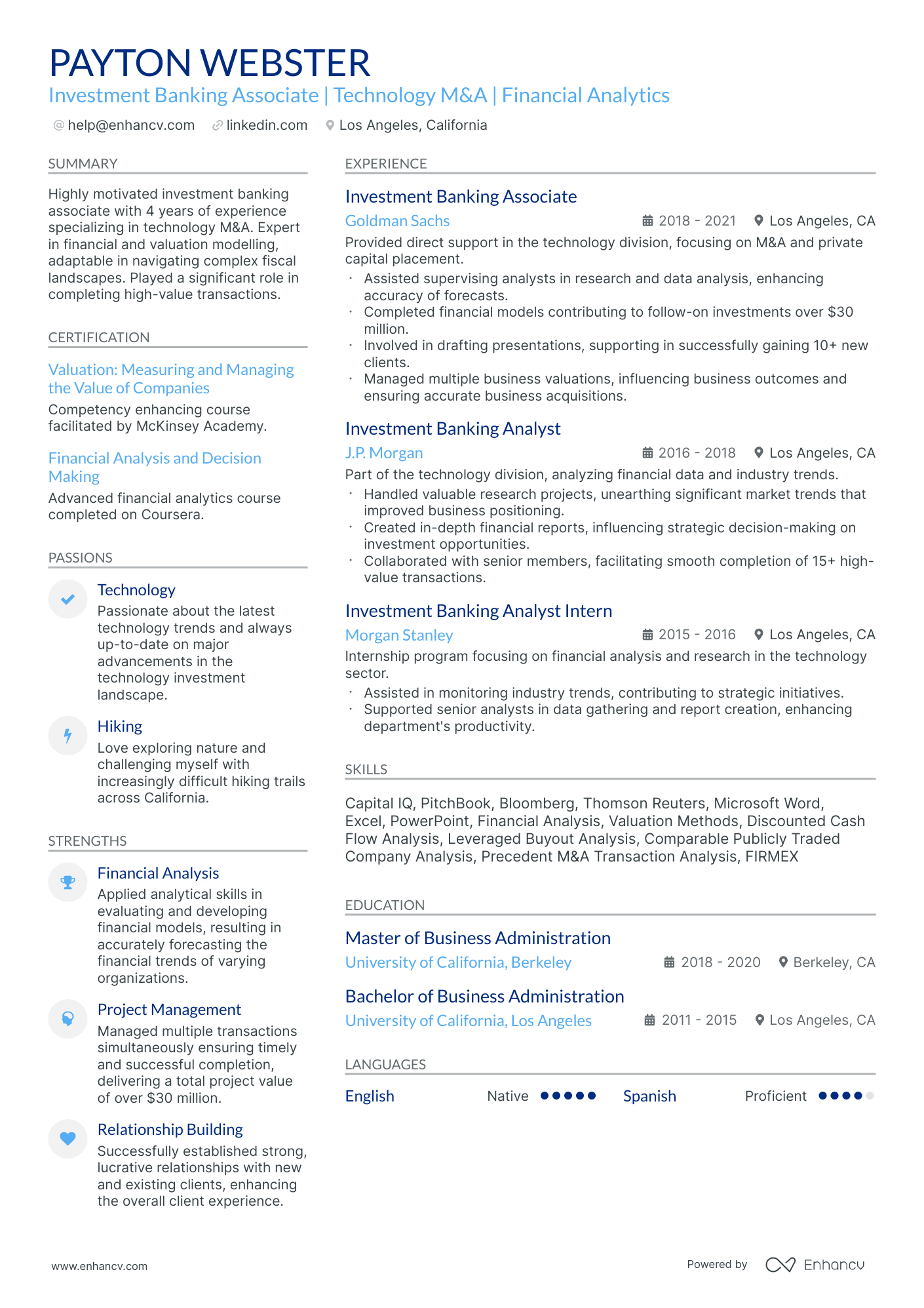

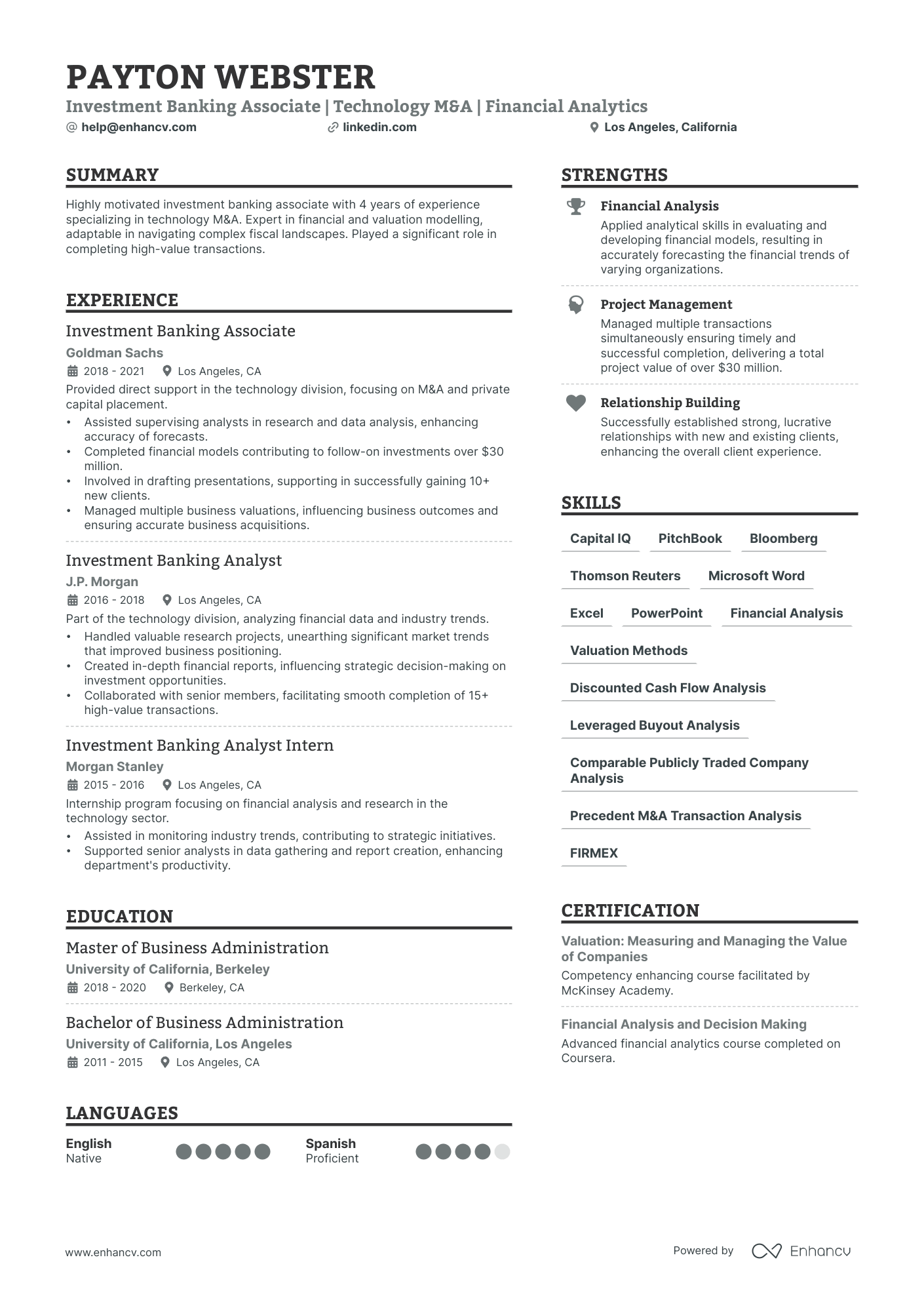

Investment banking associates often struggle with clearly articulating their complex financial projects and transactions in a concise yet effective way on their resumes. Our guide can assist in this challenge by providing specific examples and templates on how to effectively summarize such information, making it both understandable for non-specialists and impressive to industry professionals.

Dive into our investment banking associate resume guide to:

- Explore top-tier resume examples, offering insights into the industry's best practices.

- Enhance sections like experience, education, and achievements with expert advice.

- Articulate your technical prowess and personal attributes, setting you apart from other candidates.

- Sharpen your focus on the distinct skills that make your investment banking associate resume resonate with recruiters.

Recommended reads:

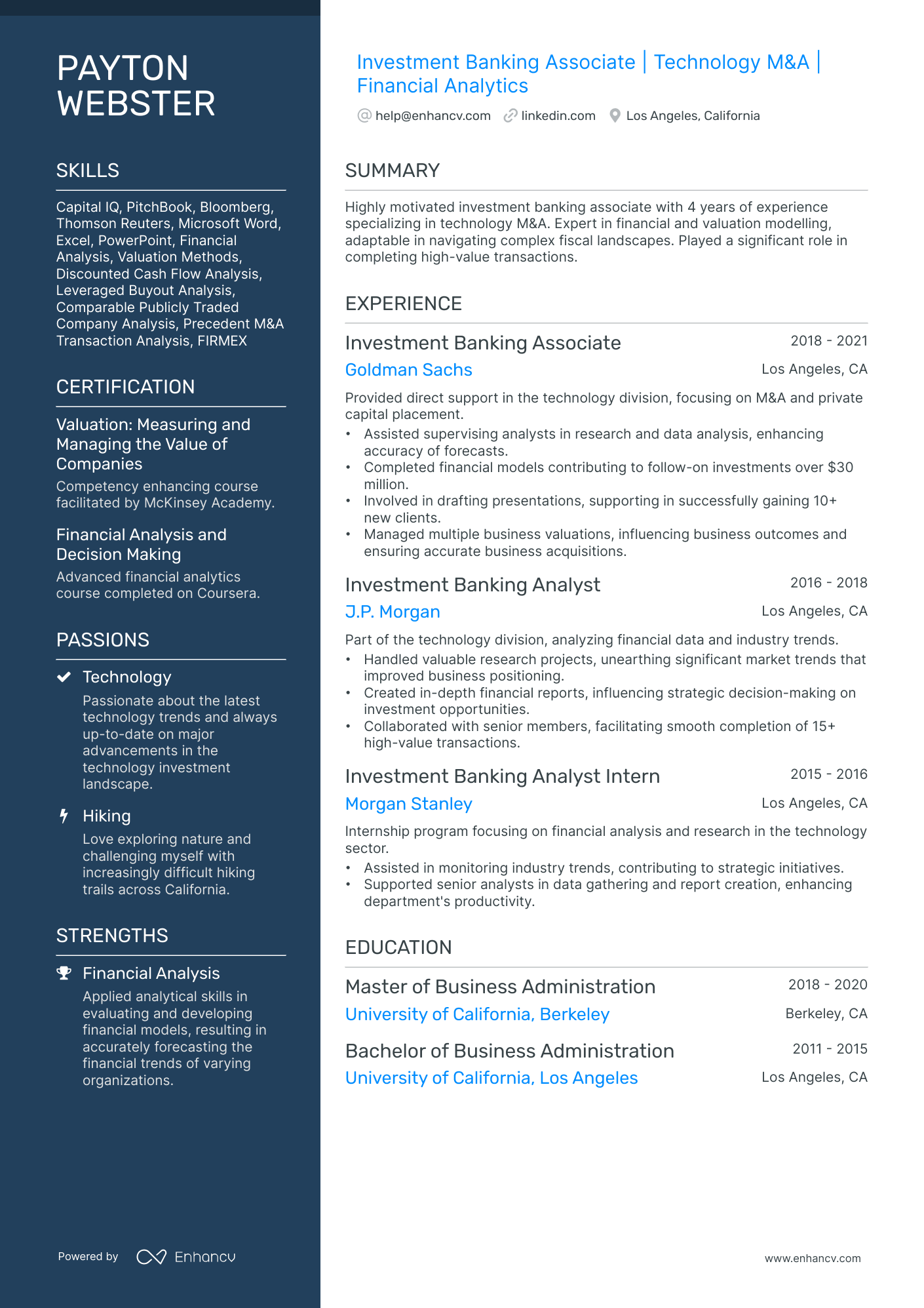

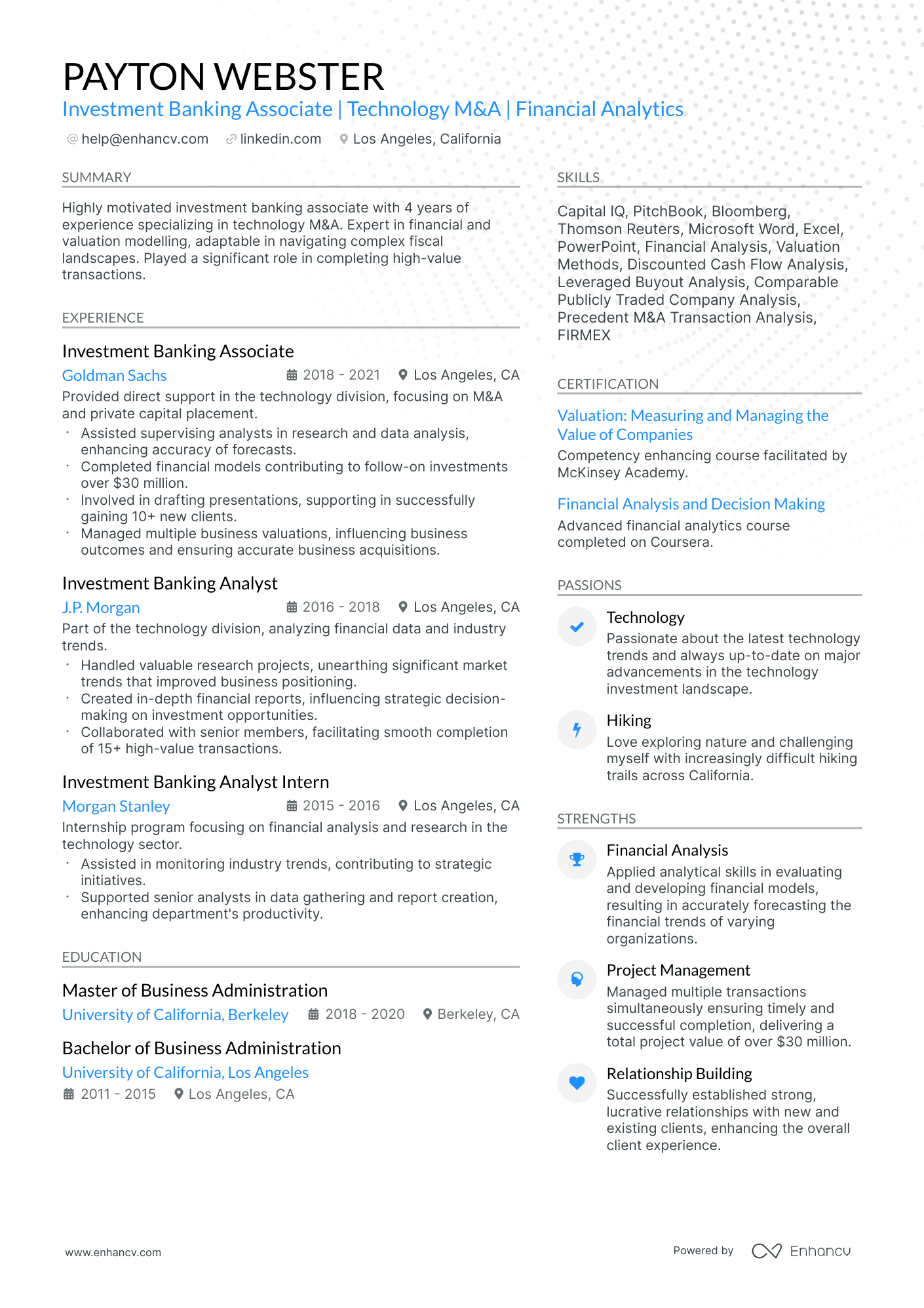

Tips for refining your investment banking associate resume format

The resume format sets the stage for your professional narrative. Ensure it:

- Adopts the reverse-chronological format, placing your most recent experiences at the forefront. This format is ideal for those with relevant and up-to-date experience.

- Features a clear headline, making it straightforward for recruiters to access your contact details, portfolio, or current role.

- Stays concise, ideally spanning no more than two pages, focusing on relevant experiences and skills.

- Maintains its layout by being saved as a PDF, ensuring compatibility with Applicant Tracking Systems (ATS).

Each market has its own resume standards – a Canadian resume layout may differ, for example.

Upload your resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Pro tip

If you don't happen to have that much relevant experience for the role, you could select a different format for your resume. Popular choices include:

- functional skill-based resume format - that puts the main focus on your skills and accomplishments;

- hybrid resume format - to get the best of both worlds with your investment banking associate experience and skills.

Must-have sections on a investment banking associate resume:

- A header to list your job title and contact information

- A resume summary or objective which highlights your top career achievements

- A detailed experience section where you emphasize the breadth of your expertise

- A skills box to put the spotlight on your social talents and technical strengths

- An education and certifications section which features your qualifications

What recruiters want to see on your resume:

- Experience in Financial Modeling: Demonstrating a robust understanding and application of various financial modeling techniques, such as discounted cash flow (DCF), leveraged buyout (LBO), or merger & acquisition (M&A) models is crucial.

- Deal Experience: Exposure to deal execution, including due diligence, transaction structuring, or negotiation, is highly sought after in an investment banking associate role.

- Industry Knowledge: Deep knowledge of specific industries or sectors, including trends, key drivers, and major players, can elevate your candidacy as it indicates your ability to provide strategic advice.

- Quantitative & Analytical Skills: Proficiency in the quantitative and analytical aspects of finance, such as financial statement analysis, valuation, and investment appraisals, are essential.

- Client Management Skills: As an associate, you need to demonstrate excellent client management skills, showcasing your experience in maintaining client relationships, managing expectations, and effectively communicating complex financial information.

Recommended reads:

Decoding the investment banking associate resume experience section

Once you've settled on your resume's format, the next step is detailing your professional journey.

Many investment banking associate professionals grapple with this section, especially when balancing between extensive or limited experience. Here's a roadmap to navigate this:

- Limit bullet points under each job role to six, focusing on high-impact contributions.

- Highlight achievements that resonate with the job's requirements, rather than just listing duties.

- Detail any on-the-job certifications or skills acquired and their relevance to your growth.

- Choose impactful verbs for each bullet, avoiding overused terms like "managed".

- Infuse relevant keywords from the job posting, especially in the context of accomplishments.

For more insights, explore these curated examples from seasoned investment banking associate professionals:

- Provided financial analysis and valuation for mergers and acquisitions transactions.

- Compiled comprehensive industry reports analyzing market trends and competitor performance.

- Assisted in the preparation of pitch books and presentations for client meetings.

- Developed complex financial models to assess investment opportunities and forecasted returns.

- Contributed to due diligence processes by conducting extensive research and data analysis.

- Executed equity and debt offerings, resulting in $500 million capital raised for clients.

- Collaborated with senior bankers to develop tailored financial solutions for corporate clients.

- Conducted company and industry research to identify potential investment opportunities.

- Prepared detailed transaction documents, including prospectuses and offering memorandums.

- Analyzed financial statements and conducted financial modeling to evaluate investment risks.

- Lead a team of analysts in executing buy-side and sell-side M&A transactions.

- Advised clients on strategic financial decisions, resulting in improved profitability.

- Developed and maintained relationships with key institutional investors and clients.

- Implemented process improvements to streamline deal execution and enhance efficiency.

- Performed detailed company and industry research to support investment recommendations.

- Managed initial public offerings (IPOs) and secondary equity offerings for technology firms.

- Analyzed market trends and investor sentiment to determine optimal offering prices.

- Collaborated with cross-functional teams to develop marketing strategies for IPO launches.

- Advised clients on capital structure optimization and financial risk management.

- Led due diligence processes, coordinating with legal, accounting, and regulatory teams.

- Managed leveraged finance transactions, securing over $1 billion in debt financing for clients.

- Conducted credit analysis and assessed project feasibility for infrastructure investments.

- Negotiated terms and conditions with lenders, resulting in favorable financing arrangements.

- Collaborated with internal teams to structure complex debt instruments and securities.

- Provided financial advisory services to clients, assisting in capital raising strategies.

- Assisted in the execution of global mergers and acquisitions transactions worth $5 billion.

- Conducted due diligence, analyzing financial statements and assessing investment risks.

- Supported senior bankers in client presentations, preparing detailed financial analyses.

- Contributed to the development of marketing materials and pitch books for potential clients.

- Performed valuation analyses, including discounted cash flow (DCF) and comparable company methods.

- Developed financial models to evaluate investment opportunities in the renewable energy sector.

- Analyzed project feasibility, assessing risks and returns for potential investors.

- Contributed to the structuring and negotiation of project finance deals for renewable energy projects.

- Conducted due diligence on prospective clients, evaluating their financial stability and viability.

- Assisted in the preparation of investor presentations and investment memorandums.

- Advised clients on capital raising strategies, facilitating successful debt and equity offerings.

- Led cross-functional teams in conducting financial analyses and valuation for transactions.

- Built and maintained relationships with institutional investors and private equity firms.

- Played a key role in negotiating complex deal structures and terms with counterparties.

- Provided strategic guidance to clients, analyzing market trends and competitor activities.

- Assisted senior bankers in executing leveraged buyout (LBO) and restructuring transactions.

- Performed detailed financial analysis to assess company valuation and investment potential.

- Supported the preparation of client presentations and pitch materials.

- Conducted industry research and competitive benchmarking to identify market opportunities.

- Analyzed debt structures and financial statements to evaluate credit risks.

- Managed a portfolio of high-net-worth clients, providing tailored investment advice.

- Conducted comprehensive financial planning and risk assessment for client portfolios.

- Performed due diligence on various investment opportunities and asset classes.

- Collaborated with research analysts to develop investment strategies and recommendations.

- Delivered presentations to clients, communicating complex financial concepts in a clear manner.

Quantifying impact on your resume

<ul>

Strategies for candidates with limited resume experience

Lack of extensive experience doesn't mean you can't make a strong impression. Here's how:

- Thoroughly understand the role's requirements and reflect them in key resume sections.

- Highlight transferable skills and personal attributes that make you a valuable candidate.

- Use the resume objective to articulate your growth vision within the company.

- Emphasize technical alignment through relevant certifications, education, and skills.

Remember, your resume's primary goal is to showcase how you align with the ideal candidate profile. The closer you match the job requirements, the higher your chances of securing an interview.

Recommended reads:

Pro tip

Your experience section should be a testament to your professional growth. If your career journey isn't particularly linear or impressive, focus on detailing specific skills and the tangible outcomes of your responsibilities.

Spotlighting your investment banking associate hard and soft skills

Hard skills denote your technological proficiency and expertise in specific tools or software. These skills are often validated through certifications and hands-on experience.

Soft skills, on the other hand, reflect your interpersonal abilities and how you navigate workplace dynamics. These skills are cultivated over a lifetime and can be more nuanced.

Why the emphasis on both? Hard skills demonstrate your technical competence and reduce training needs. Soft skills suggest adaptability and cultural fit.

To optimize your skills section:

- Forego basic skills like "Excel" in favor of more specific proficiencies like "Excel Macros".

- Highlight core values and work ethics as soft skills, indicating what you prioritize in a professional setting.

- If relevant, create a distinct section for language proficiencies.

- Balance hard and soft skills by crafting a strengths or achievements section, illustrating outcomes achieved through both skill sets.

To assist you, we've curated a list of skills highly sought after by recruiters. Ensure you integrate those that resonate with your expertise and the prospective employer's needs:

Top skills for your investment banking associate resume:

Financial Modeling

Valuation Techniques

Excel

PowerPoint

Bloomberg Terminal

Pitchbook

Mergers and Acquisitions (M&A) Analysis

Debt and Equity Financing

Capital Markets Knowledge

SQL

Analytical Thinking

Attention to Detail

Communication Skills

Teamwork

Time Management

Problem-Solving

Adaptability

Negotiation Skills

Client Relationship Management

Work Ethic

Pro tip

Don't go all over the place with your skills section by listing all keywords/ buzzwords you see within the ad. Curate both hard and soft skills that are specific to your professional experience and help you stand out.

Highlighting education and certification on your investment banking associate resume

Your education section is a testament to your foundational knowledge and expertise.

Consider:

- Detailing your academic qualifications, including the institution and duration.

- If you're still studying, mention your anticipated graduation date.

- Omit degrees that aren't pertinent to the job.

- Highlight academic experiences that underscore significant milestones.

For investment banking associate roles, relevant education and certifications can set you apart.

To effectively showcase your qualifications:

- List all pertinent degrees and certifications in line with the job requirements.

- Include additional certifications if they bolster your application.

- Provide concise details: certification name, institution, and dates.

- If you're pursuing a relevant certification, indicate your expected completion date.

Your education and certification sections validate both your foundational and advanced knowledge in the industry.

Best certifications to list on your resume

- Chartered Financial Analyst (CFA), CFA Institute

- General Securities Representative Exam (Series 7), FINRA

- Financial Risk Manager (FRM), Global Association of Risk Professionals (GARP)

- Uniform Securities Agent State Law Examination (Series 63), FINRA

- Investment Banking Representative Exam (Series 79), FINRA

- Certified Financial Planner (CFP), Certified Financial Planner Board of Standards

Pro tip

Listing your relevant degrees or certificates on your investment banking associate resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but also at a range of soft skills, including perseverance, adaptability, and motivation.

Recommended reads:

Summary or objective: making your investment banking associate resume shine

Start your resume with a strong summary or objective to grab the recruiter's attention.

- Use a resume objective if you're newer to the field. Share your career dreams and strengths.

- Opt for a resume summary if you have more experience. Highlight up to five of your top achievements.

Tailor your summary or objective for each job. Think about what the recruiter wants to see.

Resume summary and objective examples for a investment banking associate resume

- Highly motivated professional with 5 years of experience in private equity, now seeking a transition to investment banking. Demonstrated proficiency in financial modeling, due diligence, and market analysis. Remarkable accomplishment includes successfully closing deals worth $500M.

- Seasoned Index Fund Manager with over 7 years' experience managing portfolios valuing up to $1B, transferring expertise into the realm of Investment Banking. Proficient in quantitative analysis, risk management, and Bloomberg Terminal usage. Noteworthy achievement: Outperformed the S&P 500 index by 20% for three consecutive years.

- Determined Financial Analyst with 4 years of experience and demonstrated knowledge of investment strategies, eager to shift to investment banking. Skilled in analyzing company finances and industry trends. Successfully improved efficiency in financial reporting processes by 30% within the first six months of work.

- Experienced corporate lawyer with 8 years of handling mergers & acquisitions, targeting a career pivot into investment banking. Possesses deep understanding of regulatory compliance and contract negotiation, coupled with a proven record of facilitating deals above $2B mark.

- Graduate in Finance from Harvard University, aspiring to leverage my academic knowledge in real-world investment banking scenarios. Known for excellent analytical skills and keen interest in capital markets. Aims to enhance profitability and financial performance through strategic decision-making.

- MBA graduate with focus on finance, aiming to apply learned principles and methodologies to an entry-level position in investment banking. Exhibits proficiency in financial modeling and forecasting. Strong desire to assist in driving financial growth and stability.

Enhancing your investment banking associate resume with additional sections

Make your investment banking associate resume truly distinctive by adding supplementary sections that showcase:

- Awards that underscore your industry recognition.

- Projects that bolster your application's relevance.

- Hobbies, if they can further your candidacy by revealing facets of your personality.

- Community involvement to highlight causes you champion.

Key takeaways

- Pay special attention to the tiny details that make up your investment banking associate resume formatting: the more tailored your application to the role is, the better your chances at success would be;

- Select the sections you include (summary or objective, etc.) and formatting (reverse-chronological, hybrid, etc.) based on your experience level;

- Select experience items and, consequently, achievements that showcase you in the best light and are relevant to the job;

- Your profile will be assessed both based on your technical capabilities and personality skills - curate those through your resume;

- Certifications and education showcase your dedication to the particular industry.