As an actuary, articulating your complex technical skills and experience in a way that's accessible to non-specialists can be a major resume challenge. Our guide offers clear strategies and examples to help you translate your actuarial expertise into compelling, understandable language that resonates with recruiters and hiring managers.

- Defining the highlights of your actuary career through your resume summary, objective, and experience.

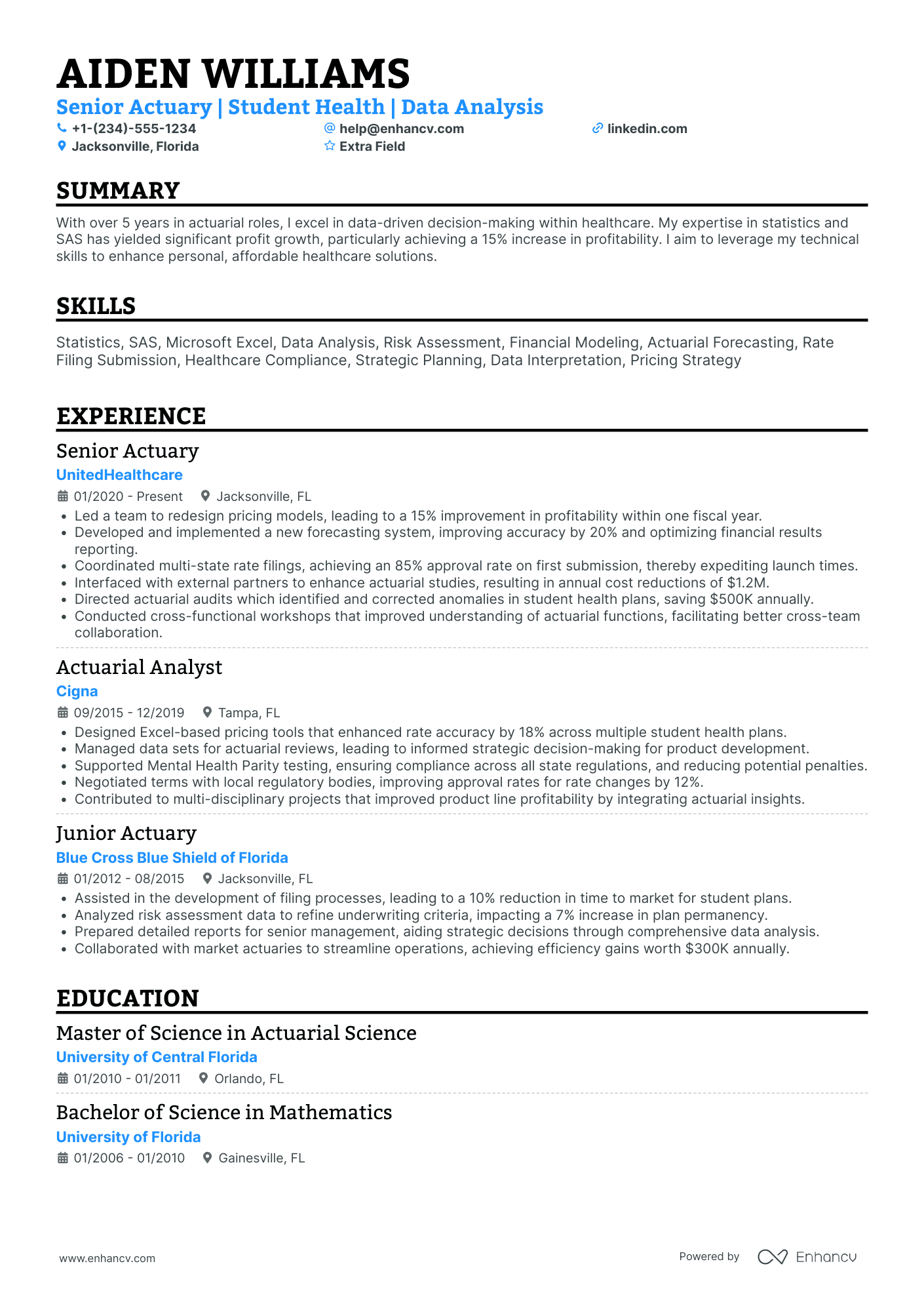

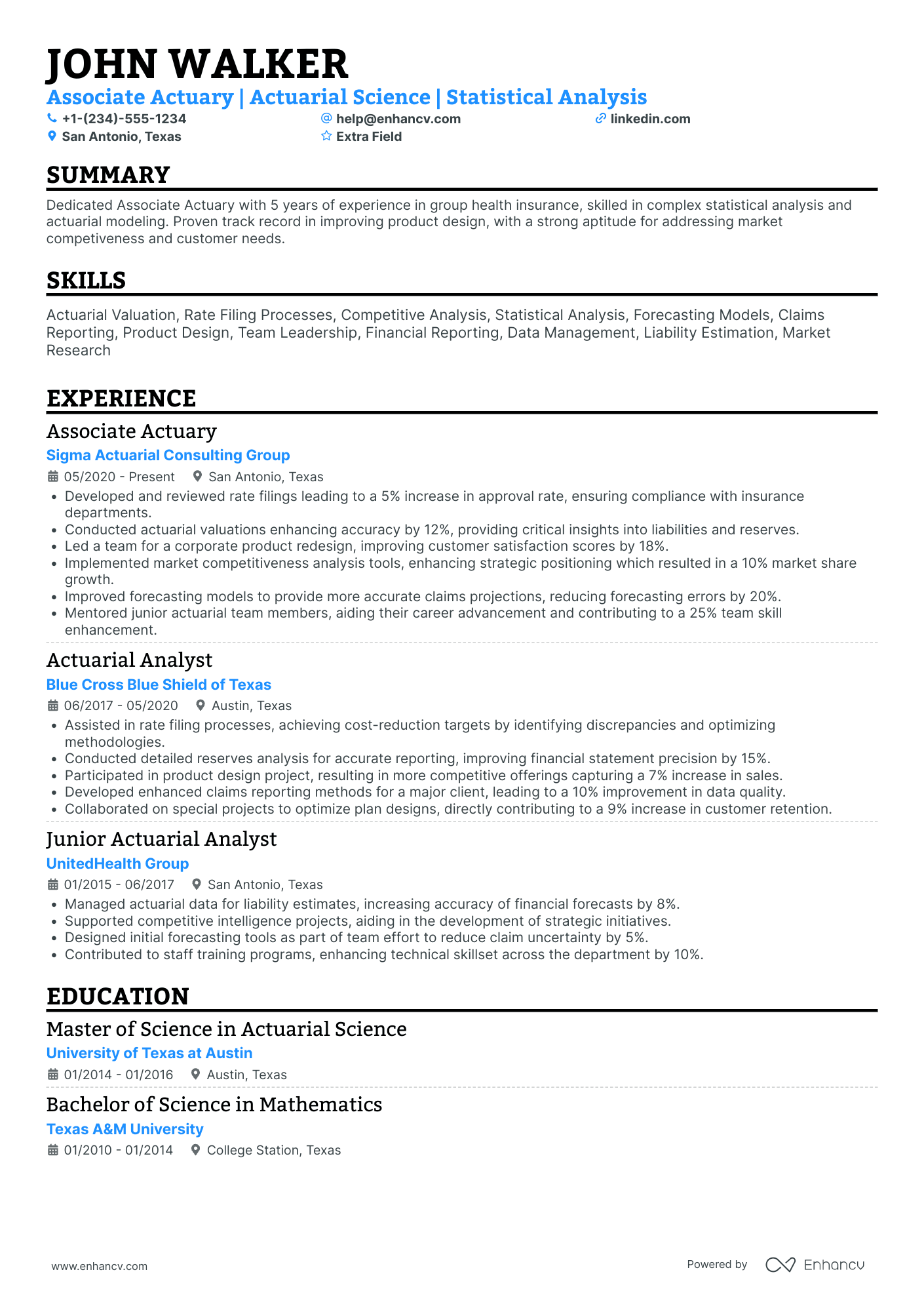

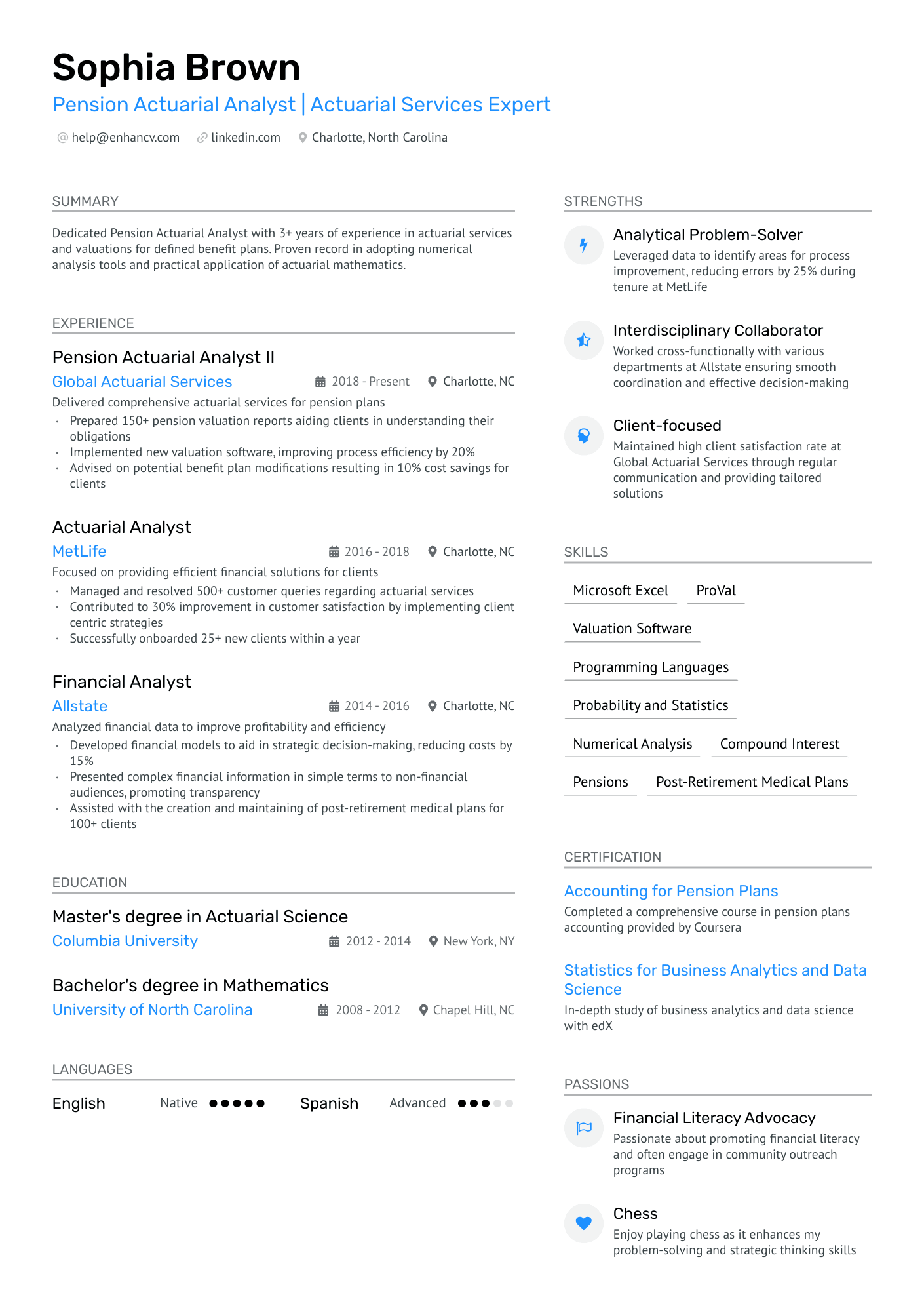

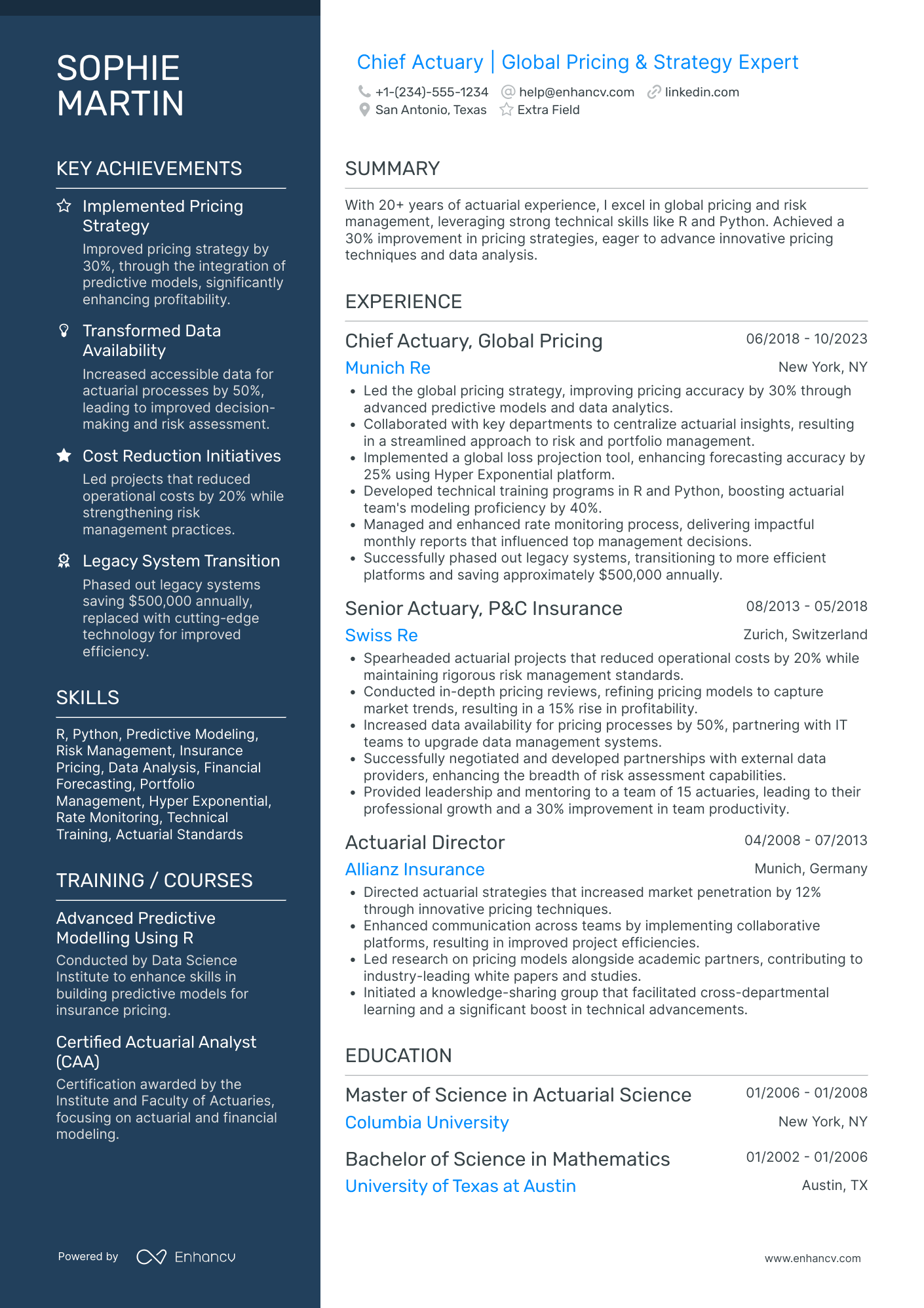

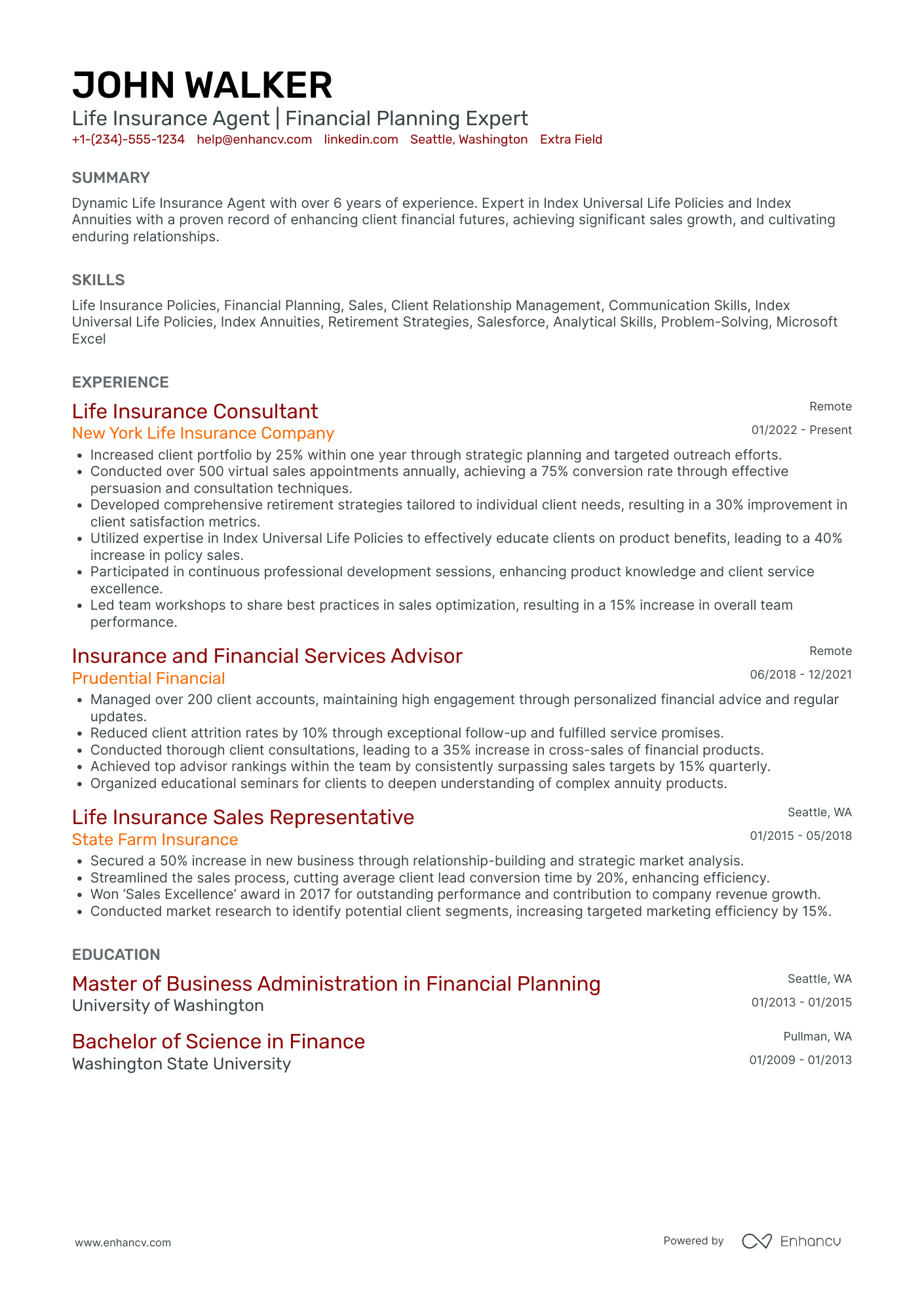

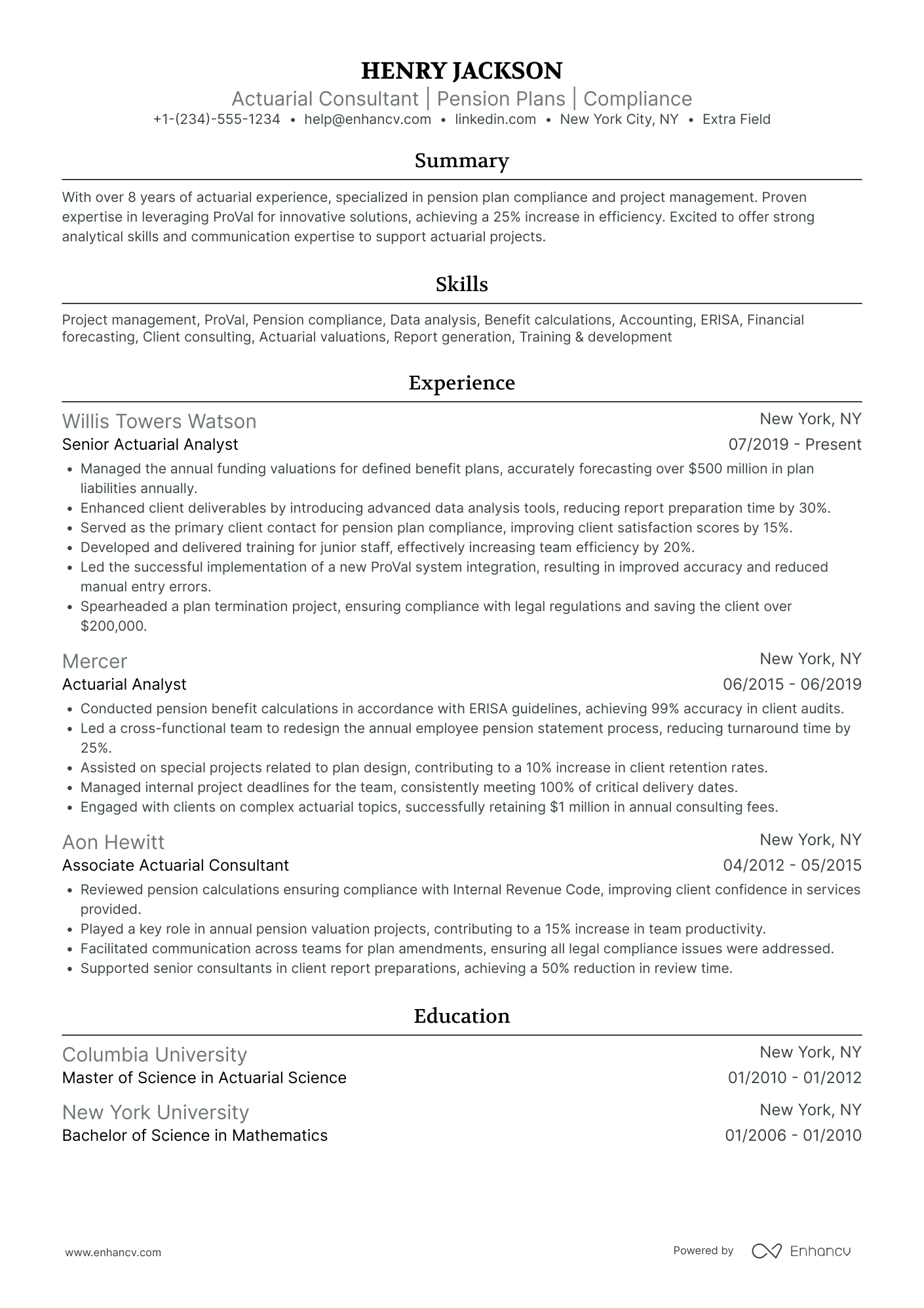

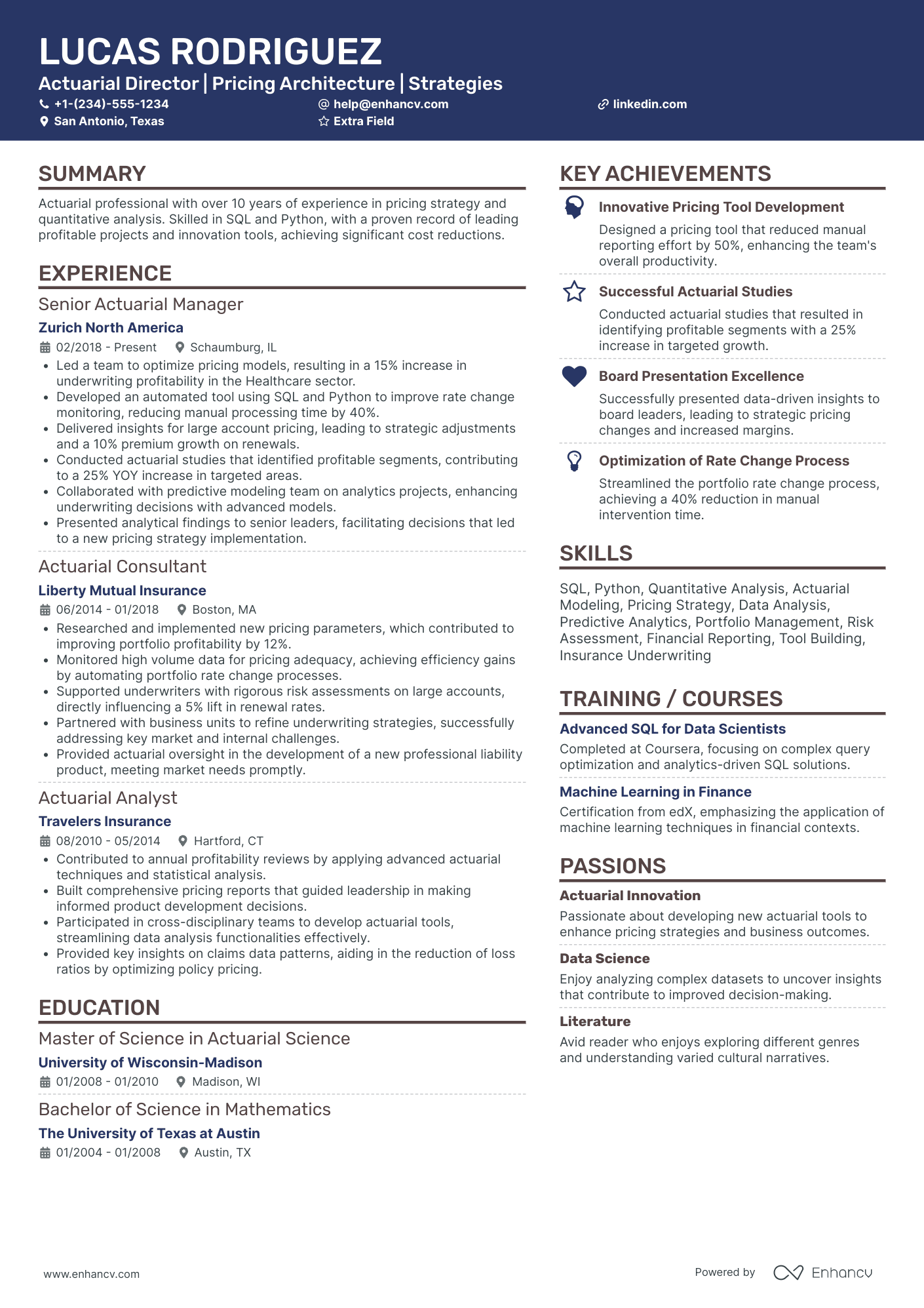

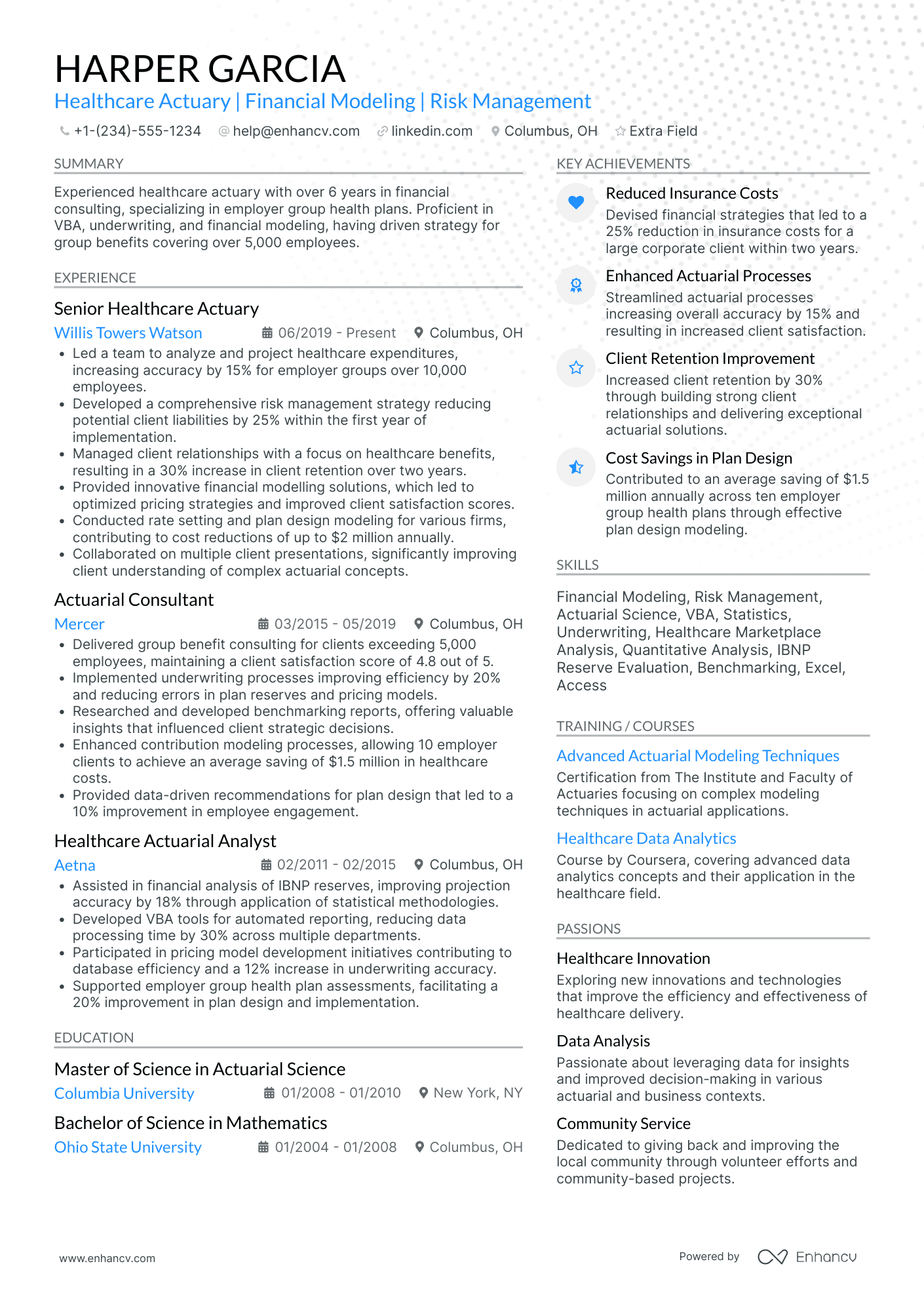

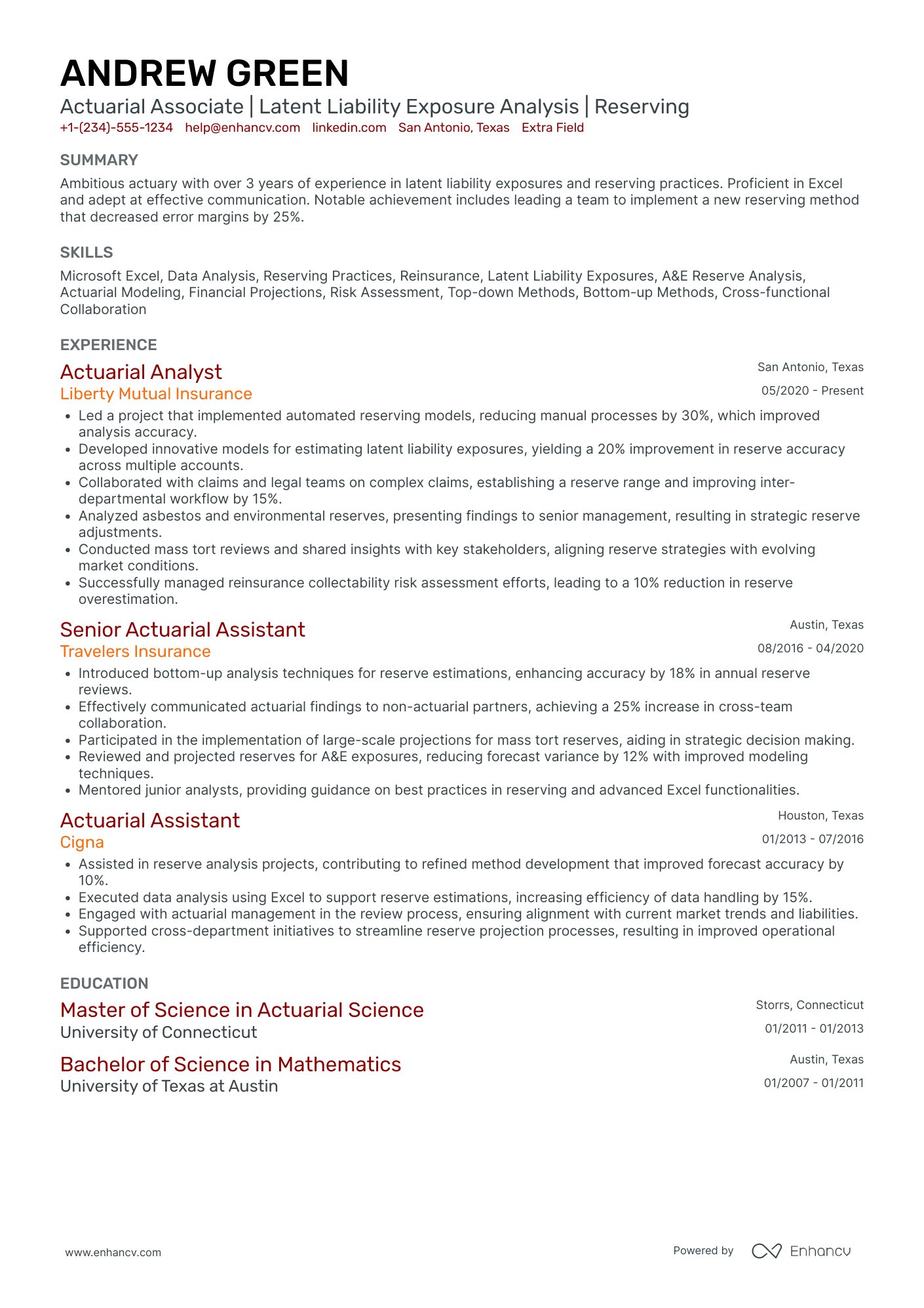

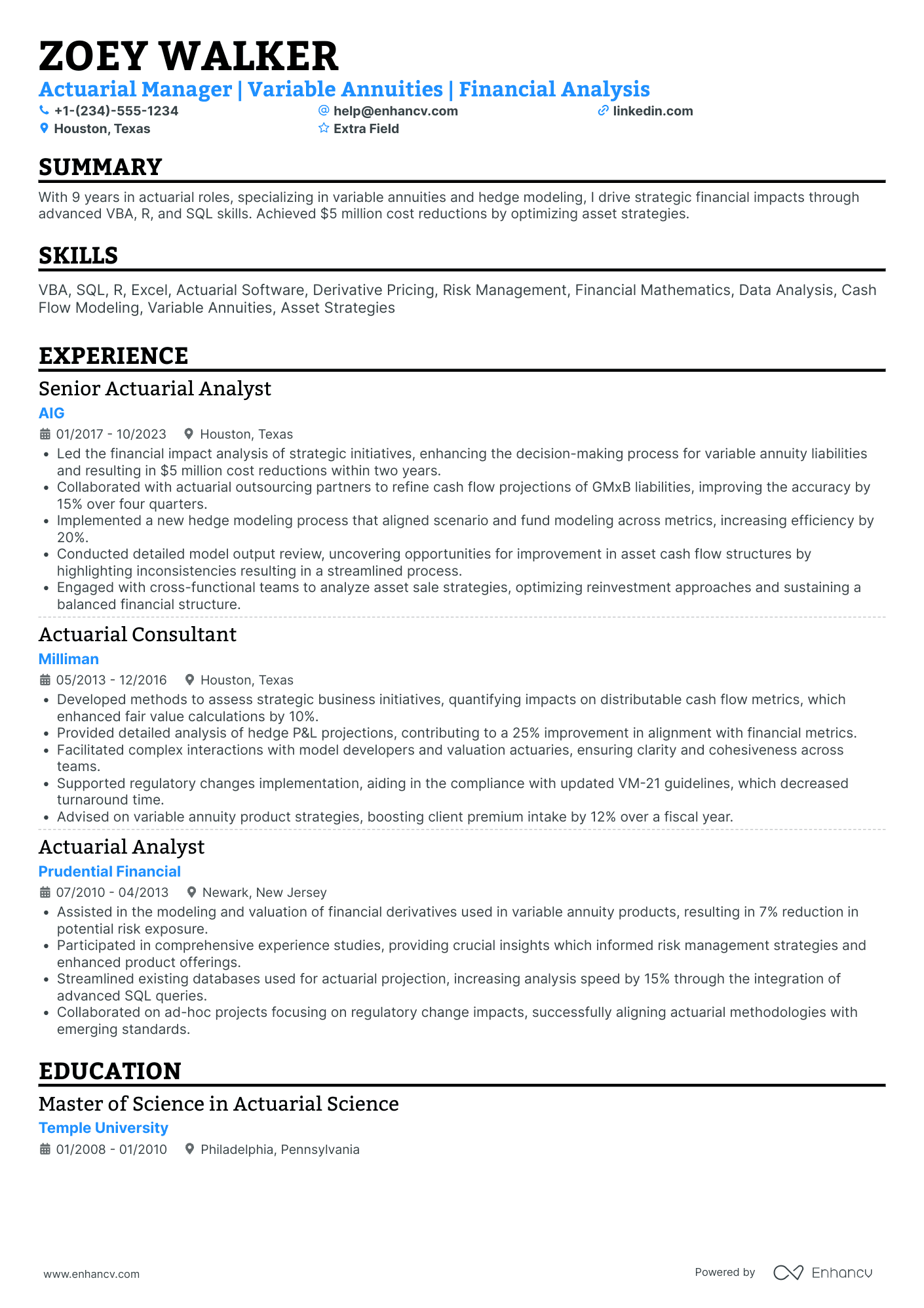

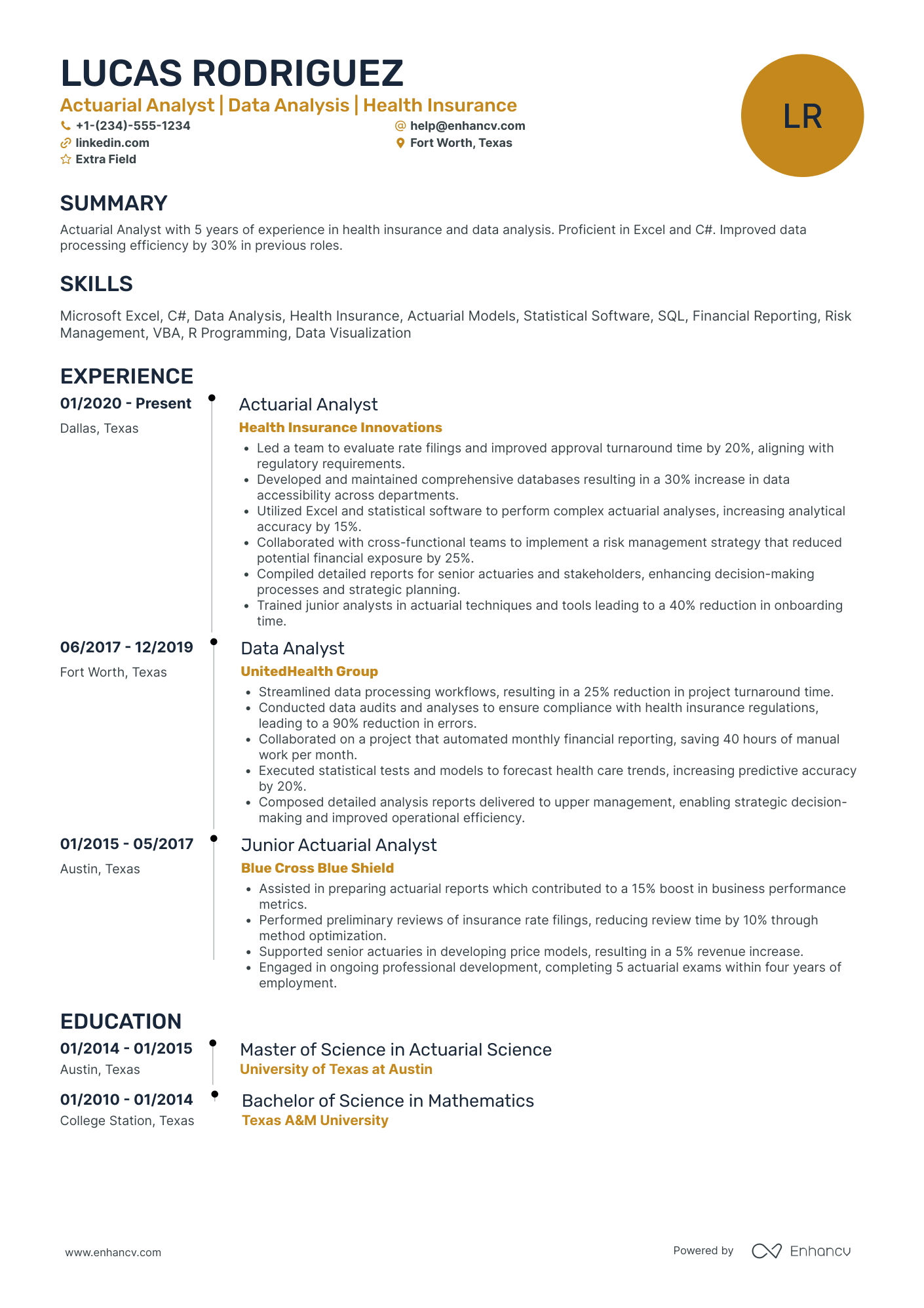

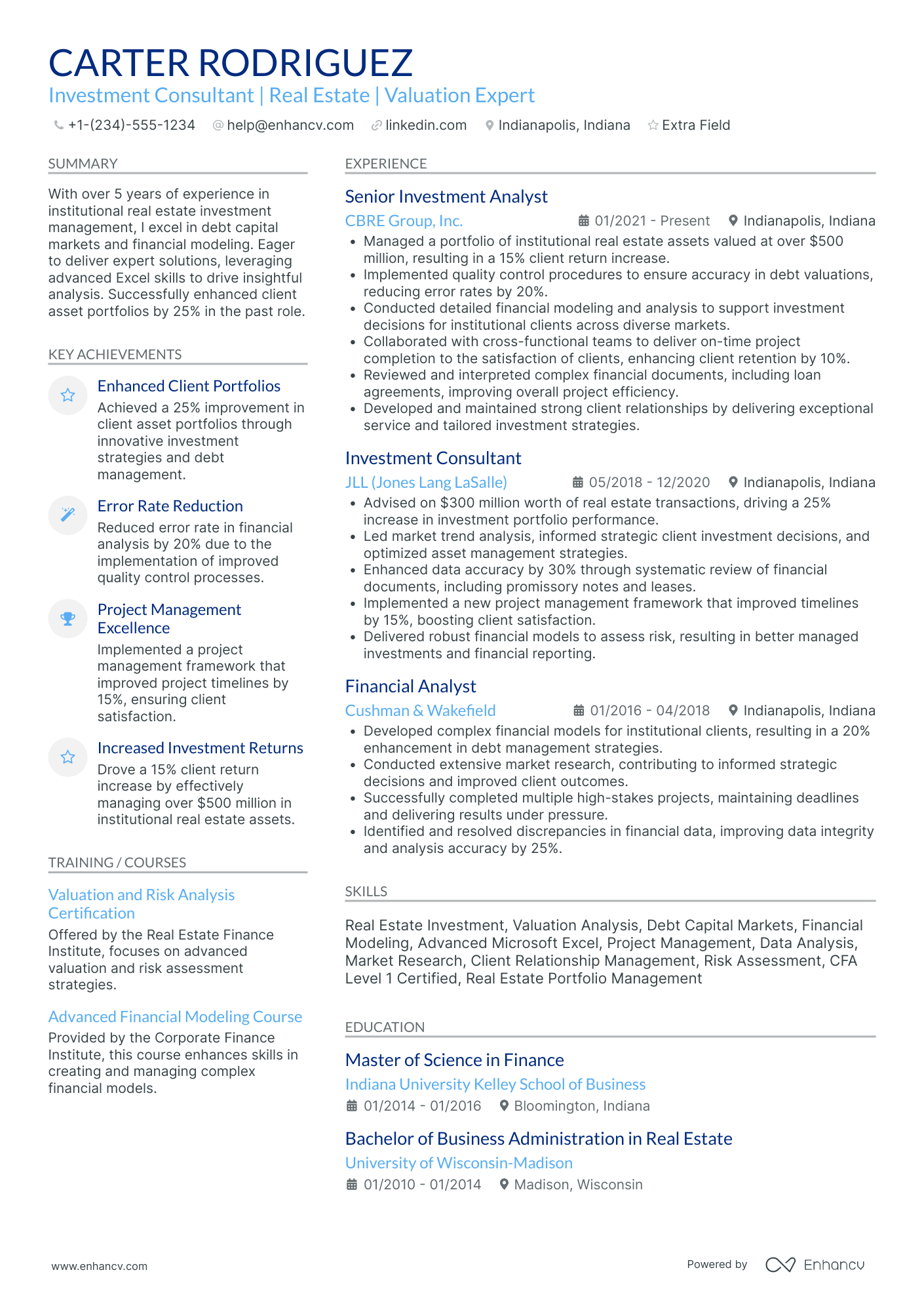

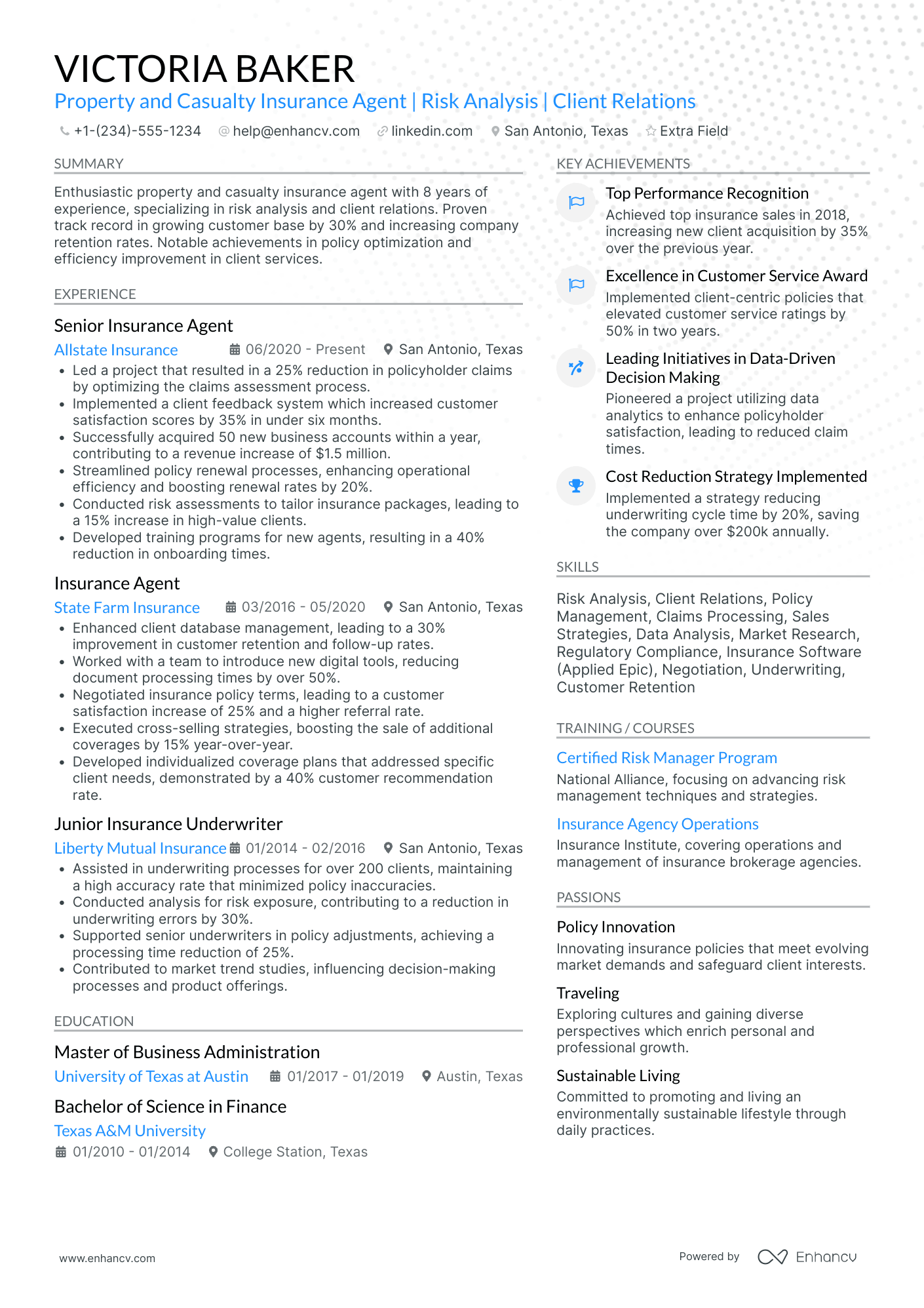

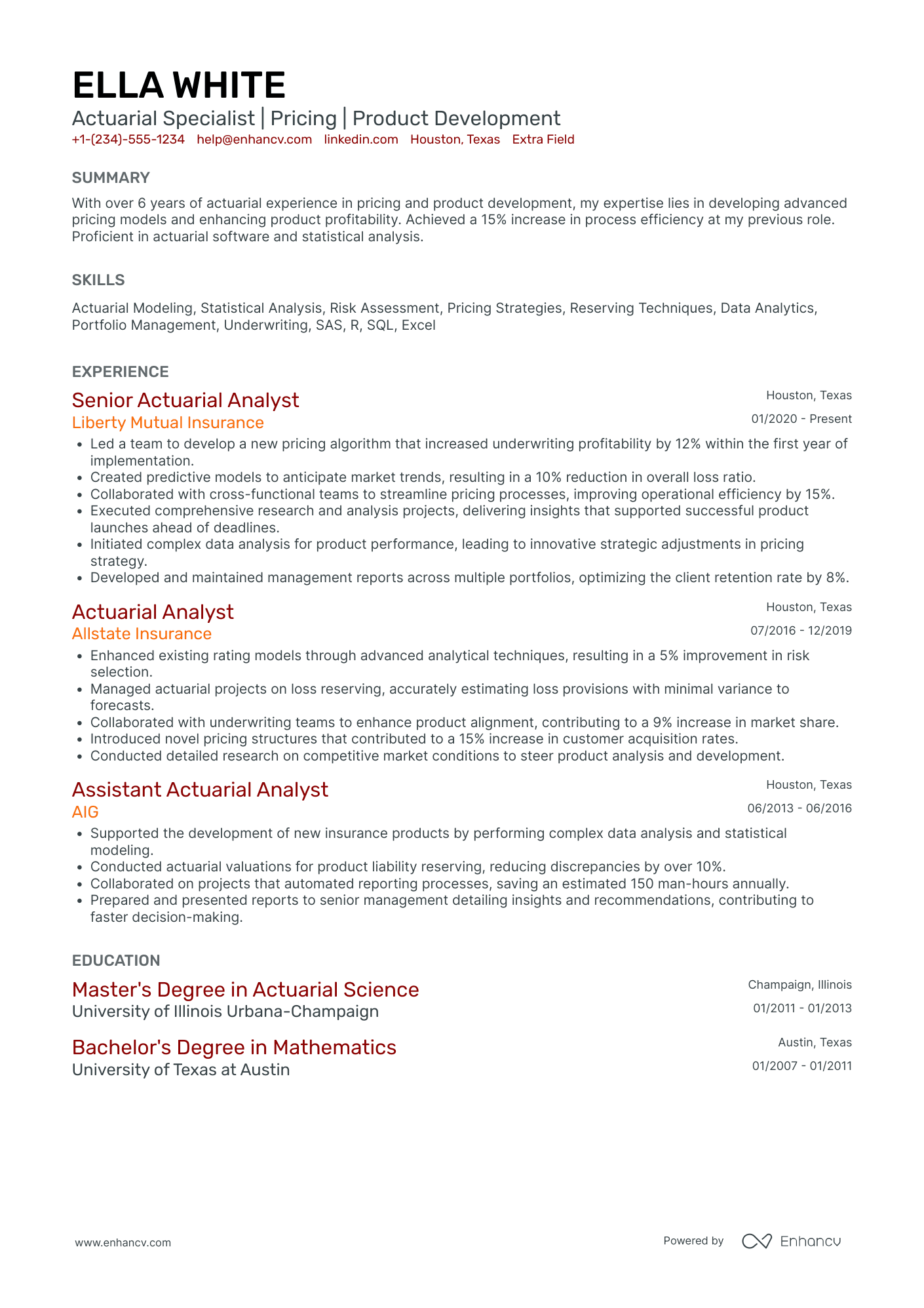

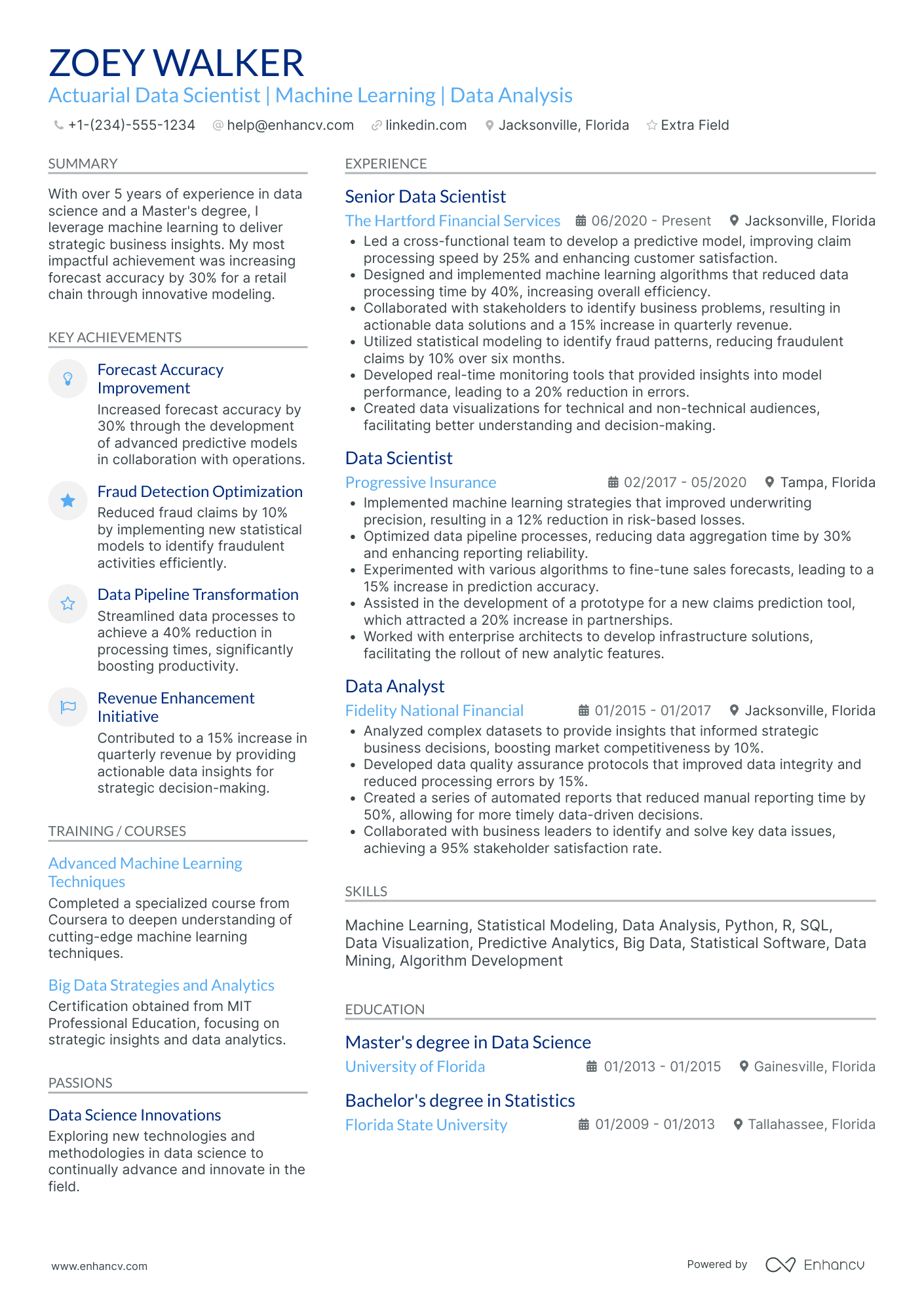

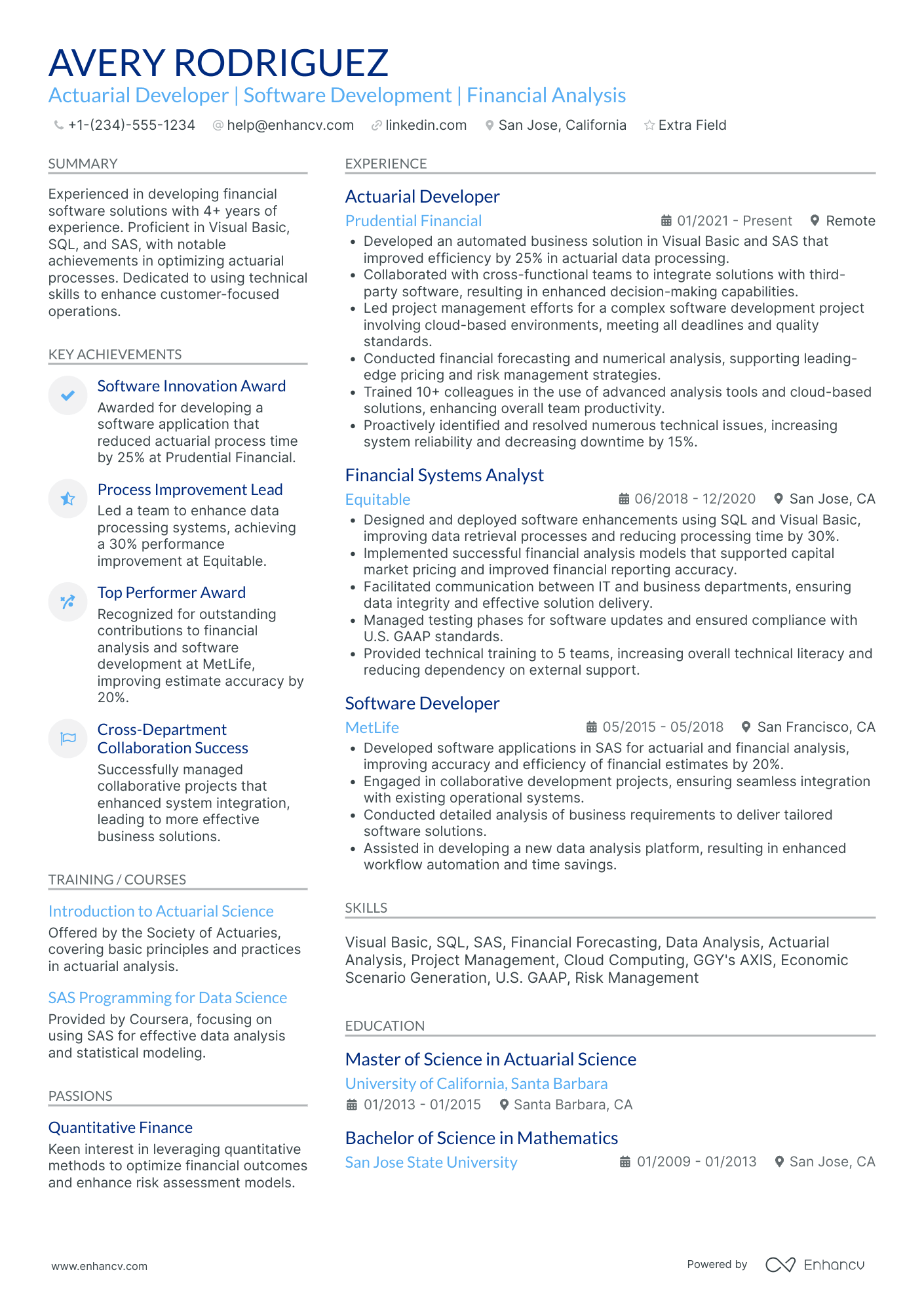

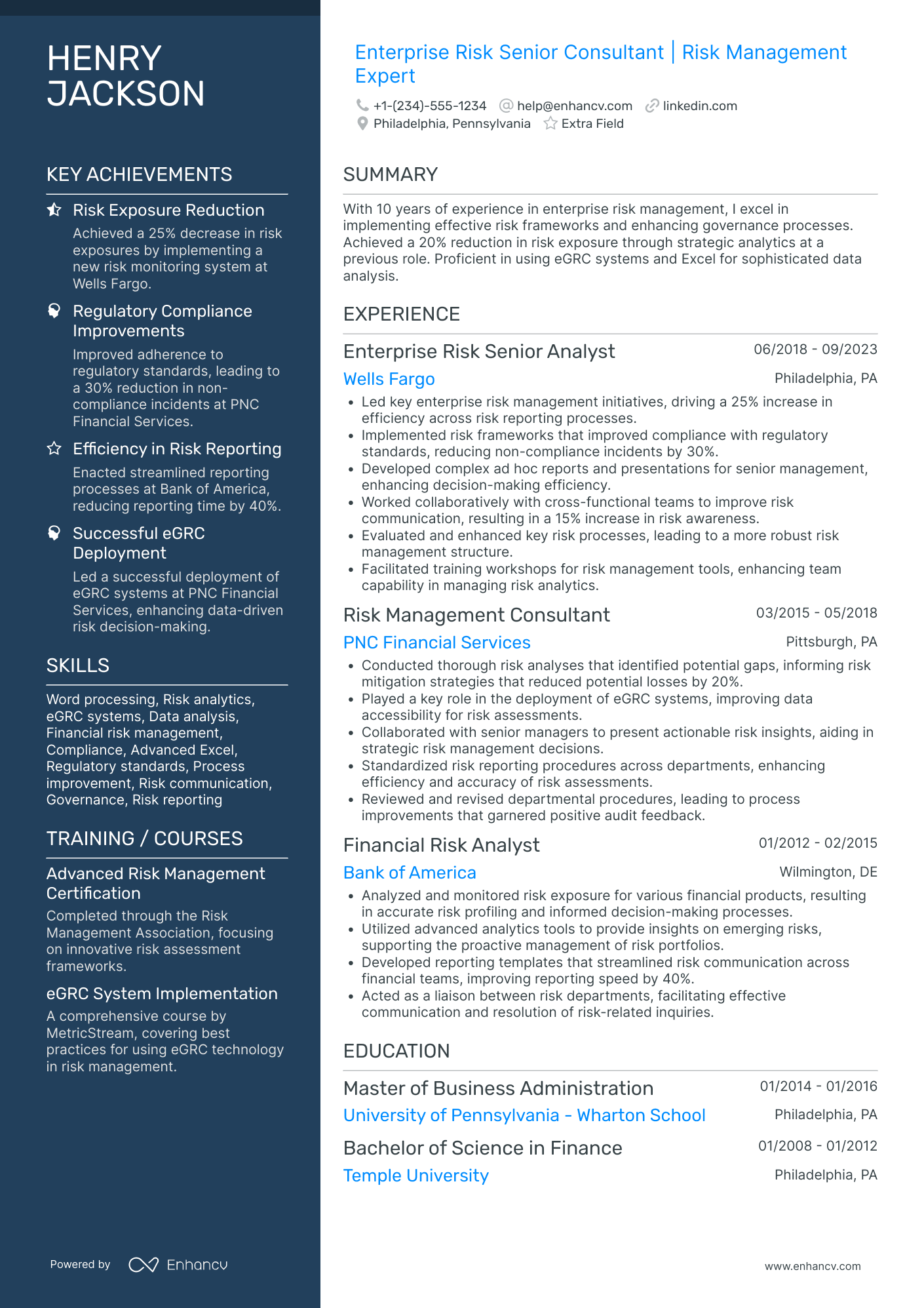

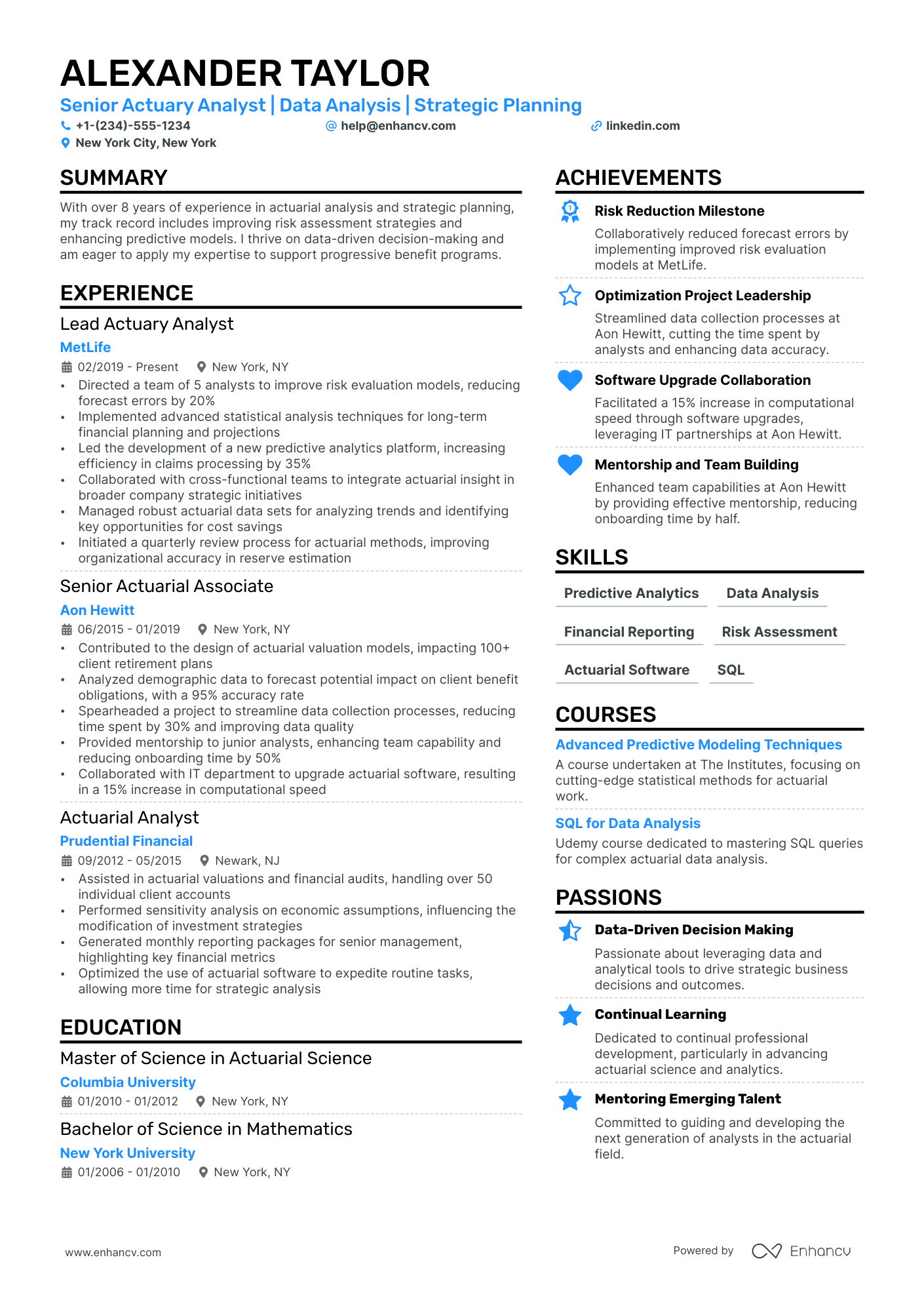

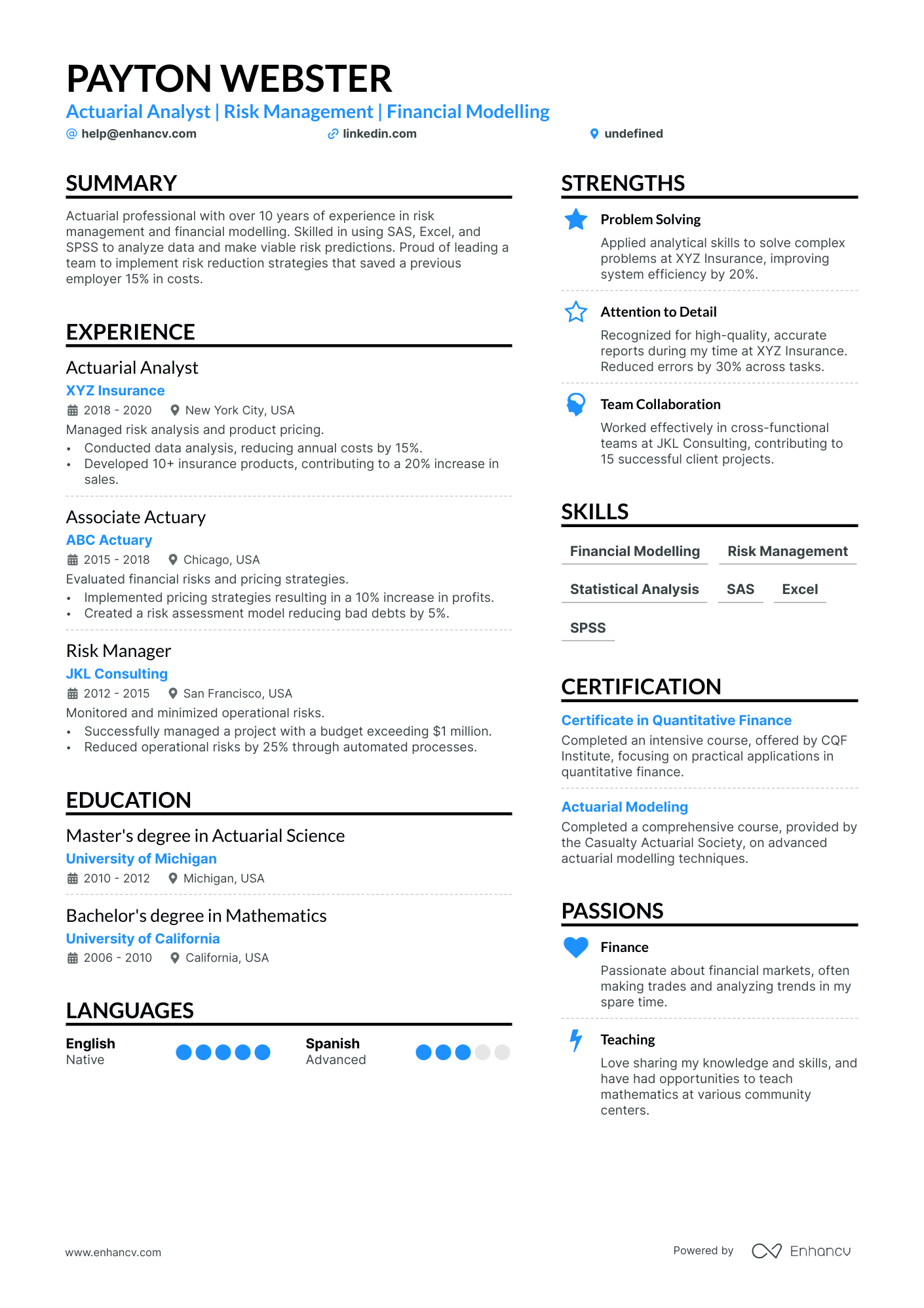

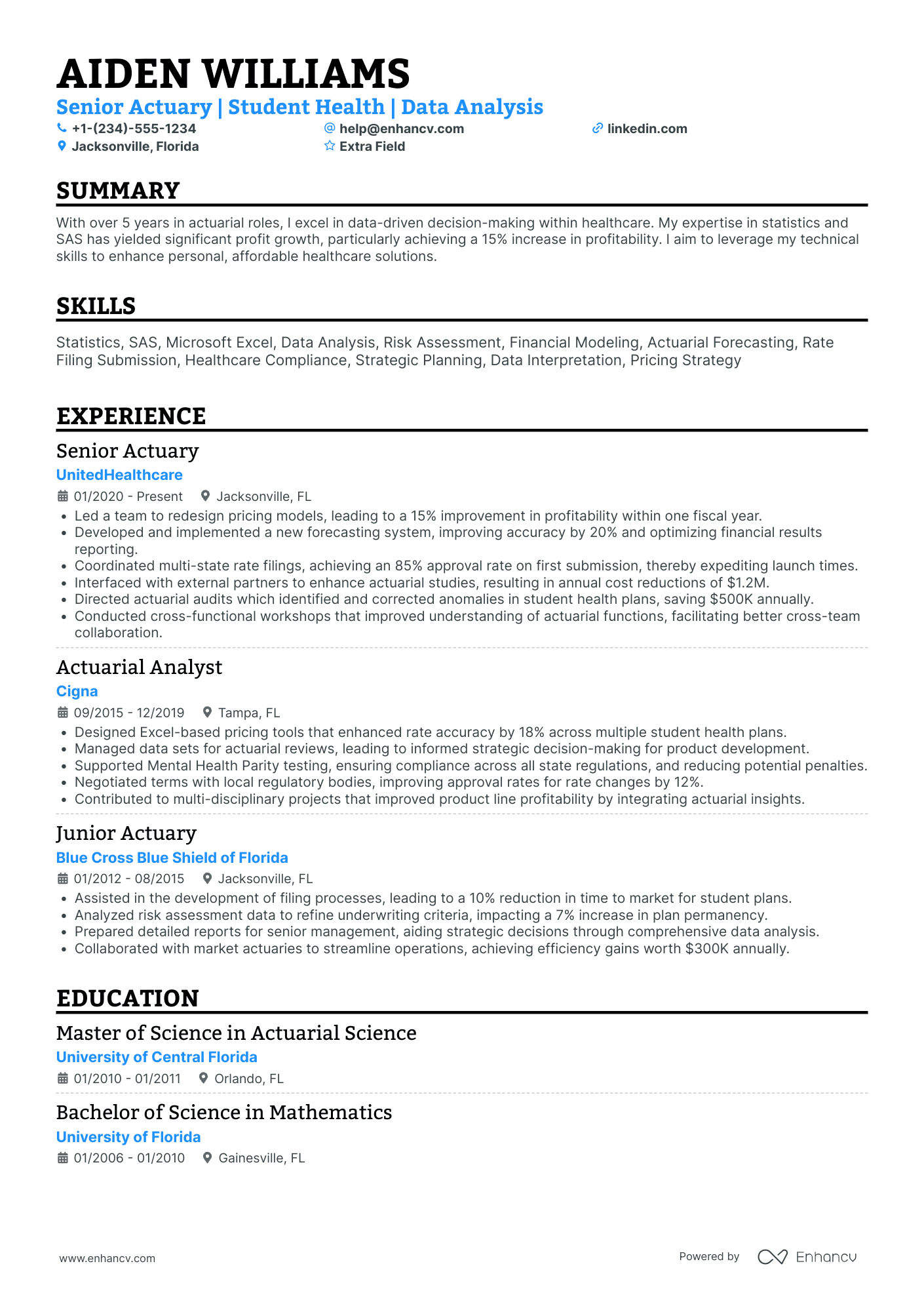

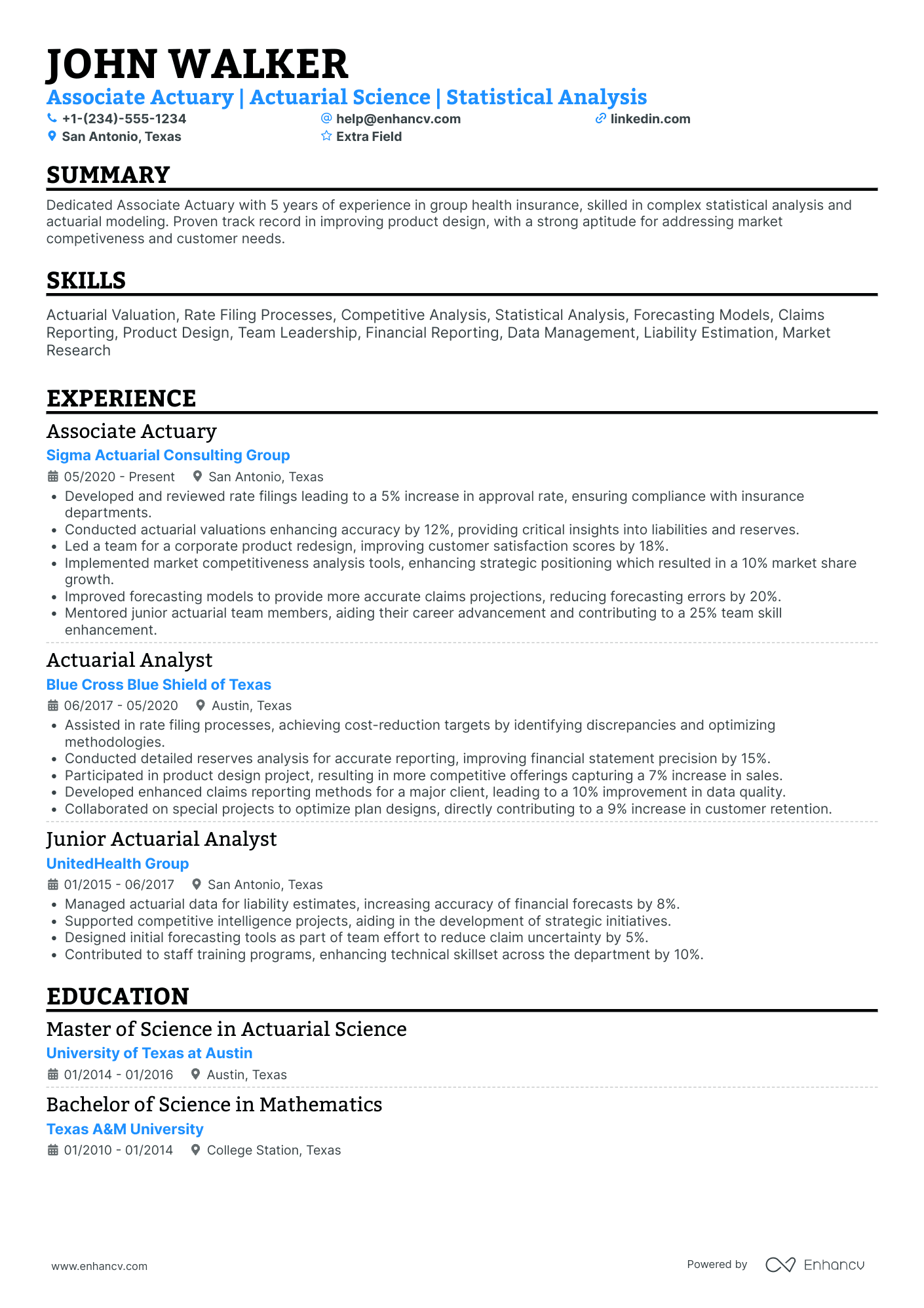

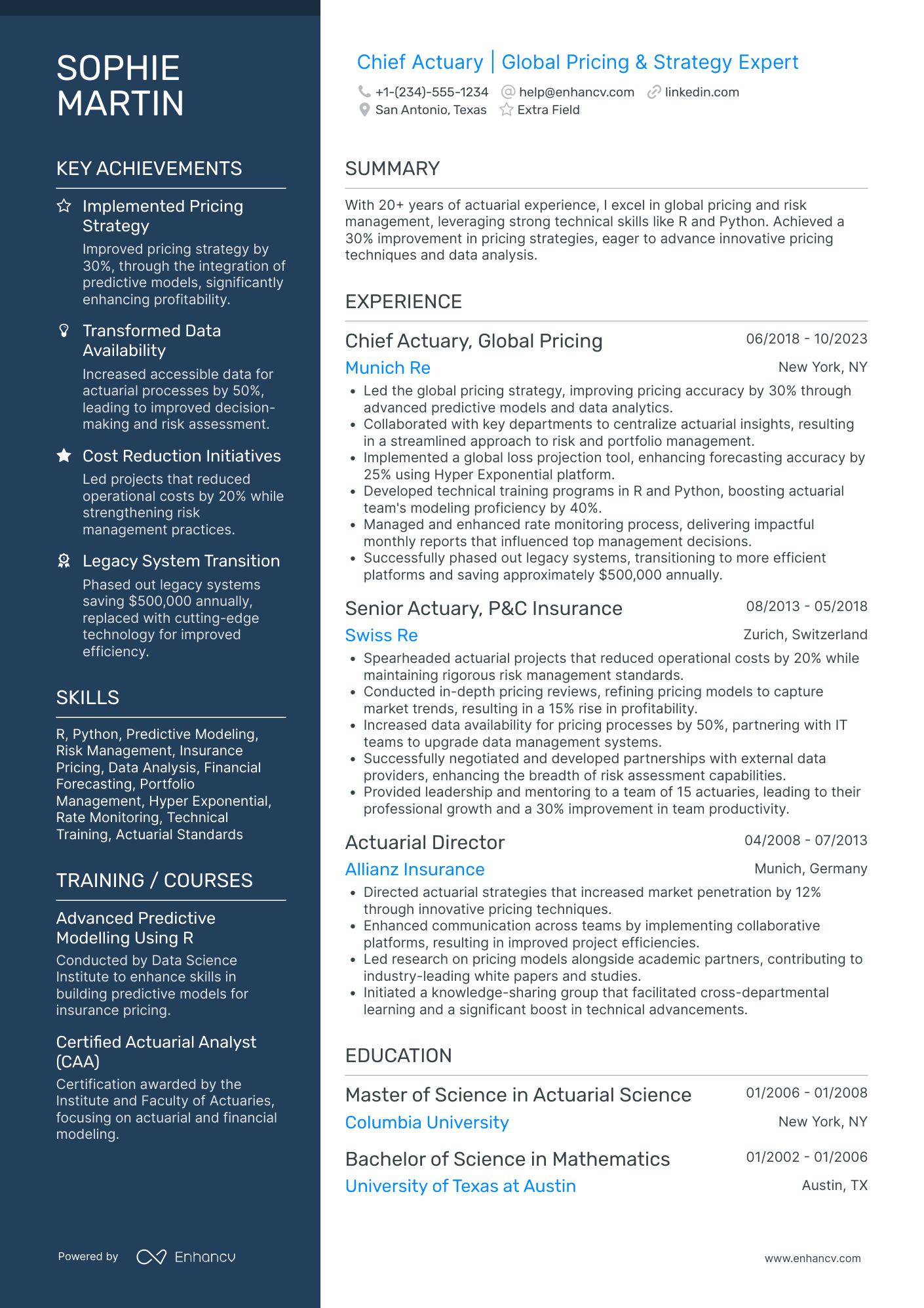

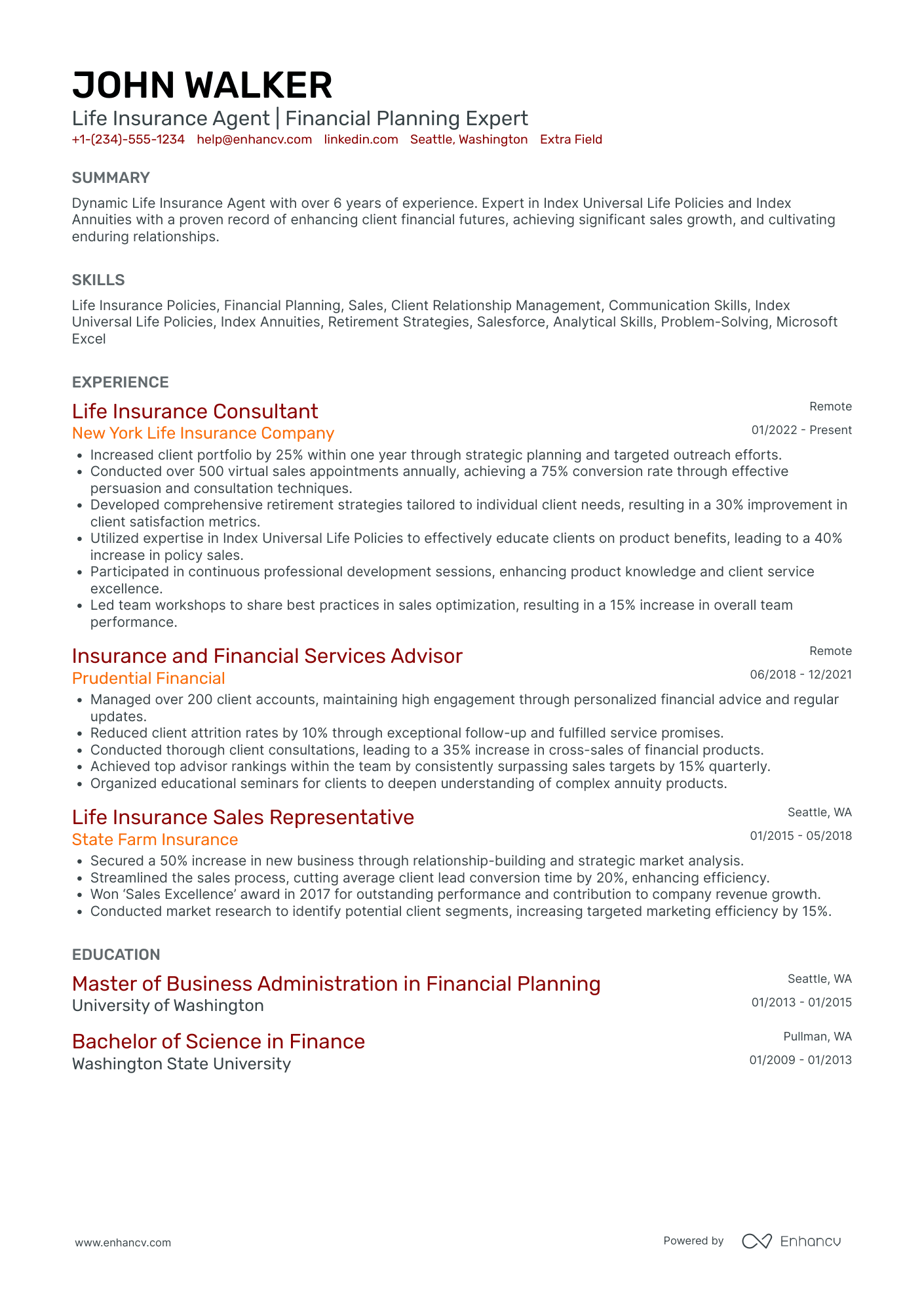

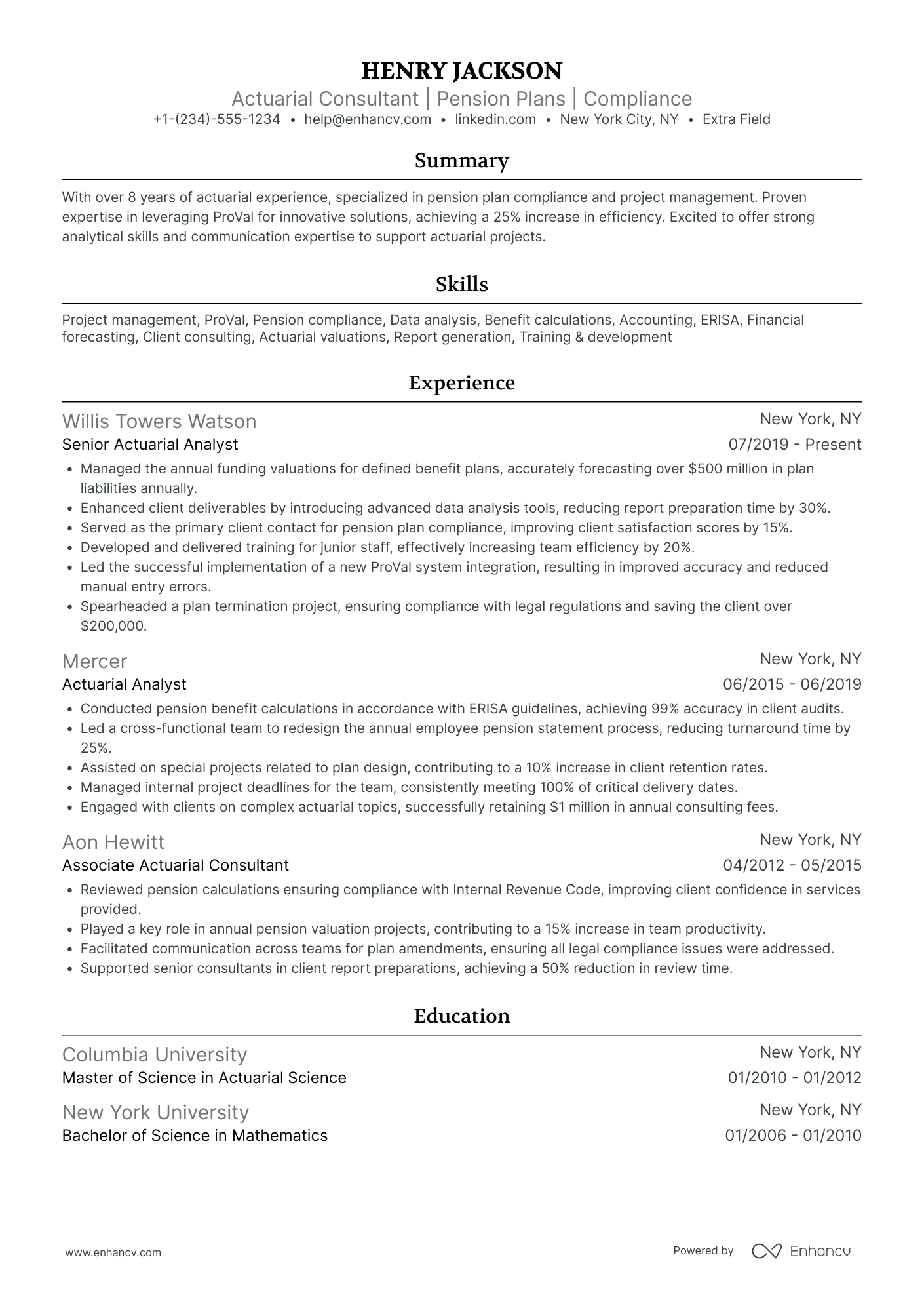

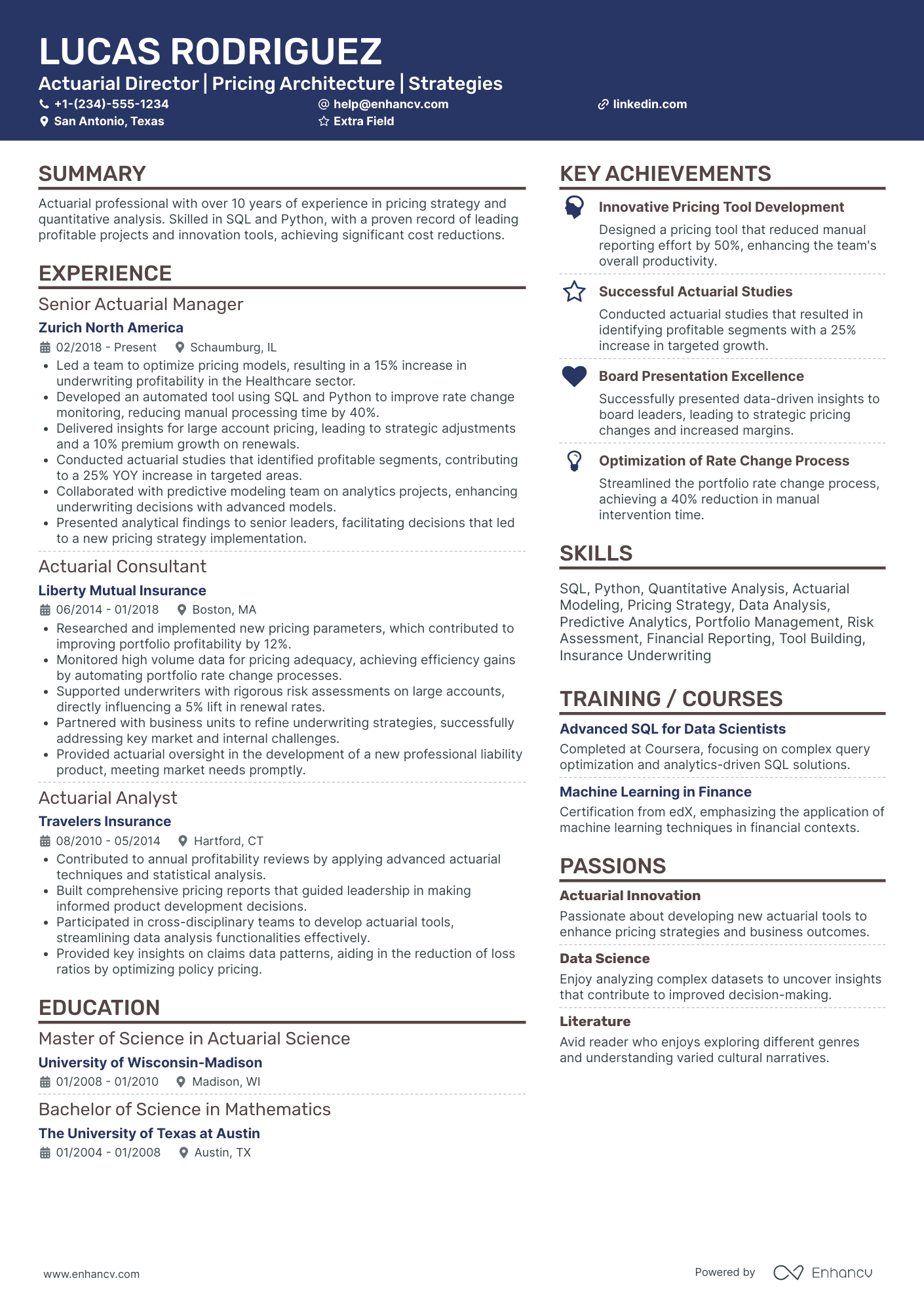

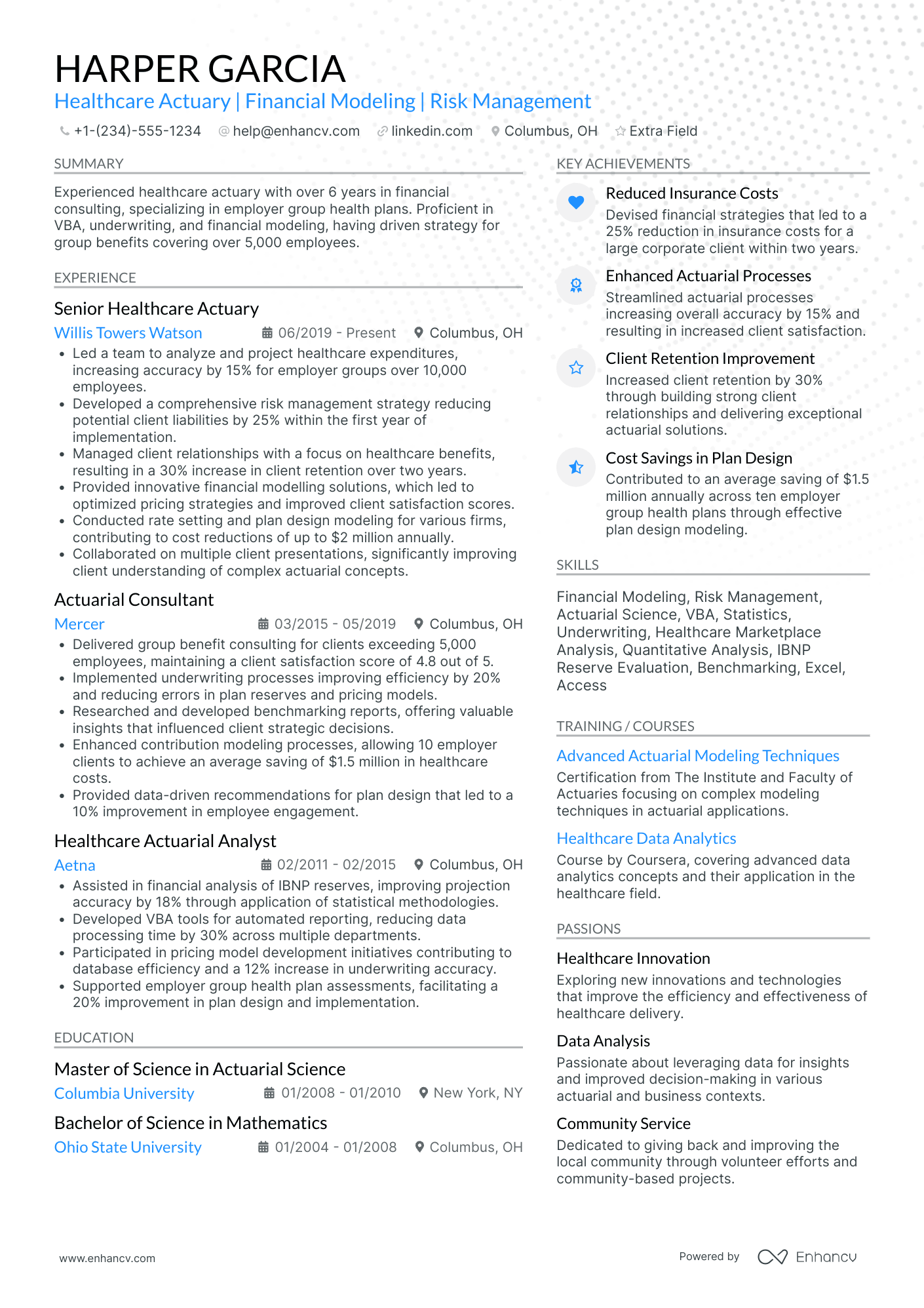

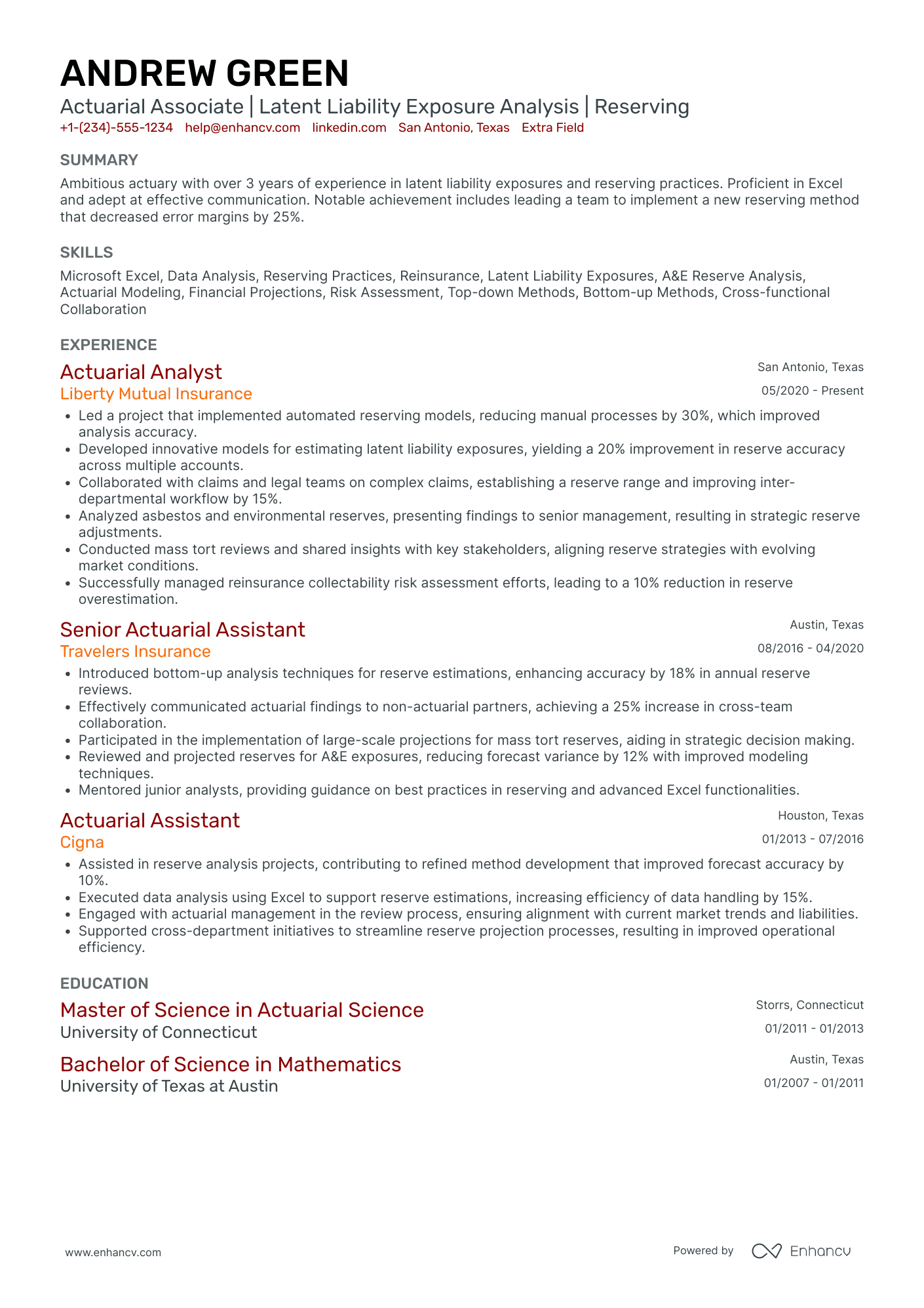

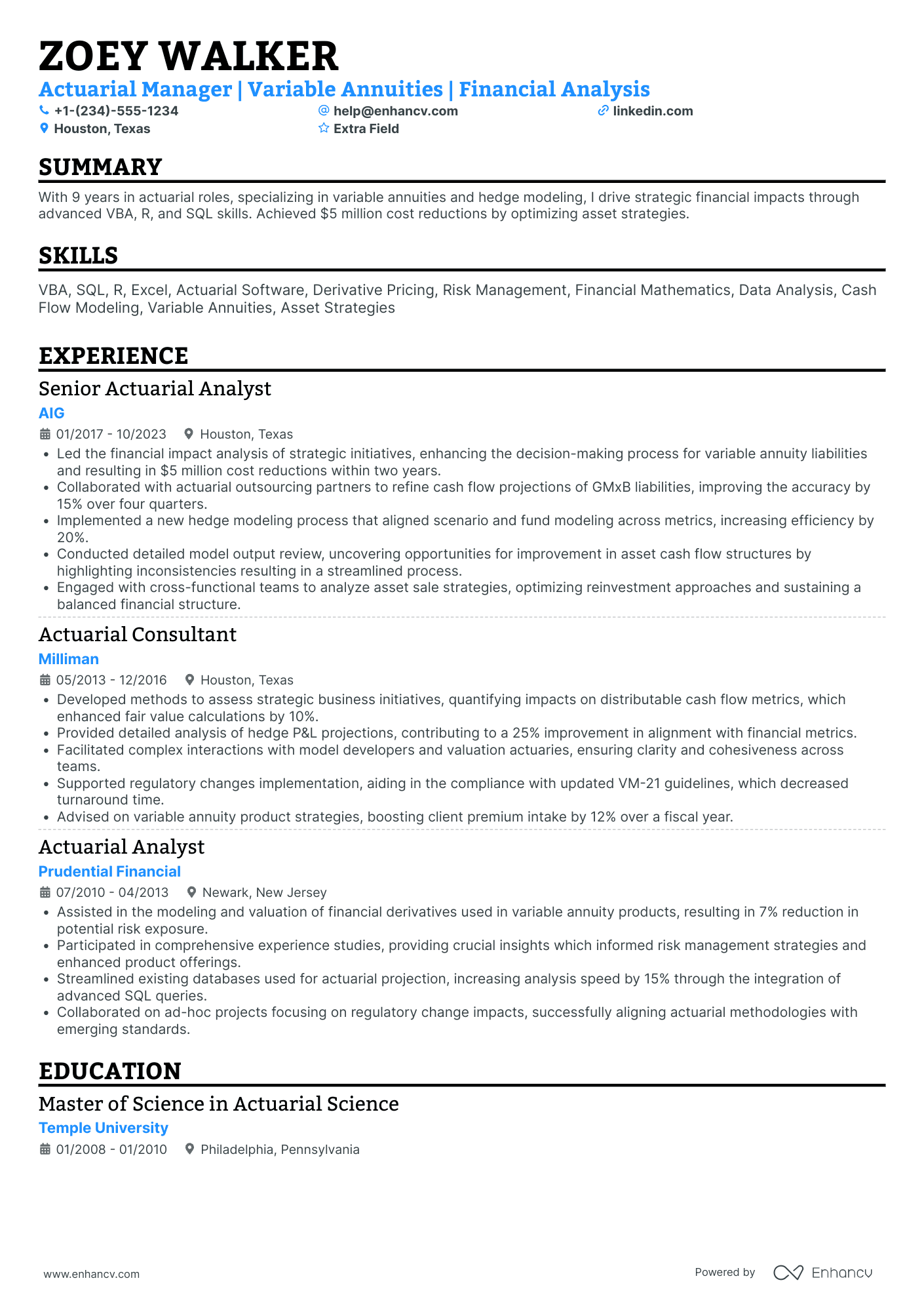

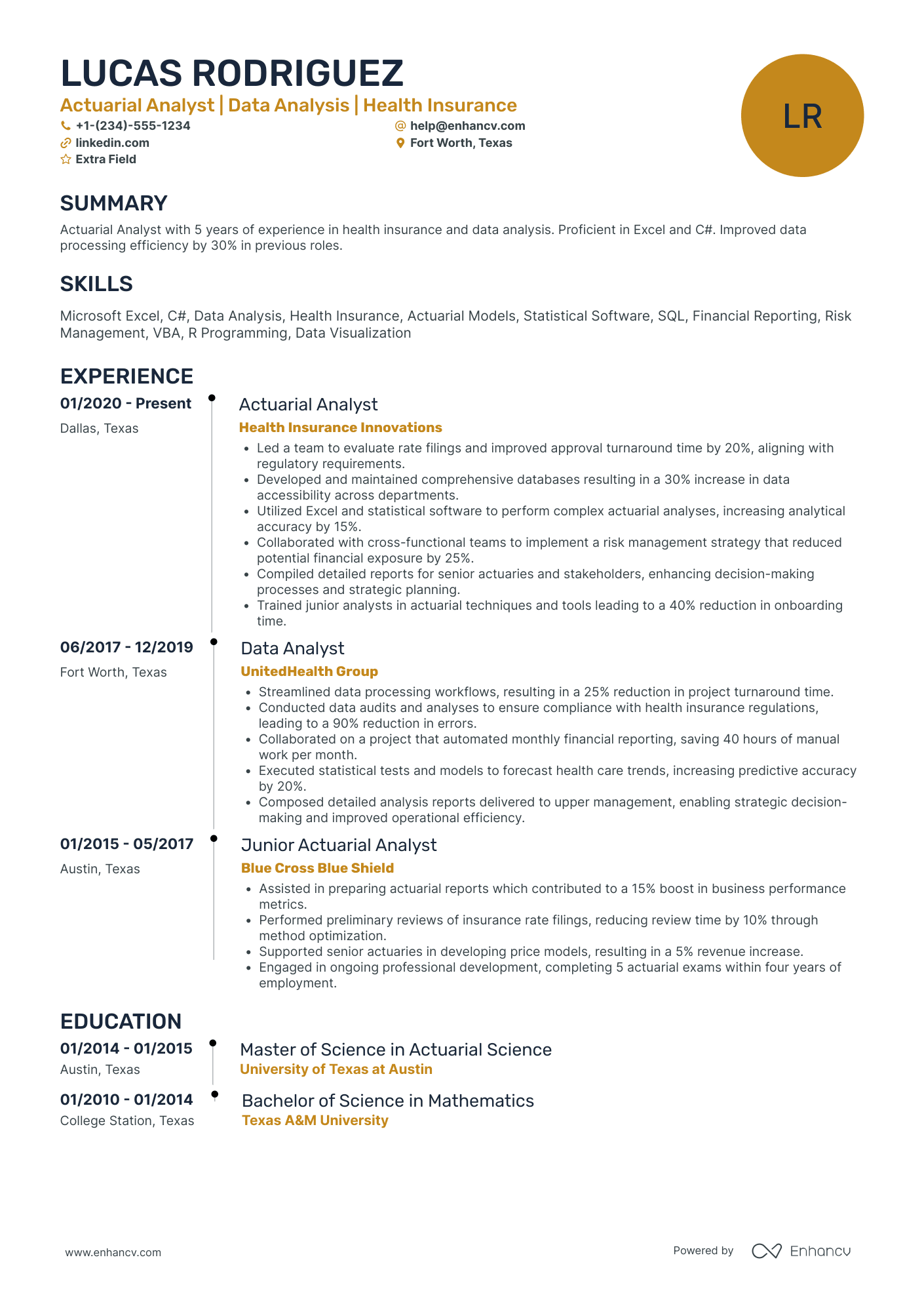

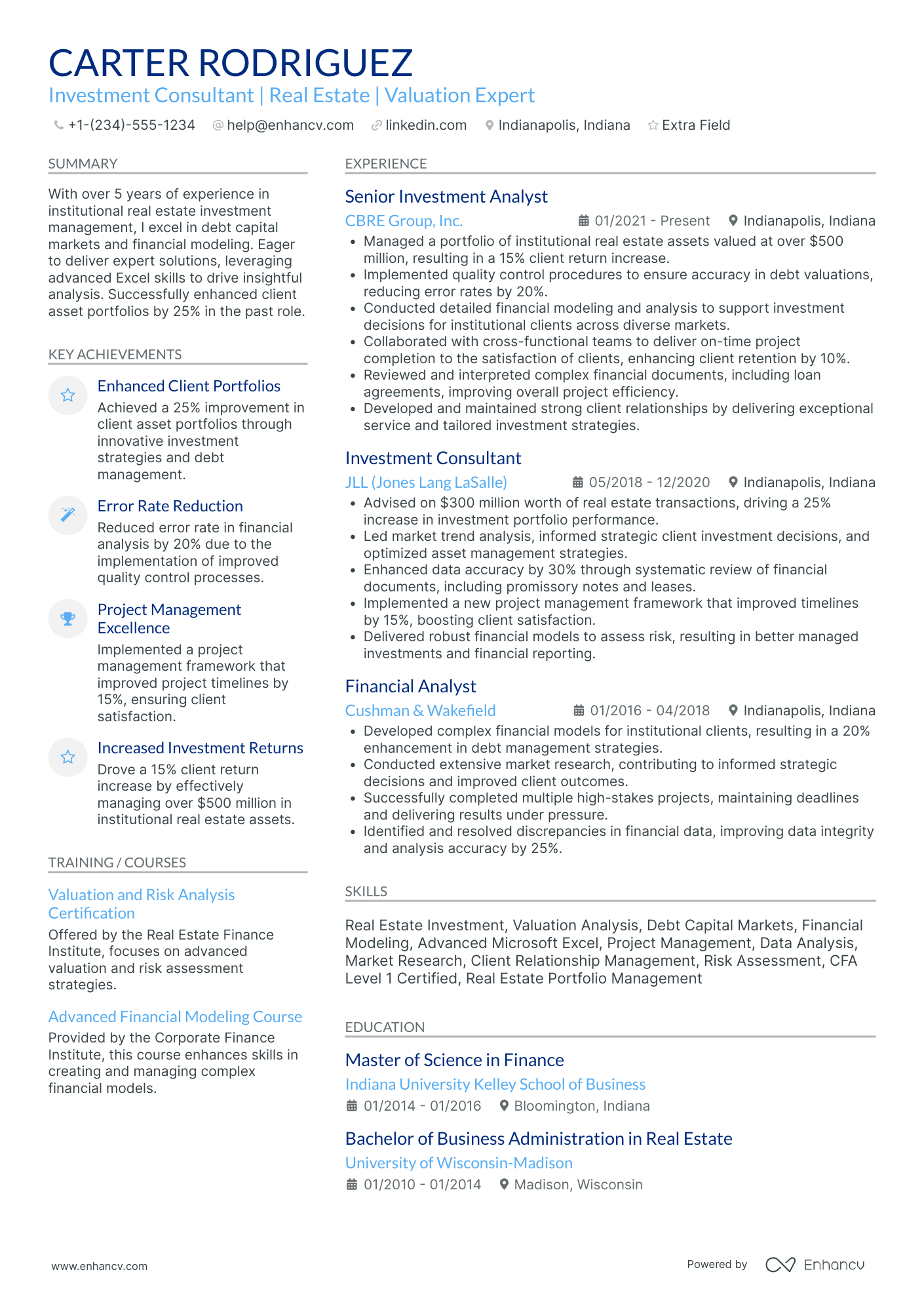

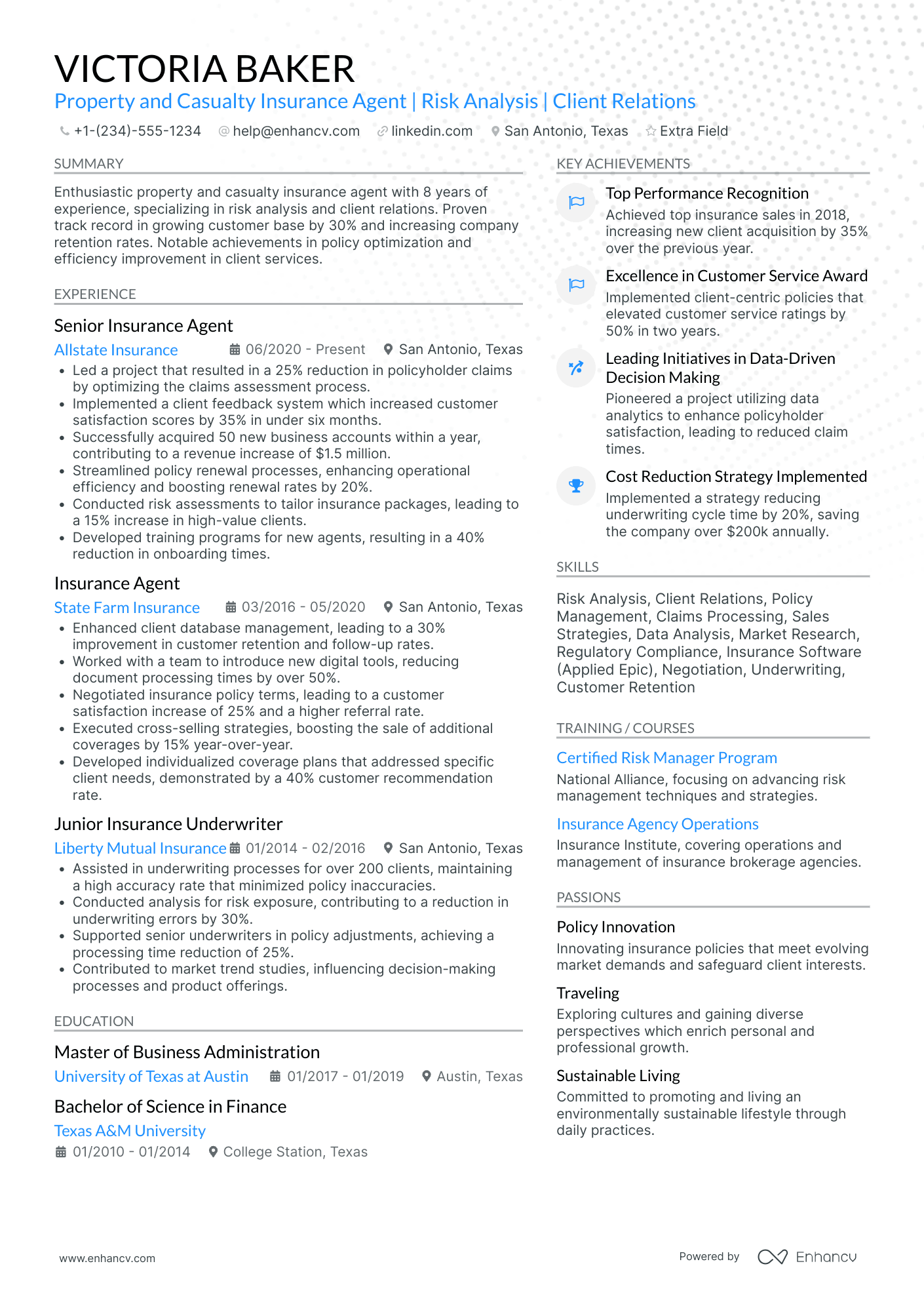

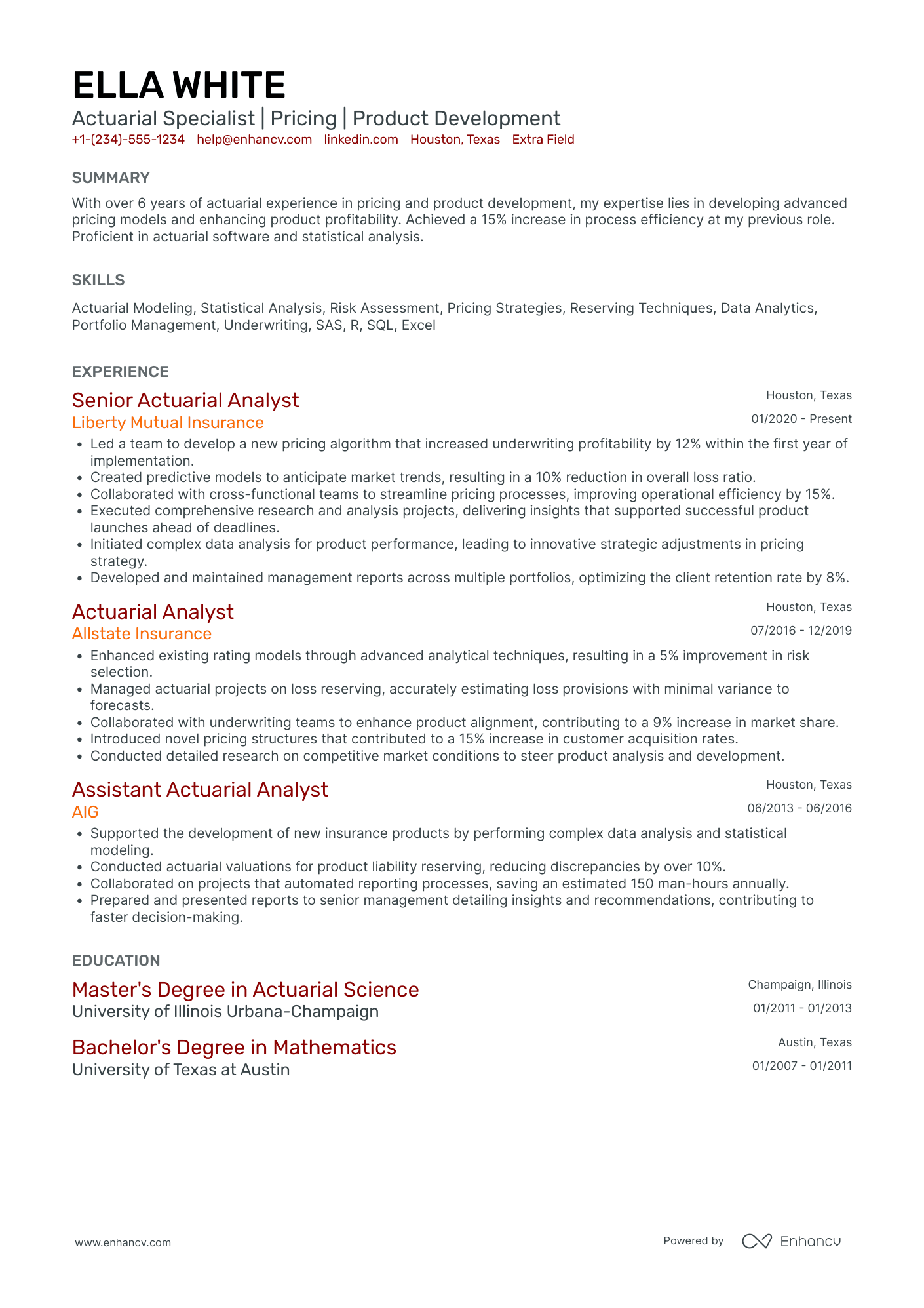

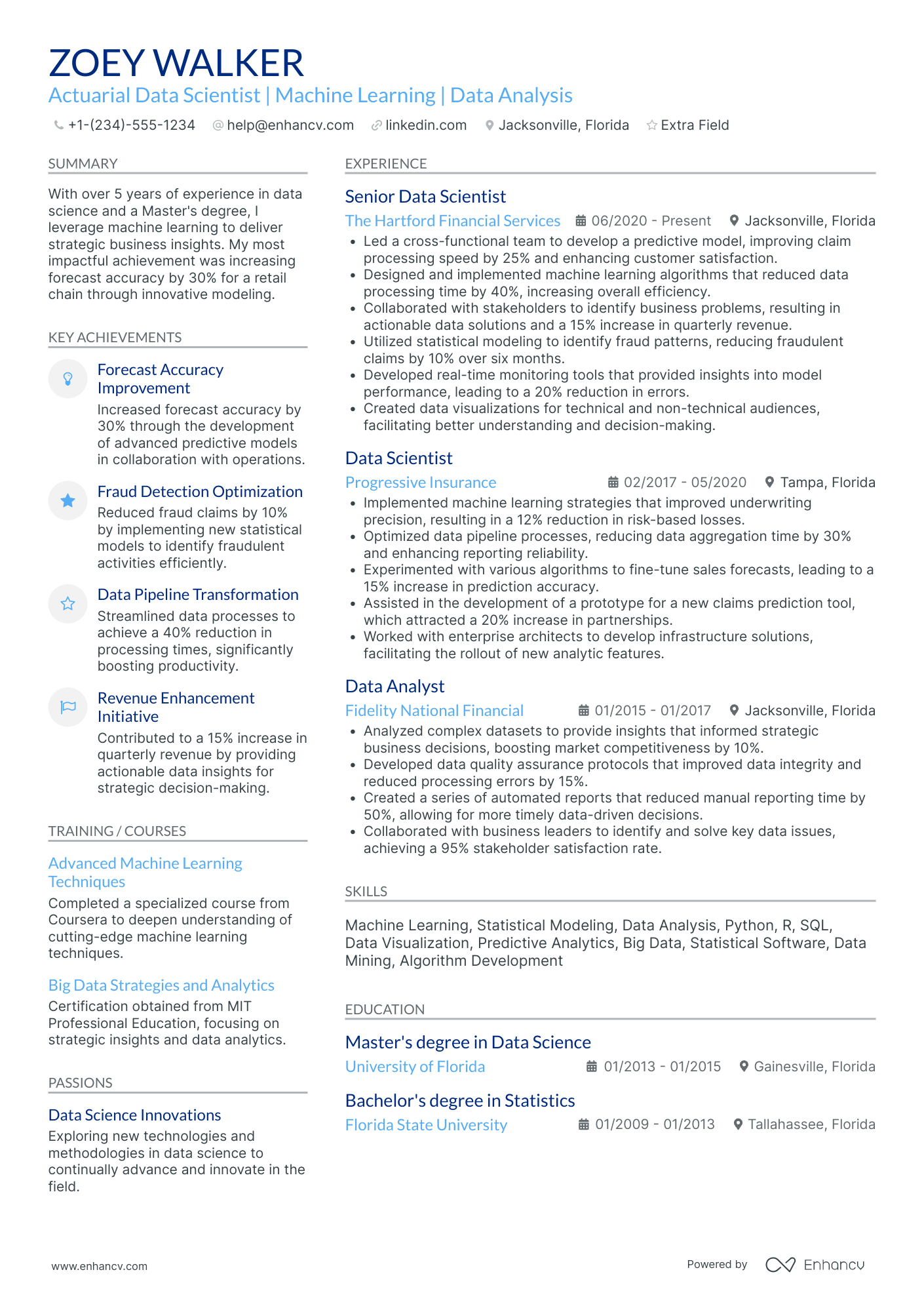

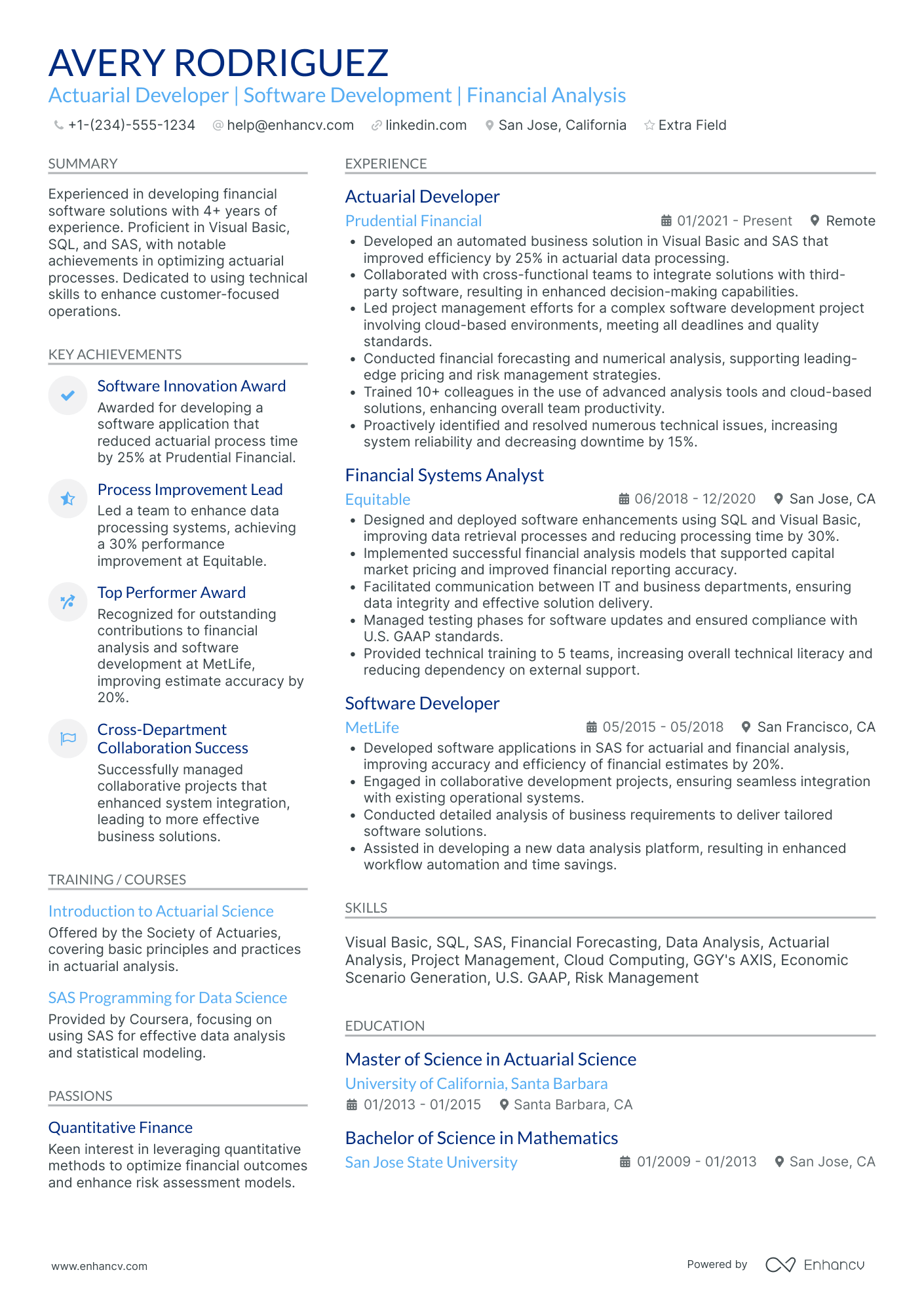

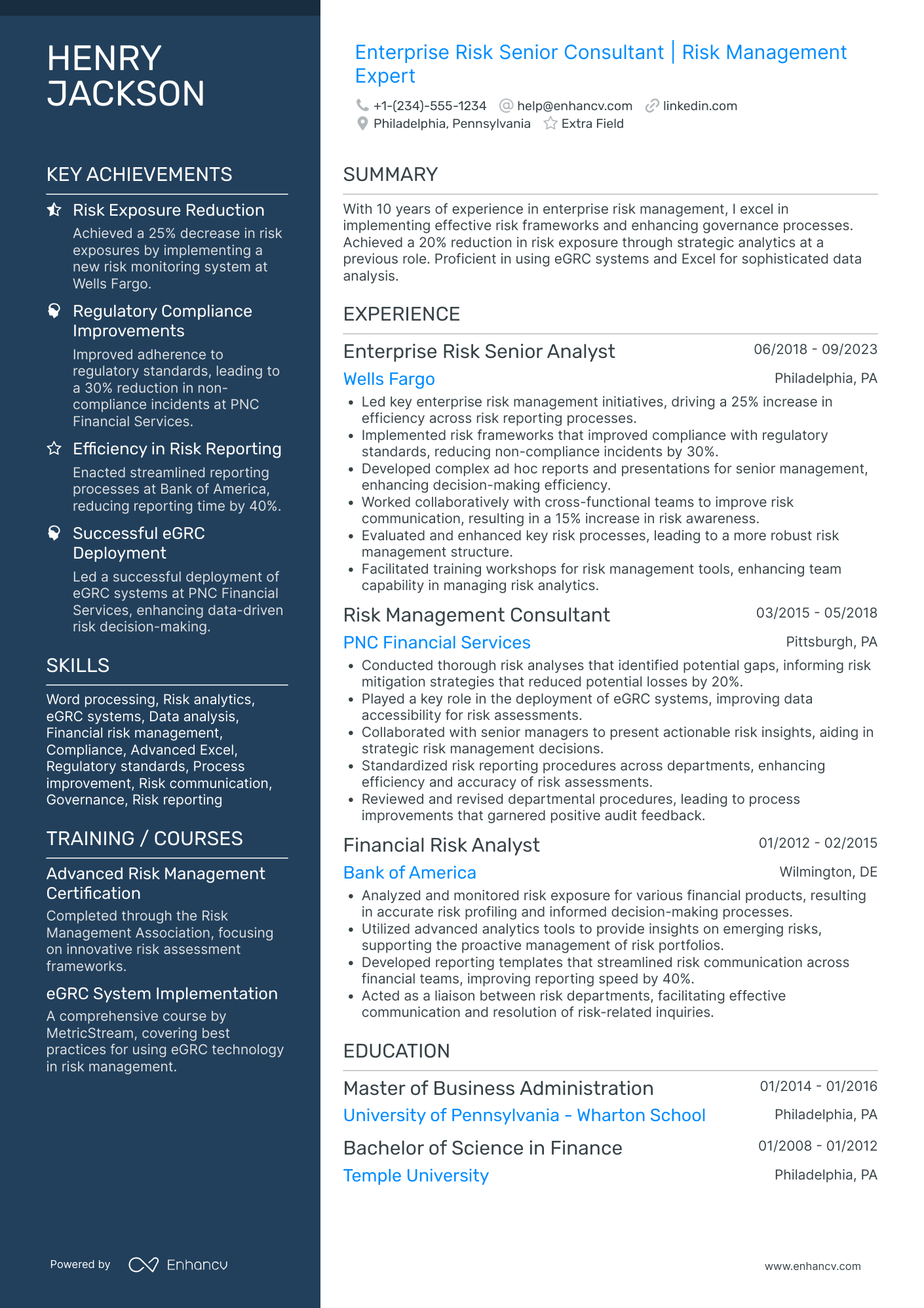

- Real-world actuary resume samples with best practices on how to stand out amongst the endless pile of candidate resumes.

- Most in-demand actuary resume skills and certifications across the industry.

- Standardizing your resume layout, while maintaining your creativity and individuality.

If the actuary resume isn't the right one for you, take a look at other related guides we have:

- Commercial Banking Resume Example

- Finance Clerk Resume Example

- Audit Director Resume Example

- Purchase Manager Resume Example

- Internal Audit Manager Resume Example

- External Auditor Resume Example

- Financial Project Manager Resume Example

- Financial Administrator Resume Example

- Night Auditor Resume Example

- Treasury Manager Resume Example

Actuary resume format made simple

You don't need to go over the top when it comes to creativity in your actuary resume format .

What recruiters care about more is the legibility of your actuary resume, alongside the relevancy of your application to the role.

That's why we're presenting you with four simple steps that could help your professional presentation check all the right boxes:

- The reverse-chronological resume format is the one for you, if you happen to have plenty of relevant (and recent) professional experience you'd like to showcase. This format follows a pretty succinct logic and puts the focus on your experience.

- Keep your header simple with your contact details; a headline that details the role you're applying for or your current job; and a link to your portfolio.

- Ensure your resume reaches an up-to-two-page limit, only if you happen to be applying for a more senior role or you have over a decade of relevant experience.

- Save your actuary resume as a PDF to retain its structure and presentation.

Tailor your resume format to the job market – a Canadian resume, for example, might differ in layout.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Always remember that your actuary certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

Fundamental sections for your actuary resume:

- The header with your name (if your degree or certification is impressive, you can add the title as a follow up to your name), contact details, portfolio link, and headline

- The summary or objective aligning your career and resume achievements with the role

- The experience section to curate neatly organized bullets with your tangible at-work-success

- Skills listed through various sections of your resume and within an exclusive sidebar

- The education and certifications for more credibility and industry-wide expertise

What recruiters want to see on your resume:

- Strong mathematical, statistical, and analytical skills

- Experience with actuarial software (e.g., Prophet, ResQ, MoSes, @RISK)

- Familiarity with data analysis tools and programming languages (e.g., SQL, R, Python)

- Professional actuarial certifications (e.g., ASA, FSA, ACAS, FCAS, CERA)

- Demonstrated experience in risk assessment and management

Guide to your most impressive actuary resume experience section

When it comes to your resume experience , stick to these simple, yet effective five steps:

- Show how your experience is relevant by including your responsibility, skill used, and outcome/-s;

- Use individual bullets to answer how your experience aligns with the job requirements;

- Think of a way to demonstrate the tangible results of your success with stats, numbers, and/or percentages ;

- Always tailor the experience section to the actuary role you're applying for - this may sometimes include taking out irrelevant experience items;

- Highlight your best (and most relevant) achievements towards the top of each experience bullet.

You're not alone if you're struggling with curating your experience section. That's why we've prepared some professional, real-life actuary resume samples to show how to best write your experience section (and more).

- Led the risk analysis team in developing predictive models to evaluate insurance liabilities, improving risk assessment accuracy by 25%.

- Directed the implementation of a new actuarial software suite which streamlined workflow and reduced manual errors by 30%.

- Successfully collaborated with underwriters to redesign life insurance products, leading to a 15% increase in sales.

- Conducted in-depth data analysis which contributed to a 20% reduction in claims overpayments and enhanced the profitability of the health insurance portfolio.

- Played a key role in developing a strategy for entering a new market segment, which resulted in an additional revenue stream contributing to 10% of company's total revenue.

- Pioneered the use of advanced statistical techniques that led to a more efficient allocation of capital reserves.

- Spearheaded a project that enhanced annuity pricing models, leading to an 8% increase in competitive edge within the retirement solutions market.

- Mentored a team of junior actuaries, enhancing their technical expertise and improving departmental productivity by 20%.

- Analyzed complex data sets to forecast financial outcomes, assisting the organization to adjust strategies accordingly and realize a 5% cost saving on claims.

- Managed the actuarial aspects of a corporate merger which resulted in streamlined operations and estimated savings of $1M per year.

- Reviewed and updated actuarial pricing assumptions which contributed to maintaining a competitive edge in the property and casualty sector.

- Facilitated regulatory compliance by developing rigorous financial reporting processes, significantly reducing the risk of non-compliance penalties.

- Instrumental in redesigning workers' compensation products, resulting in a 15% decrease in premiums while maintaining profitability targets.

- Utilized Monte Carlo simulation methods to optimize reinsurance strategies, reducing the company's exposure to catastrophic risk by 20%.

- Employed detailed variance analysis to explain budget discrepancies to stakeholders, improving transparency and communication.

- Led a cross-functional team in a project that revamped auto insurance pricing structures, achieving 12% growth in new policyholders.

- Integrated big data analytics into the existing actuarial model, enhancing prediction accuracy by identifying new risk factors.

- Coordinated with finance departments to ensure that reserves were optimally allocated for future claims, maintaining a solvency ratio above industry standards.

- Designed and conducted experience studies to refine mortality and morbidity assumptions, impacting the pricing of life and health insurance products positively.

- Leveraged cutting-edge machine learning techniques to enhance the predictive power of traditional actuarial models, resulting in more competitive product offerings.

- Engaged in corporate strategic planning sessions to provide insight on financial risk management, aiding executive decision-making.

- Orchestrated the valuation of pension fund liabilities for numerous Fortune 500 companies, ensuring compliance with both GAAP and statutory reporting standards.

- Deployed asset-liability management strategies to optimize investment portfolios, leading to a 6% better return on investment for clients.

- Initiated and executed a department-wide upskilling program focusing on predictive analytics tools, which increased efficiency and service quality.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for actuary professionals.

Top Responsibilities for Actuary:

- Ascertain premium rates required and cash reserves and liabilities necessary to ensure payment of future benefits.

- Collaborate with programmers, underwriters, accounts, claims experts, and senior management to help companies develop plans for new lines of business or improvements to existing business.

- Analyze statistical information to estimate mortality, accident, sickness, disability, and retirement rates.

- Design, review, and help administer insurance, annuity and pension plans, determining financial soundness and calculating premiums.

- Determine, or help determine, company policy, and explain complex technical matters to company executives, government officials, shareholders, policyholders, or the public.

- Construct probability tables for events such as fires, natural disasters, and unemployment, based on analysis of statistical data and other pertinent information.

- Provide advice to clients on a contract basis, working as a consultant.

- Determine equitable basis for distributing surplus earnings under participating insurance and annuity contracts in mutual companies.

- Negotiate terms and conditions of reinsurance with other companies.

- Provide expertise to help financial institutions manage risks and maximize returns associated with investment products or credit offerings.

Quantifying impact on your resume

- Highlight the size of portfolios you've managed or contributed to, emphasizing the financial impact and risk assessment precision.

- Specify the amount of money saved for past employers by optimizing insurance plans or pension schemes.

- Indicate the percentage improvement in predictive accuracy of actuarial models you've developed or refined.

- Detail the number of risk analyses conducted across various projects to showcase expertise and volume of work.

- Outline the scale of data you've analyzed by indicating the volume or diversity, to convey your ability to handle complex information.

- Showcase any reductions in process time or cost efficiencies you achieved through implementing new systems or procedures.

- Quote figures to represent the magnitude of regulatory compliance projects you have led or substantially contributed to.

- Include the number of cross-departmental collaborations that led to successful outcomes, reflecting your team player attitude and multidisciplinary approach.

Action verbs for your actuary resume

No experience, no problem: writing your actuary resume

You're quite set on the actuary role of your dreams and think your application may add further value to your potential employers. Yet, you have no work experience . Here's how you can curate your resume to substitute your lack of experience:

- Don't list every single role you've had so far, but focus on ones that would align with the job you're applying for

- Include any valid experience in the field - whether it's at research or intern level

- Highlight the soft skills you'd bring about - those personality traits that have an added value to your application

- Focus on your education and certifications, if they make sense for the role.

Recommended reads:

PRO TIP

Mention specific courses or projects that are pertinent to the job you're applying for.

Creating your actuary resume skills section: balancing hard skills and soft skills

Recruiters hiring for actuary roles are always keen on hiring candidates with relevant technical and people talents. Hard skills or technical ones are quite beneficial for the industry - as they refer to your competency with particular software and technologies. Meanwhile, your soft (or people) skills are quite crucial to yours and the company's professional growth as they detail how you'd cooperate and interact in your potential environment. Here's how to describe your hard and soft skill set in your actuary resume:

- Consider what the key job requirements are and list those towards the top of your skills section.

- Think of individual, specific skills that help you stand out amongst competitors, and detail how they've helped you succeed in the past.

- Look to the future of the industry and list all software/technologies which are forward-facing.

- Create a separate, technical skills section to supplement your experience and further align with the actuary job advert. Find the perfect balance between your resume hard and soft skills with our two lists.

Top skills for your actuary resume:

Statistical Analysis Software (e.g., SAS, R)

Actuarial Modeling Software (e.g., Prophet, MoSes)

Excel and Advanced Excel Functions

Programming Languages (e.g., Python, SQL)

Data Visualization Tools (e.g., Tableau, Power BI)

Risk Assessment Tools

Financial Reporting Software

Database Management Systems

Excel Add-ins for Actuarial Work

Machine Learning Techniques

Analytical Thinking

Problem-Solving

Attention to Detail

Communication Skills

Team Collaboration

Time Management

Adaptability

Critical Thinking

Decision-Making

Interpersonal Skills

Next, you will find information on the top technologies for actuary professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Actuary’s resume:

- Microsoft SQL Server

- Oracle Database

- Microsoft PowerPoint

- Oak Mountain Software AnnuityValue

- Pricing software

PRO TIP

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

Qualifying your relevant certifications and education on your actuary resume

In recent times, employers have started to favor more and more candidates who have the "right" skill alignment, instead of the "right" education.

But this doesn't mean that recruiters don't care about your certifications .

Dedicate some space on your resume to list degrees and certificates by:

- Including start and end dates to show your time dedication to the industry

- Adding credibility with the institutions' names

- Prioritizing your latest certificates towards the top, hinting at the fact that you're always staying on top of innovations

- If you decide on providing further information, focus on the actual outcomes of your education: the skills you've obtained

If you happen to have a degree or certificate that is irrelevant to the job, you may leave it out.

Some of the most popular certificates for your resume include:

The top 5 certifications for your actuary resume:

- Fellow of the Society of Actuaries (FSA) - Society of Actuaries (SOA)

- Chartered Enterprise Risk Analyst (CERA) - Society of Actuaries (SOA)

- Associate of the Society of Actuaries (ASA) - Society of Actuaries (SOA)

- Fellow of the Casualty Actuarial Society (FCAS) - Casualty Actuarial Society (CAS)

- Associate of the Casualty Actuarial Society (ACAS) - Casualty Actuarial Society (CAS)

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for actuary professionals.

Top US associations for a Actuary professional

- American Academy of Actuaries

- Casualty Actuarial Society

- American Society of Pension Professionals and Actuaries

- Be an Actuary

- CFA Institute

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

Recommended reads:

Your actuary resume top one third: choosing between a resume summary or an objective

The top third of your resume is crucial, as recruiters might focus only on this section rather than reading the entire document. Therefore, it's important to carefully decide whether to include a resume summary or an objective.

- The resume summary encapsulates your most significant experiences, key achievements, and skills in the field. Ideal for candidates with substantial relevant experience, the summary previews what recruiters will find in the rest of your resume.

- The resume objective outlines your professional aspirations. It describes your career goals for the coming years and how you envision your role evolving in the prospective company. The resume objective is suitable if you have less professional experience and wish to emphasize various soft skills such as motivation, vision, and planning.

Explore some of the best examples of resume summaries and objectives from real-life professional resumes in the industry.

Resume summaries for a actuary job

- With over 8 years of dedicated actuarial experience, a Fellowship in the Society of Actuaries, and expertise in predictive modeling, I effectively led a team that achieved a 20% increase in portfolio profitability for a major insurance firm by restructuring underwriting strategies.

- Chartered financial analyst making the transition to actuarial science, bringing a robust 10-year track record in quantitative analysis and asset management, aims to apply advanced statistical techniques to mitigate financial risks and drive informed decision-making.

- Seasoned risk management consultant with six years of intense experience, seeking to leverage deep understanding of data analysis, economic trends, and risk assessment tools to transition into the actuarial field and contribute to informed and strategic policy development.

- Eager to apply a solid foundation in mathematics and economics, honed through a rigorous academic career at a top-tier university, to embark on an actuarial journey, aiming to analyze complex datasets and support strategic decision-making in insurance risk management.

- As a new graduate possessing a strong passion for applied mathematics and a profound interest in statistical analysis, my objective is to integrate into the actuarial profession, where I can develop practical skills while contributing to financial evaluations and risk assessments.

- Looking to leverage my Master's degree in Statistics, profound interest in predictive analytics, and a recent internship experience that involved in-depth market risk analysis, my goal is to immerse myself in the actuarial profession, where I can foster strong analytical competencies and support risk management processes.

Average salary info by state in the US for actuary professionals

Local salary info for Actuary.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $120,000 |

| California (CA) | $120,650 |

| Texas (TX) | $108,770 |

| Florida (FL) | $105,790 |

| New York (NY) | $140,760 |

| Pennsylvania (PA) | $116,880 |

| Illinois (IL) | $119,650 |

| Ohio (OH) | $112,230 |

| Georgia (GA) | $128,200 |

| North Carolina (NC) | $130,190 |

| Michigan (MI) | $93,250 |

More relevant sections for your actuary resume

Perhaps you feel that your current resume could make use of a few more details that could put your expertise and personality in the spotlight.

We recommend you add some of these sections for a memorable first impression on recruiters:

- Projects - you could also feature noteworthy ones you've done in your free time;

- Awards - showcasing the impact and recognition your work has across the industry;

- Volunteering - the social causes you care the most about and the soft skills they've helped you sustain and grow;

- Personality resume section - hobbies, interests, favorite quote/books, etc. could help recruiters gain an even better understanding of who you are.

Key takeaways

- Impactful actuary resumes have an easy-to-read format that tells your career narrative with highlights;

- Select a resume summary or objective, depending on what sort of impression you'd like to leave and if your accomplishments are relevant to the job;

- If you don't happen to have much industry expertise, curate additional gigs you've had, like contracts and internships, to answer how your experience aligns with the actuary job;

- Be specific about the hard and soft skills you list on your resume to define your niche expertise and outcomes of using those particular skills;

- Always tailor your resume for each actuary application to ensure you meet all job requirements.

Actuary resume examples

By Experience

Entry Level Actuary

Actuary Internship

Experienced Actuary

Senior Actuary

Entry-Level Actuary

Junior Actuary

By Role