Writing a strong cover letter requires close attention to detail, from the tone of voice to avoiding those pesky spelling or grammar mistakes.

Overlooking similar small details can weaken your application.

Many candidates also struggle with how to address the letter, often opting for 'Dear Sir or Madam' when they can’t find the correct contact. This can make your cover letter feel impersonal.

In this guide, we’ll show you how to perfect these crucial elements, ensuring your cover letter is polished and professional without relying on clichés.

Cover letter examples for personal banker

By Experience

Senior Personal Banker

- Personalisation: The cover letter effectively tailors experience and skills specifically for roles in Fintech, Customer Service, and Account Management, showcasing a deep understanding of these sectors and related responsibilities.

- Quantifiable Achievements: Incorporating specific metrics like a 35% increase in customer satisfaction ratings and a 20% reduction in errors highlights the tangible impact made in previous positions, demonstrating a results-oriented approach.

- Relevant Certifications: Highlighting a Banking Compliance Certification from a reputable institution underscores the candidate’s commitment to adhering to financial regulations, a crucial aspect for roles in the financial sector.

- Key Skills Alignment: Listing skills such as Transaction Processing, Compliance, and Financial Analysis aligns with the requirements of a Fintech Specialist role, showcasing the candidate’s capability in handling relevant job functions efficiently.

Junior Personal Banker

- Emphasise quantifiable achievements, such as a 15% increase in customer satisfaction scores and surpassing personal targets by 20% quarter on quarter, to demonstrate impactful contributions in sales and customer outreach.

- Highlight relevant certifications and courses such as the 'Retail Banking Certification' and 'Financial Services Digital Skills' to showcase specialised knowledge and continuous professional development in the financial sector.

- Incorporate specific skills pertinent to the role like 'Financial Guidance', 'Digital Banking Solutions', and 'Interpersonal Communication' to align with the requirements of a Financial Services Specialist.

- Include language proficiency, such as being fluent in English and proficient in Spanish, to indicate readiness to engage with a diverse customer base, a valuable asset in customer-facing roles.

Lead Personal Banker

- Highlighting Leadership: Leading a team of five at Lloyds Banking Group to overachieve customer service KPIs by 15% demonstrates strong leadership and the ability to drive results.

- Emphasising Specialised Skills: Mentioning acquired certifications like the Driver Certificate of Professional Competence showcases specialisation in mobile branch operations, which is a unique skill for a banking role.

- Showcasing Community Engagement: Coordinating initiatives like the 'bank-on-wheels' and developing strong ties with community hubs emphasises a commitment to community engagement, expanding customer base and enhancing customer relations.

- Demonstrating Efficiency and Innovation: Streamlining transaction processes and designing new onboarding procedures highlight an ability to innovate and improve operational efficiency, leading to enhanced service delivery and customer satisfaction.

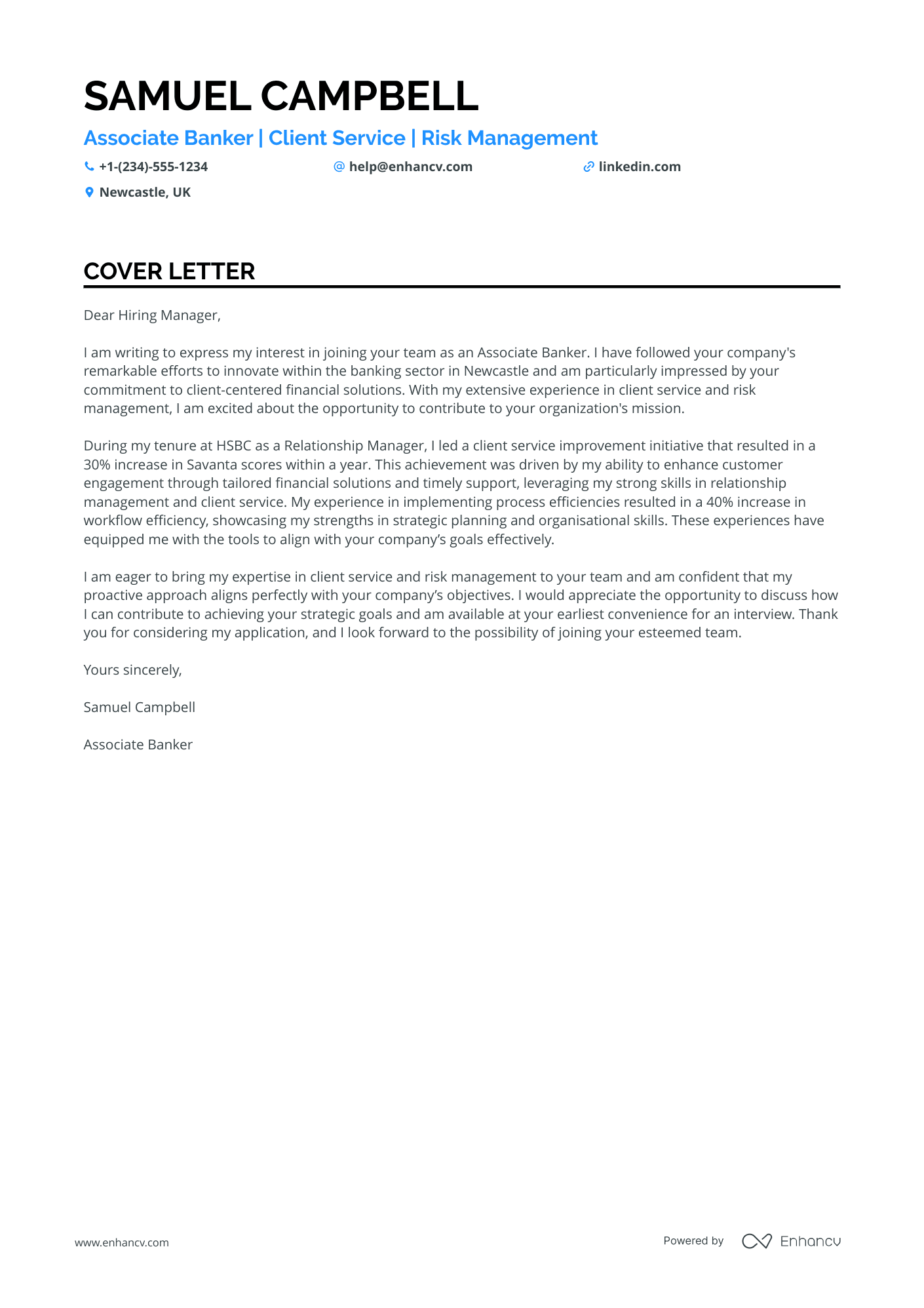

Associate Personal Banker

- Relevant Experience: The cover letter effectively emphasizes the applicant's extensive banking experience across different roles, highlighting accomplishments like achieving top performance and facilitating revenue growth through strategic client service.

- Targeted Skills: It clearly identifies key skills such as Relationship Management, Risk Management, and Digital Banking Solutions, which are crucial for a candidate applying for a banking role focused on client service and risk management.

- Certification and Courses: By mentioning specialised courses and certifications, such as the Certificate in Credit Risk Management and Advanced Corporate Banking Solutions, the candidate demonstrates a commitment to continuous learning and expertise in specialised banking areas.

- Achievements and Impact: The letter highlights specific, quantifiable achievements, such as a 30% increase in Savanta scores and improved compliance rates, showcasing the candidate's ability to deliver tangible results in banking operations.

By Role

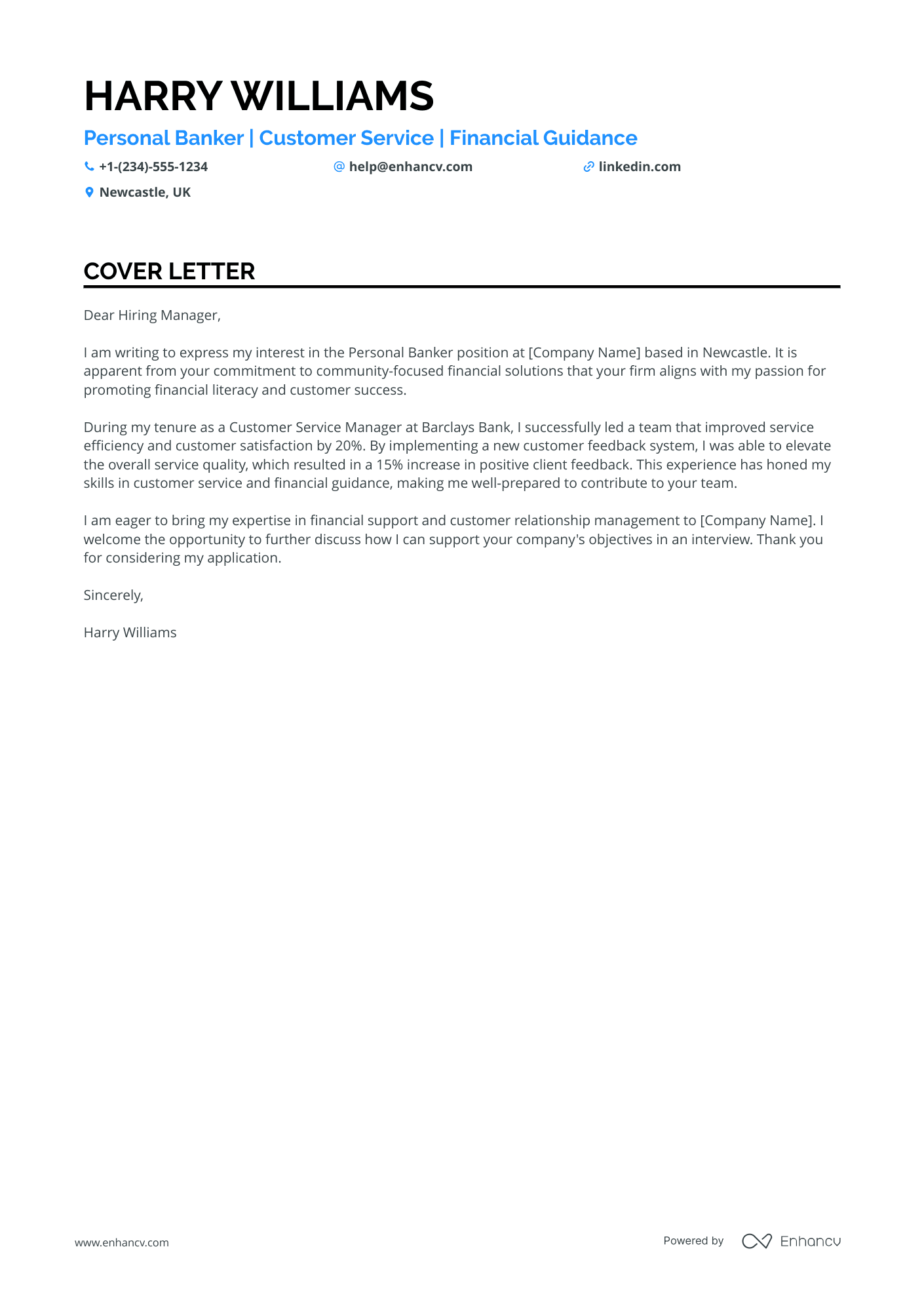

Personal Banker for Retail Services

- Role-Specific Experience: The cover letter showcases extensive experience in customer-facing and banking roles, which is crucial for a personal banker position.

- Achievements and Metrics: It effectively uses quantifiable achievements, such as a 20% increase in customer satisfaction and a 30% increase in customer portfolio growth, to highlight past success and impact.

- Relevant Certifications and Education: The inclusion of the MBA from Durham University and certifications such as the Certificate in Banking and Financial Markets aligns well with the professional development required for a banking career.

- Skills Emphasising Customer Interaction: Skills like Customer Service, Financial Guidance, and Interpersonal Skills are pivotal for roles focused on customer relationship management and are prominently highlighted.

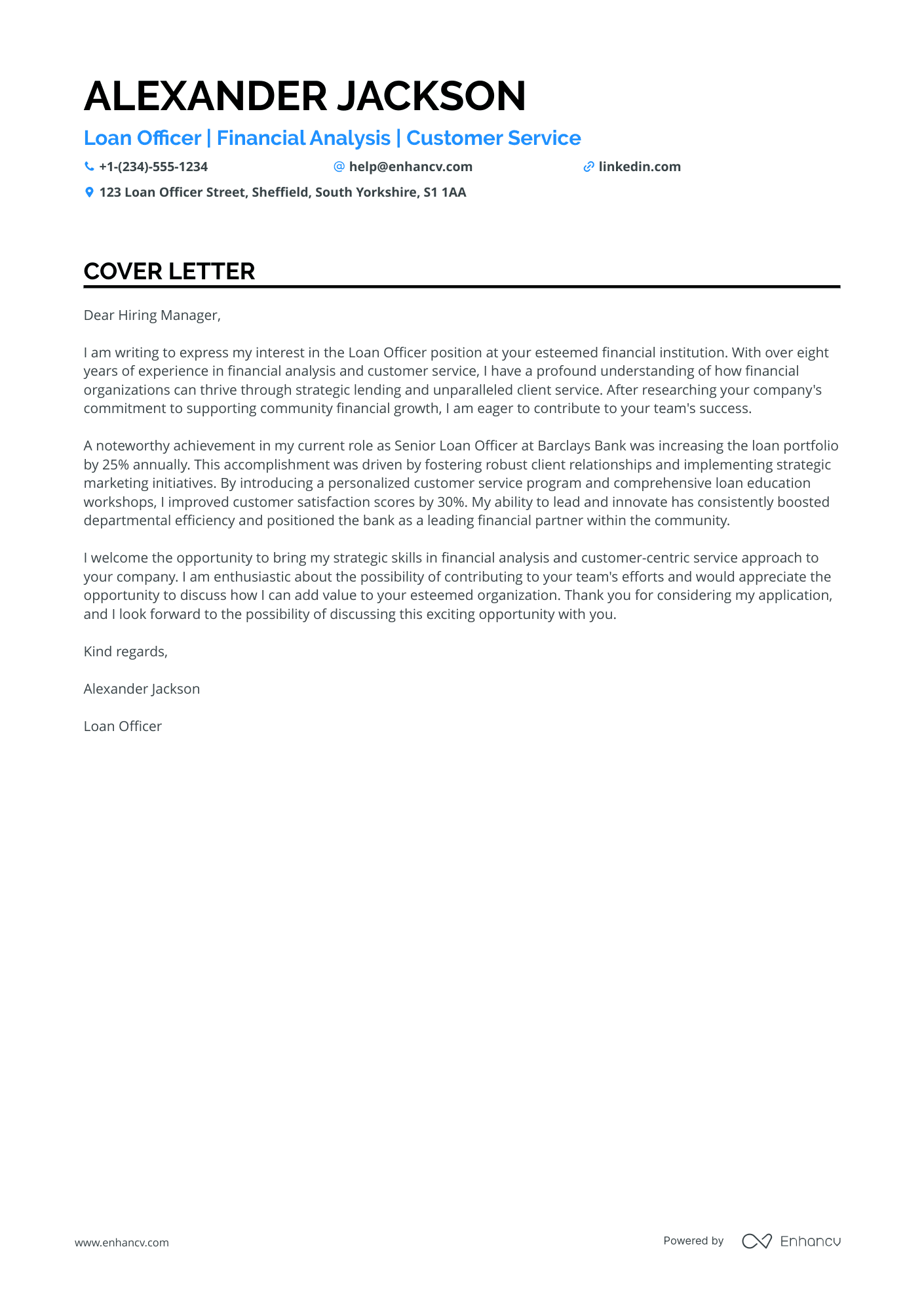

Personal Banker for Business Services

- Relevant Experience: Demonstrating over 8 years of relevant experience as a Loan Officer, the candidate highlights expertise in financial analysis, customer service, and community engagement, making a strong case for their capability in the financial services industry.

- Significant Achievements: The cover letter effectively outlines tangible achievements, such as increasing loan portfolios by 25% and enhancing customer satisfaction scores by 30%, showcasing the candidate's ability to deliver concrete results.

- Specialised Certifications: The candidate's mention of the Certified Banking & Credit Analyst (CBCA) course reinforces their expertise in advanced financial statement analysis and credit evaluation methodologies, relevant for a specialised role in financial services.

- Community Engagement: Highlighting involvement in over 100 community financial literacy programmes positions the candidate as a community leader, which is valuable for banks looking to strengthen community ties and enhance corporate social responsibility initiatives.

Personal Banker for Wealth Management

- Highlighting certifications such as the Certified Financial Planner (CFP), which is crucial for demonstrating expertise and credibility in financial planning and wealth management roles.

- Emphasising achievements like increasing client assets under management by 40%, which showcases ability to drive financial growth and client trust in high-net-worth client settings.

- Showcasing key skills such as regulatory compliance and investment strategies that are essential for managing complex portfolios and ensuring adherence to industry standards.

- Mentioning educational qualifications, such as a Master of Science in Wealth Management from a reputed institution, strengthens the applicant's formal knowledge and capability in this specialised field.

Personal Banker for Mortgage Services

- Emphasising the Top Performer Award 2020 aligns with showcasing tangible achievement in exceeding mortgage origination targets, crucial for decision-makers hiring a seasoned Mortgage Specialist.

- Highlighting bilingual capabilities (Spanish) addresses potential client diversity, showing added value in bridging language barriers and expanding client reach.

- Mentioning expertise in Government and Conventional Loan Products directly relates to the specialised knowledge expected in the role, making Olivia a strong candidate for complex client requirements.

- Showcasing participation in courses like Advanced Mortgage Solutions and associated certifications demonstrates a commitment to professional development in the sphere of mortgage advisory.

Personal Banker for Commercial Lending

- Highlighting Impactful Achievements: The cover letter effectively details tangible achievements, such as managing a portfolio that led to a 20% increase in loan approval rates, showcasing the candidate's ability to deliver concrete results in commercial lending.

- Emphasising Relevant Experience: The progression from a Junior Credit Analyst to a Relationship Manager is well-highlighted, emphasising a clear trajectory of growth and increased responsibility in the financial sector.

- Demonstrating Community Engagement: The candidate's active involvement with local businesses and passion for community engagement are significant, aligning with the role's emphasis on building client relationships and supporting local businesses.

- Showcasing Critical Skills and Training: The cover letter underscores key skills such as credit analysis and portfolio management, reinforced by relevant courses and training in Advanced Credit Risk Management, essential for excelling in commercial lending roles.

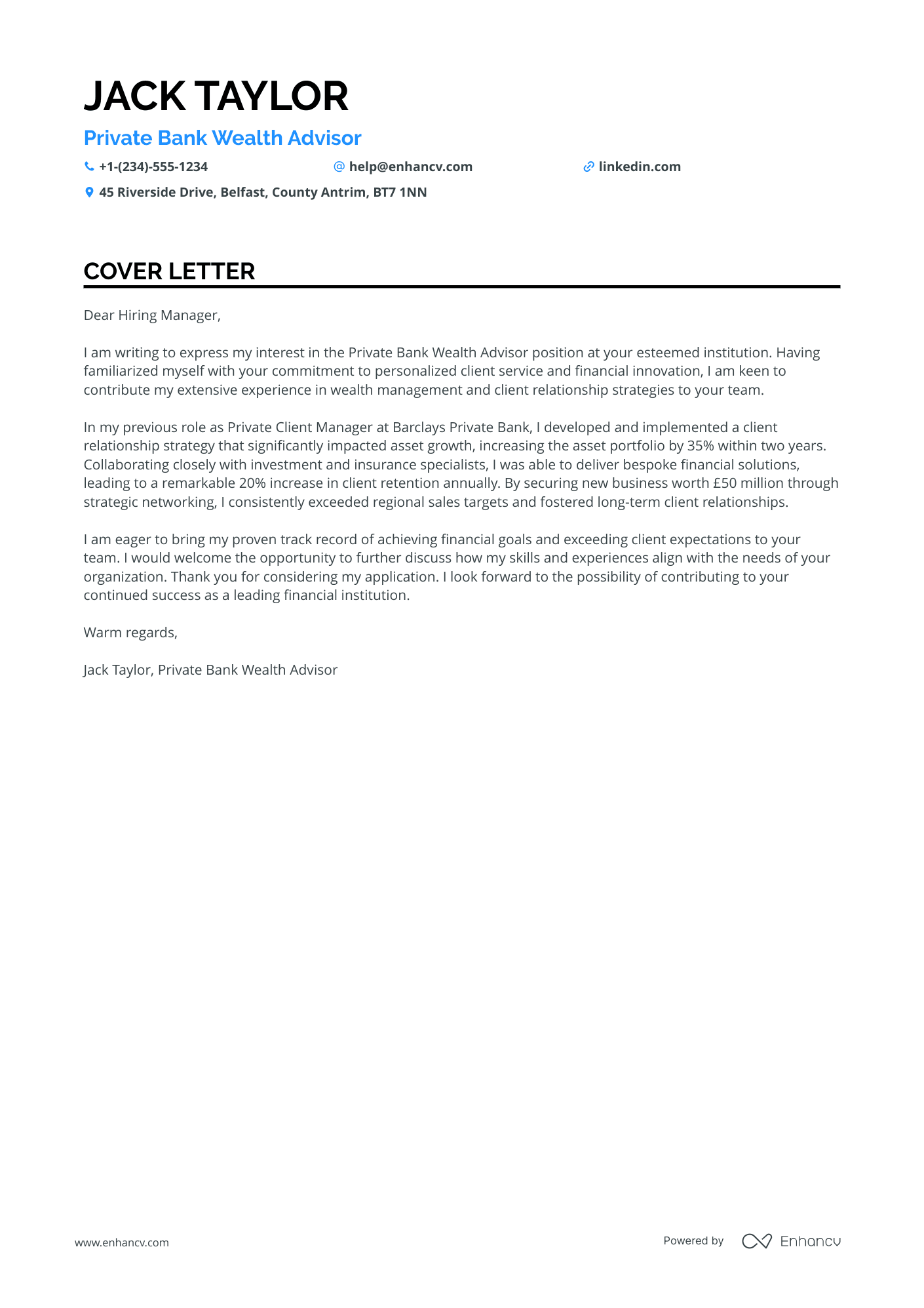

Personal Banker for Private Banking

- Highlight Specific Achievements: Demonstrating a track record of managing high-net-worth portfolios and achieving tangible results, such as a 95% client retention rate and generating £5M in new business annually, showcases effectiveness and success in the field.

- Emphasise Relevant Certifications and Courses: Mentioning the "Chartered Wealth Manager Qualification" and "Certificate in Mortgage Advice and Practice" can distinguish the candidate by demonstrating specialised knowledge and commitment to professional development.

- Showcase Leadership and Mentorship: Describing experience in leading a team of junior bankers and being recognised for exceptional leadership skills suggests valuable management abilities and a potential for further leadership roles.

- Community Engagement Involvement: Highlighting active participation in community financial literacy events not only reflects a socially responsible professional image but also underscores skills in growing client bases through local client acquisition.

Personal Banker for Small Business Services

- Professional Summary: The cover letter includes a concise professional summary that highlights over 3 years of experience in small business lending, emphasising core skills such as financial analysis and client acquisition. This provides a snapshot of the candidate's expertise and value addition to potential employers.

- Certifications and Courses: The letter mentions specialised certifications such as the "SBA Lending Certification" from the National Association of Government Guaranteed Lenders and completion of "Advanced Credit Risk Analysis" with Moody's Analytics, which are crucial for roles in financial lending and analysis.

- Quantifiable Achievements: Specific achievements such as a "30% increase in loan approvals" and a "25% reduction in loan processing time" provide measurable evidence of the candidate's ability to create value and improve processes within the financial sector, demonstrating their impact on past roles.

- Passion for Role-related Causes: The inclusion of personal passions, such as "Financial Empowerment of SMEs" and "Sustainable Banking Practices," aligns personal values with professional ambitions, showcasing a holistic and genuine interest in the field of financial services.

Personal Banker for Corporate Banking

- Emphasising expertise in loan origination and account management, both critical components of a Retail Banking Specialist role, showcasing how these skills have driven tangible branch success.

- Highlighting relevant certifications such as the "Certified Retail Banker" and "Certificate in Consumer Loan Processing" to demonstrate specialised knowledge and commitment to the field.

- Showcasing successful cross-selling strategies leading to a 20% sales increase, which aligns with the sales and service aspects of the role, demonstrating proven capability in enhancing branch revenue.

- Integrating experiences from different banks, providing a well-rounded view of sector adaptability and versatility, enhancing credibility as a Retail Banking Specialist.

Personal Banker for Investment Services

- Highlighting Key Achievements: The cover letter effectively underscores Scarlett's quantifiable achievements such as increasing revenue by 30% and successfully closing loans worth £10 million, demonstrating her capability to drive financial growth and client satisfaction.

- Emphasising Relevant Experience: With roles at top banks like Barclays and HSBC, the letter efficiently showcases Scarlett's extensive experience in managing high net worth clientele and offering strategic financial solutions, solidifying her expertise in private banking and wealth management.

- Featuring Professional Certifications: Mentioning the Chartered Wealth Manager Qualification and the Diploma in Private Banking accentuates Scarlett's advanced knowledge in financial and investment services, which is critical for high-level positions in wealth management.

- Incorporating Soft Skills: Skills like "Relationship Management" and "Customer Service" are highlighted, which are essential for building robust client relationships and ensuring superior client interaction in the role of a Private Banker.

Personal Banker for International Banking

- Emphasise Active Listening and Query Resolution Skills: As a Relationship Specialist in a customer-centric role, highlighting these skills showcases the ability to effectively address customer needs and resolve issues promptly.

- Demonstrate Experience in Customer Satisfaction Initiatives: Mentioning specific achievements, like improving client satisfaction scores and streamlining communication procedures, provides tangible evidence of past success in enhancing customer experiences.

- Highlight Relevant Education and Courses: Including a degree in Business Administration and courses in Financial Services Customer Care and Advanced Banking Operations establishes a strong academic foundation relevant to the banking sector.

- Showcase Passion for Community Service and Financial Education: Mentioning volunteer experience, such as organising financial literacy workshops, indicates a commitment to both community service and the dissemination of financial knowledge.

Personal Banker for Consumer Lending

- Emphasising over eight years of banking experience immediately establishes credibility and expertise in the loan servicing domain.

- Highlighting specific achievements such as a 15% increase in customer satisfaction through process improvements demonstrates the ability to have a tangible positive impact on the organisation.

- Including advanced certifications like the "Advanced Consumer Lending Strategies" from the Chartered Banker Institute showcases specialised knowledge relevant to the field.

- Illustrating leadership and efficiency improvements, such as streamlining the document scanning process, underscores skills in process optimisation and initiative-taking.

Personal Banker for Credit Card Services

- Emphasising industry experience: Isla King highlights over 5 years of experience in the banking industry, which is crucial for demonstrating expertise and reliability to potential employers in similar roles.

- Showcasing customer retention achievements: The letter notes an increase in customer retention and satisfaction, reflecting the candidate’s capability to build lasting client relationships—an essential quality for a personal banking expert.

- Highlighting specific certifications: Mentioning the 'Certificate in Financial Services' from the Chartered Institute for Securities & Investment showcases specialised knowledge and commitment to professional development in financial services.

- Demonstrating technological proficiency: References to managing digital banking solutions and using CRM systems illustrate adaptability and technical proficiency, which are increasingly important in modern banking roles.

Personal Banker for Treasury Services

- Highlight specific achievements: Emphasise the 25% profitability increase through advanced asset-liability strategies, showcasing the candidate's impact and effectiveness in similar senior treasury roles.

- Showcase leadership experience: Detail leading a team of financial analysts with a 20% productivity improvement, demonstrating strong leadership and team management skills essential for a VP Treasury position.

- Certifications and advanced education: Mention relevant certifications, such as the "Asset Liability Management Certification," and advanced degrees like the MBA, underlining the candidate's expertise and dedication to their field.

- Use of specific tools and skills: Include proficiency with technical tools, like Microsoft Excel and PowerBI, emphasising technical skills crucial for strategic financial analysis and decision-making in the role.

Personal Banker for Asset Management

- Tailored Experience: The cover letter effectively highlights the candidate's leadership role in executing significant M&A transactions, showcasing experience that is directly relevant to the Vice President position in FIG Asset Management.

- Highlighting Achievements: By listing specific awards such as the M&A Deal of the Year Award, the candidate showcases credibility and success in prior roles, which is critical for high-stakes positions in asset management.

- Skill Emphasis: There is a clear emphasis on advanced financial modelling and quantitative analysis skills, which are vital in M&A and asset management, reassuring the employer of the candidate's technical capabilities.

- Strategic Contributions: The cover letter effectively outlines the candidate's strategic contributions, such as increasing customer pitch success rates and facilitating successful integration projects, demonstrating added value to potential employers.

Personal Banker for Trade Finance

- Emphasise certifications relevant to trade finance, such as the Advanced Trade Finance and Documentation certification from the International Chamber of Commerce, to highlight specialised knowledge and qualifications in the field.

- Highlight achievements in revenue growth and risk mitigation, such as increasing trade finance revenue by 30% and reducing client credit risk by 25%, to demonstrate effectiveness in major areas of the role.

- Showcase client relations skills, such as maintaining a 100% retention rate for top-tier clients, to underline the ability to sustain and grow business relationships, which is crucial for the role.

- Incorporate relevant skills such as structuring, legal and regulatory compliance, and strategic planning, which are essential for a Vice President role in trade finance.

Personal Banker for Capital Markets

- Experience and Achievements: The cover letter highlights Freya Richardson's extensive experience in capital markets, with quantified achievements such as a 30% increase in HELOC origination efficiency and a 25% reduction in funding costs, demonstrating her expertise and contribution to previous roles.

- Skills in AI and Tech-Driven Solutions: The mention of AI-driven lending models and tech-driven financial solutions aligns well with the role's requirements, showcasing Freya's ability to integrate technology into financial services for optimised outcomes.

- Regulatory Compliance and Risk Management: Emphasising oversight of regulatory compliance and risk assessment skills assures potential employers of Freya's ability to navigate complex financial regulations effectively.

- Passion and Values: Highlighting her interests in sustainable investing and volunteering reflects Freya's values, which may resonate well with companies that prioritise corporate social responsibility and ethical finance.

Personal Banker cover letter example

Harper Webb

Birmingham, UK

+44 1234 567890

help@enhancv.com

- Alignment with Company Values: The applicant effectively aligns their personal values and professional track record with the company’s mission of enhancing customer experiences through innovative technology. This demonstrates an understanding of the company’s goals and establishes a connection from the outset.

- Quantifiable Achievements: By citing specific statistics—such as a 20% improvement in customer satisfaction and a 15% revenue increase—the candidate provides measurable proof of their impact, which is critical in highlighting the tangible benefits they can bring to the potential employer.

- Strategic Initiatives and Leadership: The mention of spearheading a project and managing a team underscores leadership and project management skills, which are essential for a role focused on customer service excellence and strategic financial initiatives.

- Clear Call to Action: The candidate concludes with a clear and professional call to action, indicating eagerness for further discussion and an interview, thereby reinforcing interest in the position and encouraging a response from the hiring manager.

Importance of cover letters in the United Kingdom

Cover letters provide recruiters with the opportunity to learn more about your career aspirations, hinting at how you’d integrate within the organisation over the long term.

Here are three additional reasons why cover letters are important:

- Making an excellent first impression (and a formal introduction): Your cover letter is often the employer’s first introduction to you, showcasing your personality, communication skills, and motivation for the role.

- Complementing your career history: While your CV lists qualifications and experience, a cover letter provides the context, explaining how your background fits the role.

- Demonstrates your genuine interest: A well-crafted cover letter reflects the effort you’ve put into researching the company and role as well as your attention to detail.

What UK employers expect from a cover letter

Your UK employers will appreciate your application if you've taken the effort to tailor your cover letter to their job requirements.

Here’s how to ensure yours ticks all the right boxes:

- Research the company thoroughly: It's not enough to have only read the job advert. Look into the company's history, products, services, and recent achievements to demonstrate your genuine interest and knowledge.

- Connect with the company’s values: Every company has core principles that shape its culture and operations. Identify these values and use your cover letter to show how they align with your professional conduct and ethics.

- Emphasise your relevant skills: Highlight specific skills that match the job description and are most in demand. Use examples from your previous experience to support your claims and set yourself apart from other candidates.

How to format a personal banker cover letter

Have you ever wondered about the formatting and structure of your cover letter?

Read on to discover some guidance from industry-leading professionals:

- Within the header, include your address and contact details, the employer's name and address, and the date, followed up by a personalised salutation.

- The body should should consist of an opening paragraph, middle paragraphs expanding on your unique experience and skills, and a closing paragraph.

- End with a formal sign-off and your signature.

- Choose modern fonts such as Volkhov, Chivo, or Bitter instead of the more traditional Arial or Times New Roman.

- All of ENhancv's templates maintain single-spacing with approximately 1-inch (2.5 cm) margins on all sides to ensure a neat presentation.

- Always send your cover letter as a PDF to keep the formatting intact and prevent any edits once submitted.

Your CV and cover letter maintain consistent formatting. Use the same fonts, margins, and style to create a professional and cohesive look for your application.

Finally, remember that Applicant Tracking Systems (the software some companies use to align job keywords to your experience, also known as ATS) do not read cover letters–it's intended solely for recruiters. Make it stand out by highlighting your achievements and relevant skills for the role.

How to write your personal banker cover letter salutation

In a world of AI and instant prompts, taking the extra time to personalise your cover letter truly makes a difference.

Address the hiring manager directly with a customised greeting (e.g., 'Dear Mr Bond', 'Dear Ms Penny').

You can often find their name on LinkedIn (under the job listing or by searching) or in the ‘About’ or ‘Meet the Team’ section of the company's website. If in doubt, you can also contact the reception for assistance.

If you can't find the name, rather than using 'Dear Sir or Madam', opt for something more personal, such as 'Dear [Company Name] Hiring Manager'.

How to write your personal banker cover letter intro

It's never a bad time to show enthusiasm about the role, company, or team in your cover letter introduction.

Begin by sharing one or two aspects that genuinely excite you about the position—whether it's the company culture, specific responsibilities, or the team's past achievements.

Your enthusiasm demonstrates that you'll bring a strong work ethic, are eager to contribute, and are motivated to succeed.

How to write your personal banker cover letter body

You’ve personalised your greeting and introduction—now it’s time to focus on writing the body of your cover letter.

Instead of listing off skills and responsibilities from your CV, focus on one career highlight that’s relevant to the role.

Use your hard and soft skills, success metrics (e.g., percentages or sales figures), and the long-term impact it had on the company.

A concise, well-told story centred on your value as a candidate will make a strong impression.

How to write a closing paragraph

There’s a wrong and a right way to close your cover letter. Here’s how.

The wrong way is to end with a signature or a formal 'Thank you in advance.'

The right way is to either promise how you’d make a positive impact on the company or ask when you can expect a response. This will highlight you as a forward-thinking candidate who’s enthusiastic about securing the role.

Conclusion

A well-crafted cover letter can significantly enhance your job application and set you apart from other candidates. Begin by personalising your message to the hiring manager and connecting your experiences to the company's values.

Emphasise your key accomplishments that reflect your skills and passion for the role, while maintaining a professional tone throughout. Ensure that your cover letter and CV present a unified and polished image to maximise your chances of success.