As a financial reporting manager, articulating the complex nature of your role while ensuring your resume remains digestible to non-expert readers can be especially challenging. Our guide will provide you with the tools and examples you need to effectively communicate your expertise and accomplishments, guaranteeing your resume stands out in a competitive job market.

- Aligning the top one-third of your financial reporting manager resume with the role you're applying for.

- Curating your specific financial reporting manager experience to get the attention of recruiters.

- How to list your relevant education to impress hiring managers recruiting for the financial reporting manager role.

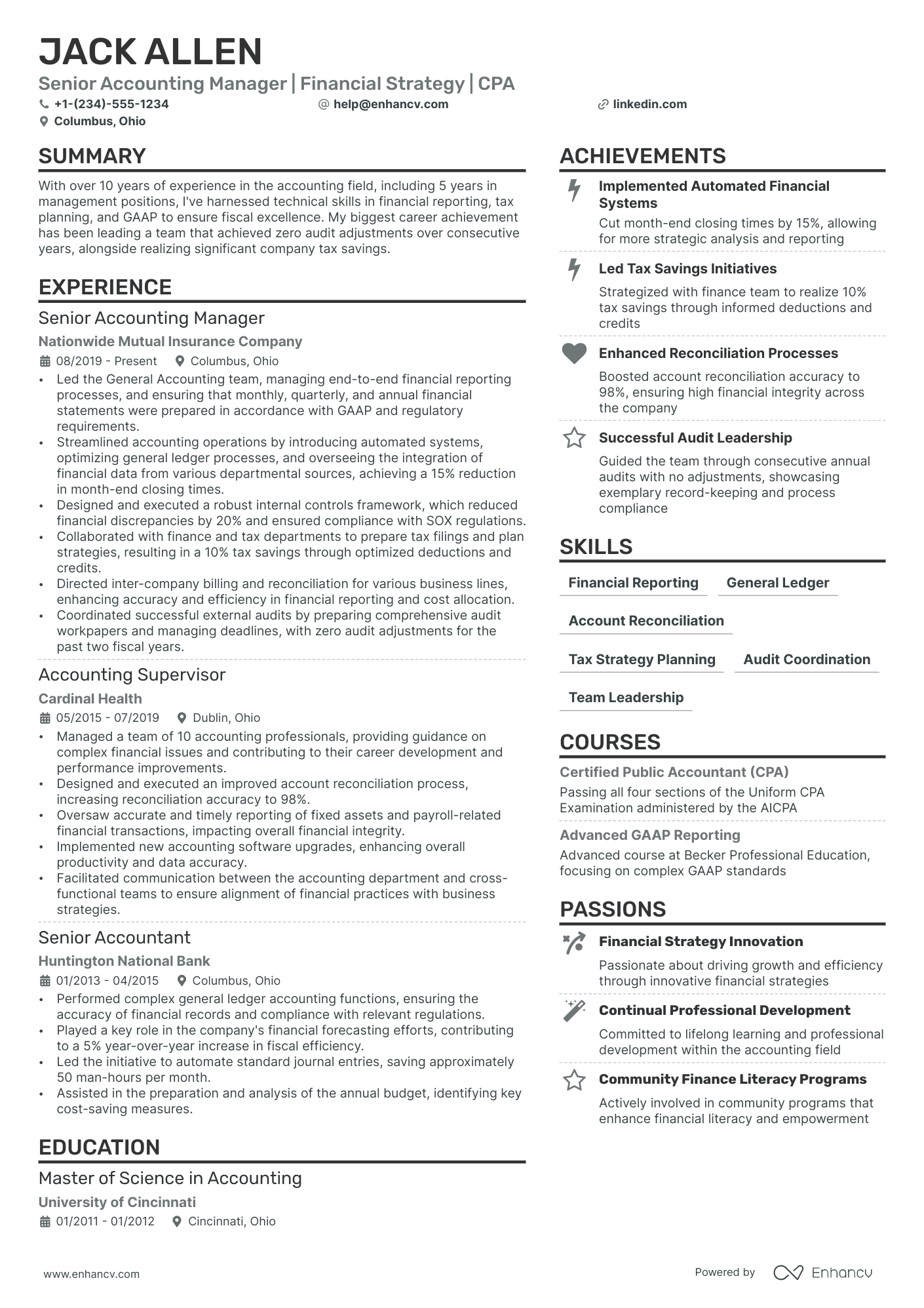

Discover more financial reporting manager professional examples to help you write a job-winning resume.

- Financial Auditor Resume Example

- Financial Accounting Resume Example

- Payroll Director Resume Example

- Public Accounting Resume Example

- Financial Representative Resume Example

- Accounts Payable Resume Example

- Cost Accounting Resume Example

- Financial Management Analyst Resume Example

- Audit Director Resume Example

- Financial Risk Analyst Resume Example

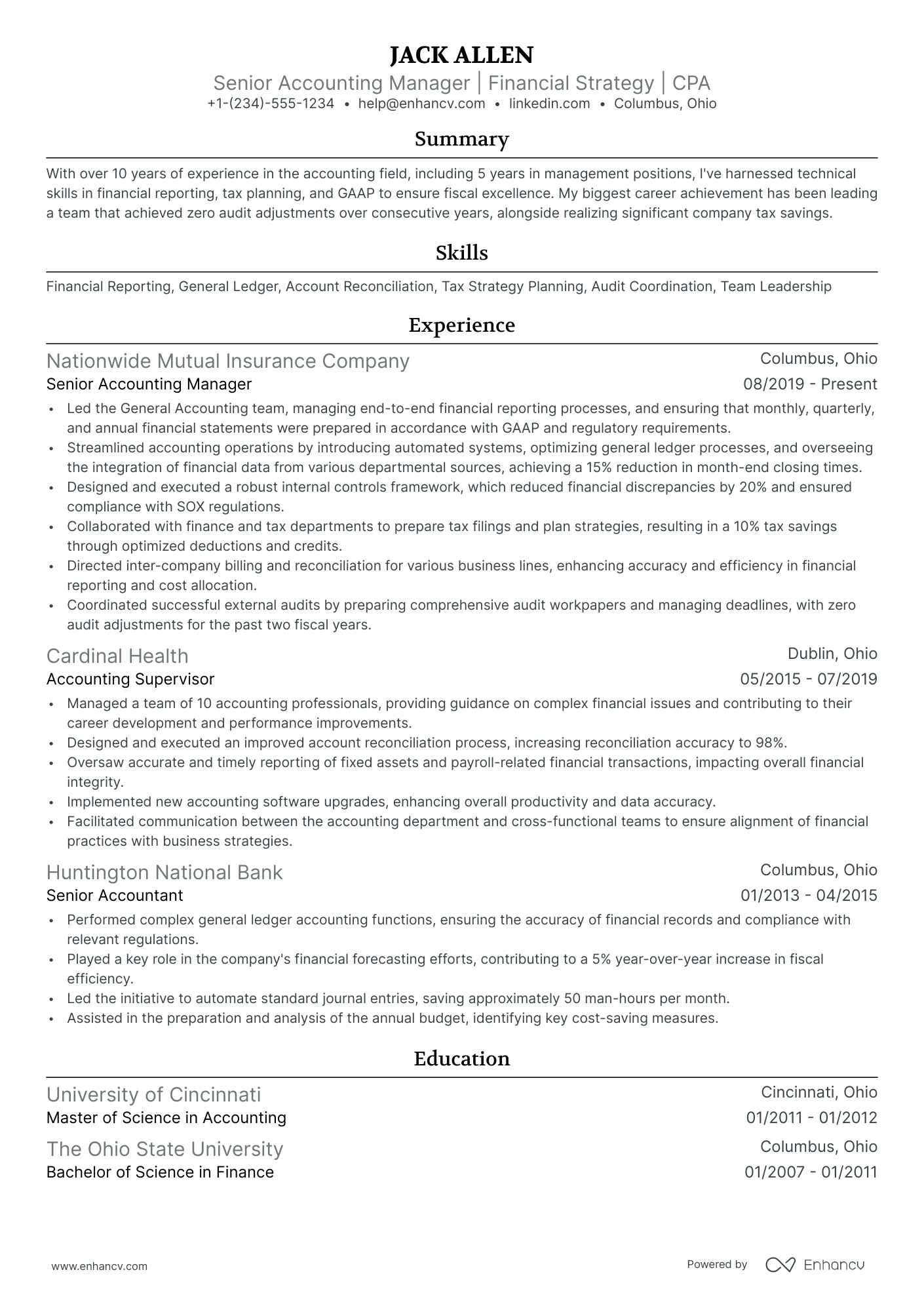

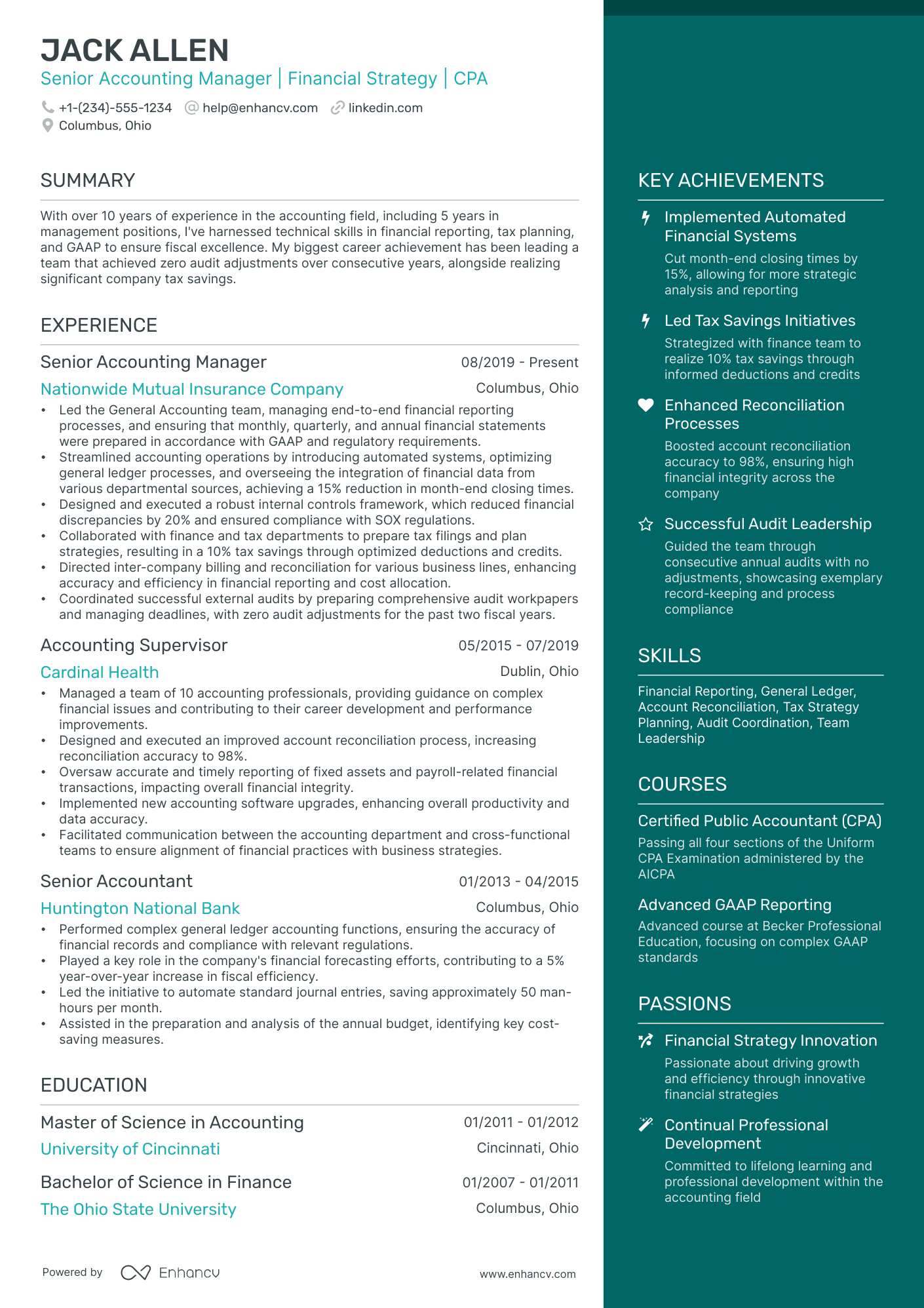

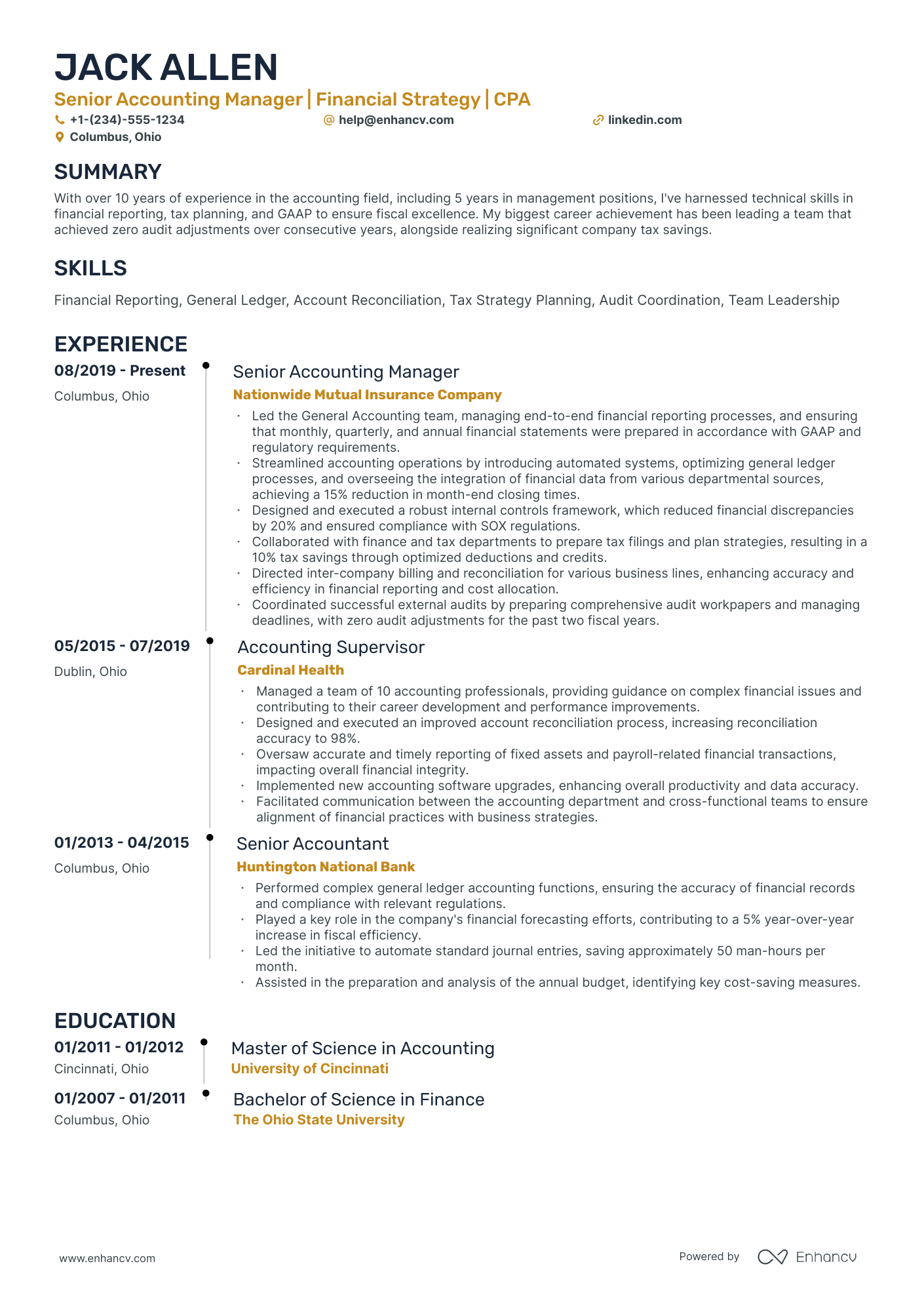

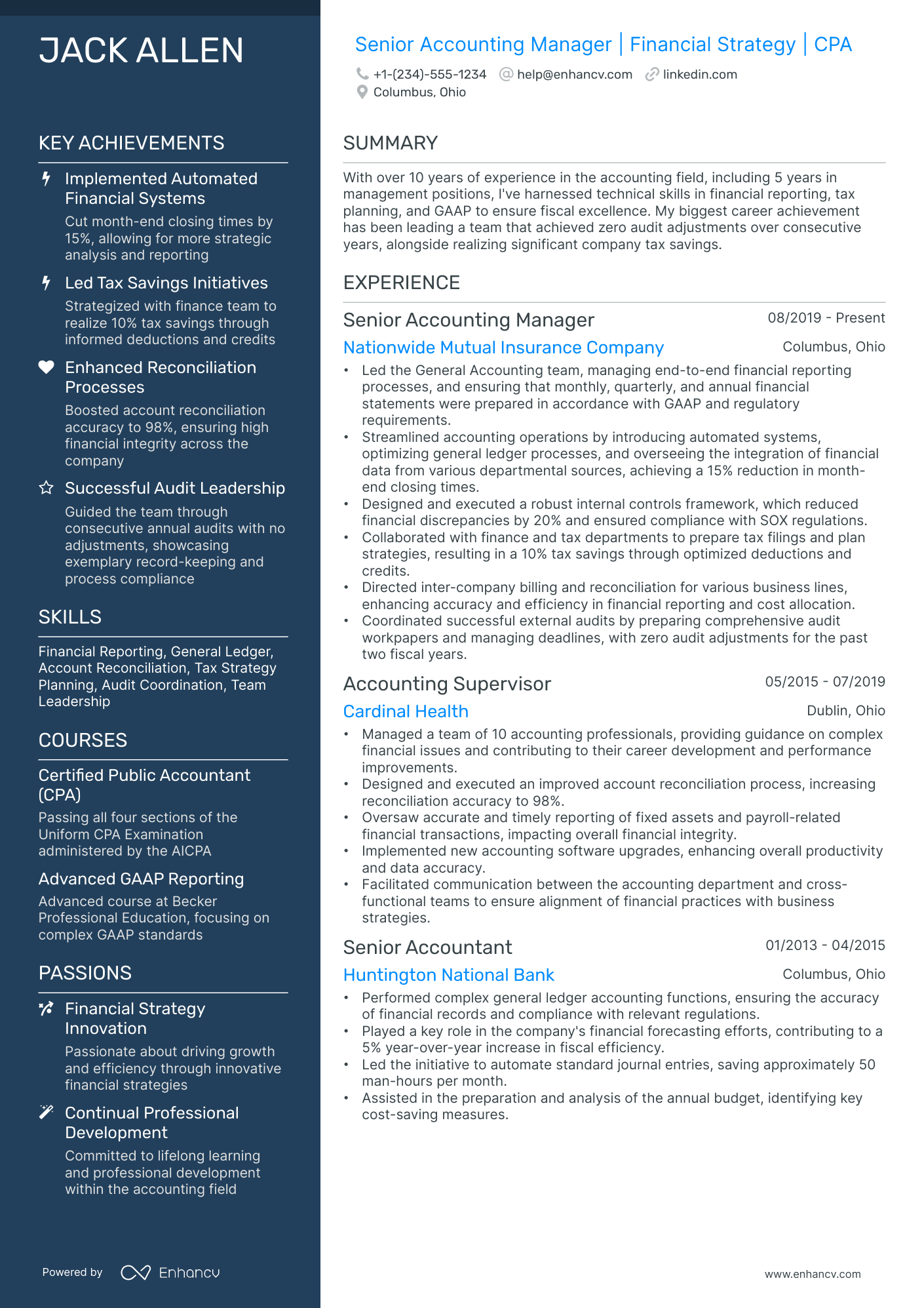

Tips and tricks for your financial reporting manager resume format

Before you start writing your resume, you must first consider its look-and-feel - or resume format . Your professional presentation hence should:

- Follow the reverse-chronological resume format , which incroporates the simple logic of listing your latest experience items first. The reverse-chronological format is the perfect choice for candidates who have plenty of relevant (and recent) experience.

- State your intention from the get-go with a clear and concise headline - making it easy for recruiters to allocate your contact details, check out your portfolio, or discover your latest job title.

- Be precise and simple - your resume should be no more than two pages long, representing your experience and skills that are applicable to the financial reporting manager job.

- Ensure your layout is intact by submitting it as a PDF. Thus, your resume sections would stay in place, even when assessed by the Applicant Tracker System (ATS).

Different markets have specific resume styles – a Canadian resume, for instance, may require a different approach.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you happen to have some basic certificates, don't invest too much of your financial reporting manager resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

Essential sections that should make up your financial reporting manager resume include:

- The header - with your contact details (e.g. email and telephone number), link to your portfolio, and headline

- The summary (or objective) - to spotlight the peaks of your professional career, so far

- The experience section - with up to six bullets per role to detail specific outcomes

- The skills list - to provide a healthy mix between your personal and professional talents

- The education and certification - showing your most relevant degrees and certificates to the financial reporting manager role

What recruiters want to see on your resume:

- Strong understanding of Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

- Proven experience in financial statement preparation, consolidation, and analysis.

- Expertise with financial reporting software and advanced Excel skills for data analysis and reporting.

- Knowledge of internal controls and compliance with Sarbanes-Oxley (SOX) or similar regulations.

- Leadership experience with the ability to manage and develop a financial reporting team.

Defining your professional expertise in your financial reporting manager resume work experience section

The work experience section, often the most detailed part of your resume, is where you discuss your past roles and achievements. To effectively list your experience, consider these four key tips:

- Align your expertise with the job requirements. It's vital to integrate keywords matching the job criteria to pass initial assessments;

- Show, don’t just tell. Quantify your responsibilities by stating your actual achievements in previous roles;

- Include measurable metrics. For instance, how did your performance impact the annual ROI?

- Highlight crucial industry skills. Mention both technological knowledge and interpersonal skills in this section.

These guidelines will help you craft an impressive financial reporting manager resume work experience section that is bound to catch recruiters' attention.

- Developed and executed comprehensive monthly and annual financial reporting processes for a Fortune 500 company, improving reporting accuracy by 30%.

- Led a team of analysts in streamlining financial data collection and validation, enabling the distribution of internal reports 15 days ahead of schedule.

- Managed the successful migration of financial reporting systems to a cloud-based platform, enhancing data accessibility for remote teams.

- Orchestrated the revision of the company's financial compliance framework, leading to a 20% decrease in compliance-related issues.

- Collaborated with external auditors to complete annual audits with zero discrepancies for three consecutive years.

- Introduced new GAAP-compliant reporting procedures that served as a benchmark within the financial industry and were adopted by peers.

- Advised on the strategic financial planning process, contributing to an annual revenue growth of 12% by identifying key financial trends and cost-saving opportunities.

- Spearheaded the development of quarterly financial statements, including balance sheets, income, and cash flow statements, for public reporting.

- Initiated and supervised a cross-departmental task force that reduced monthly close cycle times by 25%, enhancing operational efficiency.

- Crafted and maintained a financial reporting calendar that aligned with SEC filing deadlines, resulting in a 100% on-time filing rate.

- Directed the compilation and review of the 10-Q and 10-K reports, which consistently received positive remarks from the SEC for clarity and accuracy.

- Devised specialized financial models to project long-term growth scenarios, informing C-suite strategic planning sessions.

- Played a pivotal role in redesigning the internal reporting framework, which reduced reporting errors by 40% within the first six months.

- Provided expert guidance and mentorship to a team of 10 financial analysts, fostering a culture of continuous improvement and professional growth.

- Implemented an enhanced reconciliation system that identified over $5 million in unreconciled transactions, recouping significant funds for the company.

- Streamlined operational reporting procedures which boosted the reporting team's productivity by 20%.

- Drove a company-wide initiative to increase financial literacy which empowered departmental managers with greater financial decision-making capabilities.

- Negotiated and secured software contracts with vendors, improving report generation speed and reducing annual costs by $250,000.

- Led the implementation of a centralized financial reporting system that saved the company over 500 hours in manual data consolidation annually.

- Managed a portfolio of financial reporting projects with budgets exceeding $2 million, delivering each project under budget and ahead of schedule.

- Coordinated with IT to develop custom financial reporting software that increased data accuracy and reduced the time needed for report generation by 35%.

- Oversaw the transition to a new ERP system which included complex financial reporting functions, improving overall data integrity and operational performance.

- Developed a set of key operational metrics and dashboards that provided executives with real-time insights into the company’s financial status.

- Authored comprehensive training materials on financial reporting standards and practices for new hires, markedly improving team knowledge and performance.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for financial reporting manager professionals.

Top Responsibilities for Financial Reporting Manager:

- Establish and maintain relationships with individual or business customers or provide assistance with problems these customers may encounter.

- Oversee the flow of cash or financial instruments.

- Plan, direct, or coordinate the activities of workers in branches, offices, or departments of establishments, such as branch banks, brokerage firms, risk and insurance departments, or credit departments.

- Recruit staff members.

- Evaluate data pertaining to costs to plan budgets.

- Oversee training programs.

- Establish procedures for custody or control of assets, records, loan collateral, or securities to ensure safekeeping.

- Communicate with stockholders or other investors to provide information or to raise capital.

- Develop or analyze information to assess the current or future financial status of firms.

- Approve, reject, or coordinate the approval or rejection of lines of credit or commercial, real estate, or personal loans.

Quantifying impact on your resume

- Include the size of the budgets you have managed to demonstrate your experience with handling significant financial resources.

- List key financial performance indicators you improved, such as revenue growth or cost reduction percentages, to show your capability to drive profitability.

- Specify the number of financial reporting cycles you've overseen to establish your experience in meeting critical deadlines.

- Detail the amount of money saved through financial process optimizations you implemented to showcase your efficiency and cost-saving skills.

- Quantify the number of team members you have supervised to communicate your leadership and management skills.

- Mention any increases in compliance or accuracy rates you've achieved in your reports to illustrate your attention to detail and adherence to standards.

- Describe the scope of financial systems or tools you've implemented or improved with relevant metrics to highlight your technical expertise.

- State the volume of financial transactions or reports you've handled regularly to represent your capability of managing large-scale operations.

Action verbs for your financial reporting manager resume

Remember these four tips when writing your financial reporting manager resume with no experience

You've done the work - auditing the job requirements for keywords and have a pretty good idea of the skill set the ideal candidate must possess.

Yet, your professional experience amounts to a summer internship .

Even if you have limited or no professional expertise that matches the role you're applying for, you can use the resume experience section to:

- List extracurricular activities that are relevant to the job requirements. Let's say you were editor-in-chief of your college newspaper or part of the engineering society. Both activities have taught you invaluable, transferrable skills (e.g. communication or leadership) that can be crucial for the job;

- Substitute jobs with volunteer experience. Participating in charity projects has probably helped you develop an array of soft skills (e.g. meeting deadlines and interpersonal communications). On the other hand, volunteering shows potential employers more about you: who you are and what are the causes you care about;

- Align job applications with your projects. Even your final-year thesis work could be seen as relevant experience, if it's in the same industry as the job you're applying for. Ensure you've listed the key skills your project has taught you, alongside tangible outcomes or your project success;

- Shift the focus to your transferrable skills. We've said it before, but recruiters will assess your profile upon both job requirements and the skills you possess. Consider what your current experience - both academic and life - has taught you and how you've been able to develop your talents.

Recommended reads:

PRO TIP

Mention specific courses or projects that are pertinent to the job you're applying for.

Key hard skills and soft skills for your financial reporting manager resume

At the top of any recruiter financial reporting manager checklist, you'd discover a list of technical competencies, balanced with personal skills.

Hard or technical skills are your opportunity to show how you meet the essential responsibilities of the role. The ability to use a particular job-crucial technology or software would also hint to recruiters whether you'd need a prolonged period of on-the-job training - or you'd fit right in the job.

But to land your dream role, you'd also need to demonstrate a variety of soft or people resume skills . Employers care about soft skills as they show how each candidate would fit into the team and company culture.

Both types of skills are specific and to best curate them on your resume, you'd need to:

- Create a skill section within which you showcase your hard and soft skills and present how they help you succeed.

- List specific examples of projects, tasks, or competitions, within which your skill set has assisted your results.

- Soft skills are harder to measure, so think about situations in which they've helped you thrive. Describe those situations concisely, focusing on how the outcome has helped you grow as a professional.

- Metrics of success - like positive ROI or optimized workplace processes - are the best way to prove your technical and people skills.

Take a look at some of financial reporting manager industry leaders' favorite hard skills and soft skills, as listed on their resumes.

Top skills for your financial reporting manager resume:

Financial Reporting Software (e.g., SAP, Oracle)

Advanced Excel

SQL

Data Analysis Tools (e.g., Tableau, Power BI)

Financial Statement Preparation

GAAP and IFRS Knowledge

Budgeting and Forecasting Tools

Accounting Software (e.g., QuickBooks, Sage)

Tax Compliance Software

ERP Systems

Analytical Thinking

Attention to Detail

Communication Skills

Problem Solving

Time Management

Leadership

Team Collaboration

Adaptability

Critical Thinking

Interpersonal Skills

Next, you will find information on the top technologies for financial reporting manager professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Financial Reporting Manager’s resume:

- Oracle PeopleSoft

- Workday software

- Microsoft PowerPoint

- Microsoft SQL Server

- Yardi software

PRO TIP

Mention specific courses or projects that are pertinent to the job you're applying for.

Listing your education and certifications on your financial reporting manager resume

Don't underestimate the importance of your resume education section . As it may hint at various skills (and experience) that are relevant to the job. When writing your education section:

- Include only higher education degrees with information about the institution and start/end dates

- If you're in the process of obtaining your degree, include your expected graduation date

- Consider leaving off degrees that aren't relevant to the job or industry

- Write a description of your education if it presents you with an opportunity to further showcase your achievements in a more research-focused environment

When describing your certifications on your resume, always consider their relevancy to the role. Use the same format to describe them as you would for your education. If you're wondering what the best certificates out there are for financial reporting manager roles, check out the list below.

The top 5 certifications for your financial reporting manager resume:

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants (AICPA)

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Management Accountant (CMA) - Institute of Management Accountants (IMA)

- Chartered Global Management Accountant (CGMA) - American Institute of CPAs (AICPA) & Chartered Institute of Management Accountants (CIMA)

- Certified Financial Services Auditor (CFSA) - The Institute of Internal Auditors (IIA)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for financial reporting manager professionals.

Top US associations for a Financial Reporting Manager professional

- AICPA and CIMA

- American Bankers Association

- Association for Financial Professionals

- Association of Government Accountants

- CFA Institute

PRO TIP

If you happen to have some basic certificates, don't invest too much of your financial reporting manager resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

Recommended reads:

Professional summary or objective for your financial reporting manager resume

financial reporting manager candidates sometimes get confused between the difference of a resume summary and a resume objective.

Which one should you be using?

Remember that the:

- Resume objective has more to do with your dreams and goals for your career. Within it, you have the opportunity to showcase to recruiters why your application is an important one and, at the same time, help them imagine what your impact on the role, team, and company would be.

- Resume summary should recount key achievements, tailored for the role, through your career. Allowing recruiters to quickly scan and understand the breadth of your financial reporting manager expertise.

The resume objectives are always an excellent choice for candidates starting off their career, while the resume summary is more fitting for experienced candidates.

No matter if you chose a summary or objective, get some extra inspiration from real-world professional financial reporting manager resumes:

Resume summaries for a financial reporting manager job

- Dedicated CPA with over 12 years of experience expertly leading financial reporting and compliance for multinational corporations. Spearheaded an initiative that slashed report processing time by 30%, showcasing a strong affinity for automation and process improvement. Mastery in GAAP, IFRS, and SAP is complemented by a proven track record in optimizing financial operations.

- Accomplished finance professional bringing 15 years of experience overseeing financial reporting activities within high-growth technology firms. Successfully directed a financial system migration, enhancing reporting accuracy and efficiency. Exceptional command of budget forecasting, regulatory compliance, and strategic planning. Proud recipient of the 'Finance Leader of the Year' award in 2020.

- Former Senior Data Analyst eager to transition into financial reporting management, bringing a robust analytical background, including 8 years leveraging big data insights to drive business strategy and performance. Trained in advanced statistical analysis and possess solid experience with Python and R. Keen to apply analytical acumen to enhance financial reporting precision and facilitate informed decision-making.

- High-performing IT Project Manager with a decade of success in software deployment and process optimization, ready to segue into financial reporting management. Adept at cross-functional team leadership and complex problem-solving. Seeking to leverage project management skills to improve financial reporting accuracy and drive effective financial strategies.

- Aspiring to launch a career in financial reporting management, enthusiastic about applying strong analytical abilities and a recent Master's degree in Finance. Eager to develop expertise in regulatory compliance, financial analysis, and report generation within a dynamic and growth-oriented financial environment.

- Recent Finance graduate poised to contribute keen analytical skills and a fresh perspective to the field of financial reporting management. Driven to excel in financial analysis and eager to undertake challenges that will help facilitate accurate financial reporting and support effective decision-making processes in a fast-paced corporate setting.

Average salary info by state in the US for financial reporting manager professionals

Local salary info for Financial Reporting Manager.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $156,100 |

| California (CA) | $169,780 |

| Texas (TX) | $155,380 |

| Florida (FL) | $135,780 |

| New York (NY) | $215,430 |

| Pennsylvania (PA) | $137,770 |

| Illinois (IL) | $149,900 |

| Ohio (OH) | $131,610 |

| Georgia (GA) | $159,620 |

| North Carolina (NC) | $146,860 |

| Michigan (MI) | $131,770 |

Four more sections for your financial reporting manager resume

Your financial reporting manager resume can be supplemented with other sections to highlight both your personality and efforts in the industry. Use the ones you deem most relevant to your experience (and the role):

- Awards - to celebrate your success;

- Interests - to detail what you're passionate about outside of work (e.g. music, literature, etc.);

- Publications - to show your footprint in the wider community;

- Projects - to pinpoint noteworthy achievements, potentially even outside of work.

Key takeaways

- All aspects of your resume should be selected to support your bid for being the perfect candidate for the role;

- Be intentional about listing your skill set to be balanced with both technical and people capabilities, while aligning with the job;

- Include any experience items that are relevant to the role and ensure you feature the outcomes of your responsibilities;

- Use the summary or objective as a screenshot of your best experience highlights;

- Curate various resume sections to showcase personal, transferable skills.