A significant challenge for an accounts payable manager is demonstrating their ability to optimize accounts payable processes and implement cost-saving strategies on their resume. Our guide assists in addressing this challenge by providing specific examples and action verbs to effectively showcase these skills and achievements, making your experience more tangible to potential employers.

Stay tuned for more ideas on how to write your accounts payable manager resume:

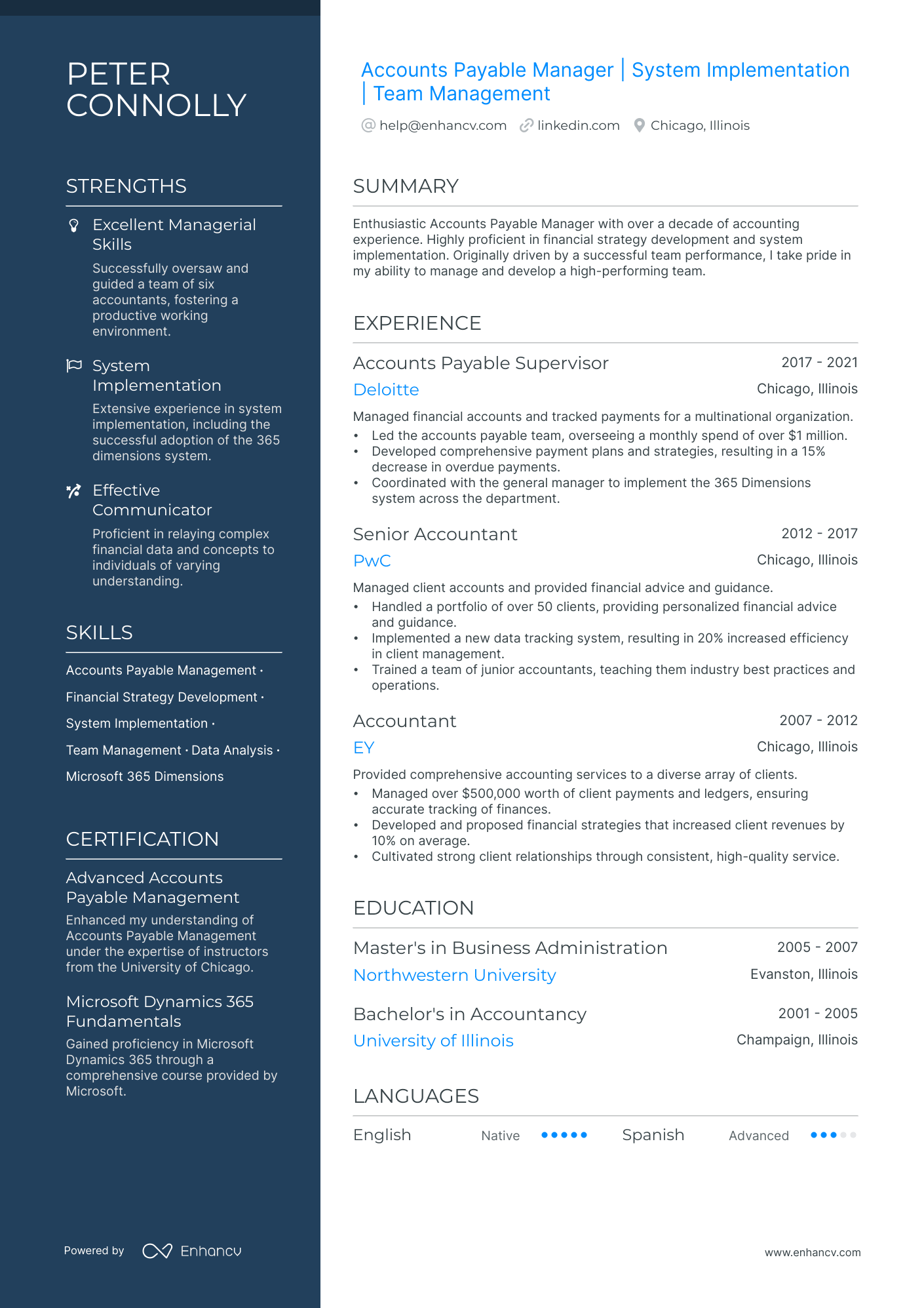

- Find different accounts payable manager resume examples to serve as inspiration to your professional presentation.

- How to use the summary or objective to highlight your career achievements.

- How to create the experience section to tell your story.

- Must have certificates and what to include in the education section of your resume.

Recommended reads:

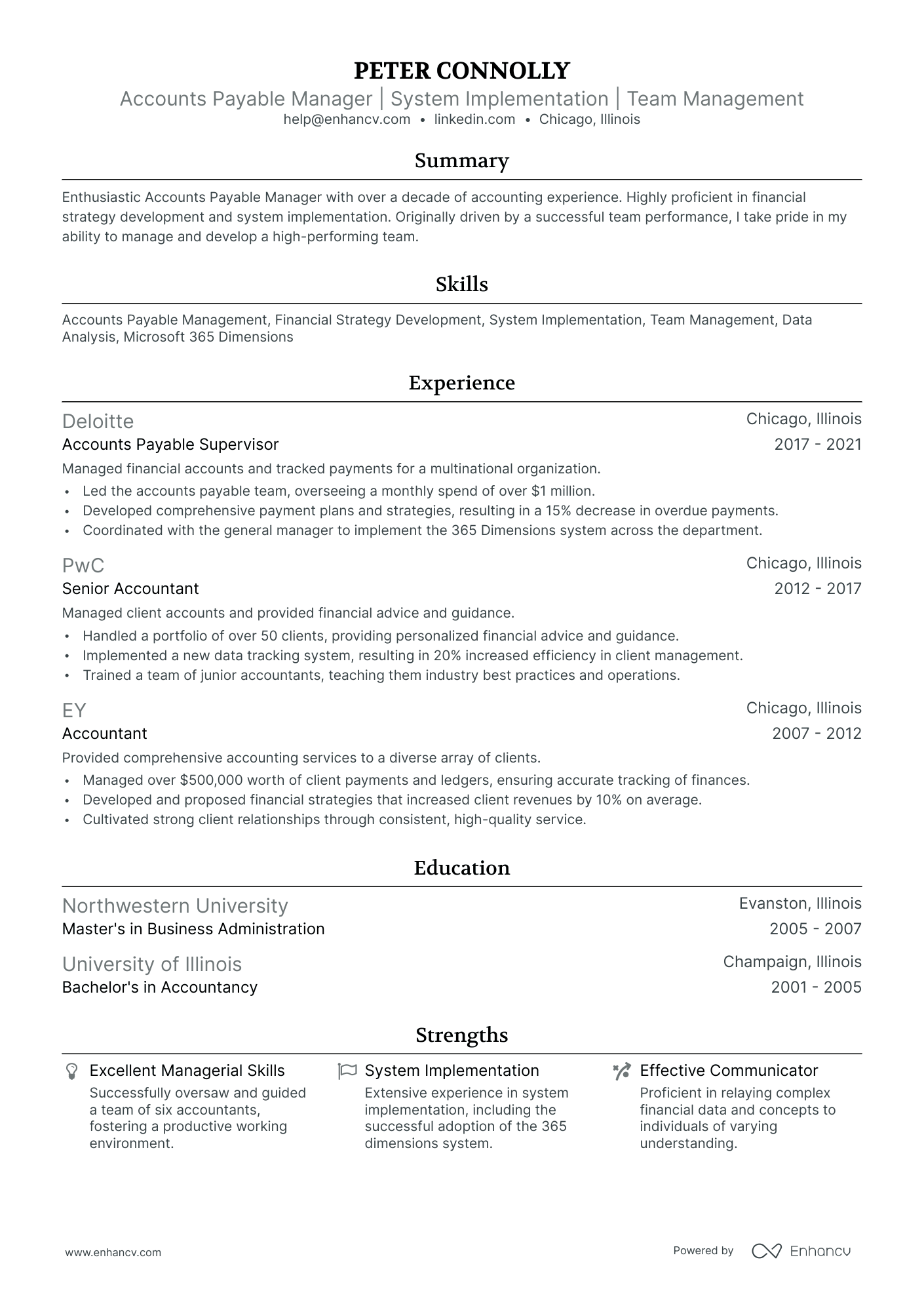

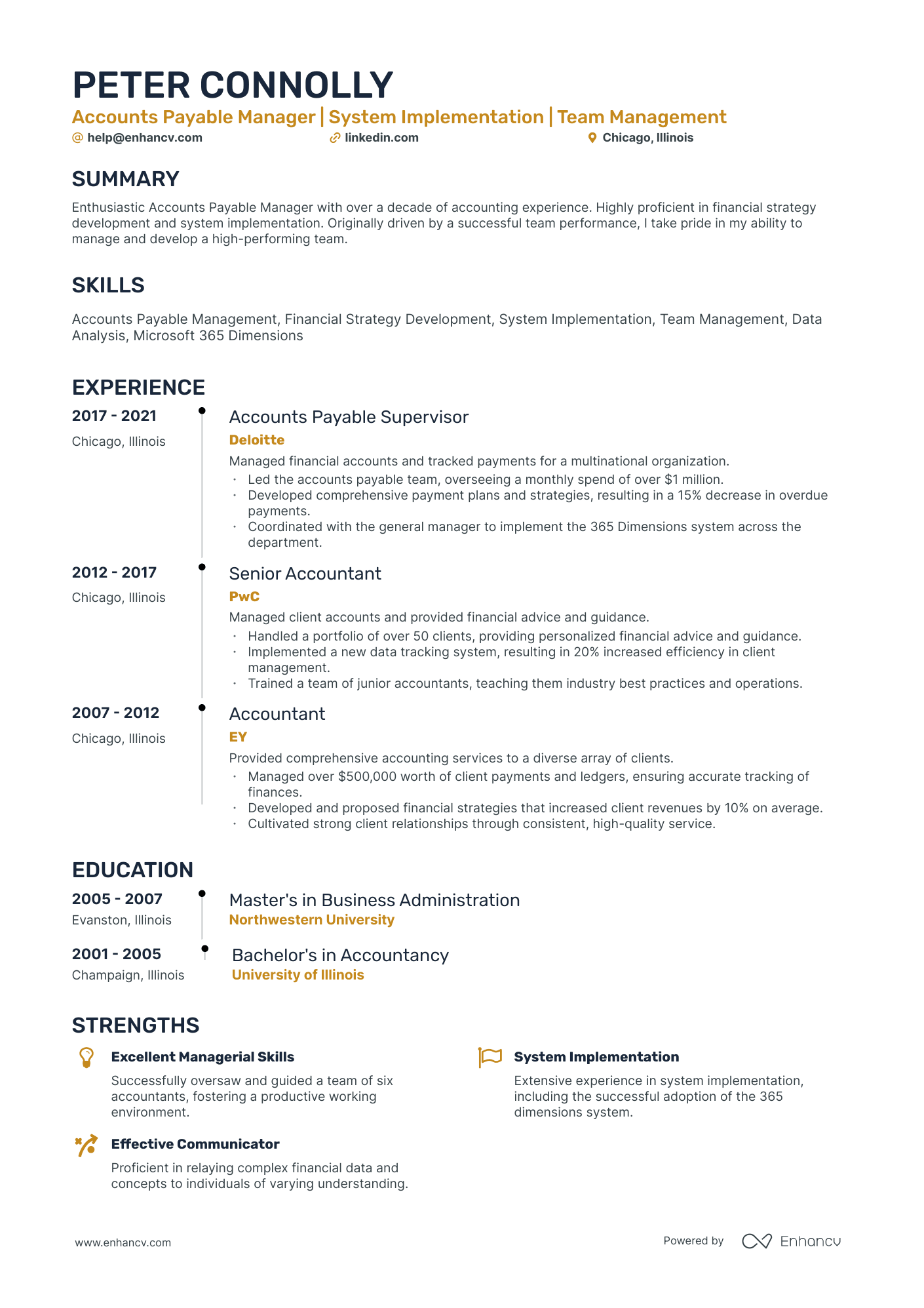

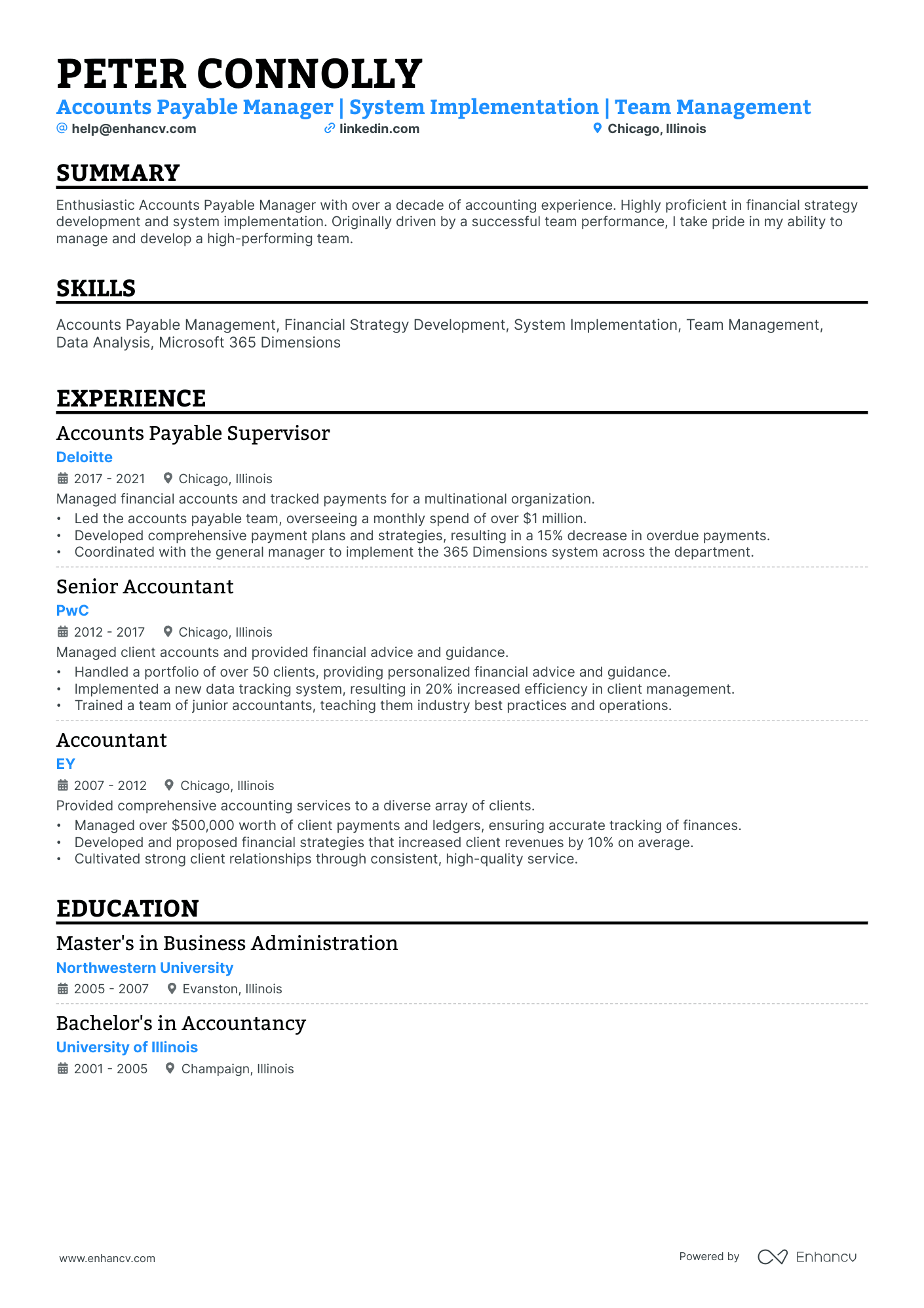

Demystifying the accounts payable manager resume format

While a touch of creativity can be appealing, it's the clarity and relevance of your accounts payable manager resume format that truly resonates with recruiters.

To ensure your resume not only captures attention but also maintains it, consider these four streamlined steps:

- If your career boasts a wealth of pertinent and recent accomplishments, the reverse-chronological resume format is your ally. It naturally emphasizes your experience, placing your most recent roles at the forefront.

- Design a straightforward header: incorporate your contact information, a headline reflecting the position you're vying for or your current designation, and a link to your professional portfolio.

- While brevity is key, if you're targeting a senior position or have accumulated over ten years of industry-relevant experience, extending your resume to two pages is permissible.

- To ensure consistent formatting across various platforms, always save and submit your accounts payable manager resume as a PDF.

Keep in mind the market you’re applying to – a Canadian resume, for instance, might have a unique layout.

Upload your resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Pro tip

Make sure your resume is ATS compliant and catches the recruiters' attention by tailoring your experience to the specific job requirements. Quantify and highlight why you're the best candidate for the role on the first page of your resume.

To craft a compelling senior accountant resume, focus on these sections:

- A scannable header

- A snapshot of your professional persona, showcasing soft skills, achievements, and a summary or objective

- Skills that align with the job advert

- Quantifiable achievements in your experience section

- An education and technical skills section that underscores your proficiency with specific tools or software

What recruiters want to see on your resume:

- Experience in managing full-cycle accounts payable processes, including invoice processing, payment processing, and vendor management.

- Demonstrated knowledge of generally accepted accounting principles (GAAP) and financial software applications (like SAP, Oracle, etc.).

- Proven skills in leading and developing an efficient accounts payable team, highlighting any successful implementations or improvements.

- Evidence of strong analytical abilities and problem-solving skills, especially in resolving discrepancies and optimizing workflow efficiency.

- Proficiency in regulatory compliance related to accounts payable, including taxation laws and auditing procedures.

Recommended reads:

How to create the cornerstone experience section of your accounts payable manager resume

A meticulously crafted accounts payable manager resume experience section is a recruiter's delight. This segment not only responds to job criteria but also throws light on your technical expertise and character.

To craft an impactful experience section:

- Highlight roles directly related to the position in question.

- Pair each role or task with a metric that quantifies your achievements.

- Chronicle your accounts payable manager career progression, illustrating your dedication and growth in the domain.

- For each role, elucidate challenges faced, strategies employed, and the broader organizational impact.

Examine the following accounts payable manager samples to discern how seasoned professionals have articulated their experiences:

- Managed accounts payable team of 5, overseeing invoice processing and payment disbursements.

- Implemented automated expense tracking system, reducing processing time by 30%.

- Negotiated vendor contracts resulting in 15% cost savings.

- Led a cross-functional project to streamline accounts payable processes, improving accuracy and efficiency.

- Supervised the accounts payable department, ensuring timely and accurate payments.

- Developed and implemented cash flow forecasting model, optimizing working capital management.

- Collaborated with internal auditors to ensure compliance with financial regulations and policies.

- Initiated process improvements resulting in a 20% reduction in erroneous payments.

- Oversee end-to-end accounts payable operations, managing a team of 8 professionals.

- Implemented a document management system, reducing paper usage by 60% and enhancing data accessibility.

- Developed key performance indicators (KPIs) to monitor team productivity and accuracy.

- Led a successful migration to a new ERP system, ensuring minimal disruption to payment processes.

- Managed vendor relationships, negotiating favorable terms resulting in a 10% discount on annual spend.

- Introduced a vendor performance evaluation system, improving accountability and quality control.

- Led the implementation of an electronic invoice processing system, reducing processing time by 40%.

- Developed and conducted training programs for accounts payable staff to enhance their skills.

- Oversaw the month-end close process, ensuring accurate financial reporting and adherence to deadlines.

- Implemented a vendor self-service portal, reducing invoice discrepancies by 25%.

- Collaborated with cross-functional teams to streamline the procure-to-pay process, resulting in 20% cycle time reduction.

- Managed a successful transition from manual check printing to electronic payments, improving efficiency.

- Performed analysis of accounts payable data to identify cost-saving opportunities and improve cash flow management.

- Implemented a three-way matching process, reducing discrepancies and ensuring accurate payments.

- Led a team in migrating from a legacy system to a cloud-based accounts payable platform.

- Developed and implemented policies and procedures to ensure compliance with SOX regulations.

- Processed high volume of invoices with accuracy and efficiency, meeting tight deadlines.

- Assisted in the implementation of an automated accounts payable system, improving invoice processing time by 50%.

- Collaborated with purchasing department to resolve vendor payment discrepancies.

- Managed vendor inquiries and reconciled statements, ensuring timely resolution of issues.

- Developed and implemented a comprehensive vendor onboarding process, ensuring compliance and reducing risk.

- Led system integration project between accounts payable and procurement modules, streamlining end-to-end processes.

- Implemented data analytics tools for invoice review, resulting in a 20% reduction in payment errors.

- Participated in cost-saving initiatives, identifying opportunities to optimize supplier contracts.

- Managed international accounts payable operations, handling multi-currency transactions and foreign vendor relationships.

- Implemented a vendor performance scorecard, resulting in improved supplier accountability and service levels.

- Led a team in transitioning from manual expense reporting to an automated expense management system.

- Collaborated with IT department to enhance system integrations and automate reconciliation processes.

- Performed regular audits of vendor accounts to identify billing errors and recover overpayments.

- Developed and maintained strong relationships with key vendors, facilitating timely dispute resolution.

- Led a project to centralize the accounts payable function across multiple subsidiaries, improving efficiency.

- Implemented cost allocation methodology resulting in accurate expense distribution across departments.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for accounts payable manager professionals.

Top Responsibilities for Accounts Payable Manager:

- Supervise the work of office, administrative, or customer service employees to ensure adherence to quality standards, deadlines, and proper procedures, correcting errors or problems.

- Resolve customer complaints or answer customers' questions regarding policies and procedures.

- Provide employees with guidance in handling difficult or complex problems or in resolving escalated complaints or disputes.

- Review records or reports pertaining to activities such as production, payroll, or shipping to verify details, monitor work activities, or evaluate performance.

- Discuss job performance problems with employees to identify causes and issues and to work on resolving problems.

- Prepare and issue work schedules, deadlines, and duty assignments for office or administrative staff.

- Recruit, interview, and select employees.

- Interpret and communicate work procedures and company policies to staff.

- Evaluate employees' job performance and conformance to regulations and recommend appropriate personnel action.

- Train or instruct employees in job duties or company policies or arrange for training to be provided.

Quantifying impact on your resume

<ul>

Tips for accounts payable manager newcomers launching their careers

Lacking extensive experience for that accounts payable manager role? No worries.

Sometimes, hiring managers go for the unexpected candidate when they see potential.

Here's how to convince them you're the right fit:

- Opt for the functional skill-based or hybrid formats to highlight your unique professional value.

- Always tailor your accounts payable manager resume to emphasize the most critical requirements, usually listed at the top of the job ad.

- Compensate for limited experience with other relevant sections like achievements, projects, and research.

- In your accounts payable manager resume objective, pinpoint both your achievements and how you envision your role in the position.

Recommended reads:

Pro tip

The experience section is all about relevancy to the accounts payable manager role. Decide on items that will show your expertise and skills in the best possible light.

Highlighting your hard and soft skills on your accounts payable manager resume

The skills section of your accounts payable manager resume should showcase your capabilities that align with job requirements.

Your hard skills, or technical skills, demonstrate your proficiency with technological innovations and specific software. On the other hand, your soft skills illustrate how you'd excel in the workplace environment with personal attributes like resilience, negotiation, and organization.

For a well-rounded accounts payable manager resume, it's essential to include both. Here's how to craft a standout skills section:

- Prioritize skills listed at the top of the job advert.

- Highlight unique skills you've honed over time.

- Choose soft skills that resonate with the company or department culture.

- Address essential job requirements by listing key skills for the accounts payable manager role that haven't been mentioned elsewhere in your resume.

Check out our sample skill list for accounts payable manager to get ideas on the most sought-after hard and soft skills in the industry.

Top skills for your accounts payable manager resume:

SAP

Oracle Financial Services

QuickBooks

Microsoft Excel

Accounts Payable Software

Data Entry Systems

e-invoicing platforms

Financial Reporting Tools

ERP Systems

Payment Processing Systems

Leadership

Communication

Problem-solving

Attention to Detail

Time Management

Analytical Thinking

Teamwork

Adaptability

Conflict Resolution

Interpersonal Skills

Next, you will find information on the top technologies for accounts payable manager professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Accounts Payable Manager’s resume:

- Microsoft Dynamics

- Oracle PeopleSoft

- Blackboard software

- Yardi software

- Intuit QuickBooks

- Sage 50 Accounting

Pro tip

Sometimes, basic skills mentioned in the job ad can be important. Include them in your resume, but don't give them too much space.

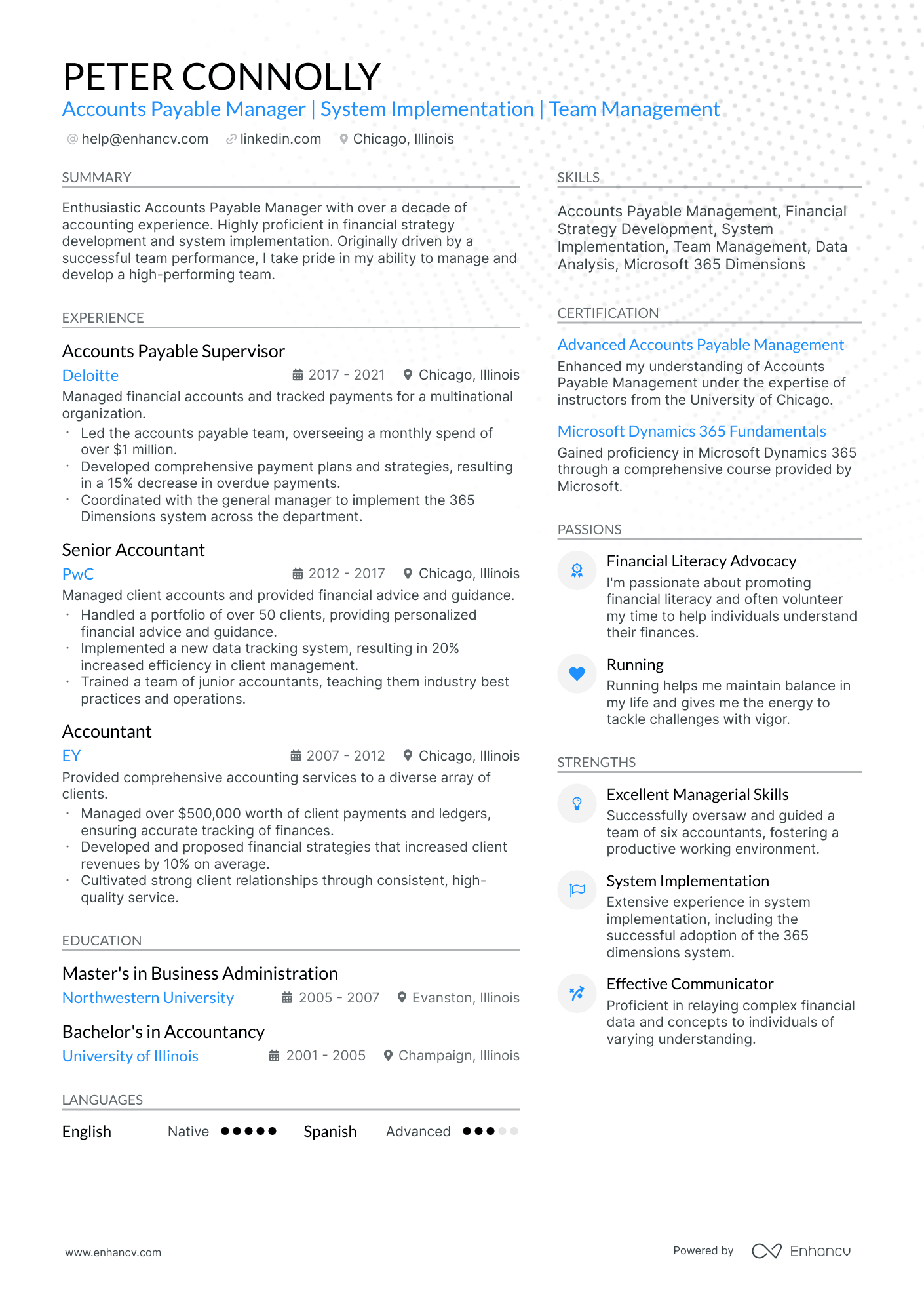

how to properly list your resume's education and certifications

Don't underestimate the importance of your resume education section , as it oftentimes helps you further tailor your resume to the job ad.

When writing your education section:

- Include the most relevant degree you have with information about the institution and dates of start and completion;

- If you're in the process of obtaining your degree, include your expected graduation date;

- Consider leaving off degrees that aren't relevant to the job or industry;

- Add bullet points to show how you gained valuable experience relevant for the job in an academic environment.

When describing your resume certifications , always consider their relevancy to the role.

Use the same format to describe them as you will for your education. If you're wondering what are the best certificates for accounts payable manager roles, check out the list below.

Best certifications to list on your resume

Pro tip

List your degrees in reverse order, starting with the newest. A recent PhD or unique field could set you apart.

Recommended reads:

Summary or objective: maximizing the impact of the top third of your resume

The top third of your accounts payable manager resume is crucial. It's often the first thing recruiters see and can set the tone for the rest of your application.

Whether you choose a resume summary or a resume objective, make it count. The former is great for showcasing career highlights, while the latter balances your achievements with your future aspirations.

Both should be tailored to the role, as there's no universal approach to crafting the perfect accounts payable manager summary or objective. Use the examples below as a starting point.

Resume summary and objective examples for a accounts payable manager resume

1. Accomplished finance professional with over 10 years of experience in managing accounts payable. Proven expertise in streamlining financial processes, improving accuracy, and reducing payment errors by 45%. Adept at leveraging advanced accounting software to enhance efficiency.

2. Seasoned accountant with a track record of 8+ years in overseeing complex financial operations. Profound understanding of accounts payable, demonstrated by reducing invoice discrepancies by 40%. Skilled in ERP systems which contribute to prompt and accurate payments.

3. Transitioning from a six-year career in project management into accounts payable. Strong organizational skills coupled with extensive experience in budget management. Keen to apply proficiency in negotiation and communication within a financial context.

4. Software engineer pivoting to accounts payable management after gaining interest in financial operations during a 5-year tenure at a tech firm. Detail-oriented and analytical, seeking to utilize problem-solving capabilities in a fiscal setting.

5. Aspiring accounts payable manager equipped with solid knowledge of financial principles garnered through an intensive finance degree. Eager to bring strong computational and analytical abilities to effectively handle monetary transactions and resolve discrepancies.

6. Finance graduate looking to start a career in accounts payable management. Highly motivated to learn and grow while applying my strong numeracy skills and business acumen to maintain accurate financial records.

Extra sections to boost your accounts payable manager resume

Add more sections to show off your unique skills and personality.

- Projects - Include any impressive ones you've done outside of work.

- Awards - Show off any industry recognition.

- Volunteering - Share causes you care about and skills you've gained.

- Personality - Hobbies or favorite books can give a glimpse into who you are.

Key takeaways

- Keep your accounts payable manager resume clear and organized with key sections.

- Only include relevant details. Space is limited.

- Support your achievements with both hard and soft skills.

- Detail your experience, focusing on your industry expertise.

- Highlight the most relevant certifications to show your dedication to the field.