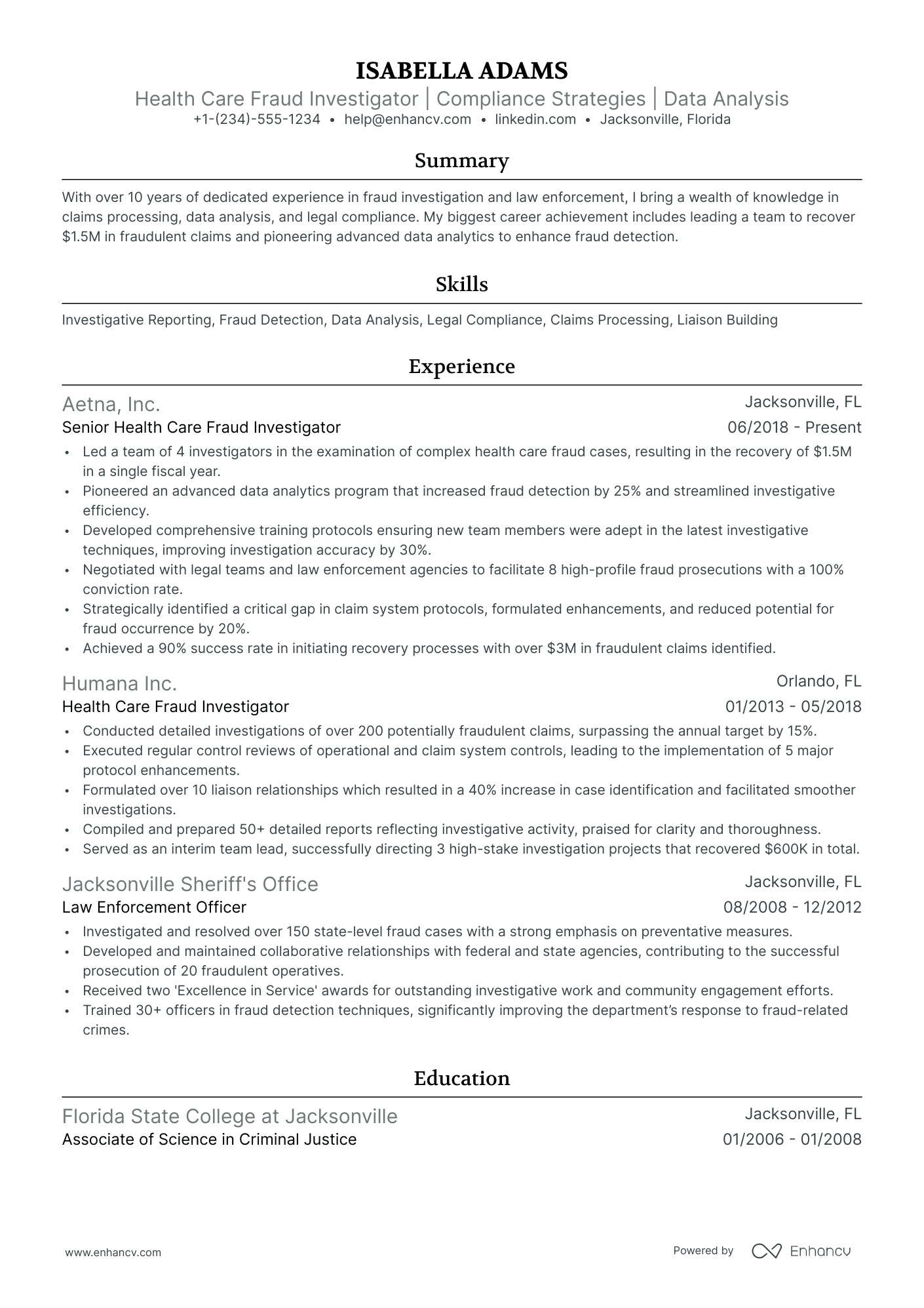

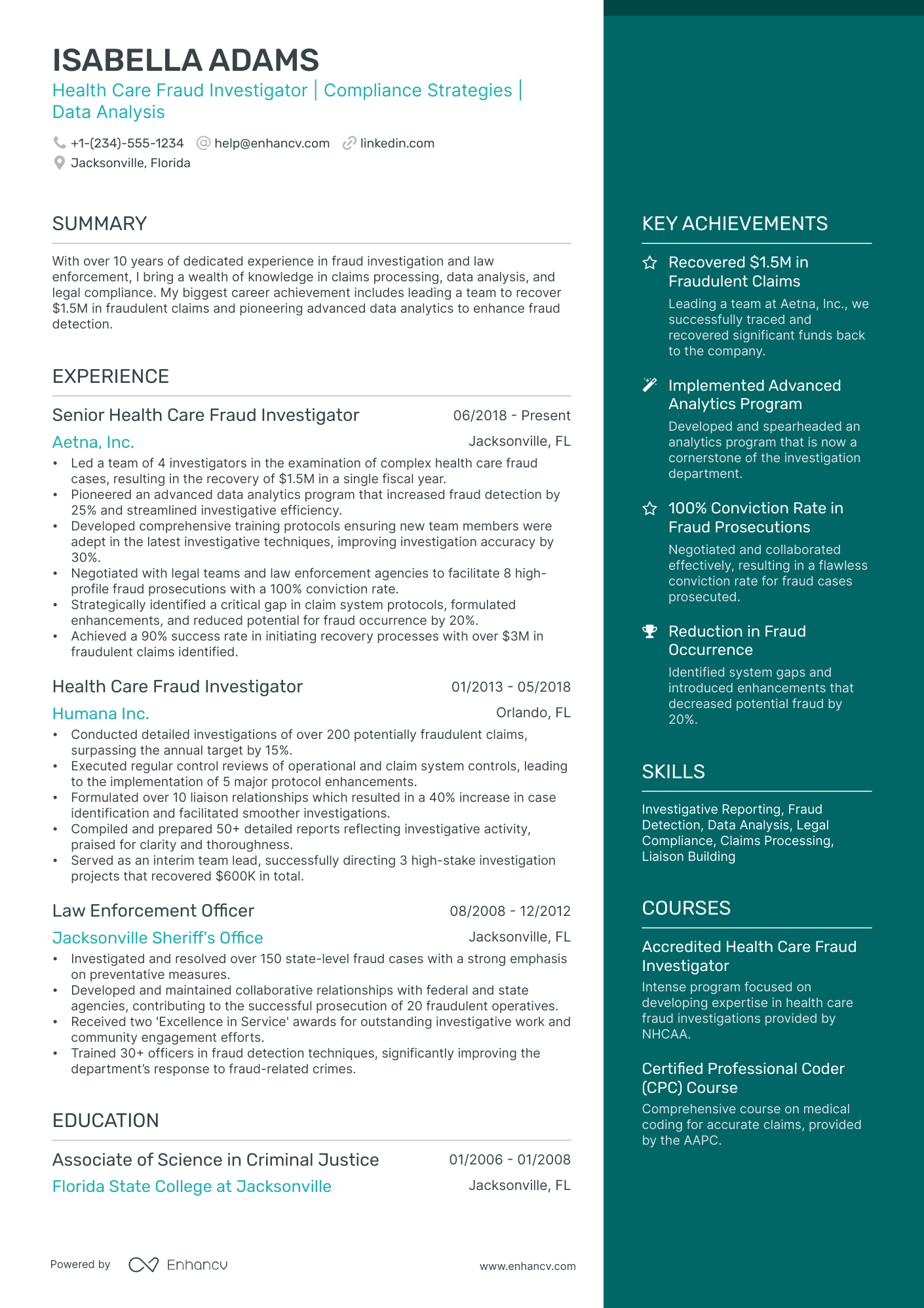

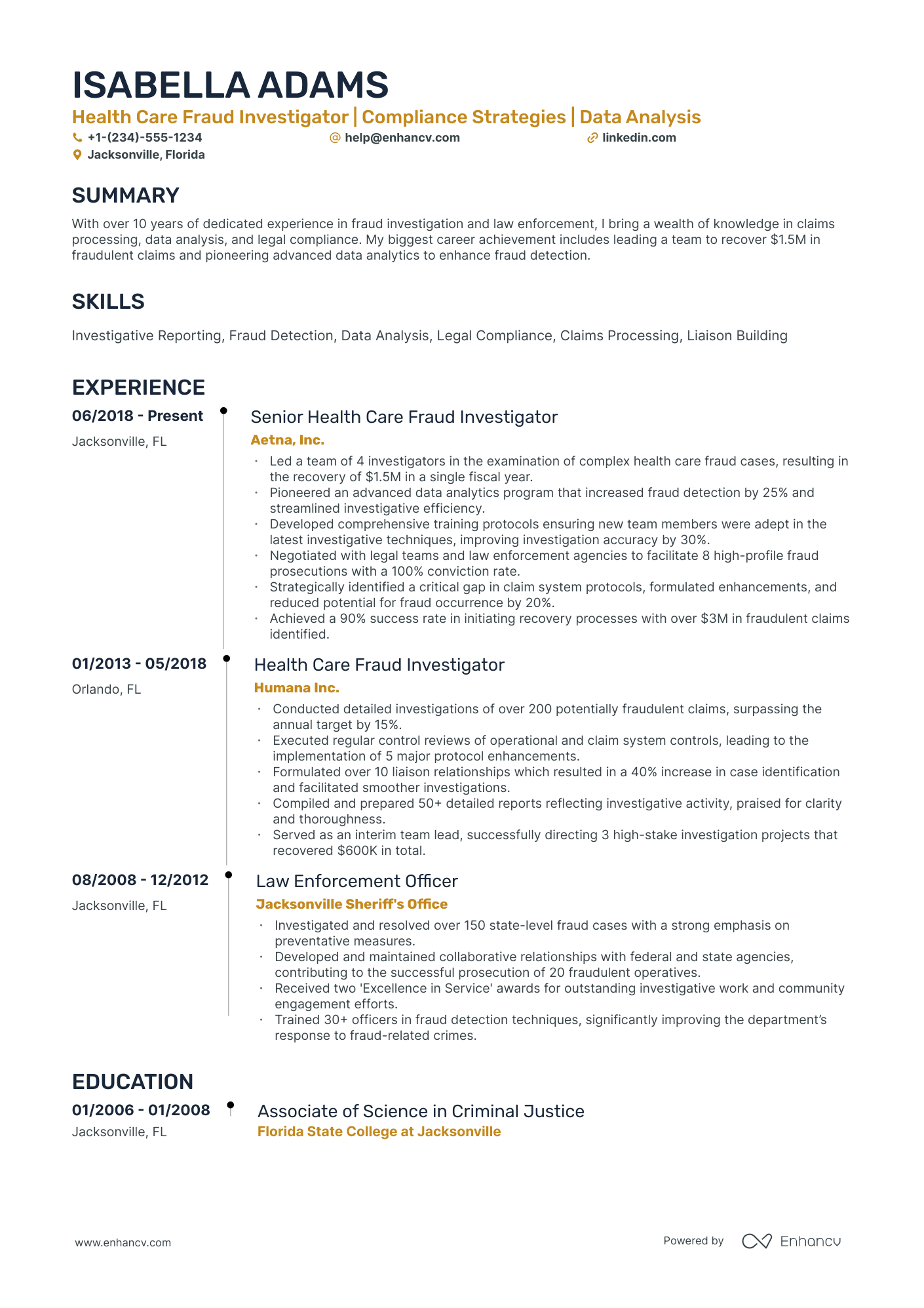

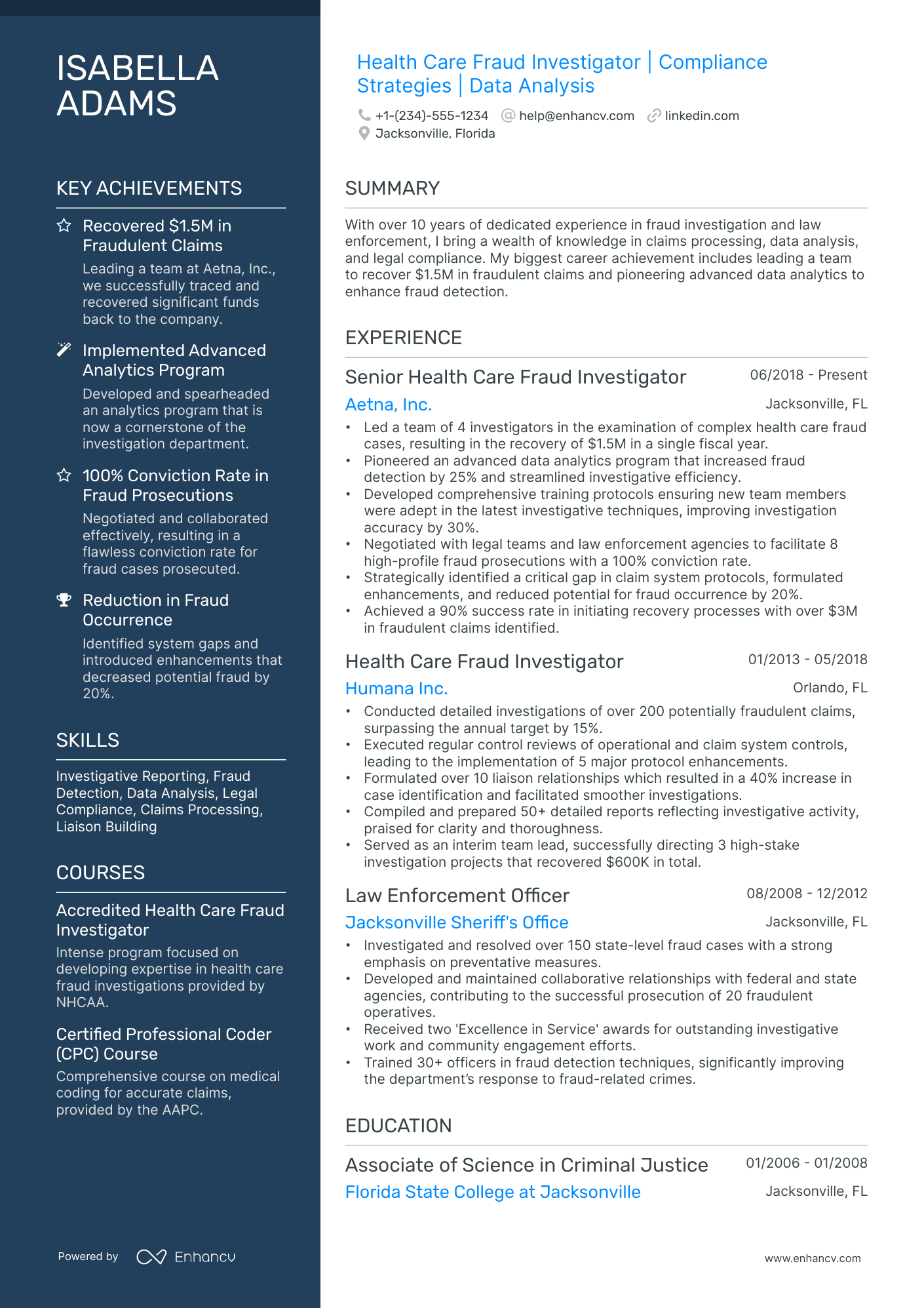

As a fraud investigator, one common resume challenge is effectively highlighting your analytical skills and experience in a way that stands out to potential employers. Our guide offers targeted advice and examples designed to showcase your investigative expertise and help your resume make a compelling case for your hire.

- Defining the highlights of your fraud investigator career through your resume summary, objective, and experience.

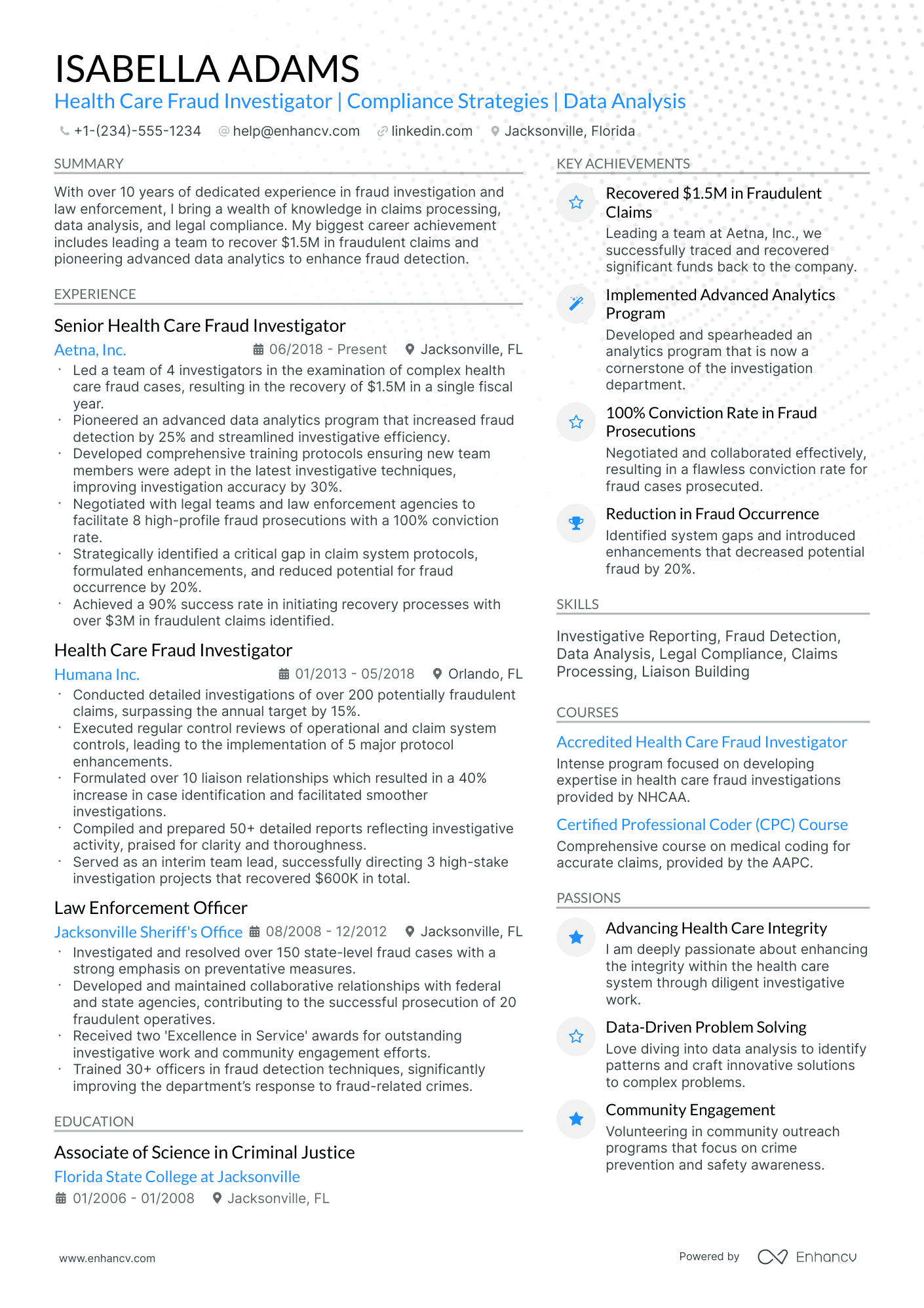

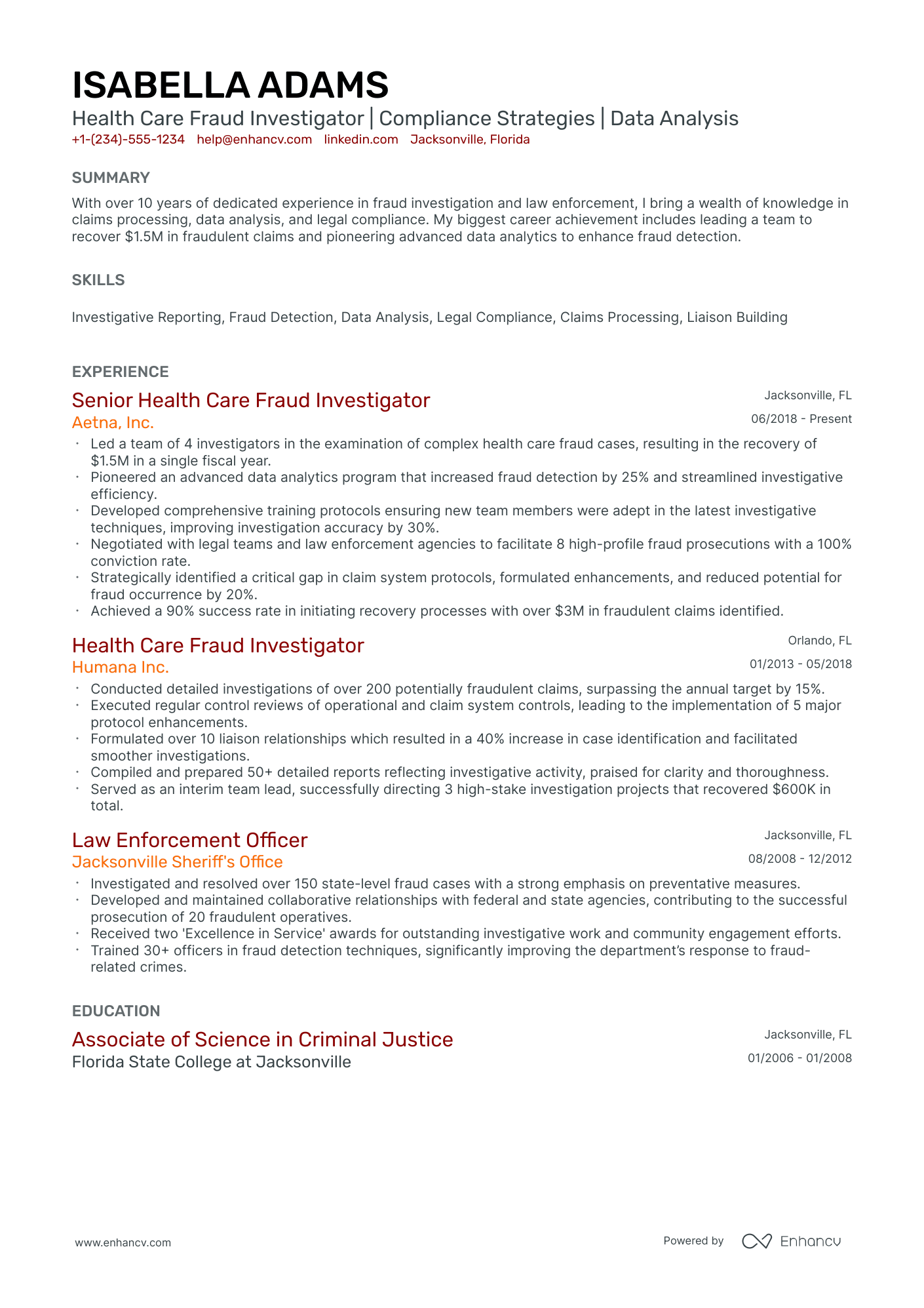

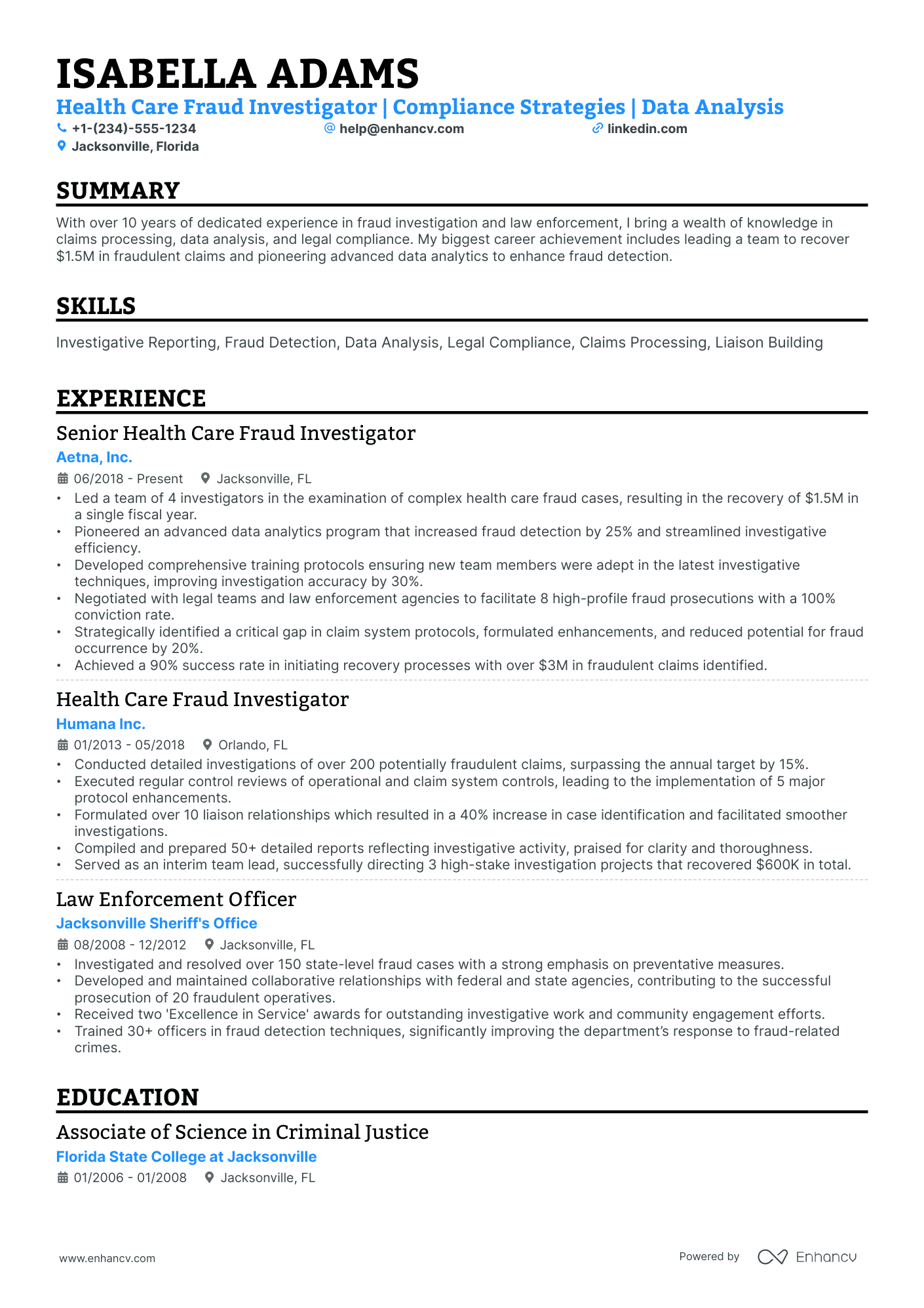

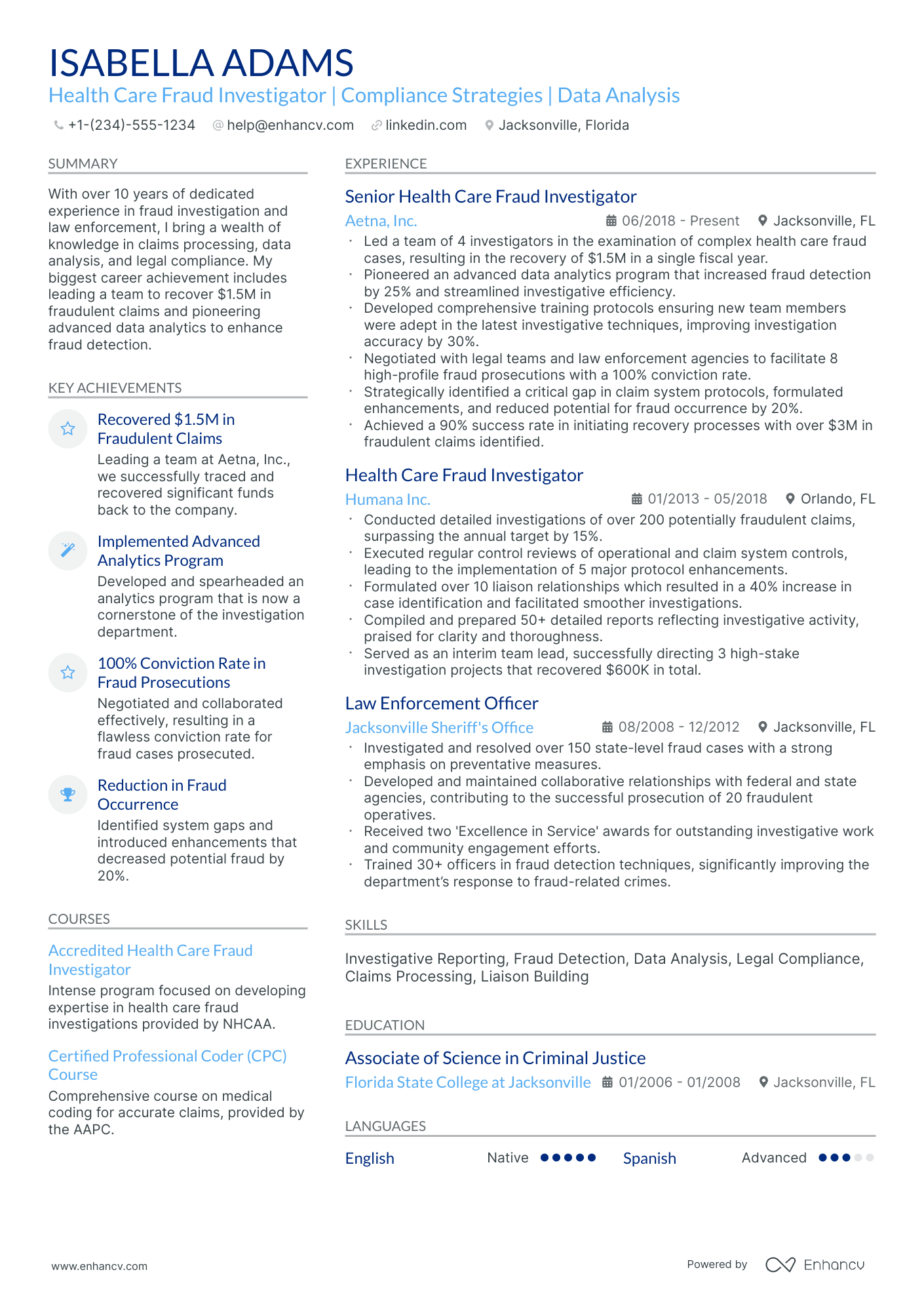

- Real-world fraud investigator resume samples with best practices on how to stand out amongst the endless pile of candidate resumes.

- Most in-demand fraud investigator resume skills and certifications across the industry.

- Standardizing your resume layout, while maintaining your creativity and individuality.

If the fraud investigator resume isn't the right one for you, take a look at other related guides we have:

Designing your fraud investigator resume format to catch recruiters' eyes

Your fraud investigator resume will be assessed on a couple of criteria, one of which is the actual presentation.

Is your resume legible and organized? Does it follow a smooth flow?

Or have you presented recruiters with a chaotic document that includes everything you've ever done in your career?

Unless specified otherwise, there are four best practices to help maintain your resume format consistency.

- The top one third of your fraud investigator resume should definitely include a header, so that recruiters can easily contact you and scan your professional portfolio (or LinkedIn profile).

- Within the experience section, list your most recent (and relevant) role first, followed up with the rest of your career history in a reverse-chronological resume format .

- Always submit your resume as a PDF file to sustain its layout. There are some rare exceptions where companies may ask you to forward your resume in Word or another format.

- If you are applying for a more senior role and have over a decade of applicable work experience (that will impress recruiters), then your fraud investigator resume can be two pages long. Otherwise, your resume shouldn't be longer than a single page.

Be mindful of regional differences in resume formats – a Canadian layout, for instance, might vary.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you happen to have some basic certificates, don't invest too much of your fraud investigator resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

Fundamental sections for your fraud investigator resume:

- The header with your name (if your degree or certification is impressive, you can add the title as a follow up to your name), contact details, portfolio link, and headline

- The summary or objective aligning your career and resume achievements with the role

- The experience section to curate neatly organized bullets with your tangible at-work-success

- Skills listed through various sections of your resume and within an exclusive sidebar

- The education and certifications for more credibility and industry-wide expertise

What recruiters want to see on your resume:

- Demonstrated analytical and investigative skills with a track record of successfully resolving complex fraud cases.

- Proficiency in using fraud detection software and forensic accounting tools to identify discrepancies and gather evidence.

- Knowledge of financial regulations, anti-fraud standards, and legal proceedings related to fraud and financial crimes.

- Excellent attention to detail and ability to remain unbiased and ethical while conducting investigations.

- Strong interpersonal and communication skills to coordinate with law enforcement, legal teams, and financial institutions.

Adding your relevant experience to your fraud investigator resume

If you're looking for a way to show recruiters that your expertise is credible, look no further than the resume experience section.

Your fraud investigator resume experience can be best curated in a structured, bulleted list detailing the particulars of your career:

- Always integrate metrics of success - what did you actually achieve in the role?

- Scan the fraud investigator advert for your dream role in search of keywords in the job requirements - feature those all through your past/current experience;

- Dedicate a bullet (or two) to spotlight your technical capabilities and how you're able to use the particular software/technology in your day-to-day roles;

- Write simple by including your responsibility, a job advert keyword or skill, and a tangible outcome of your success;

- Use the experience section to also define the unique value of working with you in the form of soft skills, relevant feedback, and the company culture you best thrive in.

Industry leaders always ensure that their resume experience section offers an enticing glimpse at their expertise, while telling a career narrative. Explore these sample fraud investigator resumes on how to best create your resume experience section.

- Led a team of 5 investigators in uncovering a sophisticated credit card fraud scheme, securing evidence that led to the arrest of 10 individuals.

- Implemented new digital forensic techniques to analyze financial data, which increased the detection of fraudulent transactions by 25%.

- Managed cross-functional collaboration with IT and Legal departments to streamline the investigation process, decreasing case resolution times by 30%.

- Investigated complex insurance fraud cases involving staged accidents and false claims, resulting in over $2 million in recovered assets.

- Developed and conducted fraud awareness training for over 100 employees, enhancing company-wide vigilance and reducing potential fraud incidents.

- Authored comprehensive fraud investigation reports that were used as a model for improving reporting procedures across regional offices.

- Utilized advanced analytics to identify patterns in large datasets, pinpointing fraudulent activities within the company's e-commerce platform.

- Collaborated with payment processors to develop safeguards that reduced fraudulent chargebacks by 40% over a two-year period.

- Orchestrated the roll-out of a predictive fraud detection system, increasing proactive fraud detection by 50%.

- Oversee investigations of internal fraud cases by leveraging comprehensive knowledge of banking regulations and financial crime analysis.

- Initiated a partnership with cybersecurity teams to thwart phishing attacks, thereby safeguarding customer accounts and maintaining the integrity of the banking network.

- Increased the effectiveness of the bank's fraud prevention strategies by conducting detailed trend analyses and adjusting protocols accordingly.

- Played a pivotal role in a task force that cracked down on identity theft rings, contributing to a 35% decline in identity fraud cases in the region.

- Formulated and executed the adoption of biometric authentication measures, dramatically reducing the rate of fraudulent account access.

- Identified a critical security vulnerability within the customer database and spearheaded an initiative to enhance data encryption protocols.

- Directed forensic accounting reviews for suspected financial irregularities, recovering misappropriated funds approaching $5 million.

- Spearheaded the development of an internal whistleblower program that led to a 75% increase in reported suspicions of fraud within one fiscal year.

- Crafted detailed investigative strategies for use in high-profile regulatory compliance investigations, supporting both local and federal law enforcement agencies.

- Facilitated multinational coordination to dismantle an extensive wire fraud operation, resulting in the safeguarding of approximately $3.5 million in potential losses.

- Developed a proprietary fraud detection algorithm that improved the capture rate of suspicious financial transfers by 60%.

- Cultivated and managed relationships with international law enforcement, which were instrumental in pursuing cross-border financial investigations.

- Leader of a high-profile project that integrated machine learning techniques into fraud risk models, reducing false positive alerts by 45% and enhancing operational efficiency.

- Executed comprehensive due diligence investigations on new merchant accounts, reducing the likelihood of onboarding fraudulent entities by 70%.

- Fostered strategic partnerships with technology service providers to ensure continuous updating and optimization of fraud detection systems.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for fraud investigator professionals.

Top Responsibilities for Fraud Investigator:

- Gather financial documents related to investigations.

- Interview witnesses or suspects and take statements.

- Prepare written reports of investigation findings.

- Document all investigative activities.

- Create and maintain logs, records, or databases of information about fraudulent activity.

- Coordinate investigative efforts with law enforcement officers and attorneys.

- Lead, or participate in, fraud investigation teams.

- Testify in court regarding investigation findings.

- Prepare evidence for presentation in court.

- Recommend actions in fraud cases.

Quantifying impact on your resume

- Include the number of fraud cases you have successfully investigated and resolved to demonstrate your effectiveness.

- List the total amount of money you have recovered or helped to save through your investigative work.

- Mention the percentage reduction in fraudulent activities as a result of your interventions.

- Highlight the number of fraud prevention initiatives you have implemented to illustrate your proactive approach.

- Detail the size of teams you have led or collaborated with on fraud investigations to show leadership and teamwork skills.

- Quantify the number of training sessions you've conducted on fraud awareness and prevention to exhibit your educational contributions.

- Specify the range of industries or sectors you have experience in to showcase your versatility and breadth of knowledge.

- Report the number of analytical tools and software you are proficient with to underline your technical capabilities.

Action verbs for your fraud investigator resume

No relevant experience - what to feature instead

Suppose you're new to the job market or considering a switch in industry or niche. In such cases, it's common to have limited standard professional experience. However, this isn't a cause for concern. You can still craft an impressive fraud investigator resume by emphasizing other sections, showing why you're a great fit for the role:

- Emphasize your educational background and extracurricular activities to demonstrate your industry knowledge;

- Replace the typical experience section with internships or temporary jobs where you've gained relevant skills and expertise;

- Highlight your unique skill set, encompassing both technological and personal abilities;

- Showcase transferable skills acquired throughout your life and work experiences so far.

Recommended reads:

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

The heart and soul of your fraud investigator resume: hard skills and soft skills

If you read between the lines of the fraud investigator role you're applying for, you'll discover that all requirements are linked with candidates' hard skills and soft skills.

What do those skills have to do with your application?

Hard or technical skills are the ones that hint at your aptitude with particular technologies. They are easy to quantify via your professional experience or various certifications.

Meanwhile, your soft skills are more difficult to assess as they are personality traits, you've gained thanks to working in different environments/teams/organizations.

Your fraud investigator resume skills section is the perfect opportunity to shine a light on both types of skills by:

- Dedicating a technical skills section to list up to six technologies you're apt at.

- Focusing a strengths section on your achievements, thanks to using particular people skills or technologies.

- Including a healthy balance of hard and soft skills in the skills section to answer key job requirements.

- Creating a language skills section with your proficiency level - to hint at an abundance of soft skills you've obtained, thanks to your dedication to learning a particular language.

Within the next section of this guide, stay tuned for some of the most trending hard skills and soft skills across the industry.

Top skills for your fraud investigator resume:

Data Analysis Software

Fraud Detection Tools

SQL

Excel

Forensic Accounting Techniques

Case Management Systems

Network Analysis Tools

Data Visualization Tools

Machine Learning Algorithms

Statistical Analysis Software

Critical Thinking

Attention to Detail

Problem Solving

Communication

Analytical Skills

Interpersonal Skills

Decision Making

Time Management

Adaptability

Ethical Judgement

Next, you will find information on the top technologies for fraud investigator professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Fraud Investigator’s resume:

- Tableau

- TIBCO Spotfire

- Microsoft PowerPoint

- Microsoft SQL Server

- Structured query language SQL

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

How to include your education and certifications on your resume

We're taking you back to your college days with this part of our guide, but including your relevant higher education is quite important for your resume.

Your degree shows recruiters your dedication to the industry, your recent and relevant know-how, and some form of experience in the field.

Your fraud investigator resume education should:

- Include your applicable degrees, college (-s) you've graduated from, as well as start and end dates of your higher education;

- Skip your high school diploma. If you still haven't graduated with your degree, list that your higher education isongoing;

- Feature any postgraduate diplomas in your resume header or summary - this is the perfect space to spotlight your relevant MBA degree;

- Showcase any relevant coursework, if you happen to have less professional experience and think this would support your case in being the best candidate for the role.

As far as your job-specific certificates are concerned - choose up to several of the most recent ones that match the job profile, and include them in a dedicated section.

We've saved you some time by selecting the most prominent industry certificates below.

The top 5 certifications for your fraud investigator resume:

- Certified Fraud Examiner (CFE) - Association of Certified Fraud Examiners

- Accredited fraud investigator (AFI) - National Healthcare Anti-Fraud Association

- Certified Financial Crime Specialist (CFCS) - Association of Certified Financial Crime Specialists

- Certified Anti-Money Laundering Specialist (CAMS) - Association of Certified Anti-Money Laundering Specialists

- Certified Forensic Interviewer (CFI) - International Association of Interviewers

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for fraud investigator professionals.

Top US associations for a Fraud Investigator professional

- AICPA and CIMA

- ASIS International

- Association of Certified Fraud Examiners

- CFA Institute

- Financial Industry Regulatory Authority

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

Recommended reads:

The fraud investigator resume summary or objective: integrating keywords, achievements, and more

Deciding whether to include a resume summary or an objective in your fraud investigator resume is crucial. Both serve as key introductory elements at the top of your resume, encapsulating your profile in up to five sentences and incorporating relevant keywords from the job advert.

Here are the key differences between the two:

- The resume summary focuses on aligning your achievements and experience with the job requirements. It provides recruiters with a snapshot of your expertise, helping you stand out as an ideal candidate for the role.

- The resume objective, on the other hand, centers on your career goals and aspirations, detailing how the role aligns with your career progression. It's particularly suitable for candidates with less professional experience or those new to the job market.

Below are examples demonstrating best practices in utilizing the resume summary and/or objective to make a strong first impression with your fraud investigator resume.

Resume summaries for a fraud investigator job

- With over 8 years of specialized experience in forensic accounting and fraud investigation within the financial sector, I've developed advanced analytical skills and a proven track record in uncovering financial discrepancies and fraud schemes. Recognized for leading high-profile investigations that resulted in the recovery of multimillion-dollar losses.

- Accomplished former law enforcement officer with a decade's expertise in investigative work, shifting focus to fraud investigation in the financial industry. Skilled in interview techniques and evidence gathering, I have a deep understanding of criminal behaviors which inform my approach to complex fraud cases.

- A seasoned IT professional with 12 years' experience in cybersecurity, embarking on a new path in fraud investigation. Possessing strong technical skills and a keen eye for security vulnerabilities, I bring a unique perspective to the detection and prevention of sophisticated, technology-driven fraud attempts.

- As a former auditor bringing five years of rigorous financial examination experience to the table, I am transitioning into the realm of fraud investigation. My extensive background in compliance and risk management equips me with the necessary tools to meticulously dissect financial records and identify fraudulent activities.

- Eager to embark on a career in fraud investigation, leveraging my recent degree in criminal justice and keen interest in financial crimes. Passionate about applying my academic knowledge, strong analytical abilities, and unwavering integrity to assist in resolving fraud cases and upholding the highest standards of justice.

- Driven by a desire to protect consumers and businesses, I aim to contribute my fresh perspective and relentless dedication as I seek a starting position in fraud investigation. I bring with me an unyielding ethical framework, critical thinking skills, and a commitment to learn and grow within the industry.

Average salary info by state in the US for fraud investigator professionals

Local salary info for Fraud Investigator.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $78,310 |

| California (CA) | $78,500 |

| Texas (TX) | $65,000 |

| Florida (FL) | $62,820 |

| New York (NY) | $100,690 |

| Pennsylvania (PA) | $75,820 |

| Illinois (IL) | $89,480 |

| Ohio (OH) | $83,610 |

| Georgia (GA) | $72,330 |

| North Carolina (NC) | $78,010 |

| Michigan (MI) | $75,430 |

More sections to ensure your fraud investigator resume stands out

If you're looking for additional ways to ensure your fraud investigator application gets noticed, then invest in supplementing your resume with extra sections, like:

These supplementary resume sections show your technical aptitude (with particular technologies and software) and your people skills (gained even outside of work).

Key takeaways

At the end of our guide, we'd like to remind you to:

- Invest in a simple, modern resume design that is ATS friendly and keeps your experience organized and legible;

- Avoid just listing your responsibilities in your experience section, but rather focus on quantifiable achievements;

- Always select resume sections that are relevant to the role and can answer job requirements. Sometimes your volunteering experience could bring more value than irrelevant work experience;

- Balance your technical background with your personality traits across various sections of your resume to hint at how much time employers would have to invest in training you and if your profile would be a good cultural fit to the organization;

- Include your academic background (in the form of your relevant higher education degrees and certifications) to show recruiters that you have the technical basics of the industry covered.