As a financial professional, articulating your complex quantitative achievements without overwhelming non-specialist hiring managers can be a significant resume challenge. Our comprehensive guide is tailored to help you distill intricate financial concepts into clear, impactful bullet points that resonate across diverse audiences.

- Aligning the top one-third of your financial professional resume with the role you're applying for.

- Curating your specific financial professional experience to get the attention of recruiters.

- How to list your relevant education to impress hiring managers recruiting for the financial professional role.

Discover more financial professional professional examples to help you write a job-winning resume.

- Corporate Financial Analyst Resume Example

- Corporate Banking Resume Example

- Finance Executive Resume Example

- Staff Auditor Resume Example

- Financial Consultant Resume Example

- Payroll Admin Resume Example

- Finance Business Analyst Resume Example

- Cost Accounting Resume Example

- Credit Manager Resume Example

- Internal Audit Manager Resume Example

Formatting the layout of your financial professional resume: design, length, and more

When it comes to the format of your financial professional resume , you've plenty of opportunities to get creative. But, as a general rule of thumb, there are four simple steps you could integrate into your resume layout.

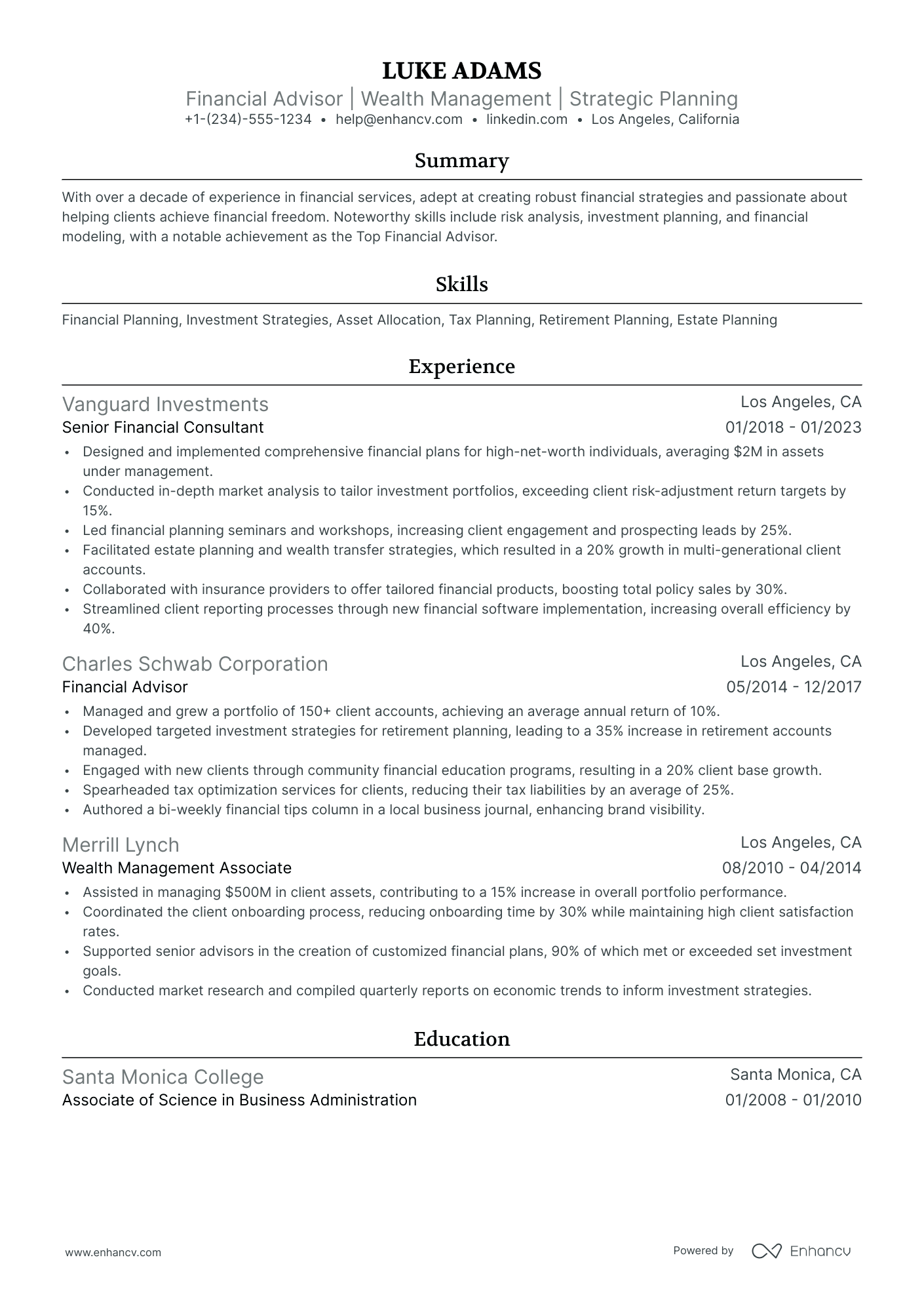

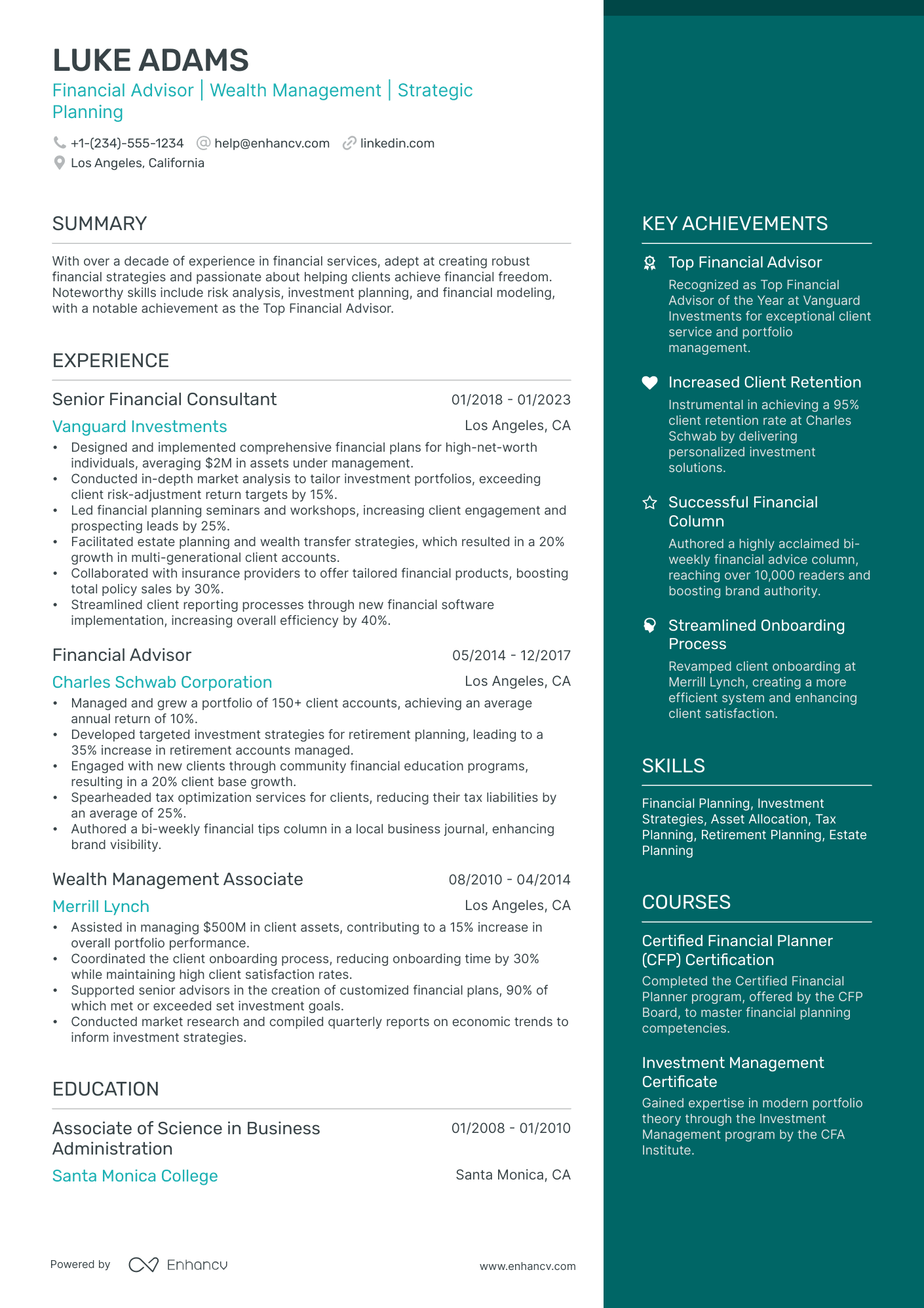

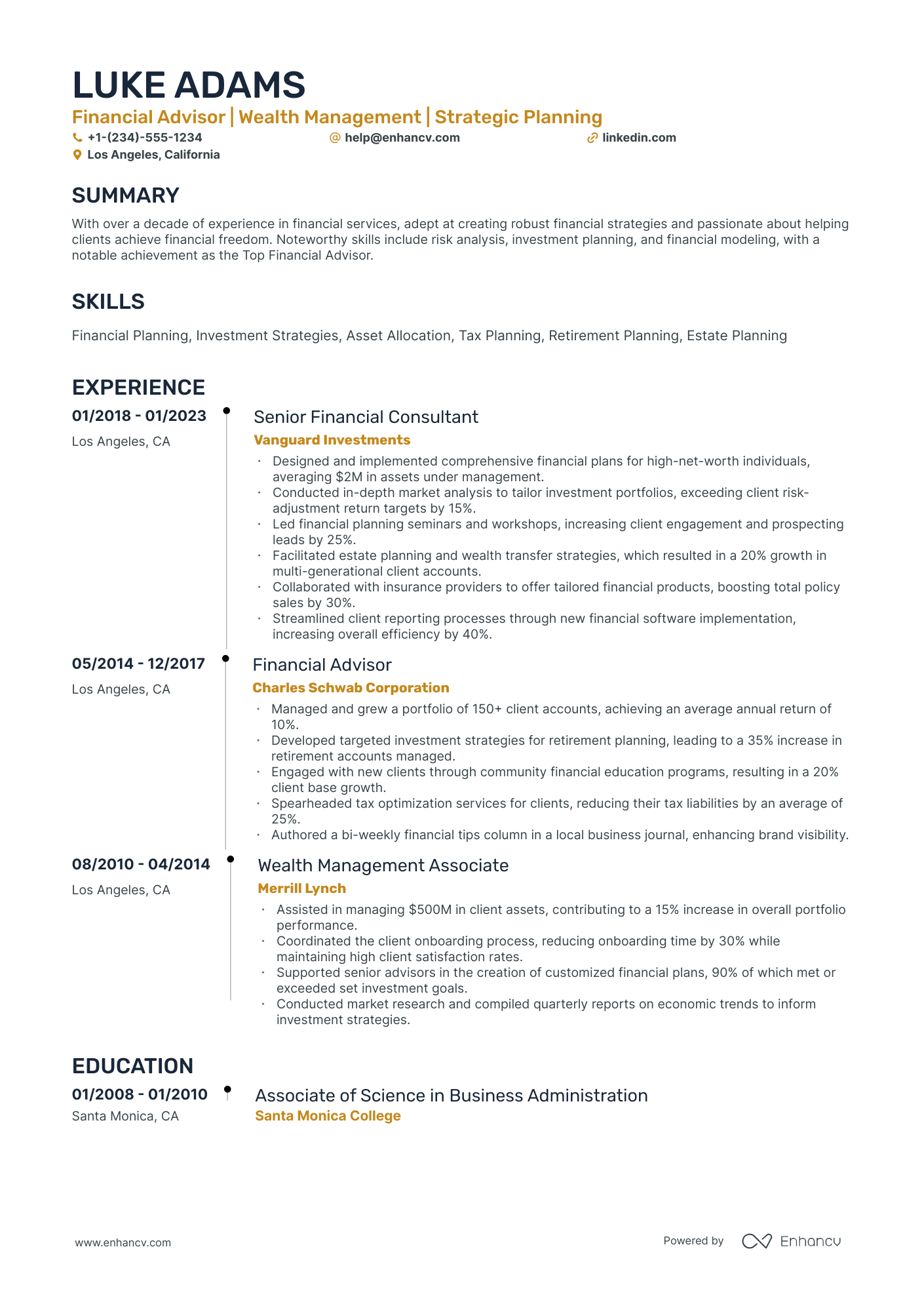

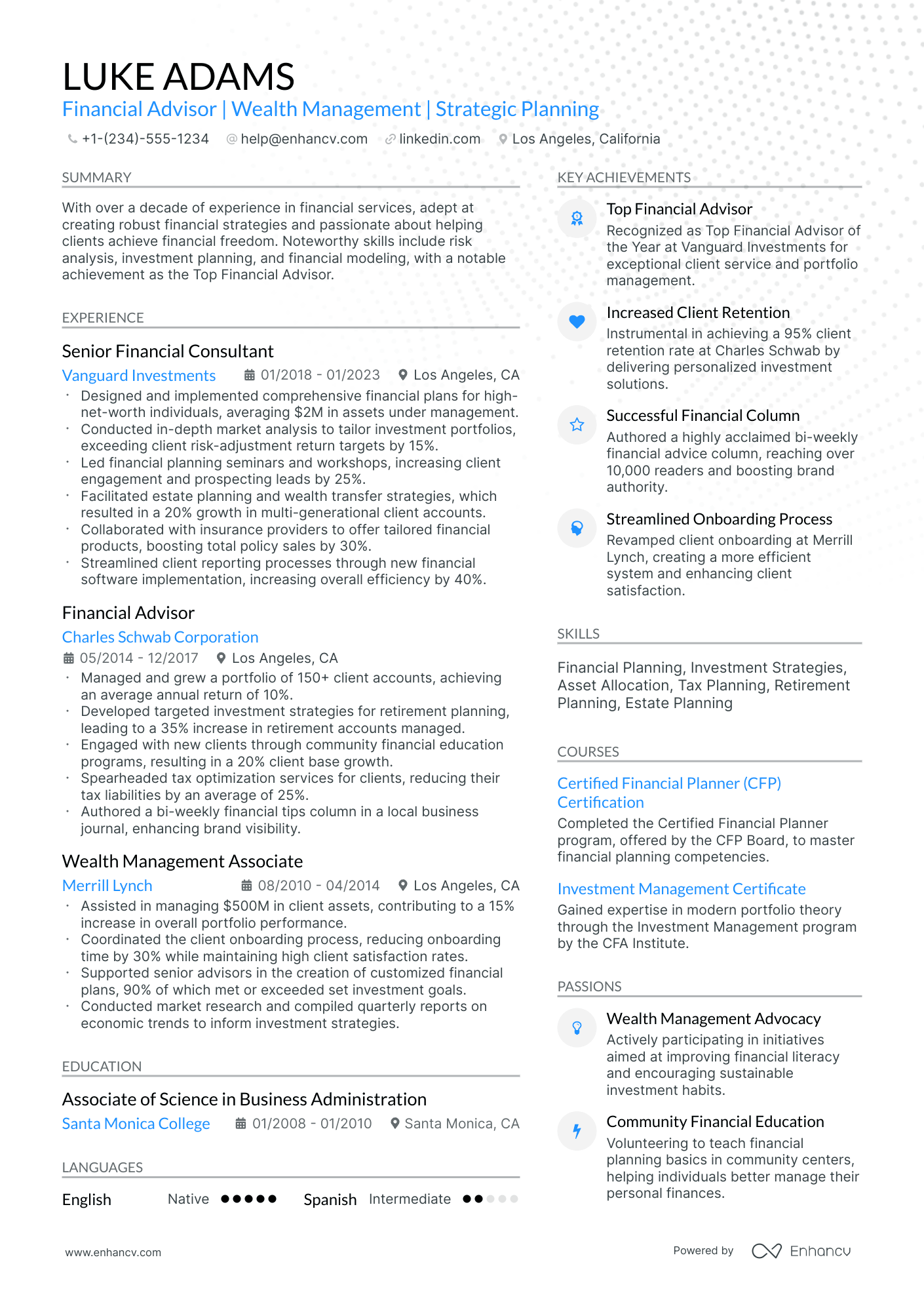

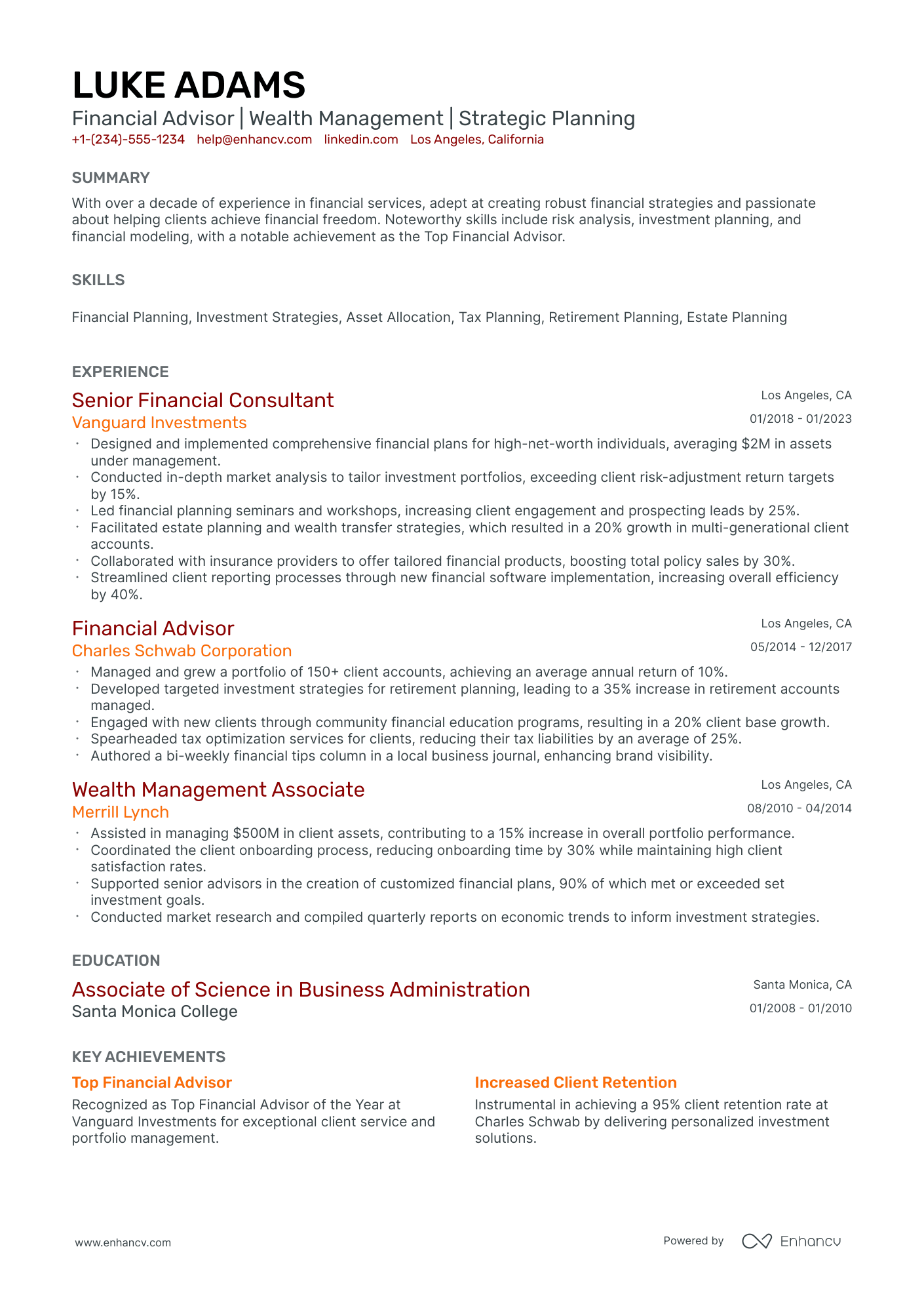

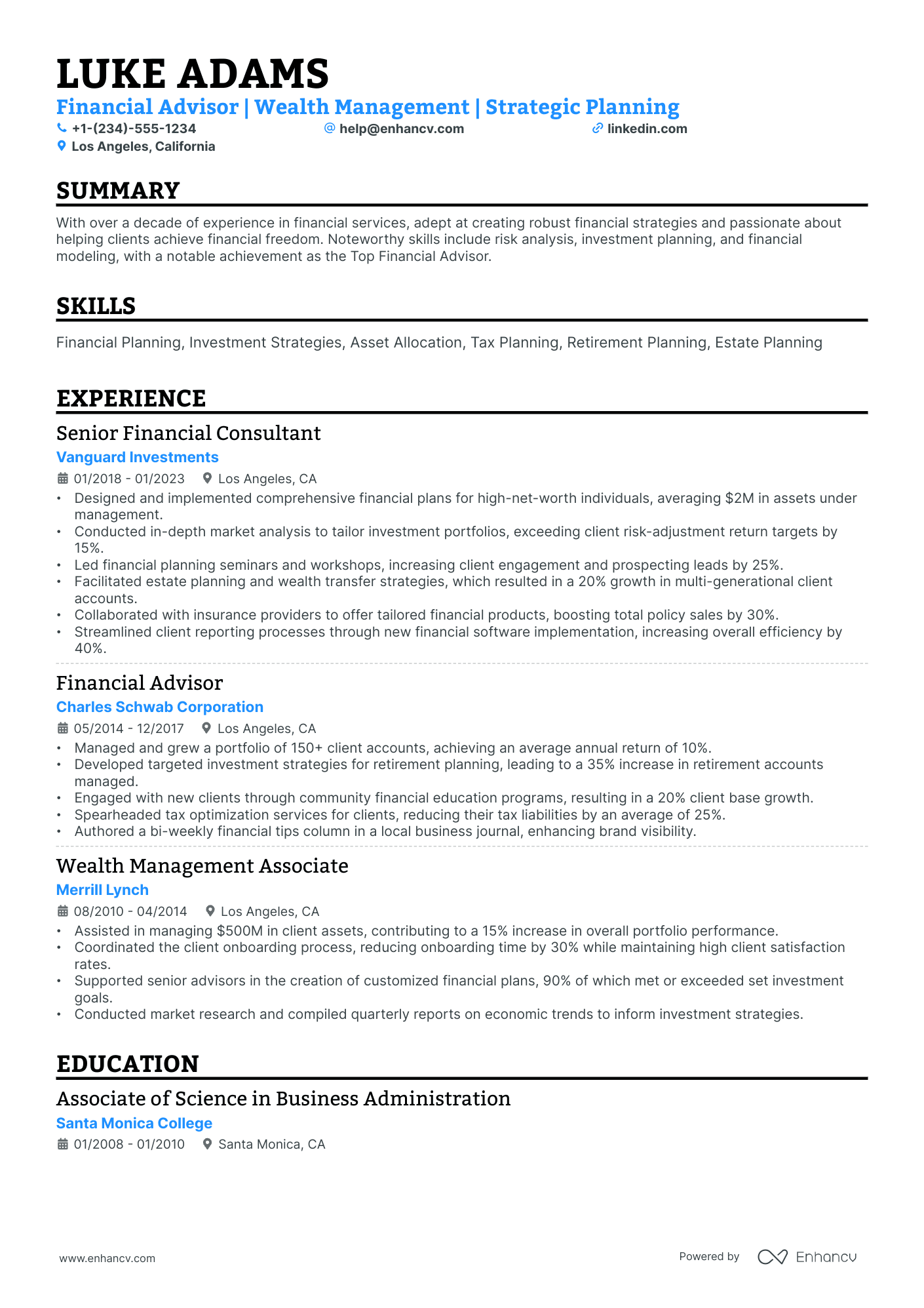

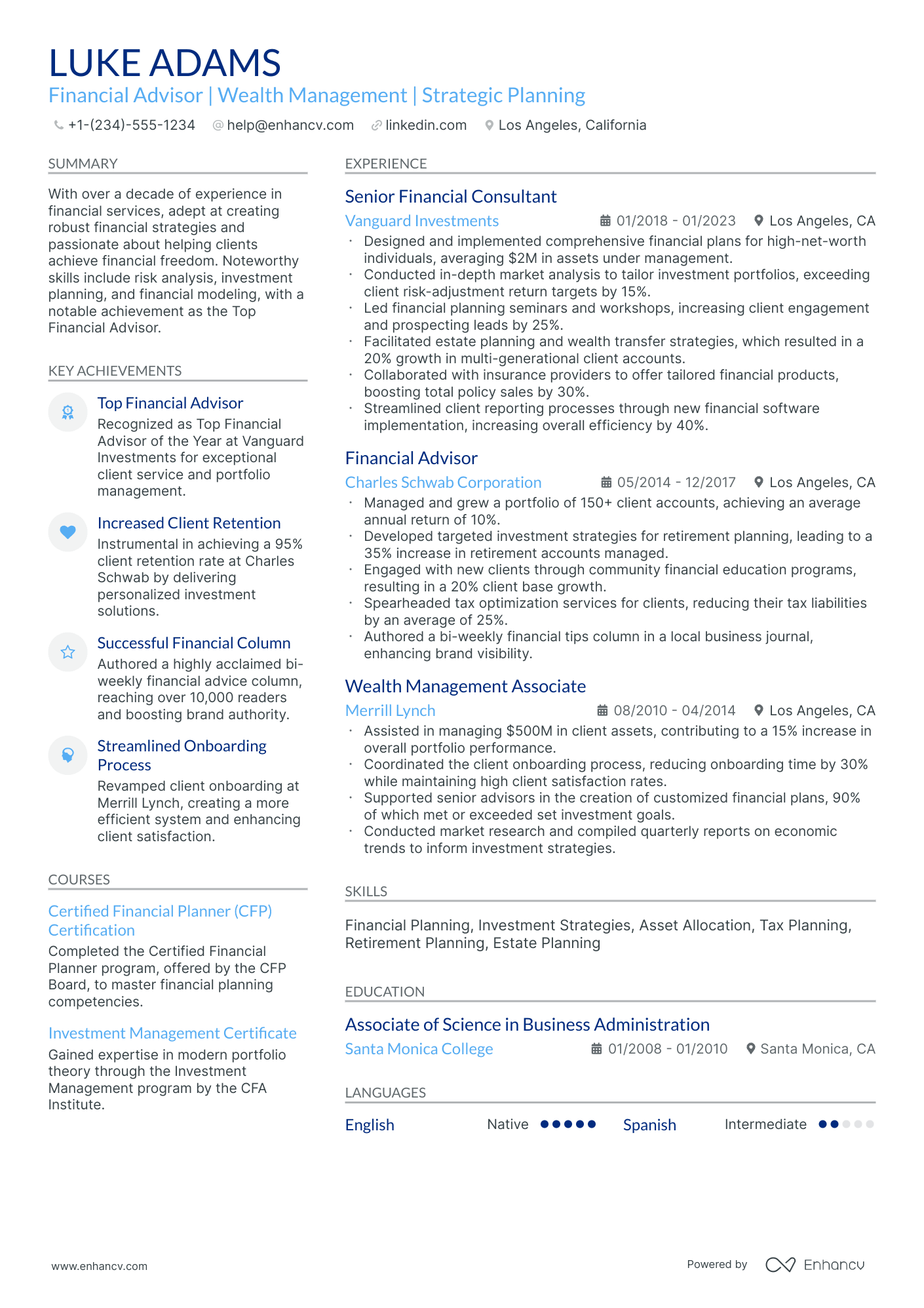

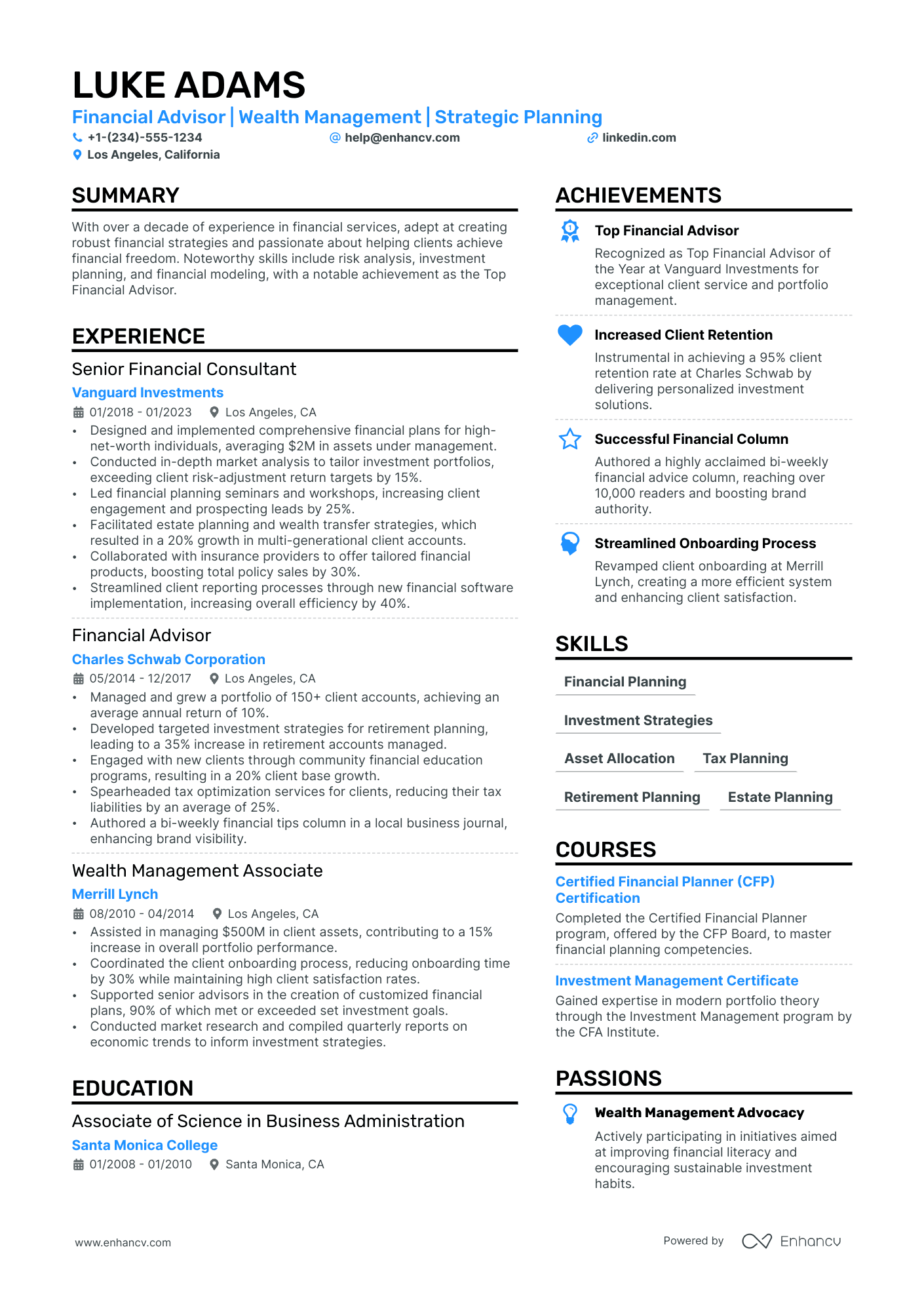

- If you have plenty of experience, you'd like to showcase, invest in the reverse-chronological resume format . This format focuses on your latest experience items and skills you've learned during your relevant (and recent) jobs.

- Don't go over the two-page limit, when creating your professional financial professional resume. Curate within it mainly experience and skills that are relevant to the job.

- Make sure your financial professional resume header includes all of your valid contact information. You could also opt to display your professional portfolio or LinkedIn profile.

- Submit or send out your financial professional resume as a PDF, so you won't lose its layout and design.

Each market has its own resume standards – a Canadian resume layout may differ, for example.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

List all your relevant higher education degrees within your resume in reverse chronological order (starting with the latest). There are cases when your PhD in a particular field could help you stand apart from other candidates.

Don't forget to include these six sections on your financial professional resume:

- Header and summary for your contact details and to highlight your alignment with the financial professional job you're applying for

- Experience section to get into specific technologies you're apt at using and personal skills to deliver successful results

- Skills section to further highlight how your profile matches the job requirements

- Education section to provide your academic background

- Achievements to mention any career highlights that may be impressive, or that you might have missed so far in other resume sections

What recruiters want to see on your resume:

- Quantitative Analysis Skills – Demonstrating strong capabilities in financial modeling, statistical analysis, and proficiency with tools such as Excel or other financial software.

- Relevant Financial Certifications – Possessing certifications such as CFA (Chartered Financial Analyst), CPA (Certified Public Accountant), or FRM (Financial Risk Manager) that are pertinent to the role.

- Experience with Financial Reporting and Compliance – Experience with GAAP, IFRS, or knowledge of relevant financial regulations and compliance requirements.

- Portfolio Management Expertise – For roles such as financial advisors, showing a track record of successful portfolio management and investment strategies.

- Risk Management Skills – Ability to identify, assess, and manage financial risks, which is crucial for roles in corporate finance, investment banking, and trading.

Writing your financial professional resume experience

Within the body of your financial professional resume is perhaps one of the most important sections - the resume experience one. Here are five quick tips on how to curate your financial professional professional experience:

- Include your expertise that aligns to the job requirements;

- Always ensure that you qualify your achievements by including a skill, what you did, and the results your responsibility led to;

- When writing each experience bullet, ensure you're using active language;

- If you can include a personal skill you've grown, thanks to your experience, this would help you stand out;

- Be specific about your professional experience - it's not enough that you can "communicate", but rather what's your communication track record?

Wondering how other professionals in the industry are presenting their job-winning financial professional resumes? Check out how these financial professional professionals put some of our best practices into action:

- Directed a team of 5 analysts to develop comprehensive financial models for mid-sized tech startups, enhancing investment decision-making processes.

- Implemented a new budgeting system using adaptive insights, thereby increasing forecast accuracy by 35% within the first year.

- Negotiated complex credit arrangements for clients, securing interest rates on average 1.5% lower than industry standards.

- Played a pivotal role in a $50M capital raising effort for a fintech startup, supporting aggressive expansion plans.

- Conducted thorough due diligence on potential acquisitions, providing the strategic insights that informed the successful merger with a peer company.

- Orchestrated the deployment of an AI-driven risk assessment tool that reduced operational risks by 25%.

- Led a cross-functional team in the streamlining of financial reporting processes, cutting report generation time by 40%.

- Designed and executed financial training for over 100 employees, enhancing the organization's financial literacy and decision-making capabilities.

- Managed a portfolio of over $200M, outperforming the S&P 500 by 5% annually.

- Implemented a cutting-edge risk management platform, which contributed to a reduction in financial discrepancies by over $2M in the first year.

- Championed the financial analysis for a successful market entry strategy into Asia, driving a 20% increase in global revenue.

- Collaborated with IT to automate accounts payable, increasing processing speed by 50% and accuracy by 98%.

- Streamlined financial data integration from various systems, improving reporting efficiency and data reliability.

- Oversaw the financial management of a $100M real estate investment portfolio, achieving an annual return of 10%.

- Collaborated with sales and operations to create performance dashboards, increasing financial transparency and supporting revenue growth by 15%.

- Led a successful IPO process for a high-growth software company, resulting in a market capitalization exceeding $500M.

- Developed a dynamic forecasting model that reduced the time taken for quarterly closing from 15 to 10 days.

- Oversaw the mitigation of currency risk on international transactions for the firm, protecting profit margins against foreign exchange volatility.

- Directed and managed a financial team responsible for the fiscal health of a $250M technology sector portfolio.

- Improved cash flow management, resulting in a sustained 5% reduction in operational costs annually.

- Developed and launched innovative financial products that increased customer engagement by 30%.

- Collaborated with senior management to plan and execute a corporate restructuring that saved the company $10M in annual costs.

- Enhanced the firm’s equity research division by incorporating advanced analytics, improving the accuracy of stock recommendations by 20%.

- Facilitated a series of workshops and seminars on financial compliance, bolstering the organization's adherence to regulatory standards.

- Transformed financial reporting mechanisms to align with evolving GAAP standards, enforcing compliance and reducing potential audit risks.

- Pioneered the use of big data analysis in financial forecasting, leading to a 10% improvement in year-over-year budget accuracy.

- Spearheaded a sustainable cost-reduction program that shaved 15% off of the supply chain expenditures.

- Engineered an employee stock ownership plan (ESOP) that increased employee retention by 25% over two years.

- Contributed to a robust M&A strategy that expanded the company's market presence and added $30M to its annual revenues.

- Optimized tax strategies for cross-border transactions, effectively reducing the company's tax liabilities by 18%.

Quantifying impact on your resume

- Include the percentage by which you exceeded your financial targets to demonstrate your ability to surpass goals and generate revenue.

- Specify the dollar amount of budgets you’ve managed to illustrate your competence in handling substantial financial responsibilities.

- Detail the number of financial reports you’ve generated to highlight your analytics skills and regular contribution to informed decision-making.

- Quantify the reduction in costs or expenses you’ve achieved to show your effectiveness in increasing operational efficiency.

- Mention the size of the portfolios you've managed in terms of assets under management to reflect your trustworthiness and investment acumen.

- State the number of compliance audits you’ve successfully navigated to verify your expertise in adhering to regulations and mitigating risks.

- Indicate the scale of teams or projects you’ve led, using headcounts or project value, to underscore your leadership and project management skills.

- List any growth in market share or customer base in percentage terms to confirm your ability to drive business expansion and enhance profitability.

Action verbs for your financial professional resume

Four quick steps for candidates with no resume experience

Those with less or no relevant experience could also make a good impression on recruiters by:

- Taking the time to actually understand what matters most to the role and featuring this within key sections of their resume

- Investing resume space into defining what makes them a valuable candidate with transferrable skills and personality

- Using the resume objective to showcase their personal vision for growth within the company

- Heavily featuring their technical alignment with relevant certifications, education, and skills.

Remember that your resume is about aligning your profile to that of the ideal candidate.

The more prominently you can demonstrate how you answer job requirements, the more likely you'd be called in for an interview.

Recommended reads:

PRO TIP

If the certificate you've obtained is especially vital for the industry or company, include it as part of your name within the resume headline.

Shining a light on your financial professional hard skills and soft skills

To win recruiters over, you must really have a breadth of skill set presented and supported within your financial professional resume.

On hiring managers' checklists, you'd initially discover hard or technical skills. Those are the technology (and software) that help you perform on the job. Hard skills are easy to quantify via your education, certificates, and on-the-job success.

Another main criterion recruiters are always assessing your financial professional resume on is soft skills. That is your ability to communicate, adapt, and grow in new environments. Soft skills are a bit harder to measure, as they are gained both thanks to your personal and professional experience.

Showcase you have the ideal skill set for the role by:

- Dedicating both a skills box (for your technical capabilities) and an achievements or strengths section (to detail your personal skills).

- When listing your skills, be specific about your hard skills (name the precise technology you're able to use) and soft skills (aim to always demonstrate what the outcomes were).

- Avoid listing overused cliches in the skills section (e.g. Microsoft Office and Communication), unless they're otherwise specified as prominent for the role.

- Select up to ten skills which should be defined via various sections in your resume skills sidebar (e.g. a technical skills box, industry expertise box with sliders, strengths section with bullets).

Spice up your resume with leading technical and people skills, that'd help you get noticed by recruiters.

Top skills for your financial professional resume:

Financial Modeling

Excel

QuickBooks

SAP

Tableau

SQL

Bloomberg Terminal

Risk Management Software

Accounting Software

Data Analysis Tools

Analytical Thinking

Communication

Problem Solving

Attention to Detail

Time Management

Interpersonal Skills

Adaptability

Teamwork

Client Relationship Management

Decision Making

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

The basics of your financial professional resume certifications and education sections

Improve the education and certification sections of your financial professional resume by:

- Dedicating more prominent space to certificates that are more recent and have helped you update your skill set

- Keeping all the information you list to the basics: certificate/degree name, institution, and graduation dates

- Writing supplementary information in the details of your certification or education section, only if you lack experience or want to show further skill alignment

- Including your credential or license number, only if the information is valid to your application or certification

Within financial professional job adverts, relevant education, and certification are always listed within the key prerequisite for the role.

Ensure you meet all job requirements with some of the leading certificates in the industry:

The top 5 certifications for your financial professional resume:

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Public Accountant (CPA) - American Institute of CPAs (AICPA)

- Certified Financial Planner (CFP) - Certified Financial Planner Board of Standards, Inc.

- Chartered Alternative Investment Analyst (CAIA) - CAIA Association

- Financial Risk Manager (FRM) - Global Association of Risk Professionals (GARP)

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

Recommended reads:

Should you write a resume summary or an objective?

No need to research social media or ask ChatGPT to find out if the summary or objective is right for your financial professional resume.

- Experienced candidates always tend to go for resume summaries. The summary is a three to five sentence long paragraph that narrates your career highlights and aligns your experience to the role. In it you can add your top skills and career achievements that are most impressive.

- Junior professionals or those making a career change, should write a resume objective. These shouldn't be longer than five sentences and should detail your career goals . Basically, how you see yourself growing in the current position and how would your experience or skill set could help out your potential employers.

Think of both the resume summary and objective as your opportunity to put your best foot forward - from the get go - answering job requirements with skills.

Use the below real-world financial professional professional statements as inspiration for writing your resume summary or objective.

Resume summaries for a financial professional job

- Seasoned Financial Analyst with over 12 years of in-depth experience in quantitative analysis, budget forecasting, and risk assessment for reputable financial firms. Proficient in leveraging advanced Excel functions and financial modeling software to enhance operational efficiency, culminating in a track record of increasing ROI by 30% for top-tier clients.

- Dynamic CPA with 8 years of experience shaping financial strategies for Fortune 500 companies. Specializes in tax planning and compliance, adept in the use of QuickBooks and SAP. Recognized for restructuring a multinational tax approach that saved the firm $2 million annually.

- Former Senior Software Engineer making a strategic transition to Financial Technology with a profound understanding of data analytics, coding in Python, and a proven history of optimizing algorithm efficiency by 40% in previous tech roles. Keen to apply technical expertise to financial problem-solving and market analysis.

- Accomplished Strategic Marketing Lead eager to transfer 10 years of experience in data-driven decision making and implementing growth initiatives to the financial sector. Brings a solid grasp of analytics tools and a history of producing a 25% increase in campaign ROI through targeted data segmentation techniques.

- Driven graduate with a Bachelor's in Finance and a passion for statistical analysis, proactively seeking to enter the financial industry. Equipped with academic knowledge in investment strategies and advanced proficiency in Excel, eager to deliver actionable insights and drive financial performance for forward-thinking entities.

- Recent MBA graduate eager to leverage educational background in finance and leadership skills to transition into the financial sector. Coming with internship experience in strategic financial planning and deep enthusiasm for identifying growth opportunities through market research and financial modeling.

Showcasing your personality with these four financial professional resume sections

Enhance your financial professional expertise with additional resume sections that spotlight both your professional skills and personal traits. Choose options that not only present you in a professional light but also reveal why colleagues enjoy working with you:

- My time - a pie chart infographic detailing your daily personal and professional priorities, showcasing a blend of hard and soft skills;

- Hobbies and interests - share your engagement in sports, fandoms, or other interests, whether in your local community or during personal time;

- Quotes - what motivates and inspires you as a professional;

- Books - indicating your reading and comprehension skills, a definite plus for employers, particularly when your reading interests align with your professional field.

Key takeaways

- Ensure your financial professional resume uses a simple, easy-to-read format that reflects upon your experience and aligns with the role;

- Be specific within the top one-third of your resume (header and summary or objective) to pinpoint what makes you the ideal candidate for the financial professional role;

- Curate information that is tailored to the job by detailing skills, achievements, and actual outcomes of your efforts;

- List your certifications and technical capabilities to demonstrate your aptitude with specific software and technologies;

- The sections you decide on including on your financial professional should pinpoint your professional expertise and personality.