As a Certified Public Accountant (CPA), you may struggle to differentiate your resume in a market saturated with finance professionals. Our guide offers tailored strategies that can elevate your professional narrative, ensuring your unique expertise and accomplishments stand out to potential employers.

- Incorporate CPA job advert keywords into key sections of your resume, such as the summary, header, and experience sections;

- Quantify your experience using achievements, certificates, and more in various CPA resume sections;

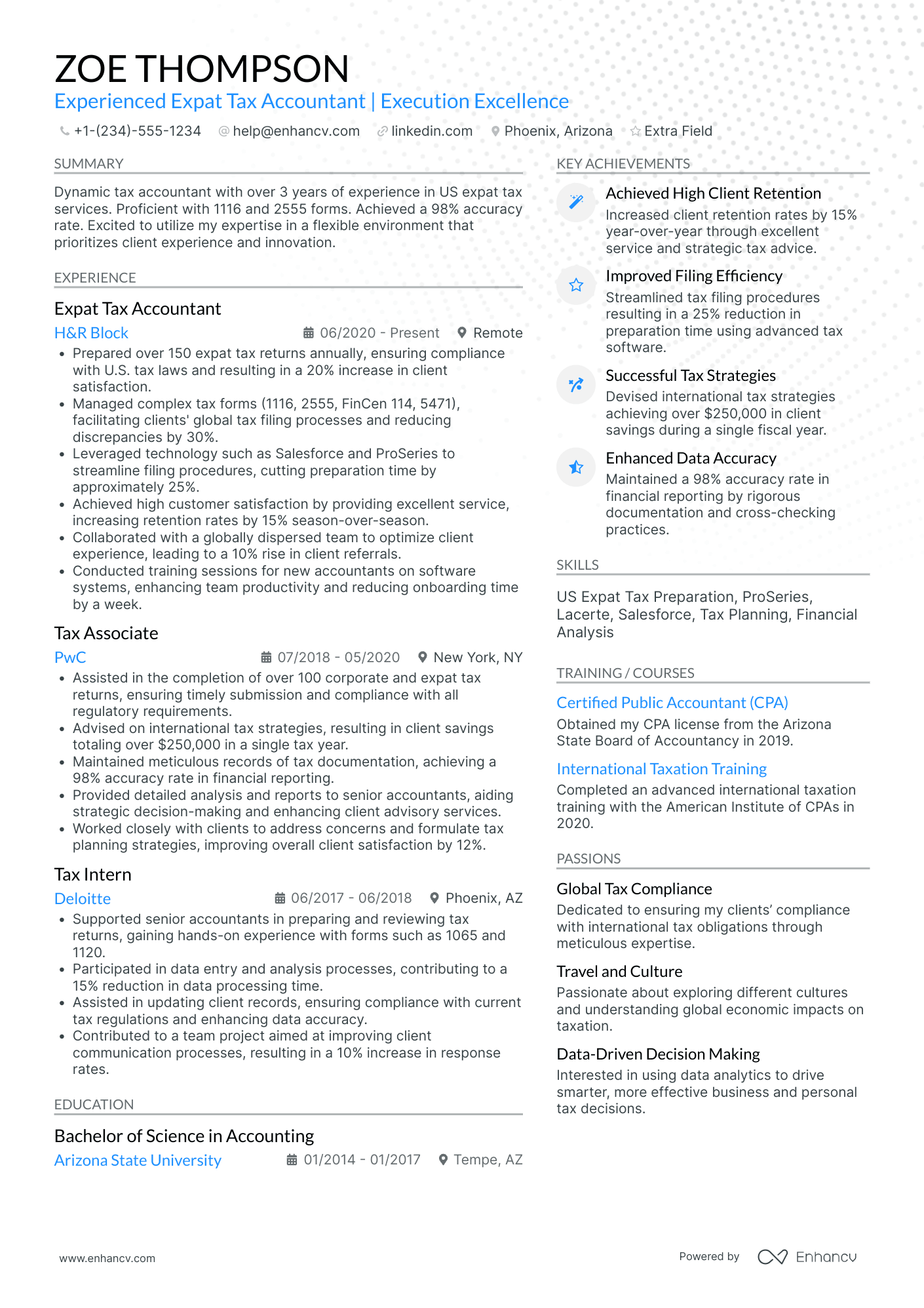

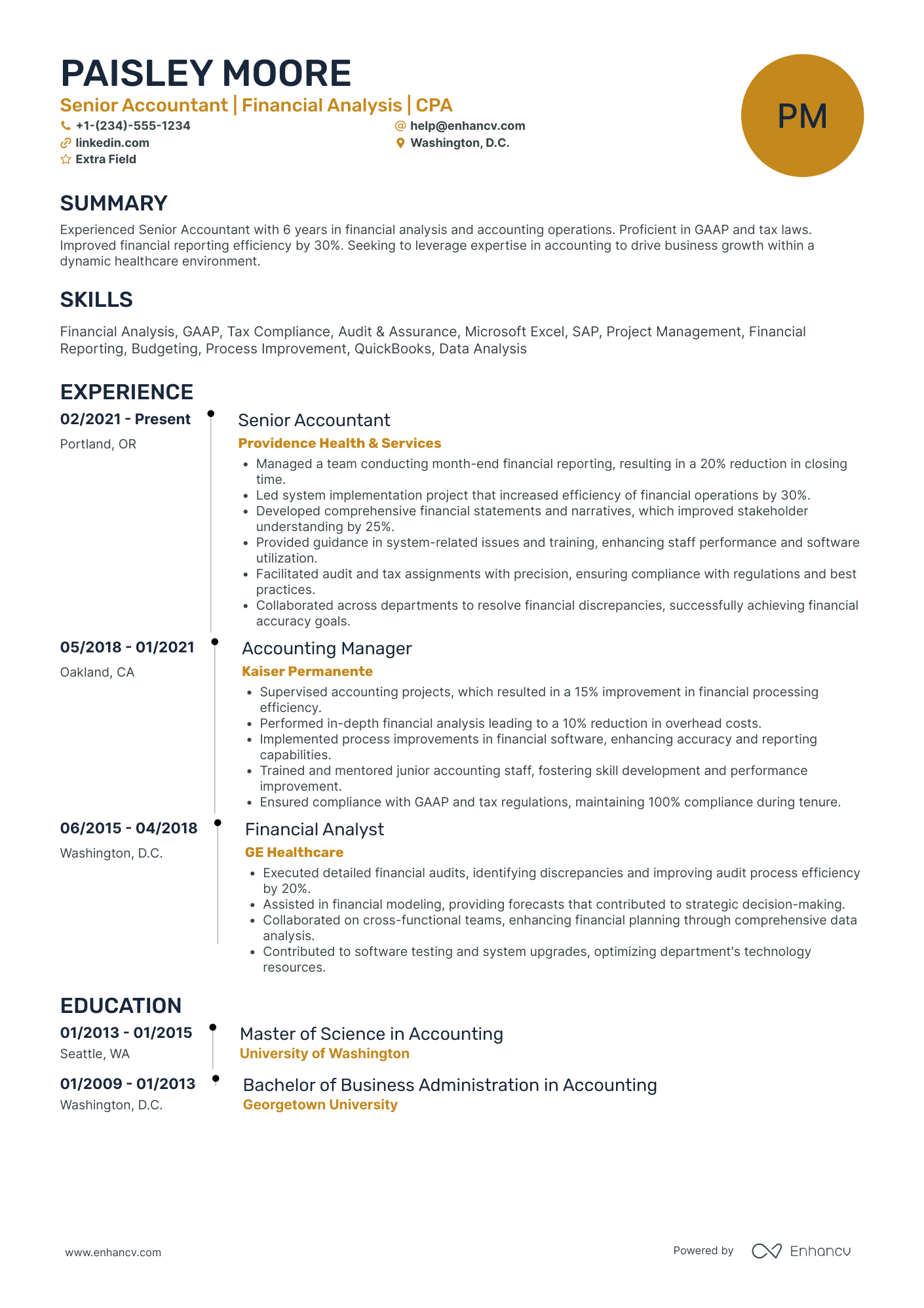

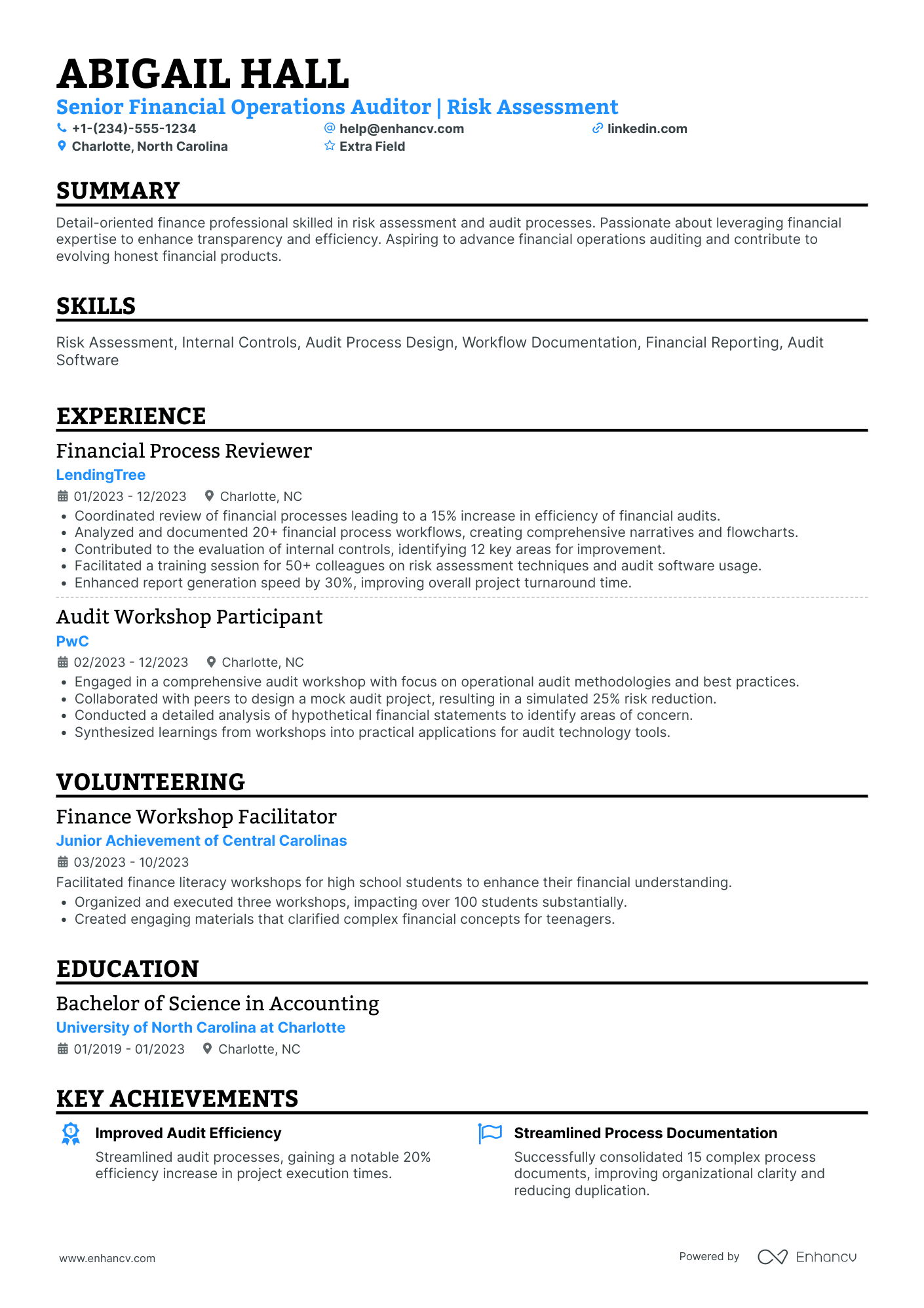

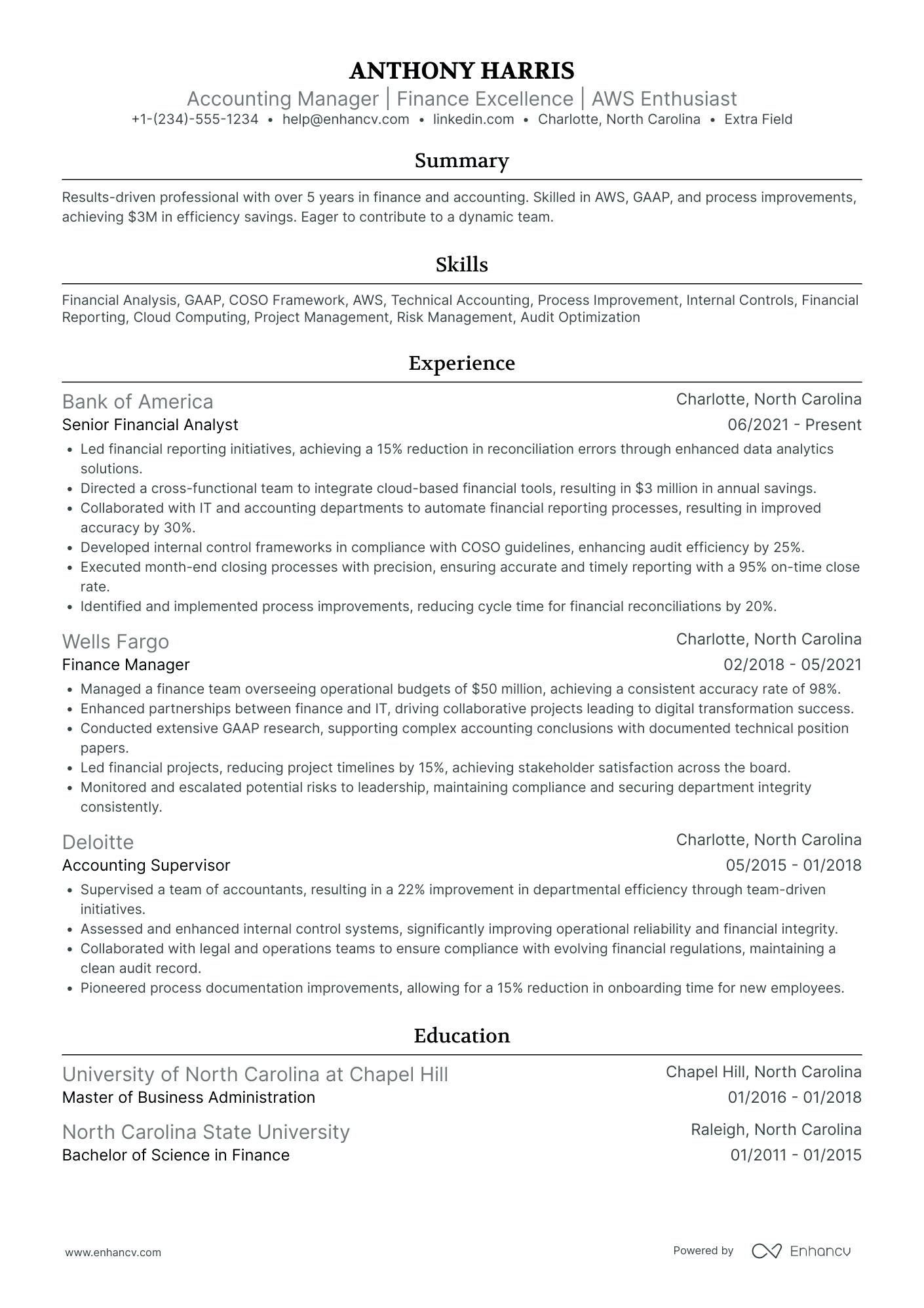

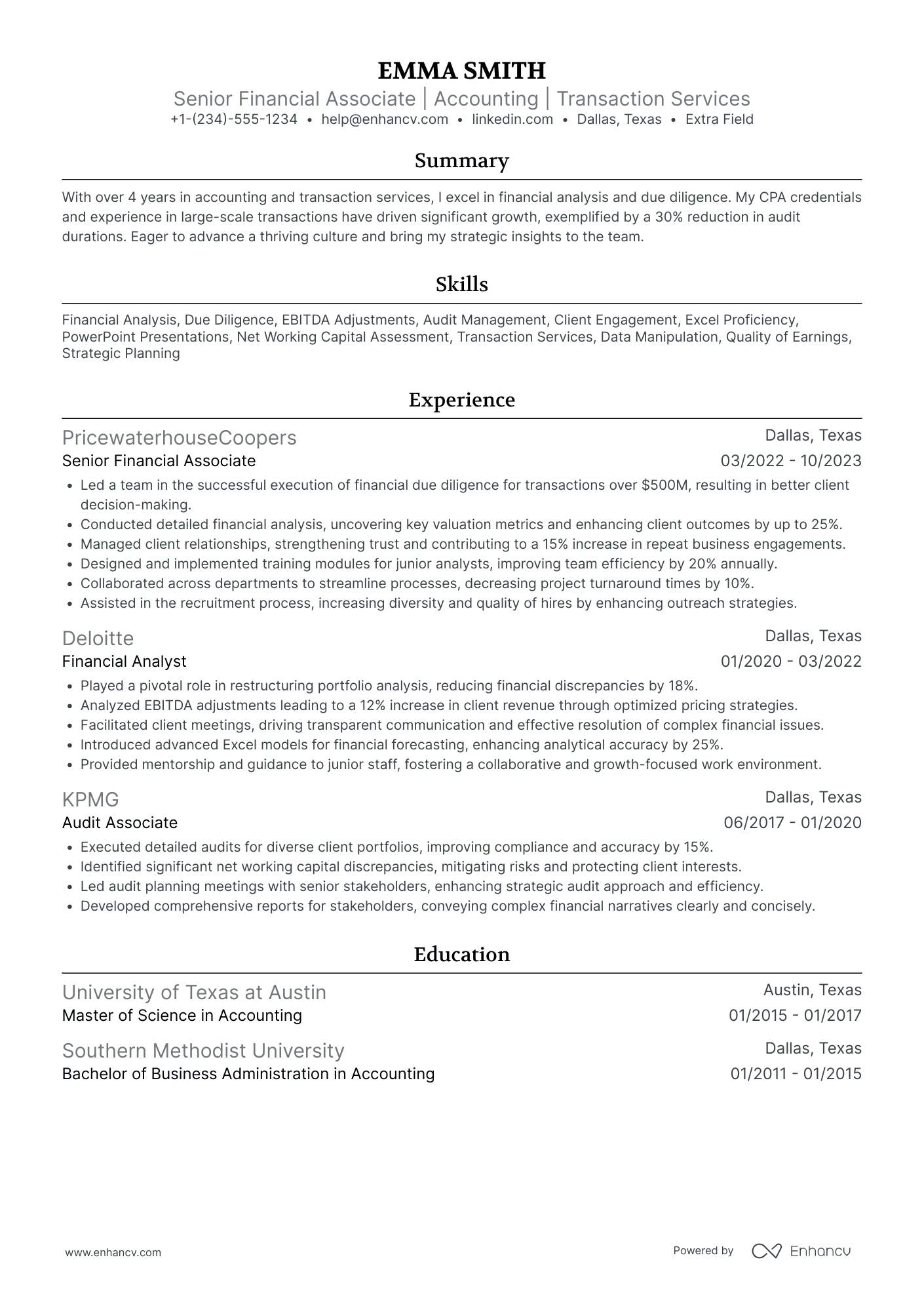

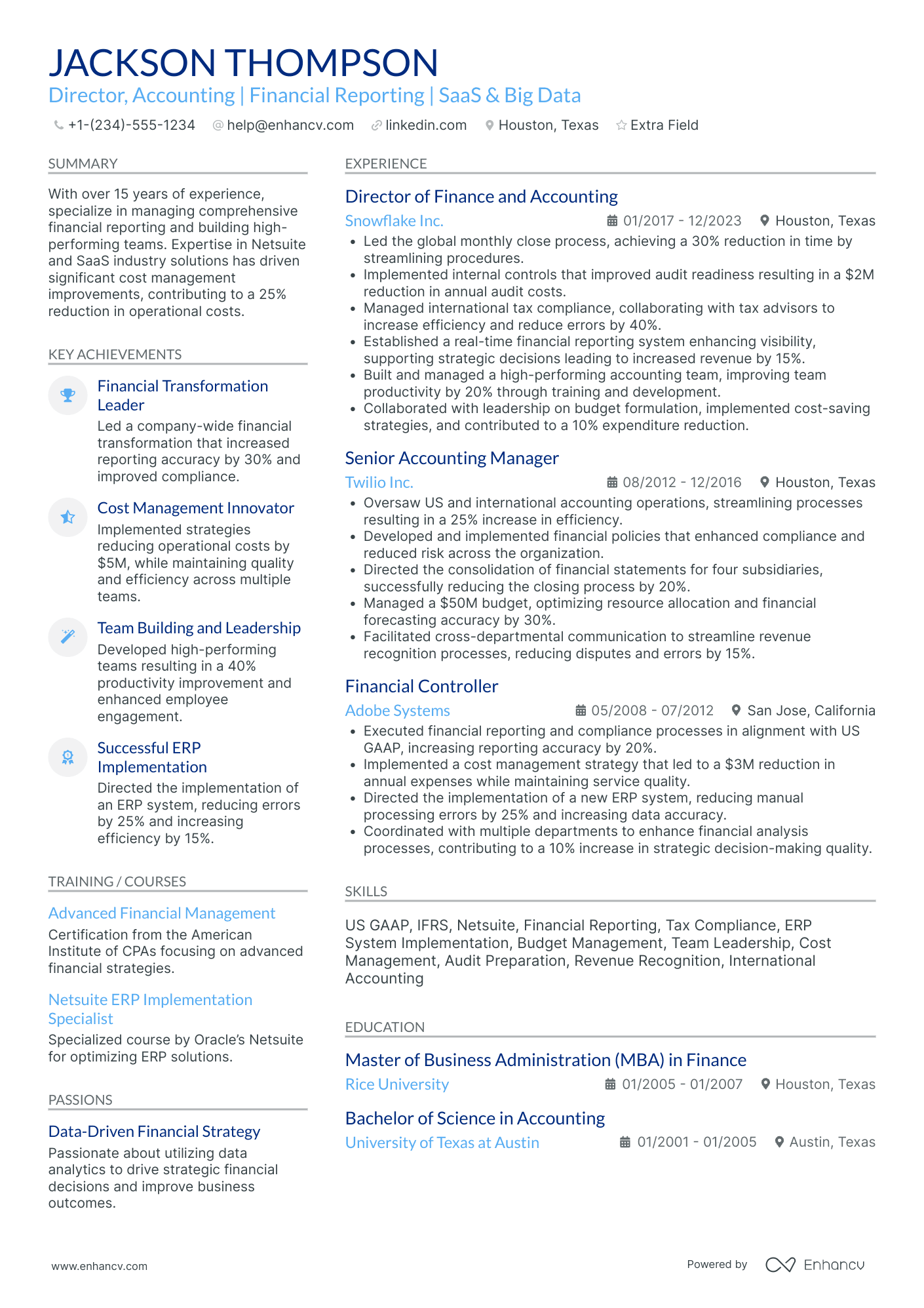

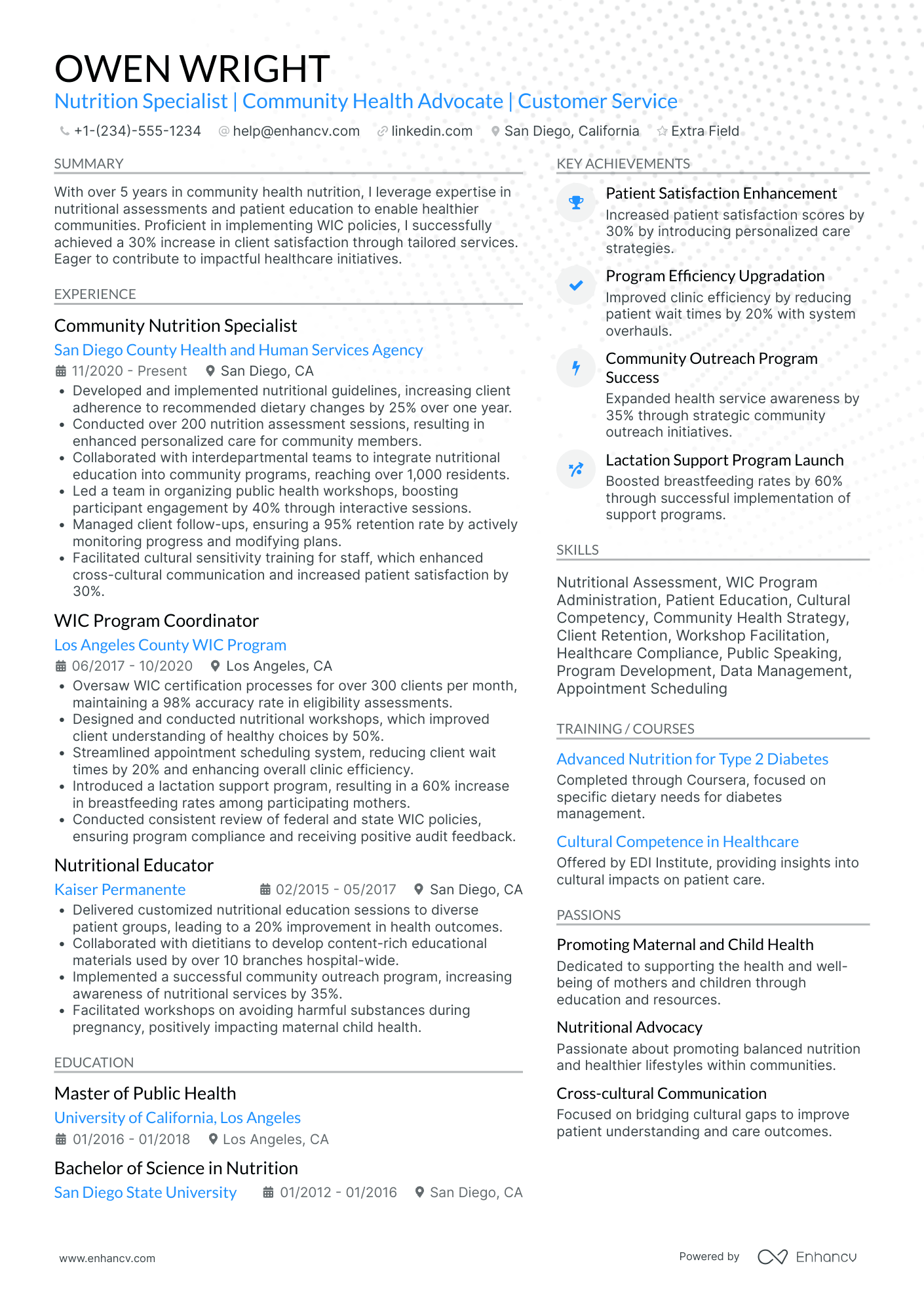

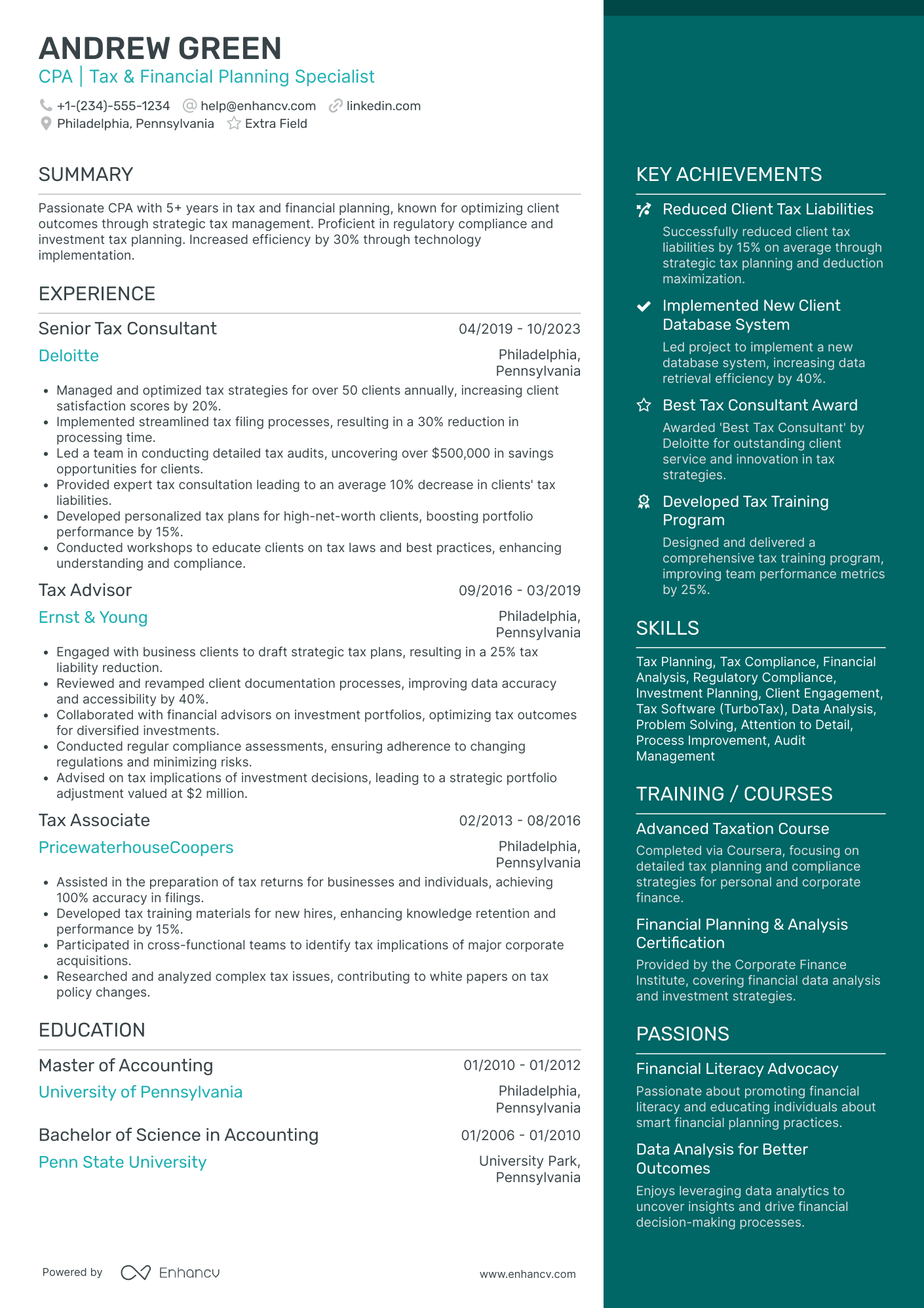

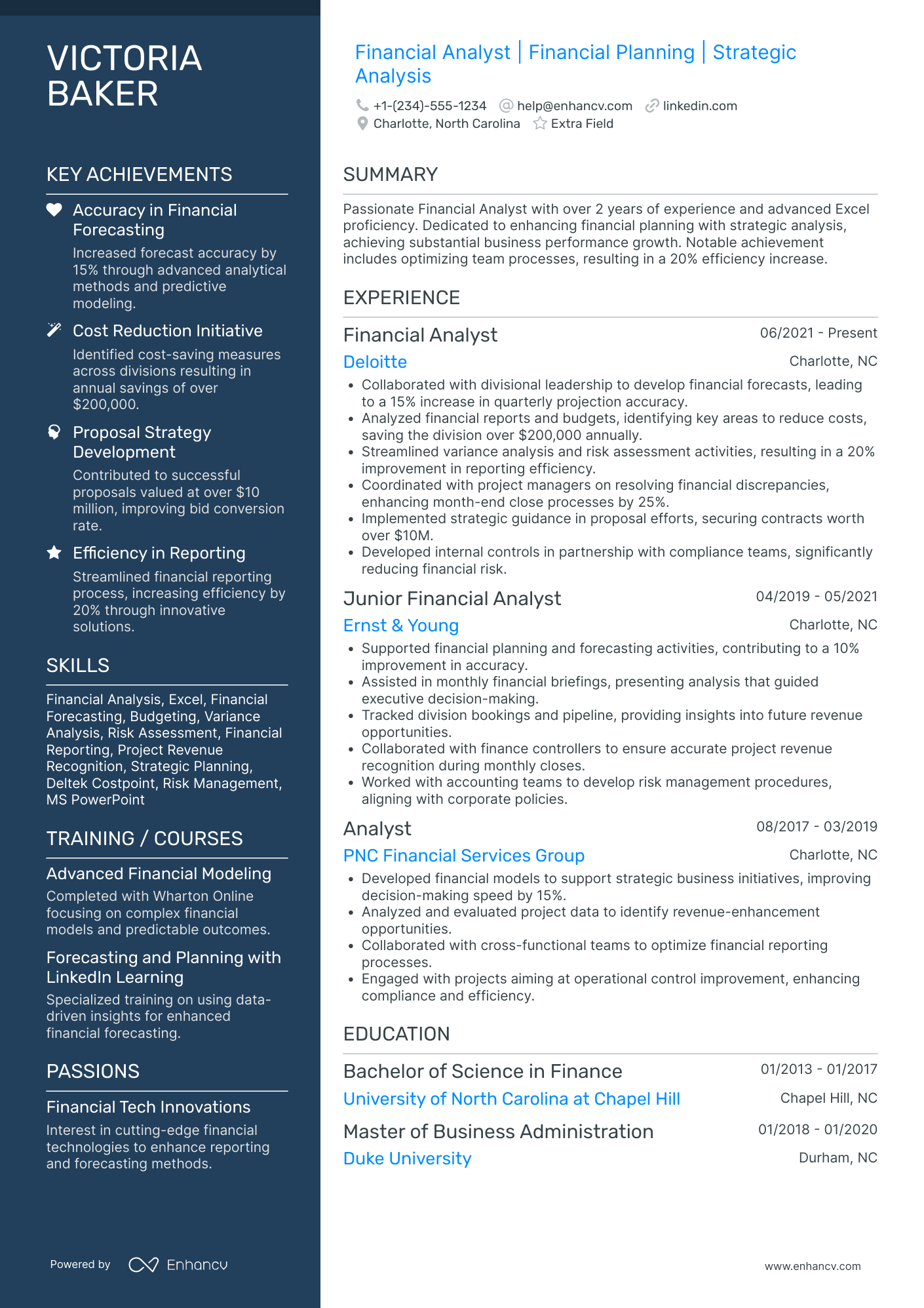

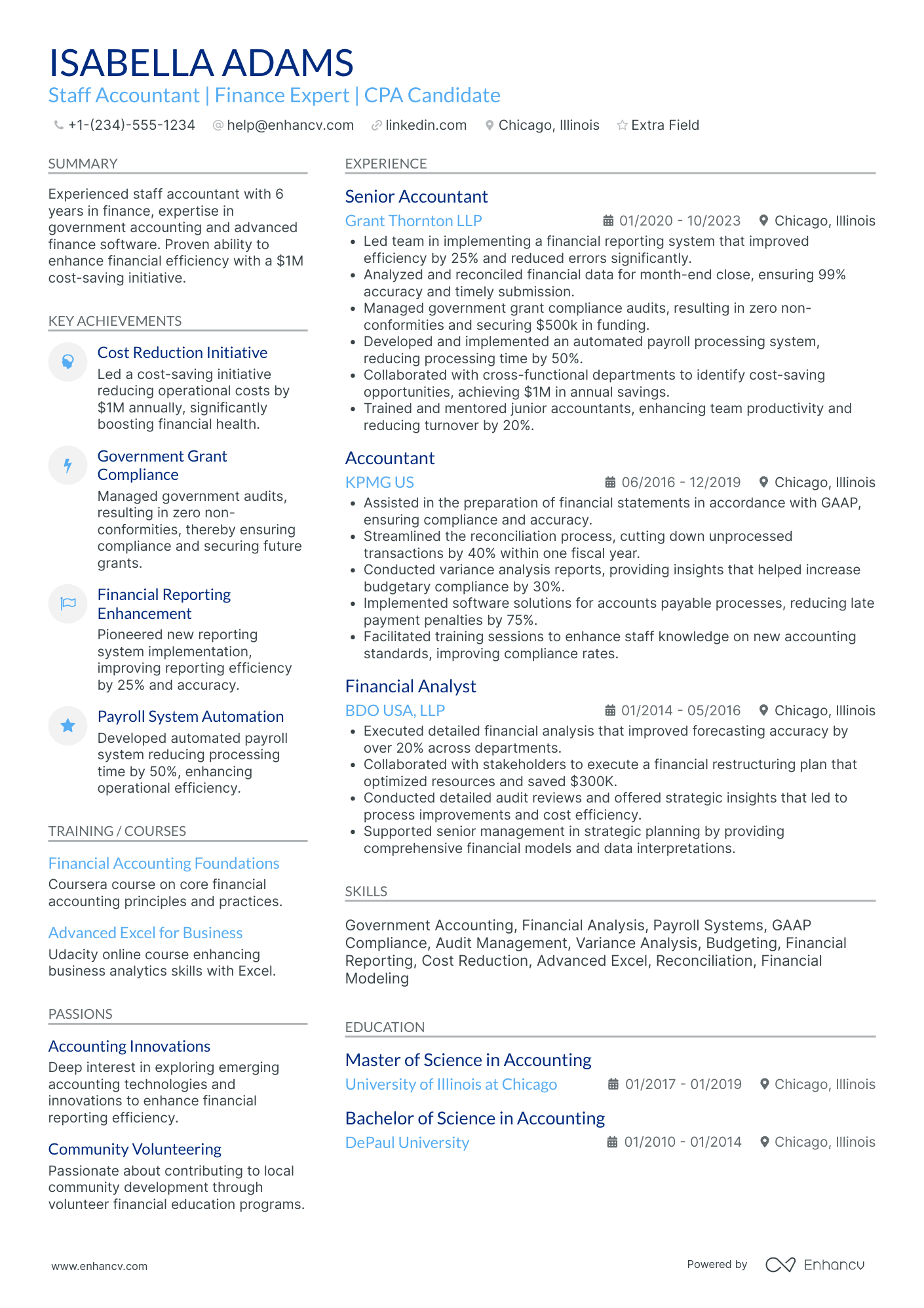

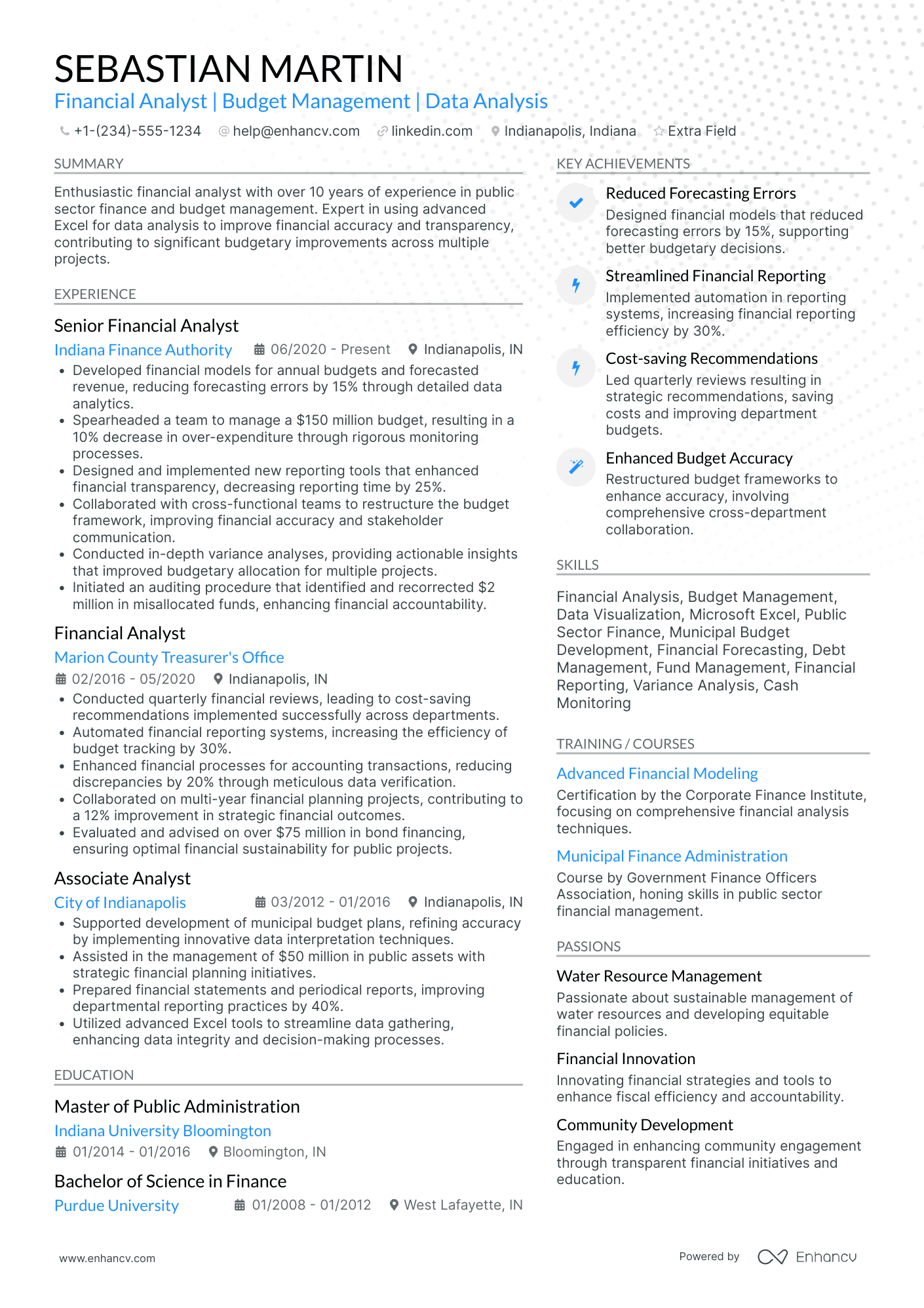

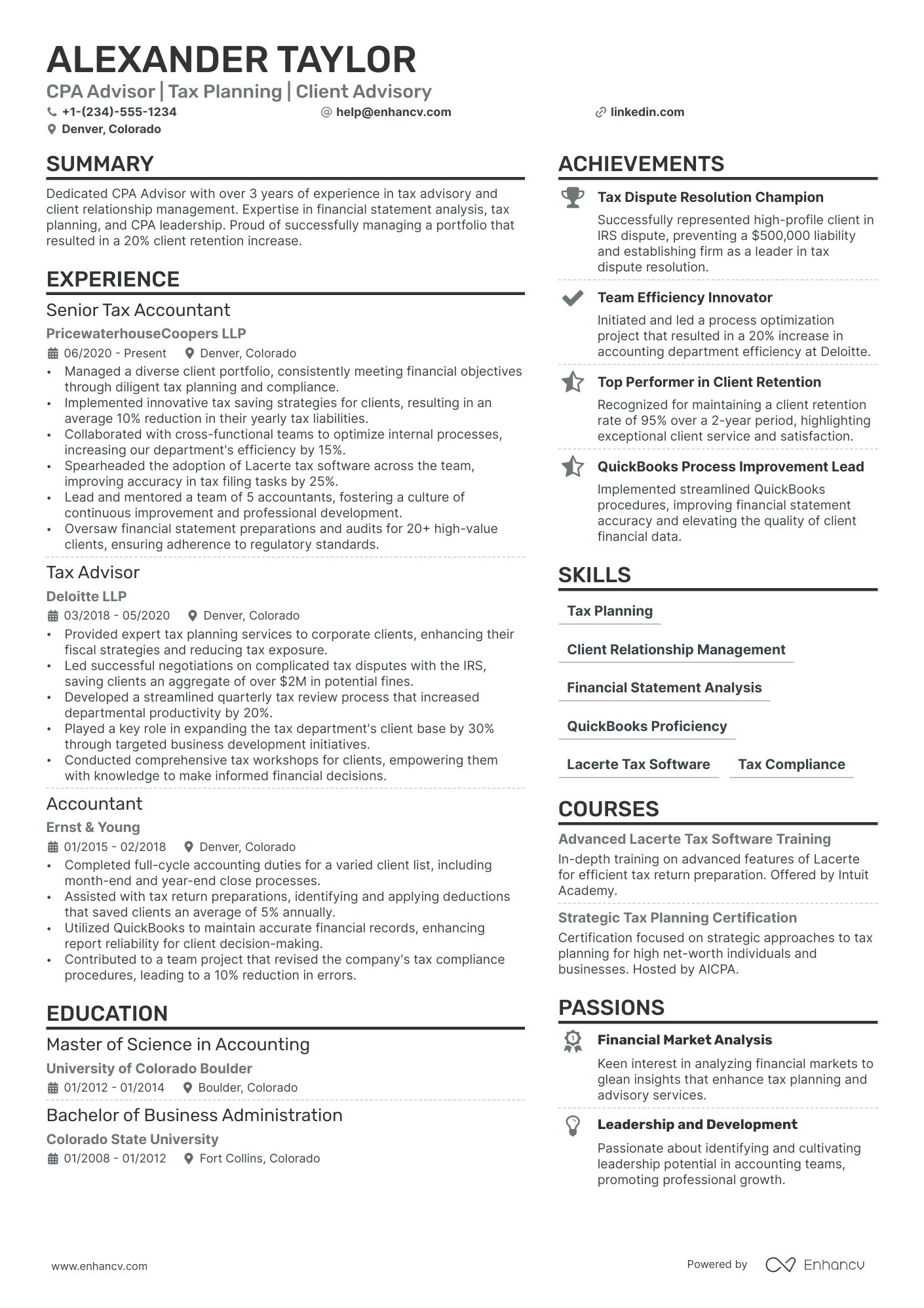

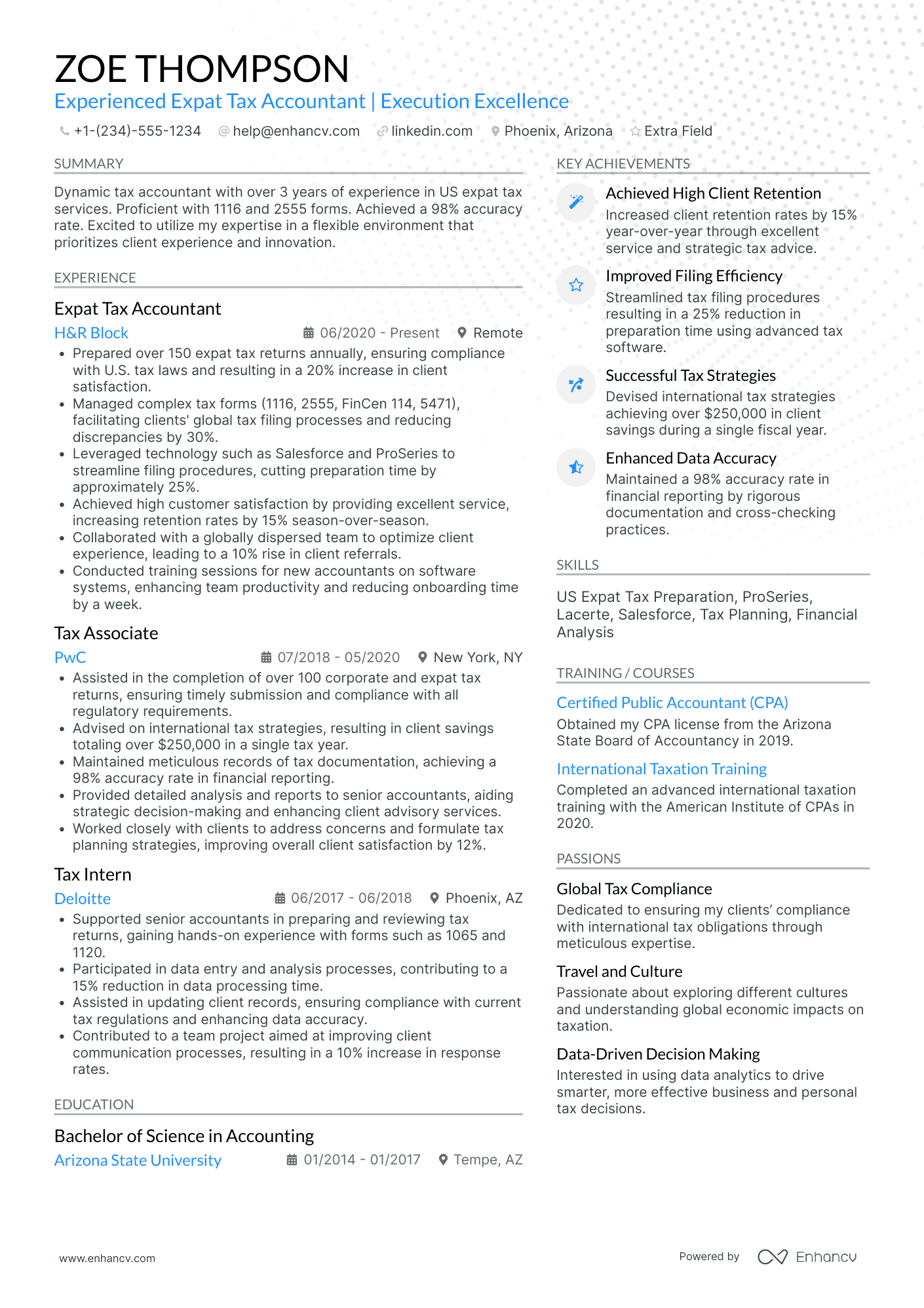

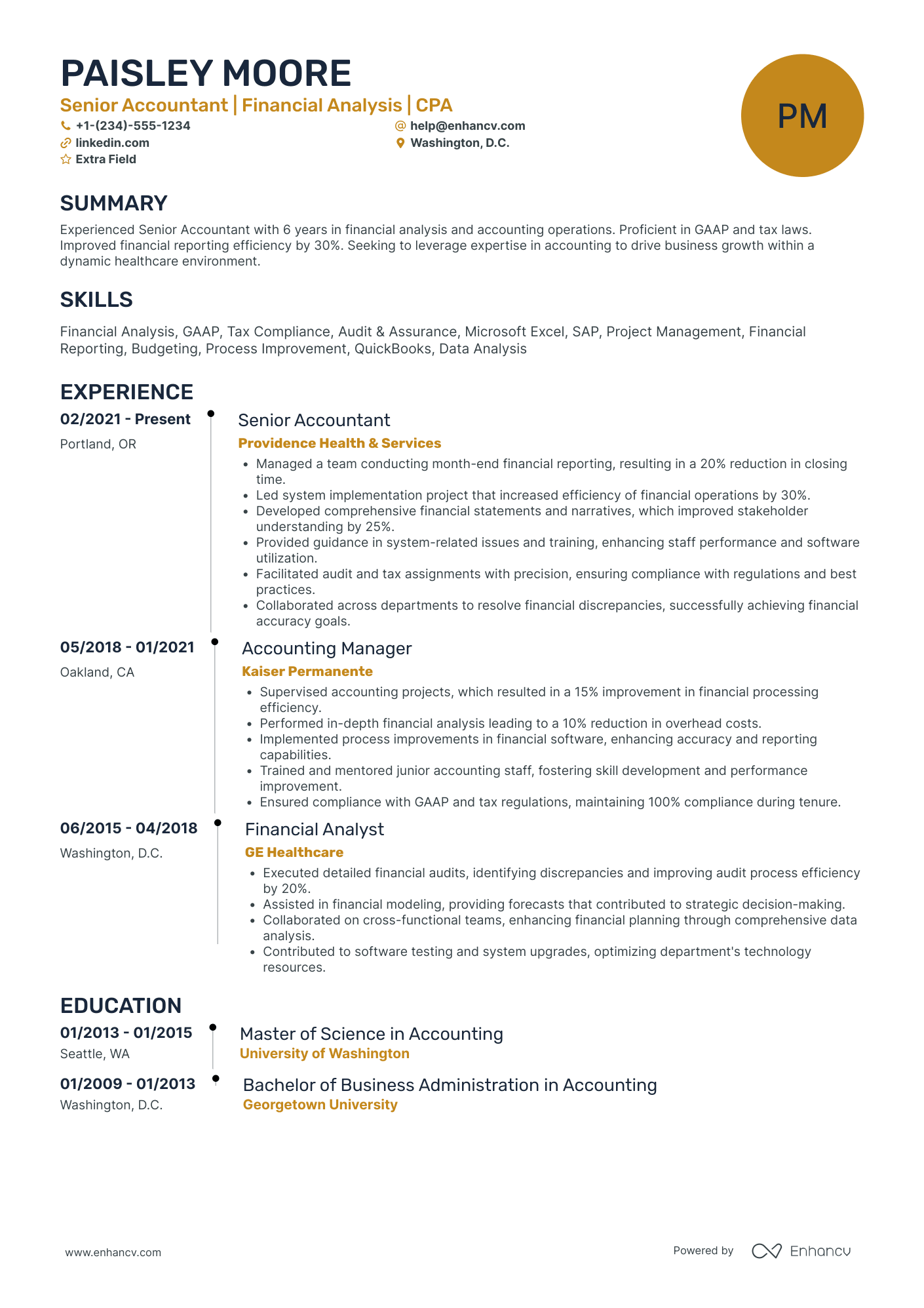

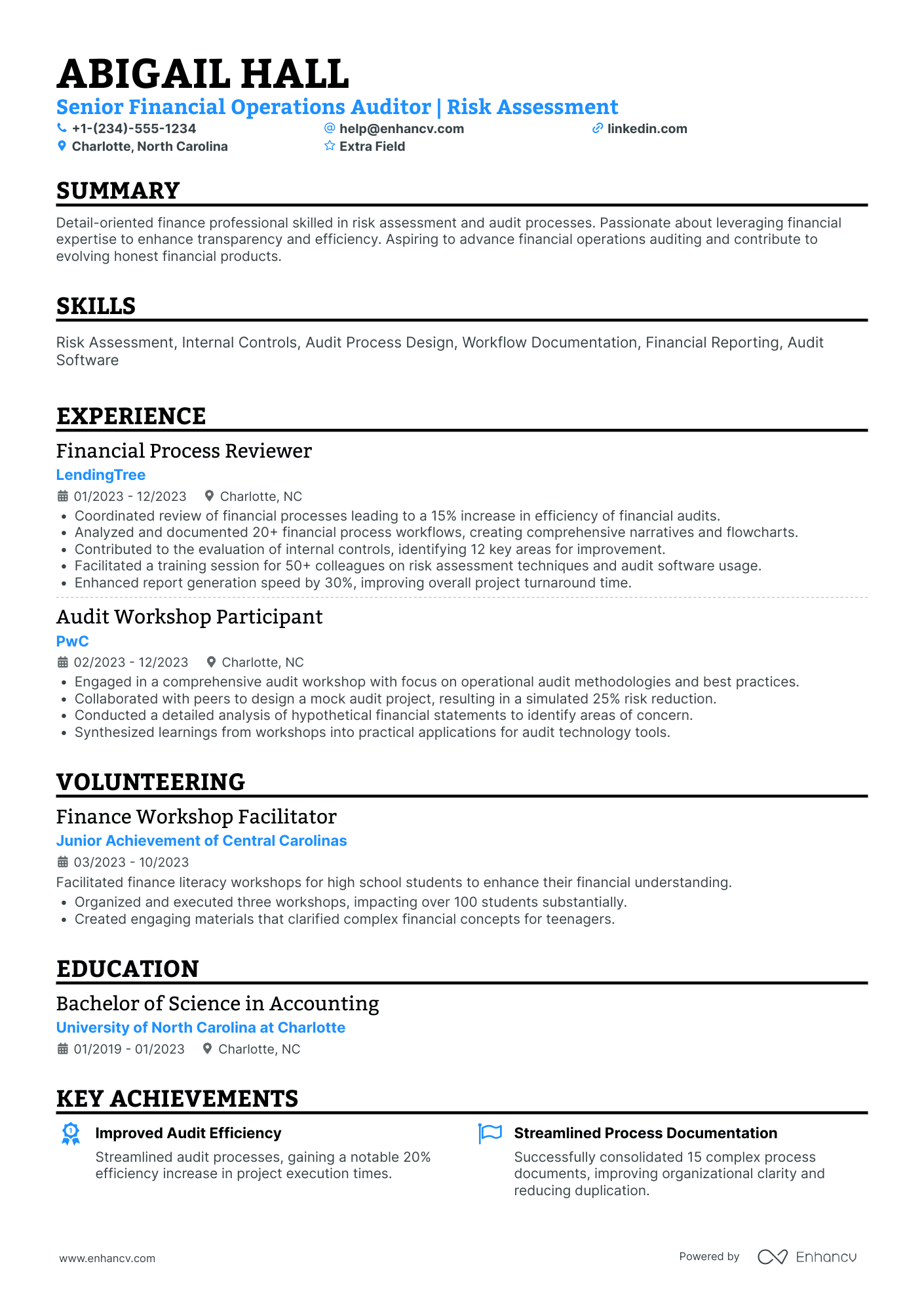

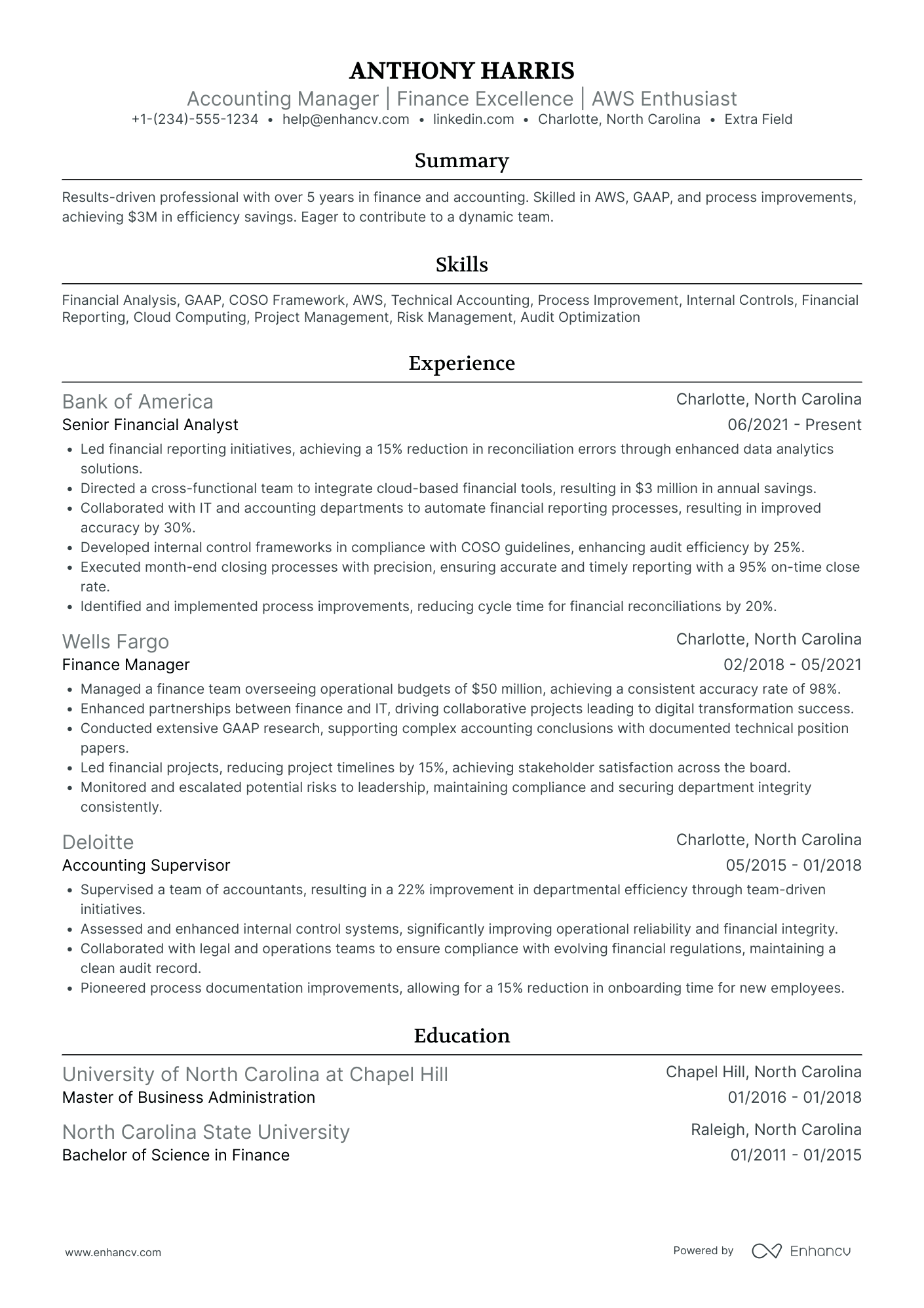

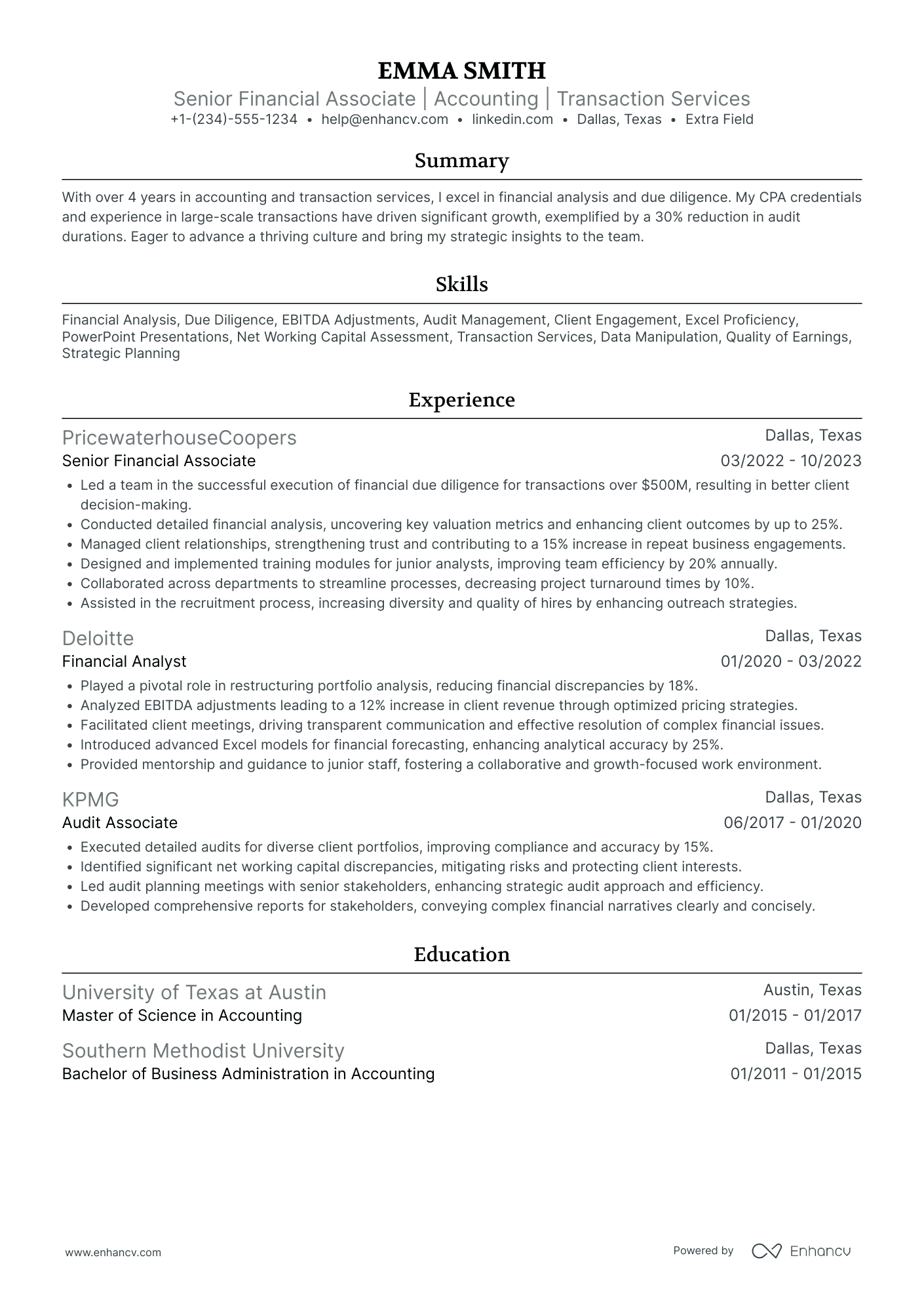

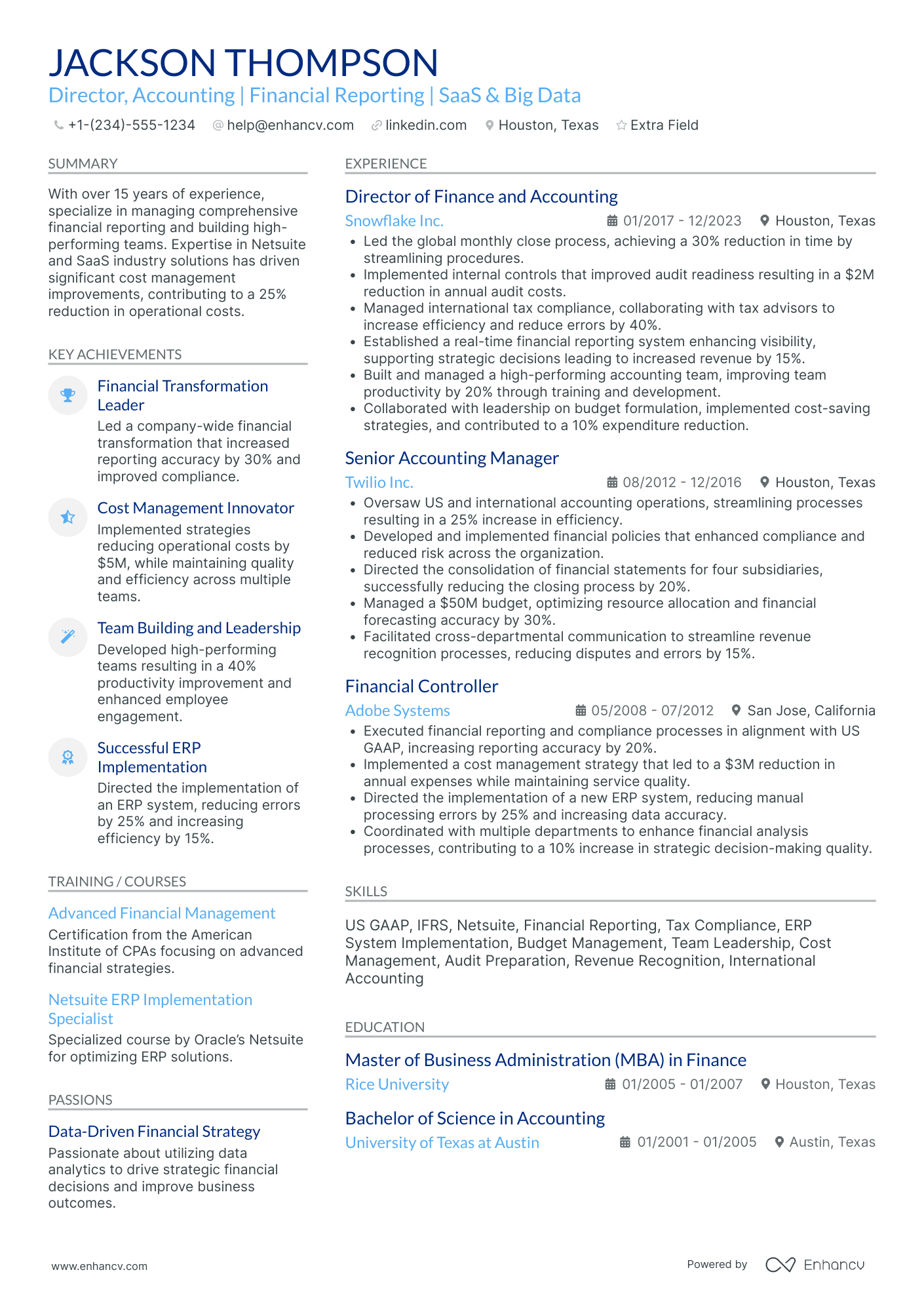

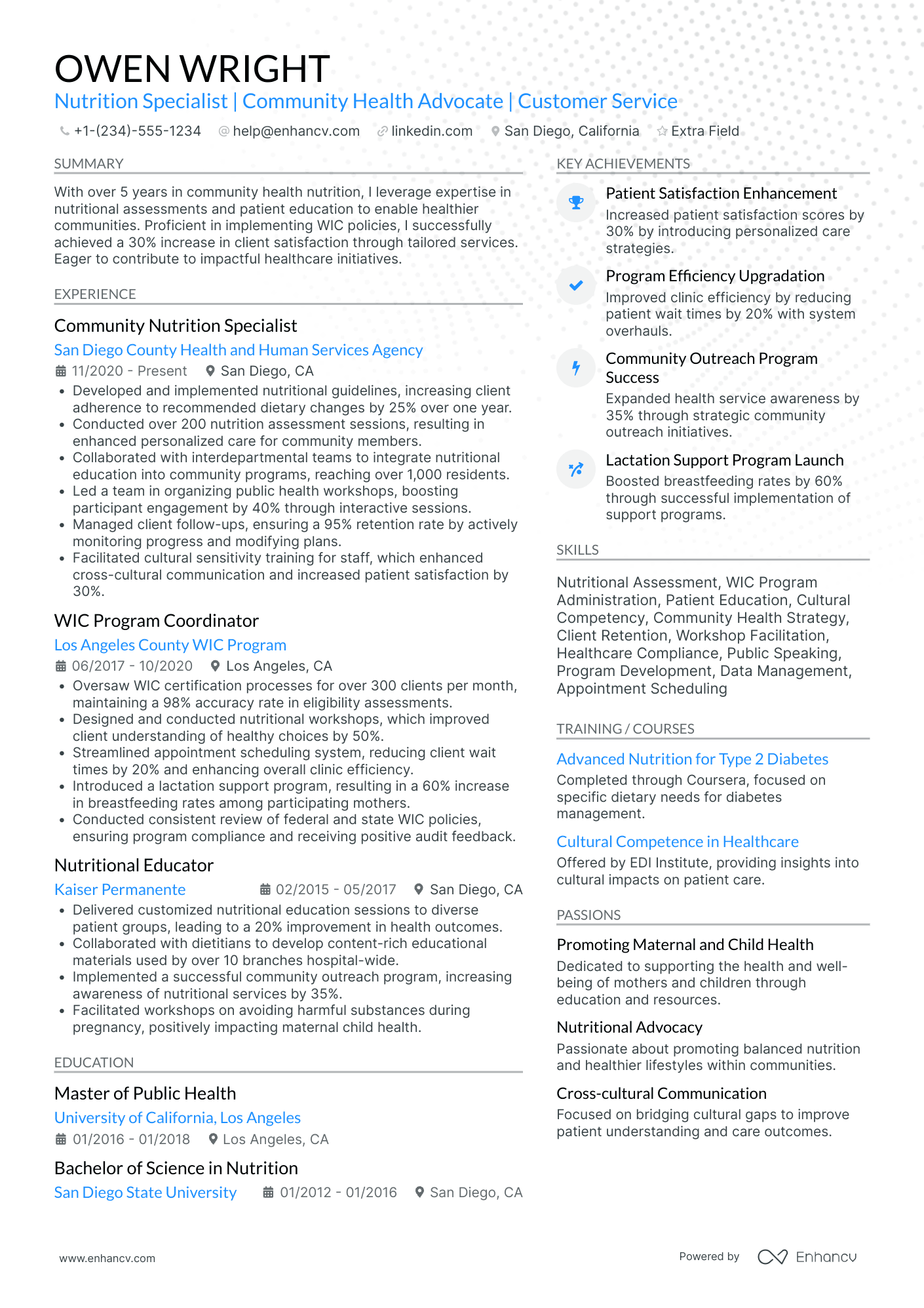

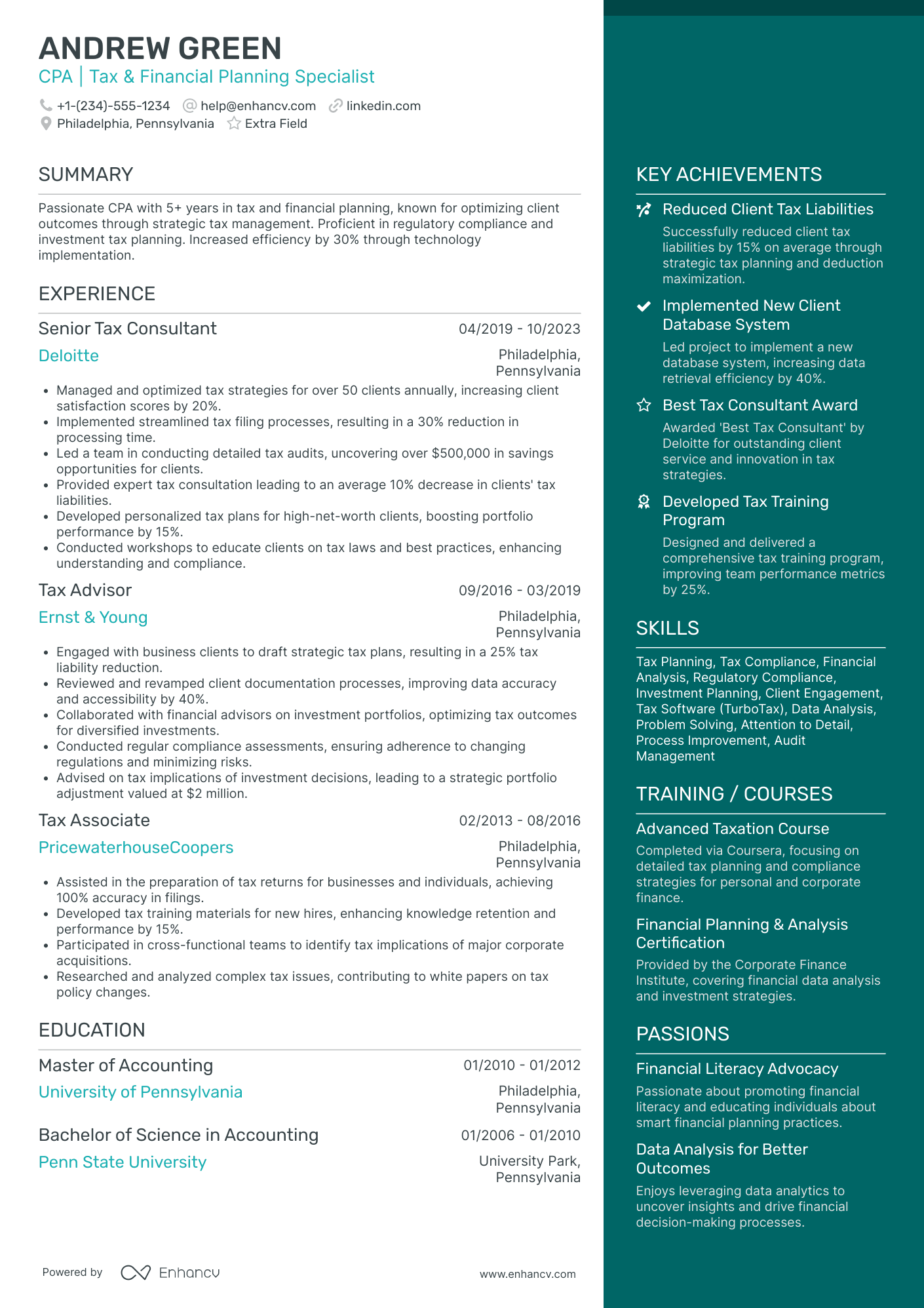

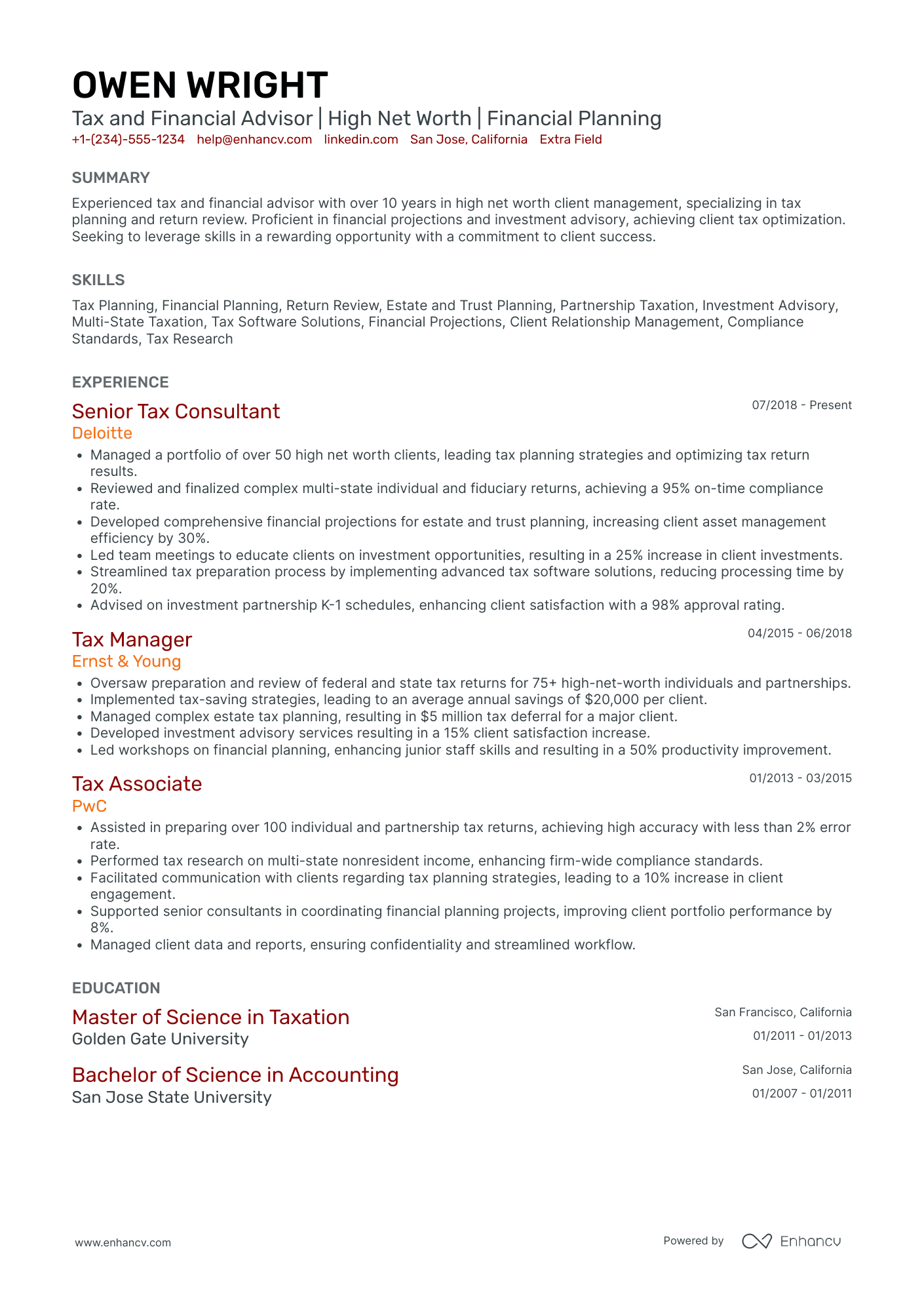

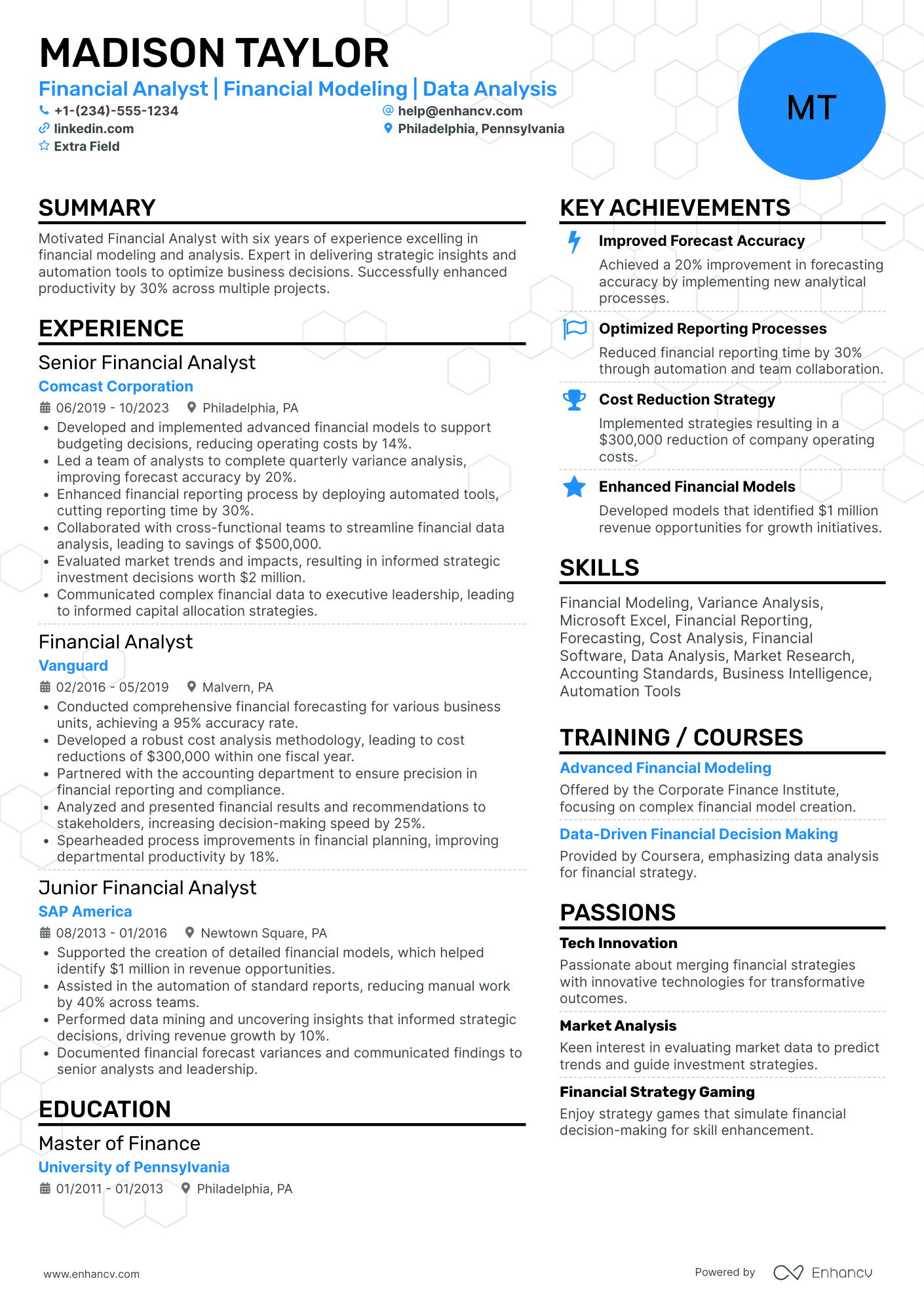

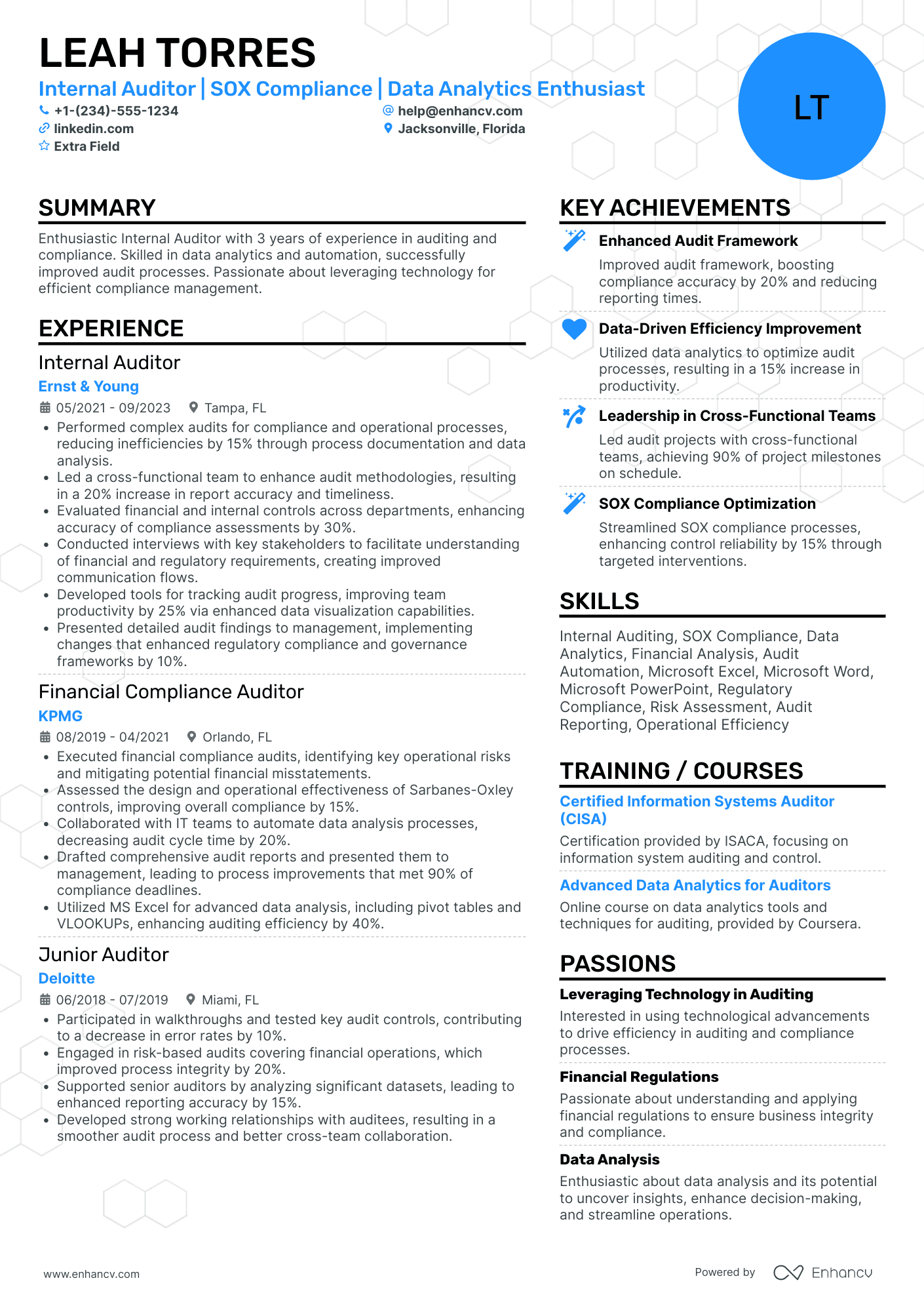

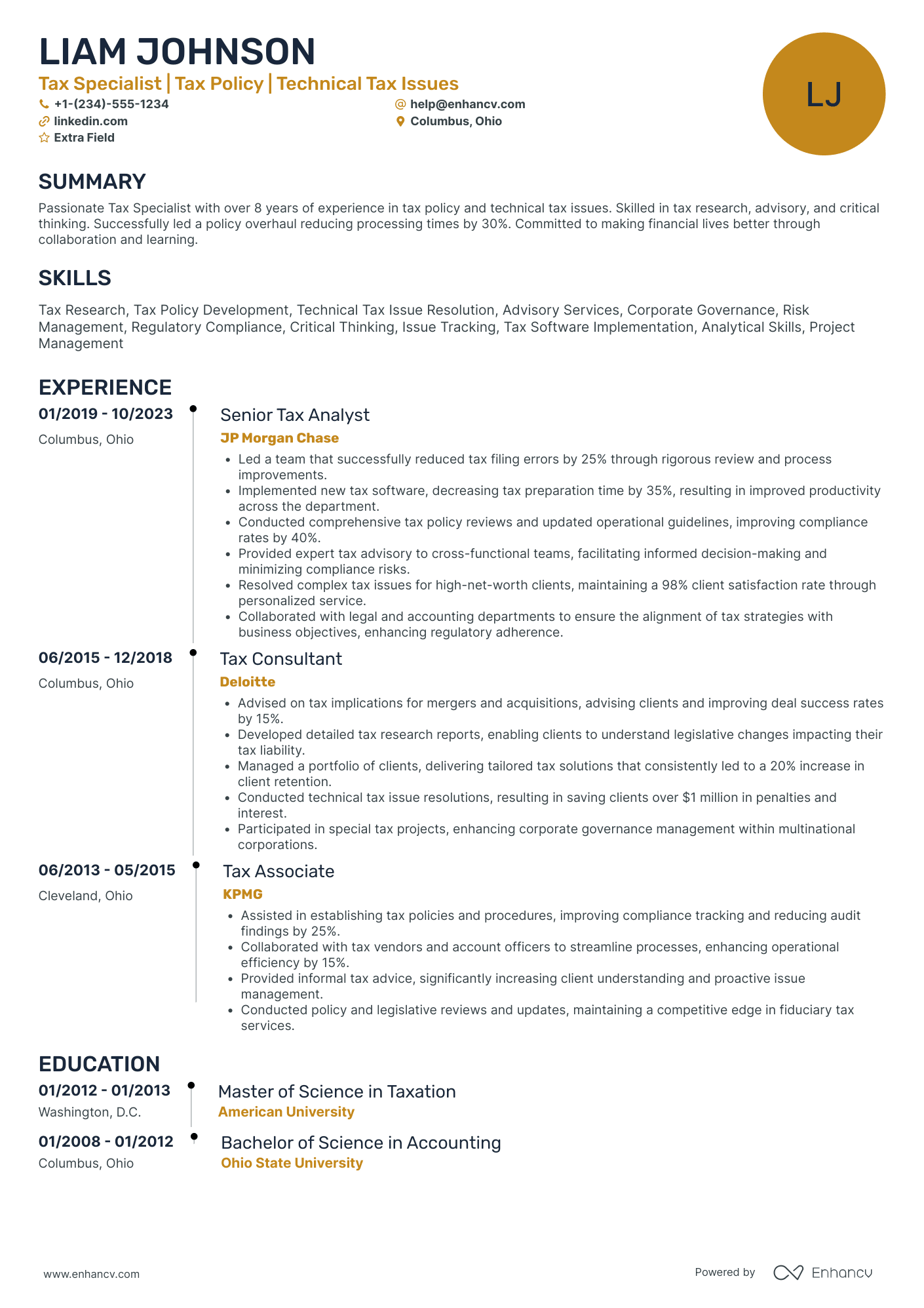

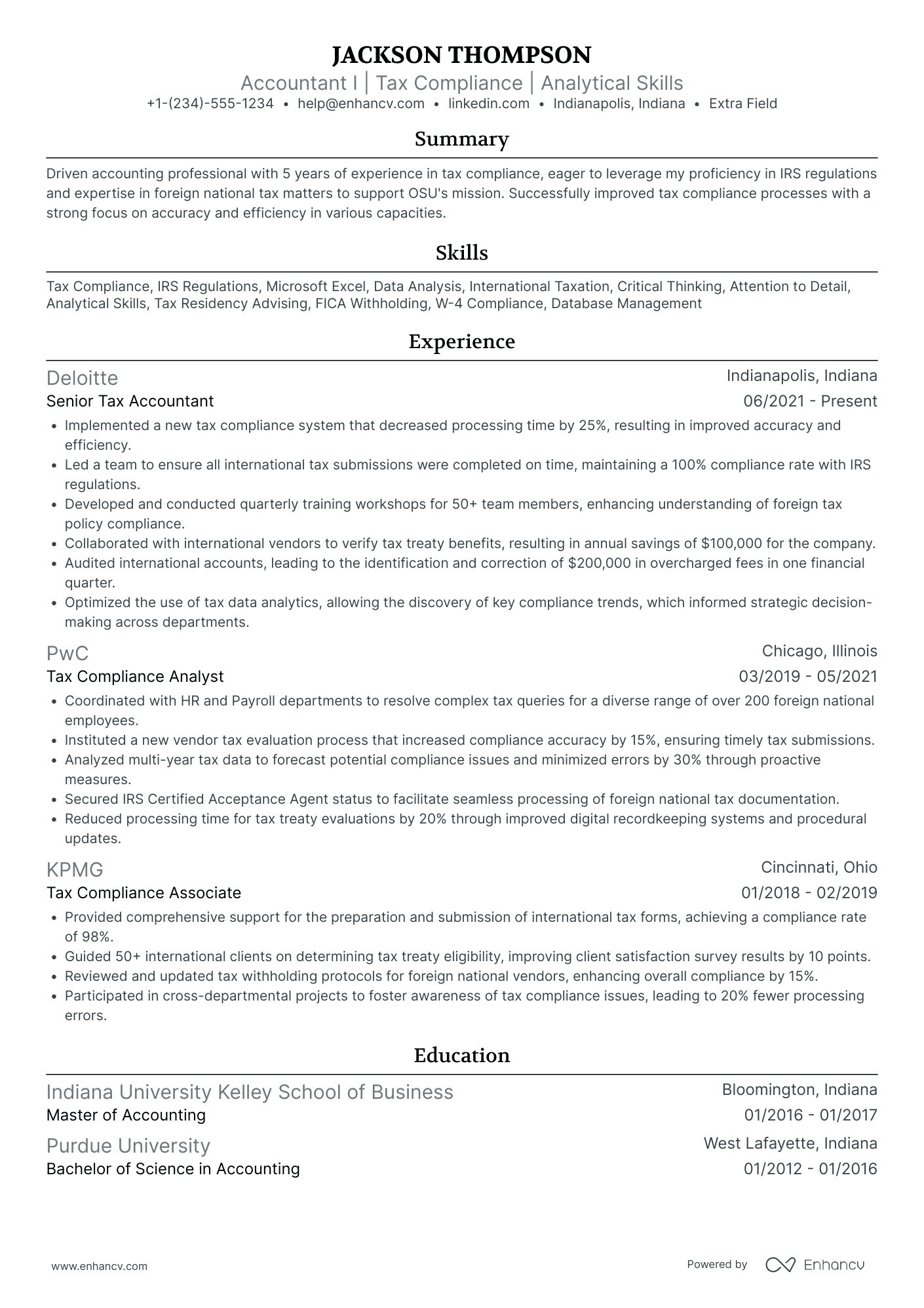

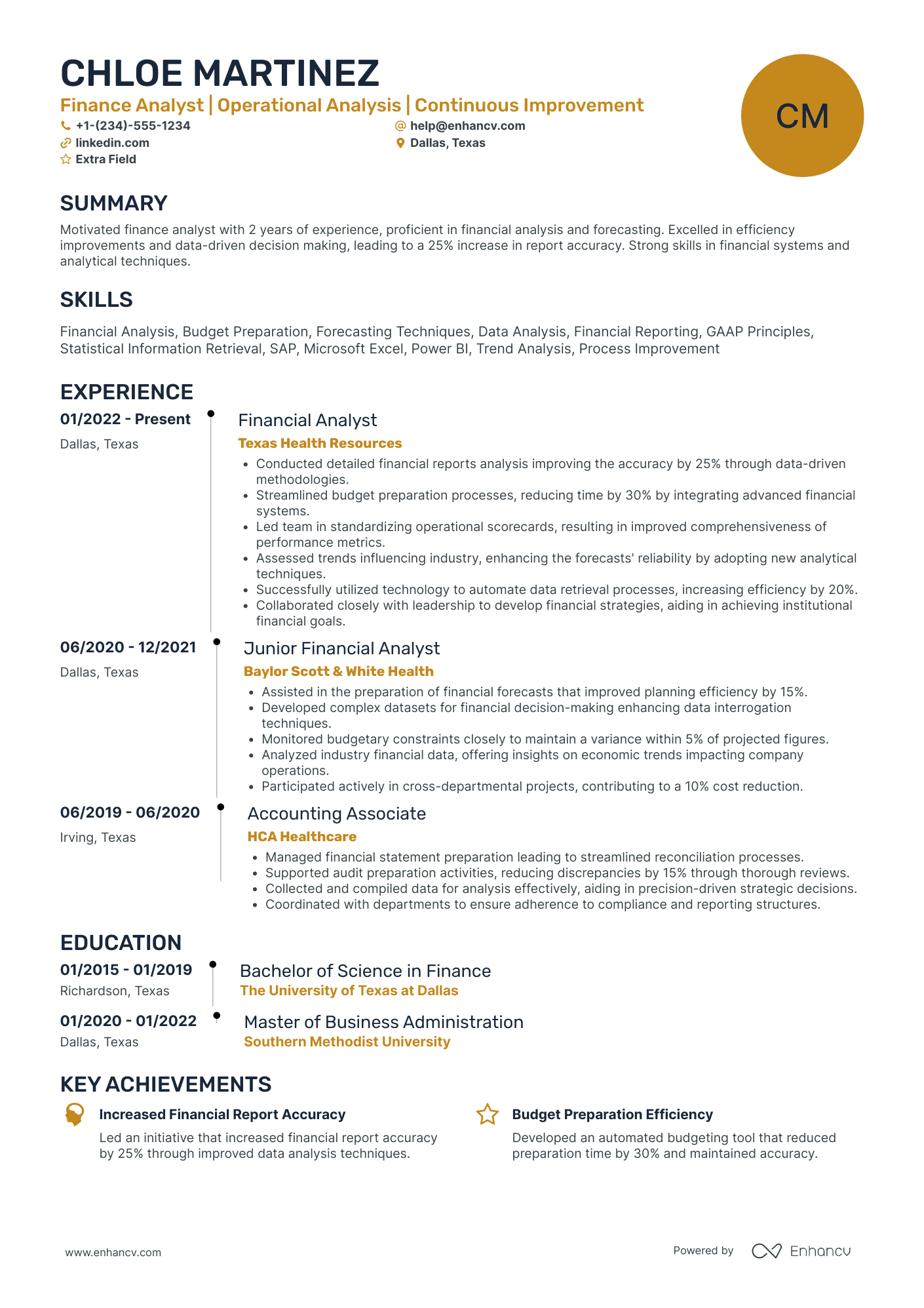

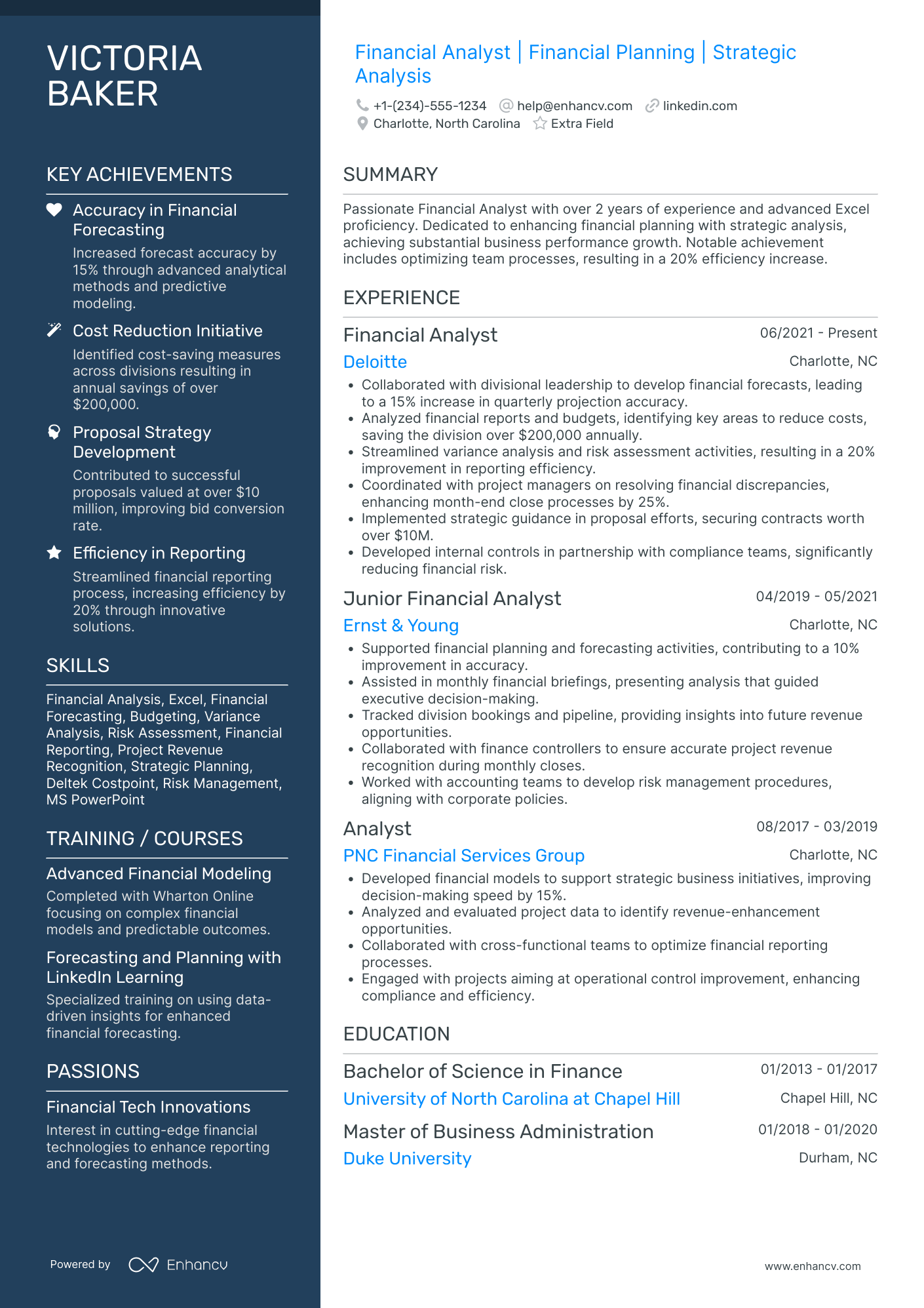

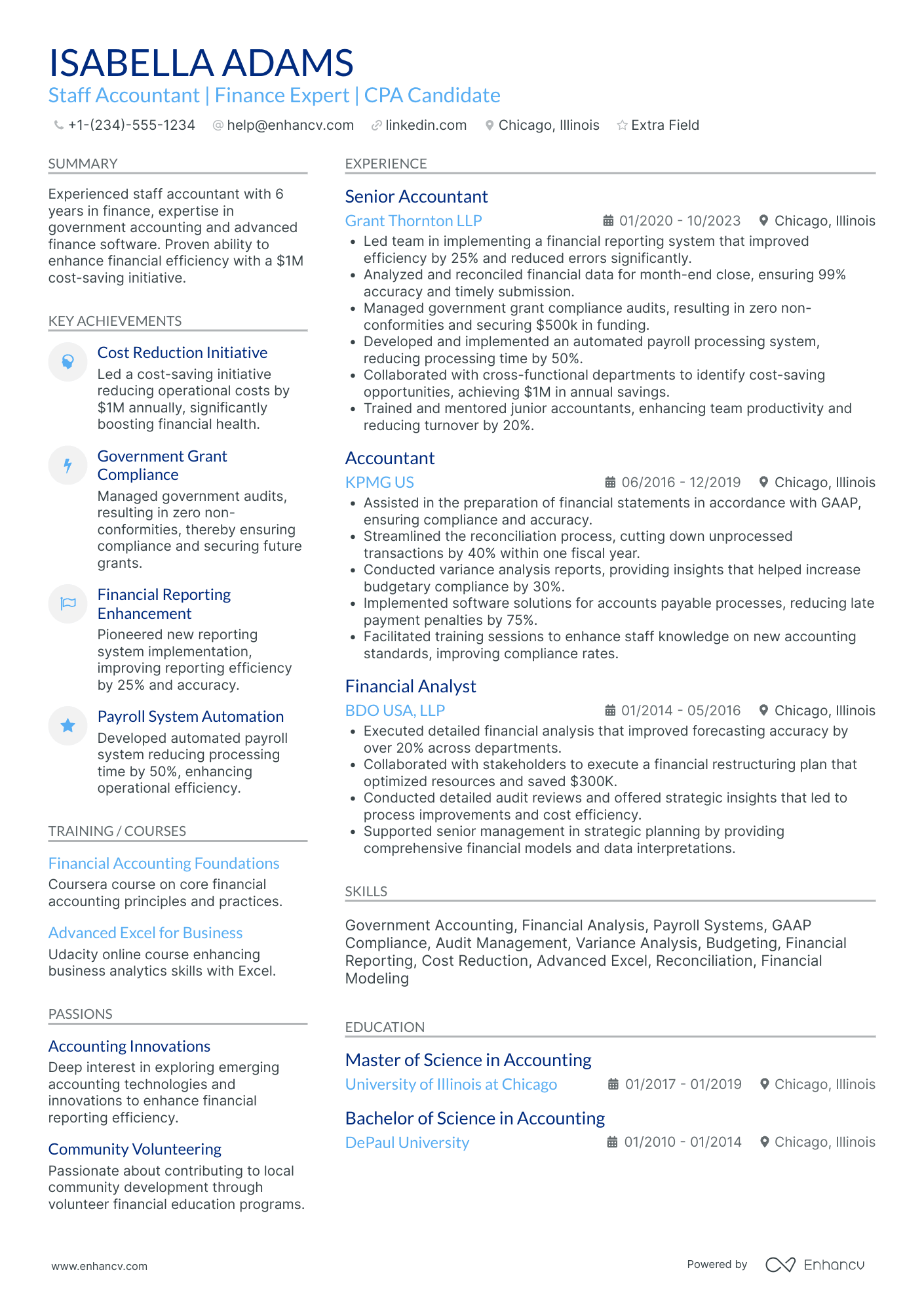

- Apply practical insights from real-life CPA resume examples to enhance your own profile;

- Choose the most effective CPA resume format to succeed in any evaluation process.

- Cost Accounting Resume Example

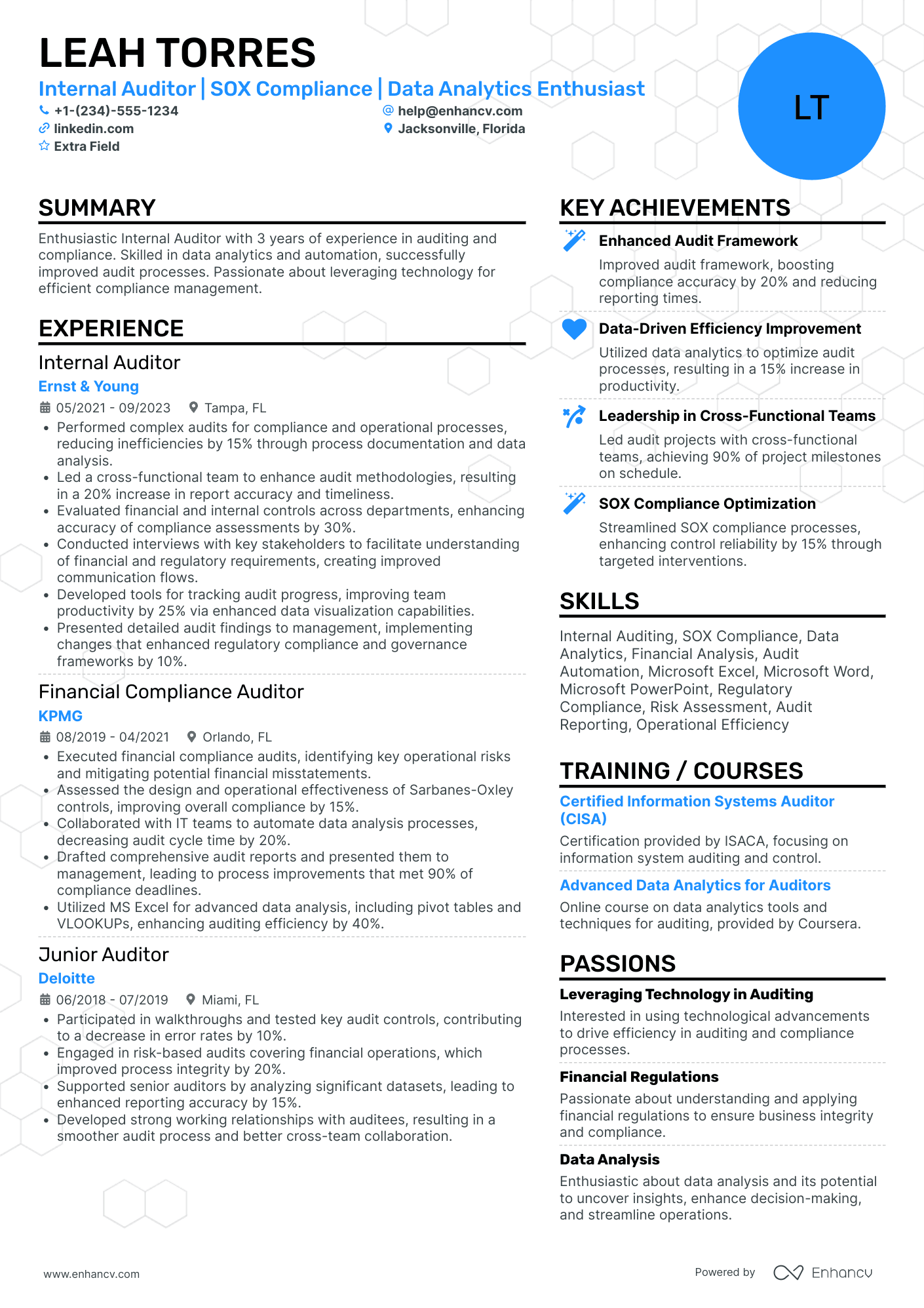

- Public Accounting Auditor Resume Example

- Forensic Accounting Resume Example

- Management Accounting Resume Example

- Financial Auditor Resume Example

- Financial Consultant Resume Example

- Payroll Director Resume Example

- Construction Accounting Resume Example

- Project Accounting Resume Example

- Senior Finance Manager Resume Example

How to style your CPA resume: layout and format

When creating your CPA resume, have you ever wondered how long it should be? Experts point out that it should be between one and two pages. Choose the longer format, if you happen to have over a decade of relevant experience. What is more, resume formats play a crucial role in presenting your experience. Use the:- Reverse-chronological resume format to highlight your experience;

- Functional skill-based resume format if you have less experience and want to focus on skills;

- Hybrid resume format to guide recruiters through both your experience and skills.

- Make sure your headline is simple and includes the job you're applying for or your current role, an abbreviation of a certificate you have, or even your professional area of interest;

- Always tailor your CPA resume to the role you're applying for by matching job requirements to your experience via different resume sections;

- Once you've created your resume, download it in PDF (unless otherwise specified). This is to ensure readability and that the layout remains fixed.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Listing your relevant degrees or certificates on your CPA resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

Essential sections that should make up your CPA resume include:

- The header - with your contact details (e.g. email and telephone number), link to your portfolio, and headline

- The summary (or objective) - to spotlight the peaks of your professional career, so far

- The experience section - with up to six bullets per role to detail specific outcomes

- The skills list - to provide a healthy mix between your personal and professional talents

- The education and certification - showing your most relevant degrees and certificates to the CPA role

What recruiters want to see on your resume:

- Relevant Certifications (CPA licensure and other accounting or industry-specific certifications)

- Technical Proficiency (experience with accounting software such as QuickBooks, Oracle, SAP, or advanced Excel skills)

- Accounting Experience (demonstration of experience in financial reporting, tax preparation, auditing, or compliance)

- Attention to Detail (specific examples of meticulous work with financial data and error-free reporting)

- Soft Skills (communication skills and ability to work on a team, as well as leadership experience if applicable)

Quick formula for writing your CPA resume experience section

Have you ever wondered why recruiters care about your CPA expertise?

For starters, your past roles show that you've obtained the relevant on-the job training and expertise that'd be useful for the role.

What is more, the resume work experience section isn't just your work history , but:

- shows what you're capable of achieving based on your past success;

- proves your skills with (oftentimes, tangible) achievements;

- highlights the unique value of what it's like to work with you.

To ensure your resume work experience section is as effective as possible, follow this formula:

- start each bullet with a powerful, action verb , followed up by your responsibilities, and your workplace success.

The more details you can include - that are relevant to the job and linked with your skill set - the more likely you are to catch recruiters' attention.

Additionally, you can also scan the job advert for key requirements or buzzwords , which you can quantify across your experience section.

Not sure what we mean by this? Take inspiration from the CPA resume experience sections below:

- Managed a portfolio of financial audits for mid-sized corporations, ensuring compliance with GAAP and reducing average audit completion times by 20%.

- Streamlined tax planning processes for a diverse clientele, resulting in a 15% reduction in clients’ annual tax liabilities through strategic deferral and tax credit application.

- Led a cross-departmental team to implement a new financial reporting software, improving reporting accuracy and reducing report generation times by 35%.

- Directed a financial team in restructuring the company's debt portfolio, saving the company an average of $2 million per annum in interest expenses.

- Oversaw the successful external audit processes annually, with zero non-conformance issues reported over a five-year period.

- Implemented a continuous financial monitoring system that increased the operational fund's efficiency by 25%, supporting strategic business expansion.

- Developed and executed a robust tax strategy for international operations, reducing the effective tax rate by 10% through the utilization of foreign tax credits.

- Enhanced internal audit procedures by incorporating risk-based audit techniques, significantly improving the detection of fiscal discrepancies and vulnerabilities.

- Trained and mentored a team of 15 junior accountants, raising the department's overall productivity and accuracy in financial reporting.

- Played a key role in advising on a high-profile merger worth $30 million, conducting due diligence and financial analysis that informed the successful negotiation strategy.

- Executed a company-wide cost-reduction initiative by analyzing expenditure patterns, leading to a sustained 15% reduction in operational costs.

- Collaborated with IT to co-develop a custom accounting software module to handle industry-specific financial transactions, increasing processing efficiency by 40%.

- Provided expert witness testimony on financial matters in 20+ legal cases, which contributed to favorable outcomes in highly contested financial disputes.

- Led the initiative to automate the accounts payable process, cutting down transaction processing time by 30% and reducing manual errors significantly.

- Mastered the application of blockchain technology in accounting, enhancing data security and integrity across financial operations.

- Championed the adoption of a new financial modeling protocol which accurately projected fiscal outcomes and influenced the company's long-term strategic decisions.

- Prepared detailed quarterly financial statements and reports for executive management that enhanced the decision-making process regarding new market ventures.

- Integrated sustainable financial practices by advising on the adoption of green investments, leading to a recognized 5% improvement in corporate social responsibility ratings.

- Performed comprehensive research and analysis to navigate complex tax legislation, resulting in the recapture of $500,000 in overpaid taxes for a number of clients.

- Crafted and executed a strategic plan to manage a $25 million non-profit portfolio, achieving a consistent 8% return on investments annually.

- Facilitated in-depth internal control assessments which identified key areas for improvement, subsequently enhancing operational efficiency by 20%.

- Contributed to a vigorous restructuring of the company's payroll system, which supported a 10% increase in employee satisfaction relating to payroll accuracy and timeliness.

- Identified and implemented cost-saving measures in procurement and supply chain management, leading to a reduction in costs of goods sold by 12%.

- Assisted in the successful negotiation of a major vendor contract, securing favorable terms that saved the company $1.2 million over the duration of the contract.

Quantifying impact on your resume

- Highlight the volume of financial transactions processed or audited to demonstrate efficient handling of high-volume workloads.

- Emphasize the size of budgets managed or financial portfolios to show capability in overseeing substantial fiscal responsibilities.

- Quantify any cost savings achieved through process improvements to showcase a direct impact on the company's bottom line.

- Include the percentage of compliance issues resolved to illustrate problem-solving abilities and attention to regulatory standards.

- Detail the number of tax filings completed to display proficiency in managing complex tax-related tasks.

- Present the amount of financial reports prepared to evidence thoroughness in financial documentation and reporting.

- Mention the scope of any financial analysis conducted to highlight strategic thinking and decision-support capabilities.

- Specify the extent of cross-departmental collaboration to demonstrate interpersonal skills and the ability to work in team-oriented environments.

Action verbs for your CPA resume

No experience, no problem: writing your CPA resume

You're quite set on the CPA role of your dreams and think your application may add further value to your potential employers. Yet, you have no work experience . Here's how you can curate your resume to substitute your lack of experience:

- Don't list every single role you've had so far, but focus on ones that would align with the job you're applying for

- Include any valid experience in the field - whether it's at research or intern level

- Highlight the soft skills you'd bring about - those personality traits that have an added value to your application

- Focus on your education and certifications, if they make sense for the role.

Recommended reads:

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

Defining your unique CPA skill set with hard skills and soft skills

In any job advertisement, a blend of specific technologies and interpersonal communication skills is typically sought after. Hard skills represent your technical expertise and indicate your job performance capacity. Soft skills, on the other hand, demonstrate how well you would integrate within the company culture.

Incorporating a balanced mix of both skill types in your CPA resume is crucial. Here's how you can do it:

- In your resume summary or objective, incorporate up to three hard and/or soft skills. Make sure to quantify these skills with relevant or impressive achievements; less

- The skills section should list your technical know-how.

- The strengths section is an ideal place to quantify your competencies by focusing on the achievements facilitated by these skills.

Top skills for your CPA resume:

Accounting Software (e.g., QuickBooks, Sage)

Microsoft Excel

Tax Preparation Software (e.g., TurboTax, H&R Block)

Financial Modeling

Audit Software (e.g., ACL, CaseWare)

ERP Systems (e.g., SAP, Oracle)

Data Analysis Tools (e.g., Tableau, Power BI)

Payroll Systems

Regulatory Compliance Tools

Accounting Standards (GAAP, IFRS)

Analytical Thinking

Attention to Detail

Time Management

Communication Skills

Problem-Solving

Ethical Judgment

Team Collaboration

Adaptability

Client Management

Leadership

PRO TIP

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

Qualifying your relevant certifications and education on your CPA resume

In recent times, employers have started to favor more and more candidates who have the "right" skill alignment, instead of the "right" education.

But this doesn't mean that recruiters don't care about your certifications .

Dedicate some space on your resume to list degrees and certificates by:

- Including start and end dates to show your time dedication to the industry

- Adding credibility with the institutions' names

- Prioritizing your latest certificates towards the top, hinting at the fact that you're always staying on top of innovations

- If you decide on providing further information, focus on the actual outcomes of your education: the skills you've obtained

If you happen to have a degree or certificate that is irrelevant to the job, you may leave it out.

Some of the most popular certificates for your resume include:

The top 5 certifications for your CPA resume:

- Certified Public Accountant (CPA) - American Institute of Certified Public Accountants (AICPA)

- Certified Management Accountant (CMA) - Institute of Management Accountants (IMA)

- Certified Internal Auditor (CIA) - Institute of Internal Auditors (IIA)

- Certified Information Systems Auditor (CISA) - Information Systems Audit and Control Association (ISACA)

- Chartered Financial Analyst (CFA) - CFA Institute

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

Recommended reads:

Adding a summary or objective to your CPA resume

One of the most crucial elements of your professional presentation is your resume's top one-third. This most often includes:

- Either a resume summary - your career highlights at a glance. Select the summary if you have plenty of relevant experience (and achievements), you'd like recruiters to remember about your application.

- Or, a resume objective - to showcase your determination for growth. The perfect choice for candidates with less experience, who are looking to grow their career in the field.

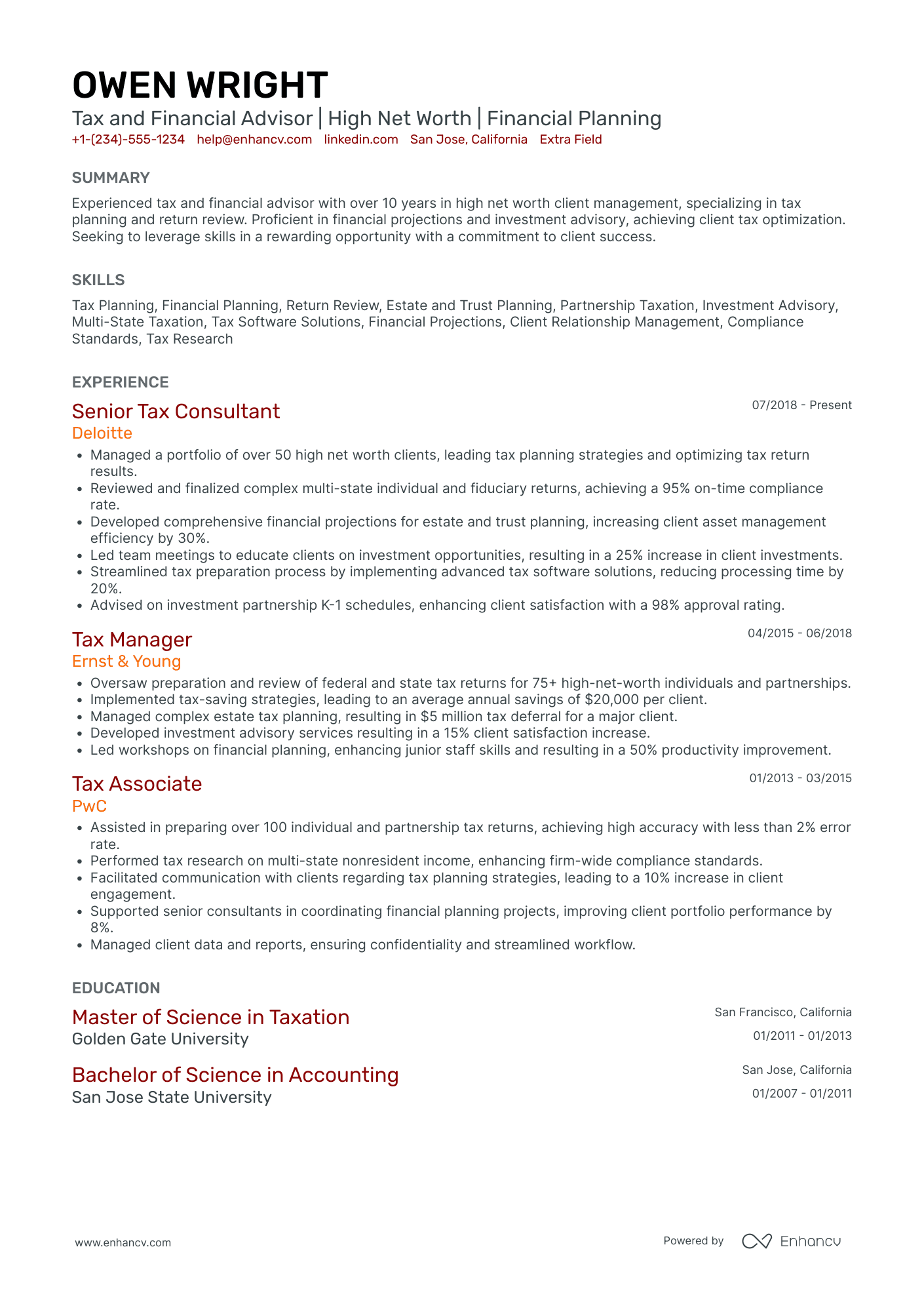

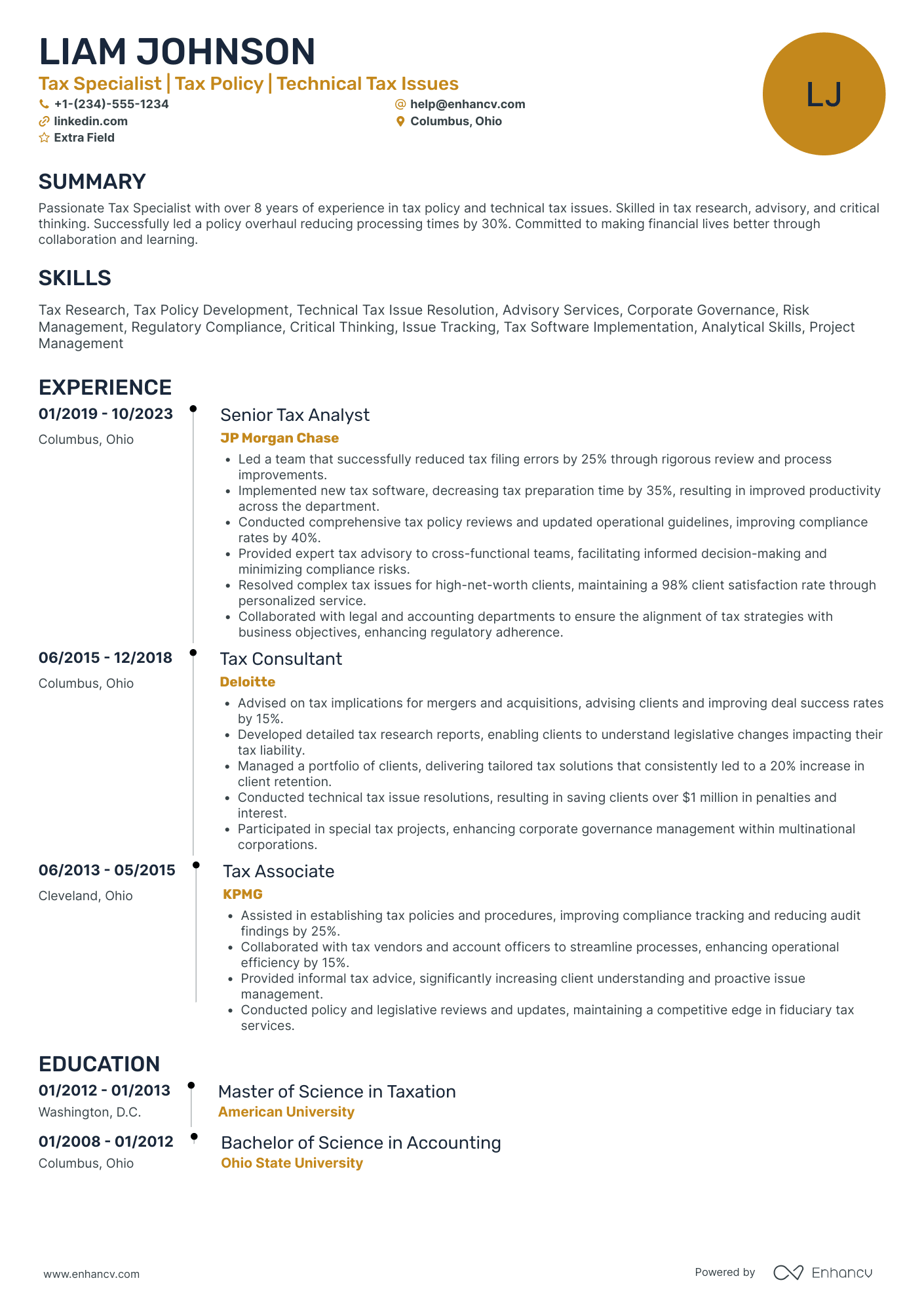

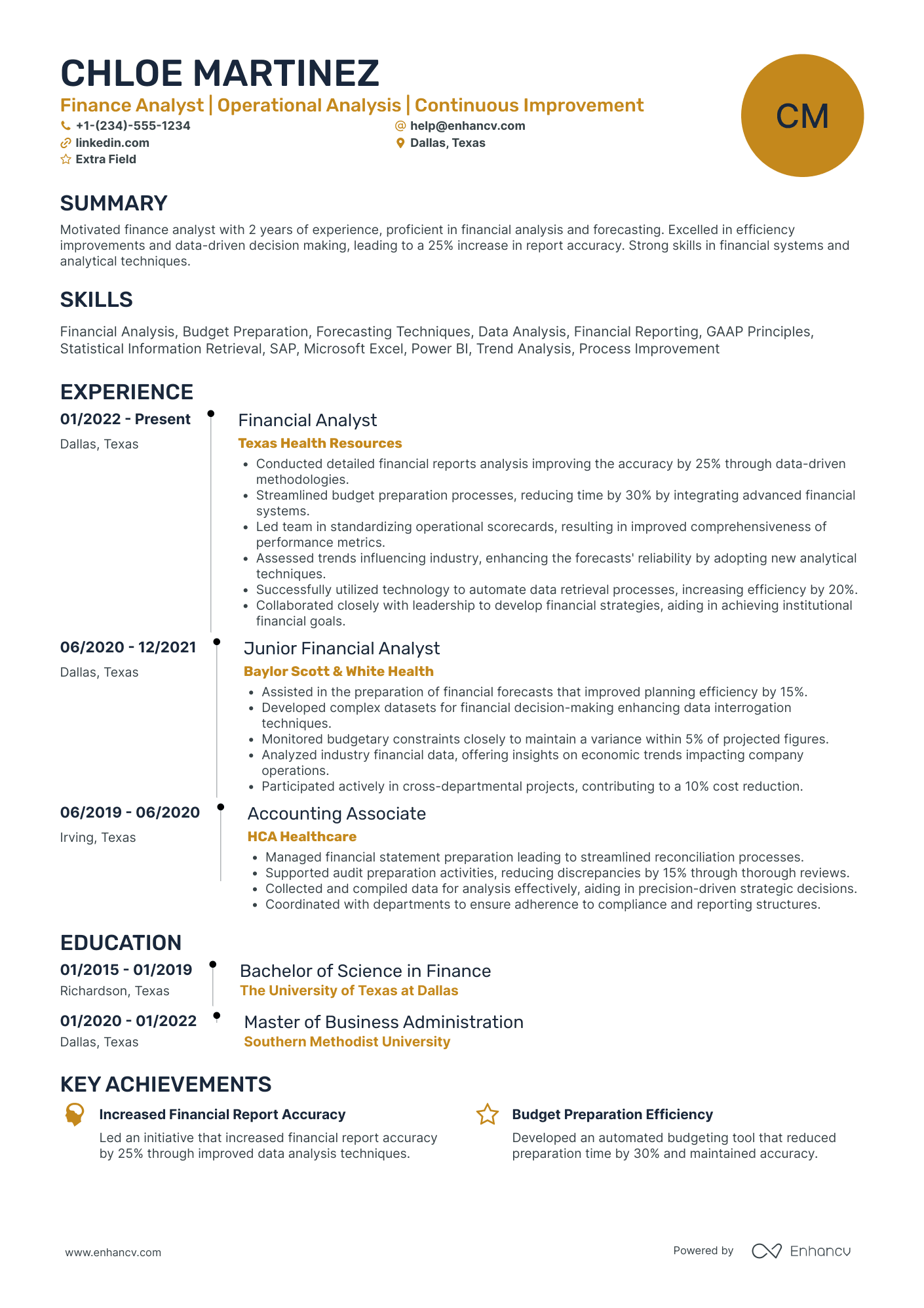

If you want to go above and beyond with your CPA resume summary or resume objective, make sure to answer precisely why recruiters need to hire you. What is the additional value you'd provide to the company or organization? Now here are examples from real-life CPA professionals, whose resumes have helped them land their dream jobs:

Resume summaries for a CPA job

- Seasoned CPA with over 12 years of experience in financial strategy and tax planning for multinational corporations. Amassed expertise in managing end-to-end accounting processes, reducing tax liabilities by 30%, and leading teams to successfully navigate complex audits. Known for precise financial analysis and robust strategy development.

- Dedicated financial researcher, transitioning to the CPA field, brings a Ph.D. in Economics and 5 years of experience in data-driven financial policy development. Adept in advanced statistical analysis and a proven track record in academic research focused on fiscal efficiency and reform.

- Adept in providing exceptional financial services with over eight years in the accounting industry, managing portfolios exceeding $50 million. Leverage expertise in GAAP, tax compliance, and strategic cost reduction initiatives, having achieved a 20% increase in cost savings for previous employers through meticulous financial oversight.

- Forward-thinking professional with a background in management consulting, eager to leverage a strong foundation in business analytics and strategy to embark on a career in accounting. With 5 years of formulating data-informed business solutions, keen to apply analytical and problem-solving skills in a new CPA context.

- Recent finance graduate fueled by a desire to contribute fresh perspectives and a strong work ethic to the field of accounting. Eager to apply comprehensive knowledge from a Bachelor’s degree in Accounting and Finance, coupled with hands-on internship experience in financial reporting and tax preparation.

- Aspiring CPA with a solid foundation in business administration, including recent coursework in accounting principles and corporate finance. Combining enthusiasm for learning and professional development with a commitment to applying academic knowledge and strong analytical skills to excel in the world of accounting.

Other relevant sections for your CPA resume

Apart from the standard CPA resume sections listed in this guide, you have the opportunity to get creative with building your profile. Select additional resume sections that you deem align with the role, department, or company culture. Good choices for your CPA resume include:

- Language skills - always ensure that you have qualified each language you speak according to relevant frameworks;

- Hobbies - you could share more about your favorite books, how you spend your time, etc. ;

- Volunteering - to highlight the causes you care about;

- Awards - for your most prominent CPA professional accolades and achievements.

Make sure that these sections don't take too much away from your experience, but instead build up your CPA professional profile.

Key takeaways

- Your resume layout plays an important role in presenting your key information in a systematic, strategic manner;

- Use all key resume sections (summary or objective; experience; skills; education and certification) to ensure you’ve shown to recruiters just how your expertise aligns with the role and why you're the best candidate;

- Be specific about listing a particular skill or responsibility you've had by detailing how this has helped the role or organization grow;

- Your personality should shine through your resume via the interests or hobbies, and strengths or accomplishments skills sections;

- Certifications go to provide further accreditation to your technical capabilities, so make sure you've included them within your resume.

CPA resume examples

By Experience

Junior CPA

Senior CPA

CPA Internal Auditor

By Role