As a financial planning analyst, you may struggle with effectively showcasing your complex analytical skills and experience with financial modeling on your resume. Our guide provides targeted advice and examples to help you articulate these competencies clearly, ensuring your resume stands out to potential employers.

- Aligning the top one-third of your financial planning analyst resume with the role you're applying for.

- Curating your specific financial planning analyst experience to get the attention of recruiters.

- How to list your relevant education to impress hiring managers recruiting for the financial planning analyst role.

Discover more financial planning analyst professional examples to help you write a job-winning resume.

- Accounting Assistant Resume Example

- Tax Accountant Resume Example

- Government Accounting Resume Example

- Bank Branch Manager Resume Example

- Big 4 Auditor Resume Example

- Purchasing Director Resume Example

- Financial Reporting Manager Resume Example

- Tax Manager Resume Example

- Hotel Night Auditor Resume Example

- Management Accounting Resume Example

Creating the best financial planning analyst resume format: four simple steps

The most appropriate financial planning analyst resume format is defined by precision and a systematic approach. What is more, it should reflect upon how your application will be assessed by recruiters. That is why we've gathered four of the most vital elements to keep in mind when designing your resume:

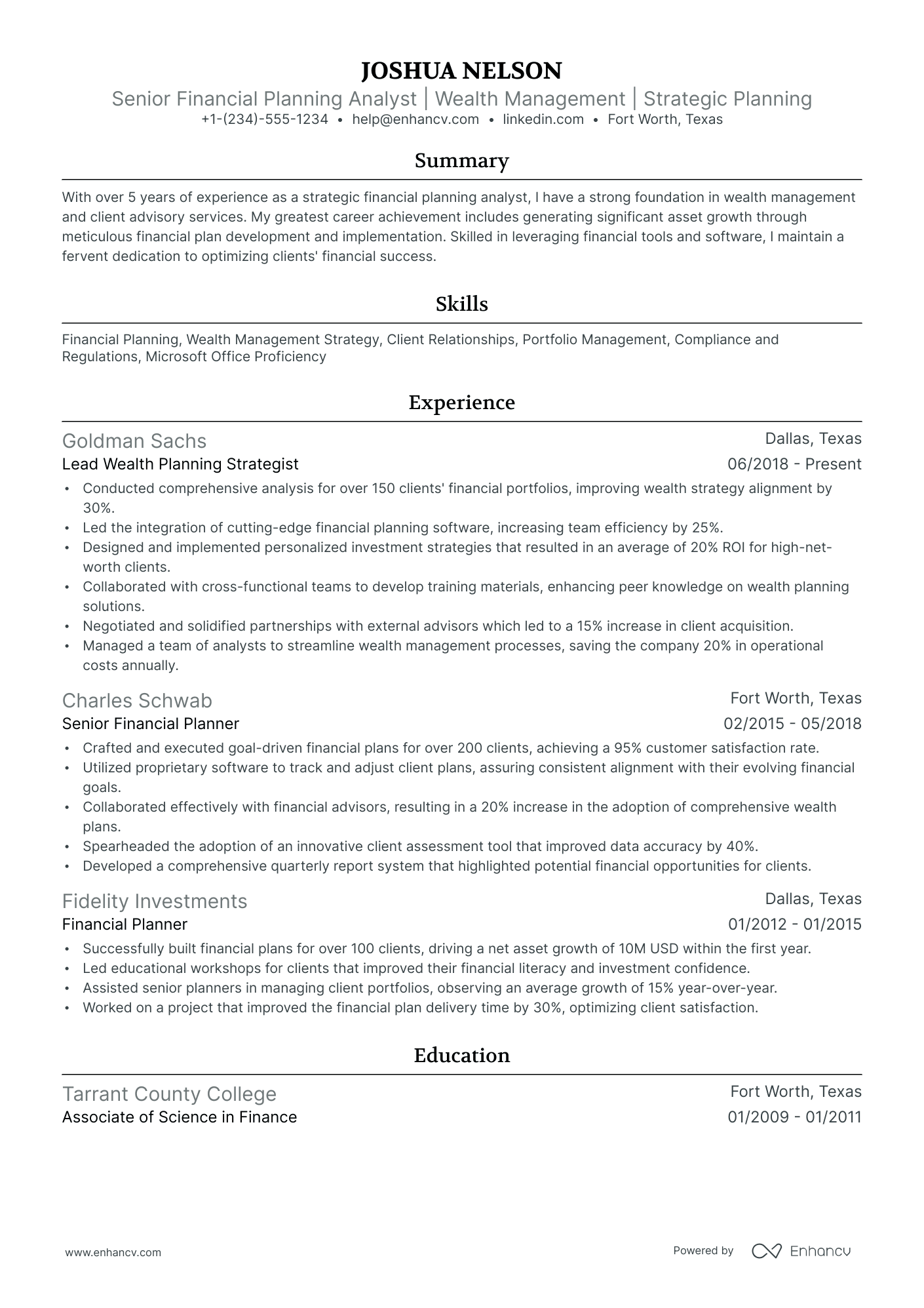

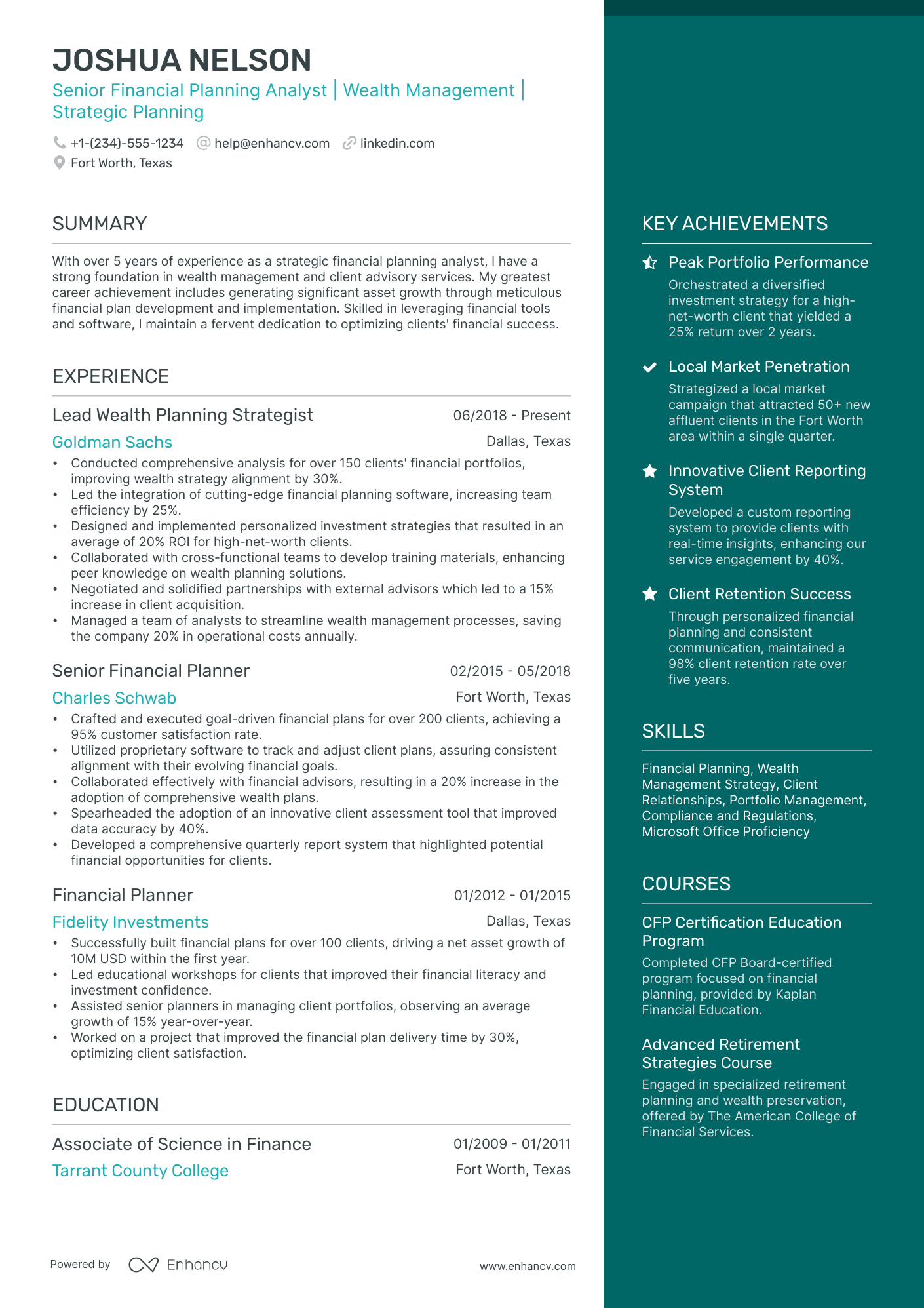

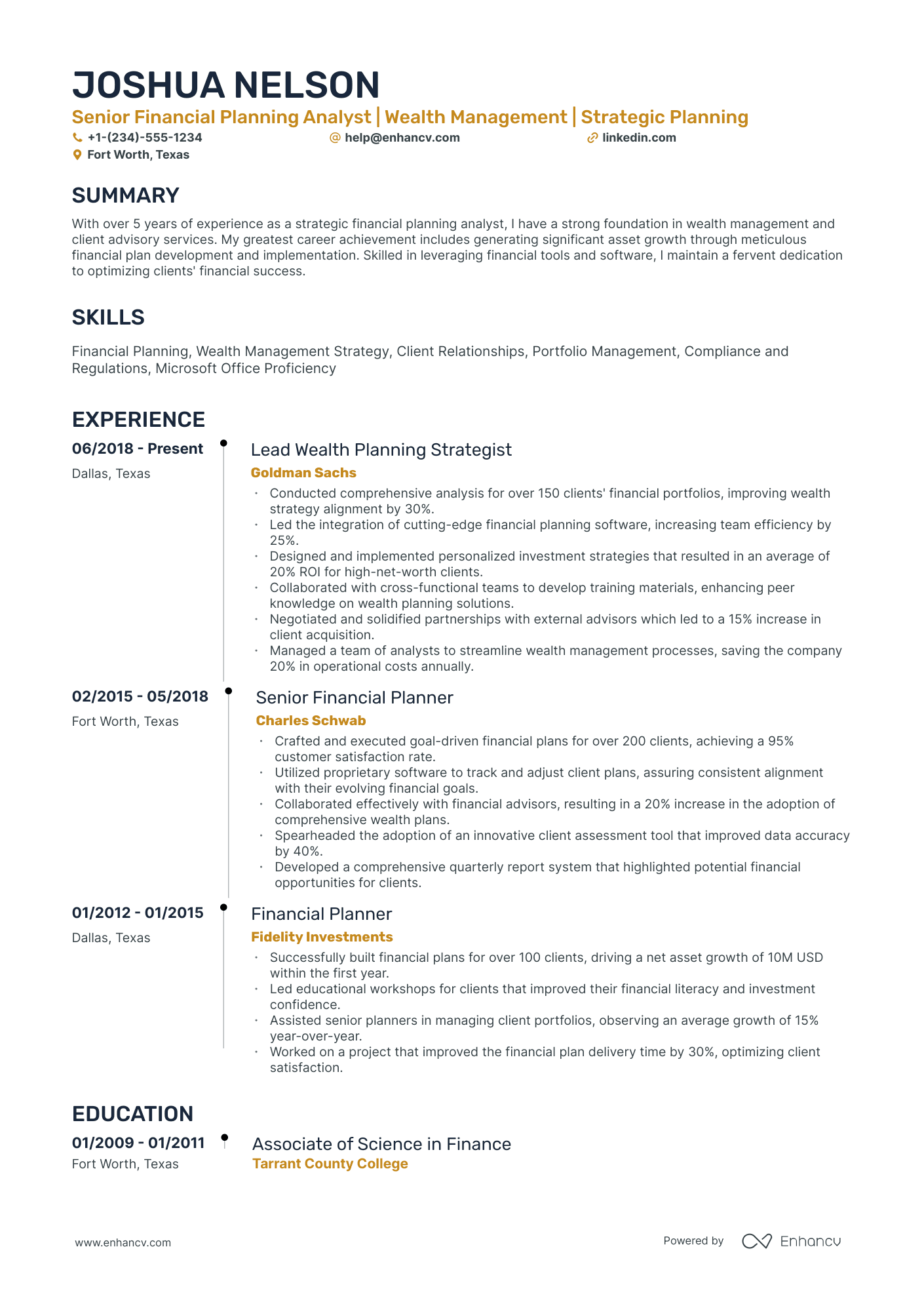

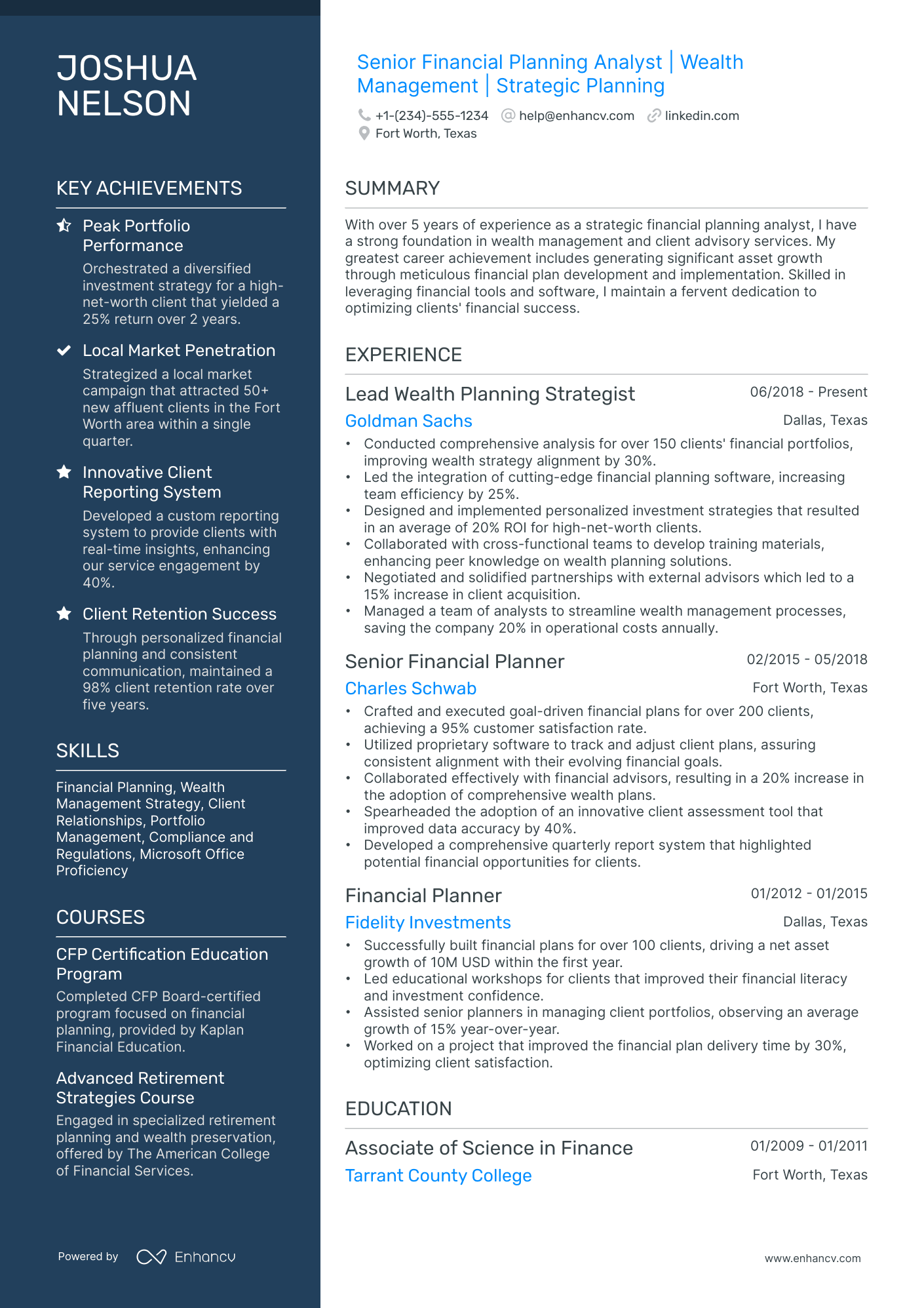

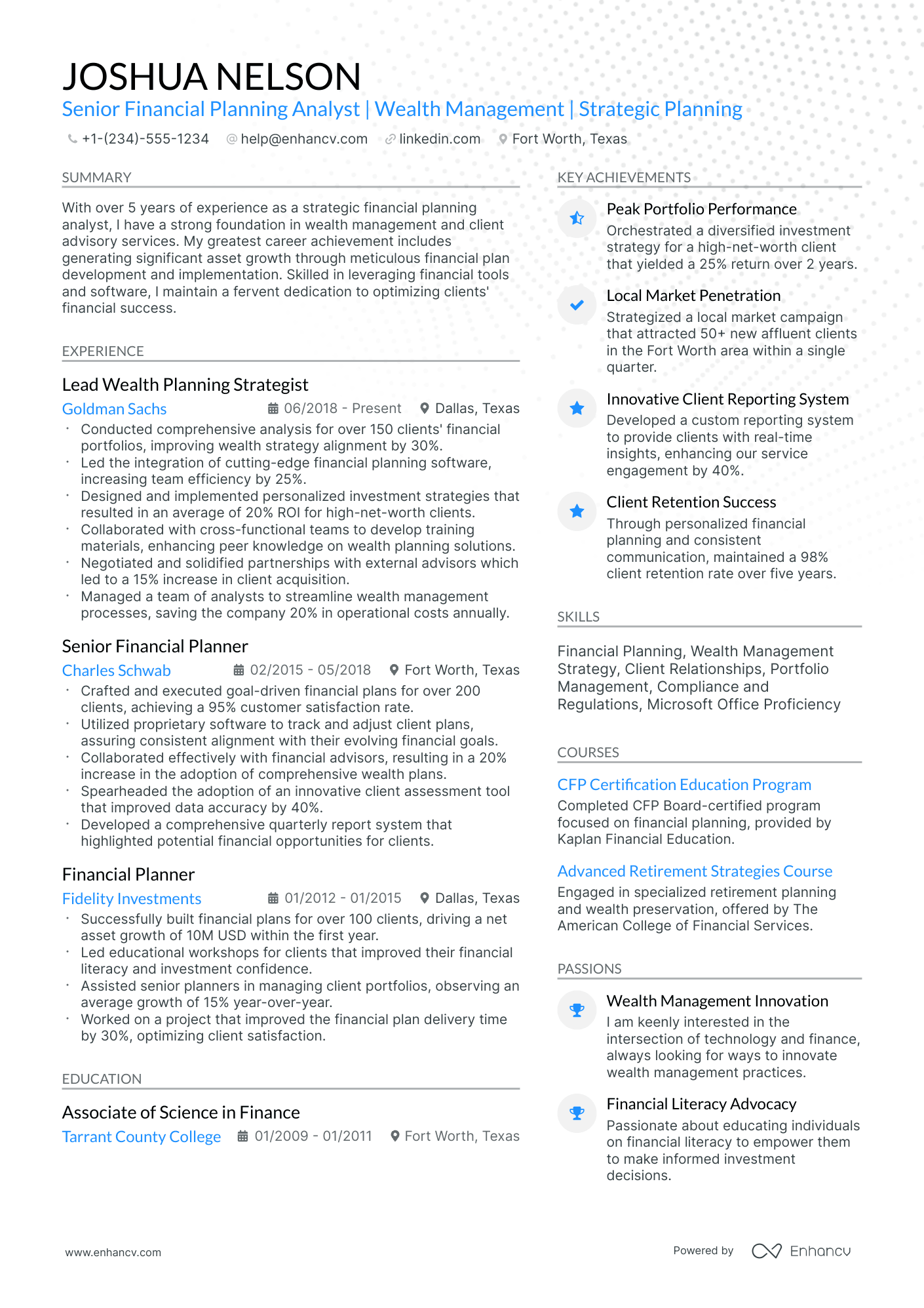

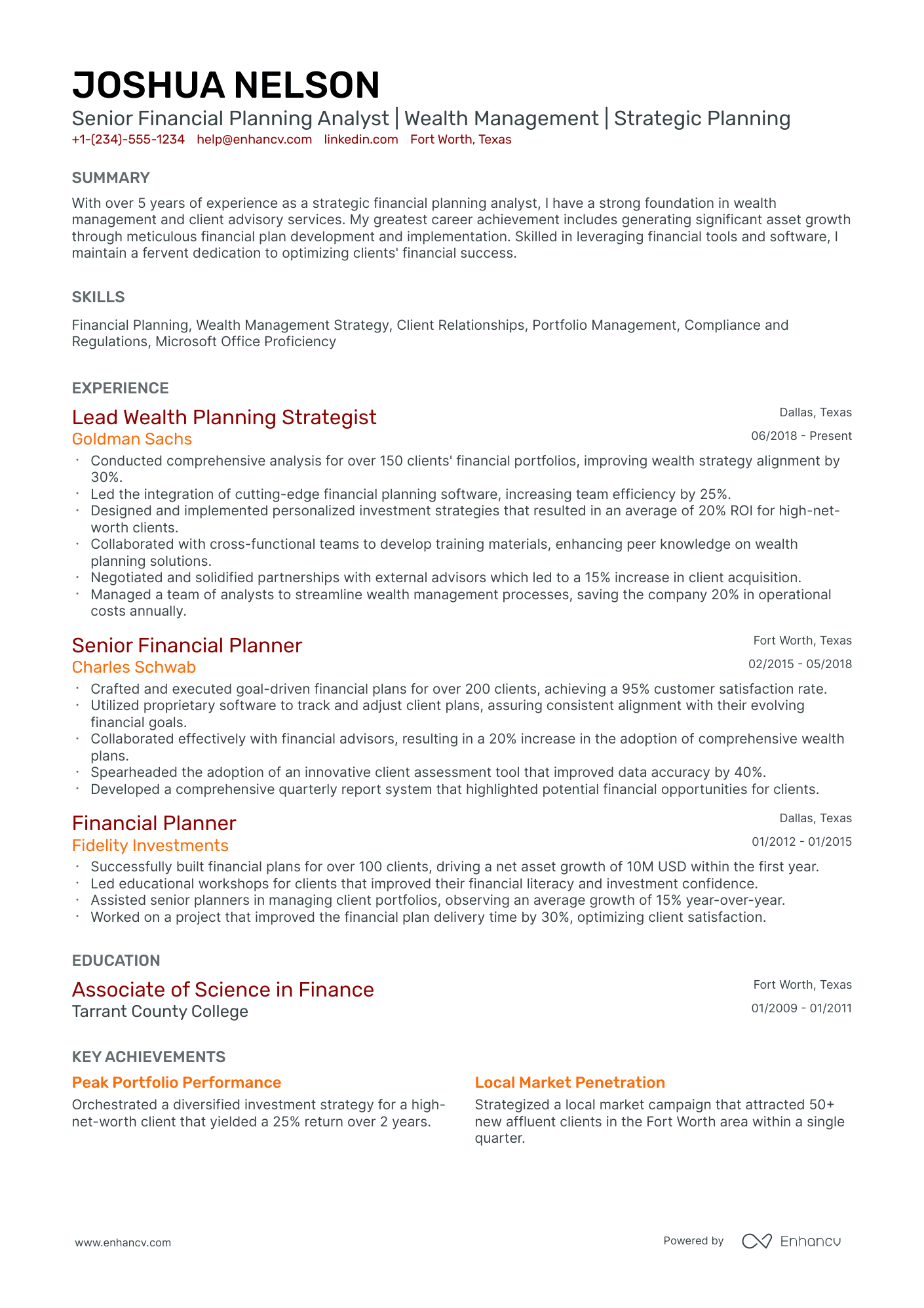

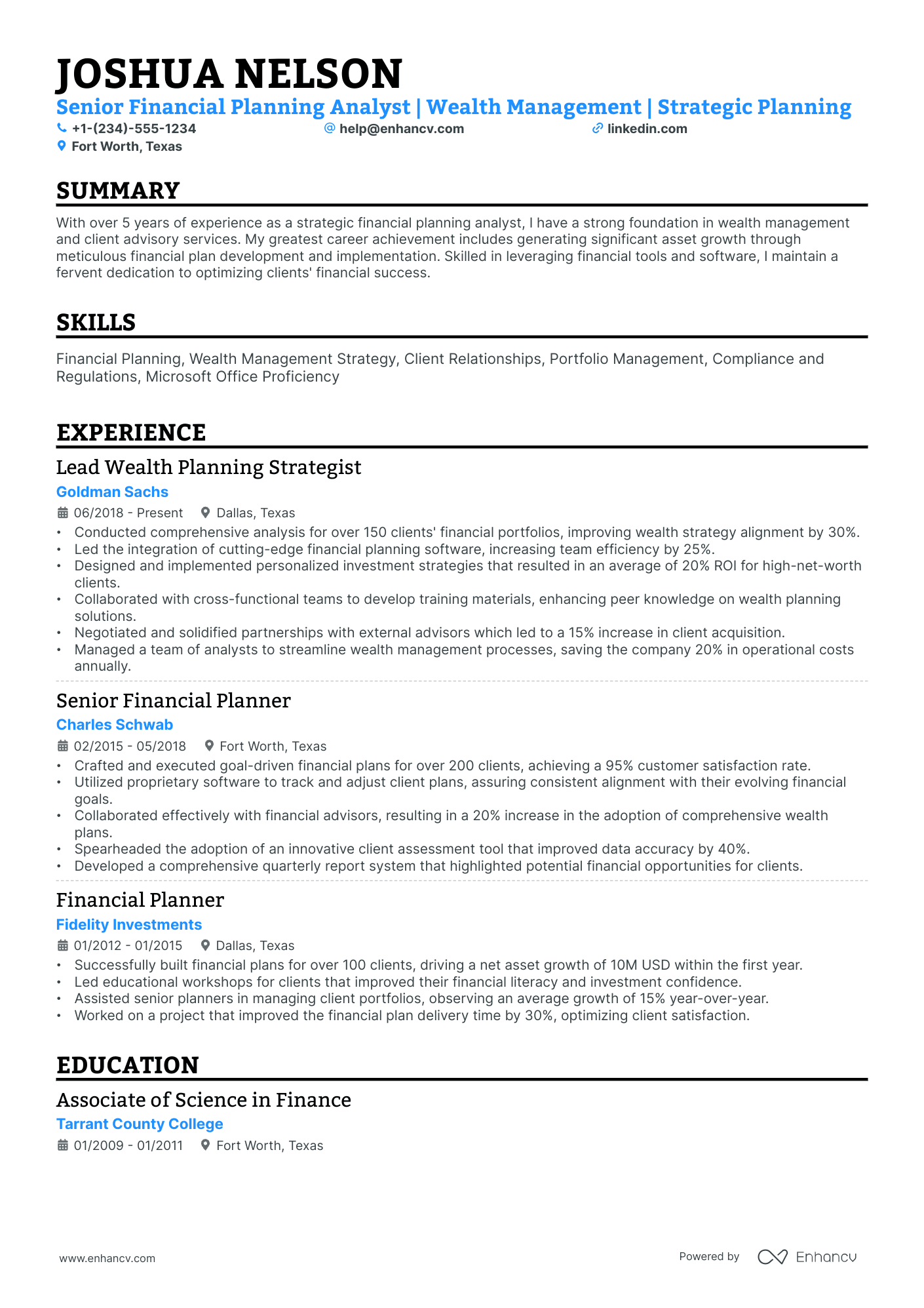

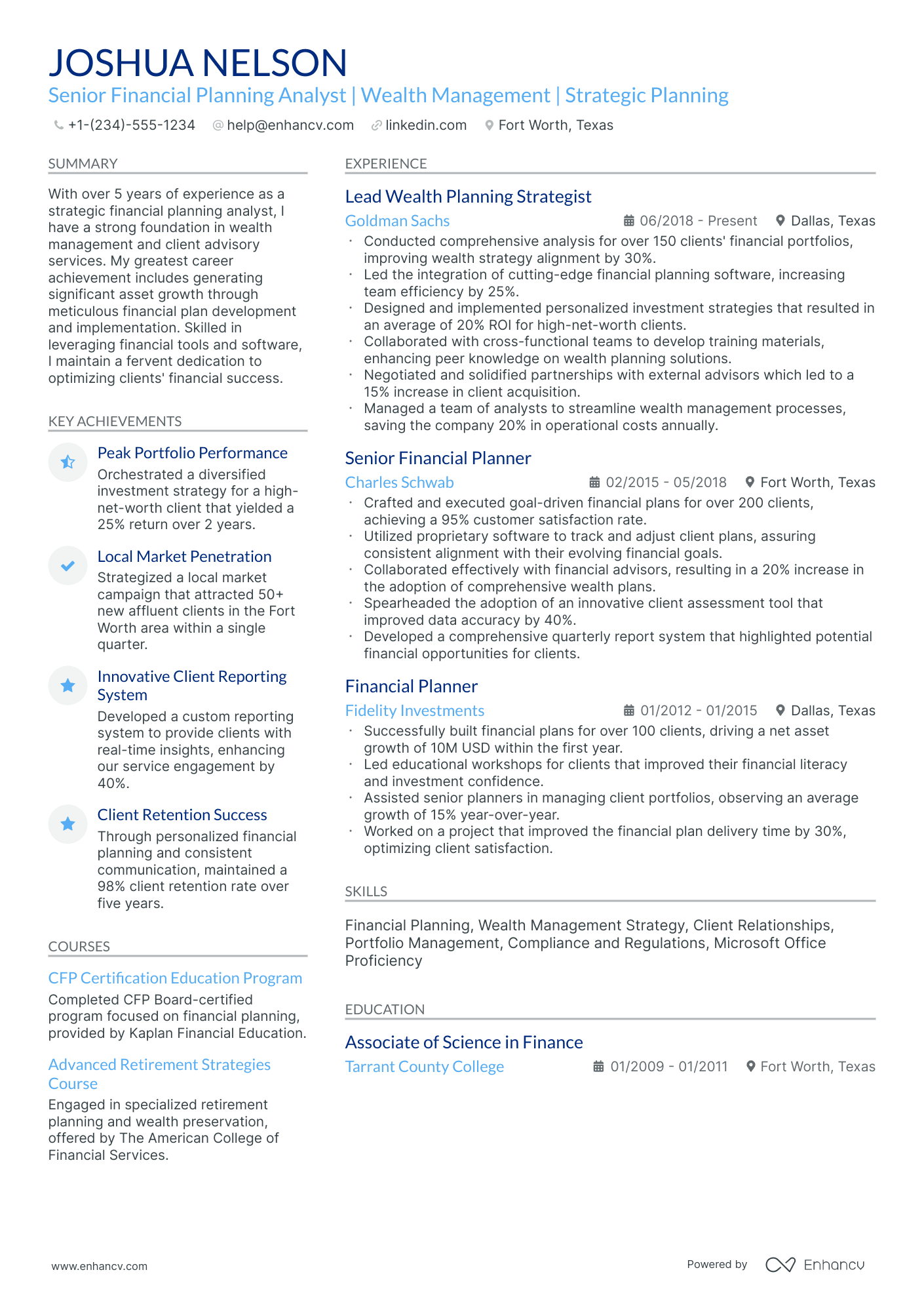

- It's all about presenting how your experience or skills align with the job. Use the reverse-chronological resume format , if your expertise is relevant to the financial planning analyst role. Otherwise, select the functional skill-based resume format or the hybrid resume format to shift the focus to your skill set.

- Resume header - make sure you've filled out all relevant (and correct) information, like your contact details and link to your portfolio.

- Resume length - unless you've over a decade of applicable expertise in the field, stick with a one-page resume format. If you'd like to present more of your professional experience, go up to two pages.

- Resume file - submit your financial planning analyst resume in a PDF format to ensure all information stays in the same place.

Adjust your resume layout based on the market – Canadian resumes, for example, may follow a unique format.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

Don't forget to include these six sections on your financial planning analyst resume:

- Header and summary for your contact details and to highlight your alignment with the financial planning analyst job you're applying for

- Experience section to get into specific technologies you're apt at using and personal skills to deliver successful results

- Skills section to further highlight how your profile matches the job requirements

- Education section to provide your academic background

- Achievements to mention any career highlights that may be impressive, or that you might have missed so far in other resume sections

What recruiters want to see on your resume:

- Proficiency in financial modeling and forecasting, with experience using tools like Excel or specialized financial planning software.

- Understanding of financial regulations and compliance, and experience in creating plans that adhere to these standards.

- Demonstrated experience in budgeting, variance analysis, and providing actionable insights to drive financial decision-making.

- Strong analytical and data interpretation skills, with the ability to turn complex financial data into clear, concise reports and presentations.

- Experience with performance measurement, financial risk management, and strategic planning to support long-term financial goals.

Advice for your financial planning analyst resume experience section - setting your application apart from other candidates

Your resume experience section needs to balance your tangible workplace achievements with job requirements.

The easiest way to sustain this balance between meeting candidate expectations, while standing out, is to:

- Select really impressive career highlights to detail under each experience and support those with your skills;

- Assess the job advert to define both the basic requirements (which you could answer with more junior roles) and the more advanced requirements - which could play a more prominent role through your experience section;

- Create a separate experience section, if you decide on listing irrelevant experience items. Always curate those via the people or technical skills you've attained that match the current job you're applying for;

- Don't list experience items from a decade ago - as they may no longer be relevant to the industry. That is, unless you're applying for a more senior role: where experience would go to demonstrate your character and ambitions;

- Define how your role has helped make the team, department, or company better. Support this with your skill set and the initial challenge you were able to solve.

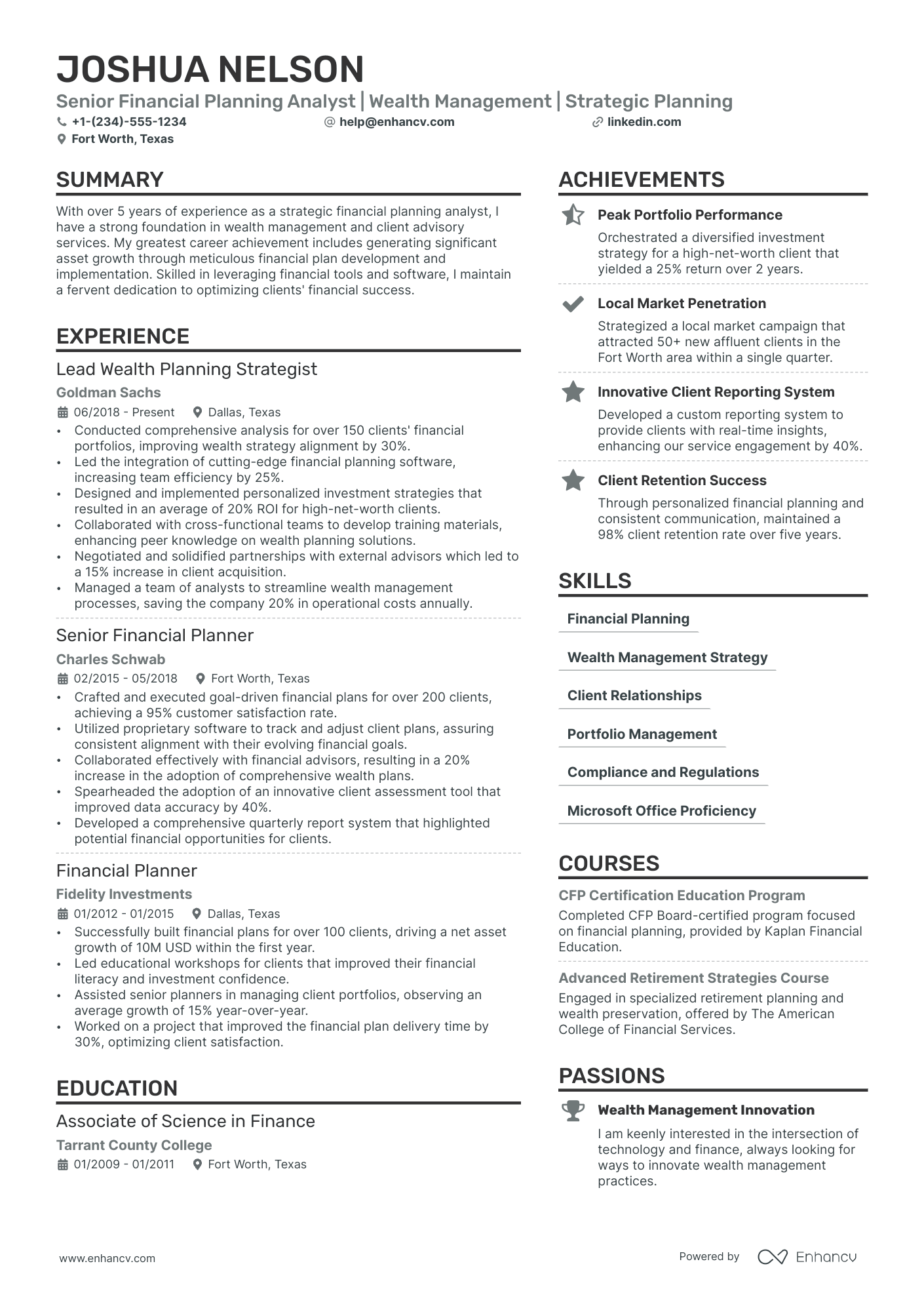

Take a look at how real-life financial planning analyst professionals have presented their resume experience section - always aiming to demonstrate their success.

- Led a budgeting process overhaul for mid-sized technology firms, increasing forecasting accuracy by 35% over a 12-month period.

- Managed the implementation of a cloud-based financial planning software, streamlining data analysis and reporting workflows for the finance team.

- Conducted monthly and quarterly financial reviews, identifying trends and providing strategic recommendations to executives, contributing to a 10% year-over-year revenue growth.

- Coordinated with cross-functional teams to develop comprehensive financial models supporting a $50 million project, directly influencing investment decisions.

- Authored detailed variance analysis reports, pinpointing discrepancies and facilitating the reallocation of funds to optimize fiscal performance.

- Spearheaded the financial due diligence for potential merger and acquisition targets, assisting in the successful acquisition of two companies.

- Transformed the company's cost structure analysis process, resulting in a 20% reduction in unnecessary expenses over two fiscal years.

- Liaised with department heads to track and manage a $100 million budget, ensuring alignment with long-term strategic plans.

- Prepared financial presentations for quarterly board meetings, clearly articulating financial status and guiding future financial strategy.

- Collaborated with IT to develop data visualization dashboards, which increased financial reporting efficiency by 25% by providing real-time insights.

- Performed rigorous market analysis to support leadership in making informed expansion decisions, contributing to a 15% market share increase.

- Guided a team of junior analysts in the regular updating of financial forecasts and budgets, maintaining exceptional accuracy and accountability.

- Played a pivotal role in the financial modeling for an international product launch, which exceeded revenue projections by $5 million in the first year.

- Facilitated a company-wide transition to zero-based budgeting, fostering a culture of cost accountability and potentially saving $3 million annually.

- Developed quarterly benchmarking reports against industry standards, enabling the leadership to prioritize initiatives that improved operational efficiency by 18%.

- Introduced an advanced risk assessment framework that shored up financial controls and mitigated risk factors, protecting the company's asset base.

- Orchestrated a thorough audit of existing financial plans, identifying performance gaps and implementing improved processes that increased profitability margins by 12%.

- Pioneered the use of predictive analytics in financial forecasting, enhancing decision-making and contributing to a strong and adaptive financial strategy.

- Managed and successfully reduced financial discrepancies by employing a new reconciliation system, cutting down on month-end close time by 40%.

- Played a key role in strategic planning initiatives, which saw the company successfully penetrate two new international markets.

- Lead weekly financial review meetings with senior leadership, providing insights that directly influenced the allocation of a $200 million capital investment fund.

- Developed comprehensive capital budgeting processes that improved investment decision-making, leading to a 30% ROI on new capital projects.

- Streamlined the quarterly forecasting process through the implementation of advanced statistical modeling techniques, improving forecast accuracy by 22%.

- Authored an in-depth competitive analysis report that shaped the company's pricing strategy adjustment, resulting in a 7% increase in competitive bid win rate.

Quantifying impact on your resume

- Include the size of the budgets you have managed to demonstrate your financial responsibility and trustworthiness.

- List any cost-saving outcomes you've achieved, as this shows your ability to positively affect the company's bottom line.

- Detail the percentage of revenue growth for which you have been responsible to highlight your contribution to business expansion.

- Specify the number of financial models you have developed or optimized to showcase your technical expertise and analytical skills.

- Present the amount of funds you have raised or portfolios you have managed to exhibit your capabilities in asset and investment management.

- Mention the number of compliance projects completed to emphasize your understanding of regulatory requirements and risk management.

- Describe the extent of cross-functional teams you have worked with, indicating your collaboration skills and ability to work in diverse environments.

- Quantify any improvements in efficiency or productivity you have introduced, showing your initiative to streamline processes.

Action verbs for your financial planning analyst resume

Remember these four tips when writing your financial planning analyst resume with no experience

You've done the work - auditing the job requirements for keywords and have a pretty good idea of the skill set the ideal candidate must possess.

Yet, your professional experience amounts to a summer internship .

Even if you have limited or no professional expertise that matches the role you're applying for, you can use the resume experience section to:

- List extracurricular activities that are relevant to the job requirements. Let's say you were editor-in-chief of your college newspaper or part of the engineering society. Both activities have taught you invaluable, transferrable skills (e.g. communication or leadership) that can be crucial for the job;

- Substitute jobs with volunteer experience. Participating in charity projects has probably helped you develop an array of soft skills (e.g. meeting deadlines and interpersonal communications). On the other hand, volunteering shows potential employers more about you: who you are and what are the causes you care about;

- Align job applications with your projects. Even your final-year thesis work could be seen as relevant experience, if it's in the same industry as the job you're applying for. Ensure you've listed the key skills your project has taught you, alongside tangible outcomes or your project success;

- Shift the focus to your transferrable skills. We've said it before, but recruiters will assess your profile upon both job requirements and the skills you possess. Consider what your current experience - both academic and life - has taught you and how you've been able to develop your talents.

Recommended reads:

PRO TIP

The more time and effort you've put into obtaining the relevant certificate, the closer to the top it should be listed. This is especially important for more senior roles and if the company you're applying for is more forward-facing.

How to showcase hard skills and soft skills on your resume

Reading between the lines of your dream job, you find recruiters are looking for candidates who have specific software or hardware knowledge, and personal skills.

Any technology you're adept at shows your hard skills. This particular skill set answers initial job requirements, hinting at how much time your potential employers would have to invest in training you. Showcase you have the relevant technical background in your communicate, solve problems, and adapt to new environments. Basically, your interpersonal communication skills that show recruiters if you'd fit into the team and company culture. You could use the achievements section to tie in your greatest wins with relevant soft skills.

It's also a good idea to add some of your hard and soft skills across different resume sections (e.g. summary/objective, experience, etc.) to match the job requirements and pass the initial screening process. Remember to always check your skill spelling and ensure that you've copy-pasted the name of the desired skills from the job advert as is.

Top skills for your financial planning analyst resume:

Financial Modeling

Excel (Advanced)

SQL

Power BI

Tableau

Forecasting Techniques

Budgeting Software

Data Analysis Tools

Accounting Software

ERP Systems

Analytical Thinking

Attention to Detail

Communication Skills

Problem-Solving

Time Management

Team Collaboration

Adaptability

Critical Thinking

Interpersonal Skills

Presentation Skills

PRO TIP

Listing your relevant degrees or certificates on your financial planning analyst resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

Certifications and education: in-demand sections for your financial planning analyst resume

Your academic background in the form of certifications on your resume and your higher degree education is important to your application.

The certifications and education sections pinpoint a variety of hard and soft skills you possess, as well as your dedication to the industry.

Add relevant certificates to your financial planning analyst resume by:

- Add special achievements or recognitions you've received during your education or certification, only if they're really noteworthy and/or applicable to the role

- Be concise - don't list every and any certificate you've obtained through your career, but instead, select the ones that would be most impressive to the role

- Include the name of the certificate or degree, institution, graduation dates, and certificate license numbers (if possible)

- Organize your education in reverse chronological format, starting with the latest degree you have that's most applicable for the role

Think of the education and certification sections as the further credibility your financial planning analyst resume needs to pinpoint your success.

Now, if you're stuck on these resume sections, we've curated a list of the most popular technical certificates across the industry.

Have a look, below:

The top 5 certifications for your financial planning analyst resume:

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Financial Planner (CFP) - Certified Financial Planner Board of Standards, Inc.

- Chartered Alternative Investment Analyst (CAIA) - CAIA Association

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

- Certified Investment Management Analyst (CIMA) - Investments & Wealth Institute

PRO TIP

Highlight any significant extracurricular activities that demonstrate valuable skills or leadership.

Recommended reads:

Practical guide to your financial planning analyst resume summary or objective

First off, should you include a summary or objective on your financial planning analyst resume?

We definitely recommend you choose the:

- Resume summary to match job requirements with most noteworthy accomplishments.

- Resume objective as a snapshot of career dreams

Both the resume summary and objective should set expectations for recruiters as to what your career highlights are.

These introductory paragraphs (that are no more than five sentences long) should help you answer why you're the best candidate for the job.

Industry-wide best practices pinpoint that the financial planning analyst resume summaries and objectives follow the structures of these samples:

Resume summaries for a financial planning analyst job

- Seasoned financial planning analyst with over 15 years of experience specializing in complex data analysis, strategic budgeting, and financial forecasting for a Fortune 500 company. Recognized for driving multimillion-dollar revenue increases through insightful market trend analysis and cost reduction strategies, culminating in a CFO commendation for excellence.

- Dedicated Certified Public Accountant transitioning into financial planning, leveraging 10 years in tax consultancy and compliance to enhance financial accuracy and efficiency. Excel in financial modeling and risk assessment, eager to apply a rich background in financial legislation to strategic planning and analysis.

- Former Business Consultant with a focus on SMB growth strategies, venturing into financial planning analysis after 8 years of experience. Renowned for a keen analytical approach that led to a 25% profitability increase for a portfolio of small businesses, now aiming to deliver similar impactful insights in financial market trends.

- Accomplished Financial Analyst with a track record of delivering data-driven insights and strategic advice, aligning financial plans with organizational goals over 12 years at a top-tier investment bank. Championed the development of an award-winning analytical toolset, resulting in a 30% improvement in forecasting accuracy.

- Aiming to leverage a strong foundation in mathematics and recent MBA graduate's fervor to embark on a career in financial planning analysis. Eager to combine academic knowledge with an ardent interest in financial markets to contribute to the fiscal wellbeing and strategic growth of a dynamic financial department.

- As an ambitious professional with a freshly minted degree in Economics and Finance, my objective is to immerse myself in the world of financial planning analysis. I am eager to apply rigorous academic training and a natural aptitude for quantitative analysis to deliver top-tier financial strategies and solutions.

What else can you add to your financial planning analyst resume

What most candidates don't realize is that their financial planning analyst resumes should be tailored both for the job and their own skillset and personality.

To achieve this balance between professional and personal traits, you can add various other sections across your resume.

Your potential employers may be impressed by your:

- Awards - spotlight any industry-specific achievements and recognitions that have paved your path to success;

- Languages - dedicate some space on your financial planning analyst resume to list your multilingual capabilities, alongside your proficiency level;

- Publications - with links and descriptions to both professional and academic ones, relevant to the role;

- Your prioritization framework - include a "My Time" pie chart, that shows how you spend your at-work and free time, would serve to further backup your organization skill set.

Key takeaways

- All aspects of your resume should be selected to support your bid for being the perfect candidate for the role;

- Be intentional about listing your skill set to be balanced with both technical and people capabilities, while aligning with the job;

- Include any experience items that are relevant to the role and ensure you feature the outcomes of your responsibilities;

- Use the summary or objective as a screenshot of your best experience highlights;

- Curate various resume sections to showcase personal, transferable skills.