Crafting a CV that effectively highlights your strategic leadership and financial expertise can be a daunting task for any aspiring bank manager. Our tailor-made guide offers step-by-step assistance, ensuring your curriculum vitae stands out in the competitive banking sector by showcasing your strong track record and management skills.

- Create an attention-grabbing header that integrates keywords and includes all vital information;

- Add strong action verbs and skills in your experience section, and get inspired by real-world professionals;

- List your education and relevant certification to fill in the gaps in your career history;

- Integrate both hard and soft skills all through your CV.

Discover more industry-specific guides to help you apply for any role in the links below:

Resume examples for bank manager

By Experience

Assistant Bank Manager

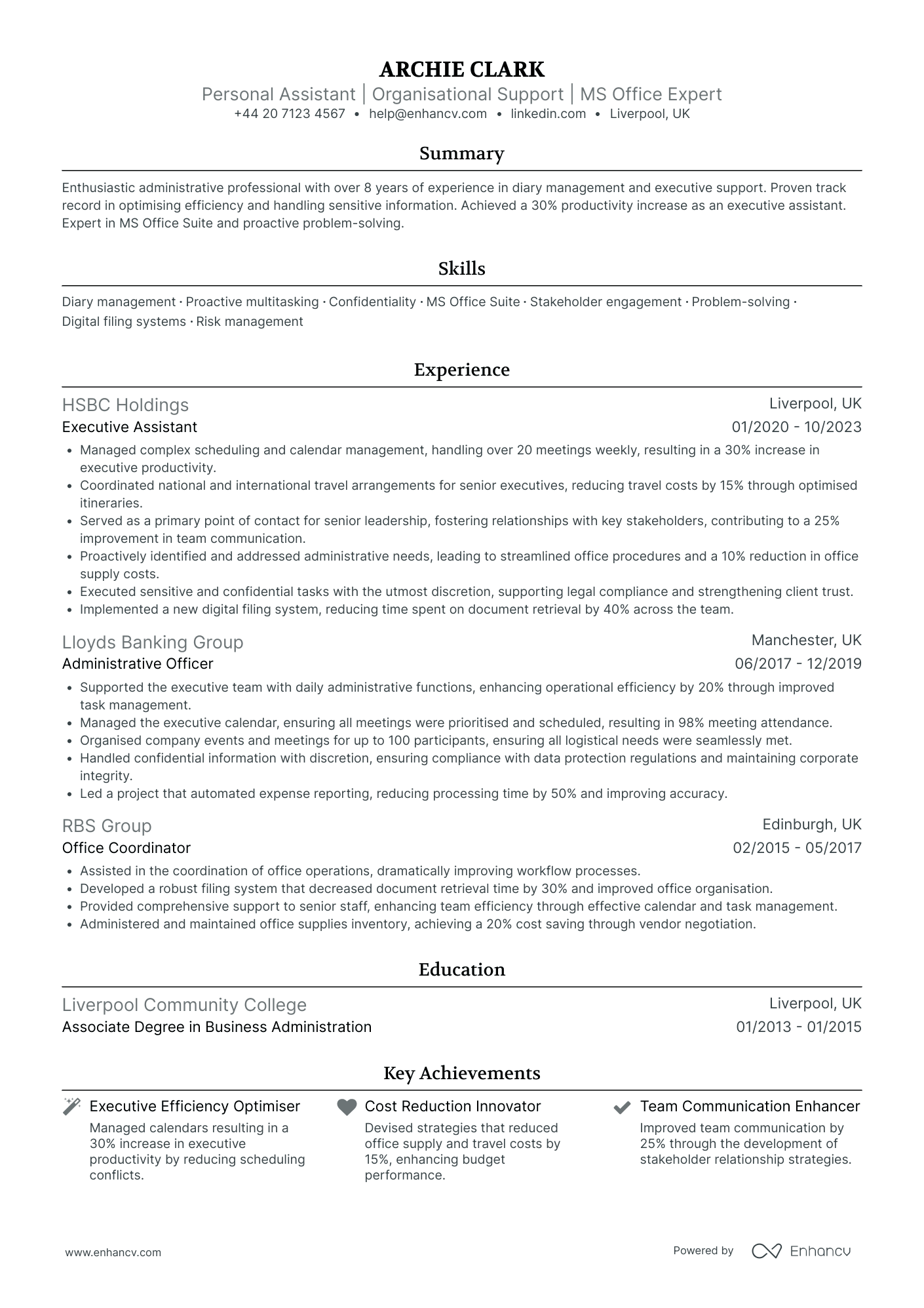

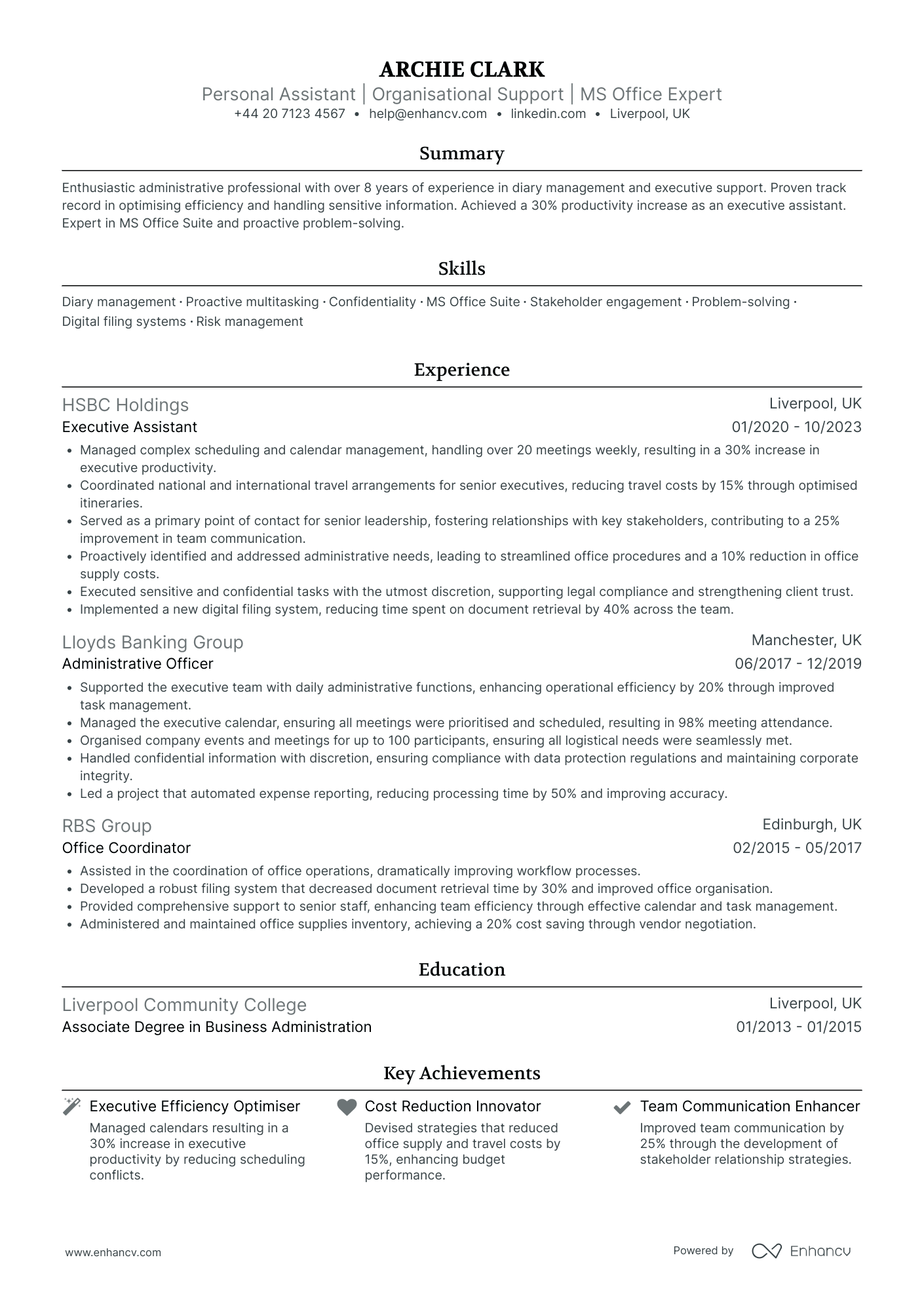

- Clarity and Structure in Content Presentation - The CV is presented in a clear and concise manner, which ensures the reader can easily navigate through the various sections. It starts with a straightforward header, followed by well-organized sections including experience, education, skills, courses, achievements, languages, and passions. Each job entry is structured consistently, highlighting key contributions and outcomes, thus making it easy to digest the information quickly.

- Growth and Advancement in Career Trajectory - Archie's career trajectory shows a clear path of growth and progression. Starting as an Office Coordinator and advancing to Executive Assistant roles within prominent banking institutions such as HSBC and Lloyds, the CV highlights a steady climb in responsibility levels. This steady upward movement demonstrates a reliable and ambitious professional eager to take on more challenging roles within the administrative and executive support domains.

- Proven Achievements with Business Impact - The CV isn't just a list of roles; it emphasizes specific achievements that underline Archie's business impact. Achievements like a 30% increase in executive productivity and a 15% reduction in travel costs illustrate measurable benefits to the organizations. These accomplishments clearly indicate Archie's ability to implement efficiency and cost-saving initiatives that align with business goals.

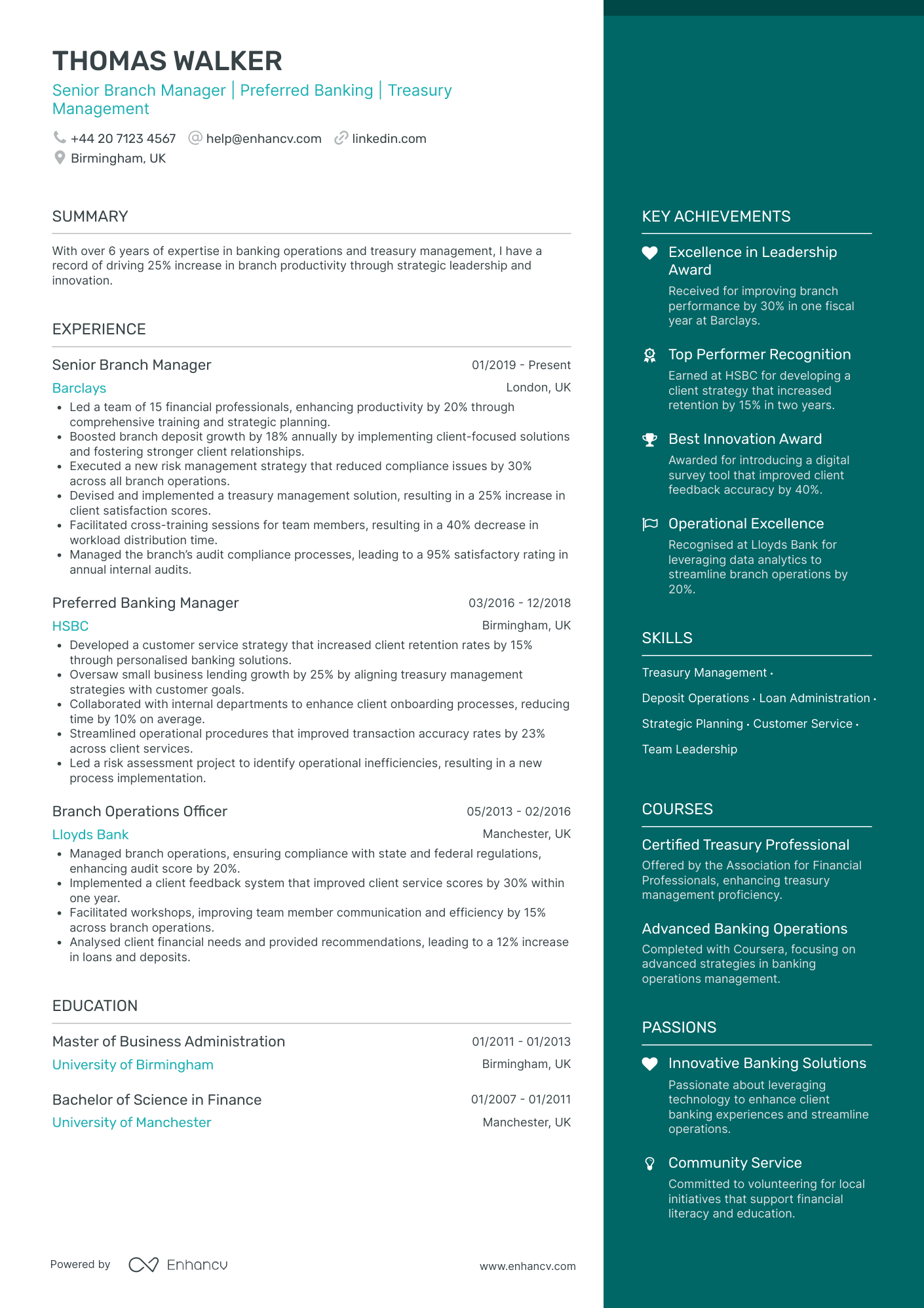

Senior Bank Manager

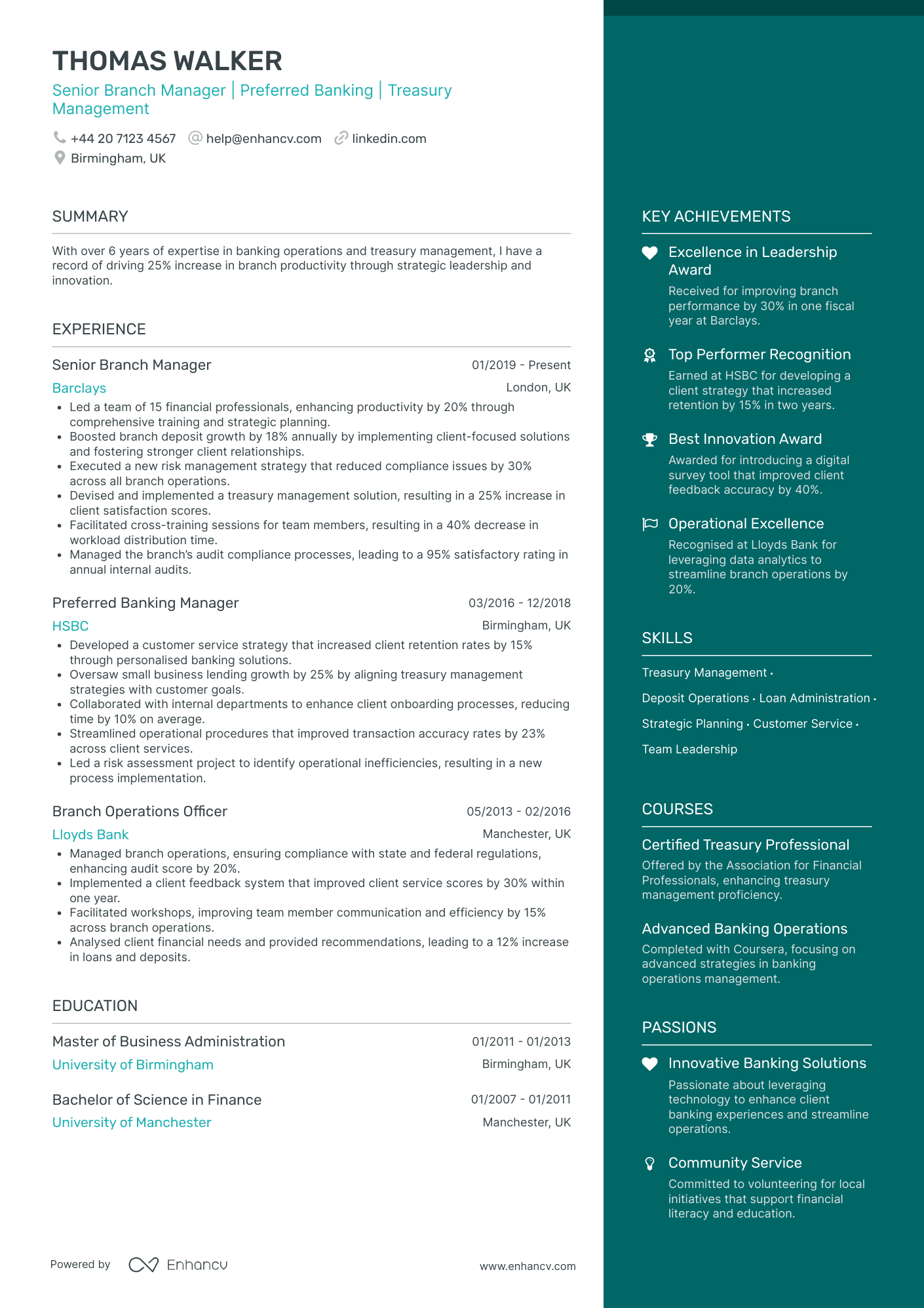

- Structured Career Progression - The CV clearly illustrates Thomas Walker's upward career trajectory from a Branch Operations Officer to a Senior Branch Manager, showcasing growth within major banking institutions in the UK. This steady progression highlights his ability to take on increasing responsibilities and leadership roles.

- Strategic Impact through Quantifiable Achievements - The CV effectively uses hard metrics to demonstrate Thomas's achievements, such as a 25% increase in productivity and an 18% annual deposit growth at Barclays. These figures underscore his strategic impact and ability to drive business performance improvements.

- Inclusive Section Variety for Comprehensive Representation - The CV includes distinct sections like education, skills, certifications, and languages, which are tailored to emphasize Thomas’s readiness for a senior management role in banking. This comprehensive approach ensures that all aspects of his qualifications are presented effectively to employers.

By Role

Bank Branch Manager

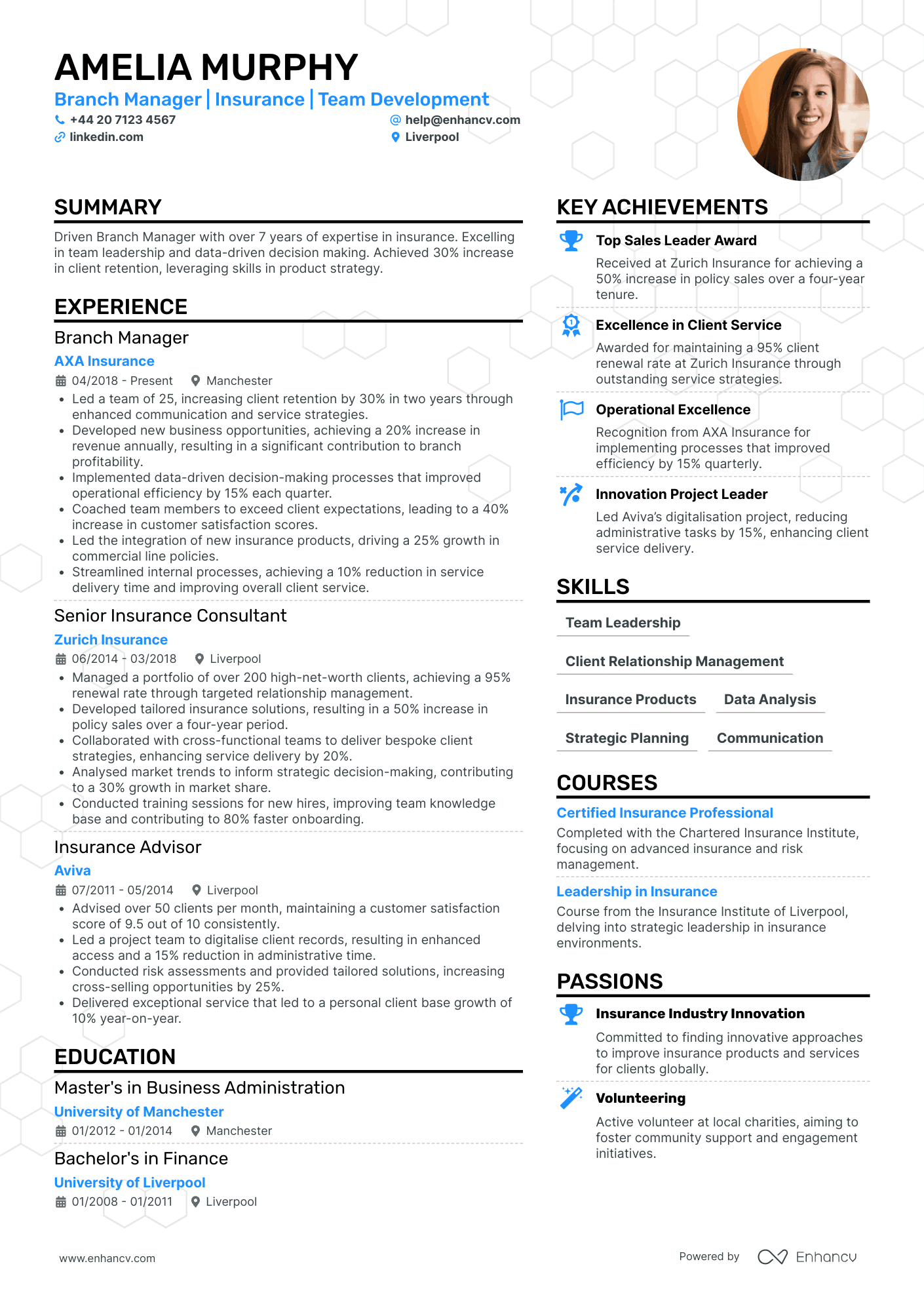

- Career Progression Reflects Effective Leadership - Amelia Murphy's career trajectory is notable for consistent upward mobility, demonstrating her capability as a leader. Starting as an Insurance Advisor and rising to a Branch Manager, she has taken on increasing responsibilities, showcasing her ability to develop and lead teams effectively. Her progression signifies a strong understanding of the insurance industry and an aptitude for managing branches successfully.

- Strong Focus on Client Retention and Satisfaction - The CV emphasizes Amelia's dedication to client retention and satisfaction, a key aspect of her roles in the insurance industry. Her achievements in increasing client satisfaction scores by 40% and client retention by 30% are not mere figures but reflect her strategic prowess in building client relationships and fostering loyalty, ensuring long-term business stability and growth.

- Diverse Skill Set and Adaptability - Amelia's CV lists a wide range of competencies, including team leadership, strategic planning, and data analysis, which underline her versatility and adaptability in various roles. Her experience in cross-functional collaboration and project management, such as digitalizing client records to reduce administrative time, further proves her capability to adapt and optimize operations efficiently.

Bank Operations Manager

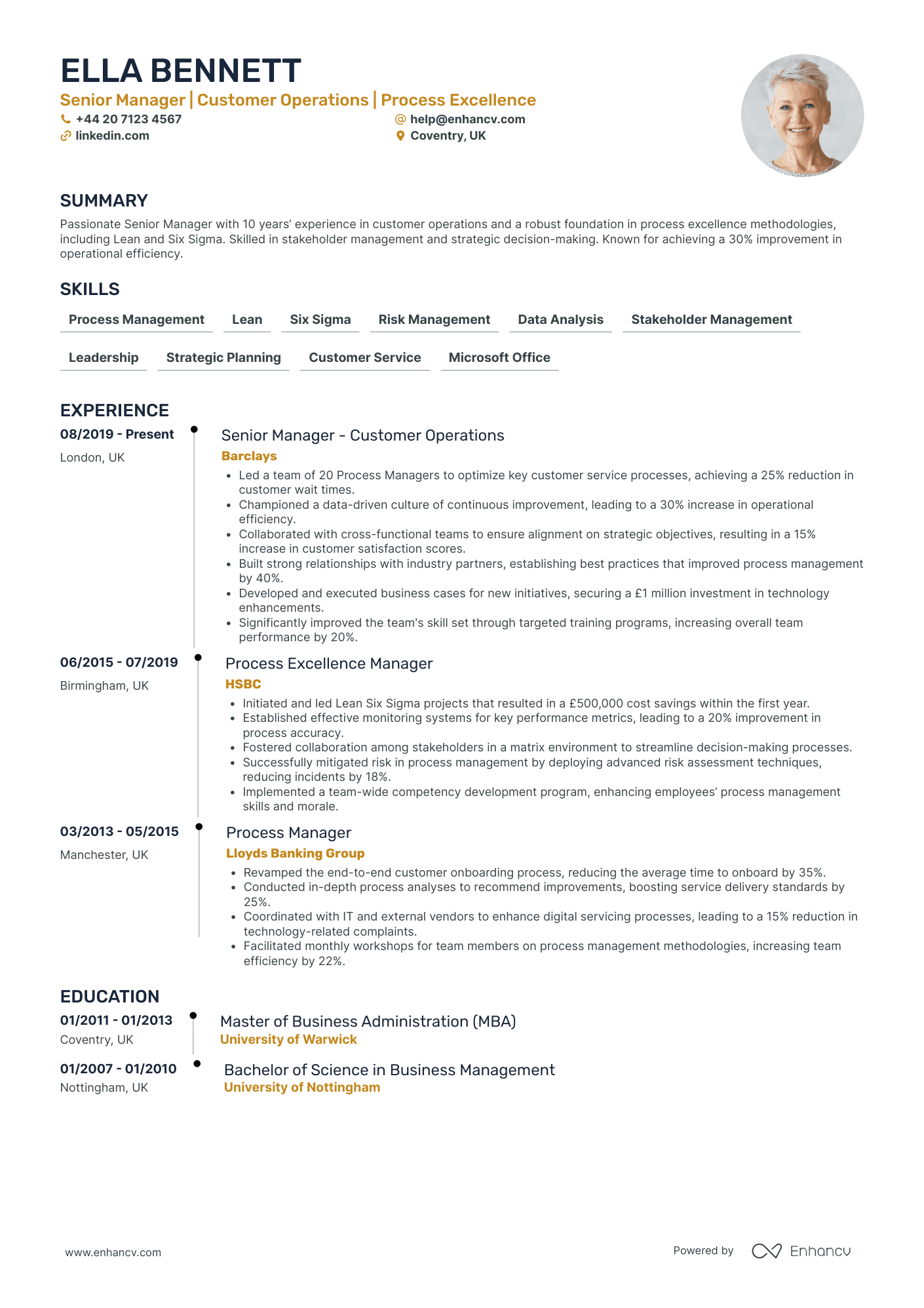

- Impressive Career Trajectory - Ella Bennett's career progression is marked by strategic promotions, moving from a Process Manager to a Senior Manager in well-known financial institutions. This growth reflects her ability to take on higher responsibilities and deliver greater impact over time, signifying both leadership potential and industry trust in her capabilities.

- Strong Focus on Methodologies and Tools - The CV stands out by emphasizing a rich foundation in process excellence methodologies, particularly Lean and Six Sigma. This depth in technical proficiency indicates a solid grasp of industry-specific tools that are crucial for driving efficiency in customer operations and can differentiate her from peers in similar roles.

- Demonstrated Stakeholder and Cross-Functional Management - Bennett's experience section highlights her adeptness at managing relationships with stakeholders and collaborating with cross-functional teams. These abilities are essential in implementing strategic objectives and underline her capacity to maneuver through complex organizational landscapes, ensuring initiatives align with broader business goals.

Bank Risk Manager

- Logical Structure and Conciseness - The CV is organized with clear sections, making it easy to navigate through Samuel's professional journey. Each section is concise yet informative, with bullet points that quickly convey achievements and responsibilities, allowing the reader to grasp his capabilities efficiently.

- Progressive Career Growth - Samuel's career trajectory shows a clear progression, from starting as an Internal Auditor at PwC to becoming a Credit Risk Internal Audit Manager at Deloitte. This upward movement signifies not only his dedication and expertise in the field but also his ability to take on increasing responsibilities over a decade.

- Technical Proficiency and Innovations - The CV incorporates industry-specific elements like audit process automations and technology-driven audit solutions, reflecting Samuel's technical depth. These tools and methods have enhanced operational efficiency and accuracy in reporting, showcasing his impact in the field.

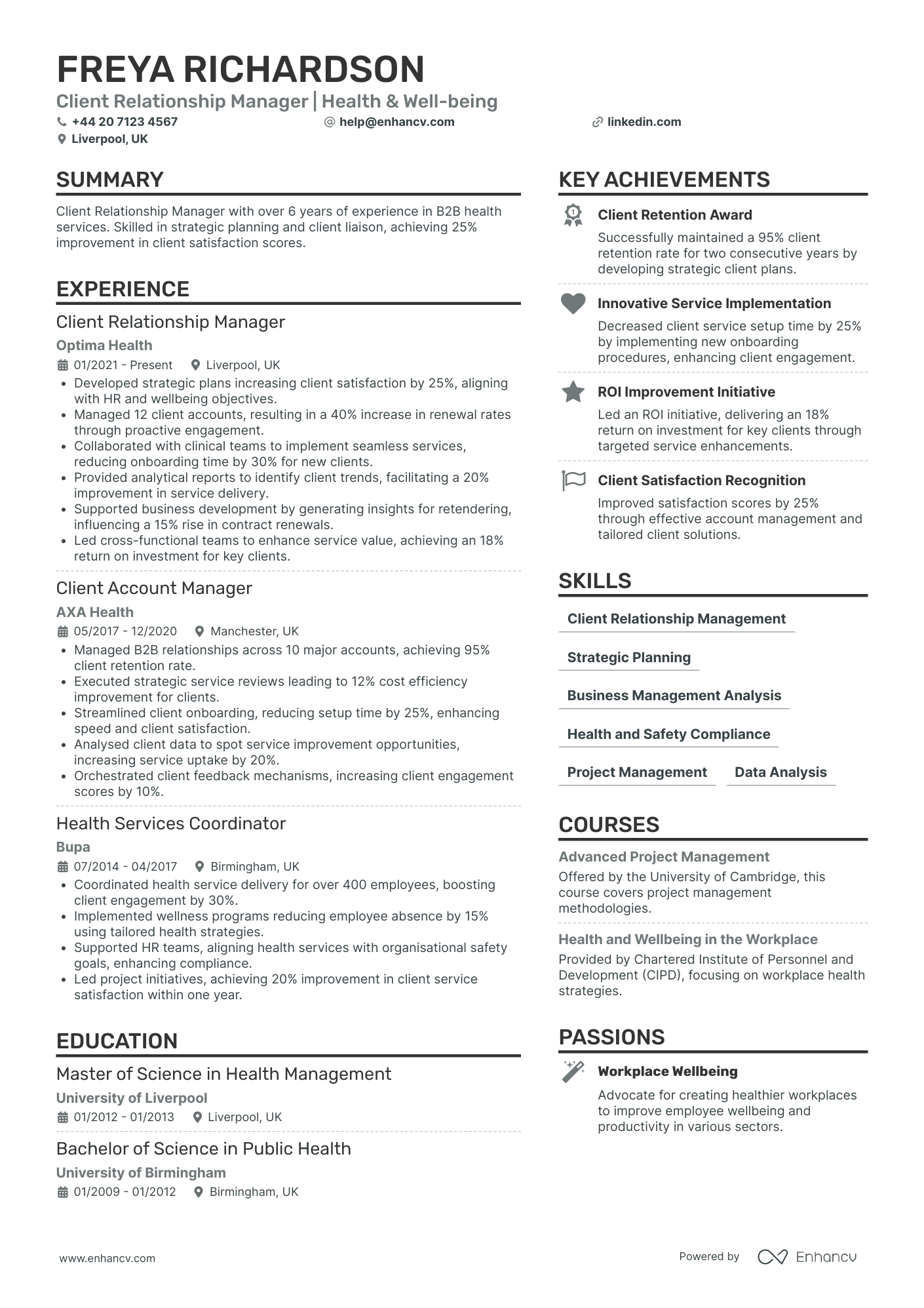

Bank Relationship Manager

- Exceptional Structure and Clarity - The CV is meticulously organized, featuring key sections such as experience, education, skills, courses, and achievements, which makes it easy to navigate. Each section is concise, with bullet points ensuring that essential information is presented clearly and effectively, specifically appealing to hiring managers looking for a streamlined document.

- Progressive Career Development in Health Sector - Freya Richardson showcases a steady career progression, highlighted by her advancement from Health Services Coordinator to Client Account Manager, and finally to Client Relationship Manager. This illustrates her growing responsibility over time and her commitment to the health and well-being industry, demonstrating strong career development.

- Strong Focus on Measurable Business Outcomes - The CV effectively uses quantitative data to illustrate achievements, such as a 25% improvement in client satisfaction and a 40% increase in renewal rates. These figures not only highlight her ability to achieve significant business results but also provide concrete evidence of her impact on company performance.

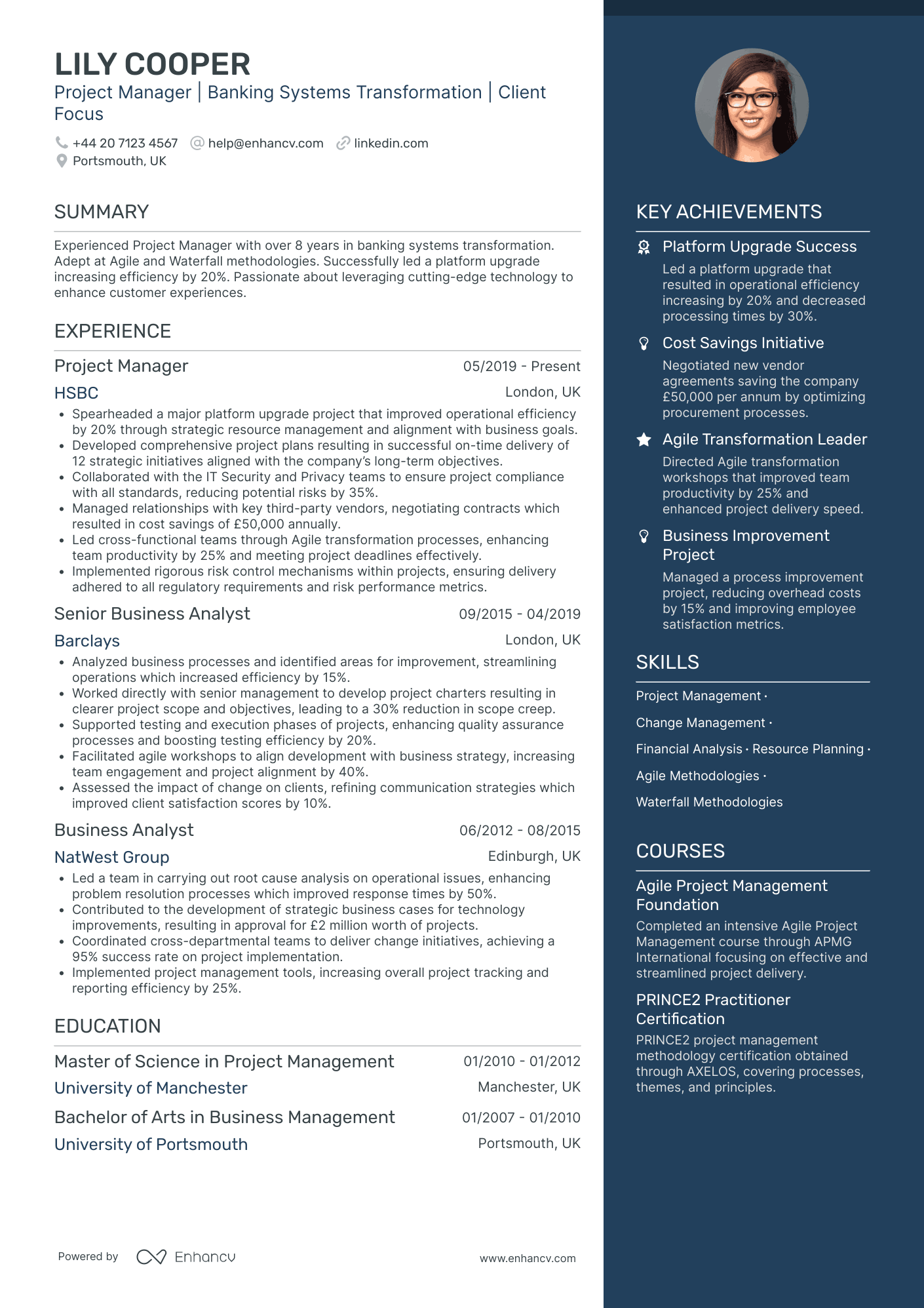

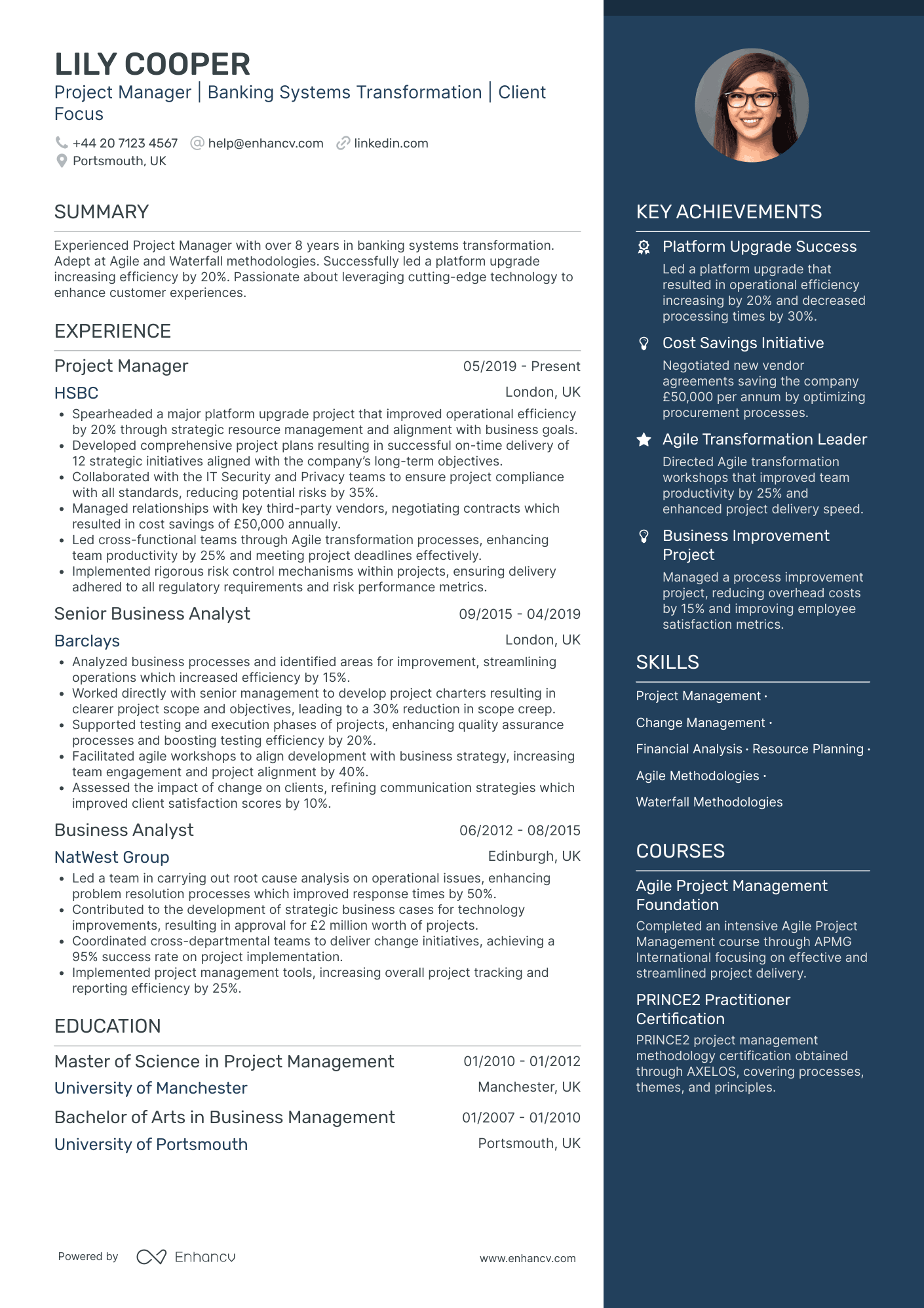

Bank Project Manager

- Exceptional Career Progression - Lily Cooper's career trajectory is noteworthy, having progressed from a Business Analyst at NatWest Group to a Project Manager at HSBC. This advancement highlights her ability to adapt and excel in increasingly complex roles and demonstrates her consistent development in the banking sector over the years.

- Robust Project Management Skills - The CV effectively showcases Lily's expertise in utilizing both Agile and Waterfall methodologies. Her proficiency with industry-standard tools like JIRA and MS Project further underscores her technical depth, providing evidence of her capability to manage projects across different environments effectively.

- Impactful Achievements with Business Relevance - The document outlines significant achievements, such as leading platform upgrades that enhance operational efficiency and negotiating cost savings with vendors. These accomplishments are framed not just in terms of numbers, but in the context of their broader impact on business performance and client satisfaction, reinforcing the valuable contributions she makes to her organizations.

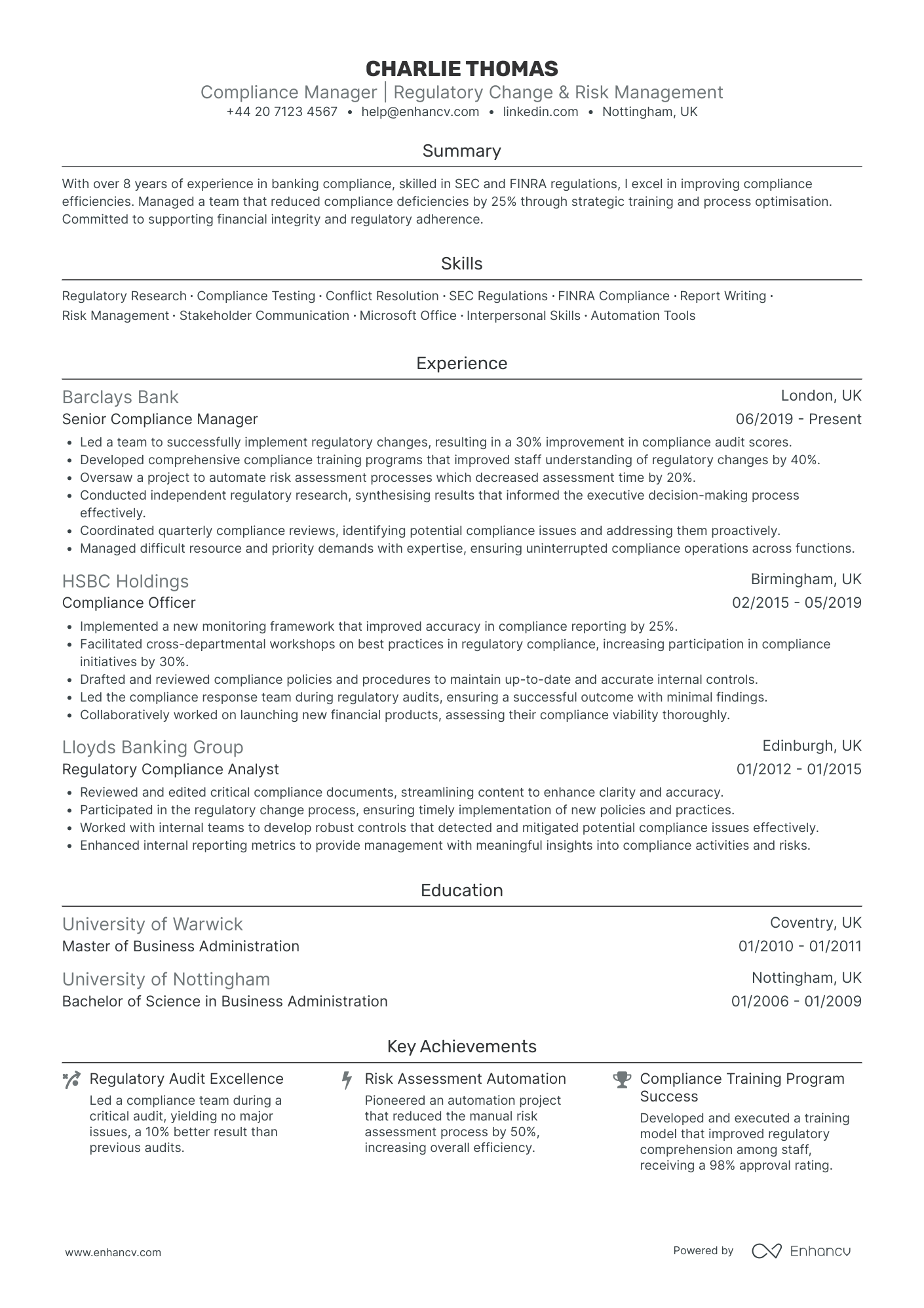

Bank Compliance Manager

- Comprehensive Career Progression - Charlie Thomas has demonstrated significant career growth, progressing from a Regulatory Compliance Analyst to a Senior Compliance Manager. This upward trajectory within major corporations like Barclays, HSBC, and Lloyds Banking Group highlights the trust and responsibility vested in Charlie by each employer, illustrating strong professional development within the finance and banking sector.

- Impactful Achievements with Business Relevance - The CV effectively highlights achievements that not only quantify success but also emphasize business outcomes. For instance, Charlie managed a team to reduce compliance deficiencies by 25%, which reflects a direct impact on operational efficiency and highlights his role in driving strategic improvements. Furthermore, pioneering risk assessment automation cut manual processes by half, showcasing Charlie's initiative in leveraging technology to enhance operational efficiency.

- Diverse and Relevant Skill Set - The skills section outlines a diverse set of abilities pertinent to the compliance field, including SEC Regulations, FINRA Compliance, and Stakeholder Communication. This rounded expertise is complemented by soft skills such as Interpersonal Skills and Conflict Resolution, indicating Charlie's capability to handle complex compliance scenarios and lead diverse teams effectively. These competencies align closely with the demands of a compliance managerial role.

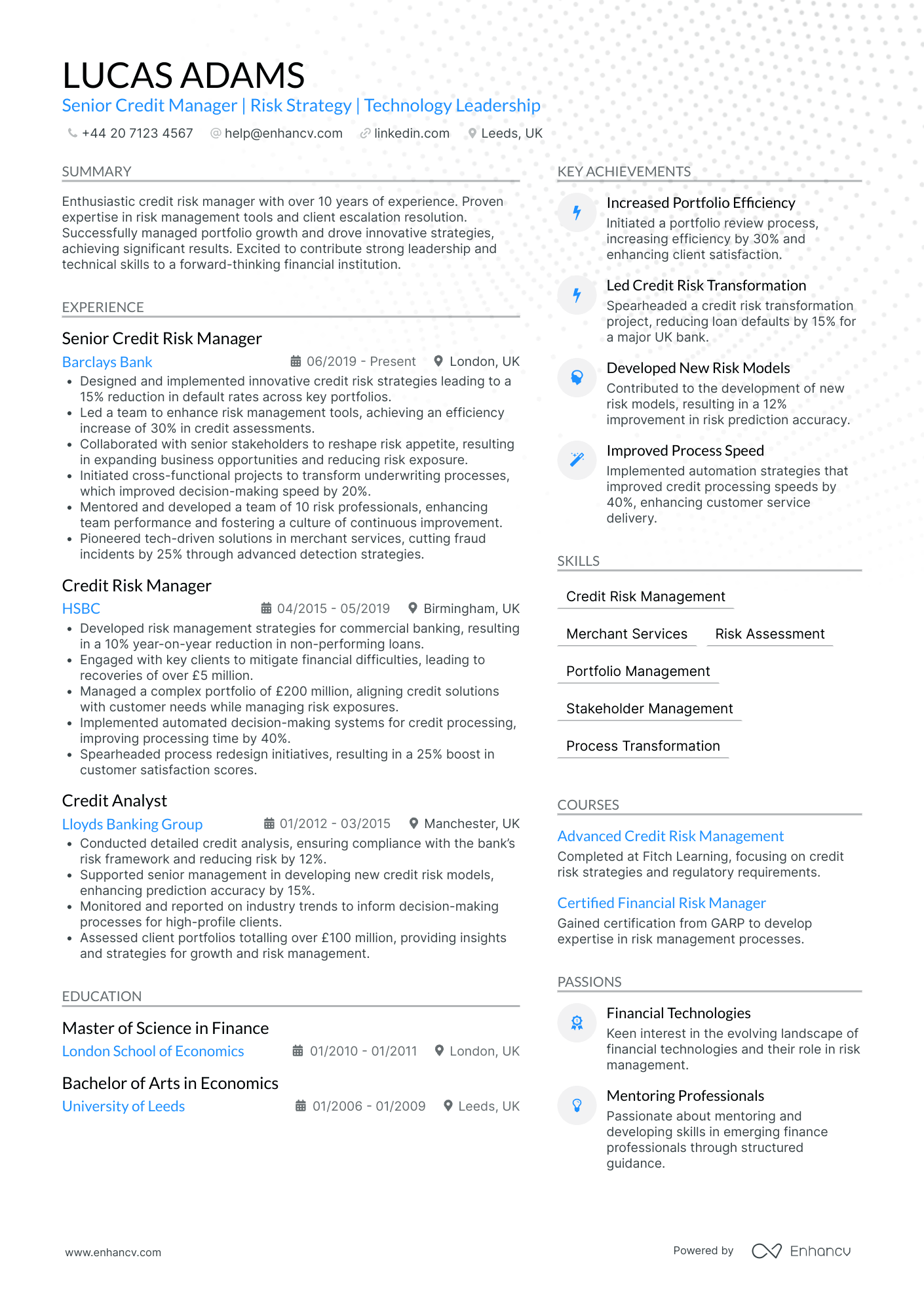

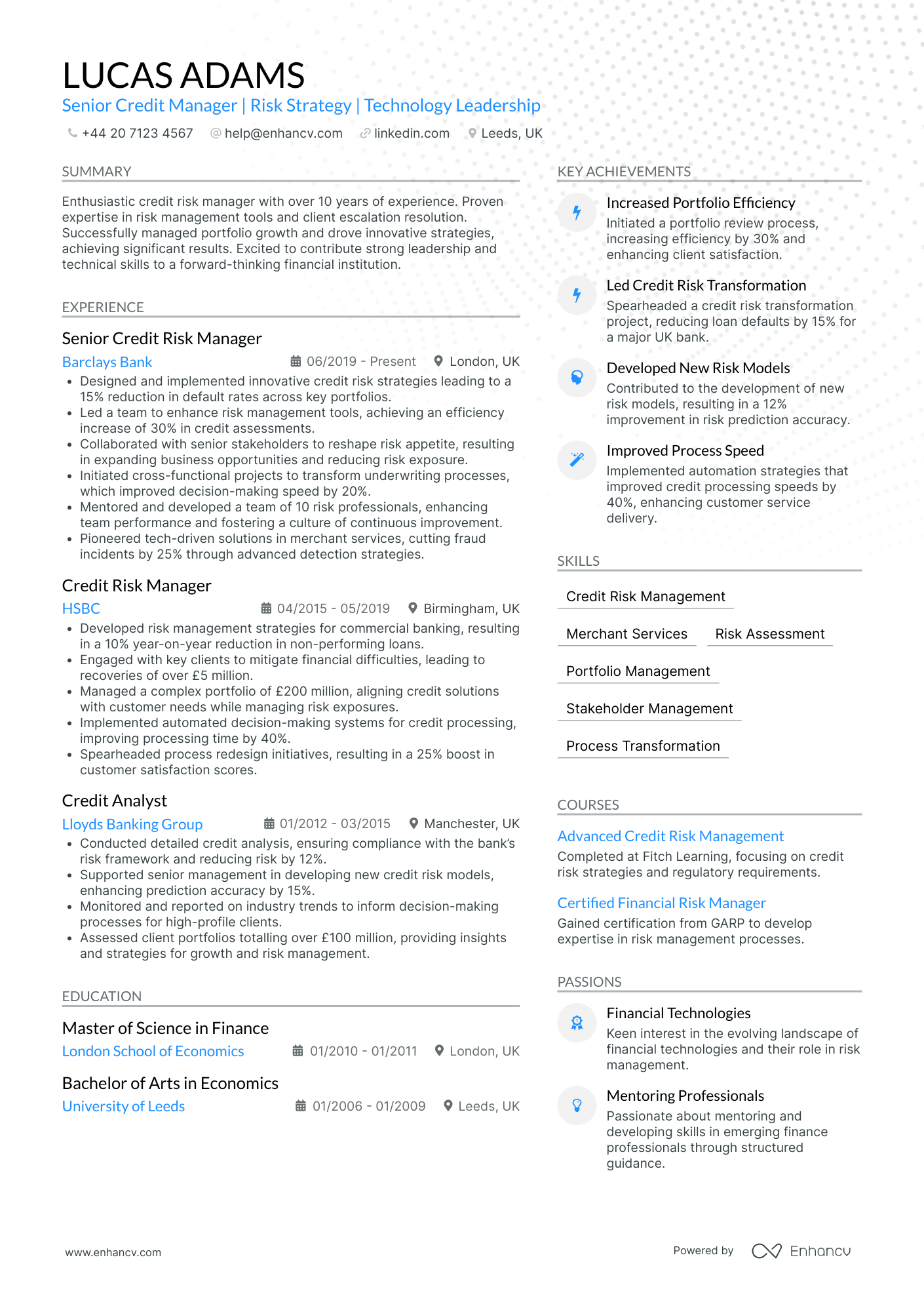

Bank Credit Manager

- Impressive Career Growth - Lucas Adams' career trajectory shows continuous elevation from a Credit Analyst to a Senior Credit Risk Manager, highlighting his upward mobility within major financial institutions like Barclays Bank, HSBC, and Lloyds Banking Group. This progression underscores his capability in taking on more responsibility and his growing influence in the financial sector.

- Innovative Use of Credit Risk Strategies - The CV illustrates a deep technical expertise in credit risk management, demonstrated by the implementation of innovative strategies that led to a significant 15% reduction in default rates and a 25% decrease in fraud incidents at Barclays Bank. These elements highlight his ability to apply industry-specific methodologies in practical scenarios to yield measurable improvements.

- Leadership and Mentorship Acumen - Beyond technical skills, Lucas shows strong leadership qualities, having mentored a team of 10 risk professionals and fostering a culture of continuous improvement. His ability to enhance team performance reflects his soft skills and commitment to developing future leaders in the finance industry.

Bank Portfolio Manager

- Strategically Structured for Clarity and Impact - The CV stands out with its clear and concise presentation, ensuring all sections are systematically organized. Each segment—professional experience, education, skills, achievements—is meticulously detailed and aligned with impactful bullet points that highlight core competencies and pivotal roles, making it easy for employers to quickly grasp key qualifications.

- Diverse and Progressive Career Trajectory - Ivy Ward's career journey is marked by steady growth in the financial sector, transitioning from an Assistant Portfolio Manager to a Senior Portfolio Manager, and eventually occupying a Vice President role. This trajectory showcases her upward mobility and industry commitment, emphasizing her capability to handle increased responsibilities and leadership roles.

- Integration of Robust Risk Management Frameworks - An impressive aspect of the CV is the focus on risk management methodologies within the experience sections. Ivy has consistently improved risk frameworks at different companies, demonstrating a profound understanding of risk mitigation strategies that are essential in her field. This technical depth is further supported by her achievements in enhancing compliance and liquidity management.

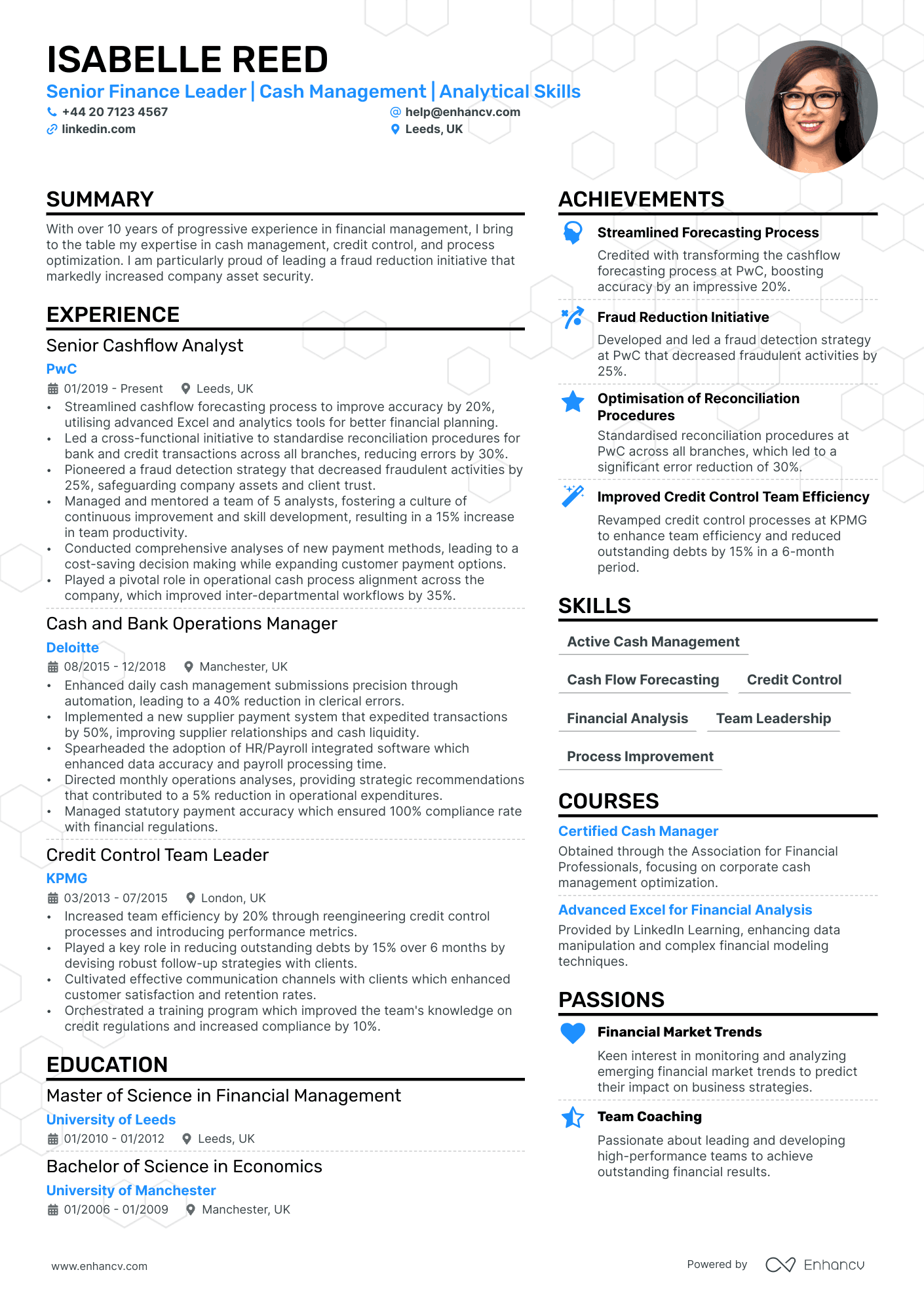

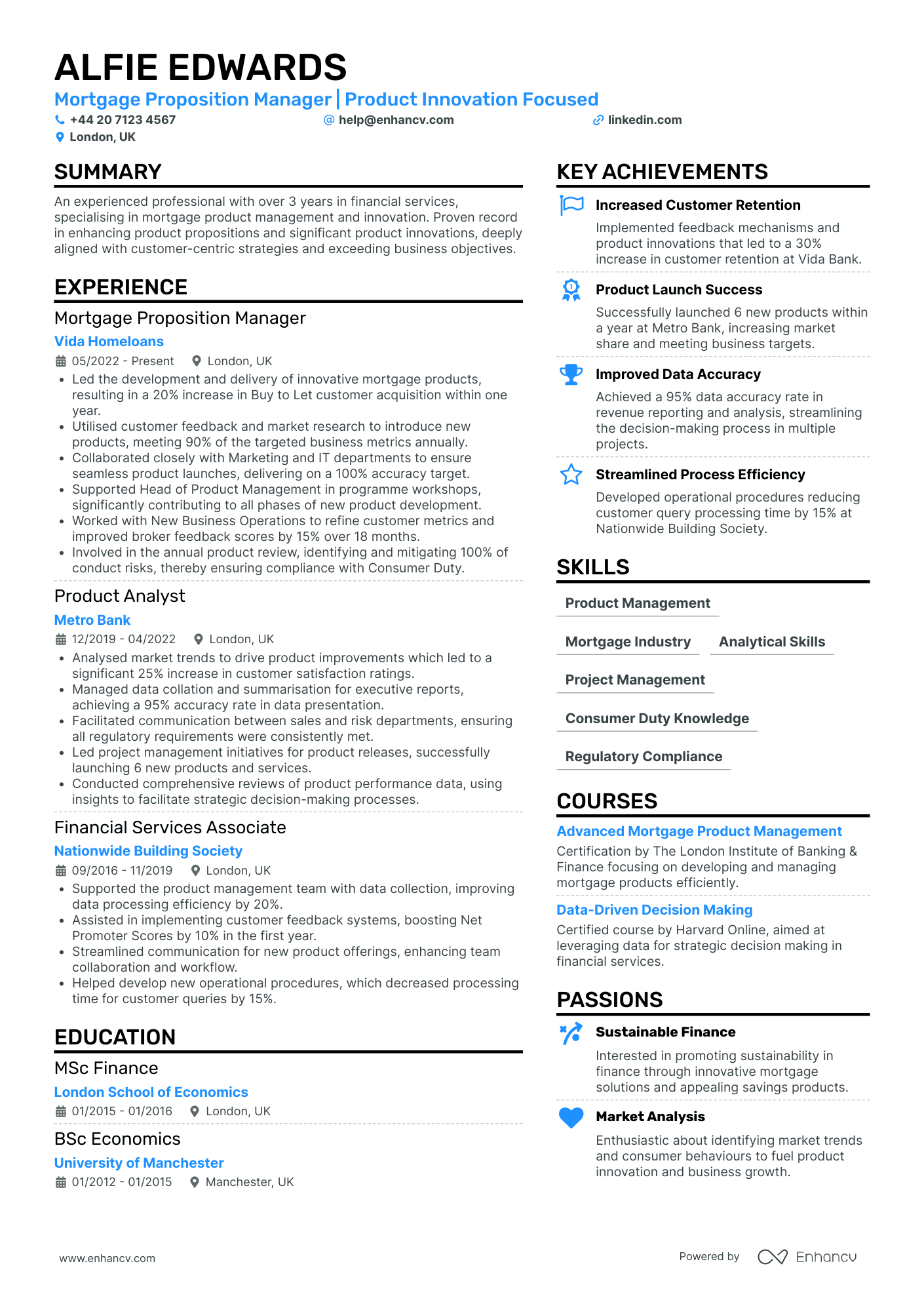

Bank Treasury Manager

- Clear and Concise Presentation - The CV is well-structured, starting with the candidate's personal details and a summary that clearly outlines their expertise. The use of bullet points in the experience section enhances readability and helps highlight key achievements and responsibilities concisely, making it easy for recruiters to capture the essential information quickly.

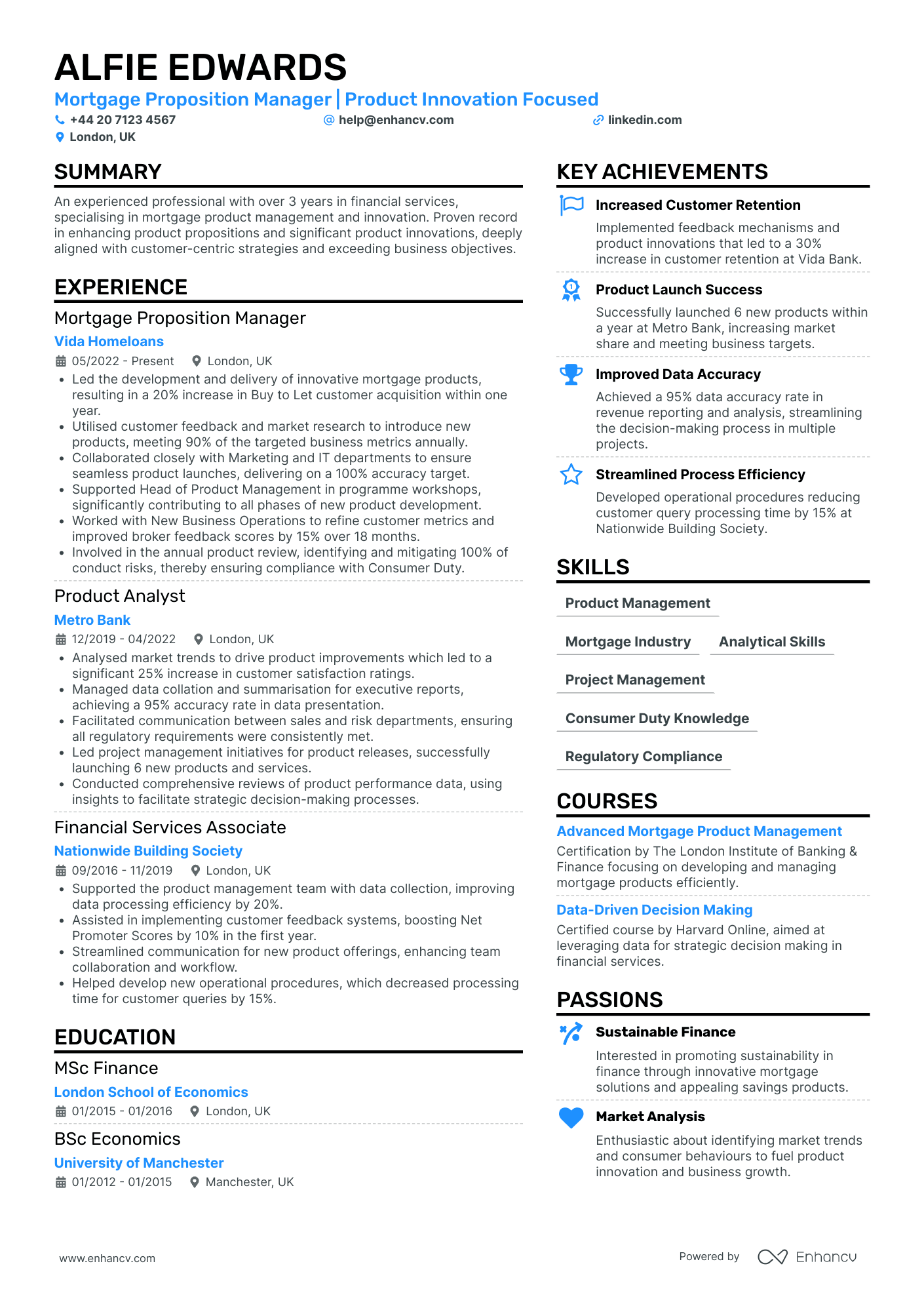

- Consistent Career Growth and Focus - Alfie Edwards shows a clear upward trajectory in his career, evolving from a Financial Services Associate to a Mortgage Proposition Manager. This progression within the financial services sector underscores his developing expertise and commitment to mortgage product management and innovation, emphasizing his readiness for leadership roles.

- Industry-Specific Tools and Methodologies - The CV reflects a deep understanding of industry-specific elements, notably through his proficiency in Consumer Duty Knowledge and Regulatory Compliance. The candidate’s innovative approach, accentuated by insights from customer feedback and market research, highlights his technical depth and expertise in aligning mortgage products with customer needs.

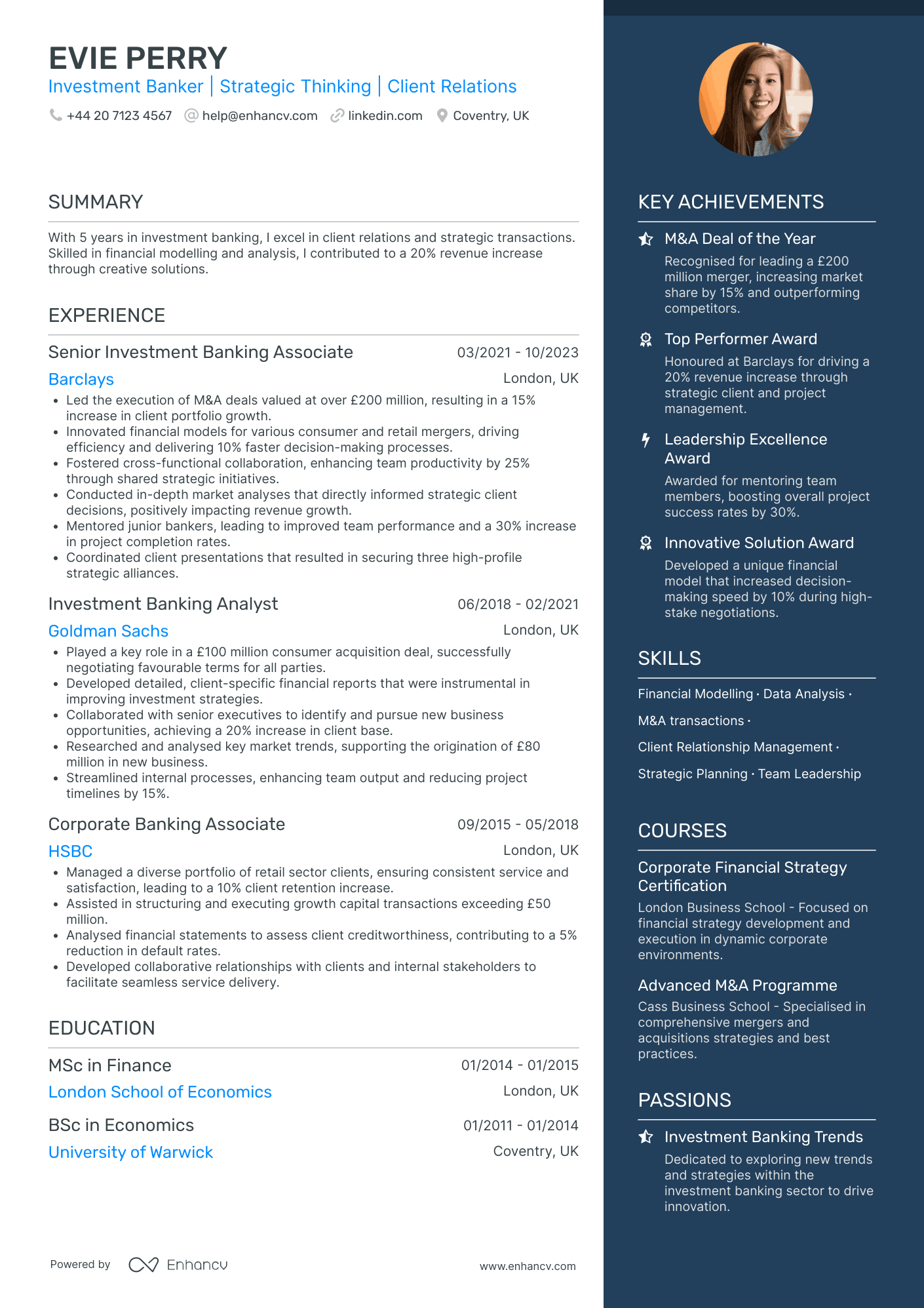

Bank Investment Manager

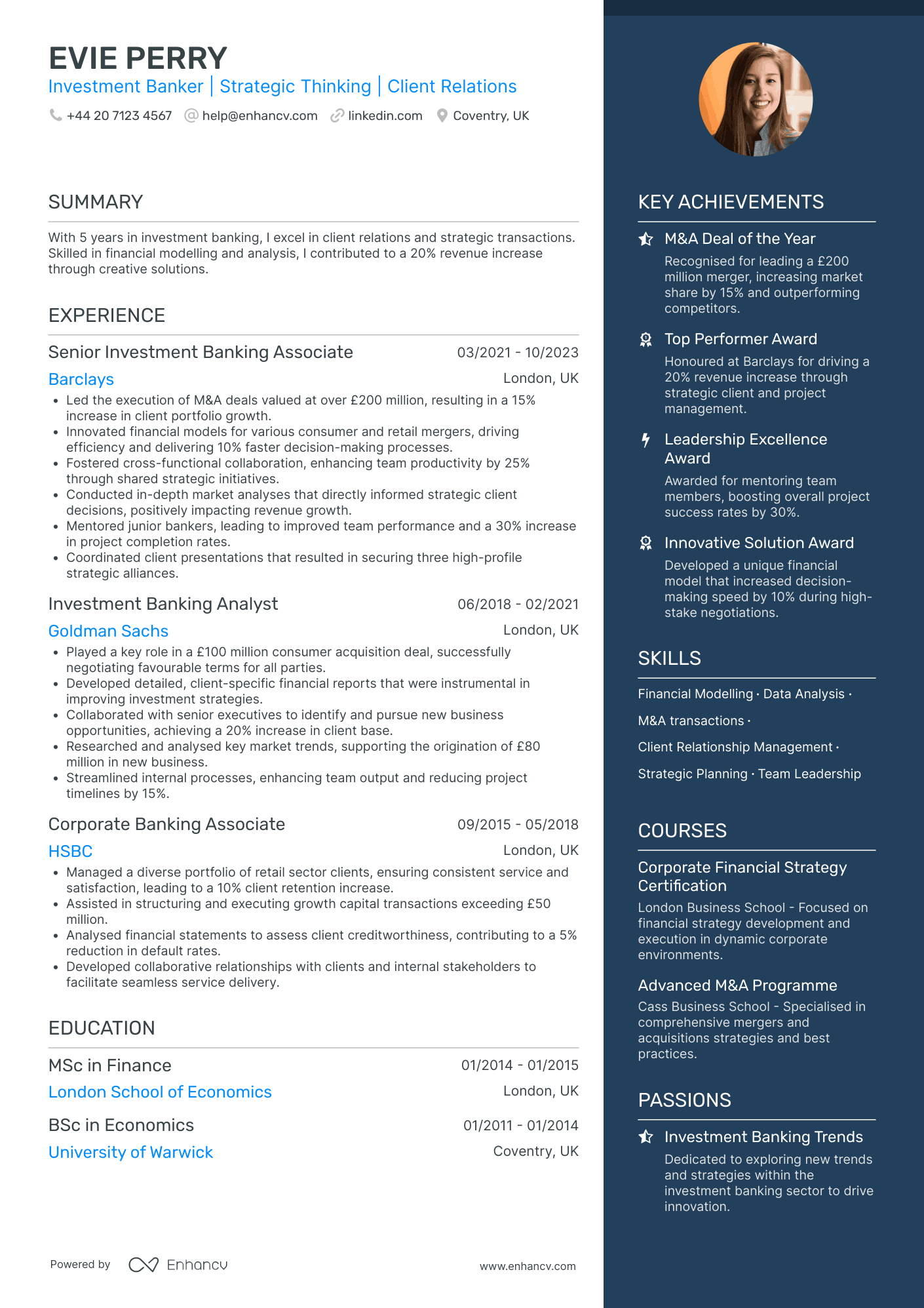

- Career Progression and Growth - Evie Perry's CV illustrates a clear and impressive career trajectory, starting from a Corporate Banking Associate position at HSBC and advancing to a Senior Investment Banking Associate at Barclays. This progression demonstrates her consistent ability to take on higher responsibilities and master more complex financial initiatives, revealing her readiness for further leadership roles.

- Integration of Finance and Strategy - The CV distinctively emphasizes Evie's proficiency in both the financial and strategic dimensions of investment banking. Her experiences include leading M&A deals, innovating financial models, and conducting market analyses which have positive business impacts like increasing portfolio growth and securing strategic alliances, indicating her vital role in bridging operational execution and strategic planning.

- Adaptability and Cross-functional Collaboration - Evie has shown considerable adaptability in her roles, moving adeptly between different facets of banking and demonstrating cross-functional collaboration. Her successful coordination of client presentations and fostering productive teamwork highlight her ability to work effectively with varied teams and roles, enhancing overall organizational productivity.

Bank Audit Manager

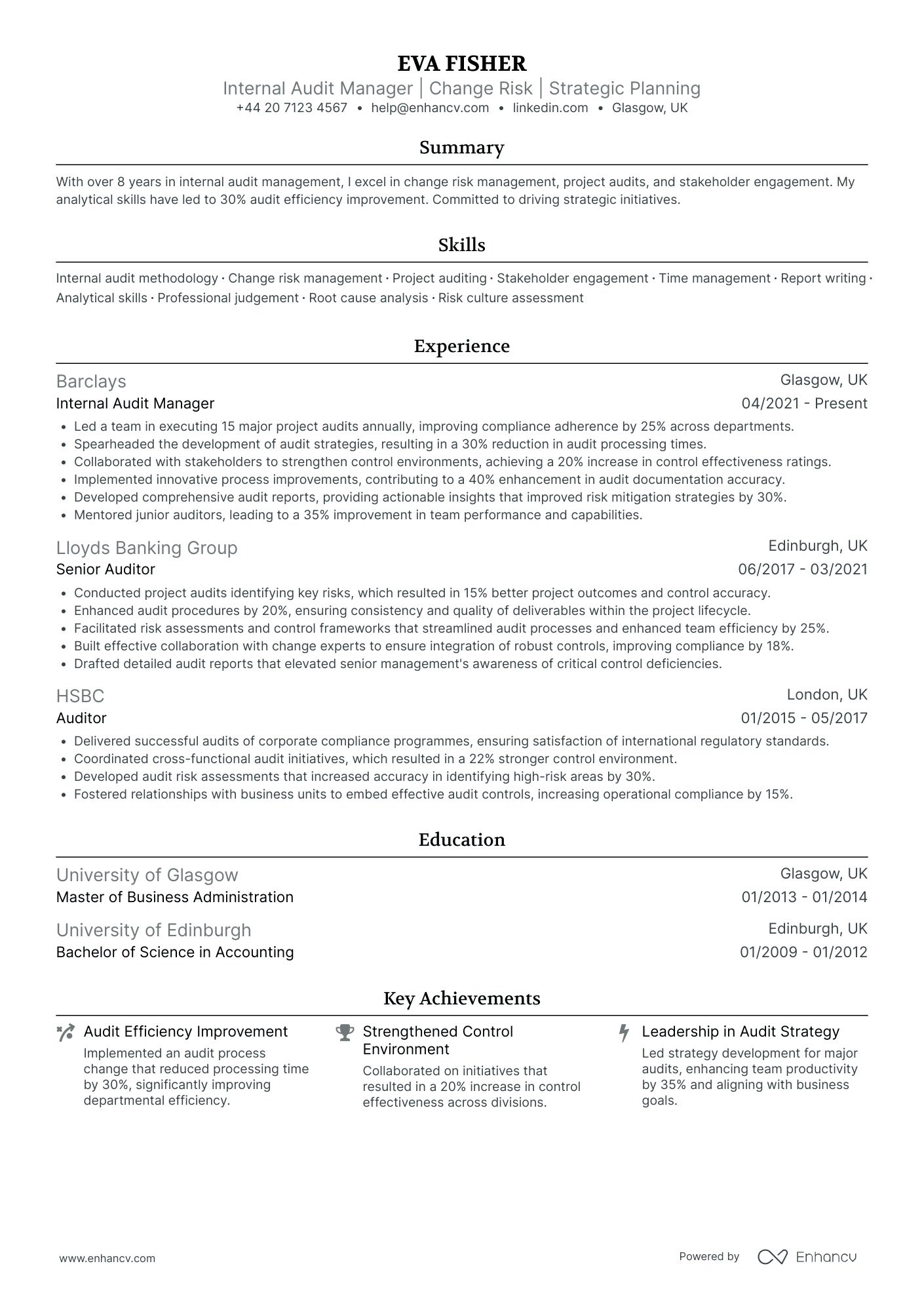

- Clear and Structured Presentation - The CV is neatly structured, making it easy to navigate through different sections such as experience, education, and achievements. The bullet points under each job title help in quickly gleaning the essence of responsibilities and the impact made, ensuring clarity and conciseness.

- Proven Career Progression - Eva Fisher's career trajectory is marked by logical promotions and increased responsibilities, from Auditor to Internal Audit Manager, which demonstrates a clear path of growth within the banking sector. This progression highlights her commitment and the trust placed in her capabilities by leading financial institutions.

- Impactful Achievements with Business Relevance - The CV effectively communicates achievements with significant business implications, such as a 30% improvement in audit efficiency and a strengthened control environment by 20%. These numbers not only showcase her proficiency but also underscore her ability to contribute to strategic business improvement.

Commercial Bank Manager

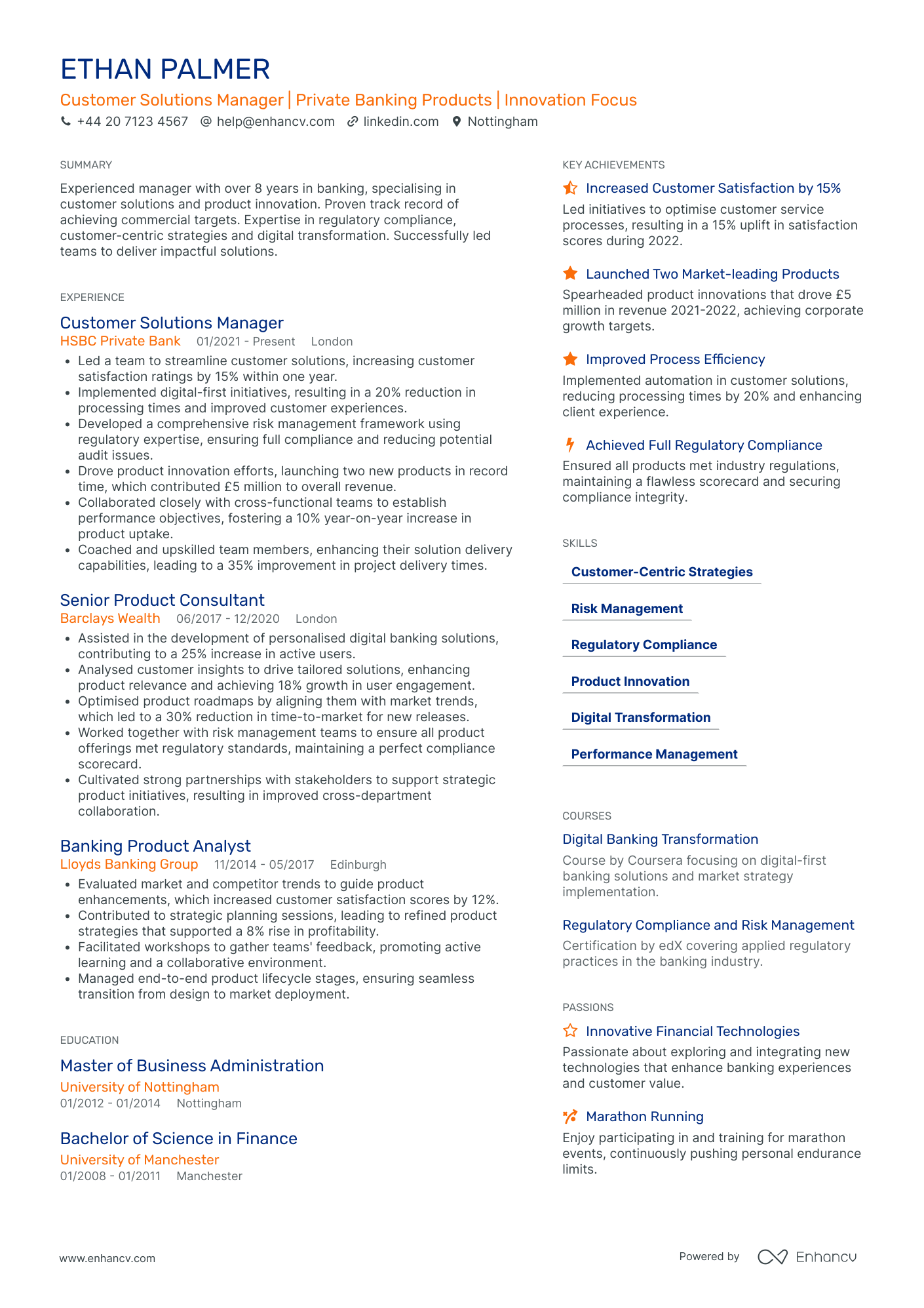

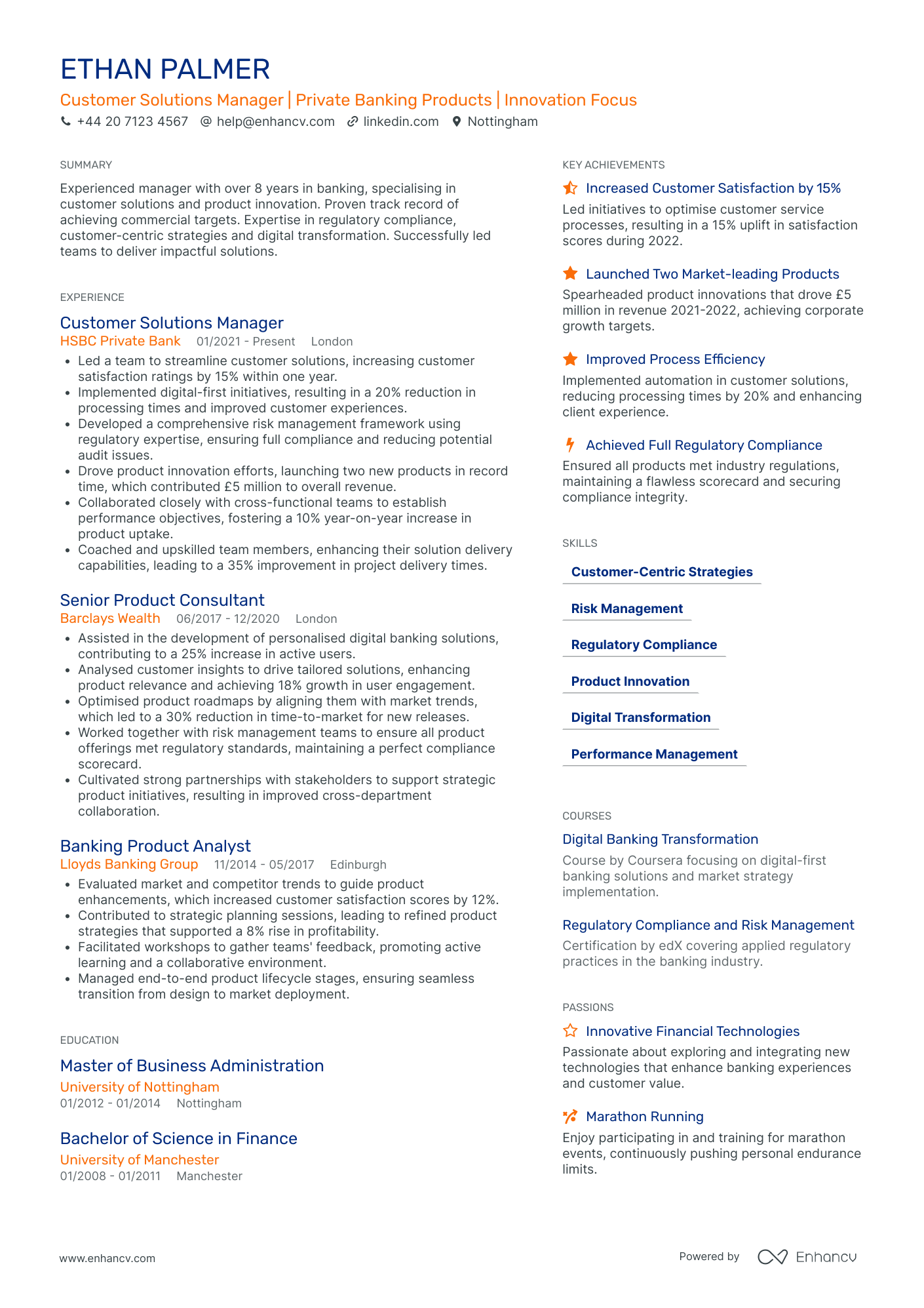

- Clear Structure and Conciseness - The CV is well-organized, with each section clearly defined, allowing for easy navigation between the candidate's summary, experience, education, and skills. Information is presented succinctly, focusing on relevant successes and professional growth, which ensures that the reader can quickly grasp the key aspects of Ethan Palmer's qualifications.

- Progressive Career Trajectory - Ethan Palmer's progression from a Banking Product Analyst to a Customer Solutions Manager highlights his upward career movement within prominent financial institutions like HSBC and Barclays. These roles reflect increases in responsibility and leadership, showcasing his ability to handle more complex challenges and lead larger teams over time.

- Impactful Achievements - The CV details achievements not only in numerical terms but in their broader business impact. Ethan’s initiatives that led to increased customer satisfaction ratings, product launches contributing £5 million to revenue, and efficiency improvements reflect his ability to convert strategic planning into real-world outcomes, demonstrating tangible business relevance.

Retail Bank Manager

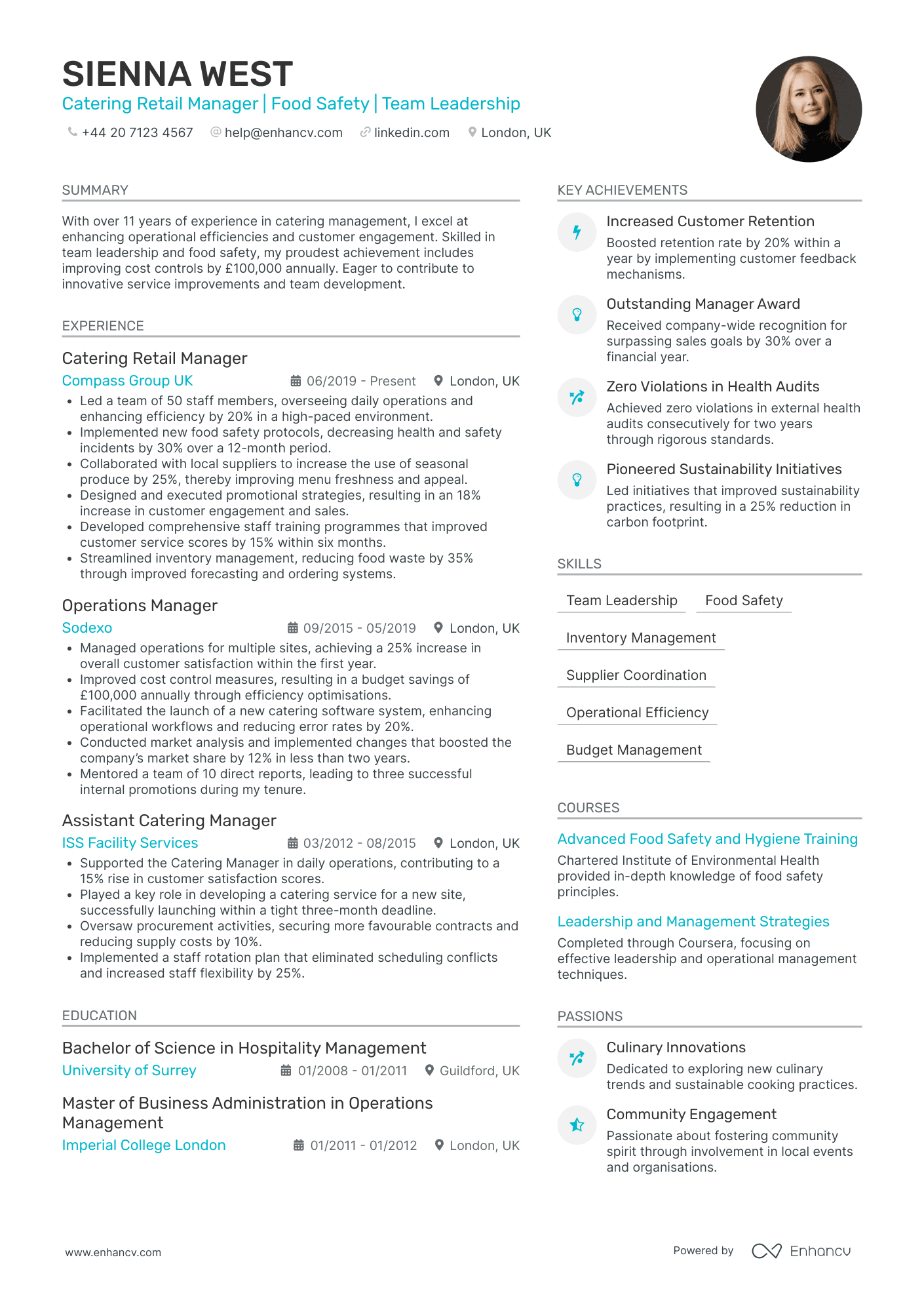

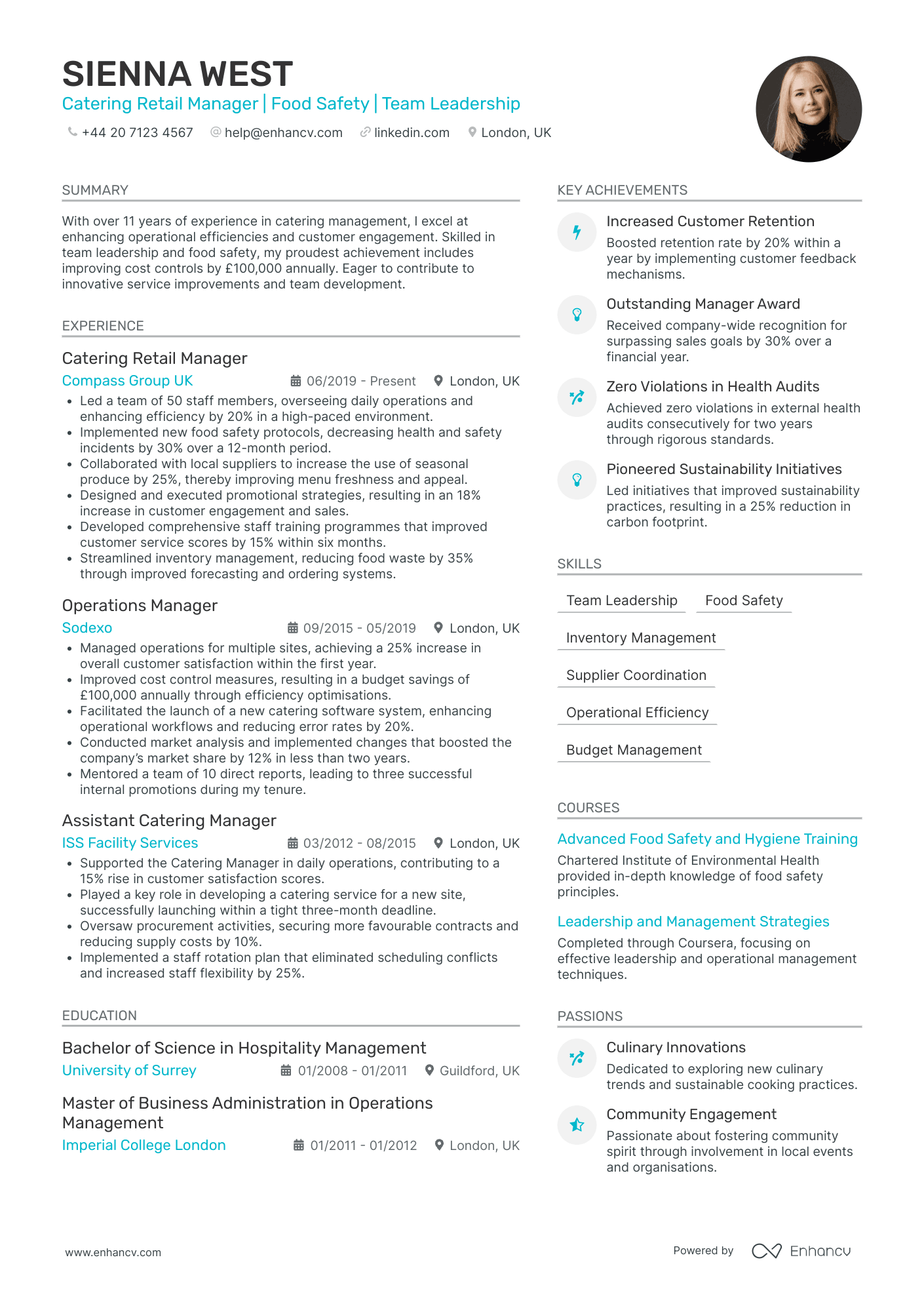

- Content Presentation and Clarity - The CV is structured with clear, concise sections that are easy to navigate. Each role and responsibility are broken down into bullet points, summarizing key contributions without overwhelming detail. This clarity allows a quick yet comprehensive overview of Sienna’s competencies and accomplishments, perfectly balancing detail with readability.

- Career Trajectory and Growth - Sienna's career demonstrates a clear upward trajectory, progressing from an Assistant Catering Manager to a Catering Retail Manager. Each role highlights increased responsibility and greater impact, such as leading a team of 50 and overseeing multiple site operations, indicative of strong professional growth and leadership capabilities within the catering industry.

- Achievements and Business Relevance - The CV underscores significant achievements with quantifiable impacts, such as increasing customer engagement by 18% and reducing food waste by 35%. These figures aren't just metrics; they represent enhanced operational effectiveness and financial savings, showcasing Sienna’s ability to drive successful business outcomes through innovative strategies and precise execution.

Private Bank Manager

- Dynamic Presentation and Structure - The CV’s structure is clean and easy to navigate, breaking down information into concise bullet points which allow for quick comprehension. It effectively employs sections that are logically ordered, which helps create a fluid reading experience and positions key information at the forefront.

- Impressive Career Trajectory and Growth - Samuel Campbell's career trajectory demonstrates a clear upward path, reflecting strong professional growth from a Pricing Analyst to a Commercial & Pricing Manager. This progression is indicative of his increasing responsibilities and leadership in the private banking sector while also showcasing stability and dedication within reputable financial institutions.

- Achievements Resonating Business Impact - The CV highlights Samuel’s significant achievements not just in numbers but also in business relevance, such as a 25% increase in revenue from implementing a dynamic pricing model and improving team sales by 30%. These accomplishments illustrate his ability to drive strategic initiatives that have tangible impacts on the bottom line.

Bank Asset Manager

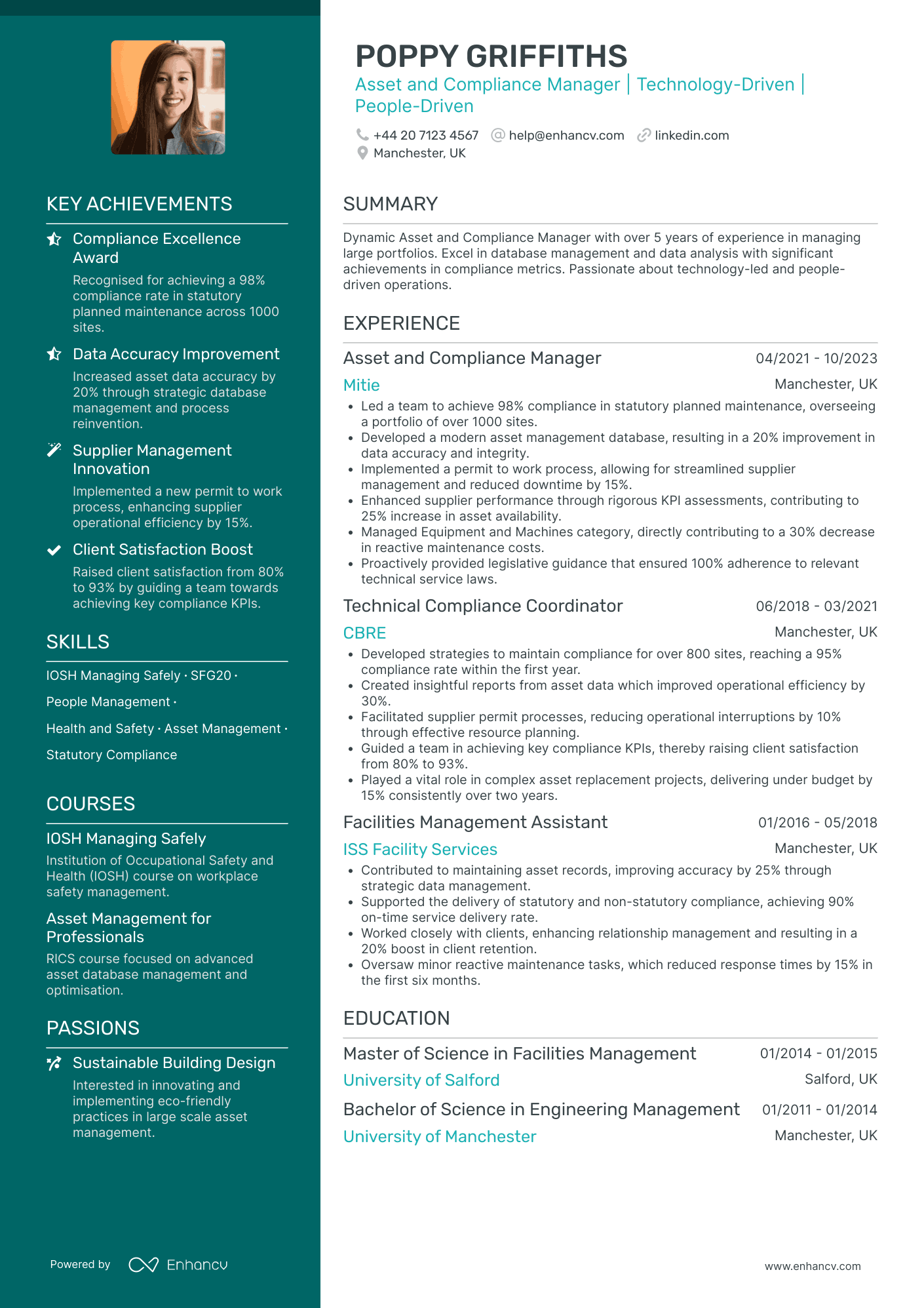

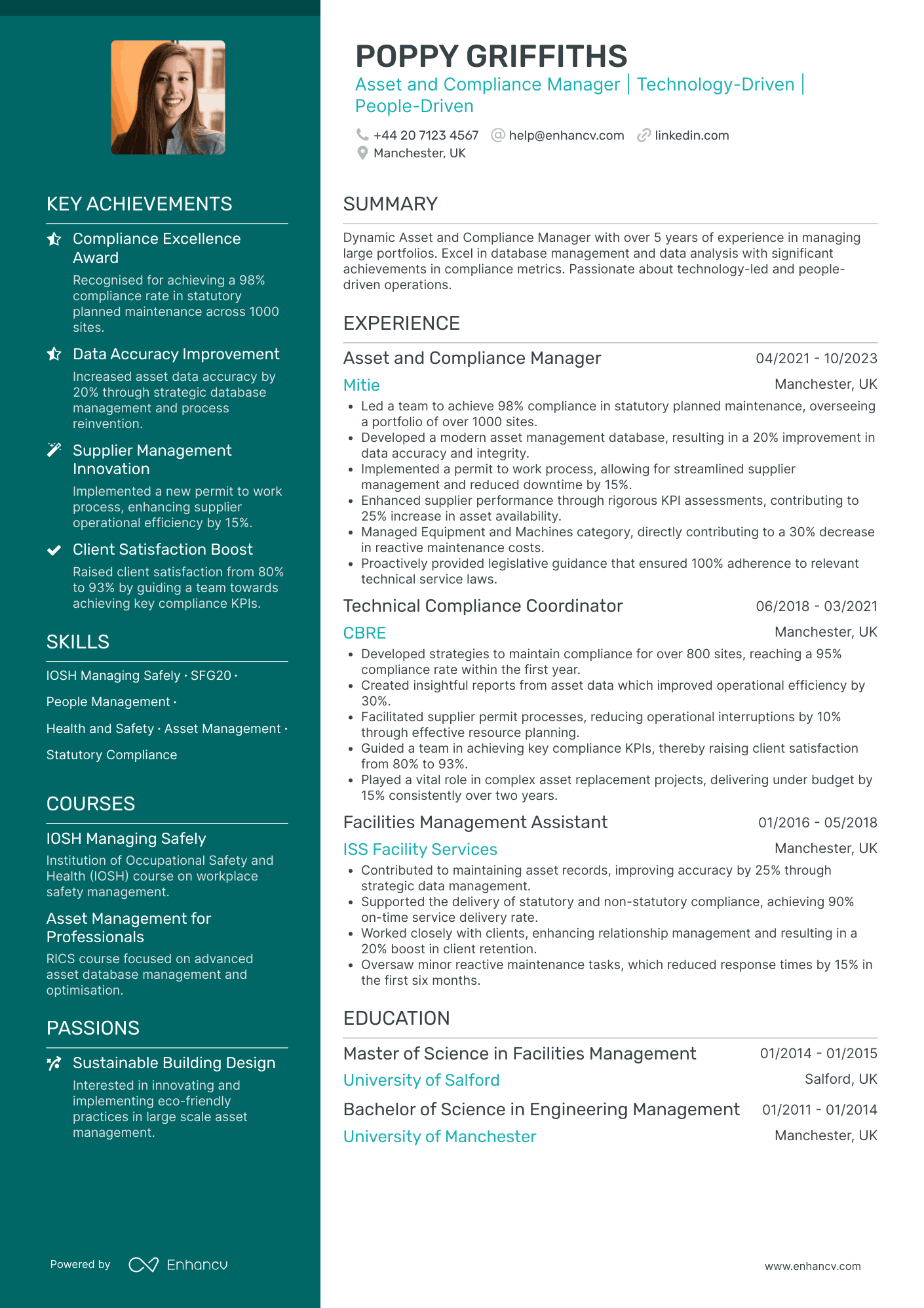

- Comprehensive career growth and role advancement - Poppy Griffiths' CV outlines a clear and upward career trajectory, moving from a Facilities Management Assistant to an Asset and Compliance Manager. This progression showcases her ability to grow within the industry and take on increasingly responsible roles, demonstrating her competence and leadership potential over the years.

- Exceptional achievements with measurable outcomes - The CV highlights significant business impacts, such as leading a team at Mitie to achieve a 98% compliance rate, and improving data accuracy by 20% through database modernization. These accomplishments not only emphasize her technical proficiency but also her capacity to deliver strategic improvements that benefit the organization substantially.

- Integration of soft skills and technological expertise - Poppy effectively combines her soft skills in people management and problem resolution with her technical expertise in compliance and asset management. This dual approach underscores her ability to lead teams and drive technology-driven projects, crucial for maintaining both compliance and operational efficiency in the asset management sector.

Bank Mortgage Manager

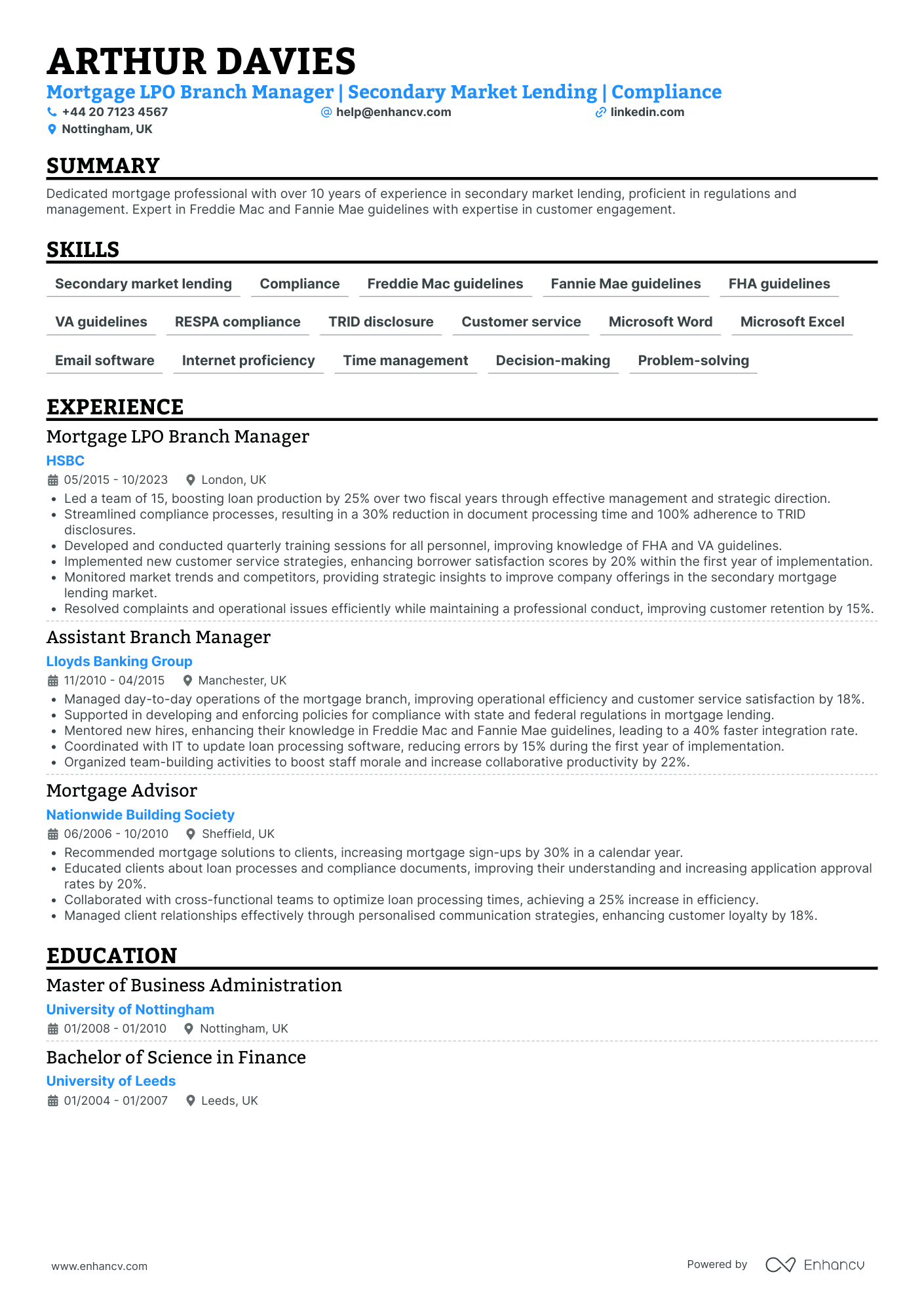

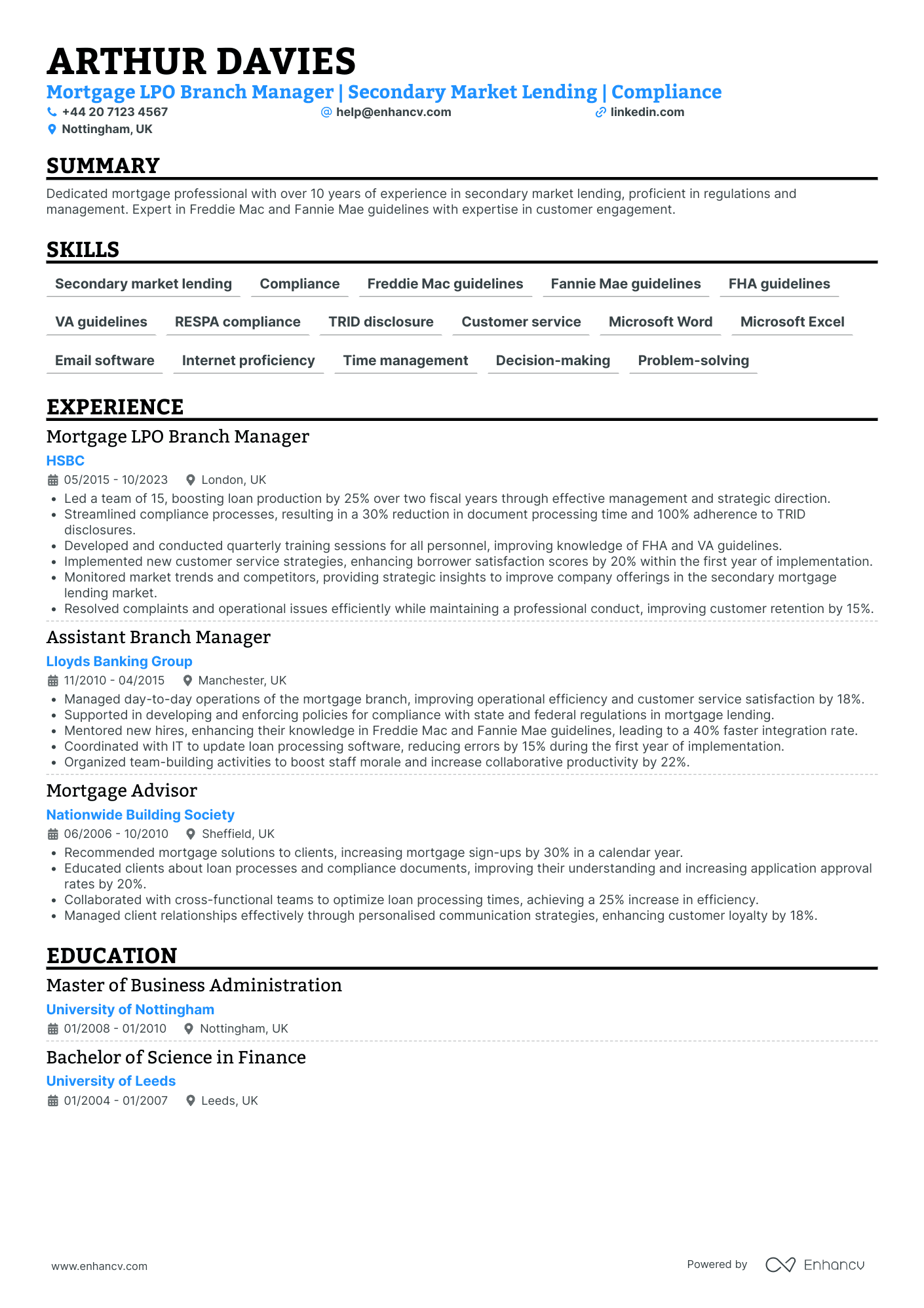

- Clear and Structured Content - The CV is well-organized, beginning with crucial personal information followed by a detailed summary that captures the candidate's expertise concisely. Each job position is detailed with dates, locations, and bullet points that clearly articulate responsibilities and accomplishments, making it easy to follow and understand the career progression.

- Demonstrated Leadership and Soft Skills - Arthur Davies's ability to lead is evident in roles where he managed teams and implemented strategic plans to enhance productivity and efficiency. His leadership is further highlighted by mentoring new hires and organizing team-building activities, showcasing his ability to improve workplace morale and develop team talent.

- Impactful Achievements with Practical Business Relevance - The CV is rich with quantifiable achievements, such as boosting loan production by 25% and exceeding sales targets by 30% annually. These numbers are not just impressive figures; they represent significant contributions to organizational growth and efficiency, validating his effectiveness in the financial services industry.

Bank Product Manager

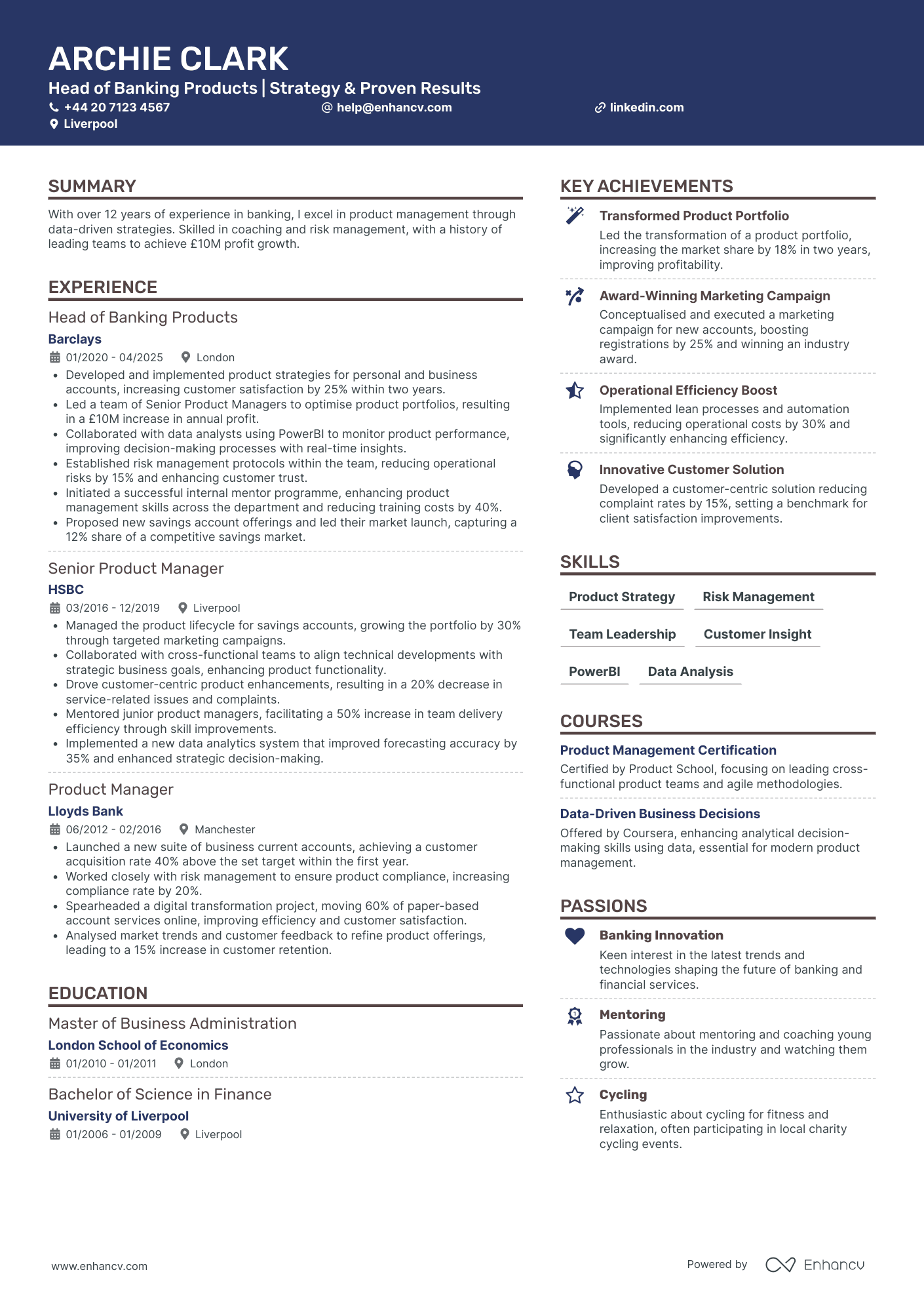

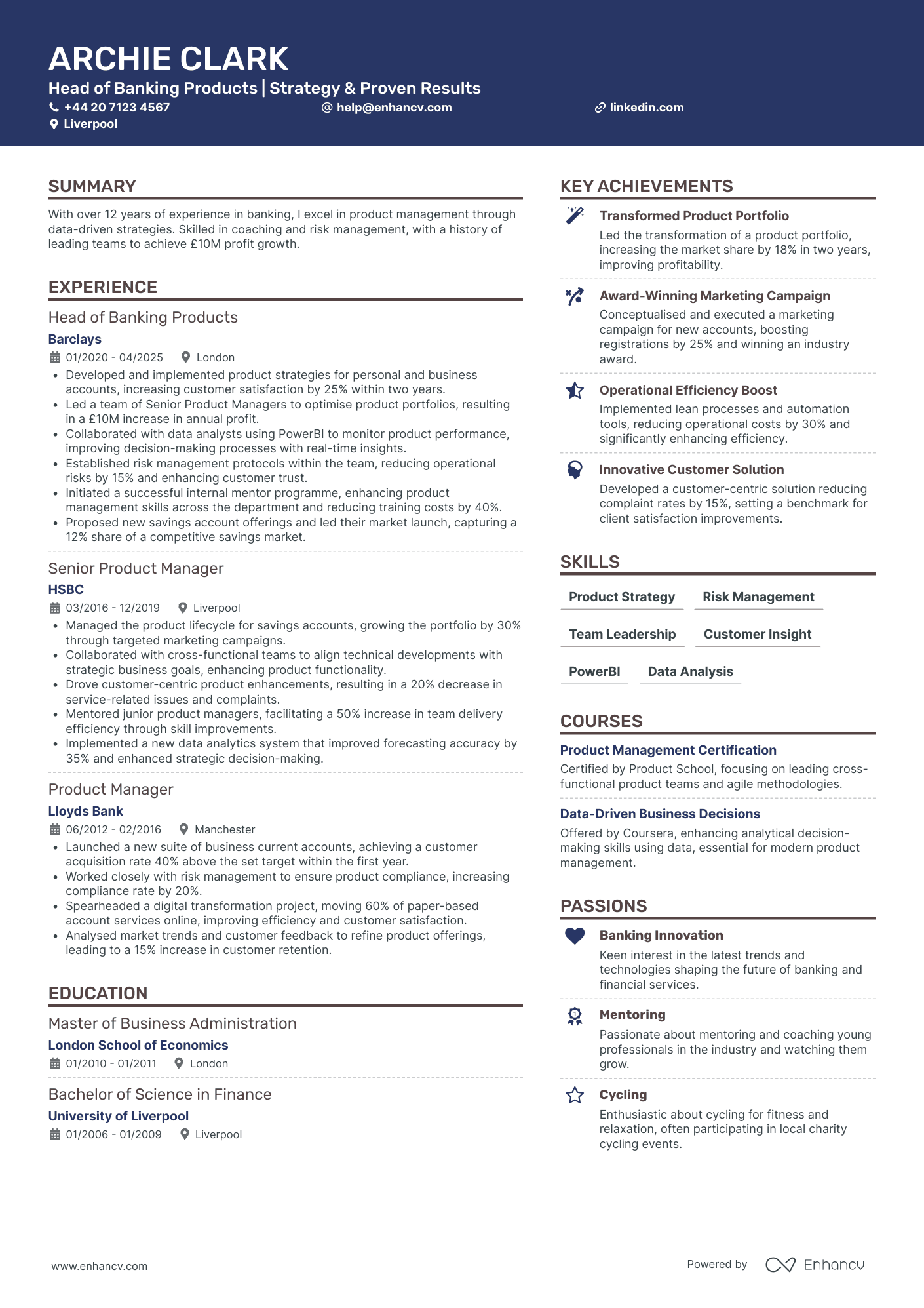

- Linear and measurable career growth - The CV illustrates a clear trajectory with increasing responsibilities, shifting from a Product Manager role at Lloyds Bank through to becoming the Head of Banking Products at Barclays. This progression showcases Archie Clark's ability to take on larger management roles, expand expertise in banking products, and lead substantial growth projects, demonstrating readiness for senior leadership roles.

- Strategic use of industry tools and methodologies - The CV highlights Archie’s adept use of PowerBI and other data analysis tools which are crucial for product performance monitoring in the banking sector. Additionally, there’s a focus on data-driven decision-making and implementing risk management protocols, which reflect deep technical knowledge and strategic foresight tailored to banking operations.

- Impactful achievements aligned with business objectives - The CV effectively communicates the business relevance of achievements, such as capturing a significant market share with new savings accounts and transforming a product portfolio to substantially increase profitability. These contributions underscore Archie’s role in driving financial success and customer satisfaction within the banking industry.

Bank Security Manager

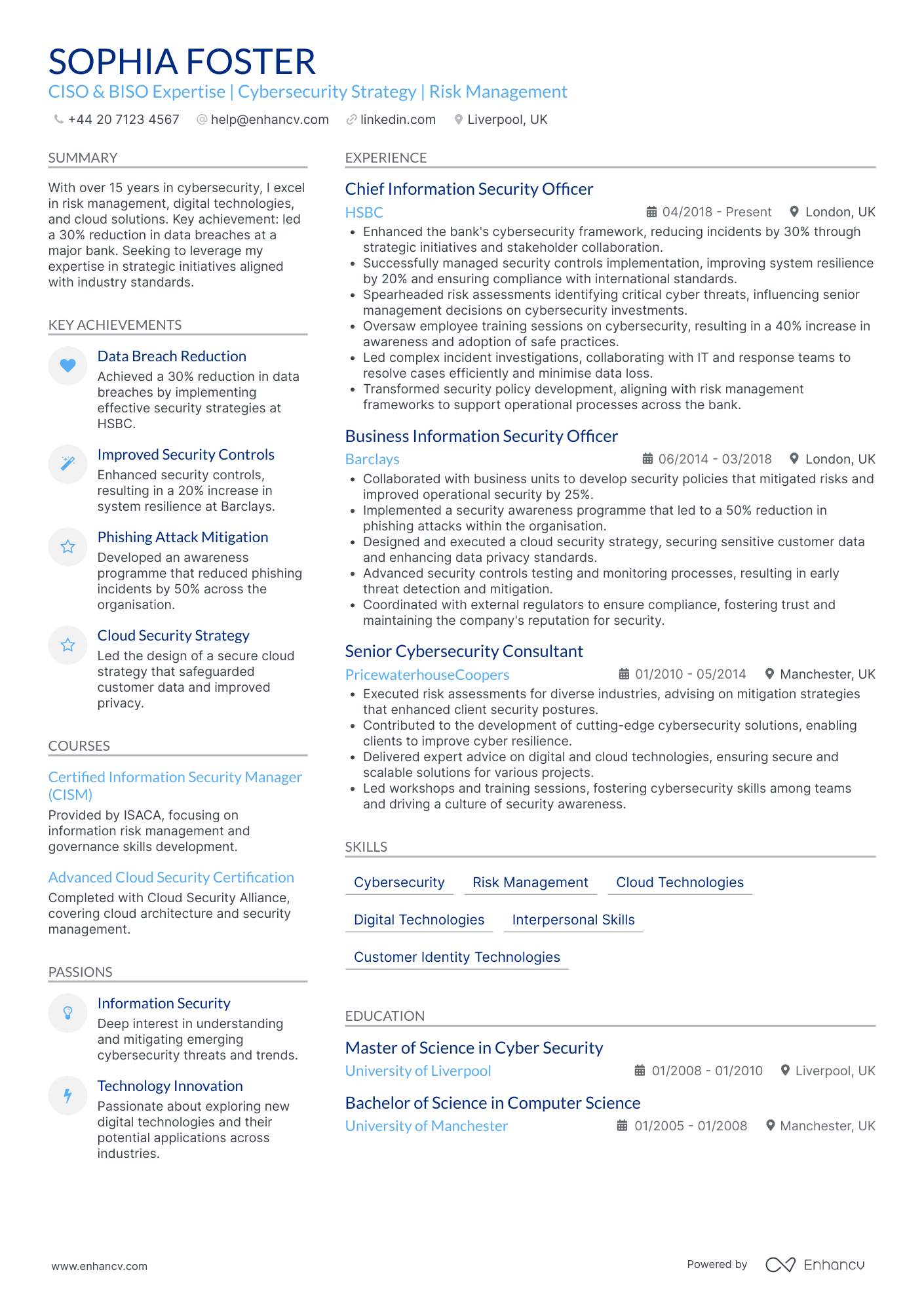

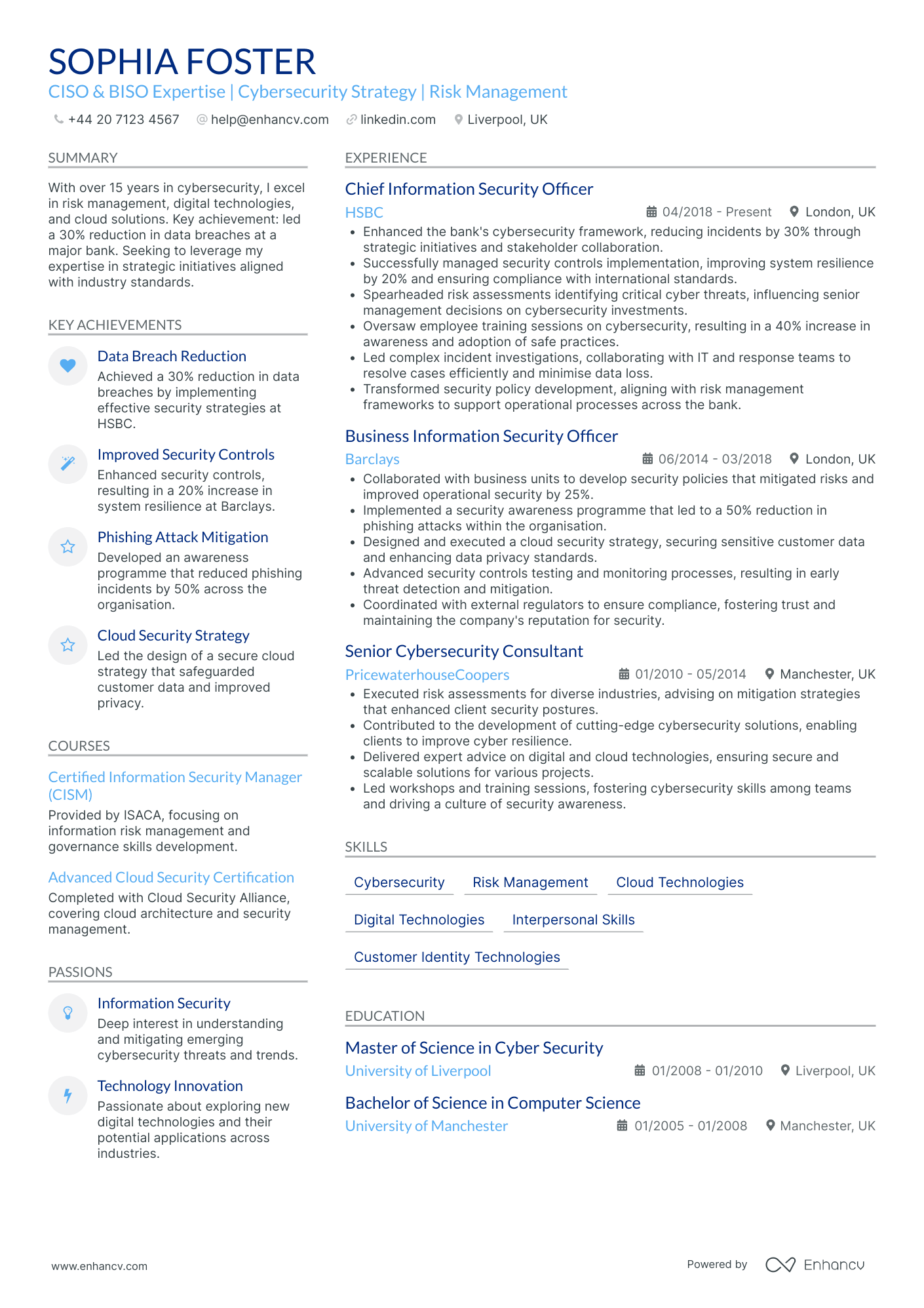

- Content presentation and structure - The CV is thoughtfully organized with sections that are easy to navigate, such as Experience, Education, Skills, and Achievements. Each section is concise yet comprehensive, allowing quick absorption of the candidate's qualifications and key impacts. Bullet points under each role provide clear insights into responsibilities and outcomes, enhancing readability and comprehension.

- Career trajectory and progression - Sophia Foster's career demonstrates impressive growth and upward mobility, from a Senior Cybersecurity Consultant at PwC to holding key leadership roles such as Chief Information Security Officer at HSBC. This progression highlights her ability to adapt, assume greater responsibilities, and drive strategic security initiatives in prominent financial institutions.

- Achievements with business relevance - The CV emphasizes accomplishments that are not merely quantified but articulated in context of their impact on business performance. For example, a 30% reduction in data breaches at a major bank illustrates not just a security win but also an enhancement in organizational trust and operational integrity, directly correlating cybersecurity efforts with business outcomes.

How to ensure your profile stands out with your bank manager CV format

It's sort of a Catch 22. You want your bank manager CV to stand out amongst a pile of candidate profiles, yet you don't want it to be too over the top that it's unreadable. Where is the perfect balance between your CV format simple, while using it to shift the focus to what matters most. That is - your expertise. When creating your bank manager CV:

- list your experience in the reverse chronological order - starting with your latest roles;

- include a header with your professional contact information and - optionally - your photograph;

- organise vital and relevant CV sections - e.g. your experience, skills, summary/ objective, education - closer to the top;

- use no more than two pages to illustrate your professional expertise;

- format your information using plenty of white space and standard (2.54 cm) margins, with colours to accent key information.

Once you've completed your information, export your bank manager CV in PDF, as this format is more likely to stay intact when read by the Applicant Tracker System or the ATS. A few words of advice about the ATS - or the software used to assess your profile:

- Generic fonts, e.g. Arial and Times New Roman, are ATS-compliant, yet many candidates stick with these safe choices. Ensure your CV stands out by using a more modern, and simple, fonts like Lato, Exo 2, Volkhov;

- All serif and sans-serif fonts are ATS-friendly. Avoid the likes of fancy decorative or script typography, as this may render your information to be illegible;

- Both single- and double-column formatted CVs could be assessed by the ATS;

- Integrating simple infographics, icons, and charts across your CV won't hurt your chances during the ATS assessment.

PRO TIP

Incorporate a touch of colour in headers or section breaks, but keep it professional and ensure it doesn’t detract from readability, especially in more conservative industries.

The top sections on a bank manager CV

- Professional Summary emphasises leadership skills and bank management expertise which are critical for a first impression.

- Banking Experience showcases a history of responsible financial oversight and strategic management.

- Key Achievements in Banking highlights specific accomplishments, demonstrating the ability to deliver results.

- Educational Background in Finance or Business shows foundational knowledge necessary for banking operations.

- Professional Development and Certifications underline commitment to staying current with industry standards and regulations.

What recruiters value on your CV:

- Highlight your financial acumen by showcasing quantifiable achievements such as portfolio growth or cost-saving measures implemented under your management; banks appreciate evidence of strong fiscal responsibility.

- Emphasise leadership and relationship-building skills by including examples of team development, successful negotiation with stakeholders, and customer service excellence to show your capability in fostering a supportive and efficient work environment.

- Demonstrate risk management expertise by citing instances where you identified, assessed, and mitigated financial risks, thereby ensuring regulatory compliance and maintaining the bank's reputation.

- Include specific banking certifications and education such as a Chartered Banker status or an MBA with a specialisation in finance; these qualifications are often required and highly valued in the banking sector.

- Provide examples of innovation and adaptability, such as the implementation of new banking technologies or the development of digital banking strategies, to reflect your ability to lead a bank in an evolving industry.

Recommended reads:

Our checklist for the must-have information in your bank manager CV header

Right at the very top of your bank manager CV is where you'd find the header section or the space for your contact details, headline, and professional photo. Wondering how to present your the name of the city you live in and the country abbreviation as your address;

- are tailored to the role you're applying for by integrating key job skills and requirements;

- showcase what your unique value is, most often in the form of your most noteworthy accomplishment;

- select your relevant qualifications, skills, or current role to pass the Applicant Tracker System (ATS) assessment. Still not sure how to write your CV headline? Our examples below showcase best practices on creating effective headlines:

Examples of good CV headlines for bank manager:

- Senior Branch Manager | Chartered Banker | Risk Management | Strategic Planning | 15+ Years’ Experience

- Assistant Bank Manager | Financial Services Professional | SME Lending Expert | ACIB Certified | 5+ Years in Banking

- Commercial Banking Manager | BSc Economics | Client Relationship Specialist | Credit Analysis | Over 10 Years’ Experience

- Retail Banking Manager | Customer Service Excellence | Operational Efficiency | 8 Years Progressive Leadership

- Investment Banking Manager | MSc Finance | Portfolio Growth Strategist | Regulatory Compliance | 12 Years in Sector

- Regional Bank Manager | Leadership in Financial Services | Business Development | MBA | 18+ Years’ Expertise

Catching recruiters' attention with your bank manager CV summary or objective

Located closer to the top of your CV, both the summary and objective are no more than five sentences long and serve as an introduction to your experience. What is more, you could use either to entice recruiters to read on. Select the:

- Summary, if you happen to have plenty of relevant experience. Feature your most impressive accomplishments and up to three skills that are relevant to the job you're applying for;

- Objective, if you're just starting your career off. Provide your career goals and answer how you see the role you are applying for will match your professional growth.

Judging which one you need to add to your bank manager CV may at times seem difficult. That’s why you need to check out how professionals, with similar to your experience, have written their summary or objective, in the examples below:

CV summaries for a bank manager job:

- Accomplished bank manager with over 15 years of experience steering regional banks towards financial success, adept at strategic oversight, and fostering profitable client relationships, culminating in a 20% increase in customer base within two years.

- Dynamic professional with a decade's tenure in the finance sector, expert in risk management and compliance, successfully led a mid-sized bank's expansion by opening three new branches, achieving a record growth in deposits by 30% in one fiscal year.

- Former financial analyst with 8 years of rigorous experience pivoting into bank management, leveraging strong analytical skills and a keen understanding of market trends to improve financial forecasting, aiming to enhance the service quality of a forward-thinking banking institution.

- Senior tech manager transitioning into banking, with over 12 years orchestrating IT projects, seeks to apply project management proficiency and digital innovation strategies to elevate banking operations, having previously increased efficiency by 25% at a multinational tech firm.

- Aspiring to merge a fresh perspective and a robust enthusiasm for financial services into a bank management career, eager to develop a profound understanding of banking operations and contribute to achieving exceptional customer service levels.

- Seeking an entry-level bank manager position, armed with an MBA and a passionate commitment to learning, aiming to utilize strategic analytical abilities and a vigorous work ethic to significantly impact a bank's success while gaining invaluable industry insight.

How to meet job requirements with your bank manager CV experience

We've now reached the essence of your actual CV - your experience section. This is the space where you can list your career roles and on-the-job successes. Many candidates tend to underestimate just how much time and effort they should put into writing this CV section. Your experience shouldn't be a random list of your responsibilities, but instead:

- Match the job description with your skills, values, and accomplishments;

- Start each bullet with a strong action verb, followed up with one key skill and your outcome of applying this skill;

- Spotlight parts of your career history that are relevant to the job you're applying for.

Before we move on, make sure to check out some professional CV experience sections.

Best practices for your CV's work experience section

- Managed a team of 25 staff, establishing performance measures and conducting regular appraisals to ensure a high-quality client service experience.

- Implemented risk management policies which resulted in a 20% reduction in loan defaults, demonstrating strong competence in credit risk assessment.

- Oversee the smooth running of daily bank operations, complying with all regulatory requirements and maintaining operational integrity.

- Developed and launched two new financial products that increased the customer base by 15% within the first year of introduction.

- Fostered long-term relationships with high-net-worth clients, contributing to a 30% growth in the wealth management division.

- Conducted quarterly training sessions on anti-money laundering practices, significantly lowering the risk of financial frauds in the branch.

- Collaborated with the marketing team to initiate customer satisfaction surveys, using feedback to enhance service delivery and improve customer retention by 25%.

- Implemented an innovative digital strategy that increased online banking sign-ups by 40%, demonstrating a commitment to driving digital transformation.

- Managed branch budget and reduced overheads by 10% through strategic cost-cutting measures, displaying strong financial and business acumen.

- Steered successful branch transformation initiative integrating technology upgrades, resulting in a 75% increase in mobile app registrations.

- Supervised a team of 30 employees, fostering a collaborative work environment that led to a 20% rise in staff satisfaction as measured by annual surveys.

- Exceeded lending targets by 40% through effective portfolio management and launching innovative loan products tailored to the local market needs.

- Orchestrated the turnaround of an underperforming branch, achieving a top 5% ranking in national customer service scores within two years through targeted staff coaching.

- Developed and implemented risk management protocols that decreased loan default rates by 18% across the branch's clientele.

- Increased revenue streams by diversifying financial products and establishing a successful wealth management advisory service for high-net-worth individuals.

- Implemented cost-control measures that reduced operational expenses by 15%, positively impacting the branch's overall profitability.

- Led the adoption of a customer relationship management system that improved client retention rates by 25% and streamlined service processes.

- Expanded the client base by 30% through community outreach events and strategic local partnerships to promote the bank's services.

- Drove a digital marketing campaign that attracted 2,000+ new accounts within the first quarter, significantly bolstering the branch's client base.

- Chaired a cross-functional team that redesigned in-branch customer experience pathways, increasing customer satisfaction ratings by 22%.

- Negotiated and secured a lucrative corporate partnership, leading to a sustained 15% deposit growth year-on-year for the duration of the partnership.

- Instrumental in integrating a sophisticated data analysis system, enhancing the bank's loan underwriting processes and reducing processing times by 35%.

- Led a workforce optimisation strategy that improved operational efficiency by cross-training staff, resulting in a 10% reduction in customer wait times.

- Pioneered a new corporate social responsibility program that increased the bank's engagement with local businesses and charity organisations.

- Cultivated a customer-centric culture that empowered employees and delivered a 50% improvement in net promoter score over a three-year period.

- Directed the deployment of an omnichannel service model, enhancing customer access to financial services both online and in-branch.

- Led critical negotiations with fintech companies to modernise payment processing services, elevating the bank's technological competitive edge.

- Accelerated loan and mortgage growth by 55% through the implementation of a regional cross-selling strategy among different departments.

- Managed the integration of compliance practices that aligned with updated financial regulations, avoiding costly penalties and reinforcing the bank's reputation.

- Established a training program for junior managers that improved leadership skills and significantly reduced employee turnover by 12% within the branch.

- Conceptualised and executed a bespoke investment strategy specifically designed for the branch's demographics, which successfully attracted a 20% increase in investment funds.

- Spearheaded an initiative to rebrand the branch, resulting in a modernised customer-facing image and a 30% upturn in new customer enquiries.

- Played a pivotal role in mentoring new bank managers, deploying an innovative leadership development program that streamlined branch management practices.

Swapping your professional experience (when you have none) with skills and more

Never underestimate the importance of relevancе when it comes to your bank manager CV. Even if you don't happen to have much or any standard (full-time contract) professional experience, this doesn't mean you shouldn't apply for the role. Instead of a bespoke CV experience section:

- Showcase more prominently any internships, part-time roles, and volunteer experience that are applicable to the role and have taught you job-crucial skills;

- Feature a strengths or achievements section with your transferrable skills or talents you've obtained thanks to your work or life experience;

- Write an objective statement that clearly outlines your values as a candidate and defines your career ambitions;

- List your education or certificates that match the job profile closer to the top of your CV.

Recommended reads:

PRO TIP

If you have experience in diverse fields, highlight how this has broadened your perspective and skill set, making you a more versatile candidate.

Describing your unique skill set using both hard skills and soft skills

Your bank manager CV provides you with the perfect opportunity to spotlight your talents, and at the same time - to pass any form of assessment. Focusing on your skill set across different CV sections is the way to go, as this would provide you with an opportunity to quantify your achievements and successes. There's one common, very simple mistake, which candidates tend to make at this stage. Short on time, they tend to hurry and mess up the spelling of some of the key technologies, skills, and keywords. Copy and paste the particular skill directly from the job requirement to your CV to pass the Applicant Tracker System (ATS) assessment. Now, your CV skills are divided into:

- Technical or hard skills, describing your comfort level with technologies (software and hardware). List your aptitude by curating your certifications, on the work success in the experience section, and technical projects. Use the dedicated skills section to provide recruiters with up to twelve technologies, that match the job requirements, and you're capable of using.

- People or soft skills provide you with an excellent background to communicate, work within a team, solve problems. Don't just copy-paste that you're a "leader" or excel at "analysis". Instead, provide tangible metrics that define your success inusing the particular skill within the strengths, achievements, summary/ objective sections.

Top skills for your bank manager CV:

Financial Analysis

Risk Management

Banking Software Proficiency

Regulatory Compliance

Credit Analysis

Budget Management

Strategic Planning

Financial Reporting

Sales and Marketing

Investment Management

Leadership

Communication

Decision-Making

Problem-Solving

Customer Service

Time Management

Adaptability

Teamwork

Attention to Detail

Negotiation

PRO TIP

Order your skills based on the relevance to the role you're applying for, ensuring the most pertinent skills catch the employer's attention first.

Education and more professional qualifications to include in your bank manager CV

If you want to showcase to recruiters that you're further qualified for the role, ensure you've included your relevant university diplomas. Within your education section:

- Describe your degree with your university name(-s) and start-graduation dates;

- List any awards you've received, if you deem they would be impressive or are relevant to the industry;

- Include your projects and publications, if you need to further showcase how you've used your technical know-how;

- Avoid listing your A-level marks, as your potential employers care to learn more about your university background.

Apart from your higher education, ensure that you've curated your relevant certificates or courses by listing the:

- name of the certificate or course;

- name of the institution within which you received your training;

- the date(-s) when you obtained your accreditation.

In the next section, discover some of the most relevant certificates for your bank manager CV:

PRO TIP

Order your skills based on the relevance to the role you're applying for, ensuring the most pertinent skills catch the employer's attention first.

Recommended reads:

Key takeaways

Write your professional bank manager CV by studying and understanding what the role expectations are. You should next:

- Focus on tailoring your content to answer specific requirements by integrating advert keywords through various CV sections;

- Balance your technical know-how with your personal skills to showcase what the unique value would be of working with you;

- Ensure your CV grammar and spelling (especially of your key information and contact details) is correct;

- Write a CV summary, if your experience is relevant, and an objective, if your career ambitions are more impressive;

- Use active language by including strong, action verbs across your experience, summary/objective, achievements sections.