A specific challenge treasury analysts often face when crafting their resumes is demonstrating their technical proficiencies and complex financial analysis abilities in a concise, easy-to-understand manner. Our guide can assist by providing targeted examples and actionable tips for conveying complicated financial concepts and skills effectively, helping you stand out to potential employers.

Dive into this guide to learn how to craft a treasury analyst resume that offers recruiters a clear view of your career journey:

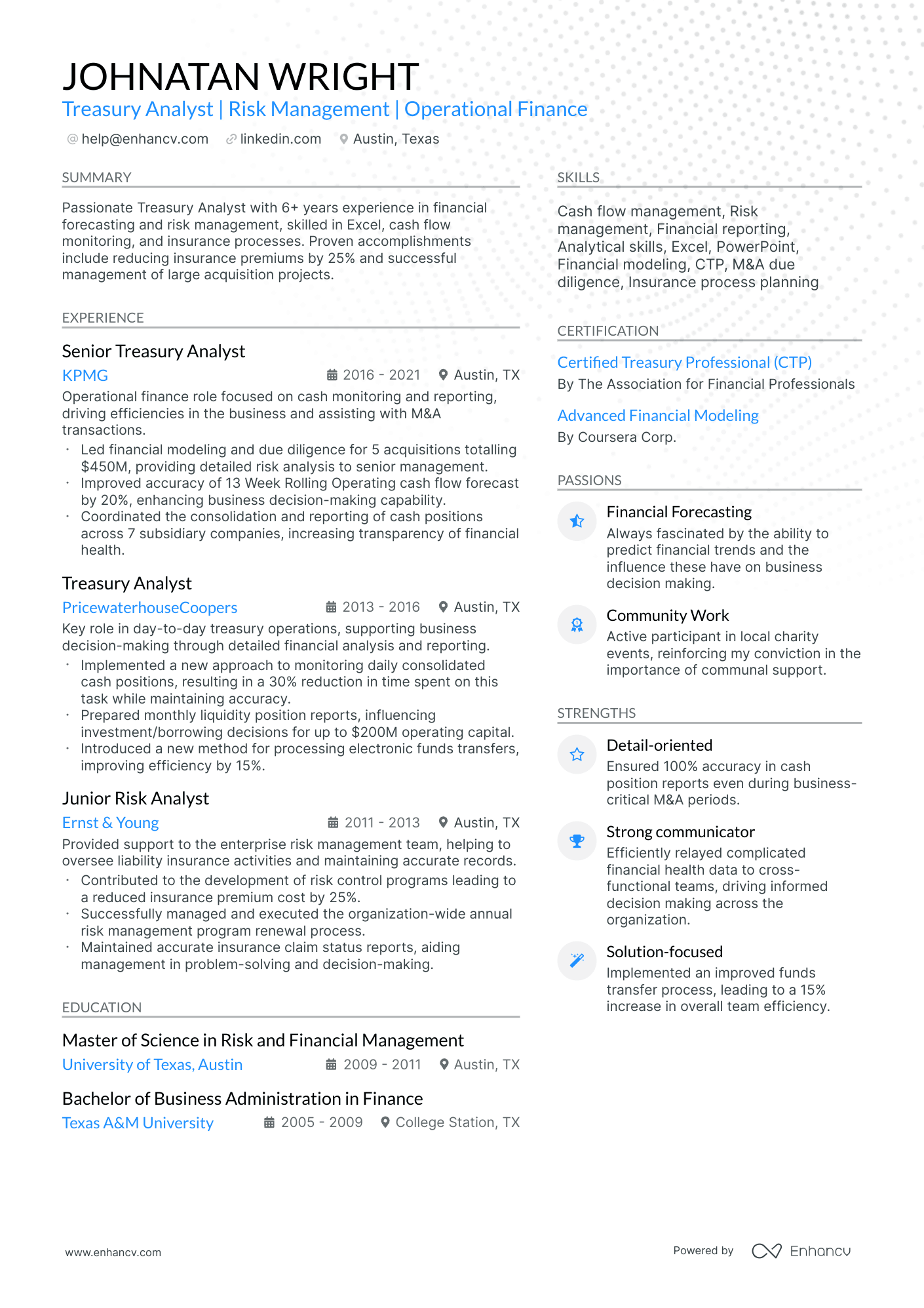

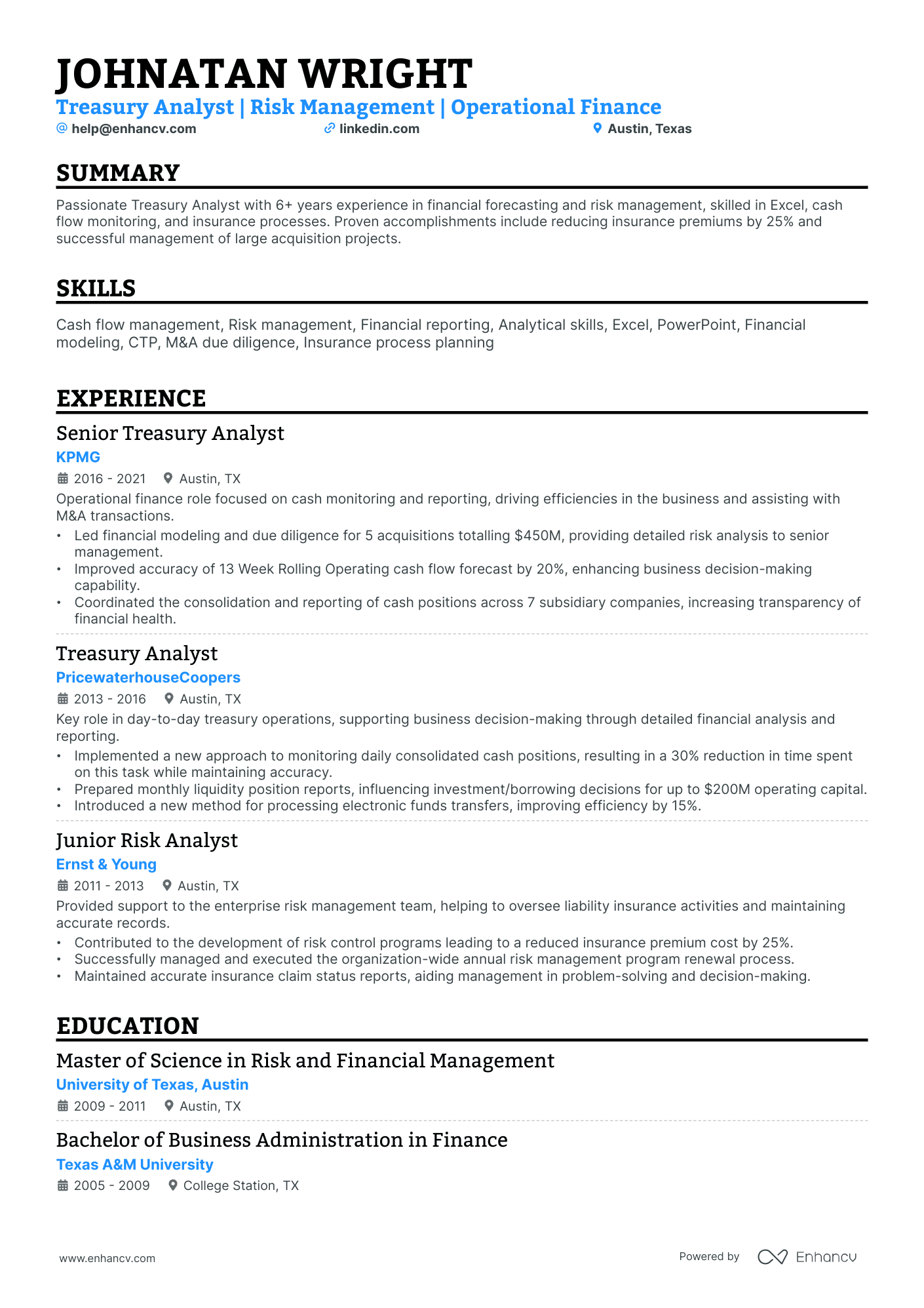

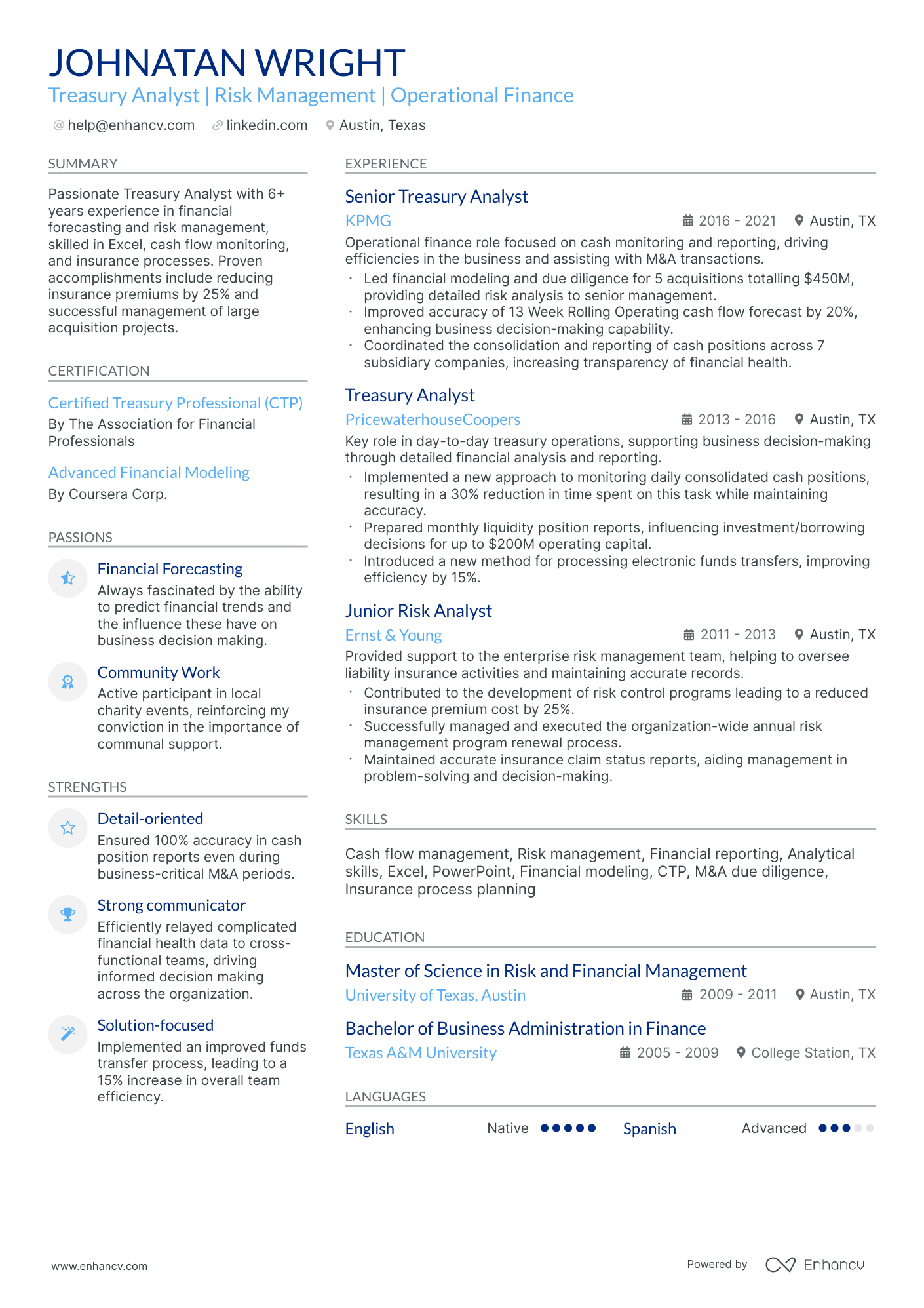

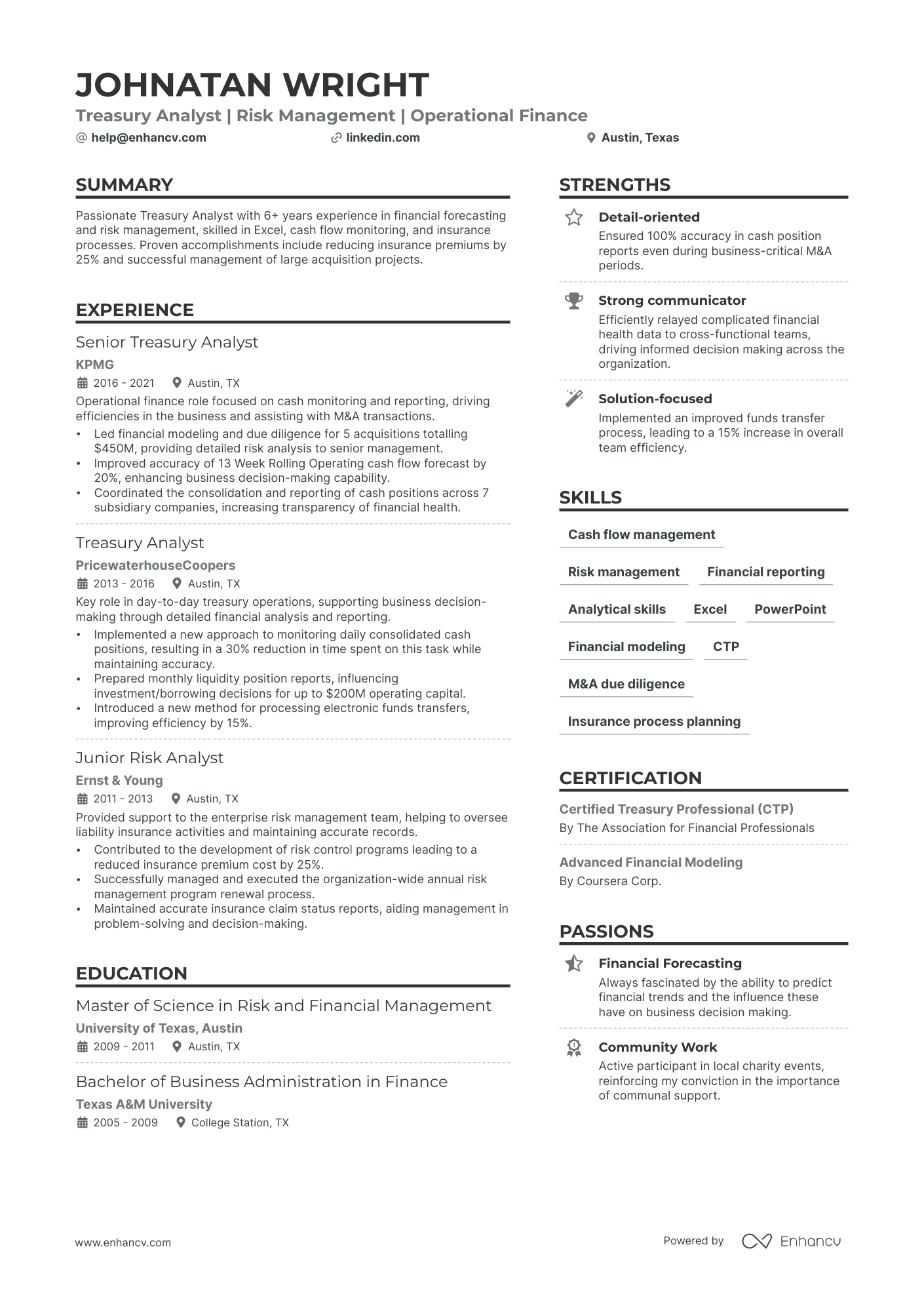

- Draw from our treasury analyst resume samples, highlighting top skills, certifications, and more.

- Illuminate the potential impact you can bring to an organization through your resume summary and experience.

- Spotlight your unique treasury analyst expertise, emphasizing tangible results and standout achievements.

Recommended reads:

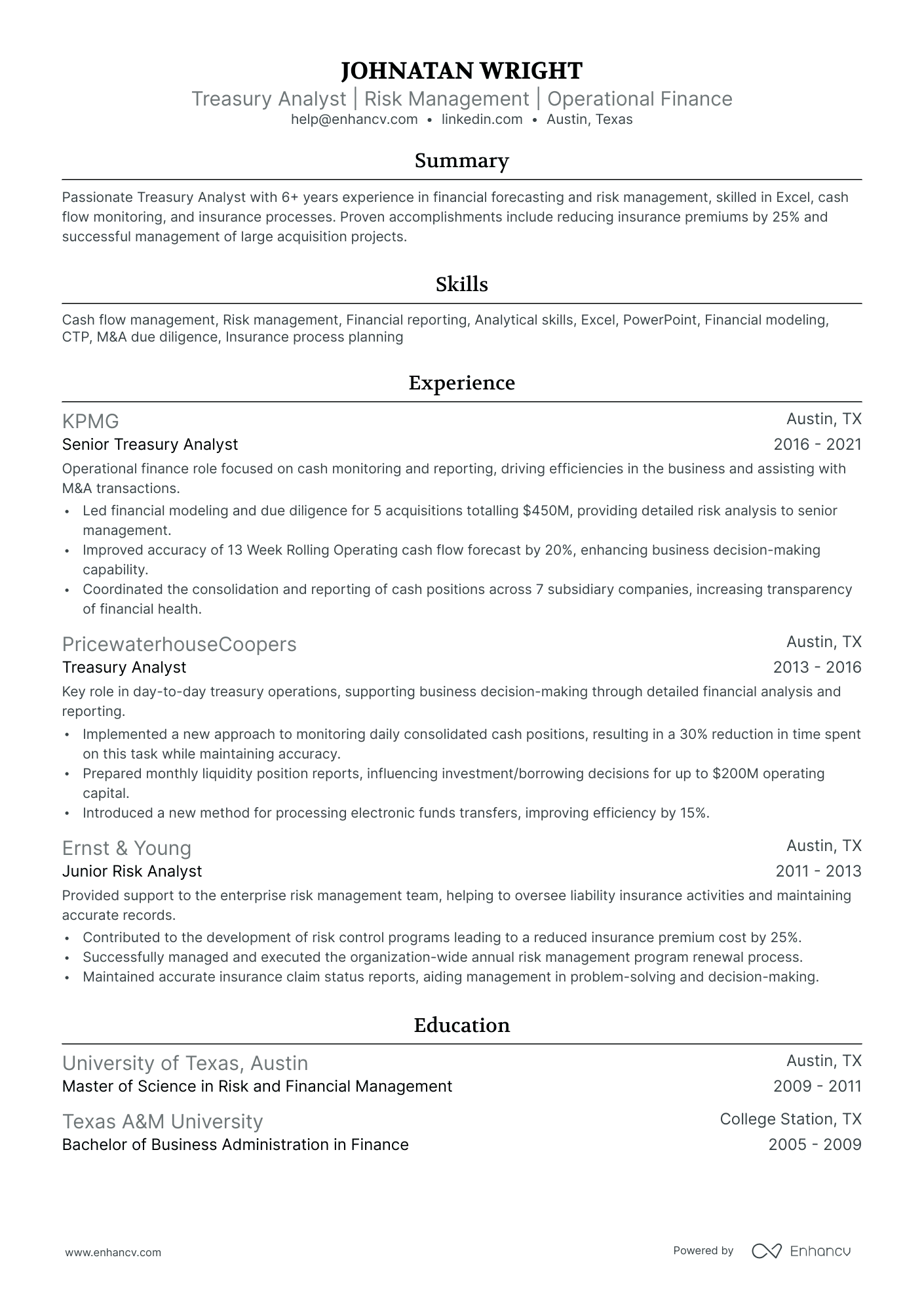

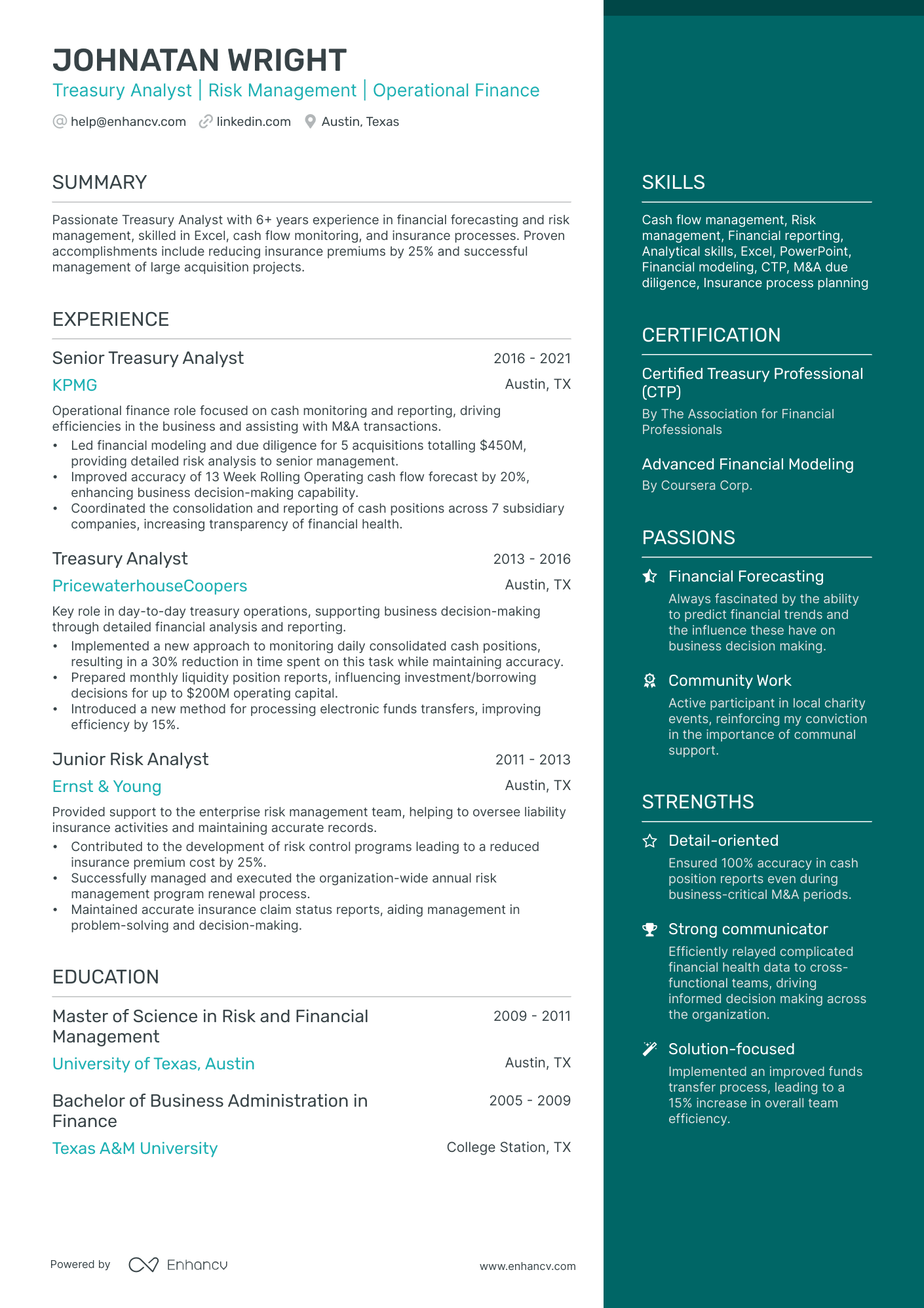

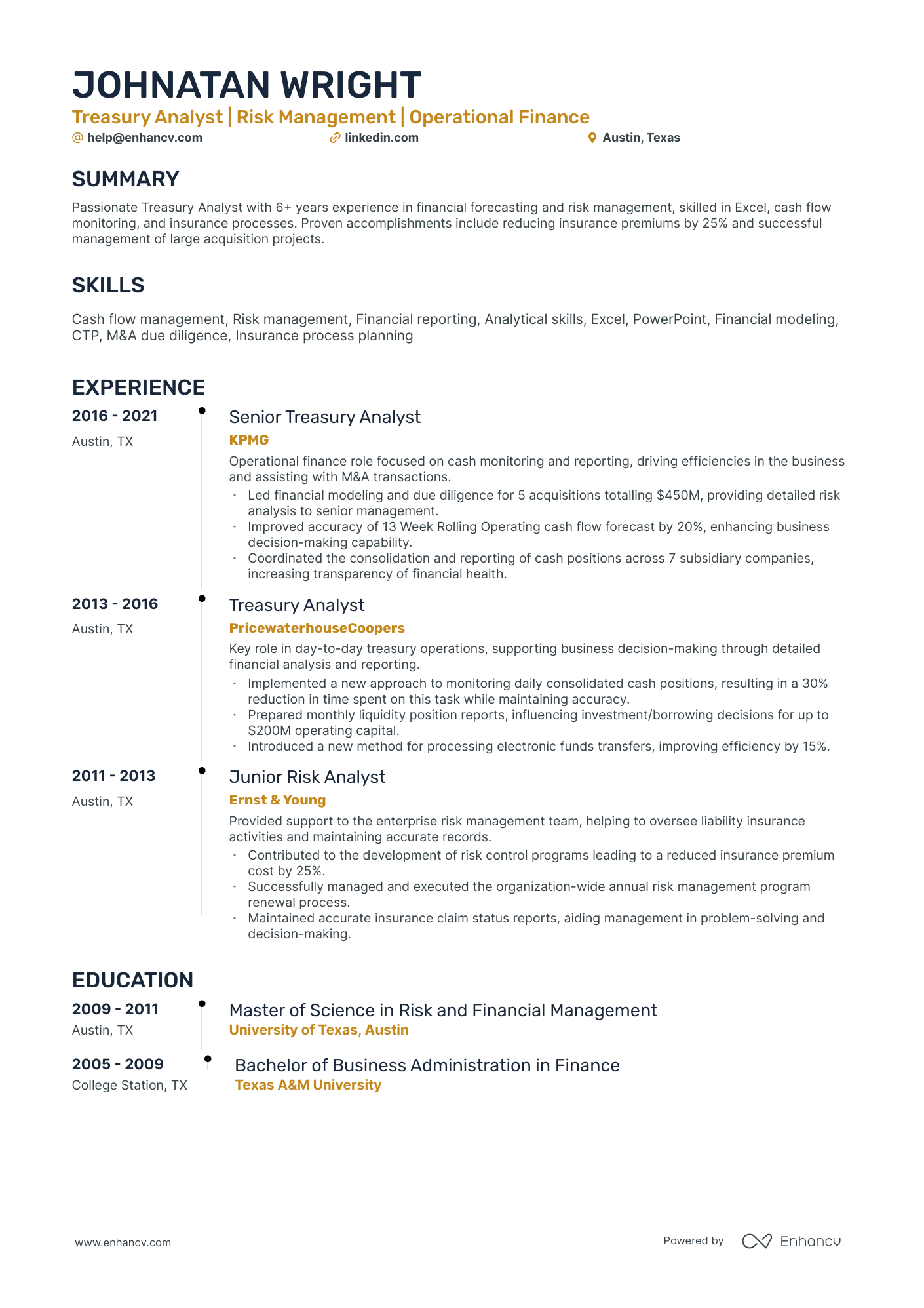

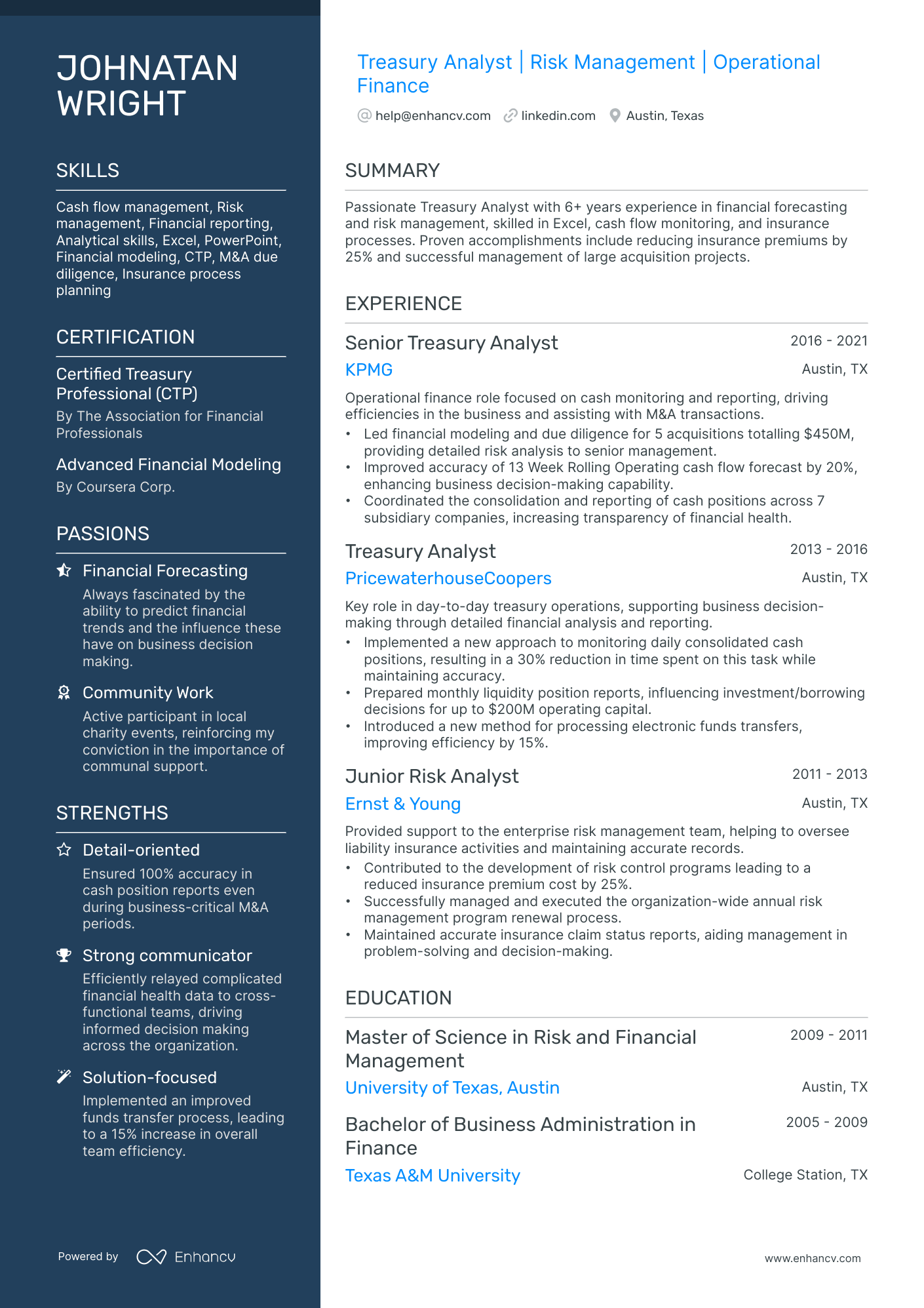

Demystifying the treasury analyst resume format

While a touch of creativity can be appealing, it's the clarity and relevance of your treasury analyst resume format that truly resonates with recruiters.

To ensure your resume not only captures attention but also maintains it, consider these four streamlined steps:

- If your career boasts a wealth of pertinent and recent accomplishments, the reverse-chronological resume format is your ally. It naturally emphasizes your experience, placing your most recent roles at the forefront.

- Design a straightforward header: incorporate your contact information, a headline reflecting the position you're vying for or your current designation, and a link to your professional portfolio.

- While brevity is key, if you're targeting a senior position or have accumulated over ten years of industry-relevant experience, extending your resume to two pages is permissible.

- To ensure consistent formatting across various platforms, always save and submit your treasury analyst resume as a PDF.

Align your resume with the market’s standards – Canadian resumes may have unique layout guidelines.

Upload your resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Pro tip

Choose a functional resume template that offers ample space to showcase your unique treasury analyst expertise.

Recruiters' top picks for treasury analyst resume sections:

- A header with essential contact details and a headline showcasing your current role.

- A summary or objective that aligns your standout expertise with the role's demands.

- An experience section that delves into your key responsibilities and achievements.

- A skills section that intertwines job requirements with your unique capabilities.

- Education and certifications sections that bolster your professional credentials.

What recruiters want to see on your resume:

- Proven experience with treasury operations and financial risk management.

- Demonstrated knowledge of cash forecasting and liquidity management strategies.

- Proficiency in the use of treasury software and other financial systems, such as ERP.

- Strong analytical skills, including experience with financial modeling and data analysis.

- Evidence of regulatory compliance understanding, particularly within finance and banking sectors.

Recommended reads:

guide to your most impressive treasury analyst resume experience section

When it comes to your resume experience, stick to these simple, yet effective five steps:

- Show how your experience is relevant by including your responsibility, skill used, and outcome/-s;

- Use individual bullets to answer how your experience aligns with the job requirements;

- Think of a way to demonstrate the tangible results of your success with stats, numbers, and/or percentages ;

- Always tailor the experience section to the treasury analyst role you're applying for - this may sometimes include taking out irrelevant experience items;

- Highlight your best (and most relevant) achievements towards the top of each experience bullet.

You're not alone if you're struggling with curating your experience section. That's why we've prepared some professional, real-life treasury analyst resume samples to show how to best write your experience section (and more).

- Executed cash management strategies, resulting in a 20% reduction in borrowing costs.

- Developed and maintained financial models to analyze investment opportunities, leading to a 15% increase in ROI.

- Collaborated with cross-functional teams to implement treasury systems, enhancing efficiency by 25%.

- Assisted in the development of risk management policies and procedures, ensuring compliance with regulatory standards.

- Managed daily cash positioning and forecasting, optimizing cash utilization and minimizing idle balances.

- Conducted cash flow analysis and prepared reports for senior management, facilitating informed decision-making.

- Assisted in the implementation of a centralized payment system, streamlining processes and reducing manual errors by 30%.

- Performed financial risk assessments and recommended hedging strategies, mitigating currency exchange risks.

- Collaborated with banks to negotiate favorable terms for credit facilities, resulting in cost savings of $500,000 annually.

- Supported the treasury team in maintaining banking relationships and resolving operational issues.

- Analyzed financial statements and identified cash flow optimization opportunities, leading to a 10% reduction in working capital.

- Assisted in the development and execution of short-term investment strategies, improving overall portfolio performance.

- Prepared monthly cash position reports and forecasts, ensuring accurate liquidity management.

- Collaborated with internal stakeholders to optimize trade finance operations, resulting in a 20% reduction in transaction costs.

- Assisted in the implementation of a treasury management system, automating processes and improving data accuracy.

- Managed the company's foreign exchange exposure and implemented hedging strategies, minimizing currency risk by 40%.

- Supported debt issuance activities, resulting in successful bond placements totaling $100 million.

- Developed financial models for cash flow forecasting, enabling effective liquidity planning.

- Collaborated with cross-functional teams to implement a treasury workstation, improving cash visibility and control.

- Conducted regular reviews of bank fees and negotiated contracts, reducing annual banking costs by 15%.

- Develop and implement treasury policies and procedures, ensuring compliance with regulatory requirements.

- Manage short-term cash investments and optimize returns through portfolio diversification.

- Lead the implementation of a global cash pooling structure, resulting in improved cash concentration and reduced borrowing costs.

- Provide analytical support for capital structure decisions, including debt refinancing and equity offerings.

- Collaborate with banks and financial institutions to negotiate favorable terms for credit facilities and banking services.

- Assisted in the development and implementation of a treasury risk management framework, enhancing risk mitigation strategies.

- Managed the company's cash position and forecasted short-term liquidity needs, optimizing cash utilization.

- Evaluated investment opportunities and conducted due diligence on potential acquisitions, resulting in successful transactions totaling $50 million.

- Implemented process improvements in cash management operations, reducing manual efforts by 20%.

- Collaborated with external auditors to ensure compliance with accounting standards and facilitate annual audits.

- Developed and maintained relationships with financial institutions, negotiating favorable terms for credit facilities and banking services.

- Conducted financial analysis and prepared reports on liquidity, interest rate risk, and foreign exchange exposure.

- Coordinated with cross-functional teams to implement treasury systems and automate processes, improving efficiency by 30%.

- Managed daily cash positioning and cash forecasting activities, ensuring optimal liquidity management.

- Supported debt capital markets transactions, including bond issuances and refinancing, resulting in cost savings of $1 million.

- Analyzed financial data and assessed counterparty risks related to derivative instruments, implementing risk mitigation strategies.

- Managed intercompany funding and coordinated cash pooling arrangements, optimizing working capital utilization.

- Assisted in the implementation of a treasury management system, streamlining processes and enhancing data accuracy.

- Performed variance analysis on interest income and expense, identifying opportunities for cost optimization.

- Collaborated with the tax department on transfer pricing initiatives to ensure compliance with regulatory requirements.

- Developed and maintained treasury policies and procedures, ensuring adherence to financial regulations.

- Managed foreign currency risk through hedging strategies, resulting in a 30% reduction in exchange rate losses.

- Analyzed investment opportunities and prepared business cases for capital allocation decisions.

- Led cross-functional teams in implementing cash management solutions, improving cash visibility and control.

- Negotiated favorable terms with banks for credit facilities, reducing borrowing costs by $200,000 per year.

- Implemented a global cash pooling structure, optimizing intercompany funding and reducing external financing needs.

- Conducted financial due diligence on potential acquisitions, supporting decision-making for growth strategies.

- Managed relationships with rating agencies, facilitating credit rating reviews and maintaining favorable credit ratings.

- Collaborated with internal audit to ensure compliance with treasury policies and recommend process enhancements.

- Prepared and presented reports on key treasury metrics and KPIs to senior management and stakeholders.

Quantifying impact on your resume

<ul>

Crafting the experience section for novice treasury analyst candidates

Lack of extensive experience doesn't equate to an empty resume. Here's how you can enrich your experience section:

- Volunteer Roles: Community involvement often equips you with valuable interpersonal skills, and sometimes even technical ones, relevant to the job.

- Academic Projects: Highlight significant university projects that contributed to the field, showcasing your hands-on experience.

- Internships: Even short-term internships can be invaluable. If they're pertinent to the role, they deserve a spot on your resume.

- Past Jobs: Even if unrelated to the treasury analyst, these roles can demonstrate transferable skills that are beneficial for the position.

Recommended reads:

Pro tip

If your experience section doesn't directly address the job's requirements, think laterally. Highlight industry-relevant awards or positive feedback to underscore your potential.

How to create an impactful treasury analyst resume skills section

Recruiters always care about the skill set you'd bring about to the treasury analyst role. That's why it's a good idea to cherry pick yours wisely, integrating both hard (or technical) and soft skills.

Hard skills are gained through studying, are certifiable, and it's impossible to do your job without them. All in all, they show your suitability for the technical aspect of the role.

Your soft skills are those personality traits you've gained over time and most often than not - outside of the workplace. Soft skills are more difficult to quantify but are definitely worth it - as they show how you'll fit and adapt into a new team environment.

How do you build the skills section of your resume?

- Include up to five or six skills in the section as keywords to align with the advert.

- Create a specific technical skills section to highlight your hard skills aptitude.

- Read more about the culture of the company you're applying and cherry pick the soft skills you have that deserve a mention.

- Make sure you answer the majority of the job requirements that are in the advert within your skills section.

A treasury analyst's resume requires a specific skill set that balances both industry-specific hard skills with personal, soft skills. Discover the most often used ones on treasury analyst resumes from our list:

Top skills for your treasury analyst resume:

Financial Modeling

Cash Management Systems

Quantitative Analysis

Excel Advanced Functions

Treasury Management Software

Risk Assessment Tools

Data Visualization Tools

ERP Systems

SAP

Bloomberg Terminal

Analytical Thinking

Attention to Detail

Communication Skills

Problem Solving

Time Management

Team Collaboration

Adaptability

Critical Thinking

Decision Making

Interpersonal Skills

Pro tip

When detailing your skills, always back them up with tangible evidence, be it quantifiable results or certifications.

Optimizing the education and certification sections of your treasury analyst resume

Your education and certification sections can be game-changers on your treasury analyst resume, showcasing your commitment to professional growth.

For the education section:

- Highlight advanced education, noting the institution and duration.

- If you're currently studying, mention your expected graduation date.

- Exclude degrees that don't align with the job's requirements.

- If relevant, delve into your academic journey, spotlighting significant achievements.

When listing degrees and certifications:

- Feature those directly relevant to the role.

- Highlight recent and significant knowledge or certifications at the top of your resume.

- Provide essential details like the issuing institution and dates for credibility.

- Avoid listing irrelevant degrees or certifications, such as your high school diploma or unrelated specializations.

Remember, even if you're tempted to omit your education or certifications, they can offer a competitive edge, signaling a long-term commitment to the industry.

Best certifications to list on your resume

- Chartered Financial Analyst (CFA) - CFA Institute

- Associate, Insurance & Risk Management (AIRM) - The Institutes Risk and Insurance Knowledge Group

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

- Energy Risk Professional (ERP) - Global Association of Risk Professionals

- Certified Healthcare Financial Professional (CHFP) - Healthcare Financial Management Association

- Professional Risk Manager (PRM) - Global Risk Institute

Pro tip

Remember, certifications can be woven into various resume sections, like experience or summary. Detail how a particular certification enhanced your performance or opened new opportunities.

Recommended reads:

Choosing between a resume summary or objective based on your experience

The relevance of a resume summary or a resume objective for your treasury analyst application hinges on your experience.

Both provide a snapshot of your expertise and accomplishments. However:

- A resume objective emphasizes your career aspirations, ideal for candidates looking to balance their experience with future goals.

- A resume summary offers a space to detail your unique value and notable accomplishments, perfect for candidates with a rich career history.

Ensure your introduction aligns with the job description, and if possible, quantify details for a compelling narrative.

Resume summary and objective examples for a treasury analyst resume

- Accomplished treasury analyst with over 8 years of experience, possessing an in-depth understanding of risk management and financial forecasting. Proven track record in optimizing cash flow through data analysis and implementing efficient payment systems. Successfully managed a $100M investment portfolio at XYZ Corp.

- Seasoned Financial Analyst eager to transition into a treasury analyst role. Over 6 years in finance, offering a robust foundation in quantitative analysis, financial modeling, and risk assessment. Accolades include improving cost savings by 20% at ABC Company through strategic financial planning.

- A seasoned Professional Accountant with 5+ years of comprehensive experience, looking to leverage my knowledge of budgeting, auditing, and tax-related tasks to transition into a treasury analyst role. Awarded 'Accountant of the Year' for two consecutive years at DEF Corp for excellence in financial reporting and compliance.

- Treasury professional with more than 10 years under his belt, adept at liquidity management and working capital optimization. Familiar with treasury software and financial modeling. Noteworthy accomplishment includes reducing debt by 30% in FY2022 at GHI Inc, freeing up substantial resources for business expansion.

- Recently graduated Finance major seeking to launch a career as a treasury analyst. Holds a solid understanding of financial principles and a strong mathematical aptitude. Excited to apply academic knowledge to practical scenarios, contribute meaningfully to financial forecasting and cash management strategies.

- MBA graduate with focus in Finance aiming to establish a career as a treasury analyst. Equipped with a perceptive understanding of corporate finance, keen analytical skills and a determination to implement theoretical knowledge to drive effective financial decision-making.

Extra sections to include in your treasury analyst resume

What should you do if you happen to have some space left on your resume, and want to highlight other aspects of your profile that you deem are relevant to the role?

Add to your treasury analyst resume some of these personal and professional sections:

- Passions/Interests - to detail how you spend both your personal and professional time, invested in various hobbies;

- Awards - to present those niche accolades that make your experience unique;

- Publications - an excellent choice for professionals, who have just graduated from university or are used to a more academic setting;

- < a href="https://enhancv.com/blog/volunteering-on-resume/"> Volunteering - your footprint within your local (or national/ international) community.

Key takeaways

- The format and layout of your treasury analyst resume should reflect your career experience;

- Use the resume summary and objective to highlight your most prominent accomplishments;

- Always be specific about your experience and consider what value each bullet adds to your treasury analyst application;

- Consider how your academic background and technical capabilities could further showcase your alignment to the role;

- Your soft skills should contribute to your overall treasury analyst profile - aligning your personality with your professional self.