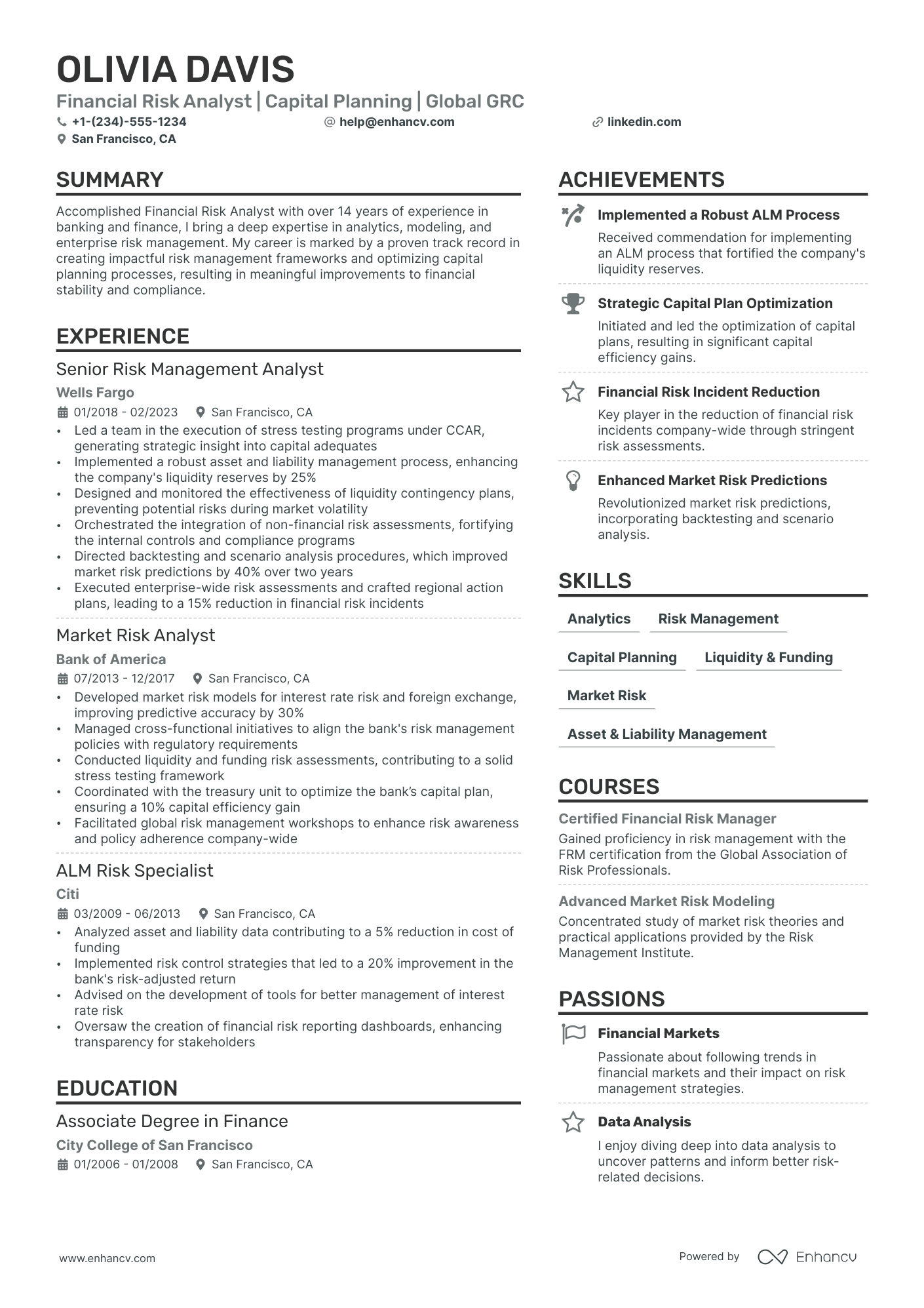

As a financial risk analyst, articulating your complex quantitative skills and conveying the impact of your risk mitigation strategies in a concise resume can be daunting. Our guide offers tailored strategies to effectively showcase your expertise and demonstrates how to distill your achievements into powerful, resume-worthy bullet points.

- Utilize real-life examples to refine your financial risk analyst resume;

- Effectively write the experience section of your financial risk analyst resume, even if you have minimal or no professional experience;

- Incorporate the industry's top 10 essential skills throughout your resume;

- Include your education and certifications to highlight your specific expertise.

If the financial risk analyst resume isn't the right one for you, take a look at other related guides we have:

- Payroll Director Resume Example

- Financial Management Specialist Resume Example

- Government Accounting Resume Example

- Accounts Clerk Resume Example

- Private Equity Resume Example

- Full Cycle Accounting Resume Example

- External Auditor Resume Example

- Financial Reporting Analyst Resume Example

- Corporate Financial Analyst Resume Example

- CPA Resume Example

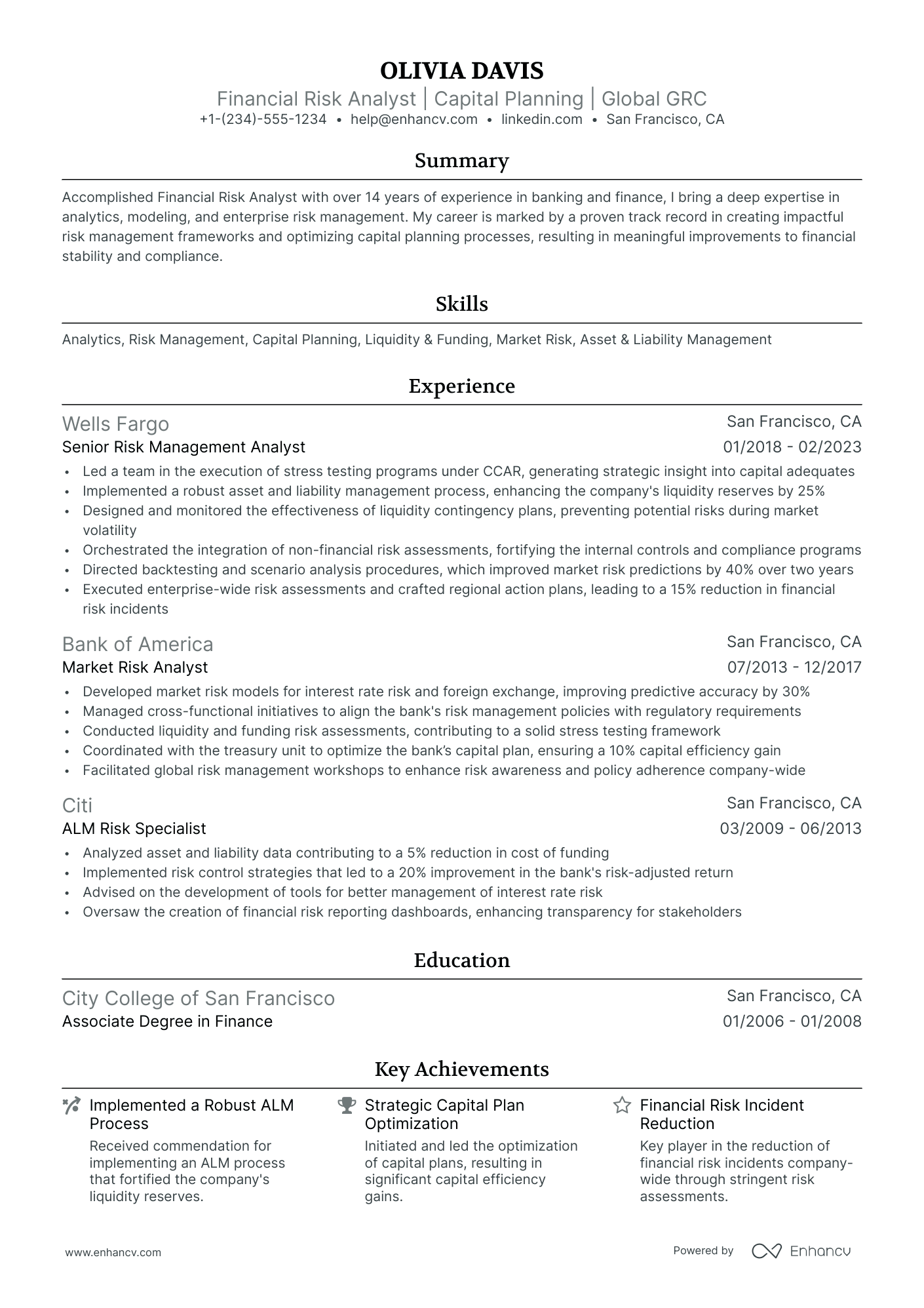

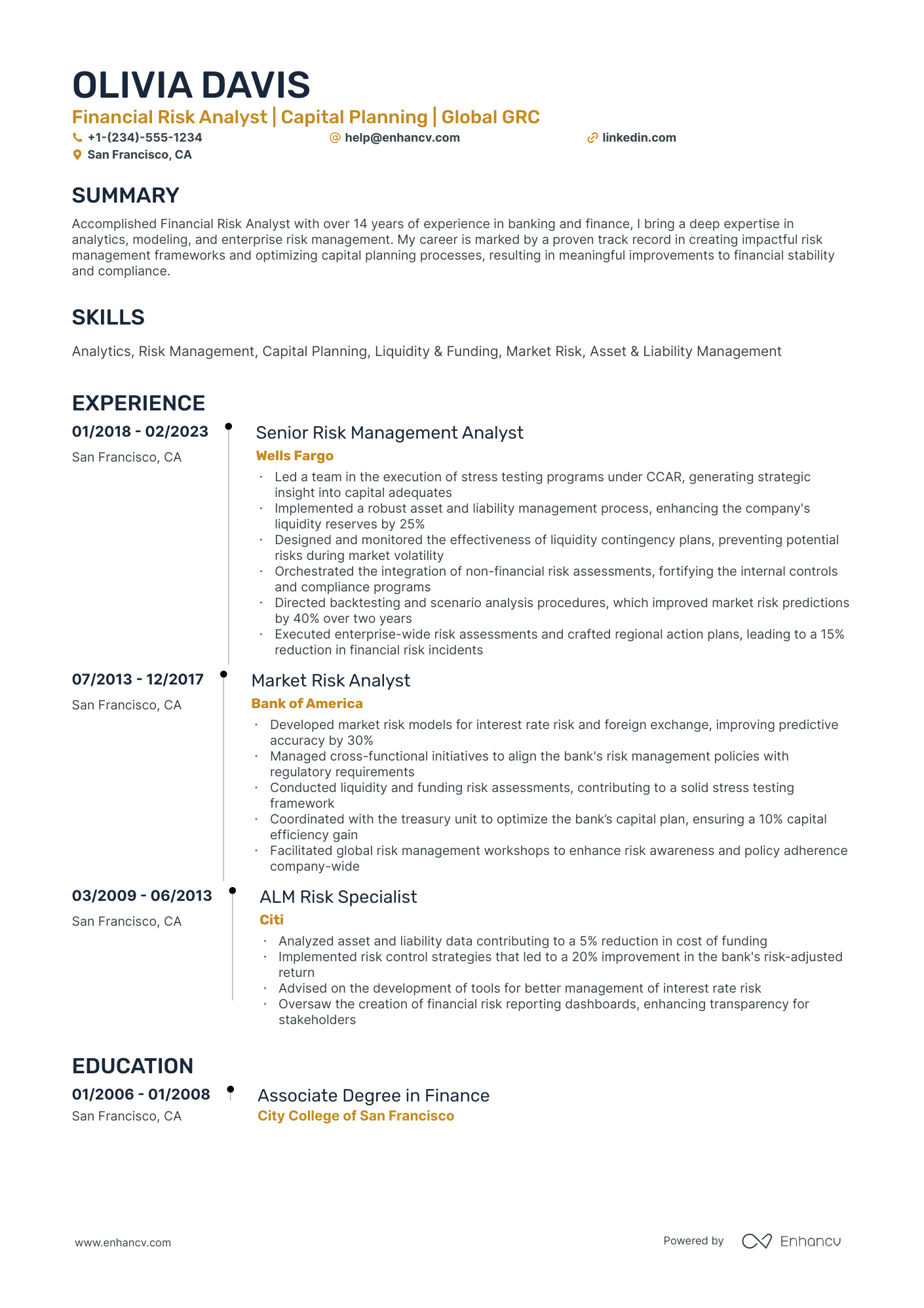

Optimize your financial risk analyst resume format to pass the recruiters' assessment

You may be wondering just how much time you need to spend on designing your financial risk analyst resume.What recruiters are looking for is systematised content that is clear and coherent. Thus, your financial risk analyst resume needs to answer requirements and why you're the best candidate for the role from the get-go.

Often, a clear layout consists of:

- Sorting your experience in the reverse chronological order - starting with your most recent and relevant roles. This is an excellent choice for more experienced professionals;

- Writing your contact information (e.g. personal phone number and email address) and your portfolio or LinkedIn link in your financial risk analyst resume header. If you're wondering to include a photo or not, always make sure that it's appropriate for the country you're applying in;

- Use the basic, most important financial risk analyst resume sections - your experience, education, summary, etc. Use your resume's real estate wisely to tell a compelling, professional story and match job description's keywords;

- Don't go overboard with the length of your resume. One page is absolutely fine if you happen to have under a decade of relevant experience.

Are you still wondering if you should submit your financial risk analyst resume in PDF or Word format ? The PDF has a few more advantages, as it doesn't change the format and the text can't be altered upon application.

Format matters most when your financial risk analyst resume is assessed by the Applicant Tracker System (or the ATS).

The ATS parses resumes, looking for specific keywords, skills or experience that match the job description.

P.S. We recently did a study on how the ATS works and were able to demystify three of the biggest misconceptions about how it assesses candidate resumes.

To pass the ATS evaluation, select any of the serif or sans-serif fonts. Popular choices that would help your financial risk analyst resume stand out include Raleway, Exo 2, Montserrat, etc.

Most traditionalists go for Arial or Times New Roman, but it's often the case that many candidates choose these fonts, and you'd thus lose points on the uniqueness front.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you happen to have some basic certificates, don't invest too much of your financial risk analyst resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

Essential sections that should make up your financial risk analyst resume include:

- The header - with your contact details (e.g. email and telephone number), link to your portfolio, and headline

- The summary (or objective) - to spotlight the peaks of your professional career, so far

- The experience section - with up to six bullets per role to detail specific outcomes

- The skills list - to provide a healthy mix between your personal and professional talents

- The education and certification - showing your most relevant degrees and certificates to the financial risk analyst role

What recruiters want to see on your resume:

- Experience with financial modeling and risk assessment tools (e.g., @RISK, Crystal Ball, Moody's Analytics)

- Proficiency in statistical analysis and software (e.g., SAS, R, Python, Excel)

- Knowledge of financial markets, instruments, and regulatory frameworks

- Demonstrable expertise in risk management methodologies (e.g., Value at Risk, stress testing, scenario analysis)

- Relevant certifications (e.g., Financial Risk Manager (FRM), Professional Risk Manager (PRM), Chartered Financial Analyst (CFA))

What to include in the experience section of your financial risk analyst resume

The resume experience section is perhaps the most important element in your application as it needs to showcase how your current profile matches the job.

While it may take some time to perfect your financial risk analyst experience section, here are five tips to keep in mind when writing yours:

- Assess the advert to make a list of key requirements and look back on how each of your past jobs answers those;

- Don't just showcase you know a particular skill, instead, you need proof in the form of tangible results (e.g. numbers, percent, etc.);

- It's perfectly fine to leave off experience items that don't bring anything extra to your skill set or application;

- Recruiters want to understand what the particular value is of working with you, so instead of solely featuring technologies, think about including at least one bullet that's focused on your soft skills;

- Take care with wording each bullet to demonstrate what you've achieved, using a particular skill, and an action verb.

The below financial risk analyst resume examples can help guide you to curate your professional experience, following industry-leading tips and advice.

- Led a team of 4 analysts to develop and implement complex risk models which reduced unanticipated financial losses by 25% for FY2021.

- Championed the integration of machine learning forecasting tools that increased the accuracy of risk prediction by 40%.

- Cultivated relationships with internal departments to streamline data collection processes, enhancing the speed of risk assessment and decision-making.

- Conducted comprehensive risk analysis on investment portfolios that reduced volatility and resulted in a 15% increase in annual returns.

- Authored and presented risk assessment reports to stakeholders, providing strategic recommendations that led to more informed decision-making.

- Collaborated with the compliance team to ensure all financial practices adhered to regulatory standards and reduced non-compliance incidents by 30%.

- Supported the risk management team in identifying and mitigating potential risks that could impede the company’s financial stability.

- Assisted in the quarterly financial risk assessment, which protected the company’s capital by ensuring adequate provisions for potential losses.

- Participated in the development of a proprietary risk scoring system that improved risk identification effectiveness by 20%.

- Evaluated financial statements and market trends to deliver actionable insights, contributing to a reduction in unnecessary credit extensions by 10%.

- Collaborated on a project to refine economic capital models, which ensured a more accurate allocation of capital for operational risk.

- Monitored daily risk reports and escalated critical issues to the management team, successfully averting potential financial discrepancies.

- Designed and executed scenario analysis for stress testing, leading to enhanced resiliency against market shocks and robust contingency planning.

- Created detailed risk management documentation, which served as the foundation for the team's procedures and reduced onboarding time for new analysts by 50%.

- Provided regular risk exposure analysis that allowed the firm to manage its capital efficiently, securing its long-term growth trajectory.

- Spearheaded a data analytics project to improve credit risk models, which significantly reduced default rates by 18% within the retail banking sector.

- Facilitated cross-functional workshops to enhance the understanding of risk strategies, resulting in more aligned risk mitigation efforts across departments.

- Developed and maintained a risk report dashboard that provided executives with real-time insights, driving quicker and more informed risk management decisions.

- Directed a major financial risk assessment initiative that was credited with safeguarding against a potential multi-million dollar operational risk event.

- Mentored a cohort of up-and-coming risk analysts by providing in-depth training on cutting-edge quantitative models and financial theory.

- Initiated a collaborative effort with IT to deploy a real-time fraud detection system, reducing financial fraud instances by over 22%.

- Played a key role in the implementation of a new enterprise risk management platform, leading to a 30% improvement in risk identification processes.

- Managed quarterly risk reporting to senior management, ensuring that all credit, market, and liquidity risk matters were transparent and well-documented.

- Developed an improved method for analyzing counterparty risk that significantly streamlined the vendor evaluation process.

- Performed in-depth operational risk evaluations resulting in the implementation of improved internal controls and a 20% decrease in operational losses.

- Organized risk management training sessions for key staff members, greatly enhancing company-wide risk awareness and mitigation skills.

- Established a set of risk metrics that allowed for more effective monitoring of operational procedures, supporting a culture of continuous improvement.

- Led the development of an advanced credit risk rating system that more accurately predicted borrower defaults and adjusted interest rates accordingly.

- Analyzed portfolio exposure to various market conditions, providing insights that directed a re-balancing in favor of more secure, lower-risk investments.

- Facilitated the transition to a new loan origination software that improved underwriting efficiency and reduced processing times by 35%.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for financial risk analyst professionals.

Top Responsibilities for Financial Risk Analyst:

- Analyze areas of potential risk to the assets, earning capacity, or success of organizations.

- Analyze new legislation to determine impact on risk exposure.

- Conduct statistical analyses to quantify risk, using statistical analysis software or econometric models.

- Confer with traders to identify and communicate risks associated with specific trading strategies or positions.

- Consult financial literature to ensure use of the latest models or statistical techniques.

- Contribute to development of risk management systems.

- Determine potential environmental impacts of new products or processes on long-term growth and profitability.

- Develop contingency plans to deal with emergencies.

- Develop or implement risk-assessment models or methodologies.

- Devise scenario analyses reflecting possible severe market events.

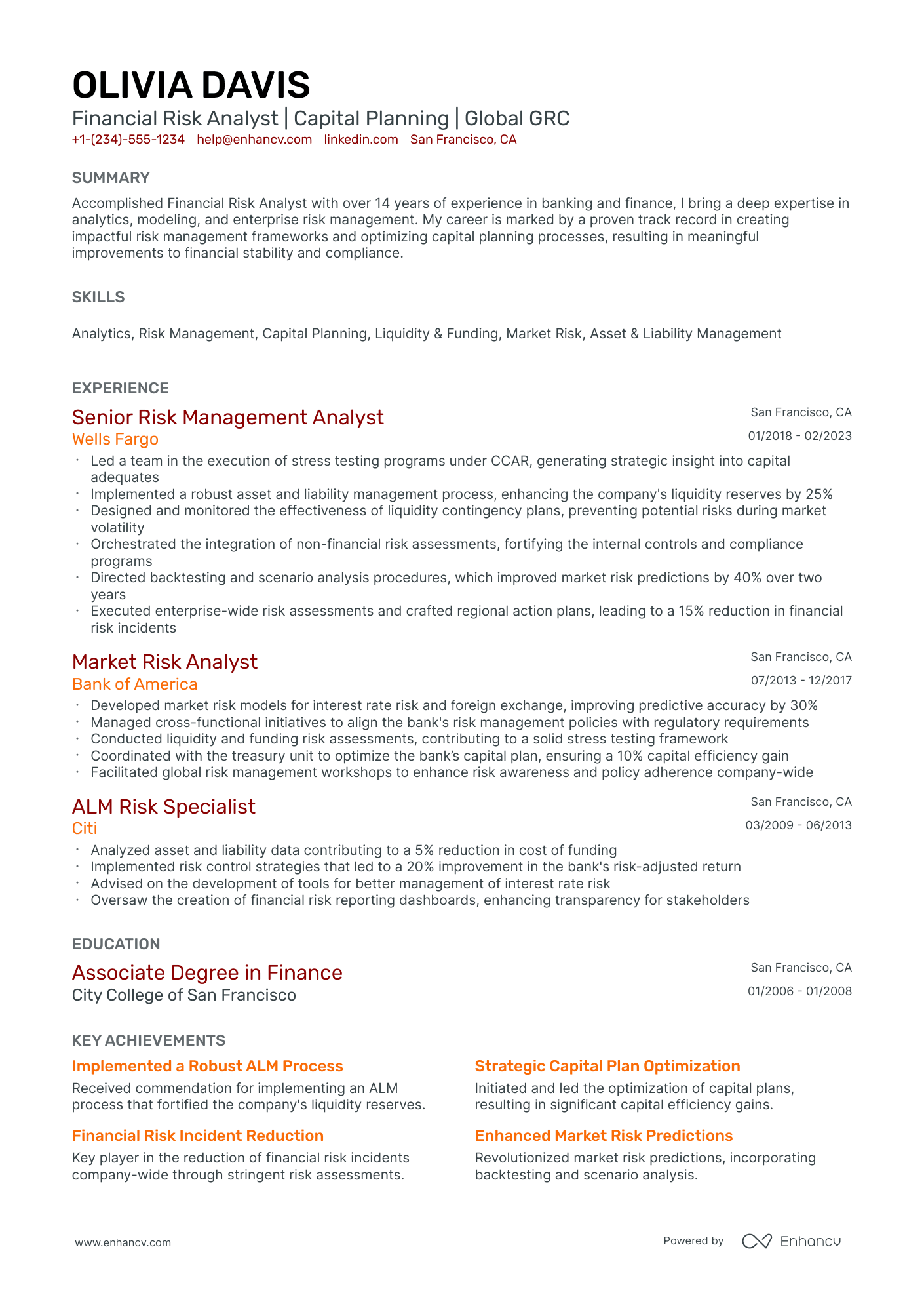

Quantifying impact on your resume

- Include the size of investment portfolios you have managed, showcasing your capacity to handle substantial financial assets.

- List the specific financial modeling techniques you are proficient in, demonstrating technical expertise and precision.

- Highlight risk mitigation strategies you’ve developed or contributed to, emphasizing your proactive approach to minimizing losses.

- Detail the percentage reduction in financial risk you achieved for projects or the organizations you've worked for.

- Mention any risk analysis tools or software you are skilled in using, indicating your relevance in a tech-driven industry.

- Explain how you've improved reporting processes or risk assessment methodologies, showing your impact on efficiency and effectiveness.

- Describe any increases in revenue or cost savings as a result of your risk management practices, demonstrating a direct contribution to profitability.

- Quantify the number of stakeholder presentations you've delivered on risk-related insights, establishing your communication skills and expertise.

Action verbs for your financial risk analyst resume

Four quick steps for candidates with no resume experience

Those with less or no relevant experience could also make a good impression on recruiters by:

- Taking the time to actually understand what matters most to the role and featuring this within key sections of their resume

- Investing resume space into defining what makes them a valuable candidate with transferrable skills and personality

- Using the resume objective to showcase their personal vision for growth within the company

- Heavily featuring their technical alignment with relevant certifications, education, and skills.

Remember that your resume is about aligning your profile to that of the ideal candidate.

The more prominently you can demonstrate how you answer job requirements, the more likely you'd be called in for an interview.

Recommended reads:

PRO TIP

Listing your relevant degrees or certificates on your financial risk analyst resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

In-demand hard skills and soft skills for your financial risk analyst resume

A vital element for any financial risk analyst resume is the presentation of your skill set.

Recruiters always take the time to assess your:

- Technological proficiency or hard skills - which software and technologies can you use and at what level?

- People/personal or soft skills - how apt are you at communicating your ideas across effectively? Are you resilient to change?

The ideal candidate presents the perfect balance of hard skills and soft skills all through the resume, but more particular within a dedicated skills section.

Building your financial risk analyst skills section, you should:

- List up to six skills that answer the requirements and are unique to your expertise.

- Include a soft skill (or two) that defines you as a person and professional - perhaps looking back on feedback you've received from previous managers, etc.

- Create up to two skills sections that are organized based on the types of skills you list (e.g. "technical skills", "soft skills", "financial risk analyst skills", etc.).

- If you happen to have technical certifications that are vital to the industry and really impressive, include their names within your skills section.

At times, it really is frustrating to think back on all the skills you possess and discover the best way to communicate them across.

We understand this challenge - that's why we've prepared two lists (of hard skills and soft skills) to help you build your next resume, quicker and more efficiently:

Top skills for your financial risk analyst resume:

Risk Management Software

Statistical Analysis Tools

Financial Modeling

Quantitative Analysis

Data Visualization Software

Microsoft Excel

SQL

Python

R

Credit Risk Assessment Tools

Analytical Thinking

Attention to Detail

Problem Solving

Communication Skills

Team Collaboration

Adaptability

Time Management

Decision Making

Critical Thinking

Interpersonal Skills

Next, you will find information on the top technologies for financial risk analyst professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Financial Risk Analyst’s resume:

- IBM SPSS Statistics

- The MathWorks MATLAB

- Google Docs

- Microsoft Word

- Oracle E-Business Suite Financials

- Wolfram Research Mathematica UnRisk Pricing Engine

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

How to include your education and certifications on your resume

We're taking you back to your college days with this part of our guide, but including your relevant higher education is quite important for your resume.

Your degree shows recruiters your dedication to the industry, your recent and relevant know-how, and some form of experience in the field.

Your financial risk analyst resume education should:

- Include your applicable degrees, college (-s) you've graduated from, as well as start and end dates of your higher education;

- Skip your high school diploma. If you still haven't graduated with your degree, list that your higher education isongoing;

- Feature any postgraduate diplomas in your resume header or summary - this is the perfect space to spotlight your relevant MBA degree;

- Showcase any relevant coursework, if you happen to have less professional experience and think this would support your case in being the best candidate for the role.

As far as your job-specific certificates are concerned - choose up to several of the most recent ones that match the job profile, and include them in a dedicated section.

We've saved you some time by selecting the most prominent industry certificates below.

The top 5 certifications for your financial risk analyst resume:

- Financial Risk Manager (FRM) - Global Association of Risk Professionals (GARP)

- Professional Risk Manager (PRM) - Professional Risk Managers’ International Association (PRMIA)

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Risk Analyst (CRA) - The American Academy of Financial Management (AAFM)

- Certified Enterprise Risk Professional (CERP) - American Bankers Association (ABA)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for financial risk analyst professionals.

Top US associations for a Financial Risk Analyst professional

- Alternative Investment Management Association

- American Finance Association

- American Risk and Insurance Association

- Association for Financial Professionals

- Association of Certified Fraud Examiners

PRO TIP

Highlight any significant extracurricular activities that demonstrate valuable skills or leadership.

Recommended reads:

Financial risk analyst resume summary or objective? The best choice is based on your experience

If you're wondering about the relevancy of the resume summary or the resume objective to your financial risk analyst application - here's the truth.

The summary and objective provide recruiters with your expertise and accomplishments at a glance, within an up-to-five-sentence structure.

The difference is that the:

- Resume objective is also more focused on emphasizing your career goals. The objective is the perfect fit for (potentially more junior) candidates who'd like to balance their relevant experience with their career goals.

- Resume summary can provide you with space to also detail the unique value of what it's like to work with you. Financial risk analyst candidates who have many noteworthy accomplishments start from the get-go with their summary.

Ensure that either type of resume introduction presents your financial risk analyst expertise in the best light and aligns it with the job advert.

The more details you can provide with numbers, the more compelling your resume summary or objective will be.

Real-world financial risk analyst candidates follow these frameworks in writing their resume summaries and objectives.

The end results are usually as such:

Resume summaries for a financial risk analyst job

- Seasoned finance professional with over eight years of experience in risk management, specializing in quantitative modeling and risk analysis for major banking institutions in New York. Developed and implemented robust financial systems that cut operational risks by 15%. Deeply skilled in the use of MATLAB and SQL for financial data analysis and reporting purposes.

- Dynamic actuarial analyst transitioning into financial risk analysis, bringing four years of experience in statistical modeling and data-driven strategy formulation for insurance firms in London. Engineered a predictive model that reduced underwriting errors by 20%. Now seeking to leverage advanced proficiency in R and Python programming to optimize financial risk strategies.

- Energetic economist with a decade-long background in market analysis and fiscal policy research, aspiring to apply strategic insights to the financial risk sector. Successfully advised on economic strategies that generated a 10% increase in ROI for a nonprofit organization. Proficient in leveraging Big Data insights to forecast financial trends and mitigate potential fiscal risks.

- Driven professional with recently attained CFA designation aiming to leverage strong analytical skills and a passion for financial markets to break into the field of financial risk analysis. Eager to apply knowledge gained from a rigorous academic background in finance and internships at top-tier accounting firms to make a significant impact in managing and assessing financial risks.

- Objective: To apply my strong foundation in finance theory, honed through a recent Master's degree and internships at various financial institutions, towards mastering risk analysis and management strategies. Eager to contribute fresh insights and a keen analytics-driven approach to identifying and mitigating financial risks in a challenging new environment.

- Objective: A recent graduate with a Bachelor's degree in Economics, enthusiastic to develop a career in financial risk analysis. Committed to expanding expertise in financial modeling and machine learning to contribute to an organization's robust risk assessment and decision-making processes. Eager to embrace hands-on experience and continue professional growth in a dynamic setting.

Average salary info by state in the US for Financial Risk Analyst professionals

Local salary info for Financial Risk Analyst.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $106,090 |

| California (CA) | $109,160 |

| Texas (TX) | $91,370 |

| Florida (FL) | $101,020 |

| New York (NY) | $139,670 |

| Pennsylvania (PA) | $97,240 |

| Illinois (IL) | $100,700 |

| Ohio (OH) | $100,490 |

| Georgia (GA) | $103,570 |

| North Carolina (NC) | $109,270 |

| Michigan (MI) | $90,260 |

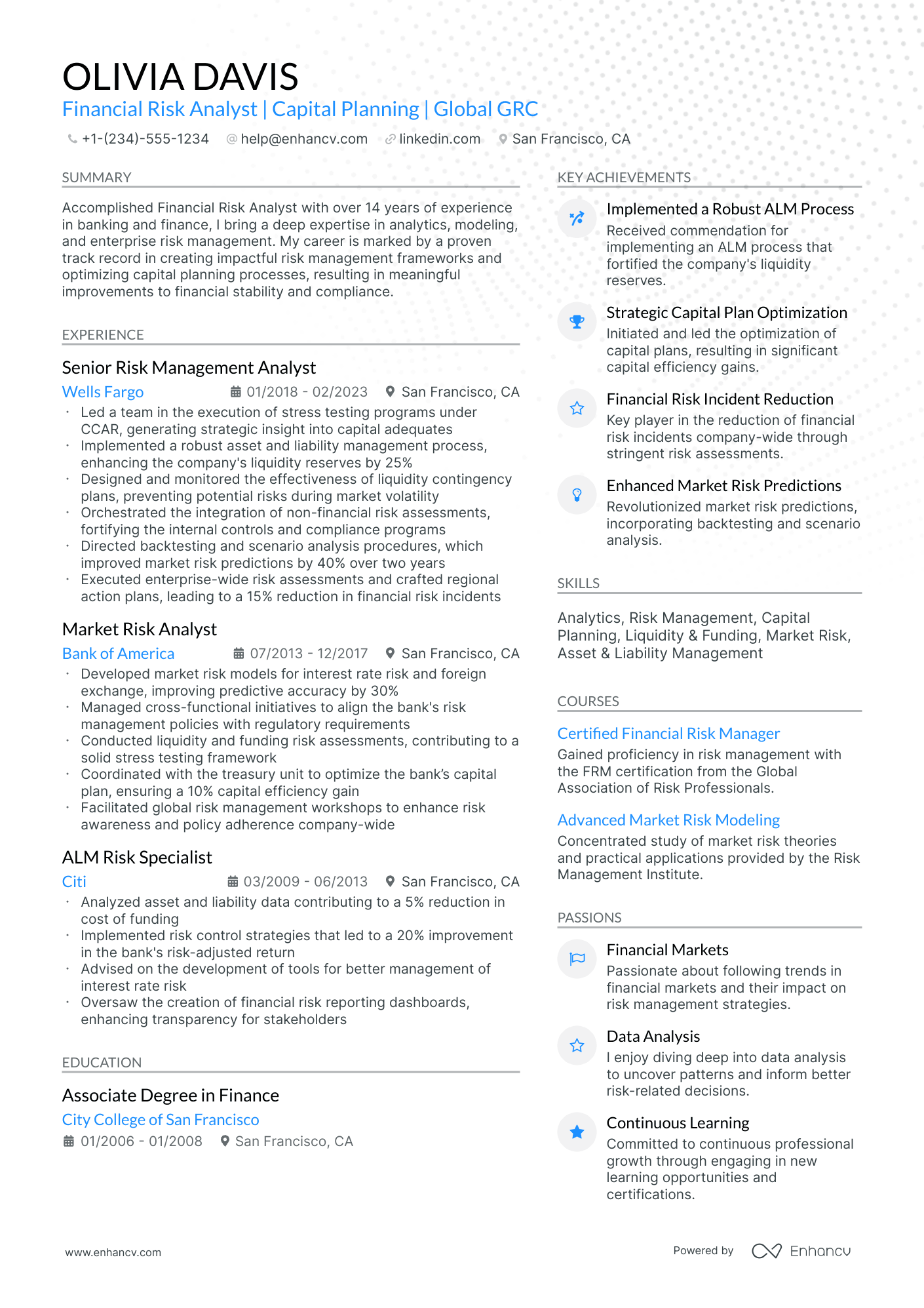

Four more sections for your financial risk analyst resume

Your financial risk analyst resume can be supplemented with other sections to highlight both your personality and efforts in the industry. Use the ones you deem most relevant to your experience (and the role):

- Awards - to celebrate your success;

- Interests - to detail what you're passionate about outside of work (e.g. music, literature, etc.);

- Publications - to show your footprint in the wider community;

- Projects - to pinpoint noteworthy achievements, potentially even outside of work.

Key takeaways

Securing your ideal job starts with crafting a compelling financial risk analyst resume. It should not only highlight your professional strengths but also reflect your personality. Key aspects to remember include:

- Choose a clear, easily editable format, allowing more time to focus on the content of your resume;

- Emphasize experience relevant to the job, focusing on your impact on the team;

- Opt for a resume summary if you have extensive professional experience, and a resume objective if you're just starting out;

- Include technical skills in the skills section and interpersonal skills in the achievements section;

- Recognize the importance of various resume sections (e.g., My Time, Projects) in showcasing both your professional abilities and personal traits.