As a corporate financial analyst, articulating complex financial strategies and achievements within the confined space of a resume can be a daunting challenge. Our guide offers strategies and language tips that will help you succinctly convey your expertise and accomplishments, ensuring your resume stands out to potential employers.

- Apply best practices from professional resumes to spotlight your application;

- Quantify your professional experience with achievements, career highlights, projects, and more;

- Write an eye-catching corporate financial analyst resume top one-third with your header, summary/objective, and skills section;

- Fill in the gaps of your experience with extracurricular, education, and more vital resume sections.

We've selected, especially for you, some of our most relevant corporate financial analyst resume guides. Getting you from thinking about your next career move to landing your dream job.

- Purchase Manager Resume Example

- Tax Manager Resume Example

- Finance Clerk Resume Example

- IT Auditor Resume Example

- Phone Banking Resume Example

- Billing Manager Resume Example

- Public Accounting Auditor Resume Example

- Purchasing Director Resume Example

- Government Accounting Resume Example

- Corporate Accounting Resume Example

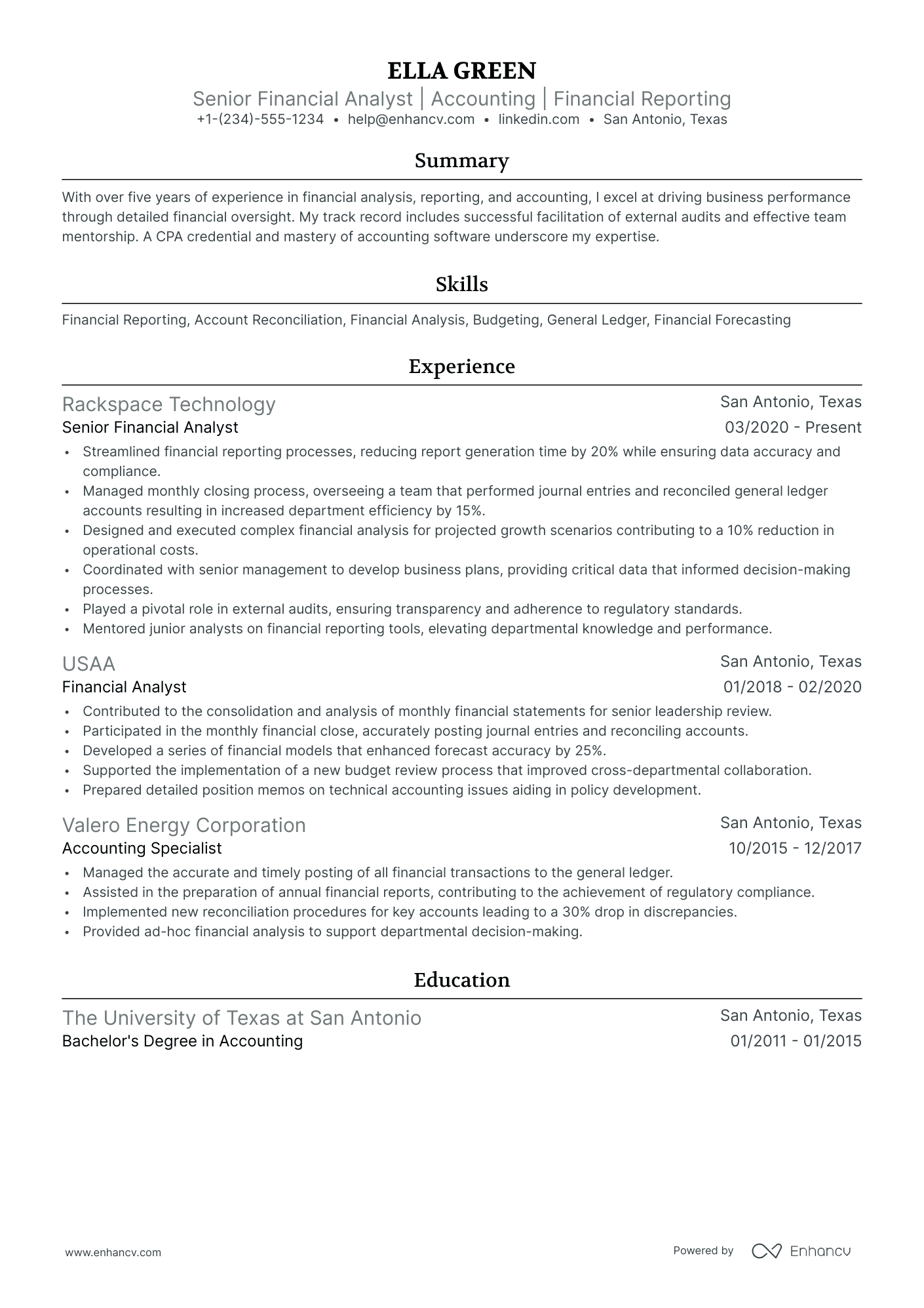

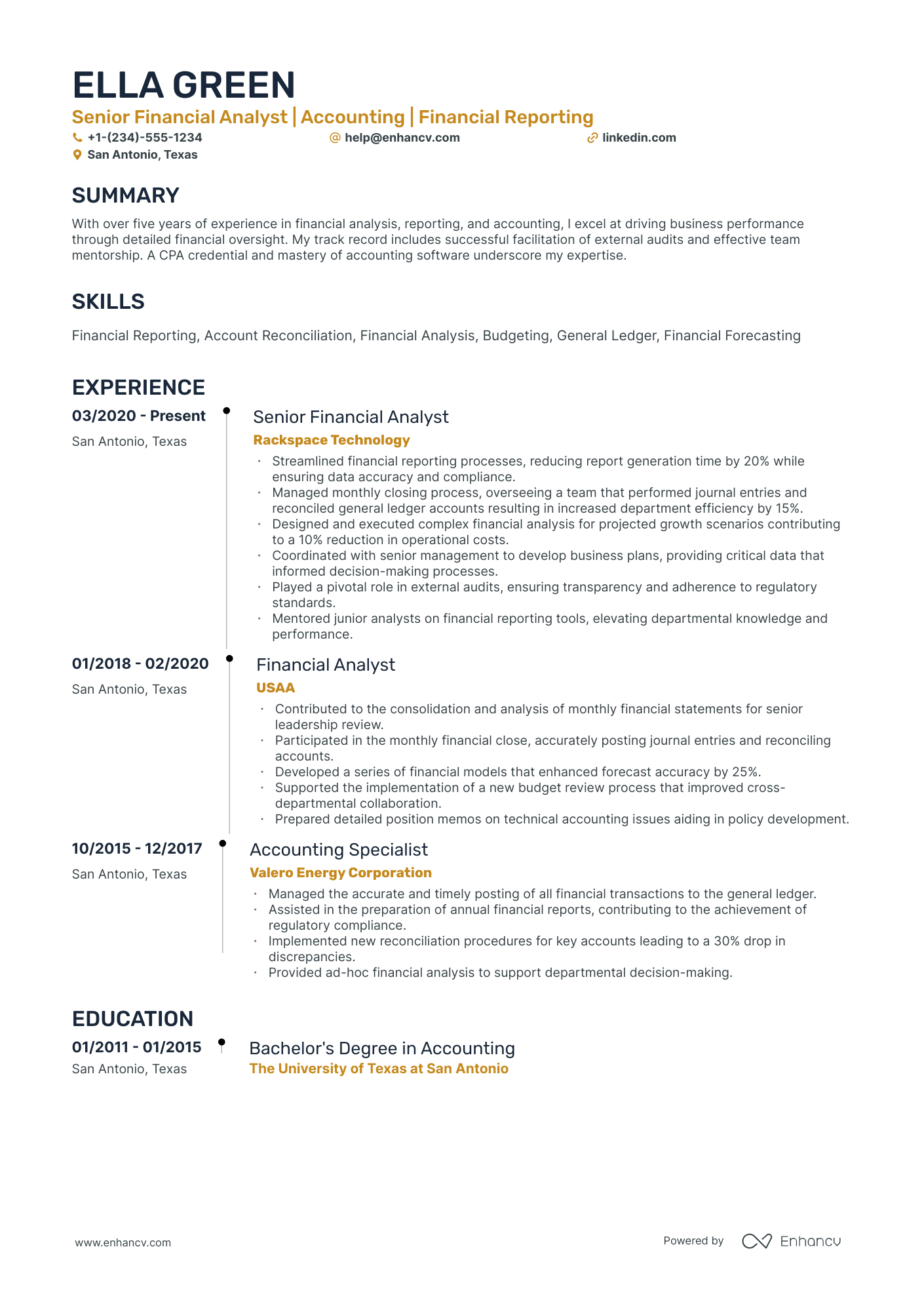

Don't stress out over your corporate financial analyst resume format

Remember, the elaborate design of your corporate financial analyst resume isn't what impresses recruiters most. They are primarily searching for candidates who meet the job requirements. The main aim of your resume should be to clearly and concisely explain why employers should hire you.

Here are four straightforward steps to consider in your corporate financial analyst resume design:

- Organize your resume based on experience: Start with your most recent roles. Besides using reverse chronological order, choose jobs relevant to the position you're applying for.

- Include your contact details (and portfolio or LinkedIn link) in your resume's header to ensure recruiters can easily reach you. If considering adding a professional photo, check acceptable practices in different countries first.

- Don't omit essential corporate financial analyst resume sections such as the summary or objective, experience, and education. These sections should reflect your career progression and align with job requirements.

- Maintain conciseness in your resume. For those with less than ten years of experience, a one-page format is advisable.

Regarding the format to submit your corporate financial analyst resume, PDF is preferable. PDFs are more likely to maintain their formatting when processed through recruitment software or ATS, saving you time in the application process.

When selecting a font for your corporate financial analyst resume, consider the following:

- Choose ATS-friendly fonts such as Exo 2, Volkhov, Lato, etc., to keep your resume's content legible;

- All serif and sans-serif fonts are easily readable by ATS;

- While Arial and Times New Roman are common choices, opting for unique typography can help your resume stand out.

Concerned about ATS compatibility with charts and infographics? Our recent study has debunked this and other myths.

Be mindful of regional differences in resume formats – a Canadian layout, for instance, might vary.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

Corporate financial analyst resume sections to answer recruiters' checklists:

- Header to help recruiters quickly allocate your contact details and have a glimpse over your most recent portfolio of work

- Summary or objective to provide an overview of your career highlights, dreams, and goals

- Experience to align with job requirements and showcase your measurable impact and accomplishments

- Skills section/-s to pinpoint your full breadth of expertise and talents as a candidate for the corporate financial analyst role

- Education and certifications sections to potentially fill in any gaps in your experience and show your commitment to the industry

What recruiters want to see on your resume:

- Strong expertise in financial modeling and forecasting, with a proven ability to create accurate financial reports and performance analysis.

- Proficiency with financial software and systems such as Excel, Access, and specialized financial analysis tools (e.g., Bloomberg, SAP, Oracle Financials).

- Experience with budgeting, variance analysis, and strategic planning that drives corporate financial decisions.

- Demonstrated ability to communicate complex financial information to stakeholders in a clear and concise manner.

- A solid understanding of financial regulations and compliance, as well as experience in internal controls and risk management.

Essential tips for crafting your corporate financial analyst resume experience section

The experience section is indeed the core of your corporate financial analyst resume. It's where you present your past and current job roles. But how should you approach this crucial part?

A common error is treating the experience section as merely a list of job duties. Many candidates fall into the trap of detailing what they did without illustrating the impact of their actions.

To effectively write your corporate financial analyst resume experience section, consider these guidelines:

- Emphasize your achievements, supported by concrete metrics such as percentages, revenue increases, or customer satisfaction rates;

- Avoid using generic buzzwords like communication, hard work, or leadership. Instead, demonstrate how these skills added value in your previous roles;

- Begin each bullet point with a strong action verb, followed by a skill, and then the result of your actions;

- Tailor your resume for each job application by selecting the most relevant experiences, responsibilities, and successes.

We have an array of resume examples that illustrate how to optimally curate your corporate financial analyst resume experience section.

- Developed and executed financial models for strategic planning that enhanced forecasting accuracy by 25%, optimizing our capital allocations.

- Led a cross-functional team to analyze market trends, resulting in a portfolio adjustment that increased returns by 18% year-over-year.

- Created comprehensive risk analysis procedures that reduced financial discrepancies by 40%, significantly improving our internal audit compliance.

- Implemented new budgeting process using financial analytics software, cutting report generation time by 35% while increasing data accuracy.

- Spearheaded quarterly earnings reports, consolidating information from various departments to provide clear, concise insights to stakeholders.

- Managed a portfolio of investments, using financial modelling to drive decisions that led to an average annualized return of 10% over the investment horizon.

- Identified cost-saving opportunities in supply chain finance, leading to annual savings of $1.2 million.

- Automated the corporate reporting system with advanced Excel features, reducing human error and saving approximately 20 hours per month.

- Collaborated closely with the M&A team to provide financial due diligence for a $500 million acquisition.

- Delivered monthly financial reports and dashboards for executives that improved decision-making efficiency significantly.

- Orchestrated a company-wide budget overhaul that enhanced spending visibility and cut costs by 15% in non-essential areas.

- Analyzed competitor financials and market position to assist leadership in understanding potential threats and opportunities.

- Conducted thorough financial statement analyses that contributed to an investment strategy outperforming the benchmark index by 5%.

- Evaluated financial systems and recommended upgrades that resulted in a 30% increase in processing efficiency.

- Provided critical financial insights that guided the restructuring of business units, aligning them more closely with corporate strategic goals.

- Improved inter-departmental financial communication protocols, which led to the elimination of redundant processes and a 10% reduction in operational costs.

- Conducted and presented variance analysis reports that promoted proactive adjustments in spending, resulting in more optimized departmental budgets.

- Championed the implementation of a new forecasting tool that increased the precision of sales and revenue predictions by 20%.

- Developed a cash flow projection model that is adopted company-wide, providing key insights into working capital requirements.

- Facilitated a new KPI framework for financial performance metrics which were instrumental in shaping the strategic direction of the company.

- Initiated and managed a successful cost-reduction initiative that saved the company $800,000 annually without sacrificing quality or performance.

- Led quarterly financial planning meetings, identifying trends that helped pivot the business strategy towards more profitable ventures.

- Managed the integration of financial data post-merger, ensuring seamless systems consolidation and maintaining data integrity.

- Drove the adoption of cloud-based financial analysis tools that trimmed the data collation time by 50% and improved collaboration.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for corporate financial analyst professionals.

Top Responsibilities for Corporate Financial Analyst:

- Advise clients on aspects of capitalization, such as amounts, sources, or timing.

- Analyze financial or operational performance of companies facing financial difficulties to identify or recommend remedies.

- Assess companies as investments for clients by examining company facilities.

- Collaborate on projects with other professionals, such as lawyers, accountants, or public relations experts.

- Collaborate with investment bankers to attract new corporate clients.

- Conduct financial analyses related to investments in green construction or green retrofitting projects.

- Confer with clients to restructure debt, refinance debt, or raise new debt.

- Create client presentations of plan details.

- Determine the prices at which securities should be syndicated and offered to the public.

- Develop and maintain client relationships.

Quantifying impact on your resume

- Include the precise size of the budgets you have managed to demonstrate your experience with significant financial responsibilities.

- List any cost-saving measures you initiated, quantifying the monetary value saved, to showcase your ability to drive profitability.

- Describe financial models you have built, noting the types and sizes of the datasets used to highlight your analytical expertise.

- Quantify any revenue growth that was a direct result of your strategic planning or analysis to illustrate your impact on the bottom line.

- Detail the percentage reduction in financial risk through your risk assessment or mitigation strategies to show your risk management capabilities.

- Mention the exact number of cross-departmental financial presentations you have led to convey your communication and leadership skills.

- Highlight any efficiency improvements in financial processes by stating the time percentage saved to emphasize your operational improvement skills.

- Specify the increase in investor or stakeholder confidence, using metrics like stock price appreciation or ratings improvement, to display your contribution to company valuation.

Action verbs for your corporate financial analyst resume

How to shift the focus from your corporate financial analyst resume experience section to your professional profile

If you're at the start of your career journey or transitioning industries, you might be concerned about the lack of professional experience while crafting your corporate financial analyst resume.

How can you effectively present your corporate financial analyst resume experience section under these circumstances?

Rather than a traditional, extensive experience section, demonstrate your expertise through:

- Emphasizing your education. Your academic background might impress recruiters, especially if it includes recent, industry-relevant knowledge;

- Creating a compelling objective statement. The first few sentences of your resume should map out your motivations and career aspirations, offering insight into your goals;

- Highlighting your transferable skills. For example, if you've honed communication skills through volunteering, illustrate on your corporate financial analyst resume how these can benefit a potential employer;

- Detailing your technical background in certifications and skills sections. As a recent graduate, your technological foundations might be particularly attractive to employers looking to develop these skills further.

It's important to remember that employers sometimes prefer candidates with less experience but who are a better cultural fit for their organization.

Recommended reads:

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

Corporate financial analyst resume skills section: writing about your hard skills and soft skills

Recruiters always care about the skill set you'd bring about to the corporate financial analyst role. That's why it's a good idea to curate yours wisely, integrating both hard (or technical) and soft skills. Hard skills are the technology and software you're apt at using - these show your suitability for the technical aspect of the role. They are easy to track via your experience, certifications, and various resume sections. Your soft skills are those personality traits you've gained over time that show how you'd perform in the specific team, etc. Soft skills are more difficult to qualify but are definitely worth it - as they make you stand out and show your adaptability to new environments. How do you build the skills section of your resume? Best practices point that you could:

- Include up to five or six skills in the section as keywords to align with the advert.

- Create a specific technical skills section to highlight your hard skills aptitude.

- Align the culture of the company you're applying to with your soft skills to determine which ones should be more prominent in your skills section.

- Make sure you answer majority of the job requirements that are in the advert within your skills section.

A corporate financial analyst's resume requires a specific skill set that balances both industry-specific hard skills with personal, soft skills. Discover the perfect mix for the corporate financial analyst role from our list:

Top skills for your corporate financial analyst resume:

Financial Modeling

Excel

Power BI

SQL

Tableau

ERP Software (e.g., SAP, Oracle)

Financial Reporting Tools

Forecasting Software

Data Analysis Tools

Budgeting Software

Analytical Thinking

Attention to Detail

Communication Skills

Problem-Solving

Time Management

Team Collaboration

Adaptability

Critical Thinking

Presentation Skills

Strategic Planning

Next, you will find information on the top technologies for corporate financial analyst professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Corporate Financial Analyst’s resume:

- IBM SPSS Statistics

- The MathWorks MATLAB

- Google Docs

- Microsoft Word

- Oracle E-Business Suite Financials

- Oracle Hyperion Financial Management

PRO TIP

If you happen to have some basic certificates, don't invest too much of your corporate financial analyst resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

The basics of your corporate financial analyst resume certifications and education sections

Improve the education and certification sections of your corporate financial analyst resume by:

- Dedicating more prominent space to certificates that are more recent and have helped you update your skill set

- Keeping all the information you list to the basics: certificate/degree name, institution, and graduation dates

- Writing supplementary information in the details of your certification or education section, only if you lack experience or want to show further skill alignment

- Including your credential or license number, only if the information is valid to your application or certification

Within corporate financial analyst job adverts, relevant education, and certification are always listed within the key prerequisite for the role.

Ensure you meet all job requirements with some of the leading certificates in the industry:

The top 5 certifications for your corporate financial analyst resume:

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Financial Planner (CFP) - Certified Financial Planner Board of Standards, Inc.

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

- Certified Management Accountant (CMA) - Institute of Management Accountants

- Chartered Alternative Investment Analyst (CAIA) - CAIA Association

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for corporate financial analyst professionals.

Top US associations for a Corporate Financial Analyst professional

- Association for Financial Professionals

- Alternative Investment Management Association

- American Bankers Association

- American Economic Association

- American Finance Association

PRO TIP

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

Recommended reads:

Writing the corporate financial analyst resume summary or objective: achievements, keywords, dreams, and more

Deciding on whether to include a resume summary or resume objective should entirely depend on your career situation.

If you have:

- Plenty of relevant achievements you'd like to bring recruiters' focus to, make use of the resume summary. Ensure each of your achievements is quantified with concrete proof (e.g. % of cases solved).

- Less applicable experience, utilize the resume objective. Within the objective include a few noteworthy, past successes, followed up by your professional dreams.

As a bonus, you could define in either your corporate financial analyst resume summary or objective what makes you the perfect candidate for the role.

Think about your unique hard and soft skills that would make your expertise even more important to the job.

These corporate financial analyst professionals have completely covered the formula for the ideal resume introduction:

Resume summaries for a corporate financial analyst job

- With over 12 years of rigorous experience in corporate finance at multinational firms, adept at complex financial modeling, risk analysis, and strategic investment decisions, I have successfully managed a $500M investment portfolio, increasing ROI by 15% over three years.

- As a seasoned financial strategist with a CPA and 8 years at a top-tier investment bank, I leveraged advanced analytics to drive M&A activities, overseeing deals upwards of $250M and enhancing client portfolios by consistently outperforming market benchmarks.

- Transitioning from a 10-year tenure in management consulting to corporate finance, I bring a robust skill set including in-depth market analysis, operational efficiency optimization, and a track record of improving client financial health by 20% year-on-year.

- Eager to apply an extensive background in software engineering and data science within a financial context, promising a unique perspective towards financial analysis, modeling, and algorithmic trading, aiming to use technical skills to uncover novel profit-maximization strategies.

- Keen to embark on a career in corporate finance, my strong quantitative background, honed through a Mathematics degree and passion for market analytics, equips me to deliver fresh insights and a rigorous approach to financial challenge-solving.

- As an ambitious recent graduate with a B.S. in Economics, I am enthusiastic about applying my academic knowledge of econometrics and financial theory to practical financial analysis, aiming to contribute meaningfully to strategic decision-making.

Average salary info by state in the US for corporate financial analyst professionals

Local salary info for Corporate Financial Analyst.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $99,010 |

| California (CA) | $109,080 |

| Texas (TX) | $87,950 |

| Florida (FL) | $81,680 |

| New York (NY) | $125,110 |

| Pennsylvania (PA) | $82,810 |

| Illinois (IL) | $101,510 |

| Ohio (OH) | $83,960 |

| Georgia (GA) | $83,610 |

| North Carolina (NC) | $99,990 |

| Michigan (MI) | $83,920 |

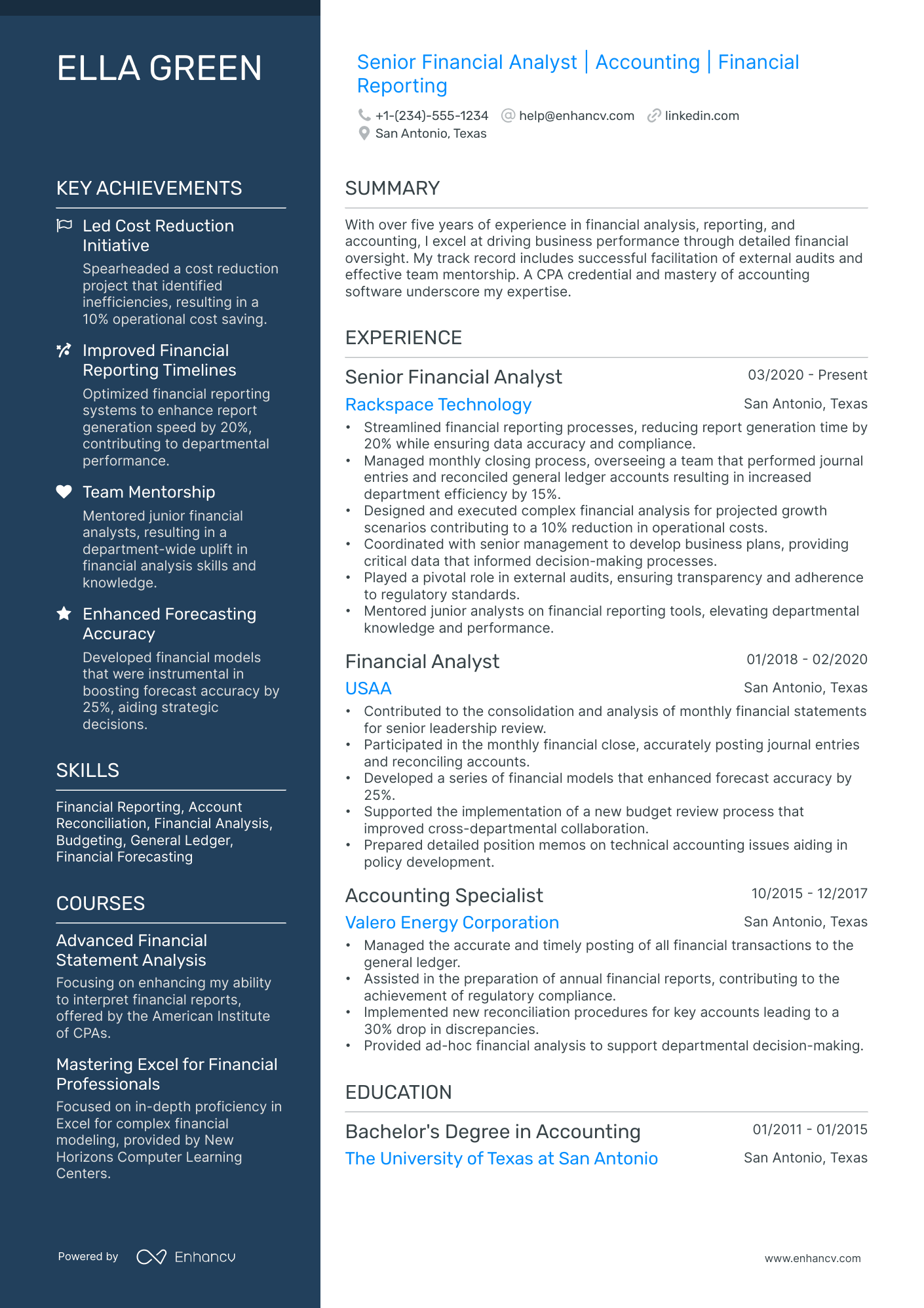

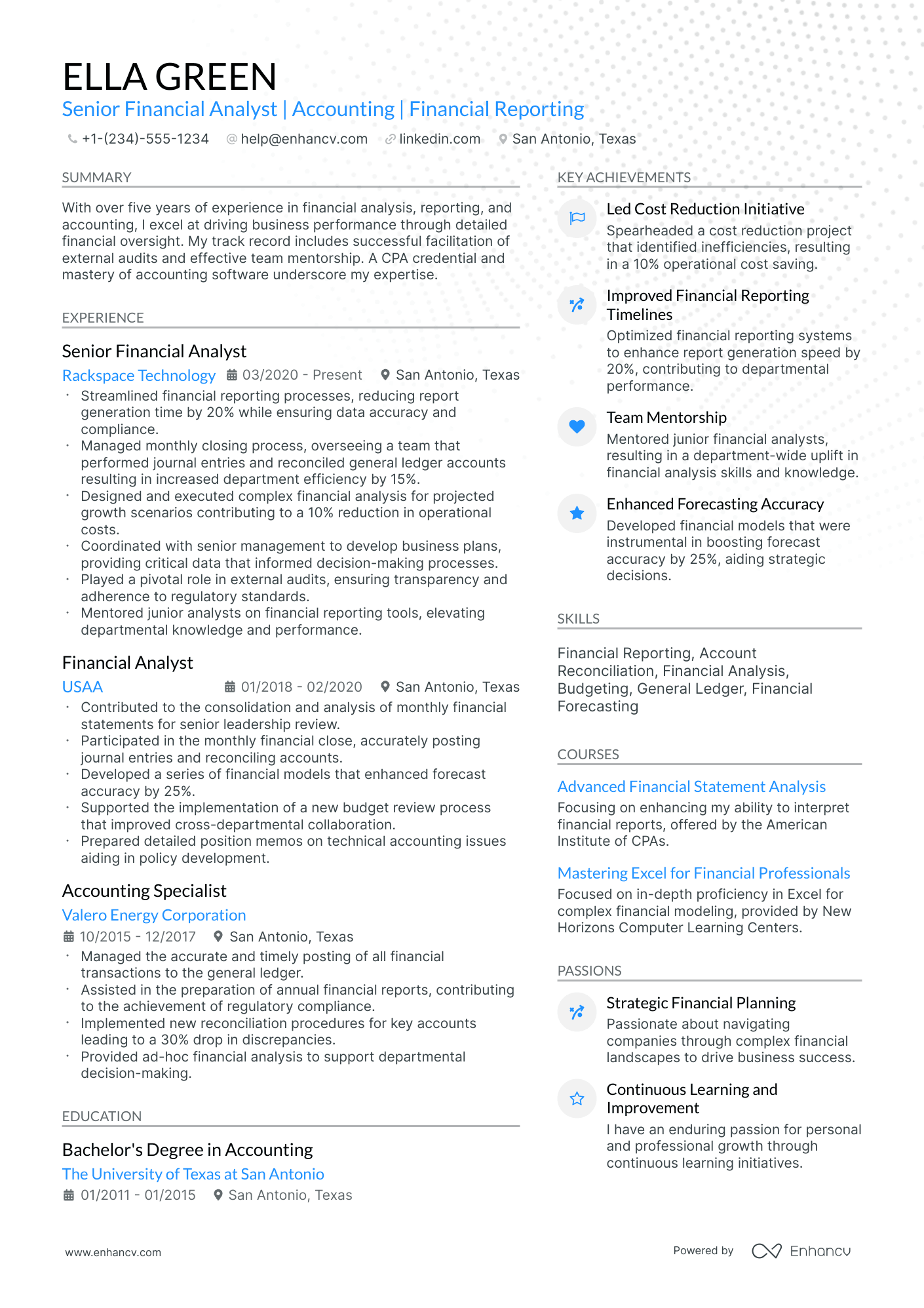

Miscellaneous corporate financial analyst resume sections for a more personalized approach

Your corporate financial analyst resume can reflect even more upon your personality and best qualities - that is if you decide on including a couple of additional resume sections to support your application.

Some of the best-accepted industry-wide choices include the:

- Resume projects - getting into the outcomes of your most important work, so far;

- Languages on your resume - detailing your proficiency level;

- Special recognitions - dedicated to your most prominent industry awards;

- Hobbies and interests - defining how you spend your free time.

Key takeaways

- Your resume layout plays an important role in presenting your key information in a systematic, strategic manner;

- Use all key resume sections (summary or objective; experience; skills; education and certification) to ensure you’ve shown to recruiters just how your expertise aligns with the role and why you're the best candidate;

- Be specific about listing a particular skill or responsibility you've had by detailing how this has helped the role or organization grow;

- Your personality should shine through your resume via the interests or hobbies, and strengths or accomplishments skills sections;

- Certifications go to provide further accreditation to your technical capabilities, so make sure you've included them within your resume.