One specific CV challenge faced by accounts receivable is the accurate prediction of cash flow to ensure efficient working capital management. By utilising our guide, you'll discover strategies to leverage AI-driven forecasting tools, optimising your financial processes and decision-making.

- Answer job requirements with your accounts receivable CV and experience;

- Curate your academic background and certificates, following industry-leading CV examples;

- Select from +10 niche skills to match the ideal candidate profile

- Write a more succinct experience section that consists of all the right details.

Do you need more specific insights into writing your accounts receivable CV? Our guides focus on unique insights for each individual role:

Resume examples for accounts receivable

By Experience

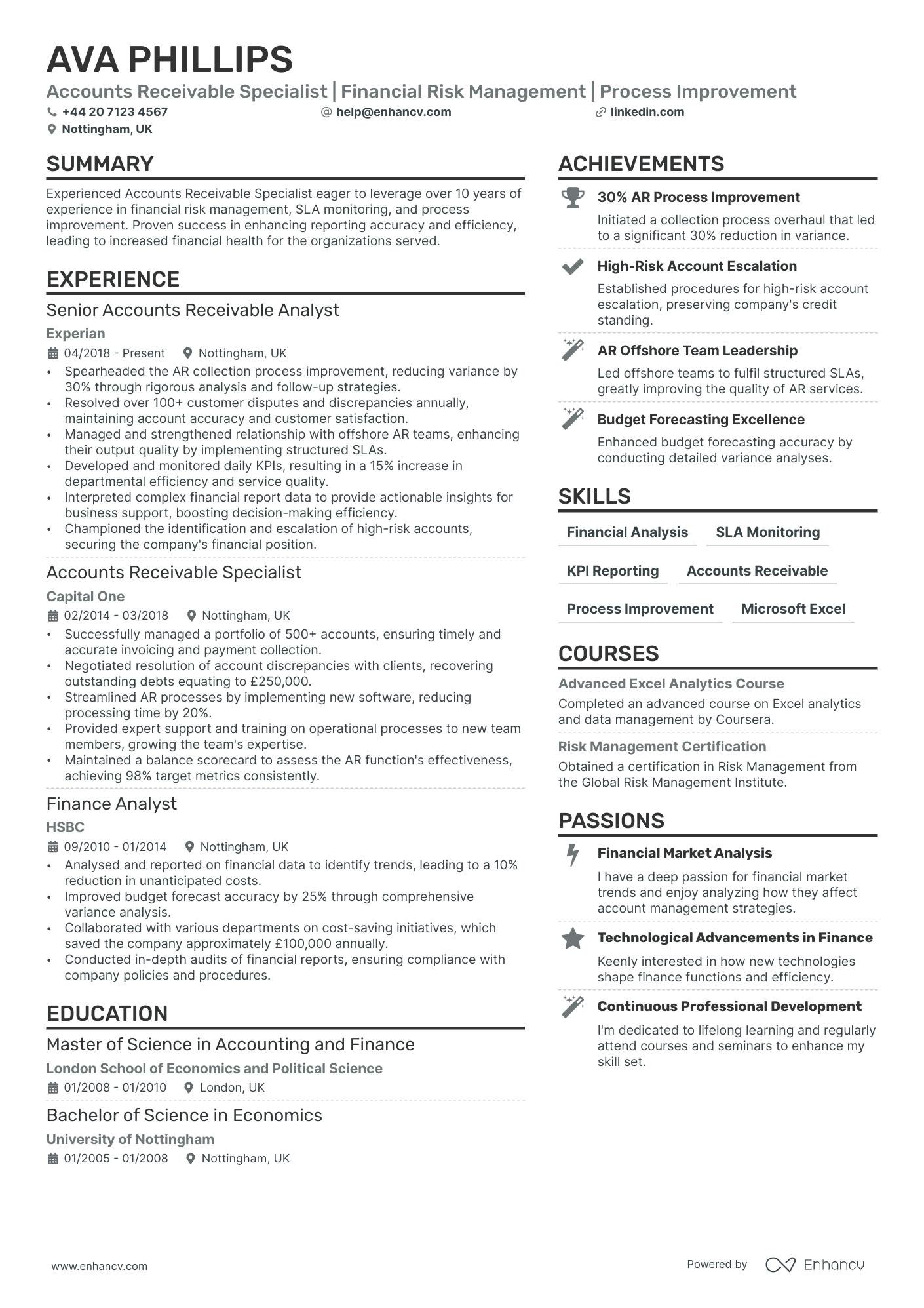

Senior Accounts Receivable Specialist

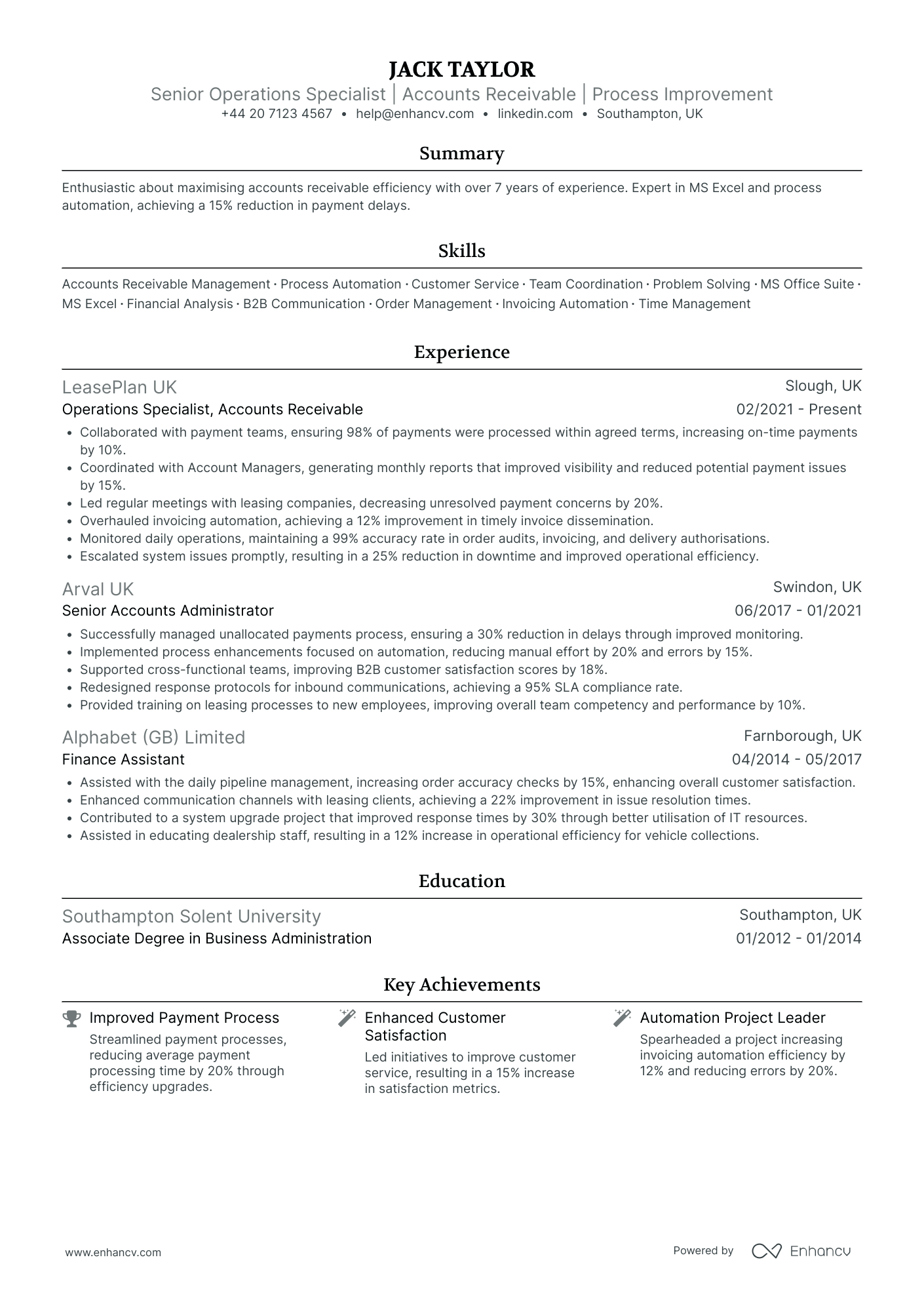

- Structured Career Development - Jack Taylor's CV clearly illustrates a well-defined career progression, moving from a Finance Assistant role to a Senior Operations Specialist. This trajectory shows optimized growth and increasing responsibility in the accounts receivable space, underlining his professional development and expertise in the field.

- Integration of Advanced Tools and Techniques - The CV highlights Jack's expertise in process automation and MS Excel, which are crucial for efficiency in the operations and accounts receivable sector. This technical depth is further evidenced by his accomplishments in automation efficiency, showcasing his ability to apply technological solutions to financial problems.

- Cross-functional Collaboration and Impactful Leadership - Demonstrated through the CV is Jack's adeptness at working across teams, as well as his leadership capabilities. Examples include coordinating with payment teams and liaising with account managers, showing his influence on cross-functional initiatives that substantially improve operational effectiveness.

Junior Accounts Receivable Associate

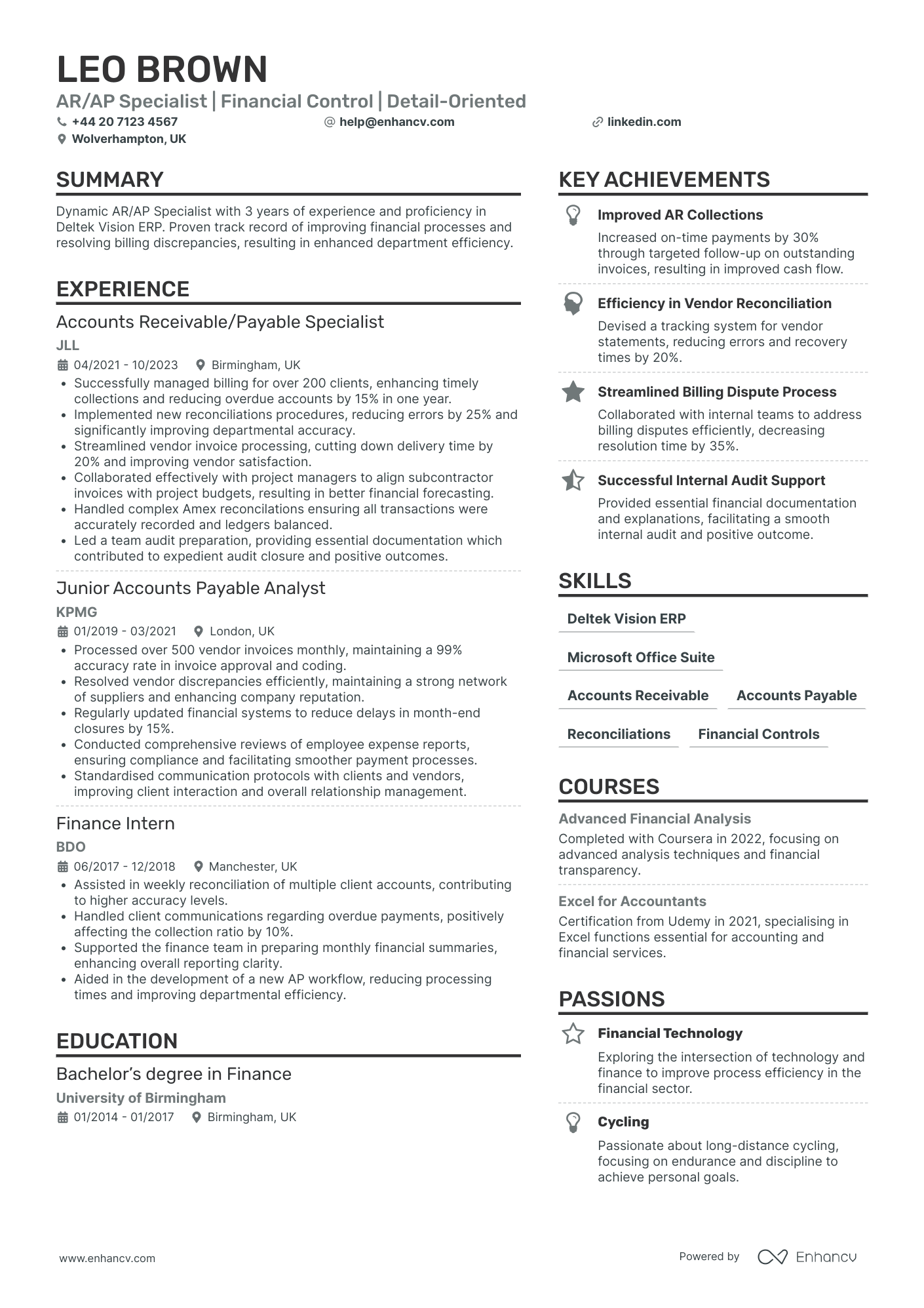

- Impressive Career Progression - Leo Brown's career trajectory from a Finance Intern to an AR/AP Specialist over a few years demonstrates a purposeful growth path. Moving from initial roles at BDO, progressing through KPMG, and currently holding a specialist position at JLL reflects a strategic career path within the finance sector, highlighting adaptability and an increasing scope of responsibility.

- Technical Proficiency and Industry Tools - The CV lists specific industry-relevant tools and methodologies like Deltek Vision ERP, Microsoft Office Suite, and advanced Excel techniques (e.g., Pivot Tables, VLOOKUP). These technical skills are crucial for roles in AR/AP and financial control, indicating Leo's preparedness to handle complex financial systems and analyses, thereby enhancing efficiencies in accounts management.

- Impactful Achievements with Tangible Outcomes - Leo's achievements are not just numbers; they indicate significant business relevance. For instance, increasing on-time payments by 30% improved cash flow, while innovations in vendor reconciliation and billing dispute processes significantly enhanced operational efficiency and departmental performance. Such outcomes reflect his ability to drive meaningful improvements within the organizations.

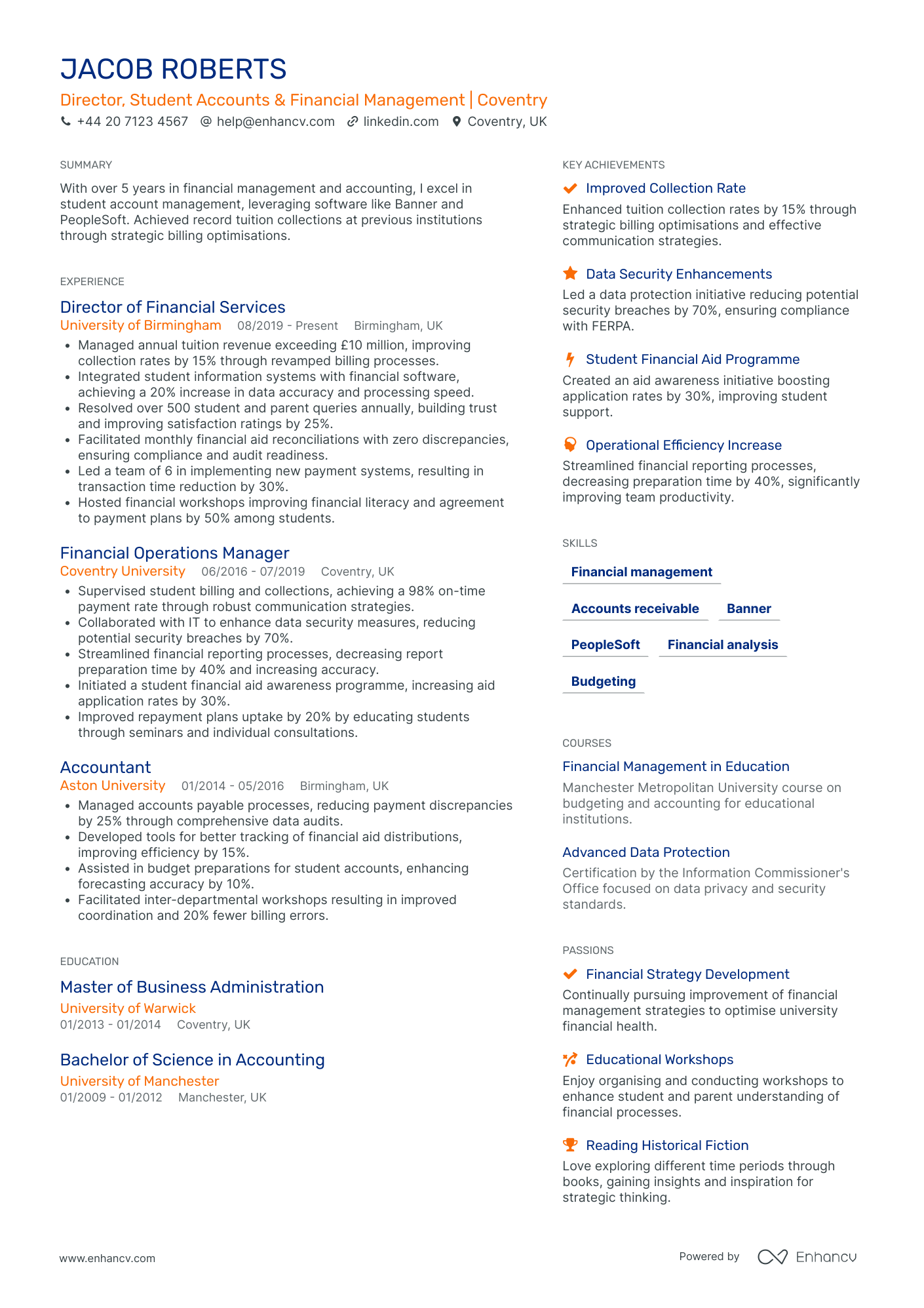

Accounts Receivable Director

- Well-structured and clear content presentation - The CV is organized in a clear, concise format that facilitates quick comprehension for readers. Key sections such as experience, education, and achievements are easy to navigate, and each role lists specific accomplishments concisely, enhancing readability and impact.

- Evidence of progressive career trajectory - The journey from an Accountant to Director of Financial Services illustrates a clear upward trajectory, showcasing promotions within the educational sector. This progression demonstrates growth in responsibilities and leadership capabilities, relevant to the Director-level position targeted.

- Integration of industry-specific software knowledge - The candidate’s expertise in using specialized software like Banner and PeopleSoft is highlighted, illustrating technical depth and familiarity with critical tools in student financial management. This inclusion emphasizes their capability to meet sector-specific demands efficiently.

By Role

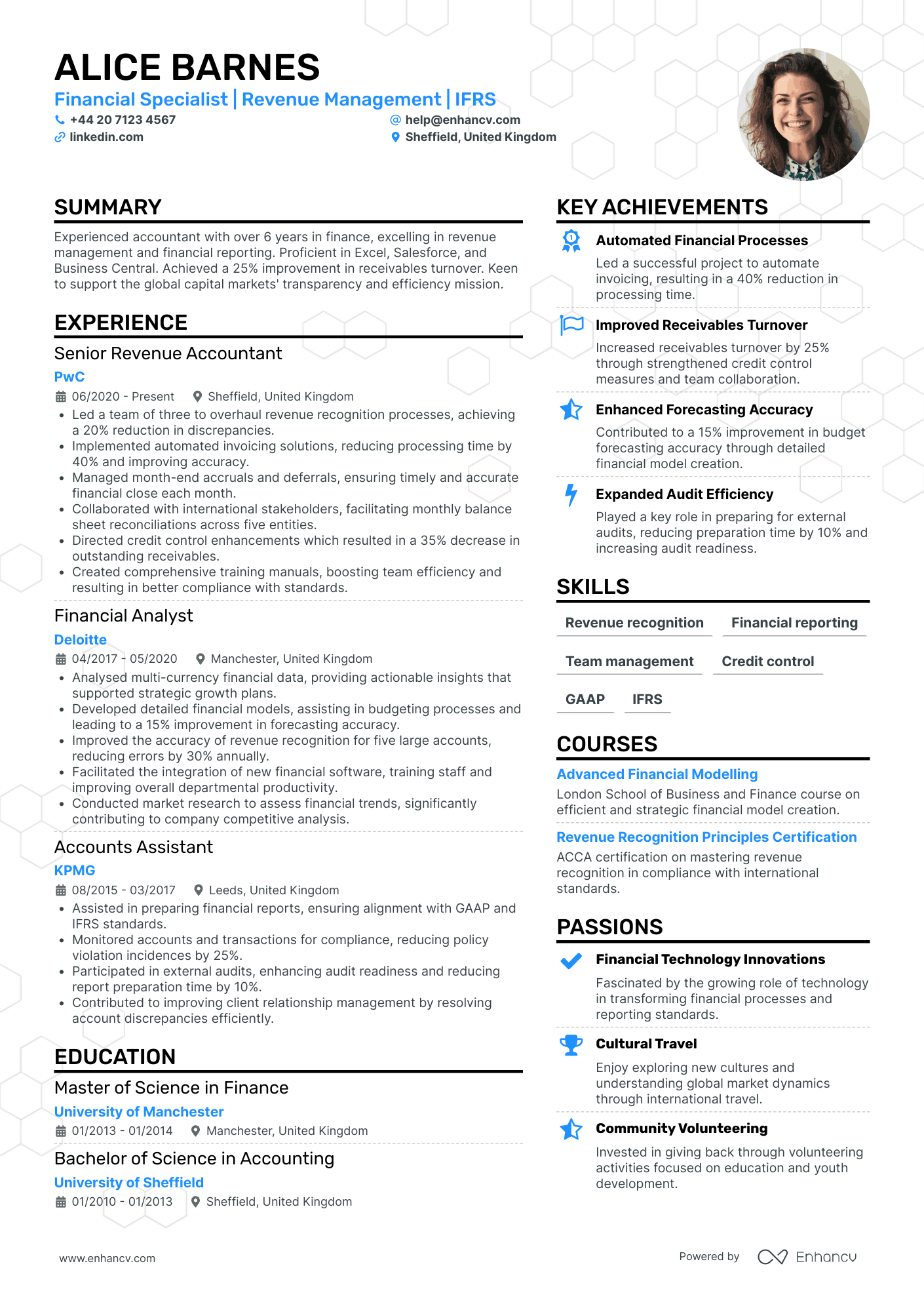

Accounts Receivable Manager

- Clear and structured content presentation - The CV is formatted with clarity and precision, making it easy for recruiters to navigate. Each section, from experience to education, is concise yet informative, allowing the reader to quickly assess Alice Barnes’s qualifications and career achievements without any unnecessary information clutter.

- Diverse career trajectory indicating upward mobility - Alice’s progression from an Accounts Assistant at KPMG to a Senior Revenue Accountant at PwC demonstrates a clear advancement in her career. The steady promotions reflect her growing expertise in financial management and her ability to handle increasing levels of responsibility within prominent firms.

- Impressive technical depth with industry-specific tools - Alice shows proficiency in a range of financial tools such as Excel, Salesforce, and Business Central, which are essential to her field. Her skills in revenue recognition and financial reporting underscore her ability to integrate technical knowledge with practical application, providing significant value to any finance team.

Accounts Receivable Clerk

- Clear and Structured Presentation - The CV is well-organized, with each section clearly delineated and structured for easy reading. This clarity aids in quickly identifying the candidate's qualifications, experience, and achievements. It summarizes key information succinctly using bullet points for rapid comprehension, which is crucial for busy hiring managers.

- Progressive Career Trajectory - Isla King's career reflects a clear upward progression from a Credit Controller to a Credit Control Manager. Each role change demonstrates increased responsibilities and leadership capabilities, indicating a strong career trajectory and readiness for more senior roles within the industry.

- Industry-Specific Technical Proficiency - The CV highlights expertise with industry-specific tools such as Sage 200 and advanced IT skills. These highlight Isla's technical proficiency and her ability to leverage technology for improved credit control processes, making her a valuable asset in a finance-focused role.

Accounts Receivable Analyst

- Effective Content Structuring - Oscar Evans' CV is logically structured, presenting information in a clear and concise manner. Each section is perfectly delineated, guiding the reader through his professional journey without overwhelming with details. The use of bullet points effectively highlights his achievements and responsibilities, making it easy to assess his qualifications at a glance.

- Progressive Career Development - The CV showcases a solid career trajectory, with Oscar progressing from a Junior Accountant to an Accounts Receivable Specialist. His career growth within reputable companies such as Unilever UK, Britvic Plc, and Tropicana Brands Group indicates a pattern of gaining more specialized roles and increasing responsibilities, reflecting his expanded expertise and leadership capabilities.

- Proficiency in Advanced Financial Tools and Automation - A standout element of Oscar's CV is his expertise in leveraging advanced Excel skills and financial systems to drive efficiency. His accomplishments in automating invoicing and tracking systems are particularly noteworthy, demonstrating a forward-thinking approach by integrating EDI invoicing and automated accounting systems to significantly enhance process accuracy and efficiency.

Accounts Receivable Coordinator

- Structured and Concise Presentation - The CV benefits from a well-organized layout, with sections clearly delineated and concise bullet points that emphasize key responsibilities and achievements. This format allows for easy navigation and highlights the candidate's relevant expertise in a straightforward manner.

- Progressive Career Trajectory - Archie Clark has demonstrated a clear career progression from a Finance Coordinator to an Accounts Receivable Specialist, reflecting upward mobility and success in increasingly complex roles. This growth is evident through promotions within the field, underscoring a consistent focus on accounts receivable and financial management.

- Achievement with Business Impact - The CV effectively showcases accomplishments that have tangible impacts on business operations. For example, the 25% improvement in cash flow and 15% reduction in outstanding debts not only highlight Archie Clark’s expertise but also demonstrate their ability to positively influence a company's financial health and customer satisfaction.

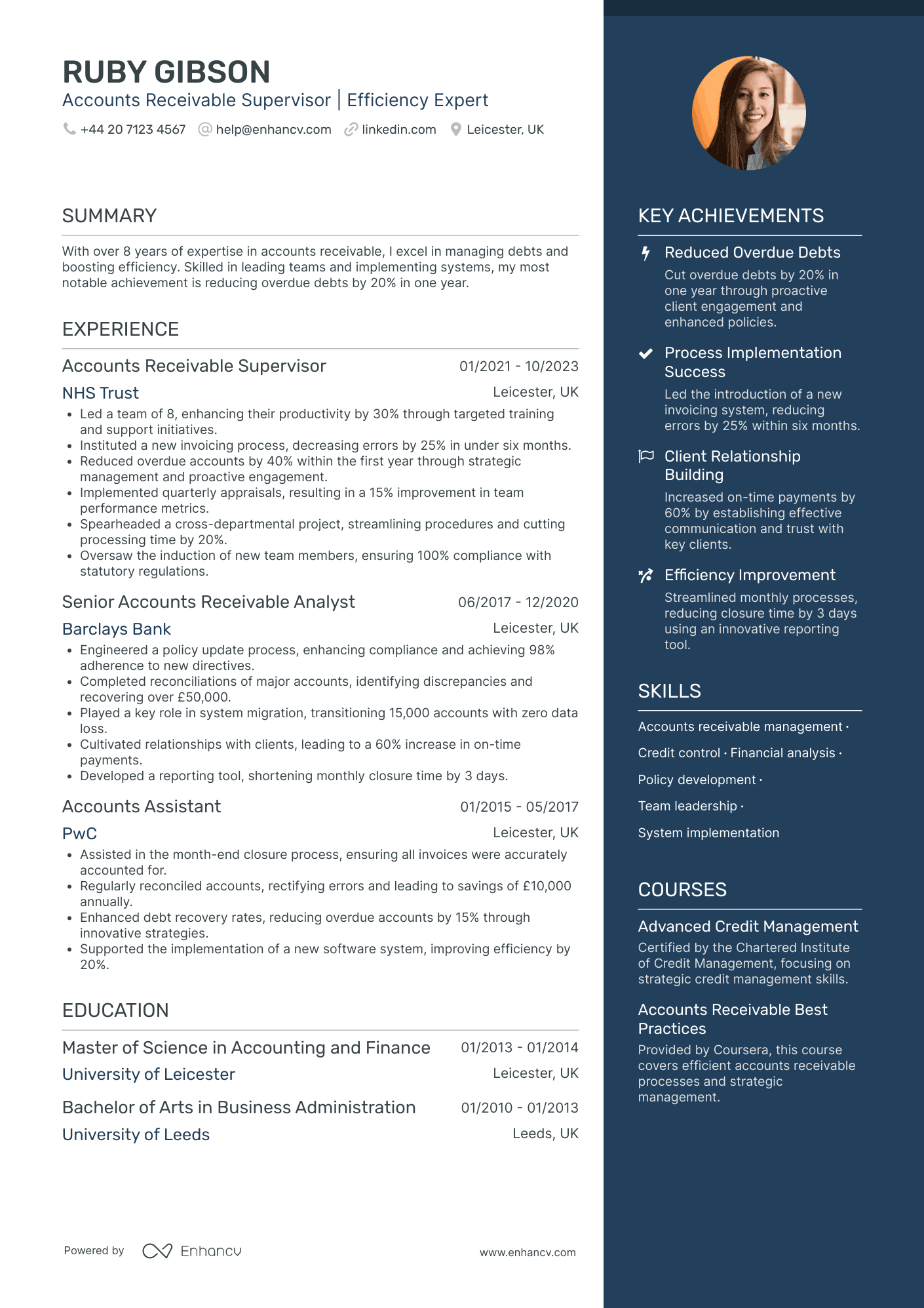

Accounts Receivable Supervisor

- Clear and Logical Presentation - The CV is structured in a way that enhances clarity and navigability, starting with a succinct header that immediately communicates essential information regarding Ruby’s qualifications and contact details. Each section is well-defined, allowing for a clear, linear understanding of her career journey and accomplishments.

- Demonstrated Career Growth and Expertise - Ruby's career trajectory showcases steady growth, with promotions from an Accounts Assistant to a Senior Analyst, eventually becoming a Supervisor. This progression highlights her developing expertise and increasing responsibility within the finance and accounts receivable domain, underscoring her capability to take on complex, leadership roles.

- Industry-Specific Tools and Impactful Methodologies - The CV emphasizes Ruby’s proficiency with industry-specific tools like SAP and Oracle Financials, alongside her ability to implement new invoicing processes and reporting tools. These technical elements, combined with a strong emphasis on system implementation and process improvements, reflect her deep technical understanding and practical application that drives business efficiencies.

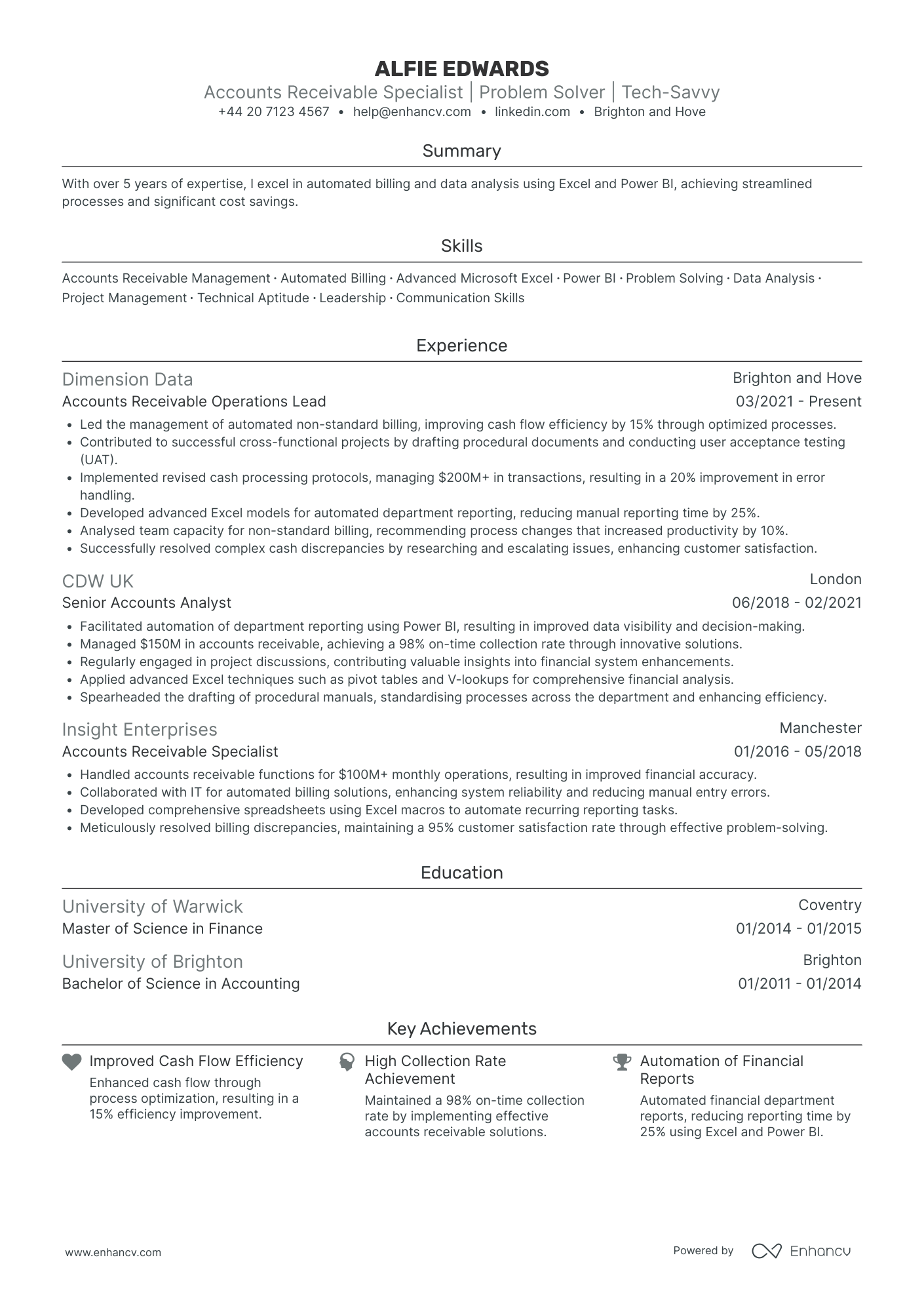

Accounts Receivable Operations Lead

- Structured and Detailed Presentation - Alfie Edwards’ CV is notably clear and concise, effectively organizing key career details like summary, experience, education, and skills. Each section is clearly defined, making the document easy to navigate and ensuring that important information is readily accessible to potential employers.

- Progressive Career Path - The CV shows a clear trajectory of career growth, moving from an Accounts Receivable Specialist to a leadership role as Accounts Receivable Operations Lead. This upward movement, along with the geographical transition between major UK cities, reflects adaptability and a continuous pursuit of professional advancement within the financial sector.

- Advanced Technical Proficiency - Particularly impressive is the use of industry-specific tools such as Excel and Power BI, showcasing technical depth in financial data analysis and automation. The candidate's ability to implement and leverage these tools to drive process efficiencies and enhance reporting capabilities underlines their expertise and forward-thinking approach.

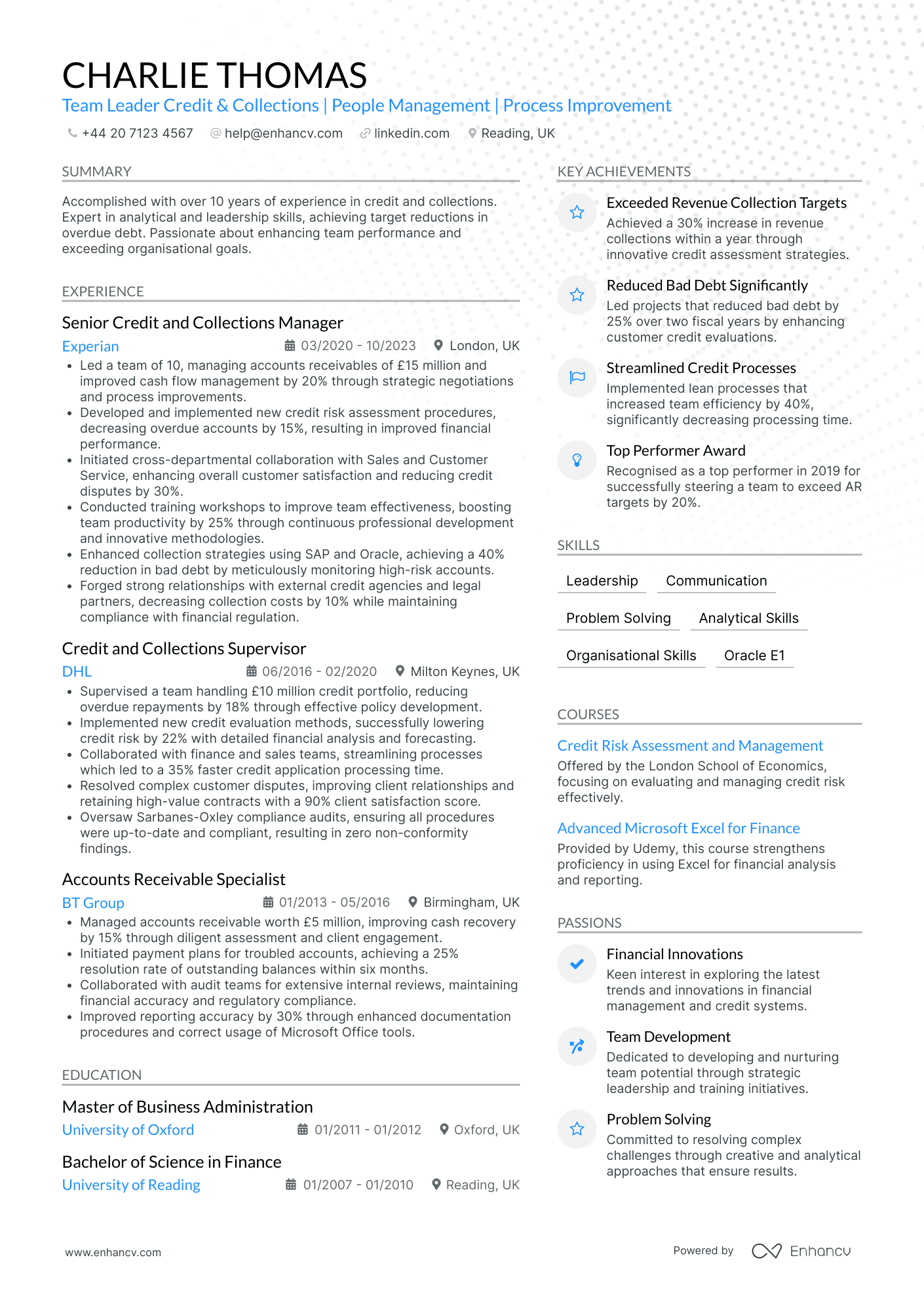

Accounts Receivable Team Leader

- Clear and Structured Presentation - The CV is meticulously organized, providing a structured narrative of the candidate’s professional journey. Each section is clearly delineated, contributing to a seamless reading experience, while concise bullet points ensure easy consumption of key information regarding the candidate’s duties and achievements.

- Progressive Career Trajectory - Charlie Thomas’s career shows an impressive upward trajectory, marked by a series of promotions from Accounts Receivable Specialist to Senior Credit and Collections Manager. This progression not only reflects a dedication to the field but also highlights an accumulation of responsibilities and expertise over a significant period.

- Impactful Achievements with Business Relevance - The CV emphasizes achievements that have led to substantial business outcomes, such as a significant reduction in overdue debt and improvement in cash flow management. These accomplishments are not just numerical but demonstrate the candidate’s ability to implement strategies that result in measurable improvements in financial performance and operational efficiency.

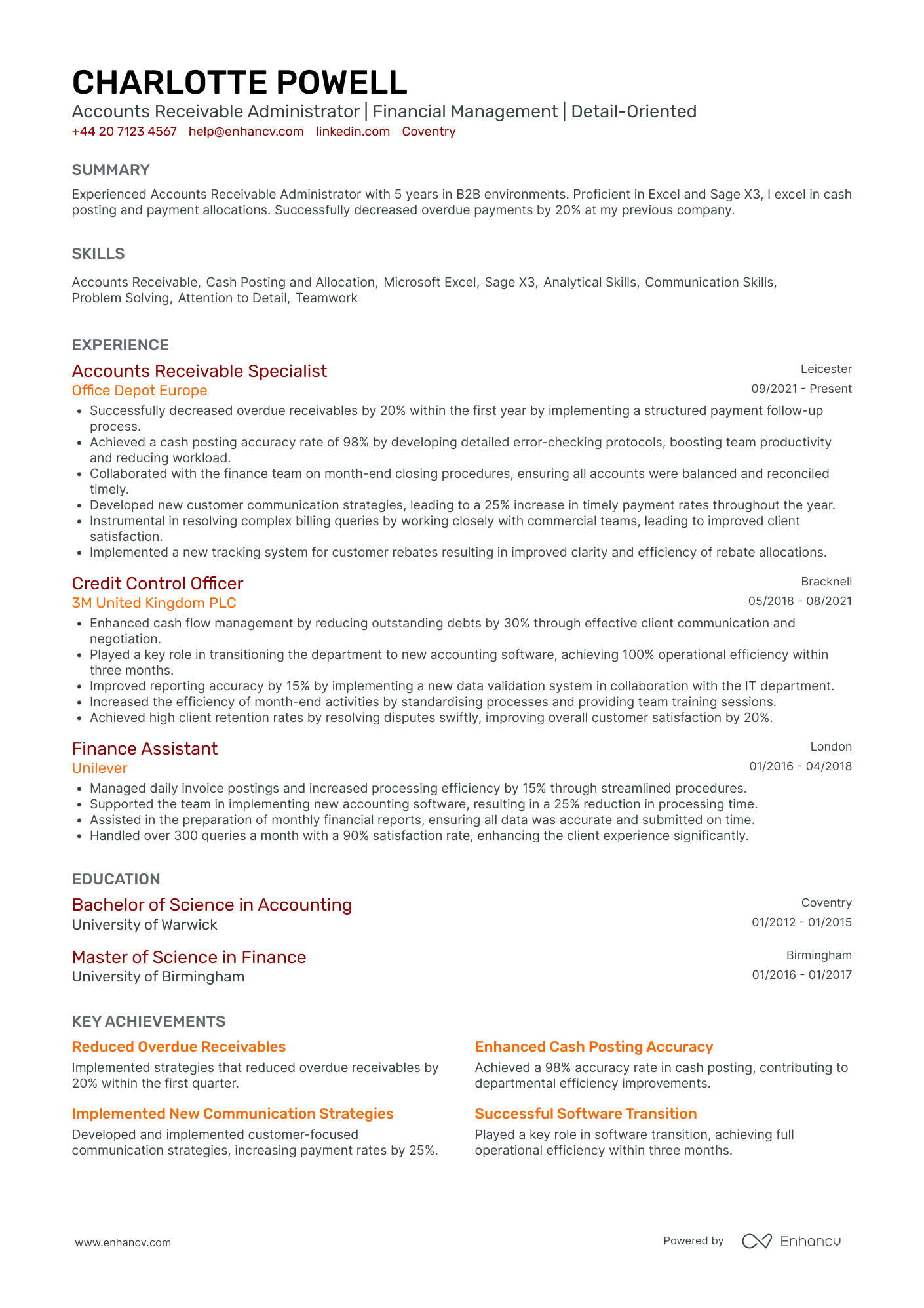

Accounts Receivable Administrator

- Detailed Career Progression Highlighting Growth - Charlotte Powell's CV demonstrates a clear trajectory of growth in the field of financial management. Starting as a Finance Assistant at Unilever, she quickly progressed to a Credit Control Officer role at 3M United Kingdom PLC, and now serves as an Accounts Receivable Specialist at Office Depot Europe. This progression underscores a commitment to advancing within her niche, building on each role’s experience to tackle increased responsibilities and deliver impactful results.

- Strategic Implementation of Industry Tools - The CV underscores Charlotte's adept use of industry-specific tools such as Sage X3 and Microsoft Excel, illustrating her technical capability in financial management. Her achievements in cash posting accuracy and structured payment follow-up processes reveal a practical application of these tools to improve operational efficiencies and achieve business goals like reducing overdue payments and enhancing cash flow management.

- Significant Achievements with Business Impact - Charlotte's accomplishments are framed in terms of their business relevance, such as reducing overdue receivables by 20% within her role at Office Depot Europe, and enhancing cash posting accuracy to 98%. These achievements are not just numbers; they signify a substantial positive impact on the companies’ financial health. Her strategic initiatives in client communication and billing query resolution further demonstrate her capacity to drive meaningful improvements in financial operations.

Accounts Receivable Collections Specialist

- Cohesive Career Development - Charlie's CV reflects a seamless career progression within the finance sector, showcasing a strategic climb from a Financial Operations Analyst to a Payments Collections Specialist. This trajectory not only underscores their growing expertise but also their increasing leadership roles in financial operations, thereby highlighting their ambition and commitment to the field.

- Proven Results and Business Impact - The CV provides numerous examples of Charlie's tangible contributions, such as a 30% reduction in outstanding balances and a substantial decrease in processing errors. These achievements extend beyond numbers to illustrate Charlie’s ability to enact meaningful change that drives the financial success and operational efficiency of their employers.

- Cross-Departmental Collaboration and Soft Skills - Demonstrating strong soft skills, Charlie's ability to collaborate with internal departments and resolve complex client disputes highlights their effectiveness in communication and client management. Their role in leading regulatory compliance initiatives further showcases their proficiency in fostering teamwork and ensuring adherence to industry standards.

Accounts Receivable Assistant

- Structured and Comprehensive Presentation - The CV of Louis Wood is well-structured, providing a clear overview of professional experience, skills, and achievements. Key information is grouped logically, making it easy for hiring managers to quickly grasp the candidate's qualifications and experience. The concise bullet points in the experience section efficiently communicate responsibilities and results.

- Strategic Career Progression in Finance - Louis's career trajectory showcases a strategic progression in the finance industry, moving from an Accounts Assistant to an Accounts Receivable Specialist. This growth highlights not only technical skill enhancement but also increased responsibility and leadership in roles, particularly in managing significant client portfolios and contributing to financial process improvements.

- Focus on Results and Impact - The CV emphasizes achievements with direct business impact, going beyond mere numbers. For instance, Louis’s contribution to a 20% reduction in overdue debts and a 30% improvement in invoice processing time are articulated to demonstrate how these accomplishments positively affected company cash flow and operational efficiency. This focus on impact shows a deep understanding of the role’s importance in financial management.

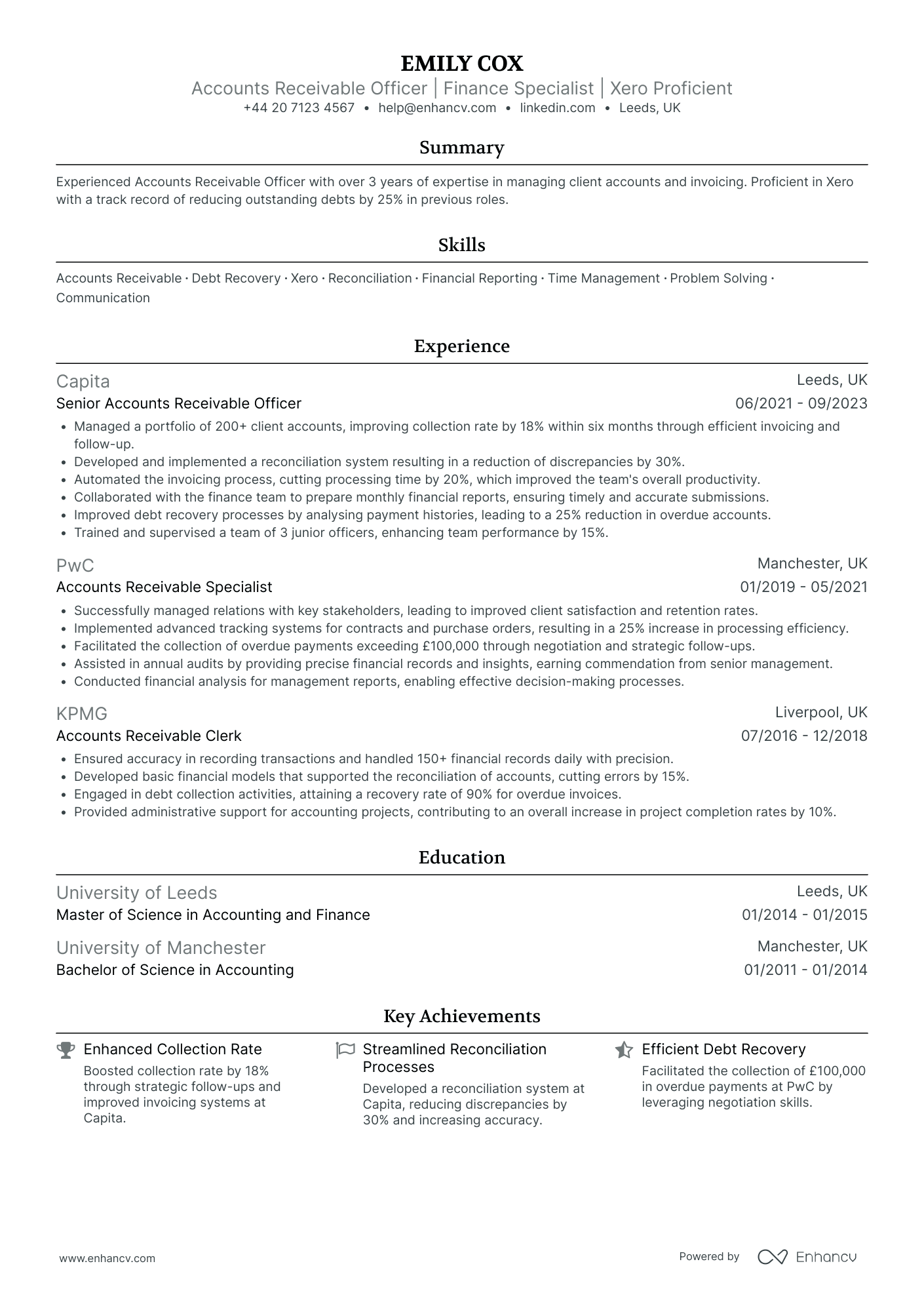

Accounts Receivable Officer

- Illustrates a robust career progression - The CV narrates a compelling career trajectory, showcasing Emily's advancement from an Accounts Receivable Clerk at KPMG to a Senior Accounts Receivable Officer at Capita. This upward movement within the industry highlights her growing expertise and leadership capabilities, reflecting consistent professional development and the acquisition of complex responsibilities over time.

- Exemplifies proficiency with industry-standard tools - By emphasizing her proficiency in Xero, Emily demonstrates her capability with essential financial software, a critical skill in accounts receivable management. Her completion of courses on Xero accounting software and debt collection strategies further underlines her commitment to maintaining industry-specific knowledge and adapting to technological advancements.

- Achievements showcased with quantifiable business impacts - The CV excels in articulating Emily's achievements in measurable terms. For instance, the reduction of outstanding debts by 25% and the collection of £100,000 in overdue payments are concrete indicators of her impact on business operations. These metrics not only validate her effectiveness but also her potential to drive financial stability and growth within an organization.

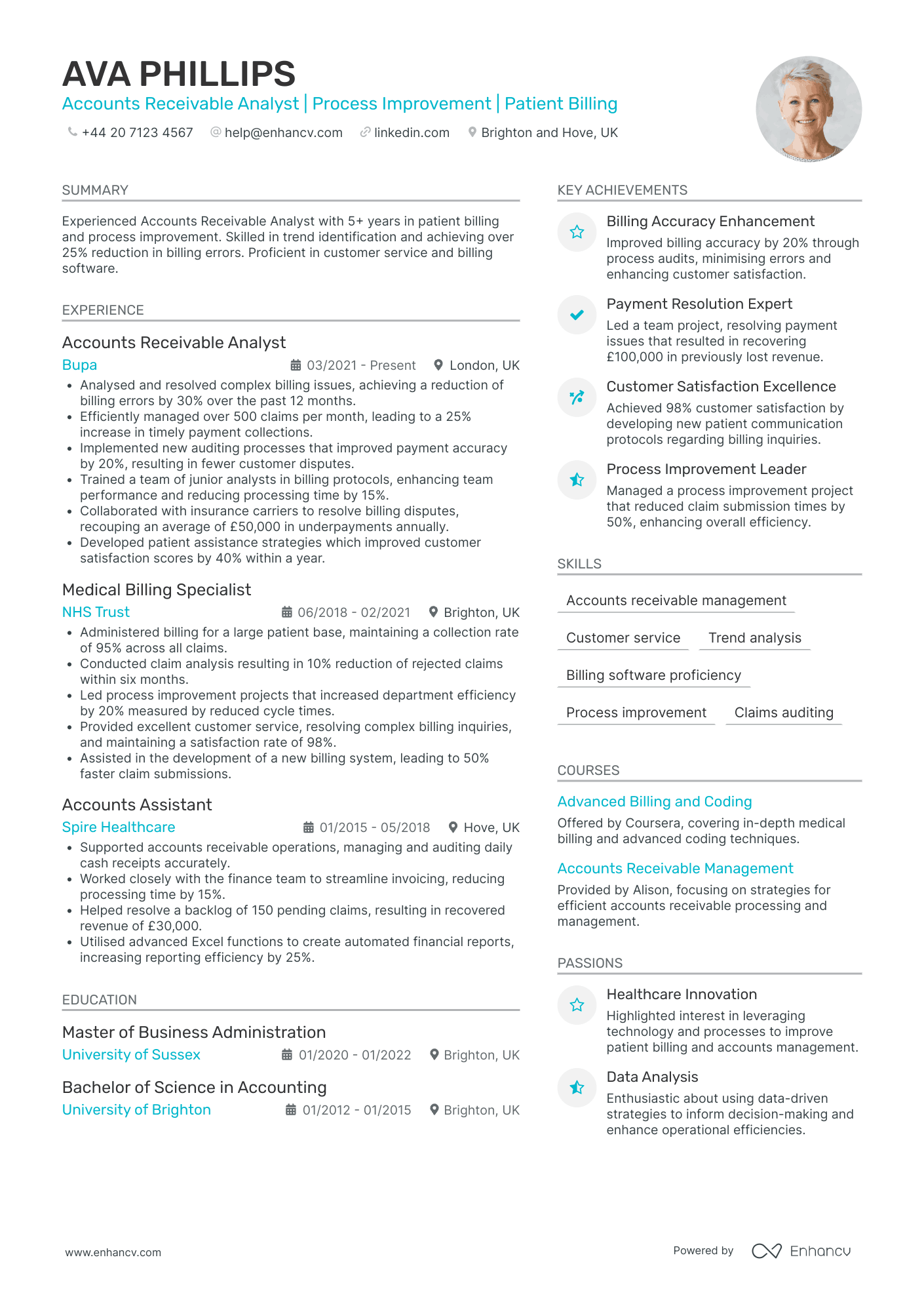

Accounts Receivable Consultant

- Strong Emphasis on Measurable Achievements - Ava's CV effectively utilizes quantitative metrics to demonstrate her impact, such as a 30% reduction in billing errors and a 25% increase in timely payments, showcasing her ability to deliver substantial business improvements.

- Career Growth and Stability in Healthcare Sector - Her career trajectory reflects consistent growth within the healthcare industry, moving from an Accounts Assistant to an Analyst at reputable organizations. This demonstrates her ability to advance and contribute meaningfully in a sector that aligns with her skills and interests.

- Integration of Process Improvement Expertise - The CV highlights Ava's strength in process improvement, with several initiatives leading to efficiency gains, such as reduced cycle times and payment accuracy improvements. This focus on operational enhancements underscores her strategic approach to driving change in accounts management.

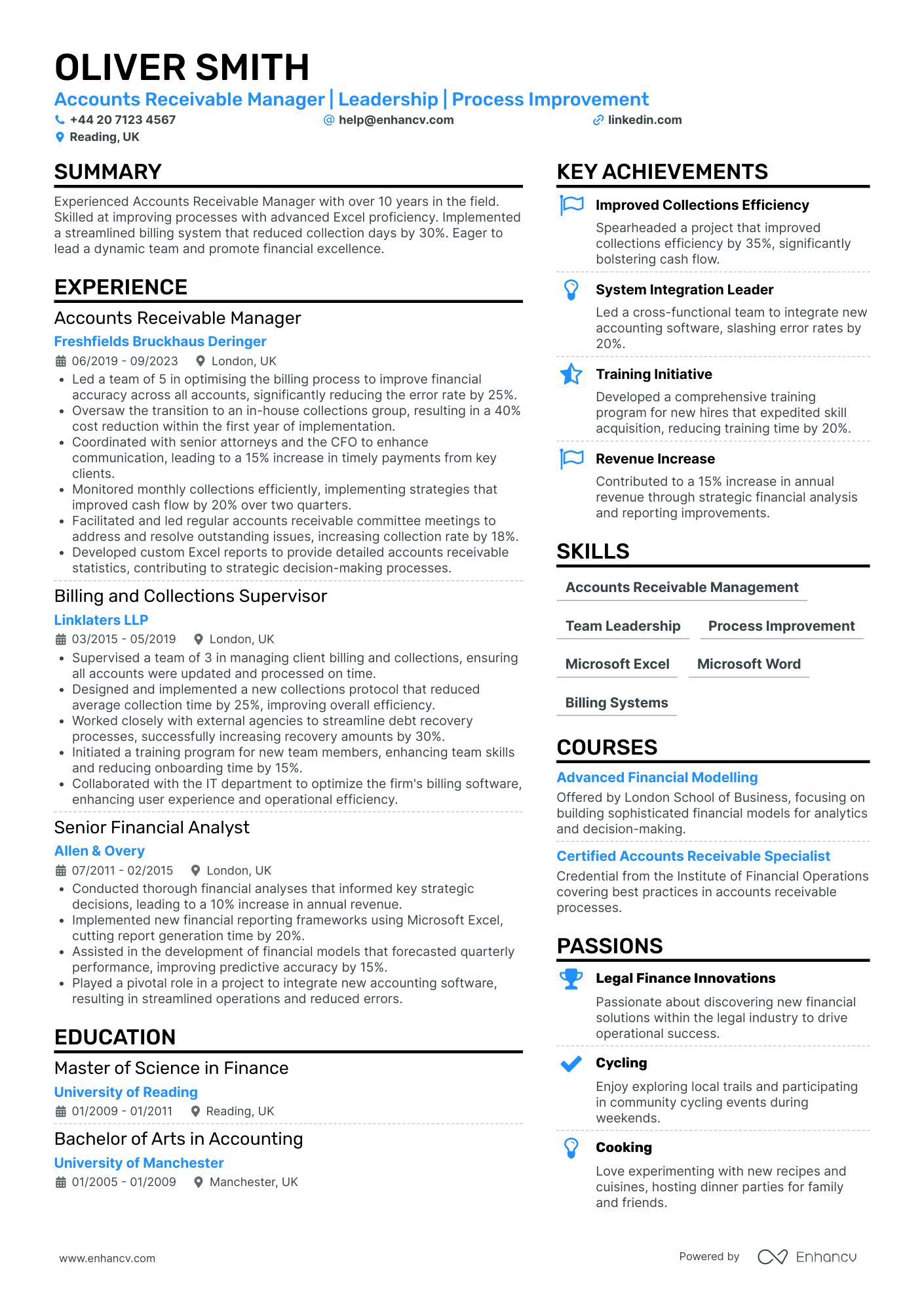

Accounts Receivable Operations Manager

- Clear and Organized Structure - The CV presents information in a clear and organized manner, with distinct sections for experience, education, skills, and achievements. This structured approach allows for easy navigation and quick assessment of the candidate's qualifications and career highlights.

- Consistent Career Progression - The candidate demonstrates a steady upward career trajectory from a Senior Financial Analyst to Accounts Receivable Manager, affirming growth and an increasing level of responsibility. This progression underscores their dedication and ability to excel in financial management roles within prestigious law firms.

- Advanced Financial and Technical Proficiency - Unique to this CV is the emphasis on industry-specific technical skills. Advanced proficiency in financial tools such as Microsoft Excel and billing systems like Aderant and Elite Enterprise indicates a high level of technical depth and capability in managing complex accounts receivable functions efficiently.

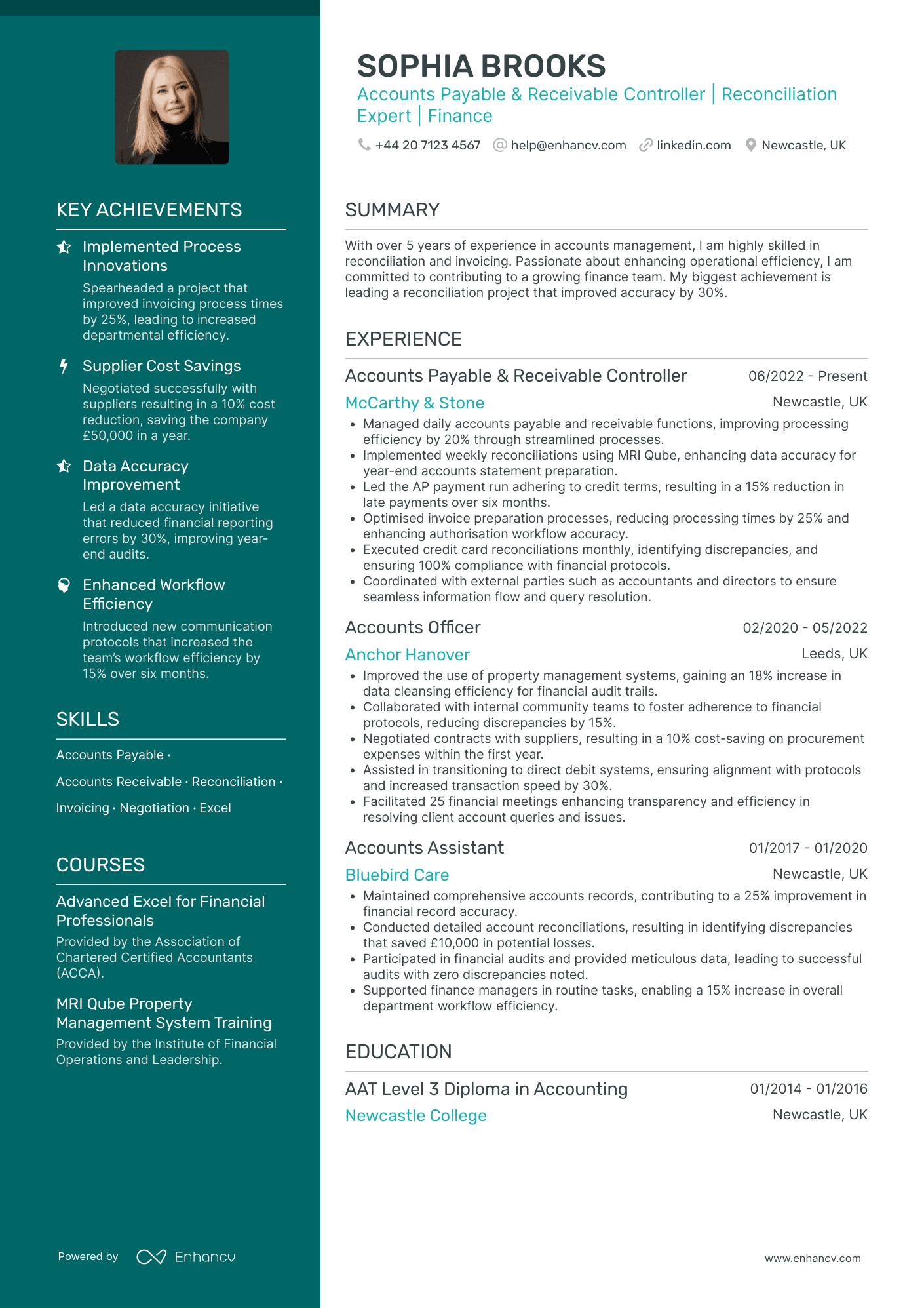

Accounts Receivable and Payable Specialist

- Structured and Clear Presentation - The CV is remarkably well-organized with distinct sections that facilitate easy navigation. Important career highlights are concisely presented, ensuring clarity in communicating the candidate’s competencies and work history. The use of bullet points under each experience section aids in highlighting achievements succinctly.

- Demonstrates Progressive Career Growth - Sophia's career trajectory shows a clear progression from an Accounts Assistant to an Accounts Payable & Receivable Controller. This upward movement within finance roles highlights the development of her skills and the increasing complexity of her responsibilities, signifying her capability and drive to take on greater challenges.

- Expertise with Industry-Specific Tools - The CV showcases proficiency with relevant financial management systems like MRI Qube, enhancing her value to prospective employers in the finance industry. This proficiency not only demonstrates her technical depth but also signifies her ability to optimize financial processes effectively.

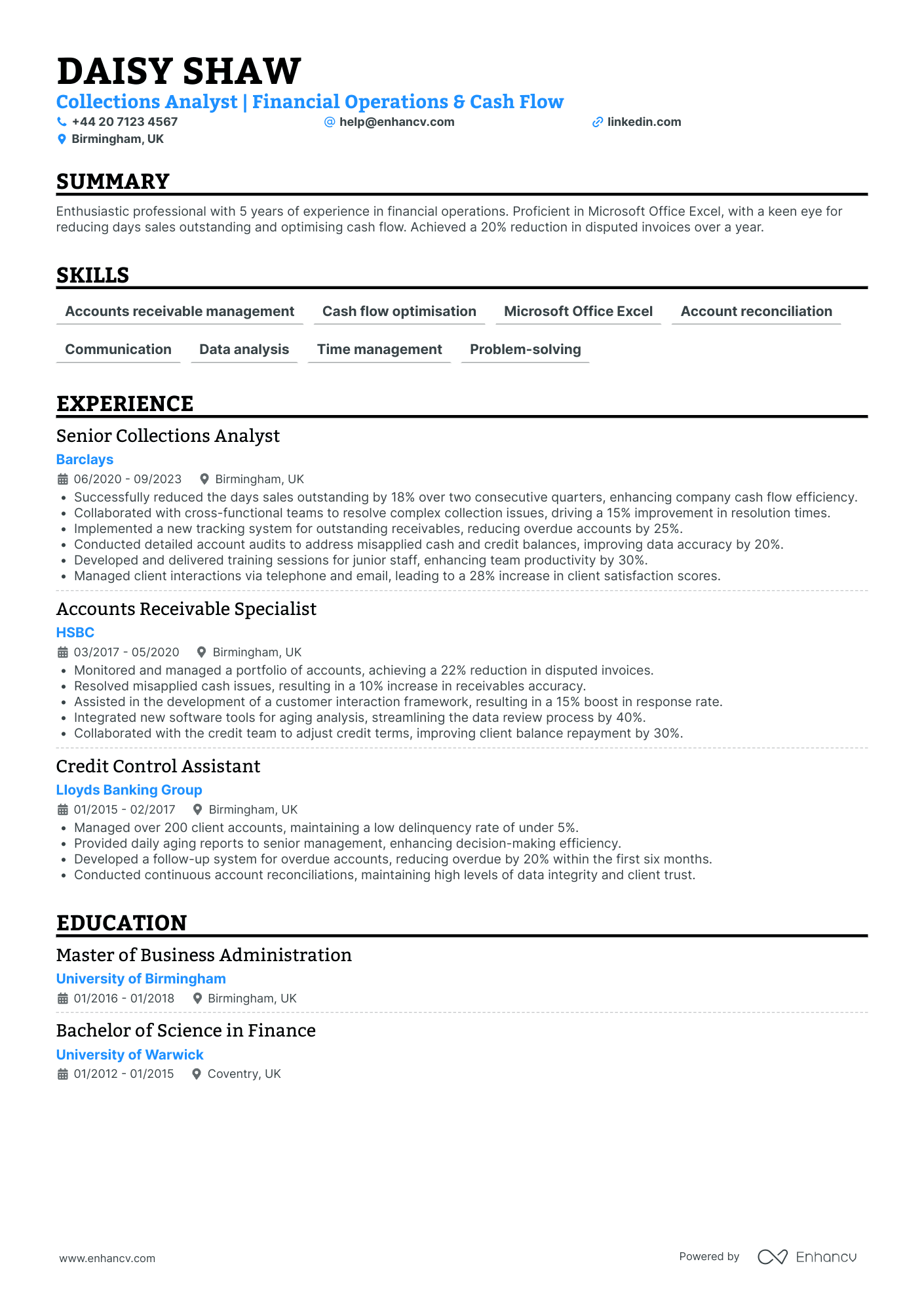

Accounts Receivable and Collections Analyst

- Structured Presentation and Clarity - Daisy Shaw's CV is impeccably structured, with clear headings and concise bullet points that effectively highlight the individual's strengths and achievements. Each section is easy to navigate, making it straightforward for hiring managers to quickly glean the most pertinent information about her qualifications and career highlights.

- Career Progression and Growth - The career trajectory depicted in the CV illustrates impressive upward mobility within the financial operations industry. With progressive roles at prominent institutions like Lloyds Banking Group, HSBC, and Barclays, Daisy has clearly demonstrated her capability to grow within her field, moving from Credit Control Assistant to a Senior Collections Analyst over a span of several years.

- Significant Achievements and Business Impact - The CV is rich with notable achievements that underscore Daisy's business acumen and value-added contributions. For instance, her role in reducing days sales outstanding by 18% and boosting client satisfaction scores by 28% not only highlights her technical abilities but also her impact on improving company cash flow and client relations.

Accounts Receivable and Billing Specialist

- Refined Career Progression - Finley Robinson's CV showcases a strategic career trajectory within the billing and accounts receivable domains. Starting as a Junior Accounts Officer, they have consistently progressed through responsible roles, leading to their current position as an Accounts Receivable Specialist. This upward movement highlights their ability to handle increasing responsibilities and challenges effectively.

- Impressive Adaptability and Process Optimization - The CV reflects Finley's adaptability and cross-functional skills through their role in implementing a new invoicing system and the adoption of cloud-based solutions. These initiatives not only improved efficiency by 30% but also illustrate their commitment to integrating modern technologies into traditional billing processes, enhancing cash flow and data integrity.

- Strong Focus on Business Impact - The CV effectively quantifies achievements, drawing attention to key accomplishments such as reducing billing discrepancies by 15% and increasing invoice accuracy to 98%. These figures are not just numbers but demonstrate a clear impact on business operations, showcasing Finley's capability to drive meaningful improvements in client satisfaction and financial performance.

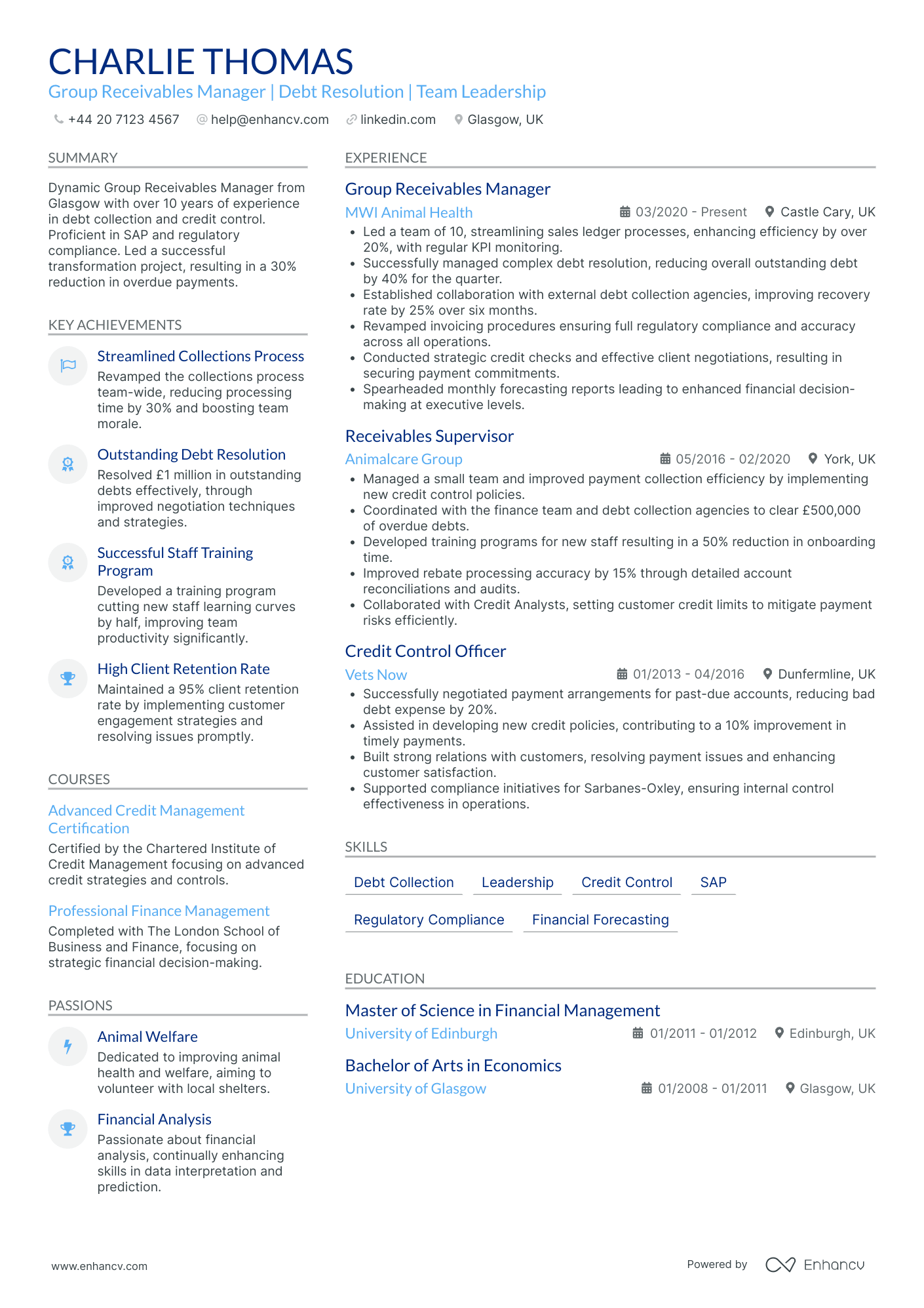

Accounts Receivable and Credit Control Manager

- Illustrates Leadership and Team Management Abilities - Charlie Thomas' CV emphasizes his leadership acumen, detailing how he leads a team of ten to streamline processes, boosting sales ledger efficiency by over 20%, and consistently monitoring KPIs. His past role as a Receivables Supervisor further showcases his competence in driving team performance and operational improvements.

- Demonstrates Expertise in Debt Resolution and Financial Strategy - With a history of reducing outstanding debt by significant margins and conducting strategic credit checks, the CV highlights Charlie's ability to resolve financial issues effectively. His initiatives in regulatory compliance and credit policies reflect a sophisticated understanding of financial strategy that aligns with the role's demands.

- Showcases Commitment to Professional Development and Industry Standards - Through courses such as the Advanced Credit Management Certification and a Master's degree in Financial Management, the CV presents Charlie as someone committed to continuous learning and adhering to industry standards. This underscores his dedication to maintaining and enhancing his expertise in the fast-evolving financial sector.

How to ensure your profile stands out with your accounts receivable CV format

It's sort of a Catch 22. You want your accounts receivable CV to stand out amongst a pile of candidate profiles, yet you don't want it to be too over the top that it's unreadable. Where is the perfect balance between your CV format simple, while using it to shift the focus to what matters most. That is - your expertise. When creating your accounts receivable CV:

- list your experience in the reverse chronological order - starting with your latest roles;

- include a header with your professional contact information and - optionally - your photograph;

- organise vital and relevant CV sections - e.g. your experience, skills, summary/ objective, education - closer to the top;

- use no more than two pages to illustrate your professional expertise;

- format your information using plenty of white space and standard (2.54 cm) margins, with colours to accent key information.

Once you've completed your information, export your accounts receivable CV in PDF, as this format is more likely to stay intact when read by the Applicant Tracker System or the ATS. A few words of advice about the ATS - or the software used to assess your profile:

- Generic fonts, e.g. Arial and Times New Roman, are ATS-compliant, yet many candidates stick with these safe choices. Ensure your CV stands out by using a more modern, and simple, fonts like Lato, Exo 2, Volkhov;

- All serif and sans-serif fonts are ATS-friendly. Avoid the likes of fancy decorative or script typography, as this may render your information to be illegible;

- Both single- and double-column formatted CVs could be assessed by the ATS;

- Integrating simple infographics, icons, and charts across your CV won't hurt your chances during the ATS assessment.

PRO TIP

Incorporate a touch of colour in headers or section breaks, but keep it professional and ensure it doesn’t detract from readability, especially in more conservative industries.

The top sections on a accounts receivable CV

- Key skills in accounts receivable highlight your expertise in managing and tracking financial transactions.

- Professional experience in finance shows your work history and accomplishments in similar roles.

- Educational background with emphasis on accounting or finance outlines your relevant academic qualifications.

- Software proficiency in accounting tools demonstrates your ability to use necessary financial software.

- Achievements in credit control reflects your success in managing and collecting receivables.

What recruiters value on your CV:

- Highlight your experience with various accounting software and platforms, such as Sage, QuickBooks or Xero, to show familiarity with the tools commonly used in accounts receivable roles.

- Emphasise your ability to manage and reconcile complex accounts, demonstrating your meticulous attention to detail and ability to ensure accuracy in financial records.

- Include specific metrics, such as the volume of invoices processed, the value of receivables managed, or improvements in days sales outstanding (DSO), to provide concrete examples of your effectiveness.

- Showcase your communication skills by mentioning any experience you have liaising with clients or internal departments to resolve payment issues or discrepancies.

- Detail any experience you have with credit control, risk assessment, or setting payment terms, as these are key aspects of the accounts receivable function.

Recommended reads:

How to present your contact details and job keywords in your accounts receivable CV header

Located at the top of your accounts receivable CV, the header presents recruiters with your key personal information, headline, and professional photo. When creating your CV header, include your:

- Contact details - avoid listing your work email or telephone number and, also, email addresses that sound unprofessional (e.g. koolKittyCat$3@gmail.com is definitely a big no);

- Headline - it should be relevant, concise, and specific to the role you're applying for, integrating keywords and action verbs;

- Photo - instead of including a photograph from your family reunion, select one that shows you in a more professional light. It's also good to note that in some countries (e.g. the UK and US), it's best to avoid photos on your CV as they may serve as bias.

What do other industry professionals include in their CV header? Make sure to check out the next bit of your guide to see real-life examples:

Examples of good CV headlines for accounts receivable:

- Accounts Receivable Specialist | AAT Certified | Credit Control | 5+ Years' Experience

- Senior Accounts Receivable Analyst | Reconciliation Expert | Cash Flow Management | CICM Member

- Accounts Receivable Team Lead | Invoice Management | Client Relations | 8 Years in Finance

- Accounts Receivable Clerk | Data Entry Pro | Efficient in Receivables Tracking | Recently Qualified

- Accounts Receivable Manager | Strategic Debt Recovery | Financial Reporting | 10+ Years’ Expertise

- Junior Accounts Receivable Coordinator | Billing and Collections Enthusiast | Fast Learner | 2 Years Hands-On Experience

Opting between a accounts receivable CV summary or objective

Within the top one third of your accounts receivable CV, you have the opportunity to briefly summarise your best achievements or present your professional goals and dreams. Those two functions are met by either the CV summary or the objective.

- The summary is three-to-five sentences long and should narrate your best successes, while answering key requirements for the role. Select up to three skills which you can feature in your summary. Always aim to present what the actual outcomes were of using your particular skill set. The summary is an excellent choice for more experienced professionals.

- The objective is more focused on showcasing your unique value as a candidate and defining your dreams and ambitions. Think about highlighting how this current opportunity would answer your career vision. Also, about how you could help your potential employers grow. The objective matches the needs of less experienced candidates, who need to prove their skill set and, in particular, their soft skills.

Still not sure about how to write your CV opening statement? Use some best industry examples as inspiration:

CV summaries for a accounts receivable job:

- Diligent Accounts Receivable Specialist with over 5 years of comprehensive experience effectively managing invoicing, credit controls, and financial record-keeping for a multimillion-pound organisation. Proven track record in reducing debtor days by 30% and improving cash flow through robust account management strategies.

- Detail-oriented professional, boasting a successful 7-year career in financial analysis, seeking to transition into Accounts Receivable management. Expert in data interpretation with a strong foundation in accounting principles, ready to apply analytical skills to manage receivables efficiently.

- Financial Analyst with a decade's experience in managing large data sets and forecasting trends, aiming to bring analytical acuity to the accounts receivable realm. Keen to leverage big-data experience to ensure accurate billing processes and improve collection times in a dynamic invoice management setting.

- Former Retail Manager, with hands-on experience supervising multi-disciplinary teams over 8 years, eager to apply strong leadership and customer service skills to an Accounts Receivable position. Adept at driving performance and productivity through effective communication and team collaboration.

- Recent finance graduate, enthusiastic about commencing a career in Accounts Receivable. Equipped with fresh knowledge of accounting software and a keen interest in developing practical skills in credit management and financial reporting.

- Aspiring Accounts Receivable Clerk, currently pursuing a Bachelor’s degree in Accounting. Committed to learning on the job and contributing to the effective management of receivables. Eager to apply academic finance principles to real-world scenarios while developing proficiency in industry-standard accounting systems.

More detailed look into your work history: best advice on writing your accounts receivable CV experience section

The CV experience is a space not just to merely list your past roles and responsibilities. It is the CV real estate within which you could detail your greatest accomplishments and skills, while matching the job requirements. Here's what to have in your experience section:

- Prove you have what the job wants with your unique skill set and past successes;

- Start each bullet with a strong, action verb, and continue with the outcome of your responsibility;

- Use any awards, nominations, and recognitions you've received as solid proof of your skill set and expertise;

- align your experience with the role responsibilities and duties.

For more help on how to write your CV experience section, check out the next section of our guide:

Best practices for your CV's work experience section

- Managed a portfolio of over 500 client accounts, consistently maintaining a 98% collection rate, surpassing industry benchmarks.

- Implemented an automated invoicing system that reduced errors by 25% and accelerated payment times by an average of 15 days.

- Liaised with sales and customer service departments to resolve discrepancies, leading to a 30% decrease in disputed invoices.

- Negotiated payment plans with clients experiencing financial difficulties, which resulted in a 20% reduction in overdue accounts.

- Conducted monthly reconciliations of the accounts receivable ledger, ensuring accuracy and compliance with financial reporting standards.

- Initiated credit checks on potential customers, decreasing the risk of non-payment and contributing to a more robust credit control system.

- Collaborated with the legal team to successfully recover long-standing debts, recouping significant amounts that were written off previously.

- Analysed trends in payment patterns to forecast potential cash flow issues, aiding in more effective strategic planning and resource allocation.

- Provided training to new team members on accounts receivable processes, fostering a knowledgeable and efficient team environment.

- Leveraged advanced Excel skills to streamline invoice tracking, reducing processing time by 30% for monthly billing cycles.

- Implemented a new customer credit scoring system which decreased bad debt expenses by 15% through more accurate risk assessments.

- Coordinated with the sales department to reconcile accounts totaling over $500,000, ensuring accuracy and customer satisfaction.

- Introduced an automated payment reminder system that reduced overdue invoices by 40%, securing consistent cash flow.

- Managed the monthly closing of financial records and posting of month-end information, which led to a 25% reduction in closing time.

- Negotiated with key accounts to facilitate the early settlement of outstanding balances, improving the company's Days Sales Outstanding (DSO) by 10 days.

- Performed detailed financial analysis on receivables to identify patterns and resolve outstanding payment issues.

- Coordinated with cross-functional teams to enhance the billing system, which reduced errors by 20% and improved client satisfaction ratings.

- Assisted in the preparation for annual audits, resulting in zero discrepancies related to receivables for the fiscal year.

- Collaborated with IT to develop a custom automated billing system, shortening the average collection period by 15 days.

- Played a pivotal role in introducing electronic invoicing, which enhanced operational efficiency by 35%.

- Administered training for new hires on accounts receivable processes and software, boosting team productivity by 20%.

- Processed an average of 500 invoices per month while maintaining a 98% accuracy rate, contributing to the department's performance excellence.

- Collaborated on the implementation of a new ERP system that enhanced reporting capabilities and invoice tracking.

- Initiated a customer service program to address and resolve invoice disputes, successfully recovering $300,000 in receivables.

- Spearheaded a project to standardize invoicing procedures across all departments, leading to a 90% reduction in intra-departmental discrepancies.

- Trained and mentored two junior accounts receivable clerks, who went on to become valuable contributors to the finance department.

- Took initiative to personally reach out to high-risk accounts, securing payments on more than $250,000 of aging receivables.

Writing your CV without professional experience for your first job or when switching industries

There comes a day, when applying for a job, you happen to have no relevant experience, whatsoever. Yet, you're keen on putting your name in the hat. What should you do? Candidates who part-time experience , internships, and volunteer work.

Recommended reads:

PRO TIP

If you have experience in diverse fields, highlight how this has broadened your perspective and skill set, making you a more versatile candidate.

Describing your unique skill set using both hard skills and soft skills

Your accounts receivable CV provides you with the perfect opportunity to spotlight your talents, and at the same time - to pass any form of assessment. Focusing on your skill set across different CV sections is the way to go, as this would provide you with an opportunity to quantify your achievements and successes. There's one common, very simple mistake, which candidates tend to make at this stage. Short on time, they tend to hurry and mess up the spelling of some of the key technologies, skills, and keywords. Copy and paste the particular skill directly from the job requirement to your CV to pass the Applicant Tracker System (ATS) assessment. Now, your CV skills are divided into:

- Technical or hard skills, describing your comfort level with technologies (software and hardware). List your aptitude by curating your certifications, on the work success in the experience section, and technical projects. Use the dedicated skills section to provide recruiters with up to twelve technologies, that match the job requirements, and you're capable of using.

- People or soft skills provide you with an excellent background to communicate, work within a team, solve problems. Don't just copy-paste that you're a "leader" or excel at "analysis". Instead, provide tangible metrics that define your success inusing the particular skill within the strengths, achievements, summary/ objective sections.

Top skills for your accounts receivable CV:

Accounts Receivable Management

Invoicing

Financial Reporting

Cash Application

Credit Management

Collections

General Ledger

Reconciliation

ERP Software Proficiency

Microsoft Excel

Attention to Detail

Communication Skills

Organisational Skills

Time Management

Problem-Solving

Teamwork

Customer Service Orientation

Adaptability

Negotiation

Analytical Thinking

PRO TIP

Use mini case studies or success stories in your CV to demonstrate how your skills have positively impacted previous roles or projects.

Further professional qualifications for your accounts receivable CV: education and certificates

As you're nearing the end of your accounts receivable CV, you may wonder what else will be relevant to the role. Recruiters are keen on understanding your academic background, as it teaches you an array of hard and soft skills. Create a dedicated education section that lists your:

- applicable higher education diplomas or ones that are at a postgraduate level;

- diploma, followed up with your higher education institution and start-graduation dates;

- extracurricular activities and honours, only if you deem that recruiters will find them impressive.

Follow a similar logic when presenting your certificates. Always select ones that will support your niche expertise and hint at what it's like to work with you. Balance both technical certification with soft skills courses to answer job requirements and company values. Wondering what the most sought out certificates are for the industry? Look no further:

PRO TIP

If you have received professional endorsements or recommendations for certain skills, especially on platforms like LinkedIn, mention these to add credibility.

Recommended reads:

Key takeaways

Your successful job application depends on how you well you have aligned your accounts receivable CV to the job description and portrayed your best skills and traits. Make sure to:

- Select your CV format, so that it ensures your experience is easy to read and understand;

- Include your professional contact details and a link to your portfolio, so that recruiters can easily get in touch with you and preview your work;

- Write a CV summary if you happen to have more relevant professional experience. Meanwhile, use the objective to showcase your career dreams and ambitions;

- In your CV experience section bullets, back up your individual skills and responsibilities with tangible achievements;

- Have a healthy balance between hard and soft skills to answer the job requirements and hint at your unique professional value.