One resume challenge you, as a financial auditor, may encounter is effectively showcasing your detail-oriented approach and complex problem-solving skills in a concise manner. Our guide provides tailored strategies to help you highlight these key competencies, ensuring your resume captures the attention of prospective employers in the finance industry.

- Which sections do you need to include in your resume to meet recruiters' requirements;

- How to write your financial auditor resume experience section - even if you have don't have little to no work experience;

- Real-life professional examples to guide you how to write the most important financial auditor resume sections;

- Adding even more sections so your financial auditor resume stands out with professionalism and your personality.

We've also selected some of the best (and most relevant) resume guides for the financial auditor role you're applying for:

- Financial Consultant Resume Example

- Financial Accounting Resume Example

- Financial Management Specialist Resume Example

- Financial Data Analyst Resume Example

- Finance Executive Resume Example

- Portfolio Manager Resume Example

- Accounting Supervisor Resume Example

- Loan Officer Resume Example

- Functional Accounting Resume Example

- Public Accounting Auditor Resume Example

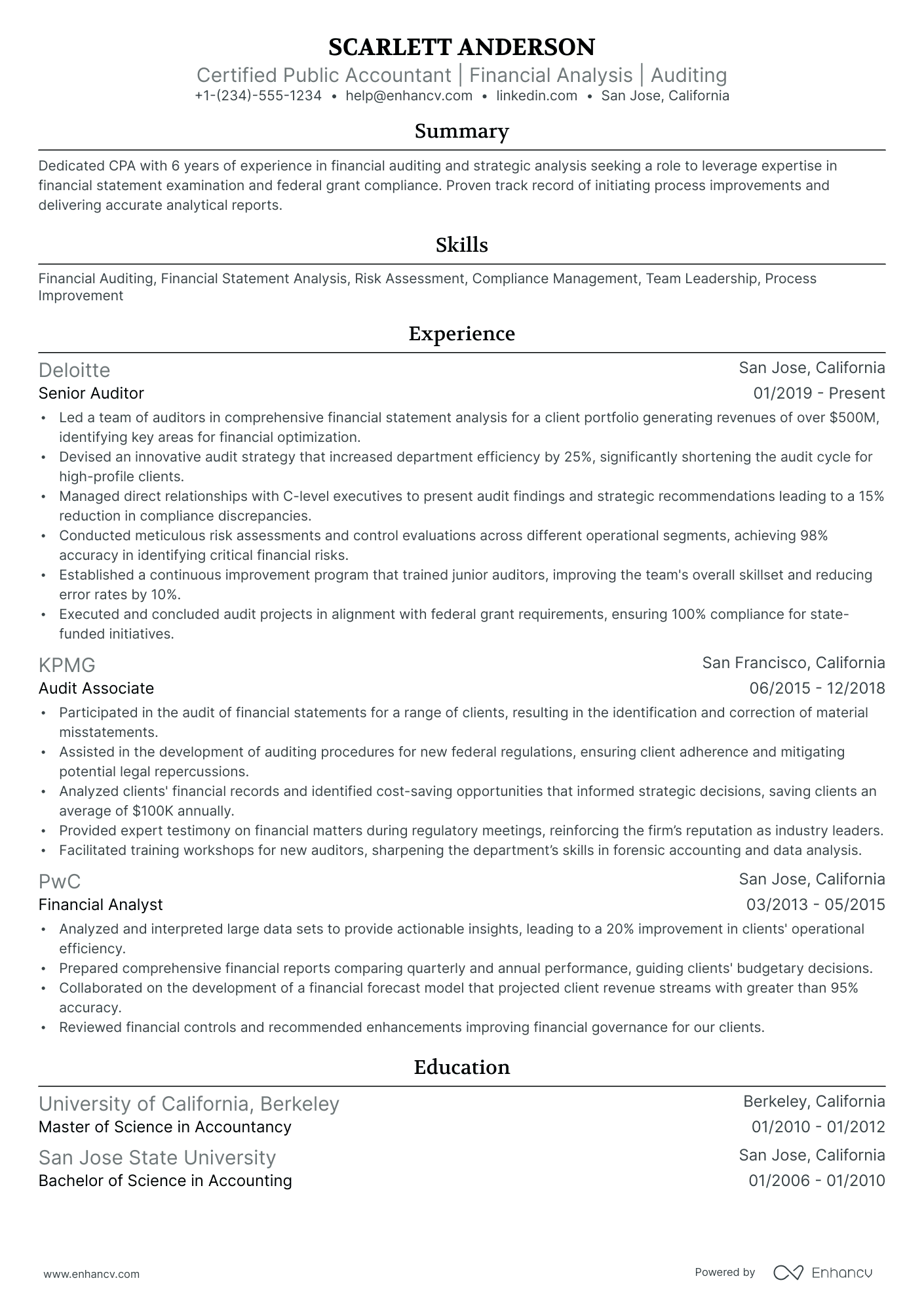

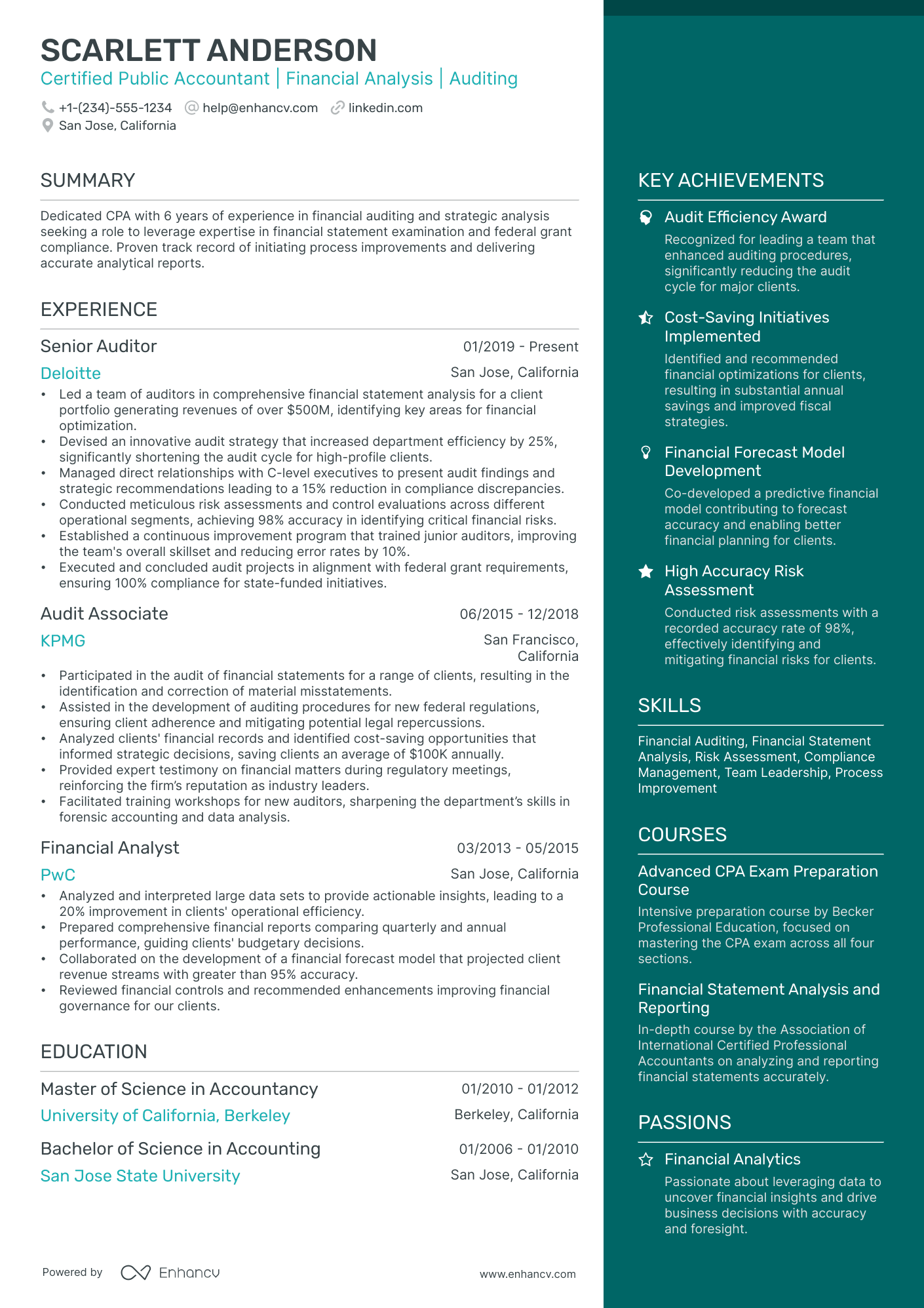

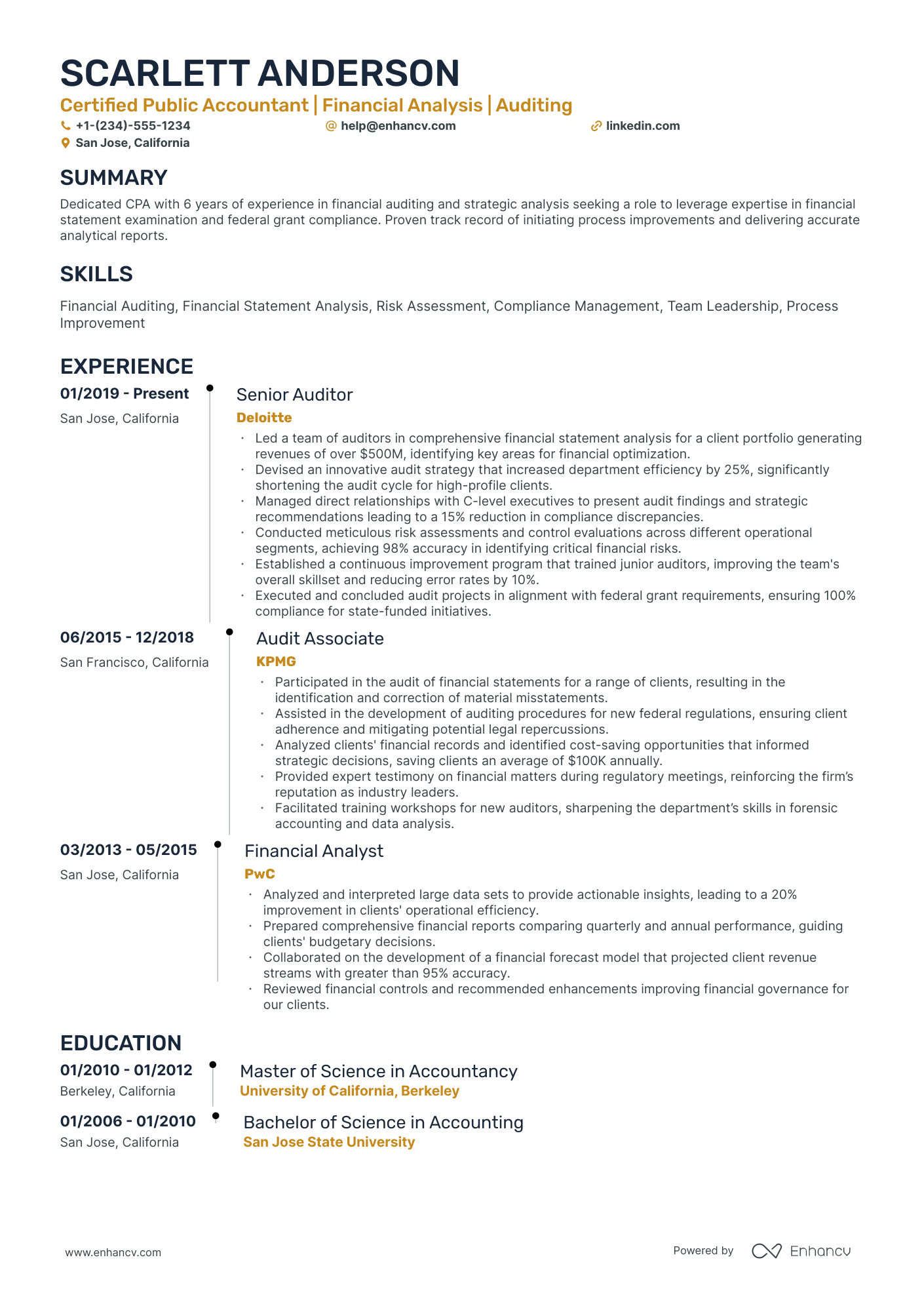

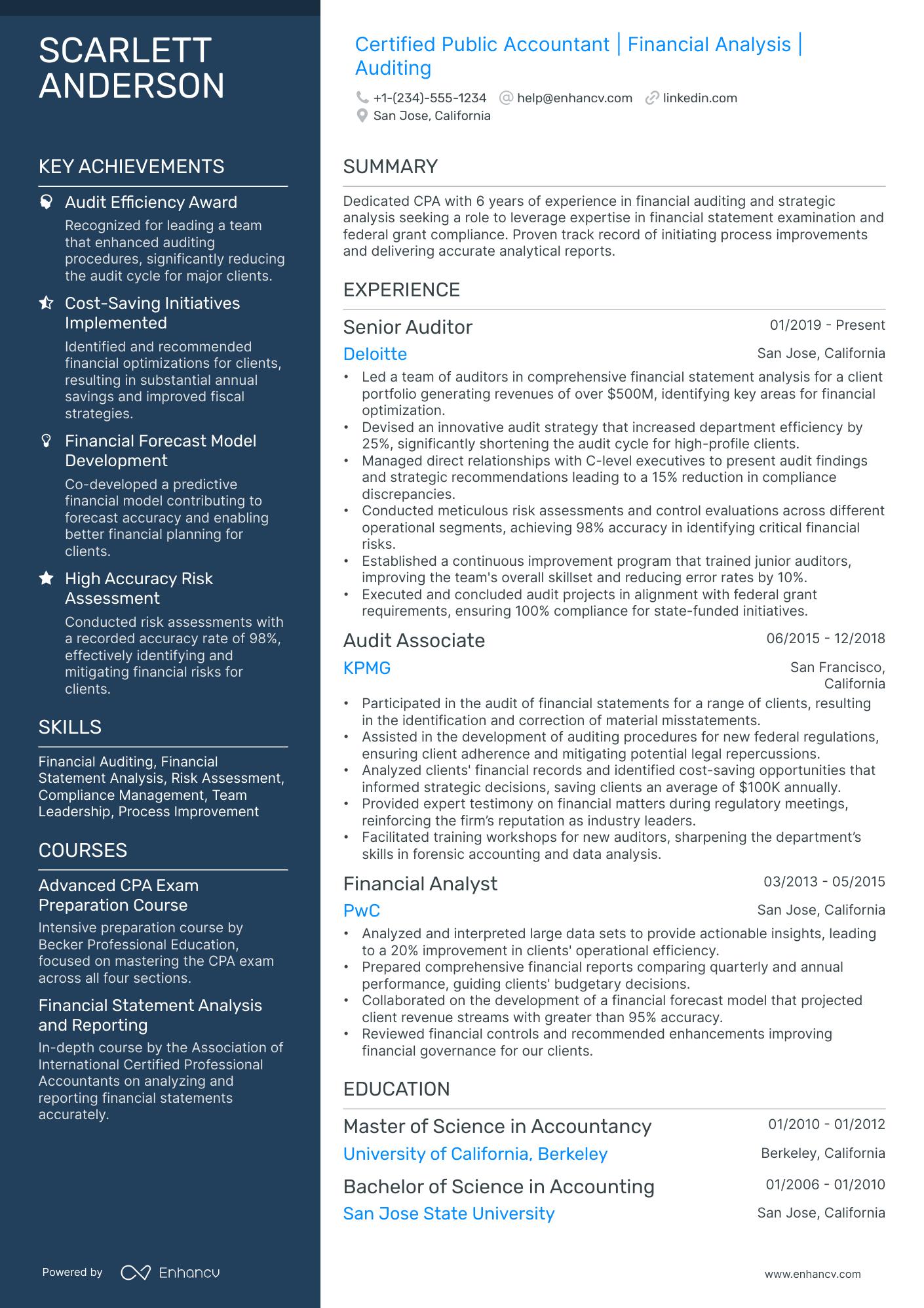

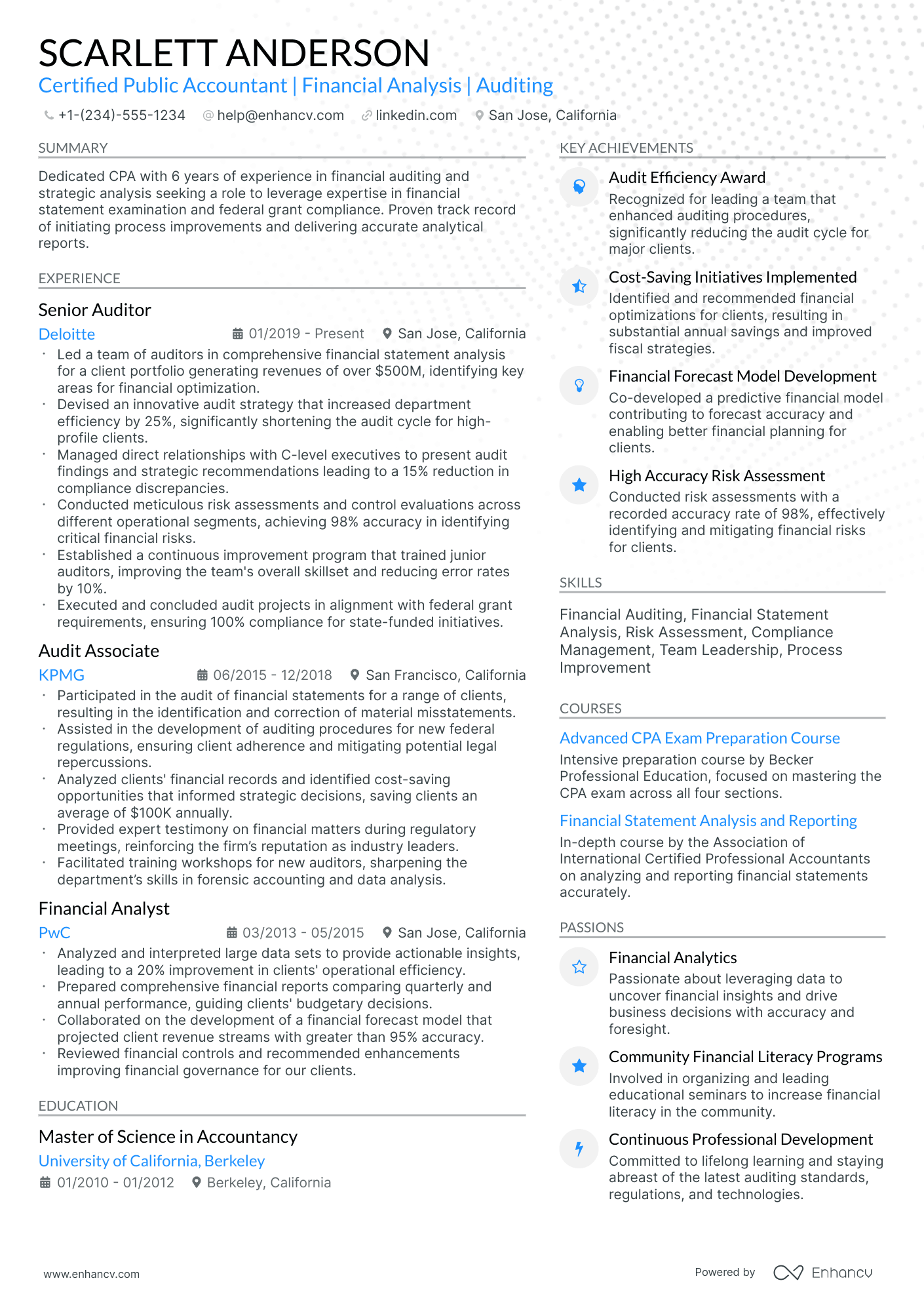

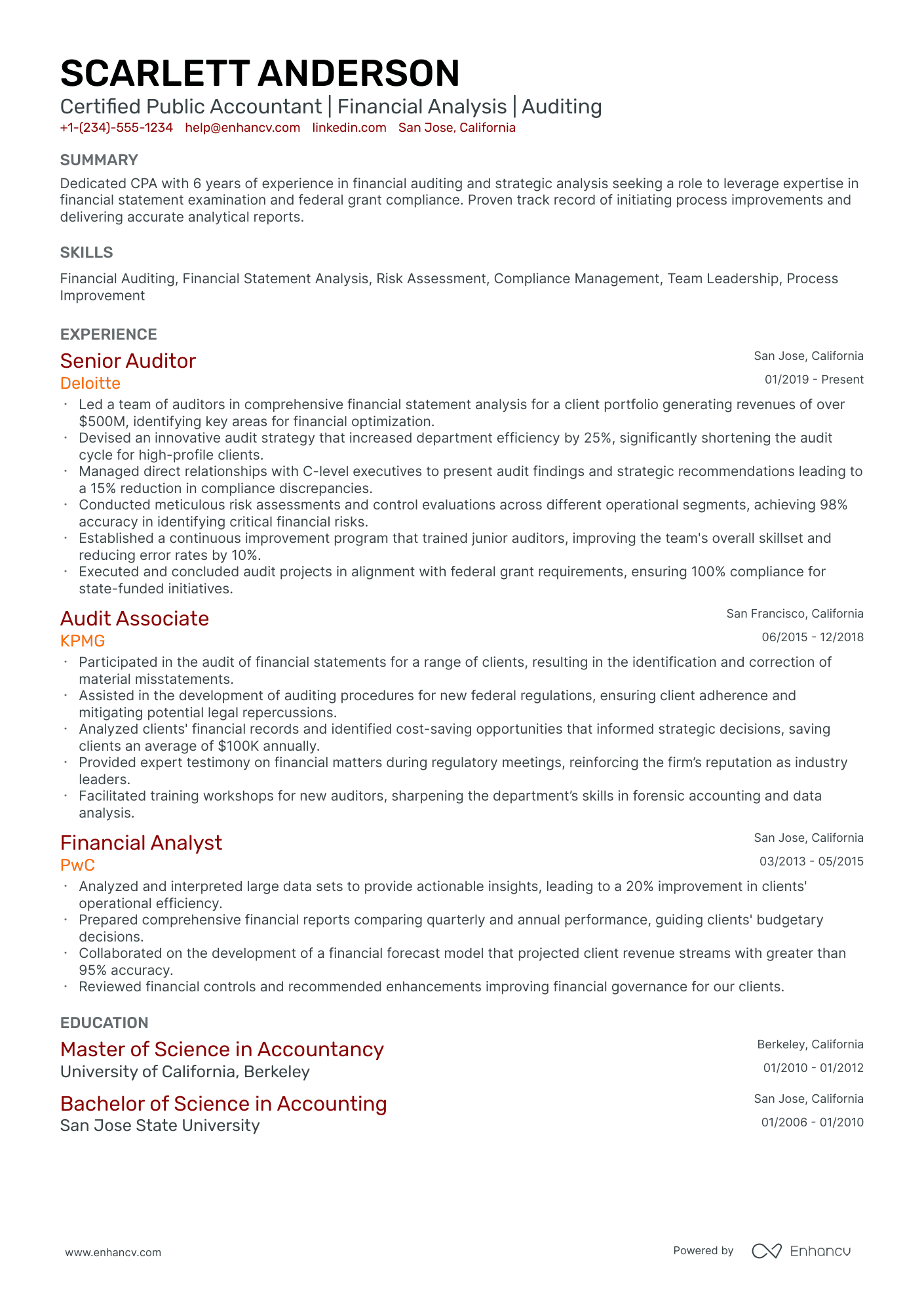

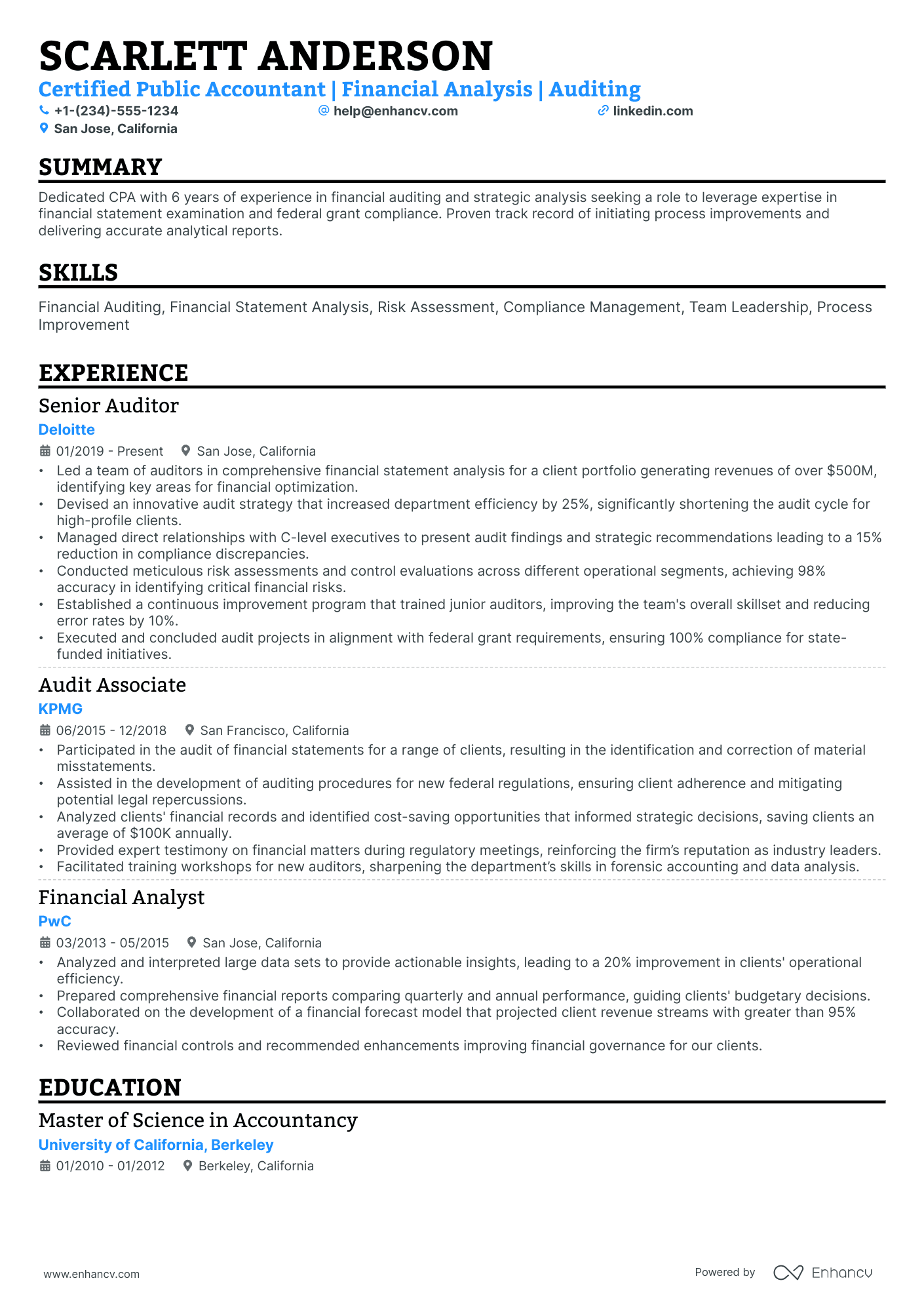

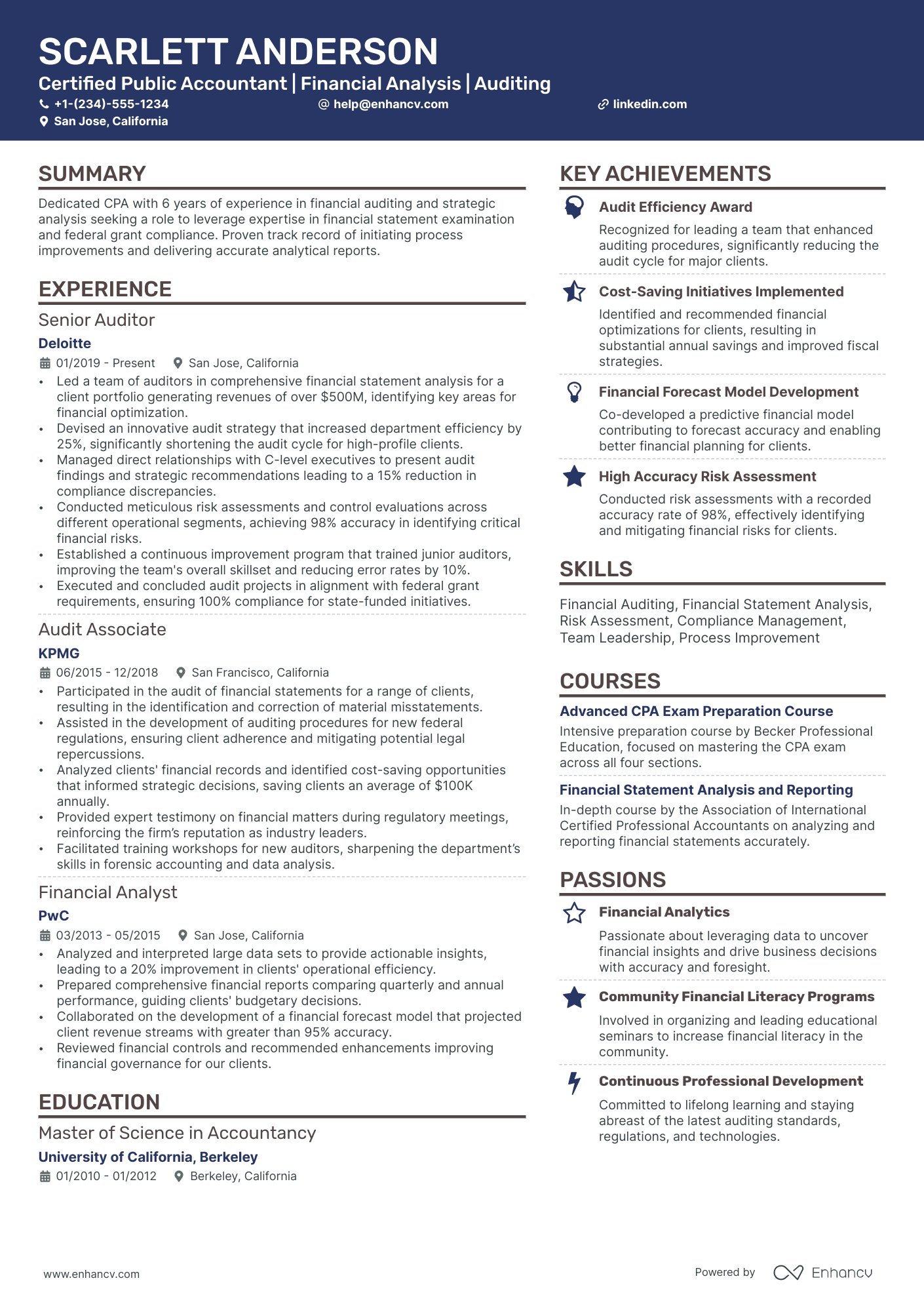

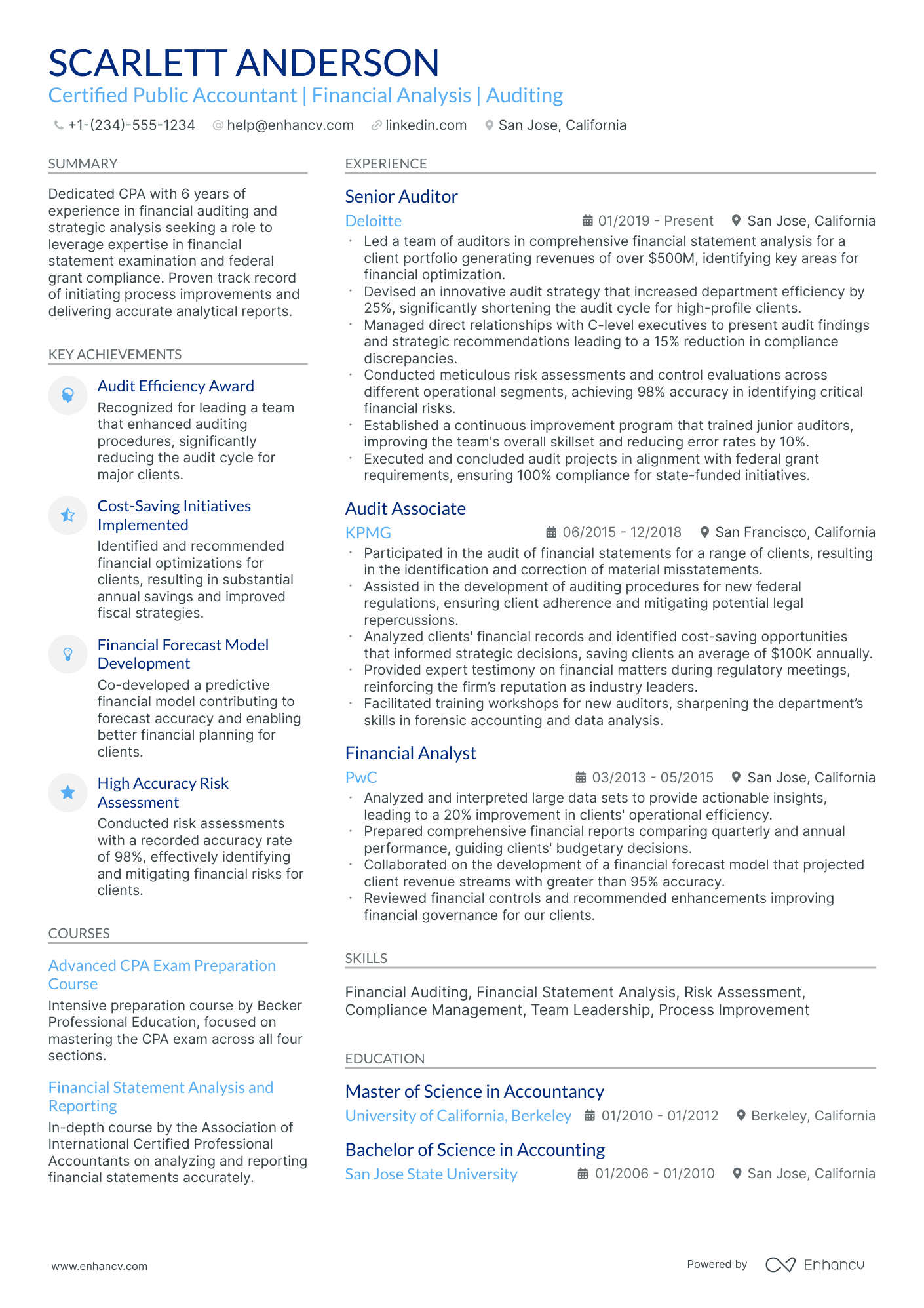

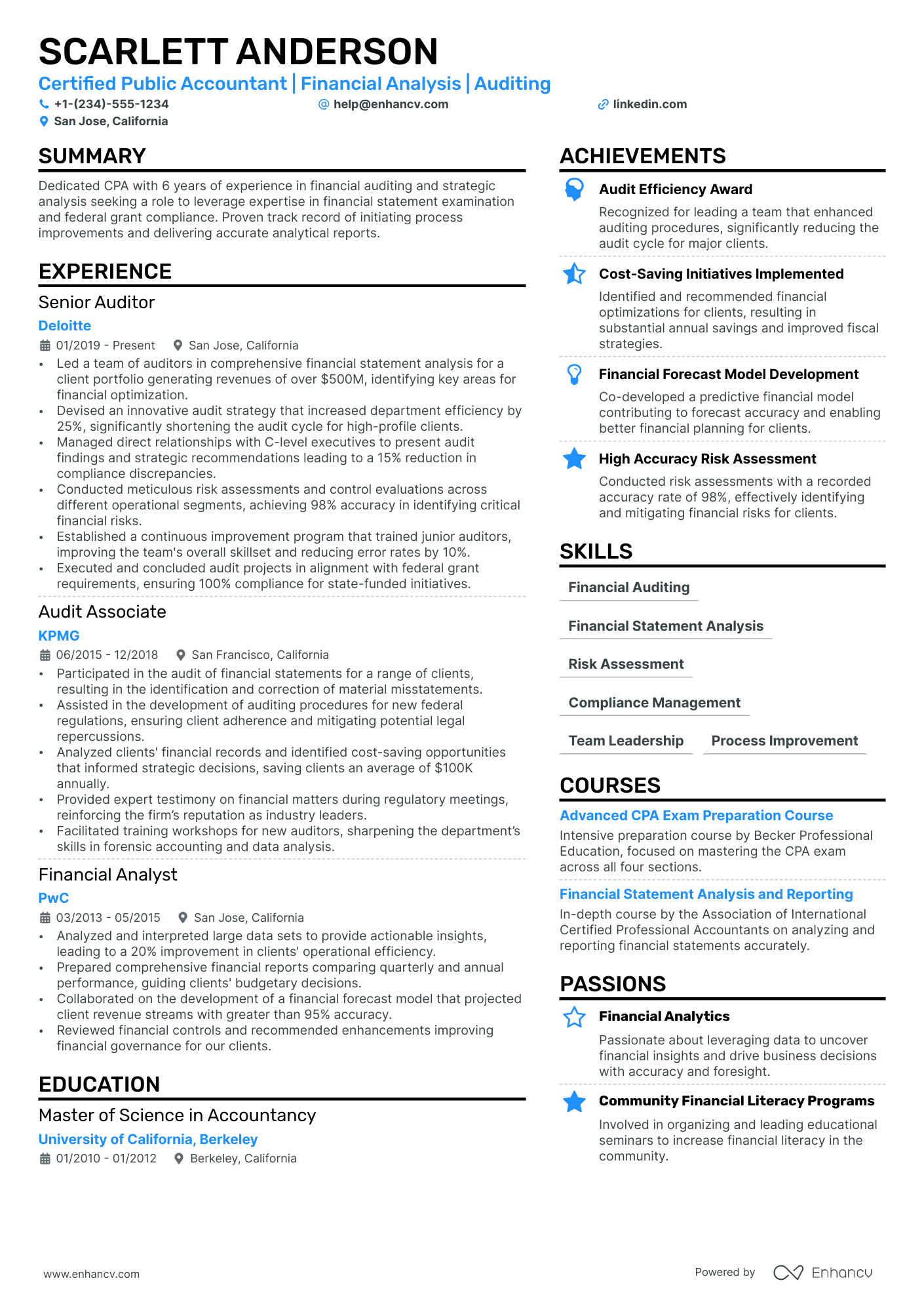

Designing your financial auditor resume format to catch recruiters' eyes

Your financial auditor resume will be assessed on a couple of criteria, one of which is the actual presentation.

Is your resume legible and organized? Does it follow a smooth flow?

Or have you presented recruiters with a chaotic document that includes everything you've ever done in your career?

Unless specified otherwise, there are four best practices to help maintain your resume format consistency.

- The top one third of your financial auditor resume should definitely include a header, so that recruiters can easily contact you and scan your professional portfolio (or LinkedIn profile).

- Within the experience section, list your most recent (and relevant) role first, followed up with the rest of your career history in a reverse-chronological resume format .

- Always submit your resume as a PDF file to sustain its layout. There are some rare exceptions where companies may ask you to forward your resume in Word or another format.

- If you are applying for a more senior role and have over a decade of applicable work experience (that will impress recruiters), then your financial auditor resume can be two pages long. Otherwise, your resume shouldn't be longer than a single page.

Your resume should match the market – Canadian applications, for instance, may use a different layout.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

Ensure your financial auditor resume stands out with these mandatory sections:

- Header - the section recruiters look to find your contact details, portfolio, and potentially, your current role

- Summary or objective - where your achievements could meet your career goals

- Experience - showcasing you have the technical (and personal) know-how for the role

- Skills - further highlighting capabilities that matter most to the financial auditor advert and your application

- Certifications/Education - staying up-to-date with industry trends

What recruiters want to see on your resume:

- Certifications such as Certified Public Accountant (CPA) or Certified Internal Auditor (CIA).

- Proficiency with financial auditing software and tools, such as ACL, IDEA, or specialized ERP systems.

- Detailed understanding of GAAP, IFRS, or other accounting standards, and financial regulations.

- Demonstrated experience in conducting risk assessments and implementing risk management procedures.

- Proven track record of successful audit project management and ability to lead audit teams.

Advice for your financial auditor resume experience section - setting your application apart from other candidates

Your resume experience section needs to balance your tangible workplace achievements with job requirements.

The easiest way to sustain this balance between meeting candidate expectations, while standing out, is to:

- Select really impressive career highlights to detail under each experience and support those with your skills;

- Assess the job advert to define both the basic requirements (which you could answer with more junior roles) and the more advanced requirements - which could play a more prominent role through your experience section;

- Create a separate experience section, if you decide on listing irrelevant experience items. Always curate those via the people or technical skills you've attained that match the current job you're applying for;

- Don't list experience items from a decade ago - as they may no longer be relevant to the industry. That is, unless you're applying for a more senior role: where experience would go to demonstrate your character and ambitions;

- Define how your role has helped make the team, department, or company better. Support this with your skill set and the initial challenge you were able to solve.

Take a look at how real-life financial auditor professionals have presented their resume experience section - always aiming to demonstrate their success.

- Led a team of 4 auditors in a comprehensive financial statement audit for a large manufacturing firm, improving their financial accuracy by 25%.

- Implemented a new risk-based audit approach which reduced the audit cycle time by 30% and increased the detection of financial discrepancies.

- Coordinated with cross-functional teams to automate and streamline the expense reporting process, effectively cutting down report preparation time by 40%.

- Performed detailed audits of complex financial records for a portfolio of small to mid-sized companies; this effort uncovered over $1M in fiscal inconsistencies.

- Initiated a financial compliance training program for clients, enhancing their understanding of accounting principles and reducing future audit discrepancies by 20%.

- Managed the adoption of new financial software which improved reporting efficiency and analytical capabilities for the audit team.

- Executed financial and operational audits for various industries, identifying cost-saving opportunities that saved clients an average of $500K annually.

- Collaborated on a high-profile forensic audit that led to the recovery of $3M in misappropriated funds, restoring stakeholder confidence.

- Developed a set of best practices for monitoring internal controls that was adopted firm-wide and praised for its effectiveness in tackling fraud.

- Analyzed financial data and statements for discrepancies, ensuring accurate reporting and compliance with regulations.

- Recommended financial control enhancements to a major nonprofit, leading to a 15% reduction in unaccounted funds.

- Prepared audit findings reports that provided clear, actionable insights, helping clients to improve their financial operations.

- Conducted extensive risk assessments for new audit engagements, establishing the groundwork for subsequent audit plans and procedures.

- Streamlined audit processes through the introduction of automated data analysis tools, resulting in a more efficient review system and a 10% reduction in overhead costs.

- Provided mentorship to junior auditors, instilling in them a passion for financial integrity and fostering professional development.

- Led financial audits for major technology firms, often coordinating efforts between different regions to ensure global compliance with IFRS.

- Integrated cloud-based auditing tools into the practice, allowing real-time financial analysis and enhancing the ability to identify financial trends quickly.

- Facilitated training sessions on new tax legislation and its impact on auditing practices, equipping the team with updated knowledge and skills.

- Directed a specialized project auditing the financials of a merger between two leading pharmaceutical companies, ensuring a smooth transaction valued at over $2B.

- Interpreted new financial reporting standards and led the successful transition for all our audit clients within the stipulated deadlines.

- Orchestrated a departmental initiative to improve report drafting efficiency, which reduce editing time by 35% without compromising on the quality of the audit reports.

- Performed regular audits in the fast-paced fintech sector, adapting auditing techniques to new technology platforms and financial instruments.

- Identified major risk factors for a series of venture-capital funded startups, guiding them towards more robust financial practices.

- Engaged actively with clients to design and improve internal control systems, which has led to a notable decrease in financial risk.

- Spearheaded a critical audit of a multinational corporation’s offshore investments, aiding in the restructuring of their international tax compliance strategy.

- Utilized advanced data analytics to enhance sampling techniques, which helped identify key areas of financial risk and inefficiency.

- Conducted thorough due diligence for potential mergers and acquisitions, contributing to informed decision-making that influenced multi-million-dollar deals.

- Oversaw the implementation of company-wide SOX compliance measures for a client in the energy sector, dramatically cutting down the risk of non-compliance fines.

- Implemented innovative forensic auditing strategies to trace and expose fraudulent financial activities, leading to several high-profile litigation support cases.

- Negotiated with financial regulators on behalf of clients to resolve complex audit matters, demonstrating expert understanding of audit laws and regulations.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for financial auditor professionals.

Top Responsibilities for Financial Auditor:

- Prepare detailed reports on audit findings.

- Report to management about asset utilization and audit results, and recommend changes in operations and financial activities.

- Collect and analyze data to detect deficient controls, duplicated effort, extravagance, fraud, or non-compliance with laws, regulations, and management policies.

- Inspect account books and accounting systems for efficiency, effectiveness, and use of accepted accounting procedures to record transactions.

- Supervise auditing of establishments, and determine scope of investigation required.

- Confer with company officials about financial and regulatory matters.

- Examine and evaluate financial and information systems, recommending controls to ensure system reliability and data integrity.

- Inspect cash on hand, notes receivable and payable, negotiable securities, and canceled checks to confirm records are accurate.

- Examine records and interview workers to ensure recording of transactions and compliance with laws and regulations.

- Prepare, examine, or analyze accounting records, financial statements, or other financial reports to assess accuracy, completeness, and conformance to reporting and procedural standards.

Quantifying impact on your resume

- Quantify the total assets you have audited and highlight the value this brought in maintaining financial integrity for the businesses.

- Specify the number of audit reports you have prepared to demonstrate your experience and proficiency in documenting financial findings.

- Include the percentage of risk reduction achieved through your recommendations to showcase your ability to enhance the business's financial health.

- Detail the number and types of compliance audits completed to show your versatility and expertise in adhering to various regulatory standards.

- Mention the amount of cost savings identified through your audit processes to reflect your impact on the company's profitability.

- State the number of financial statements you have reviewed to establish your thoroughness and attention to detail.

- List the number of internal control systems you have assessed or implemented to portray your role in fortifying financial processes.

- Cite specific figures related to any fraud detection or prevention activities to emphasize your vigilance and value in protecting the business's assets.

Action verbs for your financial auditor resume

Four quick steps for candidates with no resume experience

Those with less or no relevant experience could also make a good impression on recruiters by:

- Taking the time to actually understand what matters most to the role and featuring this within key sections of their resume

- Investing resume space into defining what makes them a valuable candidate with transferrable skills and personality

- Using the resume objective to showcase their personal vision for growth within the company

- Heavily featuring their technical alignment with relevant certifications, education, and skills.

Remember that your resume is about aligning your profile to that of the ideal candidate.

The more prominently you can demonstrate how you answer job requirements, the more likely you'd be called in for an interview.

Recommended reads:

PRO TIP

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

Balancing hard and soft skills in your financial auditor resume

Recruiters indeed pay close attention to the specific hard and soft skills candidates possess. Hard skills refer to technical abilities or your proficiency in technologies, while soft skills are the personal attributes and qualities developed over your lifetime.

If you're unsure about effectively quantifying these skills on your resume, follow our step-by-step guide. It's crucial to first understand the key job requirements for the role. Doing so enables you to accurately list your:

- Hard skills in sections like skills, education, and certifications. Your technical expertise is straightforward to quantify. Most organizations find it sufficient to mention the certificates you've earned, along with your proficiency level.

- Soft skills within your experience, achievements, strengths, etc. Defining interpersonal communication traits in your resume can be challenging. Focus on showcasing the accomplishments you've achieved through these skills.

Remember, when tailoring your financial auditor resume, ensure that the skills you list match exactly with those in the job requirements. For instance, if the job listing specifies "Microsoft Word," include this exact term rather than just "Word" or "MSO."

Top skills for your financial auditor resume:

GAAP

IFRS

Excel

Audit Software (e.g., ACL, IDEA)

Data Analysis Tools

Accounting Information Systems

SAP

QuickBooks

Tax Preparation Software

Risk Assessment Tools

Attention to Detail

Analytical Thinking

Communication

Problem-Solving

Time Management

Integrity

Team Collaboration

Adaptability

Critical Thinking

Organizational Skills

Next, you will find information on the top technologies for financial auditor professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Financial Auditor’s resume:

- Intuit QuickBooks

- Sage 50 Accounting

- Google Docs

- Microsoft Word

- Oracle E-Business Suite Financials

- Tropics workers' compensation software

PRO TIP

Highlight any significant extracurricular activities that demonstrate valuable skills or leadership.

How to include your education and certifications on your resume

We're taking you back to your college days with this part of our guide, but including your relevant higher education is quite important for your resume.

Your degree shows recruiters your dedication to the industry, your recent and relevant know-how, and some form of experience in the field.

Your financial auditor resume education should:

- Include your applicable degrees, college (-s) you've graduated from, as well as start and end dates of your higher education;

- Skip your high school diploma. If you still haven't graduated with your degree, list that your higher education isongoing;

- Feature any postgraduate diplomas in your resume header or summary - this is the perfect space to spotlight your relevant MBA degree;

- Showcase any relevant coursework, if you happen to have less professional experience and think this would support your case in being the best candidate for the role.

As far as your job-specific certificates are concerned - choose up to several of the most recent ones that match the job profile, and include them in a dedicated section.

We've saved you some time by selecting the most prominent industry certificates below.

The top 5 certifications for your financial auditor resume:

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants (AICPA)

- Certified Internal Auditor (CIA) - Institute of Internal Auditors (IIA)

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Information Systems Auditor (CISA) - Information Systems Audit and Control Association (ISACA)

- Certified Fraud Examiner (CFE) - Association of Certified Fraud Examiners (ACFE)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for financial auditor professionals.

Top US associations for a Financial Auditor professional

- AACSB

- AICPA and CIMA

- American Accounting Association

- Association for Financial Professionals

- Association of Government Accountants

PRO TIP

Always remember that your financial auditor certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

Recommended reads:

Should you write a resume summary or an objective?

No need to research social media or ask ChatGPT to find out if the summary or objective is right for your financial auditor resume.

- Experienced candidates always tend to go for resume summaries. The summary is a three to five sentence long paragraph that narrates your career highlights and aligns your experience to the role. In it you can add your top skills and career achievements that are most impressive.

- Junior professionals or those making a career change, should write a resume objective. These shouldn't be longer than five sentences and should detail your career goals . Basically, how you see yourself growing in the current position and how would your experience or skill set could help out your potential employers.

Think of both the resume summary and objective as your opportunity to put your best foot forward - from the get go - answering job requirements with skills.

Use the below real-world financial auditor professional statements as inspiration for writing your resume summary or objective.

Resume summaries for a financial auditor job

- With over a decade of rigorous experience in financial auditing for multinational corporations, I have developed a robust expertise in GAAP, risk management, and financial reporting. My capacity to uncover discrepancies that led to a 15% cost saving for a Fortune 500 company underscores my analytical precision and commitment to enhancing fiscal integrity.

- Coming from a seasoned background in forensic accounting, I bring eight years of meticulous financial investigation skills to the auditing field. I am proficient in applying legal frameworks to audit procedures and adept at using data analytics tools that drive accuracy in financial assessments, ensuring transparency and regulatory compliance for high-profile clients.

- As a former financial analyst with six years of experience transitioning into auditing, I hold a deep understanding of financial markets, budgetary controls, and strategic planning. My analytical acumen, coupled with a comprehensive knowledge of financial modeling, empowers me to provide exceptional audit services that align with stringent industry standards.

- Embarking on a new journey in the financial auditing sphere, my fresh perspective is enriched by a strong foundation in corporate finance management from three years at a leading technology firm. I am eager to apply my strategic financial planning skills and passion for meticulous financial oversight to a domain that ensures organizational accountability and fiscal health.

- Eager to apply my recent educational achievements in accounting and finance to a role in financial auditing, I am determined to leverage my academic knowledge and practical skills gained through university case studies, internships, and volunteer tax assistance programs to provide diligent and accurate financial audit services.

- Graduating summa cum laude with a Master's in Accounting, my objective is to infuse my theoretical expertise and proficiency with audit software into delivering exceptional audit results. My intense curiosity about financial systems, combined with internship experiences at top-tier accounting firms, prepares me to contribute effectively from the outset.

Average salary info by state in the US for financial auditor professionals

Local salary info for Financial Auditor.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $79,880 |

| California (CA) | $92,160 |

| Texas (TX) | $78,900 |

| Florida (FL) | $76,480 |

| New York (NY) | $101,090 |

| Pennsylvania (PA) | $75,370 |

| Illinois (IL) | $78,280 |

| Ohio (OH) | $75,550 |

| Georgia (GA) | $78,970 |

| North Carolina (NC) | $79,920 |

| Michigan (MI) | $76,190 |

Other relevant sections for your financial auditor resume

Apart from the standard financial auditor resume sections listed in this guide, you have the opportunity to get creative with building your profile. Select additional resume sections that you deem align with the role, department, or company culture. Good choices for your financial auditor resume include:

- Language skills - always ensure that you have qualified each language you speak according to relevant frameworks;

- Hobbies - you could share more about your favorite books, how you spend your time, etc. ;

- Volunteering - to highlight the causes you care about;

- Awards - for your most prominent financial auditor professional accolades and achievements.

Make sure that these sections don't take too much away from your experience, but instead build up your financial auditor professional profile.

Key takeaways

We trust that this Enhancv guide has been informative and useful. To summarize the essential points:

- Opt for a simple and readable format, focusing more on your financial auditor achievements rather than just duties;

- Emphasize your accomplishments in the financial auditor experience section over mere responsibilities;

- If lacking relevant experience, utilize various resume sections like education and volunteering to demonstrate your suitable skill set;

- Never overlook the significance of pertinent higher education, training, and certifications;

- Incorporate diverse sections in your resume to highlight not just your skills expertise but also your personality.