technical certification with soft skills courses to answer job requirements and company values. Wondering what the most sought out certificates are for the industry? Look no further:

PRO TIP

Use mini case studies or success stories in your CV to demonstrate how your skills have positively impacted previous roles or projects.

Recommended reads:

Key takeaways

What matters most in your banking CV-writing process is for you to create a personalised application. One that matches the role and also showcases your unique qualities and talents.

- Use the format to supplement the actual content, to stand out, and to ensure your CV experience is easy to comprehend and follows a logic;

- Invest time in building a succinct CV top one third. One that includes a header (with your contact details and headline), a summary or an objective statement (select the one that best fits your experience), and - potentially - a dedicated skills section or achievements (to fit both hard skills and soft skills requirements);

- Prioritise your most relevant (and senior) experience closer to the top of your CV. Always ensure you're following the "power verb, skill, and achievement" format for your bullets;

- Integrate both your technical and communication background across different sections of your CV to meet the job requirements;

- List your relevant education and certificates to fill in gaps in your CV history and prove to recrutiers you have relevant technical know-how.